Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

41 viewsCharter School Sector 8-20-12

Charter School Sector 8-20-12

Uploaded by

Afiq KhidhirCharter School Sector 8-20-12

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Overview - PrintingDocument10 pagesOverview - Printingemman carlNo ratings yet

- Petition Letter TemplateDocument2 pagesPetition Letter TemplateFredel De VeraNo ratings yet

- OCRA E-Gaming BrochureDocument20 pagesOCRA E-Gaming BrochurejpamcicNo ratings yet

- U.S. Public Schools Experience More Competition For FundingDocument6 pagesU.S. Public Schools Experience More Competition For Fundingapi-227433089No ratings yet

- Obama Plan August 22 2013Document7 pagesObama Plan August 22 2013Barmak NassirianNo ratings yet

- College AffordabilityDocument7 pagesCollege AffordabilityMatthew LeonardNo ratings yet

- Trump Higher Education ActDocument5 pagesTrump Higher Education ActErin LaviolaNo ratings yet

- South Dakota ESSA FeedbackDocument4 pagesSouth Dakota ESSA FeedbackMeganNo ratings yet

- As Law School Demand Drops, Credit Quality Among U.S. Schools DivergesDocument11 pagesAs Law School Demand Drops, Credit Quality Among U.S. Schools Divergesapi-227433089No ratings yet

- Performance-Based Funding of Higher EducationDocument12 pagesPerformance-Based Funding of Higher EducationCenter for American ProgressNo ratings yet

- Superintendent Hicks: Letter To Governor CuomoDocument2 pagesSuperintendent Hicks: Letter To Governor CuomoAlan BedenkoNo ratings yet

- Survey of America's Charter Schools 2014Document23 pagesSurvey of America's Charter Schools 2014The Center for Education ReformNo ratings yet

- Third Way HEA Comments To Chairman Alexander and Ranking Member MurrayDocument8 pagesThird Way HEA Comments To Chairman Alexander and Ranking Member MurrayThird WayNo ratings yet

- HERO One PagerDocument1 pageHERO One PagerSenator Mike LeeNo ratings yet

- Commission Remarks 072909Document3 pagesCommission Remarks 072909Education Policy Center100% (2)

- Making College More AffordableDocument6 pagesMaking College More AffordableCenter for American ProgressNo ratings yet

- School Turnarounds in Colorado: Untangling A Web of Supports For Struggling SchoolsDocument24 pagesSchool Turnarounds in Colorado: Untangling A Web of Supports For Struggling SchoolsdefensedenverNo ratings yet

- Bringing Opportunity Within Reach: Renewing Our Commitment To Quality Affordable Higher Education For All AmericansDocument8 pagesBringing Opportunity Within Reach: Renewing Our Commitment To Quality Affordable Higher Education For All AmericanscorybookerNo ratings yet

- Republican Priorities For Reauthorizing The Higher Education ActDocument11 pagesRepublican Priorities For Reauthorizing The Higher Education ActsajuhereNo ratings yet

- The Implementation and Effectiveness of Supplemental Educational ServicesDocument28 pagesThe Implementation and Effectiveness of Supplemental Educational ServicesCenter for American ProgressNo ratings yet

- Charting New TerritoryDocument44 pagesCharting New TerritoryCenter for American ProgressNo ratings yet

- DMW Budget Testimony FinalDocument6 pagesDMW Budget Testimony FinalGothamSchools.orgNo ratings yet

- Too Often, High-Achieving Students Get Lost in The Shuffle in Debates AboutDocument8 pagesToo Often, High-Achieving Students Get Lost in The Shuffle in Debates Aboutnishat.seoexpert10No ratings yet

- Assessments Standards by Lonnie Tucker, CHE, CSW & Ms. Donna Wells, BS, PCWSDocument38 pagesAssessments Standards by Lonnie Tucker, CHE, CSW & Ms. Donna Wells, BS, PCWSLakotaAdvocatesNo ratings yet

- Thesis On No Child Left Behind ActDocument6 pagesThesis On No Child Left Behind ActBuyCustomPaperUK100% (2)

- Description: Tags: 0126Document6 pagesDescription: Tags: 0126anon-370062No ratings yet

- ED610040Document18 pagesED610040Harry StylesNo ratings yet

- Answering Public QuestionsDocument6 pagesAnswering Public QuestionsIndiana Family to FamilyNo ratings yet

- Top 10 Higher Education State Policy Issues For 2012: American Association of State Colleges and UniversitiesDocument6 pagesTop 10 Higher Education State Policy Issues For 2012: American Association of State Colleges and Universitiesapi-143403667No ratings yet

- ESEA Flexibility Request Amendment Proposal - REVISED March 26, 2014 - ESEAFlexAmendmentProposalREVISED032714Document3 pagesESEA Flexibility Request Amendment Proposal - REVISED March 26, 2014 - ESEAFlexAmendmentProposalREVISED032714lps2001No ratings yet

- No Child Left BehindDocument4 pagesNo Child Left BehindPaul RichardsonNo ratings yet

- Nepc Virtual 2013 Exec SumDocument5 pagesNepc Virtual 2013 Exec SumNational Education Policy CenterNo ratings yet

- Thesis Statement No Child Left Behind ActDocument7 pagesThesis Statement No Child Left Behind Actimddtsief100% (2)

- Av Idr Comment FinalDocument23 pagesAv Idr Comment FinalArnold VenturesNo ratings yet

- Positionproposal Final DraftDocument9 pagesPositionproposal Final Draftapi-246646503No ratings yet

- I Write To Comment On The News Journal Article On SaturdayDocument3 pagesI Write To Comment On The News Journal Article On SaturdayJohn AllisonNo ratings yet

- Final Signed CSPDocument5 pagesFinal Signed CSPKevinOhlandtNo ratings yet

- Education PlaybookDocument10 pagesEducation Playbooksareto2060No ratings yet

- Doug Gansler 2013 MSEA Survey ResponsesDocument36 pagesDoug Gansler 2013 MSEA Survey ResponsesDavid MoonNo ratings yet

- Openletteresea3 21 15Document32 pagesOpenletteresea3 21 15api-291550799No ratings yet

- Continued Strong Support For K-12 Education: Helping Students Everywhere Be Ready For College and Career OpportunitiesDocument3 pagesContinued Strong Support For K-12 Education: Helping Students Everywhere Be Ready For College and Career OpportunitiesjointhefutureNo ratings yet

- Presentation To The Austin CACDocument30 pagesPresentation To The Austin CACValerie F. LeonardNo ratings yet

- Needs Analysis and Solution For Change SelectionDocument28 pagesNeeds Analysis and Solution For Change Selectionapi-273612298No ratings yet

- Research Paper On Student DebtDocument8 pagesResearch Paper On Student Debttitamyg1p1j2100% (1)

- ESEA Flexibilty WavierDocument5 pagesESEA Flexibilty WavierShayla Ireland NormanNo ratings yet

- Grading Higher EducationDocument34 pagesGrading Higher EducationCenter for American Progress100% (1)

- Help Wanted: Flexibility For Innovative State Education AgenciesDocument36 pagesHelp Wanted: Flexibility For Innovative State Education AgenciesCenter for American ProgressNo ratings yet

- Inancial Ramework Eport: Delaware Department of EducationDocument8 pagesInancial Ramework Eport: Delaware Department of EducationKevinOhlandtNo ratings yet

- School Foodservice - Outsource or Self-Op?: Barry D. Sackin, SFNSDocument10 pagesSchool Foodservice - Outsource or Self-Op?: Barry D. Sackin, SFNSAndina SeptiawatiNo ratings yet

- Charter School LeadershipDocument13 pagesCharter School LeadershipvivekactNo ratings yet

- 1510 Expanding Student SuccessDocument15 pages1510 Expanding Student SuccessKevinOhlandtNo ratings yet

- Common Core State Standards PrimerDocument4 pagesCommon Core State Standards PrimerShane Vander HartNo ratings yet

- Quality Approaches in Higher Education Vol 3 No 1Document32 pagesQuality Approaches in Higher Education Vol 3 No 1Diana PetrosuNo ratings yet

- Research Paperclaire MaloneyDocument10 pagesResearch Paperclaire Maloneyapi-741491177No ratings yet

- Perfostructural Strength, Weather-Tightness, Acoustic Insulation, Fire-Resistance Rmance Funding AASCU June2011Document12 pagesPerfostructural Strength, Weather-Tightness, Acoustic Insulation, Fire-Resistance Rmance Funding AASCU June2011Rebecca SmithNo ratings yet

- No Child Left Behind WaiversDocument56 pagesNo Child Left Behind WaiversCenter for American ProgressNo ratings yet

- Education Stabilitzation ARRA StatementDocument6 pagesEducation Stabilitzation ARRA StatementNew York SenateNo ratings yet

- The New "Ecology" For Higher Education Challenges To Accreditation, Peter EwellDocument6 pagesThe New "Ecology" For Higher Education Challenges To Accreditation, Peter Ewellonlyjaded4655No ratings yet

- Appendix: Growing SmarterDocument8 pagesAppendix: Growing SmarterM-NCPPCNo ratings yet

- Making The Case For Why States Need To Count All Kids: October 2016Document4 pagesMaking The Case For Why States Need To Count All Kids: October 2016Achieve, Inc.No ratings yet

- Forecasting Mainstream School Funding: School Financial Success Guides, #5From EverandForecasting Mainstream School Funding: School Financial Success Guides, #5No ratings yet

- (Lion) Concept Deck - V8.0 - 30012019Document11 pages(Lion) Concept Deck - V8.0 - 30012019Afiq KhidhirNo ratings yet

- (Palm) Company Teaser - v1.0 - 11022019Document5 pages(Palm) Company Teaser - v1.0 - 11022019Afiq KhidhirNo ratings yet

- Gamuda Investment Teaser - v3.1 - 25.11.2018Document6 pagesGamuda Investment Teaser - v3.1 - 25.11.2018Afiq KhidhirNo ratings yet

- Inv Paper - Ducati Deck - V7 - 2-Sept-2018Document89 pagesInv Paper - Ducati Deck - V7 - 2-Sept-2018Afiq KhidhirNo ratings yet

- Presentation On Viability Data FINAL 2march16Document57 pagesPresentation On Viability Data FINAL 2march16Afiq KhidhirNo ratings yet

- 8 Negsembilanq12021Document41 pages8 Negsembilanq12021Afiq KhidhirNo ratings yet

- Company Presentation Directed Private Placement of NOK 100 - 150 MillionDocument24 pagesCompany Presentation Directed Private Placement of NOK 100 - 150 MillionAfiq KhidhirNo ratings yet

- Release Date Amount (RM) : Modelling QuestionDocument6 pagesRelease Date Amount (RM) : Modelling QuestionAfiq KhidhirNo ratings yet

- Malaysian House Price Index (MHPI)Document2 pagesMalaysian House Price Index (MHPI)Afiq KhidhirNo ratings yet

- Hertz Global Holdings, Inc.: Morgan Stanley Laguna ConferenceDocument12 pagesHertz Global Holdings, Inc.: Morgan Stanley Laguna ConferenceAfiq KhidhirNo ratings yet

- Sample Earnout ProvisionDocument4 pagesSample Earnout ProvisionAfiq KhidhirNo ratings yet

- Corporate Planning PDFDocument2 pagesCorporate Planning PDFAfiq KhidhirNo ratings yet

- Ms Conf Presentation VfinalDocument11 pagesMs Conf Presentation VfinalAfiq KhidhirNo ratings yet

- Eversendai Corporation Berhad - Bite The Bullet and Move On - 160608Document2 pagesEversendai Corporation Berhad - Bite The Bullet and Move On - 160608Afiq KhidhirNo ratings yet

- BGL Consumer Products Retail Insider May 16Document39 pagesBGL Consumer Products Retail Insider May 16Afiq KhidhirNo ratings yet

- National Survey Report of PV Power Applications in Malaysia 2014Document28 pagesNational Survey Report of PV Power Applications in Malaysia 2014Afiq KhidhirNo ratings yet

- Presentation Acquisition Italcementi enDocument40 pagesPresentation Acquisition Italcementi enAfiq KhidhirNo ratings yet

- Pip STF 05501 - 2012Document17 pagesPip STF 05501 - 2012Денис Пекшуев100% (1)

- PPP Financing Partnership NDA - DraftDocument7 pagesPPP Financing Partnership NDA - DraftMGShaonSarwarNo ratings yet

- Partnership Act, 2008Document10 pagesPartnership Act, 2008Venugopal Pandey100% (1)

- Easy Access Rules For Airworthiness and Environmental Certification (Regulation (EU) No 7482012) (Revision FroDocument583 pagesEasy Access Rules For Airworthiness and Environmental Certification (Regulation (EU) No 7482012) (Revision FroalexiscaracheNo ratings yet

- Recording of Documents General ProvisionsDocument7 pagesRecording of Documents General Provisionsapi-281859325No ratings yet

- PED Notified Body List 2020 (Casas Certificadoras)Document230 pagesPED Notified Body List 2020 (Casas Certificadoras)Judith PonceNo ratings yet

- Review of Maritime Transport 2018 (UNCTAD)Document116 pagesReview of Maritime Transport 2018 (UNCTAD)Vangelis Kounoupas100% (1)

- Arasco Induction 3 NewDocument20 pagesArasco Induction 3 NewSyed Nazar AlamNo ratings yet

- Legal Essay Writing CompetitionDocument4 pagesLegal Essay Writing CompetitioncentreforpubliclawNo ratings yet

- Adithyan DisserDocument6 pagesAdithyan DisserAnanthanarayanan Bijiraj NatarajanNo ratings yet

- Data Privacy Act of 2012" (R. A. No. 10173) and Its Implementing Rules and Regulations (IRR)Document22 pagesData Privacy Act of 2012" (R. A. No. 10173) and Its Implementing Rules and Regulations (IRR)Mayverii100% (1)

- Administrative Order No 263 Re. Anniv BonusDocument2 pagesAdministrative Order No 263 Re. Anniv BonusMay Angelica Teneza0% (1)

- ALHAMBRA CIGAR Vs SECDocument3 pagesALHAMBRA CIGAR Vs SECIraNo ratings yet

- Ar 95-1 Mission Brief Final Approval Authority para 2-14Document24 pagesAr 95-1 Mission Brief Final Approval Authority para 2-14api-280346739No ratings yet

- Guidance Note On Division II - Ind As Schedule III To The Companies Act, 2013 (Revised January, 2022 Edition)Document260 pagesGuidance Note On Division II - Ind As Schedule III To The Companies Act, 2013 (Revised January, 2022 Edition)Aaditya100% (1)

- Basics of MicroeconomicsDocument28 pagesBasics of MicroeconomicsLuka ColaricNo ratings yet

- Unit 2 Company LawDocument22 pagesUnit 2 Company LawRanjan BaradurNo ratings yet

- ISO 14001 Quality Productivity Society PakistanDocument82 pagesISO 14001 Quality Productivity Society Pakistankashifbutty2k100% (3)

- Quality Assurance Procedures Manual - Super Rock 2011Document25 pagesQuality Assurance Procedures Manual - Super Rock 2011Tracy BranderNo ratings yet

- Updates On Buy Back Offer (Company Update)Document73 pagesUpdates On Buy Back Offer (Company Update)Shyam SunderNo ratings yet

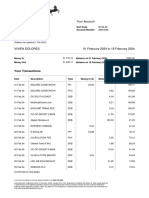

- Statement 2024 FebruaryDocument3 pagesStatement 2024 Februarycontact.sindicateNo ratings yet

- Atlas Consolidated Mining v. CirDocument2 pagesAtlas Consolidated Mining v. CirImmah Santos100% (1)

- Idbi Bank Compensation PolicyDocument17 pagesIdbi Bank Compensation Policyvicku1004No ratings yet

- 01 Distribution Agreement DraftDocument4 pages01 Distribution Agreement DraftTonyTonieNo ratings yet

- Status of Implementation of Prior Years' Audit RecommendationsDocument10 pagesStatus of Implementation of Prior Years' Audit RecommendationsJoy AcostaNo ratings yet

- COPC V9 Final PDFDocument2 pagesCOPC V9 Final PDFMohd Ismail YusofNo ratings yet

- 88878364263148Document14 pages88878364263148Ahmad Mu'tasimNo ratings yet

- Foreign Agent Registration ActOMB 1124 0001Document7 pagesForeign Agent Registration ActOMB 1124 0001tafilli54No ratings yet

Charter School Sector 8-20-12

Charter School Sector 8-20-12

Uploaded by

Afiq Khidhir0 ratings0% found this document useful (0 votes)

41 views6 pagesCharter School Sector 8-20-12

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCharter School Sector 8-20-12

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

41 views6 pagesCharter School Sector 8-20-12

Charter School Sector 8-20-12

Uploaded by

Afiq KhidhirCharter School Sector 8-20-12

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 6

Despite Funding And Regulatory

Hurdles, The U.S. Charter School

Sector Continues To Grow

Primary Credit Analyst:

Sharon A Gigante, New York (1) 212-438-2008; sharon_gigante@standardandpoors.com

Secondary Contact:

Avani Parikh, New York (1) 212-438-1133; avani_parikh@standardandpoors.com

Table Of Contents

A Dynamic Evolution

Academic Performance Drives Demand

Management Is Becoming More Sophisticated

State Funding Is Declining

More Debt Issuance Is Likely

Related Research

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT AUGUST 20, 2012 1

1003980 | 300129047

Despite Funding And Regulatory Hurdles, The

U.S. Charter School Sector Continues To Grow

Since the first one opened in Minnesota in 1992, charter schools have emerged as one of the leading tools for

education reform across much of the U.S. Yet while the charter school sector continues to grow and evolve, it faces

challenges arising from funding shortfalls, legislative oversight, and conforming with new academic standards. As of

Aug. 1, 2012, Standard & Poor's Ratings Services rated 150 charter schools across 22 states and the District of

Columbia.

The Center for Education Reform estimates that during the 2011-2012 academic year, 5,714 charter schools served

more than 1.9 million students in 39 states and the District of Columbia. Other charter school experts estimate that

another 400,000 or more children are on charter school waitlists. Considering that 2011-2012 charter school

enrollment grew by 13% from the prior year, we believe enrollment could surpass the 2 million mark at the start of the

new 2012-2013 school year.

Overview

The U.S. charter school sector continues to grow and evolve but faces challenges arising from funding

shortfalls, legislative oversight, and conforming with new academic standards.

New IRS rules could prohibit public charter school educators from participating in state retirement plans,

which would affect an estimated 95,000 public charter school employees nationwide.

Some states are making it easier for charter schools to succeed by equalizing per-pupil funding with that of

traditional public schools , lifting charter school enrollment caps, and making it easier for schools to acquire

facilities.

Continuing financial stress and performance challenges could pressure debt ratings well into 2013.

Despite the growing popularity of charter schools, the start of the 2013 school year will bring many of the same

challenges that they've been facing since their inception, including state per-pupil funding levels that can be 30% or

more lower than for traditional public schools; continually evolving legislation that dictates the general operating

environment, such as caps on enrollment levels; and new academic performance standards that will likely make it

more difficult for underperforming charter schools to stay open. In addition, we understand that new proposed IRS

regulations could force states to prohibit public charter school educators from participating in state retirement plans.

The proposed regulations, released in November 2011, would affect an estimated 95,000 public charter school

employees nationwide potentially forcing more than 93% of the nation's charter school workforce to either leave

their public charter schools or lose their state pensions, according to the National Alliance for Public Charter Schools.

The news is not all bad, however. Some states are actually changing their laws to make it easier for charter schools to

succeed by equalizing per-pupil funding with that of traditional public schools, lifting charter school enrollment caps,

and making it easier for schools to acquire facilities. According to a January 2012 report by the Center on Reinventing

Public Education, over the past three years, many more states have expanded the allowable number of charter schools

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT AUGUST 20, 2012 2

1003980 | 300129047

or students enrolled in charter schools, compared to those that have restricted them. During the 2010-2011 school

year, for every charter school that closed, nearly 3.5 new ones opened.

A Dynamic Evolution

The charter school sector continues to evolve, and its development varies widely from state to state. As state

legislators continue to lift or modify limits on the establishment of charter schools, we expect to see competition for

students intensify in some markets since the number of schools is likely to grow. Rather than opening new, unproven,

start-up schools, many charter school advocates are hoping to replicate existing charter schools that have already

proven to be highly successful in educating students to expand enrollment. This is particularly true in urban areas,

where charter school replication models continue to proliferate in response to federal policy initiatives and

private-sector influences. Because enrollments at these schools are typically large and well-diversified across several

campuses, the schools are often able to withstand greater fluctuations in student demand. A falling headcount at one

location is frequently offset by rising enrollment at another. This is generally not the case for newer, smaller schools.

Without a clearly differentiated market presence, or the means with which to expand, many small schools in certain

markets will likely face operating challenges due to enrollment losses to large and growing competitors.

Academic Performance Drives Demand

A key indicator of a charter school's success is the academic performance and success of its students, which creates

ongoing demand for the school's program. Charter schools with the strongest waiting lists are often those that offer a

rigorous and highly regarded curriculum that outperforms the local traditional public schools. In addition, the charter

authorizer closely monitors a school's academic performance, and continued underperformance can lead to charter

revocation. As a result, we're seeing a continued emphasis on curriculum development and redefining educational

programming to best meet students' needs. As education reform continues to evolve and a growing number of states

have adopted the Common Core Standards (currently 45 states, according to www.corestandards.org), we are seeing

charter schools aligning their curricula with these standards. (The Common Core State Standards Initiative is a

state-led effort coordinated by the National Governors Association Center for Best Practices (NGA Center) and the

Council of Chief State School Officers (CCSSO). The standards were developed in collaboration with teachers, school

administrators, and experts to provide a clear and consistent framework to prepare children for college and the

workforce. For more information, please see www.corestandards.org.)

When the No Child Left Behind Act was signed into law in 2002, proponents expected that every child would test at

grade level in reading and math by 2013-2014. According to the act, adequate yearly progress in test scores was the

key indicator of a school's academic success. With this key milestone approaching, more than half the states have

sought waivers from the Department of Education. The DOE required states that received waivers to demonstrate

detailed plans for preparing all students for college and careers, target federal aid to the students most in need, and

create better support of teachers and principals.

Many states, as well as the District of Columbia, that received waivers have created their own academic standards and

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT AUGUST 20, 2012 3

1003980 | 300129047

Despite Funding And Regulatory Hurdles, The U.S. Charter School Sector Continues To Grow

are emphasizing student growth and progress using new measures of success. For example, the District of Columbia

Public Charter School Board's Performance Management Framework is now in place to measure a charter school's

success or failure. According to its guidelines, the framework measures both academic performance related to student

outcomes, particularly performance growth, and nonacademic elements of school performance, such as financial

health and compliance with its charter. Charter schools in D.C. that are designated as low-performing schools under

the guidelines may be candidates for charter revocation, which underscores the importance of performing under these

measures.

This increased focus on academic accountability, which is at the root of educational reform, may also put pressure on

a school's operations and ratings in some instances. Schools with lagging academic performance could face charter

revocation and ultimately the loss of state funding. Without alternative revenue streams, which is a structural limitation

of the sector, a payment default on outstanding debt would be imminent. While charter revocation remains a

significant credit risk, most persistently low-performing schools undergo some form of remediation, which often

includes a significant restructuring of teaching staff, management, and even grade-level offerings, before the charter is

withdrawn. Although such restructurings have presented minimal operating interruptions in some cases, in others,

enrollments have declined and operating performance has weakened. Therefore, restructuring activity has become a

growing factor in deteriorating credit quality for some schools during the past calendar year. We are also seeing a

trend of charter schools and school districts forming partnerships to improve low-performing schools throughout their

communities. And some public school districts may also begin to experiment with converting their own public schools

into charter schools.

Management Is Becoming More Sophisticated

We view a strong and diverse management team as a key component to a charter school's success, and as the sector

continues to evolve, we believe charter school management teams and boards of directors are becoming more

sophisticated. Many charter schools that we rate began with strong, dynamic founders who ran almost all aspects of

the organization. And while a dynamic founder can be key to growth in the early years of a charter school, over time

many boards and founders found it necessary to bring in a professional management team with expertise in specific

functions. On the other hand, many other charter schools started out with educational or financial management

organizations in place to help manage the administrative, academic, fiscal, or other specialized services of a school.

After a few years, some schools decided that these management contracts were costly or restricted curriculum

flexibility and instead opted to pursue self-management or other more cost-effective vendors. This often resulted in an

increase in operating funds that schools could use to educate the students. We've also seen some schools begin to

contract with outside providers to explore the effectiveness and economics of distance or online learning, particularly

against the backdrop of state funding constraints. Charter schools view online learning as a good source of additional

revenue, as these students do not require additional, costly, classroom space.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT AUGUST 20, 2012 4

1003980 | 300129047

Despite Funding And Regulatory Hurdles, The U.S. Charter School Sector Continues To Grow

State Funding Is Declining

As funding levels from state sources have fallen over the past few years, many schools that had historically coped by

expanding enrollment are actively seeking approval to increase the enrollment limits under their charters, while others

are now near physical capacity. Since most charter schools derive 70% to 90% of their revenues from state sources,

flat-to-declining state appropriations represent significant operating challenges for the sector. Most have also taken

significant steps to contain costs in response to previous funding reductions. As a result, we believe the sector's

operating flexibility has already taken a hit. While state support for kindergarten through 12th-grade education appears

to be stabilizing in many areas of the country for fiscal 2013, additional reductions in some states, along with continued

funding at reduced rates or payment deferrals in others, could place significant operating strain on a number of

schools, making liquidity an important factor in meeting their ongoing payment obligations. Complicating many

schools' limited ability to respond to tighter funding are their already weak fundamental financial profiles, which

underlie the largely speculative-grade credit quality of the sector. [] These factors could put pressure on some schools'

ratings and could lead to downgrades in the face of reduced operating flexibility. Growing competitive pressure and

escalating academic accountability demands could also add to operating difficulty, although these credit factors will

not likely affect all charter schools equally.

More Debt Issuance Is Likely

We believe charter school growth will continue to be strong throughout the U.S., particularly in urban areas, where

charter schools have shown a lot of success in educating minority and low-income students. Successful charter schools

are proving that school choice can work by greatly improving standardized test scores and graduation rates in some of

the most challenging areas of the U.S., where academic success has been lagging. And we believe more states than not

are going to change their laws to allow for more school choice options, including offering vouchers to students and

lifting caps on charter school enrollment growth. Standard & Poor's thus expects more and more charter schools to

enter the bond markets as newer schools continue to grow and schools that have operated for a number of years begin

to exceed their original capacity and look for ways to expand.

Related Research

Special Report: In Tough Economic Times, Is Higher Education Still Worth The Price?, Aug. 28, 2012

U.S. Charter Schools Continue to Grow But The Sector Outlook Remains Mixed, June 11, 2012

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT AUGUST 20, 2012 5

1003980 | 300129047

Despite Funding And Regulatory Hurdles, The U.S. Charter School Sector Continues To Grow

S&P may receive compensation for its ratings and certain analyses, normally from issuers or underwriters of securities or from obligors. S&P

reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites,

www.standardandpoors.com (free of charge), and www.ratingsdirect.com and www.globalcreditportal.com (subscription), and may be distributed

through other means, including via S&P publications and third-party redistributors. Additional information about our ratings fees is available at

www.standardandpoors.com/usratingsfees.

S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective

activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established

policies and procedures to maintain the confidentiality of certain nonpublic information received in connection with each analytical process.

To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain

regulatory purposes, S&P reserves the right to assign, withdraw, or suspend such acknowledgement at any time and in its sole discretion. S&P

Parties disclaim any duty whatsoever arising out of the assignment, withdrawal, or suspension of an acknowledgment as well as any liability for any

damage alleged to have been suffered on account thereof.

Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and

not statements of fact. S&P's opinions, analyses, and rating acknowledgment decisions (described below) are not recommendations to purchase,

hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to

update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment

and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P does

not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be

reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives.

No content (including ratings, credit-related analyses and data, model, software or other application or output therefrom) or any part thereof

(Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system,

without the prior written permission of Standard & Poor's Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be used

for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or agents

(collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not responsible for

any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for the security or

maintenance of any data input by the user. The Content is provided on an "as is" basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR

IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A

PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S FUNCTIONING

WILL BE UNINTERRUPTED, OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no

event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential

damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by

negligence) in connection with any use of the Content even if advised of the possibility of such damages.

Copyright 2013 by Standard & Poor's Financial Services LLC. All rights reserved.

WWW.STANDARDANDPOORS.COM/RATINGSDIRECT AUGUST 20, 2012 6

1003980 | 300129047

You might also like

- Overview - PrintingDocument10 pagesOverview - Printingemman carlNo ratings yet

- Petition Letter TemplateDocument2 pagesPetition Letter TemplateFredel De VeraNo ratings yet

- OCRA E-Gaming BrochureDocument20 pagesOCRA E-Gaming BrochurejpamcicNo ratings yet

- U.S. Public Schools Experience More Competition For FundingDocument6 pagesU.S. Public Schools Experience More Competition For Fundingapi-227433089No ratings yet

- Obama Plan August 22 2013Document7 pagesObama Plan August 22 2013Barmak NassirianNo ratings yet

- College AffordabilityDocument7 pagesCollege AffordabilityMatthew LeonardNo ratings yet

- Trump Higher Education ActDocument5 pagesTrump Higher Education ActErin LaviolaNo ratings yet

- South Dakota ESSA FeedbackDocument4 pagesSouth Dakota ESSA FeedbackMeganNo ratings yet

- As Law School Demand Drops, Credit Quality Among U.S. Schools DivergesDocument11 pagesAs Law School Demand Drops, Credit Quality Among U.S. Schools Divergesapi-227433089No ratings yet

- Performance-Based Funding of Higher EducationDocument12 pagesPerformance-Based Funding of Higher EducationCenter for American ProgressNo ratings yet

- Superintendent Hicks: Letter To Governor CuomoDocument2 pagesSuperintendent Hicks: Letter To Governor CuomoAlan BedenkoNo ratings yet

- Survey of America's Charter Schools 2014Document23 pagesSurvey of America's Charter Schools 2014The Center for Education ReformNo ratings yet

- Third Way HEA Comments To Chairman Alexander and Ranking Member MurrayDocument8 pagesThird Way HEA Comments To Chairman Alexander and Ranking Member MurrayThird WayNo ratings yet

- HERO One PagerDocument1 pageHERO One PagerSenator Mike LeeNo ratings yet

- Commission Remarks 072909Document3 pagesCommission Remarks 072909Education Policy Center100% (2)

- Making College More AffordableDocument6 pagesMaking College More AffordableCenter for American ProgressNo ratings yet

- School Turnarounds in Colorado: Untangling A Web of Supports For Struggling SchoolsDocument24 pagesSchool Turnarounds in Colorado: Untangling A Web of Supports For Struggling SchoolsdefensedenverNo ratings yet

- Bringing Opportunity Within Reach: Renewing Our Commitment To Quality Affordable Higher Education For All AmericansDocument8 pagesBringing Opportunity Within Reach: Renewing Our Commitment To Quality Affordable Higher Education For All AmericanscorybookerNo ratings yet

- Republican Priorities For Reauthorizing The Higher Education ActDocument11 pagesRepublican Priorities For Reauthorizing The Higher Education ActsajuhereNo ratings yet

- The Implementation and Effectiveness of Supplemental Educational ServicesDocument28 pagesThe Implementation and Effectiveness of Supplemental Educational ServicesCenter for American ProgressNo ratings yet

- Charting New TerritoryDocument44 pagesCharting New TerritoryCenter for American ProgressNo ratings yet

- DMW Budget Testimony FinalDocument6 pagesDMW Budget Testimony FinalGothamSchools.orgNo ratings yet

- Too Often, High-Achieving Students Get Lost in The Shuffle in Debates AboutDocument8 pagesToo Often, High-Achieving Students Get Lost in The Shuffle in Debates Aboutnishat.seoexpert10No ratings yet

- Assessments Standards by Lonnie Tucker, CHE, CSW & Ms. Donna Wells, BS, PCWSDocument38 pagesAssessments Standards by Lonnie Tucker, CHE, CSW & Ms. Donna Wells, BS, PCWSLakotaAdvocatesNo ratings yet

- Thesis On No Child Left Behind ActDocument6 pagesThesis On No Child Left Behind ActBuyCustomPaperUK100% (2)

- Description: Tags: 0126Document6 pagesDescription: Tags: 0126anon-370062No ratings yet

- ED610040Document18 pagesED610040Harry StylesNo ratings yet

- Answering Public QuestionsDocument6 pagesAnswering Public QuestionsIndiana Family to FamilyNo ratings yet

- Top 10 Higher Education State Policy Issues For 2012: American Association of State Colleges and UniversitiesDocument6 pagesTop 10 Higher Education State Policy Issues For 2012: American Association of State Colleges and Universitiesapi-143403667No ratings yet

- ESEA Flexibility Request Amendment Proposal - REVISED March 26, 2014 - ESEAFlexAmendmentProposalREVISED032714Document3 pagesESEA Flexibility Request Amendment Proposal - REVISED March 26, 2014 - ESEAFlexAmendmentProposalREVISED032714lps2001No ratings yet

- No Child Left BehindDocument4 pagesNo Child Left BehindPaul RichardsonNo ratings yet

- Nepc Virtual 2013 Exec SumDocument5 pagesNepc Virtual 2013 Exec SumNational Education Policy CenterNo ratings yet

- Thesis Statement No Child Left Behind ActDocument7 pagesThesis Statement No Child Left Behind Actimddtsief100% (2)

- Av Idr Comment FinalDocument23 pagesAv Idr Comment FinalArnold VenturesNo ratings yet

- Positionproposal Final DraftDocument9 pagesPositionproposal Final Draftapi-246646503No ratings yet

- I Write To Comment On The News Journal Article On SaturdayDocument3 pagesI Write To Comment On The News Journal Article On SaturdayJohn AllisonNo ratings yet

- Final Signed CSPDocument5 pagesFinal Signed CSPKevinOhlandtNo ratings yet

- Education PlaybookDocument10 pagesEducation Playbooksareto2060No ratings yet

- Doug Gansler 2013 MSEA Survey ResponsesDocument36 pagesDoug Gansler 2013 MSEA Survey ResponsesDavid MoonNo ratings yet

- Openletteresea3 21 15Document32 pagesOpenletteresea3 21 15api-291550799No ratings yet

- Continued Strong Support For K-12 Education: Helping Students Everywhere Be Ready For College and Career OpportunitiesDocument3 pagesContinued Strong Support For K-12 Education: Helping Students Everywhere Be Ready For College and Career OpportunitiesjointhefutureNo ratings yet

- Presentation To The Austin CACDocument30 pagesPresentation To The Austin CACValerie F. LeonardNo ratings yet

- Needs Analysis and Solution For Change SelectionDocument28 pagesNeeds Analysis and Solution For Change Selectionapi-273612298No ratings yet

- Research Paper On Student DebtDocument8 pagesResearch Paper On Student Debttitamyg1p1j2100% (1)

- ESEA Flexibilty WavierDocument5 pagesESEA Flexibilty WavierShayla Ireland NormanNo ratings yet

- Grading Higher EducationDocument34 pagesGrading Higher EducationCenter for American Progress100% (1)

- Help Wanted: Flexibility For Innovative State Education AgenciesDocument36 pagesHelp Wanted: Flexibility For Innovative State Education AgenciesCenter for American ProgressNo ratings yet

- Inancial Ramework Eport: Delaware Department of EducationDocument8 pagesInancial Ramework Eport: Delaware Department of EducationKevinOhlandtNo ratings yet

- School Foodservice - Outsource or Self-Op?: Barry D. Sackin, SFNSDocument10 pagesSchool Foodservice - Outsource or Self-Op?: Barry D. Sackin, SFNSAndina SeptiawatiNo ratings yet

- Charter School LeadershipDocument13 pagesCharter School LeadershipvivekactNo ratings yet

- 1510 Expanding Student SuccessDocument15 pages1510 Expanding Student SuccessKevinOhlandtNo ratings yet

- Common Core State Standards PrimerDocument4 pagesCommon Core State Standards PrimerShane Vander HartNo ratings yet

- Quality Approaches in Higher Education Vol 3 No 1Document32 pagesQuality Approaches in Higher Education Vol 3 No 1Diana PetrosuNo ratings yet

- Research Paperclaire MaloneyDocument10 pagesResearch Paperclaire Maloneyapi-741491177No ratings yet

- Perfostructural Strength, Weather-Tightness, Acoustic Insulation, Fire-Resistance Rmance Funding AASCU June2011Document12 pagesPerfostructural Strength, Weather-Tightness, Acoustic Insulation, Fire-Resistance Rmance Funding AASCU June2011Rebecca SmithNo ratings yet

- No Child Left Behind WaiversDocument56 pagesNo Child Left Behind WaiversCenter for American ProgressNo ratings yet

- Education Stabilitzation ARRA StatementDocument6 pagesEducation Stabilitzation ARRA StatementNew York SenateNo ratings yet

- The New "Ecology" For Higher Education Challenges To Accreditation, Peter EwellDocument6 pagesThe New "Ecology" For Higher Education Challenges To Accreditation, Peter Ewellonlyjaded4655No ratings yet

- Appendix: Growing SmarterDocument8 pagesAppendix: Growing SmarterM-NCPPCNo ratings yet

- Making The Case For Why States Need To Count All Kids: October 2016Document4 pagesMaking The Case For Why States Need To Count All Kids: October 2016Achieve, Inc.No ratings yet

- Forecasting Mainstream School Funding: School Financial Success Guides, #5From EverandForecasting Mainstream School Funding: School Financial Success Guides, #5No ratings yet

- (Lion) Concept Deck - V8.0 - 30012019Document11 pages(Lion) Concept Deck - V8.0 - 30012019Afiq KhidhirNo ratings yet

- (Palm) Company Teaser - v1.0 - 11022019Document5 pages(Palm) Company Teaser - v1.0 - 11022019Afiq KhidhirNo ratings yet

- Gamuda Investment Teaser - v3.1 - 25.11.2018Document6 pagesGamuda Investment Teaser - v3.1 - 25.11.2018Afiq KhidhirNo ratings yet

- Inv Paper - Ducati Deck - V7 - 2-Sept-2018Document89 pagesInv Paper - Ducati Deck - V7 - 2-Sept-2018Afiq KhidhirNo ratings yet

- Presentation On Viability Data FINAL 2march16Document57 pagesPresentation On Viability Data FINAL 2march16Afiq KhidhirNo ratings yet

- 8 Negsembilanq12021Document41 pages8 Negsembilanq12021Afiq KhidhirNo ratings yet

- Company Presentation Directed Private Placement of NOK 100 - 150 MillionDocument24 pagesCompany Presentation Directed Private Placement of NOK 100 - 150 MillionAfiq KhidhirNo ratings yet

- Release Date Amount (RM) : Modelling QuestionDocument6 pagesRelease Date Amount (RM) : Modelling QuestionAfiq KhidhirNo ratings yet

- Malaysian House Price Index (MHPI)Document2 pagesMalaysian House Price Index (MHPI)Afiq KhidhirNo ratings yet

- Hertz Global Holdings, Inc.: Morgan Stanley Laguna ConferenceDocument12 pagesHertz Global Holdings, Inc.: Morgan Stanley Laguna ConferenceAfiq KhidhirNo ratings yet

- Sample Earnout ProvisionDocument4 pagesSample Earnout ProvisionAfiq KhidhirNo ratings yet

- Corporate Planning PDFDocument2 pagesCorporate Planning PDFAfiq KhidhirNo ratings yet

- Ms Conf Presentation VfinalDocument11 pagesMs Conf Presentation VfinalAfiq KhidhirNo ratings yet

- Eversendai Corporation Berhad - Bite The Bullet and Move On - 160608Document2 pagesEversendai Corporation Berhad - Bite The Bullet and Move On - 160608Afiq KhidhirNo ratings yet

- BGL Consumer Products Retail Insider May 16Document39 pagesBGL Consumer Products Retail Insider May 16Afiq KhidhirNo ratings yet

- National Survey Report of PV Power Applications in Malaysia 2014Document28 pagesNational Survey Report of PV Power Applications in Malaysia 2014Afiq KhidhirNo ratings yet

- Presentation Acquisition Italcementi enDocument40 pagesPresentation Acquisition Italcementi enAfiq KhidhirNo ratings yet

- Pip STF 05501 - 2012Document17 pagesPip STF 05501 - 2012Денис Пекшуев100% (1)

- PPP Financing Partnership NDA - DraftDocument7 pagesPPP Financing Partnership NDA - DraftMGShaonSarwarNo ratings yet

- Partnership Act, 2008Document10 pagesPartnership Act, 2008Venugopal Pandey100% (1)

- Easy Access Rules For Airworthiness and Environmental Certification (Regulation (EU) No 7482012) (Revision FroDocument583 pagesEasy Access Rules For Airworthiness and Environmental Certification (Regulation (EU) No 7482012) (Revision FroalexiscaracheNo ratings yet

- Recording of Documents General ProvisionsDocument7 pagesRecording of Documents General Provisionsapi-281859325No ratings yet

- PED Notified Body List 2020 (Casas Certificadoras)Document230 pagesPED Notified Body List 2020 (Casas Certificadoras)Judith PonceNo ratings yet

- Review of Maritime Transport 2018 (UNCTAD)Document116 pagesReview of Maritime Transport 2018 (UNCTAD)Vangelis Kounoupas100% (1)

- Arasco Induction 3 NewDocument20 pagesArasco Induction 3 NewSyed Nazar AlamNo ratings yet

- Legal Essay Writing CompetitionDocument4 pagesLegal Essay Writing CompetitioncentreforpubliclawNo ratings yet

- Adithyan DisserDocument6 pagesAdithyan DisserAnanthanarayanan Bijiraj NatarajanNo ratings yet

- Data Privacy Act of 2012" (R. A. No. 10173) and Its Implementing Rules and Regulations (IRR)Document22 pagesData Privacy Act of 2012" (R. A. No. 10173) and Its Implementing Rules and Regulations (IRR)Mayverii100% (1)

- Administrative Order No 263 Re. Anniv BonusDocument2 pagesAdministrative Order No 263 Re. Anniv BonusMay Angelica Teneza0% (1)

- ALHAMBRA CIGAR Vs SECDocument3 pagesALHAMBRA CIGAR Vs SECIraNo ratings yet

- Ar 95-1 Mission Brief Final Approval Authority para 2-14Document24 pagesAr 95-1 Mission Brief Final Approval Authority para 2-14api-280346739No ratings yet

- Guidance Note On Division II - Ind As Schedule III To The Companies Act, 2013 (Revised January, 2022 Edition)Document260 pagesGuidance Note On Division II - Ind As Schedule III To The Companies Act, 2013 (Revised January, 2022 Edition)Aaditya100% (1)

- Basics of MicroeconomicsDocument28 pagesBasics of MicroeconomicsLuka ColaricNo ratings yet

- Unit 2 Company LawDocument22 pagesUnit 2 Company LawRanjan BaradurNo ratings yet

- ISO 14001 Quality Productivity Society PakistanDocument82 pagesISO 14001 Quality Productivity Society Pakistankashifbutty2k100% (3)

- Quality Assurance Procedures Manual - Super Rock 2011Document25 pagesQuality Assurance Procedures Manual - Super Rock 2011Tracy BranderNo ratings yet

- Updates On Buy Back Offer (Company Update)Document73 pagesUpdates On Buy Back Offer (Company Update)Shyam SunderNo ratings yet

- Statement 2024 FebruaryDocument3 pagesStatement 2024 Februarycontact.sindicateNo ratings yet

- Atlas Consolidated Mining v. CirDocument2 pagesAtlas Consolidated Mining v. CirImmah Santos100% (1)

- Idbi Bank Compensation PolicyDocument17 pagesIdbi Bank Compensation Policyvicku1004No ratings yet

- 01 Distribution Agreement DraftDocument4 pages01 Distribution Agreement DraftTonyTonieNo ratings yet

- Status of Implementation of Prior Years' Audit RecommendationsDocument10 pagesStatus of Implementation of Prior Years' Audit RecommendationsJoy AcostaNo ratings yet

- COPC V9 Final PDFDocument2 pagesCOPC V9 Final PDFMohd Ismail YusofNo ratings yet

- 88878364263148Document14 pages88878364263148Ahmad Mu'tasimNo ratings yet

- Foreign Agent Registration ActOMB 1124 0001Document7 pagesForeign Agent Registration ActOMB 1124 0001tafilli54No ratings yet