Professional Documents

Culture Documents

Future Consumer Enterprises (FCEL)

Future Consumer Enterprises (FCEL)

Uploaded by

India Business Reports0 ratings0% found this document useful (0 votes)

196 views16 pagesAs on IPO date, FCEL (then called Future Ventures or FVL) was a NBFC registered with the RBI, and in the business of making investments, which it calls Business Ventures.

It had 14 Business Ventures, six of which were subsidiaries. Out of the 14 Business Ventures, FCEL had indirect shareholding in three of the Business Ventures and one of the Subsidiaries is a step-down subsidiary. FCEL intended to be a long-term owner, operator and/or partner of the Business Ventures.

The company changed character in Nov'12, when it demerged out its clothing and fashion investments like: Indus League, Lee Cooper, Celio, Holii, Indus Tree and strategic investments in AND, Biba and Turtle into Future Fashion. This was effective 1 Jan 13, or after 9 months of FY13

We analysed FCEL as it stands now (at the request of an investor). Summary of key points:

1. The best case valuation of Future Consumer Enterprises (FCEL) should be around Rs 1100 crore, or about 30% less than the current market cap. This implies a share price of ~Rs7.

2. Aggregate EBITDA loss of Rs 140 crore over FY08-14. No clarity on when would the company turn EBITDA positive. Unsettled business model.

3.On the positive side, the company had zero net debt as on 31 March’14 (short term debt of Rs 109 crore, current investment of Rs 123 crore). However, it has announced 4 investments since, the era of zero net debt could be over by now.

4. Sold Capital Food stake for Rs 180 crore in Dec’13. While the sale gave positive returns, reason for sale not clear.

5. The drop in FY14 revenue is a result of the FY13 demerger. While FCEL added new businesses (KB’s, Express retail) in FY13, it wasn’t enough to recoup the topline. The demerger also took away the profitable businesses, leaving FCEL will all loss making businesses.

6. Current business portfolio is around Rs 340 crore of sales from standalone company, and Rs 480 crore from subsidiaries.

7. Since Apr’13, the company has made 4 major new investment decisions: 100% of Future Agrovet, 35% in Sarjena Foods, 74% in a mega food park project and 50% in a JV in Sri Lanka.

8. Not clear how an investment in an infrastructure project like a food park is in synch with the company’s business. More such parks planned.

9. ACK Media is loss making non-core business requiring continual support. FCEL had invested Rs 82 cr till Mar’13; put in a further Rs 9 cr in Dec’13.

10. Acquisition of Express Retail appears another bad investment. The company appears to have closed almost half of its 65 stores.

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAs on IPO date, FCEL (then called Future Ventures or FVL) was a NBFC registered with the RBI, and in the business of making investments, which it calls Business Ventures.

It had 14 Business Ventures, six of which were subsidiaries. Out of the 14 Business Ventures, FCEL had indirect shareholding in three of the Business Ventures and one of the Subsidiaries is a step-down subsidiary. FCEL intended to be a long-term owner, operator and/or partner of the Business Ventures.

The company changed character in Nov'12, when it demerged out its clothing and fashion investments like: Indus League, Lee Cooper, Celio, Holii, Indus Tree and strategic investments in AND, Biba and Turtle into Future Fashion. This was effective 1 Jan 13, or after 9 months of FY13

We analysed FCEL as it stands now (at the request of an investor). Summary of key points:

1. The best case valuation of Future Consumer Enterprises (FCEL) should be around Rs 1100 crore, or about 30% less than the current market cap. This implies a share price of ~Rs7.

2. Aggregate EBITDA loss of Rs 140 crore over FY08-14. No clarity on when would the company turn EBITDA positive. Unsettled business model.

3.On the positive side, the company had zero net debt as on 31 March’14 (short term debt of Rs 109 crore, current investment of Rs 123 crore). However, it has announced 4 investments since, the era of zero net debt could be over by now.

4. Sold Capital Food stake for Rs 180 crore in Dec’13. While the sale gave positive returns, reason for sale not clear.

5. The drop in FY14 revenue is a result of the FY13 demerger. While FCEL added new businesses (KB’s, Express retail) in FY13, it wasn’t enough to recoup the topline. The demerger also took away the profitable businesses, leaving FCEL will all loss making businesses.

6. Current business portfolio is around Rs 340 crore of sales from standalone company, and Rs 480 crore from subsidiaries.

7. Since Apr’13, the company has made 4 major new investment decisions: 100% of Future Agrovet, 35% in Sarjena Foods, 74% in a mega food park project and 50% in a JV in Sri Lanka.

8. Not clear how an investment in an infrastructure project like a food park is in synch with the company’s business. More such parks planned.

9. ACK Media is loss making non-core business requiring continual support. FCEL had invested Rs 82 cr till Mar’13; put in a further Rs 9 cr in Dec’13.

10. Acquisition of Express Retail appears another bad investment. The company appears to have closed almost half of its 65 stores.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

196 views16 pagesFuture Consumer Enterprises (FCEL)

Future Consumer Enterprises (FCEL)

Uploaded by

India Business ReportsAs on IPO date, FCEL (then called Future Ventures or FVL) was a NBFC registered with the RBI, and in the business of making investments, which it calls Business Ventures.

It had 14 Business Ventures, six of which were subsidiaries. Out of the 14 Business Ventures, FCEL had indirect shareholding in three of the Business Ventures and one of the Subsidiaries is a step-down subsidiary. FCEL intended to be a long-term owner, operator and/or partner of the Business Ventures.

The company changed character in Nov'12, when it demerged out its clothing and fashion investments like: Indus League, Lee Cooper, Celio, Holii, Indus Tree and strategic investments in AND, Biba and Turtle into Future Fashion. This was effective 1 Jan 13, or after 9 months of FY13

We analysed FCEL as it stands now (at the request of an investor). Summary of key points:

1. The best case valuation of Future Consumer Enterprises (FCEL) should be around Rs 1100 crore, or about 30% less than the current market cap. This implies a share price of ~Rs7.

2. Aggregate EBITDA loss of Rs 140 crore over FY08-14. No clarity on when would the company turn EBITDA positive. Unsettled business model.

3.On the positive side, the company had zero net debt as on 31 March’14 (short term debt of Rs 109 crore, current investment of Rs 123 crore). However, it has announced 4 investments since, the era of zero net debt could be over by now.

4. Sold Capital Food stake for Rs 180 crore in Dec’13. While the sale gave positive returns, reason for sale not clear.

5. The drop in FY14 revenue is a result of the FY13 demerger. While FCEL added new businesses (KB’s, Express retail) in FY13, it wasn’t enough to recoup the topline. The demerger also took away the profitable businesses, leaving FCEL will all loss making businesses.

6. Current business portfolio is around Rs 340 crore of sales from standalone company, and Rs 480 crore from subsidiaries.

7. Since Apr’13, the company has made 4 major new investment decisions: 100% of Future Agrovet, 35% in Sarjena Foods, 74% in a mega food park project and 50% in a JV in Sri Lanka.

8. Not clear how an investment in an infrastructure project like a food park is in synch with the company’s business. More such parks planned.

9. ACK Media is loss making non-core business requiring continual support. FCEL had invested Rs 82 cr till Mar’13; put in a further Rs 9 cr in Dec’13.

10. Acquisition of Express Retail appears another bad investment. The company appears to have closed almost half of its 65 stores.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 16

12 JULY 2014

FUTURE CONSUMER ENTERPRISE LIMITED

RS 9.79

Company Report: India-Consumer Listed

www.indiabusinessreports.com 1

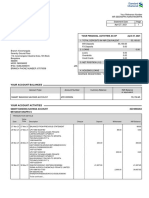

Basic Stock Info

Market Cap Rs 1564 crore

Listing BSE, NSE

Face Value Rs 6 (was Rs 10 at IPO)

IPO May 2011

IPO Price Rs 10

52 week high Rs 11.78

52 week high date 10-July-14

52 week low Rs 4.51

52 week low date 26-Nov-13

All time high Rs 11.88

All time high date 12-Nov-12

All time low Rs 4.51

All time low date 26-Nov-13

Shareholding Pattern

Mar-14 Mar-13

Promoters 41.1 39.1

FIIs 19.8 20.7

Public 39.1 40.2

% of Promoter Holding Pledged

31-Mar-14 71.1%

31-Dec-13 52.1%

31-Mar-13 52.1%

31-Mar-12 40.7%

Brief Financials

(Rs cr) FY10 FY11 FY12 FY13 FY14

Sales 157.8 547.2 858.3 959.3 822.6

EBITDA (excl OI) -23.6 14.9 19.4 -18.5 -85.6

PAT -21.0 -39.4 -65.4 -76.6 -15.3

EBITDA margin (%) -15.0% 2.7% 2.3% -1.9% -10.4%

Networth 504.5 726.9 1437.5 829.5 805.7

Debt 168.8 13 22.3 1.4 109.5

Net Fixed Assets

245.9 254.5 377.2

Investments

148.2 539.1 138.9

Net Current Assets 302.7 140.6 316.2

KEY POINTS

The best case valuation of Future Consumer

Enterprises (FCEL) should be around Rs 1100 crore,

or about 30% less than the current market cap.

This implies a share price of ~Rs7.

Aggregate EBITDA loss of Rs 140 crore over FY08-

14. No clarity on when would the company turn

EBITDA positive. Unsettled business model.

On the positive side, the company had zero net

debt as on 31 March14 (short term debt of Rs 109

crore, current investment of Rs 123 crore).

However, it has announced 4 investments since,

the era of zero net debt could be over by now.

Sold Capital Food stake for Rs 180 crore in Dec13.

While the sale gave positive returns, reason for

sale not clear.

The drop in FY14 revenue is a result of the FY13

demerger. While FCEL added new businesses (KBs,

Express retail) in FY13, it wasnt enough to recoup

the topline. The demerger also took away the

profitable businesses, leaving FCEL will all loss

making businesses.

Current business portfolio is around Rs 340 crore of

sales from standalone company, and Rs 480 crore

from subsidiaries.

Since Apr13, the company has made 4 major new

investment decisions: 100% of Future Agrovet, 35%

in Sarjena Foods, 74% in a mega food park project

and 50% in a JV in Sri Lanka.

Not clear how an investment in an infrastructure

project like a food park is in synch with the

companys business. More such parks planned.

ACK Media is loss making non-core business

requiring continual support. FCEL had invested Rs

82 cr till Mar13; put in a further Rs 9 cr in Dec13.

Acquisition of Express Retail appears another bad

investment. The company appears to have closed

almost half of its 65 stores.

To get a free copy* of this report with full content, write to reports@indiabusinessreports.com

*free for students and academicians

India-Consumer-Listed Future Consumer Enterprise 12 Jul14

www.indiabusinessreports.com 2

BUSINESS AT IPO

Was an investment company at IPO in 2011

14 Business Ventures, six of which were

subsidiaries

As on IPO date, FCEL (then called Future Ventures or FVL) was a NBFC

registered with the RBI, and in the business of making investments, which

it calls Business Ventures.

It had 14 Business Ventures, six of which were subsidiaries. Out of the 14

Business Ventures, FCEL had indirect shareholding in three of the Business

Ventures and one of the Subsidiaries is a step-down subsidiary. FCEL

intended to be a long-term owner, operator and/or partner of the

Business Ventures.

Business Venture Segment Stake Date acquired

1 AND Designs India Limited Fashion 22.86% 21.10.2009

2 Biba Apparels Private Limited Fashion 17.30% 14.03.2011

3 Holii Accessories Private Limited Fashion 50.00% 02.11.2009

4 Indus-League Clothing Limited Fashion 85.70% 30.01.2010

5 Celio Future Fashion Limited* Fashion 49.99% 30.01.2010

6 Lee Cooper (India) Limited Fashion 100.00% 30.01.2010

7 Turtle Limited* Fashion 26.00% 30.01.2010

8 Indus Tree Crafts Private Limited Home Products 52.53% 01.03.2010

9 Capital Foods Exportts Private Limited Food 40.81% 15.02.2010

10 Future Consumer Enterprises Limited FMCG 100.00% 02.08.2010

11 Future Consumer Products Limited FMCG 90.00% 29.06.2010

12 Aadhaar Retailing Limited Rural Distribution 70.00% 27.03.2008

13 Amar Chitra Katha Private Limited Media 12.79% 30.06.2011

14 SSIPL Retail Limited Footwear Distributor 6.57%

FCEL had entered into a Mentoring Services Agreement with Pantaloon

Retail (India) Limited to provide mentoring services to itself and/ or the

Business Ventures.

Additionally, it had entered into a Consulting and Advisory Services

Agreement with Future Capital Holdings Limited under which it would,

amongst other things, support resource mobilisation in investee

companies, advice on mergers and acquisitions and exit strategies and

provide research services in relation to Treasury Assets.

25% of advisory fee goes to Future Corporate Resources, rest goes to

Future Retail.

In addition to the above fee, FVL also pays Brand Royalty as per chart

shown.

These appear to go to Future Ideas Company Limited and Future Brands

Limited.

India-Consumer-Listed Future Consumer Enterprise 12 Jul14

www.indiabusinessreports.com 3

DEMERGER SCHEME IN NOV12

Gave away fashion business to Future Fashion & Lifestyle

8 Business Ventures demerged out,

effective 1 Jan13

Future Ventures (FVL) demerged out: Indus League, Lee Cooper, Celio,

Holii, Indus Tree and strategic investments in AND, Biba and Turtle into

Future Fashion. This was effective 1 Jan 13, or after 9 months of FY13.

We have attempted a rough calculation of the impact of demerger on the

P&L of FVL/FCEL.

The profitable business moved out. It

was also the larger business,

contributing >60% of FY12 revenue

The key majority owned businesses demerged out Indus League Clothing,

and its subsidiary Lee Cooper. For FY12, the cumulative turnover of these

businesses was ~Rs 540 crore, and EBITDA was Rs 46 crore.

The business which has continued had

revenue of ~Rs320 cr and EBITDA loss of

~26 crore in FY12. Since then, while

revenue has expanded sharply, so has

EBITDA loss

What the following table shows is what would financials look like, if the

demerged business was excluded.

FY12 FY13

(Rs cr) Reported Less

Demerged

Reported Less

Demerged

Sales

858.3 328.3 959.3 535.3

EBITDA

19.4 -26.6 -18.5 -55.3

Some of the minority holdings like AND, and Biba were also demerged out;

however, these dont impact the P&L.

The continuing revenue stream of the

current FCEL shows a steady 8-10%

EBITDA loss

The financials for FCELs business, if we strip out the demerged businesses

(certain approximations involved here), look like this:

(Rs cr) FY12 FY13 FY14

Sales 328.3 535.3 822.6

EBITDA -26.6 -55.3 -85.6

EBITDA Margin (%) -8.1% -10.3% -10.4%

This does give the impression that FCELs food and related businesses are

making a steady EBITDA loss of 8-10%. The sharp jump in revenue is not all

organic, new acquired businesses are a part of this, though we dont know

by how much.

Statement at the time of demerger

FVL will be a company focussed on the Food & FMCG sector with a

portfolio of FMCG brands --

Its own rural distribution chain, Aadhar and convenience store

chains, KBs Fair Price & Big Apple.

The FMCG brands portfolio includes Fresh & Pure, Premium

Harvest, Tasty Treat, Clean Mate, Care Mate, Poonya, Ekta,

Sangis Kitchen along with Smith & Jones and Chings Secret that

are owned through a 43.7% stake in Capital Foods.

It also owns an upcoming Food Park being set up for sourcing and

processing of Food & FMCG products.

FVIL will also reorganise some of its businesses held in

subsidiaries to emerge as an operating company and will continue

to look for investment opportunities for its growth

India-Consumer-Listed Future Consumer Enterprise 12 Jul14

www.indiabusinessreports.com 4

BUSINESS PORTFOLIO POST DEMERGER

Operating business + subsidiaries

Retailing, Food and FMCG are the focus

areas, ACK is an oddball

At the time of the de-merger, there are about 6 key Business Ventures left:

Aadhar, Future Consumer Products, ACK, Star and Sitara Wellness, Express

Retail and Capital Foods.

Subsidiaries as on Mar13 Investment Stake

(post de-merger) Mar-12 Mar-13 Mar-12 Mar-13

Aadhaar Retailing Limited 107 116 70.00% 70.00%

Future Consumer Enterprises Limited 160 2 100% 100%

Future Consumer Products Limited 20 20 90% 90%

Amar Chitra Katha Private Limited 82 82 68.12% 68.12%

Star and Sitara Wellness Private Limited - 18 100.00% 100.00%

Express Retail Services Private Limited - 62 100.00% 100.00%

Capital Foods Exportts Private Limited* 81 81 43.76% 43.50%

Capital Foods Exportts Private Limited 25# 25#

Total (Rs Crore) 475 405

*Capital Foods was not a subsidiary #zero coupon convertible debenture

Stand alone revenues start from FY13 From the above lot, 2 companies - Future Consumer Enterprises Limited

and Future Consumer Products Limited have moved up to figure in stand

along revenues. KBs Fair Price was also acquired in FY13 and it appears is

part of the parent standalone numbers

(Rs crore)

The demerged businesses would have continued to 3 quarters of FY13,

which explains 70-80% of FY13s sale from subsidiaries.

Express Retail added to FY13

consolidated numbers, Future Agrovet

partly came in FY14

Similarly consolidated revenue has grown through addition of Express

Retail in FY13 and Future Agrovet in Nov13 (which should have

contributed to Q4 of FY14)

0 0

303.7

342.8

FY11 FY12 FY13 FY14

Net Sales - Standalone

547.2

858.3

655.6

479.8

FY11 FY12 FY13 FY14

Sales from Subsidiaries

India-Consumer-Listed Future Consumer Enterprise 12 Jul14

www.indiabusinessreports.com 5

INVESTMENT ACTIVITY SINCE MAR13

FCEL has been quite active in FY14 and

ytd, making 6 investment

announcements

FCEL announced 6 investments since Mar13. Of this, KFC Shoemaker was

supposed to be passed on to Future Fashion and Lifestyle.

FCEL continues to support loss making ACK.

Announced a tie up with Sunkist, a

bevearages brand from USA in Dec13.

Expects a revenue of Rs 200 crore in 2

years

Besides the above equity investments, FCEL signed a long-term licensing

agreement with Sunkist. Sunkist is a citrus marketing co-operative and a

leading licensor based in California with presence across 86 countries.

In India, the company is expected to launch a range of sparkling

beverages, fruit juices and drinks which would be priced at a premium

compared with existing brands such as Fanta, Miranda or Tropicana. We

expect the Sunkist brand to record Rs 200 crore sales turnover by the

second year of launch. It would be based on a royalty payment, added

Biyani. Sunskist will be sold through the general trade and Future Group-

owned outlets such as Food Bazaar and Aadhar.

SALE OF CAPITAL FOODS

Not clear why the sale was done, given

that FCEL wanted to focus on foods

Given that FCELs focus was supposed to be foods, the sale of Capital

Foods comes as a surprise. One explanation could be that FCEL does not

want to hold minority stakes in companies, in line with its focus of being an

operating company. (However, 35% stake buy in Sarjena Foods belies this)

Oddly, in FY12, FVL invested Rs 36 crore

in Capital Food or additional 2.95%

stake, implying valuation of Rs 1220

crore!

FCELs total investment in CFL amounted to Rs 106 crore for its 44.5%

stake.

The initial investment was made in 2006, or about 7 years ago. In

2006, Future Ventures had pumped in Rs 13 crore for a minority

33% stake in Capital Foods. So the valuation at that time was Rs

39 crore.

The FY12 Annual report of FCEL says: During the year, your

Company has raised its stake in Capital Foods Exportts Private

Limited from 40.81% to 43.76% by additionally investing ` 36

crore. This suggests valuation of Rs 1220 crore!

FCEL exited Capital Foods in Dec13 at

valuation of Rs 400 crore

FCEL sold its 44.5 per cent stake for Rs 180 crore in Capital Foods in

Dec13. The stake was sold to a European family office Artal Investments.

Amount Stake When

Integrated Food Park Private Limited 73.89% 19-May-14

Sarjena Foods Private Limited 35.00% 19-Jun-14

JV in Sri Lanka 50.01% 19-May-14

Amar Chitra Katha Private Limited 9.14 5.87% 10-Dec-13

Future Agrovet 100.00% 25-Nov-13

KFC Shoemaker Private Limited 33.30% 26-Apr-13

India-Consumer-Listed Future Consumer Enterprise 12 Jul14

www.indiabusinessreports.com 6

This suggests Capital Foods was valued at ~Rs 400 crore.

At 2.5x sales, did FCEL sell its stake

cheap?

Capital Foods FY12 FY13

Sales 123.2 145.0

PBT 14.6 16.0

Equity Invested 106 106

For FY13, Capital Foods reported a consolidated turnover of Rs 145 crore

and an operating profit/EBITDA of Rs 16 crore, showing growth of 17% and

8% respectively over the previous year.

Given the above numbers, it seems Capital Foods was valued at around

2.5x sales, assuming 20% revenue growth and therefore revenue of ~Rs

160crore by the time the stake was sold.

Capital Foods, would continue to hold 26 per cent stake in the Future

Group-owned food park at Tumkur near Bangalore.

India-Consumer-Listed Future Consumer Enterprise 12 Jul14

www.indiabusinessreports.com 7

FCEL VALUATION

A very rough sum of parts calculation

Here we have tried to put together available financial information for

various businesses, and then give a valuation number to it.

An upper end valuation of FCEL should

be around Rs 1100 crore; lower end

could be ~Rs 900 crore

Entity/Segment Value (Rs Cr) Rationale

Stand alone 680 2x sales

Aadhaar 70 0.5x sales

ERSPL 50 0.5x sales

ACK 55 1x sales

Others 250

Estimated Fair Value 1105

Market Cap 1564

Difference -29.3%

This we believe is the upper end valuation. A more conservative number

could be Rs 200 crore less, the drop coming largely from the standalone

entity.

The sections below give an explanation of the various segments.

Stand alone business

Standalone entity started showing

operating revenue from FY13. These are

revenues from FCEL, earlier a subsidiary

of FVL. KB Fair Price also appears to be

part of the parent company

Till FY12, the stand alone business was zero. In FY 13 and FY14, the

standalone entity also shows operating revenue.

From what we can figure out, the stand alone revenue is the revenue of

two subsidiaries of erstwhile FVL: Future Consumer Enterprises Limited

and Future Consumer Products, which has rights to the Sach brand..

FCEL was earlier a 100% subsidiary of FVL, in which the investment stood

at Rs 160 crore as on Mar12. Since this business was amalgamated in the

main entity in FY13, which was renamed FCEL itself, FY13 AR shows only a

Rs 2 crore investment in FCEL. Moreover, the subsidiary FCEL was renamed

Future Food and Products Limited, allowing the listed parent to carry the

FCEL name.

FCEL owns exclusive right to sell and distribute various food and FMCG

products under the various brands Tasty Treat, Fresh & Pure, Clean Mate,

Care Mate, Premium Harvest, SACH, Disney, Ektaa.

50% of Big Apple stores closed down

within 12 months

While it is not clearly mentioned anywhere, we think it also operates

convenience stores under the brand KB's Fair Price. During FY13, the

Company acquired convenience store chain KBs Fair Price from Future

Value Retail Limited. It had 100 stores in Sep12, when ERPSL was

acquired. ERPSL had 65 stores at that point.

India-Consumer-Listed Future Consumer Enterprise 12 Jul14

www.indiabusinessreports.com 8

As on Mar13, the store count of KBs Fair Price was 193. It is not clear if

this included Big Apple stores, or this was just KBs.

As on Dec13, there were 176 KBs Fair price stores. Kishore Biyani, in an

interview in Dec13 said In the last six months, we have also closed down

30-35 unprofitable stores. These were mainly the stores that were

acquired from Big Apple.

This implies around 50% of Big Apple stores were closed down.

Valuing the stand alone business

Valuation

benchmarks

EV/

Sales

EV/

EBITDA

Personal care 3-5x 25x

Food 2-3x 20x

Retail 0.5-1x 10x

Financials of the standalone entity not reported properly as part of

quarterly result declaration. FCEL has reported only sales and EBITDA for

FY14. Full stand alone results are not there.

Standalone FY13 FY14

Sales 303.7 342.8

EBITDA 6.7 30.0*

Capital Employed 421.5 n.a

The consolidated numbers have reported other income of Rs 114 crore.

This should come in standalone also. If we exclude this, EBITDA could well

be ~Rs -70 crore.

Valuing at Rs 680 crore based on 2x sales Looking at valuation of food companies, we believe the best case scenario

can be 2x sales which lead to a EV (=Market cap, since debt is zero) of Rs

680 crore.

A hardnosed approach can mean lower valuation than this (1.5x sales = Rs

500 crore), based on:

o FY14 EBITDA (excl other income) is most likely a negative number

(~Rs - 70 crore). So the operations may not be profitable. Where

has this loss come from, given that FY13 EBITDA was positive? We

think the contributor could be KBs Fair Price.

o It is not clear how much of the revenue is brands, and how much

is retail revenue from KBs Fair Price.

o The brands are instore brands, there is zero customer recall of

FCELs brands. For FY13, advertising and promotion expense was

Rs 3.1crore, or just under 1% of sales. We suspect this may more

free samples. To give valuations close to a branded food company

like say a Britannia is a bit of a stretch.

Aadhaar Wholesale Trading and Distribution Limited

From a retailing business, to wholesale

(cash and carry). CoCo retail outlets

reduced from 35 in FY12 to 16 by Mar13

This company was called Aadhaar Retailing till FY13, it was renamed on 4

April 2013. It was acquired from Godrej Agrovet in 2008 (which holds

30%), where it was a rural retailing business. As on Mar12, it Aadhaar

operated 35 other retail outlets in Punjab, Haryana and Gujarat.

In FY12, Aadhaar changed focus to wholesale trading. The first wholesale

market came up in Kalol, Gujarat in FY12.

Each CNC point to cater to up to 100

franchisee retail points. There were only

2 CNCs as on Mar13, catering to 30

franchisee outlets

The FY13 annual report says: The Company is focusing on the two regions

with high rural income, Gujarat and Punjab& Haryana, for the growth of

this network. By March13, there was addition of only one more CNC store,

this was one in Barnala, Punjab. These 10,000 square feet stores offer

around 1000 SKUs in staples, food and grocery, consumer goods and

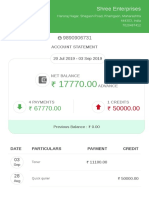

100

193

176

Sep'12 Mar'13 Dec'13

KB+Big Apple Store Count

India-Consumer-Listed Future Consumer Enterprise 12 Jul14

www.indiabusinessreports.com 9

general merchandise and serve small rural retailers in the 50 kilometers

radius. These 2 CNCs catered to 30 Aadhaar franchisee owners.

The company owned retail stores seemed to have reduced to 16 by

March13.

Valuing Aadhaar

Aadhaars best case value can be Rs 100

crore, at 0.5x sales. FCELs stake is 70%

After having been in the Future fold since 2008, Aadhaar continues to

struggle.

Aadhaar FY12 FY13

Sales 94 138

PBT -25 -22

Equity Invested 107 116

The business can at best get an EV/Sales of 0.5x. Assuming current revenue

run rate of Rs 200cr/annum, that gives us a EV of Rs 100 crore. (this is also

the market value, assuming zero debt). FCELs stake is 70%, hence value of

its stake comes to Rs 70 crore.

Express Retail Service Pvt Ltd (Big Apple)

ERPSL was acquired 100% in Sep12 for Rs 62 crore. ERSPL was selling

groceries and food products through general convenience store under the

brand 'Big Apple' in the National Capital Region for the last six years. Big

Apple had 65 outlets in Sep12.

According to an interview given by Kishore Biyani in Dec13, around 50% of

the stores of Big Apple were closed down. Its financials as on Mar13 are as

follows:

Valuing ERSPL

At 0.5x sales, value comes to Rs 50 crore

ERSPL FY12 FY13

Sales

113.8

PBT

-15.2

Equity Invested 62

Reserves and Surplus figure for ERSPL was Rs 87 crore on Mar13,

indicating it has been making losses for several years.

We can give it a value of 0.5x sales. Taking FY14 sales as Rs 100 crore, the

value comes to Rs 50 crore. (if half the stores were closed, actual sales

could be down even more).

Amar Chitra Katha

FCEL has 74% stake in ACK. As on Mar13, FCEL had an investment of Rs 82

crore for 68.12% stake. This implies an average valuation of Rs 122 crore

for its stake. In Dec13, FCEL put in another Rs 9.14 crore for a further

5.87% stake. This implies a post money valuation of Rs 155 crore.

Valuing ACK

We believe this is a lemon, it will continue to suck in money, and struggle

to justify its valuation. The historical brands of ACK have little value, since

India-Consumer-Listed Future Consumer Enterprise 12 Jul14

www.indiabusinessreports.com 10

ACK will continue to lose money. 1x

sales or Rs 75 crore is a generous

valuation for ACK

the content is generic, and consumers have moved away. Its distribution

business IBH has always lost money, and there is clear path to turnaround.

ACK FY12 FY13

Sales 69.7 76.8

PBT -8.6 -11.9

Equity Invested 82 91

Giving it a value of 1x sales we get a valuation of Rs 75 crore for the

company. Since FCEL owns 74% of ACK, the value of its stake becomes Rs

55 crore, implying value destruction here.

Other investments at Cost

FCEL has several other investments. Of these, Star and Sitara Wellness was

there in FY13. FCELs stake is 100% here for Rs 18 crore.

After Mar13, the company has made several deals.

Valuing other businesses at cost, or

around Rs 250 crore

These are

Amount Stake When

Integrated Food Park Pvt Ltd 73.89% 19-May-14

Sarjena Foods Pvt Ltd 35.00% 19-Jun-14

JV in Sri Lanka 50.01% 19-May-14

Amar Chitra Katha Pvt Ltd 9.14 5.87% 10-Dec-13

Future Agrovet 100.00% 25-Nov-13

KFC Shoemaker Pvt Ltd 33.30% 26-Apr-13

Deal values here were not revealed. We believe these can be at best

valued at cost. As on 31 march 2013, cash and cash equivalent appeared

to be ~Rs 250 crore. Assuming this was the cash deployed to make these

investments, thats the value we can place on these businesses.

INFO ON LATEST INVESTMENTS

Future Agrovet

FCEL acquired this company from Future Retail which held 96% in this

company.

FAL is engaged in procuring, processing and supplying agricultural

commodities in loose and packaged form under various private brands in

addition to dealing to other branded/ non-branded products. It supplies to

various formats such as Food Bazaar, KBs Fair Price, Big Apple, Aadhaar,

etc., besides other institutional and general trade clientele. It has about 48

distribution centres at 32 locations across 16 states.

The sales turnover of FAL, for the financial year 2012-13 was Rs 1,014.67

crore with Ebidta of Rs 15.25 crore.

FAL comes with a revenue > Rs 1000

crore, but makes negligible profit on it.

FAL appears to be an internal servicing arm of Future Retail, now owned by

FCEL. While it appears large in revenue size, its EBITDA margin is miniscule

at 1.5%. This is typical of Future Group, where its service arms like Future

Logistics, while made into independent companies, supply almost at cost

to Future Group.

India-Consumer-Listed Future Consumer Enterprise 12 Jul14

www.indiabusinessreports.com 11

Integrated Food Park Pvt Ltd

Rs 144 crore project, Rs 50 crore

government grant

This is over a 100 acre plot near Bangalore. The project cost appears to Rs

144 crore, according to a Mofpi document. Like other mega food park

projects, there is a government grant of Rs 50 crore. Future Group thus

needs to organise Rs 94 crore. In this park, Capital Foods will hold a stake

of 26%, hence FCELs commitment will less to that extent.

A media article in July14 quoted Biyani saying Future Group has invested

Rs 300 crore in this project.

We are not clear why FCEL should be getting into this project, perhaps the

government grant etc make it attractive as a supply chain base.

More food park investments coming?

Reports of FCELs interest in a Rs 600

crore project in West Bengal

There are several media reports of Future Groups food park plans in other

states. For ex, an article of Jun14 says: Future Group intends to set up a

food processing park in Kharagpur, West Bengal, which will entail an

investment of Rs 600 crore. The food park will be spread across 60 acre and

will come up at Vidyasagar Industrial Park, in Kharagpur.

About Rs 150 crore will be invested by the Future group and the company

will mobilise the balance Rs 450 crore from other investors. The group will

build collection points across the state to collect farm produce for its

proposed unit.

India-Consumer-Listed Future Consumer Enterprise 12 Jul14

www.indiabusinessreports.com 12

FCELS POSITION WITHIN THE FUTURE GROUP

The group has 3 listed companies now, FCEL is the smallest

FCEL is the smallest of the 3, and the

most unstable business model

After the last round of reorganisation in FY13, there are now 3 listed

companies from Future Group

1. Future Retail

2. Future Lifestyle and Fashion

3. FCEL

(Rs crore)

FCEL had zero net debt till Mar14. We

think this will change in FY15

On the positive side, FCEL is zero debt, and with cash on the balance sheet

of Rs 138 crore and debt of Rs 109 crore as on 31 Mar14. However, given

the aggressive investment streak to continue to show combined with cash

losses, we think the period of zero net debt is behind FCEL.

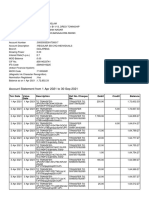

(Rs cr) Sales EBITDA Dep Int Other Inc PBT PAT Networth Total Debt

Future Retail 13654.8 943.6 451.9 726.0 307.5 99.2 94.8 3261.1 4309.8

Future Lifestyle Fashion 2744.0 256.3 385.2 163.0 331.7 34.2 23.3 1291.3 1264

Future Consumer Enterprise 822.6 -85.6 39.3 5.2 114.2 -15.9 -15.3 805.7 109.5

Market Cap EV P/EEV/EBITDA EV/Sales D/E

Future Retail 3069 7378.8 32.4 7.8 0.5 1.3

Future Lifestyle Fashion 1619 2883.0 69.5 11.2 1.1 1.0

Future Consumer Enterprise 1566 1675.5 2.0 0.1

India-Consumer-Listed Future Consumer Enterprise 12 Jul14

www.indiabusinessreports.com 13

FINANCIAL DETAILS

Consolidated P&L

FY10 FY11 FY12 FY13 FY14

Net Sales 157.8 547.2 858.3 959.3 822.6

Material Cost 116 357.7 588.7 675.2 720.1

Gross Profit 41.8 189.5 269.6 284.1 102.5

Gross Margin 26.5% 34.6% 31.4% 29.6% 12.5%

EBIDT (Excl OI) -23.6 14.9 19.4 -18.5 -85.6

EBIDT Margin -15.0% 2.7% 2.3% -1.9% -10.4%

Other Income 23.6 2.1 2.2 0.9 114.2

Operating Profit -0.1 17 21.6 -17.6 28.6

Interest 10.7 23.9 21.9 16.9 5.2

Depreciation 8.6 25.3 23 37.3 39.3

PBT before Exceptional

Items -19.4 -32.2 -23.4 -71.7 -15.9

Exceptional Income /

Expenses 0 -4.5 -33.2 0 0

Profit Before Tax -19.4 -36.7 -56.6 -71.7 -15.9

Provision for Tax 1.6 2.7 8.8 4.8 0

PAT -21 -39.4 -65.4 -76.6 -15.3

Consolidated Balance Sheet

FY11 FY12 FY13 FY14

Share Capital 826.2 1576.2 945.7 958.8

Total Reserve -99.4 -138.7 -129.3 -153.1

Shareholder's Funds 726.9 1437.5 829.5 805.7

Total Debts 13.0 22.3 1.4 109.5

Total Liabilities 774.6 1497.8 851.8 931.5

Tangible Assets

Gross 102.9 115.2 87.4 n.a

Net 72.5 76.5 66.1 n.a

Intangible Assets

Gross 201.2 222.7 351.6 n.a

Net 173.4 178.0 286.3 n.a

Investments 148.2 539.1 234.4 138.9

Inventories 121.3 158.5 58.9 104.5

Sundry Debtors (Debotrs) 186.8 209.0 28.5 109.5

Cash and Bank 7.3 25.4 9.0 11.0

Other Current Assets 0.4 6.7 3.3 7.5

Loans and Advances 69.2 236.4 159.4 207.5

Total Current Assets 384.9 636.0 259.1 440.0

India-Consumer-Listed Future Consumer Enterprise 12 Jul14

www.indiabusinessreports.com 14

Less : Current Liabilities and Provisions

Current Liabilities 319.4 327.3 115.3 110.0

Provisions 3.5 6.1 3.2 13.8

Total Current Liabilities 322.9 333.3 118.5 123.8

Net Current Assets 62.0 302.7 140.6 316.2

Total Assets 774.6 1497.8 851.8 931.5

India-Consumer-Listed Future Consumer Enterprise 12 Jul14

www.indiabusinessreports.com 15

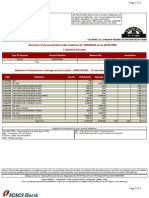

KEY ANNOUNCEMENTS

19 Jun 14 Making investment in Sarjena Foods Private Limited, by way of

acquisition of 35% stake in the Company, Sarjena Foods Private Limited is

engaged in the business of manufacturing and distribution of branded

bakery products under the name and style Baker Street.

19 May 14 Future Consumer Enterprise Ltd has informed BSE that the Committee of

Directors of the Company has at their meeting held on May 19, 2014, inter

alia, considered/ approved acquiring 50.01% in a Joint Venture for setting

up facility to manufacture Oats and other breakfast cereals in Sri Lanka.

Investment in Integrated Food Park Private Limited for acquisition of

73.89% stake in the Company, which is setting up a Food Park admeasuring

about 110 acres at Tumkur, Karnataka.

9 Dec 13 Future Consumer Enterprise Ltd has informed BSE that the Company has

entered into definitive arrangement to sell its entire investment in Capital

Foods Private Limited (earlier known as Capital Foods Exportts Private

Limited) on terms and conditions mentioned thereunder.

24 Sep 13 Future Ventures India Ltd has informed BSE that the Members of the

Company have at the 17th Annual General Meeting held on September 23,

2013, subject to such compliances as may be required, approved with

requisite majority, change in name of the Company from "Future

Ventures India Limited" to "Future Consumer Enterprises Limited" or

such other name that may be allowed by the Registrar of Companies,

Maharashtra, Mumbai, in terms of the resolution passed thereat.

30 May 13

In view of the Composite Scheme of Arrangement and Amalgamation

coming into effect pursuant to the re-structuring of the business of the

Company, to intimate Reserve Bank of India about the same and

consequently to comply with the process of de-registration as a Non-

Banking Financial Company in the manner as may be required.

4 Apr 13 Future Ventures India Ltd has informed BSE that name of Companys

subsidiary-Aadhaar Retailing Limited has been changed to 'Aadhaar

Wholesale Trading and Distribution Limited vide fresh certificate of

incorporation issued by the Registrar of Companies, Mumbai dated April

03, 2013.

India-Consumer-Listed Future Consumer Enterprise 12 Jul14

www.indiabusinessreports.com 16

Check our website to see more research

Disclaimer

This note is based on information obtained from public sources and sources believed to be reliable, but no independent verification has been made nor is its

accuracy or completeness guaranteed. The content in this note is solely for informational purpose and is not a solicitation of offer to buy or sell or subscribe for

securities or other financial instruments. Nothing in this note constitutes investment, legal, accounting and tax advice. India Business Reports or its owner-partners

accept no liabilities for any loss or damage of any kind arising out of the use of this note.

Contact

reports@indiabusinessreports.com

+91 9987474021

You might also like

- Office of The Registrar (Academic AffairsDocument1 pageOffice of The Registrar (Academic AffairsNdiku EzekielNo ratings yet

- AdvanceReceipt2021 06 25 14 29 51Document1 pageAdvanceReceipt2021 06 25 14 29 51Piyush AgarwalNo ratings yet

- Habib Metro Bank (1) (Recovered) - 1Document52 pagesHabib Metro Bank (1) (Recovered) - 1Shujja Ur Rehman TafazzulNo ratings yet

- Bank Account StatementDocument2 pagesBank Account StatementaaltafhussainNo ratings yet

- Statement 2020MTH01 65376297-UnlockedDocument4 pagesStatement 2020MTH01 65376297-UnlockedZaheda BegumNo ratings yet

- CBZ Bank Limited. - Account Statement: Transaction Date Value Date Reference Description Debit Credit BalanceDocument1 pageCBZ Bank Limited. - Account Statement: Transaction Date Value Date Reference Description Debit Credit BalanceMusiiwa FariraiNo ratings yet

- T Musekiwa Steward Avondale 1004556468 585 Refurnishment of BikeDocument1 pageT Musekiwa Steward Avondale 1004556468 585 Refurnishment of BikesimbarasheNo ratings yet

- Ach FormDocument1 pageAch Formbellurvaishnaviprint0% (1)

- Myntra Designs PVT LTDDocument6 pagesMyntra Designs PVT LTDIndia Business ReportsNo ratings yet

- Krishi Rasayan Exports PVT LTDDocument5 pagesKrishi Rasayan Exports PVT LTDIndia Business ReportsNo ratings yet

- Bhawesh Allen Soly Analysis 1.2.1.311Document43 pagesBhawesh Allen Soly Analysis 1.2.1.311Páŕàģ Thê Lëgîóñ100% (1)

- Assignment Brief-Summer 2021-BUS-L5-U37-CBI-EY - (IV-EE)Document8 pagesAssignment Brief-Summer 2021-BUS-L5-U37-CBI-EY - (IV-EE)MD ARIFUL ISLAMNo ratings yet

- 2016 17 Press StatementDocument19 pages2016 17 Press StatementcharliemopicNo ratings yet

- Statement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits BalanceDocument2 pagesStatement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits BalanceNAGENDRA SINGH ShekhawatNo ratings yet

- 6388r13 Uk PC Order FRM FinalDocument2 pages6388r13 Uk PC Order FRM Finalapi-307674357No ratings yet

- Your Financial Activities As of April 27, 2021Document4 pagesYour Financial Activities As of April 27, 2021Loan LoanNo ratings yet

- Bank Reconciliation Statement - Why & How To Prepare The - Statement PDFDocument2 pagesBank Reconciliation Statement - Why & How To Prepare The - Statement PDFAman KodwaniNo ratings yet

- Mini Statement 1Document2 pagesMini Statement 1Aashish ChaudhariNo ratings yet

- GSTR1 Excel Workbook Template-V1.2Document40 pagesGSTR1 Excel Workbook Template-V1.2vkpamulapatiNo ratings yet

- Bank of ChinaDocument10 pagesBank of ChinaAnuj MongaNo ratings yet

- HDFC Bank Balance Sheet - HDFC Bank LTD Balance Sheet, Financial StatementDocument2 pagesHDFC Bank Balance Sheet - HDFC Bank LTD Balance Sheet, Financial StatementVikas Kumar PatroNo ratings yet

- Income Tax Form 2020 IDocument1 pageIncome Tax Form 2020 ISuvashreePradhanNo ratings yet

- Analysis of Bank StatementDocument1 pageAnalysis of Bank StatementPrashantTripathiNo ratings yet

- Forex Reserves IndiaDocument27 pagesForex Reserves IndiaDhaval Lagwankar100% (2)

- Bank StatementsDocument4 pagesBank StatementshanhNo ratings yet

- Basic Instructions For A Bank Reconciliation Statement PDFDocument4 pagesBasic Instructions For A Bank Reconciliation Statement PDFAman KodwaniNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Anmol KhannaNo ratings yet

- YES BANK Savings AccountDocument4 pagesYES BANK Savings AccountTanya MendirattaNo ratings yet

- Doutch Bangla BankDocument1 pageDoutch Bangla Banknusrat soaNo ratings yet

- Account Statement From 1 Apr 2021 To 30 Sep 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument15 pagesAccount Statement From 1 Apr 2021 To 30 Sep 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceMahiul IslamNo ratings yet

- Bk135 PDF enDocument48 pagesBk135 PDF enChanpreet SinghNo ratings yet

- Petroleum Licence Application Form PDFDocument10 pagesPetroleum Licence Application Form PDFnicholas idungafa100% (1)

- QT12009Document2 pagesQT12009Piyush SrivastavaNo ratings yet

- Account StatementDocument12 pagesAccount StatementMuhammad imranNo ratings yet

- HSBCDocument9 pagesHSBCMohammad Mehdi JourabchiNo ratings yet

- Arun B KadamDocument3 pagesArun B KadamRohit KumardeyNo ratings yet

- District Thana Name Institute Name EiinDocument6 pagesDistrict Thana Name Institute Name Eiinmd kamal hossainNo ratings yet

- Catholic Syrian BankDocument29 pagesCatholic Syrian BanksherwinmitraNo ratings yet

- Sep2015Document2 pagesSep2015Sidhantha JainNo ratings yet

- Ref - No. 16183558-19191991-3: Pramod Kumar S RDocument3 pagesRef - No. 16183558-19191991-3: Pramod Kumar S RS R PramodNo ratings yet

- Political Risk-Concept, Measurement and Management of Political RiskDocument10 pagesPolitical Risk-Concept, Measurement and Management of Political Riskshreya26janNo ratings yet

- AccountStatementDocument2 pagesAccountStatementch adeel100% (1)

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument2 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceBalajiNo ratings yet

- 28 Jun 2022 - (Free)Document2 pages28 Jun 2022 - (Free)Young Turbo beatsNo ratings yet

- Governing Body: International Labour OfficeDocument33 pagesGoverning Body: International Labour OfficeMu Eh HserNo ratings yet

- State Bank of India "Onlinesbi": Internet BankingDocument2 pagesState Bank of India "Onlinesbi": Internet BankingKumar PushpeshNo ratings yet

- 10A. HDFC Estatement JAN 2018Document7 pages10A. HDFC Estatement JAN 2018Nanu PatelNo ratings yet

- Ref - No. 2203166-16309213-4: Prashant KaushikDocument4 pagesRef - No. 2203166-16309213-4: Prashant KaushikVicky GunaNo ratings yet

- A ULkjckjx KDGW Yi TDocument1 pageA ULkjckjx KDGW Yi TDattatraya MulikNo ratings yet

- AccountStatement 5215Document3 pagesAccountStatement 5215Raghu RamanNo ratings yet

- Sharekhan DocumentDocument2 pagesSharekhan DocumentsprtkmitraNo ratings yet

- EEU - BILLING - Adjustment Reversal - UTM - Ver - 1.2Document50 pagesEEU - BILLING - Adjustment Reversal - UTM - Ver - 1.2metadelNo ratings yet

- StatementOfAccount 6821516086 25032021 175330Document1 pageStatementOfAccount 6821516086 25032021 175330ABDUL ASEESNo ratings yet

- Statement of Account: Mr. Rahis NerliDocument10 pagesStatement of Account: Mr. Rahis NerlichandsabmullanipytmNo ratings yet

- Credit Card Number: Name: Samir Kumar Baksi: Billing & CRMDocument2 pagesCredit Card Number: Name: Samir Kumar Baksi: Billing & CRMsrvbaksiNo ratings yet

- Bank of Baroda: Annexure - Ii Paying-In-Slip-For Neft / RtgsDocument3 pagesBank of Baroda: Annexure - Ii Paying-In-Slip-For Neft / RtgsGirish NimbhorkarNo ratings yet

- Portfolio 74246 OnDate 5-5-2022Document1 pagePortfolio 74246 OnDate 5-5-2022Shahid MahmudNo ratings yet

- CL8 N QZ It Wgo OGn EtDocument1 pageCL8 N QZ It Wgo OGn EtAnam ChandraNo ratings yet

- 5 Macroeconomics PDFDocument31 pages5 Macroeconomics PDFKing is KingNo ratings yet

- Bank Reconciliation StatementDocument3 pagesBank Reconciliation StatementTalha MahmoodNo ratings yet

- HDFC Bank Statement PDFDocument1 pageHDFC Bank Statement PDFAli Game You TubeNo ratings yet

- Account Statement From 21 Sep 2015 To 21 Sep 2015Document1 pageAccount Statement From 21 Sep 2015 To 21 Sep 2015Maheshkv MahiNo ratings yet

- Piramal Enterprises Limited Investor Presentation Nov 2016 20161108025005Document74 pagesPiramal Enterprises Limited Investor Presentation Nov 2016 20161108025005ratan203No ratings yet

- "Working Capital Management" Dabur IndiaDocument58 pages"Working Capital Management" Dabur Indiatariquewali11100% (2)

- Maxheap TechnologiesDocument5 pagesMaxheap TechnologiesIndia Business ReportsNo ratings yet

- Indian Dairy Industry (& Potential For Lactose Free Products)Document54 pagesIndian Dairy Industry (& Potential For Lactose Free Products)India Business ReportsNo ratings yet

- Nuziveedu Seeds LTDDocument5 pagesNuziveedu Seeds LTDIndia Business ReportsNo ratings yet

- Dental Services MarketDocument35 pagesDental Services MarketIndia Business ReportsNo ratings yet

- Stempeutics Research PVT LTDDocument5 pagesStempeutics Research PVT LTDIndia Business ReportsNo ratings yet

- The IBR India Newsletter Nov'12Document7 pagesThe IBR India Newsletter Nov'12India Business ReportsNo ratings yet

- Global Tyre RetailersDocument24 pagesGlobal Tyre RetailersIndia Business ReportsNo ratings yet

- Monthly Logistics Update: Sales Down 7% For IBR Universe of Listed Logistics Companies in Q1Document12 pagesMonthly Logistics Update: Sales Down 7% For IBR Universe of Listed Logistics Companies in Q1India Business ReportsNo ratings yet

- Levi'sDocument24 pagesLevi'sHassan Ali TayyabNo ratings yet

- Shopper Stop Complete Retail AnalysisDocument49 pagesShopper Stop Complete Retail AnalysisPramod SharmaNo ratings yet

- Channel DesignDocument27 pagesChannel DesignSovan MangarajNo ratings yet

- CIX 2005 Entrepreneurship Essay Covid-19Document8 pagesCIX 2005 Entrepreneurship Essay Covid-19Tan WzzzNo ratings yet

- 2019 Tle-Ictg7 8Q1Document44 pages2019 Tle-Ictg7 8Q1Leonelyn Hermosa Gasco - CosidoNo ratings yet

- A Concept Note On Retail Location AnalysisDocument4 pagesA Concept Note On Retail Location Analysisvivek kumar pathakNo ratings yet

- Foreign LiquorDocument37 pagesForeign LiquorRoddy RodriguesNo ratings yet

- Literature Review of Mother DairyDocument8 pagesLiterature Review of Mother Dairyluwop1gagos3100% (1)

- Times of IndiaDocument20 pagesTimes of IndiametrotorNo ratings yet

- Cisa 2010Document54 pagesCisa 2010Surendharan DevarajanNo ratings yet

- E-Commerce in The Nordics 2017, PostnordDocument46 pagesE-Commerce in The Nordics 2017, Postnordslash7782No ratings yet

- Coconut Water 2010 BrochureDocument6 pagesCoconut Water 2010 Brochuretatapower100% (1)

- GO-Ceries: A Business PlanDocument29 pagesGO-Ceries: A Business PlanHershey ReyesNo ratings yet

- Irfan ThesisDocument290 pagesIrfan ThesisHelp Desk RajputanaNo ratings yet

- Bloomsters Voted Best in Marketing!Document4 pagesBloomsters Voted Best in Marketing!Scott VanderpoolNo ratings yet

- Gfms Gold Survey 2016 2Document96 pagesGfms Gold Survey 2016 2Sean BrazneyNo ratings yet

- Marketing Management Assignment Case Study Alibaba - Andika Daffa Elianto - 12010119190124Document2 pagesMarketing Management Assignment Case Study Alibaba - Andika Daffa Elianto - 12010119190124Andika Daffa EliantoNo ratings yet

- 3rd Edition. Part 6 - Master Planning and Urban Design. (7 of 48)Document13 pages3rd Edition. Part 6 - Master Planning and Urban Design. (7 of 48)sehri3100% (1)

- Big BasketDocument12 pagesBig Basketsaurabh100% (1)

- Market For Craft Full Report 2020Document112 pagesMarket For Craft Full Report 2020KyleNo ratings yet

- Retail Logistics and Supply Chain Risk Management in Large-Scale Retail TradeDocument12 pagesRetail Logistics and Supply Chain Risk Management in Large-Scale Retail TradeZubin BohraNo ratings yet

- B18103 Rohit Singh CVDocument1 pageB18103 Rohit Singh CVRohit SinghNo ratings yet

- Client Backgrounder Apa Format 1 1 2Document6 pagesClient Backgrounder Apa Format 1 1 2api-479314637No ratings yet

- Business Plan EDPDocument13 pagesBusiness Plan EDPJayagokul SaravananNo ratings yet

- Exploring Decathlon's Retail Format and AssortmentDocument19 pagesExploring Decathlon's Retail Format and AssortmentParas GuptaNo ratings yet

- Executive SummaryDocument101 pagesExecutive SummaryMikaella JonaNo ratings yet

- SVKM's Narsee Monjee Institute of Management Studies, HyderabadDocument26 pagesSVKM's Narsee Monjee Institute of Management Studies, Hyderabaddeepak boraNo ratings yet

- DDA Bye LawsDocument217 pagesDDA Bye LawsAr Amit Mehta0% (1)