Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

143 viewsBs Disclosure 14

Bs Disclosure 14

Uploaded by

ChiuYipThis document summarizes the terms and risks of an investment offering from the New Zealand Baptist Savings & Development Society (BSDS). Key points include:

- BSDS is exempt from normal disclosure requirements for charities and there is less information provided than a registered prospectus. There is also no independent supervision of investments.

- Investments are used to provide low-cost financing to Christian organizations in New Zealand. Returns include repayment of principal and interest payments, though there is risk of not recovering full amounts if BSDS becomes insolvent.

- Investors would rank as unsecured creditors in insolvency and may not recover full amounts invested. No fees are charged for deposits but interest rates can be adjusted if deposits are withdrawn

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Deed of Assignment With Assumption of MortgageDocument2 pagesDeed of Assignment With Assumption of MortgageALEX ABITAN92% (52)

- Blackbuck Introduction Deck New PDFDocument28 pagesBlackbuck Introduction Deck New PDFKishan Shah90% (10)

- Review Notes For PDIC Bank Secrecy and AMLADocument89 pagesReview Notes For PDIC Bank Secrecy and AMLAJanetGraceDalisayFabrero81% (27)

- Sources of FinanceDocument35 pagesSources of Financedon_zulkey100% (23)

- BSdisclosure14 RevisedDocument2 pagesBSdisclosure14 RevisedChiuYipNo ratings yet

- Baptist Savings Investment StatementDocument4 pagesBaptist Savings Investment StatementChiuYipNo ratings yet

- Lending Club Retirement GuideDocument8 pagesLending Club Retirement Guidecera66No ratings yet

- Product Disclosure StatementDocument30 pagesProduct Disclosure StatementfunctioneightNo ratings yet

- FM Individual NidhisDocument12 pagesFM Individual NidhisAnoop AnilNo ratings yet

- Fixed DepositDocument37 pagesFixed DepositMinal DalviNo ratings yet

- 1.notes For PDICDocument6 pages1.notes For PDICAna Marie VirayNo ratings yet

- Provic Annual Report 2013Document16 pagesProvic Annual Report 2013Mirko TomicNo ratings yet

- Public DepositDocument9 pagesPublic DepositHeavy Gunner100% (3)

- Philippine Deposit Insurance CorporationDocument19 pagesPhilippine Deposit Insurance CorporationGuevarra AngeloNo ratings yet

- Public DepositsDocument3 pagesPublic DepositsPrabhjot KaurNo ratings yet

- What Is The Philippine Deposit Insurance Corporation (PDIC) ?Document21 pagesWhat Is The Philippine Deposit Insurance Corporation (PDIC) ?chibbs1324No ratings yet

- Statutory Provident Funds, Which Are Set Up Under The Provident Fund ActDocument6 pagesStatutory Provident Funds, Which Are Set Up Under The Provident Fund ActYousaf GillaniNo ratings yet

- PDICDocument5 pagesPDICMarlon EspedillonNo ratings yet

- Vantage Key FeaturesDocument6 pagesVantage Key FeaturesAlviNo ratings yet

- Banking ReviewerDocument5 pagesBanking ReviewerChristianHarveyWongNo ratings yet

- OMWealth OldMutualWealthInvestmentVehiclesOverviewDocument5 pagesOMWealth OldMutualWealthInvestmentVehiclesOverviewJohn SmithNo ratings yet

- Policy InvestmentsDocument5 pagesPolicy InvestmentsanasNo ratings yet

- Provisional Tax Saving Fixed Deposit Confirmation AdviceDocument3 pagesProvisional Tax Saving Fixed Deposit Confirmation AdviceKunda MalleshNo ratings yet

- Lesson 13 PDICDocument20 pagesLesson 13 PDICShainaNo ratings yet

- 01 PdicDocument51 pages01 PdicRyDNo ratings yet

- Product Disclosure Statement Ay Super ("Fund") 1Document7 pagesProduct Disclosure Statement Ay Super ("Fund") 1YevNo ratings yet

- PDICDocument28 pagesPDICLilibeth Dee GabuteroNo ratings yet

- Pdic Frequently Ask QuestionsDocument3 pagesPdic Frequently Ask QuestionsColleen Rose GuanteroNo ratings yet

- Philippine Deposit Insurance Corporation: R.A. 3591, AS AMENDED R.A. 9302 R.A. 9576 RA 10846Document40 pagesPhilippine Deposit Insurance Corporation: R.A. 3591, AS AMENDED R.A. 9302 R.A. 9576 RA 10846Aleah Jehan AbuatNo ratings yet

- Primer On TrustsDocument15 pagesPrimer On TrustsAnkur LakhaniNo ratings yet

- Banking Operations (MAIN TOPICS)Document32 pagesBanking Operations (MAIN TOPICS)Saqib ShahzadNo ratings yet

- Philippine Deposit Insurance CorporationDocument23 pagesPhilippine Deposit Insurance CorporationRic John Naquila CabilanNo ratings yet

- NOTES On PDIC LAW (RA 3195)Document8 pagesNOTES On PDIC LAW (RA 3195)ela kikayNo ratings yet

- Comparison Between MY V NZLDocument6 pagesComparison Between MY V NZLSerena JamesNo ratings yet

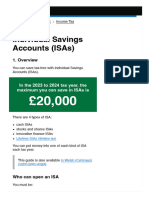

- Fact Sheet - Investment IsaDocument4 pagesFact Sheet - Investment IsaXisefNo ratings yet

- What Is The Philippine Deposit Insurance Corporation (PDIC) ?Document7 pagesWhat Is The Philippine Deposit Insurance Corporation (PDIC) ?Jo Vic Cata BonaNo ratings yet

- Bocukbondconditions With Summary Box 8 July 2015v3Document5 pagesBocukbondconditions With Summary Box 8 July 2015v3Omar DapulNo ratings yet

- Opening of Term DepositDocument8 pagesOpening of Term DepositDeepak RoyNo ratings yet

- All About PDIC: Philippine Deposit Insurance CorporationDocument18 pagesAll About PDIC: Philippine Deposit Insurance CorporationGilbert John LacorteNo ratings yet

- Unit 4 Mobilisation of FundsDocument58 pagesUnit 4 Mobilisation of FundsMohit RajputNo ratings yet

- Dear Valued ClientsDocument5 pagesDear Valued ClientsBharathi 3280No ratings yet

- Stanbic IBTC Bank Product Knowledge Assessment Test Study PackDocument32 pagesStanbic IBTC Bank Product Knowledge Assessment Test Study PackMike TelkNo ratings yet

- FWM Chapter 2Document39 pagesFWM Chapter 2aviii.h05No ratings yet

- Print Individual Savings Accounts (ISAs) - Overview - GOV - UKDocument9 pagesPrint Individual Savings Accounts (ISAs) - Overview - GOV - UKscribd.peworNo ratings yet

- Digital Assignment - 3: Submitted To: Submitted byDocument11 pagesDigital Assignment - 3: Submitted To: Submitted byMonashreeNo ratings yet

- M2 - PDIC LawDocument24 pagesM2 - PDIC LawJaycy FernandoNo ratings yet

- FAQs On DBS Wealth Management AccountDocument2 pagesFAQs On DBS Wealth Management AccountkarpeoNo ratings yet

- ATM Sales ReportDocument2 pagesATM Sales ReportAnurag SawalNo ratings yet

- Faqs 1. What Is The Philippine Deposit Insurance Corporation (PDIC) ?Document4 pagesFaqs 1. What Is The Philippine Deposit Insurance Corporation (PDIC) ?Raffy LopezNo ratings yet

- Insured DepositsDocument8 pagesInsured DepositsIsabel CaalimNo ratings yet

- Cis & AifDocument16 pagesCis & AifAkankshaNo ratings yet

- Notes On PDIC LAW RA 3195 2Document8 pagesNotes On PDIC LAW RA 3195 2Diaz, Bryan ChristopherNo ratings yet

- What Is Fixed DepositDocument2 pagesWhat Is Fixed DepositRohit DhuriNo ratings yet

- 20773d1259766411 Financial Services M y Khan Ppts CH 1 NBFC M.y.khanDocument54 pages20773d1259766411 Financial Services M y Khan Ppts CH 1 NBFC M.y.khanPriyanka VashistNo ratings yet

- General Angel FundDocument8 pagesGeneral Angel FundinforumdocsNo ratings yet

- Resource ManagementDocument9 pagesResource ManagementAdil AhmedNo ratings yet

- Important Retail Liability ProductDocument33 pagesImportant Retail Liability Productmanu.manohar0408No ratings yet

- Taxes Summary Test NotesDocument10 pagesTaxes Summary Test NotesfemiadegbayoNo ratings yet

- Investor PresentationDocument39 pagesInvestor PresentationhowellstechNo ratings yet

- How to Retire Early on Dividends: Dividend Growth Machine: Mastering the Art of Maximizing Returns Through Dividend InvestingFrom EverandHow to Retire Early on Dividends: Dividend Growth Machine: Mastering the Art of Maximizing Returns Through Dividend InvestingNo ratings yet

- Find Your Freedom: Financial Planning for a Life on PurposeFrom EverandFind Your Freedom: Financial Planning for a Life on PurposeRating: 5 out of 5 stars5/5 (1)

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- Securing Your Superannuation Future: How to Start and Run a Self Managed Super FundFrom EverandSecuring Your Superannuation Future: How to Start and Run a Self Managed Super FundNo ratings yet

- RefinanceDocument6 pagesRefinanceStoneny PairnNo ratings yet

- Kushal Mody ResumeDocument2 pagesKushal Mody ResumeBrent GoldenNo ratings yet

- Rights of A Co-Owner and Its Limitations: Civil CodeDocument9 pagesRights of A Co-Owner and Its Limitations: Civil CodeArwella Gregorio100% (2)

- An Assignment and PresentationDocument6 pagesAn Assignment and PresentationKamal BothraNo ratings yet

- LIC Housing Finance LimitedDocument5 pagesLIC Housing Finance LimitedVijay SinghNo ratings yet

- Bec P Reading and WritingDocument15 pagesBec P Reading and WritingMonica IorgulescuNo ratings yet

- Affiliated Business (RESPA)Document1 pageAffiliated Business (RESPA)Thomas JordanNo ratings yet

- Etd 2009 8 8Document16 pagesEtd 2009 8 8harsh0520No ratings yet

- Partnership Accounting Formative Assessment Requirement 1: Journal Entry To Record The Contribution of The Partners Jenny's ContributionDocument2 pagesPartnership Accounting Formative Assessment Requirement 1: Journal Entry To Record The Contribution of The Partners Jenny's ContributionKyo TieNo ratings yet

- ChapterDocument42 pagesChapterdhillonjatt499No ratings yet

- Question Paper Code:: Reg. NoDocument6 pagesQuestion Paper Code:: Reg. Nosaranya pugazhenthiNo ratings yet

- Corp Scaahemes at A GlanceDocument8 pagesCorp Scaahemes at A GlancesubodhNo ratings yet

- Civil Law Compile 07-18 PDFDocument95 pagesCivil Law Compile 07-18 PDFOshin Noleal SabacoNo ratings yet

- Amriteeshwar - Rai (CV)Document2 pagesAmriteeshwar - Rai (CV)Amriteshwar RaiNo ratings yet

- Cherie Palileo V CosioDocument3 pagesCherie Palileo V Cosioyukibambam_28No ratings yet

- Solving On Implied Co OwnershipDocument3 pagesSolving On Implied Co OwnershipAhmed GalibNo ratings yet

- Inverell Chamber of Commerce Business Awards, 2016Document16 pagesInverell Chamber of Commerce Business Awards, 2016Simon McCarthyNo ratings yet

- Obligation and Contracts MCQDocument4 pagesObligation and Contracts MCQLynNo ratings yet

- Real Estate Activities in Nigeria - SampleDocument3 pagesReal Estate Activities in Nigeria - SampleTamo44No ratings yet

- Appraisal of Term LoanDocument13 pagesAppraisal of Term LoanAabhash ShrivastavNo ratings yet

- MCash 2016Document16 pagesMCash 2016Imran ShafieNo ratings yet

- PNB v. AtendidoDocument2 pagesPNB v. AtendidoAntonio RebosaNo ratings yet

- Internship Report On General Banking of Agrani Bank LimitedDocument49 pagesInternship Report On General Banking of Agrani Bank LimitedMd Khaled NoorNo ratings yet

- Silos vs. PNB PDFDocument24 pagesSilos vs. PNB PDFdanexrainierNo ratings yet

- Chapter 3Document4 pagesChapter 3Nida RazaNo ratings yet

- Project Report-Study On Credit AppraisalDocument57 pagesProject Report-Study On Credit AppraisalPramod Serma100% (1)

- The Punjab Prohibition of Private Money Lending Act 2007Document2 pagesThe Punjab Prohibition of Private Money Lending Act 2007Reda KhanNo ratings yet

Bs Disclosure 14

Bs Disclosure 14

Uploaded by

ChiuYip0 ratings0% found this document useful (0 votes)

143 views1 pageThis document summarizes the terms and risks of an investment offering from the New Zealand Baptist Savings & Development Society (BSDS). Key points include:

- BSDS is exempt from normal disclosure requirements for charities and there is less information provided than a registered prospectus. There is also no independent supervision of investments.

- Investments are used to provide low-cost financing to Christian organizations in New Zealand. Returns include repayment of principal and interest payments, though there is risk of not recovering full amounts if BSDS becomes insolvent.

- Investors would rank as unsecured creditors in insolvency and may not recover full amounts invested. No fees are charged for deposits but interest rates can be adjusted if deposits are withdrawn

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes the terms and risks of an investment offering from the New Zealand Baptist Savings & Development Society (BSDS). Key points include:

- BSDS is exempt from normal disclosure requirements for charities and there is less information provided than a registered prospectus. There is also no independent supervision of investments.

- Investments are used to provide low-cost financing to Christian organizations in New Zealand. Returns include repayment of principal and interest payments, though there is risk of not recovering full amounts if BSDS becomes insolvent.

- Investors would rank as unsecured creditors in insolvency and may not recover full amounts invested. No fees are charged for deposits but interest rates can be adjusted if deposits are withdrawn

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

143 views1 pageBs Disclosure 14

Bs Disclosure 14

Uploaded by

ChiuYipThis document summarizes the terms and risks of an investment offering from the New Zealand Baptist Savings & Development Society (BSDS). Key points include:

- BSDS is exempt from normal disclosure requirements for charities and there is less information provided than a registered prospectus. There is also no independent supervision of investments.

- Investments are used to provide low-cost financing to Christian organizations in New Zealand. Returns include repayment of principal and interest payments, though there is risk of not recovering full amounts if BSDS becomes insolvent.

- Investors would rank as unsecured creditors in insolvency and may not recover full amounts invested. No fees are charged for deposits but interest rates can be adjusted if deposits are withdrawn

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

IMPORTANT NOTICES:

Prospective investors are advised that BSDS,

in making this offer of debt securities, is not

subject to the normal offer document and

independent supervisor requirements under

the Securities Act 1978. This is because a

general exemption from those requirements

has been granted to all charities.Accordingly,

the information required to be disclosed

in respect of this offer is less than the

information that would normally be

disclosed in a registered prospectus and an

investment statement.

Also, there is no independent supervision

of your money, and the normal mechanism

for redress if you encounter difculties in

securing repayment of your money is not

available.

The Financial Markets Authority has not

examined or approved this particular offer.

The general exemption was granted on the

basis that prospective investors in charities

are not necessarily seeking a commercial

investment opportunity, but instead wish

to support the charitable purpose of the

charity. The particular charitable and

religious purposes of BSDS are discussed

below.

If the return sought and/or security of your

investment is important to you, you should

consider seeking independent investment

advice. The FMA website maintains a list of

authorized nancial advisers that you could

consult; see www.fma.govt.nz.

WHO IS THE ISSUER?

The New Zealand Baptist Savings &

Development Society Inc. (BSDS) is the

issuer. The BSDS address is: PO Box 12738,

Penrose, Auckland 1642; Level 1, 477 Great

South Road, Penrose, Auckland 1061.

BSDS is incorporated under the Incorporated

Societies Act 1908 and has carried on

business as a Development Society since

1962. BSDS is a religious organisation within

the denition of the Securities Act (Charity

Debt Securities) Exemption Notice 2013 and

the Deposit Takers (Charitable and Religious

Organisations) Exemption Notice 2010.

WHAT SORT OF INVESTMENT IS THIS?

BSDS Call and Term deposits are

unsecured interest bearing investments

and denominated in New Zealand dollars.

Fixed term investments have a xed rate of

interest payable to you by BSDS. The interest

rate on call deposits is subject to change

at any time, or after provision of an agreed

notice period.

FOR WHAT PURPOSE WILL MY

INVESTMENT BE USED?

The rules of the BSDS only allow money

to be lent to Christian organisations

recognised by the Baptist Union of New

Zealand. BSDS provides low cost nance and

grants to Christian organisations throughout

New Zealand. The funds deposited are

utilised to satisfy the charitable purposes

of the Society, such as building facilities

and providing better resources for Christian

organisations, who in turn carry out

benevolent and charitable works in local

communities. Deposits held on reserve

may be invested with nancial institutions

or investment companies that have an

investment grade credit rating.

No member of the BSDS staff or any Board

director may use depositors money for their

own purposes, and there are strict provisions

against private pecuniary gain in the Rules

of the Society.

The BSDS obtains the majority of its funds

from churches, individuals, companies and

trusts associated with those churches.

WHAT RETURNS WILL I GET?

You are entitled to:

the repayment of the principal; and

the payment of interest on the

principal amount of the deposit.

Interest will be paid or compounded on

Term Deposits, with the frequency and on

the dates as specied on any application

form relating to the term deposit, or

as agreed with the BSDS at the time of

investment.

Resident Withholding Tax will be deducted

from interest payments to New Zealand

resident investors unless the depositor

provides a Certicate of Exemption as

issued by the Inland Revenue Department.

For non-resident investors; Non Resident

Withholding Tax will be deducted at the

appropriate rate from interest payments.

The BSDS does not charge Account Fees,

Establishment Fees, Maintenance Fees or

Transaction fees on Deposits.

WHAT ARE MY RISKS?

The main risk is not being paid on time or in

full should the BSDS become insolvent or go

into liquidation or statutory management.

This could occur if borrowers from the BSDS

or if nancial institutions or investment

companies holding funds from the BSDS

failed to repay on time or in full.

Should this occur:

you may not recover all of your principal

investment or receive the agreed interest

in full.

you will not be obliged to pay any more

than your investments with the BSDS.

Consequences of Insolvency:

If the BSDS becomes insolvent and is wound

up, you will rank equally with all other

unsecured creditors of the BSDS and behind

all secured creditors and preferred claims.

The BSDS has not given any securities to

any person/ organisation that rank prior to

unsecured creditors.

The BSDS has the right to combine deposit

accounts and may set off any credit funds

against debts owed by a depositor to the

BSDS. Loans are fully secured by registered

First Mortgages over land and buildings. All

term loans are repayable on demand except

in cases where a xed interest rate loan is

involved.

BSDS is temporarily exempted until 1 May

2015 from the following sections of the

Reserve Bank of New Zealand Act 1989:

to have a credit rating in section 157I

the governance requirements in section

157L.

BSDS is also exempted until 30 November

2016 from the following sections of the

Reserve Bank of New Zealand Act 1989:

the capital requirements in sections 157T

and 157U

the related party exposures requirement

in sections 157X and 157Y

the liquidity requirement in sections

157ZA and 157ZB

WHAT ARE THE TERMS AND CONDITIONS

OF THE OFFER?

Minimum account balances for deposits are:

$500 on Fixed Term deposits;

$100 on Call;

The minimum transaction amount on

savings accounts is $20.

Payment or delivery of investment money

can be made by cash, by cheque payable

to the New Zealand Baptist Savings &

Development Society Inc, by automatic

payment, by ordinary deposit to the BSDS

bank account or by another electronic

delivery mechanism.

No notice is required for withdrawal of

Call deposits.

Usually your term deposit is not repayable

until maturity. Should a term deposit be

repaid at your request prior to maturity

date, the interest rate may be adjusted

and the principal amount repayable

may be reduced to offset interest

payments (calculated at the rate prior to

adjustment) which you may have received

during the term of the investment.

Holding of Investment money: Money

lodged with the BSDS will be deposited in

accordance with your instructions to your

nominated account or investment. The

money will be held according to the usual

terms and conditions applying and so held

until disbursed in accordance with your

instructions.

WHAT FEES DO YOU CHARGE?

No charges apply for term or call deposit

accounts, but adjustment may be made to

the interest rate if the deposit is terminated

or partially withdrawn prior to maturity

date.

RECORD KEEPING

Any money deposited with the BSDS will be

allocated an account number. The BSDS will

keep adequate records of deposits and all

withdrawals and dealings with such money

using the account number allocated to your

investment. You may have access to those

records upon request.

ARE YOUR FINANCIAL STATEMENTS

AUDITED?

The BSDS systems and operations are

audited during each nancial year and the

nancial statements are audited annually.

It is a requirement of this investment that

all current depositors and prospective

depositors are entitled to a free copy of

the Societys most recent audited nancial

statements within ve working days of

receiving the request.

DOES BSDS HAVE PROFESSIONAL

INDEMNITY INSURANCE?

BSDS maintains a delity insurance policy

with a cover of $2,000,000.

WHAT DISPUTE RESOLUTION FACILITIES

ARE AVAILABLE?

BSDS endeavours to maintain very good

relations with all its investors. In cases

where there is a need for a formal dispute

resolution process, BSDS will refer the

matter to the Chairman and then to

Financial Services Complaints Limited

as required under the Financial Services

Providers (Registration and Dispute

Resolution) Act 2008.

Dated 1 March 2014

New Zealand Baptist

Savings & Development

Society Incorporated

Disclosure Statement

Required for the purposes of the Securities Act

1978 and the Securities Act (Charitable and

Religious Purposes) Exemption Notice 2013

and the Deposit Takers ((Charitable and

Religious Organisations) Exemption Notice 2010.

You might also like

- Deed of Assignment With Assumption of MortgageDocument2 pagesDeed of Assignment With Assumption of MortgageALEX ABITAN92% (52)

- Blackbuck Introduction Deck New PDFDocument28 pagesBlackbuck Introduction Deck New PDFKishan Shah90% (10)

- Review Notes For PDIC Bank Secrecy and AMLADocument89 pagesReview Notes For PDIC Bank Secrecy and AMLAJanetGraceDalisayFabrero81% (27)

- Sources of FinanceDocument35 pagesSources of Financedon_zulkey100% (23)

- BSdisclosure14 RevisedDocument2 pagesBSdisclosure14 RevisedChiuYipNo ratings yet

- Baptist Savings Investment StatementDocument4 pagesBaptist Savings Investment StatementChiuYipNo ratings yet

- Lending Club Retirement GuideDocument8 pagesLending Club Retirement Guidecera66No ratings yet

- Product Disclosure StatementDocument30 pagesProduct Disclosure StatementfunctioneightNo ratings yet

- FM Individual NidhisDocument12 pagesFM Individual NidhisAnoop AnilNo ratings yet

- Fixed DepositDocument37 pagesFixed DepositMinal DalviNo ratings yet

- 1.notes For PDICDocument6 pages1.notes For PDICAna Marie VirayNo ratings yet

- Provic Annual Report 2013Document16 pagesProvic Annual Report 2013Mirko TomicNo ratings yet

- Public DepositDocument9 pagesPublic DepositHeavy Gunner100% (3)

- Philippine Deposit Insurance CorporationDocument19 pagesPhilippine Deposit Insurance CorporationGuevarra AngeloNo ratings yet

- Public DepositsDocument3 pagesPublic DepositsPrabhjot KaurNo ratings yet

- What Is The Philippine Deposit Insurance Corporation (PDIC) ?Document21 pagesWhat Is The Philippine Deposit Insurance Corporation (PDIC) ?chibbs1324No ratings yet

- Statutory Provident Funds, Which Are Set Up Under The Provident Fund ActDocument6 pagesStatutory Provident Funds, Which Are Set Up Under The Provident Fund ActYousaf GillaniNo ratings yet

- PDICDocument5 pagesPDICMarlon EspedillonNo ratings yet

- Vantage Key FeaturesDocument6 pagesVantage Key FeaturesAlviNo ratings yet

- Banking ReviewerDocument5 pagesBanking ReviewerChristianHarveyWongNo ratings yet

- OMWealth OldMutualWealthInvestmentVehiclesOverviewDocument5 pagesOMWealth OldMutualWealthInvestmentVehiclesOverviewJohn SmithNo ratings yet

- Policy InvestmentsDocument5 pagesPolicy InvestmentsanasNo ratings yet

- Provisional Tax Saving Fixed Deposit Confirmation AdviceDocument3 pagesProvisional Tax Saving Fixed Deposit Confirmation AdviceKunda MalleshNo ratings yet

- Lesson 13 PDICDocument20 pagesLesson 13 PDICShainaNo ratings yet

- 01 PdicDocument51 pages01 PdicRyDNo ratings yet

- Product Disclosure Statement Ay Super ("Fund") 1Document7 pagesProduct Disclosure Statement Ay Super ("Fund") 1YevNo ratings yet

- PDICDocument28 pagesPDICLilibeth Dee GabuteroNo ratings yet

- Pdic Frequently Ask QuestionsDocument3 pagesPdic Frequently Ask QuestionsColleen Rose GuanteroNo ratings yet

- Philippine Deposit Insurance Corporation: R.A. 3591, AS AMENDED R.A. 9302 R.A. 9576 RA 10846Document40 pagesPhilippine Deposit Insurance Corporation: R.A. 3591, AS AMENDED R.A. 9302 R.A. 9576 RA 10846Aleah Jehan AbuatNo ratings yet

- Primer On TrustsDocument15 pagesPrimer On TrustsAnkur LakhaniNo ratings yet

- Banking Operations (MAIN TOPICS)Document32 pagesBanking Operations (MAIN TOPICS)Saqib ShahzadNo ratings yet

- Philippine Deposit Insurance CorporationDocument23 pagesPhilippine Deposit Insurance CorporationRic John Naquila CabilanNo ratings yet

- NOTES On PDIC LAW (RA 3195)Document8 pagesNOTES On PDIC LAW (RA 3195)ela kikayNo ratings yet

- Comparison Between MY V NZLDocument6 pagesComparison Between MY V NZLSerena JamesNo ratings yet

- Fact Sheet - Investment IsaDocument4 pagesFact Sheet - Investment IsaXisefNo ratings yet

- What Is The Philippine Deposit Insurance Corporation (PDIC) ?Document7 pagesWhat Is The Philippine Deposit Insurance Corporation (PDIC) ?Jo Vic Cata BonaNo ratings yet

- Bocukbondconditions With Summary Box 8 July 2015v3Document5 pagesBocukbondconditions With Summary Box 8 July 2015v3Omar DapulNo ratings yet

- Opening of Term DepositDocument8 pagesOpening of Term DepositDeepak RoyNo ratings yet

- All About PDIC: Philippine Deposit Insurance CorporationDocument18 pagesAll About PDIC: Philippine Deposit Insurance CorporationGilbert John LacorteNo ratings yet

- Unit 4 Mobilisation of FundsDocument58 pagesUnit 4 Mobilisation of FundsMohit RajputNo ratings yet

- Dear Valued ClientsDocument5 pagesDear Valued ClientsBharathi 3280No ratings yet

- Stanbic IBTC Bank Product Knowledge Assessment Test Study PackDocument32 pagesStanbic IBTC Bank Product Knowledge Assessment Test Study PackMike TelkNo ratings yet

- FWM Chapter 2Document39 pagesFWM Chapter 2aviii.h05No ratings yet

- Print Individual Savings Accounts (ISAs) - Overview - GOV - UKDocument9 pagesPrint Individual Savings Accounts (ISAs) - Overview - GOV - UKscribd.peworNo ratings yet

- Digital Assignment - 3: Submitted To: Submitted byDocument11 pagesDigital Assignment - 3: Submitted To: Submitted byMonashreeNo ratings yet

- M2 - PDIC LawDocument24 pagesM2 - PDIC LawJaycy FernandoNo ratings yet

- FAQs On DBS Wealth Management AccountDocument2 pagesFAQs On DBS Wealth Management AccountkarpeoNo ratings yet

- ATM Sales ReportDocument2 pagesATM Sales ReportAnurag SawalNo ratings yet

- Faqs 1. What Is The Philippine Deposit Insurance Corporation (PDIC) ?Document4 pagesFaqs 1. What Is The Philippine Deposit Insurance Corporation (PDIC) ?Raffy LopezNo ratings yet

- Insured DepositsDocument8 pagesInsured DepositsIsabel CaalimNo ratings yet

- Cis & AifDocument16 pagesCis & AifAkankshaNo ratings yet

- Notes On PDIC LAW RA 3195 2Document8 pagesNotes On PDIC LAW RA 3195 2Diaz, Bryan ChristopherNo ratings yet

- What Is Fixed DepositDocument2 pagesWhat Is Fixed DepositRohit DhuriNo ratings yet

- 20773d1259766411 Financial Services M y Khan Ppts CH 1 NBFC M.y.khanDocument54 pages20773d1259766411 Financial Services M y Khan Ppts CH 1 NBFC M.y.khanPriyanka VashistNo ratings yet

- General Angel FundDocument8 pagesGeneral Angel FundinforumdocsNo ratings yet

- Resource ManagementDocument9 pagesResource ManagementAdil AhmedNo ratings yet

- Important Retail Liability ProductDocument33 pagesImportant Retail Liability Productmanu.manohar0408No ratings yet

- Taxes Summary Test NotesDocument10 pagesTaxes Summary Test NotesfemiadegbayoNo ratings yet

- Investor PresentationDocument39 pagesInvestor PresentationhowellstechNo ratings yet

- How to Retire Early on Dividends: Dividend Growth Machine: Mastering the Art of Maximizing Returns Through Dividend InvestingFrom EverandHow to Retire Early on Dividends: Dividend Growth Machine: Mastering the Art of Maximizing Returns Through Dividend InvestingNo ratings yet

- Find Your Freedom: Financial Planning for a Life on PurposeFrom EverandFind Your Freedom: Financial Planning for a Life on PurposeRating: 5 out of 5 stars5/5 (1)

- Dividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementFrom EverandDividend Growth Investing: A Step-by-Step Guide to Building a Dividend Portfolio for Early RetirementNo ratings yet

- Securing Your Superannuation Future: How to Start and Run a Self Managed Super FundFrom EverandSecuring Your Superannuation Future: How to Start and Run a Self Managed Super FundNo ratings yet

- RefinanceDocument6 pagesRefinanceStoneny PairnNo ratings yet

- Kushal Mody ResumeDocument2 pagesKushal Mody ResumeBrent GoldenNo ratings yet

- Rights of A Co-Owner and Its Limitations: Civil CodeDocument9 pagesRights of A Co-Owner and Its Limitations: Civil CodeArwella Gregorio100% (2)

- An Assignment and PresentationDocument6 pagesAn Assignment and PresentationKamal BothraNo ratings yet

- LIC Housing Finance LimitedDocument5 pagesLIC Housing Finance LimitedVijay SinghNo ratings yet

- Bec P Reading and WritingDocument15 pagesBec P Reading and WritingMonica IorgulescuNo ratings yet

- Affiliated Business (RESPA)Document1 pageAffiliated Business (RESPA)Thomas JordanNo ratings yet

- Etd 2009 8 8Document16 pagesEtd 2009 8 8harsh0520No ratings yet

- Partnership Accounting Formative Assessment Requirement 1: Journal Entry To Record The Contribution of The Partners Jenny's ContributionDocument2 pagesPartnership Accounting Formative Assessment Requirement 1: Journal Entry To Record The Contribution of The Partners Jenny's ContributionKyo TieNo ratings yet

- ChapterDocument42 pagesChapterdhillonjatt499No ratings yet

- Question Paper Code:: Reg. NoDocument6 pagesQuestion Paper Code:: Reg. Nosaranya pugazhenthiNo ratings yet

- Corp Scaahemes at A GlanceDocument8 pagesCorp Scaahemes at A GlancesubodhNo ratings yet

- Civil Law Compile 07-18 PDFDocument95 pagesCivil Law Compile 07-18 PDFOshin Noleal SabacoNo ratings yet

- Amriteeshwar - Rai (CV)Document2 pagesAmriteeshwar - Rai (CV)Amriteshwar RaiNo ratings yet

- Cherie Palileo V CosioDocument3 pagesCherie Palileo V Cosioyukibambam_28No ratings yet

- Solving On Implied Co OwnershipDocument3 pagesSolving On Implied Co OwnershipAhmed GalibNo ratings yet

- Inverell Chamber of Commerce Business Awards, 2016Document16 pagesInverell Chamber of Commerce Business Awards, 2016Simon McCarthyNo ratings yet

- Obligation and Contracts MCQDocument4 pagesObligation and Contracts MCQLynNo ratings yet

- Real Estate Activities in Nigeria - SampleDocument3 pagesReal Estate Activities in Nigeria - SampleTamo44No ratings yet

- Appraisal of Term LoanDocument13 pagesAppraisal of Term LoanAabhash ShrivastavNo ratings yet

- MCash 2016Document16 pagesMCash 2016Imran ShafieNo ratings yet

- PNB v. AtendidoDocument2 pagesPNB v. AtendidoAntonio RebosaNo ratings yet

- Internship Report On General Banking of Agrani Bank LimitedDocument49 pagesInternship Report On General Banking of Agrani Bank LimitedMd Khaled NoorNo ratings yet

- Silos vs. PNB PDFDocument24 pagesSilos vs. PNB PDFdanexrainierNo ratings yet

- Chapter 3Document4 pagesChapter 3Nida RazaNo ratings yet

- Project Report-Study On Credit AppraisalDocument57 pagesProject Report-Study On Credit AppraisalPramod Serma100% (1)

- The Punjab Prohibition of Private Money Lending Act 2007Document2 pagesThe Punjab Prohibition of Private Money Lending Act 2007Reda KhanNo ratings yet