Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

25 viewsMA0037

MA0037

Uploaded by

Smu DocContact - 9540358147 or email at smudoc@gmail.com for solved assignments of Sikkim Manipal University.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Summary of Jurisdiction of Philippine CourtsDocument13 pagesSummary of Jurisdiction of Philippine CourtsXavier Hawkins Lopez Zamora83% (18)

- Solo Parent Application FormDocument1 pageSolo Parent Application Formjeffrey yokoto100% (3)

- Arundhati RoyDocument19 pagesArundhati Roydeepika_naikNo ratings yet

- Corporate and Economic Laws Test 4 May Test 1609311095Document9 pagesCorporate and Economic Laws Test 4 May Test 1609311095CAtestseriesNo ratings yet

- SuggestionDocument6 pagesSuggestionMeheraf ShamimNo ratings yet

- Difference Between Cheque Promissory Note and Bill of ExchangeDocument2 pagesDifference Between Cheque Promissory Note and Bill of ExchangeMario Tuliao50% (2)

- Advanced Banking Law MAY 2014 PAPERDocument4 pagesAdvanced Banking Law MAY 2014 PAPERBasilio MaliwangaNo ratings yet

- Banking Law KSLU Notes Grand FinalDocument83 pagesBanking Law KSLU Notes Grand FinalSherminasNo ratings yet

- Fair Practice CodepdfDocument8 pagesFair Practice CodepdfBharat SolankiNo ratings yet

- Banking Law 100marks March April 2023 (Dec 2022)Document7 pagesBanking Law 100marks March April 2023 (Dec 2022)Veena T NNo ratings yet

- NISM-Series-IX: Merchant Banking Certification Examination Test Objectives Chapter 1: Introduction To The Capital MarketDocument6 pagesNISM-Series-IX: Merchant Banking Certification Examination Test Objectives Chapter 1: Introduction To The Capital MarketSanket MohapatraNo ratings yet

- Banking Law Questions - 024016Document4 pagesBanking Law Questions - 024016Nanditha SwamyNo ratings yet

- Case Studies of Banking & FinanceDocument3 pagesCase Studies of Banking & FinancePooja Patil20% (5)

- BASIC Promotion 2011Document119 pagesBASIC Promotion 2011tanviriubdNo ratings yet

- Answers To The Respective Questions Are Given Below inDocument7 pagesAnswers To The Respective Questions Are Given Below inLakshmi NairNo ratings yet

- Bar Exam Questions in Banking LawsDocument54 pagesBar Exam Questions in Banking LawsKayzer SabaNo ratings yet

- Functions of Banks PDFDocument10 pagesFunctions of Banks PDFSumit K SankhlaNo ratings yet

- Banking Law AssignmentDocument7 pagesBanking Law AssignmentSangeetha RoyNo ratings yet

- Activity Sheet In: Business FinanceDocument7 pagesActivity Sheet In: Business FinanceCatherine LarceNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityShyamsunder SinghNo ratings yet

- FIRM A2-WORKSHOP 1-Corporate & Commercial Practice-Term 3-Week 2Document43 pagesFIRM A2-WORKSHOP 1-Corporate & Commercial Practice-Term 3-Week 2MUBANGIZI ABBYNo ratings yet

- Rotomac Bank FraudDocument8 pagesRotomac Bank FraudAnand Christudas100% (3)

- Financial Regulation IBC. ICADocument14 pagesFinancial Regulation IBC. ICAJahnaviSinghNo ratings yet

- 1 - Credit & Lending - Tutorial Questions Set 1 - 2022Document3 pages1 - Credit & Lending - Tutorial Questions Set 1 - 2022Abdulkarim Hamisi KufakunogaNo ratings yet

- Law Relating To Banking May 2010 Main PaperDocument5 pagesLaw Relating To Banking May 2010 Main PaperBasilio MaliwangaNo ratings yet

- Banker and CustomerDocument8 pagesBanker and CustomerbasalingolumaNo ratings yet

- SR - No Table of Content NODocument53 pagesSR - No Table of Content NONeha AhireNo ratings yet

- Himalayan Reply CONTINUING (1) - 1Document13 pagesHimalayan Reply CONTINUING (1) - 1Gaurav KumarNo ratings yet

- Urgent Legal Notice To Kotak - 30102021 - 211030 - 182306Document4 pagesUrgent Legal Notice To Kotak - 30102021 - 211030 - 182306spahujNo ratings yet

- Sarfaesi Act, 2002 PptnewDocument27 pagesSarfaesi Act, 2002 PptnewCharu Pundir50% (2)

- FORMATIVE ASSESSMENT I - Overview of Credit Policy and Loan CharacteristicsDocument3 pagesFORMATIVE ASSESSMENT I - Overview of Credit Policy and Loan CharacteristicsLorey Joy IdongNo ratings yet

- Banking LawDocument3 pagesBanking LawtrizahNo ratings yet

- Format IIIDocument6 pagesFormat IIIAman GargNo ratings yet

- Revision g11 BST Round 2Document4 pagesRevision g11 BST Round 2Smart GamerNo ratings yet

- Bba 3 Sem AccountsDocument9 pagesBba 3 Sem Accountsanjali LakshcarNo ratings yet

- Q1 Module 5-Week 5-Loan Requirements of Different Banks and Non Bank InstitutionsDocument24 pagesQ1 Module 5-Week 5-Loan Requirements of Different Banks and Non Bank InstitutionsJusie ApiladoNo ratings yet

- Learning Activity Sheet Business Finance Quarter 1, Week 5 Lesson 1Document5 pagesLearning Activity Sheet Business Finance Quarter 1, Week 5 Lesson 1Von Violo BuenavidesNo ratings yet

- Banking Workshop Term 3Document55 pagesBanking Workshop Term 3Arthur AmolaNo ratings yet

- Law Relating To Banking - Nov 2013Document4 pagesLaw Relating To Banking - Nov 2013Basilio MaliwangaNo ratings yet

- Credit AwarenessDocument62 pagesCredit AwarenessHimanshu Mishra100% (1)

- I Csi Brochure Banking Law and PracticeDocument4 pagesI Csi Brochure Banking Law and PracticeAditya KumarNo ratings yet

- Different Types of IssuesDocument9 pagesDifferent Types of IssuesDeepak LohiaNo ratings yet

- Open Letter To Mr. Uday Suresh Kotak, MD & Ceo, Kotak Mahindra Bank, Alongwith Questions Which Remained UnansweredDocument24 pagesOpen Letter To Mr. Uday Suresh Kotak, MD & Ceo, Kotak Mahindra Bank, Alongwith Questions Which Remained UnansweredLaw WhizNo ratings yet

- MemorandumDocument17 pagesMemorandumfliz1889No ratings yet

- Phone: (033) 22735611 Amit Bachhawat: MarksDocument4 pagesPhone: (033) 22735611 Amit Bachhawat: MarksAmit PaulNo ratings yet

- 25 S49Loans, GoldLoans, UBLN, SuretyLoanDocument13 pages25 S49Loans, GoldLoans, UBLN, SuretyLoanSyed FaisalNo ratings yet

- Mohammadzahid&NasirRathod DocxdDocument29 pagesMohammadzahid&NasirRathod DocxdTrexus TrexusNo ratings yet

- Siddaganga Institute of Technology, Tumkur - 572 103: MBA207 USNDocument3 pagesSiddaganga Institute of Technology, Tumkur - 572 103: MBA207 USNNayan KanthNo ratings yet

- Investment 01Document4 pagesInvestment 01Intiser RockteemNo ratings yet

- Banking LawDocument23 pagesBanking LawHarshdeep groverNo ratings yet

- JAIIB Principles and Practices of Banking Q & ADocument13 pagesJAIIB Principles and Practices of Banking Q & ARahul FouzdarNo ratings yet

- Central Banking Indian Specific Issue - 0f6a19f9 9d1e 4830 87be 8557fe576fdbDocument13 pagesCentral Banking Indian Specific Issue - 0f6a19f9 9d1e 4830 87be 8557fe576fdbprachi bhattNo ratings yet

- RETCRD Module II CH 4 Documentation - 3Document13 pagesRETCRD Module II CH 4 Documentation - 3somesh5907No ratings yet

- Practice Paper 4 - QuestionsDocument4 pagesPractice Paper 4 - Questionsniteshkumar.38000No ratings yet

- Mock Bar Examinations in Mercantile LawDocument7 pagesMock Bar Examinations in Mercantile LawjasperNo ratings yet

- In The National Company Law Tribunal Mumbai Bench: Per: Bhaskara Pantula Mohan, Member (J)Document12 pagesIn The National Company Law Tribunal Mumbai Bench: Per: Bhaskara Pantula Mohan, Member (J)saurabhNo ratings yet

- Neeraj Malhotra Vs Deustche Post Bank Home FinancCO100001COM466165Document153 pagesNeeraj Malhotra Vs Deustche Post Bank Home FinancCO100001COM466165urvashiNo ratings yet

- JAIIB - PPB - All Modules NotesDocument501 pagesJAIIB - PPB - All Modules Notesmanu.manohar0408No ratings yet

- Letter of Credit FAQS PDFDocument38 pagesLetter of Credit FAQS PDFVenkataramakrishna Thubati100% (3)

- FIN301Document3 pagesFIN301Smu DocNo ratings yet

- PM0016 - AddDocument5 pagesPM0016 - AddSmu DocNo ratings yet

- Program - Mba - Semester Iv Subject Code & Name Mi0041 - Java and Web DesignDocument5 pagesProgram - Mba - Semester Iv Subject Code & Name Mi0041 - Java and Web DesignSmu DocNo ratings yet

- PM0015 - AddDocument5 pagesPM0015 - AddSmu DocNo ratings yet

- Explain The Requirements of Quality Patient CareDocument5 pagesExplain The Requirements of Quality Patient CareSmu DocNo ratings yet

- Ma0043 - AddDocument5 pagesMa0043 - AddSmu DocNo ratings yet

- MH0057 - AddDocument5 pagesMH0057 - AddSmu DocNo ratings yet

- MF0018 - AddDocument5 pagesMF0018 - AddSmu DocNo ratings yet

- Ib0015 - AddDocument5 pagesIb0015 - AddSmu DocNo ratings yet

- SNAP ApprovalDocument14 pagesSNAP ApprovalLajharus EvansNo ratings yet

- Transgender Rights ThesisDocument6 pagesTransgender Rights Thesisaflpaftaofqtoa100% (2)

- Ch.1 Introduction: Rti & Good GovernanceDocument16 pagesCh.1 Introduction: Rti & Good Governancenirshan rajNo ratings yet

- Gopal Krishna Gokhale G K Jha 190520Document11 pagesGopal Krishna Gokhale G K Jha 190520BlonkoNo ratings yet

- United States v. Dante Duffy, 4th Cir. (2014)Document3 pagesUnited States v. Dante Duffy, 4th Cir. (2014)Scribd Government DocsNo ratings yet

- Timothy Adzati ReportDocument2 pagesTimothy Adzati Reportkojo kum essienNo ratings yet

- Retainer AgreementDocument2 pagesRetainer AgreementVittoria DaelliNo ratings yet

- De Villaruel Vs Manila MotorDocument2 pagesDe Villaruel Vs Manila MotorGale Charm SeñerezNo ratings yet

- C&F ListDocument605 pagesC&F ListSales Ingress ITNo ratings yet

- Slip - TemplateDocument2 pagesSlip - TemplateEddy YNo ratings yet

- Izvestaj o Medijima Preciscen Eng.Document44 pagesIzvestaj o Medijima Preciscen Eng.siriusistNo ratings yet

- Intel Pentium D Processor 900 Sequence and Intel Pentium Processor Extreme Edition 955, 965Document112 pagesIntel Pentium D Processor 900 Sequence and Intel Pentium Processor Extreme Edition 955, 965قناة تعدد في المحتوىNo ratings yet

- Garcia Vs Llamas - G.R. No. 154127. December 8, 2003Document9 pagesGarcia Vs Llamas - G.R. No. 154127. December 8, 2003Ebbe DyNo ratings yet

- Income Tax Ordinance, 2001: Government of PakistanDocument5 pagesIncome Tax Ordinance, 2001: Government of PakistanwaqaswaNo ratings yet

- State v. Hon. Steinle/alejandra Moran, Ariz. (2016)Document8 pagesState v. Hon. Steinle/alejandra Moran, Ariz. (2016)Scribd Government DocsNo ratings yet

- Demat AccountDocument31 pagesDemat AccountTina ChoudharyNo ratings yet

- Corporate Ethics and GovernanceDocument16 pagesCorporate Ethics and GovernancePhilipNo ratings yet

- CSS v2Document36 pagesCSS v2Carlos PavaNo ratings yet

- Fujitsu Mainboard D3 Mainboard D3162-A ATX: Data SheetDocument3 pagesFujitsu Mainboard D3 Mainboard D3162-A ATX: Data SheetpziolkoNo ratings yet

- Motion - Process ServerDocument4 pagesMotion - Process ServerSyannil VieNo ratings yet

- Macbeth Student PacketDocument17 pagesMacbeth Student Packetlilyparker100% (3)

- Defendant Memorial RJ-21Document31 pagesDefendant Memorial RJ-21Mandira PrakashNo ratings yet

- Taxavvy Issue19 PDFDocument5 pagesTaxavvy Issue19 PDFSergio VinsennauNo ratings yet

- From 00:00:05-Nov-2022 To 04-Nov-2023 Midnight: Basic Own DamageDocument3 pagesFrom 00:00:05-Nov-2022 To 04-Nov-2023 Midnight: Basic Own DamageayubNo ratings yet

- Criteria For Denim CompetitionDocument21 pagesCriteria For Denim CompetitionLester Gene Villegas Arevalo100% (1)

- Reinforced Concrete One Way Slab DesignDocument4 pagesReinforced Concrete One Way Slab DesignIzzan SabelloNo ratings yet

MA0037

MA0037

Uploaded by

Smu Doc0 ratings0% found this document useful (0 votes)

25 views2 pagesContact - 9540358147 or email at smudoc@gmail.com for solved assignments of Sikkim Manipal University.

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentContact - 9540358147 or email at smudoc@gmail.com for solved assignments of Sikkim Manipal University.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

25 views2 pagesMA0037

MA0037

Uploaded by

Smu DocContact - 9540358147 or email at smudoc@gmail.com for solved assignments of Sikkim Manipal University.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

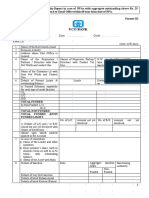

ASSIGNMENT

DRIVE SUMMER 2014

PROGRAM MBADS (SEM 3/SEM 5)

MBAFLEX/ MBA (SEM 3)

PGDBMN (SEM 1)

SUBJECT CODE &

NAME

MA0037-

BANKING RELATED LAWS AND PRACTICES

BK ID B1618

CREDIT 4

MARKS 60

Note: Answer all questions. Kindly note that answers for 10 marks questions should be

approximately of 400 words. Each question is followed by evaluation scheme.

Q.No Question Marks Total Marks

1 Refer a bill of exchange and discuss its features. Elucidate the difference between a cheque and a

bill of exchange.

Bill of exchange and its features

Difference between cheque and bill of exchange

5

5

10

2 A person deposits some jewellery with a bank as a security for a debt. After repaying the debt, he

demands the return of the jewellery. He owes some other debts to the bank. Is he entitled to

recover the jewels from the bank?

Discuss the lien and differentiate types of lien. Explain Rule in claytons case.

Lien and different types of liens

Rule in claytons case

5

5

10

3 A mortgage a certain plot of building land to B and afterwards erects a house on the plot. For the

purpose of his security, B is entitled to the house as well as the plot. Discuss the right of mortgager

and mortgagee.

Rights of mortgager

Rights of mortgagee

5

5

10

4 Bangalore based Janalakshmi Financial Services has recently completed a securitization

transaction worth INR 250 million with IFMR Capital. Closed on August 18th, IFMR Capitals

latest transaction Delta Pioneer IFMR Capital 2010, is backed by 35,560 microloans originated by

Janalakshmi, a microfinance NBFC (Non-Banking Financial Company). Explain registration of

securitisation company or reconstruction company. Discuss the documents involved in this

transaction.

A

Securitisation registration

documents

7

3

10

5 Are digital records admitted as evidence under Bankers book of evidence act?

Discuss the conditions in the printout.

A

Bankers book of evidence act

conditions in the printout

5

5

10

6 Rohit is not a customer of the bank. He is a university student. He applies for a bankers cheque at

the extension counter of a bank. He was refused at the first instance but the bank realised its

mistake and agreed to issue the bankers cheque. The process took more than 4 hours. What is the

recourse available to Rohit? What type of documentary evidence can Rohit produce? What is the

procedure for redressal of grievances under Banking ombudsman scheme?

A

Recourse available to Rohit

Documentary evidence

Banking ombudsman scheme

2

2

6

10

You might also like

- Summary of Jurisdiction of Philippine CourtsDocument13 pagesSummary of Jurisdiction of Philippine CourtsXavier Hawkins Lopez Zamora83% (18)

- Solo Parent Application FormDocument1 pageSolo Parent Application Formjeffrey yokoto100% (3)

- Arundhati RoyDocument19 pagesArundhati Roydeepika_naikNo ratings yet

- Corporate and Economic Laws Test 4 May Test 1609311095Document9 pagesCorporate and Economic Laws Test 4 May Test 1609311095CAtestseriesNo ratings yet

- SuggestionDocument6 pagesSuggestionMeheraf ShamimNo ratings yet

- Difference Between Cheque Promissory Note and Bill of ExchangeDocument2 pagesDifference Between Cheque Promissory Note and Bill of ExchangeMario Tuliao50% (2)

- Advanced Banking Law MAY 2014 PAPERDocument4 pagesAdvanced Banking Law MAY 2014 PAPERBasilio MaliwangaNo ratings yet

- Banking Law KSLU Notes Grand FinalDocument83 pagesBanking Law KSLU Notes Grand FinalSherminasNo ratings yet

- Fair Practice CodepdfDocument8 pagesFair Practice CodepdfBharat SolankiNo ratings yet

- Banking Law 100marks March April 2023 (Dec 2022)Document7 pagesBanking Law 100marks March April 2023 (Dec 2022)Veena T NNo ratings yet

- NISM-Series-IX: Merchant Banking Certification Examination Test Objectives Chapter 1: Introduction To The Capital MarketDocument6 pagesNISM-Series-IX: Merchant Banking Certification Examination Test Objectives Chapter 1: Introduction To The Capital MarketSanket MohapatraNo ratings yet

- Banking Law Questions - 024016Document4 pagesBanking Law Questions - 024016Nanditha SwamyNo ratings yet

- Case Studies of Banking & FinanceDocument3 pagesCase Studies of Banking & FinancePooja Patil20% (5)

- BASIC Promotion 2011Document119 pagesBASIC Promotion 2011tanviriubdNo ratings yet

- Answers To The Respective Questions Are Given Below inDocument7 pagesAnswers To The Respective Questions Are Given Below inLakshmi NairNo ratings yet

- Bar Exam Questions in Banking LawsDocument54 pagesBar Exam Questions in Banking LawsKayzer SabaNo ratings yet

- Functions of Banks PDFDocument10 pagesFunctions of Banks PDFSumit K SankhlaNo ratings yet

- Banking Law AssignmentDocument7 pagesBanking Law AssignmentSangeetha RoyNo ratings yet

- Activity Sheet In: Business FinanceDocument7 pagesActivity Sheet In: Business FinanceCatherine LarceNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityShyamsunder SinghNo ratings yet

- FIRM A2-WORKSHOP 1-Corporate & Commercial Practice-Term 3-Week 2Document43 pagesFIRM A2-WORKSHOP 1-Corporate & Commercial Practice-Term 3-Week 2MUBANGIZI ABBYNo ratings yet

- Rotomac Bank FraudDocument8 pagesRotomac Bank FraudAnand Christudas100% (3)

- Financial Regulation IBC. ICADocument14 pagesFinancial Regulation IBC. ICAJahnaviSinghNo ratings yet

- 1 - Credit & Lending - Tutorial Questions Set 1 - 2022Document3 pages1 - Credit & Lending - Tutorial Questions Set 1 - 2022Abdulkarim Hamisi KufakunogaNo ratings yet

- Law Relating To Banking May 2010 Main PaperDocument5 pagesLaw Relating To Banking May 2010 Main PaperBasilio MaliwangaNo ratings yet

- Banker and CustomerDocument8 pagesBanker and CustomerbasalingolumaNo ratings yet

- SR - No Table of Content NODocument53 pagesSR - No Table of Content NONeha AhireNo ratings yet

- Himalayan Reply CONTINUING (1) - 1Document13 pagesHimalayan Reply CONTINUING (1) - 1Gaurav KumarNo ratings yet

- Urgent Legal Notice To Kotak - 30102021 - 211030 - 182306Document4 pagesUrgent Legal Notice To Kotak - 30102021 - 211030 - 182306spahujNo ratings yet

- Sarfaesi Act, 2002 PptnewDocument27 pagesSarfaesi Act, 2002 PptnewCharu Pundir50% (2)

- FORMATIVE ASSESSMENT I - Overview of Credit Policy and Loan CharacteristicsDocument3 pagesFORMATIVE ASSESSMENT I - Overview of Credit Policy and Loan CharacteristicsLorey Joy IdongNo ratings yet

- Banking LawDocument3 pagesBanking LawtrizahNo ratings yet

- Format IIIDocument6 pagesFormat IIIAman GargNo ratings yet

- Revision g11 BST Round 2Document4 pagesRevision g11 BST Round 2Smart GamerNo ratings yet

- Bba 3 Sem AccountsDocument9 pagesBba 3 Sem Accountsanjali LakshcarNo ratings yet

- Q1 Module 5-Week 5-Loan Requirements of Different Banks and Non Bank InstitutionsDocument24 pagesQ1 Module 5-Week 5-Loan Requirements of Different Banks and Non Bank InstitutionsJusie ApiladoNo ratings yet

- Learning Activity Sheet Business Finance Quarter 1, Week 5 Lesson 1Document5 pagesLearning Activity Sheet Business Finance Quarter 1, Week 5 Lesson 1Von Violo BuenavidesNo ratings yet

- Banking Workshop Term 3Document55 pagesBanking Workshop Term 3Arthur AmolaNo ratings yet

- Law Relating To Banking - Nov 2013Document4 pagesLaw Relating To Banking - Nov 2013Basilio MaliwangaNo ratings yet

- Credit AwarenessDocument62 pagesCredit AwarenessHimanshu Mishra100% (1)

- I Csi Brochure Banking Law and PracticeDocument4 pagesI Csi Brochure Banking Law and PracticeAditya KumarNo ratings yet

- Different Types of IssuesDocument9 pagesDifferent Types of IssuesDeepak LohiaNo ratings yet

- Open Letter To Mr. Uday Suresh Kotak, MD & Ceo, Kotak Mahindra Bank, Alongwith Questions Which Remained UnansweredDocument24 pagesOpen Letter To Mr. Uday Suresh Kotak, MD & Ceo, Kotak Mahindra Bank, Alongwith Questions Which Remained UnansweredLaw WhizNo ratings yet

- MemorandumDocument17 pagesMemorandumfliz1889No ratings yet

- Phone: (033) 22735611 Amit Bachhawat: MarksDocument4 pagesPhone: (033) 22735611 Amit Bachhawat: MarksAmit PaulNo ratings yet

- 25 S49Loans, GoldLoans, UBLN, SuretyLoanDocument13 pages25 S49Loans, GoldLoans, UBLN, SuretyLoanSyed FaisalNo ratings yet

- Mohammadzahid&NasirRathod DocxdDocument29 pagesMohammadzahid&NasirRathod DocxdTrexus TrexusNo ratings yet

- Siddaganga Institute of Technology, Tumkur - 572 103: MBA207 USNDocument3 pagesSiddaganga Institute of Technology, Tumkur - 572 103: MBA207 USNNayan KanthNo ratings yet

- Investment 01Document4 pagesInvestment 01Intiser RockteemNo ratings yet

- Banking LawDocument23 pagesBanking LawHarshdeep groverNo ratings yet

- JAIIB Principles and Practices of Banking Q & ADocument13 pagesJAIIB Principles and Practices of Banking Q & ARahul FouzdarNo ratings yet

- Central Banking Indian Specific Issue - 0f6a19f9 9d1e 4830 87be 8557fe576fdbDocument13 pagesCentral Banking Indian Specific Issue - 0f6a19f9 9d1e 4830 87be 8557fe576fdbprachi bhattNo ratings yet

- RETCRD Module II CH 4 Documentation - 3Document13 pagesRETCRD Module II CH 4 Documentation - 3somesh5907No ratings yet

- Practice Paper 4 - QuestionsDocument4 pagesPractice Paper 4 - Questionsniteshkumar.38000No ratings yet

- Mock Bar Examinations in Mercantile LawDocument7 pagesMock Bar Examinations in Mercantile LawjasperNo ratings yet

- In The National Company Law Tribunal Mumbai Bench: Per: Bhaskara Pantula Mohan, Member (J)Document12 pagesIn The National Company Law Tribunal Mumbai Bench: Per: Bhaskara Pantula Mohan, Member (J)saurabhNo ratings yet

- Neeraj Malhotra Vs Deustche Post Bank Home FinancCO100001COM466165Document153 pagesNeeraj Malhotra Vs Deustche Post Bank Home FinancCO100001COM466165urvashiNo ratings yet

- JAIIB - PPB - All Modules NotesDocument501 pagesJAIIB - PPB - All Modules Notesmanu.manohar0408No ratings yet

- Letter of Credit FAQS PDFDocument38 pagesLetter of Credit FAQS PDFVenkataramakrishna Thubati100% (3)

- FIN301Document3 pagesFIN301Smu DocNo ratings yet

- PM0016 - AddDocument5 pagesPM0016 - AddSmu DocNo ratings yet

- Program - Mba - Semester Iv Subject Code & Name Mi0041 - Java and Web DesignDocument5 pagesProgram - Mba - Semester Iv Subject Code & Name Mi0041 - Java and Web DesignSmu DocNo ratings yet

- PM0015 - AddDocument5 pagesPM0015 - AddSmu DocNo ratings yet

- Explain The Requirements of Quality Patient CareDocument5 pagesExplain The Requirements of Quality Patient CareSmu DocNo ratings yet

- Ma0043 - AddDocument5 pagesMa0043 - AddSmu DocNo ratings yet

- MH0057 - AddDocument5 pagesMH0057 - AddSmu DocNo ratings yet

- MF0018 - AddDocument5 pagesMF0018 - AddSmu DocNo ratings yet

- Ib0015 - AddDocument5 pagesIb0015 - AddSmu DocNo ratings yet

- SNAP ApprovalDocument14 pagesSNAP ApprovalLajharus EvansNo ratings yet

- Transgender Rights ThesisDocument6 pagesTransgender Rights Thesisaflpaftaofqtoa100% (2)

- Ch.1 Introduction: Rti & Good GovernanceDocument16 pagesCh.1 Introduction: Rti & Good Governancenirshan rajNo ratings yet

- Gopal Krishna Gokhale G K Jha 190520Document11 pagesGopal Krishna Gokhale G K Jha 190520BlonkoNo ratings yet

- United States v. Dante Duffy, 4th Cir. (2014)Document3 pagesUnited States v. Dante Duffy, 4th Cir. (2014)Scribd Government DocsNo ratings yet

- Timothy Adzati ReportDocument2 pagesTimothy Adzati Reportkojo kum essienNo ratings yet

- Retainer AgreementDocument2 pagesRetainer AgreementVittoria DaelliNo ratings yet

- De Villaruel Vs Manila MotorDocument2 pagesDe Villaruel Vs Manila MotorGale Charm SeñerezNo ratings yet

- C&F ListDocument605 pagesC&F ListSales Ingress ITNo ratings yet

- Slip - TemplateDocument2 pagesSlip - TemplateEddy YNo ratings yet

- Izvestaj o Medijima Preciscen Eng.Document44 pagesIzvestaj o Medijima Preciscen Eng.siriusistNo ratings yet

- Intel Pentium D Processor 900 Sequence and Intel Pentium Processor Extreme Edition 955, 965Document112 pagesIntel Pentium D Processor 900 Sequence and Intel Pentium Processor Extreme Edition 955, 965قناة تعدد في المحتوىNo ratings yet

- Garcia Vs Llamas - G.R. No. 154127. December 8, 2003Document9 pagesGarcia Vs Llamas - G.R. No. 154127. December 8, 2003Ebbe DyNo ratings yet

- Income Tax Ordinance, 2001: Government of PakistanDocument5 pagesIncome Tax Ordinance, 2001: Government of PakistanwaqaswaNo ratings yet

- State v. Hon. Steinle/alejandra Moran, Ariz. (2016)Document8 pagesState v. Hon. Steinle/alejandra Moran, Ariz. (2016)Scribd Government DocsNo ratings yet

- Demat AccountDocument31 pagesDemat AccountTina ChoudharyNo ratings yet

- Corporate Ethics and GovernanceDocument16 pagesCorporate Ethics and GovernancePhilipNo ratings yet

- CSS v2Document36 pagesCSS v2Carlos PavaNo ratings yet

- Fujitsu Mainboard D3 Mainboard D3162-A ATX: Data SheetDocument3 pagesFujitsu Mainboard D3 Mainboard D3162-A ATX: Data SheetpziolkoNo ratings yet

- Motion - Process ServerDocument4 pagesMotion - Process ServerSyannil VieNo ratings yet

- Macbeth Student PacketDocument17 pagesMacbeth Student Packetlilyparker100% (3)

- Defendant Memorial RJ-21Document31 pagesDefendant Memorial RJ-21Mandira PrakashNo ratings yet

- Taxavvy Issue19 PDFDocument5 pagesTaxavvy Issue19 PDFSergio VinsennauNo ratings yet

- From 00:00:05-Nov-2022 To 04-Nov-2023 Midnight: Basic Own DamageDocument3 pagesFrom 00:00:05-Nov-2022 To 04-Nov-2023 Midnight: Basic Own DamageayubNo ratings yet

- Criteria For Denim CompetitionDocument21 pagesCriteria For Denim CompetitionLester Gene Villegas Arevalo100% (1)

- Reinforced Concrete One Way Slab DesignDocument4 pagesReinforced Concrete One Way Slab DesignIzzan SabelloNo ratings yet