Professional Documents

Culture Documents

Hathodaa

Hathodaa

Uploaded by

sayogiyogeshwarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hathodaa

Hathodaa

Uploaded by

sayogiyogeshwarCopyright:

Available Formats

1.

INTRODUCTION TO THE

STUDY

India and China are one of the largest economies of the world and which have the one

third of the world population. And they have talent and skilled manpower, resources and

area but still they are not among the developed economies. They lag far behind the

developed countries in the infrastructure. These countries have been striving hard for the

development from the past six seven stories of these developing countries i.e. Foreign

Direct Investment. It has helped in increasing the rate of growth in the form of green field

projects, investing money in brown field projects, bringing new technology in the country

etc.

Though the amount of FDI received by India every year is increasing but China is taking

the major share of FDI in the Asia pacific region.

Add FDI scenario of last 5-10 years and give little analysis

FDI in India and China

Net FDI Inflow( Please tell which table i shud use net FDI inflow or total FDI inflow)

Year India amt(US$) China amt(US$)

2004 0.8 3.2

2005 0.9 4.6

2006 2.1 4.6

2007 2.0 4.5

2008 3.5 3.8

2009 2.6 2.6

2010 1.6 4.1

2011 1.9 3.8

2012 1.3 3.1

2013

Year Amount(US$)

2003 4,322,747,673

2004 3,581,372,930

2005 7,269,407,226

2006 20,029,119,267

2007 25,227,740,887

2008 43,406,277,076

2009 35,581,372,930

2010 27,396,885,034

2011 36,498,654,598

2012 23,995,685,014

From the table we can see that the flow of FDI in India was increasing till 2008 and due

to recession and global meltdown was hit in 2009 and 2010 and again

But FDI has been an important factor in the growth of Indian economy. India was the

second most important FDI destination (after China) for transnational corporations during

2010-2012. It has helped in bridging the gap between the required resources and the

available resources. The major sectors attracting FDI are services sector, construction

development sector and telecommunication sector. Other major sectors attracting FDI are

Computer software & hardware and Drugs & pharmaceuticals. The top investment

attracting regions are Mumbai, Delhi and Chennai.

The leading sources of FDI for India are Mauritius, Singapore, The US and the UK.

Mauritius account for the 38% of the total inflow, Singapore 9.8%, UK 8.7% and US

6.7%. The other contributing countries are Japan, Netherlands, Cyprus, Germany, France

and UAE.

Though India is a attractive FDI destination among the emerging markets but still it not

able to attract a major chunk. There are many reasons but the poor infrastructure is one of

the major reasons.

From the table we can compare and see that China is getting higher amount of FDI than

India. China has been taking a major chunk of share in FDI among the developing

nations. It currently attracts 19%-38% of FDI in Asia. Especially the cities on the coastal

line are getting the major share.

China opened it's economy for the FDI in the country long time back and have proactive

policies for the FDI which helped to attract the FDI which in turn helped in the economic

development of the country and specially the manufacturing sector. Today China is the

largest exporter of goods in the world and more than half of the exported goods are

produced by the foreign invested enterprises. Manufacturing sector attracts the large part

of FDI in china. In China the secondary sector attracts the major FDI and the primary and

the tertiary sector receives only a small amount of the total FDI.

Few of the reasons being a huge domestic market, low labor cost, rich natural resources,

the well developed.

SIGNIFICANCE OF THE STUDY

This study will help in finding out the major differences between the investment

environment and the policies of two countries and help to understand the actions required

to attract more FDI in India

ECONOMIC DEVELOPMENT

According to the web definition economic development means sustained, concerted

actions of policy makers and communities that promote the standard of living and

economic health of a specific area.

The level of economic development of any country can be measured by the Quality of

Human capital, safety, social security, rate of literacy, life expectancy rate, health etc. In

the developed countries like America, U.K., Germany the standard of living of people,

level of social security, education level is much higher as compared to the developing and

the underdeveloped countries.

The comparative table of their Human development Index number, literacy rate, per

capita income here.

Table 1: The Human Development Index no for various countries

Serial No. Country HDI Ranking

1. Norway 1

2. USA 3

3. Germany 5

4. China 101

5. India 136

Table 2: The Literacy rate for various countries

Serial No. Country Literacy Rate Male Literacy Female Literacy

1 Norway 100% 100% 100%

2 USA 99% 99% 99%

3 Germany 99% 99% 99%

4 China 95.1% 97.5% 92.7%

5 India 74% 82.1% 65.5%

According to CIA world fact book, almost 75% of the world's illiterate adults are

concentrated in 10 countries including India and China on the top.

Table 3: Per capita Income for various countries

Serial No. Country Per Capita Income

1. Norway $54,397

2. USA $51,704

3. UK $36,569

4. China $9,055

5. India $3,843

ECONOMIC DEVELOPMENT IN INDIA

After Independence India has been on the path of economic development. In the various

5 year plans the objective was to achieve growth and development of the country. The

growth rate in the last 10 years is as follows

Table 4: Indicators

Indicators Real GDP

growth rate (%)

Agriculture

growth (%)

Industry growth

(%)

Services growth

(%)

2000-01 7.59 2.67 5.96 11.19

2001-02 4.30 -0.01 6.03 5.37

2002-03 5.52 6.01

2003-04

2004-05

2005-06

2006-07

2007-08

2008-09

2009-10

2010-11

2011-12

2012-13

FDI was allowed in India before 1974. But gradually the govt controlled the amount of

CFDI flow in the country and that led to the exit of big companies like IBM, Coca Cola

etc from India.

The growth rate increases considerably post liberalization and it was highest during 2007-

2011. The growth rate decreased gradually after 2008 due to the recession in the world

economy. Though it did not affected India much immediately. During 1990s it was one of

the fastest growing economies of the world.

But now the amount of inflow of FDI in India has increased gradually and has

contributed in the growth and economic development.

ECONOMIC DEVELOPMENT IN CHINA

China is the world's second largest economy and the largest exporter of goods. It has

been able to maintain a very good growth rate in the past decade. It has been able to

maintain growth rate. of 9%-10%. And it is among one of the countries to who witnessed

the fastest growth in consumption. There has been a huge increase in the per capita

income of the Chinese citizens which has helped them to come out of the rank of poor

nation to the middle income bracket and increased their standard of living

China promoted FDI in the country long time back and which has helped a lot in the

economic development of the country. And China was able to survive the world

economic recession and able to maintain it's economy and employment in track. And

But the now the young workforce in China is decreasing and the liability of pensions is

increasing on the government which can have a negative effect in the coming years.

2. REVIEW OF LITERATURE

Role of FDI in India: An Analytical study ( Dr JasbirSingh, Ms Sumita Chadha, Dr

Anupama Sharma)

They studied that India is facing the problem of scarcity of resources and low rate of

capital formation so the domestic resources are not sufficient to carryout the various

reforms and the developmental projects. They discovered that large part of global FDI is

attracted by the developed countries rather than developing and under developing

countries. But even the small portion of global FDI coming to developing countries are

supplementing the scarce domestic resources and fulfilling the financial requirement for

building up the basic and essential infrastructure industries of the priority sector. In India

the highest amount of FDI is gone to financing sector, insurance sector, Real Estate and

Business services which is 33.05% of the total cumulative inflow of FDI.

FDI policies in China and India: Evidence from Firm Survey

(Yasheng Huang & Heiwai Tang)

They found out a major difference between the policies of India and china which are

completely opposite. While china has pursued a more proactive policy towards FDI,

opposite pattern is observed in India. It has more restrictions on Foreign Invested firms as

compared to the domestic firms. Secondly in China Govt officials are more helpful to the

Foreign Invested Firms while in India these firms face lot of obstacles and financial

constraints as compared to the domestic firms due to national preference

Can India adopt strategic Flexibility like China did?( Swapna S Sinha)

In this study the writer has tried to explore the factors determining the FDI in the

emerging markets of India and China. According to him the reason for India being a

laggard is it's dependency on services and specialized skills as comared to China who is

dependent on manufacturing model.

Role of FDI in different sectors (Sharma Reetu, Kurana Nikita)

In this study they have tried to establish the fact that FDI is playing a significant role in

the economic growth in India and enhancing the financial position of the country. FDI is

also contributes in the GDP and Foreign exchange reserves of the country. There are

many factors which affects the flow of FDI in an economy like market size, Inflation,

Trade openness, interest rate, wage rate, business environment etc. Although India is

receiving a constant flow of FDI but it is too low as compared to it's neigbour China

Inspite of having a large domestic market and low labour costs. This is attributed to

restricted FDI regime, high Tariffs, exit barriers for firms, stringent labour laws, poor

quality infrastructure, centralized decision making process and very limited scale of

export processing zones make India an unattractive investment location

An inclusive study of Foreign Investment in the Indian Economy (Dr P.S. Vohra *

Ms Preeti Sehgal)

In this paper the authors are trying to say that although India has been quite successful in

attracting Foreign capital in the form of FDI, Foreign portfolio Investment, External

Commercial Borrowings, ADRs, GDR's which have helped in the economic growth but

it's largely concentrated in service sector which provides less employment opportunities

as compared to the Agriculture and manufacturing sector. And secondly this foreign

capital has helped only in the internal growth and not helped much to increase the exports

of the country.

Exchange rate- A key Determinant of FDI in India (Diki S.V.and Shringarpura

A.A)

India's new Foreign Policy is attracting lot of Foeign investors in which 100% FDI is

permitted under automatic route. But the amount of Foreign Investment we receive

depends a lot on the Exchange rate. In turn exchange rate is a lot deteremined by various

factors like interest rate, political stability, public debt, balance of trade etc.

FDI in china- what we know and what we need to study next (chung Ming Lau and

Garry D. Brutan.)

Researchers need to know the factors that lead to success & Failure in managing both

joint ventures & Foreign investments in China & we should go beyond understanding

entry-mode related decisions

FDI origin and Regional Productivity in China: A comparison between China, U.S.

& Japan

FDI is overall found to have a significant and positive impact on regional economies

productivity. This result is consistent with most previous studies. One important policy

implication drawn from this study is that attracting inflows of foreign capital with

appropriate technology in terms of the technological gap continues to be an important

strategy for promoting productivity & economic growth for the inland region

Impact of FDI on Indian economy (Rangappa)

The growth of FDI gives opportunities to Indian industry for technological upgradation,

gaining access to global managerial skills & practices, optimizing utilizing of human &

natural resources & competing internationally with higher efficiency. FDI can help to

raise the output, production and export at the sectoral level of the Indian economy.

A VAR approach to the economics of FDI in China

Market growth, lower labour cost and the performances of FDI firms in China are the

factors determining the amount of flow of FDI in China. There is little evidence to

support role of exchange rate in FDI determination. Theoretically the causality between

FDI and GDP growth could run in either direction. FDI could promote further GDP

growth in the state. Through knowledge transfer FDI is expected to augment the existing

stock of knowledge and to update the skill of the labour training and skill acquisition. As

a result foreign investor may increase productivity in the recipient economy and FDI can

be deemed to be a catalyst for domestic investment and technological progress. However

the causality could also run the other opposite way. Rapid GDP growth could induce

more inflow of FDI. This is because rapid GDP growth will usually create a high level of

capital requirement and a resource gap in the host country and hence the host country will

demand more FDI by offering concessional terms for FDI to attract overseas investors.

Sectoral location of FDI in China

The foreign investors invest in the industry with comaprative advantage

The trade cum FDI theory therefore predict that the degree of FDI presence in China

should be higher in industries that are producing labour intensive goods and also export

oriented. The FDI presence is discouraged in the sectors in which SOE's enjoy political

pecking order' preferential treatment through market acess.

The Indian govt and the FDI in retail sector in India

Indian retail industry contributes around 15% of GDP & employs more or less 7% of the

labour. The move for opening up the retail sector to FDI is said to be anti- trader and anti

farmer. The trade in India is fragmented, unorganized, unnetworked and individually

small. No denying the fact that India needs a widespread & efficient supply chain. It is

highly improbable that a few retail giants can enable the desired outcome.

Socio economic and the environmental effects of FDI in India: An economic Analysis of

the perception in two metropoliton cities. According to this article FDI has unfavourable

impact on the socio-economic environmental aspects.

3. METHODOLOGY

To carry out this research both the secondary and the Primary data will be collected.

Secondary data

Secondary data will be collected from the various sources like Research Journals,

magazines and websites

Primary data

Primary data will be collected through the questionnaires and interviews

One paragraph saying that the statistical tools as per the need of the data collected

The Problem statement

Inspite of being an attractive market for the investors and India trying hard to

attract FDI why it's is not able to attract sufficient FDI as compared to China.

What are the factors that are holding back these large economies.

Why it's lagging behind.

What are the policy differences?

Why China is able to attract more FDI in his country

And what are it's effect?

4. OBJECTIVE OF THE

RESEARCH

1. To study the Indian Economic growth scenario.

2. To study the trends of FDI in India

3. To study the Comparative analysis of FDI in India and China in selected sector wise

4. To study the perception of people for FDI as tool for economic development

5. BIBLIOGRAPHY

Swapna S. Sinha, 2008, "Can India Adopt Strategic Flexibility like China did?" Global

Journal of Flexibal Systems Managemet 9: 1-14

Yasheng Huang and Heiwai Tang, 2012, "FDI Policies in China and India: Evidence

from Firm Surveys" The world Economy

JORDAN SHAN,2002 A VAR approach to the economics of FDI in China". Applied

Economics 34:885-893

Dr. P.s. Vohra; Preeti sehgal, 2011," An inclusive study of foreign investment in the

Indian economy" Asia Pacific Journal of research in business management 2:268-

281

Dikit S.V.* and Shringarpure A.A., 2013 "Exchange Rate A Key Determinant of FDI

in India" Advances In Management 6:55-57

Chung Ming Lau and Garry D. Bruton, 2008," FDI in China: What We Know and What

We Need to Study Next", Academy of Management

Chun-Chien Kuo, I-Jan Yeh, Kuo-Wei Chang , Foreign Direct Investment Origin and

Regional Productivity in China: A Comparison between China, U.S. and Japan",

International Journal of Organizational Innovation.

Rangappa E., 2013" Impact of Foreign Direct Investment on Indian Economy" Advances

In Management 6:9-12

Komal Narang and Ravi Inder Singh, 2008," Position of Foreign Direct Investment in

India". The Icfai University Journal of Financial Economics,3:84-91

Dr. Jasbir Singh, Ms. Sumita Chadha, Dr. Anupama Sharma ,2012," Role of Foreign

Direct Investment in India: An Analytical Study" International Journal of

Engineering and Science 1:34- 42

Mi Lin and Yum K. Kwan, 2011, Sectoral Location of FDI in China," The World

Economy 1181-1198

Sharma Reetu1, Khurana Nikita 2, 2013, Role of Foreign Direct Investment (FDI) in

Different Sectors," International Journal of Advances in Management and

Economics", 2:14-19

Janardhanan a. Alse and Arun K. Srinivasan, 2012, "Socio-Economic and Environmental

Effects of Foreign Direct Investment in India: An Economic Analysis Of

Perception In Two Metropolitan Cities", Journal Of International Business And

Economics 12:11-20

Paul Uttam1and Roy Swapan Kumar2, 2013, The Indian Government and FDI in Retail

Sector in India, Advances In Management 6: 3-7

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Muskingum University Lesson Plan 366Document10 pagesMuskingum University Lesson Plan 366api-387802907No ratings yet

- 59 - Statistical MethodsDocument26 pages59 - Statistical MethodsSaurabh Raut60% (5)

- WaysssfooDocument1 pageWaysssfoosayogiyogeshwarNo ratings yet

- From Them Makers IntroductionDocument20 pagesFrom Them Makers IntroductionsayogiyogeshwarNo ratings yet

- From The Very of The Deoth of The Loca Inhibatiants For THD of The Ion The For TheDocument1 pageFrom The Very of The Deoth of The Loca Inhibatiants For THD of The Ion The For ThesayogiyogeshwarNo ratings yet

- Student'S Feed Back Form: Branch: - SemesterDocument1 pageStudent'S Feed Back Form: Branch: - SemestersayogiyogeshwarNo ratings yet

- Deutcsh LandDocument1 pageDeutcsh LandsayogiyogeshwarNo ratings yet

- Time Table For Semester NewDocument6 pagesTime Table For Semester NewsayogiyogeshwarNo ratings yet

- GooaosDocument1 pageGooaossayogiyogeshwarNo ratings yet

- ManokamanaDocument1 pageManokamanasayogiyogeshwarNo ratings yet

- OaisDocument1 pageOaissayogiyogeshwarNo ratings yet

- Student'S Feed Back Form: Branch: - SemesterDocument1 pageStudent'S Feed Back Form: Branch: - SemestersayogiyogeshwarNo ratings yet

- Student'S Feed Back Form: Branch: - SemesterDocument1 pageStudent'S Feed Back Form: Branch: - SemestersayogiyogeshwarNo ratings yet

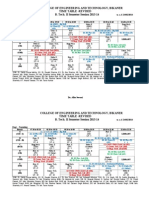

- College of Engineering and Technology, Bikaner Time Table - Revised B. Tech. II Semester Session 2013-14Document6 pagesCollege of Engineering and Technology, Bikaner Time Table - Revised B. Tech. II Semester Session 2013-14sayogiyogeshwarNo ratings yet

- Just KalayDocument1 pageJust KalaysayogiyogeshwarNo ratings yet

- Student'S Feed Back Form: Branch: - SemesterDocument1 pageStudent'S Feed Back Form: Branch: - SemestersayogiyogeshwarNo ratings yet

- Values JustDocument1 pageValues JustsayogiyogeshwarNo ratings yet

- Student'S Feed Back Form Having This and That and Tiwth and WithoutsDocument1 pageStudent'S Feed Back Form Having This and That and Tiwth and WithoutssayogiyogeshwarNo ratings yet

- Just Getting AwayDocument6 pagesJust Getting AwaysayogiyogeshwarNo ratings yet

- Student'S Feed Back Form: Branch: - SemesterDocument1 pageStudent'S Feed Back Form: Branch: - SemestersayogiyogeshwarNo ratings yet

- Probles Faced From Here and There GidoidngDocument1 pageProbles Faced From Here and There GidoidngsayogiyogeshwarNo ratings yet

- Links Between Vedas, Upanishads, Tantra and PuranasDocument1 pageLinks Between Vedas, Upanishads, Tantra and PuranassayogiyogeshwarNo ratings yet

- Impact of AstrologyDocument1 pageImpact of AstrologysayogiyogeshwarNo ratings yet

- Discovered THR I OghDocument1 pageDiscovered THR I OghsayogiyogeshwarNo ratings yet

- MatLab - Statistics Toolbox User's GuideDocument388 pagesMatLab - Statistics Toolbox User's Guideuser7man100% (2)

- Mapping Race and EthnicityDocument11 pagesMapping Race and EthnicityPiyush JhaNo ratings yet

- Teoria Gravitostatica, 11% Del Peso 8hs Al Dia Por 3 Semanas, Bajaron 3,2% de GrasaDocument7 pagesTeoria Gravitostatica, 11% Del Peso 8hs Al Dia Por 3 Semanas, Bajaron 3,2% de GrasaMartín LibonattiNo ratings yet

- Is 1146 1981Document24 pagesIs 1146 1981ShirishNo ratings yet

- Special Education Teaching Assistant: Rhoda TamDocument2 pagesSpecial Education Teaching Assistant: Rhoda Tamapi-302472199No ratings yet

- Case ManagementDocument22 pagesCase Managementahlouhah0% (1)

- E5 UoE Unit 12 PDFDocument23 pagesE5 UoE Unit 12 PDFHoracioCruiseNo ratings yet

- Introduction and Scope of The StudyDocument6 pagesIntroduction and Scope of The StudyTeeJyyNo ratings yet

- Adaptive Behavior Scale OutlineDocument3 pagesAdaptive Behavior Scale OutlineZu Gayu 'sNo ratings yet

- Talley - Monte MonteDocument153 pagesTalley - Monte MontekatmartinsNo ratings yet

- Writing An Educational Research Paper: Research Paper SectionsDocument5 pagesWriting An Educational Research Paper: Research Paper SectionsIlove DramaNo ratings yet

- Mindfulness Based Interventions For TeacDocument11 pagesMindfulness Based Interventions For TeacNanda TavaresNo ratings yet

- Marketing XLRIDocument7 pagesMarketing XLRIchinum1No ratings yet

- Indian Institute of Management Kozhikode Executive Post Graduate ProgrammeDocument4 pagesIndian Institute of Management Kozhikode Executive Post Graduate ProgrammeSanthosh alurNo ratings yet

- Alternative AssessmentDocument24 pagesAlternative AssessmentSol100% (2)

- A Vietnamese - American Cross-Cultural Study of Conversational DistancesDocument53 pagesA Vietnamese - American Cross-Cultural Study of Conversational DistanceslehuulocNo ratings yet

- Apesma NotesDocument2 pagesApesma NotesvstojnicNo ratings yet

- Blended Learning in Computing Education: It 'S Here But Does It Work?Document22 pagesBlended Learning in Computing Education: It 'S Here But Does It Work?Rafsan SiddiquiNo ratings yet

- An Overview of The Linguistics of Screenwriting and Its Interdisciplinary Connections, With Special Focus On Dialogue in Episodic TelevisionDocument20 pagesAn Overview of The Linguistics of Screenwriting and Its Interdisciplinary Connections, With Special Focus On Dialogue in Episodic TelevisionReza SaberiNo ratings yet

- Customer Care and Services Part IVDocument27 pagesCustomer Care and Services Part IVAwetahegn HagosNo ratings yet

- Control Quality OutputsDocument2 pagesControl Quality OutputssrivaishnaviNo ratings yet

- Basic Principles of PSD Analysis DeviceDocument37 pagesBasic Principles of PSD Analysis Devicejoe_kudoNo ratings yet

- Educational StatisticsDocument8 pagesEducational StatisticsKrizia May AguirreNo ratings yet

- Statistics - DR Malinga - Notes For StudentsDocument34 pagesStatistics - DR Malinga - Notes For StudentsRogers Soyekwo KingNo ratings yet

- Syllabus Discipline & Ideas in The Social SciencesDocument6 pagesSyllabus Discipline & Ideas in The Social SciencesVIRGILIO JR FABINo ratings yet

- 0099 1767 PDFDocument18 pages0099 1767 PDFhendro26No ratings yet

- Pakka Measuresofcentraltendencymeanmedianmode 140706130428 Phpapp01Document30 pagesPakka Measuresofcentraltendencymeanmedianmode 140706130428 Phpapp01pradeepNo ratings yet

- Urban Transportation System (Department Elective-I)Document2 pagesUrban Transportation System (Department Elective-I)Abhishek ThackerNo ratings yet