Professional Documents

Culture Documents

JM Financial Consolidated Performance Q4 FY14

JM Financial Consolidated Performance Q4 FY14

Uploaded by

Ankita NirolaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

JM Financial Consolidated Performance Q4 FY14

JM Financial Consolidated Performance Q4 FY14

Uploaded by

Ankita NirolaCopyright:

Available Formats

JM Financial Limited

Q4 FY14 Consolidated Performance

May 2014

Results for the Quarter and year ended March 31, 2014

Table of Contents

2

I : Key features

II : Quarterly performance

III : Annual performance

IV : Business performance

Results for the Quarter and year ended March 31, 2014

3

I : Key features

Results for the Quarter and year ended March 31, 2014

Key features of Q4 FY14 Consolidated Financial performance

4

Gross revenue ` 255 Cr (q-q ` 222 Cr, y-y ` 278 Cr)

Earning before Interest and Tax (EBIT) at ` 75 Cr (q-q ` 66 Cr, y-y ` 81 Cr)

Profit after tax ` 59 Cr (q-q ` 44 Cr, y-y ` 70 Cr)

Net Interest Margin at 6.9 % (q-q 6.8%, y-y 4.9%)

Earning Per Share stood at ` 0.79 (q-q 0.59, y-y 0.93) (not annualised)

Consolidated group annualised RoE at 11.7%

PAT Margin at 23.3 % (q-q 19.9%, y-y 25.1%)

Results for the Quarter and year ended March 31, 2014

Key features of FY14 Consolidated Financial performance

5

Gross revenue ` 1,007 Cr (` 1,042 Cr) 3 %

Earning before Interest and Tax (EBIT) at ` 295 Cr (` 266 Cr) 11 %

Profit after Tax ` 210 Cr (` 183 Cr) 15 %

PAT margin at 20.8% (17.6%)

Earning Per Share stood at ` 2.78 (` 2.44)

Consolidated group annualised RoE at 10.3%

Net Interest Margin at 6.2 % ( 4.3 %)

Results for the Quarter and year ended March 31, 2014

Key features of Q4FY14 and FY14 Consolidated Financial performance

6

Loan book on 31 Mar 2014 at ` 2,978 Cr ; treasury book for fixed income securities at ` 534 Cr

Wealth Management AUM on 31 Mar 2014 at `13,500 Cr

Dropping Cash market volumes continue to put brokerage yield under pressure

Asset Reconstruction AUM on 31 Mar 2014 at ` 3,647 Cr

Alternate Asset management AUM on 31 March 2014 at ` 1,188 Cr

Asset management Average AUM for Q4 FY14 at ` 6,046 Cr

Results for the Quarter and year ended March 31, 2014

7

II : Quarterly performance

Results for the Quarter and year ended March 31, 2014

8

Consolidated Financial Performance Quarter by Quarter

Gross Revenue

(` `` ` Crore)

250

245

268

278

282

248

222

255

0

100

200

300

Q1FY13 Q2FY13 Q3FY13 Q4FY13 Q1FY14 Q2FY14 Q3FY14 Q4FY14

Profit before tax

(` `` ` Crore)

35 34

44

70

56

50

44

59

0

25

50

75

Q1FY13 Q2FY13 Q3FY13 Q4FY13 Q1FY14 Q2FY14 Q3FY14 Q4FY14

Profit after tax

(` `` ` Crore)

EPS (` `` `) ( not annualised)

Snapshot

Net Worth as on March 31, 2014 was ` `` ` 2,092 Crore

0.47 0.45

0.59

0.93

0.74

0.67

0.59

0.79

0.0

0.3

0.6

0.9

Q1FY13 Q2FY13 Q3FY13 Q4FY13 Q1FY14 Q2FY14 Q3FY14 Q4FY14

58 55

63

78

79

68

62

71

0

30

60

90

Q1FY13 Q2FY13 Q3FY13 Q4FY13 Q1FY14 Q2FY14 Q3FY14 Q4FY14

Results for the Quarter and year ended March 31, 2014

Consolidated Financial Performance Quarter by Quarter

Book Value Per Share (` `` `)

25

26

26 26

27

27

28 28

0

10

20

30

Q1FY13 Q2FY13 Q3FY13 Q4FY13 Q1FY14 Q2FY14 Q3FY14 Q4FY14

Snapshot

Net Worth as on March 31, 2014 was ` `` ` 2,092 Crore

9

Net worth (` Cr ` Cr ` Cr ` Cr)

1,908

1,940

1,989 1,976

2,046

2,074

2,124

2,092

0

500

1,000

1,500

2,000

2,500

Q1FY13 Q2FY13 Q3FY13 Q4FY13 Q1FY14 Q2FY14 Q3FY14 Q4FY14

Results for the Quarter and year ended March 31, 2014

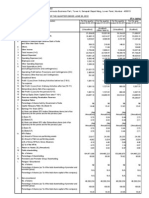

Results for Q4 FY14 (Consolidated )

10

` `` ` Cr Q4 FY14 Q3 FY14 QoQ Q4FY13 YoY

Gross Revenue 255 222 15% 278 -8%

Sub-brokerage 23 19 19% 21 5%

Net Revenue 232 203 15% 257 -9%

Employee cost 55 42 30% 51 7%

Operating cost 36 28 30% 27 36%

Finance cost 66 67 -1% 98 -32%

Depreciation 4 4 -2% 3 20%

Profit before tax 71 62 15% 78 -9%

Profit after tax 52 43 20% 57 -9%

Minority interest / Associate 7 1 740% 13 -42%

Net Consolidated profit 59 44 35% 70 -15%

Results for the Quarter and year ended March 31, 2014

SegmentsNet Revenue breakup (net of sub brokerage & finance cost)

11

IB & SB

83 Cr,

52.1%

FB 60

Cr,

37.6%

AAM 7

Cr, 4.2%

AM 6 Cr,

4.1%

Others 3

Cr, 2.0%

IB & SB

79 Cr,

47%

FB 62

Cr, 37%

AAM 10

Cr, 6%

AM 5 Cr,

3%

Others

11 Cr,

7%

Q4 FY13 Q4 FY14

` ` ` ` 159 Crore ` ` ` ` 167 Crore

Q3 FY14

IB & SB

50 Cr,

37%

FB 61

Cr, 45%

AAM 10

Cr, 7%

AM 4 Cr,

3%

Others

11 Cr,

8%

IB & SB - Investment banking and securities business, FB - Fund based activities,

AAM - Alternative asset management, AM - Asset management

` ` ` ` 136 Crore

Results for the Quarter and year ended March 31, 2014

Segments Profit after tax breakup

12

IB & SB

17 Cr,

24%

FB

49 Cr,

71%

AAM 4

Cr, 5%

AM 0.5

Cr, 0%

Others -

0.2 Cr,

0%

IB & SB

9 Cr,

15%

FB

42 Cr,

71%

AAM 5

Cr, 8%

AM 1 Cr,

2%

Others

(3 Cr),

5%

Q4 FY13 Q4 FY14

` ` ` ` 70 Crore 70 Crore 70 Crore 70 Crore

` ` ` ` 59 Crore 59 Crore 59 Crore 59 Crore

Q3 FY14

IB & SB

-1 Cr, -

1%

FB

34 Cr,

76%

AAM 5

Cr, 11%

AM 1 Cr,

1%

Others 5

Cr, 12%

IB & SB - Investment banking and securities business, FB - Fund based activities,

AAM - Alternative asset management, AM - Asset management

` ` ` ` 44 Crore 44 Crore 44 Crore 44 Crore

Results for the Quarter and year ended March 31, 2014

13

III : Annual performance

Results for the Quarter and year ended March 31, 2014

Year ended results for Mar 14 (Consolidated)

14

` `` ` Cr

FY14 FY13

YoY

Gross Revenue 1,007 1,042 -3%

Sub-brokerage 80 100 -20%

Net Revenue 926 942 -2%

Employee cost 203 198 3%

Operating cost 120 101 19%

Finance cost 308 377 -18%

Depreciation 15 12 25%

Profit before tax 280 254 10%

Profit after tax 200 179 12%

Minority interest / Associate 9 4 138%

Net Consolidated profit 210 183 15%

Results for the Quarter and year ended March 31, 2014

Balance Sheet Highlights

15

Net worth on 31 March 2014 ` 2,092 Cr (March 2013 ` 1,976 Cr)

Borrowings on 31 March 2014 ` 2,987 Cr ( March 2013 ` 4,196 Cr)

Debt Equity : Gross Gearing - 1.4x, Net Gearing 0.9x

Balance sheet size on 31 March 2014 ` 5,825 Cr (March 2013 ` 6,853 Cr)

Loan book on 31 March 2014 ` 2,978 Cr (March 2013 ` 3,005 Cr)

Treasury funds on 31 March 2014 ` 974 Cr

Short term rating by CRISIL A1+ ; long- term rating of CRISIL AA- with stable outlook

Results for the Quarter and year ended March 31, 2014

Summary Balance Sheet

16

Rs Cr

As at March

31, 2014

As at March

31, 2013

Equity and Liabilities

Shareholders Funds 2,092 1,976

Minority Interest 165 150

Borrowings 2,987 4,196

TOTAL 5,244 6,322

Assets

Loan book 2,978 3,005

Investment and Treasury fund 1,469 1,987

Arbitrage and trading book 534 1,100

Other net assets 263 230

TOTAL 5,244 6,322

Results for the Quarter and year ended March 31, 2014

Lending portfolio

17

Corporate lending 137 Cr, 5%

Lending for Commercial Real

Estate 1,374 Cr, 46%

Lending to Sponsors 696 Cr,

23%

Margin Funding 419 Cr, 14%

Loan Against Shares 352 Cr,

12%

Break-up of Loan book (%)

As on March 31, 2014, the Loan book stood at Rs.2,978 Crores

Results for the Quarter and year ended March 31, 2014

Borrowing breakup

18

Commercial Paper 2,083

Cr, 70%

Non convertible

Debentures 536 Cr, 18%

Intercorporate Deposit 25

Cr, 1%

Loan from Banks 343 Cr,

11%

Long term debt ratings: CRISIL AA-/STABLE

Short term debt ratings: CRISIL A1+.

Sources of Funds (%)

As on March 31, 2014, the total borrowing was Rs.2,987 Crores

Results for the Quarter and year ended March 31, 2014

19

IV : Business performance

Results for the Quarter and year ended March 31, 2014

Investment banking

20

Snapshot

Acted as book running lead manager to the Rs. 1,993 Crore Tata Power rights issue

Engaged as part of the team for Rs.5,449 Crore block trade for a partial exit by SUUTI

(Specified Undertaking of the Unit Trust of India) in Axis Bank.

The Monetary Authority of Singapore (MAS) has issued the Capital Markets Services (CMS)

licence to JM Financial Singapore Pte Ltd. in January 2014.

Singapore office continues to generate traction, JM Financial Singapore acted as the financial

advisor to Boston based Foliage Inc on its sale to French company Altran SA

Results for the Quarter and year ended March 31, 2014

Equities broking and Wealth advisory Highlights

21

Average daily turnover (` `` `Cr)

279

367 396

442 409

469

368

410

861

938

1,014

1,223

1,351

1,074

837

961

0

600

1200

1800

Q1FY13 Q2FY13 Q3FY13 Q4FY13 Q1FY14 Q2FY14 Q3FY14 Q4FY14

Avg Cash Avg FAO

Equity market share on NSE (%)

2.20

2.81

2.80

3.09 3.18

3.36

2.56

2.40

0.71

0.79 0.79

0.88

0.86

0.65

0.57

0.67

0.82

0.95 0.95

1.05

1.01

0.83

0.72 0.80

0

1

2

3

4

5

6

Q1FY13 Q2FY13 Q3FY13 Q4FY13 Q1FY14 Q2FY14 Q3FY14 Q4FY14

Cash Market share FAO Market share Overall Market share

Snapshot

Average daily turnover at ` 1,370 Cr in

Q4FY14

Market share on NSE at 0.80% in Q4FY14

Stocks under research coverage - 176

Wealth management AUM over ` 13,400 Cr

Over 8,000 active IFDs

Presence in 116 cities

Despite equity market upsurge, retail participation still low

Results for the Quarter and year ended March 31, 2014

Fund based activities - Quarterly

22

Income at ` 129 Cr (q-q ` 126 Cr, y-y

` 146 Cr)

Profit before tax at ` 53 Cr (q-q ` 50

Cr, y-y ` 52 Cr)

Profit after tax at ` 36 Cr (q-q ` 33

Cr, y-y ` 36 Cr)

RoE (annualised) at 15.7%

Net Interest Income at ` 47 Cr.

Net Interest Margin at 6.94 %

Capital Adequacy Ratio at 25.51%

Provision Coverage Ratio at 48%.

Provision Coverage Ratio including

standard asset provision at 299 %

Borrowings stood at 2,946 Cr

Gross Gearing - 3.0x,

Net Gearing 2.6x

Results for the Quarter and year ended March 31, 2014

Fund based activities - Yearly

23

Income at ` 529 Cr (` 552 Cr) 4 %

Profit before tax at ` 202 Cr (` 183 Cr)

11 %

Profit after tax at ` 135 Cr (` 126 Cr)

7%

RoE (annualised) at 14.7%

Loan book as on 31

st

Mar 2014

` 2,978 Cr.

Treasury book for fixed income

securities ` 534 Cr.

Net Interest Income at ` 176 Cr.

Net Interest Margin at 6.21%

Gross NPA at 0.4 % , Net NPA at 0.2

%

Net worth as on 31

st

Mar 2014 ` 975

Cr

Real Estate exposure ` 1,374 Cr

Results for the Quarter and year ended March 31, 2014

Highlights - Fund based activities

24

2,222

2,436

2,786

3,005

2,728

2,431

2,592

2,978

0

620

1,240

1,860

2,480

3,100

Q1FY13 Q2FY13 Q3FY13 Q4FY13 Q1FY14 Q2FY14 Q3FY14 Q4FY14

24.4

19.7

16.8

22.0

22.9

30.0 30.2

25.5

0

7

14

21

28

35

Q1FY13 Q2FY13 Q3FY13 Q4FY13 Q1FY14 Q2FY14 Q3FY14 Q4FY14

4.0

4.2

4.5

5.0

4.6

6.7

6.8

6.9

0

2

4

6

8

Q1FY13 Q2FY13 Q3FY13 Q4FY13 Q1FY14 Q2FY14 Q3FY14 Q4FY14

0.1

0.1

0.9

0.8

0.9

1.4

1.0

0.4

0

1

1

2

Q1FY13 Q2FY13 Q3FY13 Q4FY13 Q1FY14 Q2FY14 Q3FY14 Q4FY14

Loan book

(` `` `Cr)

Capital Adequacy Ratio

(%)

Net Interest Margin

(%)

Gross NPA

(%)

Results for the Quarter and year ended March 31, 2014

Asset Reconstruction

25

AUM at ` 3,647 Cr

JM ARC share in total AUM at ` 584 Cr

Assets acquired during the quarter at ` 2,497 Cr

JM ARC share in acquisition during the quarter at ` 224 Cr

Assets Redeemed during the quarter at ` 22 Cr

JM ARC share in redemption during the quarter at ` 8 Cr

Results for the Quarter and year ended March 31, 2014

Asset Reconstruction

26

12

85

179

205

340

367 363 368

584

18

61

420

553

743

733 732

804

3,063

30

146

599

758

1,083

1,100 1,095

1,172

3,647

0

400

800

1200

4000

FY09 FY10 FY11 FY12 FY13 Q1FY14 Q2FY14 Q3FY14 Q4FY14

JM share in AUM Others

AUM (` ` ` ` Cr) Asset acquired during the period (` ` ` ` Cr)

12

77

113

86

240

36

1

15

224

18

44

365

137

237

12

78

2,273

30

121

478

223

477

36

13

93

2,497

0

200

400

600

2800

FY09 FY10 FY11 FY12 FY13 Q1FY14 Q2FY14 Q3FY14 Q4FY14

JM Share in acquisition Others

Results for the Quarter and year ended March 31, 2014

Alternative Asset Management

27

AUM ` 855 Cr.

No. of investments: 15

No. of Exits: 5

Fully drawn down & invested

AUM ` 333 Cr

No. of investments: 14

No. of Exits: 1 full and 3 part

Fully drawn down & invested

Private Equity

Real Estate

Results for the Quarter and year ended March 31, 2014

Asset Management

28

Average AUM

Equity 458

Debt 5,588

Total 6,046

Over 2 Lacs active investors

Number of Scheme : 17

Average AUM

( ` i ` i ` i ` in Cr)

Mutual Fund

576

564

569

506 487 443 447 458

5,236

5,060

6,902

6,905

6,263

6,745

5,588

5,812

5,624

7,472

7,411

6,750

6,235

7,192

6,046

0

2000

4000

6000

8000

Q1FY13 Q2FY13 Q3FY13 Q4FY13 Q1FY14 Q2FY14 Q3FY14 Q4FY14

Equity Debt

Results for the Quarter and year ended March 31, 2014

29

The content of this document are for information purposes only and does not construe to be any investment, advice. Any action taken by you on the basis of the

information contained herein is your responsibility alone and JM Financial Limited (hereinafter referred as JM Financial) and its subsidiaries or their employees or

directors, associates will not be liable in any manner for the consequences of such action taken by you. We have taken due care regarding authenticity of the

information contained herein, but do not represent that it is accurate or complete in all respect. JM Financial or any of its subsidiaries or associates or their

employees shall not in any way be responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this

document. The recipients of this document should rely on their own judgement while taking any action based on the information provided herein.

Thank You

You might also like

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Presentation (Company Update)Document29 pagesPresentation (Company Update)Shyam SunderNo ratings yet

- Blue Dart Express LTD.: CompanyDocument5 pagesBlue Dart Express LTD.: CompanygirishrajsNo ratings yet

- YES Bank Annual Report 2014-15Document4 pagesYES Bank Annual Report 2014-15Nalini ChunchuNo ratings yet

- Press Release Q4FY 25 April 14Document7 pagesPress Release Q4FY 25 April 14Anjali Angel ThakurNo ratings yet

- Katzie First Nation - Financial Statements 2013Document32 pagesKatzie First Nation - Financial Statements 2013Monisha Caroline MartinsNo ratings yet

- A Grade SampleDocument25 pagesA Grade SampleTharindu PereraNo ratings yet

- Presentation (Company Update)Document25 pagesPresentation (Company Update)Shyam SunderNo ratings yet

- Annual Results FY 2009-10Document38 pagesAnnual Results FY 2009-10Anuj KantNo ratings yet

- Investor Presentation (Company Update)Document34 pagesInvestor Presentation (Company Update)Shyam SunderNo ratings yet

- Fiscal Management Report 2016Document123 pagesFiscal Management Report 2016Ada DeranaNo ratings yet

- UCO Bank: Performance HighlightsDocument12 pagesUCO Bank: Performance Highlightspathanfor786No ratings yet

- Earnings Update Q4FY15 (Company Update)Document45 pagesEarnings Update Q4FY15 (Company Update)Shyam SunderNo ratings yet

- Andhra Bank, 1Q FY 2014Document11 pagesAndhra Bank, 1Q FY 2014Angel BrokingNo ratings yet

- Results Press Release, Result Presentation For December 31, 2015 (Result)Document34 pagesResults Press Release, Result Presentation For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Powerspeed H1 2014Document2 pagesPowerspeed H1 2014Kristi DuranNo ratings yet

- FY 2011-12 Third Quarter Results: Investor PresentationDocument34 pagesFY 2011-12 Third Quarter Results: Investor PresentationshemalgNo ratings yet

- Pathfinder NOV 2015 Skills LevelDocument210 pagesPathfinder NOV 2015 Skills LevelAnonymous nqukBeNo ratings yet

- NTB - 1H2013 Earnings Note - BUY - 27 August 2013Document4 pagesNTB - 1H2013 Earnings Note - BUY - 27 August 2013Randora LkNo ratings yet

- 9M 2013 Unaudited ResultsDocument2 pages9M 2013 Unaudited ResultsOladipupo Mayowa PaulNo ratings yet

- QIB Financials 31 March 2015Document24 pagesQIB Financials 31 March 2015gulafsha1No ratings yet

- L&T 4Q Fy 2013Document15 pagesL&T 4Q Fy 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryArun ShekharNo ratings yet

- Bank of Baroda FY 14 Financial AnalysisDocument33 pagesBank of Baroda FY 14 Financial Analysisp2488100% (1)

- 1H15 PPT - VFDocument29 pages1H15 PPT - VFClaudio Andrés De LucaNo ratings yet

- Investor Presentation: Q2FY13 & H1FY13 UpdateDocument18 pagesInvestor Presentation: Q2FY13 & H1FY13 UpdategirishdrjNo ratings yet

- OTC Final Accounts 2016Document57 pagesOTC Final Accounts 2016Ali ZafarNo ratings yet

- Dishman 2QFY2013RUDocument10 pagesDishman 2QFY2013RUAngel BrokingNo ratings yet

- Dena Bank (DENBAN) : Core Performance Drives ProfitabilityDocument7 pagesDena Bank (DENBAN) : Core Performance Drives ProfitabilitySachin GuptaNo ratings yet

- August 2014 Quarterly Refunding Combined Charges For Archives FINALDocument81 pagesAugust 2014 Quarterly Refunding Combined Charges For Archives FINALalphathesisNo ratings yet

- Abridged 2014Document1 pageAbridged 2014Jashveer SeetahulNo ratings yet

- JP Associates, 1Q FY 2014Document13 pagesJP Associates, 1Q FY 2014Angel BrokingNo ratings yet

- 1Q14 Presentation of ResultsDocument16 pages1Q14 Presentation of ResultsMillsRINo ratings yet

- Auditors Report and Audited Financial StatementsDocument45 pagesAuditors Report and Audited Financial Statementszahir2020No ratings yet

- Bharat Telecom LTD Condensed Audited Financial Statements For The Year Ended 31 March 2015Document1 pageBharat Telecom LTD Condensed Audited Financial Statements For The Year Ended 31 March 2015L'express MauriceNo ratings yet

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- Infosys Results Q2-2005-06Document4 pagesInfosys Results Q2-2005-06Niranjan PrasadNo ratings yet

- FCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationDocument32 pagesFCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationOladipupo Mayowa PaulNo ratings yet

- Financial Results For The Quarter Ended 30 June 2012Document2 pagesFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaNo ratings yet

- DB Corp, 1Q FY 2014Document11 pagesDB Corp, 1Q FY 2014Angel BrokingNo ratings yet

- 2014 Complete Annual Report PDFDocument264 pages2014 Complete Annual Report PDFChaityAzmeeNo ratings yet

- RCap Q3FY14 Results Presentation InvestorsDocument34 pagesRCap Q3FY14 Results Presentation InvestorsRenu NerlekarNo ratings yet

- Market Outlook, 5th February, 2013Document15 pagesMarket Outlook, 5th February, 2013Angel BrokingNo ratings yet

- Unity Infraprojects (UNIINF) : Stretched Working Capital To Restrict GrowthDocument8 pagesUnity Infraprojects (UNIINF) : Stretched Working Capital To Restrict GrowthShyam RathiNo ratings yet

- 3Q JulyMar 1213Document17 pages3Q JulyMar 1213frk007No ratings yet

- Results Press Release For December 31, 2015 (Result)Document4 pagesResults Press Release For December 31, 2015 (Result)Shyam SunderNo ratings yet

- Ladder For Leaders 24 2433Document654 pagesLadder For Leaders 24 2433JosephNo ratings yet

- Financial Results Dec 2015 PDFDocument23 pagesFinancial Results Dec 2015 PDFprashanthinithangaveNo ratings yet

- Allahabad Bank, 1Q FY 2014Document11 pagesAllahabad Bank, 1Q FY 2014Angel BrokingNo ratings yet

- DLF IdbiDocument5 pagesDLF IdbivivarshneyNo ratings yet

- Honda Atlas Cars (Pakistan) Limited: 1QFY15 Result Update - Exceptional Growth To Start The YearDocument2 pagesHonda Atlas Cars (Pakistan) Limited: 1QFY15 Result Update - Exceptional Growth To Start The YearArslan IshaqNo ratings yet

- Shriram City Union Finance: Healthy Growth, Elevated Credit Costs HoldDocument9 pagesShriram City Union Finance: Healthy Growth, Elevated Credit Costs HoldRohit ThapliyalNo ratings yet

- V-Guard Industries: CMP: INR523 TP: INR650 BuyDocument10 pagesV-Guard Industries: CMP: INR523 TP: INR650 BuySmriti SrivastavaNo ratings yet

- Bank of Kigali Announces Q1 2010 ResultsDocument7 pagesBank of Kigali Announces Q1 2010 ResultsBank of KigaliNo ratings yet

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNo ratings yet

- Shoppers Stop 4qfy11 Results UpdateDocument5 pagesShoppers Stop 4qfy11 Results UpdateSuresh KumarNo ratings yet

- SPH Reit - Hold: Upholding Its StrengthDocument5 pagesSPH Reit - Hold: Upholding Its StrengthventriaNo ratings yet

- 1Q15 Financial StatementsDocument42 pages1Q15 Financial StatementsFibriaRINo ratings yet

- Demonstra??es Financeiras em Padr?es InternacionaisDocument65 pagesDemonstra??es Financeiras em Padr?es InternacionaisFibriaRINo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Rbi Guidelines On Wealth Management, Marketing, Distribution by BanksDocument20 pagesRbi Guidelines On Wealth Management, Marketing, Distribution by BanksAnkita NirolaNo ratings yet

- Alpha Tyre CompanyDocument2 pagesAlpha Tyre CompanyAnkita NirolaNo ratings yet

- Decision Making at Igate and Patni ComputersDocument16 pagesDecision Making at Igate and Patni ComputersAnkita NirolaNo ratings yet

- Ankita Emerging Concepts in Cost & MNGT AcingDocument21 pagesAnkita Emerging Concepts in Cost & MNGT AcingAnkita NirolaNo ratings yet

- ISK Eturn: University of LethbridgeDocument20 pagesISK Eturn: University of LethbridgeDavid ZhangNo ratings yet

- Coinfloor Account Review FormDocument2 pagesCoinfloor Account Review FormAnonymous pUJV4kZNo ratings yet

- 2550Mv 2Document7 pages2550Mv 2nelsonNo ratings yet

- Inflation AccountingDocument18 pagesInflation AccountingArun Pandey100% (1)

- 8.handbook On Microfinance InstitutionsDocument122 pages8.handbook On Microfinance InstitutionsAditya100% (1)

- Notes Toredemption of Preference SharesDocument40 pagesNotes Toredemption of Preference Sharesaparna bingiNo ratings yet

- 2a Ent600 - Blueprint - 2018 Guidelines & TemplateDocument14 pages2a Ent600 - Blueprint - 2018 Guidelines & TemplateMat Azib MugeNo ratings yet

- McKinsey On Chemicals 3 FINAL PDFDocument57 pagesMcKinsey On Chemicals 3 FINAL PDFFaiq Ahmad KhanNo ratings yet

- International Business Chapter-1Document19 pagesInternational Business Chapter-1Shwetha SiddaramuNo ratings yet

- Kristopher Charlz Rodriguez - ResumeDocument2 pagesKristopher Charlz Rodriguez - Resumeapi-341071945No ratings yet

- Review TestDocument1 pageReview TestKristine Joy Mendoza InciongNo ratings yet

- What Is Budget?Document23 pagesWhat Is Budget?pRiNcE DuDhAtRaNo ratings yet

- Tata Communications Annual Report 2014Document172 pagesTata Communications Annual Report 2014varaprasad_ganjiNo ratings yet

- Insurance Law Review 2015Document43 pagesInsurance Law Review 2015peanut47No ratings yet

- R. M. Edwards and Dorothy Edwards v. Commissioner of Internal Revenue, Loyd W. Disler and Joy Disler v. Commissioner of Internal Revenue, 415 F.2d 578, 10th Cir. (1969)Document8 pagesR. M. Edwards and Dorothy Edwards v. Commissioner of Internal Revenue, Loyd W. Disler and Joy Disler v. Commissioner of Internal Revenue, 415 F.2d 578, 10th Cir. (1969)Scribd Government DocsNo ratings yet

- BajajautoDocument224 pagesBajajautoThouseef AhmedNo ratings yet

- Investment Banking Assignment 2 (19BSP2845)Document1 pageInvestment Banking Assignment 2 (19BSP2845)Sonal PuriNo ratings yet

- Powerinvesting: Trading Your Way To Financial FreedomDocument42 pagesPowerinvesting: Trading Your Way To Financial FreedomIvelisse Santana100% (2)

- Dividends: Powerpoint Lecture Presentation Prof. Osler T Aquino Asia Pacific CollegeDocument22 pagesDividends: Powerpoint Lecture Presentation Prof. Osler T Aquino Asia Pacific CollegeJoseph ChristianNo ratings yet

- Top 50 Largest Apartment OperatorsDocument52 pagesTop 50 Largest Apartment OperatorsJohn ThiryNo ratings yet

- Compound InterestDocument9 pagesCompound InterestmecitfuturedreamsNo ratings yet

- Bonds Market in PakistanDocument26 pagesBonds Market in PakistanSumanSohailNo ratings yet

- Biodiesel Feasibility Studies and Business PlansDocument12 pagesBiodiesel Feasibility Studies and Business PlansJazzd Sy GregorioNo ratings yet

- Foreign Corporations.: NotesDocument16 pagesForeign Corporations.: NotesvivivioletteNo ratings yet

- KCCBNK 130626094924 Phpapp02Document19 pagesKCCBNK 130626094924 Phpapp02krahulsharma11No ratings yet

- SCC Cement in MyanmarDocument10 pagesSCC Cement in MyanmarLavu Anil ChowdaryNo ratings yet

- Simafore Whitepaper Customer Lifetime Value Modeling PDFDocument13 pagesSimafore Whitepaper Customer Lifetime Value Modeling PDFsafj,ndsaNo ratings yet

- PD 129 SummaryDocument5 pagesPD 129 SummaryFrancis De CastroNo ratings yet

- Sme InformationDocument10 pagesSme InformationKrit FinancialsNo ratings yet

- Fin 4 WC FinancingDocument2 pagesFin 4 WC FinancingHumphrey OdchigueNo ratings yet