Professional Documents

Culture Documents

Notification No. 33/2012 - Service Tax

Notification No. 33/2012 - Service Tax

Uploaded by

Mahaveer DhelariyaCopyright:

Available Formats

You might also like

- Chapter c10Document42 pagesChapter c10DrellyNo ratings yet

- cp575 1389276646545Document3 pagescp575 1389276646545api-104681517No ratings yet

- Notification No. 33 of 2012 Service TaxDocument3 pagesNotification No. 33 of 2012 Service TaxAntyoday IndiaNo ratings yet

- Small Scale Service Tax Exemption up to 10 Lakhs notified- taxguru.inDocument3 pagesSmall Scale Service Tax Exemption up to 10 Lakhs notified- taxguru.inहिनयकुमार मारुती सोनकवडेNo ratings yet

- Stock Exchange Service (A) Date of IntroductionDocument7 pagesStock Exchange Service (A) Date of Introductionarshad89057No ratings yet

- Amendments - 23rd August, 2011Document52 pagesAmendments - 23rd August, 2011Vipul MallickNo ratings yet

- Madhya Pradesh Professional Tax Act, 1995Document40 pagesMadhya Pradesh Professional Tax Act, 1995sumitkejriwalNo ratings yet

- Taxation of Financial Services Sybbi FinalDocument24 pagesTaxation of Financial Services Sybbi Finalsheenu152005No ratings yet

- Article On Reverse Charge 28jul2017Document8 pagesArticle On Reverse Charge 28jul2017kumar45caNo ratings yet

- Service Tax Credit RulesDocument4 pagesService Tax Credit Rulesgauravbarthwal123No ratings yet

- Insurance AuxiserviceDocument9 pagesInsurance AuxiservicePunit GuptaNo ratings yet

- Payment of Service TaxDocument12 pagesPayment of Service TaxPrasanth KumarNo ratings yet

- Hiring of Vehicle Agreement Used in BSNLDocument11 pagesHiring of Vehicle Agreement Used in BSNLVikram MalviyaNo ratings yet

- Contractor Agreement FormatDocument14 pagesContractor Agreement FormatRahul Patel100% (1)

- OIO AarkeyTrad 57 13Document20 pagesOIO AarkeyTrad 57 13jitendraktNo ratings yet

- Reverse Charge Mechanism in GST Regime With Chart – Updated Till Date - Taxguru - inDocument19 pagesReverse Charge Mechanism in GST Regime With Chart – Updated Till Date - Taxguru - inAjit GuptaNo ratings yet

- GST & Customs II Unit 1Document11 pagesGST & Customs II Unit 1GagandeepNo ratings yet

- Section 16 of CGST Act 2017 - Eligibility & Conditions For Taking Input Tax Credit - Taxguru - inDocument3 pagesSection 16 of CGST Act 2017 - Eligibility & Conditions For Taking Input Tax Credit - Taxguru - inDHANNNo ratings yet

- Expenses Regarding Service Tax Return Submited by Babai in The Month of June - 09Document13 pagesExpenses Regarding Service Tax Return Submited by Babai in The Month of June - 09mdbalajeeNo ratings yet

- Penal Provisions STDocument8 pagesPenal Provisions STKunalKumarNo ratings yet

- Project Report ON Service Tax: Information Technology ProgrammeDocument19 pagesProject Report ON Service Tax: Information Technology ProgrammemayankkrishnaNo ratings yet

- The Right of Citizens For Time Bound Delivery of Goods and Services and Redressal of Their Grievances Bill, 2011Document11 pagesThe Right of Citizens For Time Bound Delivery of Goods and Services and Redressal of Their Grievances Bill, 2011rvgarg21No ratings yet

- Service Tax1Document8 pagesService Tax1Suman pendharkarNo ratings yet

- Instruction To Fill Form St3Document9 pagesInstruction To Fill Form St3Dhanush GokulNo ratings yet

- 34564rtp Nov14 Ipcc-4Document59 pages34564rtp Nov14 Ipcc-4Deepal DhamejaNo ratings yet

- ST THDocument3 pagesST THDhananjaya MnNo ratings yet

- ST Determtn Value Rules PDFDocument4 pagesST Determtn Value Rules PDFKumarvNo ratings yet

- ST Determtn Value Rules 1Document4 pagesST Determtn Value Rules 1Poonam GuptaNo ratings yet

- Office of The Commissioner of Service Tax, Delhi-I 17-B, IAEA House, Indraprastha Estate, New Delhi - 110 002Document11 pagesOffice of The Commissioner of Service Tax, Delhi-I 17-B, IAEA House, Indraprastha Estate, New Delhi - 110 002pmNo ratings yet

- Service TaxDocument1 pageService TaxVarun AttriNo ratings yet

- Section 5 Sample Form of Bid, Bid Securities, EtcDocument15 pagesSection 5 Sample Form of Bid, Bid Securities, Etc2003_335No ratings yet

- 003 ITC Mismatch in GSTR 2A Vs 2BDocument7 pages003 ITC Mismatch in GSTR 2A Vs 2BAman GargNo ratings yet

- Unit - 2 Chap - 3 Input Tax CreditDocument17 pagesUnit - 2 Chap - 3 Input Tax CreditRakshit DattaniNo ratings yet

- 2024 01 19 Section 16 Central Goods and Services Tax Act 2017 Eligibility and Conditions For TakinDocument2 pages2024 01 19 Section 16 Central Goods and Services Tax Act 2017 Eligibility and Conditions For Takinswanay.mohantyNo ratings yet

- The Payment of Wages ActDocument12 pagesThe Payment of Wages ActKiran audinaNo ratings yet

- 2 of 2008 8 % To 10 % Duty ChangeDocument3 pages2 of 2008 8 % To 10 % Duty Changephani raja kumarNo ratings yet

- Reverse Charge Mechanism in GST Regime With ChartDocument14 pagesReverse Charge Mechanism in GST Regime With ChartAnkur ShahNo ratings yet

- Brief Facts of The Case: 2.1Document11 pagesBrief Facts of The Case: 2.1Gaurav SinghNo ratings yet

- Direct TaxDocument39 pagesDirect TaxPriyanka Vilas GawasNo ratings yet

- J 2014 SCC OnLine Cal 9668 2015 85 VST 465 Aryan1996arora Gmailcom 20230616 092539 1 18Document18 pagesJ 2014 SCC OnLine Cal 9668 2015 85 VST 465 Aryan1996arora Gmailcom 20230616 092539 1 18Ritwik BatraNo ratings yet

- Draft Service Agreement TemplateDocument12 pagesDraft Service Agreement Templaterohan yajurvediNo ratings yet

- Are You Under Scanner of Excise & Service Tax DepartmentDocument2 pagesAre You Under Scanner of Excise & Service Tax DepartmentMahaveer DhelariyaNo ratings yet

- Taxguru - In-Refund of ITC On Capital Goods A Possible PerspectiveDocument6 pagesTaxguru - In-Refund of ITC On Capital Goods A Possible PerspectiveVamshi Krishna Reddy PathiNo ratings yet

- (A) Date of Introduction: (B) Definition and Scope of ServiceDocument6 pages(A) Date of Introduction: (B) Definition and Scope of ServicePradeep JainNo ratings yet

- What Is Service Tax ?Document15 pagesWhat Is Service Tax ?Nawab SahabNo ratings yet

- Part I: Statutory Update: © The Institute of Chartered Accountants of IndiaDocument4 pagesPart I: Statutory Update: © The Institute of Chartered Accountants of IndiaRamanNo ratings yet

- Budget Highlights 2012Document9 pagesBudget Highlights 2012Anshul GuptaNo ratings yet

- Indian Service TaxDocument13 pagesIndian Service Taxanon_993677No ratings yet

- Labour LawDocument12 pagesLabour LawNikita ShindeNo ratings yet

- Taxguru - In-Assessee Permitted To Make Changes in Form GSTR-3B For July 2017 March 2018Document11 pagesTaxguru - In-Assessee Permitted To Make Changes in Form GSTR-3B For July 2017 March 2018ChittiNo ratings yet

- University Hospitals Form 5500 Year 2010 Employee Benefit PlanDocument68 pagesUniversity Hospitals Form 5500 Year 2010 Employee Benefit PlanJames LindonNo ratings yet

- Draft Regulation 24022023Document36 pagesDraft Regulation 24022023arunkvklNo ratings yet

- Customs & GST Ii Assignment: U P & E S SDocument16 pagesCustoms & GST Ii Assignment: U P & E S SSonal AgarwalNo ratings yet

- Law of TaxationDocument3 pagesLaw of TaxationmangalagowrirudrappaNo ratings yet

- Tax HDocument15 pagesTax HDeepesh SinghNo ratings yet

- Major Changes of Finance ActDocument5 pagesMajor Changes of Finance ActJulia RobertNo ratings yet

- GST Weekly Update - 45 - 2023-24Document5 pagesGST Weekly Update - 45 - 2023-24guptaharshit2204No ratings yet

- RR 12 - 99 DigestDocument5 pagesRR 12 - 99 DigestrodolfoverdidajrNo ratings yet

- 11-Withholding Rules 2012Document5 pages11-Withholding Rules 2012Imran MemonNo ratings yet

- NJ Subcontractor AgreementDocument14 pagesNJ Subcontractor AgreementVivek BansalNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703From EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703No ratings yet

- Top 5 Ways To Break WinRAR Password Easily and EfficientlyDocument11 pagesTop 5 Ways To Break WinRAR Password Easily and EfficientlyMahaveer DhelariyaNo ratings yet

- Bos 48771 Finalp 7Document24 pagesBos 48771 Finalp 7Mahaveer DhelariyaNo ratings yet

- Taxguru - In-Taxation of Charitable and Religious Trusts - 3Document5 pagesTaxguru - In-Taxation of Charitable and Religious Trusts - 3Mahaveer DhelariyaNo ratings yet

- Salary 2018 19Document36 pagesSalary 2018 19Mahaveer DhelariyaNo ratings yet

- 43144bos32841 PDFDocument1 page43144bos32841 PDFMahaveer DhelariyaNo ratings yet

- Salary SlipDocument1 pageSalary SlipMahaveer DhelariyaNo ratings yet

- Slump Sale and Related Income Tax ProvisionsDocument4 pagesSlump Sale and Related Income Tax ProvisionsMahaveer DhelariyaNo ratings yet

- CAclubindia News - Business Plan For A Budding Investment Advisor - Shri - BoodhimaanDocument3 pagesCAclubindia News - Business Plan For A Budding Investment Advisor - Shri - BoodhimaanMahaveer DhelariyaNo ratings yet

- Tax Deposit-Challan 281-Excel FormatDocument8 pagesTax Deposit-Challan 281-Excel FormatMahaveer DhelariyaNo ratings yet

- CAclubindia News - Speedy Disbursal of Service Tax Refund From Exporters of ServiceDocument2 pagesCAclubindia News - Speedy Disbursal of Service Tax Refund From Exporters of ServiceMahaveer DhelariyaNo ratings yet

- CAclubindia News - Forensic Audit - A Modern Day Thrust and ThirstDocument5 pagesCAclubindia News - Forensic Audit - A Modern Day Thrust and ThirstMahaveer DhelariyaNo ratings yet

- Resolutions To Be Filed With Registrar of Companies Under Companies Act 2013Document2 pagesResolutions To Be Filed With Registrar of Companies Under Companies Act 2013Mahaveer DhelariyaNo ratings yet

- GST Impact On Distribution Companies and DealersDocument3 pagesGST Impact On Distribution Companies and DealersMahaveer DhelariyaNo ratings yet

- CAclubindia News - CSR - Auditors' Responsibility To Qualify in Audit ReportDocument2 pagesCAclubindia News - CSR - Auditors' Responsibility To Qualify in Audit ReportMahaveer DhelariyaNo ratings yet

- CAclubindia News - Why Filing of Income Tax Return Before 31st July Is ImportantDocument2 pagesCAclubindia News - Why Filing of Income Tax Return Before 31st July Is ImportantMahaveer DhelariyaNo ratings yet

- CAclubindia News - Exemption On Capital GainsDocument2 pagesCAclubindia News - Exemption On Capital GainsMahaveer DhelariyaNo ratings yet

- Load TestDocument3 pagesLoad TestsujaraghupsNo ratings yet

- Goods and Services Tax - GSTR-2BDocument53 pagesGoods and Services Tax - GSTR-2BAgnelo DsouzaNo ratings yet

- Agency - Broker - Ferdinand O. BasasDocument1 pageAgency - Broker - Ferdinand O. BasasgongsilogNo ratings yet

- Financing National Government ExpendituresDocument34 pagesFinancing National Government Expendituresgilberthufana446877No ratings yet

- DsddsdsdsdsDocument7 pagesDsddsdsdsdsLemuel Jay MananapNo ratings yet

- CAF 2 Spring 2021Document8 pagesCAF 2 Spring 2021Muhammad Ahsan RiazNo ratings yet

- Bill HondaDocument1 pageBill Hondanaveenkgarg72No ratings yet

- Business Rules For Cafeteria Ordering System (Partial) : ID Rule Definition Type of Rule Static or Dynamic SourceDocument1 pageBusiness Rules For Cafeteria Ordering System (Partial) : ID Rule Definition Type of Rule Static or Dynamic SourceManh Hung TranNo ratings yet

- Journal ReportDocument3 pagesJournal ReportalpulanusofficialNo ratings yet

- Quiz 4 Income TAxDocument6 pagesQuiz 4 Income TAxGirlie Kaye Onongen PagtamaNo ratings yet

- Income Tax CalculatorDocument8 pagesIncome Tax CalculatorbabulalseshmaNo ratings yet

- CIR v. Lednicky, 11 SCRA 603Document2 pagesCIR v. Lednicky, 11 SCRA 603Homer Simpson100% (1)

- Bucharest Academy of Economic Study Facutly of Accounting and Management SystemsDocument10 pagesBucharest Academy of Economic Study Facutly of Accounting and Management Systemsanon_671929315No ratings yet

- Business Math - Chapter 1 Questions and SolutionsDocument3 pagesBusiness Math - Chapter 1 Questions and Solutionsgrace paragasNo ratings yet

- Sections:All Subject: CAF-06 Teacher: Sir Adnan/Salman Total Marks: 36 Time Allowed: 1 Hour 10 Minutes Assessment-1 Date: 17 May, 2021Document6 pagesSections:All Subject: CAF-06 Teacher: Sir Adnan/Salman Total Marks: 36 Time Allowed: 1 Hour 10 Minutes Assessment-1 Date: 17 May, 2021BablooNo ratings yet

- Elasticity and Buoyancy of The Tax System in PakistanDocument22 pagesElasticity and Buoyancy of The Tax System in PakistanShumaisa12No ratings yet

- Laffer Curve: Key TakeawaysDocument2 pagesLaffer Curve: Key TakeawaysShashwat S RNo ratings yet

- Tax Year 2013-14 (As Per Finance Act 2013) : Tax Card For Staff and Clients OnlyDocument1 pageTax Year 2013-14 (As Per Finance Act 2013) : Tax Card For Staff and Clients OnlyMuhammad sarfrazNo ratings yet

- Transaction Receipt PDFDocument1 pageTransaction Receipt PDFsoozoou sweetNo ratings yet

- Chapter 6 LeasingDocument6 pagesChapter 6 LeasingMuntazir HussainNo ratings yet

- Taxation LawDocument7 pagesTaxation LawYsiis CCNo ratings yet

- Taxation Ans AnsDocument10 pagesTaxation Ans AnsTebashiniNo ratings yet

- LectureDocument3 pagesLectureJimmy RecedeNo ratings yet

- Agreement For Mediator PartnershipDocument3 pagesAgreement For Mediator Partnershipज्ञानेन्द्र यादवNo ratings yet

- Your Reservation: Ibis Bangkok SathornDocument3 pagesYour Reservation: Ibis Bangkok SathornBusyBoy PriyamNo ratings yet

- Write Back Amount Vs GSTDocument8 pagesWrite Back Amount Vs GSTashim1No ratings yet

- Act ch10 l03 EnglishDocument5 pagesAct ch10 l03 EnglishLinds RiveraNo ratings yet

- (Original For Recipient) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountDocument1 page(Original For Recipient) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountrazaNo ratings yet

Notification No. 33/2012 - Service Tax

Notification No. 33/2012 - Service Tax

Uploaded by

Mahaveer DhelariyaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notification No. 33/2012 - Service Tax

Notification No. 33/2012 - Service Tax

Uploaded by

Mahaveer DhelariyaCopyright:

Available Formats

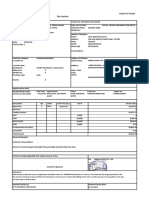

Government of India

Ministry of Finance

(Department of Revenue)

Notification No. 33/2012 - Service Tax

New Delhi, the 2th !une, 2"2

G#$#R# (%)#& In e'ercise of the powers conferred (y su(§ion (") of

section )* of the Finance +ct, ")), (*2 of ")),) (hereinafter referred to

as the said Finance +ct), and in supersession of the Government of

India in the Ministry of Finance (Department of Revenue) notification

No# -.2/&$ervice 0a', dated the "

st

March, 2/, pu(lished in the

Ga1ette of India, %'traordinary, 2art II, $ection *, $u(§ion

(i), vide G#$#R# num(er ",(%), dated the "

st

March, 2/, e'cept as

respects thin3s done or omitted to (e done (efore such supersession,

the 4entral Government, (ein3 satisfied that it is necessary in the pu(lic

interest so to do, here(y e'empts ta'a(le services of a33re3ate value

not e'ceedin3 ten la5h rupees in any financial year from the whole of the

service ta' levia(le thereon under section --6 of the said Finance

+ct7

2rovided that nothin3 contained in this notification shall apply to,&

(i) ta'a(le services provided (y a person under a (rand name or trade

name, whether re3istered or not, of another person8 or

(ii) such value of ta'a(le services in respect of which service ta' shall

(e paid (y such person and in such manner as specified under su(&

section (2) of section -9 of the said Finance +ct read with $ervice 0a'

Rules,")),#

2# 0he e'emption contained in this notification shall apply su(:ect to the

followin3

conditions, namely7&

(i) the provider of ta'a(le service has the option not to avail the

e'emption contained in this notification and pay service ta' on the

ta'a(le services provided (y him and such option, once e'ercised in a

financial year, shall not (e withdrawn durin3 the remainin3 part of such

financial year8

(ii) the provider of ta'a(le service shall not avail the 4%N;+0 credit of

service ta' paid on any input services, under rule * or rule "* of the

4%N;+0 4redit Rules, 2, (herein after referred to as the said rules),

used for providin3 the said ta'a(le service, for which e'emption from

payment of service ta' under this notification is availed of8

(iii)the provider of ta'a(le service shall not avail the 4%N;+0 credit

under rule * of the said rules, on capital 3oods received, durin3 the

period in which the service provider avails e'emption from payment of

service ta' under this notification8

(iv) the provider of ta'a(le service shall avail the 4%N;+0 credit only on

such inputs or input services received, on or after the date on which the

service provider starts payin3 service ta', and used for the provision

of ta'a(le services for which service ta' is paya(le8

(v) the provider of ta'a(le service who starts availin3 e'emption under

this notification shall (e re<uired to pay an amount e<uivalent to the

4%N;+0 credit ta5en (y him, if any, in respect of such inputs lyin3 in

stoc5 or in process on the date on which the provider of ta'a(le service

starts availin3 e'emption under this notification8

(vi) the (alance of 4%N;+0 credit lyin3 unutilised in the account of the

ta'a(le service provider after deductin3 the amount referred to in su(&

para3raph (v), if any, shall not (e utilised in terms of provision under su(&

rule (,) of rule * of the said rules and shall lapse on the day such service

provider starts availin3 the e'emption under this notification8

(vii) where a ta'a(le service provider provides one or more ta'a(le

services from one or more premises, the e'emption under this

notification shall apply to the a33re3ate value of all such ta'a(le services

and from all such premises and not separately for each premises or

each services8 and

(viii) the a33re3ate value of ta'a(le services rendered (y a provider of

ta'a(le service from one or more premises, does not e'ceed ten la5h

rupees in the precedin3 financial year#

*# For the purposes of determinin3 a33re3ate value not e'ceedin3 ten

la5h rupees, to avail e'emption under this notification, in relation to

ta'a(le service provided (y a 3oods transport a3ency, the payment

received towards the 3ross amount char3ed (y such 3oods transport

a3ency under section -= of the said Finance +ct for which the person

lia(le for payin3 service ta' is as specified under su(§ion (2) of

section -9 of the said Finance +ct read with $ervice 0a' Rules, ")),,

shall not (e ta5en into account#

%'planation#& For the purposes of this notification,&

(+) >(rand name? or >trade name? means a (rand name or a trade

name, whether re3istered or not, that is to say, a name or a mar5, such

as sym(ol, mono3ram, lo3o, la(el, si3nature, or invented word or writin3

which is used in relation to such specified services for the purpose of

indicatin3, or so as to indicate a connection in the course of trade

(etween such specified services and some person usin3 such name or

mar5 with or without any indication of the identity of that person8

(6) >a33re3ate value? means the sum total of value of ta'a(le services

char3ed in the first consecutive invoices issued durin3 a financial year

(ut does not include value char3ed in invoices issued towards such

services which are e'empt from whole of service ta' levia(le thereon

under section --6 of the said Finance +ct under any other notification#?

,# 0his notification shall come into force on the "st day of !uly, 2"2#

@F#No# **, .".2"2& 0RAB

(Ra: Cumar Di3vi:ay)

Ander $ecretary to the Government of India

You might also like

- Chapter c10Document42 pagesChapter c10DrellyNo ratings yet

- cp575 1389276646545Document3 pagescp575 1389276646545api-104681517No ratings yet

- Notification No. 33 of 2012 Service TaxDocument3 pagesNotification No. 33 of 2012 Service TaxAntyoday IndiaNo ratings yet

- Small Scale Service Tax Exemption up to 10 Lakhs notified- taxguru.inDocument3 pagesSmall Scale Service Tax Exemption up to 10 Lakhs notified- taxguru.inहिनयकुमार मारुती सोनकवडेNo ratings yet

- Stock Exchange Service (A) Date of IntroductionDocument7 pagesStock Exchange Service (A) Date of Introductionarshad89057No ratings yet

- Amendments - 23rd August, 2011Document52 pagesAmendments - 23rd August, 2011Vipul MallickNo ratings yet

- Madhya Pradesh Professional Tax Act, 1995Document40 pagesMadhya Pradesh Professional Tax Act, 1995sumitkejriwalNo ratings yet

- Taxation of Financial Services Sybbi FinalDocument24 pagesTaxation of Financial Services Sybbi Finalsheenu152005No ratings yet

- Article On Reverse Charge 28jul2017Document8 pagesArticle On Reverse Charge 28jul2017kumar45caNo ratings yet

- Service Tax Credit RulesDocument4 pagesService Tax Credit Rulesgauravbarthwal123No ratings yet

- Insurance AuxiserviceDocument9 pagesInsurance AuxiservicePunit GuptaNo ratings yet

- Payment of Service TaxDocument12 pagesPayment of Service TaxPrasanth KumarNo ratings yet

- Hiring of Vehicle Agreement Used in BSNLDocument11 pagesHiring of Vehicle Agreement Used in BSNLVikram MalviyaNo ratings yet

- Contractor Agreement FormatDocument14 pagesContractor Agreement FormatRahul Patel100% (1)

- OIO AarkeyTrad 57 13Document20 pagesOIO AarkeyTrad 57 13jitendraktNo ratings yet

- Reverse Charge Mechanism in GST Regime With Chart – Updated Till Date - Taxguru - inDocument19 pagesReverse Charge Mechanism in GST Regime With Chart – Updated Till Date - Taxguru - inAjit GuptaNo ratings yet

- GST & Customs II Unit 1Document11 pagesGST & Customs II Unit 1GagandeepNo ratings yet

- Section 16 of CGST Act 2017 - Eligibility & Conditions For Taking Input Tax Credit - Taxguru - inDocument3 pagesSection 16 of CGST Act 2017 - Eligibility & Conditions For Taking Input Tax Credit - Taxguru - inDHANNNo ratings yet

- Expenses Regarding Service Tax Return Submited by Babai in The Month of June - 09Document13 pagesExpenses Regarding Service Tax Return Submited by Babai in The Month of June - 09mdbalajeeNo ratings yet

- Penal Provisions STDocument8 pagesPenal Provisions STKunalKumarNo ratings yet

- Project Report ON Service Tax: Information Technology ProgrammeDocument19 pagesProject Report ON Service Tax: Information Technology ProgrammemayankkrishnaNo ratings yet

- The Right of Citizens For Time Bound Delivery of Goods and Services and Redressal of Their Grievances Bill, 2011Document11 pagesThe Right of Citizens For Time Bound Delivery of Goods and Services and Redressal of Their Grievances Bill, 2011rvgarg21No ratings yet

- Service Tax1Document8 pagesService Tax1Suman pendharkarNo ratings yet

- Instruction To Fill Form St3Document9 pagesInstruction To Fill Form St3Dhanush GokulNo ratings yet

- 34564rtp Nov14 Ipcc-4Document59 pages34564rtp Nov14 Ipcc-4Deepal DhamejaNo ratings yet

- ST THDocument3 pagesST THDhananjaya MnNo ratings yet

- ST Determtn Value Rules PDFDocument4 pagesST Determtn Value Rules PDFKumarvNo ratings yet

- ST Determtn Value Rules 1Document4 pagesST Determtn Value Rules 1Poonam GuptaNo ratings yet

- Office of The Commissioner of Service Tax, Delhi-I 17-B, IAEA House, Indraprastha Estate, New Delhi - 110 002Document11 pagesOffice of The Commissioner of Service Tax, Delhi-I 17-B, IAEA House, Indraprastha Estate, New Delhi - 110 002pmNo ratings yet

- Service TaxDocument1 pageService TaxVarun AttriNo ratings yet

- Section 5 Sample Form of Bid, Bid Securities, EtcDocument15 pagesSection 5 Sample Form of Bid, Bid Securities, Etc2003_335No ratings yet

- 003 ITC Mismatch in GSTR 2A Vs 2BDocument7 pages003 ITC Mismatch in GSTR 2A Vs 2BAman GargNo ratings yet

- Unit - 2 Chap - 3 Input Tax CreditDocument17 pagesUnit - 2 Chap - 3 Input Tax CreditRakshit DattaniNo ratings yet

- 2024 01 19 Section 16 Central Goods and Services Tax Act 2017 Eligibility and Conditions For TakinDocument2 pages2024 01 19 Section 16 Central Goods and Services Tax Act 2017 Eligibility and Conditions For Takinswanay.mohantyNo ratings yet

- The Payment of Wages ActDocument12 pagesThe Payment of Wages ActKiran audinaNo ratings yet

- 2 of 2008 8 % To 10 % Duty ChangeDocument3 pages2 of 2008 8 % To 10 % Duty Changephani raja kumarNo ratings yet

- Reverse Charge Mechanism in GST Regime With ChartDocument14 pagesReverse Charge Mechanism in GST Regime With ChartAnkur ShahNo ratings yet

- Brief Facts of The Case: 2.1Document11 pagesBrief Facts of The Case: 2.1Gaurav SinghNo ratings yet

- Direct TaxDocument39 pagesDirect TaxPriyanka Vilas GawasNo ratings yet

- J 2014 SCC OnLine Cal 9668 2015 85 VST 465 Aryan1996arora Gmailcom 20230616 092539 1 18Document18 pagesJ 2014 SCC OnLine Cal 9668 2015 85 VST 465 Aryan1996arora Gmailcom 20230616 092539 1 18Ritwik BatraNo ratings yet

- Draft Service Agreement TemplateDocument12 pagesDraft Service Agreement Templaterohan yajurvediNo ratings yet

- Are You Under Scanner of Excise & Service Tax DepartmentDocument2 pagesAre You Under Scanner of Excise & Service Tax DepartmentMahaveer DhelariyaNo ratings yet

- Taxguru - In-Refund of ITC On Capital Goods A Possible PerspectiveDocument6 pagesTaxguru - In-Refund of ITC On Capital Goods A Possible PerspectiveVamshi Krishna Reddy PathiNo ratings yet

- (A) Date of Introduction: (B) Definition and Scope of ServiceDocument6 pages(A) Date of Introduction: (B) Definition and Scope of ServicePradeep JainNo ratings yet

- What Is Service Tax ?Document15 pagesWhat Is Service Tax ?Nawab SahabNo ratings yet

- Part I: Statutory Update: © The Institute of Chartered Accountants of IndiaDocument4 pagesPart I: Statutory Update: © The Institute of Chartered Accountants of IndiaRamanNo ratings yet

- Budget Highlights 2012Document9 pagesBudget Highlights 2012Anshul GuptaNo ratings yet

- Indian Service TaxDocument13 pagesIndian Service Taxanon_993677No ratings yet

- Labour LawDocument12 pagesLabour LawNikita ShindeNo ratings yet

- Taxguru - In-Assessee Permitted To Make Changes in Form GSTR-3B For July 2017 March 2018Document11 pagesTaxguru - In-Assessee Permitted To Make Changes in Form GSTR-3B For July 2017 March 2018ChittiNo ratings yet

- University Hospitals Form 5500 Year 2010 Employee Benefit PlanDocument68 pagesUniversity Hospitals Form 5500 Year 2010 Employee Benefit PlanJames LindonNo ratings yet

- Draft Regulation 24022023Document36 pagesDraft Regulation 24022023arunkvklNo ratings yet

- Customs & GST Ii Assignment: U P & E S SDocument16 pagesCustoms & GST Ii Assignment: U P & E S SSonal AgarwalNo ratings yet

- Law of TaxationDocument3 pagesLaw of TaxationmangalagowrirudrappaNo ratings yet

- Tax HDocument15 pagesTax HDeepesh SinghNo ratings yet

- Major Changes of Finance ActDocument5 pagesMajor Changes of Finance ActJulia RobertNo ratings yet

- GST Weekly Update - 45 - 2023-24Document5 pagesGST Weekly Update - 45 - 2023-24guptaharshit2204No ratings yet

- RR 12 - 99 DigestDocument5 pagesRR 12 - 99 DigestrodolfoverdidajrNo ratings yet

- 11-Withholding Rules 2012Document5 pages11-Withholding Rules 2012Imran MemonNo ratings yet

- NJ Subcontractor AgreementDocument14 pagesNJ Subcontractor AgreementVivek BansalNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- The Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703From EverandThe Contractor Payment Application Audit: Guidance for Auditing AIA Documents G702 & G703No ratings yet

- Top 5 Ways To Break WinRAR Password Easily and EfficientlyDocument11 pagesTop 5 Ways To Break WinRAR Password Easily and EfficientlyMahaveer DhelariyaNo ratings yet

- Bos 48771 Finalp 7Document24 pagesBos 48771 Finalp 7Mahaveer DhelariyaNo ratings yet

- Taxguru - In-Taxation of Charitable and Religious Trusts - 3Document5 pagesTaxguru - In-Taxation of Charitable and Religious Trusts - 3Mahaveer DhelariyaNo ratings yet

- Salary 2018 19Document36 pagesSalary 2018 19Mahaveer DhelariyaNo ratings yet

- 43144bos32841 PDFDocument1 page43144bos32841 PDFMahaveer DhelariyaNo ratings yet

- Salary SlipDocument1 pageSalary SlipMahaveer DhelariyaNo ratings yet

- Slump Sale and Related Income Tax ProvisionsDocument4 pagesSlump Sale and Related Income Tax ProvisionsMahaveer DhelariyaNo ratings yet

- CAclubindia News - Business Plan For A Budding Investment Advisor - Shri - BoodhimaanDocument3 pagesCAclubindia News - Business Plan For A Budding Investment Advisor - Shri - BoodhimaanMahaveer DhelariyaNo ratings yet

- Tax Deposit-Challan 281-Excel FormatDocument8 pagesTax Deposit-Challan 281-Excel FormatMahaveer DhelariyaNo ratings yet

- CAclubindia News - Speedy Disbursal of Service Tax Refund From Exporters of ServiceDocument2 pagesCAclubindia News - Speedy Disbursal of Service Tax Refund From Exporters of ServiceMahaveer DhelariyaNo ratings yet

- CAclubindia News - Forensic Audit - A Modern Day Thrust and ThirstDocument5 pagesCAclubindia News - Forensic Audit - A Modern Day Thrust and ThirstMahaveer DhelariyaNo ratings yet

- Resolutions To Be Filed With Registrar of Companies Under Companies Act 2013Document2 pagesResolutions To Be Filed With Registrar of Companies Under Companies Act 2013Mahaveer DhelariyaNo ratings yet

- GST Impact On Distribution Companies and DealersDocument3 pagesGST Impact On Distribution Companies and DealersMahaveer DhelariyaNo ratings yet

- CAclubindia News - CSR - Auditors' Responsibility To Qualify in Audit ReportDocument2 pagesCAclubindia News - CSR - Auditors' Responsibility To Qualify in Audit ReportMahaveer DhelariyaNo ratings yet

- CAclubindia News - Why Filing of Income Tax Return Before 31st July Is ImportantDocument2 pagesCAclubindia News - Why Filing of Income Tax Return Before 31st July Is ImportantMahaveer DhelariyaNo ratings yet

- CAclubindia News - Exemption On Capital GainsDocument2 pagesCAclubindia News - Exemption On Capital GainsMahaveer DhelariyaNo ratings yet

- Load TestDocument3 pagesLoad TestsujaraghupsNo ratings yet

- Goods and Services Tax - GSTR-2BDocument53 pagesGoods and Services Tax - GSTR-2BAgnelo DsouzaNo ratings yet

- Agency - Broker - Ferdinand O. BasasDocument1 pageAgency - Broker - Ferdinand O. BasasgongsilogNo ratings yet

- Financing National Government ExpendituresDocument34 pagesFinancing National Government Expendituresgilberthufana446877No ratings yet

- DsddsdsdsdsDocument7 pagesDsddsdsdsdsLemuel Jay MananapNo ratings yet

- CAF 2 Spring 2021Document8 pagesCAF 2 Spring 2021Muhammad Ahsan RiazNo ratings yet

- Bill HondaDocument1 pageBill Hondanaveenkgarg72No ratings yet

- Business Rules For Cafeteria Ordering System (Partial) : ID Rule Definition Type of Rule Static or Dynamic SourceDocument1 pageBusiness Rules For Cafeteria Ordering System (Partial) : ID Rule Definition Type of Rule Static or Dynamic SourceManh Hung TranNo ratings yet

- Journal ReportDocument3 pagesJournal ReportalpulanusofficialNo ratings yet

- Quiz 4 Income TAxDocument6 pagesQuiz 4 Income TAxGirlie Kaye Onongen PagtamaNo ratings yet

- Income Tax CalculatorDocument8 pagesIncome Tax CalculatorbabulalseshmaNo ratings yet

- CIR v. Lednicky, 11 SCRA 603Document2 pagesCIR v. Lednicky, 11 SCRA 603Homer Simpson100% (1)

- Bucharest Academy of Economic Study Facutly of Accounting and Management SystemsDocument10 pagesBucharest Academy of Economic Study Facutly of Accounting and Management Systemsanon_671929315No ratings yet

- Business Math - Chapter 1 Questions and SolutionsDocument3 pagesBusiness Math - Chapter 1 Questions and Solutionsgrace paragasNo ratings yet

- Sections:All Subject: CAF-06 Teacher: Sir Adnan/Salman Total Marks: 36 Time Allowed: 1 Hour 10 Minutes Assessment-1 Date: 17 May, 2021Document6 pagesSections:All Subject: CAF-06 Teacher: Sir Adnan/Salman Total Marks: 36 Time Allowed: 1 Hour 10 Minutes Assessment-1 Date: 17 May, 2021BablooNo ratings yet

- Elasticity and Buoyancy of The Tax System in PakistanDocument22 pagesElasticity and Buoyancy of The Tax System in PakistanShumaisa12No ratings yet

- Laffer Curve: Key TakeawaysDocument2 pagesLaffer Curve: Key TakeawaysShashwat S RNo ratings yet

- Tax Year 2013-14 (As Per Finance Act 2013) : Tax Card For Staff and Clients OnlyDocument1 pageTax Year 2013-14 (As Per Finance Act 2013) : Tax Card For Staff and Clients OnlyMuhammad sarfrazNo ratings yet

- Transaction Receipt PDFDocument1 pageTransaction Receipt PDFsoozoou sweetNo ratings yet

- Chapter 6 LeasingDocument6 pagesChapter 6 LeasingMuntazir HussainNo ratings yet

- Taxation LawDocument7 pagesTaxation LawYsiis CCNo ratings yet

- Taxation Ans AnsDocument10 pagesTaxation Ans AnsTebashiniNo ratings yet

- LectureDocument3 pagesLectureJimmy RecedeNo ratings yet

- Agreement For Mediator PartnershipDocument3 pagesAgreement For Mediator Partnershipज्ञानेन्द्र यादवNo ratings yet

- Your Reservation: Ibis Bangkok SathornDocument3 pagesYour Reservation: Ibis Bangkok SathornBusyBoy PriyamNo ratings yet

- Write Back Amount Vs GSTDocument8 pagesWrite Back Amount Vs GSTashim1No ratings yet

- Act ch10 l03 EnglishDocument5 pagesAct ch10 l03 EnglishLinds RiveraNo ratings yet

- (Original For Recipient) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountDocument1 page(Original For Recipient) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountrazaNo ratings yet