Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

21 viewsChanges To Tax Registration

Changes To Tax Registration

Uploaded by

Ronald Luckson ChikwavaSARS will have a 'Single Registration' of a taxpayer across all taxes they pay and legal entities they're associated with. From a taxpayer's view, you will only have to register once as a new taxpayer and there-after add only the relevant details when you start paying e.g. VAT. For the first time, taxpayers or legal entities, such as Companies and trusts, will be linked to their registered representative on the SARS system.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- VAT Registration in The UAEDocument2 pagesVAT Registration in The UAEritik MishraNo ratings yet

- HMRC Statement of Practice PDFDocument356 pagesHMRC Statement of Practice PDFchc011133No ratings yet

- Topic OneDocument43 pagesTopic OneMerediths KrisKringleNo ratings yet

- It 48Document40 pagesIt 48Robert Daysor BancifraNo ratings yet

- Small Business: Essential Tax GuideDocument8 pagesSmall Business: Essential Tax GuideAndile NtuliNo ratings yet

- Getting To Grips With Tax ReturnsDocument2 pagesGetting To Grips With Tax Returnsdavid selekaNo ratings yet

- Tax GuideDocument8 pagesTax GuideGooglyNo ratings yet

- Giving Your Business The Best Start With TaxDocument32 pagesGiving Your Business The Best Start With TaxdfasnedgeNo ratings yet

- IT-AE-36-G01 - Quick Guide On How To Complete The IT12EI Return For Exempt Organisations - External GuideDocument13 pagesIT-AE-36-G01 - Quick Guide On How To Complete The IT12EI Return For Exempt Organisations - External GuideThapeloNo ratings yet

- Business Start Up & Help GuideDocument7 pagesBusiness Start Up & Help GuidenowayNo ratings yet

- Newsletter Online VAT Registration Portal v2 PDFDocument3 pagesNewsletter Online VAT Registration Portal v2 PDFNils VanhasselNo ratings yet

- How To Register A Sole Proprietor Business in The Philippines?Document23 pagesHow To Register A Sole Proprietor Business in The Philippines?Lei Anne MirandaNo ratings yet

- Business FormalitiesDocument21 pagesBusiness FormalitiesGovindNo ratings yet

- Pay As You Go (Payg) WithholdingDocument70 pagesPay As You Go (Payg) WithholdingliamNo ratings yet

- E-Filing of Income Tax Return: SUBMITTED BY: Nisha Ghodake Roll No: 17019. (Functional Project)Document7 pagesE-Filing of Income Tax Return: SUBMITTED BY: Nisha Ghodake Roll No: 17019. (Functional Project)NISHA GHODAKENo ratings yet

- An Easy Guide To Taxation For Startup EntrepreneursDocument2 pagesAn Easy Guide To Taxation For Startup EntrepreneursWell BestNo ratings yet

- Ethiopian Government Business Registration ProcessDocument6 pagesEthiopian Government Business Registration ProcesseliasNo ratings yet

- Theorypresentation 170218171210Document66 pagesTheorypresentation 170218171210SumitNo ratings yet

- Newsletter March 2010Document7 pagesNewsletter March 2010admin866No ratings yet

- Authorising Your AgentDocument2 pagesAuthorising Your AgentpronoybaruaNo ratings yet

- Register Compny in PakDocument8 pagesRegister Compny in PakMuhammad SaadNo ratings yet

- Some Questions Regarding E-Filling and Income Tax Return: 1. What Is E-Filing?Document8 pagesSome Questions Regarding E-Filling and Income Tax Return: 1. What Is E-Filing?omar_msNo ratings yet

- E-File IT Returns For Your Clients. It's FREE.: Accounts and AuditDocument7 pagesE-File IT Returns For Your Clients. It's FREE.: Accounts and Auditsundeep tayalNo ratings yet

- What I Have Learned in The Union Bank Globallinker Webinar:: Registration and Tax 101 For E-Commerce BusinessesDocument2 pagesWhat I Have Learned in The Union Bank Globallinker Webinar:: Registration and Tax 101 For E-Commerce BusinessesVillage GourmetNo ratings yet

- Agent Appointment FormDocument2 pagesAgent Appointment FormSatyen ChikhliaNo ratings yet

- How To Register For VATDocument17 pagesHow To Register For VATNeha Arjunsmamma KarvirNo ratings yet

- Filing Itr HbookDocument26 pagesFiling Itr HbookRaveendran PmNo ratings yet

- 10 1355 MoF Guide For Vendors CoverDocument25 pages10 1355 MoF Guide For Vendors CoverntombiponchNo ratings yet

- Nat 2938Document22 pagesNat 2938fred fluchterNo ratings yet

- Registration ActivationDocument1 pageRegistration ActivationThiruNo ratings yet

- QC 16161Document12 pagesQC 16161john englishNo ratings yet

- What This Is For:: BIR Form 1905Document7 pagesWhat This Is For:: BIR Form 1905shfskjdgbNo ratings yet

- Thinking of Working For Yourself?Document17 pagesThinking of Working For Yourself?Mark FowlerNo ratings yet

- VAT in UAEDocument20 pagesVAT in UAELaxmidhara NayakNo ratings yet

- Income Tax Filing For Self-Employed IndividualsDocument2 pagesIncome Tax Filing For Self-Employed IndividualsJefferson AlingasaNo ratings yet

- GUIDE - Cadiz Investment HubDocument8 pagesGUIDE - Cadiz Investment HubPedro Repeto DuranNo ratings yet

- Three Line AccountDocument3 pagesThree Line AccountkabulibazariNo ratings yet

- Application To Cancel Your VAT Registration: About This FormDocument4 pagesApplication To Cancel Your VAT Registration: About This FormychocmNo ratings yet

- Step-By-Step Sole Proprietor Business RegistrationDocument4 pagesStep-By-Step Sole Proprietor Business Registrationjen mikeNo ratings yet

- Entrepreneur's World #2Document2 pagesEntrepreneur's World #2Lex ValoremNo ratings yet

- Tax Guide For Professionals BIRDocument8 pagesTax Guide For Professionals BIRPY CaunanNo ratings yet

- Income Tax Return Filing Doubts Solution Ebook by JagoinvestorDocument13 pagesIncome Tax Return Filing Doubts Solution Ebook by Jagoinvestoranandakumar2810100% (1)

- From An Employee To A SelfDocument3 pagesFrom An Employee To A SelfChristine BobisNo ratings yet

- Simply Cleaning: Taxation IssuesDocument10 pagesSimply Cleaning: Taxation IssuesadeelmuzaffaralamNo ratings yet

- Assignment of Corporate Tax Planning On Rules For Filing Income Tax ReturnDocument8 pagesAssignment of Corporate Tax Planning On Rules For Filing Income Tax ReturnShubhamNo ratings yet

- Comprehensive Guide For Income Tax Returns FY 20-21Document34 pagesComprehensive Guide For Income Tax Returns FY 20-21mayuresh pingale100% (1)

- Income Tax Department NoticeDocument6 pagesIncome Tax Department NoticeTaxRaahiNo ratings yet

- Business Taxation MeaningDocument4 pagesBusiness Taxation MeaningSheila Mae AramanNo ratings yet

- Avoid IRS Backup Withholding Your Card Sales Settlement at A Rate of 28%Document2 pagesAvoid IRS Backup Withholding Your Card Sales Settlement at A Rate of 28%James LeeNo ratings yet

- Start Business ColombiaDocument9 pagesStart Business ColombiaDianaGreenNo ratings yet

- Sage Pastel Accounting Payroll and HR Tax Guide For 2013/2014Document52 pagesSage Pastel Accounting Payroll and HR Tax Guide For 2013/2014Patty PetersonNo ratings yet

- Istilah Cukai Sering KaliDocument14 pagesIstilah Cukai Sering KaliLydia Mohammad SarkawiNo ratings yet

- Tds Return Filing Guide: Your Online Companion For Company, Tax and Legal MattersDocument10 pagesTds Return Filing Guide: Your Online Companion For Company, Tax and Legal MattersTaxRaahiNo ratings yet

- Basic Guide To Payroll A4 Booklet 2017Document7 pagesBasic Guide To Payroll A4 Booklet 2017waqasNo ratings yet

- Bulk Return FilingDocument2 pagesBulk Return FilingShree Joytish SansthanNo ratings yet

- Tips To Legally Avoid Paying BIR Penalties During Tax MappingDocument3 pagesTips To Legally Avoid Paying BIR Penalties During Tax MappingMark Anthony CasupangNo ratings yet

- Summer Training Report ON "Marketing Management at All India Itr"Document65 pagesSummer Training Report ON "Marketing Management at All India Itr"Latest SongsNo ratings yet

- Notes: Mandatory Electronic Filing and Payment of Income TaxDocument8 pagesNotes: Mandatory Electronic Filing and Payment of Income TaxJose AlexanderNo ratings yet

- ONE-ON-ONE MARKETING GUIDE: Every Tax Business Secrets To Success!From EverandONE-ON-ONE MARKETING GUIDE: Every Tax Business Secrets To Success!No ratings yet

- Bcompt in Financial Accounting - 98302Document2 pagesBcompt in Financial Accounting - 98302Ronald Luckson ChikwavaNo ratings yet

- Chapter 24 Activity-Based Costing (ABC) PDFDocument10 pagesChapter 24 Activity-Based Costing (ABC) PDFmaklovesNo ratings yet

- Toilet Check ListDocument1 pageToilet Check ListRonald Luckson ChikwavaNo ratings yet

- Trading/speculative Purposes) : Measurement: Fair Value, Excluding Transaction CostsDocument4 pagesTrading/speculative Purposes) : Measurement: Fair Value, Excluding Transaction CostsRonald Luckson ChikwavaNo ratings yet

- BAR MemoDocument1 pageBAR MemoRonald Luckson ChikwavaNo ratings yet

- Toilet Check ListDocument1 pageToilet Check ListRonald Luckson ChikwavaNo ratings yet

- SAB Prices 2012Document1 pageSAB Prices 2012Ronald Luckson ChikwavaNo ratings yet

- Incl Consumable Order FormDocument1 pageIncl Consumable Order FormRonald Luckson ChikwavaNo ratings yet

- EasyFile MANUALDocument29 pagesEasyFile MANUALRonald Luckson ChikwavaNo ratings yet

- Mauritius Revenue Authority: T: - F: - E: - WDocument2 pagesMauritius Revenue Authority: T: - F: - E: - WAmrit ChutoorgoonNo ratings yet

- March 2021 Payslip CPSDocument41 pagesMarch 2021 Payslip CPSWjz WjzNo ratings yet

- Sop For Account DepartmentDocument50 pagesSop For Account DepartmentDavid ShebugheNo ratings yet

- Form P50 Income Tax PDFDocument2 pagesForm P50 Income Tax PDFemesjotNo ratings yet

- Tax Deduction at Source OR: Tds/TcsDocument29 pagesTax Deduction at Source OR: Tds/TcsArka PramanikNo ratings yet

- Assessment 2Document14 pagesAssessment 2zakiatalhaNo ratings yet

- The Kenyan Worker and The Law: An Information Booklet On Labour LawDocument32 pagesThe Kenyan Worker and The Law: An Information Booklet On Labour LawsashalwNo ratings yet

- ACCA P6 UK Notes FA 2017 PDFDocument133 pagesACCA P6 UK Notes FA 2017 PDFAT100% (2)

- Grade 10 Learner Marking GuidelineDocument19 pagesGrade 10 Learner Marking GuidelineyandisaNo ratings yet

- Earning Money PDFDocument28 pagesEarning Money PDFOlivia Ngo100% (2)

- This Study Resource Was: Munhumutapa School of CommerceDocument7 pagesThis Study Resource Was: Munhumutapa School of CommerceSPENCER MXOLISINo ratings yet

- Did You Know That You Can Claim Tax Relief On Your RCN Subscription?Document2 pagesDid You Know That You Can Claim Tax Relief On Your RCN Subscription?Shibu KalayilNo ratings yet

- Tanzania Budget Highlights 2021-22Document35 pagesTanzania Budget Highlights 2021-22Arden Muhumuza KitomariNo ratings yet

- Activity 1: BSBFIM502A: Manage PayrollDocument19 pagesActivity 1: BSBFIM502A: Manage PayrollManish BalharaNo ratings yet

- Key Information Document - PAYE MonthlyDocument1 pageKey Information Document - PAYE MonthlynddkNo ratings yet

- Substantive Procedures-Payroll CycleDocument2 pagesSubstantive Procedures-Payroll CycleThandoe DubeNo ratings yet

- Life Orientation Notes Grade 10 TERM 1 2023Document15 pagesLife Orientation Notes Grade 10 TERM 1 2023ntokozomkhwanazi047No ratings yet

- Payroll Calculator SpreadsheetDocument7 pagesPayroll Calculator SpreadsheetbagumbayanNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument6 pagesP45 Part 1A Details of Employee Leaving WorkCatalin FandaracNo ratings yet

- Cta Taxation of Individuals HWDocument6 pagesCta Taxation of Individuals HWEffie ChirembweNo ratings yet

- Australian Corporate Tax Rate: Local Income TaxesDocument35 pagesAustralian Corporate Tax Rate: Local Income TaxesNadine DiamanteNo ratings yet

- Budget 2023 2024Document12 pagesBudget 2023 2024finance bnbmNo ratings yet

- Employment GuideDocument51 pagesEmployment GuideSofia Teresa de BragançaNo ratings yet

- Income Tax Calculator SampleDocument10 pagesIncome Tax Calculator SamplesumondccNo ratings yet

- Computation of Taxable Income and Tax LiabilityDocument9 pagesComputation of Taxable Income and Tax LiabilityaNo ratings yet

- Den KseroDocument168 pagesDen Kseromaria_nikol_3100% (1)

- Unisa TravelAccommPolicy 15042011Document39 pagesUnisa TravelAccommPolicy 150420111234123545143No ratings yet

- Ir3 GuideDocument66 pagesIr3 GuideSusana SembranoNo ratings yet

Changes To Tax Registration

Changes To Tax Registration

Uploaded by

Ronald Luckson Chikwava0 ratings0% found this document useful (0 votes)

21 views4 pagesSARS will have a 'Single Registration' of a taxpayer across all taxes they pay and legal entities they're associated with. From a taxpayer's view, you will only have to register once as a new taxpayer and there-after add only the relevant details when you start paying e.g. VAT. For the first time, taxpayers or legal entities, such as Companies and trusts, will be linked to their registered representative on the SARS system.

Original Description:

Original Title

Changes to Tax Registration

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSARS will have a 'Single Registration' of a taxpayer across all taxes they pay and legal entities they're associated with. From a taxpayer's view, you will only have to register once as a new taxpayer and there-after add only the relevant details when you start paying e.g. VAT. For the first time, taxpayers or legal entities, such as Companies and trusts, will be linked to their registered representative on the SARS system.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

21 views4 pagesChanges To Tax Registration

Changes To Tax Registration

Uploaded by

Ronald Luckson ChikwavaSARS will have a 'Single Registration' of a taxpayer across all taxes they pay and legal entities they're associated with. From a taxpayer's view, you will only have to register once as a new taxpayer and there-after add only the relevant details when you start paying e.g. VAT. For the first time, taxpayers or legal entities, such as Companies and trusts, will be linked to their registered representative on the SARS system.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 4

Home | About Us | Types of tax | Legal & Policy | Contact Us | Consultation | Contact Centre 0800 00 7277

Individuals Businesses and Employers Tax Practitioners

SARS Home > Client Segments > Changes to Tax Registration

CHANGES TO TAX & CUSTOMS REGISTRATION

What is Single Registration?

The way you register for tax & customs and update your existing details has changed from 12 May 2014. SARS will now have a Single

Registration of a taxpayer across all taxes they pay and legal entities theyre associated with. From a taxpayers view, you will only have to

register once as a new taxpayer and there-after add only the relevant details when you start paying e.g. VAT. It will also now be easier to update

your existing details.

What will be included in Single Registration?

Single Registration will be phased in, starting with:

Single registration of taxpayers.

A simplified process to apply for:

Corporate Income Tax (CIT)

Income Tax (including Provisional Tax)

Pay-As-You-Earn (PAYE)

Value-Added Tax (VAT)

Customs and Excise.

What are the benefits of Single Registration?

Taxpayers/registered representatives will now be able to:

View all tax types registered for in a central place.

Manage all personal information centrally on eFiling or at SARS branch.

Register for additional taxes (CIT, PAYE, VAT excluding Customs and Excise) on eFiling provided you are already registered for at least

one tax on eFiling.

For the first time, taxpayers or legal entities, such as Companies and Trusts, will be linked to their registered representative on the SARS

system. For more information click here.

How does it work?

First-time taxpayers:

Top Tip: Make sure you arent already registered, by first calling and checking with the SARS Contact Centre on 0800 00 SARS

(7277). Remember your employer may have registered you or if you own a business, go to CIPC, then SARS will automatically register

the business.

If you are registering as a new taxpayer, you need to:

Go to your nearest SARS branch

Complete the applicable tax registration form:

Customs and Excise DA185 and annexures

Employers EMP101e

Income Tax for Companies IT77C

Income Tax for individuals IT77

Income Tax for Trusts IT77TR

Vendors - VAT101

Make sure you take the required relevant material (supporting documents).

You will be registered and your profile created in real-time, provided there are no problems.

Youll receive an email notification to confirm your tax type registration.

Changes to Tax Registration http://www.sars.gov.za/ClientSegments/Pages/Changes-to-Tax-Registra...

1 of 4 2014/05/21 03:02 PM

Existing taxpayers:

If youre an existing taxpayer, you can:

log in to eFiling if youre a registered eFiler, and complete the Registration, Amendment and Verification form (RAV01) where

you can update all registered details excluding Name and ID/Registered name and company registration number & your nature

of entity. Click here for a guide on how to complete the RAV01.

should you need to update these details you will have to go to your nearest SARS branch. Remember the required relevant

material (supporting documents).

go to your nearest SARS branch.

Where can I register or change details?

Depending on what you want to do, the following ways will be available:

Top Tip: Registered Representatives must visit a SARS branch first, to record their relationship with their clients on the SARS system. For more

information, click here.

A few things to note:

No registration or updating of details will be accepted by post, SARS drop-box, fax or email any longer.

Companies who register with the Companies and Intellectual Property Commission (CIPC) will automatically be registered with SARS for

Corporate Income Tax. You will then just need to link any additional taxes to your profile.

Should you need to update the company registered name or company registration number, contact the CIPC.

Employers can register employees by using the Income Tax Registration (ITREG) process. Employees may be registered via eFiling, using

e@syFile Employer or at a SARS branch. For more information see the guide Registration of employees for Income Tax Purposes.

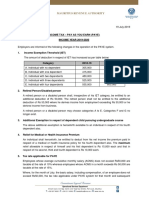

Who can do what?

Depending on your role or mandate, you will be able to do the following transactions:

Changes to Tax Registration http://www.sars.gov.za/ClientSegments/Pages/Changes-to-Tax-Registra...

2 of 4 2014/05/21 03:02 PM

Again, a few things to note:

Once-off mandates how does it work? In exceptional circumstances e.g. incapacitated clients, an individual may be appointed to act

on a taxpayers behalf once off. The individual appointed must have a signed power of attorney to request a service each time they visit a

branch.

Top Tip: The individual who will act on the taxpayers behalf must be registered with SARS.

Once-off mandates will only be allowed under the following exceptional circumstances:

Estates

Incapacitated/terminally ill client

Non-resident

Imprisonment

SARS Registered Tax practitioners

When you are more than 200 km distance from nearest SARS branch. To check your distance to your nearest branch or mobile

unit, click here.

Registered Tax Practitioners will still be required to produce a signed power of attorney with each branch visit, and their current eFiling

profile will remain unchanged.

When Tax Practitioners phone the SARS Contact Centre, a link between the Practitioner and their clients must already exist on

eFiling otherwise the Contact Centre will not be able to assist, read more.

Need help?

Call the SARS Contact Centre on 0800 00 SARS (7277) or visit your nearest SARS branch. Make sure you take your relevant material along.

Top Publications

Registration of Employees for Income Tax Purposes

Top Forms

EMP102e - Application for Separate Registration of

Business or Branch (Form)

Changes to Tax Registration http://www.sars.gov.za/ClientSegments/Pages/Changes-to-Tax-Registra...

3 of 4 2014/05/21 03:02 PM

Careers Media Procurement Glossary T&C's Site Map Tax Can Be Fun

Tax Touching Lives National Treasury Davis Tax Committee Office of the Tax Ombud

2014 All rights reserved

Quick Guide on How to Complete the IT12EI Return for

Exempt Organisations

Change of Banking Details for Companies Income Tax

Change of Banking Details for Personal Income Tax

Change of Banking Details for a Registered VAT Vendor

See More

EMP101e - Application for Registration PAYE SDL UIF

(Form)

IT77TR - Application for Registration as a Trusts and

Change in Particulars Trust - External (Form)

IT77 - Application for Registration as a Taxpayer or

Changing of Registered Particulars Individual - External

(Form)

VAT101 - Application for Registration for Value Added

Tax - External (Form)

See More

Changes to Tax Registration http://www.sars.gov.za/ClientSegments/Pages/Changes-to-Tax-Registra...

4 of 4 2014/05/21 03:02 PM

You might also like

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

- VAT Registration in The UAEDocument2 pagesVAT Registration in The UAEritik MishraNo ratings yet

- HMRC Statement of Practice PDFDocument356 pagesHMRC Statement of Practice PDFchc011133No ratings yet

- Topic OneDocument43 pagesTopic OneMerediths KrisKringleNo ratings yet

- It 48Document40 pagesIt 48Robert Daysor BancifraNo ratings yet

- Small Business: Essential Tax GuideDocument8 pagesSmall Business: Essential Tax GuideAndile NtuliNo ratings yet

- Getting To Grips With Tax ReturnsDocument2 pagesGetting To Grips With Tax Returnsdavid selekaNo ratings yet

- Tax GuideDocument8 pagesTax GuideGooglyNo ratings yet

- Giving Your Business The Best Start With TaxDocument32 pagesGiving Your Business The Best Start With TaxdfasnedgeNo ratings yet

- IT-AE-36-G01 - Quick Guide On How To Complete The IT12EI Return For Exempt Organisations - External GuideDocument13 pagesIT-AE-36-G01 - Quick Guide On How To Complete The IT12EI Return For Exempt Organisations - External GuideThapeloNo ratings yet

- Business Start Up & Help GuideDocument7 pagesBusiness Start Up & Help GuidenowayNo ratings yet

- Newsletter Online VAT Registration Portal v2 PDFDocument3 pagesNewsletter Online VAT Registration Portal v2 PDFNils VanhasselNo ratings yet

- How To Register A Sole Proprietor Business in The Philippines?Document23 pagesHow To Register A Sole Proprietor Business in The Philippines?Lei Anne MirandaNo ratings yet

- Business FormalitiesDocument21 pagesBusiness FormalitiesGovindNo ratings yet

- Pay As You Go (Payg) WithholdingDocument70 pagesPay As You Go (Payg) WithholdingliamNo ratings yet

- E-Filing of Income Tax Return: SUBMITTED BY: Nisha Ghodake Roll No: 17019. (Functional Project)Document7 pagesE-Filing of Income Tax Return: SUBMITTED BY: Nisha Ghodake Roll No: 17019. (Functional Project)NISHA GHODAKENo ratings yet

- An Easy Guide To Taxation For Startup EntrepreneursDocument2 pagesAn Easy Guide To Taxation For Startup EntrepreneursWell BestNo ratings yet

- Ethiopian Government Business Registration ProcessDocument6 pagesEthiopian Government Business Registration ProcesseliasNo ratings yet

- Theorypresentation 170218171210Document66 pagesTheorypresentation 170218171210SumitNo ratings yet

- Newsletter March 2010Document7 pagesNewsletter March 2010admin866No ratings yet

- Authorising Your AgentDocument2 pagesAuthorising Your AgentpronoybaruaNo ratings yet

- Register Compny in PakDocument8 pagesRegister Compny in PakMuhammad SaadNo ratings yet

- Some Questions Regarding E-Filling and Income Tax Return: 1. What Is E-Filing?Document8 pagesSome Questions Regarding E-Filling and Income Tax Return: 1. What Is E-Filing?omar_msNo ratings yet

- E-File IT Returns For Your Clients. It's FREE.: Accounts and AuditDocument7 pagesE-File IT Returns For Your Clients. It's FREE.: Accounts and Auditsundeep tayalNo ratings yet

- What I Have Learned in The Union Bank Globallinker Webinar:: Registration and Tax 101 For E-Commerce BusinessesDocument2 pagesWhat I Have Learned in The Union Bank Globallinker Webinar:: Registration and Tax 101 For E-Commerce BusinessesVillage GourmetNo ratings yet

- Agent Appointment FormDocument2 pagesAgent Appointment FormSatyen ChikhliaNo ratings yet

- How To Register For VATDocument17 pagesHow To Register For VATNeha Arjunsmamma KarvirNo ratings yet

- Filing Itr HbookDocument26 pagesFiling Itr HbookRaveendran PmNo ratings yet

- 10 1355 MoF Guide For Vendors CoverDocument25 pages10 1355 MoF Guide For Vendors CoverntombiponchNo ratings yet

- Nat 2938Document22 pagesNat 2938fred fluchterNo ratings yet

- Registration ActivationDocument1 pageRegistration ActivationThiruNo ratings yet

- QC 16161Document12 pagesQC 16161john englishNo ratings yet

- What This Is For:: BIR Form 1905Document7 pagesWhat This Is For:: BIR Form 1905shfskjdgbNo ratings yet

- Thinking of Working For Yourself?Document17 pagesThinking of Working For Yourself?Mark FowlerNo ratings yet

- VAT in UAEDocument20 pagesVAT in UAELaxmidhara NayakNo ratings yet

- Income Tax Filing For Self-Employed IndividualsDocument2 pagesIncome Tax Filing For Self-Employed IndividualsJefferson AlingasaNo ratings yet

- GUIDE - Cadiz Investment HubDocument8 pagesGUIDE - Cadiz Investment HubPedro Repeto DuranNo ratings yet

- Three Line AccountDocument3 pagesThree Line AccountkabulibazariNo ratings yet

- Application To Cancel Your VAT Registration: About This FormDocument4 pagesApplication To Cancel Your VAT Registration: About This FormychocmNo ratings yet

- Step-By-Step Sole Proprietor Business RegistrationDocument4 pagesStep-By-Step Sole Proprietor Business Registrationjen mikeNo ratings yet

- Entrepreneur's World #2Document2 pagesEntrepreneur's World #2Lex ValoremNo ratings yet

- Tax Guide For Professionals BIRDocument8 pagesTax Guide For Professionals BIRPY CaunanNo ratings yet

- Income Tax Return Filing Doubts Solution Ebook by JagoinvestorDocument13 pagesIncome Tax Return Filing Doubts Solution Ebook by Jagoinvestoranandakumar2810100% (1)

- From An Employee To A SelfDocument3 pagesFrom An Employee To A SelfChristine BobisNo ratings yet

- Simply Cleaning: Taxation IssuesDocument10 pagesSimply Cleaning: Taxation IssuesadeelmuzaffaralamNo ratings yet

- Assignment of Corporate Tax Planning On Rules For Filing Income Tax ReturnDocument8 pagesAssignment of Corporate Tax Planning On Rules For Filing Income Tax ReturnShubhamNo ratings yet

- Comprehensive Guide For Income Tax Returns FY 20-21Document34 pagesComprehensive Guide For Income Tax Returns FY 20-21mayuresh pingale100% (1)

- Income Tax Department NoticeDocument6 pagesIncome Tax Department NoticeTaxRaahiNo ratings yet

- Business Taxation MeaningDocument4 pagesBusiness Taxation MeaningSheila Mae AramanNo ratings yet

- Avoid IRS Backup Withholding Your Card Sales Settlement at A Rate of 28%Document2 pagesAvoid IRS Backup Withholding Your Card Sales Settlement at A Rate of 28%James LeeNo ratings yet

- Start Business ColombiaDocument9 pagesStart Business ColombiaDianaGreenNo ratings yet

- Sage Pastel Accounting Payroll and HR Tax Guide For 2013/2014Document52 pagesSage Pastel Accounting Payroll and HR Tax Guide For 2013/2014Patty PetersonNo ratings yet

- Istilah Cukai Sering KaliDocument14 pagesIstilah Cukai Sering KaliLydia Mohammad SarkawiNo ratings yet

- Tds Return Filing Guide: Your Online Companion For Company, Tax and Legal MattersDocument10 pagesTds Return Filing Guide: Your Online Companion For Company, Tax and Legal MattersTaxRaahiNo ratings yet

- Basic Guide To Payroll A4 Booklet 2017Document7 pagesBasic Guide To Payroll A4 Booklet 2017waqasNo ratings yet

- Bulk Return FilingDocument2 pagesBulk Return FilingShree Joytish SansthanNo ratings yet

- Tips To Legally Avoid Paying BIR Penalties During Tax MappingDocument3 pagesTips To Legally Avoid Paying BIR Penalties During Tax MappingMark Anthony CasupangNo ratings yet

- Summer Training Report ON "Marketing Management at All India Itr"Document65 pagesSummer Training Report ON "Marketing Management at All India Itr"Latest SongsNo ratings yet

- Notes: Mandatory Electronic Filing and Payment of Income TaxDocument8 pagesNotes: Mandatory Electronic Filing and Payment of Income TaxJose AlexanderNo ratings yet

- ONE-ON-ONE MARKETING GUIDE: Every Tax Business Secrets To Success!From EverandONE-ON-ONE MARKETING GUIDE: Every Tax Business Secrets To Success!No ratings yet

- Bcompt in Financial Accounting - 98302Document2 pagesBcompt in Financial Accounting - 98302Ronald Luckson ChikwavaNo ratings yet

- Chapter 24 Activity-Based Costing (ABC) PDFDocument10 pagesChapter 24 Activity-Based Costing (ABC) PDFmaklovesNo ratings yet

- Toilet Check ListDocument1 pageToilet Check ListRonald Luckson ChikwavaNo ratings yet

- Trading/speculative Purposes) : Measurement: Fair Value, Excluding Transaction CostsDocument4 pagesTrading/speculative Purposes) : Measurement: Fair Value, Excluding Transaction CostsRonald Luckson ChikwavaNo ratings yet

- BAR MemoDocument1 pageBAR MemoRonald Luckson ChikwavaNo ratings yet

- Toilet Check ListDocument1 pageToilet Check ListRonald Luckson ChikwavaNo ratings yet

- SAB Prices 2012Document1 pageSAB Prices 2012Ronald Luckson ChikwavaNo ratings yet

- Incl Consumable Order FormDocument1 pageIncl Consumable Order FormRonald Luckson ChikwavaNo ratings yet

- EasyFile MANUALDocument29 pagesEasyFile MANUALRonald Luckson ChikwavaNo ratings yet

- Mauritius Revenue Authority: T: - F: - E: - WDocument2 pagesMauritius Revenue Authority: T: - F: - E: - WAmrit ChutoorgoonNo ratings yet

- March 2021 Payslip CPSDocument41 pagesMarch 2021 Payslip CPSWjz WjzNo ratings yet

- Sop For Account DepartmentDocument50 pagesSop For Account DepartmentDavid ShebugheNo ratings yet

- Form P50 Income Tax PDFDocument2 pagesForm P50 Income Tax PDFemesjotNo ratings yet

- Tax Deduction at Source OR: Tds/TcsDocument29 pagesTax Deduction at Source OR: Tds/TcsArka PramanikNo ratings yet

- Assessment 2Document14 pagesAssessment 2zakiatalhaNo ratings yet

- The Kenyan Worker and The Law: An Information Booklet On Labour LawDocument32 pagesThe Kenyan Worker and The Law: An Information Booklet On Labour LawsashalwNo ratings yet

- ACCA P6 UK Notes FA 2017 PDFDocument133 pagesACCA P6 UK Notes FA 2017 PDFAT100% (2)

- Grade 10 Learner Marking GuidelineDocument19 pagesGrade 10 Learner Marking GuidelineyandisaNo ratings yet

- Earning Money PDFDocument28 pagesEarning Money PDFOlivia Ngo100% (2)

- This Study Resource Was: Munhumutapa School of CommerceDocument7 pagesThis Study Resource Was: Munhumutapa School of CommerceSPENCER MXOLISINo ratings yet

- Did You Know That You Can Claim Tax Relief On Your RCN Subscription?Document2 pagesDid You Know That You Can Claim Tax Relief On Your RCN Subscription?Shibu KalayilNo ratings yet

- Tanzania Budget Highlights 2021-22Document35 pagesTanzania Budget Highlights 2021-22Arden Muhumuza KitomariNo ratings yet

- Activity 1: BSBFIM502A: Manage PayrollDocument19 pagesActivity 1: BSBFIM502A: Manage PayrollManish BalharaNo ratings yet

- Key Information Document - PAYE MonthlyDocument1 pageKey Information Document - PAYE MonthlynddkNo ratings yet

- Substantive Procedures-Payroll CycleDocument2 pagesSubstantive Procedures-Payroll CycleThandoe DubeNo ratings yet

- Life Orientation Notes Grade 10 TERM 1 2023Document15 pagesLife Orientation Notes Grade 10 TERM 1 2023ntokozomkhwanazi047No ratings yet

- Payroll Calculator SpreadsheetDocument7 pagesPayroll Calculator SpreadsheetbagumbayanNo ratings yet

- P45 Part 1A Details of Employee Leaving WorkDocument6 pagesP45 Part 1A Details of Employee Leaving WorkCatalin FandaracNo ratings yet

- Cta Taxation of Individuals HWDocument6 pagesCta Taxation of Individuals HWEffie ChirembweNo ratings yet

- Australian Corporate Tax Rate: Local Income TaxesDocument35 pagesAustralian Corporate Tax Rate: Local Income TaxesNadine DiamanteNo ratings yet

- Budget 2023 2024Document12 pagesBudget 2023 2024finance bnbmNo ratings yet

- Employment GuideDocument51 pagesEmployment GuideSofia Teresa de BragançaNo ratings yet

- Income Tax Calculator SampleDocument10 pagesIncome Tax Calculator SamplesumondccNo ratings yet

- Computation of Taxable Income and Tax LiabilityDocument9 pagesComputation of Taxable Income and Tax LiabilityaNo ratings yet

- Den KseroDocument168 pagesDen Kseromaria_nikol_3100% (1)

- Unisa TravelAccommPolicy 15042011Document39 pagesUnisa TravelAccommPolicy 150420111234123545143No ratings yet

- Ir3 GuideDocument66 pagesIr3 GuideSusana SembranoNo ratings yet