Professional Documents

Culture Documents

Accounting

Accounting

Uploaded by

Adelaine Dalang-AnoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounting

Accounting

Uploaded by

Adelaine Dalang-AnoCopyright:

Available Formats

Introduction to Accounting Principles

There are general rules and concepts that govern the field of accounting. These general

rulesreferred to as basic accounting principles and guidelinesform the groundwork on

which more detailed, complicated, and legalistic accounting rules are based. For example,

the Financial Accounting Standards Board (FASB) uses the basic accounting principles and

guidelines as a basis for their own detailed and comprehensive set of accounting rules and

standards.

The phrase "generally accepted accounting principles" (or "GAAP") consists of three

important sets of rules: (1) the basic accounting principles and guidelines, (2) the detailed

rules and standards issued by FASB and its predecessor the Accounting Principles Board

(APB), and (3) the generally accepted industry practices.

If a company distributes its financial statements to the public, it is required to follow generally

accepted accounting principles in the preparation of those statements. Further, if a

company's stock is publicly traded, federal law requires the company's financial statements

be audited by independent public accountants. Both the company's management and the

independent accountants must certify that the financial statements and the related notes to

the financial statements have been prepared in accordance with GAAP.

GAAP is exceedingly useful because it attempts to standardize and regulate accounting

definitions, assumptions, and methods. Because of generally accepted accounting principles

we are able to assume that there is consistency from year to year in the methods used to

prepare a company's financial statements. And although variations may exist, we can make

reasonably confident conclusions when comparing one company to another, or comparing

one company's financial statistics to the statistics for its industry. Over the years the

generally accepted accounting principles have become more complex because financial

transactions have become more complex.

Basic Accounting Principles and Guidelines

Since GAAP is founded on the basic accounting principles and guidelines, we can better

understand GAAP if we understand those accounting principles. The following is a list of the

ten main accounting principles and guidelines together with a highly condensed explanation

of each.

1. Economic Entity Assumption

The accountant keeps all of the business transactions of a sole proprietorship separate from

the business owner's personal transactions. For legal purposes, a sole proprietorship and its

owner are considered to be one entity, but for accounting purposes they are considered to

be two separate entities.

2. Monetary Unit Assumption

Economic activity is measured in U.S. dollars, and only transactions that can be expressed

in U.S. dollars are recorded.

Because of this basic accounting principle, it is assumed that the dollar's purchasing power

has not changed over time. As a result accountants ignore the effect of inflation on recorded

amounts. For example, dollars from a 1960 transaction are combined (or shown) with dollars

from a 2013 transaction.

3. Time Period Assumption

This accounting principle assumes that it is possible to report the complex and ongoing

activities of a business in relatively short, distinct time intervals such as the five months

ended May 31, 2013, or the 5 weeks ended May 1, 2013. The shorter the time interval, the

more likely the need for the accountant to estimate amounts relevant to that period. For

example, the property tax bill is received on December 15 of each year. On the income

statement for the year ended December 31, 2012, the amount is known; but for the income

statement for the three months ended March 31, 2013, the amount was not known and an

estimate had to be used.

It is imperative that the time interval (or period of time) be shown in the heading of each

income statement, statement of stockholders' equity, and statement of cash flows. Labeling

one of thesefinancial statements with "December 31" is not good enoughthe reader needs

to know if the statement covers the one week ended December 31, 2012 the month ended

December 31, 2012 the three months ended December 31, 2012 or the year ended December

31, 2012.

4. Cost Principle

From an accountant's point of view, the term "cost" refers to the amount spent (cash or the

cash equivalent) when an item was originally obtained, whether that purchase happened last

year or thirty years ago. For this reason, the amounts shown on financial statements are

referred to ashistorical cost amounts.

Because of this accounting principle asset amounts are not adjusted upward for inflation. In

fact, as a general rule, asset amounts are not adjusted to reflect any type of increase in

value. Hence, an asset amount does not reflect the amount of money a company would

receive if it were to sell the asset at today's market value. (An exception is certain

investments in stocks and bonds that are actively traded on a stock exchange.) If you want

to know the current value of a company's long-term assets, you will not get this information

from a company's financial statementsyou need to look elsewhere, perhaps to a third-party

appraiser.

5. Full Disclosure Principle

If certain information is important to an investor or lender using the financial statements, that

information should be disclosed within the statement or in the notes to the statement. It is

because of this basic accounting principle that numerous pages of "footnotes" are often

attached to financial statements.

As an example, let's say a company is named in a lawsuit that demands a significant amount

of money. When the financial statements are prepared it is not clear whether the company

will be able to defend itself or whether it might lose the lawsuit. As a result of these

conditions and because of the full disclosure principle the lawsuit will be described in the

notes to the financial statements.

A company usually lists its significant accounting policies as the first note to its financial

statements.

6. Going Concern Principle

This accounting principle assumes that a company will continue to exist long enough to carry

out its objectives and commitments and will not liquidate in the foreseeable future. If the

company's financial situation is such that the accountant believes the company will not be

able to continue on, the accountant is required to disclose this assessment.

The going concern principle allows the company to defer some of its prepaid expenses until

future accounting periods.

7. Matching Principle

This accounting principle requires companies to use the accrual basis of accounting. The

matching principle requires that expenses be matched with revenues. For example, sales

commissions expense should be reported in the period when the sales were made (and not

reported in the period when the commissions were paid). Wages to employees are reported

as an expense in the week when the employees worked and not in the week when the

employees are paid. If a company agrees to give its employees 1% of its 2013 revenues as

a bonus on January 15, 2014, the company should report the bonus as an expense in 2013

and the amount unpaid at December 31, 2013 as a liability. (The expense is occurring as the

sales are occurring.)

Because we cannot measure the future economic benefit of things such as advertisements

(and thereby we cannot match the ad expense with related future revenues), the accountant

charges the ad amount to expense in the period that the ad is run.

(To learn more about adjusting entries go to Explanation of Adjusting Entries and Quiz for

Adjusting Entries.)

8. Revenue Recognition Principle

Under the accrual basis of accounting (as opposed to the cash basis of

accounting), revenues are recognized as soon as a product has been sold or a service has

been performed, regardless of when the money is actually received. Under this basic

accounting principle, a company could earn and report $20,000 of revenue in its first month

of operation but receive $0 in actual cash in that month.

For example, if ABC Consulting completes its service at an agreed price of $1,000, ABC

should recognize $1,000 of revenue as soon as its work is doneit does not matter whether

the client pays the $1,000 immediately or in 30 days. Do not confuse revenue with a cash

receipt.

9. Materiality

Because of this basic accounting principle or guideline, an accountant might be allowed to

violate another accounting principle if an amount is insignificant. Professional judgement is

needed to decide whether an amount is insignificant or immaterial.

An example of an obviously immaterial item is the purchase of a $150 printer by a highly

profitable multi-million dollar company. Because the printer will be used for five years,

thematching principle directs the accountant to expense the cost over the five-year period.

Themateriality guideline allows this company to violate the matching principle and to

expense the entire cost of $150 in the year it is purchased. The justification is that no one

would consider it misleading if $150 is expensed in the first year instead of $30 being

expensed in each of the five years that it is used.

Because of materiality, financial statements usually show amounts rounded to the nearest

dollar, to the nearest thousand, or to the nearest million dollars depending on the size of the

company.

10. Conservatism

If a situation arises where there are two acceptable alternatives for reporting an item,

conservatism directs the accountant to choose the alternative that will result in less net

income and/or less asset amount. Conservatism helps the accountant to "break a tie." It

does not direct accountants to be conservative. Accountants are expected to be unbiased

and objective.

The basic accounting principle of conservatism leads accountants to anticipate or disclose

losses, but it does not allow a similar action for gains. For example, potential losses from

lawsuits will be reported on the financial statements or in the notes, but potential gains will

not be reported. Also, an accountant may write inventory down to an amount that is lower

than the original cost, but will not write inventory up to an amount higher than the original

cost. Other Characteristics of Accounting Information

When financial reports are generated by professional accountants, we have certain

expectations of the information they present to us:

We expect the accounting information to be reliable, verifiable, and objective.

We expect consistency in the accounting information.

We expect comparability in the accounting information.

1. Reliable, Verifiable, and Objective

In addition to the basic accounting principles and guidelines listed in Part 1, accounting

information should be reliable, verifiable, and objective. For example, showing land at its

original cost of $10,000 (when it was purchased 50 years ago) is considered to be

more reliable, verifiable, and objective than showing it at its current market value of

$250,000. Eight different accountants will wholly agree that the original cost of the land was

$10,000they can read the offer and acceptance for $10,000, see a transfer tax based on

$10,000, and review documents that confirm the cost was $10,000. If you ask the same

eight accountants to give you the land's current value, you will likely receive eight different

estimates. Because the current value amount is less reliable, less verifiable, and less

objective than the original cost, the original cost is used.

The accounting profession has been willing to move away from the cost principle if there are

reliable, verifiable, and objective amounts involved. For example, if a company has an

investment in stock that is actively traded on a stock exchange, the company may be

required to show the current value of the stock instead of its original cost.

2. Consistency

Accountants are expected to be consistent when applying accounting principles, procedures,

and practices. For example, if a company has a history of using the FIFO cost flow

assumption, readers of the company's most current financial statements have every reason

to expect that the company is continuing to use the FIFO cost flow assumption. If the

company changes this practice and begins using the LIFO cost flow assumption, that change

must be clearly disclosed.

3. Comparability

Investors, lenders, and other users of financial statements expect that financial statements of

one company can be compared to the financial statements of another company in the same

industry. Generally accepted accounting principles may provide for comparabilitybetween the

financial statements of different companies. For example, the FASB requires that expenses

related to research and development (R&D) be expensed when incurred. Prior to its rule,

some companies expensed R&D when incurred while other companies deferred R&D to the

balance sheet and expensed them at a later date.

How Principles and Guidelines Affect Financial Statements

The basic accounting principles and guidelines directly affect the way financial statements

are prepared and interpreted. Let's look below at how accounting principles and guidelines

influence the (1) balance sheet, (2) income statement, and (3) the notes to the financial

statements.

1. Balance Sheet

Let's see how the basic accounting principles and guidelines affect the balance sheet of

Mary's Design Service, a sole proprietorship owned by Mary Smith. (To learn more about the

balance sheet go to Explanation of Balance Sheet and Quiz for Balance Sheet.)

A balance sheet is a snapshot of a company's assets, liabilities, and owner's equity at one

point in time. (In this case, that point in time is after all of the transactions through

September 30, 2013 have been recorded.) Because of the economic entity assumption, only

the assets, liabilities, and owner's equity specifically identified with Mary's Design Service

are shownthe personal assets of the owner, Mary Smith, are not included on the

company's balance sheet.

The assets listed on the balance sheet have a cost that can be measured and each amount

shown is the original cost of each asset. For example, let's assume that a tract of land was

purchased in 1956 for $10,000. Mary's Design Service still owns the land, and the land is

now appraised at $250,000. The cost principle requires that the land be shown in the asset

account Land at its original cost of $10,000 rather than at the recently appraised amount of

$250,000.

If Mary's Design Service were to purchase a second piece of land, the monetary unit

assumption dictates that the purchase price of the land bought today would simply be added

to the purchase price of the land bought in 1956, and the sum of the two purchase prices

would be reported as the total cost of land.

The Supplies account shows the cost of supplies (if material in amount) that were obtained

by Mary's Design Service but have not yet been used. As the supplies are consumed, their

cost will be moved to the Supplies Expense account on the income statement. This complies

with the matching principle which requires expenses to be matched either with revenues or

with the time period when they are used. The cost of the unused supplies remains on the

balance sheet in the asset account Supplies.

The Prepaid Insurance account represents the cost of insurance that has not yet expired. As

the insurance expires, the expired cost is moved to Insurance Expense on the income

statement as required by the matching principle. The cost of the insurance that has not yet

expired remains on Mary's Design Service's balance sheet (is "deferred" to the balance

sheet) in the asset account Prepaid Insurance. Deferring insurance expense to the balance

sheet is possible because of another basic accounting principle, the going concern

assumption.

The cost principle and monetary unit assumption prevent some very valuable assets from

ever appearing on a company's balance sheet. For example, companies that sell consumer

products with high profile brand names, trade names, trademarks, and logos are not

reported on their balance sheets because they were not purchased. For example, Coca-

Cola's logo and Nike's logo are probably the most valuable assets of such companies, yet

they are not listed as assets on the company balance sheet. Similarly, a company might

have an excellent reputation and a very skilled management team, but because these were

not purchased for a specific cost and we cannot objectively measure them in dollars, they

are not reported as assets on the balance sheet. If a company actually purchases the

trademark of another company for a significant cost, the amount paid for the trademark will

be reported as an asset on the balance sheet of the company that bought the trademark.

2. Income Statement

Let's see how the basic accounting principles and guidelines might affect the income

statement of Mary's Design Service. (To learn more about the income statement go

to Explanation of Income Statement and Quiz for Income Statement.)

An income statement covers a period of time (or time interval), such as a year, quarter,

month, or four weeks. It is imperative to indicate the period of time in the heading of the

income statement such as "For the Nine Months Ended September 30, 2013". (This means

for the period of January 1 through September 30, 2013.) If prepared under the accrual basis

of accounting, an income statement will show how profitable a company was during the

stated time interval.

Revenues are the fees that were earned during the period of time shown in the heading.

Recognizing revenues when they are earned instead of when the cash is actually received

follows the revenue recognition principle and the matching principle. (The matching principle

is what steers accountants toward using the accrual basis of accounting rather than the cash

basis. Small business owners should discuss these two methods with their tax advisors.)

Gains are a net amount related to transactions that are not considered part of the company's

main operations. For example, Mary's Design Service is in the business of designing, not in

the land development business. If the company should sell some land for $30,000 (land that

is shown in the company's accounting records at $25,000) Mary's Design Service will report

a Gain on Sale of Land of $5,000. The $30,000 selling price will not be reported as part of the

company's revenues.

Expenses are costs used up by the company in performing its main operations. The matching

principle requires that expenses be reported on the income statement when the related sales

are made or when the costs are used up (rather than in the period when they are paid).

Losses are a net amount related to transactions that are not considered part of the

company's main operating activities. For example, let's say a retail clothing company owns

an old computer that is carried on its accounting records at $650. If the company sells that

computer for $300, the company receives an asset (cash of $300) but it must also remove

$650 of asset amounts from its accounting records. The result is a Loss on Sale of

Computer of $350. The $300 selling price will not be included in the company's sales or

revenues.

3. The Notes To Financial Statements

Another basic accounting principle, the full disclosure principle, requires that a company's

financial statements include disclosure notes. These notes include information that helps

readers of the financial statements make investment and credit decisions. The notes to the

financial statements are considered to be an integral part of the financial statements.

Basic Accounting Principles and Concepts

Post written by MissCPA

Photo via www.sxc.hu

Accounting is called the language of business that which communicates

the financial condition and performance of a business to interested users,

also referred to as stakeholders.

In order to become effective in carrying out the accounting procedure, as

well as in communicating the financial information of the business, there

is a widely accepted set of rules, concepts and principles that governs the

application of the accounting procedures, and it is referred to as the

Generally Accepted Accounting Principles or GAAP.

In this article, you will learn and familiarize yourself with the accounting

principles and accounting concepts relevant in performing the accounting

procedures. It is relevant to understand it because you need to abide by

these concepts and principles every time you analyze record, summarize,

report and interpret financial transactions of a business.

Guidelines on Basic Accounting Principles and Concepts

GAAP is the framework, rules and guidelines of the financial accounting

profession with a purpose of standardizing the accounting concepts,

principles and procedures.

Here are the basic accounting principles and concepts under this

framework:

1. Business Entity

A business is considered a separate entity from the owner(s) and should

be treated separately. Any personal transactions of its owner should not

be recorded in the business accounting book, vice versa. Unless the

owners personal transaction involves adding and/or withdrawing

resources from the business.

2. Going Concern

It assumes that an entity will continue to operate indefinitely. In this

basis, assets are recorded based on their original cost and not on market

value. Assets are assumed to be used for an indefinite period of time and

not intended to be sold immediately.

3. Monetary Unit

The business financial transactions recorded and reported should be in

monetary unit, such as US Dollar, Canadian Dollar, Euro, etc. Thus, any

non-financial or non-monetary information that cannot be measured in a

monetary unit are not recorded in the accounting books, but instead, a

memorandum will be used.

4. Historical Cost

All business resources acquired should be valued and recorded based on

the actual cash equivalent or original cost of acquisition, not the

prevailing market value or future value. Exception to the rule is when the

business is in the process of closure and liquidation.

5. Matching

This principle requires that revenue recorded, in a given accounting

period, should have an equivalent expense recorded, in order to show the

true profit of the business.

6. Accounting Period

This principle entails a business to complete the whole accounting process

of a business over a specific operating time period. It may be monthly,

quarterly or annually. For annual accounting period, it may follow a

Calendar or Fiscal Year.

7. Conservatism

This principle states that given two options in the valuation of business

transactions, the amount recorded should be the lower rather than the

higher value.

8. Consistency

This principle ensures consistency in the accounting procedures used by

the business entity from one accounting period to the next. It allows fair

comparison of financial information between two accounting periods.

9. Materiality

Ideally, business transactions that may affect the decision of a user of

financial information are considered important or material, thus, must be

reported properly. This principle allows errors or violations of accounting

valuation involving immaterial and small amount of recorded business

transaction.

10. Objectivity

This principle requires recorded business transactions should have some

form of impartial supporting evidence or documentation. Also, it entails

that bookkeeping and financial recording should be performed with

independence, thats free of bias and prejudice.

11. Accrual

This principle requires that revenue should be recorded in the period it is

earned, regardless of the time the cash is received. The same is true for

expense. Expense should be recognized and recorded at the time it is

incurred, regardless of the time that cash is paid.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- House Bill 2526Document17 pagesHouse Bill 2526Kristofer PlonaNo ratings yet

- CRC Ace Mas First PBDocument10 pagesCRC Ace Mas First PBJohn Philip Castro100% (2)

- Questions and Exercises GOVE'T CH-1Document8 pagesQuestions and Exercises GOVE'T CH-1GETAHUN ASSEFA ALEMUNo ratings yet

- OLC Chap 6Document11 pagesOLC Chap 6Isha SinghNo ratings yet

- Revenue Recognition Over TimeDocument11 pagesRevenue Recognition Over TimeFAEETNo ratings yet

- CH04Document35 pagesCH04Elen LimNo ratings yet

- Form 20B: (Refer Section 159 of The Companies Act, 1956)Document6 pagesForm 20B: (Refer Section 159 of The Companies Act, 1956)Surendra DevadigaNo ratings yet

- 1Document3 pages1Flordeliza VidadNo ratings yet

- Investment Planning Mock Test: Practical Questions: Section 1: 41 Questions (1 Mark Each)Document17 pagesInvestment Planning Mock Test: Practical Questions: Section 1: 41 Questions (1 Mark Each)its_different17No ratings yet

- Basic CapTable - No Valuation CapDocument6 pagesBasic CapTable - No Valuation CapsonkarmanishNo ratings yet

- Laporan Laba RugiDocument1 pageLaporan Laba RugiRictu SempakNo ratings yet

- State of CVC 2022Document30 pagesState of CVC 2022Starix JajajNo ratings yet

- Merger & AcquisitionDocument16 pagesMerger & Acquisitionvarsha_kuchara01No ratings yet

- Financial Statements 2020Document160 pagesFinancial Statements 2020Dennis AngNo ratings yet

- Reading 28 Introduction To DerivativesDocument6 pagesReading 28 Introduction To DerivativesRahul GuptaNo ratings yet

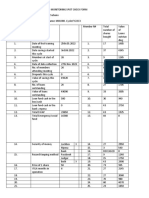

- Vsla Financial and Monitoring Reporting Tool For December (Mikuini)Document2 pagesVsla Financial and Monitoring Reporting Tool For December (Mikuini)Christopher Subano100% (3)

- Struktur OrganisasiDocument1 pageStruktur OrganisasiAhmad ZakariaNo ratings yet

- Ambika Cotton Mills Limited - Equity Research ReportDocument12 pagesAmbika Cotton Mills Limited - Equity Research ReportDr. SbNo ratings yet

- Valuation Method 1Document7 pagesValuation Method 1alliahnahNo ratings yet

- Feasibility Study of Hospital With A Capital Budgeting ApproachDocument10 pagesFeasibility Study of Hospital With A Capital Budgeting ApproachInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- P22Document64 pagesP22Adnan MemonNo ratings yet

- Cost AssignmentDocument4 pagesCost Assignmentnewaybeyene5No ratings yet

- 08 Long Term Construction ContractsDocument2 pages08 Long Term Construction ContractsErineNo ratings yet

- Lecture 5 Initial Public Offerings 02112022 010816pmDocument14 pagesLecture 5 Initial Public Offerings 02112022 010816pmdua nadeemNo ratings yet

- Group Project 2 Far620Document8 pagesGroup Project 2 Far620NUR ATHIRAH SUKAIMINo ratings yet

- CH 1Document85 pagesCH 1EmadNo ratings yet

- Comparitive Analysis of Mutual Funds With Equity Shares Project ReportDocument83 pagesComparitive Analysis of Mutual Funds With Equity Shares Project ReportRaghavendra yadav KM78% (69)

- Valix Intacc 1 Answer Key For Chapter 10 (1-15)Document5 pagesValix Intacc 1 Answer Key For Chapter 10 (1-15)Bella FlairNo ratings yet

- Chapter 2 - Statement of Cash FlowsDocument23 pagesChapter 2 - Statement of Cash FlowsCholophrex SamilinNo ratings yet

- Hoki 2019 PDFDocument95 pagesHoki 2019 PDFPutriNo ratings yet