Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

33 viewsTempe FS Final v3

Tempe FS Final v3

Uploaded by

edgsd05The document provides financial statements for Tempe, Inc. for the years 2004-2007. It includes statements of financial condition, performance, and cash flows. Some key points:

- Cash and cash equivalents fluctuated over the years, highest in 2007 at 30 billion PHP.

- Revenue grew each year from 70 billion PHP in 2005 to 86 billion PHP in 2007.

- Net income also increased each year, from 5.9 billion PHP in 2005 to 11.7 billion PHP in 2007.

- Cash flow from operating activities was positive in 2005 and 2007 but negative in 2006.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You might also like

- Chapter 13-Investments in Noncurrent Operating Assets-Utilization & Re-TirementDocument26 pagesChapter 13-Investments in Noncurrent Operating Assets-Utilization & Re-Tirement수지No ratings yet

- Petron Corp - Financial Analysis From 2014 - 2018Document4 pagesPetron Corp - Financial Analysis From 2014 - 2018Neil Nadua100% (1)

- MCB Financial AnalysisDocument30 pagesMCB Financial AnalysisMuhammad Nasir Khan100% (4)

- Philippine Seven Corporation and SubsidiariesDocument4 pagesPhilippine Seven Corporation and Subsidiariesgirlie ValdezNo ratings yet

- MasanDocument46 pagesMasanNgọc BíchNo ratings yet

- Atlas Honda (2019 22)Document6 pagesAtlas Honda (2019 22)husnainbutt2025No ratings yet

- Balance Sheet - Assets: Period EndingDocument3 pagesBalance Sheet - Assets: Period Endingvenu54No ratings yet

- Balance Sheet For 2009 & 2008: Assets 2009 (Nu.) 2008 (Nu.)Document3 pagesBalance Sheet For 2009 & 2008: Assets 2009 (Nu.) 2008 (Nu.)Singye SherubNo ratings yet

- AssetsDocument3 pagesAssetsyasrab abbasNo ratings yet

- Askari Bank Limited Financial Statement AnalysisDocument16 pagesAskari Bank Limited Financial Statement AnalysisAleeza FatimaNo ratings yet

- Pragathi Infra - Financial StatementDocument3 pagesPragathi Infra - Financial StatementAnurag ShuklaNo ratings yet

- Ratio AnaylisDocument5 pagesRatio Anaylisfinance.mhotelkigaliNo ratings yet

- Empire East: Q2/H1 Financial StatementDocument34 pagesEmpire East: Q2/H1 Financial StatementBusinessWorldNo ratings yet

- Property and Assets: AB Bank Balance SheetDocument17 pagesProperty and Assets: AB Bank Balance SheetRafiul IslamNo ratings yet

- Pinancle FinancialsDocument6 pagesPinancle FinancialsJhorghe GonzalezNo ratings yet

- Starbucks Corporation (SBUX) Income Statement: Análisis de Estados FinancierosDocument7 pagesStarbucks Corporation (SBUX) Income Statement: Análisis de Estados FinancierosjosolcebNo ratings yet

- Excel File SuzukiDocument18 pagesExcel File SuzukiMahnoor AfzalNo ratings yet

- Filinvest Land 2006-2010Document18 pagesFilinvest Land 2006-2010Christian VillarNo ratings yet

- HBL Financial Statements - December 31, 2022Document251 pagesHBL Financial Statements - December 31, 2022Muhammad MuzammilNo ratings yet

- Suzuki Motor Corporation Balance Sheet AS ON DEC 31 .. AssetsDocument3 pagesSuzuki Motor Corporation Balance Sheet AS ON DEC 31 .. AssetsM Bilal KNo ratings yet

- Deferred Tax Asset Retirement Benefit Assets: TotalDocument2 pagesDeferred Tax Asset Retirement Benefit Assets: TotalSrb RNo ratings yet

- BHEL Valuation FinalDocument33 pagesBHEL Valuation FinalragulNo ratings yet

- Finance NFL & MitchelsDocument10 pagesFinance NFL & Mitchelsrimshaanwar617No ratings yet

- 2-Annex A Cpfi Afs ConsoDocument97 pages2-Annex A Cpfi Afs ConsoCynthia PenoliarNo ratings yet

- FIN440 Phase 2 ExcelDocument27 pagesFIN440 Phase 2 ExcelRiddo BadhonNo ratings yet

- MFI NCC Bank XL ReportsDocument27 pagesMFI NCC Bank XL ReportsSaid Ur RahmanNo ratings yet

- FirstBank Unaudited Half Year Results For Period Ending June 2010Document1 pageFirstBank Unaudited Half Year Results For Period Ending June 2010Kunle AdegboyeNo ratings yet

- Crescent Textile Mills LTD AnalysisDocument23 pagesCrescent Textile Mills LTD AnalysisMuhammad Noman MehboobNo ratings yet

- Auditors Report: Financial Result 2005-2006Document11 pagesAuditors Report: Financial Result 2005-2006Hay JirenyaaNo ratings yet

- Balance Sheet: Pyramid Analysis Exercise Year 1 Year 2 Year 3 Year 4Document9 pagesBalance Sheet: Pyramid Analysis Exercise Year 1 Year 2 Year 3 Year 4PylypNo ratings yet

- Assets: Balance SheetDocument4 pagesAssets: Balance SheetAsadvirkNo ratings yet

- Netflix Spreadsheet - SMG ToolsDocument9 pagesNetflix Spreadsheet - SMG ToolsJohn AngNo ratings yet

- Fsap 8e - Pepsico 2012Document46 pagesFsap 8e - Pepsico 2012Allan Ahmad Sarip100% (1)

- PIOC Data For Corporate ValuationDocument6 pagesPIOC Data For Corporate ValuationMuhammad Ali SamarNo ratings yet

- Balance SheetDocument3 pagesBalance SheetMd. Saiful IslamNo ratings yet

- GSK Financial FiguresDocument35 pagesGSK Financial FiguresKalenga CyrilleNo ratings yet

- Complete Financial Model & Valuation of ARCCDocument46 pagesComplete Financial Model & Valuation of ARCCgr5yjjbmjsNo ratings yet

- Purcari Lucru IndividualDocument7 pagesPurcari Lucru IndividualLenuța PapucNo ratings yet

- ABS-CBN Corporation and Subsidiaries Consolidated Statements of Financial Position (Amounts in Thousands)Document10 pagesABS-CBN Corporation and Subsidiaries Consolidated Statements of Financial Position (Amounts in Thousands)Mark Angelo BustosNo ratings yet

- Valuation Report SonyDocument38 pagesValuation Report SonyankurNo ratings yet

- Rak Ceramics: Income StatementDocument27 pagesRak Ceramics: Income StatementRafsan JahangirNo ratings yet

- Final Pyramid of Ratios: Strictly ConfidentialDocument3 pagesFinal Pyramid of Ratios: Strictly ConfidentialaeqlehczeNo ratings yet

- Annual Report 2014, 2105 & 2016: Financial Statemnts & Financial Ratio AnalysisDocument12 pagesAnnual Report 2014, 2105 & 2016: Financial Statemnts & Financial Ratio AnalysisM Bilal K100% (1)

- FIN 440 Group Task 1Document104 pagesFIN 440 Group Task 1দিপ্ত বসুNo ratings yet

- NICOL Financial Statement For The Period Ended 30 Sept 2023Document4 pagesNICOL Financial Statement For The Period Ended 30 Sept 2023Uk UkNo ratings yet

- Non-Mark-up/Interest Income: Profit Before Taxation 22,198,843 23,249,286Document8 pagesNon-Mark-up/Interest Income: Profit Before Taxation 22,198,843 23,249,286shahzad khalidNo ratings yet

- Sterling Bank PLC Abridged Financial Statement For The Year Ended September 30, 2008Document1 pageSterling Bank PLC Abridged Financial Statement For The Year Ended September 30, 2008Sterling Bank PLCNo ratings yet

- Greetings Everyone: To My PresentationDocument15 pagesGreetings Everyone: To My PresentationZakaria ShuvoNo ratings yet

- IFRS FinalDocument69 pagesIFRS FinalHardik SharmaNo ratings yet

- Group D - Case 28 AutozoneDocument29 pagesGroup D - Case 28 AutozoneVinithi ThongkampalaNo ratings yet

- Finacial Position FINAL GLOBE TELECOMDocument4 pagesFinacial Position FINAL GLOBE TELECOMLenard TaberdoNo ratings yet

- Renata LimitedDocument18 pagesRenata LimitedSaqeef RayhanNo ratings yet

- Atlas Honda - Balance SheetDocument1 pageAtlas Honda - Balance SheetMail MergeNo ratings yet

- GDT Fsa 1Document17 pagesGDT Fsa 1Đào Huyền Trang 4KT-20ACNNo ratings yet

- Financial Statement Analysis UnsolvedDocument3 pagesFinancial Statement Analysis Unsolvedavani singhNo ratings yet

- International Finance Investment and Commerce Bank Limited Profit and Loss Account For The Year Ended 31 December 2020 Particulars 2020 2021Document2 pagesInternational Finance Investment and Commerce Bank Limited Profit and Loss Account For The Year Ended 31 December 2020 Particulars 2020 2021Md. Safiqul IslamNo ratings yet

- Balance Sheet of WiproDocument3 pagesBalance Sheet of WiproRinni JainNo ratings yet

- ($ in Millions, Unless Othrewise Denoted) : Financial StatementsDocument4 pages($ in Millions, Unless Othrewise Denoted) : Financial Statementsapi-454737634No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- MBA Dissertation TitleDocument5 pagesMBA Dissertation Titleyadgar_870% (1)

- AIN2601 Assessment 2 Download S2Document24 pagesAIN2601 Assessment 2 Download S2Makhathini KutlwanoNo ratings yet

- Dupont System For Financial AnalysisDocument31 pagesDupont System For Financial AnalysisNacho Trujillo MazorraNo ratings yet

- Recent Trend in New Issue MarketDocument14 pagesRecent Trend in New Issue MarketAbhi SinhaNo ratings yet

- ContinueDocument2 pagesContinuePrakash MishraNo ratings yet

- Money Measurement ConceptDocument3 pagesMoney Measurement Conceptabramuli859No ratings yet

- IFRS 17 Assets For Acquisition Cash Flows: Explanatory ReportDocument34 pagesIFRS 17 Assets For Acquisition Cash Flows: Explanatory ReportWubneh AlemuNo ratings yet

- Megaworld 2017 Bonds Main Prospectus As of 19 January 2017Document117 pagesMegaworld 2017 Bonds Main Prospectus As of 19 January 2017Eunji eunNo ratings yet

- Data Example E: Chapter 8: Applying ExcelDocument12 pagesData Example E: Chapter 8: Applying ExcelBana KhafafNo ratings yet

- Best Mutual Fund For SIPDocument129 pagesBest Mutual Fund For SIPRishi KumarNo ratings yet

- Question Revision A182Document5 pagesQuestion Revision A182Ke TingNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/22Document20 pagesCambridge International AS & A Level: ACCOUNTING 9706/22tarunyadavfutureNo ratings yet

- CP Project 09 16Document50 pagesCP Project 09 16trialerrr0No ratings yet

- Behavioral Finance and The Psychology of Investing: Mcgraw-Hill/IrwinDocument54 pagesBehavioral Finance and The Psychology of Investing: Mcgraw-Hill/IrwinNINDI VAULIANo ratings yet

- Market Risk For Single Trading PositionsDocument18 pagesMarket Risk For Single Trading PositionsDaplet ChrisNo ratings yet

- Futures and Options Spring17-Part IIIDocument95 pagesFutures and Options Spring17-Part IIITharun SriramNo ratings yet

- DepartmentalDocument29 pagesDepartmentalnus jahanNo ratings yet

- Ar2018 FinancialDocument321 pagesAr2018 FinancialJam UsmanNo ratings yet

- Fixed Asset Register NotesDocument9 pagesFixed Asset Register NotesNeema EzekielNo ratings yet

- (Ust-Jpia) Quiz 1 Intermediate Accounting 2 Solution ManualDocument6 pages(Ust-Jpia) Quiz 1 Intermediate Accounting 2 Solution ManualRENZ ALFRED ASTRERONo ratings yet

- Business Plan Pro Forma For ZGE 4308. - 69011769Document6 pagesBusiness Plan Pro Forma For ZGE 4308. - 69011769reyes.rachiellaloisNo ratings yet

- SAP Results Analysis For BeginnersDocument21 pagesSAP Results Analysis For BeginnersSUNIL palNo ratings yet

- Bond Prices and YieldsDocument52 pagesBond Prices and YieldsNaeemNo ratings yet

- Resilience 2021-Market PulseDocument45 pagesResilience 2021-Market PulseNishit GolchhaNo ratings yet

- Independent Equity ResearchDocument12 pagesIndependent Equity ResearchsubodhsharmaNo ratings yet

- Accounting SyllabiDocument2 pagesAccounting SyllabiJyotirmaya MaharanaNo ratings yet

- Kane, Jim - 07 Trade ManagementDocument243 pagesKane, Jim - 07 Trade Managementeleph100% (1)

- Quiz Ia1 Chapter 5 Notes ReceivableDocument1 pageQuiz Ia1 Chapter 5 Notes ReceivableRoyu BreakerNo ratings yet

- Financial Markets: Mid-Term ExaminationDocument13 pagesFinancial Markets: Mid-Term ExaminationJazzmine DalangpanNo ratings yet

Tempe FS Final v3

Tempe FS Final v3

Uploaded by

edgsd050 ratings0% found this document useful (0 votes)

33 views5 pagesThe document provides financial statements for Tempe, Inc. for the years 2004-2007. It includes statements of financial condition, performance, and cash flows. Some key points:

- Cash and cash equivalents fluctuated over the years, highest in 2007 at 30 billion PHP.

- Revenue grew each year from 70 billion PHP in 2005 to 86 billion PHP in 2007.

- Net income also increased each year, from 5.9 billion PHP in 2005 to 11.7 billion PHP in 2007.

- Cash flow from operating activities was positive in 2005 and 2007 but negative in 2006.

Original Description:

Tempe Case Study

Copyright

© © All Rights Reserved

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides financial statements for Tempe, Inc. for the years 2004-2007. It includes statements of financial condition, performance, and cash flows. Some key points:

- Cash and cash equivalents fluctuated over the years, highest in 2007 at 30 billion PHP.

- Revenue grew each year from 70 billion PHP in 2005 to 86 billion PHP in 2007.

- Net income also increased each year, from 5.9 billion PHP in 2005 to 11.7 billion PHP in 2007.

- Cash flow from operating activities was positive in 2005 and 2007 but negative in 2006.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

0 ratings0% found this document useful (0 votes)

33 views5 pagesTempe FS Final v3

Tempe FS Final v3

Uploaded by

edgsd05The document provides financial statements for Tempe, Inc. for the years 2004-2007. It includes statements of financial condition, performance, and cash flows. Some key points:

- Cash and cash equivalents fluctuated over the years, highest in 2007 at 30 billion PHP.

- Revenue grew each year from 70 billion PHP in 2005 to 86 billion PHP in 2007.

- Net income also increased each year, from 5.9 billion PHP in 2005 to 11.7 billion PHP in 2007.

- Cash flow from operating activities was positive in 2005 and 2007 but negative in 2006.

Copyright:

© All Rights Reserved

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

Download as xls, pdf, or txt

You are on page 1of 5

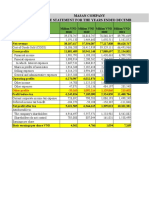

Tempe, Inc.

Statements of Financial Condition

As of December 31

Annex B-1

(Amounts in Php '000s) 2004 2005 2006 2007 Notes

Assets

Current Assets

Cash and cash equivalents 10,391,301 27,398,529 17,830,549 30,366,623

Accounts and notes receivable - net 17,469,560 38,571,243 51,245,348 30,421,314

Inventories 8,729,384 9,391,896 9,959,899 10,216,768

Interest receivable 234,284 350,987 107,568 846,523

Other current assets 3,047,165 3,961,315 4,357,447 3,601,195

Total current Assets 39,871,694 79,673,970 83,500,810 75,452,423

Noncurrent assets

Noncurrent accounts and notes receivable 2,519,816 2,799,796 1,259,908 - Starting from 2004, Tempe ceased to allow installment sales. Hence, the decline is due to the maturity of the existing installment sales only

Land and improvements 16,587,010 16,587,010 16,587,010 16,587,010 No change in value

Investments in associates and jointly-controlled entities - net 21,294,519 16,770,984 25,023,882 34,732,060

Investments in bonds and other securities 6,390,363 6,385,701 6,458,125 7,253,706 Assume to be foreign bonds and securities, no change except for forex loss; generates dividend income

Investment properties 16,794,662 14,443,845 15,927,160 12,575,037 Investment income is assumed to be derived from this, as well as gain from sale of investments

Property, Plant and equipment, net 19,057,075 17,342,398 14,752,040 11,763,161 No new investment in PPE

Intangible assets 4,429,855 2,514,115 2,296,535 1,633,944 No new investment in intangible assets

Other noncurrent assets 1,785,374 1,623,067 2,053,180 2,231,718

Total noncurrent assets 88,858,674 78,466,916 84,357,840 86,776,636

Total assets 128,730,368 158,140,885 167,858,651 162,229,059

Liabilities and equity

Current liabilities

Accounts payable and accrued expenses 18,325,716 45,974,369 31,180,077 24,775,418

Short term debt 2,504,007 2,504,007 2,504,007 -

Current portion of noncurrent bank debt 9,359,594 9,359,594 9,359,594 9,359,594

Interest Payable 1,899,765 2,671,717 3,449,526 2,997,580

Income tax payable 457,653 1,088,603 1,334,552 1,627,526

Other current liabilities 1,453,013 1,651,151 1,380,362 1,598,314

Total current liabilities 33,999,748 63,249,441 49,208,118 40,358,432

Noncurrent liabilities

Bank debt 47,543,879 38,517,839 29,158,245 19,798,651

Bonds offered - - 25,000,000 25,000,000 Issued bonds at face value on Oct 1, 2006, at 9% coupon rate. Principal payable after 15 years

Other noncurrent liabilities 2,306,079 5,582,786 5,169,247 6,018,244

Total noncurrent liabilities 49,849,958 44,100,625 59,327,492 50,816,895

Total Liabilities 83,849,706 107,350,066 108,535,610 91,175,327

Equity

Paid up capital 41,045,676 41,045,676 41,045,676 41,045,676

Retained earnings 3,834,986 9,745,143 18,277,365 30,008,056

Total equity 44,880,662 50,790,819 59,323,041 71,053,732

Total liabilities and owners's quity 128,730,368 158,140,885 167,858,651 162,229,059

Tempe, Inc.

Statements of Financial Performance

For the years ended December 31

Annex B-2

(Amounts in Php '000s) 2005 2006 2007 Notes

Revenue

Sales and services 58,789,776 63,394,230 68,578,214

Equity in net income of associates and jointly controlled entities 3,202,301 3,252,898 4,708,178

Interest Income 1,753,654 1,520,858 1,693,045

Other income 5,948,459 6,998,009 10,728,375

Total Revenue 69,694,190 75,165,995 85,707,812

Costs and expenses

Cost of Sales and Services 48,678,956 50,857,337 53,169,110

General and administrative 6,311,324 7,708,161 9,498,306

Interest expense and other financing charges 5,343,433 5,586,552 6,370,160

Other charges 2,219,300 386,919 1,569,944

Total costs and expenses 62,553,013 64,538,969 70,607,520

Income before income tax 7,141,177 10,627,026 15,100,292

Income tax (at 35%) 1,231,020 2,094,805 3,369,601

Net income 5,910,157 8,532,221 11,730,692

Tempe, Inc.

Statements of Cash Flows

As of December 31

Annex B-3

(Amounts in Php '000s) 2,005 2,006 2,007

EBIT 7,141,177 10,627,026 15,100,292

Adjustments: noncash items and interest

Depreciation 1,714,677 2,590,358 2,988,879

Goodwill amortization and impairment 1,915,740 217,580 662,591

Provision for bad debts 401,418 379,783 412,770

Interest income (1,753,654) (1,520,858) (1,693,045)

Interest expense 5,343,433 5,586,552 6,370,160

Forex gain/loss 4,662 (72,424) (795,581)

Equity from net income of associates and jointly-controlled entities (3,202,301) (3,252,898) (4,708,178)

EBITDA 11,565,152 14,555,119 18,337,888

Adjustments: cash items not from operating activities

Gain from sale of investments (1,146,473) (1,385,523) (2,211,206)

Dividend income (95,774) (180,250) (73,500)

Investment income (889,407) (285,227) (73,500)

Operating income before working capital changes 9,433,499 12,704,120 15,979,683

Working capital changes

Accounts and notes receivable - gross (21,503,101) (13,053,888) 20,411,264

Inventories (662,512) (568,003) (256,869)

Other current assets (914,150) (396,132) 756,251

Noncurrent accounts and notes receivable (279,980) 1,539,888 1,259,908

Accounts payable and accrued expenses 27,648,653 (14,794,293) (6,404,659)

Short term debt - - (2,504,007)

Other current liabilities 198,138 (270,789) 217,952

Payment for income tax (600,070) (1,848,855) (3,076,627)

Net cash from operating activities 13,320,478 (16,687,952) 26,382,896

Cash flow from investing activities

Investments in associates and jointly-controlled entities - net 7,725,836 (5,000,000) (5,000,000)

Proceeds from interest receivable 1,636,951 1,764,277 954,091

Investment properties

Acquisition - (4,359,850) -

Disposal 2,350,817 2,876,535 3,352,123

Gain from Disposal 1,146,473 1,385,523 2,211,206

Other noncurrent assets 162,307 (430,113) (178,537)

Dividend income (from investment in bonds and other securities) 95,774 180,250 73,500

Investment income (from investment property) 889,407 285,227 73,500

Other noncurrent liabilities 3,276,707 (413,540) 848,997

Net cash from investing activities 17,284,271 (3,711,691) 2,334,879

Cash flow from financing activities

Proceeds from bond issuance - 25,000,000 -

Payments for debt (9,026,040) (9,359,594) (9,359,594)

Payments for interest payable (4,571,482) (4,808,743) (6,822,106)

Net cash from financing activities (13,597,522) 10,831,664 (16,181,700)

Net cash flow 17,007,228 (9,567,980) 12,536,074

Beginning cash 10,391,301 27,398,529 17,830,549

Ending cash 27,398,529 17,830,549 30,366,623

Tempe, Inc.

Balance Sheet Schedules

As of December 31

Annex B-4

(Amounts in Php '000s) 2005 2006 2007

Schedule 1: Interest Receivable

Interest Receivable, Beginning 234,284 350,987 107,568

Interest Income 1,753,654 1,520,858 1,693,045

Interest Receivable, end 350,987 107,568 846,523

Interest Received 1,636,951 1,764,277 954,091

Schedule 2: Interest Payable

Interest Payable, Beginning 1,899,765 2,671,717 3,449,526

Interest Expense 5,343,433 5,586,552 6,370,160

Interest Payable, End 2,671,717 3,449,526 2,997,580

Interest Paid 4,571,482 4,808,743 6,822,106

Schedule 3: Income Tax Payable

Interest Payable, Beginning 457,653 1,088,603 1,334,552

Interest Expense 1,231,020 2,094,805 3,369,601

Interest Payable, End 1,088,603 1,334,552 1,627,526

Interest Paid 600,070 1,848,855 3,076,627

Schedule 4: Investment Property

Investment Property, beginning 16,794,662 14,443,845 15,927,160

Investment Property, end 14,443,845 15,927,160 12,575,037

difference 2,350,817 (1,483,315) 3,352,123

Acquisitions (book value) 4,359,850

Disposals (book value) 2,350,817 2,876,535 3,352,123

Schedule 5: Bank interest

bank debt beginning 47,543,879 38,517,839 29,158,245

Bank debt, end 38,517,839 29,158,245 19,798,651

Reclassification to current debt 9,026,040 9,359,594 9,359,594

Short term debt beginning 2,504,007 2,504,007 2,504,007

Short term debt end 2,504,007 2,504,007 -

Payments made - - 2,504,007

Current portion of bank debt, beginning 9,359,594 9,359,594 9,359,594

Current portion of bank debt, end 9,359,594 9,359,594 9,359,594

Difference - - -

Reclassification from long-term bank debt 9,026,040 9,359,594 9,359,594

Payments made 9,026,040 9,359,594 9,359,594

Schedule 6: Bonds issued

Bonds - beginning balance - - 25,000,000

Bonds - ending balance - 25,000,000 25,000,000

Cash from bonds - 25,000,000 -

Tempe, Inc.

Profit and Loss Schedules

For the years ended December 31

Annex B-5

(Amounts in Php '000s) 2005 2006 2007 Notes

Schedule 1: Components of Depreciation Expense

Depreciation Expense

In Cost of sales and services 1,243,495 1,960,042 1,971,932

in General and administrative expenses 471,182 630,316 1,016,947

Total Depreciation Expense 1,714,677 2,590,358 2,988,879

Schedule 2: Components of General and Administrative Expense

General and administrative expenses

Personnel costs 3,110,135 3,959,265 4,168,554

Depreciation and amortization 471,182 630,316 1,016,947

Profesisonal fees 375,825 574,881 796,979

Taxes and licenses 240,930 349,229 530,583

Transportation and travel 246,878 347,977 376,087

Rental and utilities 157,090 253,519 357,666

Advertising and promotion 129,398 158,455 234,330

Research and development 49 48,561 189,693

Supplies 58,515 111,509 161,459

Postal and Communication 93,234 126,733 153,649

Entertainment 123,474 188,911 141,782

Repairs and maintenance 79,487 81,239 132,257

Provision for doubtful accounts 401,418 379,783 412,770

Donations and contributions 99,927 106,969 126,541

Dues and fees 64,819 65,381 61,033

Insurance 39,319 45,088 59,703

Contract Labor 20,405 23,051 36,952

Others 599,239 557,294 826,390

Total General and administrative expenses 6,311,324 8,008,161 9,783,375

Schedule 3: Other income

Other income

Gain on sale of investments 1,146,473 1,385,523 2,211,206 This is associated with investment property sold

Foreign exchange gain (loss) (4,662) 72,424 795,581 Forex gain/loss is due to the investment in foreign currency bonds

Management and marketing fees 382,050 590,066 485,802 Management and marketing fees are received in cash

Dividend income 95,774 180,250 73,500 Dividend income is received in cash

Investment Income 889,407 285,227 73,500 Investment income is received in cash

Miscellaneous 3,439,418 4,484,520 7,088,787 Miscellaneous Income is received in cash

5,948,459 6,998,009 10,728,375

Schedule 4: Interest Charges

Interest expense and other financing charges

Long term debt 3,630,831 4,160,169 3,506,030

Short-term debt 845,377 512,997 321,891

Bond issuance 562,500 2,250,000 This is associated with bonds issued at the beginning of October 2006, at 9% coupon rate

Others 867,225 350,886 292,239

Total Interest and financing charges 5,343,433 5,586,552 6,370,160

Schedule 5: Other Charges

Other charges

Goodwill amortization and impairment loss 1,915,740 217,580 662,591

Total other charges 303,560 169,339 907,353 Assumed to be cash charges

2,219,300 386,919 1,569,944

You might also like

- Chapter 13-Investments in Noncurrent Operating Assets-Utilization & Re-TirementDocument26 pagesChapter 13-Investments in Noncurrent Operating Assets-Utilization & Re-Tirement수지No ratings yet

- Petron Corp - Financial Analysis From 2014 - 2018Document4 pagesPetron Corp - Financial Analysis From 2014 - 2018Neil Nadua100% (1)

- MCB Financial AnalysisDocument30 pagesMCB Financial AnalysisMuhammad Nasir Khan100% (4)

- Philippine Seven Corporation and SubsidiariesDocument4 pagesPhilippine Seven Corporation and Subsidiariesgirlie ValdezNo ratings yet

- MasanDocument46 pagesMasanNgọc BíchNo ratings yet

- Atlas Honda (2019 22)Document6 pagesAtlas Honda (2019 22)husnainbutt2025No ratings yet

- Balance Sheet - Assets: Period EndingDocument3 pagesBalance Sheet - Assets: Period Endingvenu54No ratings yet

- Balance Sheet For 2009 & 2008: Assets 2009 (Nu.) 2008 (Nu.)Document3 pagesBalance Sheet For 2009 & 2008: Assets 2009 (Nu.) 2008 (Nu.)Singye SherubNo ratings yet

- AssetsDocument3 pagesAssetsyasrab abbasNo ratings yet

- Askari Bank Limited Financial Statement AnalysisDocument16 pagesAskari Bank Limited Financial Statement AnalysisAleeza FatimaNo ratings yet

- Pragathi Infra - Financial StatementDocument3 pagesPragathi Infra - Financial StatementAnurag ShuklaNo ratings yet

- Ratio AnaylisDocument5 pagesRatio Anaylisfinance.mhotelkigaliNo ratings yet

- Empire East: Q2/H1 Financial StatementDocument34 pagesEmpire East: Q2/H1 Financial StatementBusinessWorldNo ratings yet

- Property and Assets: AB Bank Balance SheetDocument17 pagesProperty and Assets: AB Bank Balance SheetRafiul IslamNo ratings yet

- Pinancle FinancialsDocument6 pagesPinancle FinancialsJhorghe GonzalezNo ratings yet

- Starbucks Corporation (SBUX) Income Statement: Análisis de Estados FinancierosDocument7 pagesStarbucks Corporation (SBUX) Income Statement: Análisis de Estados FinancierosjosolcebNo ratings yet

- Excel File SuzukiDocument18 pagesExcel File SuzukiMahnoor AfzalNo ratings yet

- Filinvest Land 2006-2010Document18 pagesFilinvest Land 2006-2010Christian VillarNo ratings yet

- HBL Financial Statements - December 31, 2022Document251 pagesHBL Financial Statements - December 31, 2022Muhammad MuzammilNo ratings yet

- Suzuki Motor Corporation Balance Sheet AS ON DEC 31 .. AssetsDocument3 pagesSuzuki Motor Corporation Balance Sheet AS ON DEC 31 .. AssetsM Bilal KNo ratings yet

- Deferred Tax Asset Retirement Benefit Assets: TotalDocument2 pagesDeferred Tax Asset Retirement Benefit Assets: TotalSrb RNo ratings yet

- BHEL Valuation FinalDocument33 pagesBHEL Valuation FinalragulNo ratings yet

- Finance NFL & MitchelsDocument10 pagesFinance NFL & Mitchelsrimshaanwar617No ratings yet

- 2-Annex A Cpfi Afs ConsoDocument97 pages2-Annex A Cpfi Afs ConsoCynthia PenoliarNo ratings yet

- FIN440 Phase 2 ExcelDocument27 pagesFIN440 Phase 2 ExcelRiddo BadhonNo ratings yet

- MFI NCC Bank XL ReportsDocument27 pagesMFI NCC Bank XL ReportsSaid Ur RahmanNo ratings yet

- FirstBank Unaudited Half Year Results For Period Ending June 2010Document1 pageFirstBank Unaudited Half Year Results For Period Ending June 2010Kunle AdegboyeNo ratings yet

- Crescent Textile Mills LTD AnalysisDocument23 pagesCrescent Textile Mills LTD AnalysisMuhammad Noman MehboobNo ratings yet

- Auditors Report: Financial Result 2005-2006Document11 pagesAuditors Report: Financial Result 2005-2006Hay JirenyaaNo ratings yet

- Balance Sheet: Pyramid Analysis Exercise Year 1 Year 2 Year 3 Year 4Document9 pagesBalance Sheet: Pyramid Analysis Exercise Year 1 Year 2 Year 3 Year 4PylypNo ratings yet

- Assets: Balance SheetDocument4 pagesAssets: Balance SheetAsadvirkNo ratings yet

- Netflix Spreadsheet - SMG ToolsDocument9 pagesNetflix Spreadsheet - SMG ToolsJohn AngNo ratings yet

- Fsap 8e - Pepsico 2012Document46 pagesFsap 8e - Pepsico 2012Allan Ahmad Sarip100% (1)

- PIOC Data For Corporate ValuationDocument6 pagesPIOC Data For Corporate ValuationMuhammad Ali SamarNo ratings yet

- Balance SheetDocument3 pagesBalance SheetMd. Saiful IslamNo ratings yet

- GSK Financial FiguresDocument35 pagesGSK Financial FiguresKalenga CyrilleNo ratings yet

- Complete Financial Model & Valuation of ARCCDocument46 pagesComplete Financial Model & Valuation of ARCCgr5yjjbmjsNo ratings yet

- Purcari Lucru IndividualDocument7 pagesPurcari Lucru IndividualLenuța PapucNo ratings yet

- ABS-CBN Corporation and Subsidiaries Consolidated Statements of Financial Position (Amounts in Thousands)Document10 pagesABS-CBN Corporation and Subsidiaries Consolidated Statements of Financial Position (Amounts in Thousands)Mark Angelo BustosNo ratings yet

- Valuation Report SonyDocument38 pagesValuation Report SonyankurNo ratings yet

- Rak Ceramics: Income StatementDocument27 pagesRak Ceramics: Income StatementRafsan JahangirNo ratings yet

- Final Pyramid of Ratios: Strictly ConfidentialDocument3 pagesFinal Pyramid of Ratios: Strictly ConfidentialaeqlehczeNo ratings yet

- Annual Report 2014, 2105 & 2016: Financial Statemnts & Financial Ratio AnalysisDocument12 pagesAnnual Report 2014, 2105 & 2016: Financial Statemnts & Financial Ratio AnalysisM Bilal K100% (1)

- FIN 440 Group Task 1Document104 pagesFIN 440 Group Task 1দিপ্ত বসুNo ratings yet

- NICOL Financial Statement For The Period Ended 30 Sept 2023Document4 pagesNICOL Financial Statement For The Period Ended 30 Sept 2023Uk UkNo ratings yet

- Non-Mark-up/Interest Income: Profit Before Taxation 22,198,843 23,249,286Document8 pagesNon-Mark-up/Interest Income: Profit Before Taxation 22,198,843 23,249,286shahzad khalidNo ratings yet

- Sterling Bank PLC Abridged Financial Statement For The Year Ended September 30, 2008Document1 pageSterling Bank PLC Abridged Financial Statement For The Year Ended September 30, 2008Sterling Bank PLCNo ratings yet

- Greetings Everyone: To My PresentationDocument15 pagesGreetings Everyone: To My PresentationZakaria ShuvoNo ratings yet

- IFRS FinalDocument69 pagesIFRS FinalHardik SharmaNo ratings yet

- Group D - Case 28 AutozoneDocument29 pagesGroup D - Case 28 AutozoneVinithi ThongkampalaNo ratings yet

- Finacial Position FINAL GLOBE TELECOMDocument4 pagesFinacial Position FINAL GLOBE TELECOMLenard TaberdoNo ratings yet

- Renata LimitedDocument18 pagesRenata LimitedSaqeef RayhanNo ratings yet

- Atlas Honda - Balance SheetDocument1 pageAtlas Honda - Balance SheetMail MergeNo ratings yet

- GDT Fsa 1Document17 pagesGDT Fsa 1Đào Huyền Trang 4KT-20ACNNo ratings yet

- Financial Statement Analysis UnsolvedDocument3 pagesFinancial Statement Analysis Unsolvedavani singhNo ratings yet

- International Finance Investment and Commerce Bank Limited Profit and Loss Account For The Year Ended 31 December 2020 Particulars 2020 2021Document2 pagesInternational Finance Investment and Commerce Bank Limited Profit and Loss Account For The Year Ended 31 December 2020 Particulars 2020 2021Md. Safiqul IslamNo ratings yet

- Balance Sheet of WiproDocument3 pagesBalance Sheet of WiproRinni JainNo ratings yet

- ($ in Millions, Unless Othrewise Denoted) : Financial StatementsDocument4 pages($ in Millions, Unless Othrewise Denoted) : Financial Statementsapi-454737634No ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- MBA Dissertation TitleDocument5 pagesMBA Dissertation Titleyadgar_870% (1)

- AIN2601 Assessment 2 Download S2Document24 pagesAIN2601 Assessment 2 Download S2Makhathini KutlwanoNo ratings yet

- Dupont System For Financial AnalysisDocument31 pagesDupont System For Financial AnalysisNacho Trujillo MazorraNo ratings yet

- Recent Trend in New Issue MarketDocument14 pagesRecent Trend in New Issue MarketAbhi SinhaNo ratings yet

- ContinueDocument2 pagesContinuePrakash MishraNo ratings yet

- Money Measurement ConceptDocument3 pagesMoney Measurement Conceptabramuli859No ratings yet

- IFRS 17 Assets For Acquisition Cash Flows: Explanatory ReportDocument34 pagesIFRS 17 Assets For Acquisition Cash Flows: Explanatory ReportWubneh AlemuNo ratings yet

- Megaworld 2017 Bonds Main Prospectus As of 19 January 2017Document117 pagesMegaworld 2017 Bonds Main Prospectus As of 19 January 2017Eunji eunNo ratings yet

- Data Example E: Chapter 8: Applying ExcelDocument12 pagesData Example E: Chapter 8: Applying ExcelBana KhafafNo ratings yet

- Best Mutual Fund For SIPDocument129 pagesBest Mutual Fund For SIPRishi KumarNo ratings yet

- Question Revision A182Document5 pagesQuestion Revision A182Ke TingNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/22Document20 pagesCambridge International AS & A Level: ACCOUNTING 9706/22tarunyadavfutureNo ratings yet

- CP Project 09 16Document50 pagesCP Project 09 16trialerrr0No ratings yet

- Behavioral Finance and The Psychology of Investing: Mcgraw-Hill/IrwinDocument54 pagesBehavioral Finance and The Psychology of Investing: Mcgraw-Hill/IrwinNINDI VAULIANo ratings yet

- Market Risk For Single Trading PositionsDocument18 pagesMarket Risk For Single Trading PositionsDaplet ChrisNo ratings yet

- Futures and Options Spring17-Part IIIDocument95 pagesFutures and Options Spring17-Part IIITharun SriramNo ratings yet

- DepartmentalDocument29 pagesDepartmentalnus jahanNo ratings yet

- Ar2018 FinancialDocument321 pagesAr2018 FinancialJam UsmanNo ratings yet

- Fixed Asset Register NotesDocument9 pagesFixed Asset Register NotesNeema EzekielNo ratings yet

- (Ust-Jpia) Quiz 1 Intermediate Accounting 2 Solution ManualDocument6 pages(Ust-Jpia) Quiz 1 Intermediate Accounting 2 Solution ManualRENZ ALFRED ASTRERONo ratings yet

- Business Plan Pro Forma For ZGE 4308. - 69011769Document6 pagesBusiness Plan Pro Forma For ZGE 4308. - 69011769reyes.rachiellaloisNo ratings yet

- SAP Results Analysis For BeginnersDocument21 pagesSAP Results Analysis For BeginnersSUNIL palNo ratings yet

- Bond Prices and YieldsDocument52 pagesBond Prices and YieldsNaeemNo ratings yet

- Resilience 2021-Market PulseDocument45 pagesResilience 2021-Market PulseNishit GolchhaNo ratings yet

- Independent Equity ResearchDocument12 pagesIndependent Equity ResearchsubodhsharmaNo ratings yet

- Accounting SyllabiDocument2 pagesAccounting SyllabiJyotirmaya MaharanaNo ratings yet

- Kane, Jim - 07 Trade ManagementDocument243 pagesKane, Jim - 07 Trade Managementeleph100% (1)

- Quiz Ia1 Chapter 5 Notes ReceivableDocument1 pageQuiz Ia1 Chapter 5 Notes ReceivableRoyu BreakerNo ratings yet

- Financial Markets: Mid-Term ExaminationDocument13 pagesFinancial Markets: Mid-Term ExaminationJazzmine DalangpanNo ratings yet