Professional Documents

Culture Documents

Its Activists Not Buffett Who Can Change Corporate America - Nytimes

Its Activists Not Buffett Who Can Change Corporate America - Nytimes

Uploaded by

api-249461242Copyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Eoi Amnesty of Fines and Penalties - Aff63417Document2 pagesEoi Amnesty of Fines and Penalties - Aff63417meliton capricho100% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Otis - FujitecDocument2 pagesOtis - Fujitecapi-249461242No ratings yet

- BUS020 Chapter 1 (Outline - Libby Libby)Document5 pagesBUS020 Chapter 1 (Outline - Libby Libby)Amanda RodriguezNo ratings yet

- Options Strategy PosterDocument1 pageOptions Strategy PosterMark Taylor86% (7)

- Coca Cola HellenicDocument2 pagesCoca Cola Hellenicapi-249461242No ratings yet

- Songbird Estates Research NoteDocument1 pageSongbird Estates Research Noteapi-249461242No ratings yet

- Zooplus Research NoteDocument1 pageZooplus Research Noteapi-249461242No ratings yet

- Miko Research NoteDocument1 pageMiko Research Noteapi-249461242No ratings yet

- Thorntons Research NoteDocument2 pagesThorntons Research Noteapi-249461242No ratings yet

- Stef Research Note 1Document1 pageStef Research Note 1api-249461242No ratings yet

- Fujitec Research Note 3Document2 pagesFujitec Research Note 3api-249461242No ratings yet

- Mondelez Research Note 1Document1 pageMondelez Research Note 1api-249461242No ratings yet

- Global Brass and Copper Holdings Research Note 1Document2 pagesGlobal Brass and Copper Holdings Research Note 1api-249461242No ratings yet

- Good Energy Research NoteDocument2 pagesGood Energy Research Noteapi-249461242No ratings yet

- 1-27454190 EprintDocument2 pages1-27454190 Eprintapi-249461242No ratings yet

- News2008 03 28Document2 pagesNews2008 03 28api-249461242No ratings yet

- Theravance Inc - Form 4may-13-2014Document2 pagesTheravance Inc - Form 4may-13-2014api-249461242No ratings yet

- Stef Research NoteDocument1 pageStef Research Noteapi-249461242No ratings yet

- Transportation ProblemDocument21 pagesTransportation ProblemRahul SharmaNo ratings yet

- Partnership Case Digest (1800 Teague vs. Martin-1816 Co Pitco Vs YuloDocument20 pagesPartnership Case Digest (1800 Teague vs. Martin-1816 Co Pitco Vs YuloNhoj Liryc TaptagapNo ratings yet

- WQU Financial Markets Module 4 Compiled ContentDocument29 pagesWQU Financial Markets Module 4 Compiled ContentPPP100% (1)

- Market Risk: You Manage What You MeasureDocument14 pagesMarket Risk: You Manage What You MeasureLuis EcheNo ratings yet

- Gold Forward ContractDocument3 pagesGold Forward ContracttabVlaeNo ratings yet

- Greenhills OperationsDocument39 pagesGreenhills OperationsMarcel BaqueNo ratings yet

- IBPS RRB Office Assistant Mains 2018Document23 pagesIBPS RRB Office Assistant Mains 2018Debadutta SethiNo ratings yet

- Banking LawDocument19 pagesBanking LawAmado Vallejo IIINo ratings yet

- Inflation Accounting New CourseDocument11 pagesInflation Accounting New CourseAkshay Mhatre100% (1)

- Vo Le Thanh Truc - CLDTTC Chap 4Document3 pagesVo Le Thanh Truc - CLDTTC Chap 4trucvo.31211025879No ratings yet

- Southeastern Steel Company Dividend Policy Financial ManagementDocument24 pagesSoutheastern Steel Company Dividend Policy Financial ManagementJobiCosmeNo ratings yet

- Comprehensive Examinations 2 (Part I)Document13 pagesComprehensive Examinations 2 (Part I)Yander Marl BautistaNo ratings yet

- Acc Assignment 2 Hasan Ahmed 321600 Bese10ADocument9 pagesAcc Assignment 2 Hasan Ahmed 321600 Bese10AHasan AhmedNo ratings yet

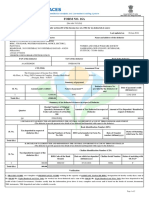

- T D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19Document2 pagesT D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19MinatiBindhaniNo ratings yet

- Adversity Is Often The Mother of Innovation: by Tom J. ReavisDocument72 pagesAdversity Is Often The Mother of Innovation: by Tom J. ReavisŞamil CeyhanNo ratings yet

- Foreign CorporationDocument8 pagesForeign CorporationRomNo ratings yet

- Top 20 Day Trading Rules For SuccessDocument4 pagesTop 20 Day Trading Rules For Successbugbugbugbug100% (3)

- Study On Equity Diversified Mutual Fund Schemes in IndiaDocument18 pagesStudy On Equity Diversified Mutual Fund Schemes in IndiaShashwat ShrivastavaNo ratings yet

- Game Plan: Scenario 1 - Highs Made First Unable To Make A Higher High (HH), or If We Do BreakDocument3 pagesGame Plan: Scenario 1 - Highs Made First Unable To Make A Higher High (HH), or If We Do BreakRICARDONo ratings yet

- Presentation Fe670 Lecture01Document24 pagesPresentation Fe670 Lecture01desikudi9000No ratings yet

- JM Financial - L&T Technology Services Ltd. - An Imbalanced Equation (4QFY17 RU) (HOLD)Document9 pagesJM Financial - L&T Technology Services Ltd. - An Imbalanced Equation (4QFY17 RU) (HOLD)darshanmadeNo ratings yet

- From To: RealityDocument96 pagesFrom To: RealityAw Yuong TuckNo ratings yet

- Company Meetings NavinDocument12 pagesCompany Meetings NavinNavin SureshNo ratings yet

- Case Study (Aakash Lakhani, Muhammad Talha)Document9 pagesCase Study (Aakash Lakhani, Muhammad Talha)Muhammad TalhaNo ratings yet

- Managing Diversification SSRN-id1358533Document23 pagesManaging Diversification SSRN-id1358533mshuffma971518No ratings yet

- 3946 Mohamed Alameri ResumeDocument2 pages3946 Mohamed Alameri Resumeapi-413425549No ratings yet

- Finance: Kenneth J Boudreaux Is Professor of Economics and Finance at The AB Freeman SchoolDocument58 pagesFinance: Kenneth J Boudreaux Is Professor of Economics and Finance at The AB Freeman SchoolMazen AlbsharaNo ratings yet

Its Activists Not Buffett Who Can Change Corporate America - Nytimes

Its Activists Not Buffett Who Can Change Corporate America - Nytimes

Uploaded by

api-249461242Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Its Activists Not Buffett Who Can Change Corporate America - Nytimes

Its Activists Not Buffett Who Can Change Corporate America - Nytimes

Uploaded by

api-249461242Copyright:

Available Formats

9/8/2014 It' s Activists, Not Buffett, Who Can Change Corporate America - NYTimes.

com

http://dealbook.nytimes.com/2014/05/12/its-activists-not-buffett-who-can-change-corporate-america/?_php=true&_type=blogs&smid=pl-share&_r=0 1/4

Its Activists, Not Buffett, Who Can Change

Corporate America

By ANTHONY SCARAMUCCI

May 12, 2014 9:30 am

Anthony Scaramucci is founder and co-managing partner of

SkyBridge Capital, a global asset management firm with about $10.5

billion in assets under management and advisement as of March 31.

In my adult life, I have had an intellectual love affair with Warren

E. Buffett. Lets face it: If some of us were being honest, we would have

replaced our fading Farrah Fawcett posters with a splendid one of the

Oracle of Omaha, after our 21st birthdays.

He helped explain the value of compound interest which to

anyone really paying attention is the master key to untold riches. A

penny doubling every day for a month ($5.4 million) is worth more than

receiving $10,000 a day ($300,000).

Lately, however, my favorite idol like an aging model or athlete

is missing a beat and has lost a step with the times. Its not that we

wont love Mr. Buffett anymore. Even a decade of underperformance

wont destroy his legacy.

Yet Mr. Buffett and his business partner, Charles Munger, with

their highly reported comments that activism scares the hell out of

managers and is bad for corporate America at the recent annual

shareholder meeting, are missing the boat on todays current

shareholder activism in the market and what it means.

Another View

9/8/2014 It' s Activists, Not Buffett, Who Can Change Corporate America - NYTimes.com

http://dealbook.nytimes.com/2014/05/12/its-activists-not-buffett-who-can-change-corporate-america/?_php=true&_type=blogs&smid=pl-share&_r=0 2/4

Vi ew al l posts

Today, the replacement for the buy-and-hold strategy is the savvy

corporate activist.

To help capitalism evolve, corporations need to be re-engineered

and reinvigorated about every 30 years. In the 1980s, Michael Milken

developed the high-yield, or junk, bond market and, with the

innovation, some of the brightest minds in finance developed the

leveraged buyout, shaking big corporate management teams to the

bone.

Natural human tendency is to get fat, lazy and a little clubby. Over

30 years, that can lead to tremendous economic inefficiency, and lack of

growth and job creation. Just like your garden, corporate America

occasionally needs to be weeded, replanted and re-fertilized.

So why has there been such a proliferation in activism over the last

few years?

There are a number of factors driving this. First, its cyclical. We

are overdue for the restructuring and retooling that our largest

corporations need. After spending years repairing balance sheets after

the crisis, being understandably concerned about abnormally slow

postcrisis economic growth, the euro zone crisis and continuous

political dysfunction, management teams are finally returning their

focus to how best to compensate shareholders.

Corporations in the Standard & Poors 500-stock index are flush

with about $2 trillion in cash on their balance sheets. That record

amount is partly a function of our broken tax code and government

policies that discourage hiring and investment.

Additionally, management teams are finally confident in sufficient

continued economic stability. They also have the financing to pursue

transactions that reduce costs, provide greater pricing power, expand

product pipelines, divest underperforming or nonsynergistic assets and

9/8/2014 It' s Activists, Not Buffett, Who Can Change Corporate America - NYTimes.com

http://dealbook.nytimes.com/2014/05/12/its-activists-not-buffett-who-can-change-corporate-america/?_php=true&_type=blogs&smid=pl-share&_r=0 3/4

provide share buybacks and enhanced dividends which rightfully return

capital to shareholders. Each of these steps is intended to benefit

shareholders over the shorter and longer term.

Add to those factors the need for an overhaul to the tax code.

Corporate renaissance and tax changes typically go hand in hand.

Just think about it for a moment. The last major tax reform

happened in 1986 during the first part of President Ronald Reagans

second term. The thousands of pages added to the code since then have

created a situation where our corporate chieftains are working just as

hard to avoid taxes as they are to make stuff. Perversely, their

stockholders reward them for legally avoiding taxes and driving down

costs, just as much as for growing profits or revenue.

Pfizers proposed merger with AstraZeneca is a good example of

this it is being done mainly to move Pfizer to Britain to save billions in

taxes. If this deal goes through, the red light has to be on the dashboard

of both branches of government, and I predict their hands will be

forced into some sort of bipartisan agreement in Congress to finally

change the tax laws.

Finally, there are the unintended consequences of Dodd-Frank

legislation, which are now aiding the billionaire hedge fund activist.

Embedded in the 2,000-plus page law are sections on minority

shareholder rights. The purpose, with good intent, was to protect the

mom-and-pop shareholders from big, bad, ugly chief executives and

their clubby board members.

What the lawmakers did, in fact, is hand over a sledgehammer to

guys like Carl Icahn, who can now establish a small position, walk into

the boardroom and swing it down on the boards conference table. This

regulatory opportunity, in addition to the cash on hand, has created an

enormous profit incentive for the activists. They have dug in and are

shaking up corporate boardrooms all over America and we are still in

the early innings.

9/8/2014 It' s Activists, Not Buffett, Who Can Change Corporate America - NYTimes.com

http://dealbook.nytimes.com/2014/05/12/its-activists-not-buffett-who-can-change-corporate-america/?_php=true&_type=blogs&smid=pl-share&_r=0 4/4

My firm has over $4 billion of our $10.5 billion in these strategies.

This week, at our sixth annual SkyBridge Alternatives Conference,

several prominent investors will be explaining their vision of this

opportunity.

The greatest thing about our country is we still have one of the

most adaptive cultures of all of the nations. Tell us the rules, and we

will adapt and innovate to make a success of ourselves. Simplify the tax

code, and there will be less emphasis on tax avoidance.

Deploy and allocate cash properly at the corporate level, and

activists will move on to other activities. For the most part they are

effecting change and putting people on their toes.

Mr. Buffett and Mr. Munger are missing this. Their contemporary,

that young lad Mr. Icahn isnt, and he is just amping up the fight.

2014 The New York Times Company

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Eoi Amnesty of Fines and Penalties - Aff63417Document2 pagesEoi Amnesty of Fines and Penalties - Aff63417meliton capricho100% (3)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Otis - FujitecDocument2 pagesOtis - Fujitecapi-249461242No ratings yet

- BUS020 Chapter 1 (Outline - Libby Libby)Document5 pagesBUS020 Chapter 1 (Outline - Libby Libby)Amanda RodriguezNo ratings yet

- Options Strategy PosterDocument1 pageOptions Strategy PosterMark Taylor86% (7)

- Coca Cola HellenicDocument2 pagesCoca Cola Hellenicapi-249461242No ratings yet

- Songbird Estates Research NoteDocument1 pageSongbird Estates Research Noteapi-249461242No ratings yet

- Zooplus Research NoteDocument1 pageZooplus Research Noteapi-249461242No ratings yet

- Miko Research NoteDocument1 pageMiko Research Noteapi-249461242No ratings yet

- Thorntons Research NoteDocument2 pagesThorntons Research Noteapi-249461242No ratings yet

- Stef Research Note 1Document1 pageStef Research Note 1api-249461242No ratings yet

- Fujitec Research Note 3Document2 pagesFujitec Research Note 3api-249461242No ratings yet

- Mondelez Research Note 1Document1 pageMondelez Research Note 1api-249461242No ratings yet

- Global Brass and Copper Holdings Research Note 1Document2 pagesGlobal Brass and Copper Holdings Research Note 1api-249461242No ratings yet

- Good Energy Research NoteDocument2 pagesGood Energy Research Noteapi-249461242No ratings yet

- 1-27454190 EprintDocument2 pages1-27454190 Eprintapi-249461242No ratings yet

- News2008 03 28Document2 pagesNews2008 03 28api-249461242No ratings yet

- Theravance Inc - Form 4may-13-2014Document2 pagesTheravance Inc - Form 4may-13-2014api-249461242No ratings yet

- Stef Research NoteDocument1 pageStef Research Noteapi-249461242No ratings yet

- Transportation ProblemDocument21 pagesTransportation ProblemRahul SharmaNo ratings yet

- Partnership Case Digest (1800 Teague vs. Martin-1816 Co Pitco Vs YuloDocument20 pagesPartnership Case Digest (1800 Teague vs. Martin-1816 Co Pitco Vs YuloNhoj Liryc TaptagapNo ratings yet

- WQU Financial Markets Module 4 Compiled ContentDocument29 pagesWQU Financial Markets Module 4 Compiled ContentPPP100% (1)

- Market Risk: You Manage What You MeasureDocument14 pagesMarket Risk: You Manage What You MeasureLuis EcheNo ratings yet

- Gold Forward ContractDocument3 pagesGold Forward ContracttabVlaeNo ratings yet

- Greenhills OperationsDocument39 pagesGreenhills OperationsMarcel BaqueNo ratings yet

- IBPS RRB Office Assistant Mains 2018Document23 pagesIBPS RRB Office Assistant Mains 2018Debadutta SethiNo ratings yet

- Banking LawDocument19 pagesBanking LawAmado Vallejo IIINo ratings yet

- Inflation Accounting New CourseDocument11 pagesInflation Accounting New CourseAkshay Mhatre100% (1)

- Vo Le Thanh Truc - CLDTTC Chap 4Document3 pagesVo Le Thanh Truc - CLDTTC Chap 4trucvo.31211025879No ratings yet

- Southeastern Steel Company Dividend Policy Financial ManagementDocument24 pagesSoutheastern Steel Company Dividend Policy Financial ManagementJobiCosmeNo ratings yet

- Comprehensive Examinations 2 (Part I)Document13 pagesComprehensive Examinations 2 (Part I)Yander Marl BautistaNo ratings yet

- Acc Assignment 2 Hasan Ahmed 321600 Bese10ADocument9 pagesAcc Assignment 2 Hasan Ahmed 321600 Bese10AHasan AhmedNo ratings yet

- T D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19Document2 pagesT D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19MinatiBindhaniNo ratings yet

- Adversity Is Often The Mother of Innovation: by Tom J. ReavisDocument72 pagesAdversity Is Often The Mother of Innovation: by Tom J. ReavisŞamil CeyhanNo ratings yet

- Foreign CorporationDocument8 pagesForeign CorporationRomNo ratings yet

- Top 20 Day Trading Rules For SuccessDocument4 pagesTop 20 Day Trading Rules For Successbugbugbugbug100% (3)

- Study On Equity Diversified Mutual Fund Schemes in IndiaDocument18 pagesStudy On Equity Diversified Mutual Fund Schemes in IndiaShashwat ShrivastavaNo ratings yet

- Game Plan: Scenario 1 - Highs Made First Unable To Make A Higher High (HH), or If We Do BreakDocument3 pagesGame Plan: Scenario 1 - Highs Made First Unable To Make A Higher High (HH), or If We Do BreakRICARDONo ratings yet

- Presentation Fe670 Lecture01Document24 pagesPresentation Fe670 Lecture01desikudi9000No ratings yet

- JM Financial - L&T Technology Services Ltd. - An Imbalanced Equation (4QFY17 RU) (HOLD)Document9 pagesJM Financial - L&T Technology Services Ltd. - An Imbalanced Equation (4QFY17 RU) (HOLD)darshanmadeNo ratings yet

- From To: RealityDocument96 pagesFrom To: RealityAw Yuong TuckNo ratings yet

- Company Meetings NavinDocument12 pagesCompany Meetings NavinNavin SureshNo ratings yet

- Case Study (Aakash Lakhani, Muhammad Talha)Document9 pagesCase Study (Aakash Lakhani, Muhammad Talha)Muhammad TalhaNo ratings yet

- Managing Diversification SSRN-id1358533Document23 pagesManaging Diversification SSRN-id1358533mshuffma971518No ratings yet

- 3946 Mohamed Alameri ResumeDocument2 pages3946 Mohamed Alameri Resumeapi-413425549No ratings yet

- Finance: Kenneth J Boudreaux Is Professor of Economics and Finance at The AB Freeman SchoolDocument58 pagesFinance: Kenneth J Boudreaux Is Professor of Economics and Finance at The AB Freeman SchoolMazen AlbsharaNo ratings yet