Professional Documents

Culture Documents

Core Balanced Composite - 2QTR 2014

Core Balanced Composite - 2QTR 2014

Uploaded by

jai6480Copyright:

Available Formats

You might also like

- XLS092-XLS-EnG Tire City - RaghuDocument49 pagesXLS092-XLS-EnG Tire City - RaghuSohini Mo BanerjeeNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Risk and Rates of Return ExerciseDocument61 pagesRisk and Rates of Return ExerciseLee Wong100% (2)

- Money and Risk ManagementDocument38 pagesMoney and Risk ManagementMel100% (3)

- Stochastic Methods in Finance: Lecture Notes For STAT3006 / STATG017Document27 pagesStochastic Methods in Finance: Lecture Notes For STAT3006 / STATG017doomriderNo ratings yet

- Core Balanced Composite - 1QTR 2014Document2 pagesCore Balanced Composite - 1QTR 2014jai6480No ratings yet

- Core Balanced Composite: Performance SummaryDocument2 pagesCore Balanced Composite: Performance Summaryjai6480No ratings yet

- Income Balanced Composite - 1QTR 2014Document2 pagesIncome Balanced Composite - 1QTR 2014jai6480No ratings yet

- Core Balanced Composite - 3QTR 2013Document2 pagesCore Balanced Composite - 3QTR 2013jai6480No ratings yet

- Core Balanced Composite 2QTR 2013Document2 pagesCore Balanced Composite 2QTR 2013Jason BenteauNo ratings yet

- Core Balanced Composite 2QTR 2012Document2 pagesCore Balanced Composite 2QTR 2012jai6480No ratings yet

- Income Balanced Composite: Performance SummaryDocument2 pagesIncome Balanced Composite: Performance Summaryjai6480No ratings yet

- Conservative Composite - 1QTR 2014Document2 pagesConservative Composite - 1QTR 2014jai6480No ratings yet

- Income Balanced Composit 2QTR 2012Document2 pagesIncome Balanced Composit 2QTR 2012jai6480No ratings yet

- Conservative Composite 2QTR 2012Document2 pagesConservative Composite 2QTR 2012jai6480No ratings yet

- Conservative Composite - 4QTR 2012-5Document2 pagesConservative Composite - 4QTR 2012-5Jason BenteauNo ratings yet

- NielsenDocument17 pagesNielsenCanadianValue0% (1)

- 4Q11 Earnings Release: Conference Call PresentationDocument23 pages4Q11 Earnings Release: Conference Call PresentationMultiplan RINo ratings yet

- 5 TomCollier SPEE Annual Parameters SurveyDocument20 pages5 TomCollier SPEE Annual Parameters SurveymdshoppNo ratings yet

- Canadian Value Fund 1QTR 2012Document2 pagesCanadian Value Fund 1QTR 2012Jason BenteauNo ratings yet

- Supreme Industries FundamentalDocument8 pagesSupreme Industries FundamentalSanjay JaiswalNo ratings yet

- Bank of Kigali Announces Q1 2010 ResultsDocument7 pagesBank of Kigali Announces Q1 2010 ResultsBank of KigaliNo ratings yet

- Cfa Research PaperDocument5 pagesCfa Research Paperfvey0xan100% (1)

- Company Visit Q1 11 ThaiDocument49 pagesCompany Visit Q1 11 ThaiMeghna GuptaNo ratings yet

- Hedge Fund Indices MayDocument3 pagesHedge Fund Indices Mayj.fred a. voortmanNo ratings yet

- REITs WatchlistDocument9 pagesREITs WatchlistKhriztopher PhayNo ratings yet

- SIPRI Milex Data 1988 2015Document169 pagesSIPRI Milex Data 1988 2015Marius DumitruNo ratings yet

- PT Garuda Indonesia (Persero) TBKDocument30 pagesPT Garuda Indonesia (Persero) TBKburungtweetyNo ratings yet

- 1Q14 Presentation of ResultsDocument16 pages1Q14 Presentation of ResultsMillsRINo ratings yet

- ABG ShipyardDocument9 pagesABG ShipyardTejas MankarNo ratings yet

- Financial Statement AnalysisDocument31 pagesFinancial Statement AnalysisAK_Chavan100% (1)

- Atlas BankDocument145 pagesAtlas BankWaqas NawazNo ratings yet

- Weekend Market Summary Week Ending 2015 February 8Document3 pagesWeekend Market Summary Week Ending 2015 February 8Australian Property ForumNo ratings yet

- Alok Industries LTD: Q1FY12 Result UpdateDocument9 pagesAlok Industries LTD: Q1FY12 Result UpdatejaiswaniNo ratings yet

- Meritor DownloadDocument68 pagesMeritor DownloadShubham BhatiaNo ratings yet

- A Global Market Rotation Strategy With An Annual Performance of 41.4% Since 2003 - Seeking AlphaDocument96 pagesA Global Market Rotation Strategy With An Annual Performance of 41.4% Since 2003 - Seeking Alpha_karr99No ratings yet

- Teleflex Fourth Quarter Earnings Conference Call SlidesDocument41 pagesTeleflex Fourth Quarter Earnings Conference Call SlidesmedtechyNo ratings yet

- Financial Statement Analysis - 2023 (Auto-Saved)Document63 pagesFinancial Statement Analysis - 2023 (Auto-Saved)Rienhardt Van EedenNo ratings yet

- Acct330 - Ayush Raj GiriDocument19 pagesAcct330 - Ayush Raj GiriAyush GiriNo ratings yet

- Asustek: 1Q 2014 Investor ConferenceDocument31 pagesAsustek: 1Q 2014 Investor ConferenceFarhan SyahmieNo ratings yet

- Deloitte GCC PPT Fact SheetDocument22 pagesDeloitte GCC PPT Fact SheetRakawy Bin RakNo ratings yet

- ES - Avalon Presentation - May 2014Document34 pagesES - Avalon Presentation - May 2014macconsa0% (1)

- Are Hedge Funds Becoming Regular Asset Managers or Are Regular Managers Pretending To Be Hedge Funds?Document45 pagesAre Hedge Funds Becoming Regular Asset Managers or Are Regular Managers Pretending To Be Hedge Funds?mayur8898357200No ratings yet

- Weekend Market Summary Week Ending 2014 November 9Document3 pagesWeekend Market Summary Week Ending 2014 November 9Australian Property ForumNo ratings yet

- Chap 7Document27 pagesChap 7Joanne Chau100% (1)

- KAREX AnnualReport2015Document139 pagesKAREX AnnualReport2015SKNo ratings yet

- Wipro LTD: Disappointing Writ All OverDocument6 pagesWipro LTD: Disappointing Writ All OverswetasagarNo ratings yet

- SSI Feasibility Study SampleDocument116 pagesSSI Feasibility Study SampleAJi AdilNo ratings yet

- Analysts Meet May068Document34 pagesAnalysts Meet May068Sabarish_1991No ratings yet

- Golden Agri-Resources - Hold: Disappointing Fy12 ShowingDocument4 pagesGolden Agri-Resources - Hold: Disappointing Fy12 ShowingphuawlNo ratings yet

- Presentation 3Q13Document19 pagesPresentation 3Q13Multiplan RINo ratings yet

- BRF - Deutsche Paris Jun15Document30 pagesBRF - Deutsche Paris Jun15PedroShawNo ratings yet

- Goldman Sachs Basic Materials Conference: June 2-4, 2010Document26 pagesGoldman Sachs Basic Materials Conference: June 2-4, 2010FibriaRINo ratings yet

- Transnet Annual Report 2003 - 2004Document126 pagesTransnet Annual Report 2003 - 2004cameroonwebnewsNo ratings yet

- Financial HighlightsDocument6 pagesFinancial Highlightsangels_birdsNo ratings yet

- 360 ONE Results Update Q4FY23Document2 pages360 ONE Results Update Q4FY23firesafetyhyderabadNo ratings yet

- PNB Analyst Presentation March16Document29 pagesPNB Analyst Presentation March16tamirisaarNo ratings yet

- FXCM Q1 2014 Earnings PresentationDocument21 pagesFXCM Q1 2014 Earnings PresentationRon FinbergNo ratings yet

- SSP Templates: Business Name: Last Completed Fiscal YearDocument23 pagesSSP Templates: Business Name: Last Completed Fiscal YearMee TootNo ratings yet

- Nomura Global Quantitative Equity Conference 435935Document48 pagesNomura Global Quantitative Equity Conference 435935Mukund Singh100% (1)

- MODULE 2.2 Affordability Analysis & Affordable OptionsDocument56 pagesMODULE 2.2 Affordability Analysis & Affordable Optionsbanate LGUNo ratings yet

- 4Q15 PresentationDocument21 pages4Q15 PresentationMultiplan RINo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Canadian Value Fund: Performance SummaryDocument2 pagesCanadian Value Fund: Performance Summaryjai6480No ratings yet

- Canadian Value Fund: Performance SummaryDocument2 pagesCanadian Value Fund: Performance Summaryjai6480No ratings yet

- Core Balanced Composite - 1QTR 2014Document2 pagesCore Balanced Composite - 1QTR 2014jai6480No ratings yet

- Core Balanced Composite: Performance SummaryDocument2 pagesCore Balanced Composite: Performance Summaryjai6480No ratings yet

- Income Balanced Composite: Performance SummaryDocument2 pagesIncome Balanced Composite: Performance Summaryjai6480No ratings yet

- Income Balanced Composite - 1QTR 2014Document2 pagesIncome Balanced Composite - 1QTR 2014jai6480No ratings yet

- Conservative Composite - 1QTR 2014Document2 pagesConservative Composite - 1QTR 2014jai6480No ratings yet

- Core Balanced Composite - 3QTR 2013Document2 pagesCore Balanced Composite - 3QTR 2013jai6480No ratings yet

- Select Shares US Fund 2QTR 2012Document2 pagesSelect Shares US Fund 2QTR 2012jai6480No ratings yet

- Income Balanced Composit 2QTR 2012Document2 pagesIncome Balanced Composit 2QTR 2012jai6480No ratings yet

- Core Balanced Composite 2QTR 2012Document2 pagesCore Balanced Composite 2QTR 2012jai6480No ratings yet

- Conservative Composite 2QTR 2012Document2 pagesConservative Composite 2QTR 2012jai6480No ratings yet

- Buy Back of Shares: - Secretarial PracticeDocument6 pagesBuy Back of Shares: - Secretarial PracticecoolsikhNo ratings yet

- WSO Resume 47Document1 pageWSO Resume 47John MathiasNo ratings yet

- Financial Statement AnalysisDocument72 pagesFinancial Statement AnalysisPadyala SriramNo ratings yet

- UBS 20-F Annual Reporting 2008Document583 pagesUBS 20-F Annual Reporting 2008kalvinwhiteoakNo ratings yet

- Reinstate at UW With 5.0 PT: High Leverage Equals Unnecessary RiskDocument37 pagesReinstate at UW With 5.0 PT: High Leverage Equals Unnecessary RiskChristian?97No ratings yet

- Let's Plan Your Financial FreedomDocument11 pagesLet's Plan Your Financial FreedomvedantNo ratings yet

- Erb HarveyDocument61 pagesErb HarveytopsecretuserNo ratings yet

- India Glycols 2018-19 PDFDocument162 pagesIndia Glycols 2018-19 PDFPuneet367No ratings yet

- FM09-CH 03 PDFDocument14 pagesFM09-CH 03 PDFGregNo ratings yet

- Hospital Supply Inc Background of The Case PDF FreeDocument35 pagesHospital Supply Inc Background of The Case PDF Freewho sinoNo ratings yet

- الوساطة المالية ودورها في إنشاء سوق تمويلية للإقتصاد الوطني. دراسة حالة الجزائر خلال الفترة 2001- 2018. Financial intermediation and its role in establishing a financing market for the national economy. Case study oDocument16 pagesالوساطة المالية ودورها في إنشاء سوق تمويلية للإقتصاد الوطني. دراسة حالة الجزائر خلال الفترة 2001- 2018. Financial intermediation and its role in establishing a financing market for the national economy. Case study obatouNo ratings yet

- Appendices of Section B - 4Document150 pagesAppendices of Section B - 4booksanand1No ratings yet

- FM 02 - Mfis NotesDocument7 pagesFM 02 - Mfis NotesCorey PageNo ratings yet

- Annexure I - Syllabus Outline NISM-Series-X-A: Investment Adviser (Level 1) Certification Examination Objective of The ExaminationDocument2 pagesAnnexure I - Syllabus Outline NISM-Series-X-A: Investment Adviser (Level 1) Certification Examination Objective of The Examinationchetan bhagatNo ratings yet

- CFAS Consolidated Mock Exam 2Document3 pagesCFAS Consolidated Mock Exam 2josevgomez1234567No ratings yet

- 100 Crucial LBO Model Jargons You Need To KnowDocument16 pages100 Crucial LBO Model Jargons You Need To Knownaghulk1No ratings yet

- FINAL DOCUMENT (SIP) ReportDocument16 pagesFINAL DOCUMENT (SIP) ReportSairaj MudhirajNo ratings yet

- Entrepreneurship Quarter 1 - Module 4 OutputDocument8 pagesEntrepreneurship Quarter 1 - Module 4 OutputryanjamesrevaleNo ratings yet

- Tuto 10 Group ADocument5 pagesTuto 10 Group Aanaury17No ratings yet

- The Beginners Guide To Investing in The Nigerian Stock MarketDocument50 pagesThe Beginners Guide To Investing in The Nigerian Stock MarketMuhammad Ghani100% (1)

- 29aug Computational Forecasting of Default Probability Using Systems theory-FYDP Group 14Document88 pages29aug Computational Forecasting of Default Probability Using Systems theory-FYDP Group 14radiaqaziNo ratings yet

- Valuation Concepts: 1 Free Cash Flow Estimation (FCF)Document3 pagesValuation Concepts: 1 Free Cash Flow Estimation (FCF)The GravityNo ratings yet

- CMA Part 1Document11 pagesCMA Part 1Aaron Abano100% (1)

- How To Read A Balance SheetDocument17 pagesHow To Read A Balance Sheetismun nadhifahNo ratings yet

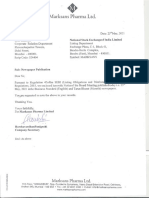

- Marksans Pharma LTD.: Date: 25"may, 2021Document3 pagesMarksans Pharma LTD.: Date: 25"may, 2021Shrin RajputNo ratings yet

- Market Capitalization CalculationDocument26 pagesMarket Capitalization CalculationSaifulKhalidNo ratings yet

- ST439 - Chapter 1: Financial Derivatives, Binomial ModelsDocument27 pagesST439 - Chapter 1: Financial Derivatives, Binomial ModelslowchangsongNo ratings yet

Core Balanced Composite - 2QTR 2014

Core Balanced Composite - 2QTR 2014

Uploaded by

jai6480Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Core Balanced Composite - 2QTR 2014

Core Balanced Composite - 2QTR 2014

Uploaded by

jai6480Copyright:

Available Formats

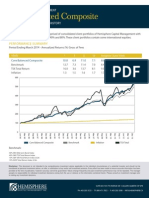

HEMISPHERE CAPITAL MANAGEMENT

Core Balanced Composite

PERFORMANCE SUMMARY AND HISTORY

The Core Balanced Composite is comprised of consolidated client portfolios of Hemisphere Capital Management with

an equity asset mix weight between 40% and 80%. These client portfolios contain some international equities.

PERFORMANCE SUMMARY

Period Ending June 2014 - Annualized Returns (%) Gross of Fees

YEARS

10

Inception (June/1994)

Core Balanced Composite

15.1

8.0

10.2

7.7

8.9

Benchmark

19.0

8.9

9.9

7.4

8.5

Inflation

1.8

1.7

1.6

1.7

1.7

600

500

400

300

200

100

0

Jun 14

Dec 13

Jun 13

Dec 12

Jun 12

Dec 11

Jun 11

Dec 10

Jun 10

Dec 09

Jun 09

Dec 08

Jun 08

Dec 07

Jun 07

Benchmark

Dec 06

Jun 06

Dec 05

Jun 05

Dec 04

Jun 04

Dec 03

Jun 03

Dec 02

Jun 02

Dec 01

Jun 01

Dec 00

Jun 00

Dec 99

Jun 99

Dec 98

Jun 98

Dec 97

Jun 97

Dec 96

Jun 96

Dec 95

Jun 95

Dec 94

Jun 94

Core Balanced Composite

Inflation

Benchmark:

June 1994 - December 2013

40% DEX Mid-term Bond Index

40% S&P/TSX Total Return Index

10% S&P 500 Total Return Index $Cdn

10% EAFE Total Return Index $Cdn

January 2014 - Current

20% DEX Short-term Bond Index

20% DEX Mid-term Bond Index

30% S&P/TSX Total Return Index

20% S&P 500 Total Return Index $Cdn

10% EAFE Total Return Index $Cdn

Disclaimer: This document is not intended to be comprehensive investment advice applicable to the individual circumstances of a potential investor and should not be

considered as personal investment advice, an offer, or solicitation to buy and/or sell investment products. Every effort has been made to ensure accurate information has been

provided at the time of publication, however accuracy cannot be guaranteed. Values change frequently and past investment performance may not be repeated. The manager

accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained herein. Please consult an investment manager prior

to making any investment decisions.

SUITE 603 734-7TH AVENUE SW CALGARY, ALBERTA T2P 3P8

PH: 403-205-3533 TF: 800-471-7853 F: 403-205-3588 INFO@HEMISPHERE.CA

PAGE 2

CORE BALANCED COMPOSITE

PERFORMANCE HISTORY

3Q

4Q

YTD

# of

Port

2.6%

2.0%

4.6%

Net Fee

2.5%

1.8%

4.3%

Net Fee

Benchmark

5.6%

-0.2%

5.3%

Benchmark

1Q

Year

2Q

1994 Gross Fee

1995 Gross Fee

Net Fee

Benchmark

1996 Gross Fee

Net Fee

Benchmark

1997 Gross Fee

Net Fee

Benchmark

4.5%

5.6%

3.1%

1.8%

15.8%

4.2%

5.3%

2.9%

1.5%

14.6%

4.7%

5.1%

2.3%

5.4%

18.6%

3.6%

2.3%

8.7%

10.5%

27.2%

3.3%

2.0%

8.4%

10.2%

25.8%

3.0%

2.3%

4.5%

7.8%

18.9%

-2.2%

3.1%

9.8%

-3.4%

7.0%

-2.4%

2.8%

9.5%

-3.7%

5.9%

13

Year

2006 Gross Fee

2007 Gross Fee

-0.2%

3.9%

-6.0%

-6.2%

-8.6%

Net Fee

-0.4%

3.6%

-6.2%

-6.5%

-9.5%

Benchmark

-0.7%

2.6%

-9.8%

-8.9%

-16.2%

2009 Gross Fee

1.6%

7.2%

5.0%

3.9%

18.9%

Net Fee

1.4%

6.9%

4.8%

3.7%

17.8%

Benchmark

-1.7%

10.9%

7.3%

1.8%

19.0%

Gross Fee

3.0%

0.3%

5.7%

5.1%

14.7%

Net Fee

2.8%

0.0%

5.4%

4.9%

13.7%

Benchmark

9.1%

0.8%

-9.9%

11.4%

10.4%

1.4%

4.1%

0.2%

-0.3%

5.5%

Net Fee

1.2%

3.8%

-0.1%

-0.5%

4.4%

Benchmark

1.5%

2.7%

-0.4%

10.8%

15.0%

4.5%

6.2%

4.1%

1.4%

17.1%

Net Fee

4.2%

5.9%

3.8%

1.1%

15.8%

Benchmark

6.6%

3.7%

1.2%

-5.3%

6.0%

2.8%

2.4%

-2.8%

5.6%

8.0%

Net Fee

2.5%

2.1%

-3.0%

5.3%

6.8%

Net Fee

Benchmark

-6.7%

0.1%

-4.5%

7.7%

-3.9%

Benchmark

3.8%

-2.9%

-1.3%

3.6%

3.1%

Net Fee

3.4%

-3.1%

-1.6%

3.3%

1.9%

Benchmark

0.7%

-4.4%

-6.3%

5.4%

-4.8%

-1.9%

5.5%

2.6%

6.0%

12.6%

Net Fee

-2.1%

5.2%

2.3%

5.7%

11.4%

Benchmark

-4.1%

8.1%

4.2%

6.7%

15.3%

-1.7%

2.2%

3.1%

7.6%

-1.9%

1.9%

2.8%

6.5%

Benchmark

4.3%

-0.3%

0.7%

5.6%

10.5%

2005 Gross Fee

1.2%

4.8%

4.0%

1.4%

11.7%

Net Fee

0.9%

4.6%

3.7%

1.1%

10.6%

Benchmark

2.0%

3.6%

4.9%

1.9%

13.0%

Benchmark

2011 Gross Fee

Net Fee

Benchmark

2012 Gross Fee

Net Fee

Benchmark

43

48

12.8%

3.6%

-0.6%

3.7%

6.7%

7.1%

-0.2%

2.8%

3.9%

2.6%

3.7%

0.7%

-9.0%

Net Fee

2.8%

-2.7%

1.4%

1.4%

2004 Gross Fee

-2.3%

4.4%

1.7%

4.8%

37

3.5%

Benchmark

Net Fee

2003 Gross Fee

51

1.2%

0.4%

20

7.8%

2.2%

14.8%

2002 Gross Fee

2.8%

0.5%

3.0%

18

3.1%

0.7%

-1.1%

2001 Gross Fee

-2.1%

0.1%

6.5%

19

3.8%

-0.2%

-8.8%

2000 Gross Fee

# of

Port

1.0%

8.8%

18

YTD

1.2%

1.6%

1999 Gross Fee

4Q

0.1%

2008 Gross Fee

2010

3Q

-0.1%

0.2%

14

2Q

Net Fee

5.1%

1998 Gross Fee

1Q

2013 Gross Fee

1.9%

-2.6%

7.7%

4.4%

11.6%

2.7%

0.2%

-1.3%

3.7%

5.3%

2.6%

0.0%

-1.5%

3.4%

4.5%

2.6%

-0.9%

-4.4%

3.3%

0.4%

2.7%

-3.3%

3.5%

0.7%

3.5%

2.5%

-3.5%

3.3%

0.5%

2.6%

3.7%

-1.7%

4.0%

1.6%

7.6%

3.9%

-0.4%

1.9%

4.5%

10.1%

3.7%

-0.6%

1.7%

4.3%

9.2%

3.9%

5.4%

11.9%

4.0%

-1.8%

4.5%

3.4%

Net Fee

4.3%

3.2%

Benchmark

4.8%

3.7%

2014 Gross Fee

53

52

55

58

80

87

101

109

Benchmark:

June 1994 - December 2013

40% DEX Mid-term Bond Index

40% S&P/TSX Total Return Index

10% S&P 500 Total Return Index $Cdn

10% EAFE Total Return Index $Cdn

January 2014 - Current

20% DEX Short-term Bond Index

20% DEX Mid-term Bond Index

30% S&P/TSX Total Return Index

20% S&P 500 Total Return Index $Cdn

10% EAFE Total Return Index $Cdn

SUITE 603 734-7TH AVENUE SW CALGARY, ALBERTA T2P 3P8

PH: 403-205-3533 TF: 800-471-7853 F: 403-205-3588 INFO@HEMISPHERE.CA

You might also like

- XLS092-XLS-EnG Tire City - RaghuDocument49 pagesXLS092-XLS-EnG Tire City - RaghuSohini Mo BanerjeeNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- Risk and Rates of Return ExerciseDocument61 pagesRisk and Rates of Return ExerciseLee Wong100% (2)

- Money and Risk ManagementDocument38 pagesMoney and Risk ManagementMel100% (3)

- Stochastic Methods in Finance: Lecture Notes For STAT3006 / STATG017Document27 pagesStochastic Methods in Finance: Lecture Notes For STAT3006 / STATG017doomriderNo ratings yet

- Core Balanced Composite - 1QTR 2014Document2 pagesCore Balanced Composite - 1QTR 2014jai6480No ratings yet

- Core Balanced Composite: Performance SummaryDocument2 pagesCore Balanced Composite: Performance Summaryjai6480No ratings yet

- Income Balanced Composite - 1QTR 2014Document2 pagesIncome Balanced Composite - 1QTR 2014jai6480No ratings yet

- Core Balanced Composite - 3QTR 2013Document2 pagesCore Balanced Composite - 3QTR 2013jai6480No ratings yet

- Core Balanced Composite 2QTR 2013Document2 pagesCore Balanced Composite 2QTR 2013Jason BenteauNo ratings yet

- Core Balanced Composite 2QTR 2012Document2 pagesCore Balanced Composite 2QTR 2012jai6480No ratings yet

- Income Balanced Composite: Performance SummaryDocument2 pagesIncome Balanced Composite: Performance Summaryjai6480No ratings yet

- Conservative Composite - 1QTR 2014Document2 pagesConservative Composite - 1QTR 2014jai6480No ratings yet

- Income Balanced Composit 2QTR 2012Document2 pagesIncome Balanced Composit 2QTR 2012jai6480No ratings yet

- Conservative Composite 2QTR 2012Document2 pagesConservative Composite 2QTR 2012jai6480No ratings yet

- Conservative Composite - 4QTR 2012-5Document2 pagesConservative Composite - 4QTR 2012-5Jason BenteauNo ratings yet

- NielsenDocument17 pagesNielsenCanadianValue0% (1)

- 4Q11 Earnings Release: Conference Call PresentationDocument23 pages4Q11 Earnings Release: Conference Call PresentationMultiplan RINo ratings yet

- 5 TomCollier SPEE Annual Parameters SurveyDocument20 pages5 TomCollier SPEE Annual Parameters SurveymdshoppNo ratings yet

- Canadian Value Fund 1QTR 2012Document2 pagesCanadian Value Fund 1QTR 2012Jason BenteauNo ratings yet

- Supreme Industries FundamentalDocument8 pagesSupreme Industries FundamentalSanjay JaiswalNo ratings yet

- Bank of Kigali Announces Q1 2010 ResultsDocument7 pagesBank of Kigali Announces Q1 2010 ResultsBank of KigaliNo ratings yet

- Cfa Research PaperDocument5 pagesCfa Research Paperfvey0xan100% (1)

- Company Visit Q1 11 ThaiDocument49 pagesCompany Visit Q1 11 ThaiMeghna GuptaNo ratings yet

- Hedge Fund Indices MayDocument3 pagesHedge Fund Indices Mayj.fred a. voortmanNo ratings yet

- REITs WatchlistDocument9 pagesREITs WatchlistKhriztopher PhayNo ratings yet

- SIPRI Milex Data 1988 2015Document169 pagesSIPRI Milex Data 1988 2015Marius DumitruNo ratings yet

- PT Garuda Indonesia (Persero) TBKDocument30 pagesPT Garuda Indonesia (Persero) TBKburungtweetyNo ratings yet

- 1Q14 Presentation of ResultsDocument16 pages1Q14 Presentation of ResultsMillsRINo ratings yet

- ABG ShipyardDocument9 pagesABG ShipyardTejas MankarNo ratings yet

- Financial Statement AnalysisDocument31 pagesFinancial Statement AnalysisAK_Chavan100% (1)

- Atlas BankDocument145 pagesAtlas BankWaqas NawazNo ratings yet

- Weekend Market Summary Week Ending 2015 February 8Document3 pagesWeekend Market Summary Week Ending 2015 February 8Australian Property ForumNo ratings yet

- Alok Industries LTD: Q1FY12 Result UpdateDocument9 pagesAlok Industries LTD: Q1FY12 Result UpdatejaiswaniNo ratings yet

- Meritor DownloadDocument68 pagesMeritor DownloadShubham BhatiaNo ratings yet

- A Global Market Rotation Strategy With An Annual Performance of 41.4% Since 2003 - Seeking AlphaDocument96 pagesA Global Market Rotation Strategy With An Annual Performance of 41.4% Since 2003 - Seeking Alpha_karr99No ratings yet

- Teleflex Fourth Quarter Earnings Conference Call SlidesDocument41 pagesTeleflex Fourth Quarter Earnings Conference Call SlidesmedtechyNo ratings yet

- Financial Statement Analysis - 2023 (Auto-Saved)Document63 pagesFinancial Statement Analysis - 2023 (Auto-Saved)Rienhardt Van EedenNo ratings yet

- Acct330 - Ayush Raj GiriDocument19 pagesAcct330 - Ayush Raj GiriAyush GiriNo ratings yet

- Asustek: 1Q 2014 Investor ConferenceDocument31 pagesAsustek: 1Q 2014 Investor ConferenceFarhan SyahmieNo ratings yet

- Deloitte GCC PPT Fact SheetDocument22 pagesDeloitte GCC PPT Fact SheetRakawy Bin RakNo ratings yet

- ES - Avalon Presentation - May 2014Document34 pagesES - Avalon Presentation - May 2014macconsa0% (1)

- Are Hedge Funds Becoming Regular Asset Managers or Are Regular Managers Pretending To Be Hedge Funds?Document45 pagesAre Hedge Funds Becoming Regular Asset Managers or Are Regular Managers Pretending To Be Hedge Funds?mayur8898357200No ratings yet

- Weekend Market Summary Week Ending 2014 November 9Document3 pagesWeekend Market Summary Week Ending 2014 November 9Australian Property ForumNo ratings yet

- Chap 7Document27 pagesChap 7Joanne Chau100% (1)

- KAREX AnnualReport2015Document139 pagesKAREX AnnualReport2015SKNo ratings yet

- Wipro LTD: Disappointing Writ All OverDocument6 pagesWipro LTD: Disappointing Writ All OverswetasagarNo ratings yet

- SSI Feasibility Study SampleDocument116 pagesSSI Feasibility Study SampleAJi AdilNo ratings yet

- Analysts Meet May068Document34 pagesAnalysts Meet May068Sabarish_1991No ratings yet

- Golden Agri-Resources - Hold: Disappointing Fy12 ShowingDocument4 pagesGolden Agri-Resources - Hold: Disappointing Fy12 ShowingphuawlNo ratings yet

- Presentation 3Q13Document19 pagesPresentation 3Q13Multiplan RINo ratings yet

- BRF - Deutsche Paris Jun15Document30 pagesBRF - Deutsche Paris Jun15PedroShawNo ratings yet

- Goldman Sachs Basic Materials Conference: June 2-4, 2010Document26 pagesGoldman Sachs Basic Materials Conference: June 2-4, 2010FibriaRINo ratings yet

- Transnet Annual Report 2003 - 2004Document126 pagesTransnet Annual Report 2003 - 2004cameroonwebnewsNo ratings yet

- Financial HighlightsDocument6 pagesFinancial Highlightsangels_birdsNo ratings yet

- 360 ONE Results Update Q4FY23Document2 pages360 ONE Results Update Q4FY23firesafetyhyderabadNo ratings yet

- PNB Analyst Presentation March16Document29 pagesPNB Analyst Presentation March16tamirisaarNo ratings yet

- FXCM Q1 2014 Earnings PresentationDocument21 pagesFXCM Q1 2014 Earnings PresentationRon FinbergNo ratings yet

- SSP Templates: Business Name: Last Completed Fiscal YearDocument23 pagesSSP Templates: Business Name: Last Completed Fiscal YearMee TootNo ratings yet

- Nomura Global Quantitative Equity Conference 435935Document48 pagesNomura Global Quantitative Equity Conference 435935Mukund Singh100% (1)

- MODULE 2.2 Affordability Analysis & Affordable OptionsDocument56 pagesMODULE 2.2 Affordability Analysis & Affordable Optionsbanate LGUNo ratings yet

- 4Q15 PresentationDocument21 pages4Q15 PresentationMultiplan RINo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Canadian Value Fund: Performance SummaryDocument2 pagesCanadian Value Fund: Performance Summaryjai6480No ratings yet

- Canadian Value Fund: Performance SummaryDocument2 pagesCanadian Value Fund: Performance Summaryjai6480No ratings yet

- Core Balanced Composite - 1QTR 2014Document2 pagesCore Balanced Composite - 1QTR 2014jai6480No ratings yet

- Core Balanced Composite: Performance SummaryDocument2 pagesCore Balanced Composite: Performance Summaryjai6480No ratings yet

- Income Balanced Composite: Performance SummaryDocument2 pagesIncome Balanced Composite: Performance Summaryjai6480No ratings yet

- Income Balanced Composite - 1QTR 2014Document2 pagesIncome Balanced Composite - 1QTR 2014jai6480No ratings yet

- Conservative Composite - 1QTR 2014Document2 pagesConservative Composite - 1QTR 2014jai6480No ratings yet

- Core Balanced Composite - 3QTR 2013Document2 pagesCore Balanced Composite - 3QTR 2013jai6480No ratings yet

- Select Shares US Fund 2QTR 2012Document2 pagesSelect Shares US Fund 2QTR 2012jai6480No ratings yet

- Income Balanced Composit 2QTR 2012Document2 pagesIncome Balanced Composit 2QTR 2012jai6480No ratings yet

- Core Balanced Composite 2QTR 2012Document2 pagesCore Balanced Composite 2QTR 2012jai6480No ratings yet

- Conservative Composite 2QTR 2012Document2 pagesConservative Composite 2QTR 2012jai6480No ratings yet

- Buy Back of Shares: - Secretarial PracticeDocument6 pagesBuy Back of Shares: - Secretarial PracticecoolsikhNo ratings yet

- WSO Resume 47Document1 pageWSO Resume 47John MathiasNo ratings yet

- Financial Statement AnalysisDocument72 pagesFinancial Statement AnalysisPadyala SriramNo ratings yet

- UBS 20-F Annual Reporting 2008Document583 pagesUBS 20-F Annual Reporting 2008kalvinwhiteoakNo ratings yet

- Reinstate at UW With 5.0 PT: High Leverage Equals Unnecessary RiskDocument37 pagesReinstate at UW With 5.0 PT: High Leverage Equals Unnecessary RiskChristian?97No ratings yet

- Let's Plan Your Financial FreedomDocument11 pagesLet's Plan Your Financial FreedomvedantNo ratings yet

- Erb HarveyDocument61 pagesErb HarveytopsecretuserNo ratings yet

- India Glycols 2018-19 PDFDocument162 pagesIndia Glycols 2018-19 PDFPuneet367No ratings yet

- FM09-CH 03 PDFDocument14 pagesFM09-CH 03 PDFGregNo ratings yet

- Hospital Supply Inc Background of The Case PDF FreeDocument35 pagesHospital Supply Inc Background of The Case PDF Freewho sinoNo ratings yet

- الوساطة المالية ودورها في إنشاء سوق تمويلية للإقتصاد الوطني. دراسة حالة الجزائر خلال الفترة 2001- 2018. Financial intermediation and its role in establishing a financing market for the national economy. Case study oDocument16 pagesالوساطة المالية ودورها في إنشاء سوق تمويلية للإقتصاد الوطني. دراسة حالة الجزائر خلال الفترة 2001- 2018. Financial intermediation and its role in establishing a financing market for the national economy. Case study obatouNo ratings yet

- Appendices of Section B - 4Document150 pagesAppendices of Section B - 4booksanand1No ratings yet

- FM 02 - Mfis NotesDocument7 pagesFM 02 - Mfis NotesCorey PageNo ratings yet

- Annexure I - Syllabus Outline NISM-Series-X-A: Investment Adviser (Level 1) Certification Examination Objective of The ExaminationDocument2 pagesAnnexure I - Syllabus Outline NISM-Series-X-A: Investment Adviser (Level 1) Certification Examination Objective of The Examinationchetan bhagatNo ratings yet

- CFAS Consolidated Mock Exam 2Document3 pagesCFAS Consolidated Mock Exam 2josevgomez1234567No ratings yet

- 100 Crucial LBO Model Jargons You Need To KnowDocument16 pages100 Crucial LBO Model Jargons You Need To Knownaghulk1No ratings yet

- FINAL DOCUMENT (SIP) ReportDocument16 pagesFINAL DOCUMENT (SIP) ReportSairaj MudhirajNo ratings yet

- Entrepreneurship Quarter 1 - Module 4 OutputDocument8 pagesEntrepreneurship Quarter 1 - Module 4 OutputryanjamesrevaleNo ratings yet

- Tuto 10 Group ADocument5 pagesTuto 10 Group Aanaury17No ratings yet

- The Beginners Guide To Investing in The Nigerian Stock MarketDocument50 pagesThe Beginners Guide To Investing in The Nigerian Stock MarketMuhammad Ghani100% (1)

- 29aug Computational Forecasting of Default Probability Using Systems theory-FYDP Group 14Document88 pages29aug Computational Forecasting of Default Probability Using Systems theory-FYDP Group 14radiaqaziNo ratings yet

- Valuation Concepts: 1 Free Cash Flow Estimation (FCF)Document3 pagesValuation Concepts: 1 Free Cash Flow Estimation (FCF)The GravityNo ratings yet

- CMA Part 1Document11 pagesCMA Part 1Aaron Abano100% (1)

- How To Read A Balance SheetDocument17 pagesHow To Read A Balance Sheetismun nadhifahNo ratings yet

- Marksans Pharma LTD.: Date: 25"may, 2021Document3 pagesMarksans Pharma LTD.: Date: 25"may, 2021Shrin RajputNo ratings yet

- Market Capitalization CalculationDocument26 pagesMarket Capitalization CalculationSaifulKhalidNo ratings yet

- ST439 - Chapter 1: Financial Derivatives, Binomial ModelsDocument27 pagesST439 - Chapter 1: Financial Derivatives, Binomial ModelslowchangsongNo ratings yet