Professional Documents

Culture Documents

DBLM Solutions Carbon Newsletter 23 May 2014

DBLM Solutions Carbon Newsletter 23 May 2014

Uploaded by

David BolesCopyright:

Available Formats

You might also like

- AMLA QuestionsDocument4 pagesAMLA Questionsjoselle gaviola33% (3)

- DBLM Solutions Carbon Newsletter 05 June 2014Document1 pageDBLM Solutions Carbon Newsletter 05 June 2014David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 09 Oct 2014Document1 pageDBLM Solutions Carbon Newsletter 09 Oct 2014David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 07 Aug 2014 PDFDocument1 pageDBLM Solutions Carbon Newsletter 07 Aug 2014 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 24 July 2014 PDFDocument1 pageDBLM Solutions Carbon Newsletter 24 July 2014 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 15 May 2014Document1 pageDBLM Solutions Carbon Newsletter 15 May 2014David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 26 June 2014 PDFDocument1 pageDBLM Solutions Carbon Newsletter 26 June 2014 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 16 Oct 2014 PDFDocument2 pagesDBLM Solutions Carbon Newsletter 16 Oct 2014 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 03 April 2014Document1 pageDBLM Solutions Carbon Newsletter 03 April 2014David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 25 Sep 2014 PDFDocument1 pageDBLM Solutions Carbon Newsletter 25 Sep 2014 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 24 April 2014Document1 pageDBLM Solutions Carbon Newsletter 24 April 2014David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 03 Oct 2014Document1 pageDBLM Solutions Carbon Newsletter 03 Oct 2014David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 31 July 2014 PDFDocument1 pageDBLM Solutions Carbon Newsletter 31 July 2014 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 23 Oct 2014 PDFDocument1 pageDBLM Solutions Carbon Newsletter 23 Oct 2014 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 04 Sep 2014 PDFDocument1 pageDBLM Solutions Carbon Newsletter 04 Sep 2014 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 July 2014 PDFDocument1 pageDBLM Solutions Carbon Newsletter 10 July 2014 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 14 Aug 2014 PDFDocument1 pageDBLM Solutions Carbon Newsletter 14 Aug 2014 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 18 Sep 2014 PDFDocument1 pageDBLM Solutions Carbon Newsletter 18 Sep 2014 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 April 2014Document1 pageDBLM Solutions Carbon Newsletter 10 April 2014David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 19 June 2014 (Repaired)Document1 pageDBLM Solutions Carbon Newsletter 19 June 2014 (Repaired)David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 12 June 2014Document1 pageDBLM Solutions Carbon Newsletter 12 June 2014David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 10 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 02 July 2015Document1 pageDBLM Solutions Carbon Newsletter 02 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 25 June 2015Document1 pageDBLM Solutions Carbon Newsletter 25 June 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 21 May 2015Document1 pageDBLM Solutions Carbon Newsletter 21 May 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 15 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 15 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 28 May 2015Document1 pageDBLM Solutions Carbon Newsletter 28 May 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 30 July 2015Document1 pageDBLM Solutions Carbon Newsletter 30 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 09 Apr 2015Document1 pageDBLM Solutions Carbon Newsletter 09 Apr 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 16 July 2015 PDFDocument1 pageDBLM Solutions Carbon Newsletter 16 July 2015 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 22 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 22 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 23 Jan 2014Document1 pageDBLM Solutions Carbon Newsletter 23 Jan 2014David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 16 Apr 2015Document1 pageDBLM Solutions Carbon Newsletter 16 Apr 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 Sep 2015Document1 pageDBLM Solutions Carbon Newsletter 10 Sep 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 20 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 20 Aug 2015David BolesNo ratings yet

- Keith Carron 12602421 Economics of CBDocument8 pagesKeith Carron 12602421 Economics of CBdeszieNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 23 July 2015Document1 pageDBLM Solutions Carbon Newsletter 23 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 14 May 2015Document1 pageDBLM Solutions Carbon Newsletter 14 May 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 05 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 05 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 29 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 29 Oct 2015David BolesNo ratings yet

- Carbon Update 16 July 2013Document1 pageCarbon Update 16 July 2013David BolesNo ratings yet

- Carbon Update 28 Aug 2013Document1 pageCarbon Update 28 Aug 2013David BolesNo ratings yet

- Value of Green TransitionDocument16 pagesValue of Green TransitionEdward Lai100% (1)

- HoC Treasury QE QT FinalDocument48 pagesHoC Treasury QE QT FinalplozlozNo ratings yet

- Mark Scheme January 2007: GCE O Level Accounting (7011)Document13 pagesMark Scheme January 2007: GCE O Level Accounting (7011)karmenlopezholaNo ratings yet

- DBLM Solutions Carbon Newsletter 27 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 27 Aug 2015David BolesNo ratings yet

- Carbon Update 26 Aug 2013Document1 pageCarbon Update 26 Aug 2013David BolesNo ratings yet

- Carbon Update 21 Aug 2013Document1 pageCarbon Update 21 Aug 2013David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 03 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 03 Dec 2015David BolesNo ratings yet

- Tighter Control of Fiscal Policy: Morning ReportDocument3 pagesTighter Control of Fiscal Policy: Morning Reportnaudaslietas_lvNo ratings yet

- Market Over-View: Paul@gmdgroup - Co.ukDocument58 pagesMarket Over-View: Paul@gmdgroup - Co.ukapi-87733769No ratings yet

- FY2023 Results - Transcript WebcastDocument20 pagesFY2023 Results - Transcript WebcastKevin ParkerNo ratings yet

- 050TRENDocument4 pages050TRENPRABHASH SINGHNo ratings yet

- Liam Mescall CDS Trading 1Document7 pagesLiam Mescall CDS Trading 1Liam MescallNo ratings yet

- Is Fiscal Union The Answer To The Euro's Problems?: Morning ReportDocument3 pagesIs Fiscal Union The Answer To The Euro's Problems?: Morning Reportnaudaslietas_lvNo ratings yet

- ESV Issue18 PDFDocument32 pagesESV Issue18 PDFricky_kscNo ratings yet

- UK Declaration of ConformityDocument1 pageUK Declaration of ConformityRenivaldo PenteadoNo ratings yet

- Government Bond Yields Slides Further: Morning ReportDocument3 pagesGovernment Bond Yields Slides Further: Morning Reportnaudaslietas_lvNo ratings yet

- Daily Currency Briefing: After The Vote Is Before The VoteDocument4 pagesDaily Currency Briefing: After The Vote Is Before The VotetimurrsNo ratings yet

- Trading Economics: A Guide to Economic Statistics for Practitioners and StudentsFrom EverandTrading Economics: A Guide to Economic Statistics for Practitioners and StudentsNo ratings yet

- DBLM Solutions Carbon Newsletter 17 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 17 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 26 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 26 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 10 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 03 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 03 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 29 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 29 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 05 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 05 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 01 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 01 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 12 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 12 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 08 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 08 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 22 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 22 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 15 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 15 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 18 June 2015Document1 pageDBLM Solutions Carbon Newsletter 18 June 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 16 July 2015 PDFDocument1 pageDBLM Solutions Carbon Newsletter 16 July 2015 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 27 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 27 Aug 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 13 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 13 Aug 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 24 Sep 2015Document1 pageDBLM Solutions Carbon Newsletter 24 Sep 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 20 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 20 Aug 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 23 July 2015Document1 pageDBLM Solutions Carbon Newsletter 23 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 Sep 2015Document1 pageDBLM Solutions Carbon Newsletter 10 Sep 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 30 July 2015Document1 pageDBLM Solutions Carbon Newsletter 30 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 04 June 2015Document1 pageDBLM Solutions Carbon Newsletter 04 June 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 25 June 2015Document1 pageDBLM Solutions Carbon Newsletter 25 June 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 09 July 2015Document1 pageDBLM Solutions Carbon Newsletter 09 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 June 2015Document1 pageDBLM Solutions Carbon Newsletter 10 June 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 02 July 2015Document1 pageDBLM Solutions Carbon Newsletter 02 July 2015David BolesNo ratings yet

- Country Partnership Strategy: Georgia 2014 - 2018Document19 pagesCountry Partnership Strategy: Georgia 2014 - 2018David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 14 May 2015Document1 pageDBLM Solutions Carbon Newsletter 14 May 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 28 May 2015Document1 pageDBLM Solutions Carbon Newsletter 28 May 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 30 Apr 2015Document1 pageDBLM Solutions Carbon Newsletter 30 Apr 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 21 May 2015Document1 pageDBLM Solutions Carbon Newsletter 21 May 2015David BolesNo ratings yet

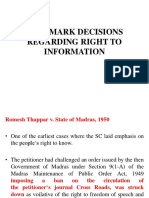

- RTI - Case LawsDocument36 pagesRTI - Case LawsAafreenNo ratings yet

- Gonzales V Solid CementDocument2 pagesGonzales V Solid CementPaula Villarin100% (1)

- Lecture 4 Robredo's Tsinelas Leadership PDFDocument20 pagesLecture 4 Robredo's Tsinelas Leadership PDFYram Einalem EMzieeiyh AranasNo ratings yet

- Civil Procedure Outline: Abernathy, Fall 2015 I. Phases of Litigation Pleadings: Complaint (Class 3 or 9/4)Document48 pagesCivil Procedure Outline: Abernathy, Fall 2015 I. Phases of Litigation Pleadings: Complaint (Class 3 or 9/4)Lauren MikeNo ratings yet

- Send To:: 102BD9 Bylsma, Orion University of Michigan 801 Monroe ST ANN ARBOR, MI 48109-1210 00:01:33 ESTDocument13 pagesSend To:: 102BD9 Bylsma, Orion University of Michigan 801 Monroe ST ANN ARBOR, MI 48109-1210 00:01:33 ESTOrion BylsmaNo ratings yet

- R41 Sps Lebin V MirasolDocument2 pagesR41 Sps Lebin V MirasolIsay YasonNo ratings yet

- Topic 3 (pt1) Legal PositivismDocument20 pagesTopic 3 (pt1) Legal PositivismJitha RithaNo ratings yet

- Agot V RiveraDocument3 pagesAgot V RiveraJohn CjNo ratings yet

- Case #79, 91, 103Document6 pagesCase #79, 91, 103RogelineNo ratings yet

- People Vs Henry T GoDocument8 pagesPeople Vs Henry T GoNath Antonio100% (1)

- Mejoff vs. DIrector of PrisonsDocument2 pagesMejoff vs. DIrector of PrisonsAra KimNo ratings yet

- United States v. Jagassar, A.F.C.C.A. (2014)Document6 pagesUnited States v. Jagassar, A.F.C.C.A. (2014)Scribd Government DocsNo ratings yet

- Korea 1950Document297 pagesKorea 1950Bob Andrepont100% (6)

- Penilla Vs AlcidDocument1 pagePenilla Vs AlcidMyra BarandaNo ratings yet

- Prelims Opening StatementDocument2 pagesPrelims Opening StatementritvikNo ratings yet

- Amity University Rajasthan: Lock-Out Under Industrial Dispute ACT, 1947Document6 pagesAmity University Rajasthan: Lock-Out Under Industrial Dispute ACT, 1947Sahida ParveenNo ratings yet

- CVC Manual - Volume IDocument79 pagesCVC Manual - Volume Ikrajeeshkrajeesh0% (1)

- Sample Teacher ContractDocument2 pagesSample Teacher ContractClaire RoxasNo ratings yet

- Letter To Lancaster County District Attorney Craig Stedman Re FULTON BANK Stamped Relieved in Lancaster County District Attorney Office June 18, 2008 12-56pmDocument2 pagesLetter To Lancaster County District Attorney Craig Stedman Re FULTON BANK Stamped Relieved in Lancaster County District Attorney Office June 18, 2008 12-56pmStan J. CaterboneNo ratings yet

- Photo of The Barangay Office: Barangay Ma-A, Davao CityDocument4 pagesPhoto of The Barangay Office: Barangay Ma-A, Davao CityAngela Jessa HifumeNo ratings yet

- Pak DiaryDocument388 pagesPak DiaryParmar LaxmikantNo ratings yet

- Bullies Vs DictatorsDocument3 pagesBullies Vs DictatorsFaizah Fiza100% (1)

- Delhi High Court Judgment of One Bar One VoteDocument50 pagesDelhi High Court Judgment of One Bar One VoteLatest Laws TeamNo ratings yet

- Globalization Processes and Geoeconomic StrategiesDocument56 pagesGlobalization Processes and Geoeconomic StrategiesОксана ЛипееваNo ratings yet

- Crim Pro Digest Matrido V People GR No. 179061 July 13, 2009Document1 pageCrim Pro Digest Matrido V People GR No. 179061 July 13, 2009inxzNo ratings yet

- Unit 1 and 2Document103 pagesUnit 1 and 2Rvi MahayNo ratings yet

- Form 3-Details of Family MembersDocument1 pageForm 3-Details of Family MembersNagamahesh100% (1)

- Horry County Answer, Counterclaim To Myrtle Beach LawsuitDocument30 pagesHorry County Answer, Counterclaim To Myrtle Beach LawsuitWMBF NewsNo ratings yet

- Accountability Judiciary EnglandDocument11 pagesAccountability Judiciary EnglandALEEMNo ratings yet

DBLM Solutions Carbon Newsletter 23 May 2014

DBLM Solutions Carbon Newsletter 23 May 2014

Uploaded by

David BolesOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DBLM Solutions Carbon Newsletter 23 May 2014

DBLM Solutions Carbon Newsletter 23 May 2014

Uploaded by

David BolesCopyright:

Available Formats

Issue CXV

The contents of the Newsletter is not a recommendation, either implicit or explicit, to buy or sell emission permits.

Contact: David Boles, Compliance Markets -Direct: +3531 4433 584; Mob:00353 831744707

DBLM Solutions is partly funded by the Wicklow Enterprise Board.

Carbon Newsletter

DBLM Solutions

23 May 2014

The EUA Dec13 contract is currently at 5.23.

The rise in carbon prices from Tuesday to

Thursday is seen as speculative in nature and is not

supported by utility hedging strategies. The

predicted bearish correction has already started

from this mornings market opening. That said, the

decrease in emissions year on year and an increase

in the surplus (now estimated at 2.1 billion tonnes)

is not seen as a sustained bearish factor by the

majority of analysts.

Weekly

Recap

ICE

EUA

Spot

ICE

CER

Spot

ICE

EUA

Dec13

ICE CER

Dec13

16/05/2014 4.82 0.12 4.83 0.12

19/05/2014 4.70 0.12 4.74 0.12

20/05/2014 4.82 0.10 4.89 0.10

21/05/2014 5.12 0.12 5.15 0.12

22/05/2014 5.12 0.09 5.29 0.09

Volumes lots 1,073 881 109,633 207,107

Week %

6.22% -25% 9.52% -25%

The EUA/CER widened this week to 5.03, at

close of business last night versus the 5.01 spread

we witnessed last week and 5.25 the week before.

Auctions

EEX held auctions last Thursday, Friday, Monday

Tuesday & yesterday. Auction prices were

4.75,4.72,4.60, 4.59 & 4.23 respectively. The

cover ratios for the above auctions were

7.30,6.75,7.33,4.84 & 4.02 respectively.

Market Reform

The European Commissions leading Climate

Change official, Jos Delbeke, stated that they are

open to the idea of bringing forward the proposed

market stability reserve The initial date

mentioned earlier in the year was 2021 but a sense

of urgency seems to have entered the debate after

emissions data shows an ever increasing surplus.

How effective this might be is another question as

industrial participants account for 1.2 billion of the

surplus. Real demand will be created by utilities.

The German Environment minister added It is true

that I suggested launching the market stability

reserve already as soon as 2016. From my point of

view, this should also include the shift of so-called

backloading volumes into the reserve. Both

measures would help to strengthen the EU ETS

quickly and sustainably. The German government

has no final position on these details yet, but we are

confident to come to an agreement soon.

According to what I hear so far from my

colleagues in other member states, there seems to

be a lot of support for measures to strengthen the

EU ETS already before 2020. People seem to

recognize that we cannot wait another six years to

reform this flagship instrument of European

climate policy.

You might also like

- AMLA QuestionsDocument4 pagesAMLA Questionsjoselle gaviola33% (3)

- DBLM Solutions Carbon Newsletter 05 June 2014Document1 pageDBLM Solutions Carbon Newsletter 05 June 2014David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 09 Oct 2014Document1 pageDBLM Solutions Carbon Newsletter 09 Oct 2014David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 07 Aug 2014 PDFDocument1 pageDBLM Solutions Carbon Newsletter 07 Aug 2014 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 24 July 2014 PDFDocument1 pageDBLM Solutions Carbon Newsletter 24 July 2014 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 15 May 2014Document1 pageDBLM Solutions Carbon Newsletter 15 May 2014David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 26 June 2014 PDFDocument1 pageDBLM Solutions Carbon Newsletter 26 June 2014 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 16 Oct 2014 PDFDocument2 pagesDBLM Solutions Carbon Newsletter 16 Oct 2014 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 03 April 2014Document1 pageDBLM Solutions Carbon Newsletter 03 April 2014David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 25 Sep 2014 PDFDocument1 pageDBLM Solutions Carbon Newsletter 25 Sep 2014 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 24 April 2014Document1 pageDBLM Solutions Carbon Newsletter 24 April 2014David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 03 Oct 2014Document1 pageDBLM Solutions Carbon Newsletter 03 Oct 2014David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 31 July 2014 PDFDocument1 pageDBLM Solutions Carbon Newsletter 31 July 2014 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 23 Oct 2014 PDFDocument1 pageDBLM Solutions Carbon Newsletter 23 Oct 2014 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 04 Sep 2014 PDFDocument1 pageDBLM Solutions Carbon Newsletter 04 Sep 2014 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 July 2014 PDFDocument1 pageDBLM Solutions Carbon Newsletter 10 July 2014 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 14 Aug 2014 PDFDocument1 pageDBLM Solutions Carbon Newsletter 14 Aug 2014 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 18 Sep 2014 PDFDocument1 pageDBLM Solutions Carbon Newsletter 18 Sep 2014 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 April 2014Document1 pageDBLM Solutions Carbon Newsletter 10 April 2014David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 19 June 2014 (Repaired)Document1 pageDBLM Solutions Carbon Newsletter 19 June 2014 (Repaired)David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 12 June 2014Document1 pageDBLM Solutions Carbon Newsletter 12 June 2014David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 10 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 02 July 2015Document1 pageDBLM Solutions Carbon Newsletter 02 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 25 June 2015Document1 pageDBLM Solutions Carbon Newsletter 25 June 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 21 May 2015Document1 pageDBLM Solutions Carbon Newsletter 21 May 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 15 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 15 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 28 May 2015Document1 pageDBLM Solutions Carbon Newsletter 28 May 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 30 July 2015Document1 pageDBLM Solutions Carbon Newsletter 30 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 09 Apr 2015Document1 pageDBLM Solutions Carbon Newsletter 09 Apr 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 16 July 2015 PDFDocument1 pageDBLM Solutions Carbon Newsletter 16 July 2015 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 22 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 22 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 23 Jan 2014Document1 pageDBLM Solutions Carbon Newsletter 23 Jan 2014David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 16 Apr 2015Document1 pageDBLM Solutions Carbon Newsletter 16 Apr 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 Sep 2015Document1 pageDBLM Solutions Carbon Newsletter 10 Sep 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 20 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 20 Aug 2015David BolesNo ratings yet

- Keith Carron 12602421 Economics of CBDocument8 pagesKeith Carron 12602421 Economics of CBdeszieNo ratings yet

- DBLM Solutions Carbon UpdateDocument1 pageDBLM Solutions Carbon UpdateDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 23 July 2015Document1 pageDBLM Solutions Carbon Newsletter 23 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 14 May 2015Document1 pageDBLM Solutions Carbon Newsletter 14 May 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 05 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 05 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 29 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 29 Oct 2015David BolesNo ratings yet

- Carbon Update 16 July 2013Document1 pageCarbon Update 16 July 2013David BolesNo ratings yet

- Carbon Update 28 Aug 2013Document1 pageCarbon Update 28 Aug 2013David BolesNo ratings yet

- Value of Green TransitionDocument16 pagesValue of Green TransitionEdward Lai100% (1)

- HoC Treasury QE QT FinalDocument48 pagesHoC Treasury QE QT FinalplozlozNo ratings yet

- Mark Scheme January 2007: GCE O Level Accounting (7011)Document13 pagesMark Scheme January 2007: GCE O Level Accounting (7011)karmenlopezholaNo ratings yet

- DBLM Solutions Carbon Newsletter 27 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 27 Aug 2015David BolesNo ratings yet

- Carbon Update 26 Aug 2013Document1 pageCarbon Update 26 Aug 2013David BolesNo ratings yet

- Carbon Update 21 Aug 2013Document1 pageCarbon Update 21 Aug 2013David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 03 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 03 Dec 2015David BolesNo ratings yet

- Tighter Control of Fiscal Policy: Morning ReportDocument3 pagesTighter Control of Fiscal Policy: Morning Reportnaudaslietas_lvNo ratings yet

- Market Over-View: Paul@gmdgroup - Co.ukDocument58 pagesMarket Over-View: Paul@gmdgroup - Co.ukapi-87733769No ratings yet

- FY2023 Results - Transcript WebcastDocument20 pagesFY2023 Results - Transcript WebcastKevin ParkerNo ratings yet

- 050TRENDocument4 pages050TRENPRABHASH SINGHNo ratings yet

- Liam Mescall CDS Trading 1Document7 pagesLiam Mescall CDS Trading 1Liam MescallNo ratings yet

- Is Fiscal Union The Answer To The Euro's Problems?: Morning ReportDocument3 pagesIs Fiscal Union The Answer To The Euro's Problems?: Morning Reportnaudaslietas_lvNo ratings yet

- ESV Issue18 PDFDocument32 pagesESV Issue18 PDFricky_kscNo ratings yet

- UK Declaration of ConformityDocument1 pageUK Declaration of ConformityRenivaldo PenteadoNo ratings yet

- Government Bond Yields Slides Further: Morning ReportDocument3 pagesGovernment Bond Yields Slides Further: Morning Reportnaudaslietas_lvNo ratings yet

- Daily Currency Briefing: After The Vote Is Before The VoteDocument4 pagesDaily Currency Briefing: After The Vote Is Before The VotetimurrsNo ratings yet

- Trading Economics: A Guide to Economic Statistics for Practitioners and StudentsFrom EverandTrading Economics: A Guide to Economic Statistics for Practitioners and StudentsNo ratings yet

- DBLM Solutions Carbon Newsletter 17 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 17 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 26 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 26 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 10 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 03 Dec 2015Document1 pageDBLM Solutions Carbon Newsletter 03 Dec 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 29 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 29 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 05 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 05 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 01 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 01 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 12 Nov 2015Document1 pageDBLM Solutions Carbon Newsletter 12 Nov 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 08 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 08 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 22 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 22 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 15 Oct 2015Document1 pageDBLM Solutions Carbon Newsletter 15 Oct 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 18 June 2015Document1 pageDBLM Solutions Carbon Newsletter 18 June 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 16 July 2015 PDFDocument1 pageDBLM Solutions Carbon Newsletter 16 July 2015 PDFDavid BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 27 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 27 Aug 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 13 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 13 Aug 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 24 Sep 2015Document1 pageDBLM Solutions Carbon Newsletter 24 Sep 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 20 Aug 2015Document1 pageDBLM Solutions Carbon Newsletter 20 Aug 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 23 July 2015Document1 pageDBLM Solutions Carbon Newsletter 23 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 Sep 2015Document1 pageDBLM Solutions Carbon Newsletter 10 Sep 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 30 July 2015Document1 pageDBLM Solutions Carbon Newsletter 30 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 04 June 2015Document1 pageDBLM Solutions Carbon Newsletter 04 June 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 25 June 2015Document1 pageDBLM Solutions Carbon Newsletter 25 June 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 09 July 2015Document1 pageDBLM Solutions Carbon Newsletter 09 July 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 10 June 2015Document1 pageDBLM Solutions Carbon Newsletter 10 June 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 02 July 2015Document1 pageDBLM Solutions Carbon Newsletter 02 July 2015David BolesNo ratings yet

- Country Partnership Strategy: Georgia 2014 - 2018Document19 pagesCountry Partnership Strategy: Georgia 2014 - 2018David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 14 May 2015Document1 pageDBLM Solutions Carbon Newsletter 14 May 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 28 May 2015Document1 pageDBLM Solutions Carbon Newsletter 28 May 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 30 Apr 2015Document1 pageDBLM Solutions Carbon Newsletter 30 Apr 2015David BolesNo ratings yet

- DBLM Solutions Carbon Newsletter 21 May 2015Document1 pageDBLM Solutions Carbon Newsletter 21 May 2015David BolesNo ratings yet

- RTI - Case LawsDocument36 pagesRTI - Case LawsAafreenNo ratings yet

- Gonzales V Solid CementDocument2 pagesGonzales V Solid CementPaula Villarin100% (1)

- Lecture 4 Robredo's Tsinelas Leadership PDFDocument20 pagesLecture 4 Robredo's Tsinelas Leadership PDFYram Einalem EMzieeiyh AranasNo ratings yet

- Civil Procedure Outline: Abernathy, Fall 2015 I. Phases of Litigation Pleadings: Complaint (Class 3 or 9/4)Document48 pagesCivil Procedure Outline: Abernathy, Fall 2015 I. Phases of Litigation Pleadings: Complaint (Class 3 or 9/4)Lauren MikeNo ratings yet

- Send To:: 102BD9 Bylsma, Orion University of Michigan 801 Monroe ST ANN ARBOR, MI 48109-1210 00:01:33 ESTDocument13 pagesSend To:: 102BD9 Bylsma, Orion University of Michigan 801 Monroe ST ANN ARBOR, MI 48109-1210 00:01:33 ESTOrion BylsmaNo ratings yet

- R41 Sps Lebin V MirasolDocument2 pagesR41 Sps Lebin V MirasolIsay YasonNo ratings yet

- Topic 3 (pt1) Legal PositivismDocument20 pagesTopic 3 (pt1) Legal PositivismJitha RithaNo ratings yet

- Agot V RiveraDocument3 pagesAgot V RiveraJohn CjNo ratings yet

- Case #79, 91, 103Document6 pagesCase #79, 91, 103RogelineNo ratings yet

- People Vs Henry T GoDocument8 pagesPeople Vs Henry T GoNath Antonio100% (1)

- Mejoff vs. DIrector of PrisonsDocument2 pagesMejoff vs. DIrector of PrisonsAra KimNo ratings yet

- United States v. Jagassar, A.F.C.C.A. (2014)Document6 pagesUnited States v. Jagassar, A.F.C.C.A. (2014)Scribd Government DocsNo ratings yet

- Korea 1950Document297 pagesKorea 1950Bob Andrepont100% (6)

- Penilla Vs AlcidDocument1 pagePenilla Vs AlcidMyra BarandaNo ratings yet

- Prelims Opening StatementDocument2 pagesPrelims Opening StatementritvikNo ratings yet

- Amity University Rajasthan: Lock-Out Under Industrial Dispute ACT, 1947Document6 pagesAmity University Rajasthan: Lock-Out Under Industrial Dispute ACT, 1947Sahida ParveenNo ratings yet

- CVC Manual - Volume IDocument79 pagesCVC Manual - Volume Ikrajeeshkrajeesh0% (1)

- Sample Teacher ContractDocument2 pagesSample Teacher ContractClaire RoxasNo ratings yet

- Letter To Lancaster County District Attorney Craig Stedman Re FULTON BANK Stamped Relieved in Lancaster County District Attorney Office June 18, 2008 12-56pmDocument2 pagesLetter To Lancaster County District Attorney Craig Stedman Re FULTON BANK Stamped Relieved in Lancaster County District Attorney Office June 18, 2008 12-56pmStan J. CaterboneNo ratings yet

- Photo of The Barangay Office: Barangay Ma-A, Davao CityDocument4 pagesPhoto of The Barangay Office: Barangay Ma-A, Davao CityAngela Jessa HifumeNo ratings yet

- Pak DiaryDocument388 pagesPak DiaryParmar LaxmikantNo ratings yet

- Bullies Vs DictatorsDocument3 pagesBullies Vs DictatorsFaizah Fiza100% (1)

- Delhi High Court Judgment of One Bar One VoteDocument50 pagesDelhi High Court Judgment of One Bar One VoteLatest Laws TeamNo ratings yet

- Globalization Processes and Geoeconomic StrategiesDocument56 pagesGlobalization Processes and Geoeconomic StrategiesОксана ЛипееваNo ratings yet

- Crim Pro Digest Matrido V People GR No. 179061 July 13, 2009Document1 pageCrim Pro Digest Matrido V People GR No. 179061 July 13, 2009inxzNo ratings yet

- Unit 1 and 2Document103 pagesUnit 1 and 2Rvi MahayNo ratings yet

- Form 3-Details of Family MembersDocument1 pageForm 3-Details of Family MembersNagamahesh100% (1)

- Horry County Answer, Counterclaim To Myrtle Beach LawsuitDocument30 pagesHorry County Answer, Counterclaim To Myrtle Beach LawsuitWMBF NewsNo ratings yet

- Accountability Judiciary EnglandDocument11 pagesAccountability Judiciary EnglandALEEMNo ratings yet