Professional Documents

Culture Documents

Direct Tax Codes

Direct Tax Codes

Uploaded by

karnsatyarthiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Direct Tax Codes

Direct Tax Codes

Uploaded by

karnsatyarthiCopyright:

Available Formats

Kaushiki Sanyal

kaushiki@prsindia.org

September 2, 2010

PRS Legislative Research Centre for Policy Research Dharma Marg Chanakyapuri New Delhi 110021

Tel: (011) 2611 5273-76, Fax: 2687 2746

Bill Summary

The Direct Tax Code, 2010

The Direct Tax Code Bill, 2010 was introduced in the Lok

Sabha on August 30, 2010. The Bill was introduced by the

Minister of Corporate Affairs, Shri Salman Kurshid. The Bill

was referred to the Standing Committee on Finance, which is

scheduled to present its report within two months.

The Code seeks to consolidate and amend the law relating to

all direct taxes. The Code was referred to the Standing

Committee on Finance September 10, 2010. The

Committee has to submit its report within three months.

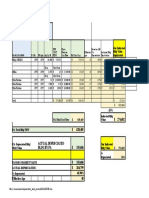

The Code changes the existing rates of income-tax. The

table below shows the changes proposed in the Code to the

existing income-tax rates:

Proposed changes to existing tax-rates for individuals

Existing tax-rates Direct Tax Code

Income (Rs.) Tax rate Income (Rs.) Tax rate

Less than 1.6

lakh

Nil Less than 2 lakh Nil

1.6 3 lakh 10% 2 5 lakh 10%

3 5 lakh 20% 5 10 lakh 20%

More than 5 lakh 30% More than 10

lakh

30%

Sources: Direct Tax Code, 2010; Finance Act, 2010; PRS.

Companies and unincorporated bodies will be taxed at 30

percent of their total income. Non-profits will not have to

pay tax for income below Rs. 1 lakh. For income above Rs.

1 lakh, they will be charged at the rate of 15 percent of their

total income.

The Code proposes a minimum alternate tax on companies.

The tax will have to be paid in case the normal income tax

of a company is less than the tax on the book profit of a

company. The tax will be applicable at 20 percent of the

book profits of the company. The Draft Direct Tax Code

had proposed a marginal tax on certain investments (such as

provident funds and pension schemes) at the time of

redemption. In the Code introduced in the Lok Sabha

investments such as government Provident Fund, approved

provident fund schemes and life insurance schemes will be

exempt from tax at the time of redemption.

Persons other than non-profit organizations will have to pay

wealth tax. Wealth up to Rs 1 crore is exempt. Wealth

above Rs 1 crore will be taxed at 1 percent.

The Code allows deductions for savings up to an amount of

Rs. 1 lakh as contributions to approved funds. Deductions

up to five percent on existing life insurance policies shall be

allowed. A total deduction of up to Rs 50,000 will also be

allowed on sums paid for health insurance, and for the

education of children.

Deductions shall also be allowed on the interest paid on

loans taken for house property and higher education.

Deductions on housing loans shall be allowed up to a limit

of Rs 1,50,000. There is no limit on the deduction available

for higher education.

A person not receiving house rent allowance will be allowed

a deduction on the rent paid towards his own residence. The

deduction shall only be available if the rent paid exceeds ten

percent of an individuals total income.

Capital gains are computed in the following manner. For

assets on which securities transaction tax is payable, the

long term capital gains (if held for more than one year) will

be nil. Short term capital gains will be computed as half of

the actual gains. For other investment assets, long term

capital gains will be given indexation benefits.

The Code repeals the Income Tax Act, 1961 and the Wealth

Tax Act, 1957.

DISCLAIMER: This document is being furnished to you for your information. You may choose to reproduce or redistribute this report for non-commercial

purposes in part or in full to any other person with due acknowledgement of PRS Legislative Research (PRS). The opinions expressed herein are entirely those

of the author(s). PRS makes every effort to use reliable and comprehensive information, but PRS does not represent that the contents of the report are accurate or

complete. PRS is an independent, not-for-profit group. This document has been prepared without regard to the objectives or opinions of those who may receive

it.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5824)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Poverty and Famines - V1Document3 pagesPoverty and Famines - V1karnsatyarthiNo ratings yet

- Poverty and Famines, Amartya Sen, 167 PagesDocument1 pagePoverty and Famines, Amartya Sen, 167 PageskarnsatyarthiNo ratings yet

- Poverty and FaminesDocument4 pagesPoverty and FamineskarnsatyarthiNo ratings yet

- Co2010 Consulting Case BookDocument235 pagesCo2010 Consulting Case BookkarnsatyarthiNo ratings yet

- Science and MysticismDocument3 pagesScience and MysticismkarnsatyarthiNo ratings yet

- Logical Fallacies and The Art of DebateDocument10 pagesLogical Fallacies and The Art of DebatekarnsatyarthiNo ratings yet

- Batch 22Document268 pagesBatch 22karnsatyarthiNo ratings yet

- A Modern Insurgency: India's Evolving Naxalite ProblemDocument4 pagesA Modern Insurgency: India's Evolving Naxalite ProblemkarnsatyarthiNo ratings yet

- MIT Resume GuideDocument80 pagesMIT Resume Guidecalculusdouche100% (1)

- REVENUE MEMORANDUM CIRCULAR NO. 21-2018 Issued On April 5, 2018Document1 pageREVENUE MEMORANDUM CIRCULAR NO. 21-2018 Issued On April 5, 2018Hansel Jake B. PampiloNo ratings yet

- 620 Iova M SA100 11-12Document16 pages620 Iova M SA100 11-12Natalia Ciocirlan100% (1)

- THE ECONOMIC PROGRAMΜΕ OF SYRIZA-EKMDocument17 pagesTHE ECONOMIC PROGRAMΜΕ OF SYRIZA-EKMinfo_left_grNo ratings yet

- Module 4 EXEMPT SALES AND VAT PART IDocument33 pagesModule 4 EXEMPT SALES AND VAT PART IVenice Marie ArroyoNo ratings yet

- BAM 127 Day 12 - TGDocument8 pagesBAM 127 Day 12 - TGPaulo BelenNo ratings yet

- P6uk 2018 Jun ADocument11 pagesP6uk 2018 Jun ADilawar HayatNo ratings yet

- Monitor BillDocument1 pageMonitor BillGulf JobsNo ratings yet

- Problems With Solution Capital GainsDocument12 pagesProblems With Solution Capital Gainsnaqi ali100% (1)

- 002 EntrepDocument2 pages002 EntrepKristine RodriguezNo ratings yet

- PAYE AE 06 G06 Guide For Codes Applicable To Employees Tax Certificates 2022 External GuideDocument32 pagesPAYE AE 06 G06 Guide For Codes Applicable To Employees Tax Certificates 2022 External GuideZaneleNo ratings yet

- Shubham Devnani DM21A61 (Case Study)Document3 pagesShubham Devnani DM21A61 (Case Study)Shubham DevnaniNo ratings yet

- 2015W8BEN AfinirderempliretsigneDocument2 pages2015W8BEN Afinirderempliretsigneneocortex92No ratings yet

- Update On Mandanas RulingDocument3 pagesUpdate On Mandanas RulingLean Manuel Paragas100% (1)

- Bir-2550q 2007Document1 pageBir-2550q 2007Atashii Xenxi60% (5)

- Form IL-W-4 Illinois Withholding Allowance Certificate and InstructionsDocument2 pagesForm IL-W-4 Illinois Withholding Allowance Certificate and Instructionspuyang48No ratings yet

- Submitted To: Dr. Abid Hussain Submitted By: Hamood Ahmad 17-ME-69 Section CDocument3 pagesSubmitted To: Dr. Abid Hussain Submitted By: Hamood Ahmad 17-ME-69 Section CArslan ShabbirNo ratings yet

- Taxation E211 2017 12 4ED - RDocument95 pagesTaxation E211 2017 12 4ED - RSaid Safa TurabiNo ratings yet

- Objectives and Techniques of Fiscal Policy Economics EssayDocument4 pagesObjectives and Techniques of Fiscal Policy Economics EssayseemaNo ratings yet

- UP vs. City Treasurer of Quezon City, GR No. 214044, 19 Jun 2019Document2 pagesUP vs. City Treasurer of Quezon City, GR No. 214044, 19 Jun 2019Bernalyn Domingo AlcanarNo ratings yet

- Abm Income TaxationDocument8 pagesAbm Income TaxationNardsdel RiveraNo ratings yet

- Act 03Document1 pageAct 03Áÿmên BênåîssàNo ratings yet

- Hours 40 Rate 50 Gross Pay 2000 Tax and Deductions 200 Net Pay 1800Document5 pagesHours 40 Rate 50 Gross Pay 2000 Tax and Deductions 200 Net Pay 1800Nickey DickeyNo ratings yet

- RPH FinalsDocument2 pagesRPH FinalsHagia CanapiNo ratings yet

- Payslip FebruaryDocument1 pagePayslip FebruaryPrachi JoshiNo ratings yet

- Dep Calc SampleDocument1 pageDep Calc SampleGeorge GutierrezNo ratings yet

- 02 Wage RegisterDocument7 pages02 Wage RegisterShritej nirmalNo ratings yet

- Canada - DeclarationDocument2 pagesCanada - DeclarationDhanush SiváNo ratings yet

- 2.0 GENERAL PRINCIPLES OF TAXATION Part 2Document36 pages2.0 GENERAL PRINCIPLES OF TAXATION Part 2carldomingoNo ratings yet

- Hong Thien PhuocBui2018Document6 pagesHong Thien PhuocBui2018Thien BaoNo ratings yet

- Income Tax of Each Slab.: Solution: Monthly Income 250,000 Annual Income 250,000 X 12 3,000,000Document3 pagesIncome Tax of Each Slab.: Solution: Monthly Income 250,000 Annual Income 250,000 X 12 3,000,000Abrar Ahmed KhanNo ratings yet