Professional Documents

Culture Documents

85th Business Outlook Survey

85th Business Outlook Survey

Uploaded by

shreeju86Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

85th Business Outlook Survey

85th Business Outlook Survey

Uploaded by

shreeju86Copyright:

Available Formats

th

85 Business

Outlook Survey

October- December 2013

www.cii.in

Confederation of Indian Industry

Copyright 2013 by Confederation of Indian Industry (CII), All rights reserved.

No part of this publication may be reproduced, stored in, or introduced into a retrieval system, or transmitted in

any form or by any means (electronic, mechanical, photocopying, recording or otherwise), without the prior

written permission of the copyright owner. CII has made every effort to ensure the accuracy of information

presented in this document. However, neither CII nor any of its office bearers or analysts or employees can be

held responsible for any financial consequences arising out of the use of information provided herein

However, in case of any discrepancy, error, etc., same may please be brought to the notice of CII for

appropriate corrections.

Published by Confederation of Indian Industry (CII)

The Mantosh Sondhi Centre; 23, Institutional Area, Lodi Road, New Delhi-110003 (INDIA)

T: +91-11-24629994-7; F: +91-11-24626149; E: info@cii.in; W: www.cii.in

Contents

th

85 Business Outlook Survey : Oct. - Dec. 2013

Highlights 1

Business Confidence Index 2

General Economic Prospects 3

General Business Prospects 5

Overall Trends 6

Export and Import Trends 9

Business Concerns 10

Coverage & Methodology 10

Indicating sharp improvement in investors sentiments, the CII Business Confidence Index (CII-

BCI) for Oct- Dec 2013 quarter increased sharply to 54.9 from 45.7 in the previous survey.

Breaching the psychological 50-level mark, index reached its highest value since Q2FY13.

Majority of the respondents (42 per cent) felt that GDP growth in the current fiscal would lie in the

range of 4.5-5.0 per cent. Only 28 per cent of them expected it to fall in the range of 5.0-5.5 per

cent.

Inflation is expected to cross 7 per cent mark during the current fiscal, according to largest 41

per cent of the respondents.

The largest 32 per cent of respondents expect fiscal deficit to lie in a range of 4.5-5.0 per cent of

GDP in 2013-14. This would be in line with the governments target of 4.8 per cent for the year

63 per cent of respondents expect current account deficit to lie in a range of 3.5-5.0 per cent of

GDP in 2013-14, which would be above the comfort level of RBI, even though the current

account deficit moderated sharply to 1.2 per cent of GDP in second quarter of the current fiscal.

55 per cent of the respondents expect exchange rate to reach Rs 61-63 per US$ by March 2014.

In a worrying sign of companys performance, 56 per cent of respondents have been running

their companies at less than 75 per cent capacity utilization in the second quarter of the current

fiscal. However, in a sign of improvement in the situation, much smaller (only 45 per cent) per

cent of respondents expect capacity utilization to fall below 75 per cent in the current quarter.

Majority of the respondents (53 per cent) have not planned an increase in capacity expansion

during the third quarter of current fiscal.

The survey reveals that 58 per cent of the respondents expect increase in their sales, new

orders and value of production in the third quarter of 2013-14, which is much larger than only 45

per cent who witnessed increase in their sales in the previous quarter.

Majority of the respondents expect increase in input cost in most cases. As regards the input

cost in the current quarter as compared to the actual of the previous quarter, there is significant

decline in percentage of respondents who expect expenses on raw materials, electricity, and

wages & salaries to increase.

As compared to only 31 per cent respondents who witnessed an increase in their pre-tax profit in

second quarter, 43 per cent respondents expect an increase in the pre-tax profit in the third

quarter of current fiscal.

Majority of respondents (53 per cent) expect their exports to increase in the current quarter.

Only 49 per cent of the respondent had seen increase in their exports during the previous

quarter.

The largest 56 per cent of the respondents didnt expect their imports to increase during the

current quarter.

In the 85th Business Outlook Survey, domestic economic/political instability, slackening

consumer demand, high level of corruption, persistent high inflation and risk from exchange

rate volatility emerged as the top five current concerns in order of severity to most firms.

Highlights

1

th

85 Business Outlook Survey : Oct. - Dec. 2013

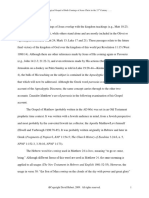

Business Confidence Index

Indicating sharp improvement in investors sentiments, the CII Business Confidence Index (CII-

BCI) for Oct- Dec 2013 quarter increased sharply to 54.9 from 45.7 in the previous survey.

Breaching the psychological 50-level mark, index reached its highest value since Q2FY13. The

pick-up in BCI for the current quarter comes as a silver lining for the economy, which is otherwise

devoid of any positive news. However, it should also be approached with a bit of cautious

optimism as the downside risks to growth have still not abated from the horizon.

The respondents in the survey were asked to provide a view on the performance of their firm,

sector and the economy based on their perceptions for the current and next quarter. The CII-BCI

is then constructed as a weighted average of the Current Situations Index (CSI) and the

Expectation Index (EI). It is significant to note that both current as well as expectation indices

contributed to the sharp increase in BCI. In both indices, respondents rated the situation to

improve drastically with respect to all constituents - overall economy, sector, and own activity.

2

th

85 Business Outlook Survey : Oct. - Dec. 2013

Index

Business Confidence

Index

Current Situation Index

Overall Economy

Own Activity Sector

Own Company

Expectation Index

Overall Economy

Own Activity Sector

Own Company

Q3*

FY11

66.2

64.0

65.0

63.2

64.3

67.3

66.0

66.3

68.4

Q4

FY11

66.7

62.7

59.9

63.0

63.4

68.7

65.6

68.8

69.7

Q1

FY12

62.5

62.6

61.1

61.8

63.7

62.4

61.1

61.1

63.7

Q2

FY12

53.6

52.7

49.2

51.8

54.4

54.0

48.5

53.7

56.1

Q3

FY12

48.6

47.7

44.5

46.0

50.0

49.1

44.2

47.5

51.7

Q4

FY12

52.9

54.7

49.4

46.9

56.3

51.9

48.9

46.9

56.3

Q1

FY13

55.0

51.9

48.9

46.9

56.3

56.5

52.8

53.5

59.7

Q2

FY13

51.3

47.5

36.3

44.6

53.2

53.2

44.6

49.8

58.4

Q3

FY13

49.9

48.6

44.5

45.9

51.7

50.6

47.5

48.1

53.3

Q4

FY13

51.3

47.1

44.2

46.3

48.7

53.4

49.1

52.2

55.7

Quarterly Business Confidence Index (BCI)

* The Survey is conducted on a quarterly basis since the 74th Business Outlook Survey

Q2

FY14

45.7

46.1

35.1

43.9

51.3

45.4

37.0

43.6

49.5

Q1

FY14

51.2

48.7

44.5

46.1

51.7

52.5

49.4

50.6

54.7

Q3

FY14

54.9

51.0

41.6

47.7

56.3

56.8

50.1

54.3

60.7

52.9

55.0

51.3

49.9

51.3 51.2

45.7

54.9

66.2

Q3*

FY11

66.7

Q4

FY11

62.5

Q1

FY12

53.6

Q2

FY12

48.6

Q3

FY12

Q4

FY12

Q1

FY13

Q2

FY13

Q3

FY13

Q4

FY13

Q1

FY14

Q2

FY14

Q3

FY14

Business Confidence Index

General Economic Prospects

Growth & Inflation

GDP expected to decelerate in the range of 4.5-5.0 per cent in 2013-14, while

WPI inflation to lie above 7 per cent

GDP growth is expected to decelerate to a range of 4.5-5 per cent in 2013-14 by 42 per cent of

the respondents, while only 28 per cent expect it to lie between 5.0-5.5 per cent. Further, most of

the respondent firms (41 per cent) expected inflation to lie above 7 per cent for the current fiscal,

which is way higher than the comfort level of RBI.

Expected GDP Growth in 2013-14

(% of Respondents)

The Twin Deficits - Fiscal & Current Account

53 per cent of respondents expect fiscal deficit to lie in a range of 4.5-5.5 per

cent of GDP in 2013-14, while 63 per cent expect current account deficit to lie

in a range of 3.5-5.0 per cent of GDP in 2013-14

At a time when subsidies have escalated sharply and the expenses of government have upside

risk owing to impending Lok Sabha elections in the country, it is comforting to note that the fiscal

deficit in the current year may remain below 5.5 per cent mark, as endorsed by 53 per cent of the

respondents. However, the upside risks to fiscal deficit are also high this year given the fact that

weak economic growth would translate into sluggish tax revenue and the ambitious

disinvestment target would be at risk due to the not-so-favorable market conditions.

3

th

85 Business Outlook Survey : Oct. - Dec. 2013

Expected WPI Inflation in 2013-14

(% of Respondents)

6.0 - 6.5%

2%

<4.5%

16%

4.5 - 5.0%

42%

5.0 5.5%

28%

5.5 6.0%

10%

>6.5%

2%

>7.5%

41%

7.0 - 7.5%

21%

6.5 - 7.0%

19%

6.0 - 6.5%

12%

<5.5%

1%

5.5 6.0%

6%

<3.5%

7%

5.0 - 5.5%

17%

>5.5%

13%

3.5 4.0%

21%

4.0 4.5%

20%

4.5 - 5.0%

22%

Even though the current account deficit (CAD) for the second quarter of the current fiscal dipped

to 1.2 per cent of GDP, 63 per cent of respondents expect current account deficit to lie in a range

of 3.5-5.0 per cent of GDP in 2013-14, much above the comfort zone of RBI. In some respite,

only 30 per cent believed that CAD may cross 5 per cent mark.

Expected Current Account Deficit in 2013-14

(% of Respondents)

Exchange Rate

Rupee to remain in the range of 61-63 per US$ by March 2014

55 per cent of the respondents expect exchange rate to remain in the range of Rs 61-63 per US$

by March 2014. Given that US has now announced tapering of its monetary stimulus beginning

next year, this is a positive news. Only 19 per cent feel that exchange rate my cross Rs 63 per

US$ by March 2014.

4

Expected Exchange Rate by March 2014

(% of Respondents)

th

85 Business Outlook Survey : Oct. - Dec. 2013

Expected Fiscal Deficit in 2013-14

(% of Respondents)

<4.5%

7%

>6.0%

21%

5.5 6.0%

19%

5.0 5.5%

21%

4.5 - 5.0%

32%

Rs.62-63

30%

Rs.61-62

25%

Rs.60-61

11%

>Rs.63

19%

Rs.59-60

10%

<Rs.59

5%

>100%

2%

50-75%

36%

Below 50%

20%

75-100%

42%

5

General Business Prospects

Capacity Expansion & Capacity Utilization

As compared to 56 per cent respondent firms reporting below 75 per cent

capacity utilization in second quarter, only 45 per cent expect the same for

third quarter

56 per cent of respondents have been running their companies at less than 75 per cent capacity

utilization in the second quarter of the current fiscal. In a sign of improvement in the situation,

much smaller (only 45 per cent) percentage of respondents expect capacity utilization to fall

below 75 per cent in the current quarter. Firms, it appears from the survey, are going slow on

adding capacity at the moment. Majority of the respondents (53 per cent) have not planned an

increase in capacity expansion during the current quarter.

th

85 Business Outlook Survey : Oct. - Dec. 2013

Capacity Expansion during July-Sep, 2013

(% of Respondents)

Capacity Expansion during Oct-Dec, 2013

(% of Respondents)

Change in Spending on Capacity Expansion during Oct-Dec over July-Sep, 2013

(% of Respondents)

75-100%

51%

Below 50%

13%

50-75%

32%

>100%

4%

Decrease

15%

No Change

53%

Increase

32%

6

th

85 Business Outlook Survey : Oct. - Dec. 2013

Investment Plans

Majority of respondents expect either no change/decline in their domestic

and international investment plans in 3QFY14

According to the survey, majority of the respondents (54 per cent) expect their domestic

investments to show either a decline or no change in the Oct-December 2013 quarter. Mirroring

this, nearly of half of the respondents (47 per cent) expect their international investments to

either decline or show no change in the third quarter of 2013-14.

Investment Plans for Oct-Dec, 2013 - Domestic

(% of Respondents)

Investment Plans for Oct-Dec, 2013 International

(% of Respondents)

Not Applicable

5%

>20%

Increase

6%

0-10%

Increase

25%

Decline or

no change

54%

10-20%

Increase

10%

>20%

Increase

4%

Not

Applicable

18%

Decline or

no change

47%

10-20%

Increase

11%

0-10%

Increase

20%

Overall Trends

Overall Sales & New Orders

A surge in new orders may push sales

The survey reveals that 58 per cent of the respondents expect increase in their sales, new

orders and value of production in the third quarter of 2013-14, which is much larger than only 45

per cent who witnessed increase in their sales in the previous quarter. This is indeed a healthy

sign for the economy and bodes well for the growth prospects. It is significant to note that the

percentage of respondents reporting increase in new orders and value of production has

increased significantly between the second and third quarter, while the same for inventories

declined.

7

th

85 Business Outlook Survey : Oct. - Dec. 2013

Overall Sales & New orders in July-Sep, 2013

(% of Respondents)

Overall Sales & New orders in Oct-Dec, 2013

(% of Respondents)

Decrease

27%

No Change

28%

Increase

45%

Increase

No Change

Decrease

Increase

58%

No Change

28%

Decrease

14%

Trends in output indicators: Actual (July-Sep) vs. Expected (Oct-Dec), 2013

(% of Respondents)

40

55

39

51

33

31

40

31

40

37

52

45

20.2

14.1

20.9

12.3

14.9

24.0

New Orders

(July - Sep)

New Orders

(Oct - Dec)

Value of

Production

(July - Sep)

Value of

Production

(Oct - Dec)

Inventories

(July - Sep)

Inventories

(Oct - Dec)

Increase No Change Decrease

Expenditure

Majority expect increase in input cost in third quarter even though this

number has fallen from the last quarter

As regards the input cost in the current quarter as compared to the previous quarter, there is a

significant decline in the percentage of respondents who expect expenses on raw materials,

electricity, and wages & salaries to increase. However, majority of the respondents expect

increase in other input costs during the current quarter.

Increase No Change Decrease

8

th

85 Business Outlook Survey : Oct. - Dec. 2013

Input Costs

(% of Respondents)

62

55

66

45

47

38

45 45

35

37

32

48

51

62

54 55

3.4

8.2

1.3

6.5

1.9

0.0

0.7 0.7

Raw Materials

Cost (Actual)

Raw Materials

Cost (Exp)

Electricity

Cost (Actual)

Wages &

Salaries (Exp)

Cost of

credit (Actual)

Cost of

credit (Exp)

Wages &

Salaries (Actual)

Electricity

Cost (Exp)

Pre-tax Profits

Majority expect an increase in profits

Majority of the respondents (43 per cent) expect an increase in their per-tax profit margin in the

third quarter and this marks a sharp increase of 31 per cent in the last quarter. This may be

attributed to expectation of a sharp increase in sales and moderation in input costs.

31

32

37

43

32

26

Increase No Change Decrease

Pre-Tax Profits (Actual) Pre-Tax Profits (Expected)

Pre-tax Profits

(% of Respondents)

Export and Import Trends

Majority expect an increase in export orders and stagnancy in imports

Majority of respondents (53 per cent) expect their exports to increase in the third quarter of the

current fiscal. Only 49 per cent of the respondent had seen increase in their exports during the

previous quarter. Exports are likely to find some support amidst economic recovery in both the

US and the Euro Zone. Besides, a weaker Rupee is also likely to aid exports.

The largest 56 per cent of the respondents didnt expect their imports to increase during the

current quarter. Only 23 per cent said that they might witness an increase in imports in the third

quarter. This is positive news as it is expected to keep the current account deficit in check.

9

th

85 Business Outlook Survey : Oct. - Dec. 2013

49

35

15

53

39

8

Increase No Change Decrease

Actual Expected

Export Volume

(% of Respondents)

Import Volume

(% of Respondents)

18

57

24

23

56

21

Increase No Change Decrease

Actual Expected

10

Business Concerns

Domestic economic/political instability, slackening consumer demand,

high level of corruption, persistent inflation and risk from exchange rate

volatility are the top current business concerns

th

In the 85 Business Outlook Survey, domestic economic/political instability, slackening

consumer demand, high level of corruption, persistent high inflation and risk from exchange rate

volatility emerged as the top five concerns in order of severity to most firms.

Coverage & Methodology

CIIs 85th Business Outlook Survey is based on sample survey of firms covering all industry

sectors, including micro, small, medium and large enterprises from different regions. The

survey also enumerated responses across industry groups both in public and private sectors

engaged in manufacturing and services sector.

The survey was conducted from October-December 2013, covering 174 firm of varying sizes.

Majority of the respondents (63.2 per cent) belonged to large-scale firms, while 12.1 per cent

were from medium-scale firms and 24.7 were from small-scale firms. Sectoral break up shows

that 65 per cent of the respondents were from manufacturing sector while 35 per cent were

from services sector, respectively.

CII-BCI is calculated as a weighted average of the Current Situation Index (CSI) and the

Expectation Index (EI), with greater weight given to EI as compared to CSI. These indices are

based on questions pertaining to performance of the economy and respondents firm.

Respondents are asked to rate the current and expected performance on a scale of 0 to 100. A

score above 50 indicates positive confidence while a score above 75 would indicate strong

positive confidence. On the contrary, a score of less than 50 indicates a weak confidence

index.

th

85 Business Outlook Survey : Oct. - Dec. 2013

The Confederation of Indian Industry (CII) works to create and sustain an environment conducive to the

development of India, partnering industry, Government, and civil society, through advisory and

consultative processes.

CII is a non-government, not-for-profit, industry-led and industry-managed organization, playing a

proactive role in India's development process. Founded over 118 years ago, India's premier business

association has over 7100 members, from the private as well as public sectors, including SMEs and

MNCs, and an indirect membership of over 90,000 enterprises from around 257 national and regional

sectoral industry bodies.

CII charts change by working closely with Government on policy issues, interfacing with thought

leaders, and enhancing efficiency, competitiveness and business opportunities for industry through a

range of specialized services and strategic global linkages. It also provides a platform for consensus-

building and networking on key issues.

Extending its agenda beyond business, CII assists industry to identify and execute corporate

citizenship programmes. Partnerships with civil society organizations carry forward corporate

initiatives for integrated and inclusive development across diverse domains including affirmative action,

healthcare, education, livelihood, diversity management, skill development, empowerment of women,

and water, to name a few.

The CII Theme for 2013-14 is Accelerating Economic Growth through Innovation,

Transformation, Inclusion and Governance. Towards this, CII advocacy will accord top priority to

stepping up the growth trajectory of the nation, while retaining a strong focus on accountability,

transparency and measurement in the corporate and social eco-system, building a knowledge

economy, and broad-basing development to help deliver the fruits of progress to all.

With 63 offices, including 10 Centres of Excellence, in India, and 7 overseas offices in Australia, China,

Egypt, France, Singapore, UK, and USA, as well as institutional partnerships with 224 counterpart

organizations in 90 countries, CII serves as a reference point for Indian industry and the international

business community.

Confederation of Indian Industry

The Mantosh Sondhi Centre

23, Institutional Area, Lodi Road, New Delhi 110 003 (India)

T: +91 11 45771000 / 24629994-7 | F: +91 11 24626149

E: info@cii.in | W: www.cii.in

Reach us via our Membership Helpline: 00-91-11-435 46244 / 00-91-99104 46244

CII Helpline Toll free No: 1800-103-1244

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5835)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (350)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (824)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Western Rite Morning and Evening Prayers - Latin and EnglishDocument12 pagesWestern Rite Morning and Evening Prayers - Latin and EnglishTribulatio100% (3)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Https://fullgradestore ComDocument80 pagesHttps://fullgradestore ComTestBank zone0% (7)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- MyIntealth User GuideDocument50 pagesMyIntealth User Guidedz9696969No ratings yet

- Generate and Check Guest For AccuracyDocument7 pagesGenerate and Check Guest For AccuracyJanet PreposiNo ratings yet

- 1.4.2 ParousiaTeachingsDocument6 pages1.4.2 ParousiaTeachingskay addoNo ratings yet

- R. W. Grand Master of Penna. Grand Masters' Conference: FREE:M:A.SODocument4 pagesR. W. Grand Master of Penna. Grand Masters' Conference: FREE:M:A.SOEliyael YisraelNo ratings yet

- Honest AwangDocument50 pagesHonest AwangDana JamesNo ratings yet

- Legal Techniques and Logic Study GuideDocument53 pagesLegal Techniques and Logic Study GuideLoren Delos SantosNo ratings yet

- Visvesvaraya Technological University: "Jnana Sangama", Belgaum - 590018Document13 pagesVisvesvaraya Technological University: "Jnana Sangama", Belgaum - 590018vjy stvkbNo ratings yet

- Anderson County SC May 2 2023 Sale ResultsDocument3 pagesAnderson County SC May 2 2023 Sale ResultsSheera LaineNo ratings yet

- Screenshot 2023-07-04 at 21.45.12Document1 pageScreenshot 2023-07-04 at 21.45.12ankur123890No ratings yet

- Huttner V Jensen LLC Vaedce-23-01261 0001.0Document14 pagesHuttner V Jensen LLC Vaedce-23-01261 0001.0Sam OrlandoNo ratings yet

- 3-Value Added Tax Its Impact in The Philippine EconomyDocument23 pages3-Value Added Tax Its Impact in The Philippine Economymis_administrator100% (8)

- Phrasalverb1 CheckDocument3 pagesPhrasalverb1 CheckTruc NguyenNo ratings yet

- Attack On Titan v01 (2012) (Digital) (LostNerevarine-Empire)Document203 pagesAttack On Titan v01 (2012) (Digital) (LostNerevarine-Empire)JulianNo ratings yet

- The Muslim Jesus Dead or Alive? - G.S. Reynolds PDFDocument22 pagesThe Muslim Jesus Dead or Alive? - G.S. Reynolds PDFehimarNo ratings yet

- Mckinsey Quarterly - Strategy Under UncertaintyDocument10 pagesMckinsey Quarterly - Strategy Under Uncertaintyqween100% (1)

- DGW NU 1-1: Creation To Judges (Teacher Manual)Document14 pagesDGW NU 1-1: Creation To Judges (Teacher Manual)Religious Supply Center, Inc.100% (6)

- Priyam Miteshbhai Patel (20190201097) Bba-Iv Sec-A Production & Operation Management AssignmentDocument4 pagesPriyam Miteshbhai Patel (20190201097) Bba-Iv Sec-A Production & Operation Management AssignmentPriyam PatelNo ratings yet

- Electrical Asst Manager E01Document18 pagesElectrical Asst Manager E01Siddharth RaiNo ratings yet

- Diamond Foam - Proposed StrategyDocument34 pagesDiamond Foam - Proposed Strategyhjilani87No ratings yet

- The Earliest Economic Growth in World History: Proceedings of The Berlin Workshop 1st Edition David A. Warburton (Editor)Document52 pagesThe Earliest Economic Growth in World History: Proceedings of The Berlin Workshop 1st Edition David A. Warburton (Editor)rickwray577711100% (4)

- Engine Model Lead Time (Weeks) Engine Model Lead Time (Weeks) Engine Model Lead Time (Weeks) Engine Model Lead Time (Weeks)Document2 pagesEngine Model Lead Time (Weeks) Engine Model Lead Time (Weeks) Engine Model Lead Time (Weeks) Engine Model Lead Time (Weeks)dinduntobzNo ratings yet

- ODONGO BOSCO - Week 3 Report PDFDocument7 pagesODONGO BOSCO - Week 3 Report PDFBosco Odongo OpiraNo ratings yet

- Pricing The Epipen: This Is Going To StingDocument9 pagesPricing The Epipen: This Is Going To StingADITYAROOP PATHAKNo ratings yet

- Five Star Env Audit Specification Amp Pre Audit ChecklistDocument20 pagesFive Star Env Audit Specification Amp Pre Audit ChecklistMazhar ShaikhNo ratings yet

- (Drawing) What To Draw and How To Draw ItDocument88 pages(Drawing) What To Draw and How To Draw ItBolivar Chagas100% (2)

- Checklist of Mandatory Documentation Required by ISO/IEC 20000-1:2018Document18 pagesChecklist of Mandatory Documentation Required by ISO/IEC 20000-1:2018Anas Abu Hijail100% (1)

- Sybba Sem-3 HRM Question BankDocument5 pagesSybba Sem-3 HRM Question BankHitesh TejwaniNo ratings yet

- 3 Foreign Exchange Markets - IIDocument5 pages3 Foreign Exchange Markets - IINaomi LyngdohNo ratings yet