Professional Documents

Culture Documents

Tax

Tax

Uploaded by

irfanbaig36Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax

Tax

Uploaded by

irfanbaig36Copyright:

Available Formats

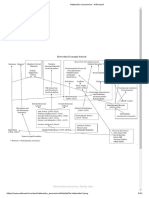

300000 12 3600000 1.

Where the taxable income does not exceed Rs 400,000, rate of tax is 0%;

135000 12 1620000 2. where the taxable income exceeds Rs 400,000 but does not exceed Rs 750,000, rate of tax is 5% of the amount exceeding Rs 400,000;

435000 5220000 3. where the taxable income exceeds Rs 750,000 but does not exceed Rs 1,400,000, rate of tax is Rs 17,500 + 10% of the amount exceeding Rs 750,000;

357041.7 4. where the taxable income exceeds Rs 1,400,000 but does not exceed Rs 1,500,000, rate of tax is Rs 82,500 + 12.5% of the amount exceeding Rs 1,400,000;

600000 4000000 5. where the taxable income exceeds Rs 1,500,000 but does not exceed Rs 1,800,000, rate of tax is Rs 95,000 + 15% of the amount exceeding Rs 1,500,000;

6. where the taxable income exceeds Rs 1,800,000 but does not exceed Rs 2,500,000, rate of tax is Rs 140,000 + 17.5% of the amount exceeding Rs 1,800,000;

27.5 335500 7. where the taxable income exceeds Rs 2,500,000 but does not exceed Rs 3,000,000, rate of tax is Rs 262,500 + 20% of the amount exceeding Rs 2,500,000;

935500 8. where the taxable income exceeds Rs 3,000,000 but does not exceed Rs 3,500,000, rate of tax is Rs 362,500 + 22.5% of the amount exceeding Rs 3,000,000;

4284500 77958.33 17.9% 9. where the taxable income exceeds Rs 3,500,000 but does not exceed Rs 4,000,000, rate of tax is Rs 475,000 + 25% of the amount exceeding Rs 3,500,000;

10. where the taxable income exceeds Rs 4,000,000 but does not exceed Rs 7,000,000; rate of tax is Rs 600,000 + 27.5% of the amount exceeding Rs 4,000,000;

357041.7 11. where the taxable income exceeds Rs 7,000,000, rate of tax is Rs 1,425,000 + 30% of the amount exceeding Rs 7,000,000.

150000 1800000 9000000

1. Where the taxable income does not exceed Rs 400,000, rate of tax is 0%;

2. where the taxable income exceeds Rs 400,000 but does not exceed Rs 750,000, rate of tax is 5% of the amount exceeding Rs 400,000;

3. where the taxable income exceeds Rs 750,000 but does not exceed Rs 1,400,000, rate of tax is Rs 17,500 + 10% of the amount exceeding Rs 750,000;

4. where the taxable income exceeds Rs 1,400,000 but does not exceed Rs 1,500,000, rate of tax is Rs 82,500 + 12.5% of the amount exceeding Rs 1,400,000;

5. where the taxable income exceeds Rs 1,500,000 but does not exceed Rs 1,800,000, rate of tax is Rs 95,000 + 15% of the amount exceeding Rs 1,500,000;

6. where the taxable income exceeds Rs 1,800,000 but does not exceed Rs 2,500,000, rate of tax is Rs 140,000 + 17.5% of the amount exceeding Rs 1,800,000;

7. where the taxable income exceeds Rs 2,500,000 but does not exceed Rs 3,000,000, rate of tax is Rs 262,500 + 20% of the amount exceeding Rs 2,500,000;

8. where the taxable income exceeds Rs 3,000,000 but does not exceed Rs 3,500,000, rate of tax is Rs 362,500 + 22.5% of the amount exceeding Rs 3,000,000;

9. where the taxable income exceeds Rs 3,500,000 but does not exceed Rs 4,000,000, rate of tax is Rs 475,000 + 25% of the amount exceeding Rs 3,500,000;

10. where the taxable income exceeds Rs 4,000,000 but does not exceed Rs 7,000,000; rate of tax is Rs 600,000 + 27.5% of the amount exceeding Rs 4,000,000;

11. where the taxable income exceeds Rs 7,000,000, rate of tax is Rs 1,425,000 + 30% of the amount exceeding Rs 7,000,000.

2. where the taxable income exceeds Rs 400,000 but does not exceed Rs 750,000, rate of tax is 5% of the amount exceeding Rs 400,000;

3. where the taxable income exceeds Rs 750,000 but does not exceed Rs 1,400,000, rate of tax is Rs 17,500 + 10% of the amount exceeding Rs 750,000;

4. where the taxable income exceeds Rs 1,400,000 but does not exceed Rs 1,500,000, rate of tax is Rs 82,500 + 12.5% of the amount exceeding Rs 1,400,000;

5. where the taxable income exceeds Rs 1,500,000 but does not exceed Rs 1,800,000, rate of tax is Rs 95,000 + 15% of the amount exceeding Rs 1,500,000;

6. where the taxable income exceeds Rs 1,800,000 but does not exceed Rs 2,500,000, rate of tax is Rs 140,000 + 17.5% of the amount exceeding Rs 1,800,000;

7. where the taxable income exceeds Rs 2,500,000 but does not exceed Rs 3,000,000, rate of tax is Rs 262,500 + 20% of the amount exceeding Rs 2,500,000;

8. where the taxable income exceeds Rs 3,000,000 but does not exceed Rs 3,500,000, rate of tax is Rs 362,500 + 22.5% of the amount exceeding Rs 3,000,000;

9. where the taxable income exceeds Rs 3,500,000 but does not exceed Rs 4,000,000, rate of tax is Rs 475,000 + 25% of the amount exceeding Rs 3,500,000;

10. where the taxable income exceeds Rs 4,000,000 but does not exceed Rs 7,000,000; rate of tax is Rs 600,000 + 27.5% of the amount exceeding Rs 4,000,000;

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Modern Monetary Theory and Practice An Introductory by William Mitchell, L. Randall Wray, Martin Watts PDFDocument397 pagesModern Monetary Theory and Practice An Introductory by William Mitchell, L. Randall Wray, Martin Watts PDFAhmed DanafNo ratings yet

- Structure and Change Douglass NorthDocument17 pagesStructure and Change Douglass NorthDiego Mauricio Diaz VelásquezNo ratings yet

- Character Analysis EssayDocument5 pagesCharacter Analysis Essayirfanbaig36100% (1)

- Lavoie (2014) - New FoundationsDocument660 pagesLavoie (2014) - New FoundationsDaisy Pereira100% (1)

- Socialism in Habonim Dror (Resource Book) PDFDocument37 pagesSocialism in Habonim Dror (Resource Book) PDFGeorge StevensNo ratings yet

- (Karl Brunner (Ed.) ) Economics and Social InstitutionsDocument288 pages(Karl Brunner (Ed.) ) Economics and Social InstitutionsSalvador SaballosNo ratings yet

- History of Economic ThoughtDocument155 pagesHistory of Economic ThoughtDeanNo ratings yet

- Machine Room Ventilation - International Code: InputDocument15 pagesMachine Room Ventilation - International Code: Inputirfanbaig36No ratings yet

- Life Life Cost Cost OF OF IN IN Buildings in Buildings In: AIR Air - Conditioning ConditioningDocument15 pagesLife Life Cost Cost OF OF IN IN Buildings in Buildings In: AIR Air - Conditioning Conditioningirfanbaig36No ratings yet

- HVAC For Doc StoreDocument27 pagesHVAC For Doc Storeirfanbaig36No ratings yet

- Character Analysis Paper AssignmentDocument3 pagesCharacter Analysis Paper Assignmentirfanbaig36No ratings yet

- Challan #: Challan #: Challan #:: Total Total TotalDocument1 pageChallan #: Challan #: Challan #:: Total Total Totalirfanbaig36No ratings yet

- Cost AE CalcsDocument18 pagesCost AE Calcsirfanbaig36No ratings yet

- 30% Glycol AHU: Friday, February 01, 2008 9:41 AMDocument6 pages30% Glycol AHU: Friday, February 01, 2008 9:41 AMirfanbaig36No ratings yet

- Heat Pipe MITDocument221 pagesHeat Pipe MITirfanbaig36No ratings yet

- 30% Glycol AHU: Friday, February 01, 2008 9:41 AMDocument3 pages30% Glycol AHU: Friday, February 01, 2008 9:41 AMirfanbaig36No ratings yet

- Irfan Baig Account Number: 300200139510001 Product: Currency: From Date: Fri 14-Sep-2012 To Date: Thu 20-Sep-2012Document1 pageIrfan Baig Account Number: 300200139510001 Product: Currency: From Date: Fri 14-Sep-2012 To Date: Thu 20-Sep-2012irfanbaig36No ratings yet

- Genetics Pharma Dehumidifying Load Input Sheet: 1 BlisteringDocument1 pageGenetics Pharma Dehumidifying Load Input Sheet: 1 Blisteringirfanbaig36No ratings yet

- QD Volume 22 October 2006Document128 pagesQD Volume 22 October 2006irfanbaig36No ratings yet

- Income Tax Return E-Filing Guide (Salaried) - 2009Document16 pagesIncome Tax Return E-Filing Guide (Salaried) - 2009Zohaib HussainNo ratings yet

- Hvac Works - NPT Labs: 2 Make (For Reference Only) Aerotech Aerotech AerotechDocument1 pageHvac Works - NPT Labs: 2 Make (For Reference Only) Aerotech Aerotech Aerotechirfanbaig36No ratings yet

- Air Duct CalculatorDocument1 pageAir Duct Calculatoraravoof84No ratings yet

- Mixed Air CalculatorDocument4 pagesMixed Air Calculatorirfanbaig36No ratings yet

- Shajrah TayebahDocument50 pagesShajrah Tayebahirfanbaig36No ratings yet

- 7535 7500 1750 1060 13 14 5.4 Inches 8.9 Inches 38 Inches 0.875 7.77 InchesDocument2 pages7535 7500 1750 1060 13 14 5.4 Inches 8.9 Inches 38 Inches 0.875 7.77 Inchesirfanbaig36No ratings yet

- Risk of Using Balancing Dampers or Long Lengths of Flexible DuctingDocument1 pageRisk of Using Balancing Dampers or Long Lengths of Flexible Ductingirfanbaig36No ratings yet

- Switchgear Selection ChartsDocument6 pagesSwitchgear Selection Chartsirfanbaig36No ratings yet

- Behind The Beautiful Forevers EssayDocument6 pagesBehind The Beautiful Forevers EssayKaliyah MartinNo ratings yet

- Hsitory of Thoughts Historical Critics of Neoclassical EconomicsDocument9 pagesHsitory of Thoughts Historical Critics of Neoclassical EconomicsGörkem AydınNo ratings yet

- 4.2 Pre-Analytical Visions of The Economy and The Role of PricesDocument4 pages4.2 Pre-Analytical Visions of The Economy and The Role of PricesFebbyNo ratings yet

- Contending Perspectives in Econmics - Exam 1 Study GuideDocument7 pagesContending Perspectives in Econmics - Exam 1 Study Guide123nntNo ratings yet

- Khalil 1995Document45 pagesKhalil 1995Alcibiades MorteraNo ratings yet

- Marc Lavoie History and Methods of Post Keynesian Economics 184458Document34 pagesMarc Lavoie History and Methods of Post Keynesian Economics 184458José Ignacio Fuentes PeñaililloNo ratings yet

- Reorienting History (Of Economics)Document17 pagesReorienting History (Of Economics)Marcos BandeiraNo ratings yet

- Bus& Trans Tax Valencia, 5th Ed, Chapter 1 - Intro To IrtDocument2 pagesBus& Trans Tax Valencia, 5th Ed, Chapter 1 - Intro To IrtNeLson ALcanarNo ratings yet

- International Political Economy:: A Tale of Two HeterodoxiesDocument26 pagesInternational Political Economy:: A Tale of Two Heterodoxieschrz90No ratings yet

- Direct Taxes Ready Reckoner 2012Document2 pagesDirect Taxes Ready Reckoner 2012Veerkumar PuttaNo ratings yet

- Feminist Economics: Theoretical and Political Dimensions: A - C and L G - MDocument30 pagesFeminist Economics: Theoretical and Political Dimensions: A - C and L G - MgustavoNo ratings yet

- Tax MCQDocument1 pageTax MCQMaan Dellosa-BañaresNo ratings yet

- AbichuDocument7 pagesAbichuAnonymous Bn2PYF4uUNo ratings yet

- J.E. King-The Microfoundations Delusion - Metaphor and Dogma in The History of Macroeconomics-Edward Elgar Publishing LTD (2014) PDFDocument297 pagesJ.E. King-The Microfoundations Delusion - Metaphor and Dogma in The History of Macroeconomics-Edward Elgar Publishing LTD (2014) PDFPaola Naranjo0% (1)

- IRS Publication 962Document2 pagesIRS Publication 962Francis Wolfgang UrbanNo ratings yet

- GramsciDocument9 pagesGramsciAndreea ChipailaNo ratings yet

- Review of Vincent Mosco's BookDocument2 pagesReview of Vincent Mosco's BookjosephNo ratings yet

- Peck 2013Document24 pagesPeck 2013Christian JavierNo ratings yet

- MacroeoconomicsIIHeterodoxMacroDocument6 pagesMacroeoconomicsIIHeterodoxMacroAnonymous QG0EbzsNo ratings yet

- Byron Kaldis Encyclopedia of Philosophy and The Social SciencesDocument1,195 pagesByron Kaldis Encyclopedia of Philosophy and The Social SciencesSyams Fathur75% (4)

- Is There A Future For Heterodox Economics?: Geoffrey M. HodgsonDocument28 pagesIs There A Future For Heterodox Economics?: Geoffrey M. HodgsonPeter De GrootNo ratings yet

- Heterodox Economics - WikiwandDocument11 pagesHeterodox Economics - WikiwandDaniel Victoriano BremontNo ratings yet

- The RC ExcelDocument12 pagesThe RC ExcelGorang PatNo ratings yet

- The Central Focus of Modern Economic ThoughtDocument5 pagesThe Central Focus of Modern Economic ThoughtМ-ва ДжейранNo ratings yet