Professional Documents

Culture Documents

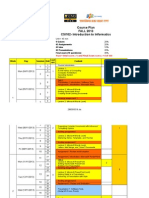

Gap (The Difference Between What The Economy Could Produce and What It Actually Produced) Widened To

Gap (The Difference Between What The Economy Could Produce and What It Actually Produced) Widened To

Uploaded by

Đào Duy TúOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Gap (The Difference Between What The Economy Could Produce and What It Actually Produced) Widened To

Gap (The Difference Between What The Economy Could Produce and What It Actually Produced) Widened To

Uploaded by

Đào Duy TúCopyright:

Available Formats

The 2008-2009 recession was long and deep, and called the most severe economic contraction since

the

1930s (but still much less severe than the Great Depression).

When the fall of economic activity finally bottomed out in the second half of 2009, real gross domestic

product (GDP) had decreased by approximately 5.1%, or by about $680 billion. At this point the output

gap (the difference between what the economy could produce and what it actually produced) widened to

an estimated 8.1%. The decline in economic activity was much sharper than in the 10 previous post-war

recessions, in which the fall of real GDP averaged about 2.0% and the output gap increased to near 4.0%

(see Figure 1). However, the decline falls well short of the experience during the Great Depression, when

real GDP decreased by 30% and the output gap probably exceeded 40%.

The U.S. economy, as measured by real GDP growth (i.e., GDP adjusted for inflation) began to recover in

mid-2009. However, the pace of growth over the next 3% years was slow and uneven. From the second half

of 2009 and through 2010 real GDP increased at an annualized rate of 2.5%. Compared with the early stage

of previous post-war economic recoveries, this is a relatively slow pace and much of the economys upward

momentum at this time was sustained by the transitory factors of inventory increases and fiscal stimulus.

Therefore, sustainable recovery would depend on more enduring sources of demand such spending by

consumers and businesses reviving to give continued momentum to the recovery. To a degree, this

occurred, but the momentum provided has been lackluster, with the pace of growth decelerating to a

1.8% annualized rate, and the output gap remains sizable (see Figure 2), prompting recurring concerns

about the recoverys sustainability.

While business investment spending has been relatively strong during the recovery, consumer spending,

typically accounting for two-thirds of final demand, has been relatively weak. Moreover, in 2011-2012, the

sharply fading effects of fiscal stimulus and weaker growth in Europe have likely dampened economic

growth. Nonetheless, economic activity in the private economy shows signs of slow but steady

improvement.

Credit conditions have improved, making getting loans easier for consumers and businesses,

loosening a constraint on many types of credit supported expenditures. The Feds January

2013 survey of senior loan officers indicated that, on net, bank lending standards and terms

continued to ease during the previous three months and that the demand for commercial and

industrial loans had increased.

The stock market has rebounded and interest rate spreads on corporate bonds have narrowed.

The Dow Jones stock index, which had plunged to near 6500 in March 2009, by early 2013

had regained all of its lost capitalization. Spreads on investment-grade corporate bonds, a

measure of the lenders perception of risk and creditworthiness of borrowers, have fallen

from a high of 600 basis points in December 2008 to near 25 basis points in early 2013.

Manufacturing activity has shown steady improvement during the recovery. Through

February 2013, output had increased 2.0% over a year earlier. Capacity utilization has risen

from a low of 64% in mid-2009 to 78.3% in February 2013. (A capacity utilization rate of

80%-85% would be typical for a fully recovered economy.)

From mid-2009 through February 2013, non-farm payroll employment has increased by

about 4 million jobs. Monthly gains have been consistently positive since late 2010, but as

evidenced by a weak gain of only 88,000 jobs in March 2013, often not at a scale

characteristic of a strong recovery. However, for the 12 months ending in March 2013,

monthly employment gains have increased; averaging about 160,000 jobs (see Figure 3).

The housing sector has recently shown evidence of improving health. Private new housing

starts pushed above 900,000 in December 2012, most recently increasing at an annual rate of

917,000 units in February 2013, up from less than

units during the recession (see Figure 4). Also, house prices have begun to increase, on average, up

about 8% over 12 months ending January 2013.

Source: U.S. Department of Labor: Bureau of Labor Statistics.

Figure 3. Monthly Employment Net Gain or Loss

2000 2002 2004 2006 2008 2010 2012 2014

Shaded areas indicate US recessions.

2013 research.stlouisfed.org

On the other hand, growth is well below the historical norm for U.S. economic recoveries as persistent

sources of economic weakness continue to dampen economic activity.

Pointing to the slow pace of real GDP growth over 3% years of recovery, the output gap had

narrowed to only 5.8% of real GDP (see Figure 2).

Consumer spending, the usual engine of a strong economic recovery, remains tepid, generally

slowed by households ongoing need to rebuild substantial net worth lost during the recession,

continued high unemployment and underemployment, and a surge in energy prices in the first

half of 2012.

Employment conditions, despite improvement, remain weak. The unemployment rate, which

had peaked at 10.0% in October 2009, has edged down to 7.6% in March 2013, but is still

high for this stage of the economic recovery (see Figure 5). A considerable share of the

improvement in the unemployment rate is not the result of workers finding jobs, but by

discouraged workers leaving the ranks of the officially unemployed by leaving the labor force.

The employment to population ratio, which is not affected by changes in labor force

participation, has remained near its recession low through three years of economic recovery

(see Figure 6). This suggests a labor market that, at best, is only treading water.

The housing market, although showing signs of revival, is likely to continue to fall short of its

typical contribution to economic recoveries. Although the value of households financial

Figure 4. Housing Starts

Source: U.S. Department of Commerce: Census Bureau.

assets have bounced back since 2009, the value of their real estate assets have not, continuing

to dampen consumer spending.

Growth in the UK and the Euro area has been weak and fiscal austerity measures to stem the

growth of public debt have likely pushed the region back into recession, slowing growth

further. Slower growth in this region, a major U.S. export market, has likely transmitted a

contractionary impulse to the United States, slowing the pace of the U.S. recovery in 2012

and will likely continue to do so into 2013.

Fiscal policy has tightened significantly since 2010, with federal government

expenditures contracting 2.8% in 2011 and 2.2% in 2012, and exerting a dampening

effect on economic growth. The current budget debate points to more fiscal tightening in

2013.

Source: U.S. Department of Labor: Bureau of Labor Statistics.

Figure 5. Unemployment Rate

2000 2002 2004 2006 2008 2010 2012 2014

Shaded areas indicate US recessions.

2013 research.stlouisfed.org

Source: U.S. Department of Labor: Bureau of Labor Statistics.

Sau thi kz khng hong vo cui nm 2008 v u nm 2009, nn kinh t M ang ly li

tng trng. C th, t l tht nghip M gn y gim t 10% cui nm 2009, xung cn 7,2% vo

qu III/2013; th trng bt ng sn phc hi v n nh Chnh ph M c bit quan tm n li sut

v a ra mt s chnh sch ti u phc hi kinh t M thot khi khng hong.Kt qu trn c c

l nh vo mt s chnh sch v tin t ng thi ko theo s nh hng ti tnh trng tht nghip v

lm pht M:

+ chnh sch tin t: l qu trnh qun l h tr ng tin ca chnh ph hay ngn hng trung

ng t c nhng mc ch c bit- nh kim ch lm pht, duy tr n nh t gi hi oi, t

c ton dng lao ng hay tng trng kinh t. Chnh sch lu thng tin t bao gm vic thay i

Figure 6. Employment Population Ratio

2000 2002 2004 2006 2008 2010 2012 2014

Shaded areas indicate US recessions.

2013 research.stlouisfed.org

cc loi li sut nht nh, c th trc tip hay gin tip thng qua cc nghip v th trng m; qui nh

mc d tr bt buc; hoc trao i trn th trng ngoi hi.

+Chnh sch lm pht: C th ni rng l lm pht l mt trong nhng nhn t ch cht nh

hng n li sut tn dng .Lm pht l mt hin tng ca tin t ,chnh bi vy chng ta khng th

trnh khi n m ch c kim ch n mc t hay nhiu . Vy y lm pht c nh hng nh th no

n li sut ? Khi lm pht tng ln mt trong nhng bin php ca Nh nc gim pht chnh l p

dng cc bin pht ht bt lng tin lu thng v .ng thi cc c nhn ,t chc trong nn kinh t

ang nm d lng vn ,tin cng s khng dm cho vay do lo s ng vn ca mnh s b mt gi ,bi

vy h s chuyn hng sang d tr cc loi hng ho nh vng ,ngoi t hay u t ra nc ngoi .Hai

iu ny khin cho kh nng cung ng vn trn th trng s gim nhanh chng ,nh ni trn th

khi cung ng vn gim th tt yu s khin cho li sut tng . Khi p dng cc bin pht nhm kim ch

lm pht cho sn xut ,u t s b thu hp khin cho nn kinh t c kh nng i vo suy thoi .Chnh

bi vy mt khi lm pht c kim ch ,gim pht th Ngn hng TW s gim li sut tn dng nhm

gip cho cc c nhn ,t chc ,doanh nghip trong nn kinh t d dng tip cn c ngun vn . c

th m rng sn xut , u t gip cho nn kinh t phc hi . Trong nn kinh t th trng th lm pht

v li sut c mi quan h cht ch v tc ng qua li mt thit vi nhau .

You might also like

- HVAC Design ModuleDocument8 pagesHVAC Design ModuleParth PatelNo ratings yet

- PrecisionGrinding English V0911-1Document100 pagesPrecisionGrinding English V0911-1Vasundhara Kumari PeddintiNo ratings yet

- Internship Survival Guide NSHDocument36 pagesInternship Survival Guide NSHRichardNo ratings yet

- Effective PresentationDocument4 pagesEffective PresentationAssignmentLab.comNo ratings yet

- Advanced Economics QuestionsDocument5 pagesAdvanced Economics QuestionsIainNo ratings yet

- Macroeconomics: Theory and Applications: SpringDocument15 pagesMacroeconomics: Theory and Applications: Springmed2011GNo ratings yet

- The Forces Shaping The Economy Over 2012Document10 pagesThe Forces Shaping The Economy Over 2012economicdelusionNo ratings yet

- American: Memorandum (SAMPLE ONLY)Document8 pagesAmerican: Memorandum (SAMPLE ONLY)testtest1No ratings yet

- Weekly Economic Commentary 3/18/2013Document7 pagesWeekly Economic Commentary 3/18/2013monarchadvisorygroupNo ratings yet

- Monthly Economic Outlook 06082011Document6 pagesMonthly Economic Outlook 06082011jws_listNo ratings yet

- Gearing For Growth: 1. U.S. Economic Recovery Has Geared!Document8 pagesGearing For Growth: 1. U.S. Economic Recovery Has Geared!api-191194240No ratings yet

- Group 6 - AM BDocument14 pagesGroup 6 - AM BABHAY KUMAR SINGHNo ratings yet

- Business Cycles: GDP C + I + G + NXDocument5 pagesBusiness Cycles: GDP C + I + G + NXMaira OyarzúnNo ratings yet

- Japanese Economy HistoryDocument12 pagesJapanese Economy Historydebarka100% (1)

- Monetary & Fiscal PolicyDocument20 pagesMonetary & Fiscal PolicyMadhupriya DugarNo ratings yet

- Executive Summary: The Global OutlookDocument34 pagesExecutive Summary: The Global OutlookmarrykhiNo ratings yet

- Masaaki Shirakawa: Globalization and Population Aging - Challenges Facing JapanDocument16 pagesMasaaki Shirakawa: Globalization and Population Aging - Challenges Facing JapanIvan YanezNo ratings yet

- Global Financial Crisis and Sri LankaDocument5 pagesGlobal Financial Crisis and Sri LankaRuwan_SuNo ratings yet

- Economic AssignmentDocument8 pagesEconomic AssignmentMST. MAHBUBA ATIKA TUNNURNo ratings yet

- Introduction To Business FluctuationsDocument68 pagesIntroduction To Business FluctuationsSuruchi SinghNo ratings yet

- Outlook 2012 - Raymond JamesDocument2 pagesOutlook 2012 - Raymond JamesbubbleuppNo ratings yet

- Economic Assignment MaterialDocument5 pagesEconomic Assignment MaterialAnmol killerNo ratings yet

- Evaluate The Effectiveness of Australia's Monetary Policy in Addressing The Economic Issues Resulting From The Global Financial Crisis of 2008-2009Document5 pagesEvaluate The Effectiveness of Australia's Monetary Policy in Addressing The Economic Issues Resulting From The Global Financial Crisis of 2008-2009yingy0116No ratings yet

- Weekly Economic Commentary 01-10-12Document6 pagesWeekly Economic Commentary 01-10-12karen_rogers9921No ratings yet

- Peruvian Financial System Growth and StrategiesDocument17 pagesPeruvian Financial System Growth and StrategiesGustavo MenaNo ratings yet

- Jul 16 Erste Group Macro Markets UsaDocument6 pagesJul 16 Erste Group Macro Markets UsaMiir ViirNo ratings yet

- Weekly Economic Commentary 07-05-2011Document3 pagesWeekly Economic Commentary 07-05-2011Jeremy A. MillerNo ratings yet

- c1 PDFDocument11 pagesc1 PDFDanish CooperNo ratings yet

- Van Hoisington Letter, Q3 2011Document5 pagesVan Hoisington Letter, Q3 2011Elliott WaveNo ratings yet

- The Business Cycle, Aggregate Demand and Aggregate Supply: Jeff's PARTDocument19 pagesThe Business Cycle, Aggregate Demand and Aggregate Supply: Jeff's PARTDaniel ArriesgadoNo ratings yet

- 4feb11 Retrospectiva2010 Scenarii2011 PDFDocument16 pages4feb11 Retrospectiva2010 Scenarii2011 PDFCalin PerpeleaNo ratings yet

- Executive 1Document6 pagesExecutive 1KhardenNo ratings yet

- Macroeconomics AssignmentDocument16 pagesMacroeconomics AssignmentHarkishen Singh0% (2)

- Managing India's Macroeconomics - Lessons From The 2008 Crisis and BeyondDocument19 pagesManaging India's Macroeconomics - Lessons From The 2008 Crisis and BeyondVarun SinghNo ratings yet

- 2010-12-29 Yearly Review: World Economy in 2010: People in The KnowDocument5 pages2010-12-29 Yearly Review: World Economy in 2010: People in The KnowJohn Raymond Salamat PerezNo ratings yet

- What Is GDP?: Kimberly AmadeoDocument44 pagesWhat Is GDP?: Kimberly AmadeobhupenderkamraNo ratings yet

- World Economy Recovering or NotDocument3 pagesWorld Economy Recovering or NotCristina GheorgheNo ratings yet

- Evaluate The View That The Growth of Credit Is Likely To Have An Adverse Effect On The Uks Macroeconomic PerformanceDocument4 pagesEvaluate The View That The Growth of Credit Is Likely To Have An Adverse Effect On The Uks Macroeconomic Performanceapi-294123260No ratings yet

- Policy Perspectives: Sri Lanka: State of The Economy 2009Document7 pagesPolicy Perspectives: Sri Lanka: State of The Economy 2009IPS Sri LankaNo ratings yet

- Eco Ass BiftDocument15 pagesEco Ass BiftSumon91062No ratings yet

- SYZ & CO - SYZ Asset Management - 1 Month in 10 Snapshots March 2013Document4 pagesSYZ & CO - SYZ Asset Management - 1 Month in 10 Snapshots March 2013SYZBankNo ratings yet

- 2009 Mid Year Report On Receipts and DisbursementsDocument35 pages2009 Mid Year Report On Receipts and DisbursementsNew York SenateNo ratings yet

- Recession:: Recession? Depression? What's The Difference? How Do We Know If We're in One?Document4 pagesRecession:: Recession? Depression? What's The Difference? How Do We Know If We're in One?sandeepreddy1886No ratings yet

- Getting To The Core: Budget AnalysisDocument37 pagesGetting To The Core: Budget AnalysisfaizanbhamlaNo ratings yet

- NAB Forecast (12 July 2011) : World Slows From Tsunami Disruptions and Tighter Policy.Document18 pagesNAB Forecast (12 July 2011) : World Slows From Tsunami Disruptions and Tighter Policy.International Business Times AUNo ratings yet

- Understanding of UK EconomyDocument11 pagesUnderstanding of UK EconomyNeelanjana DattaNo ratings yet

- An Smu Economics Intelligence Club ProductionDocument14 pagesAn Smu Economics Intelligence Club ProductionSMU Political-Economics Exchange (SPEX)No ratings yet

- BC ReportDocument4 pagesBC ReportValerie CoNo ratings yet

- Socital ProjectDocument9 pagesSocital ProjectkmohammedsafeeqNo ratings yet

- SEB Report: Oil Price Gives Support To Russia's GrowthDocument3 pagesSEB Report: Oil Price Gives Support To Russia's GrowthSEB GroupNo ratings yet

- World Economic Outlook UpdateDocument13 pagesWorld Economic Outlook UpdateSachin Kumar BassiNo ratings yet

- Global Employmennt Trends 2013Document9 pagesGlobal Employmennt Trends 2013mary engNo ratings yet

- Make More - Oct 2011Document8 pagesMake More - Oct 2011vidithrt143No ratings yet

- Global Economic Recession & It'S Impact On Indian EconomyDocument2 pagesGlobal Economic Recession & It'S Impact On Indian EconomybhaviniiNo ratings yet

- SN 06629Document12 pagesSN 06629newtscriptNo ratings yet

- Edited 2Document10 pagesEdited 2leakyNo ratings yet

- 2012 Budget PublicationDocument71 pages2012 Budget PublicationPushpa PatilNo ratings yet

- Case Study Group 2-2Document5 pagesCase Study Group 2-2Fatima AliyevaNo ratings yet

- Global 4Document89 pagesGlobal 4MiltonThitswaloNo ratings yet

- Deflation Danger 130705Document8 pagesDeflation Danger 130705eliforuNo ratings yet

- India Economic Update: September, 2011Document17 pagesIndia Economic Update: September, 2011Rahul KaushikNo ratings yet

- Course Plan I2I Fall 2013 Block 3Document6 pagesCourse Plan I2I Fall 2013 Block 3Đào Duy TúNo ratings yet

- LawDocument5 pagesLawĐào Duy TúNo ratings yet

- FPT University Subject: Introduction To Informatics Assignment 1Document3 pagesFPT University Subject: Introduction To Informatics Assignment 1Đào Duy TúNo ratings yet

- Qizz 1,2,4Document60 pagesQizz 1,2,4Đào Duy TúNo ratings yet

- Chapter 5-Problem Solving and Decision Making: Multiple ChoiceDocument11 pagesChapter 5-Problem Solving and Decision Making: Multiple ChoiceĐào Duy TúNo ratings yet

- CH 16Document10 pagesCH 16Đào Duy Tú100% (1)

- Assignment 2: Distinguish Implicit and Explicit Cost. Give Examples of These CostsDocument3 pagesAssignment 2: Distinguish Implicit and Explicit Cost. Give Examples of These CostsĐào Duy TúNo ratings yet

- Sem - Ii Pharmacology Lab ManualDocument36 pagesSem - Ii Pharmacology Lab ManualLokesh MahataNo ratings yet

- FondueDocument15 pagesFondueWeldon Owen Publishing100% (5)

- 1-5 Weeks GravimetryDocument9 pages1-5 Weeks Gravimetrykh omarNo ratings yet

- Intelidrive Lite 2 5 0 New FeaturesDocument19 pagesIntelidrive Lite 2 5 0 New Featuresluat1983No ratings yet

- Fine Love Dolls User ManualDocument11 pagesFine Love Dolls User ManualFine Love Dolls (Ultra Realistic TPE Dolls)33% (3)

- Pathology Lecture 2, Cell Injury (Notes/tafree3')Document18 pagesPathology Lecture 2, Cell Injury (Notes/tafree3')Ali Al-Qudsi100% (3)

- Waste Collection Point: Proposal Letter: PlasticDocument3 pagesWaste Collection Point: Proposal Letter: PlasticdocumentsNo ratings yet

- RLO CableDocument1 pageRLO CableLeiden O'SullivanNo ratings yet

- Susten DS For WebDocument1 pageSusten DS For WebkinamedeboNo ratings yet

- Interim Valuation 1Document11 pagesInterim Valuation 1musthaqhassan100% (1)

- Workbook Grade 11&12 English-1Document40 pagesWorkbook Grade 11&12 English-1Kamil Ali33% (3)

- Anatomical Effects of Woolly Apple Aphid (Eriosoma Lanigerum Haus) in The Apple Tree BranchDocument9 pagesAnatomical Effects of Woolly Apple Aphid (Eriosoma Lanigerum Haus) in The Apple Tree BranchSaurabh SharmaNo ratings yet

- 2014 Ftir LabDocument10 pages2014 Ftir LabAnurak OnnnoomNo ratings yet

- Week 4Document10 pagesWeek 4Gissele AbolucionNo ratings yet

- GATE EE 2005 With SolutionsDocument53 pagesGATE EE 2005 With SolutionsAbhishek Mohan50% (2)

- Sanitation, Plumbing Design & Installation: G. Dry and Wet StandpipeDocument10 pagesSanitation, Plumbing Design & Installation: G. Dry and Wet StandpipeDwight Swayne AlegrosNo ratings yet

- Fire Alarm Control (IFC 640)Document84 pagesFire Alarm Control (IFC 640)thephuocNo ratings yet

- Times Leader 04-22-2011Document41 pagesTimes Leader 04-22-2011The Times LeaderNo ratings yet

- Plaster of Paris and Other Fracture Immobilizations: Icrc Physiotherapy Reference ManualDocument107 pagesPlaster of Paris and Other Fracture Immobilizations: Icrc Physiotherapy Reference ManualNur Anish Amira SalimNo ratings yet

- Nursing Care of The Client With High-Risk Labor and DeliveryDocument23 pagesNursing Care of The Client With High-Risk Labor and DeliveryMarie Ashley CasiaNo ratings yet

- FINAL Phase2 PVA GuidelinesDocument59 pagesFINAL Phase2 PVA GuidelinesBellaNo ratings yet

- Hidayah, N., A. N. Al-Baarri, Dan C. BudiartiDocument6 pagesHidayah, N., A. N. Al-Baarri, Dan C. Budiartiaulia rahmahNo ratings yet

- USS Springfield Sailor Receives Proclamation From Ledyard Mayor For Act of HeroismDocument8 pagesUSS Springfield Sailor Receives Proclamation From Ledyard Mayor For Act of HeroismdolphingrlzNo ratings yet

- CIS Electrical Standard Rev 001Document46 pagesCIS Electrical Standard Rev 001Tarek AbulailNo ratings yet

- 1 4 2 Liste Signaux Type UKDocument14 pages1 4 2 Liste Signaux Type UKAmirouche BenlakehalNo ratings yet

- Mcqs Pharmacognosy Part IDocument41 pagesMcqs Pharmacognosy Part Ihibadesi00No ratings yet

- Instruction Book: All Models 2019 / 2020Document64 pagesInstruction Book: All Models 2019 / 2020Joshua WelbaumNo ratings yet