Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

48 viewsSM Prime: Pricing of P15B Retail Bonds

SM Prime: Pricing of P15B Retail Bonds

Uploaded by

BusinessWorldSM Prime Holdings, Inc. has set the interest rates for its upcoming retail bond offering totaling PHP15 billion, with an option to issue up to an additional PHP10 billion. The 5.5-year bonds will have an interest rate of 5.1% annually, the 7-year bonds will be 5.2% annually, and the 10-year bonds will be 5.74% annually. The bonds received the highest rating of PRS Aaa from PhilRatings, denoting the highest quality with minimal credit risk. The bonds will be offered to investors from August 13-22 and issued on September 1.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- FDHTFB YdjDocument5 pagesFDHTFB YdjSarathy KannanNo ratings yet

- Welcome To Wall Street Prep's Financial Modeling Quick Lessons!Document3 pagesWelcome To Wall Street Prep's Financial Modeling Quick Lessons!alexandre1411No ratings yet

- SM Prime: Clarification of News ReportDocument4 pagesSM Prime: Clarification of News ReportBusinessWorldNo ratings yet

- SM Prime Holdings, Inc. - Sec Form 17-C - February 19 2024Document26 pagesSM Prime Holdings, Inc. - Sec Form 17-C - February 19 2024two4karNo ratings yet

- Cover Sheet: Month Day Month DayDocument6 pagesCover Sheet: Month Day Month DayKenneth GarciaNo ratings yet

- SM Prime: Clarification of News ReportDocument4 pagesSM Prime: Clarification of News ReportBusinessWorldNo ratings yet

- Cover Sheet: Month Day Month DayDocument5 pagesCover Sheet: Month Day Month DayJhon Khayll PasuquinNo ratings yet

- SM Prime: P18 Billion Fundraising From Equity PlacementDocument4 pagesSM Prime: P18 Billion Fundraising From Equity PlacementBusinessWorldNo ratings yet

- CEB SEC Form 17A, Conso FS and Sustainability Report - December 31, 2023Document250 pagesCEB SEC Form 17A, Conso FS and Sustainability Report - December 31, 2023Walen JosefNo ratings yet

- ECVC - SEC Form 17-C - Result of ASM and OBMDocument5 pagesECVC - SEC Form 17-C - Result of ASM and OBMJulius Mark TolitolNo ratings yet

- Pal 2009Document125 pagesPal 2009SorryUsernameCreateNo ratings yet

- Cover Sheet For GFFS PDFDocument105 pagesCover Sheet For GFFS PDFMARIA FRANCISCA E. VICTOLERONo ratings yet

- SMPH: Clarification of News ReportDocument4 pagesSMPH: Clarification of News ReportBusinessWorldNo ratings yet

- SMPH: Clarification of News ReportsDocument4 pagesSMPH: Clarification of News ReportsBusinessWorldNo ratings yet

- PHI 17A-Dec 2017Document170 pagesPHI 17A-Dec 2017Jansen BenavidezNo ratings yet

- Rrhi Sec 17-A 2019 PDFDocument221 pagesRrhi Sec 17-A 2019 PDFJonnafe Almendralejo IntanoNo ratings yet

- .PHWP contentuploads202204RRHI SEC 17 A 2021 Audited Financial Statements PDFDocument219 pages.PHWP contentuploads202204RRHI SEC 17 A 2021 Audited Financial Statements PDFTagaca, Zybienne Yhue S.No ratings yet

- Millennium Global: Acquisition of Cebu Canning CorpDocument4 pagesMillennium Global: Acquisition of Cebu Canning CorpBusinessWorldNo ratings yet

- Disclosure No. 996 2019 Annual Report For Fiscal Year Ended December 31 2018 SEC Form 17 ADocument320 pagesDisclosure No. 996 2019 Annual Report For Fiscal Year Ended December 31 2018 SEC Form 17 ASamael LightbringerNo ratings yet

- Rrhi Sec 17-A 2020Document109 pagesRrhi Sec 17-A 2020Sam Thing ElseNo ratings yet

- PHI 17A-Dec 2018 PAL Fin Statement 2018Document162 pagesPHI 17A-Dec 2018 PAL Fin Statement 2018makane100% (1)

- Global Ferronickels Holding Incorporated PDFDocument137 pagesGlobal Ferronickels Holding Incorporated PDFRey NaranjoNo ratings yet

- 17-A Annual Report As of December 31 2020 5.7.21Document380 pages17-A Annual Report As of December 31 2020 5.7.21Jonabel Lenares BorresNo ratings yet

- Disclosure No. 1654 2021 Annual Report For Fiscal Year Ended December 31 2020 SEC Form 17 ADocument531 pagesDisclosure No. 1654 2021 Annual Report For Fiscal Year Ended December 31 2020 SEC Form 17 ACezarene FernandoNo ratings yet

- STR - PSE - SEC Form 17C - Tender Offer and Potential Fixed-Rate Dollar Notes - July 08 2020Document6 pagesSTR - PSE - SEC Form 17C - Tender Offer and Potential Fixed-Rate Dollar Notes - July 08 2020Onyeta HICUwnaNo ratings yet

- PAL Holdings Inc - 17A - Dec 2023Document262 pagesPAL Holdings Inc - 17A - Dec 2023Walen JosefNo ratings yet

- AGI 17A Dec2011 (AR 2011)Document156 pagesAGI 17A Dec2011 (AR 2011)cuonghienNo ratings yet

- East Coast Vulcan Corporation - 2023 Preliminary Information StatementDocument135 pagesEast Coast Vulcan Corporation - 2023 Preliminary Information StatementPaul De CastroNo ratings yet

- PAL Holdings, Inc.: CertificationDocument53 pagesPAL Holdings, Inc.: CertificationJerryJoshuaDiaz100% (1)

- 2018 Audited Financial StatementDocument175 pages2018 Audited Financial StatementTULIO, Jeremy I.No ratings yet

- Month Day Day: Registrant Telephone NumberDocument3 pagesMonth Day Day: Registrant Telephone NumberOnyeta HICUwnaNo ratings yet

- Annual Report (March 2020)Document254 pagesAnnual Report (March 2020)Alexander Jacob SmithNo ratings yet

- q3 2022 Acen Sec17-Q - Signed - CleanedDocument97 pagesq3 2022 Acen Sec17-Q - Signed - CleanedRomnick Dela Cruz GasparNo ratings yet

- Altus Property Ventures, Inc. - 2021 SEC Form 17-ADocument142 pagesAltus Property Ventures, Inc. - 2021 SEC Form 17-Amac macNo ratings yet

- PAL 17A Mar2011Document126 pagesPAL 17A Mar2011Lian Blakely CousinNo ratings yet

- CEB 17A Ended December 31 2018 PDFDocument170 pagesCEB 17A Ended December 31 2018 PDFpotatoNo ratings yet

- PSPC 17 Q q3 2019Document42 pagesPSPC 17 Q q3 2019Mikx LeeNo ratings yet

- q2 2022 Acen Sec17-Q Final (Signed)Document88 pagesq2 2022 Acen Sec17-Q Final (Signed)Romnick Dela Cruz GasparNo ratings yet

- Abscbn Annual Report 2013Document212 pagesAbscbn Annual Report 2013Maria Arrah BorjaNo ratings yet

- 2022 Annual Report Final - Dizon MinesDocument112 pages2022 Annual Report Final - Dizon MinesJun BelenNo ratings yet

- SEC Form 17-C - Change in Corporate Name, Address and Stock Symbol With Amended AOI Certificate2Document12 pagesSEC Form 17-C - Change in Corporate Name, Address and Stock Symbol With Amended AOI Certificate2Paul De CastroNo ratings yet

- Far Eastern University, Inc. Annual Report FY 2019-2020Document370 pagesFar Eastern University, Inc. Annual Report FY 2019-2020Llanzana EVersonNo ratings yet

- PHI 17Q March 2023Document53 pagesPHI 17Q March 2023garciarhodjeannemarthaNo ratings yet

- SHLPH 2022 Annex e Annual ReportDocument75 pagesSHLPH 2022 Annex e Annual ReportMary Rose II NatividadNo ratings yet

- SM Prime Holdings, Inc. - SEC Form 17-A-2020 - 15april2021Document190 pagesSM Prime Holdings, Inc. - SEC Form 17-A-2020 - 15april2021Beat Karb100% (1)

- SM Prime Holdings, Inc. - Sec Form 17-A-2020Document265 pagesSM Prime Holdings, Inc. - Sec Form 17-A-2020Lorraine AlboNo ratings yet

- 2018 PDFDocument308 pages2018 PDFcedrick calalangNo ratings yet

- Certificate of Incorporation: Hotels and Restaurants Association in Pampanga (Harp) IncDocument17 pagesCertificate of Incorporation: Hotels and Restaurants Association in Pampanga (Harp) IncLablee CatzNo ratings yet

- Cover Sheet: Unaudited Financial StatementsDocument70 pagesCover Sheet: Unaudited Financial StatementsDan GammadNo ratings yet

- AEV 17A Dec2011 (AR 2011)Document292 pagesAEV 17A Dec2011 (AR 2011)cuonghienNo ratings yet

- HSSSI - SEC Form 17-Q - 1Q22 - 20may2022Document71 pagesHSSSI - SEC Form 17-Q - 1Q22 - 20may2022Julius Mark Carinhay TolitolNo ratings yet

- PSPC - 17-Q - Q3 2018Document43 pagesPSPC - 17-Q - Q3 2018Michael Francis Uy CastiloNo ratings yet

- SEC Form 17-C Results of ASMDocument5 pagesSEC Form 17-C Results of ASMJulius Mark TolitolNo ratings yet

- Month Day Day: Registrant Telephone NumberDocument4 pagesMonth Day Day: Registrant Telephone NumberOnyeta HICUwnaNo ratings yet

- SHLPH SEC Form 17-C Regular Meeting of The Board of Directors Held On 10 August 2022 (Final) - SignedDocument4 pagesSHLPH SEC Form 17-C Regular Meeting of The Board of Directors Held On 10 August 2022 (Final) - SignedJulius Mark Carinhay TolitolNo ratings yet

- HOME - PSE - SEC Form 17C - Board Resolution - April 14, 2023Document4 pagesHOME - PSE - SEC Form 17C - Board Resolution - April 14, 2023Julius Mark Carinhay TolitolNo ratings yet

- SEC Form 17-C - Results of Board Meeting June 6, 2023Document3 pagesSEC Form 17-C - Results of Board Meeting June 6, 2023Paul De CastroNo ratings yet

- PNB SEC 17-A - 31 Dec 2019 PDFDocument324 pagesPNB SEC 17-A - 31 Dec 2019 PDFJiordan Gabriel SimonNo ratings yet

- Emperador Inc. Annual Report 2016Document167 pagesEmperador Inc. Annual Report 2016grail.donaelNo ratings yet

- Chapter 13 Property Plant and Equi PDFDocument234 pagesChapter 13 Property Plant and Equi PDFMary MariaNo ratings yet

- Investing Redefined: A Proven Investment Approach for a Changing WorldFrom EverandInvesting Redefined: A Proven Investment Approach for a Changing WorldNo ratings yet

- Modern Real Estate Investing: The Delaware Statutory TrustFrom EverandModern Real Estate Investing: The Delaware Statutory TrustNo ratings yet

- Ifrs15 - BdoDocument110 pagesIfrs15 - BdoSajjad CheemaNo ratings yet

- Contoh Dokumen PerjanjianDocument13 pagesContoh Dokumen PerjanjianAzreen M Amin0% (1)

- Turner Construction CompanyDocument2 pagesTurner Construction CompanySwapnil J. SoniNo ratings yet

- The Linkage of EstablishmentDocument4 pagesThe Linkage of Establishmentnorielle najeNo ratings yet

- Answer - Capital BudgetingDocument19 pagesAnswer - Capital Budgetingchowchow123No ratings yet

- Dealmaker The NetworkerDocument11 pagesDealmaker The NetworkerMarcinNo ratings yet

- 40 - Financial Statements - TheoryDocument9 pages40 - Financial Statements - TheoryクロードNo ratings yet

- Tax Credits Applicable To Individuals - Zimbabwe Revenue Authority (ZIMRA)Document2 pagesTax Credits Applicable To Individuals - Zimbabwe Revenue Authority (ZIMRA)rodgington duneNo ratings yet

- Ratio Analysis Is An Instrument - For Decision Making - A StudyDocument6 pagesRatio Analysis Is An Instrument - For Decision Making - A Studys.muthuNo ratings yet

- Research Journal On Consentia On LawDocument198 pagesResearch Journal On Consentia On LawSkandh NathamNo ratings yet

- Complete Report On A Study On Job Satisfaction of Employees inDocument74 pagesComplete Report On A Study On Job Satisfaction of Employees injai sharma78% (32)

- Advantages of VarDocument3 pagesAdvantages of Varankit_coolhead50% (2)

- Advertising Project FinalDocument95 pagesAdvertising Project FinalIramNo ratings yet

- Learning Material Level 1 FinalDocument165 pagesLearning Material Level 1 FinalPpNo ratings yet

- Taxation CH 4Document3 pagesTaxation CH 4Kristel Nuyda LobasNo ratings yet

- Receivables Management: © Tata Mcgraw-Hill Publishing Company Limited, Financial ManagementDocument46 pagesReceivables Management: © Tata Mcgraw-Hill Publishing Company Limited, Financial Managementarchana_anuragi100% (1)

- Chapter 7 Economic Dev'tDocument6 pagesChapter 7 Economic Dev'tmonique payong100% (2)

- Measuring Exposure To Exchange Rate FluctuationsDocument35 pagesMeasuring Exposure To Exchange Rate FluctuationsarifNo ratings yet

- Sme Financing of FSIBLDocument60 pagesSme Financing of FSIBLKhan Jewel100% (4)

- Construction Contracts: International Accounting Standard 11Document5 pagesConstruction Contracts: International Accounting Standard 11Babu babuNo ratings yet

- KhmerKeyboard NiDA V1.0Document5 pagesKhmerKeyboard NiDA V1.0Phearun PayNo ratings yet

- Research Proposal: Effects of Working Capital Management On Sme ProfitabilityDocument3 pagesResearch Proposal: Effects of Working Capital Management On Sme Profitabilitykashifshaikh760% (1)

- Cost Concepts and Design EconomicsDocument25 pagesCost Concepts and Design EconomicsTushar SinglaNo ratings yet

- The Business Plan, Creating and Starting The VentureDocument24 pagesThe Business Plan, Creating and Starting The VentureE Kay Mutemi100% (1)

- R28 Return Concepts Q Bank PDFDocument6 pagesR28 Return Concepts Q Bank PDFZidane KhanNo ratings yet

- Antal Fekete - The Exchange of Income and WealthDocument13 pagesAntal Fekete - The Exchange of Income and WealthLibertarianVzlaNo ratings yet

- Contract Logistics Definition - InvestopediaDocument4 pagesContract Logistics Definition - InvestopediarodolfosolismovilloNo ratings yet

- CH 1 Engineering Economic DecisionsDocument14 pagesCH 1 Engineering Economic DecisionsAnanthan RameshNo ratings yet

SM Prime: Pricing of P15B Retail Bonds

SM Prime: Pricing of P15B Retail Bonds

Uploaded by

BusinessWorld0 ratings0% found this document useful (0 votes)

48 views4 pagesSM Prime Holdings, Inc. has set the interest rates for its upcoming retail bond offering totaling PHP15 billion, with an option to issue up to an additional PHP10 billion. The 5.5-year bonds will have an interest rate of 5.1% annually, the 7-year bonds will be 5.2% annually, and the 10-year bonds will be 5.74% annually. The bonds received the highest rating of PRS Aaa from PhilRatings, denoting the highest quality with minimal credit risk. The bonds will be offered to investors from August 13-22 and issued on September 1.

Original Description:

SM Prime: Pricing of P15B retail bonds

Original Title

SM Prime: Pricing of P15B retail bonds

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSM Prime Holdings, Inc. has set the interest rates for its upcoming retail bond offering totaling PHP15 billion, with an option to issue up to an additional PHP10 billion. The 5.5-year bonds will have an interest rate of 5.1% annually, the 7-year bonds will be 5.2% annually, and the 10-year bonds will be 5.74% annually. The bonds received the highest rating of PRS Aaa from PhilRatings, denoting the highest quality with minimal credit risk. The bonds will be offered to investors from August 13-22 and issued on September 1.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

48 views4 pagesSM Prime: Pricing of P15B Retail Bonds

SM Prime: Pricing of P15B Retail Bonds

Uploaded by

BusinessWorldSM Prime Holdings, Inc. has set the interest rates for its upcoming retail bond offering totaling PHP15 billion, with an option to issue up to an additional PHP10 billion. The 5.5-year bonds will have an interest rate of 5.1% annually, the 7-year bonds will be 5.2% annually, and the 10-year bonds will be 5.74% annually. The bonds received the highest rating of PRS Aaa from PhilRatings, denoting the highest quality with minimal credit risk. The bonds will be offered to investors from August 13-22 and issued on September 1.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 4

A S 0 9 4 - 0 0 0 0 8 8

SEC Registration Number

S M P R I M E H O L D I N G S , I N C . A N D S U B S I

D

D I A R I E S

(Companys Full Name)

M a l l o f A s i a A r e n a A n n e x B u i l d i n g

, C o r a l W a y c o r . J . W . D i o k n o B l v d

. , M a l l o f A s i a C o m p l e x , B r g y . 7 6

Z o n e 1 0 , C B P - 1 A , P a s a y C i t y 1 3 0 0

Teresa Cecilia H. Reyes 831-1000

(Contact Person) (Company Telephone Number)

0 8 1 2 1 7 - C

Month Day (Form Type) Month Day

(Calendar Period) (Annual Meeting)

(Secondary License Type, If Applicable)

Dept. Requiring this Doc. Amended Articles Number/Section

Total Amount of Borrowings

Total No. of Stockholders Domestic Foreign

To be accomplished by SEC Personnel concerned

File Number LCU

Document ID Cashier

S T A M P S

Remarks: Please use BLACK ink for scanning purposes.

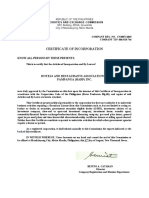

COVER SHEET

SECURITIES AND EXCHANGE COMMISSION

SEC FORM 17-C

CURRENT REPORT UNDER SECTION 17

OF THE SECURITIES REGULATION CODE (SRC)

AND SRC RULE 17(a)-1(b)(3) THEREUNDER

1. August 12, 2014

Date of Report

2. SEC Identification Number AS094-000088 3. BIR Tax Identification No. 003-058-789

4. SM PRIME HOLDINGS, INC.

Exact name of registrant as specified in its charter

5. PHILIPPINES 6. (SEC Use Only)

Province, country or other jurisdiction of

incorporation

Industry Classification Code:

7. Mall of Asia Arena Annex Building, Coral Way cor. J.W. Diokno Blvd., Mall of Asia Complex,

Brgy. 76, Zone 10, CBP-1A, Pasay City, Philippines 1300

Address of principal office Postal Code

8. (632) 831-1000

Registrant's telephone number, including area code

9. N/A

Former name or former address, if changed since last report

10. Securities registered pursuant to Sections 4 and 8 of the RSA

Title of Each Class Number of Shares of Common Stock

Outstanding and Amount of Debt Outstanding

COMMON STOCK, P1 PAR VALUE 27,819,137,294

......................................................................................................................................................

......................................................................................................................................................

......................................................................................................................................................

11. Indicate the item numbers reported herein: ITEM # 9, LETTER B.

PRESS RELEASE

SM Prime Sets Interest Rates for Php15 Billion Retail Bonds

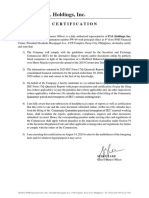

(12 August 2014, Pasay City, Philippines) SM Prime Holdings, Inc. (SMPH) has set the interest rates for

its Peso-denominated Series A, 5.5-year retail bonds at 5.1000% p.a., Series B, 7-year retail bonds at

5.2006% p.a., and its Series C, 10-year retail bonds at 5.7417% p.a. SMPH will issue an aggregate

principal amount of Php15.0 billion of the Series A, Series B and Series C bonds, with an option to issue

an additional amount of up to Php10.0 billion. The bonds are scheduled to be offered by SMPH to

investors through underwriters from August 13 to 22, 2014. The retail bonds are set to be issued on

September 1, 2014.

This series of SMPH bonds due 2020, 2021 and 2024 is the maiden offering by SMPH of Peso-

denominated retail bonds to the public. The SMPH bonds have been rated PRS Aaa by Philippine Rating

Services Corporation (PhilRatings), the highest rating assigned by PhilRatings. A PRS Aaa rating denotes

that such obligations are of the highest quality with minimal credit risk, and that the issuing companys

capacity to meet its financial commitment on the obligations is extremely strong.

The SMPH bonds joint issue managers and joint bookrunners are BDO Capital & Investment

Corporation and First Metro Investment Corporation, while the joint lead underwriters are BDO Capital

& Investment Corporation, BPI Capital Corporation, China Banking Corporation and First Metro

Investment Corporation. Land Bank of the Philippines, Philippine Commercial Capital, Inc., PNB Capital

and Investment Corporation, RCBC Capital Corporation and SB Capital Investment Corp. are

participating underwriters for the bond issue.

--END--

For further inquiries:

Alex Pomento

Vice President, Investor Relations

SM Prime Holdings, Inc.

E-mail: alex.pomento@smprime.com

Tel. no.: +632 862 7940

SIGNATURES

Pursuant to the requirements of the Securities Regulation Code, the registrant has duly caused this

report to be signed on its behalf by the undersigned hereunto duly authorized.

SM PRIME HOLDINGS, INC.

Registrant

Date: August 12, 2014 ___________________________

TERESA CECILIA H. REYES

Vice President Finance

You might also like

- FDHTFB YdjDocument5 pagesFDHTFB YdjSarathy KannanNo ratings yet

- Welcome To Wall Street Prep's Financial Modeling Quick Lessons!Document3 pagesWelcome To Wall Street Prep's Financial Modeling Quick Lessons!alexandre1411No ratings yet

- SM Prime: Clarification of News ReportDocument4 pagesSM Prime: Clarification of News ReportBusinessWorldNo ratings yet

- SM Prime Holdings, Inc. - Sec Form 17-C - February 19 2024Document26 pagesSM Prime Holdings, Inc. - Sec Form 17-C - February 19 2024two4karNo ratings yet

- Cover Sheet: Month Day Month DayDocument6 pagesCover Sheet: Month Day Month DayKenneth GarciaNo ratings yet

- SM Prime: Clarification of News ReportDocument4 pagesSM Prime: Clarification of News ReportBusinessWorldNo ratings yet

- Cover Sheet: Month Day Month DayDocument5 pagesCover Sheet: Month Day Month DayJhon Khayll PasuquinNo ratings yet

- SM Prime: P18 Billion Fundraising From Equity PlacementDocument4 pagesSM Prime: P18 Billion Fundraising From Equity PlacementBusinessWorldNo ratings yet

- CEB SEC Form 17A, Conso FS and Sustainability Report - December 31, 2023Document250 pagesCEB SEC Form 17A, Conso FS and Sustainability Report - December 31, 2023Walen JosefNo ratings yet

- ECVC - SEC Form 17-C - Result of ASM and OBMDocument5 pagesECVC - SEC Form 17-C - Result of ASM and OBMJulius Mark TolitolNo ratings yet

- Pal 2009Document125 pagesPal 2009SorryUsernameCreateNo ratings yet

- Cover Sheet For GFFS PDFDocument105 pagesCover Sheet For GFFS PDFMARIA FRANCISCA E. VICTOLERONo ratings yet

- SMPH: Clarification of News ReportDocument4 pagesSMPH: Clarification of News ReportBusinessWorldNo ratings yet

- SMPH: Clarification of News ReportsDocument4 pagesSMPH: Clarification of News ReportsBusinessWorldNo ratings yet

- PHI 17A-Dec 2017Document170 pagesPHI 17A-Dec 2017Jansen BenavidezNo ratings yet

- Rrhi Sec 17-A 2019 PDFDocument221 pagesRrhi Sec 17-A 2019 PDFJonnafe Almendralejo IntanoNo ratings yet

- .PHWP contentuploads202204RRHI SEC 17 A 2021 Audited Financial Statements PDFDocument219 pages.PHWP contentuploads202204RRHI SEC 17 A 2021 Audited Financial Statements PDFTagaca, Zybienne Yhue S.No ratings yet

- Millennium Global: Acquisition of Cebu Canning CorpDocument4 pagesMillennium Global: Acquisition of Cebu Canning CorpBusinessWorldNo ratings yet

- Disclosure No. 996 2019 Annual Report For Fiscal Year Ended December 31 2018 SEC Form 17 ADocument320 pagesDisclosure No. 996 2019 Annual Report For Fiscal Year Ended December 31 2018 SEC Form 17 ASamael LightbringerNo ratings yet

- Rrhi Sec 17-A 2020Document109 pagesRrhi Sec 17-A 2020Sam Thing ElseNo ratings yet

- PHI 17A-Dec 2018 PAL Fin Statement 2018Document162 pagesPHI 17A-Dec 2018 PAL Fin Statement 2018makane100% (1)

- Global Ferronickels Holding Incorporated PDFDocument137 pagesGlobal Ferronickels Holding Incorporated PDFRey NaranjoNo ratings yet

- 17-A Annual Report As of December 31 2020 5.7.21Document380 pages17-A Annual Report As of December 31 2020 5.7.21Jonabel Lenares BorresNo ratings yet

- Disclosure No. 1654 2021 Annual Report For Fiscal Year Ended December 31 2020 SEC Form 17 ADocument531 pagesDisclosure No. 1654 2021 Annual Report For Fiscal Year Ended December 31 2020 SEC Form 17 ACezarene FernandoNo ratings yet

- STR - PSE - SEC Form 17C - Tender Offer and Potential Fixed-Rate Dollar Notes - July 08 2020Document6 pagesSTR - PSE - SEC Form 17C - Tender Offer and Potential Fixed-Rate Dollar Notes - July 08 2020Onyeta HICUwnaNo ratings yet

- PAL Holdings Inc - 17A - Dec 2023Document262 pagesPAL Holdings Inc - 17A - Dec 2023Walen JosefNo ratings yet

- AGI 17A Dec2011 (AR 2011)Document156 pagesAGI 17A Dec2011 (AR 2011)cuonghienNo ratings yet

- East Coast Vulcan Corporation - 2023 Preliminary Information StatementDocument135 pagesEast Coast Vulcan Corporation - 2023 Preliminary Information StatementPaul De CastroNo ratings yet

- PAL Holdings, Inc.: CertificationDocument53 pagesPAL Holdings, Inc.: CertificationJerryJoshuaDiaz100% (1)

- 2018 Audited Financial StatementDocument175 pages2018 Audited Financial StatementTULIO, Jeremy I.No ratings yet

- Month Day Day: Registrant Telephone NumberDocument3 pagesMonth Day Day: Registrant Telephone NumberOnyeta HICUwnaNo ratings yet

- Annual Report (March 2020)Document254 pagesAnnual Report (March 2020)Alexander Jacob SmithNo ratings yet

- q3 2022 Acen Sec17-Q - Signed - CleanedDocument97 pagesq3 2022 Acen Sec17-Q - Signed - CleanedRomnick Dela Cruz GasparNo ratings yet

- Altus Property Ventures, Inc. - 2021 SEC Form 17-ADocument142 pagesAltus Property Ventures, Inc. - 2021 SEC Form 17-Amac macNo ratings yet

- PAL 17A Mar2011Document126 pagesPAL 17A Mar2011Lian Blakely CousinNo ratings yet

- CEB 17A Ended December 31 2018 PDFDocument170 pagesCEB 17A Ended December 31 2018 PDFpotatoNo ratings yet

- PSPC 17 Q q3 2019Document42 pagesPSPC 17 Q q3 2019Mikx LeeNo ratings yet

- q2 2022 Acen Sec17-Q Final (Signed)Document88 pagesq2 2022 Acen Sec17-Q Final (Signed)Romnick Dela Cruz GasparNo ratings yet

- Abscbn Annual Report 2013Document212 pagesAbscbn Annual Report 2013Maria Arrah BorjaNo ratings yet

- 2022 Annual Report Final - Dizon MinesDocument112 pages2022 Annual Report Final - Dizon MinesJun BelenNo ratings yet

- SEC Form 17-C - Change in Corporate Name, Address and Stock Symbol With Amended AOI Certificate2Document12 pagesSEC Form 17-C - Change in Corporate Name, Address and Stock Symbol With Amended AOI Certificate2Paul De CastroNo ratings yet

- Far Eastern University, Inc. Annual Report FY 2019-2020Document370 pagesFar Eastern University, Inc. Annual Report FY 2019-2020Llanzana EVersonNo ratings yet

- PHI 17Q March 2023Document53 pagesPHI 17Q March 2023garciarhodjeannemarthaNo ratings yet

- SHLPH 2022 Annex e Annual ReportDocument75 pagesSHLPH 2022 Annex e Annual ReportMary Rose II NatividadNo ratings yet

- SM Prime Holdings, Inc. - SEC Form 17-A-2020 - 15april2021Document190 pagesSM Prime Holdings, Inc. - SEC Form 17-A-2020 - 15april2021Beat Karb100% (1)

- SM Prime Holdings, Inc. - Sec Form 17-A-2020Document265 pagesSM Prime Holdings, Inc. - Sec Form 17-A-2020Lorraine AlboNo ratings yet

- 2018 PDFDocument308 pages2018 PDFcedrick calalangNo ratings yet

- Certificate of Incorporation: Hotels and Restaurants Association in Pampanga (Harp) IncDocument17 pagesCertificate of Incorporation: Hotels and Restaurants Association in Pampanga (Harp) IncLablee CatzNo ratings yet

- Cover Sheet: Unaudited Financial StatementsDocument70 pagesCover Sheet: Unaudited Financial StatementsDan GammadNo ratings yet

- AEV 17A Dec2011 (AR 2011)Document292 pagesAEV 17A Dec2011 (AR 2011)cuonghienNo ratings yet

- HSSSI - SEC Form 17-Q - 1Q22 - 20may2022Document71 pagesHSSSI - SEC Form 17-Q - 1Q22 - 20may2022Julius Mark Carinhay TolitolNo ratings yet

- PSPC - 17-Q - Q3 2018Document43 pagesPSPC - 17-Q - Q3 2018Michael Francis Uy CastiloNo ratings yet

- SEC Form 17-C Results of ASMDocument5 pagesSEC Form 17-C Results of ASMJulius Mark TolitolNo ratings yet

- Month Day Day: Registrant Telephone NumberDocument4 pagesMonth Day Day: Registrant Telephone NumberOnyeta HICUwnaNo ratings yet

- SHLPH SEC Form 17-C Regular Meeting of The Board of Directors Held On 10 August 2022 (Final) - SignedDocument4 pagesSHLPH SEC Form 17-C Regular Meeting of The Board of Directors Held On 10 August 2022 (Final) - SignedJulius Mark Carinhay TolitolNo ratings yet

- HOME - PSE - SEC Form 17C - Board Resolution - April 14, 2023Document4 pagesHOME - PSE - SEC Form 17C - Board Resolution - April 14, 2023Julius Mark Carinhay TolitolNo ratings yet

- SEC Form 17-C - Results of Board Meeting June 6, 2023Document3 pagesSEC Form 17-C - Results of Board Meeting June 6, 2023Paul De CastroNo ratings yet

- PNB SEC 17-A - 31 Dec 2019 PDFDocument324 pagesPNB SEC 17-A - 31 Dec 2019 PDFJiordan Gabriel SimonNo ratings yet

- Emperador Inc. Annual Report 2016Document167 pagesEmperador Inc. Annual Report 2016grail.donaelNo ratings yet

- Chapter 13 Property Plant and Equi PDFDocument234 pagesChapter 13 Property Plant and Equi PDFMary MariaNo ratings yet

- Investing Redefined: A Proven Investment Approach for a Changing WorldFrom EverandInvesting Redefined: A Proven Investment Approach for a Changing WorldNo ratings yet

- Modern Real Estate Investing: The Delaware Statutory TrustFrom EverandModern Real Estate Investing: The Delaware Statutory TrustNo ratings yet

- Ifrs15 - BdoDocument110 pagesIfrs15 - BdoSajjad CheemaNo ratings yet

- Contoh Dokumen PerjanjianDocument13 pagesContoh Dokumen PerjanjianAzreen M Amin0% (1)

- Turner Construction CompanyDocument2 pagesTurner Construction CompanySwapnil J. SoniNo ratings yet

- The Linkage of EstablishmentDocument4 pagesThe Linkage of Establishmentnorielle najeNo ratings yet

- Answer - Capital BudgetingDocument19 pagesAnswer - Capital Budgetingchowchow123No ratings yet

- Dealmaker The NetworkerDocument11 pagesDealmaker The NetworkerMarcinNo ratings yet

- 40 - Financial Statements - TheoryDocument9 pages40 - Financial Statements - TheoryクロードNo ratings yet

- Tax Credits Applicable To Individuals - Zimbabwe Revenue Authority (ZIMRA)Document2 pagesTax Credits Applicable To Individuals - Zimbabwe Revenue Authority (ZIMRA)rodgington duneNo ratings yet

- Ratio Analysis Is An Instrument - For Decision Making - A StudyDocument6 pagesRatio Analysis Is An Instrument - For Decision Making - A Studys.muthuNo ratings yet

- Research Journal On Consentia On LawDocument198 pagesResearch Journal On Consentia On LawSkandh NathamNo ratings yet

- Complete Report On A Study On Job Satisfaction of Employees inDocument74 pagesComplete Report On A Study On Job Satisfaction of Employees injai sharma78% (32)

- Advantages of VarDocument3 pagesAdvantages of Varankit_coolhead50% (2)

- Advertising Project FinalDocument95 pagesAdvertising Project FinalIramNo ratings yet

- Learning Material Level 1 FinalDocument165 pagesLearning Material Level 1 FinalPpNo ratings yet

- Taxation CH 4Document3 pagesTaxation CH 4Kristel Nuyda LobasNo ratings yet

- Receivables Management: © Tata Mcgraw-Hill Publishing Company Limited, Financial ManagementDocument46 pagesReceivables Management: © Tata Mcgraw-Hill Publishing Company Limited, Financial Managementarchana_anuragi100% (1)

- Chapter 7 Economic Dev'tDocument6 pagesChapter 7 Economic Dev'tmonique payong100% (2)

- Measuring Exposure To Exchange Rate FluctuationsDocument35 pagesMeasuring Exposure To Exchange Rate FluctuationsarifNo ratings yet

- Sme Financing of FSIBLDocument60 pagesSme Financing of FSIBLKhan Jewel100% (4)

- Construction Contracts: International Accounting Standard 11Document5 pagesConstruction Contracts: International Accounting Standard 11Babu babuNo ratings yet

- KhmerKeyboard NiDA V1.0Document5 pagesKhmerKeyboard NiDA V1.0Phearun PayNo ratings yet

- Research Proposal: Effects of Working Capital Management On Sme ProfitabilityDocument3 pagesResearch Proposal: Effects of Working Capital Management On Sme Profitabilitykashifshaikh760% (1)

- Cost Concepts and Design EconomicsDocument25 pagesCost Concepts and Design EconomicsTushar SinglaNo ratings yet

- The Business Plan, Creating and Starting The VentureDocument24 pagesThe Business Plan, Creating and Starting The VentureE Kay Mutemi100% (1)

- R28 Return Concepts Q Bank PDFDocument6 pagesR28 Return Concepts Q Bank PDFZidane KhanNo ratings yet

- Antal Fekete - The Exchange of Income and WealthDocument13 pagesAntal Fekete - The Exchange of Income and WealthLibertarianVzlaNo ratings yet

- Contract Logistics Definition - InvestopediaDocument4 pagesContract Logistics Definition - InvestopediarodolfosolismovilloNo ratings yet

- CH 1 Engineering Economic DecisionsDocument14 pagesCH 1 Engineering Economic DecisionsAnanthan RameshNo ratings yet