Professional Documents

Culture Documents

Marico Investor Presentation - June14

Marico Investor Presentation - June14

Uploaded by

Goutham BabuCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Marico Investor Presentation - June14

Marico Investor Presentation - June14

Uploaded by

Goutham BabuCopyright:

Available Formats

0

June 2014

This investor presentation has been prepared by Marico Limited (Marico) and does not constitute a

prospectus or placement memorandum or an offer to acquire any securities. This presentation or any other

documentation or information (or any part thereof) delivered or supplied should not be deemed to constitute

an offer.

No representation or warranty, express or implied is made as to, and no reliance should be placed on, the

fairness, accuracy, completeness or correctness of such information or opinions contained herein. The

information contained in this presentation is only current as of its date. Certain statements made in this

presentation may not be based on historical information or facts and may be forward looking statements,

including those relating to the general business plans and strategy of Marico, its future financial condition and

growth prospects, future developments in its industry and its competitive and regulatory environment, and

statements which contain words or phrases such as will, expected to, horizons of growth, strong growth

prospects, etc., or similar expressions or variations of such expressions. These forward-looking statements

involve a number of risks, uncertainties and other factors that could cause actual results, opportunities and

growth potential to differ materially from those suggested by the forward-looking statements. These risks and

uncertainties include, but are not limited to risks with respect to its hair care, its healthcare business and its

skin care business.

Marico may alter, modify or otherwise change in any manner the content of this presentation, without

obligation to notify any person of such revision or changes. This presentation cannot be copied and

disseminated in any manner.

No person is authorized to give any information or to make any representation not contained in and not

consistent with this presentation and, if given or made, such information or representation must not be relied

upon as having been authorized by or on behalf of Marico. This presentation is strictly confidential.

1

Disclaimer

2

Marico : Snapshot

Beauty & Wellness Solutions

Hair Care, Health Care, Skin Care, Male Grooming

A leading Indian MNC Group INR USD

Market Capitalization 14,000 Cr 2.4 Billion

Turnover FY 14 4,687 Cr 781 Million

Profit FY 14 485 Cr 81 Million

Turnover from overseas 25%

Sustained Profitable Growth

Turnover 16% Profits 21% (5 yr CAGR)

$1 = Rs.60

Hair Care

Hair Oils : Pre/Post Wash

Hair Colour

Healthcare

Healthy refined edible oils

Functional Foods

Male grooming/ styling

Deodorants

Hair Creams/Gels/Wax

Skincare

Body Lotion

Cosmetics

3

Portfolio : Beauty & Wellness

3

Category Choice Making Framework

Enter Categories/Segments with Right to Win

Strong Brand, shared channel, shared consumer and shared supply

chain

Developing & Emerging markets of Asia and Africa

Underpenetrated categories with potential to grow

Changing consumer habits or affluence

Will not enter categories having hyper competition

Increase share of higher value added categories

4

5

Focus on Growth

Prioritize volume growth (consumer franchise expansion) over

short term profit

Emerging markets with low/moderate penetration

Maintain unit gross margin within a band

Re-invest profits to reinforce established brands and build new

growth engines for the future

Prototyping : maintain innovation pipeline

Strategic Funding (% of profits each year)

ASP range of 10% to 12%

Inorganic Growth to supplement Organic Growth

6

Inorganic Growth

Focused on hair care, skin care and health care in India

International : primarily hair care, skin care and male grooming

Internationally focused on developing markets in Asia and Africa

Provides opportunity to enter a new market

New category in a core market

Achieve scale in an existing category

Establish potential to become No.1 or No.2

Establish potential to add value in branding and distribution

Enhance depth of category knowledge in hair care / skin care

Leverage across all Marico geographies

Keep track of ROCE benchmark over the medium term

7

Market Leadership: Key to Category Choice

Brand Category

Indicative Market

Share (%) #

Rank

Penetr

ation

Level

Parachute/Nihar Coconut Oil (India) ~ 56% 1 High

Parachute Coconut Oil (Bangladesh) ~ 84% 1 High

Saffola

Super Premium Refined Edible

Oils

~ 55% 1 Low

Saffola Oats ~ 14% 2 Low

Parachute Jasmine, Nihar Shanti

Amla, Hair & Care, Nihar Naturals

Hair Oils ~ 28% 1 High

X-Men Male Shampoo (Vietnam) ~ 39% 1 Low

Fiance / Hair Code Hair Styling (Egypt) ~ 52% 1 Medium

Set Wet / Parachute Advansed Hair Gels & Creams (India) ~ 33% 1 Low

Livon / Silk & Shine Post Wash Hair Serum ~82% 1 Low

Set Wet / Zatak Male Deodorants 5% 5 Low

# Mar14 rolling 12 month volume market share data sourced from AC Nielsen

Marico brands have a no 1 position in their respective segments over around 90% of its turnover

8

Coconut Oil

5 yr volume CAGR in rigid packs ~8%

Likely medium term volume growth : 6-8%

Headroom for growth

Conversion from loose to branded

Market share gain in rural

Market Size

Branded ~ INR 28 bn (~USD 467 mio)

Loose ~ INR 8 bn (~USD 133 mio)

30-35% market (by volume)

estimated to be in loose form

Volume Market Share

Parachute 45%

Nihar 9%

Oil of Malabar 2%

Total 56%

The only Company with a national presence in INR 28 bn (~USD 467 mio) branded CNO market

Portfolio Share

31%

9

Hair Oils

Value Added Hair Oils

Market : INR 45 bn (~USD 818 mio)

Light Hair Oils

24%

Amla Oils

23%

Cooling Oils

18%

Value Added

Coconut Oils

18%

Anti-Hair Fall

10%

Others

7%

Category Play : Significant participation in most key sub-segments

Maricos Volume Market Share in Hair Oil Market ~ 28%

Likely Medium term Volume Growth ~ 15-17%

Specific Benefits creating more occasions of use

Promotes Dual Usage

Expanding rural reach

Portfolio Share

18%

10

Hair Oiling Category

Likely to see sustained growth

Category growth rate in last 5 years : 17-18%

Belief in benefits of leave-in conditioner (oil) versus rinse off

Research to support benefits of hair oiling

Reduces breakage

Stress management

Reduces protein loss

Softens hair

Improves thickness, strength and length

Improvement sought in format/sensorials

Marico acquired SetWet & Zatak in May 2012

Tail wind categories with low penetration

Synergies with existing business

Leverage widespread Distribution network

Gain access to cosmetic/chemist outlets

Deo market expected to consolidate in the next 4-5 years

Modern Trade Channel : Future opportunity

Achieved market leadership in Gels/Creams with 33% market share

Growth in Male Grooming in FY14: 16%

11 11

Male Grooming

Deodorants

Rs.1800 Cr (USD 300 mn) Market

Hair Gels/Creams

Rs.200 Cr (USD 35 mn)

12

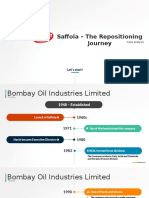

Saffola Saffola

Evolution from an edible oil brand to a leading healthy lifestyle brand

Riding a health care tailwind in India : Saffola 5 yr volume CAGR ~12%

Leadership position in super premium refined edible oil segment (55% Volume Market Share)

Entry into breakfast cereals market in 2010 (Saffola oats and savory oats)

22 million addressable households : Out of which Saffola reaches 3 million

Likely medium term volume growth: ~13-15%

Increasing trend of cardiovascular diseases, diabetes & hypertension in India

Rising incomes and higher level of heart health awareness

Increase in the number of nuclear families and working women

Portfolio Share

15%

13

Recent Launches Recent Launches

Body Lotion (FY12)

Market Size : INR 800 cr (USD 130 mn)

Market Growth Rate : ~15%

Marico Market Share : ~6%

No. 3 position

Oats (FY13)

Market Size : INR 250 cr (USD 40 mn)

Market Growth Rate : ~15%

Marico Market Share : ~14%

No. 2 position

Livon Conditioning Cream Colour (FY14)

Market Size : INR 2500 cr (USD 420 mn)

Creams form 25% of the market, growing at the

fastest pace

Cream format at affordable price points

Strong Distribution Network (India)

Urban Rural

Direct Reach: Over 900,000 outlets

Indirect Reach: ~ 4 million outlets

Leveraged Modern Trade Channel to drive urban growth

7% of India sales comes from modern trade

GTM Transformation initiatives planned

Leveraged technology to drive impact

Enhancing quality of rural reach

Rural sales up from 25% in FY10 to 31% in FY14

Access to chemist and cosmetic outlets through Youth brand

acquisition & Distribution of Bio Oil

Focus on each General Trade Channel

(Chemist/Cosmetics/Mom&Pop/Key)

Targeted sales force through bifurcation of portfolio

14

70%

Revenue

30%

Revenue

15

Marico International

Focus on :

Emerging markets of Asia & Africa

Hair & Skin Nourishment and Male Grooming

Operates in Geographic hubs leading to supply chain and media synergies

Opportunities for expanding footprint

From Bangladesh, Malaysia, Vietnam to Rest of South East Asia

From GCC, Egypt to Levant, NA Rim

From South Africa to Sub Saharan Africa

Brands with regional identity & expression

Customization based on local market insights

Likely medium term organic growth : ~20%

Maintain Operating Margin at ~14%

Portfolio Share

25%

16

International Portfolio

Categories :

Coconut Oil, Value

Added Hair Oils,

Powdered Hair

Dyes, Deodorants,

Edible Oils

Brands : Parachute,

Parachute

Advansed, Hair

Code, Set Wet,

Saffola, Livon

Categories : Hair

Oils, Hair

Creams/Gels

Brands:

Parachute Secrets,

Parachute Gold

Categories :

Hair

Creams/Gels

Brands:

Hair Code &

Fiancee

Categories:

Male

Grooming,

Skin Care &

Foods

Brands : X-

Men, LOvite,

Thuan Phat

Categories :

Ethnic Hair Care,

Kids Hair Care,

OTC Health Care

Brands : Caivil,

Black Chic, Just for

Kids, Hercules

Bangladesh

44%

Egypt

13%

Vietnam

25%

Middle East

6%

South Africa

9%

17

International Strategy

* Leverage

distribution

network

* Grow Value

Added Hair Oils

* Introduce

products from

India portfolio

* Gain back lost

share in hair oils,

creams/gels

* Return to

profitability

* Grow

Creams/Gels

market

* Establish Value

Added Hair Oils

* Expand into

North

Africa/Levant

* Grow market in

male

shampoo/shower

gels

* Gain share in

male deos

* Extend into other

SEA countries

* Build Scale in

SA

* Expand in Sub-

Saharan Africa

Bangladesh

44%

Egypt

13%

Vietnam

25%

Middle East

6%

South Africa

9%

Gain scale by leveraging common product platforms

18

Future Growth Strategy

Expand Markets where we have significant leadership

Parachute coconut oil in India and Bangladesh

Saffola Premium healthy refined edible oil

Hair Code/Fiancee hair gels/creams in Egypt

Post Wash Conditioner/Hair Serums in India

Increase Share in other categories

Hair Oils in India & Bangladesh

Hair creams & gels in the Middle East

Male Deodorants in India & Vietnam

Male Shampoo in Vietnam

Introduce new products larger size than in the past

Saffola Oats, Parachute Advansed Body Lotion, Livon Hair Colours

Broader play of our product platforms across key markets

Geographic Expansion

South East Asia, Sub-Saharan Africa

Inorganic Growth to supplement organic growth

Dividend Distribution & Cash Deployment

Focus on maximization of shareholder value

Marico has followed a conservative dividend policy over past few years

Deployed internal accruals to fuel organic & inorganic growth

With higher cash generation, increased dividend in FY14 to 350% (Rs.3.50 per share)

Payout : 47%

Payout excluding the one-time Silver Jubilee dividend : 24%

Could increase payout further if there are no M&A opportunities

19

Talent Management & Succession Planning

Professionally managed organization

Believes Culture drives business

Fosters entrepreneurial spirit and sense of ownership in all members

Strategic Business Planning (SBP) articulates Maricos future imperatives and

capability needs

Translated to individual actions through Management By Results (MBR)

Short term incentive plan is linked to MBR

Personal Development Planning(PDP) to assess and nurture a members Potential

and is distinct from Performance

Long term incentive plan, ESOPs drives long term performance behavior.

20

21

Financial Highlights

Particulars (INR Crores) FY10 FY11 FY12 FY13 FY14

Revenue from Operations 2661 3128 3980 4596 4687

Profit Before Tax 298 376 400 552 695

Profit After Tax 232 286 317 396 485

EPS: Annualized (INR) 3.8 4.7 5.2 6.1 7.5

Book Value per Share (INR) 10.70 14.90 18.59 30.77 21.1

Capital Employed 1112 1712 1953 2889 2076

Net Worth 654 915 1143 1982 1361

EBITDA % 14.1% 13.3% 12.1% 13.6% 16.0%

ROCE % 34% 27% 26% 24% 25%

Note: FY14 financials do not include Kaya

22

The Most Awarded FMCG

Featured amongst eight Indian companies in Standards & Poors list of Global Challengers

Super brands voted Parachute a Super Brand in UAE & Bangladesh

Marico won the Annual Supplier Award by Bharti Walmart and Joint Business Planning Best Debutant for 2012

Innovator of the year-Supply Chain for Agro Products Award by Supply Chain Leadership Council in 2012

Gold for Saffola Oats and a Silver for Parachute Advansed Ayurvedic at The APPIES 2012 for innovations in

marketing communications across Asia

Saffola won a Gold at the Inaugural Mobile Marketing Association Awards 2012 in India

Parachute Coconut Oil declared the Overall #1 Brand in Bangladesh by the Bangladesh Brand Forum 2012

Marico won the CIO 100 Award for the fourth time in a row. Entered the Hall Of Fame of the CIO 100 winners.

Hair Code in Egypt won an Effies MENA

Marico Pondicherry won the IMC Ramkrishna Bajaj National Quality Award (RBNQA) 2012 (Certificate of

Commendation), in the manufacturing category

Marico ranked 2nd for Best Investors Relations in the Consumer Sector across Asia in the 2012 Asia Investor

Relations Perception Study

Marico ranked No.1 in the Euro Money Asias Best Managed Companies ratings 2013 in the Consumer Good

category

23

Shareholding Pattern as on March14

24

Investor Relations Communications

One on one meetings with the Buy side and Sell side

Marico Website

Annual Report

Latest Quarterly Updates

AGM Notice

Shareholding Pattern

http://www.marico.com/html/investor/overview.php

Quarterly Results

Information Update

Media Release

Earnings Call with the management team

For all the quarterly documents, visit the website

http://www.marico.com/html/investor/latest-quartely-updates.php

Investor Relations App

Annual Report

News & Updates

Quarterly Results

To download the App, click www.maricoinvestorapp.com

Thank You

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5834)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (405)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Man CompnyDocument5 pagesThe Man CompnykundanNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Rajat Gupta Case IssuesDocument8 pagesRajat Gupta Case IssuesGoutham Babu100% (1)

- SaffolaDocument35 pagesSaffolaSu_Neil100% (3)

- Marico Livon ReportDocument30 pagesMarico Livon ReportAbhirupMondalNo ratings yet

- Issues With Calculating Economic Growth in IndiaDocument4 pagesIssues With Calculating Economic Growth in IndiaGoutham BabuNo ratings yet

- US Fed Tapering and Its ImpactDocument2 pagesUS Fed Tapering and Its ImpactGoutham BabuNo ratings yet

- Transport StrategyDocument31 pagesTransport StrategyGoutham BabuNo ratings yet

- Grenoble Sample BudgetDocument3 pagesGrenoble Sample BudgetGoutham BabuNo ratings yet

- The Modi and Vam Methods of Solving Transportation Problems: Online TutorialDocument10 pagesThe Modi and Vam Methods of Solving Transportation Problems: Online TutorialVivek KumarNo ratings yet

- Paris Information Package PDFDocument26 pagesParis Information Package PDFGoutham BabuNo ratings yet

- Summary of The World Happiness Report 2013Document3 pagesSummary of The World Happiness Report 2013Goutham BabuNo ratings yet

- UFLEX LTD Q3 FY 2013 Net Revenue Up 15 at Rs 1295 CroresDocument2 pagesUFLEX LTD Q3 FY 2013 Net Revenue Up 15 at Rs 1295 CroresGoutham BabuNo ratings yet

- Edible OilDocument14 pagesEdible OilsmotsobNo ratings yet

- Pricing Strategies of Edible Oil: With Focus On Greater GhaziabadDocument19 pagesPricing Strategies of Edible Oil: With Focus On Greater Ghaziabadsahilk63No ratings yet

- InstaPDF - in Marico Products List 409Document31 pagesInstaPDF - in Marico Products List 409sridhar thokalaNo ratings yet

- Case Study OnDocument14 pagesCase Study OnRamzan KhalidNo ratings yet

- The World of MaricoDocument43 pagesThe World of MaricoPradeep ReddyNo ratings yet

- Presentation 372 Marico Ltd.Document15 pagesPresentation 372 Marico Ltd.UpomaAhmedNo ratings yet

- Marico Ltd.-Company ResearchDocument12 pagesMarico Ltd.-Company ResearchVenkatesh BoddepalliNo ratings yet

- Scrip Symbol: MARICO: Hemangi Ghag Company Secretary & Compliance OfficerDocument28 pagesScrip Symbol: MARICO: Hemangi Ghag Company Secretary & Compliance OfficerParthibanNo ratings yet

- Case Presentation Marico LimitedDocument26 pagesCase Presentation Marico LimiteddishaNo ratings yet

- Analysis of Edible Oil IndustryDocument213 pagesAnalysis of Edible Oil IndustryRicha Bandra100% (1)

- Annual Report FY 2019 20Document328 pagesAnnual Report FY 2019 20Monil BNo ratings yet

- Important Profiles PDFDocument39 pagesImportant Profiles PDFramki020983No ratings yet

- KAYADocument12 pagesKAYABikash SharmaNo ratings yet

- SWOT Analysis of PatanjaliDocument4 pagesSWOT Analysis of Patanjalipiyush kumarNo ratings yet

- Marico's Case StudyDocument13 pagesMarico's Case StudyAnjali GuptaNo ratings yet

- SIP Report - JeremyDocument58 pagesSIP Report - JeremyStephen STNo ratings yet

- Case - Marico SCMDocument26 pagesCase - Marico SCMChandan Gupta50% (2)

- Marico LTD.: ME Final Project PresentationDocument28 pagesMarico LTD.: ME Final Project PresentationSaumitra AmbegaokarNo ratings yet

- A Presentation On Cooking Refined Oils: By-Kavim MathurDocument10 pagesA Presentation On Cooking Refined Oils: By-Kavim MathurKavim MathurNo ratings yet

- Critically Analyze The Sales & Distribution Strategy of Cavin Care and MaricoDocument12 pagesCritically Analyze The Sales & Distribution Strategy of Cavin Care and MaricoBhavin V RaykaNo ratings yet

- FMCG Companies in IndiaDocument7 pagesFMCG Companies in IndiaAnuj KumarNo ratings yet

- Muskan JainDocument22 pagesMuskan Jainmuskan jainNo ratings yet

- Module 5 MBA MGUDocument89 pagesModule 5 MBA MGUNithin Mathew Jose MBA 2020No ratings yet

- Pioneer Institute of Professional Studies Indore: Swot Analysis OF Marico India LTDDocument50 pagesPioneer Institute of Professional Studies Indore: Swot Analysis OF Marico India LTDSusmita KayalNo ratings yet

- Assignment On Financial Analysis of Marico PVT LTDDocument65 pagesAssignment On Financial Analysis of Marico PVT LTDRãjâ Rj100% (1)

- Hair OilDocument7 pagesHair OilKetanMehta100% (1)

- Task: Assume That You Are The MARKETING STRATEGIST of Your Assigned BRAND: Propose ONEDocument5 pagesTask: Assume That You Are The MARKETING STRATEGIST of Your Assigned BRAND: Propose ONEMeskat Hassan KhanNo ratings yet