Professional Documents

Culture Documents

Hayward Form 1

Hayward Form 1

Uploaded by

Anonymous ZRsuuxNcCCopyright:

Available Formats

You might also like

- WWW - Irs.gov Pub Irs-PDF f4506tDocument2 pagesWWW - Irs.gov Pub Irs-PDF f4506tJennifer GonzalezNo ratings yet

- Tin IndividualDocument60 pagesTin IndividualrajdeeppawarNo ratings yet

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax ReturnMarie LópezNo ratings yet

- Committee To Recall Mayor Jean Quan and Restore Oakland - 410 Initial 11-15-11 REDACTEDDocument4 pagesCommittee To Recall Mayor Jean Quan and Restore Oakland - 410 Initial 11-15-11 REDACTEDRecordTrac - City of OaklandNo ratings yet

- Pac Rep RRF 2004Document4 pagesPac Rep RRF 2004L. A. PatersonNo ratings yet

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax ReturnBilboDBaggins100% (1)

- Processed: Form6 Full and Public Disclosure of 2012 Financial InterestsDocument2 pagesProcessed: Form6 Full and Public Disclosure of 2012 Financial InterestsMy-Acts Of-SeditionNo ratings yet

- Blank 4506TDocument2 pagesBlank 4506TRoger PeiNo ratings yet

- Building International Bridges BIB Articles of Incorporation Page 19 BY LAWSDocument32 pagesBuilding International Bridges BIB Articles of Incorporation Page 19 BY LAWSJk McCreaNo ratings yet

- New Fresno Fax NumberDocument3 pagesNew Fresno Fax Numberfitness255No ratings yet

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax ReturnJulie Payne-King100% (2)

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax Returnapi-268415505No ratings yet

- Bureau of Internal Revenue Form 1604e 2016Document2 pagesBureau of Internal Revenue Form 1604e 2016Lynnard Philip PanesNo ratings yet

- Philhealth RF1-Employer RemittanceDocument2 pagesPhilhealth RF1-Employer RemittanceAimee F100% (3)

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax Returndavis_dion22No ratings yet

- Form 1023 Checklist: (Revised June 2006)Document44 pagesForm 1023 Checklist: (Revised June 2006)huffpostNo ratings yet

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax ReturnmarlygradeNo ratings yet

- ApplicationDocument4 pagesApplicationBrieMeyerNo ratings yet

- 4506-T FormDocument1 page4506-T FormStephen J. O'MalleyNo ratings yet

- Form 4506 TDocument2 pagesForm 4506 Tbhill07No ratings yet

- UCC1Document2 pagesUCC1kingsep007100% (2)

- Print Reset: Ucc Financing StatementDocument2 pagesPrint Reset: Ucc Financing Statementandy millerNo ratings yet

- Print Reset: + - +,##) 0 - E ("#& (/%#F#GH+&%#+ #) +&0 0# (0# - % #I@JAK@63LMDocument2 pagesPrint Reset: + - +,##) 0 - E ("#& (/%#F#GH+&%#+ #) +&0 0# (0# - % #I@JAK@63LMlyocco1No ratings yet

- IRS Form 1023 - 501c3 Application For Recognition of Non ExemptionDocument30 pagesIRS Form 1023 - 501c3 Application For Recognition of Non ExemptioneleanorawardNo ratings yet

- 4506 T FormDocument1 page4506 T FormSolomon WoldeNo ratings yet

- BIR Form 1604EDocument2 pagesBIR Form 1604Ecld_tiger100% (2)

- LLC 12Document3 pagesLLC 12fitness255No ratings yet

- Committee To Recall Mayor Quan Now - 410 Term 07-29-13 REDACTEDDocument3 pagesCommittee To Recall Mayor Quan Now - 410 Term 07-29-13 REDACTEDRecordTrac - City of OaklandNo ratings yet

- Easiest & Fastest!: Online Scan and Upload Your Form Directly To Your Loan Through Our Online Portal atDocument3 pagesEasiest & Fastest!: Online Scan and Upload Your Form Directly To Your Loan Through Our Online Portal atBrady-Juice FaucettNo ratings yet

- Judgement Lein FormDocument4 pagesJudgement Lein Formlizako100% (2)

- Instructions For Completing This Form 13.1 Financial StatementDocument33 pagesInstructions For Completing This Form 13.1 Financial StatementMy Support CalculatorNo ratings yet

- Annual Information Return of Creditable Income Taxes Withheld (Expanded) / Income Payments Exempt From Withholding TaxDocument2 pagesAnnual Information Return of Creditable Income Taxes Withheld (Expanded) / Income Payments Exempt From Withholding TaxAngela ArleneNo ratings yet

- 1604 e 99Document4 pages1604 e 99ILubo AkNo ratings yet

- Agions KT: For Instructions, Back of For DR-1Document1 pageAgions KT: For Instructions, Back of For DR-1Zach EdwardsNo ratings yet

- PhilHealth Revised Employer Remittance Report-RF-1 PDFDocument2 pagesPhilHealth Revised Employer Remittance Report-RF-1 PDFYvan Jackson Marquez NacionalesNo ratings yet

- Indigency Application (Completed) PDFDocument4 pagesIndigency Application (Completed) PDFdcarson90No ratings yet

- Taxpayer Registration Form TRF 01 For STRNNTNDocument8 pagesTaxpayer Registration Form TRF 01 For STRNNTNHammad Nazir MalikNo ratings yet

- Instructions For Semiannual Report For CW-1 Employers: Purpose of Form I-129CWRDocument6 pagesInstructions For Semiannual Report For CW-1 Employers: Purpose of Form I-129CWRDenis Eduardo Mix muñosNo ratings yet

- F 3949 ADocument3 pagesF 3949 Aiamsomedude100% (3)

- 4506 TDocument3 pages4506 Tteddy rooseveltNo ratings yet

- Short Form Request For Individual Tax Return TranscriptDocument2 pagesShort Form Request For Individual Tax Return TranscriptAmber CarterNo ratings yet

- Government Form 1310Document3 pagesGovernment Form 1310EmilyNo ratings yet

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnKaradi KuttiNo ratings yet

- Fss 4Document2 pagesFss 4craz8gtNo ratings yet

- Request For Public Inspection or Copy of Exempt or Political Organization IRS FormDocument2 pagesRequest For Public Inspection or Copy of Exempt or Political Organization IRS FormIRS100% (1)

- 2848 - Arnold Part 2Document2 pages2848 - Arnold Part 2Arnissia Dior100% (5)

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax Returntemp ashisNo ratings yet

- Employer's QUARTERLY Federal Tax Return: 5 3 1 3 1 0 0 1 0 Kenifer Corp Computer SolutionsDocument4 pagesEmployer's QUARTERLY Federal Tax Return: 5 3 1 3 1 0 0 1 0 Kenifer Corp Computer SolutionsrobbickelNo ratings yet

- Filling Instructions 03Document1 pageFilling Instructions 03Abdurrehman ShaheenNo ratings yet

- Bloomberg 2012Document316 pagesBloomberg 2012josephlordNo ratings yet

- UCC1Document2 pagesUCC1Thomas Bull Rearden50% (4)

- CRS - 2022Document13 pagesCRS - 2022johny SahaNo ratings yet

- f1099msc 2019Document8 pagesf1099msc 2019pyatetsky100% (1)

- Fomtnp RRF 2015Document2 pagesFomtnp RRF 2015L. A. PatersonNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- PR-Sisson Personnel FileDocument51 pagesPR-Sisson Personnel FileAnonymous ZRsuuxNcCNo ratings yet

- Potential SuspectDocument6 pagesPotential SuspectAnonymous ZRsuuxNcCNo ratings yet

- Schmitt SchedulingDocument7 pagesSchmitt SchedulingAnonymous ZRsuuxNcCNo ratings yet

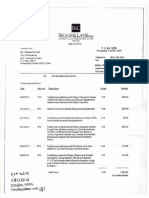

- B&L InvoicesDocument6 pagesB&L InvoicesAnonymous ZRsuuxNcCNo ratings yet

- Scan Doc0035Document1 pageScan Doc0035Anonymous ZRsuuxNcCNo ratings yet

- Handwritten NotesDocument1 pageHandwritten NotesAnonymous ZRsuuxNcCNo ratings yet

- M. Casey Rodgers: United States District Court Northern District of Florida Pensacola DivisionDocument1 pageM. Casey Rodgers: United States District Court Northern District of Florida Pensacola DivisionAnonymous ZRsuuxNcCNo ratings yet

- Scan Doc0005Document3 pagesScan Doc0005Anonymous ZRsuuxNcCNo ratings yet

- DocumentsDocument6 pagesDocumentsAnonymous ZRsuuxNcCNo ratings yet

- Taxi Denied Appeal ListDocument3 pagesTaxi Denied Appeal ListAnonymous ZRsuuxNcCNo ratings yet

- MX-2615N 20160204 171738Document24 pagesMX-2615N 20160204 171738Anonymous ZRsuuxNcCNo ratings yet

- Scan Doc0004Document2 pagesScan Doc0004Anonymous ZRsuuxNcCNo ratings yet

- City of Pensacola Penny For Progress Unfunded Projects: T T R RiDocument1 pageCity of Pensacola Penny For Progress Unfunded Projects: T T R RiAnonymous ZRsuuxNcCNo ratings yet

- Scan Doc0001Document1 pageScan Doc0001Anonymous ZRsuuxNcCNo ratings yet

- Company Labor Statistics-17-0519-00-EDocument2 pagesCompany Labor Statistics-17-0519-00-EPrasad D VishnuNo ratings yet

- Islam - : Shiism - The Quran Has Been CorruptedDocument1 pageIslam - : Shiism - The Quran Has Been Corruptedsuria0384No ratings yet

- Articles of IncorporationDocument3 pagesArticles of IncorporationRossette AnasarioNo ratings yet

- Vocab 27 NewDocument2 pagesVocab 27 Newapi-359741140No ratings yet

- Proftvo2 Chapter 1 MetacognitionDocument10 pagesProftvo2 Chapter 1 MetacognitionHannah CoNo ratings yet

- Round 1 Case StudyDocument15 pagesRound 1 Case StudyChánh Thảo LêNo ratings yet

- Shashwat Bhaiya ReferencesDocument10 pagesShashwat Bhaiya ReferencesAnant KumarNo ratings yet

- The Korean WarDocument11 pagesThe Korean WarbbybellsNo ratings yet

- Minimising Pollution Intakes: Technical MemorandaDocument27 pagesMinimising Pollution Intakes: Technical MemorandaAmando GonzalesNo ratings yet

- Bài tập tiếng Anh lớp 12 unit 9 kèm đáp án chuẩnDocument9 pagesBài tập tiếng Anh lớp 12 unit 9 kèm đáp án chuẩnЮляNo ratings yet

- Industry Requirement Anlaysis For Corporate Gifting in FMCGDocument19 pagesIndustry Requirement Anlaysis For Corporate Gifting in FMCGPrinceCharmIngMuthilyNo ratings yet

- Lopez Edilbert B. Back Up Power System For Water Supply Station FinalDocument32 pagesLopez Edilbert B. Back Up Power System For Water Supply Station Finalalvin castroNo ratings yet

- Should Students Have To Wear School UniformsDocument2 pagesShould Students Have To Wear School UniformsAoi Miyu Shino100% (1)

- AhichchhatraDocument7 pagesAhichchhatraSeshagiriNo ratings yet

- The Cassata Foundation Gives Supports Local Businesses and Suffolk County Police DepartmentDocument2 pagesThe Cassata Foundation Gives Supports Local Businesses and Suffolk County Police DepartmentPR.comNo ratings yet

- Behavioral Finance Quiz 1 FlashcardsDocument7 pagesBehavioral Finance Quiz 1 FlashcardsBinod ThakurNo ratings yet

- The Customs of The Tagalogs: By: Juan de PlasenciaDocument19 pagesThe Customs of The Tagalogs: By: Juan de Plasenciajoan100% (2)

- Chose T1-God's Vision of A FamilyDocument4 pagesChose T1-God's Vision of A FamilyraceNo ratings yet

- Psychosocial Assessment SWK Practice IIIDocument7 pagesPsychosocial Assessment SWK Practice IIIapi-628734736No ratings yet

- StrategyDocument22 pagesStrategyPraveen GaikwadNo ratings yet

- Following Are The Honda Atlas' Important Strengths, Weaknesses, Opportunities and ThreatsDocument3 pagesFollowing Are The Honda Atlas' Important Strengths, Weaknesses, Opportunities and ThreatsSaad MajeedNo ratings yet

- Macroeconomics Module11 LectureDocument13 pagesMacroeconomics Module11 LectureCeleste LeeNo ratings yet

- True DiscipleshipDocument34 pagesTrue DiscipleshipErzsebet Farkas100% (1)

- Room To Roam England's Irish TravellersDocument130 pagesRoom To Roam England's Irish TravellersGundappa GunaNo ratings yet

- Women Depiction in Fairy TalesDocument6 pagesWomen Depiction in Fairy TalesSaad SaeedNo ratings yet

- CLJ 2005 1 793Document26 pagesCLJ 2005 1 793Hui ZhenNo ratings yet

- Media Policy 101Document20 pagesMedia Policy 101empressrulerNo ratings yet

- Establishment Serials of SECR - 01/2011Document31 pagesEstablishment Serials of SECR - 01/2011msnhot40No ratings yet

- Palestine Israel ConflictDocument6 pagesPalestine Israel ConflictajeehaniaziNo ratings yet

- Flap T - The American TDocument18 pagesFlap T - The American TrrrgbfjjNo ratings yet

Hayward Form 1

Hayward Form 1

Uploaded by

Anonymous ZRsuuxNcCOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hayward Form 1

Hayward Form 1

Uploaded by

Anonymous ZRsuuxNcCCopyright:

Available Formats

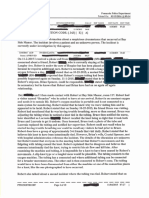

FORM 1

k

Please prirt or type your neme, mNlllng

addrcss, agency name, and posltlon below:

STATEMENT OF

FTNANCIAL INTBRBSTS

2A'3,

FOR OFFICE USE ONLY:

LAST NAME

*

FIRST NAME

-

MIDDLE NAME :

'D

ll.tnrtr{ 4rL/o-'

l^^p3

t|o.

6,atc tz I

to

'94.jil!{

lx

ls:

CITY:

fcnsc tol-

zt?:

Jz,f

2l

COUNW:

NAME OF OFFICE OR POSITION HEID OR SOUGHT:

y'le7o-

You are not limited to th gxc6 on the llnes on ttb form, Attach addhlonal sheets, lf nece$ary,

.-

CHECK ONLY rF

ff

CnruoronrE oR

O

NEWEMPLOYEE ORAPPO|NTEE

*"N"

BOTH PARTS OF THIS SECTION MUST BE COMPLETED

**N*

DISCLOSURE PERIOD:

THIS SIATEMENT REFLECTS YOUR FINANCIAL INTERESTS FOR THE PRECEDING TAX YEAR, WHETHER BASED ON A CALENOAR

YEAR OR ON A FISCAL YEAR. PLEASE STATE BELOW TMIETHER THIS STATEMENT IS FOR THE PRECEDING TAX YEAR ENDING

EITHER (mgl check one):

{ DEcEMBER31,2013

oa D spEcTFyTnxyEARTFoTHERTHANTHEcALENDARyEAR:

MANNER OF CALCULATING REPORTABLE INTERESTS:

FILERS HAVE THE OPTION OF USING REPORTING THRESHOLDS THATARE ABSOLUTE DOTIAR VALUES, WHICH REQUIRES FEWER

CALCULATIONS, OR USING COMPARATIVE THRESHOLDS, WHICH ARE USUALLY BASED ON PERCENTAGE VALUES (see instructions for

further details). CHECK THE ONE YOU ARE USTNG:

*--

4 coMPARATtvE(pERcENTAcElrHREsHoLDs

aa tr DoLLARVALUETHRESHoLDS

PART A

-

PRllulARY SOURCES OF INCOME

lMajor

sources of income to the reporting person - See instructions]

(lf you have nothing to roport, write "none" or "nla")

NAME OF SOURCE

I

oF rNcoME

I

souRcE's

ADDRESS

I

DEscRtpIoN oF THE souRcE's

I PRINCIPALBUSINESSACTIVITY

'*

f^-

"

PART B

-

SECONDARY SOURCES OF INCOI,IE

[Major

customers, clients, and other sources of income to businesses owned by the reporting person - See instructionsl

(lf you have nothing to repor! write "none" or.'nla..)

NAME OF

BUSINESS ENTIry

I

NAME OF MAJOR SOURCES

I

I

oF BUSTNESS,TNCOME

I

ADDRESS

OF SOURCE

I

PR|NCIPAT BUSTNESS

I

ACTTVTTY OF SOURCE

"

4/.

"

PART C

-

REAL PROPERW

[Land,

buildings or,r/ned by the reporting person - See instructions]

(lf you have nolhing to reporl, write "none" or "n/a")

FILING INSTRUCTIONS for

when and where to file this

form are located at the bottom

of page 2,

INSTRUCTION$ on who must

file this form and how to fill it

out begin on page 3.

t

t 7ao

7t+,,.a..'17

fu..nF

,rto-r2

Esc Co

-

CE FORM I - E fecive: Janusry 1, 2014.

Adoptgd by referanco in Rut 3+8.202t1), FA.C

(Gontlnued on revorse sld6) PAGE 1

PART D

-

tNTAilGtBLE

pERSOitAL

PROPERW

[Stocks,

bonds, certificates of deposit, etc. - see instructions]

{lt

you have nothlng to report, write'none" or "nla")

I

NAMEoFGRED|ToR|-ADDRESSoFCRED|ToR

PART E

-

LIABILITIES [Major

debts - See instruc$onsl

(lf you have nothlng to roport, wdte "none' or "nla')

llo

3. 6o; /a-t tf.ccf . ?c.satol+,tsf. l*fe?-

-r=

igOe?

8a

zrtac..s 4,2c. ?easaoola

Fl J2$-o2

v

(tf you have nothing to repor! write "nons" or "nla")

BUStNEss ENTtry # r

r

BUslNEss ENTlry # 2

NAME OF BUSTNESS ENrlrY

|

'!-'

'

I

PART F

-

INTERESTS lN SpEclFlED BUSINESSES [Ownarshlp

or poclttons ln certaln

gpes of busineeseg'se instructlonsl

ADDRESS OF BUSINESS ENTIW

PRINCIPAL BUSINESS ACTIVITY

POSITION HELD WTH ENTITY

I OVVN MORE THAN A 5% INTEREST IN THE BUSINESS

NATURE OF MY OIINERSHIP INTEREST

SIGNATURE

(reouired):

kfrz/4

DATE SIGNED

(reouiredl:

t

/t,/tv

-

f a certified

public accountffised

under ch$ter 4i3, or attomey in good standing with the Florida Bar

prepared this form for you,

ihe musl complete the following statement:

.

prepared

the CE Form 1 in accordance with Section 1'12.3145, Florida Statutes,

Inoilied'ge and belief, the disclosure herein is true and correct.

he or

my

Signature

Date

WHAT TO FILE:

Afier completing all parts of this form, lnClgdbC

3igning snd datlno lt send back only the first

sheet (pages 'l and 2) for filing.

lf you havo nothlng to roport in a particular

section,

you must write 'none" or "rVa" in that

section(s).

NOTE:

MULTIPLE FILING UNNECESSARY:

Generally, a person who has filed Form 1 for a

calendar or fiscal year is not required to file a

second Form 1 for the same year. However' a

candidate who previously filed Form 1 because of

another

pubtic po$ition must at least fle a copy of

his or her original Form 1 when gualifying.

WHERE TO FILE:

lf you were mailed the form by the Commlssion

on Ethics or a County SupoMsor of Eleciions for

your annual disdosure filir, retum the form to that

location.

Local officers/employees

file with the Supervisor

of Elections of the county in which they permanendy

reside. (lf you do not permanenty eside in Florida'

file with the Supervisor of lhe county where your

agency has its headguarters.)

State offcer4s or qecilled slrte ettproyees file

with the Commission on Ethics, P.O. Drawer 15709'

Tallahassee, FL 32317-5709; physical address:

325 John Knox Road, Building E' Suiie 200'

Tallahassee, FL 32303.

WHEN TO FILE:

lninatty, each local ofrcer/employee, state oficer,

and speofied state employee must file lslfiin

30 days of the date of his or her appdntrnent

or of the beginnitE of employnent. Appointees

who must be confirmed by the Senate must file

prior to confrmation, even if that is less than

30 days from the date of their appointnent.

Candidales for pubticly-eteded local offce must file

st the same time they file their qualirying papers.

Thercafter, local oftcers/employees, state offices

and specifed state employees are required to file

by July 1st following eadl calendar year in whiclt

they hold their positions.

Finally, at the end of ofice or employmert, eadl

local oficer/employee, stiate offcer, and specifted

state employee is required to file a final disclosure

form (Form 1F) within 60 days of leaving office or

employment. Hoarever, filing a CE Fofm 1F (Final

Statement of Financial Interests) does ngl

telievs

tre filer of filing a CE Form 1 if he or she was in their

position on December 31, 20'13.

Candida|.c,s

file this form together with

qualirying

PaPers.

To determine what category your position falls

under, see the 'V\ltro Must File" Instruolions on

page 3.

Facsimiles

will not be accePted.

their

CE FORM 1 - Eltec{ve: January 1,2014.

Adoptd by cisronce in Rule 3+8.202(l)' F.A.C.

PAGE 2

You might also like

- WWW - Irs.gov Pub Irs-PDF f4506tDocument2 pagesWWW - Irs.gov Pub Irs-PDF f4506tJennifer GonzalezNo ratings yet

- Tin IndividualDocument60 pagesTin IndividualrajdeeppawarNo ratings yet

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax ReturnMarie LópezNo ratings yet

- Committee To Recall Mayor Jean Quan and Restore Oakland - 410 Initial 11-15-11 REDACTEDDocument4 pagesCommittee To Recall Mayor Jean Quan and Restore Oakland - 410 Initial 11-15-11 REDACTEDRecordTrac - City of OaklandNo ratings yet

- Pac Rep RRF 2004Document4 pagesPac Rep RRF 2004L. A. PatersonNo ratings yet

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax ReturnBilboDBaggins100% (1)

- Processed: Form6 Full and Public Disclosure of 2012 Financial InterestsDocument2 pagesProcessed: Form6 Full and Public Disclosure of 2012 Financial InterestsMy-Acts Of-SeditionNo ratings yet

- Blank 4506TDocument2 pagesBlank 4506TRoger PeiNo ratings yet

- Building International Bridges BIB Articles of Incorporation Page 19 BY LAWSDocument32 pagesBuilding International Bridges BIB Articles of Incorporation Page 19 BY LAWSJk McCreaNo ratings yet

- New Fresno Fax NumberDocument3 pagesNew Fresno Fax Numberfitness255No ratings yet

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax ReturnJulie Payne-King100% (2)

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax Returnapi-268415505No ratings yet

- Bureau of Internal Revenue Form 1604e 2016Document2 pagesBureau of Internal Revenue Form 1604e 2016Lynnard Philip PanesNo ratings yet

- Philhealth RF1-Employer RemittanceDocument2 pagesPhilhealth RF1-Employer RemittanceAimee F100% (3)

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax Returndavis_dion22No ratings yet

- Form 1023 Checklist: (Revised June 2006)Document44 pagesForm 1023 Checklist: (Revised June 2006)huffpostNo ratings yet

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax ReturnmarlygradeNo ratings yet

- ApplicationDocument4 pagesApplicationBrieMeyerNo ratings yet

- 4506-T FormDocument1 page4506-T FormStephen J. O'MalleyNo ratings yet

- Form 4506 TDocument2 pagesForm 4506 Tbhill07No ratings yet

- UCC1Document2 pagesUCC1kingsep007100% (2)

- Print Reset: Ucc Financing StatementDocument2 pagesPrint Reset: Ucc Financing Statementandy millerNo ratings yet

- Print Reset: + - +,##) 0 - E ("#& (/%#F#GH+&%#+ #) +&0 0# (0# - % #I@JAK@63LMDocument2 pagesPrint Reset: + - +,##) 0 - E ("#& (/%#F#GH+&%#+ #) +&0 0# (0# - % #I@JAK@63LMlyocco1No ratings yet

- IRS Form 1023 - 501c3 Application For Recognition of Non ExemptionDocument30 pagesIRS Form 1023 - 501c3 Application For Recognition of Non ExemptioneleanorawardNo ratings yet

- 4506 T FormDocument1 page4506 T FormSolomon WoldeNo ratings yet

- BIR Form 1604EDocument2 pagesBIR Form 1604Ecld_tiger100% (2)

- LLC 12Document3 pagesLLC 12fitness255No ratings yet

- Committee To Recall Mayor Quan Now - 410 Term 07-29-13 REDACTEDDocument3 pagesCommittee To Recall Mayor Quan Now - 410 Term 07-29-13 REDACTEDRecordTrac - City of OaklandNo ratings yet

- Easiest & Fastest!: Online Scan and Upload Your Form Directly To Your Loan Through Our Online Portal atDocument3 pagesEasiest & Fastest!: Online Scan and Upload Your Form Directly To Your Loan Through Our Online Portal atBrady-Juice FaucettNo ratings yet

- Judgement Lein FormDocument4 pagesJudgement Lein Formlizako100% (2)

- Instructions For Completing This Form 13.1 Financial StatementDocument33 pagesInstructions For Completing This Form 13.1 Financial StatementMy Support CalculatorNo ratings yet

- Annual Information Return of Creditable Income Taxes Withheld (Expanded) / Income Payments Exempt From Withholding TaxDocument2 pagesAnnual Information Return of Creditable Income Taxes Withheld (Expanded) / Income Payments Exempt From Withholding TaxAngela ArleneNo ratings yet

- 1604 e 99Document4 pages1604 e 99ILubo AkNo ratings yet

- Agions KT: For Instructions, Back of For DR-1Document1 pageAgions KT: For Instructions, Back of For DR-1Zach EdwardsNo ratings yet

- PhilHealth Revised Employer Remittance Report-RF-1 PDFDocument2 pagesPhilHealth Revised Employer Remittance Report-RF-1 PDFYvan Jackson Marquez NacionalesNo ratings yet

- Indigency Application (Completed) PDFDocument4 pagesIndigency Application (Completed) PDFdcarson90No ratings yet

- Taxpayer Registration Form TRF 01 For STRNNTNDocument8 pagesTaxpayer Registration Form TRF 01 For STRNNTNHammad Nazir MalikNo ratings yet

- Instructions For Semiannual Report For CW-1 Employers: Purpose of Form I-129CWRDocument6 pagesInstructions For Semiannual Report For CW-1 Employers: Purpose of Form I-129CWRDenis Eduardo Mix muñosNo ratings yet

- F 3949 ADocument3 pagesF 3949 Aiamsomedude100% (3)

- 4506 TDocument3 pages4506 Tteddy rooseveltNo ratings yet

- Short Form Request For Individual Tax Return TranscriptDocument2 pagesShort Form Request For Individual Tax Return TranscriptAmber CarterNo ratings yet

- Government Form 1310Document3 pagesGovernment Form 1310EmilyNo ratings yet

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnKaradi KuttiNo ratings yet

- Fss 4Document2 pagesFss 4craz8gtNo ratings yet

- Request For Public Inspection or Copy of Exempt or Political Organization IRS FormDocument2 pagesRequest For Public Inspection or Copy of Exempt or Political Organization IRS FormIRS100% (1)

- 2848 - Arnold Part 2Document2 pages2848 - Arnold Part 2Arnissia Dior100% (5)

- Request For Transcript of Tax ReturnDocument2 pagesRequest For Transcript of Tax Returntemp ashisNo ratings yet

- Employer's QUARTERLY Federal Tax Return: 5 3 1 3 1 0 0 1 0 Kenifer Corp Computer SolutionsDocument4 pagesEmployer's QUARTERLY Federal Tax Return: 5 3 1 3 1 0 0 1 0 Kenifer Corp Computer SolutionsrobbickelNo ratings yet

- Filling Instructions 03Document1 pageFilling Instructions 03Abdurrehman ShaheenNo ratings yet

- Bloomberg 2012Document316 pagesBloomberg 2012josephlordNo ratings yet

- UCC1Document2 pagesUCC1Thomas Bull Rearden50% (4)

- CRS - 2022Document13 pagesCRS - 2022johny SahaNo ratings yet

- f1099msc 2019Document8 pagesf1099msc 2019pyatetsky100% (1)

- Fomtnp RRF 2015Document2 pagesFomtnp RRF 2015L. A. PatersonNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- PR-Sisson Personnel FileDocument51 pagesPR-Sisson Personnel FileAnonymous ZRsuuxNcCNo ratings yet

- Potential SuspectDocument6 pagesPotential SuspectAnonymous ZRsuuxNcCNo ratings yet

- Schmitt SchedulingDocument7 pagesSchmitt SchedulingAnonymous ZRsuuxNcCNo ratings yet

- B&L InvoicesDocument6 pagesB&L InvoicesAnonymous ZRsuuxNcCNo ratings yet

- Scan Doc0035Document1 pageScan Doc0035Anonymous ZRsuuxNcCNo ratings yet

- Handwritten NotesDocument1 pageHandwritten NotesAnonymous ZRsuuxNcCNo ratings yet

- M. Casey Rodgers: United States District Court Northern District of Florida Pensacola DivisionDocument1 pageM. Casey Rodgers: United States District Court Northern District of Florida Pensacola DivisionAnonymous ZRsuuxNcCNo ratings yet

- Scan Doc0005Document3 pagesScan Doc0005Anonymous ZRsuuxNcCNo ratings yet

- DocumentsDocument6 pagesDocumentsAnonymous ZRsuuxNcCNo ratings yet

- Taxi Denied Appeal ListDocument3 pagesTaxi Denied Appeal ListAnonymous ZRsuuxNcCNo ratings yet

- MX-2615N 20160204 171738Document24 pagesMX-2615N 20160204 171738Anonymous ZRsuuxNcCNo ratings yet

- Scan Doc0004Document2 pagesScan Doc0004Anonymous ZRsuuxNcCNo ratings yet

- City of Pensacola Penny For Progress Unfunded Projects: T T R RiDocument1 pageCity of Pensacola Penny For Progress Unfunded Projects: T T R RiAnonymous ZRsuuxNcCNo ratings yet

- Scan Doc0001Document1 pageScan Doc0001Anonymous ZRsuuxNcCNo ratings yet

- Company Labor Statistics-17-0519-00-EDocument2 pagesCompany Labor Statistics-17-0519-00-EPrasad D VishnuNo ratings yet

- Islam - : Shiism - The Quran Has Been CorruptedDocument1 pageIslam - : Shiism - The Quran Has Been Corruptedsuria0384No ratings yet

- Articles of IncorporationDocument3 pagesArticles of IncorporationRossette AnasarioNo ratings yet

- Vocab 27 NewDocument2 pagesVocab 27 Newapi-359741140No ratings yet

- Proftvo2 Chapter 1 MetacognitionDocument10 pagesProftvo2 Chapter 1 MetacognitionHannah CoNo ratings yet

- Round 1 Case StudyDocument15 pagesRound 1 Case StudyChánh Thảo LêNo ratings yet

- Shashwat Bhaiya ReferencesDocument10 pagesShashwat Bhaiya ReferencesAnant KumarNo ratings yet

- The Korean WarDocument11 pagesThe Korean WarbbybellsNo ratings yet

- Minimising Pollution Intakes: Technical MemorandaDocument27 pagesMinimising Pollution Intakes: Technical MemorandaAmando GonzalesNo ratings yet

- Bài tập tiếng Anh lớp 12 unit 9 kèm đáp án chuẩnDocument9 pagesBài tập tiếng Anh lớp 12 unit 9 kèm đáp án chuẩnЮляNo ratings yet

- Industry Requirement Anlaysis For Corporate Gifting in FMCGDocument19 pagesIndustry Requirement Anlaysis For Corporate Gifting in FMCGPrinceCharmIngMuthilyNo ratings yet

- Lopez Edilbert B. Back Up Power System For Water Supply Station FinalDocument32 pagesLopez Edilbert B. Back Up Power System For Water Supply Station Finalalvin castroNo ratings yet

- Should Students Have To Wear School UniformsDocument2 pagesShould Students Have To Wear School UniformsAoi Miyu Shino100% (1)

- AhichchhatraDocument7 pagesAhichchhatraSeshagiriNo ratings yet

- The Cassata Foundation Gives Supports Local Businesses and Suffolk County Police DepartmentDocument2 pagesThe Cassata Foundation Gives Supports Local Businesses and Suffolk County Police DepartmentPR.comNo ratings yet

- Behavioral Finance Quiz 1 FlashcardsDocument7 pagesBehavioral Finance Quiz 1 FlashcardsBinod ThakurNo ratings yet

- The Customs of The Tagalogs: By: Juan de PlasenciaDocument19 pagesThe Customs of The Tagalogs: By: Juan de Plasenciajoan100% (2)

- Chose T1-God's Vision of A FamilyDocument4 pagesChose T1-God's Vision of A FamilyraceNo ratings yet

- Psychosocial Assessment SWK Practice IIIDocument7 pagesPsychosocial Assessment SWK Practice IIIapi-628734736No ratings yet

- StrategyDocument22 pagesStrategyPraveen GaikwadNo ratings yet

- Following Are The Honda Atlas' Important Strengths, Weaknesses, Opportunities and ThreatsDocument3 pagesFollowing Are The Honda Atlas' Important Strengths, Weaknesses, Opportunities and ThreatsSaad MajeedNo ratings yet

- Macroeconomics Module11 LectureDocument13 pagesMacroeconomics Module11 LectureCeleste LeeNo ratings yet

- True DiscipleshipDocument34 pagesTrue DiscipleshipErzsebet Farkas100% (1)

- Room To Roam England's Irish TravellersDocument130 pagesRoom To Roam England's Irish TravellersGundappa GunaNo ratings yet

- Women Depiction in Fairy TalesDocument6 pagesWomen Depiction in Fairy TalesSaad SaeedNo ratings yet

- CLJ 2005 1 793Document26 pagesCLJ 2005 1 793Hui ZhenNo ratings yet

- Media Policy 101Document20 pagesMedia Policy 101empressrulerNo ratings yet

- Establishment Serials of SECR - 01/2011Document31 pagesEstablishment Serials of SECR - 01/2011msnhot40No ratings yet

- Palestine Israel ConflictDocument6 pagesPalestine Israel ConflictajeehaniaziNo ratings yet

- Flap T - The American TDocument18 pagesFlap T - The American TrrrgbfjjNo ratings yet