Professional Documents

Culture Documents

In Practice: Reforming Customs Clearance in Pakistan

In Practice: Reforming Customs Clearance in Pakistan

Uploaded by

Aleem AhmedOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

In Practice: Reforming Customs Clearance in Pakistan

In Practice: Reforming Customs Clearance in Pakistan

Uploaded by

Aleem AhmedCopyright:

Available Formats

A

p

r

i

l

2

0

1

0

IN PRACTICE

n

o

.

9

During the 1990s international trade and

government tax revenues were stagnant in

Pakistan. Average annual GDP growth exceeded

6 percent in the 1980s, but in the 1990s it fell

to less than 4 percent, and the fscal defcit and

public debt rose sharply. In the 1990s more than

70 percent of Pakistans tax revenue was related

to imports, through customs duties, sales taxes,

and income tax withholdings. Accordingly, the

new administration that came to power in 1999

(headed by then President Pervez Musharraf )

targeted improvements in trade and customs as

part of its reform agenda.

Despite attempts at outsourcing, in the 1990s

little progress was made on streamlining

Pakistans cumbersome customs regulations.

Goods clearance involved more than a dozen

government agencies and usually took more

than two weeks. An importer of something

as simple as powdered milk was required to

complete six copies of a bill of entry, which

were then registered, manually checked against

an import general manifest, and subject to

810 additional steps.

At one point in the 1990s, Pakistans commercial

judiciary had a backlog of more than 80,000 cases

brought against the customs administration by

traders and manufacturers. Te country was also

the leading source of tarif classifcation disputes

referred to the World Customs Organization.

Ineffective outsourcing

In the 1990s the Pakistani government outsourced

customs clearance to two Swiss inspection

Reforming Customs Clearance

in Pakistan

Simple, fast, transparent customs clearance procedures encourage

tradeand the resulting tarifs and related taxes raise government

revenue and stimulate economic development. After outsourcing failed

to make customs more ef cient or increase revenue, in 2002 Pakistan

began pursuing a modern single window system for customs clearance.

In 2005 the system was introduced at the port of Karachi, replacing

numerous procedures with one electronic declaration and sharply

cutting customs processing times. Despite dramatically reduced tarifs,

annual customs revenue grew dramatically after the reformthough

tarif and customs reform have since stalled.

TRADE LOGISTICS

investment climate

Manzoor Ahmad

Dr. Manzoor Ahmad is the

Director of the Food and

Agriculture Organization of the

United Nations Liaison Ofce in

Geneva. He served as Pakistans

Ambassador and Permanent

Representative to the World

Trade Organization from 2002

to 2008 and as Director-General

of Pakistan Customs from

2000 to 2002. He also worked

for 10 years (198696) for the

World Customs Organization

in Brussels.

This note is one in a series

developed by the Trade Logistics

team of the World Bank Groups

Investment Climate Advisory

Services. The series focuses on

implementation aspects of

recent trade reform initiatives

and risk management issues.

The Trade Logistics team

advises governments in devel-

oping and transition economies

on improving their import,

export, and risk management

systems and procedures to

increase their potential for trade

and investment.

IN PRACTICE TRADE LOGISTICS 2

companiesCotecna in 199091 and Socit

Gnrale de Surveillance (SGS) in 199597

with the goals of: raising government revenue

through more efective collection of customs

tarifs and related taxes, facilitating trade, and

reducing corruption.

Te government had predicted that outsourcing

customs could double customs revenue, but the

inspection fees charged by the outsourcers raised

clearance costs by 23 percent for traders, and

customs revenue did not increase. Meanwhile,

clearance times did not improve, so complaints

persisted about goods being held up at ports. In

addition, the customs administration resented the

presence of the Swiss companies.

In 1998 a rudimentary single window system, the

Customer Service Center, was introduced. Te

center was run by a local frm under an outsourcing

agreement. A small fxed fee was levied on each

goods declaration to cover expenses, and while

the center was an improvement over the previous

systemeliminating 810 steps and introducing

some automation and transparencycustoms

clearance remained predominantly paper-based

and cumbersome.

Customs House Karachi, which handles 60 percent

of Pakistans imports and exports, then became the

venue for a series of reforms, including:

1998: the Express Lane Facility was

introduced to simplify examination

procedures.

2000: the Electronic Assessment System

began assessing duties based on risk

profles.

2001: a single goods declaration was

introduced.

2002: risk-indicated selective examination

started assessing risks in examination

procedures.

2004: an automated clearance procedure was

introduced.

Tough these reforms simplifed clearance

procedures, most companies had to continue

following arcane procedures because it was

feared that fewer customs checks would lead

some traders to try to cheat the system, resulting

in lost revenue.

Broad tax reforms lead to

simpler customs

As part of a structural adjustment program

developed with the World Bank and International

Monetary Fund, in 2001 Pakistans Central

Board of Revenue (now the Federal Board of

Revenue) began simplifying tax laws. Reforms

included introducing self-assessment for all

taxes, including customs tarifs and related excise

and value added taxes. With a few exceptions,

the maximum tarif was lowered from 45 percent

in 199899 to 25 percent in 200203. The

number of tariff duty ranges was cut from 16 to

4, and tariff exceptions were reduced or clarified.

Fifty years worth of procedural notifications on

tariffs were reviewed and updated to simplify

customs declarations.

Clearance reform also occurred as part of customs

administration reforms. In early 2002 a reform

team of three mid-level customs of cers was

created to develop an all-encompassing, fully

automated customs system. Te team visited

customs authorities that were using the United

Nations Automated System for Customs Data

(ASYCUDA)designed to automate and

administer core customs processes and obtain

trade data to support government planningbut

decided that the system did not meet all the needs

of stakeholders in Pakistan. ASYCUDA was being

used in countries with small customs operations,

and the version available then did not enable the

level of integration required with stakeholders

such as carriers, commercial banks, and regulators.

Furthermore, while the ASYCUDA software was

free, hiring consultants to implement it would

have been rather expensive.

Te reform team decided that it would be better to

adopt a system customized to Pakistans needs, which

the team described in a 4,000-page document. Te

teams vision was to create a customs system that was

Web-enabled, paperless, automated, and allowed

intervention by customs only through an automated

risk management system.

Te team wanted the system to provide real-time

integration with other government authorities,

to create an integrated tarif regime, as well as

with other parties involved in the supply chain

Reforms sought to

create a customs system

that was Web-enabled,

paperless, automated,

and more transparent.

IN PRACTICE TRADE LOGISTICS 3

and customs clearance (such as carriers, ports

and terminals, non-vessel operating common

carriers, freight forwarders, warehouses, customs

brokers, and banks involved in collecting

customs revenue). Finally, the new customs

system was to be compliant with international

best practices such as the Convention on

Facilitation of International Maritime Traf c,

World Customs Organization Data Model,

revised Kyoto Convention, and postSeptember

11 security requirements.

Te resulting Pakistan Customs Computerized

System (PaCCS) was formally launched in 2005 at

the port of Karachi.

The 80-20 rule as

applied to managing customs

stakeholders

Relatively few government agencies are involved

in Pakistani customs (port authorities, State

Bank of Pakistan, Central Statistical Of ce,

Ministry of Commerce), so private companies

are key stakeholders in customs reform. Pakistans

strategy for stakeholder management involved

using the Pareto principle (also known as the

law of the vital few or 80-20 rule), which

states that for many events, 80 percent of the

efects result from 20 percent of the causes.

Studies by the small reform team found that of

the 24,000 registered importers and exporters

in Pakistan, 200 accounted for more than 70

percent of international trade. Shipping was

also concentrated, with the top four shipping

lines carrying more than 80 percent of business

through Pakistani customs.

Winning the early support of key players in

Pakistans private sector helped create momentum

for broad participation. Key companies that

embraced the single window included the

port operator Karachi International Container

Terminal Limited (KICTL) and American

President Lines (APL), a major shipper. KICTL

had already automated, and its management

immediately recognized the potential of a fully

automated, risk-managed customs system that

worked 24/7 with the companys servers using

electronic data interchangeincluding the

benefts for KICTLs competitive standing.

Similarly, APLs management immediately

understood the savings that would result from

ships not being tied up for days in the Karachi

port. Other companies, seeing the enthusiastic

participation of KICTL and APL, then became

eager to participate.

Not all private actors were won over so easily. Some

agents that served as intermediaries for traders

remained committed to arcane practices, as did

some traders that benefted from nontransparent

procedures. While these critics account for just

1015 percent of companies, and for even less of

trade volume, they continue to be vocal opponents

of customs reform.

Between 2002 and 2004 a series of seminars,

workshops, and other sessions were conducted

with key traders and shippers to develop new

procedures and reach consensus. Having small

teams manage the entire process helped expedite

reforms. Te key reform group made nearly

all key decisions in the reform process. Active

support and involvement from the top (such as

the minister of fnance and chair of the Federal

Board of Revenue) greatly facilitated the reform

implementation process.

While work on PaCCS was still at the conceptual

stage and mostly being done at Customs House

Karachi, two teams of two mid-level of cers,

selected by the head of customs, were stationed

at the headquarters of the Federal Board of

Revenue to simplify tarif and customs rules. Tis

element of reform was independent of PaCCS

and coincided with budget making exercises for

fscal 2001 and 2002.

Pakistans single customs

window in action

PaCCS relies on self-assessments by flers, using

software developed by vendors selected through

the World Banks international tendering process.

1

Traders or their agents fle declarations online

and pay duties or taxes at any bank connected

to PaCCS or by debiting their prepaid accounts

with the government (Figure 1). PaCCS then

generates an online receipt of the declaration,

Winning the early

support of key players

in Pakistans private

sector helped create

momentum for broad

participation.

IN PRACTICE TRADE LOGISTICS 4

assigns a customs reference number, and verifes

the declaration through its risk management

system. Te customs administration makes an

online request to the fler if it requires any

clarifcation or additional documentation, which

can also be provided online.

PaCCS was designed to perform customs functions

without manual intervention. Physical inspection

of goods, if needed, can occur without the trader

being present. Processing can take place in just a

few seconds.

Importers fle disputes electronically and can

request reviews of any duty or other customs

issue. If the problem is not resolved on frst

review, importers can request a second review and

personal hearing with a mid-level manager at the

Customs House. Although few disputes are not

resolved by that point, importers can still clear

cargo by fling security payments equivalent to

the amount in dispute. Te traders funds are then

kept or released based on a fnal assessment by the

Valuation Department.

Results of implementing

the electronic single

window system

Te government and customs administration hoped

that implementing a single window would:

Lower the costs of doing business by reducing

delays and demurrages, simplifying processes,

and enabling just-in-time inventory.

Increase government revenue through more

reliable collection of customs duties and

related taxes.

Improve cash fow for businesses by

expanding access to markets through simpler

procedures and expediting rebates of export

duties to traders.

Reduce corruption.

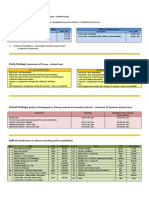

Figure 1: Processing of Goods Declarations for Imports by the Pakistan

Customs Computerized System

Requests

second

review

Requests

release

against

security

Risk Management System

Agrees

Client

Disagrees

Green

Yellow

Red

Agrees

Customs

Disagrees

Declaration

accepted

Declaration

rejected

Requests

review

Serious

mis-declaration

Source: PaCCS management.

When a goods declaration is fled, PaCCS computes the importers duties, logs payment, assigns a customs reference number, and then either

clears the goods declaration through customs or requires further scrutiny by customs.

Pays as

determined

or

provides

security payment

Bill of lading

cleared. Client and

terminal operator

informed online

Information and

documents

requested

from client

Minor or

no issues

Physical

examinations

Further

action

Duties paid

against the

goods

declaration.

Customs

reference

number

generated

by PaCCs

Goods

declaration

fled

against a

bill of

lading.

Duties

computed

by PaCCS

Declaration

routed to

Customs

House for

scrutiny

IN PRACTICE TRADE LOGISTICS 5

Customs processes at the port of Karachi have

been simplifed considerably since PaCCS was

implemented. Te port, once considered among

the worst functioning in the world, is now

competitive with any in the regionincluding

those in India.

Under PaCCS one simple electronic declaration

has replaced up to 26 clearance steps, 34 signatures,

and 62 verifcations. After the system was frst

introduced, 87 percent of consignments cleared the

single window within an hour (Figure 2), though

that pace has slowed considerably since some

manual checks were introduced.

2

Rebates to traders

are made automatically without their having to fle

claims, and refunds now take less than 2 days

compared with 90 before.

PaCCS also introduced more sophisticated risk

management. It maintains a taxpayer compliance

history for the past year, and taxpayers with

higher compliance ratings are considered less

risky. Conducting fewer examinations based on

automated risk profling greatly reduces processing

costs for port operators, who can begin processing

before shipments arrive, and for shipping com-

panies, which no longer have to maintain ships at

port while goods are cleared.

Figure 2: Clearance Times at the Port of Karachi Before and After Reform

(percent)

After Before

Source: PaCCS management.

After the customs computerized system was frst introduced in Pakistan, 87 percent of consignments cleared customs in less than one hour and

93 percent cleared in less than 24 hours.

4 Less than 1 day

13 Less than 2 days

32 Less than 4 days

26 Less than 6 days

25 More than 6 days

70 Less than 5 minutes

14 Less than 30 minutes

3 Less than 1 hour

5 Less than 12 hours

1 Less than 24 hours

7 More than 24 hours

Te single window system was designed to reduce

corruption by eliminating contact between traders

and customs agents. Pakistani of cials estimate that

90 percent of corruption has been eliminated for

goods passing through the single window system

in Karachi (which accounts for 60 percent of

Pakistans international trade). Collusion between

taxpayers and tax collectors is largely mitigated by

physical structures that separate taxpayers from

examination and assessment areas. In addition,

biometric identifcation and cell phone jammers

are used to ensure that customs staf remains

unaware of the identity of taxpayers.

Te introduction of the single window, combined

with the lowering and simplifcation of tarifs,

has made traders more cooperative and reduced

opportunities and motivations for bribery. As a

result, despite sharp cuts in tarifs between 1998 and

2002, tarif revenue grew by more than 20 percent a

year after reform (from fscal 2003 until fscal 2006).

Lessons from Pakistans

experience

Carefully consider outsourcing

In Pakistan, outsourcing customs inspection and

clearance raised costs for traders by 23 percent and

IN PRACTICE TRADE LOGISTICS 6

did not achieve any of the intended goals. Customs

revenue did not increase, trade was not simplifed,

and corruption may have intensifed. Outsourcing

also created resentment among customs workers,

eroded domestic expertise, and stunted customs

capacity building.

Develop the legal and regulatory

framework for reform

To enable the single window, Pakistan had to

enact more than a hundred changes to its Customs

Act. Most involved the switch to electronic

documentationfor example, revisions were

needed on provisions requiring signatures, hard

documents, and the physical presence of traders (or

their agents) during goods clearance. Other steps

included introducing a single goods declaration,

implementing the World Trade Organization

Agreement on Customs Valuation, and lowering

the maximum tarif from 45 to 25 percent.

Aim for a critical mass of reforms

built on quick wins

Limited reforms will likely not satisfy stakeholders

or achieve reform goals, and implementing a single

window can take several yearssometimes more.

But reaching smaller goals along the way can help

build momentum. In Pakistan one quick win

involved simplifying, at relatively low cost and

efort, arcane tarif rates and rules accumulated over

50 years. Tough Pakistan had been the leading

country in tarif classifcation disputes referred to

the World Customs Organization, such complaints

nearly disappeared after tarifs were simplifed.

Pakistan also introduced some risk profling before

introducing the single window, which reduced the

volume of goods backlogged on docks awaiting

inspection.

Adopt a countrywide plan for

reform while momentum is strong

Te increased transparency and accountability that

accompany reform can threaten customs agents

and authorities, as well as trader intermediaries

and legacy vendors. Indeed, these vested interests

have stalled further adoption of single window

customs reforms throughout Pakistan, refecting

the lack of a widespread PaCCS rollout plan from

the outset. Today only 60 percent of Pakistans

international trade (what passes through the port

of Karachi) goes through PaCCS. As a result,

shipping lines and terminal operators must cater

to dual processes and maintain a paper-based

system, which raises costs.

Maintain a stable but inclusive

team for reform management

Achieving a single window requires a dedicated

management team working for a sustained period.

Tis team must have ownership of the reform

process and be motivated to overcome obstacles.

Pakistans reform management team may have been

too small, possibly fostering resentment among

trade and customs colleagues. Reform management

teams should include as many stakeholders as

possible to help minimize criticism after reforms

and to sustain reform momentum as managers,

policymakers, and administrations change.

Use private sector champions and market

forces to catalyze reforms where possible

Pakistani reformers recognized early that international

trade was highly concentrated among traders, shippers,

and port operators. Winning early support from key

companies drove momentum for participation in

the single window because other companies became

eager to maintain competitivenessproviding a

lesson in how market forces can be harnessed to

encourage reforms.

Measure the results of reform

Reform outcomes should be measured and

benchmarked where possible. In Pakistan the key

indicators of customs reform were the average

time to clear goods and the number of court cases,

referrals to the World Customs Organization, and

days to refund trader duty drawbacks. Such data

are often not available before an automated system

is adopted, so determining reform results may

require comparing anecdotes or surveys of traders

and other stakeholders with hard data once the

new system is in place.

Tarif classifcation

disputes nearly

disappeared after tarifs

were simplifed.

IN PRACTICE TRADE LOGISTICS 7

The Investment Climate IN

PRACTICE note series is published

by the Investment Climate

Advisory Services of the World

Bank Group. It discusses practical

considerations and approaches

for implementing reforms that

aim to improve the business

environment. The ndings,

interpretations, and conclusions

included in this note are those of

the author and do not necessarily

reect the views of the Executive

Directors of the World Bank or the

governments they represent.

About the Investment

Climate Advisory

Services

The Investment Climate Advisory

Services of the World Bank Group

helps governments implement

reforms to improve their business

environments and encourage and

retain investment, thus fostering

competitive markets, growth, and

job creation. Funding is provided by

the World Bank Group (IFC, MIGA,

and the World Bank) and over 15

donor partners working through the

multidonor FIAS platform.

Conclusion

Many governments share the same basic goals for

customs reform: facilitating trade while reducing

corruption and increasing revenue from tarifs

and customs-related taxes. Achieving these goals

is more likely when reforms simplify procedures,

clarify tarif structures, and minimize human

interactions. Governments seeking a quick

fx sometimes outsource customs functions to

private companiesbut this should be done with

caution. Outsourcing was inefective in Pakistan,

where streamlined customs procedures and higher

customs revenue were achieved only when a

single window system for trade declarations was

implemented in 2005.

Ideally, implementation of a single window should

occur in the context of broader trade reforms. Tarif

structures must be simplifed, and duties should be

low enough to encourage payment of tarifs and

related taxes. A single window system must also

allow electronic exchanges of documents and be

supported by a legal and regulatory framework

based on international standards.

A properly implemented single window system

can deliver signifcant benefts. During 200207

Pakistans single window system eliminated numerous

procedures, and customs revenue soared because

bribes were replaced by legitimate duties and related

taxes at the port of Karachi.

But powerful vested interests can impede reform,

especially as government administrations change.

Tus reformers should act aggressively, while

reform momentum is strong, and reform eforts

should include as many stakeholders as possible to

foster lasting support.

Since PaCCS was successfully implemented, there

has been some rollback of automation in favor of

more manual checking, and new management is

conducting an audit to inform plans for further

system rollout. For more information, contact Uma

Subramanian, Global Product Leader, Trade Logistics

(usubramanian@worldbank.org).

Endnotes

1

Tese vendors include Microsoft, PWC

Logistics of Kuwait (now Agility), and

Accountancy Outsourcing Systems of

Pakistan.

2

Since the introduction of these checks, only

one-third of consignments are now cleared

within one hour.

IN PRACTICE

WWW.WBGINVESTMENTCLIMATE.ORG

World Bank Group

International

Finance Corporation

You might also like

- View DocumentDocument6 pagesView Documentcss480% (1)

- Study of Tata Motor Financing & RecoveryDocument73 pagesStudy of Tata Motor Financing & Recoveryujwaljaiswal50% (2)

- Customs Reforms WB PaperDocument8 pagesCustoms Reforms WB PaperManzoor AhmadNo ratings yet

- Methods of ResearchDocument8 pagesMethods of ResearchMherick VersozaNo ratings yet

- ASYCYDA in Perspective of Bangladesh & InternationalDocument14 pagesASYCYDA in Perspective of Bangladesh & InternationalTasmiaNo ratings yet

- Custom Duty CalculationDocument3 pagesCustom Duty CalculationDu DuNo ratings yet

- Kyoto 2000Document3 pagesKyoto 2000ltubalaNo ratings yet

- Weboc 1Document30 pagesWeboc 1Altaf Ur RehmanNo ratings yet

- WTO Workshop On Technical Assistance and Capacity Building in Trade FacilitationDocument10 pagesWTO Workshop On Technical Assistance and Capacity Building in Trade FacilitationAlgerico TapeNo ratings yet

- Tanzania Regulatory AuthoritiesDocument14 pagesTanzania Regulatory Authoritiestonix210No ratings yet

- The Pakistan Single Window System MNGMNTDocument3 pagesThe Pakistan Single Window System MNGMNTTarjuman E EllahiNo ratings yet

- Post Clearance Customs AuditDocument3 pagesPost Clearance Customs AuditMohammad Shahjahan SiddiquiNo ratings yet

- Ease of BusinessDocument9 pagesEase of BusinessJanhaviNo ratings yet

- TonnageTaxation Manish AgarwalDocument8 pagesTonnageTaxation Manish AgarwalPriyanka AgarwalNo ratings yet

- Country Presentation Customs KenyaDocument5 pagesCountry Presentation Customs KenyavictormathaiyaNo ratings yet

- Unctad: Technical Assistance and Capacity Building inDocument27 pagesUnctad: Technical Assistance and Capacity Building inchowmowNo ratings yet

- Foreign Trade PolicyDocument35 pagesForeign Trade PolicyswapanNo ratings yet

- Ascuda ++Document3 pagesAscuda ++nanowassieNo ratings yet

- Import Chap 2-5 New ChamberDocument38 pagesImport Chap 2-5 New ChamberDawit MekonnenNo ratings yet

- Customs Clearance in France: Concrete MeasuresDocument20 pagesCustoms Clearance in France: Concrete Measurestantra shivaNo ratings yet

- Clearance Procedure For Imports: Prepared By: Legal Services Cell-B&SdsDocument15 pagesClearance Procedure For Imports: Prepared By: Legal Services Cell-B&SdsWYNBADNo ratings yet

- Iii. Trade Policies and Practices by Measure (1) I: Mauritius WT/TPR/S/198/Rev.1Document38 pagesIii. Trade Policies and Practices by Measure (1) I: Mauritius WT/TPR/S/198/Rev.1Nanda MunisamyNo ratings yet

- Customs Reform & Trade Facilitation: Welcome To PaccsDocument20 pagesCustoms Reform & Trade Facilitation: Welcome To PaccsRaheel Abdul RehmanNo ratings yet

- May28.2014.docsolon Seeks Passage of Customs Modernization Bill This 16th CongressDocument2 pagesMay28.2014.docsolon Seeks Passage of Customs Modernization Bill This 16th Congresspribhor2No ratings yet

- IMF OECD 2019 - Progress Report On Tax CertaintyDocument54 pagesIMF OECD 2019 - Progress Report On Tax CertaintyHoài HạNo ratings yet

- Edited Import Chap 2Document18 pagesEdited Import Chap 2Dawit MekonnenNo ratings yet

- Customs, Logistics and Supply ChainDocument22 pagesCustoms, Logistics and Supply ChainAhmed Moustafa ElSebaayNo ratings yet

- Customs Regulatory FrameDocument115 pagesCustoms Regulatory FrameCarlos Adolfo Salah FernandezNo ratings yet

- Positions and Statements: Revised Kyoto Convention To Standardize Customs Procedures and Policies August 2001Document3 pagesPositions and Statements: Revised Kyoto Convention To Standardize Customs Procedures and Policies August 2001TonyNo ratings yet

- 1 Kenia - EnglishDocument15 pages1 Kenia - EnglishStudy IitNo ratings yet

- Iii. Trade Policies and Practices by Measure (1) M D A I (I) ProceduresDocument19 pagesIii. Trade Policies and Practices by Measure (1) M D A I (I) ProceduresgghNo ratings yet

- EXERCISE 3 Tere JongcoDocument4 pagesEXERCISE 3 Tere JongcoTeresa JongcoNo ratings yet

- Asycuda ++ NewDocument2 pagesAsycuda ++ NewEliphaz KalaweNo ratings yet

- Tonnage TaxDocument10 pagesTonnage TaxUrvish MunshiNo ratings yet

- Ibmr, Ips Academy: SESSION-2018-2019 International Marketing Topic-Foreign Trade Policy 2002-2007Document10 pagesIbmr, Ips Academy: SESSION-2018-2019 International Marketing Topic-Foreign Trade Policy 2002-2007Rachi JainNo ratings yet

- Iii. Trade Policies by Measure (1) O: The Dominican Republic WT/TPR/S/207Document47 pagesIii. Trade Policies by Measure (1) O: The Dominican Republic WT/TPR/S/207MansiDoshiNo ratings yet

- Guide Portnet Cgem enDocument24 pagesGuide Portnet Cgem enTavia WaltersNo ratings yet

- ICC Customs GuidelinesDocument8 pagesICC Customs GuidelinesalejandrosantizoNo ratings yet

- IBI Bangladesh Trade Facilitation Activity NewsletterDocument8 pagesIBI Bangladesh Trade Facilitation Activity NewsletterRyan BrennerNo ratings yet

- Trade and Facilitation ASEANDocument8 pagesTrade and Facilitation ASEANwick3d88No ratings yet

- Abenezer GetachewDocument12 pagesAbenezer GetachewGetachew AdaneNo ratings yet

- (9781589062115 - Changing Customs) CHAPTER 4. Simplifying Procedures and Improving Control Prior To Release of GoodsDocument7 pages(9781589062115 - Changing Customs) CHAPTER 4. Simplifying Procedures and Improving Control Prior To Release of Goodsyedinkachaw shferawNo ratings yet

- Country Presentation Customs GhanaDocument7 pagesCountry Presentation Customs GhanakwameNo ratings yet

- BD 2006 Customs ProceduresDocument17 pagesBD 2006 Customs ProceduresyeNo ratings yet

- Wla Lang eDocument11 pagesWla Lang eortizjake193No ratings yet

- Safe Framework of StandardsDocument8 pagesSafe Framework of StandardsvictormathaiyaNo ratings yet

- Tax CultureDocument9 pagesTax CultureDuaa SoomroNo ratings yet

- Customs Customs Administration Modernization Project (CAM-1)Document6 pagesCustoms Customs Administration Modernization Project (CAM-1)khshiblyNo ratings yet

- Bos 50633Document2 pagesBos 50633Krishna SharmaNo ratings yet

- III: The Airline Industry: A Case StudyDocument25 pagesIII: The Airline Industry: A Case StudyMd Faisal AkhtarNo ratings yet

- Unec GM4Document63 pagesUnec GM4Emiraslan MhrrovNo ratings yet

- 7.5 Chinese Taipei - Case Study of Customs Post-Clearance Audit System by Chinese TaipeiDocument7 pages7.5 Chinese Taipei - Case Study of Customs Post-Clearance Audit System by Chinese TaipeiRuwen Joice Abacan BunquinNo ratings yet

- IMG MainDocument79 pagesIMG MainNikhil KhobragadeNo ratings yet

- Pakistan Taxation SystemDocument31 pagesPakistan Taxation SystemUsman KhanNo ratings yet

- JereosDocument10 pagesJereosvendetta scrubNo ratings yet

- IntegrationPoint ChinaBrochure 2012Document1 pageIntegrationPoint ChinaBrochure 2012ipcharlotteNo ratings yet

- Chapter ThreeDocument45 pagesChapter ThreeAlemu yohannesNo ratings yet

- Trade Logistics Facilitation Key To CompetitivenessDocument13 pagesTrade Logistics Facilitation Key To CompetitivenessKenneth TiongNo ratings yet

- Iii. Trade Policies and Practices by Measure (1) I: Sri Lanka WT/TPR/S/128Document45 pagesIii. Trade Policies and Practices by Measure (1) I: Sri Lanka WT/TPR/S/128activatedcarbonsolutionsNo ratings yet

- Indian Customs EDI SystemDocument9 pagesIndian Customs EDI SystemBalkar SinghNo ratings yet

- Impact assessment AAK: The impact of Tax on the Local Manufacture of PesticidesFrom EverandImpact assessment AAK: The impact of Tax on the Local Manufacture of PesticidesNo ratings yet

- South Asia Subregional Economic Cooperation: Trade Facilitation Strategic Framework 2014-2018From EverandSouth Asia Subregional Economic Cooperation: Trade Facilitation Strategic Framework 2014-2018No ratings yet

- Mann ArticlesDocument35 pagesMann Articlesthe kingfishNo ratings yet

- QNB Oman - Tariff of Charges-Retail-Version-2ENDocument5 pagesQNB Oman - Tariff of Charges-Retail-Version-2ENshady emadNo ratings yet

- 1676435842information and Communication Technology in Financial Institutions (ICTFI)Document305 pages1676435842information and Communication Technology in Financial Institutions (ICTFI)MD. RABIUL ISLAMNo ratings yet

- Dance Application Form FormatDocument2 pagesDance Application Form Formatvirbharat2000100% (1)

- Mobile BankingDocument90 pagesMobile Bankingneehal.singh13No ratings yet

- Planning and Working Capital ManagementDocument4 pagesPlanning and Working Capital ManagementSheena Mari Uy ElleveraNo ratings yet

- Tender Document - 1 - 2 - 3 PDFDocument60 pagesTender Document - 1 - 2 - 3 PDFsunikesh shuklaNo ratings yet

- Past Year QuestionsDocument21 pagesPast Year QuestionsJaswinNo ratings yet

- The Purchasing Process: Multiple Choice QuestionsDocument16 pagesThe Purchasing Process: Multiple Choice QuestionsPhoebe LanoNo ratings yet

- T & C A4 Formerly BDONomura PDFDocument7 pagesT & C A4 Formerly BDONomura PDFMark Alvin DelizoNo ratings yet

- Chapter Three Cash ManagementDocument19 pagesChapter Three Cash ManagementeferemNo ratings yet

- 2 D21 - Packages - 020617Document2 pages2 D21 - Packages - 020617CHIA SIA HOCKNo ratings yet

- Final Digital Banking of Services The City Bank Limited-Mahfuz RahmanDocument48 pagesFinal Digital Banking of Services The City Bank Limited-Mahfuz Rahmanhitech.mahfuzNo ratings yet

- RBI Commercial Paper FAQDocument5 pagesRBI Commercial Paper FAQSourav BhowmickNo ratings yet

- Torts Cases 26 37Document16 pagesTorts Cases 26 37Russel SirotNo ratings yet

- MPM Expenditure Audit Cheque Payment DraftDocument27 pagesMPM Expenditure Audit Cheque Payment DraftYolande Gyles LevyNo ratings yet

- Banker-Customer - Relationship: Nature, Types-General and Special Including Legal AspectsDocument61 pagesBanker-Customer - Relationship: Nature, Types-General and Special Including Legal AspectsSaiful IslamNo ratings yet

- Auditing Problem Cash and Cash Equivalent - Compress 1Document19 pagesAuditing Problem Cash and Cash Equivalent - Compress 1Vianney Claire RabeNo ratings yet

- Allied Banking Corp Vs Lim Sio Wan GR133179Document2 pagesAllied Banking Corp Vs Lim Sio Wan GR133179Atheena MondidoNo ratings yet

- Use The Following Information For The Next Two QuestionsDocument25 pagesUse The Following Information For The Next Two QuestionsJovel Paycana100% (1)

- ACC311-Final-Term-By Rana Abubakar KhanDocument17 pagesACC311-Final-Term-By Rana Abubakar Khanfari khNo ratings yet

- BillImage 1Document3 pagesBillImage 1Carlos Andres Barrera CastillaNo ratings yet

- ChequeDocument91 pagesChequeSaddy MehmoodbuttNo ratings yet

- Mca Deck NoeDocument10 pagesMca Deck NoeBright OkunkpolorNo ratings yet

- Bern Fly Rods - Case StudyDocument8 pagesBern Fly Rods - Case Studymasterdrews75% (4)

- Blank FormsDocument69 pagesBlank Formshgadkjg jdsgakjNo ratings yet

- Summary of Current Charges (RS) : Talk To Us SMSDocument13 pagesSummary of Current Charges (RS) : Talk To Us SMSBrandon FloresNo ratings yet

- Time and Expenses - Guide PDFDocument33 pagesTime and Expenses - Guide PDFNikhil SaravanNo ratings yet