Professional Documents

Culture Documents

MIT15 450F10 Lec04

MIT15 450F10 Lec04

Uploaded by

seanwu95Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MIT15 450F10 Lec04

MIT15 450F10 Lec04

Uploaded by

seanwu95Copyright:

Available Formats

Expected Utility Risk Aversion Derivatives and Portfolio Choice

Dynamic Portfolio Choice I

Static Approach to Dynamic Portfolio Choice

Leonid Kogan

MIT, Sloan

15.450, Fall 2010

Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 1 / 35 c

Expected Utility Risk Aversion Derivatives and Portfolio Choice

Outline

1

2

3

Expected Utility

Risk Aversion

Derivatives and Portfolio Choice

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 2 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

Outline

1

2

3

Expected Utility

Risk Aversion

Derivatives and Portfolio Choice

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 3 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

Constant Portfolio Weights

Consider a market with Nassets.

Gross asset returns, R

t

n

, n=1,2,...,Nare IID over time.

Consider self-nancing portfolio rules with constant weights

Portfolio Rule: = (

1

,

2

,...,

N

)

Focus on constant weights is natural in an IID environment.

Under rule , portfolio value W

t

changes as

N

W

t

=W

t 1

n

R

t

n

n=1

Single out a particular rule

, such that

N

=arg max E ln

n

R

t

n

n=1

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 4 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

Constant Portfolio Weights

Compare the long-run performance of the portfolio following the rule

to

the one following any other constant rule .

Denote the corresponding portfolio values by W

and

W. Assume both start

at 1 at t =0.

N

T

N

T

N

T t =1 n t

ln

W

=ln

n

N

=1

R

n

=

ln

n

R

t

n

ln

n

R

t

n

n

R

n

W

T

t =1 n=1

t

t =1 n=1 t =1 n=1

By LLN,

T N N

1

T

ln

n

R

t

n

E ln

n

R

t

n

G()

t =1 n=1 n=1

By denition of

,

G(

) G()>0

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 5 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

Constant Portfolio Weights

We have established that

1 W

ln

T

G(

) G>0

T

W

T

Conclusion: in the long run, the portfolio rule

produces higher portfolio

value than any other constant weight rule with probability one!

Is the portfolio rule maximizing the expected log of return the best choice for

any long-horizon investor? Is there role for individual preferences?

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 6 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

20-20 Hindsight

This discussion is based on the universal portfolio of Thomas Cover.

Dene the geometric rate of return on a portfolio between 0 and T as

1 W

T

ln

T W

0

Consider a market with Nstocks paying no dividends.

Suppose that, after observing returns on Nstocks between 0 and T, we

select the stock with the highest geometric rate of return.

Is it possible for a portfolio to match performance of the best-performing

stock? Yes, in the long run.

Consider an equal-weighted, buy-and-hold portfolio. It has the same

asymptotic geometric rate of return (as T ) as the best performing (ex

post) stock!

Universal portfolio is an equal-weighted allocation to all possible portfolios

with positive constant weights. It can beat the best performing stock and

matches the best (expost) constant-weight rule asymptotically.

Should we follow the equal-weight, buy-and-hold rule, or the universal

portfolio?

c Dynamic Portfolio Choice I 7 / 35 Leonid Kogan ( MIT, Sloan ) 15.450, Fall 2010

Expected Utility Risk Aversion Derivatives and Portfolio Choice

Where is the Catch

It is hard to have a meaningful discussion of which portfolio rules are

preferable without an explicitly specied objective.

Both of the portfolio rules described above may have nice asymptotic

properties, but at any nitetime point T they may produce return distributions

with too much risk.

Consistent decision making under uncertainty can be based on the concept

of expected utility.

Expected utility is not a dogma: it is based on behavioral assumptions.

Expected utility assumes rational, consistent choices.

Empirically, people often violate expected utility axioms.

No surprise there, people often behave irrationally.

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 8 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

The Framework

Dene preference over random payoffs (gambles, lotteries), e.g.,

[$1000

(0.5)

, $0

(0.5)

] vs. [$2000

(0.3)

, $200

(0.7)

]

prob. prob. prob. prob.

Preferences are over outcomes only, e.g., do not depend on the mechanism

by which cash ows are generated. Can apply to portfolio choice.

y (prefer

x to y

), x

y (indifferent between x

and

y) x

Expected Utility Theory is a mathematical representation of preferences

y E[U(

x)]>E[U(y

)] x

When we evaluate a random payoff

x, we care only about the numerical

distribution of cash ows: E[U(

x)].

Properties of preferences are captured by the shape of the utility function

U(x).

c Dynamic Portfolio Choice I 9 / 35 Leonid Kogan ( MIT, Sloan ) 15.450, Fall 2010

Expected Utility Risk Aversion Derivatives and Portfolio Choice

Outline

1

2

3

Expected Utility

Risk Aversion

Derivatives and Portfolio Choice

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 10 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

Risk Aversion

We commonly assume that people prefer more to less:

x x, 0 x+

for all

This means that the utility U(x)is non-decreasing:

U

(x)0

We also assume aversion to risk: prefer x =E[

x]to x

, i.e.,

U(x)E[U(

x)]

This means that U(x)is concave

U

(x)0

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 11 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

Risk Aversion

1 1.2 1.4 1.6 1.8 2 2.2 2.4 2.6 2.8 3

9.6

9.65

9.7

9.75

9.8

9.85

9.9

9.95

10

10.05

x

U

U(E[x])

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 12 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

Risk Aversion

1 1.2 1.4 1.6 1.8 2 2.2 2.4 2.6 2.8 3

9.6

9.65

9.7

9.75

9.8

9.85

9.9

9.95

10

10.05

x

U

U(E[x])

E[U(x)]

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 12 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

Coefcient of Relative Risk Aversion (W)

Start with initial wealth W. Compare two gambles, with payoffs

W(1 +x) and W(1 +x

CE

), x

CE

is a constant

What value of x

CE

makes the agent indifferent?

Small gamble x. Use Taylor expansion around W(1 +x):

U(W(1 +x))U(W(1 +x))+U

(W(1 +x))W(xx)+

1

U

(W(1 +x))W

2

(xx)

2

+

2

U(W(1 +x

CE

))U(W(1 +x))+U

(W(1 +x))W(x

CE

x)

Indifference implies

E [U(W(1 +x))]=U(W(1 +x

CE

))

1

U

(W(1 +x))Wx+ U

(W(1 +x))W

2

Var(x)U

(W(1 +x))Wx

CE

2

c Dynamic Portfolio Choice I 13 / 35 Leonid Kogan ( MIT, Sloan ) 15.450, Fall 2010

Expected Utility Risk Aversion Derivatives and Portfolio Choice

Coefcient of Relative Risk Aversion (W)

Certainty-Equivalent Return

x

CE

x

1

2

(W(1 +x))Var(x), where (W)=

U

(W)W

U

(W)

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 14 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

Examples of Utility Functions

Linear utility

U(W) =a+bW, b>0

implies that (W) =0.

Payoffs are compared by their expected value, linear utility implies risk

neutrality.

Exponential utility

U(W)=exp(aW), a>0

Assume W N(,

2

). Then

2

2

a

E [U(W)]=exp a+

2

Payoffs are compared by

2

a

2

Increasing relative risk aversion

(W) =aW

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 15 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

Examples of Utility Functions

Constant relative risk aversion (CRRA) utility exhibits

(W) =

Using the denition (W) = U

(W)W/U

(W), recover the utility function

1

W

1

, =1

1

U(W) =

ln W, =1

CRRA utility is a very popular choice because of its implications for portfolio

strategies.

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 16 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

Outline

1

2

3

Expected Utility

Risk Aversion

Derivatives and Portfolio Choice

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 17 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

Binomial Setting

Consider a market with constant interest rate r and a stock paying no

dividends, with price following a binomial tree:

u, with probability p

S

t

=S

t 1

d, with probability 1 p

Recall that the state-price density in this market is given by

t +1

(u) 1 1 +rd

=

t

p(1 +r ) ud

t +1

(d) 1 u (1 +r )

=

t

(1 p)(1 +r ) ud

We want to nd the portfolio maximizing expected utility

E

0

[U(W

T

)]

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 18 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

Main Idea

t =0 t =1 t =2

s

1

s

2

s

3

s

4

Imagine that any possible state-contingent claim with payoff at T =2 can be

traded. Then portfolio choice is a simple static optimization problem: choose

the claim W

T

(s)producing the highest expected utility subject to the budget

constraint.

Any state-contingent claim can be replicated by trading dynamically in the

stock and the bond, therefore our optimal choice for W

T

(s)can be generated

by dynamic trading.

c Dynamic Portfolio Choice I 19 / 35 Leonid Kogan ( MIT, Sloan ) 15.450, Fall 2010

Expected Utility Risk Aversion Derivatives and Portfolio Choice

CRRA Utility

Formulation

Suppose our objective is to maximize

E

0

1

1

W

T

1

starting with W

0

.

We look for the best state-contingent wealth allocation W

T

(s)that costs W

0

at t =0.

Recall that the time-0 value of any cash ow can be computed using the SPD

as

W

0

= Prob

0

(s)

T

(s)W

T

(s)

s

Solve the static problem

max

Prob

0

(s)

1

1

W

T

(s)

1

s.t.

Prob

0

(s)

T

(s)W

T

(s)=W

0

s s

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 20 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

CRRA Utility

Solution of the Static Problem

Solve the static problem

max

Prob

0

(s)

1

W

T

(s)

1

s.t.

Prob

0

(s)

T

(s)W

T

(s) =W

0

{W

T

(s)} 1

s s

Relax the constraint with a Lagrange multiplier

max Prob

0

(s) W

T

(s)

1

Prob

0

(s)

T

(s)W

T

(s) W

0

{W

T

(s)} 1

s s

First-order optimality conditions

W

T

(s)

=

T

(s) W

T

(s) =(

T

(s))

1/

Find the multiplier from

Prob

0

(s) (

T

(s))

1/

T

(s) =W

0

s

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 21 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

CRRA Utility

Solution of the Static Problem

We conclude that the optimal choice of time-T state-contingent cash ow is

W

T

(s) =

W

0

T

(s)

1/

Prob

0

(s)

T

(s)

11/

s

The recombining binomial tree model has a special property that the SPD is

a function of the terminal stock price.

If the terminal stock price equals

S

T

=S

0

u

(# Up moves)

d

(T# Up moves)

then the SPD in the same state equals

T

=

1

(u)

(# Up moves)

1

(d)

(T# Up moves)

1 1 +rd 1 u (1 +r )

1

(u) = ,

1

(d) =

p(1 +r ) ud (1 p)(1 +r ) ud

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 22 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

CRRA Utility

Dynamic Trading Strategy

We were able to express the optimal state-contingent portfolio value at the

terminal date, W

T

(s), as a function of the terminal stock price, denoted as

W

T

(s) =H(S

T

(s))

The optimal portfolio must replicate the European derivative security with

terminal payoff H(S

T

).

We know how to construct the optimal trading strategy in the stock and the

bond: it is the replicating strategy for the above derivative. Can compute it by

backward induction.

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 23 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

CRRA Utility

State-Contingent Allocation

Qualitatively, want to achieve higher wealth in states with lower SPD (higher

stock price).

Illustrate by plotting the analytical solution from B-S framework (below).

S

T

W

*T

= 1

S

T

W

*T

= 4

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 24 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

Discussion

In the binomial setting, nding an optimal dynamic portfolio strategy reduces

to guring out which derivative security we would like to buy with initial wealth

W

0

.

The static problem is easy to solve using a Lagrange multiplier.

Since any derivative can be replicated by dynamic trading in the stock and

the bond, we know how to construct the optimal dynamic strategy for any

utility function (e.g., proceeding backwards on the tree).

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 25 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

Black-Scholes Framework

Black-Scholes framework is a continuous-time limit of a recombining binomial

tree, and dynamic portfolio choice is equally simple.

The advantage of continuous time is that we can obtain transparent

closed-form solution.

We use the B-S framework to recover the famous Mertons solution to the

dynamic portfolio choice problem.

Assume interest rate r and the stock price process

dS

t

=dt+dZ

t

S

t

We are performing calculations under the physical probability measure, so

Z

t

=Z

t

P

.

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 26 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

CRRA Utility

Static Problem

In analogy with the binomial-tree setting, we replace the dynamic problem

with a static problem

max E

0

1

W

T

1

subject to E

0

[

T

W

T

] =W

0

{W

T

} 1

Keep in mind that W

T

and

T

are both functions of the state, which is the

entire trajectory of the Brownian motion between 0 and T.

Relax the constraint using a Lagrange multiplier :

max E

0

1

W

T

1

(

T

W

T

W

0

)

{W

T

} 1

First-order optimality conditions

(W

T

=

T

W

T

= (

T

)

1/

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 27 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

CRRA Utility

Static Problem

We nd the multiplier from the static budget constraint:

E

0

[

T

W

T

] =W

0

E

0

T

(

T

)

1/

=W

0

Find

1/

=

W

0

E

0

T

11/

We need to derive the dynamic strategy replicating the optimal

state-contingent claim W

T

.

We rst derive the process for the optimal portfolio value, W

t

, and then gure

out how to delta-hedge it using the stock.

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 28 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

CRRA Utility

Dynamic Strategy

If the optimal portfolio value at T is given by W

t

, by DCF formula, portfolio

value at earlier times must be equal to

W

t

=E

t

T

W

T

, W

T

= (

T

)

1/

t

Recall that in the Black-Scholes model, the price of risk is constant,

= (r )/, and the SPD is given by

t

=e

rt

e

2

/2

)

t Z

t

We can compute W

t

:

11/

1/

1/

1/

1/

t

=E

t

T

=E

t

t

t

=F(t )

t

1/

for some function of time F(t ), which we could compute explicitly.

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 29 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

Dynamic Strategy

To gure out the dynamic trading strategy, we relate the SPD to the stock

price, just like we did for binomial tree.

The SPD is given by

t

=e

rt

e

2

/2

)

t Z

t

The stock price equals

S

t

=S

0

e

(

2

/2)t +Z

t

We conclude that

t

=G(t )S

t

/

for some function G(t ). We can compute G(t )explicitly but do not need to.

The optimal portfolio follows

W

=F(t )G(t )

1/

S

/()

t t

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 30 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

Dynamic Strategy

Let

t

denote the optimal number of stock shares in the dynamic portfolio.

t

Dene to be the weight of the stock in the optimal portfolio:

t

S

t

W

=

t

t

Delta-hedging rule tells us how many stock shares to include in the

replicating portfolio

Using

W

t

=

t

S

t

=F(t )G(t )

1/

S

/()

t

W

t

we conclude that

r

= =

t

2

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 31 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

Dynamic Strategy

Mertons Solution

In the Black-Scholes setting with CRRA utility function, the weight of the stock in

the optimal portfolio is

t

=

r

2

Mertons solution says that the optimal portfolio weights are constant,

independent of the problem horizon T.

We call such solution myopic. It is optimal to behave as if the horizon of the

problem is very short.

The optimal weight of the stock is increasing in the risk premium, and

decreasing in relative risk aversion and stock return volatility.

For a general utility function, U(W

T

), we would not obtain the same solution,

optimal portfolio strategy would not be myopic.

CRRA utility is special: constant relative risk aversion. This, combined with

the fact that returns on all assets in the B-S model are IID, leads to a myopic

optimal portfolio.

c Dynamic Portfolio Choice I 32 / 35 Leonid Kogan ( MIT, Sloan ) 15.450, Fall 2010

Expected Utility Risk Aversion Derivatives and Portfolio Choice

Mertons Solution

Mertons solution easily generalizes to a multi-variate case.

If an investor has a CRRA utility function, interest rate is constant, r , and

returns on Nrisky assets follow

N

dS

t

i

=

i

dt+

ij

dZ

t

j

,

S

i

t

j =1

then the vector of optimal portfolio weights on the Nstocks is given by

=

1

(

)

1

(r 1)

t

where = (

1

,...,

N

)

, 1= (1,1,...,1)

, and

11

12

. . .

1N

21

22

. . .

2N

=

. . .

N1

N2

. . .

NN

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 33 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

Summary

Need a coherent objective to formulate an optimal dynamic trading strategy:

Expected Utility Theory.

In a setting in which all state-contingent claims can be replicated by dynamic

trading (e.g., binomial tree, Black-Scholes model) can connect optimal

portfolio choice to option pricing.

In the Black-Scholes setting with CRRA preferences, the optimal portfolio

strategy is myopic, given by the Mertons solution.

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 34 / 35

Expected Utility Risk Aversion Derivatives and Portfolio Choice

References

T. Cover, 1991, Universal Portfolios, MathematicalFinance1, 1-29.

c Leonid Kogan ( MIT, Sloan ) Dynamic Portfolio Choice I 15.450, Fall 2010 35 / 35

MIT OpenCourseWare

http://ocw.mit.edu

15.450 Analytics of Finance

Fall 2010

For information about citing these materials or our Terms of Use, visit: http://ocw.mit.edu/terms .

You might also like

- MOS 3311 Final NotesDocument33 pagesMOS 3311 Final Notesshakuntala12321No ratings yet

- MIT15 450F10 Lec05Document32 pagesMIT15 450F10 Lec05seanwu95No ratings yet

- Estimating Volatilities and Correlations: Options, Futures, and Other Derivatives, 9th Edition, 1Document34 pagesEstimating Volatilities and Correlations: Options, Futures, and Other Derivatives, 9th Edition, 1seanwu95No ratings yet

- Basic Utility Theory For Portfolio SelectionDocument25 pagesBasic Utility Theory For Portfolio SelectionTecwyn LimNo ratings yet

- From Navier Stokes To Black Scholes - Numerical Methods in Computational FinanceDocument13 pagesFrom Navier Stokes To Black Scholes - Numerical Methods in Computational FinanceTrader CatNo ratings yet

- Keykhaei 1062015 BJMCS1946912Document15 pagesKeykhaei 1062015 BJMCS1946912AlokNo ratings yet

- Topic 8Document44 pagesTopic 86doitNo ratings yet

- IEOR E4731: Credit Risk and Credit Derivatives: Lecture 13: A General Picture of Portfolio Credit Risk ModelingDocument27 pagesIEOR E4731: Credit Risk and Credit Derivatives: Lecture 13: A General Picture of Portfolio Credit Risk ModelingJessica HendersonNo ratings yet

- The Black-Scholes-Merton Model: Options, Futures, and Other Derivatives, 8th Edition, 1Document31 pagesThe Black-Scholes-Merton Model: Options, Futures, and Other Derivatives, 8th Edition, 1Manish Pushkar100% (1)

- Lecture 9-10 International Business CyclesDocument40 pagesLecture 9-10 International Business Cyclesmarko.drazic2809No ratings yet

- GCIF - Parte II IIIDocument94 pagesGCIF - Parte II IIIJose Pinto de AbreuNo ratings yet

- Paper - The Role of UncertaintyDocument19 pagesPaper - The Role of UncertaintyJimmy GunarsoNo ratings yet

- Portfolio Summary Notes by CA Gaurav Jain SirDocument21 pagesPortfolio Summary Notes by CA Gaurav Jain SirAksaya CaNo ratings yet

- Financial Decision-Making Under UncertaintyDocument18 pagesFinancial Decision-Making Under UncertaintyMateo PulidoNo ratings yet

- Lecture 14 - Mutual Fund Theorem and Covariance Pricing TheoremsDocument16 pagesLecture 14 - Mutual Fund Theorem and Covariance Pricing TheoremsLuis Aragonés FerriNo ratings yet

- 15.401 Recitation 15.401 Recitation: 2a: Fixed Income SecuritiesDocument29 pages15.401 Recitation 15.401 Recitation: 2a: Fixed Income SecuritieswelcometoankitNo ratings yet

- LM04 Common Probability DistributionsDocument37 pagesLM04 Common Probability Distributionsmenexe9137No ratings yet

- Review: Arbitrage-Free Pricing and Stochastic Calculus: Leonid KoganDocument16 pagesReview: Arbitrage-Free Pricing and Stochastic Calculus: Leonid Koganseanwu95No ratings yet

- Presentation Risk ManagementDocument53 pagesPresentation Risk Managementzahir abdellahNo ratings yet

- Wk1 IntroDocument25 pagesWk1 IntroputrijulianarahayuNo ratings yet

- Lecture 8 - Risk AversionDocument7 pagesLecture 8 - Risk AversionNikanon AvaNo ratings yet

- Brigo DDocument46 pagesBrigo DPoonsiri WongwiseskijNo ratings yet

- BLP Demand EstimationDocument38 pagesBLP Demand EstimationMadhur BhatiaNo ratings yet

- 2015 - 1st ExamDocument9 pages2015 - 1st ExamcataNo ratings yet

- Dynamic Portfolio Choice III: Numerical Approximations in Dynamic ProgrammingDocument15 pagesDynamic Portfolio Choice III: Numerical Approximations in Dynamic Programmingseanwu95No ratings yet

- Option Pricing With Time-Changed Levy ProcessesDocument39 pagesOption Pricing With Time-Changed Levy ProcesseslycancapitalNo ratings yet

- Robust Hedging in Incomplete Markets: Maastricht UniversityDocument16 pagesRobust Hedging in Incomplete Markets: Maastricht UniversityDmitri StepanovNo ratings yet

- Portfolio Management & Analysis: 1. UtilityDocument10 pagesPortfolio Management & Analysis: 1. UtilityMarie Remise100% (1)

- CH 14 Hull OFOD9 TH EditionDocument31 pagesCH 14 Hull OFOD9 TH Editionseanwu95No ratings yet

- Lecture 3 Prospect Theory PDFDocument49 pagesLecture 3 Prospect Theory PDFMohd. Anisul IslamNo ratings yet

- Financial Applications of Random MatrixDocument18 pagesFinancial Applications of Random Matrixxi yanNo ratings yet

- Decision TheoryDocument39 pagesDecision TheoryJanine CayabyabNo ratings yet

- DiTommasoCristian RiskAndUncertainty IndividualRiskPerceptionDocument9 pagesDiTommasoCristian RiskAndUncertainty IndividualRiskPerceptionLeonardo SimonciniNo ratings yet

- MLV6 CorrelationDocument48 pagesMLV6 CorrelationLameuneNo ratings yet

- Portfolio Optimization Problems A SurveyDocument19 pagesPortfolio Optimization Problems A SurveySuperquantNo ratings yet

- ExecCourse1 9-20pdfDocument44 pagesExecCourse1 9-20pdfpetere056No ratings yet

- Demand Analysis - SiegDocument126 pagesDemand Analysis - SiegRundong WangNo ratings yet

- General Theory Economics of Risk and Time: Toulouse School of Economics Catherine Bobtcheff Catherine - Bobtcheff@tse-Fr - EuDocument49 pagesGeneral Theory Economics of Risk and Time: Toulouse School of Economics Catherine Bobtcheff Catherine - Bobtcheff@tse-Fr - EuTrúc LinhNo ratings yet

- Comparing Behavioural and Rational Expectations For The US Post-War EconomyDocument19 pagesComparing Behavioural and Rational Expectations For The US Post-War Economymirando93No ratings yet

- In Certi Dumb ReDocument6 pagesIn Certi Dumb ReEstefaniUbillusNo ratings yet

- 1.1 Multi-Asset OptionsDocument44 pages1.1 Multi-Asset Optionsdaniel18ctNo ratings yet

- Pset3 2013Document6 pagesPset3 20136doitNo ratings yet

- 01 - Static - Decision - Making - CRRA Cert EqDocument16 pages01 - Static - Decision - Making - CRRA Cert EqmurathNo ratings yet

- Introduction To Risk ManagementDocument41 pagesIntroduction To Risk ManagementIvania CorbafoNo ratings yet

- CH 13 Hull OFOD8 TH EditionDocument31 pagesCH 13 Hull OFOD8 TH EditionAlex WanowskiNo ratings yet

- Heal 1969Document17 pagesHeal 1969Daniel Victoriano BremontNo ratings yet

- Mossin - Optimal Multiperiod Portfolio PoliciesDocument16 pagesMossin - Optimal Multiperiod Portfolio PoliciesRafael NovakNo ratings yet

- 02 Utility Functions and Risk Aversion Coefficients SlidesDocument66 pages02 Utility Functions and Risk Aversion Coefficients SlidesJeremey Julian PonrajahNo ratings yet

- Finals Microeconomics: MT11: Lectures On Risk and Expected Utility:lecture 2Document14 pagesFinals Microeconomics: MT11: Lectures On Risk and Expected Utility:lecture 2Seung Yoon LeeNo ratings yet

- Portfolio ReturnDocument23 pagesPortfolio ReturnAbhishek ChahalNo ratings yet

- Articulo de Investigación 1Document14 pagesArticulo de Investigación 1Liz SamaniegoNo ratings yet

- Black-Scholes Option Pricing ModelDocument56 pagesBlack-Scholes Option Pricing ModelstanNo ratings yet

- Expected Utility TheoryDocument10 pagesExpected Utility TheorygopshalNo ratings yet

- Topic 04 - Risk and Return, Expectations, UtilityDocument25 pagesTopic 04 - Risk and Return, Expectations, UtilityDweep KapadiaNo ratings yet

- The Effect of Estihlation Risk On Optihial Choice Roger W. KLEIN and Vijay S. BAWA+ PortfolioDocument17 pagesThe Effect of Estihlation Risk On Optihial Choice Roger W. KLEIN and Vijay S. BAWA+ PortfolioClaudio bastidasNo ratings yet

- Learn Statistics Fast: A Simplified Detailed Version for StudentsFrom EverandLearn Statistics Fast: A Simplified Detailed Version for StudentsNo ratings yet

- Green's Function Estimates for Lattice Schrödinger Operators and Applications. (AM-158)From EverandGreen's Function Estimates for Lattice Schrödinger Operators and Applications. (AM-158)No ratings yet

- Topics in Continuous-Time FinanceDocument4 pagesTopics in Continuous-Time Financeseanwu95No ratings yet

- SGSG Asf Asf AsfDocument1 pageSGSG Asf Asf Asfseanwu95No ratings yet

- Simulation of Diffusion ProcessesDocument4 pagesSimulation of Diffusion Processesseanwu95No ratings yet

- JD Vs Sfa Vs DataDocument1 pageJD Vs Sfa Vs Dataseanwu95No ratings yet

- Topics in Continuous-Time Finance, Spring 2003: T X 2 XX: (AF) (X, T)Document4 pagesTopics in Continuous-Time Finance, Spring 2003: T X 2 XX: (AF) (X, T)seanwu95No ratings yet

- A Simple Way To Find Prices, Greeks, and Static Hedges For Barrier OptionsDocument3 pagesA Simple Way To Find Prices, Greeks, and Static Hedges For Barrier Optionsseanwu95No ratings yet

- Plan AsdDocument5 pagesPlan Asdseanwu95No ratings yet

- Nordea Markets Complex Risk Presentation Wed, 14 May, 2003, ? Aud ?Document2 pagesNordea Markets Complex Risk Presentation Wed, 14 May, 2003, ? Aud ?seanwu95No ratings yet

- Topics in Continuous-Time Finance, Spring 2003Document2 pagesTopics in Continuous-Time Finance, Spring 2003seanwu95No ratings yet

- Suff - PR As Oject2Document3 pagesSuff - PR As Oject2seanwu95No ratings yet

- Cir Asfda Asfd AsdfDocument4 pagesCir Asfda Asfd Asdfseanwu95No ratings yet

- Sugga EstionsDocument4 pagesSugga Estionsseanwu95No ratings yet

- Maybe Smart Money Isn't So Smart-MaybesmartmoneyDocument28 pagesMaybe Smart Money Isn't So Smart-Maybesmartmoneyseanwu95No ratings yet

- Chapter 06Document60 pagesChapter 06seanwu95No ratings yet

- Chapter 02Document10 pagesChapter 02seanwu95No ratings yet

- Testing: TrainingDocument25 pagesTesting: Trainingseanwu95No ratings yet

- Chapter 03Document12 pagesChapter 03seanwu95No ratings yet

- Chapter 04Document38 pagesChapter 04seanwu95No ratings yet

- Djangocms InstallerDocument31 pagesDjangocms Installerseanwu95No ratings yet

- Chapter 05Document13 pagesChapter 05seanwu95No ratings yet

- MIT15 450F10 Lec02Document75 pagesMIT15 450F10 Lec02seanwu95No ratings yet

- Chapter 01Document12 pagesChapter 01seanwu95No ratings yet

- A Complete Tutorial On Tree Based Modeling From Scratch (In R & Python) PDFDocument28 pagesA Complete Tutorial On Tree Based Modeling From Scratch (In R & Python) PDFTeodor von BurgNo ratings yet

- Probability MathsDocument21 pagesProbability MathsNelsonMoseMNo ratings yet

- FIX Encryption Working Group: New York, Monday July 24 Facilitator: Ryan Pierce Townsend Analytics Ltd. / Archipelago LLCDocument40 pagesFIX Encryption Working Group: New York, Monday July 24 Facilitator: Ryan Pierce Townsend Analytics Ltd. / Archipelago LLCjuttekataNo ratings yet

- Computer Concepts and Problem Solving L T P C 4 0 0 4Document2 pagesComputer Concepts and Problem Solving L T P C 4 0 0 4Ghilli Tec0% (1)

- Stochastic Gradient Descent - Mini-Batch and More - Adventures in Machine LearningDocument11 pagesStochastic Gradient Descent - Mini-Batch and More - Adventures in Machine Learningvarun3dec1No ratings yet

- Fuzzy LogicDocument15 pagesFuzzy Logicshibu100No ratings yet

- Operes3 Lab Duality-TheoryDocument3 pagesOperes3 Lab Duality-TheoryJunica Coleen ZacariasNo ratings yet

- Chapter4 Handout 2022-2023Document79 pagesChapter4 Handout 2022-2023hien nguyen quangNo ratings yet

- DSP SyllabusDocument2 pagesDSP SyllabuskumarNo ratings yet

- Special Relativity: Massachusetts Institute of TechnologyDocument18 pagesSpecial Relativity: Massachusetts Institute of TechnologymarioasensicollantesNo ratings yet

- Computing Project: Numerical Solver For The 2D-Channel-Flow in Vorticity-Streamfunction FormulationDocument18 pagesComputing Project: Numerical Solver For The 2D-Channel-Flow in Vorticity-Streamfunction FormulationHappy SinghNo ratings yet

- Algorithmic Trading & Quantitative Strategies Gappy Lecture 4Document23 pagesAlgorithmic Trading & Quantitative Strategies Gappy Lecture 4Anshuman GhoshNo ratings yet

- Transportation Problem 2 - Initial Basic Feasible SolutionDocument70 pagesTransportation Problem 2 - Initial Basic Feasible SolutionNANDINI GUPTANo ratings yet

- 08 Numerical PheneticDocument15 pages08 Numerical Pheneticjosua nNo ratings yet

- Perasan Common Correlated Effects EstimationDocument63 pagesPerasan Common Correlated Effects EstimationEsaie OlouNo ratings yet

- Lecture 12 Spreadsheets Pt2Document27 pagesLecture 12 Spreadsheets Pt2Mani SekarNo ratings yet

- Project4 1Document17 pagesProject4 1MARYAM AMINNo ratings yet

- Machine Learning in Additive Manufacturing A ReviewDocument15 pagesMachine Learning in Additive Manufacturing A ReviewcimsanthoshNo ratings yet

- 3D Limit Equilibrium Slope StabilityDocument9 pages3D Limit Equilibrium Slope StabilityBoris Leal MartinezNo ratings yet

- Chapter 06 Discrete Probability Distributions Answer KeyDocument44 pagesChapter 06 Discrete Probability Distributions Answer KeyBao Ngoc NguyenNo ratings yet

- Modeling Transition State in GaussianDocument5 pagesModeling Transition State in GaussianBruno Moraes ServilhaNo ratings yet

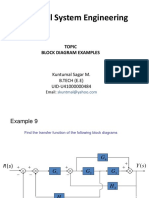

- Control System Engineering: Topic Block Diagram ExamplesDocument42 pagesControl System Engineering: Topic Block Diagram ExamplesjpatrNo ratings yet

- Case Study MysqlDocument3 pagesCase Study MysqlAsadNo ratings yet

- Linear Programming Tutorial 1Document4 pagesLinear Programming Tutorial 1Thaya IdhyomaticNo ratings yet

- Number BashingDocument5 pagesNumber BashingWithoon ChinchalongpornNo ratings yet

- 6CS4 ML Unit-5Document33 pages6CS4 ML Unit-5Nikhil KumarNo ratings yet

- CE 169 Linear Algebra 169 EDocument4 pagesCE 169 Linear Algebra 169 EOsman AlhassanNo ratings yet

- DAA-Assignment 04 (2.5 Points) : Fatima Jinnah Women University Computer ScienceDocument2 pagesDAA-Assignment 04 (2.5 Points) : Fatima Jinnah Women University Computer ScienceHafza GhafoorNo ratings yet

- JMEUT Volume 50 Issue 4 Pages 51-60Document10 pagesJMEUT Volume 50 Issue 4 Pages 51-60Behi GhNo ratings yet

- Fault Classification For Photovoltaic Modules Using Thermography and Machine Learning TechniquesDocument6 pagesFault Classification For Photovoltaic Modules Using Thermography and Machine Learning TechniquessramukNo ratings yet