Professional Documents

Culture Documents

University of Toronto - ECO 204 - 2011 - 2012 - : Department of Economics Ajaz Hussain

University of Toronto - ECO 204 - 2011 - 2012 - : Department of Economics Ajaz Hussain

Uploaded by

examkillerCopyright:

Available Formats

You might also like

- Glovo Annual Report 2023Document231 pagesGlovo Annual Report 2023koteshchoudaryNo ratings yet

- Mgeb02 FinalDocument4 pagesMgeb02 FinalexamkillerNo ratings yet

- RecentUpdate Introduction To Macroeconomics ECO2001 Final Assessment DBDocument8 pagesRecentUpdate Introduction To Macroeconomics ECO2001 Final Assessment DBdavid barnwellNo ratings yet

- Data Interpretation Guide For All Competitive and Admission ExamsFrom EverandData Interpretation Guide For All Competitive and Admission ExamsRating: 2.5 out of 5 stars2.5/5 (6)

- ECON 101 Final Practice1Document32 pagesECON 101 Final Practice1examkillerNo ratings yet

- Sap T Codes - Fico ModuleDocument3 pagesSap T Codes - Fico Modulemittalmistry629931100% (3)

- Ch1 Mini Case IntroDocument3 pagesCh1 Mini Case IntroRuany Lisbeth0% (1)

- Eco204y Final 2013wDocument32 pagesEco204y Final 2013wexamkillerNo ratings yet

- Department of Economics: ECO 204 Microeconomic Theory For Commerce 2013 - 2014 Test 1 SolutionsDocument32 pagesDepartment of Economics: ECO 204 Microeconomic Theory For Commerce 2013 - 2014 Test 1 SolutionsexamkillerNo ratings yet

- Test Simulation 12 2022Document3 pagesTest Simulation 12 2022marianaNo ratings yet

- University of Toronto - ECO 204 - Summer 2012 - : Department of Economics Ajaz HussainDocument25 pagesUniversity of Toronto - ECO 204 - Summer 2012 - : Department of Economics Ajaz HussainexamkillerNo ratings yet

- mcq1 PDFDocument15 pagesmcq1 PDFjack100% (1)

- Code 2007 Accounting Level 2 2010 Series 4Document15 pagesCode 2007 Accounting Level 2 2010 Series 4apple_syih100% (1)

- Decision Making: DR Anisur RahmanDocument27 pagesDecision Making: DR Anisur RahmanLewisNo ratings yet

- Introduction To Spreadsheets - FDP 2013Document24 pagesIntroduction To Spreadsheets - FDP 2013thayumanavarkannanNo ratings yet

- BA 502 (QMETH) Professor Hillier Sample Final ExamDocument8 pagesBA 502 (QMETH) Professor Hillier Sample Final ExamverarenNo ratings yet

- ECON 545 Business Economics Week 8 Final Exam All Sets A+ Complete AnswerDocument13 pagesECON 545 Business Economics Week 8 Final Exam All Sets A+ Complete AnswerKathy Chugg0% (1)

- University of Toronto,, ECO 204 2011 Summer: Scores Total Points Score 1 2 3 Total Points 100Document22 pagesUniversity of Toronto,, ECO 204 2011 Summer: Scores Total Points Score 1 2 3 Total Points 100examkillerNo ratings yet

- FMG 22-IntroductionDocument22 pagesFMG 22-IntroductionPrateek GargNo ratings yet

- Past Paper - 201005 MayDocument13 pagesPast Paper - 201005 MayPeggy Chan0% (1)

- (l5) Decision Making TechniquesDocument20 pages(l5) Decision Making TechniquesBruceNo ratings yet

- Allama Iqbal Open University, Islamabad Warning: Department of StatisticsDocument3 pagesAllama Iqbal Open University, Islamabad Warning: Department of StatisticsSHAH RUKH KHANNo ratings yet

- F1 May 2010 For Print. 23.3Document20 pagesF1 May 2010 For Print. 23.3mavkaziNo ratings yet

- ABE Dip 1 - Financial Accounting JUNE 2005Document19 pagesABE Dip 1 - Financial Accounting JUNE 2005spinster40% (1)

- Fin 315 Exam 1Document15 pagesFin 315 Exam 1Nick GavalekNo ratings yet

- Monash University: Semester One Examination 2008Document19 pagesMonash University: Semester One Examination 2008MichelleNo ratings yet

- Exam I October 2021Document9 pagesExam I October 2021miguelNo ratings yet

- 2020F Assignment #2 (Cover Page) - 2Document5 pages2020F Assignment #2 (Cover Page) - 2mamadou17diallo17No ratings yet

- Business Finance Sample Examination PaperDocument4 pagesBusiness Finance Sample Examination PaperYeshey ChodenNo ratings yet

- Hmci-201 End Sem Test ADocument4 pagesHmci-201 End Sem Test ARAHULNo ratings yet

- Curtin University ENGINEERING MANAGEMENT 302 Progress Test 1 - 2011Document4 pagesCurtin University ENGINEERING MANAGEMENT 302 Progress Test 1 - 2011samu1991tanNo ratings yet

- Model Question Paper - Industrial Engineering and Management - First Semester - DraftDocument24 pagesModel Question Paper - Industrial Engineering and Management - First Semester - Draftpammy313No ratings yet

- Rational Behaviour PDFDocument3 pagesRational Behaviour PDFtaraffoiNo ratings yet

- CPGA QP May 2010 For PrintDocument20 pagesCPGA QP May 2010 For PrintfaizthemeNo ratings yet

- 2010 Sem 2 Final - LatestDocument8 pages2010 Sem 2 Final - LatestArthur NitsopoulosNo ratings yet

- Tutorial Questions: Quantitative Methods IDocument5 pagesTutorial Questions: Quantitative Methods IBenneth YankeyNo ratings yet

- Ac550 FinalDocument4 pagesAc550 FinalGil SuarezNo ratings yet

- Expected Questions of FIN 515Document8 pagesExpected Questions of FIN 515Mian SbNo ratings yet

- University of Toronto - ECO 204 - Summer 2012 - : Department of Economics Ajaz HussainDocument36 pagesUniversity of Toronto - ECO 204 - Summer 2012 - : Department of Economics Ajaz HussainexamkillerNo ratings yet

- University of Toronto - ECO 204 - 2011 - 2012Document26 pagesUniversity of Toronto - ECO 204 - 2011 - 2012examkillerNo ratings yet

- Production and Operational Management: Facility LocationDocument34 pagesProduction and Operational Management: Facility LocationShahnawaz ShaikhNo ratings yet

- Quantitative Methods For Business and Management: The Association of Business Executives Diploma 1.14 QMBMDocument25 pagesQuantitative Methods For Business and Management: The Association of Business Executives Diploma 1.14 QMBMShel LeeNo ratings yet

- 1.3 ActivityDocument9 pages1.3 ActivityRonald MalicdemNo ratings yet

- Financial ManagementDocument5 pagesFinancial ManagementschawingaNo ratings yet

- Tutorial Test Question PoolDocument6 pagesTutorial Test Question PoolAAA820No ratings yet

- Simulation Import PDFDocument18 pagesSimulation Import PDFSouar YoucefNo ratings yet

- M1 - CIMA Masters Gateway Assessment 22 May 2012 - Tuesday Afternoon SessionDocument20 pagesM1 - CIMA Masters Gateway Assessment 22 May 2012 - Tuesday Afternoon Sessionkarunkumar89No ratings yet

- P1 March 2011 For PublicationDocument24 pagesP1 March 2011 For PublicationmavkaziNo ratings yet

- Econ Summer Homework 2Document16 pagesEcon Summer Homework 2Nikole Ornstein0% (1)

- Buyhouse 1030 MathDocument3 pagesBuyhouse 1030 Mathapi-260610944No ratings yet

- 00-Text-Ch2 Additional Problems UpdatedDocument3 pages00-Text-Ch2 Additional Problems Updatedzombies_meNo ratings yet

- 1 Macro-ExamDocument4 pages1 Macro-ExammindakronikNo ratings yet

- BEA140 Assign 2015S2 QDocument8 pagesBEA140 Assign 2015S2 QSyed OsamaNo ratings yet

- Financial MGMNT Sample Final ExamDocument4 pagesFinancial MGMNT Sample Final ExamJonty0% (1)

- Dec 2009 IcwaDocument8 pagesDec 2009 Icwamknatoo1963No ratings yet

- Quantitative MethodsDocument18 pagesQuantitative MethodsNikhil SawantNo ratings yet

- Business Statistics Level 3: LCCI International QualificationsDocument22 pagesBusiness Statistics Level 3: LCCI International QualificationsHein Linn Kyaw100% (1)

- QFR RTDocument3 pagesQFR RTkishorvedpathakNo ratings yet

- Question Bank 2012 Class XIIDocument179 pagesQuestion Bank 2012 Class XIINitin Dadu100% (1)

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisFrom EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNo ratings yet

- Agent-based Modeling of Tax Evasion: Theoretical Aspects and Computational SimulationsFrom EverandAgent-based Modeling of Tax Evasion: Theoretical Aspects and Computational SimulationsSascha HokampNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Eco100y1 Wolfson Tt4 2013wDocument11 pagesEco100y1 Wolfson Tt4 2013wexamkillerNo ratings yet

- Eco100y1 Wolfson Tt3 2013wDocument13 pagesEco100y1 Wolfson Tt3 2013wexamkillerNo ratings yet

- Eco100y1 Wolfson Tt2 2012fDocument12 pagesEco100y1 Wolfson Tt2 2012fexamkillerNo ratings yet

- 00 PBC Guideline Edition 1.1Document208 pages00 PBC Guideline Edition 1.1MukabiNo ratings yet

- Solidbank V Gateway April 2008Document26 pagesSolidbank V Gateway April 2008BAROPSNo ratings yet

- 121 AprgDocument272 pages121 AprgSivakumar Reddy BhemireddyNo ratings yet

- AD Ports Group Corporate Governance Report 22-EnDocument28 pagesAD Ports Group Corporate Governance Report 22-EnamalNo ratings yet

- The Effect of Stock Ownership, Independent Board of Commisioners and Characteristics of The Audit Committee On Creative Accounting PracticesDocument8 pagesThe Effect of Stock Ownership, Independent Board of Commisioners and Characteristics of The Audit Committee On Creative Accounting PracticesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- FCA NV 2018 Annual Report PDFDocument323 pagesFCA NV 2018 Annual Report PDFKulbhushan ChaddhaNo ratings yet

- Module 2 Solution Manual-2 PDFDocument41 pagesModule 2 Solution Manual-2 PDFMarvin MarianoNo ratings yet

- Rizal Ardiansyah-FebDocument124 pagesRizal Ardiansyah-FebWendy Sri MurtinaNo ratings yet

- Addl Correction of TB Errors - 20200921 - 0002Document3 pagesAddl Correction of TB Errors - 20200921 - 0002Dalemma FranciscoNo ratings yet

- Answer Key - Chapter 6 - ACCOUNTING1Document19 pagesAnswer Key - Chapter 6 - ACCOUNTING1IL MareNo ratings yet

- Samar I Electric Cooperative V CIRDocument2 pagesSamar I Electric Cooperative V CIRKristine VillanuevaNo ratings yet

- CA Final Auditpedia Exemption Charts 4 0 by CA Ravi Agarwal 1Document138 pagesCA Final Auditpedia Exemption Charts 4 0 by CA Ravi Agarwal 1geetha sai bodapatiNo ratings yet

- Literature Review Financial Risk ManagementDocument7 pagesLiterature Review Financial Risk Managementea5vpya3100% (1)

- Marasigan Medical Services - Ex 7Document4 pagesMarasigan Medical Services - Ex 7E.D.J100% (1)

- Determinant Factors Audit Delay: Evidence From IndonesiaDocument8 pagesDeterminant Factors Audit Delay: Evidence From IndonesiaAsty AstitiNo ratings yet

- Domicile Format MaleDocument6 pagesDomicile Format MaleJahangirKiyaniNo ratings yet

- Ra 9148Document16 pagesRa 9148MA Orejas RamosNo ratings yet

- Procedure - Audit MethodologyDocument7 pagesProcedure - Audit MethodologyPercy Mphulanyane0% (1)

- February 29, 2016 G.R. No. 202695 Commissioner of Internal Revenue, Petitioner, vs. GJM Philippines Manufacturing, Inc., RespondentDocument51 pagesFebruary 29, 2016 G.R. No. 202695 Commissioner of Internal Revenue, Petitioner, vs. GJM Philippines Manufacturing, Inc., RespondentCbNo ratings yet

- TK Audit ReportDocument13 pagesTK Audit ReportskyscrapperNo ratings yet

- Faisal KhanDocument23 pagesFaisal KhanFebri diani agustinNo ratings yet

- 20 RevlonDocument7 pages20 RevlonJessica Miranda VelascoNo ratings yet

- A Beginner's Guide To Fraud Detection With Data AnalyticsDocument12 pagesA Beginner's Guide To Fraud Detection With Data AnalyticsMulraj ChhedaNo ratings yet

- Budget Car Rentals SolutionDocument2 pagesBudget Car Rentals SolutionMd Jahid HossainNo ratings yet

- Compilation Report For Compilers of FSDocument1 pageCompilation Report For Compilers of FSWilliam Andrew Gutiera Bulaqueña100% (1)

- Worksheet Exercise 2: 1. Write Down The Purchase Order Number On Space Provided Below: Purchase Order Number 4500019273Document14 pagesWorksheet Exercise 2: 1. Write Down The Purchase Order Number On Space Provided Below: Purchase Order Number 4500019273Andri Gunawan PurbaNo ratings yet

- Soal Compre 020418Document7 pagesSoal Compre 020418mayda nurul alamsariNo ratings yet

University of Toronto - ECO 204 - 2011 - 2012 - : Department of Economics Ajaz Hussain

University of Toronto - ECO 204 - 2011 - 2012 - : Department of Economics Ajaz Hussain

Uploaded by

examkillerOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

University of Toronto - ECO 204 - 2011 - 2012 - : Department of Economics Ajaz Hussain

University of Toronto - ECO 204 - 2011 - 2012 - : Department of Economics Ajaz Hussain

Uploaded by

examkillerCopyright:

Available Formats

Page 1 of 20

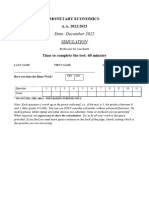

University of Toronto | Department of Economics | ECO 204 | 2011 - 2012 | Ajaz Hussain

TEST 3

TIME: 1 HOUR AND 50 MINUTES

YOU CANNOT LEAVE THE EXAM ROOM DURING THE LAST 10 MINUTES OF THE TEST

REMAIN SEATED UNTIL ALL TESTS ARE COLLECTED, COUNTED AND THE PROCTOR ANNOUNCES THAT YOU CAN LEAVE THE ROOM

IF YOU DETACH PAGES ITS YOUR RESPONSIBILITY TO RE-STAPLE THESE - GRADERS ARE NOT RESPONSIBLE FOR LOOSE PAGES

DO NOT HAVE A CELL PHONE ON YOUR DESK OR ON YOUR PERSON. ONLY AID ALLOWED: A CALCULATOR

THERE IS A WORKSHEET AT THE END OF THE TEST

GOOD LUCK!

LAST NAME (AS IT APPEARS ON ROSI)

FIRST NAME (AS IT APPEARS ON ROSI):

MIDDLE NAME (AS IT APPEARS ON ROSI)

9 - DIGIT STUDENT ID # (AS IT APPEARS ON ROSI)

PLEASE CIRCLE SECTION IN WHICH YOU ARE OFFICIALLY REGISTERED (NOT NECESSARILY THE SECTION YOU ATTEND)

MON 1-3 TUE 10-12 TUE 2-4 WED 6-8

SIGNATURE: __________________________________________________________________________

SCORES

Question Total Points Score

1 25

2 25

3 25

4 25

Total Points = 100

Page 2 of 20

Question 1 [25 Points]

The following table contains estimates of Cobb-Douglas production function parameters for select US sectors:

Tobacco Products 0.18 0.33 0.51

Food and Kindred Products 0.43 0.48 0.91

Transportation equipment 0.44 0.48 0.92

Apparel and other textiles 0.70 0.31 1.01

Furniture and fixtures 0.62 0.40 1.02

Electronics and electric equipment 0.49 0.53 1.02

Paper and allied products 0.44 0.65 1.09

Petroleum and coal products 0.30 0.88 1.18

Primary metal 0.51 0.73 1.24

(a) [5 Points] Which of these sectors exhibit increasing, constant, and decreasing returns to scale? Give a brief

explanation (including general proofs of returns to scale) and state any assumptions. You can assume that estimates of

have a margin of error.

Page 3 of 20

Page 4 of 20

(b) [5 Points] Which of these sectors exhibit increasing, constant, and decreasing returns to capital (assuming labor is

fixed)? Give a brief explanation (including general proofs of returns to capital) and state any assumptions. You can

assume that estimates of have a margin of error.

Page 5 of 20

(c) [5 Points] In which of these sectors will there be cost savings due to a horizontal merger of two companies within the

sector? Give a brief explanation (including any general proofs) and state any assumptions. You can assume that

estimates of have a margin of error. Hint: The long run cost function for the Cobb-Douglas production

function can be written as ()

Page 6 of 20

(d) [10 Points] Please sketch (rough) graphs of versus for the Tobacco, Furniture and fixtures, and Primary

Metals sectors. Provide a brief explanation next to each graph.

Answer:

Explanation

Tobacco

Explanation

Furniture and Fixtures

Explanation

Primary Metals

Page 7 of 20

Question 2 [25 Points]

The following table contains Motorolas and Research in Motions (RIM) Closing Monthly Price, Monthly Returns, and

Monthly Capital Gains in 2010:

Date

(M/D/Year)

Motorola Stocks Research in Motion (RIM) Stocks

Closing Monthly Price Returns Capital Gains Closing Monthly Price Returns Capital Gains

1/29/2010 $ 6.15 -0.207474 -0.207474 $ 62.91 -0.068551 -0.068551

2/26/2010 $ 6.76 0.099187 0.099187 $ 70.88 0.126687 0.126687

3/31/2010 $ 7.02 0.038462 0.038462 $ 73.97 0.043595 0.043595

4/30/2010 $ 7.07 0.007123 0.007123 $ 71.19 -0.037583 -0.037583

5/28/2010 $ 6.85 -0.031117 -0.031117 $ 60.69 -0.147493 -0.147493

6/30/2010 $ 6.52 -0.048175 -0.048175 $ 49.26 -0.188334 -0.188334

7/30/2010 $ 7.49 0.148773 0.148773 $ 57.53 0.167885 0.167885

8/31/2010 $ 7.52 0.004005 0.004005 $ 42.84 -0.255345 -0.255345

9/30/2010 $ 8.53 0.134309 0.134309 $ 48.69 0.136555 0.136555

10/29/2010 $ 8.16 -0.043376 -0.043376 $ 56.92 0.169029 0.169029

11/30/2010 $ 7.66 -0.061275 -0.061275 $ 61.83 0.086261 0.086261

12/31/2010 $ 9.07 0.184073 0.184073 $ 58.13 -0.059842 -0.059842

(a) [5 Points] True or false: neither Motorola nor RIM paid a monthly dividend in 2010? Give a brief explanation and

provide a formula to justify your answer.

Page 8 of 20

The following table contains the return on 30-day US Treasury Bills issued on December 31

st

2010 as well as Motorola

and RIMs average monthly returns; variance of monthly returns; and the covariance of Motorolas and RIMs monthly

returns for the period February 26

th

, 1999 to December 31

st

, 2010:

30 Day U.S. T-Bill Return (Dec 31

st

2010) 0.00081

The following figures are for the period February 26

th

, 1999 to December 31

st

, 2010

Average Motorola Monthly Returns 0.002616887

Variance of Motorola Monthly Return 0.013877326

Average RIM Monthly Returns 0.054275605

Variance RIM Monthly Returns 0.052027303

Covariance of Motorola and RIM Monthly Returns 0.012945617

(b) [5 Points] Are Motorola stocks riskier than RIM stocks, or the other way around? Give a brief explanation and justify

your answer by calculating the risk premium for each stock.

Page 9 of 20

(c) [15 Points] An investor has the following mean-variance utility function over expected portfolio returns [

] and

portfolio variance

where is a parameter reflecting the investors attitude towards risk:

[

Suppose . Suppose this investor wants to invest in a portfolio consisting of US 30 day T-Bills and a risky asset that

is a composite blend of Motorola and RIM stocks. Solve for the optimal fraction of this portfolio that will be in US 30 day

T-Bills, Motorola and RIM stocks. Show all calculations and state all assumptions.

Hint: Construct the optimal blend of Motorola and RIM stocks Construct a portfolio of US 30 day T-bills and

the blended risky asset.

Note that in a portfolio consisting of two risky assets designed to maximize the price of risk:

The fraction ( ) allocated to risky asset (the least risky of the two risky assets) is:

[(

[(

[(

[(

[(

Page 10 of 20

Page 11 of 20

Question 3 [25 Points]

Youve received a letter from the Canadian Revenue Agency (CRA) stating that you made a mistake in your 2010 tax

returns and that you owe the CRA $5,000 in back taxes. You must choose one of the following two (mutually exclusive)

decisions:

Either pay the CRA $5,000 in back taxes

Or request the CRA for an audit of your 2010 tax returns. The audit process will cost you $500 in expenses

and may result in one of two uncertain outcomes:

o With probability

the audit will agree with the CRA and you will have to pay the back taxes plus

50% of back taxes (dont forget youll also pay the $500 audit expenses)

o With probability the audit will reject the CRAs claim in which case you will owe no back taxes and

the CRA will reimburse you the $500 in audit expenses.

(a) [10 Points] Please graph the decision tree for this decision making problem under uncertainty and solve for the

optimal decision with the assumption that you are a risk neutral decision maker. Show all calculations.

Page 12 of 20

Page 13 of 20

Now suppose that you can make your decision whether to pay the back taxes or request an audit after meeting with an

accountant who (for a testing fee) will conduct a test on your tax returns and tell you the probabilities that the audit

will side with the CRA (a positive test result) or whether the audit will side with you (a negative test result). The

following probability table shows the accountants track record in the past:

Actual Outcome of Audits

Audit agreed with CRA Audit rejected the CRA Total Probabilities

Positive Test Result (+)

Negative Test Result (-)

Total Probabilities

1

(b) [15 Points] Please graph the decision tree for this decision making problem under uncertainty with testing. What is

the maximum testing fee that the accountant can charge you? Assume you are a risk neutral decision maker and show

all calculations.

Page 14 of 20

Page 15 of 20

Question 4 [25 points]

[Short Questions. All parts are independent of each other]

(a) [5 points] What is actuarially fair insurance? Please give a brief explanation and a proof. Be sure to state any

assumptions.

Page 16 of 20

(b) [5 points] Give a brief explanation for how Dell Computers reduced inventory period through learning by doing.

Page 17 of 20

(c) [5 points] What are the economies of scope from a merger of a beer manufacturer and a U.S. wine manufacturer?

Page 18 of 20

(d) [5 points] True or false: if a companys average cost () falls over time, it must be due to learning by doing?

Page 19 of 20

(e) [5 points] A company uses fixed and variable labor, fixed and variable capital, and variable materials to produce

output according to a Cobb-Douglas production function:

What is the interpretation of the Lagrange multiplier in this companys Cost Minimization Problem below?

]

Note: You do not need to solve the CMP.

Page 20 of 20

WORKSHEET

You might also like

- Glovo Annual Report 2023Document231 pagesGlovo Annual Report 2023koteshchoudaryNo ratings yet

- Mgeb02 FinalDocument4 pagesMgeb02 FinalexamkillerNo ratings yet

- RecentUpdate Introduction To Macroeconomics ECO2001 Final Assessment DBDocument8 pagesRecentUpdate Introduction To Macroeconomics ECO2001 Final Assessment DBdavid barnwellNo ratings yet

- Data Interpretation Guide For All Competitive and Admission ExamsFrom EverandData Interpretation Guide For All Competitive and Admission ExamsRating: 2.5 out of 5 stars2.5/5 (6)

- ECON 101 Final Practice1Document32 pagesECON 101 Final Practice1examkillerNo ratings yet

- Sap T Codes - Fico ModuleDocument3 pagesSap T Codes - Fico Modulemittalmistry629931100% (3)

- Ch1 Mini Case IntroDocument3 pagesCh1 Mini Case IntroRuany Lisbeth0% (1)

- Eco204y Final 2013wDocument32 pagesEco204y Final 2013wexamkillerNo ratings yet

- Department of Economics: ECO 204 Microeconomic Theory For Commerce 2013 - 2014 Test 1 SolutionsDocument32 pagesDepartment of Economics: ECO 204 Microeconomic Theory For Commerce 2013 - 2014 Test 1 SolutionsexamkillerNo ratings yet

- Test Simulation 12 2022Document3 pagesTest Simulation 12 2022marianaNo ratings yet

- University of Toronto - ECO 204 - Summer 2012 - : Department of Economics Ajaz HussainDocument25 pagesUniversity of Toronto - ECO 204 - Summer 2012 - : Department of Economics Ajaz HussainexamkillerNo ratings yet

- mcq1 PDFDocument15 pagesmcq1 PDFjack100% (1)

- Code 2007 Accounting Level 2 2010 Series 4Document15 pagesCode 2007 Accounting Level 2 2010 Series 4apple_syih100% (1)

- Decision Making: DR Anisur RahmanDocument27 pagesDecision Making: DR Anisur RahmanLewisNo ratings yet

- Introduction To Spreadsheets - FDP 2013Document24 pagesIntroduction To Spreadsheets - FDP 2013thayumanavarkannanNo ratings yet

- BA 502 (QMETH) Professor Hillier Sample Final ExamDocument8 pagesBA 502 (QMETH) Professor Hillier Sample Final ExamverarenNo ratings yet

- ECON 545 Business Economics Week 8 Final Exam All Sets A+ Complete AnswerDocument13 pagesECON 545 Business Economics Week 8 Final Exam All Sets A+ Complete AnswerKathy Chugg0% (1)

- University of Toronto,, ECO 204 2011 Summer: Scores Total Points Score 1 2 3 Total Points 100Document22 pagesUniversity of Toronto,, ECO 204 2011 Summer: Scores Total Points Score 1 2 3 Total Points 100examkillerNo ratings yet

- FMG 22-IntroductionDocument22 pagesFMG 22-IntroductionPrateek GargNo ratings yet

- Past Paper - 201005 MayDocument13 pagesPast Paper - 201005 MayPeggy Chan0% (1)

- (l5) Decision Making TechniquesDocument20 pages(l5) Decision Making TechniquesBruceNo ratings yet

- Allama Iqbal Open University, Islamabad Warning: Department of StatisticsDocument3 pagesAllama Iqbal Open University, Islamabad Warning: Department of StatisticsSHAH RUKH KHANNo ratings yet

- F1 May 2010 For Print. 23.3Document20 pagesF1 May 2010 For Print. 23.3mavkaziNo ratings yet

- ABE Dip 1 - Financial Accounting JUNE 2005Document19 pagesABE Dip 1 - Financial Accounting JUNE 2005spinster40% (1)

- Fin 315 Exam 1Document15 pagesFin 315 Exam 1Nick GavalekNo ratings yet

- Monash University: Semester One Examination 2008Document19 pagesMonash University: Semester One Examination 2008MichelleNo ratings yet

- Exam I October 2021Document9 pagesExam I October 2021miguelNo ratings yet

- 2020F Assignment #2 (Cover Page) - 2Document5 pages2020F Assignment #2 (Cover Page) - 2mamadou17diallo17No ratings yet

- Business Finance Sample Examination PaperDocument4 pagesBusiness Finance Sample Examination PaperYeshey ChodenNo ratings yet

- Hmci-201 End Sem Test ADocument4 pagesHmci-201 End Sem Test ARAHULNo ratings yet

- Curtin University ENGINEERING MANAGEMENT 302 Progress Test 1 - 2011Document4 pagesCurtin University ENGINEERING MANAGEMENT 302 Progress Test 1 - 2011samu1991tanNo ratings yet

- Model Question Paper - Industrial Engineering and Management - First Semester - DraftDocument24 pagesModel Question Paper - Industrial Engineering and Management - First Semester - Draftpammy313No ratings yet

- Rational Behaviour PDFDocument3 pagesRational Behaviour PDFtaraffoiNo ratings yet

- CPGA QP May 2010 For PrintDocument20 pagesCPGA QP May 2010 For PrintfaizthemeNo ratings yet

- 2010 Sem 2 Final - LatestDocument8 pages2010 Sem 2 Final - LatestArthur NitsopoulosNo ratings yet

- Tutorial Questions: Quantitative Methods IDocument5 pagesTutorial Questions: Quantitative Methods IBenneth YankeyNo ratings yet

- Ac550 FinalDocument4 pagesAc550 FinalGil SuarezNo ratings yet

- Expected Questions of FIN 515Document8 pagesExpected Questions of FIN 515Mian SbNo ratings yet

- University of Toronto - ECO 204 - Summer 2012 - : Department of Economics Ajaz HussainDocument36 pagesUniversity of Toronto - ECO 204 - Summer 2012 - : Department of Economics Ajaz HussainexamkillerNo ratings yet

- University of Toronto - ECO 204 - 2011 - 2012Document26 pagesUniversity of Toronto - ECO 204 - 2011 - 2012examkillerNo ratings yet

- Production and Operational Management: Facility LocationDocument34 pagesProduction and Operational Management: Facility LocationShahnawaz ShaikhNo ratings yet

- Quantitative Methods For Business and Management: The Association of Business Executives Diploma 1.14 QMBMDocument25 pagesQuantitative Methods For Business and Management: The Association of Business Executives Diploma 1.14 QMBMShel LeeNo ratings yet

- 1.3 ActivityDocument9 pages1.3 ActivityRonald MalicdemNo ratings yet

- Financial ManagementDocument5 pagesFinancial ManagementschawingaNo ratings yet

- Tutorial Test Question PoolDocument6 pagesTutorial Test Question PoolAAA820No ratings yet

- Simulation Import PDFDocument18 pagesSimulation Import PDFSouar YoucefNo ratings yet

- M1 - CIMA Masters Gateway Assessment 22 May 2012 - Tuesday Afternoon SessionDocument20 pagesM1 - CIMA Masters Gateway Assessment 22 May 2012 - Tuesday Afternoon Sessionkarunkumar89No ratings yet

- P1 March 2011 For PublicationDocument24 pagesP1 March 2011 For PublicationmavkaziNo ratings yet

- Econ Summer Homework 2Document16 pagesEcon Summer Homework 2Nikole Ornstein0% (1)

- Buyhouse 1030 MathDocument3 pagesBuyhouse 1030 Mathapi-260610944No ratings yet

- 00-Text-Ch2 Additional Problems UpdatedDocument3 pages00-Text-Ch2 Additional Problems Updatedzombies_meNo ratings yet

- 1 Macro-ExamDocument4 pages1 Macro-ExammindakronikNo ratings yet

- BEA140 Assign 2015S2 QDocument8 pagesBEA140 Assign 2015S2 QSyed OsamaNo ratings yet

- Financial MGMNT Sample Final ExamDocument4 pagesFinancial MGMNT Sample Final ExamJonty0% (1)

- Dec 2009 IcwaDocument8 pagesDec 2009 Icwamknatoo1963No ratings yet

- Quantitative MethodsDocument18 pagesQuantitative MethodsNikhil SawantNo ratings yet

- Business Statistics Level 3: LCCI International QualificationsDocument22 pagesBusiness Statistics Level 3: LCCI International QualificationsHein Linn Kyaw100% (1)

- QFR RTDocument3 pagesQFR RTkishorvedpathakNo ratings yet

- Question Bank 2012 Class XIIDocument179 pagesQuestion Bank 2012 Class XIINitin Dadu100% (1)

- Capital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisFrom EverandCapital Structure and Profitability: S&P 500 Enterprises in the Light of the 2008 Financial CrisisNo ratings yet

- Agent-based Modeling of Tax Evasion: Theoretical Aspects and Computational SimulationsFrom EverandAgent-based Modeling of Tax Evasion: Theoretical Aspects and Computational SimulationsSascha HokampNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Eco100y1 Wolfson Tt4 2013wDocument11 pagesEco100y1 Wolfson Tt4 2013wexamkillerNo ratings yet

- Eco100y1 Wolfson Tt3 2013wDocument13 pagesEco100y1 Wolfson Tt3 2013wexamkillerNo ratings yet

- Eco100y1 Wolfson Tt2 2012fDocument12 pagesEco100y1 Wolfson Tt2 2012fexamkillerNo ratings yet

- 00 PBC Guideline Edition 1.1Document208 pages00 PBC Guideline Edition 1.1MukabiNo ratings yet

- Solidbank V Gateway April 2008Document26 pagesSolidbank V Gateway April 2008BAROPSNo ratings yet

- 121 AprgDocument272 pages121 AprgSivakumar Reddy BhemireddyNo ratings yet

- AD Ports Group Corporate Governance Report 22-EnDocument28 pagesAD Ports Group Corporate Governance Report 22-EnamalNo ratings yet

- The Effect of Stock Ownership, Independent Board of Commisioners and Characteristics of The Audit Committee On Creative Accounting PracticesDocument8 pagesThe Effect of Stock Ownership, Independent Board of Commisioners and Characteristics of The Audit Committee On Creative Accounting PracticesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- FCA NV 2018 Annual Report PDFDocument323 pagesFCA NV 2018 Annual Report PDFKulbhushan ChaddhaNo ratings yet

- Module 2 Solution Manual-2 PDFDocument41 pagesModule 2 Solution Manual-2 PDFMarvin MarianoNo ratings yet

- Rizal Ardiansyah-FebDocument124 pagesRizal Ardiansyah-FebWendy Sri MurtinaNo ratings yet

- Addl Correction of TB Errors - 20200921 - 0002Document3 pagesAddl Correction of TB Errors - 20200921 - 0002Dalemma FranciscoNo ratings yet

- Answer Key - Chapter 6 - ACCOUNTING1Document19 pagesAnswer Key - Chapter 6 - ACCOUNTING1IL MareNo ratings yet

- Samar I Electric Cooperative V CIRDocument2 pagesSamar I Electric Cooperative V CIRKristine VillanuevaNo ratings yet

- CA Final Auditpedia Exemption Charts 4 0 by CA Ravi Agarwal 1Document138 pagesCA Final Auditpedia Exemption Charts 4 0 by CA Ravi Agarwal 1geetha sai bodapatiNo ratings yet

- Literature Review Financial Risk ManagementDocument7 pagesLiterature Review Financial Risk Managementea5vpya3100% (1)

- Marasigan Medical Services - Ex 7Document4 pagesMarasigan Medical Services - Ex 7E.D.J100% (1)

- Determinant Factors Audit Delay: Evidence From IndonesiaDocument8 pagesDeterminant Factors Audit Delay: Evidence From IndonesiaAsty AstitiNo ratings yet

- Domicile Format MaleDocument6 pagesDomicile Format MaleJahangirKiyaniNo ratings yet

- Ra 9148Document16 pagesRa 9148MA Orejas RamosNo ratings yet

- Procedure - Audit MethodologyDocument7 pagesProcedure - Audit MethodologyPercy Mphulanyane0% (1)

- February 29, 2016 G.R. No. 202695 Commissioner of Internal Revenue, Petitioner, vs. GJM Philippines Manufacturing, Inc., RespondentDocument51 pagesFebruary 29, 2016 G.R. No. 202695 Commissioner of Internal Revenue, Petitioner, vs. GJM Philippines Manufacturing, Inc., RespondentCbNo ratings yet

- TK Audit ReportDocument13 pagesTK Audit ReportskyscrapperNo ratings yet

- Faisal KhanDocument23 pagesFaisal KhanFebri diani agustinNo ratings yet

- 20 RevlonDocument7 pages20 RevlonJessica Miranda VelascoNo ratings yet

- A Beginner's Guide To Fraud Detection With Data AnalyticsDocument12 pagesA Beginner's Guide To Fraud Detection With Data AnalyticsMulraj ChhedaNo ratings yet

- Budget Car Rentals SolutionDocument2 pagesBudget Car Rentals SolutionMd Jahid HossainNo ratings yet

- Compilation Report For Compilers of FSDocument1 pageCompilation Report For Compilers of FSWilliam Andrew Gutiera Bulaqueña100% (1)

- Worksheet Exercise 2: 1. Write Down The Purchase Order Number On Space Provided Below: Purchase Order Number 4500019273Document14 pagesWorksheet Exercise 2: 1. Write Down The Purchase Order Number On Space Provided Below: Purchase Order Number 4500019273Andri Gunawan PurbaNo ratings yet

- Soal Compre 020418Document7 pagesSoal Compre 020418mayda nurul alamsariNo ratings yet