Professional Documents

Culture Documents

General Principles Purpose of Taxation

General Principles Purpose of Taxation

Uploaded by

Sandro SorianoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

General Principles Purpose of Taxation

General Principles Purpose of Taxation

Uploaded by

Sandro SorianoCopyright:

Available Formats

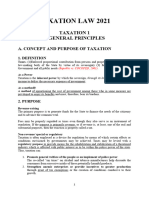

Taxation I

General Principles

As a process, it is a means by which the

sovereign, through its law-making body, raises

revenue to defray the necessary expenses of the

government. It is merely a way of apportioning the

costs of government among those who in some

measures are privileged to enoy its bene!ts and

must bear its burdens.

As a power, taxation refers to the inherent

power of the state to demand enforced

contributions for public purpose or purposes.

"axation is a symbiotic relationship, whereby

in exchange for the protection that the citi#ens get

from the government, taxes are paid.

$ature of "axation

%. It is an inherent attribute of sovereignty

&. It is legislative in character

'haracteristics of "axation

%. "he power of taxation is an incident of

sovereignty as it is inherent in the (tate, belonging

as a matter of right to every independent

government. It does need constitutional conferment.

'onstitutional provisions do not give rise to the

power to tax but merely impose limitations on what

would otherwise be an invincible power. $o attribute

of sovereignty is more pervading, and at no point

does the power of government a)ect more

constantly and intimately all the relations of life

than through the exactions made under it.

&. "he power to tax is inherent in the (tate,

and the (tate is free to select the obect of taxation,

such power being exclusively vested in the

legislature, except where the 'onstitution provides

otherwise.

"he 'ongress may by law authori#e the

President to !x within speci!ed limits, and subect to

such limitations and restrictions as it may impose,

tari) rates, import and export *uotas, tonnage and

wharf age dues, and other duties or imposts within

the framework of the national development program

of the Government.

+ach local government unit shall have the

power to create its own sources of revenues and to

levy taxes, fees, and charges subect to such

guidelines and limitations as the 'ongress may

provide, consistent with the basic policy of local

autonomy. (uch taxes, fees, and charges shall

accrue exclusively to the local governments.

,. It is subect to 'onstitutional and inherent

limitations- hence, it is not an absolute power that

can be exercised by the legislature anyway it

pleases.

Purpose of "axation

%. .evenue-raising

"o provide funds or property with which the

(tate promotes the general welfare and protection

of its citi#ens.

&. $on-revenue/special or regulatory

a0 Promotion of General 1elfare

b0 .egulation

c0 .eduction of (ocial Ine*uiality

d0 +ncourage +conomic Growth

e0 Protectionism

Principles of Sound Tax System

Fiscal Adequacy

"he sources of tax revenue should coincide

with, and approximate the needs of government

expenditure. $either an excess nor a de!ciency of

revenue vis-2-vis the needs of government would be

in keeping with the principle.

Administrative Feasibility

"ax laws should be capable of convenient,

ust and e)ective administration

Theoretical Justice

"he tax burden should be in proportion to

the taxpayer3s ability to pay. "he %456 'onstitution

re*uires taxation to be e*uitable and uniform.

Theory and Basis of Taxation

Lifeblood Theory

"axes are the lifeblood of the government,

being such, their prompt and certain availability is

an imperious need. 1ithout taxes, the government

would be paraly#ed for lack of motive power to

activate and operate it.

ecessity Theory

"axes proceed upon the theory that the existence of

the government is a necessity- that it cannot

continue without the means to pay its expenses-

and that for those means, it has the right to compel

all citi#ens and properties within its limits to

contribute.

Bene!ts"Protection Theory

"he basis of taxation is the reciprocal duty of

protection between the state and its inhabitants. In

return for the contributions, the taxpayer receives

the general advantages and protection which the

government a)ords the taxpayer and his property.

Jurisdiction over sub#ect and ob#ects

.ules7

a0 "ax laws cannot operate beyond a

(tate3s territorial limits.

b0 "he government cannot tax a particular

obect of taxation which is not within its territorial

urisdiction.

c0 Property outside ones urisdiction does

not receive any protection of the (tate.

d0 If a law is passed by 'ongress, it must

always see to it that the obect or subect of

taxation is within the territorial urisdiction of the

taxing authority.

$ouble taxation

Strict sense

.eferred to as direct duplicate taxation, it means7

%. "axing twice-

&. by the same taxing authority-

,. within the same urisdiction-

8. for the same purpose-

9. in the same year or taxing period-

:. some of the property in the territory

Broad sense

.eferred to as indirect double taxation, it is

taxation other than direct duplicate taxation. It

extends to all cases in which there is a burden of

two or more impositions.

Tax avoidance

Is the tax saving device within the means

sanctioned by law. "his method should be used by

the tax payer in good faith and at arms length. (CIR

v. Toda, Jr.)

Tax evasion

"he use by the taxpayer of illegal or

fraudulent means to defeat or lessen the payment

of tax.

;actors to <etermine7 =%0 end to be achieved, the

non-payment of tax when it is shown that a tax is

due- =&0 an accompanying state of mind which is

described as being >evil?- =,0 a course of action or

failure of action which is unlawful.

;raud @ is deemed to compromise anything

calculated to deceive.

- <isregards corporate personality

AAA may be assessed within %B yrs from discovery of

fraud

%xemption from taxation

It is the grant of immunity to particular

persons or corporations or to persons or

corporations of a particular class from a tax which

persons and corporations generally within the same

state or taxing district are obliged to pay. It is an

immunity or privilege- it is freedom from a !nancial

charge or burden to which others are subected.

ature of tax exemption

%0 It is a mere personal privilege of the

grantee.

&0 It is generally revocable by the

government unless the exemption is founded on a

contract which is contract which is protected from

impairment.

,0 It implies a waiver on the part of the

government of its right to collect what otherwise

would be due to it, and so is preudicial thereto.

80 It is not necessarily discriminatory so long

as the exemption has a reasonable foundation or

rational basis.

90 It is not transferable except if the law

expressly provides so.

&inds of tax exemption

%0 +xpress

1hen certain persons, property or

transactions are, by express provision, exempted

from all certain taxes, either entirely or in part.

&0 Implied

1hen a tax is levied on certain classes of

persons, properties, or transactions without

mentioning the other classes.

$I.'

(ec. % $ational .evenue 'ode of %446

(ec. & P/< of CI.7 A'"%"%SP

- Dnder 'ontrol E (upervision <F;

- Assessment E 'ollection of $I.", ;ee E

'harges

- +nforcement of forfeitures, penalties E !nes

- +xecution of Gudgment @ '"A / F.'ourt

- (upervisory E Police power

Sec. 15. Auth of IRO to Arrest and Seize

(ec. &%. (ources of .evenue7 $()%"PI%

a0 Income "ax-

b0 +state E <onor3s taxes-

c0 Halue-added tax-

d0 Percentage taxes-

e0 +xcise taxes-

f0 <ocumentary (tamp "axes-

g0 Fthers which can be collected by CI.

(ec. ,. 'hief FIcials of CI.

- =%0 'ommissioner =80 <eputy 'ommissioner

'ommissioner of CI.

(ec. 8. Power of 'CI. to Interpret E <ecide

su!"ect to revie# of Sec. of $inance

Aexclusive appellate urisdiction @ 'TA

(ec. &B8. Auth of 'CI. to 'ompromise, Abate, and

.efund or 'redit "axes. 'A*+'

A0 'ompromise when7 *$"I

%0 Reasona!%e dou!t as to validity of

claim against "P.

&0 ;inancial position "P. @ clear ina!i%it&

to 'a& assessed tax

A ;inancial Incapacity @ %BJ of basic assessed tax

A Fther cases 8BJ of basic assessed tax

,-. subect to a''rova% of (va%uation Board

composed of (ec. ,

C0 Abate or 'ancel tax7 %+/"A

1) ()cess or un"ust

&0 Admininstation and collection costs

do not "ustif& the amt due.

A All criminal violations may be compromised

except7 a0 those !led in court, or b0 involved in

fraud

c0 'redit or refund taxes illegally received

(ec. 9. Power of 'CI. to Fbtain Info,

(ummon/+xamine, E "ake "estimony. '(ST%

a0 +xamine @ Cooks, Paper, .ecord

b0 Fbtain @ Info on regular basis from any

oIce=r.0 of $ational E Kocal Gov3t,

government agencies and instrumentalities,

Cangko (entral ng Pilipinas, gov3t

owner/controlled corp.

c0 (ummon @ Person liable for tax or re*uired

to !le a return, or any oIcer or employee @

to give testimony

d0 "ake testimony

e0 'anvass @ revenue E in*uire liable "P.

(ec. :. Power of 'CI. to make assess*ents and

+rescri!e additional re*uirements for "ax

administration and enforcement.

<0 Ter*inate Ta) +eriod @ "P. to leave PL

or remove, hide or conceal property

o (end notice of <ecision to "P.

o .e*uest for immediate payment

+0 'CI. to +rescri!e Rea% +ro'ert& ,a%ue @

determination of fair market value. ;or

purpose of computing I.", whichever is

higher of7

o ;MH by 'CI.- or

o ;MH as shown by Provincial and 'ity

Assessors.

o 0rants to 'BI* to inquire ban1 deposits

other than Sec2 34f5

%0 <ecedent to determine estate

&0 ;ailure to pay tax due to !nancial incapacity

(ec. &B8 =a0 =&0

(ec. 6. Authority of 'CI. to delegate power @ rank

e*uivalent to division chief or higher

%6'7 a0 Power to recommend to (F;

b0 Power to issue rulings of -rst i*'ression

c0 (ec. &B8 a,b provided, that assessment

issued by regional oIces involving 5../ de-cienc&

or !e%o# sha%% !e Co*'ro*ised !& Re0iona%

(va%uation Board.

d0 Power to assign or reassign oIcers to est.

where excise taxes are kept.

(ec. 5. 'CI. to +nsure the Provision and <istribution

of ;orms and Acknowledgement of Payment of

"axes.

(ec. 4. Internal .evenue <istricts. @ with approval of

(F;, 'CI. shall divide PL into no. of revenue

districts @ under the supervision of .evenue <istrict

FIcer

(ec. %B. .evenue .egional <irector PI%"PI'

8

a0 Implement laws, rules and regulations

b0 Administer and enforce collection of taxes

c0 Issue Ketters of Auth for examination of "P.

d0 Provide +co, +Icient and e)ective service

e0 'oordinate with regional oIces

f0 'oordinate with KGD

g0 'ontrol over oIcers

h0 Perform delegated functions

(ecretary of ;inance

(ec. &88. (F; to promulgate .ules/.egulations

- Dpon recommendation of 'CI.

(ec. &8:. $on-.ectroactivity of .ulings

a0 "P. misstates or omits

b0 ;acts are materially di)erent from which

ruling is based

c0 "P. in badfaith

You might also like

- Letter - Closure of BusinessDocument1 pageLetter - Closure of BusinessB-an Javelosa91% (35)

- Essential Elements of A TaxDocument31 pagesEssential Elements of A TaxJosephine Berces100% (5)

- Notes For TaxDocument17 pagesNotes For TaxRaymond AlhambraNo ratings yet

- General Principles of TaxationDocument28 pagesGeneral Principles of TaxationMari Aguilar100% (3)

- Tax Reviewer: General Principles: BY: Rene CallantaDocument91 pagesTax Reviewer: General Principles: BY: Rene CallantaDaryl HollandNo ratings yet

- Tax Reviewer: General PrinciplesDocument53 pagesTax Reviewer: General PrinciplesBrian MoralesNo ratings yet

- Taxation Law 1 ReviewerDocument63 pagesTaxation Law 1 ReviewerNgan TuyNo ratings yet

- Principles of TaxationDocument67 pagesPrinciples of Taxationdorothy92105No ratings yet

- San BedaDocument130 pagesSan Bedajakexanne_22No ratings yet

- Notes in TaxDocument50 pagesNotes in TaxGeorge Ryan ZalanNo ratings yet

- Taxation Reviewer SAN BEDADocument133 pagesTaxation Reviewer SAN BEDAatenioncNo ratings yet

- Evasion Assessment Double CharacteristicDocument4 pagesEvasion Assessment Double CharacteristicSylver JanNo ratings yet

- Tax Generalprinciples-Abella NotesDocument44 pagesTax Generalprinciples-Abella NotesRhei BarbaNo ratings yet

- General Principles of TaxationDocument53 pagesGeneral Principles of TaxationGelai RojasNo ratings yet

- Fundamental Principles in TaxationDocument44 pagesFundamental Principles in TaxationIrish SedromeNo ratings yet

- General Principles of TaxationDocument50 pagesGeneral Principles of TaxationJessa PerdigonNo ratings yet

- General Principles of TaxationDocument37 pagesGeneral Principles of TaxationWendy CassidyNo ratings yet

- General Principles of TaxationDocument50 pagesGeneral Principles of TaxationKJ Vecino BontuyanNo ratings yet

- Local Media7305767987836246830Document20 pagesLocal Media7305767987836246830John RellonNo ratings yet

- Principles of TaxationDocument32 pagesPrinciples of TaxationAndrea WaganNo ratings yet

- Tax Midterm ReviewerDocument32 pagesTax Midterm ReviewerJunivenReyUmadhayNo ratings yet

- Income Taxation ReviewerDocument17 pagesIncome Taxation ReviewerRena Mae BalmesNo ratings yet

- Local TaxationDocument17 pagesLocal TaxationabhiramNo ratings yet

- Lesson 1 - General Principles of TaxationDocument22 pagesLesson 1 - General Principles of Taxationshairamae03No ratings yet

- Eneral Rinciples OF Axation F P T: TaxationDocument39 pagesEneral Rinciples OF Axation F P T: TaxationAiza CabenianNo ratings yet

- Fundamental Principles in TaxationDocument50 pagesFundamental Principles in TaxationKristine AllejeNo ratings yet

- Chapter 1 - General Principles of TaxationDocument4 pagesChapter 1 - General Principles of TaxationCedrickBuenaventuraNo ratings yet

- 2013 Tariff and Customs CodeDocument31 pages2013 Tariff and Customs CodeemerbmartinNo ratings yet

- Taxation Reviewer UP Sigma RhoDocument204 pagesTaxation Reviewer UP Sigma RhoMycor Castillo OpsimaNo ratings yet

- Tax HandoutsDocument220 pagesTax HandoutsChristine Gorospe100% (1)

- Tax NotesDocument8 pagesTax NotesChristian Paul PinoteNo ratings yet

- Taxation I ReviewDocument62 pagesTaxation I ReviewSK Tim RichardNo ratings yet

- Eneral Rinciples OF Axation F P T: TaxationDocument7 pagesEneral Rinciples OF Axation F P T: TaxationMarconie Nacar100% (1)

- Tax NotesDocument78 pagesTax NotesDenise VillanuevaNo ratings yet

- Taxation NOTESDocument9 pagesTaxation NOTESVeronicaFranciscoNo ratings yet

- Chapter 1 - Introduction To TaxationDocument43 pagesChapter 1 - Introduction To TaxationGladysNo ratings yet

- Strategic Tax MNGTDocument5 pagesStrategic Tax MNGTaccpco.100No ratings yet

- General Principles of TaxationDocument43 pagesGeneral Principles of TaxationChristine Joy Rejas-TubianoNo ratings yet

- Reading - TaxationDocument3 pagesReading - TaxationkamponngenhaNo ratings yet

- General Principles of TaxationDocument33 pagesGeneral Principles of TaxationjoyNo ratings yet

- Principles of TaxationDocument13 pagesPrinciples of TaxationHazel OrtegaNo ratings yet

- BBE Lawyers Notes Taxation LawDocument215 pagesBBE Lawyers Notes Taxation LawYoo PawNo ratings yet

- A. Concept, Nature, and Characteristics of Taxation TaxationDocument6 pagesA. Concept, Nature, and Characteristics of Taxation TaxationGeralyn GabrielNo ratings yet

- Tax 1 Notes-2019-20Document137 pagesTax 1 Notes-2019-20Gino GinoNo ratings yet

- General Principles of Taxation 2018Document112 pagesGeneral Principles of Taxation 2018Aleezah Gertrude RaymundoNo ratings yet

- Neral Principles of Taxation PDFDocument10 pagesNeral Principles of Taxation PDFKaren Joy MagsayoNo ratings yet

- Taxation ReviewerDocument7 pagesTaxation Reviewermanresa4everNo ratings yet

- TaxationDocument26 pagesTaxationJabeth IbarraNo ratings yet

- Tep Notes: " With God, All Things Are Possible" Mt. 19:26Document8 pagesTep Notes: " With God, All Things Are Possible" Mt. 19:26Tep DomingoNo ratings yet

- Taxation - Ramen NotesDocument8 pagesTaxation - Ramen NotesborgyambuloNo ratings yet

- General Principles of TaxationDocument6 pagesGeneral Principles of TaxationJaziel SestosoNo ratings yet

- Business TaxDocument10 pagesBusiness Taxgelalata0816No ratings yet

- Argumentative Essay On TaxationDocument3 pagesArgumentative Essay On TaxationJonnifer Quiros100% (3)

- Reviewer in TaxationDocument14 pagesReviewer in TaxationJ SakuraNo ratings yet

- Recoletos Law Center Pre-Week Notes in Taxation Law Bar Exam 2021Document23 pagesRecoletos Law Center Pre-Week Notes in Taxation Law Bar Exam 2021Daniel BrownNo ratings yet

- Taxation I Reviewer For MidtermDocument23 pagesTaxation I Reviewer For MidtermKaren CueNo ratings yet

- Tax-Notes-Chapter 1-8Document102 pagesTax-Notes-Chapter 1-8dailydoseoflawNo ratings yet

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- Learning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxFrom EverandLearning to Love Form 1040: Two Cheers for the Return-Based Mass Income TaxNo ratings yet

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Defects of TimberDocument10 pagesDefects of TimberSandro Soriano100% (2)

- Diaz v. Intermediate Appellate CourtDocument13 pagesDiaz v. Intermediate Appellate CourtSandro SorianoNo ratings yet

- ILO Convention 98Document4 pagesILO Convention 98Mira Ciele Saguinsin BusangilanNo ratings yet

- Bulacan State University College of Engineering: Ce 483 Timber Design Types of Stresses For Structural WoodDocument5 pagesBulacan State University College of Engineering: Ce 483 Timber Design Types of Stresses For Structural WoodSandro SorianoNo ratings yet

- Pc. No. T.I. T.O. Hrs Amount Pc. No. T.I. T.O. Hrs AmountDocument2 pagesPc. No. T.I. T.O. Hrs Amount Pc. No. T.I. T.O. Hrs AmountSandro SorianoNo ratings yet

- LTD Case To DigestDocument75 pagesLTD Case To DigestSandro SorianoNo ratings yet

- Rules and RegulationsDocument2 pagesRules and RegulationsSandro SorianoNo ratings yet

- Horizontal and Vertical CurvesDocument29 pagesHorizontal and Vertical CurvesSandro SorianoNo ratings yet

- Chapter 2: Safe Lab Procedures and Tool Use: IT Essentials: PC Hardware and Software v4.1Document11 pagesChapter 2: Safe Lab Procedures and Tool Use: IT Essentials: PC Hardware and Software v4.1Uditha MuthumalaNo ratings yet

- Westinghouse Style-Tone Mercury Vapor Lamps Bulletin 1975Document2 pagesWestinghouse Style-Tone Mercury Vapor Lamps Bulletin 1975Alan MastersNo ratings yet

- Duclos Family Report MissisquoiDocument195 pagesDuclos Family Report MissisquoiNancyNo ratings yet

- Bahasa Inggris Verb PDFDocument16 pagesBahasa Inggris Verb PDFeka ginanjar saputraNo ratings yet

- Cela NeseDocument1 pageCela NeseitskapilgargNo ratings yet

- Category:UR Madam / Sir,: Please Affix Your Recent Passport Size Colour Photograph & Sign AcrossDocument2 pagesCategory:UR Madam / Sir,: Please Affix Your Recent Passport Size Colour Photograph & Sign AcrossVasu Ram JayanthNo ratings yet

- MIT Insight Report On (Chemistry) Industry DigitalizationDocument21 pagesMIT Insight Report On (Chemistry) Industry DigitalizationEllezah Dela CruzNo ratings yet

- Ariza, C. Sonifying SievesDocument8 pagesAriza, C. Sonifying SievesxdimitrisNo ratings yet

- Preview and Print A File: Which Microsoft Office 2010 Program Are You Using?Document4 pagesPreview and Print A File: Which Microsoft Office 2010 Program Are You Using?mili_ccNo ratings yet

- Assessment of Temporal Hydrological Variations Due To Land Use Changes Using Remote Sensing/GISDocument38 pagesAssessment of Temporal Hydrological Variations Due To Land Use Changes Using Remote Sensing/GISWubieNo ratings yet

- 1sem-Tata Motors-Emerging MarketsDocument25 pages1sem-Tata Motors-Emerging MarketsAayush SisodiaNo ratings yet

- ULTIMATE-CI-ST-090 - 2 Stages - Compact - SIEMENS - 1FL6044Document1 pageULTIMATE-CI-ST-090 - 2 Stages - Compact - SIEMENS - 1FL6044Francesco SchioppaNo ratings yet

- Joel Nicholas Feimer - The Figure of Medea in Medieval Literature - A Thematic Metamorphosis-City University of New York (1983)Document342 pagesJoel Nicholas Feimer - The Figure of Medea in Medieval Literature - A Thematic Metamorphosis-City University of New York (1983)grzejnik1No ratings yet

- Randomized Controlled Trial On The Performance of Direct and in - 2021 - DentalDocument10 pagesRandomized Controlled Trial On The Performance of Direct and in - 2021 - Dentalnintendo anjayNo ratings yet

- Vedic Astrology LagnaDocument24 pagesVedic Astrology LagnamarketsniperteluguNo ratings yet

- Track ListDocument1 pageTrack ListTiago LopesNo ratings yet

- Lesson 3. Functions and Philosophical Perspectives On Art - PDF - Philosophical Theories - EpistemologyDocument362 pagesLesson 3. Functions and Philosophical Perspectives On Art - PDF - Philosophical Theories - EpistemologyDanica Jeane CorozNo ratings yet

- Class - 8 Chapter - 3 Synthetic Fibres and PlasticsDocument6 pagesClass - 8 Chapter - 3 Synthetic Fibres and Plastics7A04Aditya MayankNo ratings yet

- Erco Complete Catalogue 2019 en PDFDocument1,280 pagesErco Complete Catalogue 2019 en PDFarmadityaNo ratings yet

- Data Analysis PDFDocument10 pagesData Analysis PDFKenny Stephen CruzNo ratings yet

- XML and PHPDocument33 pagesXML and PHPsplokbovNo ratings yet

- Ateneo Philosophy Club: Project ProposalDocument2 pagesAteneo Philosophy Club: Project ProposalArmando MataNo ratings yet

- Pawan's ResumeDocument1 pagePawan's ResumePAWAN YADAVNo ratings yet

- Fundamntos Del Violonchelo-21-40Document20 pagesFundamntos Del Violonchelo-21-40Alejandro MoraNo ratings yet

- REPORT Multiple DisabilitiesDocument8 pagesREPORT Multiple DisabilitiesIrene FriasNo ratings yet

- The Impact of Low Heat Load and Activated Carbon Treatment of Second Wort On Beer Taste and Flavour StabilityDocument8 pagesThe Impact of Low Heat Load and Activated Carbon Treatment of Second Wort On Beer Taste and Flavour StabilitySefa YücesoyNo ratings yet

- Gold ETFDocument11 pagesGold ETFPravin ChoughuleNo ratings yet

- Commonly Asked Short QuestionsDocument4 pagesCommonly Asked Short QuestionsShubham JainNo ratings yet

- CS701 - Theory of Computation Assignment No.1: InstructionsDocument2 pagesCS701 - Theory of Computation Assignment No.1: InstructionsIhsanullah KhanNo ratings yet