Professional Documents

Culture Documents

Candidate Practice Sample Questions

Candidate Practice Sample Questions

Uploaded by

Arnold RadaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Candidate Practice Sample Questions

Candidate Practice Sample Questions

Uploaded by

Arnold RadaCopyright:

Available Formats

The McKinsey Caselets have been designed to help us learn about your ability to think about the types

of business

problems that McKinsey consultants must face. You will be presented with scenarios based on actual McKinsey cases

and asked a series of questions relating to them. This exercise should also provide you with a better idea of what

consultants do. Some of the questions ask you to select more than one answer; make certain that you read the individual

question directions carefully before answering. The solutions to these problems do not require a knowledge of McKinsey

and Company policy or procedures.

Candidate Practice

Sample Questions

1

Sample Caselet

A supermarket chain has asked McKinsey to conduct a review of its overall strategy.

1. The team has been asked to look at a number of issues that the client is considering, including whether or not to start a

customer loyaty program. In helping the client decide on this issue, which two of the following arguments, if true, would

you favor introducing such a loyalty program? (Select TWO of the following options.)

A. The client has increased sales by 15% in the last year.

B. It will lead to an increase in revenues with no significant cost increase.

C. Loyalty programs have successfully been introduced at retail electronics chains.

D. It will allow customer behavior data to be collected.

E. It will benefit the partner companies of the loyalty program.

2. A potential growth strategy for the client is to acquire a competing supermarket chain. You have been asked to create

a list of most likely targets for the client. Which of the following is not a factor when compiling this list?

A. Geographic location of the targets stores

B. Targets market share

C. Targets financial performance

D. Targets store layout

E. Targets distribution system

3. The clients current revenues are $1 billion. Its profitability is 12% of revenue. An acquisition target has been

identified, a smaller supermarket chain with revenues of $500 million and current profitability of 7%. If the smaller

company were to be acquired by the client, there would be immediate cost savings from eliminating duplicating activities

of $20 million. What would be the combined profits of the two firms if the merger took place?

A. $155 million

B. $160 million

C. $165 million

D. $170 million

E. $175 million

This completes the McKinsey Caselets.

Thank you.

2

Intermediate problem solving test: Sample

questions: the answers

b&d for Q.1

d for Q2,

e for Q.3.

You might also like

- ML Case Solution - (Individual) PGXPM VI (Term III) N.v.deepakDocument4 pagesML Case Solution - (Individual) PGXPM VI (Term III) N.v.deepakDeepak Rnv86% (7)

- The SaaS Sales Method for Account Executives: How to Win Customers: Sales Blueprints, #5From EverandThe SaaS Sales Method for Account Executives: How to Win Customers: Sales Blueprints, #5No ratings yet

- MCQ SelfDocument11 pagesMCQ SelfFaidz FuadNo ratings yet

- BAMM - Marketing Management - PDF Version 1 PDFDocument49 pagesBAMM - Marketing Management - PDF Version 1 PDFJas John100% (1)

- Double-Digit Growth (Review and Analysis of Treacy's Book)From EverandDouble-Digit Growth (Review and Analysis of Treacy's Book)No ratings yet

- International Marketing ProjectDocument31 pagesInternational Marketing ProjectRamsha Shaikh50% (4)

- j15 Marketing Exam Paper FinalDocument20 pagesj15 Marketing Exam Paper FinalSahar Osama BashirNo ratings yet

- Question Paper Marketing Management (MB221) : January 2004: Section A: Basic Concepts (30 Marks)Document18 pagesQuestion Paper Marketing Management (MB221) : January 2004: Section A: Basic Concepts (30 Marks)ganguly_ajayNo ratings yet

- MKTG201 Fundamentals of MarketingDocument10 pagesMKTG201 Fundamentals of MarketingG JhaNo ratings yet

- Business Ethics - MGT610 Quiz 5 PDFDocument8 pagesBusiness Ethics - MGT610 Quiz 5 PDFAnant TyagiNo ratings yet

- SLIM Sri LankaDocument93 pagesSLIM Sri Lankabnsamy100% (1)

- Unit 2 e - Marketing Plan and Principles: StructureDocument21 pagesUnit 2 e - Marketing Plan and Principles: Structureprskrs2No ratings yet

- 2022 - Strategic Management 731 - CA Test 2 Review QuestionsDocument19 pages2022 - Strategic Management 731 - CA Test 2 Review QuestionsMaria LettaNo ratings yet

- Multiple Choice Question For StudentsDocument39 pagesMultiple Choice Question For StudentsHoàng HàNo ratings yet

- Instructions: 1. 2. 3. 4.: MKTG 752 - Assignment # 2 - Winter 2023 - 15%Document6 pagesInstructions: 1. 2. 3. 4.: MKTG 752 - Assignment # 2 - Winter 2023 - 15%Tuhin BabooramNo ratings yet

- Sales - BasicDocument24 pagesSales - BasicPraksh chandra Rajeek kumarNo ratings yet

- WEEK 6 Short Quiz 6Document10 pagesWEEK 6 Short Quiz 6Francis BahaliaNo ratings yet

- Customer Equity Is The Total Combined Customer Lifetime Values of All of A CompanyDocument10 pagesCustomer Equity Is The Total Combined Customer Lifetime Values of All of A CompanySniper ShaikhNo ratings yet

- Marketing Strategy Notes Prof Kalim KhanDocument94 pagesMarketing Strategy Notes Prof Kalim KhanPraveen PraveennNo ratings yet

- Seeds... : The Business Planning ProcessDocument4 pagesSeeds... : The Business Planning ProcessRajetha GunturNo ratings yet

- Questions For Case DiscussionsDocument2 pagesQuestions For Case DiscussionsAkshit GangwalNo ratings yet

- Discussion Questions For Cases in Sales PromotionsDocument1 pageDiscussion Questions For Cases in Sales PromotionsPrashant BankarNo ratings yet

- A Choose The Correct Answer and Explain .: D) Supply ChainDocument6 pagesA Choose The Correct Answer and Explain .: D) Supply ChainNgọc Dương Thị BảoNo ratings yet

- Business Seminar Exam PrepDocument8 pagesBusiness Seminar Exam PrepBarbara DiasNo ratings yet

- Quizcrn HerjhDocument6 pagesQuizcrn HerjhHeament PelodiaNo ratings yet

- PCDC1Document26 pagesPCDC1punithaNo ratings yet

- Testbankformarketing6theditionbylambhairandmcdaniel2012 160622032609 PDFDocument18 pagesTestbankformarketing6theditionbylambhairandmcdaniel2012 160622032609 PDFnikowawaNo ratings yet

- Marketing Real People Real Choices 8Th Edition Solomon Test Bank Full Chapter PDFDocument36 pagesMarketing Real People Real Choices 8Th Edition Solomon Test Bank Full Chapter PDFrenee.cox250100% (12)

- Case Studies - Customer SuccessDocument3 pagesCase Studies - Customer SuccessAnish DalmiaNo ratings yet

- ADL 02 Marketing Management V4Document7 pagesADL 02 Marketing Management V4solvedcareNo ratings yet

- COL Retail Sample ExamDocument31 pagesCOL Retail Sample ExamFernanda Raquel0% (1)

- Lyhongngoc 185040602 Quantriquanhekhachhang B02EDocument9 pagesLyhongngoc 185040602 Quantriquanhekhachhang B02ENguyên Nguyễn HoàngNo ratings yet

- Bain Case 2Document13 pagesBain Case 2Ping Yuen SoNo ratings yet

- A. Strategy Formulation: B. Strategy Control C. Strategy Implementation D. Strategy EvaluationDocument17 pagesA. Strategy Formulation: B. Strategy Control C. Strategy Implementation D. Strategy EvaluationKhyla Villaveza ChavezNo ratings yet

- B-School Case Studies - ConsolidatedDocument11 pagesB-School Case Studies - ConsolidatedAkhil SoniNo ratings yet

- 45 Preguntas OriginalDocument8 pages45 Preguntas Originalcarlacatheline.sjsNo ratings yet

- CH 7Document31 pagesCH 7Vivek SuranaNo ratings yet

- C2 Strategic Marketing PlanningDocument2 pagesC2 Strategic Marketing PlanningTrang Nguyễn ThịNo ratings yet

- Chapter 5:-Creating Customer Value, Satisfaction, and LoyaltyDocument10 pagesChapter 5:-Creating Customer Value, Satisfaction, and Loyaltyapi-3753113100% (4)

- Marketbusters (Review and Analysis of Mcgrath and Macmillan's Book)From EverandMarketbusters (Review and Analysis of Mcgrath and Macmillan's Book)No ratings yet

- Managementum Case StudiesDocument3 pagesManagementum Case Studiesmba22277No ratings yet

- STR 581 Capstone Final Exam All Part 1-2-3Document7 pagesSTR 581 Capstone Final Exam All Part 1-2-3johnNo ratings yet

- MasterCard and Paypass Case Study The Hong Kong Airport ExpressDocument10 pagesMasterCard and Paypass Case Study The Hong Kong Airport ExpressNguyễn Thị Kiều DiễmNo ratings yet

- Creating Long-Term Loyalty MCQDocument10 pagesCreating Long-Term Loyalty MCQDacosta FlectureNo ratings yet

- FashionCo CaseDocument4 pagesFashionCo Caserashmi shrivastavaNo ratings yet

- Berkeley Casebook 2006 For Case Interview Practice - MasterTheCaseDocument42 pagesBerkeley Casebook 2006 For Case Interview Practice - MasterTheCaseMasterTheCase.com100% (1)

- How Can Banks Meet Customers' Changing Needs and Preferences?Document12 pagesHow Can Banks Meet Customers' Changing Needs and Preferences?vinitanaidu29No ratings yet

- Marketing Management Final ExamDocument1 pageMarketing Management Final ExamDavy RoseNo ratings yet

- The Goal ofDocument9 pagesThe Goal of31231025740No ratings yet

- DistPub NMIMS Question Bank For June 2019Document46 pagesDistPub NMIMS Question Bank For June 2019AiDLoNo ratings yet

- Test Bank For M Marketing 3Rd Edition Grewal and Levy 007802885X 9780078028854 Full Chapter PDFDocument36 pagesTest Bank For M Marketing 3Rd Edition Grewal and Levy 007802885X 9780078028854 Full Chapter PDFalbert.bernes701100% (15)

- CINTAS Corporation Case Competition: The ProactivesDocument8 pagesCINTAS Corporation Case Competition: The Proactivesapi-356054955No ratings yet

- Annamalai University MBA Assignment Answer Sheet 2019Document48 pagesAnnamalai University MBA Assignment Answer Sheet 2019palaniappannNo ratings yet

- Market-Oriented Perspectives Underlie Successful ... : Multiple Choice QuestionsDocument80 pagesMarket-Oriented Perspectives Underlie Successful ... : Multiple Choice QuestionsNhật TuấnNo ratings yet

- Marketing Transformation ChallengeDocument9 pagesMarketing Transformation ChallengeMislav MatijevićNo ratings yet

- Global Marketing EnvironmentDocument14 pagesGlobal Marketing EnvironmentbhaskaranbalamuraliNo ratings yet

- Vipin Kumar Gupta Mb0036 510914612Document52 pagesVipin Kumar Gupta Mb0036 510914612vipin2k8No ratings yet

- Marketing Research-Case Study 1Document9 pagesMarketing Research-Case Study 1Razzel VergaraNo ratings yet

- CRM in BankingDocument17 pagesCRM in BankingMohammad Ejaz AhmedNo ratings yet

- Marketing of Financial ServicesDocument4 pagesMarketing of Financial ServicesMuhammad KashifNo ratings yet

- Peer GradedDocument11 pagesPeer Gradedريم البلويNo ratings yet

- Retail Store Survey ChecklistDocument2 pagesRetail Store Survey ChecklistArnold RadaNo ratings yet

- Retail Store Team Member Return ChecklistDocument2 pagesRetail Store Team Member Return ChecklistArnold RadaNo ratings yet

- TEST I-INSTRUCTION: Answer The Following Questions Below. Write Your Answer OnDocument2 pagesTEST I-INSTRUCTION: Answer The Following Questions Below. Write Your Answer OnArnold RadaNo ratings yet

- Activity 2 Assessment of Learning 2Document1 pageActivity 2 Assessment of Learning 2Arnold RadaNo ratings yet

- Inventory Shrinkage, Spoilage Breakage and Shortage OverageDocument3 pagesInventory Shrinkage, Spoilage Breakage and Shortage OverageArnold RadaNo ratings yet

- 2016 SSS Guidebook MaternityDocument1 page2016 SSS Guidebook MaternityArnold RadaNo ratings yet

- Supplemental AffidavitDocument1 pageSupplemental AffidavitArnold RadaNo ratings yet

- Maintain Inventory RecordsDocument17 pagesMaintain Inventory RecordsMulugeta GebinoNo ratings yet

- Ans To The Question No: 1Document3 pagesAns To The Question No: 1Md.Bin Al Walid 1621230630No ratings yet

- ABM Fundamentals of ABM 1 Module 12 Accounting Cycle of A Merchandising BusinessDocument16 pagesABM Fundamentals of ABM 1 Module 12 Accounting Cycle of A Merchandising BusinessMariel Santos67% (3)

- Sunbeam Case StudyDocument9 pagesSunbeam Case StudyHangga DarismanNo ratings yet

- International Strategic ManagementDocument23 pagesInternational Strategic Managementmr_izzuNo ratings yet

- Câu hỏi ôn cuối kìDocument90 pagesCâu hỏi ôn cuối kìHà Nhi LêNo ratings yet

- Business-Plan-Small Busineess Donna MillerDocument12 pagesBusiness-Plan-Small Busineess Donna MillerStephen FrancisNo ratings yet

- Trade and Cash DiscountDocument2 pagesTrade and Cash DiscountMauilyn IbayNo ratings yet

- Sales Order Form: OriginalDocument1 pageSales Order Form: OriginalAmjad AkhtarNo ratings yet

- 7 - Delfin Tan vs. Erlinda C. Benolirao Et AlDocument2 pages7 - Delfin Tan vs. Erlinda C. Benolirao Et Almark anthony mansuetoNo ratings yet

- Resume: Ankit Sharma Profile HighlightsDocument4 pagesResume: Ankit Sharma Profile Highlightsankit sharmaNo ratings yet

- GSTR-1 Report TestingDocument14 pagesGSTR-1 Report TestingSingb BabluNo ratings yet

- Pepsi vs. CokeDocument2 pagesPepsi vs. Cokekfcsh5cbrcNo ratings yet

- Chapter 5 Strategic ProspectingDocument10 pagesChapter 5 Strategic ProspectingSally GarasNo ratings yet

- AnswerDocument31 pagesAnswerJabeth IbarraNo ratings yet

- Case 14-63Document2 pagesCase 14-63KamruzzamanNo ratings yet

- JA p.6Document2 pagesJA p.6Von Andrei MedinaNo ratings yet

- Ap04-Ev04 Taller de Comprension de LecturaDocument3 pagesAp04-Ev04 Taller de Comprension de LecturaNELCY YULIETH CONTRERAS SANCHEZ100% (4)

- Sanet - ST - Pulling - Profits - Out - of - A - Hat - Brad - Sugars (1) (001-042)Document42 pagesSanet - ST - Pulling - Profits - Out - of - A - Hat - Brad - Sugars (1) (001-042)JOSE ROBERTO ALCAZAR PADILLANo ratings yet

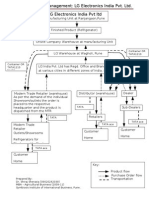

- Supply Chain Management - LG Electronics India PVT LTDDocument1 pageSupply Chain Management - LG Electronics India PVT LTDDr. Shiraj Sherasia100% (1)

- Henkel Company PresentationDocument16 pagesHenkel Company PresentationElisa BarbuNo ratings yet

- 2022-12-01-PVH.N-JPMorgan-PVH Corp. 3Q Beat W GPs Matching Our Model Follow-Up ... - 99452276Document11 pages2022-12-01-PVH.N-JPMorgan-PVH Corp. 3Q Beat W GPs Matching Our Model Follow-Up ... - 99452276darshita2706No ratings yet

- Q1 2021 E Commerce ReportDocument6 pagesQ1 2021 E Commerce ReportEstefania HernandezNo ratings yet

- Analyze The Gardenia in Porter Five Competitive ForcesDocument7 pagesAnalyze The Gardenia in Porter Five Competitive ForcesChesca AlonNo ratings yet

- Amazon Vs AlibabaDocument3 pagesAmazon Vs AlibabaPaulina CarmonaNo ratings yet

- Final Assignment: INB372, Section-4Document6 pagesFinal Assignment: INB372, Section-4Md. Shafiqul Haque BhuiyanNo ratings yet

- Marketing Management (Chapter-7)Document36 pagesMarketing Management (Chapter-7)Ashek AHmedNo ratings yet

- Project Report: National Food LimitedDocument37 pagesProject Report: National Food LimitedRukhsar Abbas Ali .No ratings yet