Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

26 viewsSpecial Economic Zones (SEZ) : The Next Frontier For India

Special Economic Zones (SEZ) : The Next Frontier For India

Uploaded by

Vani RanjanThe document discusses Special Economic Zones (SEZs) in India. Some key points:

1) SEZs aim to generate jobs and economic growth by providing world-class infrastructure, tax incentives, and streamlined regulations and procedures to attract investment and boost exports.

2) The SEZ Act of 2005 and related rules establish the legislative framework for SEZs and provide tax and fiscal incentives for developers and units located within SEZs.

3) SEZs have led to increased exports and foreign investment in India, with projected exports from SEZs reaching $10 billion by 2008. However, issues around land acquisition and regulation of SEZs remain.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Star Engineering CompanyDocument5 pagesStar Engineering CompanyChleo Espera100% (1)

- Format For Tripartite Agreement - UBIDocument5 pagesFormat For Tripartite Agreement - UBInpmehendale0% (1)

- Statement of Management Responsibility (Not Personally Owned)Document1 pageStatement of Management Responsibility (Not Personally Owned)Mabz Buan0% (2)

- Special Economic Zone - Presentation TranscriptDocument3 pagesSpecial Economic Zone - Presentation Transcriptkmr_arn100% (1)

- Special Economic Zones (SEZ) : The Next Frontier For IndiaDocument21 pagesSpecial Economic Zones (SEZ) : The Next Frontier For IndiaGurpreet Singh BhatiaNo ratings yet

- Facts On SEZDocument12 pagesFacts On SEZKush KumarNo ratings yet

- SEZ StrategyDocument13 pagesSEZ Strategymba rockstarsNo ratings yet

- What Is A Sez?Document13 pagesWhat Is A Sez?Anurag SharmaNo ratings yet

- Special Economic Zone (SEZ)Document18 pagesSpecial Economic Zone (SEZ)Nitesh SinghNo ratings yet

- Who Can Set Up Sezs? Can Foreign Companies Set Up Sezs?: Basic Difference Between Epzs and SezsDocument7 pagesWho Can Set Up Sezs? Can Foreign Companies Set Up Sezs?: Basic Difference Between Epzs and SezsMohan SubramanianNo ratings yet

- Special Economic Zone (SEZ)Document27 pagesSpecial Economic Zone (SEZ)ChunnuriNo ratings yet

- SEZsDocument18 pagesSEZsAnushree MohanNo ratings yet

- TBL S12publications File Upload 92 95 SEZsDocument6 pagesTBL S12publications File Upload 92 95 SEZsshilpaguthikondaNo ratings yet

- Special Economic Zone-1Document12 pagesSpecial Economic Zone-1Garima SinghNo ratings yet

- Special Economic Zone (SEZ)Document18 pagesSpecial Economic Zone (SEZ)Harshit MalhotraNo ratings yet

- MMMMMM: MMMMMMMMMMMMMMMM MMMMMMMMMMMMMMMMMM M MM MMMMMMM M M MDocument55 pagesMMMMMM: MMMMMMMMMMMMMMMM MMMMMMMMMMMMMMMMMM M MM MMMMMMM M M MRuby ButiNo ratings yet

- Sez & STPDocument10 pagesSez & STPumashankar_kr100% (3)

- Meaning and Definition of Special Economic ZoneDocument12 pagesMeaning and Definition of Special Economic ZoneMubina shaikhNo ratings yet

- Special Economic Zones (SEZ)Document12 pagesSpecial Economic Zones (SEZ)Ajay K PandianNo ratings yet

- State Governments Incentives For InvestorsDocument6 pagesState Governments Incentives For InvestorsbalqueesNo ratings yet

- Special Economic ZoneDocument13 pagesSpecial Economic Zonejoe80% (5)

- Special Economic Zones PPT NewDocument42 pagesSpecial Economic Zones PPT NewtimciNo ratings yet

- Presentation On Special Economic Zone - Il&Fs IdcDocument49 pagesPresentation On Special Economic Zone - Il&Fs IdcPranita PatiNo ratings yet

- Sez - India - China ProspectiveDocument24 pagesSez - India - China ProspectivegurbaniajayNo ratings yet

- Indian Sez ModelsDocument24 pagesIndian Sez ModelsAnuja BakareNo ratings yet

- Sez PDFDocument6 pagesSez PDFdilip5685No ratings yet

- MSCPL Profile FinalDocument81 pagesMSCPL Profile FinalCA Ratan MoondraNo ratings yet

- Write Up For SezDocument4 pagesWrite Up For SezmeghavijayNo ratings yet

- Project On: Special Economic ZoneDocument22 pagesProject On: Special Economic ZoneVishal GhadgeNo ratings yet

- Special Economic Zon1mamDocument4 pagesSpecial Economic Zon1mammantumahanteshNo ratings yet

- Special Economic Zones: A Brief Study OFDocument23 pagesSpecial Economic Zones: A Brief Study OFShailesh BansalNo ratings yet

- Project Report - BepDocument11 pagesProject Report - Bepstudyy bossNo ratings yet

- Special Economic Zones in IndiaDocument32 pagesSpecial Economic Zones in IndiaHari Prasad100% (1)

- Eou, Sez, TH, EhDocument26 pagesEou, Sez, TH, EhNeelam RautNo ratings yet

- Research Paper On SEZDocument6 pagesResearch Paper On SEZyogeshshukla.ys14No ratings yet

- Session 17-Trade PolicyDocument35 pagesSession 17-Trade Policysadiakhn03No ratings yet

- Special Economic Zones (SEZ) - IntroductionDocument23 pagesSpecial Economic Zones (SEZ) - IntroductionR. SainiNo ratings yet

- SEZ PolicyDocument30 pagesSEZ PolicyKushal UpadhyayaNo ratings yet

- A Special Economic ZoneDocument8 pagesA Special Economic ZonetukunadhalNo ratings yet

- Special Economic Zone Special Economic Zone Special Economic Zone Special Economic ZoneDocument13 pagesSpecial Economic Zone Special Economic Zone Special Economic Zone Special Economic ZoneXMBA 24 ITM VashiNo ratings yet

- Taxx Special Economic ZonesDocument4 pagesTaxx Special Economic ZonesAlina RizviNo ratings yet

- Role of Special Economic Zone in Strategic Plannnig For Business Unit EstablishmentDocument25 pagesRole of Special Economic Zone in Strategic Plannnig For Business Unit EstablishmentShiv RajNo ratings yet

- Foreign Direct Investment in Service Sector-Policy For India's Services SectorDocument22 pagesForeign Direct Investment in Service Sector-Policy For India's Services Sectorgeeta009singhNo ratings yet

- The Main Objectives of The SEZ Act AreDocument4 pagesThe Main Objectives of The SEZ Act AreParag YadavNo ratings yet

- 1 What Is A Special Economic Zone ?Document7 pages1 What Is A Special Economic Zone ?bhaskarraosatyaNo ratings yet

- Special Economic Zones: Issues & Implications: December 2008Document17 pagesSpecial Economic Zones: Issues & Implications: December 2008Anonymous cRMw8feac8No ratings yet

- Sez Main 123Document42 pagesSez Main 123Raj K GahlotNo ratings yet

- Sezs (Special Economic Zones)Document12 pagesSezs (Special Economic Zones)asifanisNo ratings yet

- Concept Note On Special Economic ZoneDocument17 pagesConcept Note On Special Economic ZoneNeetuMakwanaNo ratings yet

- Special Economic ZonesDocument3 pagesSpecial Economic ZonesUdhayakumar ManickamNo ratings yet

- Sez Act & Guidelines For ImplementationDocument59 pagesSez Act & Guidelines For ImplementationbharatNo ratings yet

- Sez JaipurDocument71 pagesSez JaipurSUVADIP BHOWMIKNo ratings yet

- Foreign Investment. It Has Special Economic Laws That Are More Liberal Than The Country's TypicalDocument8 pagesForeign Investment. It Has Special Economic Laws That Are More Liberal Than The Country's TypicalPritesh ShahNo ratings yet

- Internship Report 101 (Rough)Document14 pagesInternship Report 101 (Rough)Chandan KumarNo ratings yet

- SEZDocument23 pagesSEZniharika-banga-2390No ratings yet

- Industrial Licensing PolicyDocument15 pagesIndustrial Licensing PolicyrohitbatraNo ratings yet

- Seminars On General Topics: Sez and Its Effect On The EconomyDocument21 pagesSeminars On General Topics: Sez and Its Effect On The EconomyLubna ShaikhNo ratings yet

- 2007 Investing in IndiaDocument32 pages2007 Investing in IndiaDee JayNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- Miscellaneous Service Establishment Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Service Establishment Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Sarvagya Institute of CommerceDocument44 pagesSarvagya Institute of CommerceadhishcaNo ratings yet

- Economic Determinants of SavingsDocument5 pagesEconomic Determinants of Savingscoolimran76No ratings yet

- In Re Right of InspectionDocument3 pagesIn Re Right of InspectionClarissa de VeraNo ratings yet

- A History of Venture Capital - LebretDocument66 pagesA History of Venture Capital - LebretHerve LebretNo ratings yet

- Financial LiteracyDocument4 pagesFinancial LiteracyMae Althea TidalgoNo ratings yet

- Press Release Saksoft Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Saksoft Limited: Details of Instruments/facilities in Annexure-1Sandy SanNo ratings yet

- IRS TaxDocument28 pagesIRS TaxAntonio MolinaNo ratings yet

- Mount Vernon City School District AuditDocument47 pagesMount Vernon City School District AuditSamuel L. RiversNo ratings yet

- Finalised Kathi Junction Business Loan 19-5-19Document5 pagesFinalised Kathi Junction Business Loan 19-5-19Allserv TechnologiesNo ratings yet

- HigginsandHuque2014 HKDLDocument34 pagesHigginsandHuque2014 HKDLAndrew NgNo ratings yet

- Midterms Sa2 FARDocument6 pagesMidterms Sa2 FAREloiNo ratings yet

- KellogDocument2 pagesKellogDhruv Gupta100% (1)

- AR Lease Agreement - 19 May Compare V 16 May Meeting Draft revBKMS - AK 23052019 Meeting24052019 ADCO Rev09082019Document45 pagesAR Lease Agreement - 19 May Compare V 16 May Meeting Draft revBKMS - AK 23052019 Meeting24052019 ADCO Rev09082019Nicko KaruniawanNo ratings yet

- Audit Fot Liability Problem #2Document3 pagesAudit Fot Liability Problem #2Ma Teresa B. CerezoNo ratings yet

- Finacle Commands For Concurrent AuditDocument24 pagesFinacle Commands For Concurrent AuditMayur KundarNo ratings yet

- Taxa 1Document17 pagesTaxa 1Cheenee Nuestro SantiagoNo ratings yet

- Real Estate BrokersDocument15 pagesReal Estate BrokersAerwin Abesamis0% (1)

- Older Adults and BankruptcyDocument28 pagesOlder Adults and BankruptcyvictorNo ratings yet

- Joint Indivisible Obligations Obligations With A Penal ClauseDocument3 pagesJoint Indivisible Obligations Obligations With A Penal ClauseJolo RomanNo ratings yet

- Estate of Poblador Jr. v. Rosario L. ManzanoDocument1 pageEstate of Poblador Jr. v. Rosario L. ManzanoRywNo ratings yet

- MDBIU Project - Steve CentoDocument4 pagesMDBIU Project - Steve Centomichael5dunnNo ratings yet

- Wells Fargo Clear Access BankingDocument7 pagesWells Fargo Clear Access BankingdebokillsNo ratings yet

- Chapter 8 Computation of Total Income and Tax PayableDocument8 pagesChapter 8 Computation of Total Income and Tax PayablePrabhjot KaurNo ratings yet

- Business Plan:: Shannon Lowery Erin Faight Christina Rullo Alec RobertsonDocument12 pagesBusiness Plan:: Shannon Lowery Erin Faight Christina Rullo Alec RobertsonBhavin GhoniyaNo ratings yet

- General Quiz: Chiranjeevi and SharmilaDocument68 pagesGeneral Quiz: Chiranjeevi and SharmilaRavi TejaNo ratings yet

- CF 2Document2 pagesCF 2shahidameen2No ratings yet

- Shrawan Bhadra Aswin Kartik: Problem 1Document17 pagesShrawan Bhadra Aswin Kartik: Problem 1notes.mcpu100% (1)

Special Economic Zones (SEZ) : The Next Frontier For India

Special Economic Zones (SEZ) : The Next Frontier For India

Uploaded by

Vani Ranjan0 ratings0% found this document useful (0 votes)

26 views21 pagesThe document discusses Special Economic Zones (SEZs) in India. Some key points:

1) SEZs aim to generate jobs and economic growth by providing world-class infrastructure, tax incentives, and streamlined regulations and procedures to attract investment and boost exports.

2) The SEZ Act of 2005 and related rules establish the legislative framework for SEZs and provide tax and fiscal incentives for developers and units located within SEZs.

3) SEZs have led to increased exports and foreign investment in India, with projected exports from SEZs reaching $10 billion by 2008. However, issues around land acquisition and regulation of SEZs remain.

Original Description:

Original Title

sez-100405094938-phpapp01

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses Special Economic Zones (SEZs) in India. Some key points:

1) SEZs aim to generate jobs and economic growth by providing world-class infrastructure, tax incentives, and streamlined regulations and procedures to attract investment and boost exports.

2) The SEZ Act of 2005 and related rules establish the legislative framework for SEZs and provide tax and fiscal incentives for developers and units located within SEZs.

3) SEZs have led to increased exports and foreign investment in India, with projected exports from SEZs reaching $10 billion by 2008. However, issues around land acquisition and regulation of SEZs remain.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

26 views21 pagesSpecial Economic Zones (SEZ) : The Next Frontier For India

Special Economic Zones (SEZ) : The Next Frontier For India

Uploaded by

Vani RanjanThe document discusses Special Economic Zones (SEZs) in India. Some key points:

1) SEZs aim to generate jobs and economic growth by providing world-class infrastructure, tax incentives, and streamlined regulations and procedures to attract investment and boost exports.

2) The SEZ Act of 2005 and related rules establish the legislative framework for SEZs and provide tax and fiscal incentives for developers and units located within SEZs.

3) SEZs have led to increased exports and foreign investment in India, with projected exports from SEZs reaching $10 billion by 2008. However, issues around land acquisition and regulation of SEZs remain.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 21

1

GLOBAL TAX ADVISORY SERVICES

Special Economic Zones (SEZ)

The Next Frontier for India

Presentation by: Yogendra Garg Director SEZ,

Department of Commerce Government of India, New Delhi

2

INDIA -Demographics

India needs to generate 200 million additional jobs over the next

20 years.

- Planning Commission

people < 25 years

in rural areas

Working age population in 2005

(15-64 yrs as % of total population)

Working age population in 2020

People entering workforce by 2010

People entering workforce in rural areas

500 mn

333 mn

673 mn

872 mn

71 mn

48 mn

3

Why SEZs

The drivers of Economic Growth are:

Investment & Capital Formation

Improved Export Competitiveness

Need for:

World-class infrastructure

Hassle free taxation laws and

procedures

Competitive fiscal package

Limitations in achieving this all over the country

Special Economic Zones (SEZs) as

vehicle to create environment for investments

and exports

4

Objectives of Indian SEZ Act, 2005

Generation of additional economic activity

Development of infrastructure facilities;

Promotion of investment from domestic and

foreign sources

Creation of employment opportunities

Promotion of exports of goods and services

5

Legislative & Regulatory Framework

6

Legislative framework

SEZ Act 2005 SEZ Rules 2006

Basic framework for construction,

development, operation &

maintenance of SEZs prescribed

under the Act & prescribes the tax

and other fiscal incentives

available

Rules & regulations defining

guidelines & procedures for

effective operation of the SEZ Act

2005

State SEZ Policy

Prescribes guidelines & various policies for giving effect

to SEZ Act 2005 & provides for substantive &

procedural benefits offered by the State to SEZ

developers & units

7

SEZ Act & Rules-Main Features

Simplification of procedures

Single window clearance for setting up SEZ;

Single Window clearance on matters relating to

Central as well as State Governments for setting

up units in a SEZ;

Simplified compliance procedures and

documentation with an emphasis on self

certification;

One Stop Shop;

Tax concessions for both Developers & Units.

8

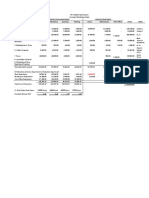

SEZ Formats

50% 40 with minimum built up area of 100,000 sq

meters

Free Trade

Warehousing Zone

50% 10 with minimum built up area of:

- 100,000 sq meters for IT

- 50,000 sq meters for Gems & Jewellery

- 40,000 sq meters for Bio-Tech and Non-

Conventional Energy

IT/ ITES, Gems &

Jewellery, Bio-Tech

and Non-

Conventional Energy

50% 100

(To promote widespread development, in

certain states and union territories the

minimum area requirement has been

reduced to 50 hectares)

Multi Services/

Sector Specific

50% 1,000 hectares to 5000 hectares (maximum)

(To promote widespread development, in

certain states and union territories the

minimum area requirement has been

reduced to 200 hectares)

Multi Product

Minimum

Processing

Area (presently

permitted)

Minimum Area Requirement

(in hectares)

Type of SEZs

9

SEZ - Developer/ Co-developer

Entry

Exit

R

e

s

t

r

i

c

t

e

d

e

n

t

r

y

/

e

x

i

t

SEZ

Entry

Exit

Processing Area*

Manufacturing &

service export units

approved by

regulatory authorities

Support infrastructure

including roads, sewerage,

ports, airports, road & rail

network, power & water

supply, residential &

business complex, hotels,

educational institutions,

hospitals, recreational

facilities, etc developer/

co-developer

Non-processing Area**

* Processing area is the demarcated area in SEZ where units can be located for manufacture of goods or rendering

of services

** Non-processing area is intended to provide support facilities to SEZ processing area and may include commercial

and social infrastructure

10

Key stakeholders

Developer

Developer

Co-developer

Co-developer

Person granted approval to develop, operate and

maintain SEZ including infrastructure facilities

Person granted approval to develop SEZ in

conjunction with developer for setting up facilities in

the non-processing area

Contractor

Contractor

Appointed by developer/ co-developer to undertake

authorized operations in SEZ

Eligible to exemptions, drawbacks and concessions

available to developer/ co-developer

Unit

Unit

Person undertaking export activities and approved for

Manufacture or production

Processing

Trading and Warehousing

Services

11

Specific conditions

Specific conditions

Processing area - permitted development ..

Regulatory Framework An overview

Land in SEZ cannot be sold

Development Commissioner to demarcate processing area

subsequent to which proposals for setting up of units will be

entertained

Only units with valid Letter of Approval from Development

Commissioner can set up operations

Land may be allotted for development of infrastructure facilities for use

by Units - specific approval may be obtained for lease of land for

creation of facilities such as canteen, PCOs, first aid centres, creche,

etc for exclusive use of unit

Only authorised persons with identity cards permitted to enter

processing area

12

Non-processing area - permitted development

General conditions

General conditions

For development of business and social purposes such as educational

institutions, hospitals, hotels, recreation and entertainment facilities, residential

and business complexes and other infrastructure needed for development,

operation and maintenance of SEZ

No Vacant land in non-processing area shall be leased for business and social

purposes such as educational institutions, hospitals, hotels, recreation and

entertainment facilities, residential and business complexes to any person except

a co-developer approved by the Board

Exemption available only with respect to set up/ development of such facilities as

approved by the Board of Approvals.

Development activities in the non-processing

area are to support the SEZ

Regulatory Framework An overview

13

Tax Framework

14

Direct Tax Incentivesfor SEZ Developers & Units

SEZ developers given IT exemption for 10 consecutive

assessment year out of first 15 years of its operations.

Exemption from Corporate Tax to SEZ units for 15 years

(5 + 5 + 5).

100% for first 5 years;

50% for next 5 years; and

50% for next 5 years to the extent of profits ploughed back

Corporate Tax exemption extended to export of services

also.

Exemption from MAT to SEZ Developers and SEZ Units

SEZ Developers exempted from Dividend Distribution Tax.

15

Indirect Tax Incentives

Customs duty exemption for goods imported into or services

provided in SEZs or to Unit

Customs duty exemption on goods exported from or

services provided from SEZs or Unit to any place outside

India

Exemption from Central excise duty on goods brought from

DTA to SEZs or Unit

Exemption from service tax on taxable services provided to

SEZ developer or Unit for their authorised operations.

However such exemption on exports made by unit need to

meet criteria of Export of Service Rules

Central sales tax exemption on sale/purchase of goods for

authorised operations other than newspapers where such

sale takes place in the course of interstate trade or

commerce

Tax exemption on electricity and power consumption

16

SEZ Current Status

362 SEZs formally approved:

17 Multi Product SEZs;

6 Port based Multi Product SEZs;

114 Sector Specific SEZs;

225 EH/IT/ITES SEZs

177 valid in-principle approvals;

132 SEZs notified; 45 SEZs functional

06-07 Exports at Rs. 34787 Crores

Growth in exports 52% over 2005-06

Projected exports 2007-08 Rs. 67088 crores (200%

increase in two years)

17

SEZ Success Stories

MOTOROLA

NOKIA

FOXCONN

APACHE

LOTUS FOOTWEAR

BRANDIX APPAREL

SUZLON

FLEXTRONICS

18

SEZ Issues

Land Acquisition

Cap on number of SEZs

Cap on maximum size of SEZ

Quantum of Processing Area

Regulation of Land use in the SEZs

Protection of Workers Rights

Review of Tax Concessions

19

Chinese SEZs

Xiamen : 131 sq. km

Shenzen : 327 sq. km

Hainan : 34000 sq. km

Total Land Area 2973190 sq km

Agricultural area 54.5% 1620388 sq km

Non Agricultural area 1352802 sq km

SEZs formally approved (362) 487 sq km

In-principal approvals (177) 1571 sq km

[Area for SEZs so far notified amounts to

only 177 sq km]

Total Area proposed for SEZ 2058 sq km

As % of total land area 0.069%

As % of Agri land 0.13%

SEZ ground realities

20

THANK YOU

THANK YOU

SEZs in

India

New Del hi

SEZs

spread

21

Thank you

You might also like

- Star Engineering CompanyDocument5 pagesStar Engineering CompanyChleo Espera100% (1)

- Format For Tripartite Agreement - UBIDocument5 pagesFormat For Tripartite Agreement - UBInpmehendale0% (1)

- Statement of Management Responsibility (Not Personally Owned)Document1 pageStatement of Management Responsibility (Not Personally Owned)Mabz Buan0% (2)

- Special Economic Zone - Presentation TranscriptDocument3 pagesSpecial Economic Zone - Presentation Transcriptkmr_arn100% (1)

- Special Economic Zones (SEZ) : The Next Frontier For IndiaDocument21 pagesSpecial Economic Zones (SEZ) : The Next Frontier For IndiaGurpreet Singh BhatiaNo ratings yet

- Facts On SEZDocument12 pagesFacts On SEZKush KumarNo ratings yet

- SEZ StrategyDocument13 pagesSEZ Strategymba rockstarsNo ratings yet

- What Is A Sez?Document13 pagesWhat Is A Sez?Anurag SharmaNo ratings yet

- Special Economic Zone (SEZ)Document18 pagesSpecial Economic Zone (SEZ)Nitesh SinghNo ratings yet

- Who Can Set Up Sezs? Can Foreign Companies Set Up Sezs?: Basic Difference Between Epzs and SezsDocument7 pagesWho Can Set Up Sezs? Can Foreign Companies Set Up Sezs?: Basic Difference Between Epzs and SezsMohan SubramanianNo ratings yet

- Special Economic Zone (SEZ)Document27 pagesSpecial Economic Zone (SEZ)ChunnuriNo ratings yet

- SEZsDocument18 pagesSEZsAnushree MohanNo ratings yet

- TBL S12publications File Upload 92 95 SEZsDocument6 pagesTBL S12publications File Upload 92 95 SEZsshilpaguthikondaNo ratings yet

- Special Economic Zone-1Document12 pagesSpecial Economic Zone-1Garima SinghNo ratings yet

- Special Economic Zone (SEZ)Document18 pagesSpecial Economic Zone (SEZ)Harshit MalhotraNo ratings yet

- MMMMMM: MMMMMMMMMMMMMMMM MMMMMMMMMMMMMMMMMM M MM MMMMMMM M M MDocument55 pagesMMMMMM: MMMMMMMMMMMMMMMM MMMMMMMMMMMMMMMMMM M MM MMMMMMM M M MRuby ButiNo ratings yet

- Sez & STPDocument10 pagesSez & STPumashankar_kr100% (3)

- Meaning and Definition of Special Economic ZoneDocument12 pagesMeaning and Definition of Special Economic ZoneMubina shaikhNo ratings yet

- Special Economic Zones (SEZ)Document12 pagesSpecial Economic Zones (SEZ)Ajay K PandianNo ratings yet

- State Governments Incentives For InvestorsDocument6 pagesState Governments Incentives For InvestorsbalqueesNo ratings yet

- Special Economic ZoneDocument13 pagesSpecial Economic Zonejoe80% (5)

- Special Economic Zones PPT NewDocument42 pagesSpecial Economic Zones PPT NewtimciNo ratings yet

- Presentation On Special Economic Zone - Il&Fs IdcDocument49 pagesPresentation On Special Economic Zone - Il&Fs IdcPranita PatiNo ratings yet

- Sez - India - China ProspectiveDocument24 pagesSez - India - China ProspectivegurbaniajayNo ratings yet

- Indian Sez ModelsDocument24 pagesIndian Sez ModelsAnuja BakareNo ratings yet

- Sez PDFDocument6 pagesSez PDFdilip5685No ratings yet

- MSCPL Profile FinalDocument81 pagesMSCPL Profile FinalCA Ratan MoondraNo ratings yet

- Write Up For SezDocument4 pagesWrite Up For SezmeghavijayNo ratings yet

- Project On: Special Economic ZoneDocument22 pagesProject On: Special Economic ZoneVishal GhadgeNo ratings yet

- Special Economic Zon1mamDocument4 pagesSpecial Economic Zon1mammantumahanteshNo ratings yet

- Special Economic Zones: A Brief Study OFDocument23 pagesSpecial Economic Zones: A Brief Study OFShailesh BansalNo ratings yet

- Project Report - BepDocument11 pagesProject Report - Bepstudyy bossNo ratings yet

- Special Economic Zones in IndiaDocument32 pagesSpecial Economic Zones in IndiaHari Prasad100% (1)

- Eou, Sez, TH, EhDocument26 pagesEou, Sez, TH, EhNeelam RautNo ratings yet

- Research Paper On SEZDocument6 pagesResearch Paper On SEZyogeshshukla.ys14No ratings yet

- Session 17-Trade PolicyDocument35 pagesSession 17-Trade Policysadiakhn03No ratings yet

- Special Economic Zones (SEZ) - IntroductionDocument23 pagesSpecial Economic Zones (SEZ) - IntroductionR. SainiNo ratings yet

- SEZ PolicyDocument30 pagesSEZ PolicyKushal UpadhyayaNo ratings yet

- A Special Economic ZoneDocument8 pagesA Special Economic ZonetukunadhalNo ratings yet

- Special Economic Zone Special Economic Zone Special Economic Zone Special Economic ZoneDocument13 pagesSpecial Economic Zone Special Economic Zone Special Economic Zone Special Economic ZoneXMBA 24 ITM VashiNo ratings yet

- Taxx Special Economic ZonesDocument4 pagesTaxx Special Economic ZonesAlina RizviNo ratings yet

- Role of Special Economic Zone in Strategic Plannnig For Business Unit EstablishmentDocument25 pagesRole of Special Economic Zone in Strategic Plannnig For Business Unit EstablishmentShiv RajNo ratings yet

- Foreign Direct Investment in Service Sector-Policy For India's Services SectorDocument22 pagesForeign Direct Investment in Service Sector-Policy For India's Services Sectorgeeta009singhNo ratings yet

- The Main Objectives of The SEZ Act AreDocument4 pagesThe Main Objectives of The SEZ Act AreParag YadavNo ratings yet

- 1 What Is A Special Economic Zone ?Document7 pages1 What Is A Special Economic Zone ?bhaskarraosatyaNo ratings yet

- Special Economic Zones: Issues & Implications: December 2008Document17 pagesSpecial Economic Zones: Issues & Implications: December 2008Anonymous cRMw8feac8No ratings yet

- Sez Main 123Document42 pagesSez Main 123Raj K GahlotNo ratings yet

- Sezs (Special Economic Zones)Document12 pagesSezs (Special Economic Zones)asifanisNo ratings yet

- Concept Note On Special Economic ZoneDocument17 pagesConcept Note On Special Economic ZoneNeetuMakwanaNo ratings yet

- Special Economic ZonesDocument3 pagesSpecial Economic ZonesUdhayakumar ManickamNo ratings yet

- Sez Act & Guidelines For ImplementationDocument59 pagesSez Act & Guidelines For ImplementationbharatNo ratings yet

- Sez JaipurDocument71 pagesSez JaipurSUVADIP BHOWMIKNo ratings yet

- Foreign Investment. It Has Special Economic Laws That Are More Liberal Than The Country's TypicalDocument8 pagesForeign Investment. It Has Special Economic Laws That Are More Liberal Than The Country's TypicalPritesh ShahNo ratings yet

- Internship Report 101 (Rough)Document14 pagesInternship Report 101 (Rough)Chandan KumarNo ratings yet

- SEZDocument23 pagesSEZniharika-banga-2390No ratings yet

- Industrial Licensing PolicyDocument15 pagesIndustrial Licensing PolicyrohitbatraNo ratings yet

- Seminars On General Topics: Sez and Its Effect On The EconomyDocument21 pagesSeminars On General Topics: Sez and Its Effect On The EconomyLubna ShaikhNo ratings yet

- 2007 Investing in IndiaDocument32 pages2007 Investing in IndiaDee JayNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportFrom EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportNo ratings yet

- Miscellaneous Service Establishment Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Service Establishment Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Oil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryFrom EverandOil Well, Refinery Machinery & Equipment Wholesale Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryFrom EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Sarvagya Institute of CommerceDocument44 pagesSarvagya Institute of CommerceadhishcaNo ratings yet

- Economic Determinants of SavingsDocument5 pagesEconomic Determinants of Savingscoolimran76No ratings yet

- In Re Right of InspectionDocument3 pagesIn Re Right of InspectionClarissa de VeraNo ratings yet

- A History of Venture Capital - LebretDocument66 pagesA History of Venture Capital - LebretHerve LebretNo ratings yet

- Financial LiteracyDocument4 pagesFinancial LiteracyMae Althea TidalgoNo ratings yet

- Press Release Saksoft Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Saksoft Limited: Details of Instruments/facilities in Annexure-1Sandy SanNo ratings yet

- IRS TaxDocument28 pagesIRS TaxAntonio MolinaNo ratings yet

- Mount Vernon City School District AuditDocument47 pagesMount Vernon City School District AuditSamuel L. RiversNo ratings yet

- Finalised Kathi Junction Business Loan 19-5-19Document5 pagesFinalised Kathi Junction Business Loan 19-5-19Allserv TechnologiesNo ratings yet

- HigginsandHuque2014 HKDLDocument34 pagesHigginsandHuque2014 HKDLAndrew NgNo ratings yet

- Midterms Sa2 FARDocument6 pagesMidterms Sa2 FAREloiNo ratings yet

- KellogDocument2 pagesKellogDhruv Gupta100% (1)

- AR Lease Agreement - 19 May Compare V 16 May Meeting Draft revBKMS - AK 23052019 Meeting24052019 ADCO Rev09082019Document45 pagesAR Lease Agreement - 19 May Compare V 16 May Meeting Draft revBKMS - AK 23052019 Meeting24052019 ADCO Rev09082019Nicko KaruniawanNo ratings yet

- Audit Fot Liability Problem #2Document3 pagesAudit Fot Liability Problem #2Ma Teresa B. CerezoNo ratings yet

- Finacle Commands For Concurrent AuditDocument24 pagesFinacle Commands For Concurrent AuditMayur KundarNo ratings yet

- Taxa 1Document17 pagesTaxa 1Cheenee Nuestro SantiagoNo ratings yet

- Real Estate BrokersDocument15 pagesReal Estate BrokersAerwin Abesamis0% (1)

- Older Adults and BankruptcyDocument28 pagesOlder Adults and BankruptcyvictorNo ratings yet

- Joint Indivisible Obligations Obligations With A Penal ClauseDocument3 pagesJoint Indivisible Obligations Obligations With A Penal ClauseJolo RomanNo ratings yet

- Estate of Poblador Jr. v. Rosario L. ManzanoDocument1 pageEstate of Poblador Jr. v. Rosario L. ManzanoRywNo ratings yet

- MDBIU Project - Steve CentoDocument4 pagesMDBIU Project - Steve Centomichael5dunnNo ratings yet

- Wells Fargo Clear Access BankingDocument7 pagesWells Fargo Clear Access BankingdebokillsNo ratings yet

- Chapter 8 Computation of Total Income and Tax PayableDocument8 pagesChapter 8 Computation of Total Income and Tax PayablePrabhjot KaurNo ratings yet

- Business Plan:: Shannon Lowery Erin Faight Christina Rullo Alec RobertsonDocument12 pagesBusiness Plan:: Shannon Lowery Erin Faight Christina Rullo Alec RobertsonBhavin GhoniyaNo ratings yet

- General Quiz: Chiranjeevi and SharmilaDocument68 pagesGeneral Quiz: Chiranjeevi and SharmilaRavi TejaNo ratings yet

- CF 2Document2 pagesCF 2shahidameen2No ratings yet

- Shrawan Bhadra Aswin Kartik: Problem 1Document17 pagesShrawan Bhadra Aswin Kartik: Problem 1notes.mcpu100% (1)