Professional Documents

Culture Documents

Public Works Agenda

Public Works Agenda

Uploaded by

Sarah BennettCopyright:

Available Formats

You might also like

- Allan Yorke Master PlanDocument37 pagesAllan Yorke Master PlanRay StillNo ratings yet

- Joint Questions ResponseDocument25 pagesJoint Questions ResponseSheila VilvensNo ratings yet

- Monkey TestingDocument4 pagesMonkey TestingNguyen HuongNo ratings yet

- TSO C58aDocument3 pagesTSO C58aRafNo ratings yet

- Master Plan ProposalDocument25 pagesMaster Plan ProposalFaizul Haslan Abu HassanNo ratings yet

- 5810 MeadowcrestDocument19 pages5810 MeadowcrestDanKoller3No ratings yet

- Sandford Street EIS: ACT PS Letter - EIS Application - 28 Oct 09Document2 pagesSandford Street EIS: ACT PS Letter - EIS Application - 28 Oct 09North Canberra Community Council IncNo ratings yet

- PC Agenda 20230301 PacketDocument78 pagesPC Agenda 20230301 PacketyolandaperdomoNo ratings yet

- Council Meeting Minutes 9.7.2022-1Document2 pagesCouncil Meeting Minutes 9.7.2022-19bvsnkwszbNo ratings yet

- North Park Recreation Center/Adult Center, 2719 Howard AvenueDocument3 pagesNorth Park Recreation Center/Adult Center, 2719 Howard Avenueapi-63385278No ratings yet

- Mission Peak Draft EIRDocument484 pagesMission Peak Draft EIRBayAreaNewsGroupNo ratings yet

- To: From: Submitted By: SubjectDocument28 pagesTo: From: Submitted By: SubjectL. A. PatersonNo ratings yet

- 041907'www Parks Sfgov Org'wcm recpark'RPC AgendaDocument8 pages041907'www Parks Sfgov Org'wcm recpark'RPC AgendapolitixNo ratings yet

- 051707'www Parks Sfgov Org'wcm recpark'RPC AgendaDocument6 pages051707'www Parks Sfgov Org'wcm recpark'RPC AgendapolitixNo ratings yet

- CFD2004-3 - Area2 - Res 7066-7070 - 2ndHillsDA-02162005Document3 pagesCFD2004-3 - Area2 - Res 7066-7070 - 2ndHillsDA-02162005Brian DaviesNo ratings yet

- 040507'www Parks Sfgov Org'wcm recpark'RPC AgendaDocument6 pages040507'www Parks Sfgov Org'wcm recpark'RPC AgendapolitixNo ratings yet

- Durango Organically Managed Parks Program Chip Osborne 2012 PDFDocument3 pagesDurango Organically Managed Parks Program Chip Osborne 2012 PDFuncleadolphNo ratings yet

- Final Environmental Impact StatementDocument107 pagesFinal Environmental Impact StatementTown of Colonie LandfillNo ratings yet

- IrvingCC Agenda 2011-02-17Document12 pagesIrvingCC Agenda 2011-02-17Irving BlogNo ratings yet

- 02-13-24 City Council Work Session Agenda Packet ODocument59 pages02-13-24 City Council Work Session Agenda Packet OSteven EngleNo ratings yet

- IrvingCC Agenda 2011-04-21Document16 pagesIrvingCC Agenda 2011-04-21Irving BlogNo ratings yet

- Bod Minutes Feb 2005Document3 pagesBod Minutes Feb 2005La Reata RanchNo ratings yet

- Prosper Is A Place Where Everyone Matters.: Meeting of The Prosper Town CouncilDocument325 pagesProsper Is A Place Where Everyone Matters.: Meeting of The Prosper Town CouncilProsper SpeaksNo ratings yet

- Grace E. Simons, Chairman: Irrig RionDocument2 pagesGrace E. Simons, Chairman: Irrig RionCitizens Committee to Save Elysian ParkNo ratings yet

- Grand Prairie, TX City Council Meeting Agenda 05-20-2014 (Includes April 15, 2014 Minutes)Document379 pagesGrand Prairie, TX City Council Meeting Agenda 05-20-2014 (Includes April 15, 2014 Minutes)Westchester GasetteNo ratings yet

- Victoria RoadDocument10 pagesVictoria RoadLeedsGuardianNo ratings yet

- Newsletter 2001.04Document2 pagesNewsletter 2001.04localonNo ratings yet

- Boulder City Council Meeting Agenda: December 16, 2014Document422 pagesBoulder City Council Meeting Agenda: December 16, 2014Michael_Lee_RobertsNo ratings yet

- Reg Doc 3Document60 pagesReg Doc 3langleyrecord8339No ratings yet

- Environmental Protection Commission AgendaDocument71 pagesEnvironmental Protection Commission AgendaMorgan Caroline McHughNo ratings yet

- Maynard's Market KitchenDocument5 pagesMaynard's Market KitchenTad SooterNo ratings yet

- 01-35 CMS PDFDocument2 pages01-35 CMS PDFRecordTrac - City of OaklandNo ratings yet

- Read Ellen Psychas and Bing Yee's Proposed Treehouse Rules in FullDocument4 pagesRead Ellen Psychas and Bing Yee's Proposed Treehouse Rules in FullRachel SadonNo ratings yet

- CMS PDFDocument2 pagesCMS PDFRecordTrac - City of OaklandNo ratings yet

- 2015-06-30 Covenant Between Archer School For Girls and Brentwood Homeowners Association and Two Neighboring FamiliesDocument109 pages2015-06-30 Covenant Between Archer School For Girls and Brentwood Homeowners Association and Two Neighboring FamiliesArcher DisasterNo ratings yet

- To: From: Submitted By: SubjectDocument14 pagesTo: From: Submitted By: SubjectL. A. PatersonNo ratings yet

- BOS Packet Love's Travel Center Rezoning and SUP RequestsDocument319 pagesBOS Packet Love's Travel Center Rezoning and SUP RequestsJanay ReeceNo ratings yet

- Acpwa 273941Document6 pagesAcpwa 273941Mr. GaskinNo ratings yet

- Building A Reston Community Response To The Draft BCP Master Plan - FINALDocument17 pagesBuilding A Reston Community Response To The Draft BCP Master Plan - FINALTerry MaynardNo ratings yet

- 031507agenda'www Parks Sfgov Org'wcm recpark'RPC AgendaDocument5 pages031507agenda'www Parks Sfgov Org'wcm recpark'RPC AgendapolitixNo ratings yet

- Shady Grove Sector Plan Advisory Committee Meeting Summary: Derwood Bible/Linden Grove PresentationDocument3 pagesShady Grove Sector Plan Advisory Committee Meeting Summary: Derwood Bible/Linden Grove PresentationM-NCPPCNo ratings yet

- Fairfax County Board MattersDocument44 pagesFairfax County Board MattersKate DavisonNo ratings yet

- Action AlertDocument3 pagesAction AlertfreestategalNo ratings yet

- Resolution Opposing Nimbus Site For Joint Operations CenterDocument6 pagesResolution Opposing Nimbus Site For Joint Operations CenterdarnellbrandonNo ratings yet

- Jim and Lynn Neckopulous 01-11-17Document14 pagesJim and Lynn Neckopulous 01-11-17L. A. PatersonNo ratings yet

- Vote Chart Notes 2010 To 2012Document4 pagesVote Chart Notes 2010 To 2012Luke DiazNo ratings yet

- ECWANDC PLUB Committee Meeting - January 27, 2015Document3 pagesECWANDC PLUB Committee Meeting - January 27, 2015Empowerment Congress West Area Neighborhood Development CouncilNo ratings yet

- September: O M OFDocument3 pagesSeptember: O M OFblogdowntownNo ratings yet

- Exhibits For TRC Meeting 101520Document162 pagesExhibits For TRC Meeting 101520Gerardo GaleanoNo ratings yet

- Recreation and Park Commission "Cultivating The Future of San Francisco"Document5 pagesRecreation and Park Commission "Cultivating The Future of San Francisco"Bobby GlassNo ratings yet

- Area 10 Ge TechDocument14 pagesArea 10 Ge TechPraveen C. ChaurasiaNo ratings yet

- Strategic Bluff To Be Added To. Elysian Park: Grace E. Simons, ChairmanDocument2 pagesStrategic Bluff To Be Added To. Elysian Park: Grace E. Simons, ChairmanCitizens Committee to Save Elysian ParkNo ratings yet

- Citrus Ranch Lawsuit CVWDV - Indio Water .02172007pdfDocument5 pagesCitrus Ranch Lawsuit CVWDV - Indio Water .02172007pdfBrian DaviesNo ratings yet

- Dicks Staff ReportDocument3 pagesDicks Staff ReportThe News-HeraldNo ratings yet

- University Park AgendaDocument4 pagesUniversity Park AgendaSarah BennettNo ratings yet

- To: From: Submitted By: SubjectDocument18 pagesTo: From: Submitted By: SubjectL. A. PatersonNo ratings yet

- Newsletter 2001.08Document2 pagesNewsletter 2001.08localonNo ratings yet

- Planning Board Draft - Limited Amendment To The Sector Plan For The Wheaton Central Business District and Vicinity (June 2008)Document20 pagesPlanning Board Draft - Limited Amendment To The Sector Plan For The Wheaton Central Business District and Vicinity (June 2008)M-NCPPCNo ratings yet

- Lake Health Rezoning Staff ReportDocument4 pagesLake Health Rezoning Staff ReportThe News-HeraldNo ratings yet

- Grace E. Simons, Chairman: Is TheDocument2 pagesGrace E. Simons, Chairman: Is TheCitizens Committee to Save Elysian ParkNo ratings yet

- To: From: Submitted By: Subject:: FiscalDocument3 pagesTo: From: Submitted By: Subject:: FiscalL. A. PatersonNo ratings yet

- How To Keep Your Camper Happy!: Soccer All SummerDocument2 pagesHow To Keep Your Camper Happy!: Soccer All SummerSarah BennettNo ratings yet

- Raider Band Booster Club: Wednesday, February 25, 2015 (All Day Event)Document1 pageRaider Band Booster Club: Wednesday, February 25, 2015 (All Day Event)Sarah BennettNo ratings yet

- Court of Appeals Fifth District of Texas at Dallas: Memorandum OpinionDocument11 pagesCourt of Appeals Fifth District of Texas at Dallas: Memorandum OpinionSarah BennettNo ratings yet

- Bus Pick - Up and Drop - Off Locations Centennial Parking Areas Centennial Bus RouteDocument1 pageBus Pick - Up and Drop - Off Locations Centennial Parking Areas Centennial Bus RouteSarah BennettNo ratings yet

- Agenda Meeting 4Document1 pageAgenda Meeting 4Sarah BennettNo ratings yet

- University Park AgendaDocument3 pagesUniversity Park AgendaSarah BennettNo ratings yet

- Court Alley Supporters For ReleaseDocument15 pagesCourt Alley Supporters For ReleaseSarah BennettNo ratings yet

- University Park AgendaDocument4 pagesUniversity Park AgendaSarah BennettNo ratings yet

- Vrbook PDFDocument218 pagesVrbook PDFShariq KhanNo ratings yet

- SERVICE MANUAL Colour Television: Model No. C14LT77M C20LB87MDocument33 pagesSERVICE MANUAL Colour Television: Model No. C14LT77M C20LB87Mhectormv22No ratings yet

- Electrodeposition of Zinc-Tin Alloys From Deep Eutectic Solvents Based On Choline ChlorideDocument7 pagesElectrodeposition of Zinc-Tin Alloys From Deep Eutectic Solvents Based On Choline ChlorideJohnSmithNo ratings yet

- April 2013 Electronics Engineer Licensure ExaminationDocument13 pagesApril 2013 Electronics Engineer Licensure ExaminationRobert SatorreNo ratings yet

- Calculating Relative Permittivity PDFDocument12 pagesCalculating Relative Permittivity PDFMark Emerson BernabeNo ratings yet

- PMT-MS-018 Rev.00 - Method of Statement For Chpping and Coring WworksDocument4 pagesPMT-MS-018 Rev.00 - Method of Statement For Chpping and Coring Wworksromeo arazaNo ratings yet

- RTI Brochure ProRox GRP 1000 - Int ENG (19-02-2016) PDFDocument8 pagesRTI Brochure ProRox GRP 1000 - Int ENG (19-02-2016) PDFTheophilus ThistlerNo ratings yet

- Cisco Data Center Network Architecture and Solutions OverviewDocument19 pagesCisco Data Center Network Architecture and Solutions OverviewEdiga VenkatadriNo ratings yet

- S10332200-3001 Electrical Engineering StandardDocument64 pagesS10332200-3001 Electrical Engineering Standardappril26No ratings yet

- Applications of Venturi Principle To Water Aeration SystemsDocument17 pagesApplications of Venturi Principle To Water Aeration SystemsCarlos CavalcanteNo ratings yet

- DRAWINGDocument20 pagesDRAWINGhai LinNo ratings yet

- Suspensions STOUGHTON - HOLLANDDocument50 pagesSuspensions STOUGHTON - HOLLANDgestada023No ratings yet

- P630 DemoDocument71 pagesP630 DemoIlaiyaa RajaNo ratings yet

- Model1 EDDocument2 pagesModel1 EDskrtamilNo ratings yet

- Berghof CPU RebootingDocument5 pagesBerghof CPU RebootingDinesh Kumar GowdNo ratings yet

- 73-Article Text-373-1-10-20210527Document20 pages73-Article Text-373-1-10-20210527Pascal RivandiNo ratings yet

- Sentiment Analysis A Solution Overview: Technology ArchivesDocument3 pagesSentiment Analysis A Solution Overview: Technology ArchivessamrakNo ratings yet

- Glass KilnsDocument16 pagesGlass Kilnsspaceskipper100% (1)

- ChartsDocument8 pagesChartsSteveDamianNo ratings yet

- What Is ESS and MSS?: Explain Briefly The Process/functionality and The Distinction Between ESS and MSSDocument3 pagesWhat Is ESS and MSS?: Explain Briefly The Process/functionality and The Distinction Between ESS and MSSmurali4983No ratings yet

- Kitz DJ E-234-03 PDFDocument16 pagesKitz DJ E-234-03 PDFYudi KurniawanNo ratings yet

- Castapress MSDSDocument3 pagesCastapress MSDSOskar DrabikowskiNo ratings yet

- Landing GearDocument20 pagesLanding GearKumaraShanNo ratings yet

- Crack Instructions (Windows)Document8 pagesCrack Instructions (Windows)আংশিক বিকৃত মস্তিষ্কNo ratings yet

- Research and Application of Ajax TechnologyDocument18 pagesResearch and Application of Ajax TechnologySachin Ganesh ShettigarNo ratings yet

- ShedgeometryDocument49 pagesShedgeometryArtisic oneNo ratings yet

- Traditional Bidet 5065.040 For Deck-Mounted Fitting (Illustrated)Document1 pageTraditional Bidet 5065.040 For Deck-Mounted Fitting (Illustrated)ren salazarNo ratings yet

- 501 453 Universal ColdFlowDocument2 pages501 453 Universal ColdFlowRavi VarmaNo ratings yet

Public Works Agenda

Public Works Agenda

Uploaded by

Sarah BennettOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Public Works Agenda

Public Works Agenda

Uploaded by

Sarah BennettCopyright:

Available Formats

Town of Highland Park, Texas

PUBLIC WORKS COMMITTEE

A G E N D A

8:00 AM

July 24, 2014

400 !rexel !ri"e

#xe$u%i"e &onferen$e 'oo(

A. Review a request from the Highland Park Independent School District to

amend the Comprehensive Site Plan for radfield !lementar"

School# $%&& Southern Avenue# to allow construction of a tool shed on

the northwest side of the school 'uilding.

. Review amending the (own of Highland Park)s Drought Contingenc"

Plan.

C. Review and discuss the Proposed udget for *iscal +ear ,&-$.-/.

**THIS MEETING IS OPEN TO THE PUBLIC. ACCORDINGLY, TOWN COUNCIL MEMBERS WHO

ARE NOT APPOINTED TO THE PUBLIC WORKS COMMITTEE MAY ATTEND. IN SUCH INSTANCE

AND PURSUANT TO SECTION 551.001 ET SEQ. OF THE TEXAS GOVERNMENT CODE, THERE

WOULD NECESSARILY BE A MEETING OF THE TOWN COUNCIL, AS THAT WORD IS DEFINED

IN SECTION 551.001!"#. THEREFORE, PROPER NOTICE FOR THIS POTENTIAL TOWN COUNCIL

MEETING IS PROVIDED HEREIN.**

SPECIAL ACCOMMODATIONS FOR TOWN COUNCIL MEETINGS

Let us know if you need spei!" !ssist!ne of !ny kind#

P"e!se ont!t t$e Town of %i&$"!nd P!'k Ad(inist'!ti)e st!ff !t *+,-. /+,0-,1,

2345 !#(# to -345 p#(#6 Mond!y t$'ou&$ F'id!y.

TITLE

Review a request from the Highland Park Independent School District to amend the Comprehensive Site Plan

for Bradfield Elementar School! "#$$ Southern %venue! to allow construction of a tool shed on the northwest

side of the school &uilding'

BACKGROUND

(n )a *+! +$*"! the ,own Council approved a request from the Highland Park Independent School District

-the .District./ for an amendment to the Comprehensive Site Plan for Bradfield Elementar School

-.Bradfield./! "#$$ Southern %venue! to allow construction of an outdoor learning garden -the .0arden./' ,he

,own Council specificall conditioned its approval of the request & removing a tool shed -the .,ool Shed./ and

referring that component to the 1oning Commission for its review and recommendation'

Bradfield is located in a Planned Development -.PD./ 2oning district with a Comprehensive Site Plan as a

component of the PD' )odifications to the PD or its components require approval & the ,own Council'

(n )a +3! +$*"! the 1oning Commission conducted a pu&lic hearing and unanimousl recommended approval

of the ,ool Shed conditioned upon4 -i/ ma5imum dimensions of si5 feet deep & eight feet wide! and ten feet!

one inch high -67 5 37 5 *$8 *./! with a shed roof9 and -ii/ the e5terior walls &eing finished with a painted siding

to match the color of the school &uilding7s e5terior' ,he 1oning Commission questioned the si2e and height of

the ,ool Shed! which the District su&stantiated' :ollowing a discussion regarding its composition of &rick or

siding! the District and the Commission agreed that painted siding would &e the material &est suited for the ,ool

Shed' % total of fift eight -;3/ propert owners within two hundred feet -+$$7/ of Bradfield were notified of the

pu&lic hearing' ,he ,own received no written comments in favor of or in opposition to the request' <o pu&lic

comments in favor of or in opposition to the request were given at the 1oning Commission hearing'

,he ,ool Shed is further defined within the attached proposed ordinance' )rs' Christine Brunner!

Principal! Bradfield Elementar School! and )s' Shawn Bookout! RE%= School 0ardens! will attend the

meeting to offer a presentation on this request and answer questions'

% pu&lic hearing is scheduled at "4$$ p'm'! on )onda! >ul +3! +$*"! for the ,own Council to4 -i/ receive the

1oning Commission7s recommendation9 -ii/ receive pu&lic input9 and -iii/ consider final action' If approved! an

ordinance is required to amend the Comprehensive Site Plan! and to amend Section +6?*$$ of the ,own8s 1oning

(rdinance to list this PD amendment within the ,own8s 1oning (rdinance'

RECOMMENDATION

,he staff recommends approval'

TOWN OF HIGHLAND PARK

Agenda Briefing

Committee )eeting4 >ul +"! +$*"

Department4 Building Inspection

Director4 Ronnie Brown

FINANCIAL IMPACT

<one

%,,%CH)E<,S4

:ile <ame Description

4300_Southern_-_Request_and_Plans.pdf 4300 Southern - Request and Plans

4300_Southern_-_Notice.pdf 4300 Southern - Notice

4300_Southern_-_Ordinance.pdf Proposed Ordinance

Amendment_to_Site_Plan_-_4300_Southern_-

_Bradfield_lementar!_School_"-#$-#0%4.pdf

&raft of 'inutes of the (onin) *ommission 'eetin)

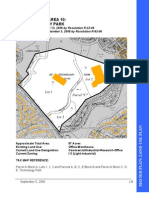

Requisite 200-ft Public Notification Area

(Zoning Commission)

TOWN OF HIGHLAND PARK

PUBLIC HEARING

The Town Council will conduct a public hearing at 4:00 p.m. on Monday, J uly 28, 2014,

4700 Drexel Drive, Highland Park, Texas, to: (i) receive public comments regarding a request

from the Highland Park Independent School District to allow construction of a tool shed on the

northwest side of Bradfield Elementary School, 4300 Southern Avenue; and (ii) receive a

recommendation from the Zoning Commission regarding this request.

For additional information, contact Kirk Smith at (214) 521-4161 or ksmith@hptx.org. All

interested parties are invited.

Page 1 of 2

ORDINANCE NO.

AN ORDINANCE OF THE TOWN COUNCIL OF THE TOWN OF HIGHLAND PARK,

TEXAS (TOWN) AMENDING ORDINANCE NO. 1308, SECTION 2, AS AMENDED,

WHICH CREATED A PLANNED DEVELOPMENT DISTRICT FOR BRADFIELD

ELEMENTARY SCHOOL, AMENDING CHAPTER 14 ZONING, SECTION 26 LIST

OF SPECIFIC USE PERMITS, PLANNED DEVELOPMENTS AND COMBINED

BUILDING SITES, OF THE TOWNS CODE OF ORDINANCES, TO ALLOW

CONSTRUCTION OF A TOOL SHED LOCATED WITHIN THE INTEGRATED LEARNING

GARDEN ON THE NORTHWEST SIDE OF THE SCHOOL BUILDING; PROVIDING A

VALIDITY CLAUSE; PROVIDING A SEVERABILITY CLAUSE; PROVIDING FOR

INCORPORATION INTO THE CODE OF ORDINANCES; AND PROVIDING AN

EFFECTIVE DATE.

WHEREAS, the Bradfield Elementary School Campus, Block 150, Highland Park West

Addition, Second Installment to the Town of Highland Park, Dallas County, Texas, is a Planned

Development with a comprehensive site plan adopted under Ordinance No. 1308 by the Town

Council on J une 5, 1995; and

WHEREAS, on May 12, 2014, the Town Council reviewed and approved the Integrated

Learning Garden with the exception of a tool shed feature, which was omitted from the Garden

Improvements, and was referred to the Zoning Commission for a review and recommendation;

and

WHEREAS, on May 28, 2014, the Zoning Commission conducted a public hearing and

unanimously recommended approval of the tool shed feature conditioned upon: (i) dimensions

of six feet deep by eight feet wide (6 x 8), with a shed roof measuring ten feet, one inch (10' 1")

above the ground, and (ii) the exterior walls being finished with a painted siding to match the

color of the school buildings exterior; and

WHEREAS, Chapter 14, Zoning, of the Code of Ordinances of the Town of Highland Park,

Texas, is also known as the Towns Zoning Ordinance;

NOW, THEREFORE, BE IT ORDAINED BY THE TOWN COUNCIL OF THE TOWN OF

HIGHLAND PARK, TEXAS:

SECTION 1. That, Ordinance No. 1308, Section 2, is hereby amended to provide for

construction of a tool shed measuring six feet deep by eight feet wide (6 x 8), with a single

sloped shed roof measuring ten feet, one inch (10 1) above the ground, to be located adjacent

to the northwest exterior wall of the school building, the walls of which are to be finished with a

painted siding to match the color of the school buildings exterior.

SECTION 2. That, Chapter 14 Zoning, Section 26, List of Specific Use Permits, Planned

Developments and Combined Building Sites, 26-100 of the Town's Zoning Ordinance, is

hereby amended to add:

Page 2 of 2

PD Ordinance No. ____ - Amending PD for Bradfield Elementary School to allow construction

of a tool shed measuring six feet deep by eight feet wide (6 x 8), with a single sloped shed roof

measuring ten feet, one inch (10 1) above the ground, to be located adjacent to the northwest

exterior wall of the school building, the walls of which are to be finished with a painted siding to

match the color of the school buildings exterior.

SECTION 3. Validity. That, all ordinances of the Town of Highland Park in conflict with the

provisions of this ordinance be, and the same are hereby superseded and all other provisions of

the ordinances of the Town of Highland Park not in conflict with the provisions of this ordinance

shall remain in full force and effect.

SECTION 4. Severability. That, should any paragraph, sentence, clause, phrase, or word of this

ordinance be declared unconstitutional or invalid for any reason, the remainder of this ordinance

shall not be affected.

SECTION 5. Incorporation. That, this ordinance shall be deemed to be incorporated into the

Code of Ordinances of the Town of Highland Park, Texas.

SECTION 6. Effective Date. That, this ordinance shall take effect immediately following its

passage, approval and publication as provided by law, and it is accordingly so ordained.

PASSED AND APPROVED this the 28th day of J uly, 2014.

APPROVED AS TO FORM: APPROVED:

Matthew C.G. Boyle J oel T. Williams, III

Town Attorney Mayor

ATTEST:

Gayle Kirby

Town Secretary

DRAFT

Page 1 of 3

MINUTES OF A MEETING OF THE ZONING COMMISSION OF THE TOWN OF HIGHLAND

PARK, TEXAS HELD AT THE TOWN HALL, 4700 DREXEL DRIVE, ON WEDNESDAY,

MAY 28, 2014, AT 4:00 P.M. TO CONSIDER A REQUEST FROM THE HIGHLAND PARK

INDEPENDENT SCHOOL DISTRICT TO AMEND THE SITE PLAN OF BRADFIELD

ELEMENTARY SCHOOL, 4300 SOUTHERN AVENUE, TO ALLOW CONSTRUCTION OF A

TOOL SHED ADJACENT TO THE NORTH WALL OF THE SCHOOL.

Present at the meeting were: David Dowler, Acting Chairman, and Commission Members Alison

Hunsicker, Rick Jones, and Carolyn Seay.

Acting Chairman Dowler called the meeting to order, introduced the Zoning Commission Members,

and explained the procedure the Commission would follow in considering the request.

Kirk Smith, Development Services Manager, explained that the Town Council originally reviewed a

request from the Highland Park Independent School District (the District) to amend the site plan

at Bradfield Elementary School (Bradfield) to allow construction of an exterior integrated

learning garden on its campus. In the course of its review and as a condition of its approval, the

Council removed the tool shed for a review and recommendation by the Zoning Commission. Mr.

Smith described three options for the storage building:

Option 1: a building composed of wood or of thin brick veneer applied to the wood, with a gable

roof, and a height of eleven feet, ten inches tall (11 10);

Option 2: a building composed of wood or of thin brick veneer applied to the wood, finished in a

color which would match that of the school buildings exterior, with a shed roof, and a

height of ten feet, one inch tall (10 1);

Option 3: a wheeled storage locker.

Photographs depicting the proposed location of the tool shed in relation to Mockingbird Lane and

the adjacent teachers parking lot were shown as part of the presentation.

Acting Chairman Dowler asked if proper notice of the meeting was provided. Gayle Kirby, Town

Secretary, stated that notice was posted on the bulletin boards at Town Hall and on the Towns

website on May 23, 2014. Kirk Smith, Development Services Manager, stated that notice of the

meeting was mailed to property owners within two hundred feet (200) of Town Hall on May 15,

2014.

Christine Brunner, Principal, Bradfield, and Shawn Bookout, REAL School Gardens, offered to

answer any questions the Zoning Commission asked.

In response to questioning by the Zoning Commission, Mr. Smith explained: (i) that the Town

Council sought the recommendation of the Zoning Commission to determine if Option 1 or Option

2 were best, or if a combination of concepts could best serve the community; (ii) that Bradfields

request for a tool shed differed from that of Armstrong Elementary School (Armstrong) because

the tool shed at Armstrong is located in the required front yard and is more visible to its neighbors;

and (iii) that thin brick veneer and wood are both acceptable building materials.

DRAFT

Page 2 of 3

In response to questioning by Acting Chairman Dowler, Christine Brunner stated that Option 1

would provide easier access to stored materials for the teachers and the students. She further stated

that Hardie plank or brick veneer were both suitable.

Acting Chairman Dowler stated his opinion that the shed would serve as a reminder that the

students are doing incredible work and in his opinion, the sheds usefulness is a major issue. He

further stated that he believed a brick veneer finish would better blend in with the area.

The Zoning Commission questioned the durability of wood versus brick veneer, to which Kirk

Smith stated that the Hardie Plank composition would likely require less maintenance. Alison

Hunsicker asked to compare of the visibility of the Armstrong Tool Shed and the Bradfield Tool

Shed, to which Mr. Smith explained that the Armstrong Tool Shed is more visible because its grade

is elevated; the Bradfield Tool Sheds visibility would be diminished because Bradfields grade is

not elevated. In response to questions pertaining to the size of the Tool Shed, Shawn Bookout

explained that she had not seen drawings for the Armstrong Tool Shed, but the size of Bradfields

Tool Shed is needed to accommodate storage of a wheelbarrow, tools, and all the materials and

supplies the utilized by the students, as well as to provide protection from weather. Additionally,

Ms. Bookout stated that the Tool Shed must be tall enough to allow students and teachers to walk in

without hitting their heads; wheeled storage lockers would not be as useful. In response to further

questions, Ms. Bookout explained that the Tool Shed would be set on concrete, and the sloped shed

roof was purposed to allow water to drain from the roof, while providing a lower profile.

In response to questions regarding the care and maintenance of the Tool Shed and the Garden

during summer and other school breaks, Christine Brunner explained that committees of Bradfield

staff members would oversee the irrigation and composting of the Garden. She further explained

that the irrigation system would be controlled by timers. In response to questioning by Rick Jones,

Ms. Brunner explained that a sun study would be conducted, and that what is planted would

depend upon the season. She further explained that every component of the Garden is planned to be

a learning element.

Acting Chairman Dowler asked if any letters were received in favor of the request. Kirk Smith

responded that no letters were received in favor of the request.

Acting Chairman Dowler asked if anyone wished to speak in favor of the request, to which there

was no response.

Acting Chairman Dowler asked if any letters were received in opposition to the request, to which

Kirk Smith responded that no letters were received in opposition to the request.

Acting Chairman Dowler asked if anyone in the audience wished to speak in opposition to the

request, to which there was no response.

Acting Chairman Dowler asked for comments by the Zoning Commission, and began the discussion

by stating that the utility of the Tool Shed seems to be more important that its size. Carolyn Seay

voiced her agreement, and asked what is located east of the Garden. Christine Brunner stated that

the wall of the gymnasium is immediately east, and beyond are dumpsters and ramps to the

cafeteria. In response to questioning by Alison Hunsicker, Kirk Smith stated that the Tool Shed

would be located in the center of the back of the Garden, against the school building. Christine

Brunner verified that the Tool Shed wall would not extend beyond the school building.

DRAFT

Page 3 of 3

Acting Chairman Dowler asked for further comments and discussion by the Zoning Commission, to

which there was no response.

Acting Chairman Dowler closed the public hearing.

On a motion by Carolyn Seay, seconded by Rick Jones, the Zoning Commission voted unanimously

to recommend approval of construction of a Tool Shed adjacent to the north wall of the Bradfield

Elementary School building, as depicted in Option 1, being a wood-sided building with a shed roof,

and a height of ten feet, one inch tall (10 1), to be finished in a color to match the schools brick

exterior.

Kirk Smith stated that the Town Council will conduct a public hearing on Monday, July 28, 2014,

to receive the recommendation of the Zoning Commission and consider final action on the zoning

request.

There being no further business to come before the Zoning Commission, the meeting was adjourned

at 4:28 p.m.

APPROVED on this ____th day of July, 2014.

By:

David Dowler

Acting Chairman

ATTEST:

Gayle Kirby

Town Secretary

TITLE

Review amending the Town of Highland Parks Drought Contingency Plan.

BACKGROUND

The Town of Highland Park (the Town! u"dated its Drought Contingency Plan (the Plan! on #"ril$ %&$ %'()$

to com"ly with the Te*as Commission on +nvironmental ,uality (-TC+,-!.s re/uirements that all water

su""liers have current water conservation and drought contingency measures to su""ort the 0tate 1ater

Plan. The Town annually initiates time2of2day watering restrictions from #"ril ( to 3cto4er 5($ during the

higher water use months. 3utdoor watering e*ce"t 4y hand2held hoses$ soaker hoses$ and6or dri"24u44lers

is "rohi4ited 4etween ('7'' a.m. and 87'' ".m. any day of the week. The staff continues to review 4est2"ractice

strategies to manage the use of water 4y the Town.s customers.

3n 9uly (&$ %'()$ following a ma:or rain event in the general watershed area of ;ake <ra"evine (the -;ake-! the

day 4efore$ the ;ake was re"orted 4eing ('.=) feet (85> full! 4elow its "ool level of =5= feet elevation. ?or

com"arison "ur"oses$ the ;ake was only 8.@ feet (A)> full! 4elow its "ool level the same "eriod last year$ and &

feet 4elow its "ool level the same date in %'(%. The forecast for the Borth Te*as region is continued drought

conditions through "otentially the ne*t decade.

The Town.s current 0tage C re/uirements "rovide for via4le alternative water su""ly strategies that allow

fle*i4ility to modify the e*isting Plan. Cn addition to the current 0tage C restrictions$ the following alternative

strategies are identified to 4e incor"orated$ effective on 0e"tem4er ($ %'()$ as "art of 0tage C re/uirements7

;imit outdoor watering or irrigation to 0undays and Thursdays for street addresses ending in an even

num4er$ and 0aturdays and 1ednesdays for street addresses ending in odd num4ers. Bon2residential

customers$ including a"artments$ 4usinesses$ "arks$ and common areas$ can water only on Tuesdays and

?ridays. Bo watering would 4e allowed on Dondays.

#llowing outdoor watering 4y hand2held hoses$ soaker hoses$ and dri"64u44lers 4etween ('7'' a.m. and

87'' ".m. any day of the week.

+*ce"tions to the watering day and time "rovisions shall 4e allowed for7 (! areas associated with "u4lic

safety$ as determined 4y the Town.s De"artment of Pu4lic 0afety$ may 4e watered to maintain safe useE %!

foundations and new "lantings (first year! of trees and shru4s may 4e hand2watered u" to two hours on any

day using a hose e/ui""ed with a "ositive shutoff valve$ soaker hose$ or a hand2held 4ucket or watering

canE 5! irrigating during the re"air or testing of a new or e*isting irrigation systemE or )! using water

singularly or in com4ination from a source other than the Town.s water system.

The Develo"ment 0ervices Danager is authoriFed to a""rove e*em"tions for "ro"erties where it is

TOWN OF HIGHLAND PARK

Agenda Briefing

Committee Deeting7 9uly %)$ %'()

De"artment7 Town 0ervices

Director7 Ronnie Grown

demonstrated that the need of outdoor watering is necessary to "rotect "articular "ro"erty im"rovements

such as swimming "ools$ foundations$ etc.

Prohi4it over2seeding with cool season grasses.

Prohi4it hydro2mulching e*ce"t for new construction6erosion control.

Prohi4it watering which results in water flowing off2site from the lot 4eing watered.

RECOMMENDATION

The staff recommends a""roval of an ordinance amending the Drought Contingency Plan to incor"orate

restrictions to time2of2day and week for outdoor watering and irrigation as a com"onent of 0tage C.

FINANCIAL IMPACT

The staff will monitor any fluctuations in water use for "ossi4le im"acts to the revenue in the Htility ?und.

#TT#CHD+BT07

?ile Bame Descri"tion

Supplementing_Drought_Contingency_Plan_-_7-28-2014.docx Propoed !rdinance

"ater_Coner#ation_$rie%ing_-_Sample_&etter.docx Sample &etter

Page 1 of 3

ORDINANCE NO.

AN ORDINANCE OF THE TOWN COUNCIL OF THE TOWN OF HIGHLAND PARK,

TEXAS (TOWN! A"ENDING THE TOWN#S DROUGHT CONTINGENC$ PLAN%

PRO&IDING A &ALIDIT$ CLAUSE% PRO&IDING A SE&ERA'ILIT$ CLAUSE%

PRO&IDING FOR INCORPORATION INTO THE CODE OF ORDINANCES% AND

PRO&IDING AN EFFECTI&E DATE.

WHEREAS, ()e To*+ Co,+-./ a001o2e3 ()e D1o,g)( Co+(.+ge+-4 P/a+ (()e P/a+! *.() ()e

a3o0(.o+ of O13.+a+-e No. 1561% a+3

WHEREAS, ()e To*+ Co,+-./ 1e-og+.7e8 ()a( +a(,1a/ /.9.(a(.o+8 3,e (o 31o,g)( -o+3.(.o+8 a+3

o()e1 a-(8 of Go3 -a++o( g,a1a+(ee a+ ,+.+(e11,0(e3 *a(e1 8,00/4 fo1 a// 0,10o8e8% a+3

WHEREAS, ()e To*+ Co,+-./ *.8)e8 (o a9e+3 a+3 ,03a(e ()e P/a+ (o e+)a+-e ()e a2a./a:/e

8afeg,a138 (o 01o(e-( ()e To*+#8 0o(a:/e *a(e1 8,00/4% a+3

WHEREAS, a// -o+8(.(,(.o+a/, 8(a(,(o14, a+3 /ega/ 01e1e;,.8.(e8 fo1 ()e 0a88age of ().8

o13.+a+-e )a2e :ee+ 9e(, .+-/,3.+g :,( +o( /.9.(e3 (o ()e O0e+ "ee(.+g8 A-(% a+3

WHEREAS, ()e To*+ .8 a Ho9e R,/e 9,+.-.0a/.(4 )a2.+g f,// 0o*e18 of 8e/f<go2e1+9e+( a+3

9a4 e+a-( o13.+a+-e8 1e/a(.2e (o .(8 -.(.7e+8# )ea/(), 8afe(4, a+3 *e/fa1e ()a( a1e +o( .+-o+8.8(e+(

*.() ()e Co+8(.(,(.o+ a+3 /a*8 of ()e S(a(e of Te=a8% a+3

WHEREAS, ()e To*+ Co,+-./ )a8 3e(e19.+e3 ()a( .( .8 .+ ()e :e8( .+(e1e8( of ()e )ea/(), 8afe(4,

a+3 *e/fa1e of ()e 0,:/.- (o a3o0( ().8 o13.+a+-e%

NOW, THEREFORE, 'E IT ORDAINED '$ THE TOWN COUNCIL OF THE TOWN OF

HIGHLAND PARK, TEXAS>

SECTION 1. T)a(, a// 9a((e18 8(a(e3 )e1e.+a:o2e a1e fo,+3 (o :e (1,e a+3 -o11e-( a+3 a1e

.+-o10o1a(e3 )e1e.+ :4 1efe1e+-e a8 .f -o0.e3 .+ ()e.1 e+(.1e(4.

SECTION ?. T)a(, ()e P/a+ .8 )e1e:4 a9e+3e3 (o a33 ()e fo//o*.+g e/e9e+(8 (o S(age I

9ea8,1e8>

L.9.( o,(3oo1 *a(e1.+g o1 .11.ga(.o+ (o S,+3a4 a+3 T),183a4 fo1 8(1ee( a331e88e8 e+3.+g

.+ a+ e2e+ +,9:e1, a+3 Sa(,13a4 a+3 We3+e83a4 fo1 8(1ee( a331e88e8 e+3.+g .+ o33

+,9:e18. No+<1e8.3e+(.a/ -,8(o9e18, .+-/,3.+g a0a1(9e+(8, :,8.+e88e8, 0a1@8 a+3

-o99o+ a1ea8, -a+ *a(e1 o+/4 o+ T,e83a4 a+3 F1.3a48. No *a(e1.+g a//o*e3 o+

"o+3a48.

A//o*.+g o,(3oo1 *a(e1.+g :4 )a+3<)e/3 )o8e8, 8oa@e1 )o8e8, a+3 31.0A:,::/e1 :e(*ee+

1B>BB a.9. a+3 C>BB 0.9. a+4 3a4 of ()e *ee@.

Page ? of 3

E=-e0(.o+8 (o ()e *a(e1.+g 3a4 a+3 (.9e 01o2.8.o+8 8)a// :e a//o*e3 fo1> 1! a1ea8

a88o-.a(e3 *.() 0,:/.- 8afe(4, a8 3e(e19.+e3 :4 ()e To*+#8 De0a1(9e+( of P,:/.- Safe(4,

9a4 :e *a(e1e3 (o 9a.+(a.+ 8afe ,8e% ?! fo,+3a(.o+8 a+3 +e* 0/a+(.+g8 (f.18( 4ea1! of

(1ee8 a+3 8)1,:8 9a4 :e )a+3<*a(e1e3 ,0 (o (*o )o,18 o+ a+4 3a4 ,8.+g a )o8e e;,.00e3

*.() a 0o8.(.2e 8),(off 2a/2e, 8oa@e1 )o8e, o1 a )a+3<)e/3 :,-@e( o1 *a(e1.+g -a+% 3!

.11.ga(.+g 3,1.+g ()e 1e0a.1 o1 (e8(.+g of a +e* o1 e=.8(.+g .11.ga(.o+ 848(e9% o1 D! ,8.+g

*a(e1 8.+g,/a1/4 o1 .+ -o9:.+a(.o+ f1o9 a 8o,1-e o()e1 ()a+ ()e To*+#8 *a(e1 848(e9.

T)e De2e/o09e+( Se12.-e8 "a+age1 .8 a,()o1.7e3 (o a001o2e e=e90(.o+8 fo1 01o0e1(.e8

*)e1e .( .8 3e9o+8(1a(e3 ()a( ()e +ee3 of o,(3oo1 *a(e1.+g .8 +e-e88a14 (o 01o(e-(

0a1(.-,/a1 01o0e1(4 .901o2e9e+(8 8,-) a8 8*.99.+g 0oo/8, fo,+3a(.o+8, e(-.

P1o).:.( o2e1<8ee3.+g *.() -oo/ 8ea8o+ g1a88e8.

P1o).:.( )431o<9,/-).+g e=-e0( fo1 +e* -o+8(1,-(.o+Ae1o8.o+ -o+(1o/.

P1o).:.( *a(e1.+g *).-) 1e8,/(8 .+ *a(e1 f/o*.+g off<8.(e f1o9 ()e /o( :e.+g *a(e1e3.

SECTION 3. T)a(, ()e To*+ Co,+-./ 3oe8 )e1e:4 f.+3 a+3 3e-/a1e ()a( 8,ff.-.e+( *1.((e+ +o(.-e

of ()e 3a(e, )o,1, 0/a-e, a+3 8,:Ee-( of ()e 9ee(.+g a3o0(.+g ().8 o13.+a+-e *a8 0o8(e3 a( a

3e8.g+a(e3 0/a-e -o+2e+.e+( (o ()e 0,:/.- fo1 ()e (.9e 1e;,.1e3 :4 /a* 01e-e3.+g ()e 9ee(.+g,

()a( 8,-) 0/a-e of 0o8(.+g *a8 1ea3./4 a--e88.:/e a( a// (.9e8 (o ()e ge+e1a/ 0,:/.-, a+3 ()a( a// of

()e fo1ego.+g *a8 3o+e a8 1e;,.1e3 :4 /a* a( a// (.9e8 3,1.+g *).-) ().8 o13.+a+-e a+3 ()e

8,:Ee-( 9a((e1 ()e1eof )a8 :ee+ 3.8-,88e3, -o+8.3e1e3, a+3 fo19a//4 a-(e3 ,0o+. T)e To*+

Co,+-./ f,1()e1 1a(.f.e8, a001o2e8, a+3 -o+f.198 8,-) *1.((e+ +o(.-e a+3 ()e 0o8(.+g ()e1eof.

SECTION D. T)a(, ()e To*+ A39.+.8(1a(o1 o1 ).8 3e8.g+ee .8 )e1e:4 3.1e-(e3 (o f./e a -o04 of

()e a9e+3e3 P/a+ a+3 ().8 o13.+a+-e *.() ()e Te=a8 Co99.88.o+ o+ E+2.1o+9e+(a/ F,a/.(4 .+

a--o13a+-e *.() T.(/e 3B, C)a0(e1 ?GG of ()e Te=a8 A39.+.8(1a(.2e Co3e.

SECTION 6. T)a(, ()e To*+ Se-1e(a14 .8 )e1e:4 a,()o1.7e3 a+3 3.1e-(e3 (o -a,8e 0,:/.-a(.o+ of

()e 3e8-1.0(.2e -a0(.o+ of ().8 o13.+a+-e a8 01o2.3e3 :4 /a*.

SECTION C. Pe+a/(4. T)a(, a+4 0e18o+, f.19, o1 -o10o1a(.o+ 2.o/a(.+g a+4 of ()e 01o2.8.o+8 o1

(e198 of ().8 o13.+a+-e, 8)a// :e 8,:Ee-( (o ()e 0e+a/(4 01o2.8.o+8 of Se-(.o+ 1.B1.BB5 of ()e Co3e

of O13.+a+-e8 of ()e To*+ of H.g)/a+3 Pa1@, Te=a8, a8 a9e+3e3 a+3Ao1 3.8-o+(.+,a+-e of *a(e1

8e12.-e :4 ()e To*+. P1oof of a -,/0a:/e 9e+(a/ 8(a(e .8 +o( 1e;,.1e3 fo1 a -o+2.-(.o+ of a+

offe+8e ,+3e1 ().8 8e-(.o+. Ea-) 3a4 a -,8(o9e1 fa./8 (o -o90/4 *.() ()e D1o,g)( Co+(.+ge+-4

P/a+ .8 a 8e0a1a(e 2.o/a(.o+. T)e To*+#8 a,()o1.(4 (o 8ee@ .+E,+-(.2e o1 o()e1 -.2./ 1e/.ef

a2a./a:/e ,+3e1 ()e /a* .8 +o( /.9.(e3 :4 ().8 8e-(.o+.

SECTION H. &a/.3.(4. T)a(, a// o13.+a+-e8 of ()e To*+ of H.g)/a+3 Pa1@ .+ -o+f/.-( *.() ()e

01o2.8.o+8 of ().8 D1o,g)( Co+(.+ge+-4 P/a+ o13.+a+-e :e, a+3 ()e 8a9e a1e )e1e:4 8,0e18e3e3

a+3 a// o()e1 01o2.8.o+8 of ()e o13.+a+-e8 of ()e To*+ of H.g)/a+3 Pa1@ +o( .+ -o+f/.-( *.() ()e

01o2.8.o+8 of ().8 o13.+a+-e 8)a// 1e9a.+ .+ f,// fo1-e a+3 effe-(.

Page 3 of 3

SECTION G. Se2e1a:./.(4. T)a(, 8)o,/3 a+4 0a1ag1a0), 8e+(e+-e, -/a,8e, 0)1a8e o1 *o13 of ().8

o13.+a+-e :e 3e-/a1e3 ,+-o+8(.(,(.o+a/ o1 .+2a/.3 fo1 a+4 1ea8o+, ()e 1e9a.+3e1 of ().8 o13.+a+-e

8)a// +o( :e affe-(e3.

SECTION 5. I+-o10o1a(.o+. T)a(, ().8 o13.+a+-e 8)a// :e 3ee9e3 (o :e .+-o10o1a(e3 .+(o ()e

Co3e of O13.+a+-e8 of ()e To*+ of H.g)/a+3 Pa1@, Te=a8.

SECTION 1B. Effe-(.2e Da(e. T)a(, ().8 o13.+a+-e 8)a// (a@e effe-( Se0(e9:e1 1, ?B1D, a+3 .( .8

a--o13.+g/4 8o o13a.+e3.

PASSED AND APPRO&ED ().8 II 3a4 of J,/4, ?B1D.

APPRO&ED AS TO FOR"> APPRO&ED>

"a(()e* C. G. 'o4/e Joe/ T. W.//.a98, III

To*+ A((o1+e4 "a4o1

ATTEST>

Ga4/e K.1:4

To*+ Se-1e(a14

August __, 2014

Dear Residents:

The Town Council recently amended its Town Drought Contingency Plan to include a limitation

or the day and time!o!day or outdoor watering and irrigation" #ecti$e %e&tem'er 1, 2014,

residential customers are all restricted to:

outdoor watering or irrigation on %unday and Thursday or street addresses ending in an

e$en num'er, and %aturday and (ednesday or street addresses ending in an e$en

num'er) no watering is allowed on *ondays)

non!residential customers, including a&artments, 'usinesses, &ar+s, and common areas,

can water only on Tuesday and ,ridays)

residents may a&&eal or an e-em&tion to the De$elo&ment %er$ices *anager or

concerns o using outdoor water to &rotect structures)

continue limitation or outdoor watering 'y hand!held hoses, soa+er hoses, and

dri&.'u''ler 'etween /:00 &"m" and 10:00 a"m" any day o the wee+"

#nclosed with this letter is a 0uic+ summary o hel&ul inormation to 'etter manage our

indi$idual water use at home" Additional inormation on the Town1s water conser$ation

&rogram is a$aila'le at www"h&t-"org 'y clic+ing 2(ater Conser$ation3 under the ta' 24earn

A'out3 ound under the category 25ow Do 63 on the ront &age o the we'site"

As a natural resource, water is essential to our community and our 0uality o lie" The current

drought demands that we in$est the time to ta+e water conser$ation more seriously" (hile

'lessed with long!range &lanning or water su&&ly o$er 70 years ago, we now see the &rolonged

im&acts o the ongoing draught to 4a+e 8ra&e$ine and its la+e le$el" 9ur draw on water rom

the la+e, and the shortage o rainall these last ew years are 'eginning to ta+e their toll on the

water le$el o the la+e"

6 loo+ orward to your acti$e su&&ort and &artici&ation in continuing to a&&reciate and saeguard

4a+e 8ra&e$ine and the drin+ing water it &ro$ides, as we ha$e all en:oyed o$er the years"

%incerely,

;oel T" (illiams, 666

*ayor

%et irrigation system timers to com&lete the cycle 'eore 4:00 a"m" This timing will a$oid the

&ea+ demand or other household uses !! li+e showers, +itchen chores and the use o laundry

a&&liances"

<rie watering does not allow water to saturate through the to& grass matt layer and reach roots"

A$oid light, daily watering" Dee& watering is the 'est or good root and grass de$elo&ment"

(ait as long as &ossi'le 'etween watering to allow the root =one to dry out, which encourages

dee&er roots and there'y drought tolerance

>now your soils and their water holding ca&acity" Don?t a&&ly water aster than the soil can

a'sor' it" %oils with slow water iniltration @clay, com&acted soilsA can only ta+e 'rie watering

without runo occurring"

%andy soils dry out aster than clay soils"

,ertili=e såly !! the more ertili=er a&&lied, the more water re0uired"

Consider using organic, slow!release ertili=ers" 6norganic ertili=ers ha$e to 'e 'ro+en down 'y

soil micro'es and con$erted to a orm &lants can use" Thereore organic ertili=ers do not deli$er

too much nitrogen to the grass at one time!also less susce&ti'le to leaching into ground water"

5igh nitrogen, water solu'le ertili=ers cause a'normal cell growth o grass ma+ing it more

susce&ti'le to diseases such as 'rown &atch" 5igh B ertili=ers leach into ground water"

(atering in the heat o day can waste u& to /C &ercent o the water through e$a&oration"

*ow only when necessary" %et the mower to the highest setting during warm weather" 4onger

grass +ee&s the soil cool, minimi=ing e$a&oration and conser$ing water"

4ea$e cli&&ings on the lawn" They su&&ly organic matter and su&&ly 1.D o your ertili=er needs"

Add E to F inch com&ost to lawn in all or s&ring" 6t will decrease water needs and su&&ly

nutrients to the lawn"

Don?t water :ust to 'e watering" 6 it has rained an inch in the last ew days, don?t water"

TITLE

Review and discuss the Proposed Budget for Fiscal Year 2014-15.

BACKGROUND

ccording to the !own "harter# each $ear the !own d%inistrator is re&uired to su'%it a proposed 'udget for

the ensuing fiscal $ear not later than thirt$ ()0* da$s prior to the end of the current fiscal $ear to the !own

"ouncil for its review# consideration# and revision if desired. !he "ouncil shall call a pu'lic hearing or hearings

on the 'udget. !he "ouncil %a$ adopt the 'udget with or without a%end%ent. +n a%ending the 'udget# it %a$

add or increase progra%s or a%ounts and %a$ delete or decrease an$ progra%s or a%ounts# e,cept e,penditures

re&uired '$ law# or for de't service# or for esti%ated cash deficit# provided that no a%end%ent to the 'udget shall

increase the authori-ed e,penditures to an a%ount greater than the total of esti%ated inco%e plus funds availa'le

fro% prior $ears.

!he 'udget ulti%atel$ adopted '$ the "ouncil %ust set forth the appropriations for services# functions# and

activities of the various !own depart%ents and agencies# and shall %eet all fund re&uire%ents provided '$

law. +f a 'udget is not adopted '$ the 15th da$ of .epte%'er# the a%ounts appropriated for the current fiscal

$ear shall 'e dee%ed adopted for the ensuing fiscal $ear on a %onth-to-%onth 'asis# with all ite%s in it prorated

accordingl$ until such ti%e as a 'udget for the ensuing fiscal $ear is adopted. !he lev$ of propert$ ta, will 'e

set to e&ual the total current fiscal $ear ta, receipts# unless the ensuing fiscal $ear 'udget is approved '$

.epte%'er 15th of the current fiscal $ear.

RECOMMENDATION

/one.

FINANCIAL IMPACT

!he Proposed Budget for fiscal $ear 2014-15 is attached for review.

TOWN OF HIGHLAND PARK

Agenda Briefing

"o%%ittee 0eeting1 2ul$ 2)# 2014

3epart%ent1 Fiscal 4 5u%an Resources

3irector1 .teven 2. le,ander

!!"506/!.1

File /a%e 3escription

Proposed_Budget_2015_Draft_07212014.pdf FY 2014-15 Proposed Budget

TOWN OF HIGHLAND PARK, TEXAS

ANAMERICANCOMMUNITYMAKINGADIFFERENCE

Fiscal Year 201415 Proposed Budget

Preliminary Draft for Discussion Purposes Only

Proposed FY 2015 Budget

October 1, 2014 September 30, 2015

July 21, 2014

This budget will raise total property taxes versus last

years budget by $713,154, or 7.12%, and of that

amount, $164,489 is tax revenue to be raised from new

property added to the tax roll this year.

This statement is required by HB 3195 of the 80

th

Texas Legislature.

TOWN OF HIGHLAND PARK, TEXAS

PROPOSED COMBINED BUDGET

OPERATING AND CAPITAL

OCTOBER 1, 2014 THROUGH SEPTEMBER 30, 2015

AS SUBMITTED TO

THE MAYOR AND THE TOWN COUNCIL

JOEL T. WILLIAMS III

MAYOR

STEPHEN ROGERS

MAYOR PRO TEM

BOB CARTER

ERIC GAMBRELL

MARGO GOODWIN

JOHN MCKNIGHT

COUNCIL MEMBERS

BILL LINDLEY

TOWN ADMINISTRATOR

STEVEN J. ALEXANDER

DIRECTOR OF ADMINISTRATIVE SERVICES & CFO

JOHN SAMFORD

CONTROLLER

Budget Message

Proposed Budget Memorandum ........................................................................................................................... 1

Combined Summary of Revenues & Expenditures All Funds .......................................................................... 11

Budget Information

Budget Calendar ................................................................................................................................................... 13

Town Charter Section 9.05 Annual Budget ................................................................................................... 16

Statement of Financial Management Policies Related to the Budget Process ..................................................... 17

Ordinance Adopting the Annual Budget .............................................................................................................. 22

Ordinance Adopting the Property Tax Rate ......................................................................................................... 23

Budget Summaries

Combined Budget Summary ................................................................................................................................ 25

Authorized Personnel ........................................................................................................................................... 26

General Fund

Summary Statement of Revenues & Expenditures by Department ..................................................................... 27

Summary Statement of Revenues & Expenditures by Object Class ................................................................... 28

Statement of Revenues ......................................................................................................................................... 29

Department Budgets

Administrative Department ............................................................................................................................ 31

Department of Public Safety .......................................................................................................................... 32

Street Department ........................................................................................................................................... 33

Street Lighting Department ............................................................................................................................ 34

Library Department ........................................................................................................................................ 35

Parks Department ........................................................................................................................................... 36

Swimming Pool Department .......................................................................................................................... 37

Municipal Court Department ......................................................................................................................... 38

Finance Department ....................................................................................................................................... 39

Building Inspection Department .................................................................................................................... 40

Service Center Department ........................................................................................................................... 41

Building Maintenance Department ................................................................................................................ 42

Non Departmental Department ...................................................................................................................... 43

Sanitation Department .................................................................................................................................... 44

Information Technology Department ............................................................................................................. 45

Transfer to Other Funds ................................................................................................................................. 46

TABLE

Utility Fund

Summary Statement of Revenues & Expenses by Department ........................................................................... 47

Summary Statement of Revenues & Expenses by Object Class ......................................................................... 48

Statement of Revenues ......................................................................................................................................... 49

Department Budgets

Administrative Department ............................................................................................................................ 50

Water Department .......................................................................................................................................... 51

Sanitary Sewer Department ............................................................................................................................ 52

Engineering Department ................................................................................................................................ 53

Transfer to Other Funds ................................................................................................................................ 54

Other Funds

Storm Water Drainage Utility Fund

Statement of Revenues & Expenditures ........................................................................................................ 55

Fund Summary .............................................................................................................................................. 56

Equipment Replacement Fund

Statement of Revenues & Expenses ............................................................................................................... 57

Equipment Inventory & Replacement Schedule ............................................................................................ 58

Technology Replacement Fund

Statement of Revenues & Expenses ............................................................................................................... 61

Equipment Replacement Listing .................................................................................................................... 62

Building Maintenance & Investment Fund

Statement of Revenues & Expenses ............................................................................................................... 65

Service Center ............................................................................................................................................... 66

Municipal Buildings ...................................................................................................................................... 67

Capital Projects Fund

Statement of Revenues & Expenditures ......................................................................................................... 69

Court Technology Fund

Statement of Revenues & Expenditures ......................................................................................................... 70

Court Security Fund

Statement of Revenues & Expenditures ......................................................................................................... 71

DPS Technology Fund

Statement of Revenues & Expenditures ......................................................................................................... 72

Pay Plan

Plan Overview ...................................................................................................................................................... 73

Non-Exempt Personnel (Excluding Public Safety) .............................................................................................. 74

Commissioned Personnel (Public Safety) ............................................................................................................ 75

Exempt Personnel ................................................................................................................................................. 76

Pay Incentives ....................................................................................................................................................... 76

Miscellaneous

Listing of Capital and New Program Requests .................................................................................................... 77

Water & Sewer Rate Study .................................................................................................................................. 79

Glossary

Glossary of Terms.. ..................................................................................................... 105

Memorandum

To: Mayor and Council Members

From: Bill Lindley, Town Administrator

Date: July 21, 2014

Subject: Fiscal Year 2014-15 Proposed Combined Budget

OVERVIEW

I am pleased to present to you a working draft of the Proposed Combined Operating Budget for fiscal

year 2014-15 (Budget). The following is a summary of the Budget and contains information including

the proposed tax rate and proposed fund summaries, as well as, overviews of key budget changes. The

Budget remains structurally balanced and continues to hold the line in the area of operational expenses

with a limited number of expense adjustments in strategically important areas. The Budget is proposed

to be $32,703,794 with the significant increase this year being additional funding to the Capital

Construction Fund for long-term infrastructure needs.

General

Fund Utility Fund

Stormwater

Fund

Other

Funds

Combined

Budget

FY 2015 20,857,670 $ 9,293,784 $ 243,755 $ 2,308,585 $ 32,703,794 $

FY 2014 19,804,395 9,400,750 236,675 1,903,715 31,345,535

FY 2013 18,854,015 8,761,570 228,180 1,769,695 29,613,460

FY 2012 18,799,835 10,152,155 473,060 12,004,838 41,429,888

FY 2011 16,031,655 9,536,925 990,040 11,176,880 37,735,500

FY 2010 16,704,460 9,223,165 602,000 792,100 27,321,725

Each budget cycle continues the Town Council (Council) philosophy of sustainable funding for

essential services and this Budget is no different. Developing a sustainable budget allows the

Council to adequately fund such repetitive expenses as equipment, vehicle and technology replacement

programming. With the completion of the Town Hall renovation, the Council is now in a position to

take-up a broader focus on continuing its attention to long-term infrastructure maintenance. In taking

up this challenge, the development of the Budget was focused in a large part to maximizing

opportunities to enhance funding for the Capital Construction Fund.

While the overall budget format continues as in past years, the Chief Financial Officer, in developing

the budget, has reallocated some expenses from one departmental category to another in efforts to

better reflect expenditures in appropriate categories. Included with this memorandum is identification

where these types of budget corrections were provided.

Page 1

As a starting point toward developing the Budget, a public hearing for citizen input was conducted on

June 9, 2014. Additionally, an opportunity was provided the Council for direction to staff towards the

preparation of the Budget. The Council has scheduled budget work sessions for July 28, 2014, and

August 11, 2014, with other meetings to be scheduled as needed. Formal adoption of the Budget is

planned for September 15, 2014 (please see the Budget Calendar attachment).

GENERAL FUND

The General Fund is the Towns principle operating fund supported by property and sales taxes,

various fees and other revenues used for a variety of purposes. This fund accounts for core Town

functions such as police, fire, parks & recreation, building code, finance, administrative operations, etc.

Revenues:

The Budget proposes no change in the Towns current property tax rate of $0.22 per $100 of taxable

assessed value which it has been for the past seven years. The Dallas County Appraisal District is in

the process of finalizing the certified tax rolls, which should be complete on July 25, 2014. As such,

the numbers presented herein are subject to change. At this point, however, the proposed budget

anticipates an increase in taxable assessed values of 7.1%. Of this, 76.6% is from existing property

revaluation while the remaining 23.4% is from new construction. The net of these two property value

components provide an additional $713,154 for the upcoming fiscal year.

Tax Rate

Property

Tax

Revenue*

Taxable

Assessed

Values

FY 2015 0.220 $ 10,837,691 $ 4,926,223,119 $

FY 2014 0.220 10,117,334 4,598,788,373

FY 2013 0.220 9,783,604 4,446,174,261

FY 2012 0.220 9,696,331 4,405,824,652

FY 2011 0.220 9,764,883 4,421,941,832

FY 2010 0.220 10,062,755 4,517,538,629

FY 2009 0.220 9,603,740 4,337,523,911

FY 2008 0.220 8,890,683 4,011,360,559

FY 2007 0.225 8,115,122 3,586,764,140

FY 2006 0.230 7,303,760 3,175,218,560

FY 2005 0.230 6,696,521 2,911,465,259

FY 2004 0.230 6,369,983 2,769,470,998

Between the fiscal years 2008 and 2010 the Town benefitted from increasing property values that

resulted in increased revenues to fund operations and capital projects. Property values declined in

fiscal years 2011 and 2012 and the Town chose to maintain the existing tax rate resulting in a decline

in property tax revenue. The economy began to rebound in 2013 and the Town has been experiencing

an increase in taxable assessed property values over the last two years, and keeping the tax rate

constant has allowed the Town to use the resulting increase in property tax revenues to address

operational and capital issues. Fiscal year 2015 presents an opportunity for the Town to experience an

increase in property tax revenues, without increasing the property tax rate, and use those additional

*Revenue presented at 100%. Town by policy budgets a 99% Collection Ratio.

Page 2

revenues to address increases in operational costs and increase funding towards the Towns Capital

Improvement program. The General Fund Budget has allocated $18,193,076 towards annual

operation, and $33,875 toward operating capital outlay and equipment purchases. The remaining

balance of $2,630,719 represents transfers between funds, of which $1,520,647 is directly related to

capital improvement funding. The capital improvement funding transfer represents an increase of

$344,432 when compared to the amount approved in the Adopted Budget (as amended) to be

transferred during fiscal year 2013-14.

Other significant revenue increases for 2015 include:

Continuing a healthy rebound the last few years, sales tax receipts, the funds second largest

source of revenue is estimated at $3,275,000, representing a 3.5% increase (excluding the prior

period payment received during the year) over the amount anticipated to be received for the

fiscal year 2013-14..

Continued steady rate of construction activity on new residential homes and remodeling

projects is reflected by the number of permits issued by the Town. Total building related

revenues in 2015 is estimated at $1,050,000.

In order to address an increase in the contractual costs of solid waste collection and disposal,

$27,596 in additional revenue is anticipated from a proposed 2.1% adjustment to solid waste

rates charged for this service, which is tied to the refuse contract.

Expenditures:

The operations portion of the budget funds the day-to-day activities of the Town such as personal

services, commodities, contractual services and equipment replacement. Less than other municipal

organizations, entity-wide, personnel costs account for 53.0% of the overall budget, excluding

transfers. Compensation and benefit strategies are tied to the Towns strategic objective of attracting,

developing and retaining a skilled workforce in our goal of continuing to be an employer of choice.

Compensation- As a service organization, Town employees are critical in the delivery of quality

services to our residents. In order to maintain service level stability, it is important to retain and attract

the type of quality employees we enjoy. In recognition of this important goal, the General Fund

Proposed Budget includes $374,753 for compensation increases. Consistent with past years,

employees are eligible for a merit up to 7%, while employees that have reached the top end of their pay

range, or employees not eligible for pay-for-performance, are budgeted to receive a 3% adjustment.

This past year the Council updated the list of comparable cities and corresponding salary survey

information for our compensation program. The system provides a financially sustainable model that

ensures a fair and predictable method of career progression and compensation for employees. Not only

was the Council able to confirm its labor market and define market positions, it also confirmed that the

current pay structure should be maintained and adjusted as market conditions warrant. As noted, our

pay system is a pure pay-for-performance format substantially different than most municipal systems

which are tenure-based where employees are granted automatic pay increases.

Pension- The Town is a member of the Texas Municipal Retirement System (TMRS) which provides

retirement, disability, and death benefits to employees of participating municipalities. Beginning in

2007, TMRS changed its actuarial cost method from traditional unit credits to projected unit credits

and this impacted positively the Town's contribution rate. The pension contribution rate paid by the

Page 3

Town for employees is decreasing by 28.57%, to 3.95% of payroll, for 2015. This is resulting in a

savings to the General Fund of $111,607.

Health Insurance- Providing a competitive health insurance plan is another significant factor in

attracting quality candidates, retaining valuable employees and continuing to be an employer of choice.

Competitively bid this past year, the Towns health insurance provider, Blue Cross Blue Shield

(BCBS), has confirmed a 7.6% premium increase for this next year. Included in this increase, the

federally mandated Affordable Care Act will for a second year result in a 3.5% increase to our health

care program beyond the control of the Town. The cost of health insurance paid for by employees

based on the plan they choose and dependent care they need is also increasing by 7.6%. The increase

in the cost of health insurance is growing the General Fund budget by $111,945.

IPS, which serves as the Towns consultant, has aggressively negotiated with the insurance carrier and

feels the current rate adjustment is very competitive to the open market. Town staff is currently

studying different options that may mitigate the increase in the cost; however, implementing such

options will likely result in a change in the benefits provided through the current plans offered.

Imbedded in the overall dependent premium cost paid in full by employees is $175,818 underwritten

by the Town. This amount is in addition to the overall premium cost paid by the Town for employee

premium. It is proposed that beginning this next year, we develop a multi-year process of distributing

this underwriting to make the two premiums self-sufficient. Over the next year, employees will be

educated about this subsidy and be informed of the plan to reallocate the portion that the Town pays

for dependent care appropriately within the employee dependent care premiums.

The carrier provides a wellness program which is currently being evaluated to identify key components

that will help drive long-term behavior change with a goal of continued premium management.

Continued management of the Town's health insurance plan does however produce a cushion against

rising health care costs seen across the country.

Capital Improvement Planning- The General Funds portion of the transfer to the Capital

Construction Fund is budgeted at $1,520,647. As noted previously, $344,432 of this amount is

proposed as new funding from enhanced revenue provided by the growth in property value while

maintaining the same property tax rate. This increase in funding exemplifies a major focus in

preparing the Budget as the Council takes-up renewed attention to the infrastructure needs for

maintenance and rehabilitation and the resulting funding demands.

Other significant proposed appropriations and adjustments to the General Fund include:

$125,000 has been added to the Budget as a contingency to cover compensation and retirement

payouts in anticipation of employees retiring during the next year. This contingency is new to

the budget and has not been provided in the past.

Costs associated with three organizational initiatives:

A part-time library clerk reclassified as a full-time assistant library manager requiring

approximately $72,000.

The additional costs for the municipal court magistrate salary adjustment required an

additional $50,000.

$95,000 has been provided for in legal services for legal and consulting services related to

Dallas Love Field.

Page 4

An additional $20,000 has been added to the Department of Public Safety Budget to fund

the contracting out of the crossing guard program. The bulk of this program is funded by

shifting annual appropriations of approximately $100,000 from Personnel Services to

Services & Charges.

The Proposed Budget includes a net increase in Town Attorney services of approximately

$40,000 which includes the cost of municipal court prosecution.

Accompanying Budget Notes:

Department of Public Safety (DPS) DPS typically has appropriations allocated within

Capital Outlay. In years past these appropriations would be made up of items that the Town

would capitalize, as well as, items that the Town would not capitalize. In the Proposed Budget

for fiscal year 2015, only those items that the Town will capitalize have been included in the

Capital Outlay object class. As a result, some of the changes in DPS budget are attributed to

proposed appropriations being allocated differently between the object class designations, as

compared to previous fiscal years.

Street Department In years past, striping maintenance for roadways has been funded

through funding provided to the Capital Projects Fund. Since this item is more appropriately

identified as a maintenance item, the Proposed Budget includes $15,000 in the Street

Department budget to fund routine striping for streets.

Fund Balance:

The Towns financial policies state that the fund balance in the General Fund shall be equal to a

minimum of 17% of General Fund operating expenditures. The Proposed Budget reflects a projected

balance of 17% of expenditures, which represents $3,281,535. This ending balance is set aside to

provide funding in the event of an unanticipated economic downturn or other emergencies to protect

the Towns budget. Upon adoption of the annual audit, any excess revenue and unallocated

appropriation (above the 17% fund balance requirement) is transferred to the Capital Construction

Fund.

UTILITY FUND

The Utility Fund is used to account for the acquisition, operation and maintenance of the Towns

municipal water and sewer utility operations. This fund is supported primarily by user charges to

utility customers. The fund accounts for operational costs, as well as, capital improvement funding for

utility system improvements. An operational transfer to the General Fund is provided to properly

account for general administration and oversight.

Revenues:

Utility Fund revenues are projected to be $9,293,784, which is a 3.9% increase, or $350,079 from the

year-end projection for the current fiscal year. Water revenues are expected to grow $273,150 and

sewer fees will follow suit with $60,869 because of anticipated increases in usage and/or rate

adjustments.

The drought impact on area water supplies continues to be at the forefront of municipal utilities - with

Highland Park being no different. Speculation is the drought will continue into the foreseeable future

Page 5

creating more demands on municipal water providers to promote greater reductions onto the burdens of

area lakes. Simultaneously discussing the budget, the Council will have an opportunity to consider

possible customer restrictions for outdoor watering and irrigation as part of promoting water

conservation. It will be important for staff to monitor the effectiveness of customer water use

restrictions for any adverse impacts to water sales and resulting need for possible rate adjustment.

During the budget work session, staff will review varied rate options including possible increases to

the volume charge along with consideration in lowering the higher tiers each designed to offset loss in

water sales from water conservation efforts by the customer base.

Expenditures:

Unlike the General Fund, which is driven principally by personnel costs, the majority of expenses for

this fund are contractually related for water purchase and sanitary sewer treatment attributing to 38.5%,

or $3,574,316, of the overall costs projected for 2015. The Proposed Budget for fiscal year 2014-15

also includes $1,920,920 for capital outlay and capital improvements related to the Towns utility

system. This represents an increase of 2.1% factored into the budget to address inflationary increases

in construction costs. Personnel costs within the Utility Fund are also impacted by the aforementioned

changes in compensation and benefits. The Utility Fund, like the General Fund, is benefiting from the

reduction in the Towns contribution rate to TMRS. Overall the budget for pension cost is proposed to

decline $14,706 when compared to the year-end projection for fiscal year 2013-14. Health insurance

cost within the Utility Fund is increasing as a result of the 7.6% increase in the Towns cost of

providing this benefit to employees.

Fund Balance (Net Working Capital):

Similar to the General Fund, the Towns fiscal policies require that the fund balance of the Utility Fund

be equal to 25% of operating expenditures. Net working capital (current assets minus current

liabilities) is used as the measure of fund balance for the Utility Fund. Currently, the calculation of

ideal fund balance excludes the operating transfer of $1,046,439 to the General Fund. This transfer is

an indirect cost allocation that is made annually and is based on certain actual expenditures made in the

General Fund that are related to the Utility Fund. The practice of excluding this transfer when

calculating fund balance began during fiscal year 2012-13. If included going forward, fund balance

would need to increase by approximately $250,000 to reach ideal fund balance. Town Staff

recommends that, over time, fund balance be grown to accommodate the inclusion of the operating

transfer in the calculation of ideal fund balance. The Proposed Budget reflects a projected ending fund

balance of 25% of expenditures (excluding the General Fund operating transfer), which represents

$1,478,963.

This ending balance is set aside to provide funding in the event of an unanticipated economic downturn

or other emergencies to protect the Towns budget.

STORM WATER UTILITY FUND

The Storm Water Utility Fund accounts for sources and uses of resources related to the maintenance,

repair, and construction of the public storm water related services and facilities. Storm water utility

fees are assessed each month on utility bills to provide a funding source for this fund. The monthly

storm water fee is based on the size of the lot. Residential properties are charged between $4.12 and

$32.55 per month for each dwelling unit that is on the property based on the size of the lot. Fees for

Page 6

non-residential properties are calculated individually in proportion to each propertys storm water

runoff potential.

Revenue:

Revenues in the Storm Water Utility Fund, from storm water fees, are projected to be $385,140 which

is slightly higher than the revenue budgeted in the prior fiscal year. Rates charged for storm water

drainage have historically been indexed to the Consumer Price Index resulting in a 2.1% increase in

rates for the next fiscal year.

Expenditure:

The Storm Water Utility Fund accounts for expenditures related to street sweeping and other drainage

related items. The overall appropriations proposed for this fund total $243,755 and includes an

indirect cost transfer to the Utility Fund for personnel costs attributed to storm water related projects

and issues. The two most significant items added to this budget include $45,000 set aside for