Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

32 viewsEffect of Dividend Distribution

Effect of Dividend Distribution

Uploaded by

Ambreen MurtazaThis document discusses dividend policy and provides information on several major banks in India. It begins by introducing the concept of dividend policy and how it involves balancing shareholder desires for dividends with corporate needs for reinvestment. Several banks are then discussed, including HDFC Bank, Axis Bank, HSBC Bank, ICICI Bank, and State Bank of India. For each bank, a brief history is provided along with tables showing dividend declarations over recent years.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Understand Banks & Financial Markets: An Introduction to the International World of Money & FinanceFrom EverandUnderstand Banks & Financial Markets: An Introduction to the International World of Money & FinanceRating: 4 out of 5 stars4/5 (9)

- DirectoryBulk DrugsDocument48 pagesDirectoryBulk DrugsPrashantsuthar100% (1)

- Grade 11 Business and Accounting Studies Past Paper 2020 3rd Term Test Western ProvinceDocument25 pagesGrade 11 Business and Accounting Studies Past Paper 2020 3rd Term Test Western Provinceinvictus azmunNo ratings yet

- Cameroon: Business inDocument68 pagesCameroon: Business inabass nchareNo ratings yet

- History of AXIS BankDocument47 pagesHistory of AXIS Banksnehalcp48No ratings yet

- A Study On Attrition Rate in Standard Chartered BankDocument55 pagesA Study On Attrition Rate in Standard Chartered BankAjay RohillaNo ratings yet

- Banking Project.Document29 pagesBanking Project.pappyjainNo ratings yet

- 1) Abn Amro BankDocument7 pages1) Abn Amro BankAbhi MaheshwariNo ratings yet

- Axis Bank Project Report-1Document20 pagesAxis Bank Project Report-1mehevishali39No ratings yet

- Brief Analysis of Some Merchant Banks in IndiaDocument6 pagesBrief Analysis of Some Merchant Banks in IndiaParul PrasadNo ratings yet

- Finance PROJECT REPORT ON "COMPARATIVE STUDY OF TOP THREE BANKS OF INDIA"Document32 pagesFinance PROJECT REPORT ON "COMPARATIVE STUDY OF TOP THREE BANKS OF INDIA"Deepika KalimuthuNo ratings yet

- Icici ProjectDocument25 pagesIcici Projectjohn_muellorNo ratings yet

- Boi and HDFCDocument24 pagesBoi and HDFCDharmikNo ratings yet

- HDFC BankDocument8 pagesHDFC BankFaraaz SalimNo ratings yet

- Home Loans of HDFC BankDocument68 pagesHome Loans of HDFC BankKartikPandeyNo ratings yet

- HDFC BankDocument6 pagesHDFC Bankdipakbora5No ratings yet

- 101 Questions & Answers-Interview For Bank Promotions-VRK100-08Nov2010Document26 pages101 Questions & Answers-Interview For Bank Promotions-VRK100-08Nov2010RamaKrishna Vadlamudi, CFA67% (3)

- Axis Bank - WikipediaDocument58 pagesAxis Bank - WikipediaPrathamesh Sawant100% (1)

- 1.1history of BankingDocument18 pages1.1history of BankingHarika KollatiNo ratings yet

- 7 P's of Private Sector BankDocument21 pages7 P's of Private Sector BankMinal DalviNo ratings yet

- FIN SerDocument3 pagesFIN SerBrindavan MohantyNo ratings yet

- Axis Bank: Talk Page An Advertisement VerificationDocument5 pagesAxis Bank: Talk Page An Advertisement VerificationakshathNo ratings yet

- The Study of Perception of StudentDocument9 pagesThe Study of Perception of Studentsuvarnachaitra27No ratings yet

- Chapter - I: Company Profile: State Bank of IndiaDocument56 pagesChapter - I: Company Profile: State Bank of IndiaprashantNo ratings yet

- Ads by Google: Submit Your Resume Malayalam GirlDocument14 pagesAds by Google: Submit Your Resume Malayalam GirlDavinder RajputNo ratings yet

- Axis BankDocument22 pagesAxis Bankअक्षय गोयल67% (3)

- Deutsche Bank India Country Fact SheetDocument3 pagesDeutsche Bank India Country Fact SheetNandan Aurangabadkar0% (1)

- Submitted To Submitted by Prof Moid Uddin Ahmad Jyoti Anand PGFA1121 PGDM-G-A-2011-13Document13 pagesSubmitted To Submitted by Prof Moid Uddin Ahmad Jyoti Anand PGFA1121 PGDM-G-A-2011-13Jyoti AnandNo ratings yet

- Axis BankDocument16 pagesAxis BankRoshan KamathNo ratings yet

- AXIS BANK Project Word FileDocument28 pagesAXIS BANK Project Word Fileअक्षय गोयलNo ratings yet

- Final Project Axis BankDocument69 pagesFinal Project Axis BankJagjit SinghNo ratings yet

- Banking SectorDocument12 pagesBanking SectorVijay RaghunathanNo ratings yet

- Introduction of Axis Bank (Modified)Document38 pagesIntroduction of Axis Bank (Modified)Ankit BadnikarNo ratings yet

- Project On HDFC BankDocument67 pagesProject On HDFC BankAarti YadavNo ratings yet

- Financial Swot Analysis of HDFC BankDocument45 pagesFinancial Swot Analysis of HDFC BankVISHAL RATHOURNo ratings yet

- Kotak MahindraDocument43 pagesKotak MahindraSatish RajNo ratings yet

- Axis Bank: SECTOR - PharmaceuticalsDocument12 pagesAxis Bank: SECTOR - PharmaceuticalsChirag ShahNo ratings yet

- A Project Report ON Industrial Exposure: (Icici Bank)Document59 pagesA Project Report ON Industrial Exposure: (Icici Bank)Gaurav MandhanaNo ratings yet

- State Bank of IndiaDocument5 pagesState Bank of IndiaMitisha GaurNo ratings yet

- Finance Major ProjectDocument16 pagesFinance Major ProjectVarshini KrishnaNo ratings yet

- Axis Bank Project ReportDocument5 pagesAxis Bank Project Reportmehevishali39No ratings yet

- AXIS BANK Company ProfileDocument7 pagesAXIS BANK Company ProfileAnjali Angel ThakurNo ratings yet

- Comparative Analysis Financial Performance of INDUSIND BANK With Other Four BanksDocument85 pagesComparative Analysis Financial Performance of INDUSIND BANK With Other Four Bankskawalpreetyahoo0% (1)

- An Anlitical Study of Loan Scheames of Icici Bank in Nagpur CityDocument52 pagesAn Anlitical Study of Loan Scheames of Icici Bank in Nagpur CityVipin KushwahaNo ratings yet

- Financial Performance & Evalution of IDLC Ltd.Document29 pagesFinancial Performance & Evalution of IDLC Ltd.Samsul ArefinNo ratings yet

- Iftm University, Moradabad: "The Study of Recruitment & Selection Procedure of Insurance Advisor/Agent" ATDocument72 pagesIftm University, Moradabad: "The Study of Recruitment & Selection Procedure of Insurance Advisor/Agent" ATCrystal GarciaNo ratings yet

- Vision: ValuesDocument8 pagesVision: ValuesBharatSeerviNo ratings yet

- BDO UnibankDocument32 pagesBDO UnibankJessybel BanaganNo ratings yet

- Axis Bank: Type Industry Founded Headquarters Key PeopleDocument5 pagesAxis Bank: Type Industry Founded Headquarters Key PeopleAlpesh PatelNo ratings yet

- HDFC Bank Final ProjectDocument48 pagesHDFC Bank Final ProjectAzim SamnaniNo ratings yet

- Industry Founded Headquarters Area Served Key People: HDFC Bank Logo - SVGDocument6 pagesIndustry Founded Headquarters Area Served Key People: HDFC Bank Logo - SVGRohit KumarNo ratings yet

- Industry Founded Headquarters Area Served Key People: HDFC Bank Logo - SVGDocument6 pagesIndustry Founded Headquarters Area Served Key People: HDFC Bank Logo - SVGRohit KumarNo ratings yet

- History of Banking & Principles of InsuranceDocument11 pagesHistory of Banking & Principles of InsuranceRudresh SrivastavaNo ratings yet

- DivyanshuprojectDocument28 pagesDivyanshuprojectalexios6390No ratings yet

- Azeem Ahmad KhanDocument15 pagesAzeem Ahmad KhanripzNo ratings yet

- HDFC Bank - AssignmentDocument15 pagesHDFC Bank - AssignmentVidya ChaudhariNo ratings yet

- Black Book (HDFC Bank)Document54 pagesBlack Book (HDFC Bank)Bhavya chhedaNo ratings yet

- Rabin ReportDocument58 pagesRabin Reportbadaladhikari12345No ratings yet

- HDFC Bank Limited Is An Indian Banking and Financial: Home LoanDocument5 pagesHDFC Bank Limited Is An Indian Banking and Financial: Home LoanSubhendu GhoshNo ratings yet

- FM Project HDFCDocument14 pagesFM Project HDFCsameer_kiniNo ratings yet

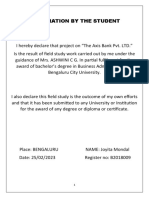

- UntitledDocument32 pagesUntitledJoyita MondalNo ratings yet

- A) Brief Relevance of The Topic and The Organization.: GrowthDocument38 pagesA) Brief Relevance of The Topic and The Organization.: GrowthShree CyberiaNo ratings yet

- Accounting 1 (SHS) - Week 6 - Accounting EquationDocument31 pagesAccounting 1 (SHS) - Week 6 - Accounting EquationAustin Capal Dela CruzNo ratings yet

- Relevant Cost-SolutionsDocument13 pagesRelevant Cost-Solutionsmaxev92106No ratings yet

- PR Algosec + Tech AGRIMDocument1 pagePR Algosec + Tech AGRIMRahul RajNo ratings yet

- PAGINA 47 Proceedings Iniic Conference 1 2020Document60 pagesPAGINA 47 Proceedings Iniic Conference 1 2020Leandro TorricelliNo ratings yet

- Insights IPB 2.0Document6 pagesInsights IPB 2.0Vinod KumarNo ratings yet

- Low-Cost Real Estate Photography Packages To Attract More Buyers and Leads, Sell Higher & Faster, Wow Your Sellers and Win More Listings!!!Document3 pagesLow-Cost Real Estate Photography Packages To Attract More Buyers and Leads, Sell Higher & Faster, Wow Your Sellers and Win More Listings!!!ayawe888888No ratings yet

- E Commerce Internet MarketingDocument20 pagesE Commerce Internet MarketingRiva Rasgo ManaloNo ratings yet

- Nestle Compensation Policies: by Humsi SinghDocument11 pagesNestle Compensation Policies: by Humsi SinghPayal KulkarniNo ratings yet

- Legal Policies For Retail StoresDocument19 pagesLegal Policies For Retail StoresTermsFeedNo ratings yet

- Hello Michael Ray,: Your Bill at A GlanceDocument3 pagesHello Michael Ray,: Your Bill at A GlancegarrettloehrNo ratings yet

- Parents Health Insurance - Payment 22-23Document1 pageParents Health Insurance - Payment 22-23nikhil nadakuditi100% (1)

- Bank Reconciliation Statement: Gravity 4 CaDocument13 pagesBank Reconciliation Statement: Gravity 4 CaAmit ChaudhryNo ratings yet

- Prinnciple of Acccounting Test (With Ans)Document21 pagesPrinnciple of Acccounting Test (With Ans)Hiếu Smith67% (3)

- VCBHJNDocument96 pagesVCBHJNMihiri MadushaniNo ratings yet

- Bank Account Management in SAP S - 4HANA - SAP BlogsDocument14 pagesBank Account Management in SAP S - 4HANA - SAP BlogsKapadia MritulNo ratings yet

- Fleet Repairs & Maintenance Audit-Final ReportDocument7 pagesFleet Repairs & Maintenance Audit-Final Reportnorintan ahmadNo ratings yet

- WWW Mt4greylabel Com Meta-Trader-5Document9 pagesWWW Mt4greylabel Com Meta-Trader-5Mt4 Grey LabelNo ratings yet

- Fragmented Contract Management: Challenges, Impacts and SolutionsDocument22 pagesFragmented Contract Management: Challenges, Impacts and SolutionsOrlando NettoNo ratings yet

- Buying Motives and RoleDocument20 pagesBuying Motives and RoleBAHHEP BAHHEPNo ratings yet

- Business Plan Final WorkDocument20 pagesBusiness Plan Final WorkJenelyn Baguio80% (5)

- Tourism Product DevelopmentDocument4 pagesTourism Product DevelopmentK GreyNo ratings yet

- A Leadership Programme For Agricultural Entrepreneurs in SwedenDocument18 pagesA Leadership Programme For Agricultural Entrepreneurs in SwedenAtikah FMNo ratings yet

- 8.4 IdentityIQ Advanced AnalyticsDocument44 pages8.4 IdentityIQ Advanced AnalyticsZoumana DiomandeNo ratings yet

- Advertising Promotes Conspicuous Consumption-2Document10 pagesAdvertising Promotes Conspicuous Consumption-2Tanushree AgrawalNo ratings yet

- SMA - Assignment Description - Vi TranDocument11 pagesSMA - Assignment Description - Vi TranTrúc Nguyễn ThanhNo ratings yet

- Assignment 2.0Document8 pagesAssignment 2.0Shanggari Sasha100% (1)

- What Is A Logframe?: Logical Framework StructureDocument9 pagesWhat Is A Logframe?: Logical Framework StructureEzedin KedirNo ratings yet

Effect of Dividend Distribution

Effect of Dividend Distribution

Uploaded by

Ambreen Murtaza0 ratings0% found this document useful (0 votes)

32 views8 pagesThis document discusses dividend policy and provides information on several major banks in India. It begins by introducing the concept of dividend policy and how it involves balancing shareholder desires for dividends with corporate needs for reinvestment. Several banks are then discussed, including HDFC Bank, Axis Bank, HSBC Bank, ICICI Bank, and State Bank of India. For each bank, a brief history is provided along with tables showing dividend declarations over recent years.

Original Description:

effect of dividend distribution on a firm

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses dividend policy and provides information on several major banks in India. It begins by introducing the concept of dividend policy and how it involves balancing shareholder desires for dividends with corporate needs for reinvestment. Several banks are then discussed, including HDFC Bank, Axis Bank, HSBC Bank, ICICI Bank, and State Bank of India. For each bank, a brief history is provided along with tables showing dividend declarations over recent years.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

32 views8 pagesEffect of Dividend Distribution

Effect of Dividend Distribution

Uploaded by

Ambreen MurtazaThis document discusses dividend policy and provides information on several major banks in India. It begins by introducing the concept of dividend policy and how it involves balancing shareholder desires for dividends with corporate needs for reinvestment. Several banks are then discussed, including HDFC Bank, Axis Bank, HSBC Bank, ICICI Bank, and State Bank of India. For each bank, a brief history is provided along with tables showing dividend declarations over recent years.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 8

INTRODUCTION

Dividend policy involves the balancing of the shareholders

desire for current dividends and the firms needs for funds for

growth.

The term dividend policy refers to the practice that management

follows in making dividend payout decisions or, in other words, the

size and pattern of cash distributions over time to shareholders. This

issue of dividend policy is one that has engaged managers since the

birth of the modern commercial corporation. Surprisingly then

dividend policy remains one of the most contested issues in finance.

The study of dividend policy has captured the attention of finance

scholars since the middle of the last century. They have attempted to

solve several issues pertaining to dividends and formulate theories

and models to explain corporate dividend behaviour.

The dividend enigma has not only been an enduring issue in finance,

it also remains unresolved. Almost three decades ago Black (1976)

described it as a puzzle, and since then an enormous amount of

research has occurred trying to solve the dividend puzzle. Allen,

Bernardo and Welch (2000, p.2499) summarised the current

consensus view when they concluded Although a number of theories

have been put forward in the literature to explain their pervasive

presence,

Dividends remain one of the thorniest puzzles in corporate finance.

The enduring nature and extensive range of the debate about dividend

policy has spawned a vast amount of literature that grows by the day.

Issues in Dividend Policy

Earnings to be distributed High vs. Low Payout.

Objective Maximize Shareholders Return.

Effects Taxes, Investment and Financing Decision.

HDFC Bank Ltd.

HDFC Bank Limited is an Indian financial services company based

in Mumbai, Maharashtra. It was incorporated in 1994. HDFC Bank is

the fifth largest bank in India by assets. It is the largest bank in India

by market capitalization as of 24 February 2014. As on Jan 2 2014,

the market cap value of HDFC was around USD 26.88B, as compared

to Credit Suisse Group with USD 47.63B.The bank was promoted by

the Housing Development Finance Corporation, a premier housing

finance company (set up in 1977) of India.

HDFC Bank Limited was incorporated in August 1994. It was

promoted by Housing Development Finance Corporation Limited

(HDFC), India's largest housing finance company. It was among the

first companies to receive an 'in principle' approval from the Reserve

Bank of India (RBI) to set up a bank in the private sector. The Bank

started operations as a scheduled commercial bank in January 1995

under the RBI's liberalization policies

Dividends Declared

Announcement Date Effective Date Dividend Date Dividend(%) Remarks

22/04/2014 05/06/2014 Final 342.5% Rs.6.8500 per share(342.5%)Dividend

23/04/2013 13/06/2013 Final 275% Rs.5.5000 per share(275%)Dividend

18/04/2012 28/06/2012 Final 215%

18/04/2011 02/06/2011 Final 165%

26/04/2010 10/06/2010 Final 120%

23/04/2009 22/06/2009 Final 100%

Axis Bank Ltd.

Axis Bank Limited (formerly UTI Bank) is the third largest private

sector bank in India. It offers financial services to customer segments

covering Large and Mid-Corporates, MSME, Agriculture and Retail

Businesses. Axis Bank has its headquarters in Mumbai, Maharashtra.

Axis Bank began its operations in 1994, after the Government of

India allowed new private banks to be established. The Bank was

promoted in 1993 jointly by the Administrator of the Unit Trust of

India (UTI-I), Life Insurance Corporation of India(LIC), General

Insurance Corporation Ltd., National Insurance Company Ltd., The

New India Assurance Company, The Oriental Insurance Corporation

and United India Insurance Company. The Unit Trust of India holds a

special position in the Indian capital markets and has promoted many

leading financial institutions in the country.

Dividends Declared

Announcement Date Effective Date Dividend Date Dividend(%) Remarks

25/04/2014 12/06/2014 Final 200% Rs.20.0000 per share(200%)Dividend

25/04/2013 05/07/2013 Final 180% Rs.18.0000 per share(180%)Dividend

27/04/2012 14/06/2012 Final 160%

22/04/2011 08/06/2011 Final 140%

20/04/2010 20/05/2010 Final 120%

20/04/2009 14/05/2009 Final 100%

HSBC BANK LTD

HSBC Holdings plc is a British multinational banking and financial

services company headquartered in London, United Kingdom. It is

one of the world's largest banks. It was founded in London in 1991

by the Hongkong and Shanghai Banking Corporation to act as a new

group holding company. The origins of the bank lie in Hong Kong

and Shanghai, where branches were first opened in 1865. The HSBC

name is derived from the initials of the Hongkong and Shanghai

Banking Corporation. As such, the company refers to both the United

Kingdom and Hong Kong as its "home markets".

HSBC HOLDINGS (00005.HK) Dividend History

Dividend Policy Trend

Dividend History

Announce Date Year End Event Paricular Type Ex-Date Book Close Date Payable Date

2014/05/07 2014/12 Interim D:USD 0.1000 Cash/Scrip 2014/05/21 2014/05/22 - 2014/07/10

2014/02/24 2013/12 Interim 4

D:USD 0.1900(equivalent to

HKD1.473034 or GBP 0.112919)

Cash/Scrip 2014/03/12 2014/03/13 - 2014/04/30

2013/10/07 2013/12 Interim 3

D:USD 0.1000(equivalent to

HKD0.775237 or GBP 0.061016)

Cash/Scrip 2013/10/23 2013/10/24 - 2013/12/11

2013/08/05 2013/12 Interim 2 D:USD 0.1000(equivalent to Cash/Scrip 2013/08/21 2013/08/22 - 2013/10/09

HKD0.775453 or GBP 0.061912)

2013/05/07 2013/12 Interim

D:USD 0.1000(equivalent to

HKD0.775485 or GBP 0.065801)

Cash/Scrip 2013/05/22 2013/05/23 - 2013/07/11

2013/03/04 2012/12 Interim 4

D:USD 0.1800(equivalent to

HKD1.397286 or GBP 0.115875)

Cash/Scrip 2013/03/20 2013/03/21 - 2013/05/08

2012/10/09 2012/12 Interim 3 D:USD 0.0900 Cash/Scrip 2012/10/24 2012/10/25 - 2012/12/12

2012/07/30 2012/12 Interim 2 D:USD 0.0900 Cash/Scrip 2012/08/15

2012/08/17 -

2012/08/17

2012/10/04

2012/04/30 2012/12 Interim D:USD 0.0900 Cash/Scrip 2012/05/16 - 2012/07/05

2012/02/27 2011/12 Interim 4 D:USD 0.1400 Cash/Scrip 2012/03/14

2012/03/16 -

2012/03/16

2012/05/02

2011/11/07 2011/12 Interim 3 D:USD 0.0900 Cash/Scrip 2011/11/23

2011/11/25 -

2011/11/25

2012/01/18

2011/08/01 2011/12 Interim 2 D:USD 0.0900 Cash/Scrip 2011/08/17

2011/08/19 -

2011/08/19

2011/10/06

2011/05/03 2011/12 Interim D:USD 0.0900 Cash/Scrip 2011/05/18

2011/05/20 -

2011/05/20

2011/07/06

2011/02/28 2010/12 Final D:USD 0.1200 Cash/Scrip 2011/03/16

2011/03/18 -

2011/03/18

2011/05/05

2010/11/01 2010/12 Interim D:USD 0.0800 Cash/Scrip 2010/11/17

2010/11/19 -

2010/11/19

2011/01/12

2010/08/02 2010/12 Interim 2 D:USD 0.0800 Cash/Scrip 2010/08/18

2010/08/20 -

2010/08/20

2010/10/06

2010/05/04 2010/12 Interim D:USD 0.0800 Cash/Scrip 2010/05/19

2010/05/21 -

2010/05/21

2010/07/07

2010/03/01 2009/12 Final D:USD 0.1000 Cash/Scrip 2010/03/17

2010/03/19 -

2010/03/19

2010/05/05

2009/11/02 2009/12 Interim 3 D:USD 0.0800 Cash/Scrip 2009/11/18

2009/11/20 -

2009/11/20

2010/01/13

2009/08/03 2009/12 Interim 2 D:USD 0.0800 Cash/Scrip 2009/08/19

2009/08/21 -

2009/08/21

2009/10/07

2009/05/05 2009/12 Interim D:USD 0.0800 Cash/Scrip 2009/05/20

2009/05/22 -

2009/05/22

2009/07/08

2009/03/02 2008/12 Final D:USD 0.1000 Cash/Scrip 2009/03/18

2009/03/20 -

2009/03/20

2009/05/06

2009/03/02 2008/12 Special R:5 -for- 12@HKD 28.0000

2009/03/12

2009/03/14 -

2009/03/14

2009/04/03

ICICI Bank Ltd.

ICICI Bank is an Indian multinational banking and financial services

company headquartered in Mumbai. It is the second largest bank in

India by assets and by market capitalization, as of 2014. It offers a

wide range of banking products and financial services to corporate

and retail customers through a variety of delivery channels and

through its specialized subsidiaries in the areas of investment

banking, life, non-life insurance, venture capital and asset

management. The Bank has a network of 3,539 branches and

11,162 ATMs in India, and has a presence in 19 countries.

ICICI Bank was established by the Industrial Credit and

Investment Corporation of India (ICICI),an Indian financial

institution, as a wholly owned subsidiary in 1955. The parent

company was formed in 1955 as a joint-venture of the World Bank,

India's public-sector banks and public-sector insurance companies to

provide project financing to Indian industry. The bank was initially

known as the Industrial Credit and Investment Corporation of India

Bank, before it changed its name to the abbreviated ICICI Bank. The

parent company was later merged with the bank.

Dividends Declared

Announcement Date Effective Date Dividend Date Dividend(%) Remarks

25/04/2014 05/06/2014 Final 230% Rs.23.0000 per share(230%)Dividend

26/04/2013 30/05/2013 Final 200% Rs.20.0000 per share(200%)Dividend

27/04/2012 31/05/2012 Final 165%

28/04/2011 02/06/2011 Final 140%

26/04/2010 10/06/2010 Final 120%

27/04/2009 11/06/2009 Final 110%

State Bank of India

State Bank of India (SBI) is a multinational banking and financial

services company based in India. It is a government-owned

corporation with its headquarters in Mumbai, Maharashtra. As of

December 2013, it had assets of US$388 billion and 17,000 branches,

including 190 foreign offices, making it the largest banking and

financial services company in India by assets.

The roots of the State Bank of India lie in the first decade of the 18th

century, when the Bank of Calcutta, later renamed the Bank of

Bengal, was established on 2 June 1806. The Bank of Bengal was one

of three Presidency banks, the other two being the Bank of Bombay

(incorporated on 15 April 1840) and the Bank of Madras

(incorporated on 1 July 1843).

Dividends Declared

Announcement Date Effective Date Dividend Date Dividend(%) Remarks

14/05/2014 29/05/2014 Final 150% Rs.15.0000 per share(150%)Dividend

04/03/2014 11/03/2014 Interim 150% Rs.15.0000 per share(150%)Interim Dividend

14/05/2013 28/05/2013 Final 415% Rs.41.5000 per share(415%)Dividend

12/05/2012 24/05/2012 Final 350%

11/05/2011 20/05/2011 Final 300%

11/05/2010 09/06/2010 Final 200%

25/01/2010 05/02/2010 Interim 100%

11/05/2009 10/06/2009 Final 290%

You might also like

- Understand Banks & Financial Markets: An Introduction to the International World of Money & FinanceFrom EverandUnderstand Banks & Financial Markets: An Introduction to the International World of Money & FinanceRating: 4 out of 5 stars4/5 (9)

- DirectoryBulk DrugsDocument48 pagesDirectoryBulk DrugsPrashantsuthar100% (1)

- Grade 11 Business and Accounting Studies Past Paper 2020 3rd Term Test Western ProvinceDocument25 pagesGrade 11 Business and Accounting Studies Past Paper 2020 3rd Term Test Western Provinceinvictus azmunNo ratings yet

- Cameroon: Business inDocument68 pagesCameroon: Business inabass nchareNo ratings yet

- History of AXIS BankDocument47 pagesHistory of AXIS Banksnehalcp48No ratings yet

- A Study On Attrition Rate in Standard Chartered BankDocument55 pagesA Study On Attrition Rate in Standard Chartered BankAjay RohillaNo ratings yet

- Banking Project.Document29 pagesBanking Project.pappyjainNo ratings yet

- 1) Abn Amro BankDocument7 pages1) Abn Amro BankAbhi MaheshwariNo ratings yet

- Axis Bank Project Report-1Document20 pagesAxis Bank Project Report-1mehevishali39No ratings yet

- Brief Analysis of Some Merchant Banks in IndiaDocument6 pagesBrief Analysis of Some Merchant Banks in IndiaParul PrasadNo ratings yet

- Finance PROJECT REPORT ON "COMPARATIVE STUDY OF TOP THREE BANKS OF INDIA"Document32 pagesFinance PROJECT REPORT ON "COMPARATIVE STUDY OF TOP THREE BANKS OF INDIA"Deepika KalimuthuNo ratings yet

- Icici ProjectDocument25 pagesIcici Projectjohn_muellorNo ratings yet

- Boi and HDFCDocument24 pagesBoi and HDFCDharmikNo ratings yet

- HDFC BankDocument8 pagesHDFC BankFaraaz SalimNo ratings yet

- Home Loans of HDFC BankDocument68 pagesHome Loans of HDFC BankKartikPandeyNo ratings yet

- HDFC BankDocument6 pagesHDFC Bankdipakbora5No ratings yet

- 101 Questions & Answers-Interview For Bank Promotions-VRK100-08Nov2010Document26 pages101 Questions & Answers-Interview For Bank Promotions-VRK100-08Nov2010RamaKrishna Vadlamudi, CFA67% (3)

- Axis Bank - WikipediaDocument58 pagesAxis Bank - WikipediaPrathamesh Sawant100% (1)

- 1.1history of BankingDocument18 pages1.1history of BankingHarika KollatiNo ratings yet

- 7 P's of Private Sector BankDocument21 pages7 P's of Private Sector BankMinal DalviNo ratings yet

- FIN SerDocument3 pagesFIN SerBrindavan MohantyNo ratings yet

- Axis Bank: Talk Page An Advertisement VerificationDocument5 pagesAxis Bank: Talk Page An Advertisement VerificationakshathNo ratings yet

- The Study of Perception of StudentDocument9 pagesThe Study of Perception of Studentsuvarnachaitra27No ratings yet

- Chapter - I: Company Profile: State Bank of IndiaDocument56 pagesChapter - I: Company Profile: State Bank of IndiaprashantNo ratings yet

- Ads by Google: Submit Your Resume Malayalam GirlDocument14 pagesAds by Google: Submit Your Resume Malayalam GirlDavinder RajputNo ratings yet

- Axis BankDocument22 pagesAxis Bankअक्षय गोयल67% (3)

- Deutsche Bank India Country Fact SheetDocument3 pagesDeutsche Bank India Country Fact SheetNandan Aurangabadkar0% (1)

- Submitted To Submitted by Prof Moid Uddin Ahmad Jyoti Anand PGFA1121 PGDM-G-A-2011-13Document13 pagesSubmitted To Submitted by Prof Moid Uddin Ahmad Jyoti Anand PGFA1121 PGDM-G-A-2011-13Jyoti AnandNo ratings yet

- Axis BankDocument16 pagesAxis BankRoshan KamathNo ratings yet

- AXIS BANK Project Word FileDocument28 pagesAXIS BANK Project Word Fileअक्षय गोयलNo ratings yet

- Final Project Axis BankDocument69 pagesFinal Project Axis BankJagjit SinghNo ratings yet

- Banking SectorDocument12 pagesBanking SectorVijay RaghunathanNo ratings yet

- Introduction of Axis Bank (Modified)Document38 pagesIntroduction of Axis Bank (Modified)Ankit BadnikarNo ratings yet

- Project On HDFC BankDocument67 pagesProject On HDFC BankAarti YadavNo ratings yet

- Financial Swot Analysis of HDFC BankDocument45 pagesFinancial Swot Analysis of HDFC BankVISHAL RATHOURNo ratings yet

- Kotak MahindraDocument43 pagesKotak MahindraSatish RajNo ratings yet

- Axis Bank: SECTOR - PharmaceuticalsDocument12 pagesAxis Bank: SECTOR - PharmaceuticalsChirag ShahNo ratings yet

- A Project Report ON Industrial Exposure: (Icici Bank)Document59 pagesA Project Report ON Industrial Exposure: (Icici Bank)Gaurav MandhanaNo ratings yet

- State Bank of IndiaDocument5 pagesState Bank of IndiaMitisha GaurNo ratings yet

- Finance Major ProjectDocument16 pagesFinance Major ProjectVarshini KrishnaNo ratings yet

- Axis Bank Project ReportDocument5 pagesAxis Bank Project Reportmehevishali39No ratings yet

- AXIS BANK Company ProfileDocument7 pagesAXIS BANK Company ProfileAnjali Angel ThakurNo ratings yet

- Comparative Analysis Financial Performance of INDUSIND BANK With Other Four BanksDocument85 pagesComparative Analysis Financial Performance of INDUSIND BANK With Other Four Bankskawalpreetyahoo0% (1)

- An Anlitical Study of Loan Scheames of Icici Bank in Nagpur CityDocument52 pagesAn Anlitical Study of Loan Scheames of Icici Bank in Nagpur CityVipin KushwahaNo ratings yet

- Financial Performance & Evalution of IDLC Ltd.Document29 pagesFinancial Performance & Evalution of IDLC Ltd.Samsul ArefinNo ratings yet

- Iftm University, Moradabad: "The Study of Recruitment & Selection Procedure of Insurance Advisor/Agent" ATDocument72 pagesIftm University, Moradabad: "The Study of Recruitment & Selection Procedure of Insurance Advisor/Agent" ATCrystal GarciaNo ratings yet

- Vision: ValuesDocument8 pagesVision: ValuesBharatSeerviNo ratings yet

- BDO UnibankDocument32 pagesBDO UnibankJessybel BanaganNo ratings yet

- Axis Bank: Type Industry Founded Headquarters Key PeopleDocument5 pagesAxis Bank: Type Industry Founded Headquarters Key PeopleAlpesh PatelNo ratings yet

- HDFC Bank Final ProjectDocument48 pagesHDFC Bank Final ProjectAzim SamnaniNo ratings yet

- Industry Founded Headquarters Area Served Key People: HDFC Bank Logo - SVGDocument6 pagesIndustry Founded Headquarters Area Served Key People: HDFC Bank Logo - SVGRohit KumarNo ratings yet

- Industry Founded Headquarters Area Served Key People: HDFC Bank Logo - SVGDocument6 pagesIndustry Founded Headquarters Area Served Key People: HDFC Bank Logo - SVGRohit KumarNo ratings yet

- History of Banking & Principles of InsuranceDocument11 pagesHistory of Banking & Principles of InsuranceRudresh SrivastavaNo ratings yet

- DivyanshuprojectDocument28 pagesDivyanshuprojectalexios6390No ratings yet

- Azeem Ahmad KhanDocument15 pagesAzeem Ahmad KhanripzNo ratings yet

- HDFC Bank - AssignmentDocument15 pagesHDFC Bank - AssignmentVidya ChaudhariNo ratings yet

- Black Book (HDFC Bank)Document54 pagesBlack Book (HDFC Bank)Bhavya chhedaNo ratings yet

- Rabin ReportDocument58 pagesRabin Reportbadaladhikari12345No ratings yet

- HDFC Bank Limited Is An Indian Banking and Financial: Home LoanDocument5 pagesHDFC Bank Limited Is An Indian Banking and Financial: Home LoanSubhendu GhoshNo ratings yet

- FM Project HDFCDocument14 pagesFM Project HDFCsameer_kiniNo ratings yet

- UntitledDocument32 pagesUntitledJoyita MondalNo ratings yet

- A) Brief Relevance of The Topic and The Organization.: GrowthDocument38 pagesA) Brief Relevance of The Topic and The Organization.: GrowthShree CyberiaNo ratings yet

- Accounting 1 (SHS) - Week 6 - Accounting EquationDocument31 pagesAccounting 1 (SHS) - Week 6 - Accounting EquationAustin Capal Dela CruzNo ratings yet

- Relevant Cost-SolutionsDocument13 pagesRelevant Cost-Solutionsmaxev92106No ratings yet

- PR Algosec + Tech AGRIMDocument1 pagePR Algosec + Tech AGRIMRahul RajNo ratings yet

- PAGINA 47 Proceedings Iniic Conference 1 2020Document60 pagesPAGINA 47 Proceedings Iniic Conference 1 2020Leandro TorricelliNo ratings yet

- Insights IPB 2.0Document6 pagesInsights IPB 2.0Vinod KumarNo ratings yet

- Low-Cost Real Estate Photography Packages To Attract More Buyers and Leads, Sell Higher & Faster, Wow Your Sellers and Win More Listings!!!Document3 pagesLow-Cost Real Estate Photography Packages To Attract More Buyers and Leads, Sell Higher & Faster, Wow Your Sellers and Win More Listings!!!ayawe888888No ratings yet

- E Commerce Internet MarketingDocument20 pagesE Commerce Internet MarketingRiva Rasgo ManaloNo ratings yet

- Nestle Compensation Policies: by Humsi SinghDocument11 pagesNestle Compensation Policies: by Humsi SinghPayal KulkarniNo ratings yet

- Legal Policies For Retail StoresDocument19 pagesLegal Policies For Retail StoresTermsFeedNo ratings yet

- Hello Michael Ray,: Your Bill at A GlanceDocument3 pagesHello Michael Ray,: Your Bill at A GlancegarrettloehrNo ratings yet

- Parents Health Insurance - Payment 22-23Document1 pageParents Health Insurance - Payment 22-23nikhil nadakuditi100% (1)

- Bank Reconciliation Statement: Gravity 4 CaDocument13 pagesBank Reconciliation Statement: Gravity 4 CaAmit ChaudhryNo ratings yet

- Prinnciple of Acccounting Test (With Ans)Document21 pagesPrinnciple of Acccounting Test (With Ans)Hiếu Smith67% (3)

- VCBHJNDocument96 pagesVCBHJNMihiri MadushaniNo ratings yet

- Bank Account Management in SAP S - 4HANA - SAP BlogsDocument14 pagesBank Account Management in SAP S - 4HANA - SAP BlogsKapadia MritulNo ratings yet

- Fleet Repairs & Maintenance Audit-Final ReportDocument7 pagesFleet Repairs & Maintenance Audit-Final Reportnorintan ahmadNo ratings yet

- WWW Mt4greylabel Com Meta-Trader-5Document9 pagesWWW Mt4greylabel Com Meta-Trader-5Mt4 Grey LabelNo ratings yet

- Fragmented Contract Management: Challenges, Impacts and SolutionsDocument22 pagesFragmented Contract Management: Challenges, Impacts and SolutionsOrlando NettoNo ratings yet

- Buying Motives and RoleDocument20 pagesBuying Motives and RoleBAHHEP BAHHEPNo ratings yet

- Business Plan Final WorkDocument20 pagesBusiness Plan Final WorkJenelyn Baguio80% (5)

- Tourism Product DevelopmentDocument4 pagesTourism Product DevelopmentK GreyNo ratings yet

- A Leadership Programme For Agricultural Entrepreneurs in SwedenDocument18 pagesA Leadership Programme For Agricultural Entrepreneurs in SwedenAtikah FMNo ratings yet

- 8.4 IdentityIQ Advanced AnalyticsDocument44 pages8.4 IdentityIQ Advanced AnalyticsZoumana DiomandeNo ratings yet

- Advertising Promotes Conspicuous Consumption-2Document10 pagesAdvertising Promotes Conspicuous Consumption-2Tanushree AgrawalNo ratings yet

- SMA - Assignment Description - Vi TranDocument11 pagesSMA - Assignment Description - Vi TranTrúc Nguyễn ThanhNo ratings yet

- Assignment 2.0Document8 pagesAssignment 2.0Shanggari Sasha100% (1)

- What Is A Logframe?: Logical Framework StructureDocument9 pagesWhat Is A Logframe?: Logical Framework StructureEzedin KedirNo ratings yet