Professional Documents

Culture Documents

Comparison Between Partnership and Company

Comparison Between Partnership and Company

Uploaded by

Neelabh KumarOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Comparison Between Partnership and Company

Comparison Between Partnership and Company

Uploaded by

Neelabh KumarCopyright:

Available Formats

Dissolution of firm Amalgamation of firm Conversion of firm Absorption of

companies

Amalgamation of

companies

1. Realization Account

a. Closing asset a/c (6points)

b. Closing liabilities a/c (3

points)

c. Realization on asset a/c (2

points)

d. Payment of liabilities a/c

(2 points)

e. Payment of realization

expenses a/c (4 points)

f. Closing of realization a/c

(2)

2. Capital account (balance

of P & L a/c, reserve &

fund, profit & loss on

realization)

3. Distribution of balance

capital

Solvent

Solvent and insolvent

Insolvent (three

methods)

4. Cash a/c: distribution

of cash

Other points

Goodwill account

Profit or loss on

sale of assets

Profit or loss in

payment of

liabilities

Distribution of

A. In the books of

amalgamating firms

1. Revaluation

account

2. Closure of the old

accounts book

3. Transfer of the

accumulated reserves,

profits and losses

4. Unrecorded assets

5. Unrecorded liabilities

6. Close the accounts of

assets & liabilities

taken over by the new

firm

7. Close the accounts of

partners capital

account and new firms

account

B. In the books of new

firm

a. For closing the

accounts of assets and

liabilities taken away

by the new firm

A. In the books of firm

1. Realization Account

a. Closing asset account (3)

b. Closing liabilities a/c

c. Purchase price due to

vendor

d. Realization of asset a/c (2

points)

e. Unrecorded assets a/c (2)

f. Payment of liabilities a/c

(2)

g. Unrecorded liabilities (2)

h. Payment of realization

expenses (firm)

i. Closing of realization a/c

(2)

2. Capital account (balance

of P & L a/c, reserve & fund,

profit & loss on realization)

3. Payment of the

purchase price

4. Distribution of shares

and debentures

5. Balance of cash a/c

B. In the book of

purchasing company

1. Taking over the assets and

liabilities by the

purchasing company

2. Payment of the purchase

price

A. In the books of

firm

1. Realization a/c

a. Closing asset a/c

(4)

b. Closing liabilities

a/c

c. Purchase price

due to vendor

d. Asset not taken

over (3)

e. Liabilities not

taken over (3)

f. Redemption of

debentures &

preference

shares (4)

g. Payment of wind

up expenses (5)

h. Provision of bad

and doubtful

debts

i. Closing of

realization

accounts (2)

2. Shareholder

account

3. Payment of

purchase price

4. Distribution of

shares of the

purchasing

company

5. Transfer of

assets realized

gradually

Proportiona

te capital

method

Maximum

loss method

capital

6. Balance of cash

a/c

B. In the books of

purchasing

company

a. For purchasing the

business

b. Giving away the

assets and

liabilities by the

vendor company

(3)

c. Payment of the

purchase price to

vendor company

d. Payment of wind

up expenses by the

purchasing

company

e. Adjustment of

goodwill to

security premium

a/c

You might also like

- 2406 8MA0-01 AS Pure Mathematics - June 2024 PDFDocument44 pages2406 8MA0-01 AS Pure Mathematics - June 2024 PDFsammytest30No ratings yet

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Financial Accounting and Analysis - Question BankDocument18 pagesFinancial Accounting and Analysis - Question BankNMIMS GA50% (2)

- Reviewer ToaDocument25 pagesReviewer ToaFlorence CuansoNo ratings yet

- Accounting Reviewer Final ExamDocument7 pagesAccounting Reviewer Final ExamJanina Frances RuideraNo ratings yet

- Normalizer Transformation OverviewDocument20 pagesNormalizer Transformation OverviewyprajuNo ratings yet

- Semester - I Mid - Semester (Make - Up) Examinations (Class of 2007) IBS559 - Accounting For Managers Part - ADocument14 pagesSemester - I Mid - Semester (Make - Up) Examinations (Class of 2007) IBS559 - Accounting For Managers Part - AIsha ShahNo ratings yet

- Test Paper CMA FADocument10 pagesTest Paper CMA FASowmya RamakrishnanNo ratings yet

- ACCO 20043 Financial Accounting and Reporting 2 Midterm HandoutsDocument20 pagesACCO 20043 Financial Accounting and Reporting 2 Midterm HandoutsKayerah KayeNo ratings yet

- Receivables QuizDocument3 pagesReceivables QuizGIRLNo ratings yet

- Problems Problem 1: True or FalseDocument11 pagesProblems Problem 1: True or FalseSarah SantosNo ratings yet

- Chapter 6 - Problem 12Document1 pageChapter 6 - Problem 12Nichole CelisNo ratings yet

- Module 35 BV Per Share and Quasi TheoryDocument2 pagesModule 35 BV Per Share and Quasi TheoryThalia UyNo ratings yet

- Reviewer For Basic AccountingDocument5 pagesReviewer For Basic AccountingSVTKhsiaNo ratings yet

- Mock Qualifying ExamDocument12 pagesMock Qualifying Examzea givonneNo ratings yet

- Par Cor Accounting Cup - Average Round QuestionsDocument6 pagesPar Cor Accounting Cup - Average Round QuestionsShin YaeNo ratings yet

- Audit ProceduresDocument4 pagesAudit ProceduresGerald PiolNo ratings yet

- Cup 2 (Far)Document8 pagesCup 2 (Far)Chan DagaleNo ratings yet

- Financial Accounting MCQs Chap 3Document3 pagesFinancial Accounting MCQs Chap 3Nhi Nguyễn Trần LiênNo ratings yet

- Cash and AccrualDocument3 pagesCash and AccrualHarvey Dienne Quiambao100% (2)

- Types of Major AccountsDocument6 pagesTypes of Major Accountsbbrightvc 一ไบร์ทNo ratings yet

- Exercise 1Document3 pagesExercise 1CZARINA COMPLENo ratings yet

- Accounting Process REVIEWDocument5 pagesAccounting Process REVIEWangelicaf.kmcastilloNo ratings yet

- Mock Final Examination AccountingDocument10 pagesMock Final Examination AccountingPlu AldiniNo ratings yet

- Multiple ChoiceDocument3 pagesMultiple ChoiceROMMUEL TOLENTINONo ratings yet

- 11 STD One MarkDocument13 pages11 STD One Markapi-417927166No ratings yet

- NOTES3Document13 pagesNOTES3Xuan HuNo ratings yet

- KwisbiDocument4 pagesKwisbiLayka ResorezNo ratings yet

- Practical Accounting 1Document32 pagesPractical Accounting 1EdenA.Mata100% (9)

- Mock Test No 1Document19 pagesMock Test No 1Owais FareediNo ratings yet

- Magpantay Q2 Acct221aDocument2 pagesMagpantay Q2 Acct221aKatherine MagpantayNo ratings yet

- Chapter 5 Test BankDocument12 pagesChapter 5 Test Bankmyngoc181233% (3)

- Activity No. 1 CA 2022 Financial Accounting and Reepeorting Far PCVDocument8 pagesActivity No. 1 CA 2022 Financial Accounting and Reepeorting Far PCVPrecious mae BarrientosNo ratings yet

- Confram SeatworkDocument10 pagesConfram SeatworkCelestine MariNo ratings yet

- Financial AccountingDocument5 pagesFinancial Accountingimsana minatozakiNo ratings yet

- Chapter 5 QuestionsDocument6 pagesChapter 5 QuestionsAbood FSNo ratings yet

- 12th Accountancy Book Back One Marks Study Materials English MediumDocument12 pages12th Accountancy Book Back One Marks Study Materials English MediumAnandNo ratings yet

- Corporate Accounting MCQDocument10 pagesCorporate Accounting MCQKumareshg GctkumareshNo ratings yet

- Theory FarDocument10 pagesTheory FarLhea VillanuevaNo ratings yet

- NOTESDocument11 pagesNOTESXuan HuNo ratings yet

- Fundamentals of Accounting 1Document8 pagesFundamentals of Accounting 1julietpamintuanNo ratings yet

- Chapter 4 - Completing The Accounting CycleDocument2 pagesChapter 4 - Completing The Accounting CycleGiang TrầnNo ratings yet

- Theory of Accounts-SIR SALVADocument245 pagesTheory of Accounts-SIR SALVASofia SanchezNo ratings yet

- P1 QuizzerDocument26 pagesP1 QuizzerLorena Joy AggabaoNo ratings yet

- ATS march-2020-insight-part-IIDocument104 pagesATS march-2020-insight-part-IIAromasodun Omobolanle IswatNo ratings yet

- Fe Acc101Document89 pagesFe Acc101Phan Thien Nhan (K17 CT)No ratings yet

- CH 3 Multiple SolutionsDocument3 pagesCH 3 Multiple SolutionsSaleema KarimNo ratings yet

- ACCOUNTING Quiz 5 6 9Document7 pagesACCOUNTING Quiz 5 6 9andreajade.cawaya10No ratings yet

- Adjustment of Final Account: Presented by Pradeep Kumar PandeyDocument19 pagesAdjustment of Final Account: Presented by Pradeep Kumar PandeySandeep NaikNo ratings yet

- Xii Mcqs CH - 8 Dissolution of Partnership FirmDocument4 pagesXii Mcqs CH - 8 Dissolution of Partnership FirmJoanna Garcia100% (1)

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- Wiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 2, Financial Decision Making (1-year access)No ratings yet

- Cambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersFrom EverandCambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersRating: 2 out of 5 stars2/5 (4)

- Bookkeeping for Nonprofits: A Step-by-Step Guide to Nonprofit AccountingFrom EverandBookkeeping for Nonprofits: A Step-by-Step Guide to Nonprofit AccountingRating: 4 out of 5 stars4/5 (2)

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursFrom EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursNo ratings yet

- French Business Dictionary: The Business Terms of France and CanadaFrom EverandFrench Business Dictionary: The Business Terms of France and CanadaNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- Risk Return Trade OffDocument13 pagesRisk Return Trade OffNeelabh KumarNo ratings yet

- Chapter 4 Supply AnalysisDocument11 pagesChapter 4 Supply AnalysisNeelabh KumarNo ratings yet

- Chapter 8Document11 pagesChapter 8Neelabh KumarNo ratings yet

- Clinical Biochemistry: End of ReportDocument1 pageClinical Biochemistry: End of ReportNeelabh KumarNo ratings yet

- 2 Presentation Material PO Co PSODocument46 pages2 Presentation Material PO Co PSONeelabh KumarNo ratings yet

- International Business EnvironmentDocument3 pagesInternational Business EnvironmentNeelabh KumarNo ratings yet

- Currency & Banking PolyDocument90 pagesCurrency & Banking PolyNeelabh KumarNo ratings yet

- Impact of Debt On Financial Health of Select CompaniesDocument6 pagesImpact of Debt On Financial Health of Select CompaniesNeelabh KumarNo ratings yet

- Public Finance PolyDocument65 pagesPublic Finance PolyNeelabh KumarNo ratings yet

- Unit 6 Single Entry SystemDocument6 pagesUnit 6 Single Entry SystemNeelabh KumarNo ratings yet

- Methods of Note IssueDocument8 pagesMethods of Note IssueNeelabh KumarNo ratings yet

- Introduction To Public FinanceDocument36 pagesIntroduction To Public FinanceNeelabh KumarNo ratings yet

- Tax Incidence and The Efficiency Cost of TaxationDocument79 pagesTax Incidence and The Efficiency Cost of TaxationNeelabh KumarNo ratings yet

- Principles of Insurance and Risk Management SyllabusDocument2 pagesPrinciples of Insurance and Risk Management SyllabusNeelabh Kumar100% (2)

- Total Quality ManagementDocument25 pagesTotal Quality ManagementNeelabh KumarNo ratings yet

- Operating CostingDocument22 pagesOperating CostingNeelabh Kumar50% (2)

- Management of Financial ServicesDocument0 pagesManagement of Financial ServicesDrYamini SharmaNo ratings yet

- Unit 4 Admission of New PartnerDocument5 pagesUnit 4 Admission of New PartnerNeelabh KumarNo ratings yet

- TMS320x28xx, 28xxx DSP Serial Communication Interface (SCI) Reference GuideDocument52 pagesTMS320x28xx, 28xxx DSP Serial Communication Interface (SCI) Reference GuidesudhacarhrNo ratings yet

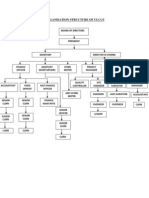

- Organisation Structure of Ulccs: Director in ChargeDocument1 pageOrganisation Structure of Ulccs: Director in ChargeMohamed RiyasNo ratings yet

- Checkpoint Science Past Papers 2008Document2 pagesCheckpoint Science Past Papers 2008Zindaba Shoko50% (2)

- LEA PERSONNEL AND RECORDS MANAGEMENT With PlanningDocument15 pagesLEA PERSONNEL AND RECORDS MANAGEMENT With PlanningJerine Alba PuebloNo ratings yet

- ICT in Rural MarketingDocument39 pagesICT in Rural MarketingpradeepsiibNo ratings yet

- Well and Testing From Fekete and EngiDocument6 pagesWell and Testing From Fekete and EngiRovshan1988No ratings yet

- International Affairs 2022 Jan To December TopicWise PDF by AffairsCloud PDFDocument31 pagesInternational Affairs 2022 Jan To December TopicWise PDF by AffairsCloud PDFbatNo ratings yet

- Dacasin Vs DacasinDocument1 pageDacasin Vs DacasinJulian DubaNo ratings yet

- 2 - How To Cretae PIRDocument8 pages2 - How To Cretae PIRSambit MohantyNo ratings yet

- Statement of Work (Sow) For "Recreational Park": ScopeDocument2 pagesStatement of Work (Sow) For "Recreational Park": ScopeIorga MihaiNo ratings yet

- CCS 3000Document27 pagesCCS 3000Kamal MulchandaniNo ratings yet

- Sample IMEC Category 3 (G4 - G5)Document8 pagesSample IMEC Category 3 (G4 - G5)anjelus371No ratings yet

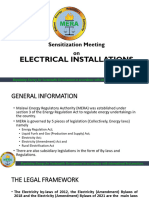

- Electrical Installers Guidelines PresentationDocument16 pagesElectrical Installers Guidelines PresentationsamuelmbomasmsNo ratings yet

- Resources and DevelopmentDocument10 pagesResources and DevelopmentswitchangryNo ratings yet

- LESSON 1 Quiz 1Document4 pagesLESSON 1 Quiz 1Carmen Florez100% (1)

- Class 2Document21 pagesClass 2md sakhwat hossainNo ratings yet

- Strategy CanvasDocument3 pagesStrategy CanvasarisuNo ratings yet

- Infinity Secure Sample AgmDocument4 pagesInfinity Secure Sample AgmAchyut AcharyaNo ratings yet

- Apollo Series 65Document2 pagesApollo Series 65okylimNo ratings yet

- 2017 CCTechSummit 7 CCX Solutions TroubleshootingDocument125 pages2017 CCTechSummit 7 CCX Solutions TroubleshootingGoutham BaratamNo ratings yet

- Applied Pharmacology For The Dental Hygienist 8th Edition Haveles Test BankDocument35 pagesApplied Pharmacology For The Dental Hygienist 8th Edition Haveles Test Bankatop.remiped25zad100% (29)

- ATOM Flashcut EASY Series Models 222 888 BrochureDocument2 pagesATOM Flashcut EASY Series Models 222 888 BrochureBowpack EngineerNo ratings yet

- Consumer Behaviour T3Document30 pagesConsumer Behaviour T3Chi Xuan KanNo ratings yet

- Bridgeing The Gap Between Academia and IndustryDocument3 pagesBridgeing The Gap Between Academia and Industrypankaj_97No ratings yet

- WDD Study D-FineDocument12 pagesWDD Study D-FineuiprailNo ratings yet

- Sixty Years of Indian ParliamentDocument19 pagesSixty Years of Indian ParliamentPawan SharmaNo ratings yet

- InvoiceDocument2 pagesInvoiceWillian CordovaNo ratings yet

- Gay-Lussac's Law Problems and SolutionsDocument1 pageGay-Lussac's Law Problems and SolutionsBasic PhysicsNo ratings yet