Professional Documents

Culture Documents

Gibbs V CIR (D)

Gibbs V CIR (D)

Uploaded by

BreAmber0 ratings0% found this document useful (0 votes)

49 views2 pagesTax

Original Title

Gibbs v CIR (d)

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTax

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

0 ratings0% found this document useful (0 votes)

49 views2 pagesGibbs V CIR (D)

Gibbs V CIR (D)

Uploaded by

BreAmberTax

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

Download as doc, pdf, or txt

You are on page 1of 2

GR No: L-13453

Date: February 21, 1960

GIBBS v CIR

Petitioners: Aison an! "st#er Gibbs

Res$on!ent: %o&&issioner o' (nterna Re)enue

Facts:

*n +ar, 14, 1956, $etitioners $roteste! t#e !e'i-ien-y in-o&e ta. assess&ent in t#e a&ount o' P12,2/4,00, t#at sai!

!e'i-ien-y assess&ent 0as base! on a !isao0an-e o' ba! !ebts an! osses -ai&e! in t#eir in-o&e ta. return 'or 1950,

*n *-t, 3, 1956, $etitioners sent a -#e-1 in t#e a&ount o' P12,2/4,00 to %(R as $ay&ent o' sai! !e'i-ien-y assess&ent,

at t#e sa&e ti&e !e&an!in2 t#e i&&e!iate re'un! o' t#e a&ount $ai!,

*n *-t, 26, 1956, res$on!ent %oe-tor !enie! t#e re3uest 'or re'un!.

Noti-e o' sai! !enia 0as re-ei)e! by $etitioners on No)e&ber 14, 1956,

*n 4e$t, 25, 1955, $etitioners 'ie! 0it# t#e %6A a $etition 'or re)ie0 an! re'un!, 0it# a &otion 'or sus$ension o'

-oe-tion o' $enaties,

*n *-t, 5, 1955, %(R 'ie! a &otion to !is&iss, on t#e 2roun! t#at t#e $etition 0as 'ie! beyon! t#e 30-!ay $erio!

$ro)i!e! un!er 4e-tion 11, in reation to 4e-tion 5, o' RA 1125,

*n De-, 2, 1955, %6A !is&isse! t#e $etition 'or #a)in2 'ie! out o' ti&e,

Petitioners, #o0e)er, -onten! t#at at#ou2# t#eir a$$ea 0as 'ie! beyon! sai! 30-!ay $erio!, %6A sti #a! 7uris!i-tion

o)er t#e sa&e, by )irtue o' t#e $ro)ision o' 4e-tion 306 o' t#e N(R%,

Issue:

89N t#e $etitioners: a$$ea 'ro& t#e !e-ision o' %(R, 0as 'ie! 0it# t#e %6A 0it#in t#e statutory $erio!, N*,

Rationale:

Sec. 11 RA 1125

SEC. 11. Who may appeal; effect of appeal.Any person, association or corporation adversely affected by a decision or ruling of the

Collector of Internal Revenue, the Collector of Customs or any provincial or city Board of Assessment Appeals may file an appeal in the

Court of Tax Appeals within thirty days after the receipt of such decision or ruling. . . .

(t is not !is$ute! t#at $etitioners re-ei)e! on No), 14, 1956, noti-e o' res$on!ent %oe-tor:s !e-ision !enyin2 t#eir

re3uest 'or a re'un! o' t#e !e'i-ien-y assess&ent $ai! by t#e&, Pursuant to t#e abo)e-3uote! $ro)ision o' 4e- 11 o' RA

1125, t#ey #a! 30 !ays 'ro& sai! !ate 0it#in 0#i-# to 'ie t#eir a$$ea 0it# res$on!ent -ourt, ;o0e)er, t#ey 'ie! sai!

a$$ea ony on 4e$t, 25, 1955, or &ore t#an ten <10= &ont#s t#erea'ter, &u-# beyon! t#e a'ore&entione! 30-!ay $erio!

0it#in 0#i-# to 'ie t#e sa&e, %onse3uenty, respondent court had acquired no jurisdiction to entertain said appeal

and the dismissal of the same was proper,

As to t#e -ai& t#at t#e %6A #as 7uris!i-tion !es$ite t#at it is beyon! t#e 30 !ay $erio!, t#e -ontention is !e)oi! o' any

&erit, (n t#e -ase o' ohnston !umber Co., Inc. vs. Court of Tax Appeals, et al. 101 P#i,, 654> 54 *'', Ga?, @16A 5226, t#e

%ourt #e!:

It is the contention of petitioner that the afore"uoted provisions cannot stand side by side because, #hereas $ection %&'

of the Tax Code re"uired the filing of a claim before an action in court may be maintained, Republic Act (o. ))*+ #hich

confers ,urisdiction upon the Court of Tax Appeals to ta-e cogni.ance of appeals from the decisions of the Collector of

Internal Revenue does not re"uire any more the filing of said claim but merely provides that said appeal may be filed

#ithin %& days from receipt of such decision or ruling.

6#e %ourt sai! t#at 4e- 306 o' t#e N(R% s#ou! be -onstrue! to2et#er 0it# 4e- 11 o' RA 1125, (n 'ine, a ta.$ayer 0#o

#as $ai! t#e ta., 0#et#er un!er $rotest or not, an! 0#o is -ai&in2 a re'un! o' t#e sa&e, &ust -o&$y 0it# t#e

re3uire&ents o' bot# se-tions, t#at is, #e &ust 'ie a -ai& 'or re'un! 0it# t#e %oe-tor o' (nterna Re)enue 0it#in 2 years

'ro& t#e !ate o' #is $ay&ent o' t#e ta., as re3uire! by sai! 4e- 306, an! a$$ea to t#e %6A 0it#in 30 !ays 'ro& re-ei$t o'

t#e %oe-tor:s !e-ision or ruin2 !enyin2 #is -ai& 'or re'un!, as re3uire! by sai! 4e- 11 o' RA 1125, (', #o0e)er, t#e

%oe-tor ta1es ti&e in !e-i!in2 t#e -ai&, an! t#e $erio! o' t0o years is about to en!, t#e suit or $ro-ee!in2 &ust be

starte! in t#e %ourt o' 6a. A$$eas be'ore t#e en! o' t#e t0o-year $erio! 0it#out a0aitin2 t#e !e-ision o' t#e %oe-tor,

6#is is so be-ause o' t#e $ositi)e re3uire&ent o' 4e-tion 306 an! t#e !o-trine t#at !eay o' t#e %oe-tor in ren!erin2

!e-ision !oes not e.ten! t#e $ere&$tory $erio! 'i.e! by t#e statute,

(n t#e -ase o' a ta.$ayer 0#o #as not yet $ai! t#e ta. an! 0#o is $rotestin2 t#e assess&ent &a!e by t#e %oe-tor o'

(nterna Re)enue, #e &ust 'ie #is a$$ea 0it# t#e %ourt o' 6a. A$$eas 0it#in 30 !ays 'ro& #is re-ei$t o' t#e %oe-tor:s

assess&ent, as re3uire! by sai! 4e- 11 o' RA 1125, *t#er0ise, his failure to comply with said statutory requirement

would bar his appeal and deprive the Court of a! "ppeals of its jurisdiction to entertain or determine the same,

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Sumifru Corp. v. Nagkahiusang Mamumuo Sa Suyapa Farm1 (Namasufa-Naflu-Kmu)Document1 pageSumifru Corp. v. Nagkahiusang Mamumuo Sa Suyapa Farm1 (Namasufa-Naflu-Kmu)Junmer OrtizNo ratings yet

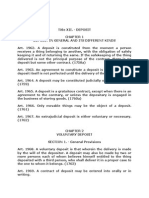

- Title XV Guaranty (2047-2084)Document7 pagesTitle XV Guaranty (2047-2084)BreAmberNo ratings yet

- GR 107383 Nizurtado Vs SandiganbayanDocument9 pagesGR 107383 Nizurtado Vs SandiganbayanBreAmberNo ratings yet

- Title XVIII Damages (2195-2235)Document8 pagesTitle XVIII Damages (2195-2235)BreAmberNo ratings yet

- Title VIII Lease (1642-1766)Document21 pagesTitle VIII Lease (1642-1766)BreAmberNo ratings yet

- Corpo - Title IIIDocument4 pagesCorpo - Title IIIBreAmberNo ratings yet

- Title XVI Pledge, Mortgage and Antichresis (2085-2141)Document9 pagesTitle XVI Pledge, Mortgage and Antichresis (2085-2141)BreAmberNo ratings yet

- Title III Natural Obligations (1423-1430)Document2 pagesTitle III Natural Obligations (1423-1430)BreAmberNo ratings yet

- Title XII Deposit (1962-2009)Document8 pagesTitle XII Deposit (1962-2009)BreAmber100% (1)

- Title IV Estoppel (1431-1439)Document2 pagesTitle IV Estoppel (1431-1439)BreAmber100% (1)

- Title XI Loan (1933-1961)Document5 pagesTitle XI Loan (1933-1961)BreAmberNo ratings yet

- Title VII Barter or Exchange (1638-1641)Document1 pageTitle VII Barter or Exchange (1638-1641)BreAmberNo ratings yet

- Title XIV Compromises and Arbitrations (2028-2046)Document3 pagesTitle XIV Compromises and Arbitrations (2028-2046)BreAmberNo ratings yet

- Title II Contracts (1305-1422)Document19 pagesTitle II Contracts (1305-1422)BreAmber33% (3)

- New DigestDocument4 pagesNew DigestBreAmberNo ratings yet

- Nego Syllabus Week 03 v97-2003 2010-12-08Document1 pageNego Syllabus Week 03 v97-2003 2010-12-08BreAmberNo ratings yet

- Jaovsca (: G.R. No. 104604 October 6, 1995) FactsDocument2 pagesJaovsca (: G.R. No. 104604 October 6, 1995) FactsBreAmberNo ratings yet

- Velayo Vs OrdovezaDocument1 pageVelayo Vs OrdovezaBreAmberNo ratings yet

- Concealment: Insurance Law Case Digests SY 2010-2011Document1 pageConcealment: Insurance Law Case Digests SY 2010-2011BreAmberNo ratings yet

- Digest Env 430Document25 pagesDigest Env 430BreAmberNo ratings yet

- Family Code (Executive Order No 209)Document53 pagesFamily Code (Executive Order No 209)BreAmberNo ratings yet

- DigestDocument15 pagesDigestBreAmberNo ratings yet

- Insurance Case DigestsDocument28 pagesInsurance Case DigestsBernadette Quitoriano67% (3)

- CIR Vs PhilamlifeDocument2 pagesCIR Vs PhilamlifeBreAmberNo ratings yet

- 22 Dela Cruz Vs Dela Cruz 419 SCRA 648Document1 page22 Dela Cruz Vs Dela Cruz 419 SCRA 648Cleofe SobiacoNo ratings yet

- GEORGE J. WALDIE TOWING CO., Inc., Petitioner-Respondent, v. Hugo F. RICCA, Executor of The Estate of Joseph S. Martin, Deceased, Claimant-AppellantDocument3 pagesGEORGE J. WALDIE TOWING CO., Inc., Petitioner-Respondent, v. Hugo F. RICCA, Executor of The Estate of Joseph S. Martin, Deceased, Claimant-AppellantScribd Government DocsNo ratings yet

- ALPA-PCM, INC., PetitionerDocument5 pagesALPA-PCM, INC., PetitionerVanzNo ratings yet

- Not PrecedentialDocument6 pagesNot PrecedentialScribd Government DocsNo ratings yet

- Case Name Antonio Geluz, Petitioner, vs. The Hon. Court of Appeals and OSCAR LAZO, Respondents. Case No. - Date Ponente FactsDocument1 pageCase Name Antonio Geluz, Petitioner, vs. The Hon. Court of Appeals and OSCAR LAZO, Respondents. Case No. - Date Ponente FactsKim B.No ratings yet

- G.R. No. 138238. September 2, 2003 Eduardo BALITAOSAN,, Petitioner, v. THEDocument4 pagesG.R. No. 138238. September 2, 2003 Eduardo BALITAOSAN,, Petitioner, v. THEJanelle Leano MarianoNo ratings yet

- In The Matter of Robert L. Chipley, JR, 448 F.2d 1234, 4th Cir. (1971)Document2 pagesIn The Matter of Robert L. Chipley, JR, 448 F.2d 1234, 4th Cir. (1971)Scribd Government DocsNo ratings yet

- Case Digest: Spouses Abad vs. Fil-Homes RealtyDocument1 pageCase Digest: Spouses Abad vs. Fil-Homes RealtyMonalizts D.No ratings yet

- 0129 - People vs. Evangelista and Ramos 57 Phil., 372, October 26, 1932 (SC E-Lib)Document2 pages0129 - People vs. Evangelista and Ramos 57 Phil., 372, October 26, 1932 (SC E-Lib)Gra syaNo ratings yet

- United States v. Gerald Stevens, 4th Cir. (1999)Document3 pagesUnited States v. Gerald Stevens, 4th Cir. (1999)Scribd Government DocsNo ratings yet

- Erica Tyne v. Time Warner Entertainment, 425 F.3d 1363, 11th Cir. (2005)Document2 pagesErica Tyne v. Time Warner Entertainment, 425 F.3d 1363, 11th Cir. (2005)Scribd Government DocsNo ratings yet

- Kaanib v. IglesiaDocument2 pagesKaanib v. Iglesiarhod leysonNo ratings yet

- Chinese Young Men's Christian Association of The Philippine Island vs. Remington Steel Corp.Document4 pagesChinese Young Men's Christian Association of The Philippine Island vs. Remington Steel Corp.Hannah Therese SajoniaNo ratings yet

- Custodio Vs CorradoDocument12 pagesCustodio Vs Corradozatarra_12No ratings yet

- 8 - Douglas Lu Ym Vs NabuaDocument1 page8 - Douglas Lu Ym Vs NabuaLouana AbadaNo ratings yet

- Gomes v. Gonzales, 4th Cir. (2006)Document3 pagesGomes v. Gonzales, 4th Cir. (2006)Scribd Government DocsNo ratings yet

- G.R. No. 172588Document2 pagesG.R. No. 172588Jay EmNo ratings yet

- Sample DigestDocument1 pageSample DigestChristopher Martin GunsatNo ratings yet

- 014.02 Natalia Realty Et. Al.. Versus DAR, GR No. 103302, August 12, 1993Document4 pages014.02 Natalia Realty Et. Al.. Versus DAR, GR No. 103302, August 12, 1993Mark Genesis Alvarez RojasNo ratings yet

- Dee v. Securities and Exchange CommissionDocument1 pageDee v. Securities and Exchange Commissioncharismamichelle140% (1)

- Plaintiff-Appellee vs. vs. Appellant The Solicitor General Brigido G. EstradaDocument3 pagesPlaintiff-Appellee vs. vs. Appellant The Solicitor General Brigido G. EstradaAndrei Jose V. LayeseNo ratings yet

- United States v. Larry Sinclair Williams-El, 60 F.3d 826, 4th Cir. (1995)Document2 pagesUnited States v. Larry Sinclair Williams-El, 60 F.3d 826, 4th Cir. (1995)Scribd Government DocsNo ratings yet

- DigestDocument2 pagesDigestRaymond ChengNo ratings yet

- Manungas V LoretoDocument2 pagesManungas V LoretoTey TorrenteNo ratings yet

- In The Matter To Declare in Contempt of Court Hon. Simeon Datumanong, G.R. No. 150274Document1 pageIn The Matter To Declare in Contempt of Court Hon. Simeon Datumanong, G.R. No. 150274Jamille YapNo ratings yet

- Seven Brothers Shipping Corporation vs. Court of Appeals FactsDocument2 pagesSeven Brothers Shipping Corporation vs. Court of Appeals Factsfed solisNo ratings yet

- 17A - Dayao vs. ComelecDocument1 page17A - Dayao vs. ComelecRenard EnrileNo ratings yet

- US Bank National Association v. Merritt Et Al - Document No. 7Document1 pageUS Bank National Association v. Merritt Et Al - Document No. 7Justia.comNo ratings yet

- Owasso Independent School District No - 8-6-21 2Document10 pagesOwasso Independent School District No - 8-6-21 2api-614777715No ratings yet