Professional Documents

Culture Documents

Danville - General Fund

Danville - General Fund

Uploaded by

SouthsideCentralCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Contemporary Calculus TextbookDocument526 pagesContemporary Calculus TextbookJosé Luis Salazar Espitia100% (2)

- Corporate Venture Studios DirectoryDocument12 pagesCorporate Venture Studios Directorymoctapka0880% (1)

- g12 Core ValuesDocument1 pageg12 Core ValuesRenzo Miclat100% (1)

- Law of Inheritance in Different ReligionsDocument35 pagesLaw of Inheritance in Different ReligionsSumbal83% (12)

- Dps 2015 StatsDocument1 pageDps 2015 StatsSouthsideCentralNo ratings yet

- EcomNets Indictment Filed and DocketedDocument27 pagesEcomNets Indictment Filed and DocketedSouthsideCentral100% (1)

- DRF 2014 GrantsDocument1 pageDRF 2014 GrantsSouthsideCentralNo ratings yet

- Final School Board BudgetDocument1 pageFinal School Board BudgetSouthsideCentralNo ratings yet

- Sutherlin Mansion Expenses-February 2016Document1 pageSutherlin Mansion Expenses-February 2016SouthsideCentralNo ratings yet

- June RIFA Agenda - Page 11-13Document3 pagesJune RIFA Agenda - Page 11-13SouthsideCentralNo ratings yet

- SSED GrantsDocument1 pageSSED GrantsSouthsideCentralNo ratings yet

- 2014-2015 RetireesDocument1 page2014-2015 RetireesSouthsideCentralNo ratings yet

- Danville-Pittsylvania Regional Industrial Facility AuthorityDocument26 pagesDanville-Pittsylvania Regional Industrial Facility AuthoritySouthsideCentralNo ratings yet

- Nascar TripDocument1 pageNascar TripSouthsideCentralNo ratings yet

- RIFA FinancialsDocument9 pagesRIFA FinancialsSouthsideCentralNo ratings yet

- Seizure WarrantDocument2 pagesSeizure WarrantSouthsideCentralNo ratings yet

- Merle Rutledge Gets Enjoined.Document18 pagesMerle Rutledge Gets Enjoined.SouthsideCentralNo ratings yet

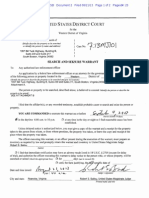

- Search Warrant - GrantedDocument2 pagesSearch Warrant - GrantedSouthsideCentralNo ratings yet

- Search Warrant - August 2013Document24 pagesSearch Warrant - August 2013SouthsideCentralNo ratings yet

- YSR Kalyanamasthu - Field - Verification - FormDocument2 pagesYSR Kalyanamasthu - Field - Verification - FormRamesh karubhukta100% (1)

- Oppositional Inference: Northwesternuniversity, IncDocument3 pagesOppositional Inference: Northwesternuniversity, IncDanica CumlatNo ratings yet

- Braille PDFDocument6 pagesBraille PDFSarah SalamatNo ratings yet

- Site Preparation and Resistance To Contaminants PDFDocument237 pagesSite Preparation and Resistance To Contaminants PDFAnasNo ratings yet

- AUTHORITY TO SELL - Literal - 10022023Document3 pagesAUTHORITY TO SELL - Literal - 10022023MICHAEL SALINASNo ratings yet

- C. Ra 6969 - Engr. Czes BongcoDocument87 pagesC. Ra 6969 - Engr. Czes Bongcorandell vasquezNo ratings yet

- David Copeland-Jackson IndictmentDocument12 pagesDavid Copeland-Jackson IndictmentWashington ExaminerNo ratings yet

- Lesson 7Document20 pagesLesson 7rj libayNo ratings yet

- 10 1016@j Tourman 2019 04 024Document15 pages10 1016@j Tourman 2019 04 024samarNo ratings yet

- 28224lab 3Document6 pages28224lab 3aman singhNo ratings yet

- A Cognitive Model of Posttraumatic Stress Disorder: Behaviour Research and Therapy April 2000Document28 pagesA Cognitive Model of Posttraumatic Stress Disorder: Behaviour Research and Therapy April 2000Fenrrir BritoNo ratings yet

- Practical Research 2 2021Document36 pagesPractical Research 2 2021Allen Paul Gamazon0% (1)

- 2024 03 06 Introduction Lecture Series Climate Protection SS2024Document45 pages2024 03 06 Introduction Lecture Series Climate Protection SS2024Abdullah Khan QadriNo ratings yet

- Chapter 7 Double Entry System: Very Short QuestionsDocument3 pagesChapter 7 Double Entry System: Very Short QuestionsVipulNo ratings yet

- Choreography Proposal: Dance Ensemble 2023: Choreographer'S InformationDocument6 pagesChoreography Proposal: Dance Ensemble 2023: Choreographer'S InformationTrey ErnyNo ratings yet

- Rose Doe v. The City of New York, Et. Al.Document57 pagesRose Doe v. The City of New York, Et. Al.Daily Caller News FoundationNo ratings yet

- New GAP Algorithm Draft 4-7-19Document1 pageNew GAP Algorithm Draft 4-7-19Umber AgarwalNo ratings yet

- Learn GermnaDocument36 pagesLearn Germnarahulchow2No ratings yet

- Kebf Prelim ReviewerDocument10 pagesKebf Prelim ReviewerJamaica EstorninosNo ratings yet

- Huawei Routing Overview CommandDocument26 pagesHuawei Routing Overview Commandeijasahamed100% (1)

- Cook and Serve Challenge 2024 Sponsorship Packages and Awards DinnerDocument3 pagesCook and Serve Challenge 2024 Sponsorship Packages and Awards DinnercarlateacherhellologosNo ratings yet

- November/December 2016Document72 pagesNovember/December 2016Dig DifferentNo ratings yet

- Unpacking Instructional Leadership QuestionnairesDocument7 pagesUnpacking Instructional Leadership QuestionnairesRENIEL MARK BASENo ratings yet

- TimetableDocument1 pageTimetableDiiptee SaravananNo ratings yet

- Welcome To Anderson Workone. Your Career Starts HereDocument28 pagesWelcome To Anderson Workone. Your Career Starts HereHilary TerryNo ratings yet

- Woody AllenDocument18 pagesWoody Allendougct100% (1)

Danville - General Fund

Danville - General Fund

Uploaded by

SouthsideCentralCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Danville - General Fund

Danville - General Fund

Uploaded by

SouthsideCentralCopyright:

Available Formats

City of Danville

Virginia

FINANCE DEPARTMENT P.O. Box 3300

_______________ Danville, Virginia 24543

Michael L. Adkins Telephone (434) 799-5186

INTERIM DIRECTOR adkinml@danvilleva.gov

To: Joseph C. King, City Manager

From: Michael L. Adkins, Interim Director of Finance

Date: August 21, 2014

Subject: Summary of Preliminary General Fund Financial Results for July 31, 2014

After completing the first month of the new fiscal year, revenues are very comparable to

the previous year. An exception exists in Categorical Aid from the State because of a

timing difference. State funding for Social Services and J uvenile Detention was

received in J uly of last year, but were not received until August of this year, causing a

timing difference of about $850,000. As of J uly 31, General Fund revenues were

$4,858,170. This represents 5% of our FY 2015 budget. Last year, at this time, we had

collected $5,597,871, or 6% of budget. Adjusting for the timing difference, revenues

would be at 6.85% of budget at J uly 31, 2014.

We continue to see good performance in the collection of delinquent real estate taxes

this year with $179,781 realized in the first month of this fiscal year. This accounts for

nearly 20% of the current years budget. Local taxes collected through J uly 31, were

$1,676,615, or 7% of budget. This is very comparable to FY 2014, showing a small

increase of $1,153 from last year. Sales tax collections in J uly amounted to $704,624,

or 8.7% of budget. Meals taxes collected for the first month of the fiscal year amounted

to $643,478, an increase of $24,107 from last year, running ahead of budget at 9.6%.

Business Licenses realized at the end of J uly were $104,056, a decrease of $45,264

from the prior year. Lodging taxes received as of J uly 31, were $68,242, or 9% of

budget, almost identical to the prior year.

Another timing difference is noted in Charges for Services. The first billing for J uvenile

Detention services was delayed until August this year, creating a $100,000 difference

between the two years. This will correct itself next month. All other revenue categories

appear to be on track at present.

Expenditures at J uly 31 were $7,955,372, or 7.9% of budget. This is an increase of

$1,621,560 from J uly 31, 2013 resulting from the timing of budgeted transfers to

Danville City Schools. Departmental expenditures at the end of J uly show a decrease

of about $485,000 from last year. Total General Fund expenditures exceeded revenues

by $3,097,202. This is typical for the start of the fiscal year in the General Fund

because the timing of the revenue recognition is not matched to expenditures. For now,

the General Fund is performing as expected.

Budgets & Actual Percent Actual

Appropriations For Revenues & Expenditures Realized/Expended Balance to be Revenues & Expenditures

Current Year For Year-to-Date This Year Encumbrances Realized/Expended At This Date Last Year

REVENUES:

Property Taxes 28,092,220 $ 526,883 $ 1.88% 27,565,337 $ 435,426 $

Other Local Taxes 23,449,000 1,676,616 7.15% 21,772,384 1,675,462

License Permits & Privilege Fees 209,180 16,979 8.12% 192,201 23,525

Fines & Forfeitures 500,200 33,915 6.78% 466,285 34,640

Revenue From Use Money & Property 919,280 67,924 7.39% 851,356 64,479

Charges For Services 3,309,270 175,192 5.29% 3,134,078 259,590

Miscellaneous Revenue/Bonds 123,000 23,979 19.50% 99,021 29,574

Recovered Cost 5,531,090 373,413 6.75% 5,157,677 353,172

Non-Categorical Aid 5,808,000 290,996 5.01% 5,517,004 272,690

Shared Expenses (Categ. Aid State) 4,610,290 389,280 8.44% 4,221,010 350,419

Categorical Aid (State) 8,616,380 43,817 0.51% 8,572,563 900,394

Emergency Services (Federal) 27,020 - 0.00% 27,020 -

Categorical Aid (Federal) - 3,343 (3,343) -

Transfers From Utilities 14,830,000 1,235,833 8.33% 13,594,167 1,198,500

Transfers From Other - - - -

TOTAL REVENUES 96,024,930 $ 4,858,170 $ 5.06% 91,166,760 $ 5,597,871 $

EXPENDITURES:

General Government Administration 7,954,553 $ 909,822 $ 11.44% 242,282 $ 6,802,449 $ 1,062,721 $

J udicial Administration 6,169,497 494,016 8.01% 2,897 5,672,584 473,777

Public Safety 26,052,601 2,082,259 7.99% 622,428 23,347,914 2,305,693

Public Works 4,306,160 272,041 6.32% 214,208 3,819,911 259,228

Health, Education, Welfare & Soc. Svc. 8,309,705 403,508 4.86% 15,854 7,890,343 552,142

Parks, Recreation & Cultural 4,890,034 356,014 7.28% 50,471 4,483,549 328,920

Community Development 2,630,796 108,330 4.12% 36,597 2,485,869 129,214

Non-Departmental 12,604,513 676,323 5.37% 10,454 11,917,736 551,285

Transfer to Schools - Operating 19,583,045 2,632,005 13.44% 904,735 16,046,305 622,895

Transfer to Capital Projects 3,903,100 - 0.00% - 3,903,100 -

Transfer to Other Funds 4,419,080 21,054 0.48% - 4,398,026 47,937

TOTAL EXPENDITURES 100,823,084 $ 7,955,372 $ 7.89% 2,099,926 $ 90,767,786 $ 6,333,812 $

Revenue over(under) Expenditures (3,097,202) $

FUND BALANCE:

Beginning Fund Balance 07/01/14 - preliminary figure 41,204,500 $

Revenue over(under) Expenditures (3,097,202)

Ending Fund Balance 07/31/2014 38,107,298 $

Composition of Fund Balance:

Reserved for Encumbrances/Designated Funds 9,408,479 $

Unassigned 28,698,819

TOTAL FUND BALANCE 07/31/2014 38,107,298 $

CITY OF DANVILLE, VIRGINIA

8% OF YEAR LAPSED AS OF JULY 31, 2014

GENERAL FUND REPORT

**PRE-CLOSING FIGURES - SUBJECT TO CHANGE - UNAUDITED**

8/21/2014

Current Revenue Percentage Prior Year Prior Year Percentage

Description Budget Realized Realized Budget Realized Prior Year

Sales Tax 8,100,000 $ 704,624 $ 8.70% 8,100,000 $ 677,009 $ 8.36%

Business Licenses 4,800,000 104,056 2.17% 4,700,000 149,320 3.18%

Meals Tax 6,700,000 643,478 9.60% 6,700,000 619,371 9.24%

Utility Taxes 981,000 81,557 8.31% 975,000 82,975 8.51%

Vehicle License Fees 960,000 44,008 4.58% 950,000 40,188 4.23%

Bank Stock Tax 750,000 - 0.00% 750,000 - 0.00%

Recordation Tax 160,000 8,872 5.55% 150,000 19,245 12.83%

Hotel Motel Tax 760,000 68,242 8.98% 700,000 68,912 9.84%

Daily Property Rental Tax 12,000 4,794 39.95% 10,000 4,113 41.13%

Motor Vehicle Tax 126,000 11,407 9.05% 100,000 9,425 9.43%

DMV Fees 100,000 5,577 5.58% 65,000 4,904 7.54%

TOTAL 23,449,000 $ 1,676,615 $ 7.15% 23,200,000 $ 1,675,462 $ 7.22%

City of Danville, Virginia

Summary of Other Local Tax Revenues PRECLOSING UNAUDITED

For the period ending July 31, 2014 (year to date)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5825)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Contemporary Calculus TextbookDocument526 pagesContemporary Calculus TextbookJosé Luis Salazar Espitia100% (2)

- Corporate Venture Studios DirectoryDocument12 pagesCorporate Venture Studios Directorymoctapka0880% (1)

- g12 Core ValuesDocument1 pageg12 Core ValuesRenzo Miclat100% (1)

- Law of Inheritance in Different ReligionsDocument35 pagesLaw of Inheritance in Different ReligionsSumbal83% (12)

- Dps 2015 StatsDocument1 pageDps 2015 StatsSouthsideCentralNo ratings yet

- EcomNets Indictment Filed and DocketedDocument27 pagesEcomNets Indictment Filed and DocketedSouthsideCentral100% (1)

- DRF 2014 GrantsDocument1 pageDRF 2014 GrantsSouthsideCentralNo ratings yet

- Final School Board BudgetDocument1 pageFinal School Board BudgetSouthsideCentralNo ratings yet

- Sutherlin Mansion Expenses-February 2016Document1 pageSutherlin Mansion Expenses-February 2016SouthsideCentralNo ratings yet

- June RIFA Agenda - Page 11-13Document3 pagesJune RIFA Agenda - Page 11-13SouthsideCentralNo ratings yet

- SSED GrantsDocument1 pageSSED GrantsSouthsideCentralNo ratings yet

- 2014-2015 RetireesDocument1 page2014-2015 RetireesSouthsideCentralNo ratings yet

- Danville-Pittsylvania Regional Industrial Facility AuthorityDocument26 pagesDanville-Pittsylvania Regional Industrial Facility AuthoritySouthsideCentralNo ratings yet

- Nascar TripDocument1 pageNascar TripSouthsideCentralNo ratings yet

- RIFA FinancialsDocument9 pagesRIFA FinancialsSouthsideCentralNo ratings yet

- Seizure WarrantDocument2 pagesSeizure WarrantSouthsideCentralNo ratings yet

- Merle Rutledge Gets Enjoined.Document18 pagesMerle Rutledge Gets Enjoined.SouthsideCentralNo ratings yet

- Search Warrant - GrantedDocument2 pagesSearch Warrant - GrantedSouthsideCentralNo ratings yet

- Search Warrant - August 2013Document24 pagesSearch Warrant - August 2013SouthsideCentralNo ratings yet

- YSR Kalyanamasthu - Field - Verification - FormDocument2 pagesYSR Kalyanamasthu - Field - Verification - FormRamesh karubhukta100% (1)

- Oppositional Inference: Northwesternuniversity, IncDocument3 pagesOppositional Inference: Northwesternuniversity, IncDanica CumlatNo ratings yet

- Braille PDFDocument6 pagesBraille PDFSarah SalamatNo ratings yet

- Site Preparation and Resistance To Contaminants PDFDocument237 pagesSite Preparation and Resistance To Contaminants PDFAnasNo ratings yet

- AUTHORITY TO SELL - Literal - 10022023Document3 pagesAUTHORITY TO SELL - Literal - 10022023MICHAEL SALINASNo ratings yet

- C. Ra 6969 - Engr. Czes BongcoDocument87 pagesC. Ra 6969 - Engr. Czes Bongcorandell vasquezNo ratings yet

- David Copeland-Jackson IndictmentDocument12 pagesDavid Copeland-Jackson IndictmentWashington ExaminerNo ratings yet

- Lesson 7Document20 pagesLesson 7rj libayNo ratings yet

- 10 1016@j Tourman 2019 04 024Document15 pages10 1016@j Tourman 2019 04 024samarNo ratings yet

- 28224lab 3Document6 pages28224lab 3aman singhNo ratings yet

- A Cognitive Model of Posttraumatic Stress Disorder: Behaviour Research and Therapy April 2000Document28 pagesA Cognitive Model of Posttraumatic Stress Disorder: Behaviour Research and Therapy April 2000Fenrrir BritoNo ratings yet

- Practical Research 2 2021Document36 pagesPractical Research 2 2021Allen Paul Gamazon0% (1)

- 2024 03 06 Introduction Lecture Series Climate Protection SS2024Document45 pages2024 03 06 Introduction Lecture Series Climate Protection SS2024Abdullah Khan QadriNo ratings yet

- Chapter 7 Double Entry System: Very Short QuestionsDocument3 pagesChapter 7 Double Entry System: Very Short QuestionsVipulNo ratings yet

- Choreography Proposal: Dance Ensemble 2023: Choreographer'S InformationDocument6 pagesChoreography Proposal: Dance Ensemble 2023: Choreographer'S InformationTrey ErnyNo ratings yet

- Rose Doe v. The City of New York, Et. Al.Document57 pagesRose Doe v. The City of New York, Et. Al.Daily Caller News FoundationNo ratings yet

- New GAP Algorithm Draft 4-7-19Document1 pageNew GAP Algorithm Draft 4-7-19Umber AgarwalNo ratings yet

- Learn GermnaDocument36 pagesLearn Germnarahulchow2No ratings yet

- Kebf Prelim ReviewerDocument10 pagesKebf Prelim ReviewerJamaica EstorninosNo ratings yet

- Huawei Routing Overview CommandDocument26 pagesHuawei Routing Overview Commandeijasahamed100% (1)

- Cook and Serve Challenge 2024 Sponsorship Packages and Awards DinnerDocument3 pagesCook and Serve Challenge 2024 Sponsorship Packages and Awards DinnercarlateacherhellologosNo ratings yet

- November/December 2016Document72 pagesNovember/December 2016Dig DifferentNo ratings yet

- Unpacking Instructional Leadership QuestionnairesDocument7 pagesUnpacking Instructional Leadership QuestionnairesRENIEL MARK BASENo ratings yet

- TimetableDocument1 pageTimetableDiiptee SaravananNo ratings yet

- Welcome To Anderson Workone. Your Career Starts HereDocument28 pagesWelcome To Anderson Workone. Your Career Starts HereHilary TerryNo ratings yet

- Woody AllenDocument18 pagesWoody Allendougct100% (1)