Professional Documents

Culture Documents

Budget 14 Analysis

Budget 14 Analysis

Uploaded by

Saurav BharadwajOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Budget 14 Analysis

Budget 14 Analysis

Uploaded by

Saurav BharadwajCopyright:

Available Formats

NILESH N. SHAH & ASSOCIATES, CHARTERED ACCOUNTANTS.

INDIA

Highlights of Budget for 2014

The following are some of the key highlights of the Union Budget

2014, presented by Honble Finance Minister Arun Jaitley in the

Parliament today on 10

th

J uly 2014:

NILESH N. SHAH & ASSOCIATES, CHARTERED ACCOUNTANTS.INDIA

NILESH N. SHAH & ASSOCIATES, CHARTERED ACCOUNTANTS.INDIA

1. All retrospective tax cases to be scrutinized by high-level

commission.. This government will not bring any

retrospective amendments.

2. Will streamline taxation and avoid harassment

3. No change in tax rate.

4. Personal tax exemption limit raised to Rs 2.5 lakh from

current Rs 2 lakh for taxpayers below 60 years.

a. Senior citizens' tax exemption limit hiked from Rs 2.5

lakh to Rs 3 lakh.

b. No Change in exemption limit of very senior citizen

assessee.

c. No change in surcharge & education cess.

d. Maximum Savings of Rs. 5150 across all individual

assesses other than very senior citizen assessee.

5. Annual Provident Fund limit will be increased from Rs. 1

Lakh to Rs.1.5 lakh

NILESH N. SHAH & ASSOCIATES, CHARTERED ACCOUNTANTS.INDIA

6. Investment limit under Section 80C from Rs 1 lakh to Rs 1.5

lakh

Maximum savings for all assessee due to changes in Section

80C as follows:

Income Range Maximum

tax

Savings

(A)

Education

cess

(B)

Total

Maximum

Savings

(A)+(B)

Up to 5,00,000 5,000 150 5,150

5,00,001-

10,00,000

10,000 300 10,300

Above 10,50,000 15,000 450 15,450

7. Housing loan interest deduction for Self Occupied Property

increased to Rs.2 lakh from Rs.1.5 lakh.(Section 24),

Maximum savings for all assessee due to changes in Section

24 as follows:

Income

Range

Maximum tax

Savings (A)

Education

cess

(B)

Total

Maximum

Savings

(A)+(B)

Up to

5,00,000

5,000 150 5,150

5,00,001-

10,00,000

10,000 300 10,300

Above

10,50,000

15,000 450 15,450

NILESH N. SHAH & ASSOCIATES, CHARTERED ACCOUNTANTS.INDIA

8. Hence TOTAL Maximum possible savings are as under:

1.) For all assessee (except very senior citizen):

Income

Range

Due to

exemption

limit

Due to 80C Due to

Interest on

housing loan

Total

Maximum

Savings

Upto

5,00,000

5,150 5,150 5,150 15,450

5,00,001-

10,00,000

5,150 10,300 10,300 25,750

Above

10,50,000

5,150 15,450 15,450 36,050

2.) For very senior citizen assessee:

Income

Range

Due to

exemption

limit

Due to 80C Due to

Interest on

housing loan

Total

Maximum

Savings

Upto

5,00,000

Nil Nil Nil Nil

5,00,001-

10,00,000

Nil 10300 10300 20600

Above

10,50,000

Nil 15450 15450 30900

NILESH N. SHAH & ASSOCIATES, CHARTERED ACCOUNTANTS.INDIA

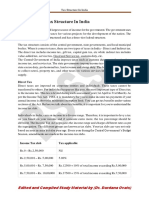

ASSESSMENT YEAR 2015-16 RELEVANT TO FINANCIAL YEAR

2014-15

1. Tax Slab for an Individual (resident & below 60 years) or

HUF/AOP/BOI/AJP

Income Slabs Tax Rates

Total income up to Rs. 2.5

Lac

0% Tax

Total income above Rs. 2.5

Lac and below Rs.5 Lac

10% on amount exceeding Rs. 2.5 Lac

Total income above Rs. 5 Lac

and below Rs.10 Lac

20% on Income exceeding Rs. 5 Lac +Rs.

25,000

Total income more than Rs.

10 Lac

30% on Income exceeding Rs. 10 Lac +Rs.

1,25,000

*U/S 87A the Individual having taxable income upto Rs 5 lacs can claim

rebate on the actual tax amount subject to a maximum of Rs 2000

Where the Taxable Income exceeds Rs. 1 crore, Surcharge @ 10% of

Income tax is applicable

2. Tax Slab for an Individual (resident & above 60 years but below 80

years)

Income Slabs Tax Rates

Total income up to Rs. 3.00

Lac

0% Tax

Total income above Rs. 3.00

Lac and below Rs.5 Lac

10% on amount exceeding Rs. 3.00 Lac

Total income above Rs. 5 Lac

and below Rs.10 Lac

20% on Income exceeding Rs. 5 Lac +Rs.

20,000

Total income more than Rs.

10 Lac

30% on Income exceeding Rs. 10 Lac +Rs.

1,20,000

*U/S 87A the Individual having taxable income upto Rs 5 lacs can claim

rebate on the actual tax amount subject to a maximum of Rs 2000

Where the Taxable Income exceeds Rs. 1 crore, Surcharge @ 10% of

Income tax is applicable

3. Tax Slab for an Individual (resident & above 80 years)

NILESH N. SHAH & ASSOCIATES, CHARTERED ACCOUNTANTS.INDIA

Income Slabs Tax Rates

Total income up to Rs. 5 Lac 0% Tax

Total income above Rs. 5 Lac

and below Rs.10 Lac

20% on Income exceeding Rs. 5 Lac

Total income more than Rs.

10 Lac

30% on Income exceeding Rs. 10 Lac +Rs.

1 Lac

Where the Taxable Income exceeds Rs. 1 crore, Surcharge @ 10% of

Income tax is applicable

EDUCATION CESS

The amount of Income-tax shall be increased by Education Cess of 3% on

Income-tax.

9. Companies whose principal business is trading in shares will

not be treated as carrying out Speculation business by

Amending Explanation of Section 73.Hence loss from such

business will not be treated as speculation loss which has a

restriction of setting off against speculation business income

only. This will be positive for Brokering & Trading

Companies.

10. Advance received and forfeited will be charged to tax

in the year in which it is received under Income from other

sources if transfer does not takes place (Section 56)

Section 51 is amended accordingly to avoid double taxation

by reducing such advance from cost of asset at the time of

actual transfer where amended Section 56 is applicable.

NILESH N. SHAH & ASSOCIATES, CHARTERED ACCOUNTANTS.INDIA

11. Clarifactory amendment of exemption from capital gain

arising on transfer of Land or building or residential house or

any other capital asset allowed only if one residential house

is constructed under Section 54/ Section 54F.

12. Deduction on account of Interest , Royalty and Fees to

non- resident will be allowed as deduction if paid before the

due date of filing of return(which was earlier allowed in the

year in which TDS was paid. By amending Section 40(a) in

line with section 40(ia).

13. 30% of expense will be disallowed instead of the

entire expenditure for non-payment of TDS on interest

,royalty, rent, fees and payment to contractor. (Section

40(ia)) This is applicable only for payment to residents.

14. Holding period of Debt oriented fund less than 36

months (previously 12 months) will be treated as a short

term.(Section 2(42A)).

a. Long term capital gains from such units will be taxed at

20% (instead of lower of 10%(without indexation) and

20% with indexation as at present.)

15. Investment allowance at 15% for 3 years up to

31.03.2017 to manufacturing company which invest more

than Rs 25 crore in plant and machinery

16. Proposed to extend 10-year holiday to power generating

companies

NILESH N. SHAH & ASSOCIATES, CHARTERED ACCOUNTANTS.INDIA

17. Kisan Vikas Patra to be reintroduced

18. Income arising to foreign portfolio investors from

transaction in securities to be treated as capital gains.

19. Introduction of range concept for determination of

arms length price in transfer pricing regulations. To allow

use of multiple year data for comparability analysis under

transfer pricing regulations.

20. TDS @ 2% on non-exempt payments made under life

insurance policy wef 01.10.2014 including the sum allocated

by way of bonus on such policy .Section 194 DA.If such

payments are more than Rs.100000/- (Rupees One lac ) in a

year

NILESH N. SHAH & ASSOCIATES, CHARTERED ACCOUNTANTS.INDIA

Service Tax:

Minimal changes. Negative list: Sales of space for

advertisements on online. Newspapers will remain

exempted. To broaden the tax base in Service Tax, sale of

space or time for advertisements in broadcast media,

extended to cover such sales on other segments like online

and mobile advertising -

Tourism to be boosted for change in service tax. Services

provided by Indian tour operators to foreign tourists in

relation to a tour wholly conducted outside India to be taken

out of the tax net and Cenvat credit for services of rent-a-cab

and tour operators to be allowed to promote tourism.

Services by air-conditioned contract carriages and technical

testing of newly developed drugs on human participants

brought under service tax.

Exemption available for specified micro insurance schemes

expanded to cover all life micro-insurance schemes where the

sum assured does not exceed `.50, 000 per life insured -

For safe disposal of medical and clinical wastes, services

provided by common biomedical waste treatment facilities

exempted.

Direct Tax Code And GST:

Govt will review and take a decision. Previous proposal lapsed

with dissolution of Lok Sabha. Introduction of GST to be given

thrust

NILESH N. SHAH & ASSOCIATES, CHARTERED ACCOUNTANTS.INDIA

Indirect Taxes

Customs duty:

Reduced basic customs duty for some industries with varying

rates

LCD and LED TV prices below 19 inches to go down.

Basic custom duty on LED panel below 19 inch made zero

Coal customs duty changed to reduce disputes regarding

quality of coal

Hikes customs duty on flat steel products to 7.5% from 5%

Excise duty:

Tweaked to boost domestic production

Concessional 2% benefit to sports clubs

Cigarettes, Pan Masala, Gutka, chewing tobacco: Price to go

up by hiking duty

Additional duty of excise on aerated waters containing added

sugar

Reduced duty in footwear, packaged food

food processing will get incentives. Excise duty would be

reduced to 6% from 10%"

Rs.10,000 crore venture capital fund will be set up to attract

new entrepreneurs

Rs 7500 crore additional revenue due to changes in indirect

taxes

Warehousing capacity will be increased. Rs.5000 crore will

be set aside for this

NILESH N. SHAH & ASSOCIATES, CHARTERED ACCOUNTANTS.INDIA

Sectoral Reforms

Andhra Pradesh-Telengana: Provisions to help both states

60 more Ayakar Sewa Kendras to be set up across the country

Rs 10000 crore extra to build railways in North East over and

above Interim Budget

Displaced Kashmiri migrants: Rs 500 crore for rehabilitation

Himalayan studies: National centre in Uttarakhand with initial

outlay at Uttarakhand

North East: organic farming development: Rs 100 crore

Metro projects for cities with over 20 lakh population must begin

now. Lucknow to get Metro.Metro for Ahmedabad too".

Currency notes to have Braille-like signs

Tourism: e-visas to be introduced at nine airports in the country in

a phased manner

NILESH N. SHAH & ASSOCIATES, CHARTERED ACCOUNTANTS.INDIA

Real estate investment trusts modified REITS is being

announced for infrastructure projects to reduce pressure on

banking system .With pas way status to avoid double taxation

Sports

National Sports academies at different parts of the country

J ammu & Kashmir: special sum of Rs 200 crore to upgrade indoor

and outdoor stadiums

Sports University in Manipur: Rs 100 crore

International events to be held in North and North East India

Rs 100 crore for training of sports persons for Asian Games

Young leader's programme: Rs 100 crore

Rivers

Serious effort to link rivers. Sets aside Rs 100 crore for a report.

Substantial money spent to clean Ganga. Integrated Ganga

Conservative Mission: Rs 2037 crore for it

Rs 100 crore for Ghat development

Science and technology

Turn 5 centres into research instituions. PPP model

2 clusters for research in Kolkata and Pune

NILESH N. SHAH & ASSOCIATES, CHARTERED ACCOUNTANTS.INDIA

Defense

Rs 2,29000 crore for defense

1 rank- 1 pension for army

Rs 1000 crore set apart for it

Capital outlay increased by Rs 5000 crore over interim Budget

Police reforms: Rs 3000 crore set asie vs Rs 1800 crore last Budget

Banking

Govt in principle agrees to consolidation of PSU banks

Rise of NPA matter of concern

6 new revival tribunals to be set up

Bank will be encouraged to give long term funds & loans to the

infrastructure sector

Insurance

Insurance Bill to be brought for consideration in Parliament

Special small saving instrument for girl child education and girl

marriage

PPF scheme: Rs 1.5 lakh per annum

Financial Sector

Essential to strengthen financial sector

Modern monitory policy to be brought in

NILESH N. SHAH & ASSOCIATES, CHARTERED ACCOUNTANTS.INDIA

Advise regulators for liquid corporate bond market, eliminate

unnecessary restrictions

Allow international settlements of bond settlements

Introduce uniform KYC norms across financial sector

1 operating Demat account to control any instrument

New accounting norms for corporate India: mandatory by 2017

Energy and transport

Rs 4200 crore: Inland navigation

Airport:Scheme for airport in Tier 1 and 2 under Airport Authority

of India. Airport to be built under PPP mode

Road:NHAI to get Rs 37000 crore; include Rs 3000 crore for

North East

New and renewable energy: Ultra modern solar plant in Tamil

Nadu, Rajasthan and Ladakh

Oil and gas: Use of PNG to be increased

15000 km of gas pipeline in the country now. Additional 15000 km

required. To be developed under appropriate PPP model.

Mining: Encourage investment, promote sustainable mining.

Current impass including iron ore to be carried out quickly.

4200 cr set aside for the Jal Marg Vikas project on river Ganga

connecting Allahabad to Haldia,over 1620 km

National Industrial corridor with headquarter in Pune

NILESH N. SHAH & ASSOCIATES, CHARTERED ACCOUNTANTS.INDIA

SME: Bulk of service sector also SMEs. Majority run by SC ST

OBC. Financing is important. Need to examine financial

architecture of this sector. Set up committee to give suggestion in 3

months.

Venture capital in SME: Rs 10,000 crore fund. To attract other

investors

Apprentice Act to be suitably amended to strengthen the

Apprentice Training Scheme

All the Govt departments and ministries will be integrated through

E-platform by 31 Dec this year

16 new port porjects this year

Agriculture sector

Fertilser- must take care of degradation of soil. Intitial fund of Rs

100 crore for climate change fund.

Farmers bank lending: propose to produce of Rs 5 lakh to

Bhumeeheen Kisan groups through NABARD

Price stabilization fund

Food, oil subsidies to be more targeted

Indigenous cattle breeding to be supported

Banks: target of Rs 8,00,000 crore to lend to agriculture sector

Short term crop loan: Farmers to get further incentive of 3% for

farmers who pay on time. Was already getting loan at 7%.

Raise RIDF corpus by Rs 5000 crore. Target of Rs 25000 crore set

by Chidambaram

NILESH N. SHAH & ASSOCIATES, CHARTERED ACCOUNTANTS.INDIA

Rs 5000 crore for infrastructure fund in agriculture

Long term rural credit bank to provide support to cooperative

banks and RRBs, by NABARD. Rs 5000 crore allocated.

Producer's development fund to get Rs 200 crore in NAABARD

Food Sector

Need to restructure FCI

Govt will undertake open market sales to keep prices under control

Farmers to get information on new techniques. Rs 100 crore set

aside

E-based platforms:

FTII Pune, SRFTI Kolkata: special status of national importance

Use of recycled water, solid waste management, sae drinking

water: hubs using PPP model to be set up

Rs 100 crore: Metro project in Lucknow

Propose to set up 5 new IIMs in HP, Punjab, Bihar, Odisha &

Maharashtra:

Low cost housings 4000 crore for National Housing Bank

Slum development to be part of CSR.

Currency notes to have Braille

Rs 200 crore for 4 agricultural institutes in 4 states

Rs 100 crore has been allocated for the modernization of Madrasas

NILESH N. SHAH & ASSOCIATES, CHARTERED ACCOUNTANTS.INDIA

Universal healthcare: 4 more AIIMS in Andhra Pradesh, West

Bengal, Vidharbha, Purvanchal. Rs 500 crore set aside

12 more medical colleges in government hospitals.

Aim to create AIIMS in every state of the country

Rs 3650 crore for safe drinking water

Toilets and drinking water in all girls' school to begin with. More

than Rs 26000 crore set aside

Under the 'Pradhanmantri sadak yojna' propose 14,389 cr for

development of roads.

Budgetory Allocations

Rs 50548 crore for SC-ST plan

Senior citizens: Additional pension introduced by NDA govt last

time.

Unclaimed amount of PPF etc. Mostly out of investments

belonging of senior citizens. Set up a committee to protect senior

citizens. Report by December 2014.

EPFO to launch unified accounts to transfer PF funds.

Min pension of Rs 1000 per month. Initial fund of Rs 250 crore.

Differently abled persons: Make incluisve opportunities. Centre for

sports for differently abled

Visually challenged: 15 new braille press.

NILESH N. SHAH & ASSOCIATES, CHARTERED ACCOUNTANTS.INDIA

Women's safety: Rs 50 crore to be spent by Roads ministry to

increase safety of women on roads: Pilot project

Beti bachao Beti padhao Yojana: Apathy towards girl child

rampant. Rs 100 crore allocation.

NREGA: Rural SHGs extend 4% loans to more rural areas.

NREGA to target more productive work.

National Housing programme: Rs 8000 crore

You might also like

- EMIRATES PPT Final1Document14 pagesEMIRATES PPT Final1Lou Modèle100% (1)

- Journey To SakhalinDocument12 pagesJourney To SakhalinSaurav BharadwajNo ratings yet

- Mildred Driver The Owner of A Nine Hole Golf Course OnDocument1 pageMildred Driver The Owner of A Nine Hole Golf Course OnAmit PandeyNo ratings yet

- 2014 Nvca Yearbook PDFDocument127 pages2014 Nvca Yearbook PDFDeepa DevanathanNo ratings yet

- Tax FinalDocument21 pagesTax Finalshweta_narkhede01No ratings yet

- Tax PlanningDocument7 pagesTax PlanningCharan AdharNo ratings yet

- BudgetDocument21 pagesBudgetshweta_narkhede01No ratings yet

- Financial Budget 2013Document9 pagesFinancial Budget 2013Mitesh PanchalNo ratings yet

- Budget 2014-RS AND CO FINALDocument23 pagesBudget 2014-RS AND CO FINALRaghavendhar AaravamudhanNo ratings yet

- Tax Planning For Year 2010Document24 pagesTax Planning For Year 2010Mehak BhargavaNo ratings yet

- Important Changes Brought in by The Budget 2011Document5 pagesImportant Changes Brought in by The Budget 2011harvinder thukralNo ratings yet

- Indian Budget 2016 Final 1Document2 pagesIndian Budget 2016 Final 1SiddhanNo ratings yet

- India: Budget 2015-16 - For The Corporates: Corporate Tax RateDocument4 pagesIndia: Budget 2015-16 - For The Corporates: Corporate Tax RateraghuNo ratings yet

- Key Highlights of The Union Budget 2012-13: A Full Service Corporate Law FirmDocument5 pagesKey Highlights of The Union Budget 2012-13: A Full Service Corporate Law FirmCn NatarajanNo ratings yet

- AcvdvdDocument4 pagesAcvdvdvivek kasamNo ratings yet

- Anubhav Sood Helga Cardoza Ragini Rastogi Sumit Kothari Vani SubramanianDocument18 pagesAnubhav Sood Helga Cardoza Ragini Rastogi Sumit Kothari Vani SubramanianSakshi TewariNo ratings yet

- India Highlights of Budget 2016 at A GlanceDocument5 pagesIndia Highlights of Budget 2016 at A GlanceKARTHIK145No ratings yet

- Income Tax - Major Highlights of Union Budget - 2011-12: Prasad V Sawant Roll No:96 Tax AssignmentDocument5 pagesIncome Tax - Major Highlights of Union Budget - 2011-12: Prasad V Sawant Roll No:96 Tax AssignmentJohn DoinNo ratings yet

- Income Tax in IndiaDocument19 pagesIncome Tax in IndiaConcepts TreeNo ratings yet

- Finance Budget 2023Document4 pagesFinance Budget 2023SakshamNo ratings yet

- Notes On DTC BillDocument5 pagesNotes On DTC Billshikah sidarNo ratings yet

- Highlights of Budget 2011-2012: Compiled by:-CA. Puneet Duggal (F.C.A) M/S Fatehpuria Duggal & AssociatesDocument14 pagesHighlights of Budget 2011-2012: Compiled by:-CA. Puneet Duggal (F.C.A) M/S Fatehpuria Duggal & AssociatesPuneet DuggalNo ratings yet

- Amendments: May 2011 ExamsDocument13 pagesAmendments: May 2011 ExamsKanth RaaveeNo ratings yet

- ItfjfygjDocument3 pagesItfjfygjKrishna GNo ratings yet

- Budget Synopsis 2015-16 PDFDocument12 pagesBudget Synopsis 2015-16 PDFBhagwan PalNo ratings yet

- Amendments: May 2011 ExamsDocument13 pagesAmendments: May 2011 ExamssureshhanNo ratings yet

- 1.0 Direct Taxes: India Budget 2014 - 15 - in A NutshellDocument3 pages1.0 Direct Taxes: India Budget 2014 - 15 - in A Nutshell61srinihemaNo ratings yet

- Amity Global Business School, PuneDocument15 pagesAmity Global Business School, PuneChand KalraNo ratings yet

- Does The Budget Benefit You?Document1 pageDoes The Budget Benefit You?mailwithvaibhav9675No ratings yet

- Introduction of Tax Sections Under It Act 1961 & Tax Slabs: SsignmentDocument19 pagesIntroduction of Tax Sections Under It Act 1961 & Tax Slabs: SsignmentRtr Sandeep ShekharNo ratings yet

- General: GDP Is Expected To Grow in The Region of 8.75% To 9.25%. The MinisterDocument5 pagesGeneral: GDP Is Expected To Grow in The Region of 8.75% To 9.25%. The MinisterSuraj NaikNo ratings yet

- Salaries PresentationDocument21 pagesSalaries PresentationDipika PandaNo ratings yet

- F 2848Document36 pagesF 2848Vineet AgrawalNo ratings yet

- Direct Tax CodeDocument5 pagesDirect Tax CodeSumit DaraNo ratings yet

- Note On Budget Proposals-2020Document4 pagesNote On Budget Proposals-2020Dhananjai SharmaNo ratings yet

- Deductions On Section 80CDocument12 pagesDeductions On Section 80CViraja GuruNo ratings yet

- How To Determine That An Individual Is NRI. 115C: Annual Statement of Tax Deducted U/s 203AA Rule No.:31ABDocument12 pagesHow To Determine That An Individual Is NRI. 115C: Annual Statement of Tax Deducted U/s 203AA Rule No.:31ABPradeep PandeyNo ratings yet

- The List of Components Which You Can Use For Salary BreakupDocument8 pagesThe List of Components Which You Can Use For Salary BreakupAnonymous VhqxrXNo ratings yet

- Tax FileDocument3 pagesTax FileBook wormNo ratings yet

- NMIMS Global Access School For Continuing Education (NGA-SCE) Course: Taxation-Direct and Indirect Internal Assignment Applicable For June 2020 ExaminationDocument10 pagesNMIMS Global Access School For Continuing Education (NGA-SCE) Course: Taxation-Direct and Indirect Internal Assignment Applicable For June 2020 ExaminationAnkit SharmaNo ratings yet

- Direct Tax Code: Capital Gains Tax On Sale of Residential PropertyDocument5 pagesDirect Tax Code: Capital Gains Tax On Sale of Residential Propertykarthikeyan.mohandossNo ratings yet

- ALEKYA - Tax Saving SchemsDocument14 pagesALEKYA - Tax Saving SchemsMOHAMMED KHAYYUMNo ratings yet

- Budget Analysis 2012Document26 pagesBudget Analysis 2012Rajpreet KaurNo ratings yet

- BUDGET 2017 by Taxpert Professionals Private LimitedDocument48 pagesBUDGET 2017 by Taxpert Professionals Private LimitedTaxpert mukeshNo ratings yet

- Tax Planning For Salaried Employees - Taxguru - inDocument5 pagesTax Planning For Salaried Employees - Taxguru - invthreefriendsNo ratings yet

- Direct Rax CodeDocument14 pagesDirect Rax CodedivajainNo ratings yet

- Taxation Law ProjectDocument15 pagesTaxation Law Projectraj vardhan agarwalNo ratings yet

- Tax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Document7 pagesTax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Harshita MarmatNo ratings yet

- Indian Institute of Technology Madras: CircularDocument5 pagesIndian Institute of Technology Madras: CircularAravinthram R am18m002No ratings yet

- Direct and Indirect Taxes: Assignment OnDocument9 pagesDirect and Indirect Taxes: Assignment Onpurn kaurNo ratings yet

- IncomeTax DeductionsDocument5 pagesIncomeTax DeductionsAjay MagarNo ratings yet

- Tax Saving InstrumentsDocument19 pagesTax Saving Instrumentsharry.anjh3613No ratings yet

- 7th Term - Legal Frameworks of ConstructionDocument79 pages7th Term - Legal Frameworks of ConstructionShreedharNo ratings yet

- Tax Icsi 2012Document84 pagesTax Icsi 2012Janani ParameswaranNo ratings yet

- Income Tax Deductions FY 2016Document13 pagesIncome Tax Deductions FY 2016Nishant JhaNo ratings yet

- IT Assignment 2Document7 pagesIT Assignment 2Srinivasulu Reddy PNo ratings yet

- Union Budget 2021 Highlights and ImpactDocument10 pagesUnion Budget 2021 Highlights and Impact200409120010No ratings yet

- Pankaj Kumar Agrawal: "Acche Din Aane Wale Hai?" "How They Prepared For Acche Din ?"Document18 pagesPankaj Kumar Agrawal: "Acche Din Aane Wale Hai?" "How They Prepared For Acche Din ?"Princess SoniyaNo ratings yet

- Ime AssignmentDocument18 pagesIme Assignmentsajalkhulbe23No ratings yet

- Bangladesh Income Tax RatesDocument5 pagesBangladesh Income Tax RatesaadonNo ratings yet

- DT AmendmentsDocument39 pagesDT AmendmentsMurali GopalakrishnaNo ratings yet

- Individual Txation FY 203 24Document44 pagesIndividual Txation FY 203 24Smarty ShivamNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- Bond ValuationDocument11 pagesBond ValuationSaurav BharadwajNo ratings yet

- Final Cost 556,000 598,000 406,000Document2 pagesFinal Cost 556,000 598,000 406,000Saurav BharadwajNo ratings yet

- KhoslaDocument16 pagesKhoslaSaurav BharadwajNo ratings yet

- MH370 - The Case of A Missing PlaneDocument3 pagesMH370 - The Case of A Missing PlaneSaurav BharadwajNo ratings yet

- AIMMS Modeling Guide - Integer Programming TricksDocument14 pagesAIMMS Modeling Guide - Integer Programming TricksSaurav BharadwajNo ratings yet

- Irf Conference - The Ultimate Retail Knowledge PlatformDocument7 pagesIrf Conference - The Ultimate Retail Knowledge PlatformSaurav BharadwajNo ratings yet

- Business Today Business India: RankingDocument15 pagesBusiness Today Business India: RankingSaurav BharadwajNo ratings yet

- Pharmaceutical Industry of PakistanDocument20 pagesPharmaceutical Industry of PakistanAli UsamaNo ratings yet

- Checklist of Every Loan FileDocument1 pageChecklist of Every Loan FileDheeraj VarkhadeNo ratings yet

- The Structure of Managerial Finance Course and Seminars - REI - 2020 - 2021Document2 pagesThe Structure of Managerial Finance Course and Seminars - REI - 2020 - 2021Teodorescu Ana MariaNo ratings yet

- Invitation Letter - General Mailing - BUY KOREA 2012Document3 pagesInvitation Letter - General Mailing - BUY KOREA 2012Kotra la Kbc100% (1)

- Concept of Bond Valuation: Presented byDocument25 pagesConcept of Bond Valuation: Presented byRohan KushwahNo ratings yet

- 20140625Document24 pages20140625កំពូលបុរសឯកាNo ratings yet

- Cash Basis Accounting vs. Accrual AccountingDocument2 pagesCash Basis Accounting vs. Accrual Accountingdibakar dasNo ratings yet

- PARCOR - 1Nature-and-Formation-of-a-PartnershipDocument31 pagesPARCOR - 1Nature-and-Formation-of-a-PartnershipHarriane Mae GonzalesNo ratings yet

- F9-11 Weighted Average Cost of Capital and GearingDocument22 pagesF9-11 Weighted Average Cost of Capital and GearingPaiNo ratings yet

- UIN Information System ("UIS") : Frequently Asked Questions (FAQ's)Document7 pagesUIN Information System ("UIS") : Frequently Asked Questions (FAQ's)Syed Hareem Ul HasanNo ratings yet

- Ra 8293Document5 pagesRa 8293Anonymous OIjr92UyY2No ratings yet

- Financing Sustainable Transport For Green CitiesDocument19 pagesFinancing Sustainable Transport For Green CitiesUrban Community of PracticeNo ratings yet

- Lecture Financial Statement Analysis 2Document36 pagesLecture Financial Statement Analysis 2Devyansh GuptaNo ratings yet

- Quiz ReorganizationDocument7 pagesQuiz ReorganizationJam SurdivillaNo ratings yet

- 33 Advanced AccountingDocument264 pages33 Advanced AccountingKrunal ShahNo ratings yet

- 7-1 Notice of Special Meeting - ShareholdersDocument1 page7-1 Notice of Special Meeting - ShareholdersDaniel100% (4)

- SOIC-Result Update Q1FY22 VideoDocument32 pagesSOIC-Result Update Q1FY22 VideoSubham JainNo ratings yet

- Speculation Demon BankDocument3 pagesSpeculation Demon BankFreya RenataNo ratings yet

- Tefr & DPR - PM - Module - IIIDocument21 pagesTefr & DPR - PM - Module - IIIAtish NairNo ratings yet

- (A) About The Founder: Quick Links. Click To Navigate Directly To Detailed ParagraphDocument7 pages(A) About The Founder: Quick Links. Click To Navigate Directly To Detailed Paragraphtarun lahotiNo ratings yet

- Private Equity - Digest 2012Document9 pagesPrivate Equity - Digest 2012Nakul GuptaNo ratings yet

- Life Cycle CostingDocument38 pagesLife Cycle CostingSapan Gupta100% (2)

- Business Plan - Guna Ram PraveenDocument15 pagesBusiness Plan - Guna Ram PraveenVarun RakeshNo ratings yet

- Form ADV Part 2 InstructionsDocument26 pagesForm ADV Part 2 InstructionsghummNo ratings yet

- Beatrice Levin v. Commissioner of Internal Revenue, 385 F.2d 521, 2d Cir. (1967)Document11 pagesBeatrice Levin v. Commissioner of Internal Revenue, 385 F.2d 521, 2d Cir. (1967)Scribd Government DocsNo ratings yet

- Sarthy Govern Study v1 by Raghav AgarwalDocument83 pagesSarthy Govern Study v1 by Raghav AgarwalRushil ShahNo ratings yet

- TSHpart5 Application Final PDFDocument21 pagesTSHpart5 Application Final PDFancutzica2000No ratings yet