Professional Documents

Culture Documents

Active Value Investing in Range Bound /sideways/ Markets: Vitaliy N. Katsenelson, CFA y

Active Value Investing in Range Bound /sideways/ Markets: Vitaliy N. Katsenelson, CFA y

Uploaded by

thjamesOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Active Value Investing in Range Bound /sideways/ Markets: Vitaliy N. Katsenelson, CFA y

Active Value Investing in Range Bound /sideways/ Markets: Vitaliy N. Katsenelson, CFA y

Uploaded by

thjamesCopyright:

Available Formats

ActiveValueInvestinginRange Bound/Sideways/Markets

VitaliyN.Katsenelson,CFA y

/directorofresearch/

I M A i I InvestmentManagementAssociates,Inc.

1 CONTRARIANEDGE.COM/IMAUSA.COM/VITALIY@USA.NET/303.796.8333

Weareusedtothinkingaboutsecular(longerthan5years)marketsinbinaryterms:

OR OR

2

Thereisanothertypeoflongtermmarket CowardlyLionorRangeBoundMarkets

or or

burstsofoccasionalbraveryleadtostockappreciation,butareultimately

overrun by fear that leads to a subsequent descent

3

overrunbyfearthatleadstoasubsequentdescent

ActiveValueInvesting:MakingMoneyinRangeBoundMarkets

DowJonesIndustrialAverage1900 2006

Thebearmarketswereactuallyrangeboundmarketsandhappenedthetime

4

CopyrightKevinA.Tuttle2007

4

Sofarmarketshavegonesidewayshellofaride,butstillsideways

DowJonesIndustrialAverage2000 2009

5

SecularBullandRangeBoundMarketCyclesWereNot Causedby:

Economy

or

Economy

Earningsgrowth

Interestrates or Interestrates

Inflation

Valuation

TheyWereCausedby:

6

AsLongAs:InflationRemainedReasonable/DeflationWasAbsent/GDPAnd

EarningsGrowthRemainedPositive MarketWasEitherBullOrRangebound.

7 Note:RealGDPgrowthwasextremelystablethroughoutallsecularmarkets

ThereIsAVeryTightRelationshipBetweenInterestRatesAndP/EsDuring19602006

8

TheRelationshipBetweenInterestRatesandP/EsIsExtremelyWeakBetween1900 1960

9

InterestRatesIrrelevant?

No But well get back to this subject in a couple of slides No,Butwe llgetbacktothissubjectinacoupleofslides

10

Bull,BearandRangeBoundMarketsHappenWhen

Market EconomicGrowth StartingValuation(P/E)

Bull Good(Average) Low

RangeBound Good(Average) High

Bear Bad High

11

StockMarketMath

EarningsGrowth EarningsGrowth

+ +

Price Price

+ +

P/E P/E

Price Price

++

Dividends Dividends

==

TotalReturnfromStock(s) TotalReturnfromStock(s)

OR OR

EarningsGrowth EarningsGrowth

++

P/E P/E

++

Dividends Dividends

==

12

==

TotalReturnfromStock(s) TotalReturnfromStock(s)

WalMartATypicalRangeBoundMarketStock

2001 - 2009

13

SourcesofReturnExample:WalMart

14

SourcesofReturn:SecularBullMarkets

15

BullMarkets:P/EExpansion +EarningsGrowth =SuperReturns

SourcesofReturn:SecularRangeBoundandBearMarkets

16

RangeBoundMarkets:P/EContraction +EarningsGrowth =LowReturns

BearMarkets:P/EContraction +EarningsDecline =NegativeReturns

JapanesebythebookBearMarket Japan

17

BullMarketsStartatBelowAverageandEndAtAboveAverageValuations.

RangeBoundMarketsStartatAboveAverageandEndatBelowAverageValuations.

Today

18

19

BullMarketsStartatBelowAverageandEndAtAboveAverageValuations.

RangeBoundMarketsStartatAboveAverageandEndatBelowAverageValuations.

Today

20

BullMarketsStartatBelowAverageandEndAtAboveAverageValuations.

RangeBoundMarketsStartatAboveAverageandEndatBelowAverageValuations.

Today

21

MarketPsychology

New average

End of Bull Market

P/E +EPS =

New average

expectationsareNOT

met P/Estopped

expanding

R B d M k t

P/E +EPS

0% +6% 6%

ReturnsareNOTnew

average,notaveragebut

belowaverage:

Range Bound Market

P/E + EPS = -6% + 6% 0%

22 22

Interestratesandinflationareveryimportantbuttheytakeasecondseattomarket

psychology.Theyultimatelydeterminethelengthandtheextremesofmarketcycles.

Interest RatesMovefrom

Good/Bad for

P/Es

Reason

Zone1 Zone2 GOOD Movetonormalcy

Zone2 Zone3 BAD Riskofinflation

Zone3 Zone2 GOOD Movetonormalcy

Zone2 Zone1 BAD Riskofdeflation

Ifinterestrates/inflationwere

highersecularrangebound

mayhaveendedsoonerat

highervaluation g

Ifinterestrates/inflationwere

23

/

notthatlowsecularbullmay

haveendedsooneratlower

valuation

StillintheRangeBound/Sideways/Market?

Valuationsarestillhigh(aboveor averageatbest)

Real earningsgrowthwillbelowerinthefutureduetohigherfuture

taxes,higherinterestrates(causedbygovernmentborrowing),consumer

deleveraging rangeboundmarketmaylastlongerthanweexpect.

Highinflationwillshortenrangeboundmarketduration,butfinalP/E

willbeloweraswell.

Ifnominalearningsgrowthdoesntmaterializeinthefuture(3,5,10

years),earningsdecline wearesetforasecularbearmarket

24

ShouldIBeInBondsInstead?

90%OfReturnComesFromAssetAllocations,

TrueOrFalse?

25

BullMarkets:StockDoOutperformBondsHandsDown

26

Throwmoneyatstocks,andyoulldomuchbetterthanbondsorcash.Ingeneral,thefewerdecisionsyou

makethebetteroffyouare(buyandforget).

RangeBoundMarkets:StocksDominanceIsNotSignificant

27

Assetallocationisnotasimportantasstockselection.

90%OfReturnComesFromAssetAllocations,TrueOrFalse?

Bullmarkets True

Range bound markets False Rangeboundmarkets False

Additionalpoint:Fedisprintingmoneyfasterthanyoucanreadthis.Inthelongruninflation

willrise badforbonds.

28

Conclusion:StockSelectionMattersALot!

InvestingasyoudidduringsecularbullmarketwillNOTwork.Youranalysisandstrategy

needstobemodified.

29

BriefSummaryofStrategyandAnalysisforTodaysEnvironment

Bebuyandsellinvestor.Buyandholdisinthecomma(seenextchart).Time

(price)stocksthroughastrictbuyandsellprocess.Buywhenundervaluedsell

whenfairlyvalued.

TimeStocksNotTheMarket:Markettimingisverydifficult.Intheshortrun

emotionsareinthedriverseat.

Dontbuyforthesakeofbeinginvested.Dontlosemoneybymaking

marginaldecisions.Inabsenceofgoodstockstobuy,beincash.Theopportunity

costofcashisnotashighasinthesecularbullmarket.

Increasemarginofsafety:Fewer(better)stockswillbeinyourportfolio.

Favor dividend paying stocks. Dividends were 95% of the return in previous Favordividendpayingstocks.Dividendswere95%ofthereturninprevious

rangeboundmarkets.(warning:dividendsarepartofanalyticalequation,notthe

equation.)

L k i t ith t i i i k

30

Lookoverseas increasesreturnwithoutincreasingrisk

SecularRangeboundMarketsIsComprisedOfManyCyclicalMarkets

31 5 Bull+5Bear+ 1 RangeBound

ThankYou!

MoreinformationaboutthebookandPDFofthispresentation

www.ActiveValueInvesting.com

Toreceivemycomplimentaryarticlesviaemailsendmeanemail:

vitaliy@usa.net

MoreinformationaboutInvestmentManagementAssociatesInc. g

www.imausa.com

Myfirmislookingtoestablisharelationshipwithbrokers/financialplanners(stillinthebusinessorgetting

outofbusiness). IfyouknowanyonewhoisinterestedhavethemcontactmypartnerMichaelConn

ik i @ (303) 796 8333

32

mike.ima@usa.net or(303)7968333.

You might also like

- Elliot Investor LetterDocument1 pageElliot Investor LetterArjun KharpalNo ratings yet

- Jeremy Grantham - Everything I Know About The Stock Market - 2003Document7 pagesJeremy Grantham - Everything I Know About The Stock Market - 2003B_U_C_KNo ratings yet

- Indonesia Flexible Packaging Market Growth, Trends, COVID 19 ImpactDocument135 pagesIndonesia Flexible Packaging Market Growth, Trends, COVID 19 ImpactIndah YuneNo ratings yet

- Safety Data Sheet: SECTION 1: Identification of The Substance/mixture and of The Company/undertakingDocument12 pagesSafety Data Sheet: SECTION 1: Identification of The Substance/mixture and of The Company/undertakingthjamesNo ratings yet

- A People and A Nation A History of The United States Volume I To 1877, 9th Edition Test BankDocument16 pagesA People and A Nation A History of The United States Volume I To 1877, 9th Edition Test Bankgloriya50% (2)

- Absorption & StrippingDocument875 pagesAbsorption & StrippingM Manas Manohar85% (55)

- Shocking Psychological Studies and The Lessons They TeachDocument99 pagesShocking Psychological Studies and The Lessons They TeachArun Sharma100% (1)

- Active Value Investing Presentation by Vitaliy Katsenelson March 2011Document33 pagesActive Value Investing Presentation by Vitaliy Katsenelson March 2011VitaliyKatsenelson100% (3)

- 0320 US Fixed Income Markets WeeklyDocument96 pages0320 US Fixed Income Markets WeeklycwuuuuNo ratings yet

- Real Investment ReportDocument24 pagesReal Investment ReportGediminas VedrickasNo ratings yet

- Hussman Funds - Stocks Extreme Conditions and Typical Outcomes - May 2, 2011Document6 pagesHussman Funds - Stocks Extreme Conditions and Typical Outcomes - May 2, 2011KoalaCapitalSICAVNo ratings yet

- Survival GuideDocument13 pagesSurvival Guidemymanual100% (1)

- The Leverage CycleDocument58 pagesThe Leverage CycleHimanshu JhambNo ratings yet

- Mauldin August 8Document10 pagesMauldin August 8richardck61No ratings yet

- FX 20140626Document2 pagesFX 20140626eliforuNo ratings yet

- Financial Market AnalysisDocument83 pagesFinancial Market AnalysisAlessandra ZannellaNo ratings yet

- Munich Presentation 2013Document48 pagesMunich Presentation 2013weissincNo ratings yet

- Ten Investment Convictions For H2 2023Document5 pagesTen Investment Convictions For H2 2023blkjack8No ratings yet

- 7-24-12 How Bad Can It Get?Document3 pages7-24-12 How Bad Can It Get?The Gold SpeculatorNo ratings yet

- Vital Signs: Death Cross-Dow Theory Warns?Document4 pagesVital Signs: Death Cross-Dow Theory Warns?GauriGanNo ratings yet

- INM 21993e DWolf Q4 2016 NewEra Retail SecuredDocument4 pagesINM 21993e DWolf Q4 2016 NewEra Retail SecureddpbasicNo ratings yet

- Friedberg Mercantile Quarterly Report Q3 2011Document16 pagesFriedberg Mercantile Quarterly Report Q3 2011richardck61No ratings yet

- Chapter 6 JonesDocument6 pagesChapter 6 JonesMaria ZakirNo ratings yet

- The Bark Is Worse Than The BiteDocument6 pagesThe Bark Is Worse Than The BitedpbasicNo ratings yet

- Hussman Market Top Exhaustion GapDocument9 pagesHussman Market Top Exhaustion GapdabarcinaNo ratings yet

- NoteDocument3 pagesNoteK59 Do Man NghiNo ratings yet

- AccOrg ReportDocument4 pagesAccOrg ReportJohn Miguel GordoveNo ratings yet

- JGLetter SummerEssays 2Q10Document13 pagesJGLetter SummerEssays 2Q10Updatest newsNo ratings yet

- Hussman Funds 2009-07-27Document2 pagesHussman Funds 2009-07-27rodmorley100% (2)

- UntitledDocument153 pagesUntitledaaronNo ratings yet

- Fixed Income Session 1 Rates and Curves-2Document36 pagesFixed Income Session 1 Rates and Curves-2r4fcd8y7v6No ratings yet

- Vix StrategyDocument15 pagesVix StrategyLisa Majmin100% (1)

- David Capital Partners, LLC - 2013 Q4 Macro Commentary FINAL-1Document6 pagesDavid Capital Partners, LLC - 2013 Q4 Macro Commentary FINAL-1AAOI2No ratings yet

- Notes IMF WordDocument47 pagesNotes IMF WordabcdefNo ratings yet

- Yield CurveDocument10 pagesYield Curvekhurram_ahmedNo ratings yet

- DeflationDocument4 pagesDeflationnadekaramit9122No ratings yet

- An Angry Army of Aunt MinniesDocument6 pagesAn Angry Army of Aunt Minniessamp123No ratings yet

- March 292010 PostsDocument12 pagesMarch 292010 PostsAlbert L. PeiaNo ratings yet

- Liam Mescall Swaption ProjectDocument20 pagesLiam Mescall Swaption ProjectLiam MescallNo ratings yet

- Quarterly Report To ClientsDocument20 pagesQuarterly Report To ClientsgnarayNo ratings yet

- The Carry Trade and FundamentalsDocument36 pagesThe Carry Trade and FundamentalsJean-Jacques RousseauNo ratings yet

- Four Phases of Business CycleDocument10 pagesFour Phases of Business CyclehardyNo ratings yet

- Security Analysis Is Primarily Concerned With The Analysis of A Security With A ViewDocument4 pagesSecurity Analysis Is Primarily Concerned With The Analysis of A Security With A ViewarmailgmNo ratings yet

- Barclays Equity Gilt Study 2011Document144 pagesBarclays Equity Gilt Study 2011parthacfaNo ratings yet

- Alopez Week4 ReportDocument2 pagesAlopez Week4 ReportAngelica LopezNo ratings yet

- Final Class of Econ 405Document16 pagesFinal Class of Econ 405Nasir Ali RizviNo ratings yet

- R03 Capital Market Expectations, Part 1 - Framework and Macro Considerations HY NotesDocument7 pagesR03 Capital Market Expectations, Part 1 - Framework and Macro Considerations HY NotesArcadioNo ratings yet

- Market Analysis November 2020Document21 pagesMarket Analysis November 2020Lau Wai KentNo ratings yet

- Is There A Double Dip Recession in The Making AC - FinalDocument2 pagesIs There A Double Dip Recession in The Making AC - FinalPremal ThakkarNo ratings yet

- SSA - STIRS Update - July 2010Document4 pagesSSA - STIRS Update - July 2010chibondkingNo ratings yet

- To: From: Christopher M. Begg, CFA - CEO, Chief Investment Officer, and Co-Founder Date: April 24, 2012 ReDocument10 pagesTo: From: Christopher M. Begg, CFA - CEO, Chief Investment Officer, and Co-Founder Date: April 24, 2012 RepolandspringsNo ratings yet

- Unconventional Policies and Their Effects On Financial Markets PDFDocument36 pagesUnconventional Policies and Their Effects On Financial Markets PDFSoberLookNo ratings yet

- From Low Volatility To High GrowthDocument4 pagesFrom Low Volatility To High GrowthdpbasicNo ratings yet

- The End of Buy and Hold ... and Hope Brian ReznyDocument16 pagesThe End of Buy and Hold ... and Hope Brian ReznyAlbert L. PeiaNo ratings yet

- Deutsche Bank ResearchDocument3 pagesDeutsche Bank ResearchMichael GreenNo ratings yet

- Convexity Maven - A Guide For The PerplexedDocument11 pagesConvexity Maven - A Guide For The Perplexedbuckybad2No ratings yet

- Financial MarketsDocument12 pagesFinancial Marketsmohamad175No ratings yet

- Market Haven Monthly Newsletter - July 2011Document11 pagesMarket Haven Monthly Newsletter - July 2011MarketHavenNo ratings yet

- T MKC G R: HE Loba L EportDocument3 pagesT MKC G R: HE Loba L EportMKC GlobalNo ratings yet

- Wally Weitz Letter To ShareholdersDocument2 pagesWally Weitz Letter To ShareholdersAnonymous j5tXg7onNo ratings yet

- Financial Markets and Economic Performance: A Model for Effective Decision MakingFrom EverandFinancial Markets and Economic Performance: A Model for Effective Decision MakingNo ratings yet

- 101 Things Everyone Should Know About Economics: From Securities and Derivatives to Interest Rates and Hedge Funds, the Basics of Economics and What They Mean for YouFrom Everand101 Things Everyone Should Know About Economics: From Securities and Derivatives to Interest Rates and Hedge Funds, the Basics of Economics and What They Mean for YouNo ratings yet

- 1.1ระเบียบฯ รถออกนอก พ.ศ. 2537Document7 pages1.1ระเบียบฯ รถออกนอก พ.ศ. 2537thjamesNo ratings yet

- JPM Global Data Watch Money-MultiplierDocument2 pagesJPM Global Data Watch Money-MultiplierthjamesNo ratings yet

- Dell Notebook 23Document6 pagesDell Notebook 23thjamesNo ratings yet

- Learning As A Habit InfographicDocument2 pagesLearning As A Habit Infographicthjames100% (2)

- Jacket Style Guide Revise PhoneDocument10 pagesJacket Style Guide Revise PhonethjamesNo ratings yet

- 2016 Membership ApplicationDocument2 pages2016 Membership ApplicationthjamesNo ratings yet

- Pants Style Guide Revise PrintDocument8 pagesPants Style Guide Revise PrintthjamesNo ratings yet

- Jacket Style Guide Revise PhoneDocument10 pagesJacket Style Guide Revise PhonethjamesNo ratings yet

- Chemical Cross ReferenceDocument4 pagesChemical Cross ReferenceparthihceNo ratings yet

- Demand Scenarios: This Is The Probabilistic Forecast Refereed To in The Swimsuit Production Case in Chapter 3Document19 pagesDemand Scenarios: This Is The Probabilistic Forecast Refereed To in The Swimsuit Production Case in Chapter 3thjamesNo ratings yet

- Fall 2013 SyllabusDocument3 pagesFall 2013 SyllabusthjamesNo ratings yet

- Price List - Signavio Process Editor (Saas)Document1 pagePrice List - Signavio Process Editor (Saas)thjamesNo ratings yet

- CUSUM: The Motivation: Cumulative Sum and Exponentially Weighted Moving Average Control Chart (CUSUM and EWMA)Document9 pagesCUSUM: The Motivation: Cumulative Sum and Exponentially Weighted Moving Average Control Chart (CUSUM and EWMA)thjamesNo ratings yet

- Aircraft LeasingDocument50 pagesAircraft LeasingBenchmarking84100% (2)

- Servant-Leadership in Higher Education: A Look Through Students' EyesDocument30 pagesServant-Leadership in Higher Education: A Look Through Students' Eyeschrist_wisnuNo ratings yet

- Malankara Catholic Church Sui Iuris: Juridical Status and Power of GovernanceDocument26 pagesMalankara Catholic Church Sui Iuris: Juridical Status and Power of GovernanceDr. Thomas Kuzhinapurath100% (6)

- Comparative Relationship Between Traditional Architecture and Modern ArchitectureDocument24 pagesComparative Relationship Between Traditional Architecture and Modern ArchitectureGem nuladaNo ratings yet

- Bancassurance PDFDocument251 pagesBancassurance PDFdivyansh singh33% (3)

- Break Even Analysis New PrintDocument22 pagesBreak Even Analysis New Printحسين النعيميNo ratings yet

- Boiler MaintenanceDocument6 pagesBoiler MaintenanceRamalingam PrabhakaranNo ratings yet

- Current Trends Issues and Problems in Education SystemDocument49 pagesCurrent Trends Issues and Problems in Education SystemfuellasjericNo ratings yet

- Exotic Options: Options, Futures, and Other Derivatives, 6Document26 pagesExotic Options: Options, Futures, and Other Derivatives, 6Pankeshwar JangidNo ratings yet

- Week 1, Hebrews 1:1-14 HookDocument9 pagesWeek 1, Hebrews 1:1-14 HookDawit ShankoNo ratings yet

- Financial and Managerial Accounting: Wild, Shaw, and Chiappetta Fifth EditionDocument41 pagesFinancial and Managerial Accounting: Wild, Shaw, and Chiappetta Fifth EditionryoguNo ratings yet

- Week 3 Digital Consumers, Communities and Influencers Workshop-1Document46 pagesWeek 3 Digital Consumers, Communities and Influencers Workshop-1rjavsgNo ratings yet

- Introduction - Online Car Booking Management SystemDocument5 pagesIntroduction - Online Car Booking Management SystemTadese JegoNo ratings yet

- M607 L01 SolutionDocument7 pagesM607 L01 SolutionRonak PatelNo ratings yet

- Grupo Inditex Annual Report Inditex 09Document316 pagesGrupo Inditex Annual Report Inditex 09akansha02No ratings yet

- Oisd STD 235Document110 pagesOisd STD 235naved ahmed100% (5)

- Analysis of Credit Risk Measurement UsinDocument6 pagesAnalysis of Credit Risk Measurement UsinDia-wiNo ratings yet

- Sasmo 2020 Grade 8 RankDocument7 pagesSasmo 2020 Grade 8 RankEtty SabirinNo ratings yet

- 14-128 MTR Veh Appraisal FormDocument2 pages14-128 MTR Veh Appraisal FormJASONNo ratings yet

- E-Commerce Assignment For MISDocument11 pagesE-Commerce Assignment For MISIrfan Amin100% (1)

- SP 70Document75 pagesSP 70Barbie Turic100% (2)

- Master Builder: PlusDocument31 pagesMaster Builder: PluswinataNo ratings yet

- The Israel Lobby ControversyDocument2 pagesThe Israel Lobby ControversysisinjhaaNo ratings yet

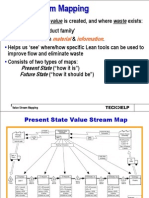

- 4 Slides Value Stream MappingDocument13 pages4 Slides Value Stream MappingRanjan Raj Urs100% (2)

- Chapters 1-5: Task No. 6 Process QuestionsDocument4 pagesChapters 1-5: Task No. 6 Process QuestionsFarNo ratings yet

- Melaka in China Ming TextsDocument40 pagesMelaka in China Ming Textsmifago8887No ratings yet

- Karl Knausgaard: My Struggle: Book One byDocument4 pagesKarl Knausgaard: My Struggle: Book One byGraciela Fregoso PlascenciaNo ratings yet