Professional Documents

Culture Documents

Thus Core Banking Components Include

Thus Core Banking Components Include

Uploaded by

Mohit AgarwalCopyright:

Available Formats

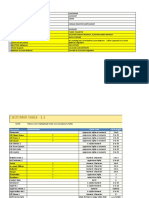

You might also like

- The Park Hotels Designing Experience Case SolutionDocument60 pagesThe Park Hotels Designing Experience Case Solutionvivek singhNo ratings yet

- Core Banking SolutionsDocument13 pagesCore Banking Solutionssharmil_jainNo ratings yet

- SEPA Payment Initiation Format (PAIN.001)Document9 pagesSEPA Payment Initiation Format (PAIN.001)Rajendra PilludaNo ratings yet

- Core Banking System Selection Services Scope Sheet v3Document3 pagesCore Banking System Selection Services Scope Sheet v3dialanassar100% (2)

- Core BankingDocument37 pagesCore Bankingnwani25No ratings yet

- Core Banking System Strategy A Complete Guide - 2020 EditionFrom EverandCore Banking System Strategy A Complete Guide - 2020 EditionNo ratings yet

- THESISDocument7 pagesTHESISJenelle EulloNo ratings yet

- Identify: Business Management April 2021 Swot AnalysisDocument2 pagesIdentify: Business Management April 2021 Swot AnalysismormorNo ratings yet

- Call Centers in India BPO Companies in India Call Centres in IndiaDocument200 pagesCall Centers in India BPO Companies in India Call Centres in IndiaChennai GuyNo ratings yet

- Core BankingDocument16 pagesCore Bankingaparnasudha136No ratings yet

- Core Banking SystemsDocument25 pagesCore Banking SystemsSaravananSrvnNo ratings yet

- Core BankingDocument15 pagesCore BankingAnkushnegiNo ratings yet

- TCS BaNCS Research Journal Issue 3 0713 1Document52 pagesTCS BaNCS Research Journal Issue 3 0713 1Poovana Kokkalera PNo ratings yet

- Temenos and SQL Server Highwater Benchmark Report Final With XIODocument18 pagesTemenos and SQL Server Highwater Benchmark Report Final With XIOsreeks456No ratings yet

- Fields and Meaning For All ApplicationsDocument11 pagesFields and Meaning For All ApplicationsPriyanka RautNo ratings yet

- Model Bank: Universal Banking - Pre-Sales Demo User Guide (R19 Build)Document19 pagesModel Bank: Universal Banking - Pre-Sales Demo User Guide (R19 Build)igomez0% (1)

- Temenos Multifonds: Investment AccountingDocument8 pagesTemenos Multifonds: Investment Accountingravishankarchauhan2455No ratings yet

- Core Banking Project On Union BankDocument36 pagesCore Banking Project On Union Bankkushal8120% (1)

- Data Migration Strategy and Design: ProjectDocument17 pagesData Migration Strategy and Design: ProjectBoogiewoogieNo ratings yet

- ACAMS-Financial Inclusion Certificate-EN-G-Study Guide-V1.0Document49 pagesACAMS-Financial Inclusion Certificate-EN-G-Study Guide-V1.0lahrourNo ratings yet

- Study On Cbs With Tcs - SBIDocument22 pagesStudy On Cbs With Tcs - SBIvarghese.mathewNo ratings yet

- Banking Products & Services IDocument34 pagesBanking Products & Services IAinnur HaziqahNo ratings yet

- t24 290 Expanded Due Diligence Questions 30 Mar 2018 Ver 1 03Document135 pagest24 290 Expanded Due Diligence Questions 30 Mar 2018 Ver 1 03Robert Livingston Jr.No ratings yet

- A Case For A Single Loan Origination System For Core Banking Products PDFDocument5 pagesA Case For A Single Loan Origination System For Core Banking Products PDFansh_hcetNo ratings yet

- Customer Information File User Manual PDFDocument314 pagesCustomer Information File User Manual PDFFahim KaziNo ratings yet

- TEFADocument2 pagesTEFAMadjid MansouriNo ratings yet

- Lecture 1 - Digital BankingDocument28 pagesLecture 1 - Digital BankingTrinh Phan Thị NgọcNo ratings yet

- Training Course Catalogue 2017 Fw1701Document80 pagesTraining Course Catalogue 2017 Fw1701adane24No ratings yet

- Core Banking Partner GuideDocument19 pagesCore Banking Partner GuideClint JacobNo ratings yet

- TLC Online Learning Pack ContentDocument15 pagesTLC Online Learning Pack ContentjennoNo ratings yet

- Infinity ProductDocument8 pagesInfinity ProductzardarwaseemNo ratings yet

- Temenos Integration With Union Pay and VISADocument5 pagesTemenos Integration With Union Pay and VISAPaxy SENGOUDONENo ratings yet

- Criticism of Core Banking Concept in India: Vijay PithadiaDocument8 pagesCriticism of Core Banking Concept in India: Vijay PithadiaParesh BhutadaNo ratings yet

- Mifos X Data Sheet July2015Document4 pagesMifos X Data Sheet July2015konverg101No ratings yet

- Lead To Loan BrochureDocument4 pagesLead To Loan Brochurejoe_inbaNo ratings yet

- Core Banking Solutions FinalDocument6 pagesCore Banking Solutions FinalShashank VarmaNo ratings yet

- SAOUG-FlexCube 12c Architect For DBADocument14 pagesSAOUG-FlexCube 12c Architect For DBAChuong NguyenNo ratings yet

- Business Case For A New Core Banking Solution - Jul 2012Document13 pagesBusiness Case For A New Core Banking Solution - Jul 2012Francis Ekemu100% (1)

- Core Banking Systems SurveyDocument71 pagesCore Banking Systems Surveyborisg3100% (1)

- cs-131121 Temenos Swissquote PDFDocument12 pagescs-131121 Temenos Swissquote PDFadnanbwNo ratings yet

- Temenos T24 PW Client ReportingDocument2 pagesTemenos T24 PW Client ReportingSyed Muhammad Ali SadiqNo ratings yet

- Core Banking SolutionDocument42 pagesCore Banking SolutionbusinessmbaNo ratings yet

- Core BankingDocument12 pagesCore BankingPriyanka GovalkarNo ratings yet

- T24 Temenos Transact Core BankingDocument2 pagesT24 Temenos Transact Core BankingG V Suhas ReddyNo ratings yet

- Product ArchitectureDocument26 pagesProduct ArchitectureTrần Hữu LượngNo ratings yet

- Core BankingDocument3 pagesCore BankingRekha Raghavan NandakumarNo ratings yet

- Temenos T24Document4 pagesTemenos T24Sind Baad50% (2)

- MIfosX-DB-Schema Diagram v02Document1 pageMIfosX-DB-Schema Diagram v02Stupid TeenNo ratings yet

- Swift Platform Readiness Webinars Jul Aug 2021 Full Deck SDCDocument30 pagesSwift Platform Readiness Webinars Jul Aug 2021 Full Deck SDCJordan FouassierNo ratings yet

- Temenos Products Infinity BrochureDocument12 pagesTemenos Products Infinity Brochureelswidi100% (1)

- Consumer Lending - Whitepaper PDFDocument3 pagesConsumer Lending - Whitepaper PDFAbhinavNo ratings yet

- Data Migration SheetDocument58 pagesData Migration SheetWai100% (1)

- Chapter 1 - Introduction To Digital Banking - V1.0Document17 pagesChapter 1 - Introduction To Digital Banking - V1.0prabhjinderNo ratings yet

- Retail Banking Training MaterialDocument96 pagesRetail Banking Training MaterialTemesgen DentamoNo ratings yet

- A Case For A Single Loan Origination System For Core Banking ProductsDocument5 pagesA Case For A Single Loan Origination System For Core Banking ProductsCognizant100% (1)

- R11 User GuideDocument39 pagesR11 User Guidemukeshdograji100% (1)

- Intermediate Verb DictionaryDocument38 pagesIntermediate Verb DictionaryDominique HoffmanNo ratings yet

- Collections 12 0Document76 pagesCollections 12 0Pearl AsiamahNo ratings yet

- TCS Bancs Core Banking 09 2009Document2 pagesTCS Bancs Core Banking 09 2009shahruchirNo ratings yet

- IT Infrastructure Deployment A Complete Guide - 2020 EditionFrom EverandIT Infrastructure Deployment A Complete Guide - 2020 EditionNo ratings yet

- Banking DomainDocument7 pagesBanking DomainManju DarsiNo ratings yet

- Mobile Application TestingDocument40 pagesMobile Application TestingChandan Dash0% (1)

- Software Testing Interview QuestionsDocument30 pagesSoftware Testing Interview QuestionsPraveen Kumar P.VNo ratings yet

- Banking DomainDocument7 pagesBanking DomainManju DarsiNo ratings yet

- Software Testing Interview QuestionsDocument30 pagesSoftware Testing Interview QuestionsPraveen Kumar P.VNo ratings yet

- Please Provide Your Written Answers To The Following. 1Document12 pagesPlease Provide Your Written Answers To The Following. 1barsapanigrahiNo ratings yet

- Mobile Application TestingDocument40 pagesMobile Application TestingChandan Dash0% (1)

- Supply Side Channel Analysis Channel Flows Ch#3 AnsaryDocument8 pagesSupply Side Channel Analysis Channel Flows Ch#3 Ansarybakedcaked100% (1)

- Bashar MHR FinalDocument12 pagesBashar MHR FinalSHUBRANSHU SEKHARNo ratings yet

- Linking Knowledge Management Orientation To Balanced Scorecard OutcomesDocument26 pagesLinking Knowledge Management Orientation To Balanced Scorecard Outcomesnanda choiriNo ratings yet

- SCI (Function of Expense Method) Tiger CompanyDocument2 pagesSCI (Function of Expense Method) Tiger Companypatricia0% (1)

- Chapter 3 Buying and SellingDocument27 pagesChapter 3 Buying and SellingJude Tan100% (2)

- Corporate Real Estate Facilities ManagementDocument36 pagesCorporate Real Estate Facilities ManagementFaiqmal ZainalNo ratings yet

- Test Bank For Decision Support and Business Intelligence Systems 9th Edition Efraim TurbanDocument12 pagesTest Bank For Decision Support and Business Intelligence Systems 9th Edition Efraim TurbanCatherine SmithNo ratings yet

- Appendix B: Pestle AnalysisDocument2 pagesAppendix B: Pestle AnalysisDerick cheruyotNo ratings yet

- Ch14 Emerging Issues in Accounting and AuditingDocument19 pagesCh14 Emerging Issues in Accounting and AuditingN.s.BudiartoNo ratings yet

- MKTG NotesDocument73 pagesMKTG NotesJonny TiwariNo ratings yet

- Far 1 - Activity 1 - Sept. 09, 2020 - Answer SheetDocument4 pagesFar 1 - Activity 1 - Sept. 09, 2020 - Answer SheetAnonn100% (1)

- Nokia Form 20F 2020Document118 pagesNokia Form 20F 2020it4728No ratings yet

- International Taxation Transfer PricingDocument130 pagesInternational Taxation Transfer PricingABC 123No ratings yet

- Learn Xtra Exam Revision Accounting Part 1 - QDocument31 pagesLearn Xtra Exam Revision Accounting Part 1 - QThuraNo ratings yet

- PHD Thesis On Organizational CultureDocument5 pagesPHD Thesis On Organizational Culturealejandrarodriguezlasvegas100% (2)

- Induvidual Assignment 2 - Hirosha Vejian (264096)Document5 pagesInduvidual Assignment 2 - Hirosha Vejian (264096)Hirosha VejianNo ratings yet

- Companies That Conduct Customer Satisfaction SurveysDocument12 pagesCompanies That Conduct Customer Satisfaction SurveysCath ReyesNo ratings yet

- HRM Report - Continental BuscuitsDocument16 pagesHRM Report - Continental Buscuitsmrblueface100% (1)

- Paper - 6: Auditing and Assurance: © The Institute of Chartered Accountants of IndiaDocument14 pagesPaper - 6: Auditing and Assurance: © The Institute of Chartered Accountants of IndiaMuraliNo ratings yet

- 2016 Revised HandbookDocument75 pages2016 Revised HandbookNoel Jun LinganayNo ratings yet

- Equity Research: Q.1 Top Down and Bottom Up ApproachDocument10 pagesEquity Research: Q.1 Top Down and Bottom Up Approachpuja bhatNo ratings yet

- Idea Generation and Business DevelopmentDocument13 pagesIdea Generation and Business DevelopmentbitetNo ratings yet

- Derivatives and Foreign Currency: Concepts and Common TransactionsDocument28 pagesDerivatives and Foreign Currency: Concepts and Common TransactionsElle PaizNo ratings yet

- EP950100 HSE Management SystemDocument62 pagesEP950100 HSE Management SystemDaniel100% (1)

- 2016 Vol 3 CH 1 AnsDocument2 pages2016 Vol 3 CH 1 AnsRikka TakanashiNo ratings yet

- Answer: DDocument13 pagesAnswer: DKevin T. Onaro100% (1)

Thus Core Banking Components Include

Thus Core Banking Components Include

Uploaded by

Mohit AgarwalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Thus Core Banking Components Include

Thus Core Banking Components Include

Uploaded by

Mohit AgarwalCopyright:

Available Formats

Thus core banking components include:

Interest calculations

Processing of cash deposits and withdrawals

Processing of incoming and outgoing remittances, cheques, etc.

Customer management

Customer account management

Definition of the banks products (product management) including such things as minimum

balances, interest rates, number of withdrawals, etc.

Interest rate definition

Customers standing instructions

Maintaining records of all financial transactions

Challenges for testing in Banking Domain:

There are 3 characteristics that pose specific challenges to testing for banks:

1. Frequently changing market and regulatory requirements

2. High data confidentiality requirements

3. Complex system landscapes including legacy systems

Resulting the Challenges:

challenge 1:Ensure cost-effective regression testing over the application life-cycle

challenge2: Ensure test data usage is compliant with data confidentiality requirements

challenge3: Ensure testing covers system integration and ensure integrity of test data

Testing Approaches:

ForChallenge1: RiskbasedTesting,Automate testcases,off-shore testactivites

It is always a good approach to think about risk-based testing before starting to automate test cases or

starting to off-shore test activities. The aim should be to reduce the number of tests to be executed for

each release (or upgrade) while keeping the risk within an acceptable range

Forchallenge2:

There are two basic approaches that can be taken to achieve compliance

with data confidentiality requirements: Data masking ,Synthetic test data

Data masking tools and techniques can be used to change production

data in a way that it is not sensitive anymore and can be used for testing purposes. The main advantages

of this approach are a good coverage regarding diversity and volume of data and the option to

reproduce production scenarios

synthetic test data is excellent under the aspects of compliance, sustainability and

integrity assuming that the synthetic data is produced the same way as real data in production.

However, the disadvantage is that some gaps regarding coverage always remain, because it is not

possible to synthetically produce all kinds and varieties of data (incl. historical data constellations) with

all systems

Challenge3:system integration test environment (incl. all systems and batch processing).

system integration test environment needs to fulfill the following requirements:

system coverage and operational coverage,Data coverage&Integrity and Environment Management.

he characteristics of a Banking application are as follows:

Multi tier functionality to support thousands of concurrent user sessions

Large scale Integration , typically a banking application integrates with numerous

other applications such as Bill Pay utility and Trading accounts

Complex Business workflows

Real Time and Batch processing

High rate of Transactions per seconds

Secure Transactions

Robust Reporting section to keep track of day to day transactions

Strong Auditing to troubleshoot customer issues

Massive storage system

Disaster Management.

banking application may have:

1. Web Server to interact with end users via Browser

2. Middle Tier to validate the input and output for web server

3. Data Base to store data and procedures

4. Transaction Processor which could be a large capacity Mainframe or any other Legacy

system to carry out Trillions of transactions per second.

http://www.gcreddy.com/2012/11/banking-domain.html#.UUCr8hx_Mmk

http://www.indiumsoft.com/banking_focus.php

books.google.co.in/books?isbn=812033535X

You might also like

- The Park Hotels Designing Experience Case SolutionDocument60 pagesThe Park Hotels Designing Experience Case Solutionvivek singhNo ratings yet

- Core Banking SolutionsDocument13 pagesCore Banking Solutionssharmil_jainNo ratings yet

- SEPA Payment Initiation Format (PAIN.001)Document9 pagesSEPA Payment Initiation Format (PAIN.001)Rajendra PilludaNo ratings yet

- Core Banking System Selection Services Scope Sheet v3Document3 pagesCore Banking System Selection Services Scope Sheet v3dialanassar100% (2)

- Core BankingDocument37 pagesCore Bankingnwani25No ratings yet

- Core Banking System Strategy A Complete Guide - 2020 EditionFrom EverandCore Banking System Strategy A Complete Guide - 2020 EditionNo ratings yet

- THESISDocument7 pagesTHESISJenelle EulloNo ratings yet

- Identify: Business Management April 2021 Swot AnalysisDocument2 pagesIdentify: Business Management April 2021 Swot AnalysismormorNo ratings yet

- Call Centers in India BPO Companies in India Call Centres in IndiaDocument200 pagesCall Centers in India BPO Companies in India Call Centres in IndiaChennai GuyNo ratings yet

- Core BankingDocument16 pagesCore Bankingaparnasudha136No ratings yet

- Core Banking SystemsDocument25 pagesCore Banking SystemsSaravananSrvnNo ratings yet

- Core BankingDocument15 pagesCore BankingAnkushnegiNo ratings yet

- TCS BaNCS Research Journal Issue 3 0713 1Document52 pagesTCS BaNCS Research Journal Issue 3 0713 1Poovana Kokkalera PNo ratings yet

- Temenos and SQL Server Highwater Benchmark Report Final With XIODocument18 pagesTemenos and SQL Server Highwater Benchmark Report Final With XIOsreeks456No ratings yet

- Fields and Meaning For All ApplicationsDocument11 pagesFields and Meaning For All ApplicationsPriyanka RautNo ratings yet

- Model Bank: Universal Banking - Pre-Sales Demo User Guide (R19 Build)Document19 pagesModel Bank: Universal Banking - Pre-Sales Demo User Guide (R19 Build)igomez0% (1)

- Temenos Multifonds: Investment AccountingDocument8 pagesTemenos Multifonds: Investment Accountingravishankarchauhan2455No ratings yet

- Core Banking Project On Union BankDocument36 pagesCore Banking Project On Union Bankkushal8120% (1)

- Data Migration Strategy and Design: ProjectDocument17 pagesData Migration Strategy and Design: ProjectBoogiewoogieNo ratings yet

- ACAMS-Financial Inclusion Certificate-EN-G-Study Guide-V1.0Document49 pagesACAMS-Financial Inclusion Certificate-EN-G-Study Guide-V1.0lahrourNo ratings yet

- Study On Cbs With Tcs - SBIDocument22 pagesStudy On Cbs With Tcs - SBIvarghese.mathewNo ratings yet

- Banking Products & Services IDocument34 pagesBanking Products & Services IAinnur HaziqahNo ratings yet

- t24 290 Expanded Due Diligence Questions 30 Mar 2018 Ver 1 03Document135 pagest24 290 Expanded Due Diligence Questions 30 Mar 2018 Ver 1 03Robert Livingston Jr.No ratings yet

- A Case For A Single Loan Origination System For Core Banking Products PDFDocument5 pagesA Case For A Single Loan Origination System For Core Banking Products PDFansh_hcetNo ratings yet

- Customer Information File User Manual PDFDocument314 pagesCustomer Information File User Manual PDFFahim KaziNo ratings yet

- TEFADocument2 pagesTEFAMadjid MansouriNo ratings yet

- Lecture 1 - Digital BankingDocument28 pagesLecture 1 - Digital BankingTrinh Phan Thị NgọcNo ratings yet

- Training Course Catalogue 2017 Fw1701Document80 pagesTraining Course Catalogue 2017 Fw1701adane24No ratings yet

- Core Banking Partner GuideDocument19 pagesCore Banking Partner GuideClint JacobNo ratings yet

- TLC Online Learning Pack ContentDocument15 pagesTLC Online Learning Pack ContentjennoNo ratings yet

- Infinity ProductDocument8 pagesInfinity ProductzardarwaseemNo ratings yet

- Temenos Integration With Union Pay and VISADocument5 pagesTemenos Integration With Union Pay and VISAPaxy SENGOUDONENo ratings yet

- Criticism of Core Banking Concept in India: Vijay PithadiaDocument8 pagesCriticism of Core Banking Concept in India: Vijay PithadiaParesh BhutadaNo ratings yet

- Mifos X Data Sheet July2015Document4 pagesMifos X Data Sheet July2015konverg101No ratings yet

- Lead To Loan BrochureDocument4 pagesLead To Loan Brochurejoe_inbaNo ratings yet

- Core Banking Solutions FinalDocument6 pagesCore Banking Solutions FinalShashank VarmaNo ratings yet

- SAOUG-FlexCube 12c Architect For DBADocument14 pagesSAOUG-FlexCube 12c Architect For DBAChuong NguyenNo ratings yet

- Business Case For A New Core Banking Solution - Jul 2012Document13 pagesBusiness Case For A New Core Banking Solution - Jul 2012Francis Ekemu100% (1)

- Core Banking Systems SurveyDocument71 pagesCore Banking Systems Surveyborisg3100% (1)

- cs-131121 Temenos Swissquote PDFDocument12 pagescs-131121 Temenos Swissquote PDFadnanbwNo ratings yet

- Temenos T24 PW Client ReportingDocument2 pagesTemenos T24 PW Client ReportingSyed Muhammad Ali SadiqNo ratings yet

- Core Banking SolutionDocument42 pagesCore Banking SolutionbusinessmbaNo ratings yet

- Core BankingDocument12 pagesCore BankingPriyanka GovalkarNo ratings yet

- T24 Temenos Transact Core BankingDocument2 pagesT24 Temenos Transact Core BankingG V Suhas ReddyNo ratings yet

- Product ArchitectureDocument26 pagesProduct ArchitectureTrần Hữu LượngNo ratings yet

- Core BankingDocument3 pagesCore BankingRekha Raghavan NandakumarNo ratings yet

- Temenos T24Document4 pagesTemenos T24Sind Baad50% (2)

- MIfosX-DB-Schema Diagram v02Document1 pageMIfosX-DB-Schema Diagram v02Stupid TeenNo ratings yet

- Swift Platform Readiness Webinars Jul Aug 2021 Full Deck SDCDocument30 pagesSwift Platform Readiness Webinars Jul Aug 2021 Full Deck SDCJordan FouassierNo ratings yet

- Temenos Products Infinity BrochureDocument12 pagesTemenos Products Infinity Brochureelswidi100% (1)

- Consumer Lending - Whitepaper PDFDocument3 pagesConsumer Lending - Whitepaper PDFAbhinavNo ratings yet

- Data Migration SheetDocument58 pagesData Migration SheetWai100% (1)

- Chapter 1 - Introduction To Digital Banking - V1.0Document17 pagesChapter 1 - Introduction To Digital Banking - V1.0prabhjinderNo ratings yet

- Retail Banking Training MaterialDocument96 pagesRetail Banking Training MaterialTemesgen DentamoNo ratings yet

- A Case For A Single Loan Origination System For Core Banking ProductsDocument5 pagesA Case For A Single Loan Origination System For Core Banking ProductsCognizant100% (1)

- R11 User GuideDocument39 pagesR11 User Guidemukeshdograji100% (1)

- Intermediate Verb DictionaryDocument38 pagesIntermediate Verb DictionaryDominique HoffmanNo ratings yet

- Collections 12 0Document76 pagesCollections 12 0Pearl AsiamahNo ratings yet

- TCS Bancs Core Banking 09 2009Document2 pagesTCS Bancs Core Banking 09 2009shahruchirNo ratings yet

- IT Infrastructure Deployment A Complete Guide - 2020 EditionFrom EverandIT Infrastructure Deployment A Complete Guide - 2020 EditionNo ratings yet

- Banking DomainDocument7 pagesBanking DomainManju DarsiNo ratings yet

- Mobile Application TestingDocument40 pagesMobile Application TestingChandan Dash0% (1)

- Software Testing Interview QuestionsDocument30 pagesSoftware Testing Interview QuestionsPraveen Kumar P.VNo ratings yet

- Banking DomainDocument7 pagesBanking DomainManju DarsiNo ratings yet

- Software Testing Interview QuestionsDocument30 pagesSoftware Testing Interview QuestionsPraveen Kumar P.VNo ratings yet

- Please Provide Your Written Answers To The Following. 1Document12 pagesPlease Provide Your Written Answers To The Following. 1barsapanigrahiNo ratings yet

- Mobile Application TestingDocument40 pagesMobile Application TestingChandan Dash0% (1)

- Supply Side Channel Analysis Channel Flows Ch#3 AnsaryDocument8 pagesSupply Side Channel Analysis Channel Flows Ch#3 Ansarybakedcaked100% (1)

- Bashar MHR FinalDocument12 pagesBashar MHR FinalSHUBRANSHU SEKHARNo ratings yet

- Linking Knowledge Management Orientation To Balanced Scorecard OutcomesDocument26 pagesLinking Knowledge Management Orientation To Balanced Scorecard Outcomesnanda choiriNo ratings yet

- SCI (Function of Expense Method) Tiger CompanyDocument2 pagesSCI (Function of Expense Method) Tiger Companypatricia0% (1)

- Chapter 3 Buying and SellingDocument27 pagesChapter 3 Buying and SellingJude Tan100% (2)

- Corporate Real Estate Facilities ManagementDocument36 pagesCorporate Real Estate Facilities ManagementFaiqmal ZainalNo ratings yet

- Test Bank For Decision Support and Business Intelligence Systems 9th Edition Efraim TurbanDocument12 pagesTest Bank For Decision Support and Business Intelligence Systems 9th Edition Efraim TurbanCatherine SmithNo ratings yet

- Appendix B: Pestle AnalysisDocument2 pagesAppendix B: Pestle AnalysisDerick cheruyotNo ratings yet

- Ch14 Emerging Issues in Accounting and AuditingDocument19 pagesCh14 Emerging Issues in Accounting and AuditingN.s.BudiartoNo ratings yet

- MKTG NotesDocument73 pagesMKTG NotesJonny TiwariNo ratings yet

- Far 1 - Activity 1 - Sept. 09, 2020 - Answer SheetDocument4 pagesFar 1 - Activity 1 - Sept. 09, 2020 - Answer SheetAnonn100% (1)

- Nokia Form 20F 2020Document118 pagesNokia Form 20F 2020it4728No ratings yet

- International Taxation Transfer PricingDocument130 pagesInternational Taxation Transfer PricingABC 123No ratings yet

- Learn Xtra Exam Revision Accounting Part 1 - QDocument31 pagesLearn Xtra Exam Revision Accounting Part 1 - QThuraNo ratings yet

- PHD Thesis On Organizational CultureDocument5 pagesPHD Thesis On Organizational Culturealejandrarodriguezlasvegas100% (2)

- Induvidual Assignment 2 - Hirosha Vejian (264096)Document5 pagesInduvidual Assignment 2 - Hirosha Vejian (264096)Hirosha VejianNo ratings yet

- Companies That Conduct Customer Satisfaction SurveysDocument12 pagesCompanies That Conduct Customer Satisfaction SurveysCath ReyesNo ratings yet

- HRM Report - Continental BuscuitsDocument16 pagesHRM Report - Continental Buscuitsmrblueface100% (1)

- Paper - 6: Auditing and Assurance: © The Institute of Chartered Accountants of IndiaDocument14 pagesPaper - 6: Auditing and Assurance: © The Institute of Chartered Accountants of IndiaMuraliNo ratings yet

- 2016 Revised HandbookDocument75 pages2016 Revised HandbookNoel Jun LinganayNo ratings yet

- Equity Research: Q.1 Top Down and Bottom Up ApproachDocument10 pagesEquity Research: Q.1 Top Down and Bottom Up Approachpuja bhatNo ratings yet

- Idea Generation and Business DevelopmentDocument13 pagesIdea Generation and Business DevelopmentbitetNo ratings yet

- Derivatives and Foreign Currency: Concepts and Common TransactionsDocument28 pagesDerivatives and Foreign Currency: Concepts and Common TransactionsElle PaizNo ratings yet

- EP950100 HSE Management SystemDocument62 pagesEP950100 HSE Management SystemDaniel100% (1)

- 2016 Vol 3 CH 1 AnsDocument2 pages2016 Vol 3 CH 1 AnsRikka TakanashiNo ratings yet

- Answer: DDocument13 pagesAnswer: DKevin T. Onaro100% (1)