Professional Documents

Culture Documents

Chap 62

Chap 62

Uploaded by

api-19641717Copyright:

Available Formats

You might also like

- John M CaseDocument10 pagesJohn M Caseadrian_simm100% (1)

- Chap 60Document3 pagesChap 60Vijay ManeNo ratings yet

- Balance of PaymentsDocument7 pagesBalance of PaymentsthokachiNo ratings yet

- MFM-103 Balance of Payment-Current ScenarioDocument8 pagesMFM-103 Balance of Payment-Current ScenarioAhel Patrick VitsuNo ratings yet

- Press Release Balance of Payments Performance in The First Half of FY 2021-2022Document5 pagesPress Release Balance of Payments Performance in The First Half of FY 2021-2022Ebtsam MohamedNo ratings yet

- Capital Flows, Economic Performance and Economic Policy: Argentina's Experience During The Last DecadeDocument13 pagesCapital Flows, Economic Performance and Economic Policy: Argentina's Experience During The Last DecadeKrunal BhuvaNo ratings yet

- Pro-Poor Fiscal Policy in CambodiaDocument19 pagesPro-Poor Fiscal Policy in CambodiaLisno SetiawanNo ratings yet

- Tab 52Document4 pagesTab 52Šöbíķá RáņčíNo ratings yet

- BOP Press Release First Quarte 2015-16Document4 pagesBOP Press Release First Quarte 2015-16Mostafa FaroukNo ratings yet

- Balance of PaymentsDocument12 pagesBalance of PaymentsVipulNo ratings yet

- BOP India BullsDocument19 pagesBOP India Bullsthexplorer008No ratings yet

- Current Macroeconomic Situation: (Based On Seven Months' Data of 2013/14)Document44 pagesCurrent Macroeconomic Situation: (Based On Seven Months' Data of 2013/14)hello worldNo ratings yet

- Balance of Payments: Group 12 Dilip K Ahmed Mudassar P B Atul Pal Jacob GeorgeDocument16 pagesBalance of Payments: Group 12 Dilip K Ahmed Mudassar P B Atul Pal Jacob Georgeatulpal112No ratings yet

- Trends in Expenditure: 163 Expenditure Budget Vol. I, 2016-2017Document4 pagesTrends in Expenditure: 163 Expenditure Budget Vol. I, 2016-2017Chawla DimpleNo ratings yet

- BoP 2017-2018Document5 pagesBoP 2017-2018Waleed ElsebaieNo ratings yet

- Session 12-Balance of PaymentsDocument19 pagesSession 12-Balance of PaymentsJai GaneshNo ratings yet

- Major Economic Indicators O..Document2 pagesMajor Economic Indicators O..mobarak_03No ratings yet

- 5-Money and CreditDocument8 pages5-Money and CreditAhsan Ali MemonNo ratings yet

- Pakistan's EconomyDocument4 pagesPakistan's EconomyMuzzamil ShahzadNo ratings yet

- BOP Press Release July March 2015 2016Document6 pagesBOP Press Release July March 2015 2016eissasamNo ratings yet

- Press Release Balance of Payments Performance in The First Quarter of FY 2022-2023Document5 pagesPress Release Balance of Payments Performance in The First Quarter of FY 2022-2023Ebtsam MohamedNo ratings yet

- ReferencesDocument12 pagesReferencesapi-532604124No ratings yet

- Tesla DCF Valuation by Ihor MedvidDocument105 pagesTesla DCF Valuation by Ihor Medvidpriyanshu14No ratings yet

- Budget 2023-24Document10 pagesBudget 2023-24komorebi0322No ratings yet

- Trade and PaymentsDocument17 pagesTrade and PaymentsmazamniaziNo ratings yet

- GMR Financial Overview-Q2 FY11Document44 pagesGMR Financial Overview-Q2 FY11anilgupta_1No ratings yet

- Financial Sector Reforms and Interest Rate Liberalization: The Kenya ExperienceDocument34 pagesFinancial Sector Reforms and Interest Rate Liberalization: The Kenya ExperiencemuuqchaNo ratings yet

- Tesla FinModelDocument58 pagesTesla FinModelPrabhdeep DadyalNo ratings yet

- Unaudited Third Quarter and Nine Months Financial Statement For The Period Ended 30 September 2014Document21 pagesUnaudited Third Quarter and Nine Months Financial Statement For The Period Ended 30 September 2014rikky adiwijayaNo ratings yet

- Unaudited Third Quarter and Nine Months Financial Statement For The Period Ended 30 September 2015Document19 pagesUnaudited Third Quarter and Nine Months Financial Statement For The Period Ended 30 September 2015rikky adiwijayaNo ratings yet

- 2.1 Gross National ProductDocument8 pages2.1 Gross National Productshoaib625No ratings yet

- Vote 13: Statistics South AfricaDocument18 pagesVote 13: Statistics South Africaputra bimoNo ratings yet

- Assignment 01Document9 pagesAssignment 01HARSHITA GAUTAMNo ratings yet

- International Fin MGT: A Brief IntroductionDocument98 pagesInternational Fin MGT: A Brief Introductionanji 123No ratings yet

- Bajaj Auto Project TestDocument61 pagesBajaj Auto Project TestSauhard Sachan0% (1)

- Global Investment Trends Monitor 42 (UNCTAD) Oct 2022Document5 pagesGlobal Investment Trends Monitor 42 (UNCTAD) Oct 2022Vương VõNo ratings yet

- India's BOPDocument12 pagesIndia's BOPVinayak BaliNo ratings yet

- Balance of PaymentsDocument9 pagesBalance of PaymentsBhanu Pratap SinghNo ratings yet

- Statistical Appendix (English-2023)Document103 pagesStatistical Appendix (English-2023)Fares Faruque HishamNo ratings yet

- Selected External Debt Ratios: (End-of-Period)Document8 pagesSelected External Debt Ratios: (End-of-Period)Mervin BocatcatNo ratings yet

- Assignment No. 1Document2 pagesAssignment No. 1AMegoz 25No ratings yet

- Brazil: From Development Aid Recipient To Donor: Anup VanishreeDocument12 pagesBrazil: From Development Aid Recipient To Donor: Anup VanishreeVanishree GmNo ratings yet

- How The Global Financial Crisis Has Affected The Small States of Seychelles & MauritiusDocument32 pagesHow The Global Financial Crisis Has Affected The Small States of Seychelles & MauritiusRajiv BissoonNo ratings yet

- Appendix Table 8: India'S Overall Balance of PaymentsDocument1 pageAppendix Table 8: India'S Overall Balance of PaymentsPandu PrasadNo ratings yet

- Appendix 1.1: Macro-Economic Indicator: 1993-94-2004-05: ConsumptionDocument52 pagesAppendix 1.1: Macro-Economic Indicator: 1993-94-2004-05: ConsumptionromanaNo ratings yet

- Budget FY12: Where Is The Headroom, Mr. Mukherjee?Document5 pagesBudget FY12: Where Is The Headroom, Mr. Mukherjee?Hitesh GuptaNo ratings yet

- M.8 Wir1998overview enDocument37 pagesM.8 Wir1998overview enanderson costa limaNo ratings yet

- 2020 4q Presentation enDocument22 pages2020 4q Presentation enHassan PansariNo ratings yet

- Post Budget Impact AnalysisDocument21 pagesPost Budget Impact AnalysisSamNo ratings yet

- GOI Union Budget TrendDocument3 pagesGOI Union Budget TrendMadhu DjoNo ratings yet

- Review of Pakistan's Balance of Payments July 2008 - June 2009Document8 pagesReview of Pakistan's Balance of Payments July 2008 - June 2009Nauman-ur-RasheedNo ratings yet

- Safari 2Document86 pagesSafari 2shhhhhhh.33333hdhrNo ratings yet

- Lecture 1-Macro Frame - Fin Prog - Overview - 2017-RevisedDocument64 pagesLecture 1-Macro Frame - Fin Prog - Overview - 2017-RevisedMark EllyneNo ratings yet

- Chapter IDocument15 pagesChapter Imohsin.usafzai932No ratings yet

- Economic Survey: 6.2: Balance of PaymentsDocument4 pagesEconomic Survey: 6.2: Balance of PaymentsAkhil RupaniNo ratings yet

- Balance of PaymentsDocument15 pagesBalance of PaymentsBalavarshini Rajasekar0% (2)

- Maroc Telecom KPI-Q12022Document9 pagesMaroc Telecom KPI-Q12022Youssef JaafarNo ratings yet

- BudgetBrief 2013Document79 pagesBudgetBrief 2013kurazaNo ratings yet

- yearlyimportDocument54 pagesyearlyimportsultan mahamudNo ratings yet

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaFrom EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNo ratings yet

- Bop DraftDocument2 pagesBop Draftapi-19641717No ratings yet

- BOP Lecture-14Document3 pagesBOP Lecture-14api-19641717No ratings yet

- Balance of PaymentsDocument4 pagesBalance of Paymentsapi-3727090100% (4)

- India BopDocument33 pagesIndia Bopapi-3836566No ratings yet

- Part I - General Principles of Taxation (Case Digest)Document140 pagesPart I - General Principles of Taxation (Case Digest)Joshua Custodio0% (1)

- Questionnaire ResponceDocument158 pagesQuestionnaire ResponceKaveesh SharmaNo ratings yet

- Fiscal Responsibility and Budget Management Act, 2003Document27 pagesFiscal Responsibility and Budget Management Act, 2003RRK Varma ChintamaneniNo ratings yet

- AP Budget Manual PDFDocument620 pagesAP Budget Manual PDFthematic reviewNo ratings yet

- APPSC MAINS PYQ - Bhavani Sir PDFDocument31 pagesAPPSC MAINS PYQ - Bhavani Sir PDFRavindra ReddyNo ratings yet

- Budgeting: A Financial Planning Tool For Individuals: June 2019Document9 pagesBudgeting: A Financial Planning Tool For Individuals: June 2019Abhishek goyalNo ratings yet

- State Finances Report 2014-15Document158 pagesState Finances Report 2014-15Valar MathiNo ratings yet

- Class Room Notes Economy Adda247Document37 pagesClass Room Notes Economy Adda247Ankit BhardwajNo ratings yet

- Public Debt ManagementDocument16 pagesPublic Debt ManagementAnuska ThapaNo ratings yet

- Pakistan Economic Survey 2022 23Document467 pagesPakistan Economic Survey 2022 23Wasif Shakil100% (3)

- SWOT Greece Tourism Report PDFDocument3 pagesSWOT Greece Tourism Report PDFHai Lúa Miền TâyNo ratings yet

- Chile 1970-1973, Economic Development and Its International Setting. Institute of Social StudiesDocument423 pagesChile 1970-1973, Economic Development and Its International Setting. Institute of Social StudiesdavidizanagiNo ratings yet

- Chapter12 Budget Balance and Government DebtDocument33 pagesChapter12 Budget Balance and Government Debtblack pinkNo ratings yet

- ISC EconomicsDocument8 pagesISC EconomicsPrincess Soniya100% (1)

- Budjet Estimate, Performance BudjetDocument28 pagesBudjet Estimate, Performance BudjetYashoda SatputeNo ratings yet

- AsdfghjklDocument49 pagesAsdfghjklhNo ratings yet

- 4Document445 pages4lilylikesturtle75% (4)

- Norway and Health An Introduction IS 1730E PDFDocument36 pagesNorway and Health An Introduction IS 1730E PDFAngelo-Daniel SeraphNo ratings yet

- City of Fort St. John - Pandemic Effect On The Operating Budget, March 2020Document4 pagesCity of Fort St. John - Pandemic Effect On The Operating Budget, March 2020AlaskaHighwayNewsNo ratings yet

- Pancham Project ReportDocument18 pagesPancham Project ReportDrRp SinghNo ratings yet

- TheLabourPartyManifesto 2010Document78 pagesTheLabourPartyManifesto 2010Katey Sarah Alice RoweNo ratings yet

- Acca f9 Revision Kit Acca 24 Old Past Paper Solved Old Professional Scheme - CrackedDocument237 pagesAcca f9 Revision Kit Acca 24 Old Past Paper Solved Old Professional Scheme - CrackedAlex SemusuNo ratings yet

- Economic Crisis Quotes and Simplified Reasons:: Terror On Wall Street, A Financial Metafiction NovelDocument6 pagesEconomic Crisis Quotes and Simplified Reasons:: Terror On Wall Street, A Financial Metafiction NovelAmoùr De Ma VieNo ratings yet

- PR Fiscal Plan - 2017Document134 pagesPR Fiscal Plan - 2017Ricardo Rossello88% (56)

- Psaf Revision Day 4Document7 pagesPsaf Revision Day 4Esther AkpanNo ratings yet

- GBE CLASS Lecture1 2020 PDFDocument46 pagesGBE CLASS Lecture1 2020 PDFJingwei ChenNo ratings yet

- Public Debts PDFDocument15 pagesPublic Debts PDFguilhemoraisNo ratings yet

- Fiscal Policy, Public Debt Management and Government Bond Markets: The Case For The PhilippinesDocument15 pagesFiscal Policy, Public Debt Management and Government Bond Markets: The Case For The Philippinesashish1981No ratings yet

- Non Profit Organizations-Theory-1Document4 pagesNon Profit Organizations-Theory-1Titiksha Joshi100% (1)

- Chapter 03 Balance of PaymeDocument50 pagesChapter 03 Balance of PaymeLiaNo ratings yet

Chap 62

Chap 62

Uploaded by

api-19641717Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 62

Chap 62

Uploaded by

api-19641717Copyright:

Available Formats

1

Balance of Payments deceleration in capital flows. In 1998-99, the

4. India’s balance of payments withstood fairly current account deficit, as a per cent of GDP, is

well the turbulence in the international economic expected to decline somewhat from the 1997-

and financial markets (Table 6.2). In fact, the 98 level, mainly because of slower growth of

balance of payments in 1997-98 remained imports on a BOP basis.

comfor table with substantial reserve

accumulation for the second year in succession, 5. The capital account of the balance of

supported by strong private capital flows. Export payments exhibited a handsome surplus of U.S.$

growth has slowed down sharply over the last 10.4 billion in 1997-98, following sustained

three years because of both international and buoyancy in foreign direct investment and

domestic factors. Total import growth also external commercial borrowing, while portfolio

decelerated (Table 6.3). Net inflows on the inflows fell sharply. The surplus in the capital

invisibles account was buoyant in 1997-98, account of balance of payments in 1997-98

benefiting from sustained growth in software exceeded the deficit in the current account by a

exports. The deficit on the current account of substantial margin, resulting in large accretion

the balance of payments widened to U.S.$ 6.5 to foreign exchange reserves amounting to U.S.$

billion or 1.6 per cent of GDP in 1997-98 from 3.9 billion (Table 6.2). Total net capital inflows in

1.1 per cent of GDP in 1996-97.The widening of 1998-99 is expected to be substantially lower

the current account deficit in 1997-98 was largely than the levels in 1996-97 and 1997-98, reflecting

attributable to poor export growth. The BOP considerable deceleration in the inflows of foreign

situation is manageable in 1998-99, despite the direct investment and commercial borrowing, and

continuing slowdown of exports and a marked significant outflow of portfolio investments by

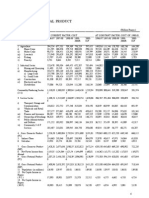

TABLE 6.2

Balance of Payments : Summary

(In US $ million)

1990-91 1991-92 1992-93 1993-94 1994-95 1995-96 1996-97 1997-98 1998-99(P)

(P) (P) (P) (P) (P) (P) (P) (P) (Apr-Sep.)

1. Exports 18477 18266 18869 22683 26855 32311 34133 34849 16634

2. Imports 27915 21064 24316 26739 35904 43670 48948 51126 24712

Of which : POL 6028 5364 6100 5753 5928 7526 10036 8217 2910

3. Trade balance -9438 -2798 -5447 -4056 -9049 -11359 -14815 -16277 -8078

4. Invisibles (net) -242 1620 1921 2898 5680 5460 10321 9804 4993

Non-factor services 980 1207 1129 535 602 -186 851 1143 744

Investment income -3752 -3830 -3423 -3270 -3431 -3205 -3307 -3520 -1141

Pvt. transfers 2069 3783 3852 5265 8093 8506 12367 11830 5269

Official Grants 461 460 363 368 416 345 410 351 121

5. Current Account

Balance -9680 -1178 -3526 -1158 -3369 -5899 -4494 -6473 -3085

6. External assistance (net) 2210 3037 1859 1901 1526 883 1109 899 -135

7. Commercial borrowing

(net)@ 2248 1456 -358 607 1030 1275 2848 3999 4605

8. IMF (net) 1214 786 1288 187 -1143 -1715 -975 -618 -199

9. NR deposits (net) 1536 290 2001 1205 172 1103 3350 1125 -393

10. Rupee debt service -1193 -1240 -878 -1053 -983 -952 -727 -767 -588

11. Foreign investment (net) 103 133 557 4235 4807 4604 5838 4993 707

of which :

(i) FDI (net) 97 129 315 586 1228 1943 2526 3165 1239

(ii) FIIs 0 0 0 1665 1503 2009 1926 979 -601

(iii) Euro equities & others 6 4 242 1984 2076 652 1386 849 69

12. Other flows (net)+ 2284 101 -245 2800 2604 -2235 -1131 735 -994

13. Capital account total

(net) 8402 4563 4224 9882 8013 2963 10312 10366 3003

14. Reserve use (-increase) 1278 -3385 -698 -8724 -4644 2936 -5818 -3893 82

(P) : Preliminary Actuals.

@ Figures include receipt on account of India Development Bonds in 1991-92 and related repayments, if any , in the subsequent years.

Besides, figure for April-Sept. 1998 includes receipt on account of Resurgent India Bonds (RIB).

+ Include, among others, delayed exports receipts and errors & omissions. For the year 1992-93, it also includes errors & omissions

arising out of dual exchange rates applicable under the Liberalised Exchange Rate Management System (LERMS).

2

TABLE 6.3

Selected Indicators of External Sector

Item/ Years 1991-92 1992-93 1993-94 1994-95 1995-96 1996-97 1997-98 1998-99

(Apr-Sept)

1. Growth of Exports - BOP (%) -1.1 3.3 20.2 18.4 20.3 5.6 2.1 -5.1

2. Growth of Imports - BOP (%) -24.5 15.4 10.0 34.3 21.6 12.1 4.4 0.9

(a) of which, POL (%) -11.0 13.7 -5.7 3.0 27.0 33.4 -18.1 -25.6

3. Exports/Imports - BOP (%) 86.7 77.6 84.8 74.8 74.0 69.7 68.2 67.3

4. Import cover of FER (No. of months) 5.3 4.9 8.6 8.4 6.0 6.5 6.9 7.1

5. External assistance (net)/TC (%) 66.6 44.0 19.2 19.0 29.8 10.8 8.7 -4.5

6. ECB (net)/TC (%) 31.9 -8.5 6.1 12.9 43.0 27.6 38.6 153.3

7. NR deposits/TC (%) 6.4 47.4 12.2 2.1 37.2 32.5 10.9 -13.1

8. Short-term debt / FER (%) 76.7 64.5 18.8 16.9 23.2 25.5 17.2 12.1

9. Debt service payments as % of 30.2 27.5 25.6 26.2 24.3 21.2 19.5 18.3

current receipts

As per cent of GDPmp

10. Exports 6.7 7.1 8.1 8.1 8.9 8.6 8.3

11. Imports 7.7 9.4 9.6 10.9 12.0 12.3 12.2

12. Trade balance -1.0 -2.2 -1.5 -2.7 -3.1 -3.7 -3.9

13. Invisibles balance 0.6 0.6 1.0 1.7 1.5 2.6 2.3

14. Current account balance -0.3 -1.7 -0.4 -1.0 -1.6 -1.1 -1.6

15. External Debt 37.7 36.6 33.1 30.0 26.3 23.8 23.8

16. Debt Service Payments 3.0 2.9 3.1 3.3 3.3 2.9 2.7

Notes :

(i) TC: Total capital flows (net).

(ii) ECB: External Commercial Borrowing.

(iii) FER: Foreign Exchange Reserves, including gold and SDRs.

(iv) GDPmp: Gross domestic product at current market prices.

(v) As total capital flows are netted after taking into account some capital outflows, the ratios against item no. 5, 6 and 7 may, in some

years, add up to more than 100 per cent.

(vi) Growth rate of exports and imports during April-Sept. 1998 are growth rates over April-Sept. 1997.

(vii) The ratios to GDP are based on new series of National Accounts Statistics with 1993-94 as base year released by the CSO

on February 3, 1999. The GDP at current market prices for the years 1991-92 and 1992-93 have been interpolated by using

average link factor of 1.0878 obtained from the overlapping data for 1993-94 to 1996-97 for which old and new series of

GDP at current market prices are available.

(viii) Rupee equivalents of BOP components are used to arrive at GDP ratios. All other percentages shown in the upper panel of the table

are based on US dollar values.

FIIs. The deceleration in private capital flows in East Asian financial crisis and uncertainty

1998-99 was partly offset by an inflow of U.S.$ emanating from domestic developments. During

4.2 billion from Resurgent India Bonds (RIBs) to 1998-99, the Rupee depreciated against the U.S.

NRIs/OCBs. During the first ten months of 1998- Dollar by about 7.1 per cent from Rs. 39.50 per

99, the foreign currency assets of the RBI U.S. dollar in March 1998 to Rs. 42.51 in January

increased by U.S.$ 1454 million from U.S.$ 1999. The movements in the exchange rate

25,975 million at end-March 1998 to U.S.$ during the current financial year helped to largely

27,429 million at end-January 1999. correct for the appreciation of the Rupee in real

6. The exchange rate of the Rupee against effective exchange rate terms, which had

the U.S. Dollar came under downward pressure occurred over the previous year or so because

intermittently since the last week of August, 1997, of the adverse inflation differential between India

attributable, largely, to nervous reactions to the and her major trading partners.

You might also like

- John M CaseDocument10 pagesJohn M Caseadrian_simm100% (1)

- Chap 60Document3 pagesChap 60Vijay ManeNo ratings yet

- Balance of PaymentsDocument7 pagesBalance of PaymentsthokachiNo ratings yet

- MFM-103 Balance of Payment-Current ScenarioDocument8 pagesMFM-103 Balance of Payment-Current ScenarioAhel Patrick VitsuNo ratings yet

- Press Release Balance of Payments Performance in The First Half of FY 2021-2022Document5 pagesPress Release Balance of Payments Performance in The First Half of FY 2021-2022Ebtsam MohamedNo ratings yet

- Capital Flows, Economic Performance and Economic Policy: Argentina's Experience During The Last DecadeDocument13 pagesCapital Flows, Economic Performance and Economic Policy: Argentina's Experience During The Last DecadeKrunal BhuvaNo ratings yet

- Pro-Poor Fiscal Policy in CambodiaDocument19 pagesPro-Poor Fiscal Policy in CambodiaLisno SetiawanNo ratings yet

- Tab 52Document4 pagesTab 52Šöbíķá RáņčíNo ratings yet

- BOP Press Release First Quarte 2015-16Document4 pagesBOP Press Release First Quarte 2015-16Mostafa FaroukNo ratings yet

- Balance of PaymentsDocument12 pagesBalance of PaymentsVipulNo ratings yet

- BOP India BullsDocument19 pagesBOP India Bullsthexplorer008No ratings yet

- Current Macroeconomic Situation: (Based On Seven Months' Data of 2013/14)Document44 pagesCurrent Macroeconomic Situation: (Based On Seven Months' Data of 2013/14)hello worldNo ratings yet

- Balance of Payments: Group 12 Dilip K Ahmed Mudassar P B Atul Pal Jacob GeorgeDocument16 pagesBalance of Payments: Group 12 Dilip K Ahmed Mudassar P B Atul Pal Jacob Georgeatulpal112No ratings yet

- Trends in Expenditure: 163 Expenditure Budget Vol. I, 2016-2017Document4 pagesTrends in Expenditure: 163 Expenditure Budget Vol. I, 2016-2017Chawla DimpleNo ratings yet

- BoP 2017-2018Document5 pagesBoP 2017-2018Waleed ElsebaieNo ratings yet

- Session 12-Balance of PaymentsDocument19 pagesSession 12-Balance of PaymentsJai GaneshNo ratings yet

- Major Economic Indicators O..Document2 pagesMajor Economic Indicators O..mobarak_03No ratings yet

- 5-Money and CreditDocument8 pages5-Money and CreditAhsan Ali MemonNo ratings yet

- Pakistan's EconomyDocument4 pagesPakistan's EconomyMuzzamil ShahzadNo ratings yet

- BOP Press Release July March 2015 2016Document6 pagesBOP Press Release July March 2015 2016eissasamNo ratings yet

- Press Release Balance of Payments Performance in The First Quarter of FY 2022-2023Document5 pagesPress Release Balance of Payments Performance in The First Quarter of FY 2022-2023Ebtsam MohamedNo ratings yet

- ReferencesDocument12 pagesReferencesapi-532604124No ratings yet

- Tesla DCF Valuation by Ihor MedvidDocument105 pagesTesla DCF Valuation by Ihor Medvidpriyanshu14No ratings yet

- Budget 2023-24Document10 pagesBudget 2023-24komorebi0322No ratings yet

- Trade and PaymentsDocument17 pagesTrade and PaymentsmazamniaziNo ratings yet

- GMR Financial Overview-Q2 FY11Document44 pagesGMR Financial Overview-Q2 FY11anilgupta_1No ratings yet

- Financial Sector Reforms and Interest Rate Liberalization: The Kenya ExperienceDocument34 pagesFinancial Sector Reforms and Interest Rate Liberalization: The Kenya ExperiencemuuqchaNo ratings yet

- Tesla FinModelDocument58 pagesTesla FinModelPrabhdeep DadyalNo ratings yet

- Unaudited Third Quarter and Nine Months Financial Statement For The Period Ended 30 September 2014Document21 pagesUnaudited Third Quarter and Nine Months Financial Statement For The Period Ended 30 September 2014rikky adiwijayaNo ratings yet

- Unaudited Third Quarter and Nine Months Financial Statement For The Period Ended 30 September 2015Document19 pagesUnaudited Third Quarter and Nine Months Financial Statement For The Period Ended 30 September 2015rikky adiwijayaNo ratings yet

- 2.1 Gross National ProductDocument8 pages2.1 Gross National Productshoaib625No ratings yet

- Vote 13: Statistics South AfricaDocument18 pagesVote 13: Statistics South Africaputra bimoNo ratings yet

- Assignment 01Document9 pagesAssignment 01HARSHITA GAUTAMNo ratings yet

- International Fin MGT: A Brief IntroductionDocument98 pagesInternational Fin MGT: A Brief Introductionanji 123No ratings yet

- Bajaj Auto Project TestDocument61 pagesBajaj Auto Project TestSauhard Sachan0% (1)

- Global Investment Trends Monitor 42 (UNCTAD) Oct 2022Document5 pagesGlobal Investment Trends Monitor 42 (UNCTAD) Oct 2022Vương VõNo ratings yet

- India's BOPDocument12 pagesIndia's BOPVinayak BaliNo ratings yet

- Balance of PaymentsDocument9 pagesBalance of PaymentsBhanu Pratap SinghNo ratings yet

- Statistical Appendix (English-2023)Document103 pagesStatistical Appendix (English-2023)Fares Faruque HishamNo ratings yet

- Selected External Debt Ratios: (End-of-Period)Document8 pagesSelected External Debt Ratios: (End-of-Period)Mervin BocatcatNo ratings yet

- Assignment No. 1Document2 pagesAssignment No. 1AMegoz 25No ratings yet

- Brazil: From Development Aid Recipient To Donor: Anup VanishreeDocument12 pagesBrazil: From Development Aid Recipient To Donor: Anup VanishreeVanishree GmNo ratings yet

- How The Global Financial Crisis Has Affected The Small States of Seychelles & MauritiusDocument32 pagesHow The Global Financial Crisis Has Affected The Small States of Seychelles & MauritiusRajiv BissoonNo ratings yet

- Appendix Table 8: India'S Overall Balance of PaymentsDocument1 pageAppendix Table 8: India'S Overall Balance of PaymentsPandu PrasadNo ratings yet

- Appendix 1.1: Macro-Economic Indicator: 1993-94-2004-05: ConsumptionDocument52 pagesAppendix 1.1: Macro-Economic Indicator: 1993-94-2004-05: ConsumptionromanaNo ratings yet

- Budget FY12: Where Is The Headroom, Mr. Mukherjee?Document5 pagesBudget FY12: Where Is The Headroom, Mr. Mukherjee?Hitesh GuptaNo ratings yet

- M.8 Wir1998overview enDocument37 pagesM.8 Wir1998overview enanderson costa limaNo ratings yet

- 2020 4q Presentation enDocument22 pages2020 4q Presentation enHassan PansariNo ratings yet

- Post Budget Impact AnalysisDocument21 pagesPost Budget Impact AnalysisSamNo ratings yet

- GOI Union Budget TrendDocument3 pagesGOI Union Budget TrendMadhu DjoNo ratings yet

- Review of Pakistan's Balance of Payments July 2008 - June 2009Document8 pagesReview of Pakistan's Balance of Payments July 2008 - June 2009Nauman-ur-RasheedNo ratings yet

- Safari 2Document86 pagesSafari 2shhhhhhh.33333hdhrNo ratings yet

- Lecture 1-Macro Frame - Fin Prog - Overview - 2017-RevisedDocument64 pagesLecture 1-Macro Frame - Fin Prog - Overview - 2017-RevisedMark EllyneNo ratings yet

- Chapter IDocument15 pagesChapter Imohsin.usafzai932No ratings yet

- Economic Survey: 6.2: Balance of PaymentsDocument4 pagesEconomic Survey: 6.2: Balance of PaymentsAkhil RupaniNo ratings yet

- Balance of PaymentsDocument15 pagesBalance of PaymentsBalavarshini Rajasekar0% (2)

- Maroc Telecom KPI-Q12022Document9 pagesMaroc Telecom KPI-Q12022Youssef JaafarNo ratings yet

- BudgetBrief 2013Document79 pagesBudgetBrief 2013kurazaNo ratings yet

- yearlyimportDocument54 pagesyearlyimportsultan mahamudNo ratings yet

- The Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaFrom EverandThe Increasing Importance of Migrant Remittances from the Russian Federation to Central AsiaNo ratings yet

- Bop DraftDocument2 pagesBop Draftapi-19641717No ratings yet

- BOP Lecture-14Document3 pagesBOP Lecture-14api-19641717No ratings yet

- Balance of PaymentsDocument4 pagesBalance of Paymentsapi-3727090100% (4)

- India BopDocument33 pagesIndia Bopapi-3836566No ratings yet

- Part I - General Principles of Taxation (Case Digest)Document140 pagesPart I - General Principles of Taxation (Case Digest)Joshua Custodio0% (1)

- Questionnaire ResponceDocument158 pagesQuestionnaire ResponceKaveesh SharmaNo ratings yet

- Fiscal Responsibility and Budget Management Act, 2003Document27 pagesFiscal Responsibility and Budget Management Act, 2003RRK Varma ChintamaneniNo ratings yet

- AP Budget Manual PDFDocument620 pagesAP Budget Manual PDFthematic reviewNo ratings yet

- APPSC MAINS PYQ - Bhavani Sir PDFDocument31 pagesAPPSC MAINS PYQ - Bhavani Sir PDFRavindra ReddyNo ratings yet

- Budgeting: A Financial Planning Tool For Individuals: June 2019Document9 pagesBudgeting: A Financial Planning Tool For Individuals: June 2019Abhishek goyalNo ratings yet

- State Finances Report 2014-15Document158 pagesState Finances Report 2014-15Valar MathiNo ratings yet

- Class Room Notes Economy Adda247Document37 pagesClass Room Notes Economy Adda247Ankit BhardwajNo ratings yet

- Public Debt ManagementDocument16 pagesPublic Debt ManagementAnuska ThapaNo ratings yet

- Pakistan Economic Survey 2022 23Document467 pagesPakistan Economic Survey 2022 23Wasif Shakil100% (3)

- SWOT Greece Tourism Report PDFDocument3 pagesSWOT Greece Tourism Report PDFHai Lúa Miền TâyNo ratings yet

- Chile 1970-1973, Economic Development and Its International Setting. Institute of Social StudiesDocument423 pagesChile 1970-1973, Economic Development and Its International Setting. Institute of Social StudiesdavidizanagiNo ratings yet

- Chapter12 Budget Balance and Government DebtDocument33 pagesChapter12 Budget Balance and Government Debtblack pinkNo ratings yet

- ISC EconomicsDocument8 pagesISC EconomicsPrincess Soniya100% (1)

- Budjet Estimate, Performance BudjetDocument28 pagesBudjet Estimate, Performance BudjetYashoda SatputeNo ratings yet

- AsdfghjklDocument49 pagesAsdfghjklhNo ratings yet

- 4Document445 pages4lilylikesturtle75% (4)

- Norway and Health An Introduction IS 1730E PDFDocument36 pagesNorway and Health An Introduction IS 1730E PDFAngelo-Daniel SeraphNo ratings yet

- City of Fort St. John - Pandemic Effect On The Operating Budget, March 2020Document4 pagesCity of Fort St. John - Pandemic Effect On The Operating Budget, March 2020AlaskaHighwayNewsNo ratings yet

- Pancham Project ReportDocument18 pagesPancham Project ReportDrRp SinghNo ratings yet

- TheLabourPartyManifesto 2010Document78 pagesTheLabourPartyManifesto 2010Katey Sarah Alice RoweNo ratings yet

- Acca f9 Revision Kit Acca 24 Old Past Paper Solved Old Professional Scheme - CrackedDocument237 pagesAcca f9 Revision Kit Acca 24 Old Past Paper Solved Old Professional Scheme - CrackedAlex SemusuNo ratings yet

- Economic Crisis Quotes and Simplified Reasons:: Terror On Wall Street, A Financial Metafiction NovelDocument6 pagesEconomic Crisis Quotes and Simplified Reasons:: Terror On Wall Street, A Financial Metafiction NovelAmoùr De Ma VieNo ratings yet

- PR Fiscal Plan - 2017Document134 pagesPR Fiscal Plan - 2017Ricardo Rossello88% (56)

- Psaf Revision Day 4Document7 pagesPsaf Revision Day 4Esther AkpanNo ratings yet

- GBE CLASS Lecture1 2020 PDFDocument46 pagesGBE CLASS Lecture1 2020 PDFJingwei ChenNo ratings yet

- Public Debts PDFDocument15 pagesPublic Debts PDFguilhemoraisNo ratings yet

- Fiscal Policy, Public Debt Management and Government Bond Markets: The Case For The PhilippinesDocument15 pagesFiscal Policy, Public Debt Management and Government Bond Markets: The Case For The Philippinesashish1981No ratings yet

- Non Profit Organizations-Theory-1Document4 pagesNon Profit Organizations-Theory-1Titiksha Joshi100% (1)

- Chapter 03 Balance of PaymeDocument50 pagesChapter 03 Balance of PaymeLiaNo ratings yet