Professional Documents

Culture Documents

2014 Comparison

2014 Comparison

Uploaded by

alykatzCopyright:

Available Formats

You might also like

- Financial Plan TemplateDocument23 pagesFinancial Plan TemplateKosong ZerozirizarazoroNo ratings yet

- Board of Elections v. MostofiDocument15 pagesBoard of Elections v. MostofialykatzNo ratings yet

- Amtrak Monthly Performance Report January 2014Document64 pagesAmtrak Monthly Performance Report January 2014peterdemNo ratings yet

- Energy Audit ActivityDocument3 pagesEnergy Audit Activitydarshak444No ratings yet

- PS1 SolutionsDocument5 pagesPS1 SolutionsRushil SurapaneniNo ratings yet

- EVA TemplateDocument4 pagesEVA TemplateFahim MoledinaNo ratings yet

- Pay Revision 14 ProposalsDocument30 pagesPay Revision 14 ProposalsDhivya ParthasarathyNo ratings yet

- Earned ValueDocument17 pagesEarned ValueBlanche PhlaumNo ratings yet

- EVM - CalculatorDocument1 pageEVM - CalculatorSumitha Selvaraj100% (1)

- 40 Costing SummaryDocument21 pages40 Costing SummaryQueasy PrintNo ratings yet

- PH 3 PEP East Injection ImprovementDocument6 pagesPH 3 PEP East Injection ImprovementElias EliasNo ratings yet

- FM StudyguideDocument18 pagesFM StudyguideVipul SinghNo ratings yet

- EVM CalculatorDocument1 pageEVM CalculatoranthonyconnorNo ratings yet

- Lesson 7 - Earned Value ManagementDocument5 pagesLesson 7 - Earned Value ManagementAbid AhmadNo ratings yet

- Part 2: ST Rategy Formu Lation and Impl Emen Tatio NDocument22 pagesPart 2: ST Rategy Formu Lation and Impl Emen Tatio NMinh Huy Nguyen50% (2)

- Note On Review/Inspection of Flagship/Other Important Centrally Sponsored Schemes in State of Punjab, 25 To 27 November, 2009Document24 pagesNote On Review/Inspection of Flagship/Other Important Centrally Sponsored Schemes in State of Punjab, 25 To 27 November, 2009Vivek KankipatiNo ratings yet

- XYZ Energy ROIDocument27 pagesXYZ Energy ROIWei ZhangNo ratings yet

- After 100 Days of New Government No Khushi, Still Gham For Bank EmployeesDocument23 pagesAfter 100 Days of New Government No Khushi, Still Gham For Bank EmployeesAnonymous 4yXWpDNo ratings yet

- Analysis of Financial StatementsDocument9 pagesAnalysis of Financial StatementsmuradkasassbekNo ratings yet

- Project Quality Plan Rev 2Document69 pagesProject Quality Plan Rev 2natrix029No ratings yet

- Acc 3606 Cheatsheet FinalDocument2 pagesAcc 3606 Cheatsheet FinaldarciechoyNo ratings yet

- Practice - Use Expenditure Inquiry: WorkbookDocument10 pagesPractice - Use Expenditure Inquiry: WorkbookSAlah MOhammedNo ratings yet

- Nike Cost of CapitalDocument23 pagesNike Cost of CapitalSaahil Ledwani100% (1)

- FM11 CH 16 Mini-Case Cap Structure DecDocument11 pagesFM11 CH 16 Mini-Case Cap Structure DecAndreea VladNo ratings yet

- Master Thesis, Fixed - Karoline PetersenDocument83 pagesMaster Thesis, Fixed - Karoline Petersendow2008No ratings yet

- School of Quantity Surveying and Construction Management: Module Name: Module CodeDocument2 pagesSchool of Quantity Surveying and Construction Management: Module Name: Module CodeHafizah EzaniNo ratings yet

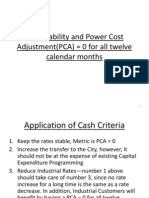

- Rate Stability and Power Cost Adjustment (PCA) 0 For All Twelve Calendar MonthsDocument44 pagesRate Stability and Power Cost Adjustment (PCA) 0 For All Twelve Calendar MonthsColin ClarkNo ratings yet

- Costing Tax Information (U.S.) 244298425.doc Effective 07/11/07 Page 1 of 10 Rev 1Document10 pagesCosting Tax Information (U.S.) 244298425.doc Effective 07/11/07 Page 1 of 10 Rev 1Kiran NambariNo ratings yet

- Production CostsDocument23 pagesProduction CostsraamseNo ratings yet

- 2010-09-02 235812 EurondaDocument6 pages2010-09-02 235812 EurondaKylie TarnateNo ratings yet

- Financial Analysis 105-115Document10 pagesFinancial Analysis 105-115deshpandep33No ratings yet

- Establishment of Electric Generation Department at Denim CityDocument3 pagesEstablishment of Electric Generation Department at Denim CityBrandon JohnsonNo ratings yet

- Shapiro CHAPTER 2 SolutionsDocument14 pagesShapiro CHAPTER 2 Solutionsjimmy_chou1314100% (1)

- Assignment 1Document4 pagesAssignment 1Ahmed IssawiNo ratings yet

- Ence 661 HM3Document3 pagesEnce 661 HM3Enrico BuggeaNo ratings yet

- Practice - Enter An Expenditure Batch: WorkbookDocument9 pagesPractice - Enter An Expenditure Batch: WorkbookSAlah MOhammedNo ratings yet

- Cover Letter For A Cost QuotationDocument1 pageCover Letter For A Cost QuotationKiran DuggarajuNo ratings yet

- Hotel Audit Work ProgramDocument60 pagesHotel Audit Work ProgramJean-Paul Hazoume100% (4)

- Assignment Finalterm MbaDocument2 pagesAssignment Finalterm MbaKazi Shafiqul AzamNo ratings yet

- TaxDocument45 pagesTaxShailesh Kediya100% (2)

- 7-3-55 - Measure of Static and Dynamic Compliance of The Ventilator PatientDocument2 pages7-3-55 - Measure of Static and Dynamic Compliance of The Ventilator PatientSherluck VonsNo ratings yet

- PERT Sample QuestionDocument4 pagesPERT Sample Questionrajkrishna03No ratings yet

- Shaikh2016 Appendix6.3Document3 pagesShaikh2016 Appendix6.3Diego PolancoNo ratings yet

- Mahmoud Megahed - Str. Fin. Mgmt. - Assginment 2Document20 pagesMahmoud Megahed - Str. Fin. Mgmt. - Assginment 2Mahmoud MegahedNo ratings yet

- LULC EI SouthDepartment 2012smallpdf - Com-1Document34 pagesLULC EI SouthDepartment 2012smallpdf - Com-1MD. ISMAIL HOSSAINNo ratings yet

- COA Ladderized Training CurriculumDocument3 pagesCOA Ladderized Training CurriculumJuan Luis LusongNo ratings yet

- 1forest Case Update Issue 80 September-October 2013Document13 pages1forest Case Update Issue 80 September-October 2013in678No ratings yet

- CH 10 IMDocument46 pagesCH 10 IMAditya Achmad Narendra WhindracayaNo ratings yet

- Gargallo 2017Document38 pagesGargallo 2017felipefinchNo ratings yet

- B.M. College of Administration: Pre - Feasibility Report On Retail Business of Gift & ArticlesDocument22 pagesB.M. College of Administration: Pre - Feasibility Report On Retail Business of Gift & ArticlesAhmed AlyaniNo ratings yet

- The Initial Data For Electroputere Is Presented BelowDocument3 pagesThe Initial Data For Electroputere Is Presented BelowAmelia ButanNo ratings yet

- Earned Value Management Tutorial Module 8: Reporting: Prepared byDocument20 pagesEarned Value Management Tutorial Module 8: Reporting: Prepared bytshawkyNo ratings yet

- Balance Sheet StatementDocument8 pagesBalance Sheet StatementsantasantitaNo ratings yet

- LDD Workshop Strategic Energy Planning: We Help The Best Buildings in The World Get That WayDocument95 pagesLDD Workshop Strategic Energy Planning: We Help The Best Buildings in The World Get That Waysenthilkumar99No ratings yet

- Processing CostsDocument21 pagesProcessing CostsKiran NambariNo ratings yet

- BUS 306 Exam 2 - Fall 2012 (B) - SolutionDocument14 pagesBUS 306 Exam 2 - Fall 2012 (B) - SolutionNguyễn Thu PhươngNo ratings yet

- Shapiro CHAPTER 2 SolutionsDocument14 pagesShapiro CHAPTER 2 SolutionsPradeep HemachandranNo ratings yet

- Water, Sewer & Pipeline Construction World Summary: Market Values & Financials by CountryFrom EverandWater, Sewer & Pipeline Construction World Summary: Market Values & Financials by CountryNo ratings yet

- Electric Bulk Power Transmission & Control World Summary: Market Values & Financials by CountryFrom EverandElectric Bulk Power Transmission & Control World Summary: Market Values & Financials by CountryNo ratings yet

- Water Well Drilling Contractors World Summary: Market Values & Financials by CountryFrom EverandWater Well Drilling Contractors World Summary: Market Values & Financials by CountryNo ratings yet

- Electricity Measuring & Testing Instruments World Summary: Market Values & Financials by CountryFrom EverandElectricity Measuring & Testing Instruments World Summary: Market Values & Financials by CountryNo ratings yet

- ThriveNYC Program BudgetDocument1 pageThriveNYC Program BudgetalykatzNo ratings yet

- State of Citys Finances2014Document57 pagesState of Citys Finances2014alykatzNo ratings yet

- Trump Tower Condo Abatement 7-18Document1 pageTrump Tower Condo Abatement 7-18alykatzNo ratings yet

- ADTL-MSCTM - Exercises - of - Data - Input - and Exploratory Analysis Using - RDocument3 pagesADTL-MSCTM - Exercises - of - Data - Input - and Exploratory Analysis Using - RPriyankaNo ratings yet

- Dynamic Simulation of The Sour Water Stripping Process and Modified Structure For Effective PresDocument11 pagesDynamic Simulation of The Sour Water Stripping Process and Modified Structure For Effective PresjavilapiedraNo ratings yet

- Lesson Plans WK 26Document7 pagesLesson Plans WK 26api-280840865No ratings yet

- Important Questions For MID I CNDocument14 pagesImportant Questions For MID I CN20H51A0540-NAKKA SREEKAR B.Tech CSE (2020-24)No ratings yet

- Introduction To Econometrics Ii (Econ-3062) : Mohammed Adem (PHD)Document83 pagesIntroduction To Econometrics Ii (Econ-3062) : Mohammed Adem (PHD)ፍቅር እስከ መቃብር100% (2)

- Standard DC Output: Simplified Internal Diagram of The Charger's Output ConnectionsDocument1 pageStandard DC Output: Simplified Internal Diagram of The Charger's Output ConnectionstoufikNo ratings yet

- Mod 4 AdministrativeDocument8 pagesMod 4 AdministrativeElla AlogNo ratings yet

- Math Chapter 3 Study GuideDocument3 pagesMath Chapter 3 Study Guideapi-311999132No ratings yet

- PRojectDocument61 pagesPRojectAditya SalunkheNo ratings yet

- Website ErrorDocument5 pagesWebsite ErrorJosé DavidNo ratings yet

- Topic On CC11Document3 pagesTopic On CC11Free HitNo ratings yet

- Food & Beverage Service Operation: Prepared By: Mr. Lance MercadoDocument22 pagesFood & Beverage Service Operation: Prepared By: Mr. Lance MercadoLyzelNo ratings yet

- Upper Primary Division Competition Paper: ThursdayDocument10 pagesUpper Primary Division Competition Paper: ThursdayOlga Rudenko BradfordNo ratings yet

- 100 S Oem S: 102R Low Flow PumpheadDocument2 pages100 S Oem S: 102R Low Flow PumpheadtechniqueNo ratings yet

- Assessment of Temporal Hydrological Variations Due To Land Use Changes Using Remote Sensing/GISDocument38 pagesAssessment of Temporal Hydrological Variations Due To Land Use Changes Using Remote Sensing/GISWubieNo ratings yet

- PS2 VGA Diagram Rev by GillBert - Rev2 PDFDocument6 pagesPS2 VGA Diagram Rev by GillBert - Rev2 PDFwuemuraNo ratings yet

- Blake Problem ComputationDocument3 pagesBlake Problem ComputationNiño del Mundo75% (4)

- Agrirobot PDFDocument103 pagesAgrirobot PDFMuhamad Azlan ShahNo ratings yet

- Application: Accounts Payables Title: Recurring Invoice: OracleDocument12 pagesApplication: Accounts Payables Title: Recurring Invoice: OraclesureshNo ratings yet

- CSP 01 Intro Study Questions Rev005Document2 pagesCSP 01 Intro Study Questions Rev005Shakeb RahmanNo ratings yet

- Marketing Plan: GoldilocksDocument18 pagesMarketing Plan: GoldilocksAkhia Visitacion100% (1)

- Solar Power PlantDocument23 pagesSolar Power Plantmadhu_bedi12No ratings yet

- Matthew PernaDocument5 pagesMatthew PernaWPXI StaffNo ratings yet

- GL005 PIPE ROUTING GUIDELINE Rev 2Document22 pagesGL005 PIPE ROUTING GUIDELINE Rev 2MIlan100% (1)

- ABLRFD v1403 Summary RevisionsDocument2 pagesABLRFD v1403 Summary RevisionsMiguel AngelNo ratings yet

- Expt. 8 Salivary DigestionDocument25 pagesExpt. 8 Salivary DigestionLESLIE JANE BALUYOS JALANo ratings yet

- My Ideal Job BankerDocument4 pagesMy Ideal Job BankerAnne MaryNo ratings yet

- Cost Justifying HRIS InvestmentsDocument19 pagesCost Justifying HRIS InvestmentsJessierene ManceraNo ratings yet

- Castel Airco 2014-15Document68 pagesCastel Airco 2014-15Anderson Giovanny Herrera DelgadoNo ratings yet

- Ateneo Philosophy Club: Project ProposalDocument2 pagesAteneo Philosophy Club: Project ProposalArmando MataNo ratings yet

2014 Comparison

2014 Comparison

Uploaded by

alykatzOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2014 Comparison

2014 Comparison

Uploaded by

alykatzCopyright:

Available Formats

!"#$%&'() +,- ./0! %(1 +,- 234 /(5"#- %(1 67$-(8- 9+:1; < =>?

@>@A

1

!"#$%&'() +,- .&'/- 0(1-2 "3 4$-&%+'() !"5+5 6.04!7 %(1 +,-

89: 0(/"#- %(1 ;2$-(5- <+=1>

Bi. }ames F. Buuson

Naich 21, 2u14

The New Yoik City Rent uuiuelines Boaiu (RuB) uses two methous foi measuiing

the change in the annual 0peiations anu Naintenance (0&N) expenses paiu by

owneis of ient stabilizeu units in New Yoik City.

The RuB !"#$%& (") *+,&"-& ./0)1 2!3*4 pioviues an analysis of expenses as

iepoiteu by owneis in the Real Piopeity Income anu Expense (RPIE) statements as

iequiieu by Local Law 6S, enacteu in 1986. These expenses aie submitteu annually

to the NYC Bepaitment of Finance anu iepiesent iepoiteu expenses by most

lanuloius with stabilizeu units baseu on the most iecent completeu calenuai yeai at

the time of filing. As with any uata collection effoit, theie aie some conceins with

uata quality anu accuiacy (uiscusseu fuithei below). Bowevei, these iepoiteu

expenses shoulu be close to the actual 0&N costs foi the iepoiting builuings, anu

can be useu to estimate the 0&N costs foi all stabilizeu builuings. In geneial, the I&E

uata shoulu be iepiesentative of actual expense changes, at least foi the builuings

with 11 oi moie units which must submit full RPIE iepoits annually. Bowevei, it

takes about a yeai foi the I&E uata to be maue available by the Bepaitment of

Finance. Foi example, the most iecent I&E uata that coulu be useu foi the 2u1S

uuiuelines was fiom 2u11.

The RuB 567#& !")&+ $8 9,&6(/7": ;$-/- 25!9;4 gatheis piices foi a maiket basket

of goous anu seivices useu in the opeiation anu maintenance of ient stabilizeu

builuings in NYC anu applies those to estimate cost changes fiom one yeai to the

next. This is the same appioach useu by the Consumei Piice Inuex (CPI) anu othei

similai inuices, but foi the goous anu seivices typically puichaseu by builuing

owneis. The key assumption heie is that the actual quantities of the vaiious items

puichaseu uo not change significantly ovei time, so the quantities puichaseu in the

oiiginal suivey aie close to those puichaseu now.

The PI0C is composeu of '+-#8 which aie inuiviuually piiceu anu aie then gioupeu

into 5"#$"(-(+8 such as Taxes, Laboi, anu Contiactoi Seivices. The I&E pioviues

uata foi a similai, but slightly uiffeient, set of 5"#$"(-(+8. The PI0C measuies

changes in piices of these items, not actual expenses. But it is timely - piice changes

thiough Naich 2u1S weie useu to help ueteimine the 2u1S uuiuelines.

The iates of inciease in oveiall opeiating costs fiom the I&E have been smallei than

those shown by the PI0C in iecent yeais. That leaus to thiee questions:

Bow uiffeient aie the PI0C anu I&E estimates.

!"#$%&'() +,- ./0! %(1 +,- 234 /(5"#- %(1 67$-(8- 9+:1; < =>?@>@A

"

#$% &'( )$(*( )+, -./-0(* /-11('(.)2

3,+ *$,45/ )$( 6789 :( -;<',=(/2

>$-* &.&5%*-* 4*(* /&)& 1',; )$( ?@@"A"B?" 6789C +$-0$ 0,=(' (*)-;&)(/ 0,*)

0$&.D(* 1',; E<'-5 ?@@" )$',4D$ F&'0$ "B?"G H,' )$( 7IJC -) 4*(* )$( 1-5-.D* 1',;

?@@? )$',4D$ "B?? K+-)$ )$( (L0(<)-,. ,1 "BBMC +$('( ., 4*(145 /&)& +('(

&=&-5&:5(NG >$-* /&)& -* 1',; OPQ '(0,'/* &./ -* -.054/(/ -. E<<(./-L ? &./

E<<(./-L "G

!"# %&''()(*+ ,)( +-( ./01 ,*% /23 (4+&5,+(46

E *-;<5( 0,;<,4./ D',+)$ ;,/(5 +&* 1-) ), )$( ,=('&55 )-;(A*('-(* /&)& &./ ), )$(

0,;<,.(.)A:%A0,;<,.(.) )-;( *('-(*G >$( ;,/(5 &**4;(* )$&) )$( 0,*) (&0$ %(&'

+-55 :( QR $-D$(' )$&. -. )$( <'(=-,4* %(&' &./ (*)-;&)(* )$( =&54( 1,' LG H,';&55%C

0,*) S E T K? U QN V ) +$('( E &./ Q &'( (*)-;&)(/ 0,(11-0-(.)* &./ ) -* )$( %(&' &1)('

?@@?G >$-* ;,/(5 <',=-/(* '(D'(**-,. *)&)-*)-0* -.054/-.D )$( OV" 1,' D,,/.(** ,1 1-)

&./ )$( W)&./&'/ J'','* 1,' (&0$ 0,(11-0-(.)G >$( )&:5( *$,+* & *4;;&'% ,1 )$(

'(*45)*G H455 '(*45)* &'( *$,+. -. E<<(./-L MG

IE

component

Avg. Rate

per year +/- PIOC component

Avg. Rate

per year +/-

Taxes 4.81% 0.88% Taxes 5.77% 0.59%

Labor 2.82% 0.25% Labor 3.66% 0.11%

Fuel 6.16% 1.78% Fuel Oil 8.35% 1.47%

dUtilities 4.35% 0.58% Utilities 5.20% 0.48%

Admin 4.63% 0.57% Management 4.34% 0.16%

Insurance 4.18% 1.12% Insurance 6.47% 1.08%

Maintenance 2.79% 0.50% Contractor 3.79% 0.20%

Misc. 4.61% 2.15% Parts & Supplies 1.88% 0.20%

Replacement 1.73% 0.24%

Total 4.28% 0.56% Total 5.21% 0.44%

8=('&55C )$( 6789 D'(+C ,. &=('&D(C :% &:,4) XG"R <(' %(&' /4'-.D )$-* "?A%(&'

<('-,/ &./ )$( 7IJ D'(+ :% &:,4) BG@ <('0(.)&D( <,-.)* 5(**C YGMRG >$( ZU[AZ

0,54;. -* )+-0( )$( *)&./&'/ /(=-&)-,.C *, -) D-=(* & ',4D$ -/(& ,1 )$( &004'&0% ,1 )$(

(*)-;&)(G #$-5( -) +,45/ :( (&*% ), 0&5045&)( )$( *)&)-*)-0&5 *-D.-1-0&.0( ,1 )$(

/-11('(.0(C ,.( *$,45/ :( *\(<)-0&5 ,1 <4))-.D ),, ;40$ )'4*) -. *)&)-*)-0&5 )(*)* +$(.

)$( *&;<5( *-]( -* *;&55 &./ )$( /&)& -* $-D$5% 0,''(5&)(/

W)-55C )$('( -* *,;( /-11('(.0( &./ )$( 6789 0$&.D(* &<<(&' ), :( 5&'D(' )$&. )$(

0$&.D(* -. (L<(.*(* *$,+. :% )$( 7IJ /&)&G

!"#$%&'() +,- ./0! %(1 +,- 234 /(5"#- %(1 67$-(8- 9+:1; < =>?@>@A

S

Regiessions weie also iun against the fiist half anu seconu half of the peiiou. In the

fiist half, the estimateu giowth iate foi the PI0C is 2.9% annually anu the estimateu

giowth iate foi the I&E is S.u%. In the seconu half, the estimateu iate foi the PI0C is

6.2% annually anu the I&E is 4.S%. So the uata suggests that the uiveigence

between the two appioaches is acceleiating.

To get a bettei unueistanuing between the uiffeiences of these two measuiements

of expense, we can examine the uiffeiences in !""#!$ giowth iates between the

inuiviuual components. In teims of the components,

Taxes uiffei by about 1%, which is somewhat suipiising because both

methous cuiiently use calculations baseu on uata fiom the Bepaitment of

Finance. But the eaily yeais of the I&E calculations weie baseu on iepoiteu

tax payments, so the seiies may not be uiiectly compaiable.

Laboi coulu be influenceu by seveial factois, incluuing the ielative

pievalence of union anu non-union laboi. In any case, the giowth iate

estimateu fiom the PI0C uata is about u.8% highei than the I&E.

The giowth iate foi Fuel is 2.2% highei in the PI0C than in the I&E, though

both aie volatile because of how much fuel piices change. (This is shown in

the laigei stanuaiu eiioi values).

0tilities costs giow about u.8% moie in the PI0C than in the I&E, anu again

these values aie faiily volatile because of the effects of fuel piices.

Auministiation costs in the I&E giow slightly fastei than Nanagement in the

PI0C, by about u.S%. This may be because of the two appioaches classify the

costs that aie pait of "Auministiation" oi "Nanagement".

Insuiance is 2.S% highei in the PI0C, but insuiance piices have also been

volatile anu the PI0C collects actual costs foi a sample of builuings. In the

past, some analyses have been uone on the effects of changes in coveiage.

Naintenance anu Niscellaneous in the I&E come closest to matching

Contiactoi Seivices, Paits & Supplies, anu Replacement Costs in the PI0C.

But the match isn't all that goou fiom one to anothei. Theiefoie, it is uifficult

to make any conclusions about how uiffeient the estimates aie.

!"# %&' ("'&' )*++'&',-'./

Both appioaches attempt to measuie changes in costs. Both appioaches also have

limitations. It's impoitant to ieview those limitations anu then uevelop hypotheses

about why the seiies uiveige. Foi some of the possible ieasons, it's also possible to

uo some testing of the hypotheses.

01234 5&6-'.. %,) 7*8*(%(*6,.

0wneis weie initially suiveyeu about theii uetaileu expenuituies on vaiious goous

anu seivices. These weie categoiizeu into the nine PI0C components anu, within

each component, to a set of items. Weights weie then calculateu foi the items. If, in

that oiiginal suivey, owneis spent 1u% of theii 0&N buuget on insuiance, then the

"expenuituie weight" foi insuiance was 1u%. If Auministiative Costs was 1S%, then

the categoiy woulu get a weight of 1S%. Thus, each of the nine components weie

weighteu accoiuingly.

!"#$%&'() +,- ./0! %(1 +,- 234 /(5"#- %(1 67$-(8- 9+:1; < =>?@>@A

4

The same piocess was useu to iuentify weights foi the items in each component. Foi

example, if half of the oiiginal expenuituies in the Auministiative Costs component

weie foi Nanagement Fees anu 2u% foi Legal Seivices, the item weights woulu be

Su% anu 2u% iespectively.

At that point, specifications weie cieateu foi iepiesentative expenuituies foi each

item, foi example painting a one-beuioom apaitment. Anu cuiient piices weie

collecteu foi each of those specifications.

The next yeai, new piices weie collecteu foi each specification (spec), along with

confiimation of pievious piices to impiove uata quality. By using the change in each

piice anu the weight on that paiticulai item, the uata coulu be iolleu up to oveiall

estimates of the Piice Inuex.

But theie is one moie step. Aftei completing the Piice Inuex each yeai, the change in

piices aie useu to iecalculate the expenuituie weights foi the next yeai. Consiuei a

simple example, with a piice inuex containing two components, each oiiginally

compiising Su% of expenuituies:

Fiist yeai

o Painting($Suu) + Plumbing($Suu)= Total Expenses($1,uuu)

Seconu yeai

o Expenuituie weight foi painting = $Suu$1uuu = Su%

o Expenuituie weight foi plumbing = $Suu$1uuu = Su%

o Painting, $6uu

o Plumbing, $Suu

o Total Expense, $1,1uu

o Piice inuex foi painting = 2u% inciease

o Piice inuex foi plumbing = u% inciease

o 0veiall piice inuex =$11uu$1uuu = 1u% inciease

Thiiu yeai

o Expenuituie weight foi painting = $6uu$11uu = SS.S%

o Expenuituie weight foi plumbing = $Suu$11uu = 4S.S%

This iecalculation of weights allows the Piice Inuex to incluue the effects of all

pievious piice changes in the bieakuown of the ownei's expenuituies.

Bowevei, it is only the effects of !"#$% changes that get incluueu in the weights. If

owneis iesponueu to these piices oi othei factois by changing &'( *+$& they buy,

foi example ielatively less painting oi ielatively moie plumbing, the yeai-by-yeai

PI0C woulu not captuie that change. That iequiies analyzing the full iange of

expenses, which woulu necessitate uoing an expenuituie suivey each yeai.

In a puie piice inuex, this is the methouology. The PI0C is actually a hybiiu - most

specifications aie piice-baseu, but some items (ieal estate taxes, management fees,

insuiance, non-union laboi) aie baseu on suiveys of actual expenses by owneis, oi

uata fiom othei agencies. Also, estimates foi fuel oil anu natuial gas foi heating aie

baseu on a combination of monthly piices anu tempeiatuies, which affect the

!"#$%&'() +,- ./0! %(1 +,- 234 /(5"#- %(1 67$-(8- 9+:1; < =>?@>@A

S

amount of fuel neeueu each month. In geneial, though, the oveiall methouology is a

piice inuex.

Theie aie seveial ways in which the PI0C piice changes might not be iepiesentative

of actual changes in expenses, especially ovei a long peiiou:

The item specifications may no longei be iepiesentative of what owneis

actually buy. Foi example, the PI0C incluues piices foi Lease Foims as

iepiesentative of geneial office supplies. It has a veiy small weight anu

piactically no effect on the oveiall PI0C, anu few owneis buy piepiinteu

Lease Foims anymoie, they use uownloauable veisions.

The item weights within the nine components coulu be incoiiect. Foi

example, the shift of fuel use away fiom #6 oil towaius #2 anu #4 oil shoulu

affect the ielative weights of those piice changes.

The weights of the components coulu have shifteu. A shift fiom oil to gas

heating shoulu leau to highei weights foi 0tilities anu lowei weights foi Fuel.

Finally, owneis coulu change the oveiall quantities of what they buy. The

PI0C is uesigneu to show the change in piices. But costs aie baseu on "piice

times quantity", anu the quantity can change. Foi example, owneis might

invest in eneigy conseivation impiovements anu ieuuce theii quantity (anu

cost) foi fuel. But the PI0C woulu only show the change in fuel piices, not the

change in oveiall cost.

All of these limitations have little effect in any paiticulai yeai because, in a single

yeai, theie aie only a limiteu numbei of aujustments maue by owneis in theii

buying patteins. 0vei time, these aujustments will builu up. A uetaileu compaiison

between 2u1S anu 2u12 in what owneis puichaseu woulu piobably show only

minoi uiffeiences. But theie woulu be majoi uiffeiences in a compaiison between

2u1S anu 198S, the yeai of the last PI0C expenuituie suivey. Anu those 198S

expenuituies aie the basis foi the quantities that unueilie the PI0C.

Any time owneis can become moie efficient anu use fewei goous anu seivices,

whethei it's by auveitising online insteau of in the newspapeis, oi by competitive

biuuing to change insuiance caiiieis, they will ieuuce theii costs. The PI0C will not

automatically captuie those efficiencies.

!"#$ &'()*++ ,-. /0102,20(-+

0wneis must submit categoiizeu iepoits, RPIE statements, of theii expenses

annually, foi builuings with 11 oi moie units. This uata is piocesseu anu

summaiizeu, actual tax billings aie auueu, anu the summaiy infoimation is pioviueu

to the Rent uuiuelines Boaiu. The RuB staff then uses a set of weights ueiiveu fiom

the B":8'() %(1 C%5%(5; 9:&D-; (BvS) to uevelop estimateu costs by boiough anu

citywiue.

Theie aie five conceins with the I&E uata foi this analysis:

!"#$%&'() +,- ./0! %(1 +,- 234 /(5"#- %(1 67$-(8- 9+:1; < =>?@>@A

6

Since the I&E stuuy uoes not incluue 6-1u unit builuings, the iesults coulu be

uistoiteu in some way.

The most iecent I&E uata is maue available about a yeai aftei the enu of the

iepoiting peiiou, so it is somewhat out of uate. Foi example, the I&E uata

available foi the 2u1S uuiuelines was fiom calenuai yeai 2u11.

0wneis may make eiiois in classifying theii expenses, paiticulaily in

ueciuing whethei a paiticulai expense is iepoitable as an opeiating cost oi

shoulu not be iepoiteu.

The I&E methouology has changeu ovei time, with impioveu uata collection,

somewhat mouifieu classification iules, anu use of tax bills iathei than

iepoiteu taxes. So the uata - anu ielateu yeai-to-yeai cost incieases - may

not ieally be compaiable.

While all builuings with 11 oi moie stabilizeu units aie iequiieu to file RPIE

uata, compliance is nevei 1uu%, anu some uata is always incomplete,

inconsistent, oi otheiwise unusable. Theie coulu also be eiiois intiouuceu

by weighting since the RuB only ieceives summaiy infoimation by boiough

anu builuing size class, not the iaw uata foi each of the iepoiting builuings.

!"# %&' ()**'+',-'. ), %&' /00+"/-&'. /**'-% %&' +'.12%.

Theie aie seveial possible ieasons foi the uiffeiences between the PI0C anu the I&E

that can be analyzeu given the uata.

Possibility 1: The I&E might not be iepiesentative because it excluues 6-1u unit

builuings.

0veiall, 6-1u unit builuings make up 42.1% of the stabilizeu B:'C1'()8 in the 2u1S

PI0C tax sample, but only 9.2% of the stabilizeu iesiuential :('+8. 0vei 9u% of those

6-1u unit builuings weie built befoie 1947.

If the costs foi smallei builuings weie incieasing moie quickly than foi laigei

builuings, the I&E might unueiestimate total costs. Theie is limiteu infoimation in

the I&E foi analyzing this, but theie aie a few inuicatois.

Fiist, we can look at the cost incieases foi othei similai, but laigei, builuings in the

I&E stuuy. 0vei the past foui yeais, the cumulative cost inciease foi pie-47

builuings in the I&E have been:

11-19 units: +1u.S1%

2u-99 units: +12.16%

1uu+ units: +1u.Su%

If the 6-1u unit builuings hau theii costs incieasing much fastei than the I&E as a

whole, one might expect the inciease foi 11-19 unit builuings to be moie than that

foi 2u-99 unit builuings, anu both to be moie than the inciease foi 1uu+ unit

builuings. In this limiteu analysis, theie is no such pattein.

Seconu, consiuei the fact that the smallei builuings aie unuei 1u% of the total

population, which means that theii costs woulu have to inciease much fastei than

!"#$%&'() +,- ./0! %(1 +,- 234 /(5"#- %(1 67$-(8- 9+:1; < =>?@>@A

"

#$% &'(#( )'* +,*-%* ./0+102- #' *,0(% #$% -*'3#$ *,#% )'* ,++ ./0+102-(4 5'2(01%* ,

(067+0)0%1 %8,67+% 3$%*% .%#3%%2 9%,* : ,21 9%,* ; &'(#( *'(% 02 ,++ ./0+102-( .9

8<= )*'6 >>>> #' ?:@A@B

C,*-% ./0+102-( DE:< ') ,++ /20#(F

o &'(# 7%* /20# 02 9%,* :B ?:@@@

o &'(# 7%* /20# 02 9%,* ;B ?:@G@

HIJ5 -*'3#$ *,#% )*'6 9%,* : #' 9%,* ;

K6,++%* ./0+102-( DE< ') ,++ /20#(F

o 5'(# 7%* /20# 02 9%,* :B ?:@@@

o 5,+&/+,#%1 &'(# 7%* /20# 02 9%,* ;= #' 6,L% #$% 'M%*,++ ,M%*,-% )'* ,++

./0+102-( ?:@A@B ?::A:

o 5,+&/+,#%1 -*'3#$ *,#% *%N/0*%1 )'* (6,++ ./0+102-(B :A4:<

I2 -%2%*,+= 0# 3'/+1 #,L% %8#*,'*102,*9 -*'3#$ *,#%( 02 #$% '7%*,#02- &'(#( )'* (6,++

./0+102-( #' *,0(% #$% ,22/,+ -*'3#$ *,#% )'/21 .9 #$% IOP (#/19 , 6%,202-)/+

,6'/2#4 Q' 6,#&$ #$% HIJ5= #$% -*'3#$ *,#% 02 ,22/,+ '7%*,#02- &'(#( )'* (6,++

./0+102-( 3'/+1 $,M% #' .% "R:@< $0-$%* #$,2 #$% IOP M,+/%( )'* +,*-%* ./0+102-(4

S21 #$'(% -*'3#$ *,#%( 02 &'(#( ,*% 2'# (/(#,02,.+%4 T'* %8,67+%= 0) #$% ,22/,+

'7%*,#02- &'(# 7%* /20# )'* UR:@ /20# ./0+102-( $,1 .%%2 ,# #$% &0#9 ,M%*,-% ') ?V"@

02 :EE:= ,21 -*%3 ,# :@< 7%* 9%,*= 0# 3'/+1 $,M% .%%2 ,.'/# ?;A@@W/20# 02 ;@::4

Q$0*1= '32%*( ') (6,++%* ./0+102-( 6,9 (/.60# ,2 XPYZ M%*(0'2 ') #$% [HIP 30#$

+060#%1 02)'*6,#0'24 Q$% (,67+%( ,*% ),0*+9 (6,++= ,21 (%+)R(%+%&#%1= ./# #$%9 ($'3

,M%*,-% '7%*,#02- &'(#( ,*'/21 ?E@@W/20# 7%* 6'2#$ )'* #$% 7,(# )%3 9%,*(B

;@@\B ?UU@4A\ 7%* /20# 7%* 6'2#$

;@@EB ?E\@4U"

;@:@B ?E;V4E;

;@::B ?E@G4@\

;@:;B ?E"@4\V

Q$0( 0( ,.'/# ?:@@W6'2#$ $0-$%* #$,2 #$% IOP (#/19 ($'3( )'* +,*-%* ./0+102-(4 I)

#$0( 1,#, 3,( )*'6 , (&0%2#0)0& (,67+%= #$% +,*-% 02&*%,(% .%#3%%2 ;@@\ ,21 ;@@E

3'/+1 2%%1 #' .% ,2,+9]%1 )/*#$%*= ,21 #$% (#%,19 &'(#( )'* ;@@ER;@:; 3'/+1 ,+('

.% (/*7*0(02-4 ^0#$ (%+)R(%+%&#%1 /2,/10#%1 1,#,= 0# 0( $,*1 #' 6,L% ,29 ('+01

&'2&+/(0'2(4 I# (%%6( M%*9 +0L%+9 #$,# '7%*,#02- &'(#( ,*% (060+,* )'* #$% (6,++%* ,21

+,*-%* ./0+102-(= #$'/-$ %87%210#/*% 7,##%*2( &'/+1 .% M%*9 10))%*%2#4

Q$% UR:@ /20# ./0+102-( 6,9 '* 6,9 2'# $,M% '7%*,#02- &'(#( 7%* /20# #$,# ,*%

$0-$%* #$,2 #$% +,*-%* ./0+102-( 02&+/1%1 02 #$% IOP (#/194 _/# #$%*% 0( 2' %M01%2&%

02 #$0( 1,#, #$,# #$% *,#% ') -*'3#$ 02 #$%0* '7%*,#02- &'(#( 0( &'2(0(#%2#+9 $0-$%*

#$,2 #$% *,#% )'* +,*-%* ./0+102-(4

H'((0.0+0#9 ;B J32%*( 6,9 .% 'M%*R '* /21%**%7'*#02- #$%0* &'(#( )'* #$% IOP4

Q$% L%9 7'02# $%*% 0( #$,# #$0( ,2,+9(0( 0( &'2&%*2%1 30#$ -*'3#$ *,#%(= 2'# 2'602,+

%87%210#/*%(4 I) '32%*( 3%*% #' &'2(0(#%2#+9 'M%*R '* /21%*R*%7'*# #$%0*

!"#$%&'() +,- ./0! %(1 +,- 234 /(5"#- %(1 67$-(8- 9+:1; < =>?@>@A

8

expenuituies foi the I&E stuuy, that woulu have only a minoi effect on the giowth

iate. Foi example, if owneis weie to consistently excluue theii costs foi natuial gas,

it woulu affect the aveiage cost pei unit in the I&E stuuy. But it woulu only affect the

giowth iate in opeiating costs when the yeai-to-yeai change in gas costs was much

moie, oi much less, than in the costs foi othei goous.

Bowevei, ovei- oi unueiiepoiting coulu affect the long-teim giowth iate if the

iepoiting iules changeu significantly ovei time. It is possible, but it woulu have to be

a laige change. Foi example, consiuei a scenaiio wheie:

neaily all owneis incluueu a type of opeiating cost in the fiist five yeais of

RPIE iepoiting, 1991-199S

half uiu so in the next five yeais, 1996-2uuu

one-quaitei uiu so fiom 2uu1-2uuS

none uiu so aftei 2uuS

A pattein like that woulu aitificially ieuuce the calculateu giowth iate foi the I&E

uata. Since each peiiou woulu ieuefine what was consiueieu an "opeiating cost," the

iesults woulu not ieally be compaiable fiom yeai to yeai.

It has been suggesteu that the iules foi RPIE iepoiting have become moie stiict

ovei the past two uecaues so that some moie iecent expenses may be excluueu oi

classifieu as capital iathei than opeiating costs. But even if that is tiue, consiuei

what woulu be iequiieu to affect the calculateu giowth iate fiom the I&E uata. To

inciease that giowth iate by u.9%, appioximately 2u% of the I&E "opeiating costs"

in the eaily yeais woulu have to have been ovei-iepoiting of invaliu costs. So, while

this is a concein, it uoes not appeai to be a majoi contiibutoi to the uiffeience

between the two stuuies.

Possibility S: 0niepiesentative PI0C specifications

The PI0C items coulu be anothei souice of uiffeience. The items in each categoiy

aie supposeu to be iepiesentative of what owneis buy. If they'ie not, anu if the tiue

piices of the items aie incieasing at a slowei iate than the PI0C items, then the PI0C

coulu be oveistateu. But the items that aie most pioblematic aie also the ones with

the lowest weights in the PI0C. Foi example, if few people buy lanuline telephones

any moie, anu the costs of cell phones, which aie not collecteu foi use in the PI0C,

weie to inciease moie slowly than the cost of lanulines, the effect of omitting the

costs of cell phones on the oveiall Piice Inuex woulu be minimal. Theiefoie,

uniepiesentative PI0C specifications aie not likely to be majoi contiibutois to the

uiffeience.

Possibility 4: Piice incieases anu Expense incieases aie not the same

The PI0C estimates changes in piices. But any business ownei will tiy to limit theii

costs. They uo this by mouifying what they buy. So, as piices foi one goou goes up,

owneis will shift to othei piouucts oi ieuuce quantities to tiy to limit theii costs. All

else being equal, a piice inuex will inciease fastei than actual costs. Bowevei, this

!"#$%&'() +,- ./0! %(1 +,- 234 /(5"#- %(1 67$-(8- 9+:1; < =>?@>@A

9

effect shoulu be faiily constant, since owneis will make those aujustments eveiy

yeai.

Possibility S: 0wneis shift theii expenuituie patteins ovei time

The PI0C assumes that owneis buy the same maiket basket of goous anu seivices as

they uiu in the oiiginal expenuituie suivey. While it uses actual costs in a few

impoitant aieas - taxes, management fees, insuiance, anu non-union laboi - it

assumes constant quantities foi all the piiceu goous. But those quantities have

unuoubteuly changeu ovei time. This is likely to be the majoi souice of the

uiffeiences between the two stuuies since it is the one that best explains the way the

two estimates aie getting less anu less similai as time goes on.

!"# %&'() *&)+) ,-. /) "*&)+ 0"1*+'/2*"+3# *&) 4). -55)-+3 *" /) 0&-16)3 '1

&"% "%1)+3 0&-16) *&)'+ 35)17'16 '1 +)35"13) *" 0&-16)3 '1 5+'0)3 -17 *&)

6""73 -17 3)+8'0)3 *&-* -+) -8-'(-/()9

!"# %&' ()* +,-. /* 0123"4*56

Theie aie thiee aspects of the PI0C which can be impioveu using the I&E anu othei

uata.

0veiall expenuituie weights

Item weights

Item specifications

-4*3&77 *82*'50(93* #*0:)(;

A piice inuex, like the PI0C, is an excellent tool foi tiacking shoit-teim changes in

the piices of a set of goous anu seivices.

But it neeus to be baseu on ieal expenuituies peiiouically oi it will become

incieasingly unconnecteu to the ieal maiket basket being puichaseu.

The I&E pioviues those ieal expenuituies, but the uata is ovei a yeai olu when the

RuB uoes its analysis anu ueteimines the guiuelines. In cases wheie theie is a majoi

change in piices - an eneigy shock, foi example, the Boaiu neeus to captuie piice

changes soonei.

So, one option woulu be to use the expenuituies iuentifieu in the I&E to cieate

component weights foi the PI0C. Foi example, the 2u1S I&E stuuy has the following

component weights (compaieu to the 2u1S PI0C component weights):

!"#$%&'() +,- ./0! %(1 +,- 234 /(5"#- %(1 67$-(8- 9+:1; < =>?@>@A

1u

2013 I&E

Component Weight

2013 PIOC

Component Weight

Taxes 26.5% Taxes 29.6%

Labor 11.4% Labor 12.9%

Fuel 13.9% Fuel 13.2%

Utilities 11.3% Utilities 16.3%

Admin 16.3% Admin 7.2%

Insurance 12.7% Insurance 6.8%

Maintenance 4.6% Contractor 12.0%

Other 3.3% Parts & Supplies 1.4%

Replacement 0.6%

Theie aie two technical issues involveu in using the I&E weights. Fiist, the

inuiviuual items in the PI0C woulu neeu to be allocateu to the coiiesponuing I&E

components. Appenuix 4 pioviues a possible allocation using the uetaileu RPIE

iepoiting lines; an allocation using the summaiieu components fiom the I&E stuuy

woulu be slightly simplei - foi example, it woulu combine the "Light anu Powei"

anu "Watei anu Sewei" lines into a "0tilities" component.

Seconu, the I&E weights aie fiom a yeai eailiei than the PI0C. So those uata shoulu

be upuateu baseu on the pievious PI0C piices. Foi example, foi 2u14 this woulu

involve:

Taking the I&E costs pei component fiom 2u12

0puating those to estimateu 2u1S costs baseu on the 2u1S PI0C

Aujusting the weights baseu on those 2u1S costs

As with the PI0C weights now, if the piices foi one component incieaseu moie than

foi anothei component, its ielative weight in the 2u14 PI0C woulu inciease.

This appioach woulu mean that the expenuituie weights foi the PI0C components

woulu nevei be moie than two yeais out of uate, which woulu be a majoi

impiovement.

!"#$ &#'()"*

The I&E uata uoes not pioviue any uetaileu bieakuown of what was puichaseu

within any of the opeiating cost components. Bowevei, in ceitain ciitical aieas, the

PI0C has alieauy been using the annual suivey uata to mouify item weights.

!"#$%&'() +,- ./0! %(1 +,- 234 /(5"#- %(1 67$-(8- 9+:1; < =>?@>@A

11

A iecent PI0C suivey iequesteu infoimation on expenses foi natuial gas anu oil.

These weie useu to mouify the item weights foi the associateu specifications baseu

on actual expenuituie patteins. This appioach shoulu be continueu. The annual

suivey shoulu collect uata foi one aiea of expenses each yeai.

Foi example, the suivey alieauy collects uata on non-union laboi costs anu the value

of apaitments pioviueu to builuing supeiintenuents eveiy yeai. So, foi instance, in

the yeai focusing on "Laboi" costs, it coulu also collect expense infoimation on

union laboi costs anu on benefits.

In the "Seivices" yeai, it coulu collect costs foi painting contiactois anu

maintenance anu iepaii seivices.

This appioach woulu pioviue new uata foi upuating item weights eveiy S-6 yeais

without gieatly incieasing the uata iepoiting buiuen foi owneis.

!"#$ &'#()*)(+"),-.

RuB staff has mouifieu item specifications in the past, paiticulaily when ceitain

items become unavailable. This iequiies iuentifying a new item, collecting piice uata

foi both the cuiient yeai anu the pievious yeai, anu then using the new item going

foiwaiu.

Bowevei, changing the style anu size, foi example, of a piiceu iefiigeiatoi is

somewhat uiffeient fiom saying "we will no longei piice office supplies, we will

piice laptops insteau".

The main oppoitunity foi mouifying the items woulu come in the annual suiveys to

collect costs foi the item weights. The I&E foims incluue a listing of typical costs to

be incluueu in each component. The RuB staff can collect uata on costs of these

types in the annual suiveys anu iuentify new item specifications wheie necessaiy.

0lu items which no longei iepiesent significant costs can be ietiieu.

/)$)"+"),-.

Aftei all is saiu anu uone, the PI0C still measuies piices, not costs. It can be expecteu

to slightly oveiestimate changes in costs. Bowevei, once the PI0C anu I&E aie

woiking with similai components anu the PI0C weights aie baseu on the I&E,

compaiisons can be uone. Foi example, the 2u1S PI0C inciease coulu be compaieu

to the I&E uata foi 2u1S ieleaseu in miu-2u14, the 2u14 PI0C to I&E uata ieleaseu

in miu-2u1S, anu so foith. This will pioviue a check on how much the PI0C

estimates uiffei fiom actual expenuituie shifts.

This analysis has lookeu at the oveiall PI0C foi Rent Stabilizeu Apaitments. The

auuitional apaitment inuexes piesent theii own challenges:

Costs foi Pie-47 anu Post-46 builuings aie iepoiteu in the I&E, so this

appioach can be useu to calculate them.

Costs foi heating builuings with 0il anu natuial uas weie incluueu in a iecent

annual suivey, so those weights can be calculateu.

!"#$%&'() +,- ./0! %(1 +,- 234 /(5"#- %(1 67$-(8- 9+:1; < =>?@>@A

12

Nastei-meteieu builuings with stabilizeu units aie veiy iaie anu theie aie no

useful uata foi calculating weights; it woulu piobably be best to simply ietiie

that calculation anu use the oveiall Apaitments Inuex.

Foi Botel-stabilizeu anu Loft builuings, theie is no useful uata in the I&E stuuy that

uesciibes theii patteins of expenuituies. The best appioach is piobably to continue

with the cuiient methous, peihaps conveiting to the I&E components to make the

uata compaiable.

If the RuB ueciues to conveit to this new appioach in 2u14, oi to iun the olu anu

new methous in paiallel, that will involve a significant inciease in woikloau foi 1-S

yeais. Aftei that point, it woulu be ieasonable to uo new expenuituie suiveys foi

hotels anu lofts to impiove theii weights; the populations of those builuings aie

faiily small so the suiveys woulu not be too buiuensome.

Note that, if the RuB implements the new appioach, it will be haiu to compaie

histoiical uata, especially foi the categoiies being ieviseu. Taxes, Fuel, 0tilities,

Laboi, anu Insuiance shoulu be compaiable. The otheis will be moie challenging.

!"#$%&'("#'

The I&E uata pioviues a supeiioi histoiical estimate of changes in 0&N costs foi all

stabilizeu units than the PI0C uoes. The PI0C has become incieasingly inaccuiate,

uiveiging fiom the I&E moie anu moie as time goes on. Theie is some eviuence that

a majoi cause is veiy olu baseline uata on expenuituies. The PI0C is also a piice

inuex anu actual expenuituies shoulu iise somewhat slowei than piices.

Bowevei, the I&E uata cannot be useu foi cuiient estimates since it lags the PI0C by

about a yeai. The PI0C piice anu cost incieases shoulu pioviue bettei infoimation

about iecent changes.

The appioach pioposeu heie is to:

0se the most iecent I&E to cieate the component weights foi each yeai's

PI0C. This will connect the PI0C much moie closely to what owneis have

actually been buying so that we can bettei estimate the oveiall effect of piice

changes.

Annually suivey owneis about theii costs foi vaiious items within a single

component, to upuate the item weights anu allow uevelopment of impioveu

items anu specifications. Since this is not necessaiy foi taxes anu insuiance

(which have one item each in theii components), it shoulu allow upuates of

items weights acioss the PI0C eveiy S-6 yeais.

If possible, suivey hotel-stabilizeu anu stabilizeu loft builuings eveiy S-1u

yeais to upuate the expenuituie weights foi those inuexes.

These steps shoulu give us a stable, iepiouucible PI0C which will stay cuiient anu

tiack bettei against actual expenuituies.

!"#$%&'() +,- ./0! %(1 +,- 234 /(5"#- %(1 67$-(8- 9+:1; < =>?@>@A

"#

!""#$%&'#(

*+,+ -(#% &$ ,.# !$+/0(&(

!"#$%&'() +,- ./0! %(1 +,- 234 /(5"#- %(1 67$-(8- 9+:1; < =>?@>@A

"#

!""#$%&' ) * +,- ."#/01&$2 -'"#$3#3 "#/ 4$&1

IE study

Data from

Tax Labor Fuel Utilities Admin. Ins. Maint. Misc. Total

1993 1991 $90 $52 $41 $38 $43 $21 $70 $27 $382

1994 1992 $95 $55 $41 $40 $45 $21 $72 $27 $395

1995 1993 $97 $58 $41 $42 $46 $21 $74 $28 $409

1996 1994 $98 $58 $40 $42 $47 $22 $77 $28 $415

1997 1995 $99 $61 $38 $43 $50 $24 $78 $29 $425

1998 1996 $101 $64 $45 $44 $52 $24 $81 $30 $444

1999 1997 $107 $64 $43 $47 $55 $23 $84 $31 $458

2000 1998 $105 $66 $35 $46 $60 $22 $92 $33 $459

2001 1999 $104 $65 $35 $48 $61 $21 $95 $35 $464

2002 2000 $108 $68 $53 $53 $62 $22 $100 $38 $503

2003 2001 $114 $70 $54 $55 $66 $24 $104 $43 $531

2004 2002 $133 $72 $46 $53 $72 $33 $110 $51 $570

2006 2004 $167 $75 $65 $59 $76 $44 $113 $55 $654

2007 2005 $159 $81 $83 $63 $75 $42 $111 $64 $679

2008 2006 $165 $80 $84 $64 $78 $42 $114 $67 $695

2009 2007 $178 $85 $97 $72 $81 $43 $118 $64 $738

2010 2008 $191 $88 $115 $79 $88 $40 $118 $70 $790

2011 2009 $200 $89 $92 $81 $92 $38 $117 $71 $781

2012 2010 $212 $90 $96 $87 $91 $36 $118 $59 $790

2013 2011 $215 $93 $113 $92 $132 $37 $104 $27 $812

!"#$%&'() +,- ./0! %(1 +,- 234 /(5"#- %(1 67$-(8- 9+:1; < =>?@>@A

"#

!""#$%&' ) * +,-. !$$/01 +#23#$4 ,$32#05#5

PIOC Changes Taxes Labor Fuel Utilities Contractor Admin. Ins. Parts Replace. Overall

1992 11.04% 5.25% -10.92% 6.61% 2.40% 2.83% 2.34% 2.48% 3.79% 3.98%

1993 3.11% 5.63% 5.18% 12.75% 2.51% 3.80% -0.47% 1.03% 4.15% 4.72%

1994 2.26% 4.28% -0.50% 2.07% 0.87% 3.66% 0.76% 0.99% 1.56% 2.04%

1995 1.37% 4.10% -12.66% -4.00% 2.38% 3.79% 5.18% -0.45% 0.21% 0.14%

1996 2.96% 3.15% 29.60% 7.79% 1.79% 3.46% 5.01% 0.84% 0.97% 5.95%

1997 2.40% 2.26% 0.41% 2.93% 3.38% 3.89% 1.87% 1.45% 1.00% 2.43%

1998 1.23% 2.69% -15.02% 2.34% 2.67% 3.29% -1.52% 1.93% 0.64% 0.13%

1999 0.37% 3.40% -18.37% -0.43% 3.50% 2.87% 3.46% 2.17% 1.67% 0.03%

2000 5.18% 2.62% 54.79% 5.68% 4.58% 3.96% 0.66% 1.93% 0.77% 7.82%

2001 5.45% 3.95% 33.33% 14.95% 3.63% 4.06% 4.86% 0.81% 0.97% 8.73%

2002 6.63% 4.03% -36.09% -9.94% 3.85% 4.64% 16.50% 0.94% -0.60% -1.61%

2003 14.80% 3.45% 66.91% 21.71% 4.81% 5.40% 40.46% 0.41% 1.41% 16.90%

2004 16.20% 4.50% -2.80% 0.80% 4.10% 4.00% 14.70% 1.20% 1.00% 6.90%

2005 1.20% 3.50% 20.00% 8.40% 4.50% 4.00% 8.90% 2.60% 3.10% 5.84%

2006 7.80% 2.50% 22.80% 7.90% 5.90% 6.50% 2.50% 5.50% 4.50% 7.80%

2007 5.79% 8.09% 0.46% 6.29% 5.59% 6.93% 1.88% 3.03% 1.60% 5.14%

2008 0.32% 3.98% 37.35% 8.89% 4.62% 5.26% 2.33% 2.28% 3.99% 7.78%

2009 11.72% 2.88% -10.12% 10.91% 2.77% 4.05% -2.90% 2.65% 6.07% 3.96%

2010 10.12% 3.13% 0.46% -1.68% 2.32% 4.11% -2.02% 1.72% 0.93% 3.43%

2011 3.51% 2.66% 23.06% 7.66% 2.65% 2.88% -0.36% 3.69% 0.64% 6.13%

2012 7.47% 2.49% 1.63% -4.01% 3.25% 2.58% 2.51% 3.70% 3.25% 2.77%

!"#$%&'() +,- ./0! %(1 +,- 234 /(5"#- %(1 67$-(8- 9+:1; < =>?@>@A

"#

!""#$%&' ) * +#,-#..&/$ !$012.&. +#.314.

I&E Component Intercept Std Err Growth Rate Std Err R2 degrees of freedom

Taxes 82.0 0.034 1.048 0.003 0.94 18

Labor 53.7 0.008 1.028 0.001 0.99 18

Fuel 31.9 0.077 1.062 0.007 0.82 18

Utilities 36.2 0.022 1.044 0.002 0.96 18

Admin 42.0 0.029 1.046 0.002 0.95 18

Insurance 19.2 0.065 1.042 0.006 0.75 18

Maintenance 73.0 0029 1.028 0.002 0.87 18

Other 26.2 0.106 1.046 0.009 0.58 18

Overall 363.2 0.018 1.043 0.002 0.98 18

PIOC Taxes 0.875 0.034 1.058 0.003 0.95 19

Labor 1.009 0.007 1.037 0.001 1.00 19

Fuel 0.767 0.086 1.084 0.007 0.86 19

Utilities 0.960 0.028 1.052 0.002 0.96 19

Contractor 0.945 0.012 1.038 0.001 0.99 19

Administrative 0.971 0.009 1.043 0.001 0.99 19

Insurance 0.869 0.063 1.065 0.005 0.88 19

Parts 0.957 0.012 1.019 0.001 0.95 19

Replacement 0.987 0.014 1.017 0.001 0.92 19

Overall 0.912 0.026 1.052 0.002 0.97 19

!"#$%&'() +,- ./0! %(1 +,- 234 /(5"#- %(1 67$-(8- 9+:1; < =>?@>@A

18

The iegiessions fit a constant giowth iate to the actual costs oi PI0C peicent incieases. They take the time seiies uata anu see what

constant giowth iate pioviues the best fit to the uata.

The key paiameteis heie aie the estimateu giowth iates. Foi example, consiuei the fiist line. The value of 1.u48 means that the

iegiession mouel estimates that opeiating costs foi Taxes fiom the I&E stuuy will giow by about 4.8% pei yeai. The stanuaiu eiioi

is u.S%, so the expectation is that, 9S% of the time, the tiue value woulu be between 4.2% anu S.4%, 9S%. While this uepenus on

vaiious statistical assumptions, it pioviues some guiuance foi how well the mouel fits the uata.

The R2 (i-squaieu) values aie anothei inuicatoi of the fit. In that same line, the R2 of u.94 means that the mouel explains about

94% of the vaiiance in the uata. Anu the uegiees of fieeuom measuie how much of the uata the mouel tiies to explain - in this case,

we have 19 oi 2u uata points anu aie estimating 2 paiameteis, so we have 17 oi 18 uegiees of fieeuom left.

The inteicepts foi the I&E aie the mouel's estimate of the costs in uollais pei unit pei month in the fiist yeai of the analysis, 1991.

The PI0C inteicepts have no actual meaning but impiove the statistical piopeities of the mouel.

!"#$%&'() +,- ./0! %(1 +,- 234 /(5"#- %(1 67$-(8- 9+:1; < =>?@>@A

"#

!""#$%&' ) * +,-. ,/#01 !11&2$#% /3 ,45 .30"3$#$/1

I&E Component

PIOC Item

PIOC Item Description

Taxes 101 Taxes Fees and Permits

Advertising 604 Newspaper Ads

Cleaning Contracts 803 Wet Mop

804 Floor Wax

806 Pushbroom

807 Detergent

808 Bucket

809 Washers

811 Pine Disinfectant

812 Window/Glass Cleaner

Fuel 301 Fuel Oil #2

302 Fuel Oil #4

303 Fuel Oil #6

405 Gas #2, 65,000 therms

406 Gas #3, 214,000 therms

407 Steam #1, 1.2m lbs

408 Steam #2, 2.6m lbs

Insurance 701 Insurance

Interior Painting and

Decorating 501 Repainting

!"#$%&'() +,- ./0! %(1 +,- 234 /(5"#- %(1 67$-(8- 9+:1; < =>?@>@A

$%

805 Paint

Leasing Commissions 606 Lease Forms

605 Agency Fees

Light and Power 401 Electricity #1, 2,500 KWH

402 Electricity #2, 15,000 KWH

403 Electricity #3, 82,000 KWH

404 Gas #1, 12,000 therms

Management and

Administration 601 Management Fees

602 Accountant Fees

603 Attorney Fees

607 Bill Envelopes

608 Ledger Paper

409 Telephone

Repairs and Maintenance 502 Plumbing, Faucet

503 Plumbing, Stoppage

504 Elevator #1, 6 fl., 1 e.

505 Elevator #2, 13 fl., 2 e.

506 Elevator #3, 19 fl., 3 e.

507 Burner Repair

508 Boiler Repair, Tube

509 Boiler Repair, Weld

510 Refrigerator Repair

511 Range Repair

!"#$%&'() +,- ./0! %(1 +,- 234 /(5"#- %(1 67$-(8- 9+:1; < =>?@>@A

$"

512 Roof Repair

513 Air Conditioner Repair

514 Floor Maint. #1, Studio

515 Floor Maint. #2, 1 Br.

516 Floor Maint. #3, 2 Br.

813 Switch Plate

814 Duplex Receptacle

815 Toilet Seat

816 Deck Faucet

Wages and Payroll 201 Payroll, Bronx, All (Union)

202 Payroll, Other, Union, Supts.

203 Payroll, Other, Union, Other

204 Payroll, Other, Non-Union, All

205 Social Security Insurance

206 Unemployment Insurance

207 Private Health & Welfare

Water and Sewer 410 Water & Sewer

Ineligible 901 Refrigerator #1

902 Refrigerator #2

903 Air Conditioner #1

904 Air Conditioner #2

905 Floor Runner

906 Dishwasher

907 Range #1

908 Range #2

You might also like

- Financial Plan TemplateDocument23 pagesFinancial Plan TemplateKosong ZerozirizarazoroNo ratings yet

- Board of Elections v. MostofiDocument15 pagesBoard of Elections v. MostofialykatzNo ratings yet

- Amtrak Monthly Performance Report January 2014Document64 pagesAmtrak Monthly Performance Report January 2014peterdemNo ratings yet

- Energy Audit ActivityDocument3 pagesEnergy Audit Activitydarshak444No ratings yet

- PS1 SolutionsDocument5 pagesPS1 SolutionsRushil SurapaneniNo ratings yet

- EVA TemplateDocument4 pagesEVA TemplateFahim MoledinaNo ratings yet

- Pay Revision 14 ProposalsDocument30 pagesPay Revision 14 ProposalsDhivya ParthasarathyNo ratings yet

- Earned ValueDocument17 pagesEarned ValueBlanche PhlaumNo ratings yet

- EVM - CalculatorDocument1 pageEVM - CalculatorSumitha Selvaraj100% (1)

- 40 Costing SummaryDocument21 pages40 Costing SummaryQueasy PrintNo ratings yet

- PH 3 PEP East Injection ImprovementDocument6 pagesPH 3 PEP East Injection ImprovementElias EliasNo ratings yet

- FM StudyguideDocument18 pagesFM StudyguideVipul SinghNo ratings yet

- EVM CalculatorDocument1 pageEVM CalculatoranthonyconnorNo ratings yet

- Lesson 7 - Earned Value ManagementDocument5 pagesLesson 7 - Earned Value ManagementAbid AhmadNo ratings yet

- Part 2: ST Rategy Formu Lation and Impl Emen Tatio NDocument22 pagesPart 2: ST Rategy Formu Lation and Impl Emen Tatio NMinh Huy Nguyen50% (2)

- Note On Review/Inspection of Flagship/Other Important Centrally Sponsored Schemes in State of Punjab, 25 To 27 November, 2009Document24 pagesNote On Review/Inspection of Flagship/Other Important Centrally Sponsored Schemes in State of Punjab, 25 To 27 November, 2009Vivek KankipatiNo ratings yet

- XYZ Energy ROIDocument27 pagesXYZ Energy ROIWei ZhangNo ratings yet

- After 100 Days of New Government No Khushi, Still Gham For Bank EmployeesDocument23 pagesAfter 100 Days of New Government No Khushi, Still Gham For Bank EmployeesAnonymous 4yXWpDNo ratings yet

- Analysis of Financial StatementsDocument9 pagesAnalysis of Financial StatementsmuradkasassbekNo ratings yet

- Project Quality Plan Rev 2Document69 pagesProject Quality Plan Rev 2natrix029No ratings yet

- Acc 3606 Cheatsheet FinalDocument2 pagesAcc 3606 Cheatsheet FinaldarciechoyNo ratings yet

- Practice - Use Expenditure Inquiry: WorkbookDocument10 pagesPractice - Use Expenditure Inquiry: WorkbookSAlah MOhammedNo ratings yet

- Nike Cost of CapitalDocument23 pagesNike Cost of CapitalSaahil Ledwani100% (1)

- FM11 CH 16 Mini-Case Cap Structure DecDocument11 pagesFM11 CH 16 Mini-Case Cap Structure DecAndreea VladNo ratings yet

- Master Thesis, Fixed - Karoline PetersenDocument83 pagesMaster Thesis, Fixed - Karoline Petersendow2008No ratings yet

- School of Quantity Surveying and Construction Management: Module Name: Module CodeDocument2 pagesSchool of Quantity Surveying and Construction Management: Module Name: Module CodeHafizah EzaniNo ratings yet

- Rate Stability and Power Cost Adjustment (PCA) 0 For All Twelve Calendar MonthsDocument44 pagesRate Stability and Power Cost Adjustment (PCA) 0 For All Twelve Calendar MonthsColin ClarkNo ratings yet

- Costing Tax Information (U.S.) 244298425.doc Effective 07/11/07 Page 1 of 10 Rev 1Document10 pagesCosting Tax Information (U.S.) 244298425.doc Effective 07/11/07 Page 1 of 10 Rev 1Kiran NambariNo ratings yet

- Production CostsDocument23 pagesProduction CostsraamseNo ratings yet

- 2010-09-02 235812 EurondaDocument6 pages2010-09-02 235812 EurondaKylie TarnateNo ratings yet

- Financial Analysis 105-115Document10 pagesFinancial Analysis 105-115deshpandep33No ratings yet

- Establishment of Electric Generation Department at Denim CityDocument3 pagesEstablishment of Electric Generation Department at Denim CityBrandon JohnsonNo ratings yet

- Shapiro CHAPTER 2 SolutionsDocument14 pagesShapiro CHAPTER 2 Solutionsjimmy_chou1314100% (1)

- Assignment 1Document4 pagesAssignment 1Ahmed IssawiNo ratings yet

- Ence 661 HM3Document3 pagesEnce 661 HM3Enrico BuggeaNo ratings yet

- Practice - Enter An Expenditure Batch: WorkbookDocument9 pagesPractice - Enter An Expenditure Batch: WorkbookSAlah MOhammedNo ratings yet

- Cover Letter For A Cost QuotationDocument1 pageCover Letter For A Cost QuotationKiran DuggarajuNo ratings yet

- Hotel Audit Work ProgramDocument60 pagesHotel Audit Work ProgramJean-Paul Hazoume100% (4)

- Assignment Finalterm MbaDocument2 pagesAssignment Finalterm MbaKazi Shafiqul AzamNo ratings yet

- TaxDocument45 pagesTaxShailesh Kediya100% (2)

- 7-3-55 - Measure of Static and Dynamic Compliance of The Ventilator PatientDocument2 pages7-3-55 - Measure of Static and Dynamic Compliance of The Ventilator PatientSherluck VonsNo ratings yet

- PERT Sample QuestionDocument4 pagesPERT Sample Questionrajkrishna03No ratings yet

- Shaikh2016 Appendix6.3Document3 pagesShaikh2016 Appendix6.3Diego PolancoNo ratings yet

- Mahmoud Megahed - Str. Fin. Mgmt. - Assginment 2Document20 pagesMahmoud Megahed - Str. Fin. Mgmt. - Assginment 2Mahmoud MegahedNo ratings yet

- LULC EI SouthDepartment 2012smallpdf - Com-1Document34 pagesLULC EI SouthDepartment 2012smallpdf - Com-1MD. ISMAIL HOSSAINNo ratings yet

- COA Ladderized Training CurriculumDocument3 pagesCOA Ladderized Training CurriculumJuan Luis LusongNo ratings yet

- 1forest Case Update Issue 80 September-October 2013Document13 pages1forest Case Update Issue 80 September-October 2013in678No ratings yet

- CH 10 IMDocument46 pagesCH 10 IMAditya Achmad Narendra WhindracayaNo ratings yet

- Gargallo 2017Document38 pagesGargallo 2017felipefinchNo ratings yet

- B.M. College of Administration: Pre - Feasibility Report On Retail Business of Gift & ArticlesDocument22 pagesB.M. College of Administration: Pre - Feasibility Report On Retail Business of Gift & ArticlesAhmed AlyaniNo ratings yet

- The Initial Data For Electroputere Is Presented BelowDocument3 pagesThe Initial Data For Electroputere Is Presented BelowAmelia ButanNo ratings yet

- Earned Value Management Tutorial Module 8: Reporting: Prepared byDocument20 pagesEarned Value Management Tutorial Module 8: Reporting: Prepared bytshawkyNo ratings yet

- Balance Sheet StatementDocument8 pagesBalance Sheet StatementsantasantitaNo ratings yet

- LDD Workshop Strategic Energy Planning: We Help The Best Buildings in The World Get That WayDocument95 pagesLDD Workshop Strategic Energy Planning: We Help The Best Buildings in The World Get That Waysenthilkumar99No ratings yet

- Processing CostsDocument21 pagesProcessing CostsKiran NambariNo ratings yet

- BUS 306 Exam 2 - Fall 2012 (B) - SolutionDocument14 pagesBUS 306 Exam 2 - Fall 2012 (B) - SolutionNguyễn Thu PhươngNo ratings yet

- Shapiro CHAPTER 2 SolutionsDocument14 pagesShapiro CHAPTER 2 SolutionsPradeep HemachandranNo ratings yet

- Water, Sewer & Pipeline Construction World Summary: Market Values & Financials by CountryFrom EverandWater, Sewer & Pipeline Construction World Summary: Market Values & Financials by CountryNo ratings yet

- Electric Bulk Power Transmission & Control World Summary: Market Values & Financials by CountryFrom EverandElectric Bulk Power Transmission & Control World Summary: Market Values & Financials by CountryNo ratings yet

- Water Well Drilling Contractors World Summary: Market Values & Financials by CountryFrom EverandWater Well Drilling Contractors World Summary: Market Values & Financials by CountryNo ratings yet

- Electricity Measuring & Testing Instruments World Summary: Market Values & Financials by CountryFrom EverandElectricity Measuring & Testing Instruments World Summary: Market Values & Financials by CountryNo ratings yet

- ThriveNYC Program BudgetDocument1 pageThriveNYC Program BudgetalykatzNo ratings yet

- State of Citys Finances2014Document57 pagesState of Citys Finances2014alykatzNo ratings yet

- Trump Tower Condo Abatement 7-18Document1 pageTrump Tower Condo Abatement 7-18alykatzNo ratings yet

- ADTL-MSCTM - Exercises - of - Data - Input - and Exploratory Analysis Using - RDocument3 pagesADTL-MSCTM - Exercises - of - Data - Input - and Exploratory Analysis Using - RPriyankaNo ratings yet

- Dynamic Simulation of The Sour Water Stripping Process and Modified Structure For Effective PresDocument11 pagesDynamic Simulation of The Sour Water Stripping Process and Modified Structure For Effective PresjavilapiedraNo ratings yet

- Lesson Plans WK 26Document7 pagesLesson Plans WK 26api-280840865No ratings yet

- Important Questions For MID I CNDocument14 pagesImportant Questions For MID I CN20H51A0540-NAKKA SREEKAR B.Tech CSE (2020-24)No ratings yet

- Introduction To Econometrics Ii (Econ-3062) : Mohammed Adem (PHD)Document83 pagesIntroduction To Econometrics Ii (Econ-3062) : Mohammed Adem (PHD)ፍቅር እስከ መቃብር100% (2)

- Standard DC Output: Simplified Internal Diagram of The Charger's Output ConnectionsDocument1 pageStandard DC Output: Simplified Internal Diagram of The Charger's Output ConnectionstoufikNo ratings yet

- Mod 4 AdministrativeDocument8 pagesMod 4 AdministrativeElla AlogNo ratings yet

- Math Chapter 3 Study GuideDocument3 pagesMath Chapter 3 Study Guideapi-311999132No ratings yet

- PRojectDocument61 pagesPRojectAditya SalunkheNo ratings yet

- Website ErrorDocument5 pagesWebsite ErrorJosé DavidNo ratings yet

- Topic On CC11Document3 pagesTopic On CC11Free HitNo ratings yet

- Food & Beverage Service Operation: Prepared By: Mr. Lance MercadoDocument22 pagesFood & Beverage Service Operation: Prepared By: Mr. Lance MercadoLyzelNo ratings yet

- Upper Primary Division Competition Paper: ThursdayDocument10 pagesUpper Primary Division Competition Paper: ThursdayOlga Rudenko BradfordNo ratings yet

- 100 S Oem S: 102R Low Flow PumpheadDocument2 pages100 S Oem S: 102R Low Flow PumpheadtechniqueNo ratings yet

- Assessment of Temporal Hydrological Variations Due To Land Use Changes Using Remote Sensing/GISDocument38 pagesAssessment of Temporal Hydrological Variations Due To Land Use Changes Using Remote Sensing/GISWubieNo ratings yet

- PS2 VGA Diagram Rev by GillBert - Rev2 PDFDocument6 pagesPS2 VGA Diagram Rev by GillBert - Rev2 PDFwuemuraNo ratings yet

- Blake Problem ComputationDocument3 pagesBlake Problem ComputationNiño del Mundo75% (4)

- Agrirobot PDFDocument103 pagesAgrirobot PDFMuhamad Azlan ShahNo ratings yet

- Application: Accounts Payables Title: Recurring Invoice: OracleDocument12 pagesApplication: Accounts Payables Title: Recurring Invoice: OraclesureshNo ratings yet

- CSP 01 Intro Study Questions Rev005Document2 pagesCSP 01 Intro Study Questions Rev005Shakeb RahmanNo ratings yet

- Marketing Plan: GoldilocksDocument18 pagesMarketing Plan: GoldilocksAkhia Visitacion100% (1)

- Solar Power PlantDocument23 pagesSolar Power Plantmadhu_bedi12No ratings yet

- Matthew PernaDocument5 pagesMatthew PernaWPXI StaffNo ratings yet

- GL005 PIPE ROUTING GUIDELINE Rev 2Document22 pagesGL005 PIPE ROUTING GUIDELINE Rev 2MIlan100% (1)

- ABLRFD v1403 Summary RevisionsDocument2 pagesABLRFD v1403 Summary RevisionsMiguel AngelNo ratings yet

- Expt. 8 Salivary DigestionDocument25 pagesExpt. 8 Salivary DigestionLESLIE JANE BALUYOS JALANo ratings yet

- My Ideal Job BankerDocument4 pagesMy Ideal Job BankerAnne MaryNo ratings yet

- Cost Justifying HRIS InvestmentsDocument19 pagesCost Justifying HRIS InvestmentsJessierene ManceraNo ratings yet

- Castel Airco 2014-15Document68 pagesCastel Airco 2014-15Anderson Giovanny Herrera DelgadoNo ratings yet

- Ateneo Philosophy Club: Project ProposalDocument2 pagesAteneo Philosophy Club: Project ProposalArmando MataNo ratings yet