Professional Documents

Culture Documents

Rules For Identifying Direct and Indirect Labor Cost 1. Direct Workers

Rules For Identifying Direct and Indirect Labor Cost 1. Direct Workers

Uploaded by

snadminOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rules For Identifying Direct and Indirect Labor Cost 1. Direct Workers

Rules For Identifying Direct and Indirect Labor Cost 1. Direct Workers

Uploaded by

snadminCopyright:

Available Formats

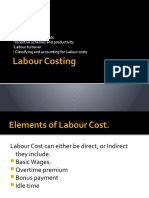

Paper F2, Management Accounting Lecture by: Mr.

Farrukh Abbas

1-Page | 27

th

of April 2011 Prepared by: Mani Shah

CENTER FOR PROFESSIONAL EXCELLENCE, RAWALPINDI

http://acca.moviezbuzz.com

RULES FOR IDENTIFYING DIRECT AND INDIRECT LABOR COST

1. Direct Workers:

The basic pay of direct workers is always Direct Cost.

When Overtime is worked they receive overtime pay and overtime pay has two portions.

o The basic portion of overtime pay is always Direct no matter why overtime is worked.

o Overtime premium is normally treated as an Indirect but with one exception. If overtime is worked

on the special request of a particular customer. The overtime premium for those hours will become

Direct.

2. Indirect Workers:

The basic pay for an indirect worker is always indirect.

Overtime pay is also treated as Indirect Cost but with one exception. If indirect workers work overtime on

the special request of a customer. In this case the overtime pay for those hours will be treated as Direct

Cost.

3. General Rules:

Idle time pay, Sick pay and Holiday pay are treated as Indirect Labor Cost.

Any type of allowance is treated as Indirect Cost.

Any type of Bonus is treated as Indirect within the exception of Group Bonus (Direct Cost).

Example:

An employee worked for 36 hours in a week and is paid @ $7/hour. Any overtime is paid at Time & a Half. During a

week employee worked for 41 Hours and overtime was worked due to following reasons,

Machine Breakdown = 3 hours

Special Request of a Customer = 2 hours

Calculate the total pay for the employee and identify the Direct and Indirect Cost?

Solution:

As an employee worked 36 hours out of which 3 hours was idle time so,

Basic Pay = 33 hours x $7/hr = $231 Direct Cost

Idle Time Pay = 3 hours x $7/hr = $21 Indirect Cost

Overtime Basic = 5 hours x $7 = $35 Direct Cost

Overtime Premium = 3 hours x $3.5 = $10.5 Indirect Cost

Overtime Premium = 2 hours x $3.5 = $7 Direct Cost

(On Special Request)

So, Total Direct Cost = $231 + $35 + $7 = $273

And, Total Indirect Cost = $21 + $10.50 = $31.50

Paper F2, Management Accounting Lecture by: Mr. Farrukh Abbas

2-Page | 27

th

of April 2011 Prepared by: Mani Shah

CENTER FOR PROFESSIONAL EXCELLENCE, RAWALPINDI

http://acca.moviezbuzz.com

DIRECT COST INDIRECT COST

Dr. Work in Progress A/C

Cr. Wages & Salaries A/C

Dr. Work in Progress A/C

Cr. Labor Control A/C

Dr. Work in Progress A/C

Cr. Pay Roll A/C

Dr. Production Overhead A/C

Cr. Wages & Salaries A/C

Dr. Production Overhead A/C

Cr. Labor Control A/C

Dr. Production Overhead A/C

Cr. Pay Roll A/C

Direct

Workers

Basic Pay

Direct

Cost

Overtime

Pay

Basic

Direct

Cost

Premium

Special

Request

Direct

Cost

General

Indirect

Cost

Indirect

Workers

Basic Pay

Indirect

Cost

Overtime

Pay

General

Basic +

Premium

Indirect

Cost

Special

Request

Basic +

Premium

Direct

Cost

You might also like

- 200 + SQL - Server - Interview - Questions - by Shivprasad KoiralaDocument311 pages200 + SQL - Server - Interview - Questions - by Shivprasad Koiralavaraprasad11987% (39)

- Jim Burke - The English Teachers Companion Fourth Edition A Completely New Guide To Classroom Curriculum and The Profession 4th Edition-Heinemann 2012Document395 pagesJim Burke - The English Teachers Companion Fourth Edition A Completely New Guide To Classroom Curriculum and The Profession 4th Edition-Heinemann 2012Ela SinghNo ratings yet

- Interface of Pandapos CounterDocument63 pagesInterface of Pandapos CountersnadminNo ratings yet

- PANDA Mobile Received Module New VersionDocument14 pagesPANDA Mobile Received Module New Versionsnadmin100% (1)

- Howard's Gift Uncommon Wisdom To Inspire Your Life's WorkDocument13 pagesHoward's Gift Uncommon Wisdom To Inspire Your Life's WorkMacmillan Publishers83% (6)

- Manual of Modern Hydronics Section 1 4Document58 pagesManual of Modern Hydronics Section 1 4Tin Aung KyiNo ratings yet

- 1466F Users Guide PowerBrush Premier PDFDocument16 pages1466F Users Guide PowerBrush Premier PDFDamien Rhys JonesNo ratings yet

- Accounting For LabourDocument23 pagesAccounting For LabourSujal DabasiaNo ratings yet

- 5accounting For Labour5Document27 pages5accounting For Labour5emmanuel.mungaiNo ratings yet

- Accounting For LabourDocument10 pagesAccounting For LabourTaleem Tableeg100% (1)

- LabourDocument67 pagesLabourRohaib MumtazNo ratings yet

- Acca Accounting For LabourDocument54 pagesAcca Accounting For LabourKiri chrisNo ratings yet

- Labor Costing and Control'Document26 pagesLabor Costing and Control'Ayesha JavedNo ratings yet

- LabourDocument16 pagesLabourmathewsem04112006No ratings yet

- Material and Labour Cost .Document6 pagesMaterial and Labour Cost .rofoba6609No ratings yet

- Accounting For Labor Slides LMSDocument33 pagesAccounting For Labor Slides LMSPrince Nanaba EphsonNo ratings yet

- Unit 3 Accounting For Labour CostsDocument54 pagesUnit 3 Accounting For Labour Costsjoseswartzsr31No ratings yet

- Chapter 3 Accounting For LabourDocument19 pagesChapter 3 Accounting For Labouralisya qistinaNo ratings yet

- LabourDocument10 pagesLabourNOR NAZLIHA EDEROSE IDRUSNo ratings yet

- Accounting For Labor CostDocument4 pagesAccounting For Labor CostGhillian Mae GuiangNo ratings yet

- Fma - 3Document35 pagesFma - 3Hammad QasimNo ratings yet

- CH3 LabourDocument9 pagesCH3 Labourzuereyda100% (4)

- Labour Cost: By:-Sagar Wadhawani Chinmay Vichare Rohit Umrao Mamta ThakurDocument29 pagesLabour Cost: By:-Sagar Wadhawani Chinmay Vichare Rohit Umrao Mamta ThakurGhansham PanwarNo ratings yet

- Unit 4 - Accounting For Labour CostDocument18 pagesUnit 4 - Accounting For Labour CostAayushi KothariNo ratings yet

- Chapter 7 Accounting For LabourDocument4 pagesChapter 7 Accounting For LabourIbrahim SameerNo ratings yet

- The Factory Labor: Property of STIDocument6 pagesThe Factory Labor: Property of STIDummy GoogleNo ratings yet

- UNIT 3 Employee OnDocument10 pagesUNIT 3 Employee OnMeghraj ChoudharyNo ratings yet

- Labour F2 (Q)Document9 pagesLabour F2 (Q)Khuwaja sahabNo ratings yet

- Unit 4 Accounting For LabourDocument18 pagesUnit 4 Accounting For LabourAayushi KothariNo ratings yet

- 1.6salaries and WagesDocument45 pages1.6salaries and WagesJes SitNo ratings yet

- Chapter9-Accounting For LaborDocument46 pagesChapter9-Accounting For LaborNashaNo ratings yet

- Chapter 2 Payroll NotesDocument7 pagesChapter 2 Payroll NotesHarithaNo ratings yet

- MH Chapter - 3 - Labor Controlling and Accounting For CostsDocument37 pagesMH Chapter - 3 - Labor Controlling and Accounting For CostsShahadat HossainNo ratings yet

- 701211-บทที่ 4 การบัญชีเกี่ยวกับค่าแรงDocument51 pages701211-บทที่ 4 การบัญชีเกี่ยวกับค่าแรงWich PanuwichNo ratings yet

- Sitxhrm004 TestDocument17 pagesSitxhrm004 Testjot jotNo ratings yet

- Labour CostingDocument21 pagesLabour CostingShweta Goel100% (1)

- 04 Handout 126Document6 pages04 Handout 126Adrasteia ZachryNo ratings yet

- Labour CostingDocument26 pagesLabour CostingArunkumar MyakalaNo ratings yet

- Labor CostingDocument34 pagesLabor CostingnimraNo ratings yet

- D2 Accounting For LabourDocument13 pagesD2 Accounting For LabourNkatlehiseng MabuselaNo ratings yet

- 20141001091039T3 Costing For LabourDocument37 pages20141001091039T3 Costing For LabourSathya RauNo ratings yet

- Principles of Accounts February 2, 2021 Grade 11 Name: - Topic: PayrollDocument3 pagesPrinciples of Accounts February 2, 2021 Grade 11 Name: - Topic: PayrollTerriNo ratings yet

- Section - 1: Chapter - 4Document22 pagesSection - 1: Chapter - 4Ahmed YoussefNo ratings yet

- NON ABMBusMath Semis 30 CopiesDocument17 pagesNON ABMBusMath Semis 30 CopiesAnthony John BrionesNo ratings yet

- Unit 2 Hiring ProcessDocument23 pagesUnit 2 Hiring Processmruthunjay kadakolNo ratings yet

- Labor 2011Document3 pagesLabor 2011Ejaz KhanNo ratings yet

- Wages and Salary AdministrationDocument23 pagesWages and Salary AdministrationSanjay ChoudharyNo ratings yet

- SITXHRM004 Written Assessment 1Document18 pagesSITXHRM004 Written Assessment 1oshiniamodana3No ratings yet

- Review Session Week 4: Labor Standards and Social Legislation Dycbalsl313 1 Semester A.Y. 2020-2021 Bsba 3 YearDocument22 pagesReview Session Week 4: Labor Standards and Social Legislation Dycbalsl313 1 Semester A.Y. 2020-2021 Bsba 3 Yearaira aguilarNo ratings yet

- Incentive SchemeDocument4 pagesIncentive Schemerahulravi4u100% (1)

- Q2 - Business Math LAS3 FOR PRINTING - 230517 - 092725Document5 pagesQ2 - Business Math LAS3 FOR PRINTING - 230517 - 092725yenny lynNo ratings yet

- lABOUR COST - Docx - 1662565663377Document4 pageslABOUR COST - Docx - 1662565663377Hammad KhanNo ratings yet

- PRP - SDM 2022Document34 pagesPRP - SDM 2022Dondapati Raga Sravya ReddyNo ratings yet

- E-Con 104 TranscriptDocument15 pagesE-Con 104 TranscriptChristian Dela PenaNo ratings yet

- Accounting For LabourDocument43 pagesAccounting For LabourMunyaradzi Onismas ChinyukwiNo ratings yet

- F2 Past PapersDocument4 pagesF2 Past PaperssikshaNo ratings yet

- LABOUR COSTING With AnswersDocument53 pagesLABOUR COSTING With AnswersHafsa Hayat100% (3)

- Accounting For Labour Ma AccaDocument28 pagesAccounting For Labour Ma AccasimranNo ratings yet

- 10.pay For Performance and Financial IncentivesDocument28 pages10.pay For Performance and Financial Incentivesabdullah islamNo ratings yet

- Cost Acctng Part2Document35 pagesCost Acctng Part2Genesis AuzaNo ratings yet

- Process of Payroll System and Establish & Maintain PayrolDocument17 pagesProcess of Payroll System and Establish & Maintain Payrolarifmustefa03No ratings yet

- Labour Cost and ControlDocument65 pagesLabour Cost and Controlaishwarya raikarNo ratings yet

- Job Order CostingDocument6 pagesJob Order CostingEross Jacob SalduaNo ratings yet

- Accounting For LaborDocument7 pagesAccounting For LaborEniola OgunmonaNo ratings yet

- Accounting For LabourDocument27 pagesAccounting For LabourGulush MammadhasanovaNo ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- The CYA Guide to Payroll and HRThe CYA Guide to Payroll and HRFrom EverandThe CYA Guide to Payroll and HRThe CYA Guide to Payroll and HRNo ratings yet

- Work Instruction Bill of Material 2013Document5 pagesWork Instruction Bill of Material 2013snadminNo ratings yet

- Po and Goods Received Policy (Pay by Invoice Format)Document3 pagesPo and Goods Received Policy (Pay by Invoice Format)snadminNo ratings yet

- Branch Price ChangeDocument4 pagesBranch Price Changesnadmin100% (1)

- Good Return Debit NoteDocument3 pagesGood Return Debit NotesnadminNo ratings yet

- Penguin Test Your Vocabulary 3 PDFDocument65 pagesPenguin Test Your Vocabulary 3 PDFLauren HeadNo ratings yet

- Panda Manual Guide - Setup Payment Term 2014Document2 pagesPanda Manual Guide - Setup Payment Term 2014snadminNo ratings yet

- Penguin - Test Your Vocabulary 5 PDFDocument58 pagesPenguin - Test Your Vocabulary 5 PDFGabriela DiazNo ratings yet

- VIM Editor Commands: (Ex. 10G Goes To Line 10)Document4 pagesVIM Editor Commands: (Ex. 10G Goes To Line 10)snadminNo ratings yet

- Penguin - Test Your Vocabulary 2Document64 pagesPenguin - Test Your Vocabulary 2Magazinul de Pantofi100% (1)

- Binary Two's ComplementDocument3 pagesBinary Two's ComplementsnadminNo ratings yet

- Active Directory Domain Services - All - Dsadd - Parameters PDFDocument3 pagesActive Directory Domain Services - All - Dsadd - Parameters PDFsnadminNo ratings yet

- CS50 Cheat Sheet - NotesDocument9 pagesCS50 Cheat Sheet - NotessnadminNo ratings yet

- Windows 7 Reference Guide PDFDocument39 pagesWindows 7 Reference Guide PDFsnadminNo ratings yet

- CS50 Appliance 2014Document12 pagesCS50 Appliance 2014snadminNo ratings yet

- Inspyrus - White PaperDocument8 pagesInspyrus - White PaperBayCreativeNo ratings yet

- Ardrox AV 30: Material Safety Data SheetDocument5 pagesArdrox AV 30: Material Safety Data SheetMueed LiaqatNo ratings yet

- Systems Neuroscience and Rehabilitation (Surjo R. Soekadar, Niels Birbaumer Etc.) (Z-Library)Document154 pagesSystems Neuroscience and Rehabilitation (Surjo R. Soekadar, Niels Birbaumer Etc.) (Z-Library)Ashish RaiNo ratings yet

- Lagos Audit Manual - Part OneDocument83 pagesLagos Audit Manual - Part OneAndy WynneNo ratings yet

- 1 L.M. College of Pharmacy Gujarat (Government of Gujarat) Assistant Professor Recruitment Examination Question Paper 2016Document9 pages1 L.M. College of Pharmacy Gujarat (Government of Gujarat) Assistant Professor Recruitment Examination Question Paper 2016pratyush swarnkarNo ratings yet

- Applied Chemistry MCQsDocument10 pagesApplied Chemistry MCQsiangarvins100% (1)

- Research Article: Three-Dimensional CST Parameterization Method Applied in Aircraft Aeroelastic AnalysisDocument16 pagesResearch Article: Three-Dimensional CST Parameterization Method Applied in Aircraft Aeroelastic AnalysisSohail AhmedNo ratings yet

- CSCI207 Lab3Document3 pagesCSCI207 Lab3Ali Rida SiblaniNo ratings yet

- Pharmaceutical Market Europe - June 2020Document50 pagesPharmaceutical Market Europe - June 2020Areg GhazaryanNo ratings yet

- STAFFINGDocument14 pagesSTAFFINGHimanshu DarganNo ratings yet

- China in A Changing Global Environment enDocument97 pagesChina in A Changing Global Environment enEskindirGirmaNo ratings yet

- Extraction of A Three Component Mixture-750mgDocument3 pagesExtraction of A Three Component Mixture-750mgDaniel McDermottNo ratings yet

- SR-750 C 611762 GB 1034-4Document12 pagesSR-750 C 611762 GB 1034-4ck_peyNo ratings yet

- Research On Moment of Inertia Measurement Method2019Document7 pagesResearch On Moment of Inertia Measurement Method2019ait oubella marouaneNo ratings yet

- Measuring Building Perimeters and Centrelines - Worked Examples PDFDocument22 pagesMeasuring Building Perimeters and Centrelines - Worked Examples PDFEzra MeshackNo ratings yet

- CMS Farming SystemDocument3 pagesCMS Farming SystemCarylSaycoNo ratings yet

- 5070 s13 QP 11Document16 pages5070 s13 QP 11Melvyn MardamootooNo ratings yet

- ZA6VSD RysDocument1 pageZA6VSD RysDanielNo ratings yet

- 5.recognizing A Firm's Intellectual AssetsDocument32 pages5.recognizing A Firm's Intellectual Assetswildan hakimNo ratings yet

- Mathematics 3Document2 pagesMathematics 3Tony StarkNo ratings yet

- Manufacturing Process For A PenDocument7 pagesManufacturing Process For A PenFeIipe MunozNo ratings yet

- LESSON PLAN Unit - 4 - at - HomeDocument8 pagesLESSON PLAN Unit - 4 - at - HomeKOSMASNo ratings yet

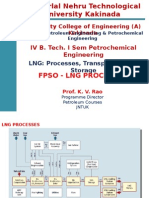

- Fpso - LNG ProcessDocument15 pagesFpso - LNG ProcessYeshWaNth100% (1)

- Peopleware Chapter 20Document14 pagesPeopleware Chapter 20Umar AshrafNo ratings yet

- SB19 Water-KomprimiertDocument101 pagesSB19 Water-KomprimiertNatasa KakesNo ratings yet

- Promc GuideDocument69 pagesPromc GuideChijioke Zion OkabieNo ratings yet