Professional Documents

Culture Documents

Samenvatting Intermediate Managing Accounting 1

Samenvatting Intermediate Managing Accounting 1

Uploaded by

eeveelution0 ratings0% found this document useful (0 votes)

44 views26 pagesThis document provides an overview of management accounting concepts including:

1. The key difference between management accounting and financial accounting is that management accounting provides insight to managers while financial accounting provides insight to investors and other stakeholders.

2. Management accounting data focuses on the value of assets, costs of products/processes, and results of activities like production and sales to help with product pricing, strategy, resource allocation, efficiency, and performance evaluation.

3. Cost objects, cost drivers, fixed vs variable costs, and service/manufacturing companies are discussed as fundamental cost accounting concepts.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides an overview of management accounting concepts including:

1. The key difference between management accounting and financial accounting is that management accounting provides insight to managers while financial accounting provides insight to investors and other stakeholders.

2. Management accounting data focuses on the value of assets, costs of products/processes, and results of activities like production and sales to help with product pricing, strategy, resource allocation, efficiency, and performance evaluation.

3. Cost objects, cost drivers, fixed vs variable costs, and service/manufacturing companies are discussed as fundamental cost accounting concepts.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

44 views26 pagesSamenvatting Intermediate Managing Accounting 1

Samenvatting Intermediate Managing Accounting 1

Uploaded by

eeveelutionThis document provides an overview of management accounting concepts including:

1. The key difference between management accounting and financial accounting is that management accounting provides insight to managers while financial accounting provides insight to investors and other stakeholders.

2. Management accounting data focuses on the value of assets, costs of products/processes, and results of activities like production and sales to help with product pricing, strategy, resource allocation, efficiency, and performance evaluation.

3. Cost objects, cost drivers, fixed vs variable costs, and service/manufacturing companies are discussed as fundamental cost accounting concepts.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 26

chapter 1: introduction

Management accounting and financial accounting

Management accounting and financial accounting often use the same data

Crucial difference is the purpose of use:

Financial accounting:

Provide insight to investors and other stakeholders

Management accounting:

Provide insight to managers

Understand the purposes of accounting systems.

depends on the organization

official records

bookkeeping

general ledger

information systems

sap, oracle

spreadsheet

production and customer data?

customer relationship management systems

(Management accounting data is mainly about:

!he value of assets

!he costs of products and processes

!he results of activities

Production, sales etc"

for e#ample:

product pricing and marketing

strategy and long$range planning

resource allocation decisions

efficiency of operations

performance measurement and management

evaluation of managers and employees

Know the terms planning, control and budgets.

Planning: Choosing goals" Predicting results under various %ays of achieving those goals and then

deciding ho% to attain the desired goals"

Control: Covers both the action that implements the planning decision and the performance evaluation of

the personnel and operations

Budgets: the &uantative e#pression of a plan of action and an aid to the coordination and implementation

of a plan"

upply chain

!he flo% of goods, services and information from cradle to grave, irrespective of %hether those activities

occur in the same organization or other organizations"

!alue chain

!he se&uence of business functions in %hich utility is added to the products or services of an

organization"

Verspreiden niet toegestaan | Gedownload door: Roza Smit | E-mail adres: rebeccaroza@yahoo.com

chapter ": cost terms and purposes

Cost ob#ects

' cost object is anything for %hich you %ant to kno% the cost

For e#ample:

' product

' service

'n activity

' department

Cost dri$ers

'ny factor that affects total costs" ' change in the cost driver %ill cause a change in the total costs

%irect $ersus indirect costs

Direct costs are directly linked to a cost ob(ect

Costs can be traced to cost ob(ects

Indirect costs cannot reasonably be linked directly to a cost ob(ect

)e need a rule to link them to cost ob(ects: this is the essence of cost allocation

&i'ed $ersus $ariable costs

Variable costs are costs that change in relation to a change in a cost driver

Cost drivers often reflect the level of activity in an organization

Fixed costs do not change in relation to the level of activity

er$ice, merchandising and manufacturing companies.

(ie)enhuis, boe)enwin)el, computer fabrie).

chapter *: #ob costing

Cost pool

'll costs that need to be traced or allocated to cost ob(ects

+ cost allocation base are.

' factor that determines ho% indirect costs are allocated to cost ob(ects

,ob and process costing.

!%o basic techni&ues for allocating costs to cost ob(ects

*se of techni&ues depends on type of production process

+ome production processes result in clearly distinct units of output

,ther production processes result in a mass product in %hich thousands of e&ual units are

produced

-ob costing: one uni&ue cost ob(ect

audit by accounting firm

aircraft

building . construction

Process costing: mass product

computer chips

oil

peanut butter

-eneral approach to #ob costing.

/" )hat is the cost ob(ect?

0" )hat are the direct costs of the (ob?

materials

labor hours

1" )hat indirect costs are associated %ith the (ob?

support activities

common (shared resources

2" +elect a cost allocation base for the indirect costs

labor hours

units

"""

3" Calculate the allocation rate

4ndirect costs allocated to cost ob(ect per unit of the allocation base

5" 'ssign the costs to the (ob

!race direct costs and allocate indirect costs using the allocation base and rate

.'ample

6ent of 077 m

0

office building in 0778: 9/07,777

Floor space department ': 83 m

0

Floor space department :: /03 m

0

'llocation base is m

0

of floor space

)hat is the allocation rate?

/07,777 . 077

;

9577 per m

0

'llocated to ': 9577 # 83 ; 923,777

'llocated to :: 9577 # /03 ; 983,777

/ormal and actual costing.

Calculating a cost allocation rate re&uires the period activity level

number of design hours

total production volume

<ou only kno% the e#act level at the end of the period

:ut can you %ait months for costing information?

'ssume a =normal> activity level

e#pected

standard

?ormal costing

*se the normal activity level (volume to calculate allocation rate

Multiply this rate by the units of the allocation base used for the (ob

!ake actual costs for direct costs

'ctual costing

use actual activity levels to calculate allocation rate

Proration

Method 1: 0n proportion to allocated costs

allocated costs proration

10P 2 34,444 5 1"6 2 1",444

&- 2 34,444 5 1"6 2 1",444

C7- 2 *84,444 5 936 2 93,444

:7:+; 2 <44,444 1446 2 144,444

Method ": 0n proportion to closing balance

Method *: direct write=off

chapter >: process costing

Production data February

%ork started in this period: 577

%ork finished: 277

ra% materials /77@ completion

completion rate for conversion: 57@

A&uivalent units of %$i$p

direct materials: 077

conversion cost: 57@ B 077 ; /07

+uppose:

!otal cost to account for: 9 11,027

materials costs: 9 //,277

conversion costs: 9 0/,C27

Duestion is: ho% much belongs to sold product and ho% much to )4P?

A&uivalent unit costs

Materials cost: //,277 . 577 ; 9 /E per e&" unit

Conversion costs: 0/,C27 . (277F/07 307 ; 9 20 per e&" unit

Cost of completed output

277 B (/EF20 ; 9 02,277

Cost of %$i$p

materials: 077 B /E ; 9 1,C77

conversion: /07 B 20 ; 9 3,727

total costs: 1,C77 F 3,727 ; 9 C,C27

so be sure to calculate materials and conversion cost of %$i$p separately

!otal cost accounted for

02,277 F C,C27 ; 9 11,027

closing

balance before

proration

proration

10P 2 "44,444 5 146 2 14,444

&- 2 *44,444 5 1<6 2 1<,444

C7- 2 1,<44,444 5 9<6 2 9<,444

:7:+; 2 ",444,444 1446 2 144,444

proration

10P 4

&- 4

C7- 2 144,444

:7:+; 2 144,444

Process costing in < steps

/" summarize flo% of goods

opening %$i$p, units started, closing %$i$p

0" calculate output in e&uivalent units

1" compute e&uivalent unit costs

2" calculate total costs to account for

3" assign total costs to units completed and units in closing %$i$p

make sure that they add up to the total costs to account for

!%o %ays to deal %ith this

%eighted average method: take all costs from opening %$i$p and %ork started during

period, and divide over e&uivalent units

first$in$first$out (F4F, method: treat current and previous production separately

1eighted a$erage

,pening stock March: 9 C,C27

materials: 9 1,C77 (077 units, fully completed

conversion: 9 3,727 (077 units, 57@ completed

Production data March

%ork started: 377

%ork completed: 337

materials costs: 9 C,377

conversion costs: 9 /8,E77

%$i$p completion: /77@ for direct materials, 17@ for conversion

tep 1: physical flow of goods

opening %$i$p: 077

started: 377

completed: 337

ending %$i$p: /37

tep ": e?ui$alent unit output

direct materials: 337 F /77@ B /37 ; 877

conversion: 337 F 17@ B /37 ; 3E3

tep *: .?. unit costs

direct materials (877 e& units

%$i$p costs: 9 1,C77

current period costs: 9 C,377

cost per e&uiv unit: (1,C77 F C,377 . 877 ; 9 /8"38

conversion costs (3E3 e& units

%$i$p costs: 9 3,727

current period costs: 9 /8,E77

cost per e&uiv unit: (3,727 F /8,E77 . 3E3 ; 9 1C"33

tep >: :otal cost to account for

C,C27 F C,377 F /8,E77 ; 9 13,027

tep <: +ssign costs to completed output and w=i=p

cost of completed output

337 B (/8"38 F 1C"33 ; 9 17,C5E

cost of %$i$p

materials: /37 B /8"38 ; 9 0,515

conversion: 23 B 1C"33 ; 9 /,813

total costs: 9 2,18/

accounted for: 17,C5E F 2,18/ ; 9 13,027

&0&7 Method

,pening stock March: 9 C,C27

materials: 9 1,C77 (077 units, fully completed

conversion: 9 3,727 (077 units, 57@ completed

Production data March

%ork started: 377

%ork completed: 337

materials costs: 9 C,377

conversion costs: 9 /8,E77

%$i$p completion: /77@ for direct materials, 17@ for conversion

tep 1: physical flow of goods

!reat %$i$p and ne% production separately

opening %$i$p: 077 (57@ conversion

started and completed: 137

closing %$i$p: /37 (17@ conversion

tep ": .?ui$alent units

materials: 137 F /37 ; 377

conversion: (/77@ G 57@ B 077 F 137 F 17@ B /37 ; 283 units

tep *: .?. unit costs

direct materials

current period costs: 9 C,377

cost per e&uivalent unit: C,377 . 377 ; 9 /8"77

conversion

current period costs: 9 /8,E77

cost per e&uivalent unit: /8,E77 . 283 ; 9 18"5C

teps > @ <

!otal cost to account for: 9 13,027

cost of completed output: 9 17,EE2

%$i$p: 9 C,C27

materials: 137 B /8"77 ; 9 3,E37

conversion: (C7 F 137 B 18"5C ; 9 /5,072

cost of %$i$p: 9 2,025

materials: /37 B /8"77 ; 9 0,337

conversion: 23 B 18"5C ; 9 /,5E5

accounted for: 17,EE2 F 2,025 ; 9 13,027

)hy is there a difference?

Here:

Fifo method has only =cheap> units in stock

)' still has some of the more e#pensive inputs in stock

chapter <: cost allocation

:he four purposes of cost allocation

!o facilitate economic decision making

!o give incentives to managers and employees

!o (ustify costs to outside parties

For financial accounting reasons

ingle rate method

' fashion chain has t%o shops

*trecht: 07 employees, 277 m

0

floor space, direct costs 9 0 mln

6otterdam: /3 empl, 577 m

0

, direct costs 9 0"3 mln

!hese divisions are supported by:

purchasing: department costs 9 /"3 mln

general mgt: department costs 9 / mln

For direct costs as the allocation base:

Iirect cost ;

9 0 mln F 9 0"3 mln ; 9 2"3 mln

!hus, for each / 9 of direct cost, there %ill be

9 0"3. 9 2"3 ; 9 7"35 indirect cost

4ndirect costs *trecht is 0 mln B 7"35 ; 9 /"// mln

4ndirect costs 6>dam is 0"3 mln B 7"35 ; 9 /"1E mln

9 0"3 mln

%ual rate method

Iual$rate: classify costs in subpools"

Aach subpool has a different allocation rate or a different allocation base"

For instance:

For purchasing, the allocation base is direct cost

For general, the allocation base is employees

Purchasing: cost pool ;/"3 mln

'llocation base; direct cost ; 2"3 mln

Jeneral: cost pool ; 0"3 mln

*trecht: (0 . 2"3B /"3 mln ; 9 7"58 mln

6>dam: (0"3 . 2"3B /"3 mln ; 9 7"C1 mln

9 /"37 mln

Jeneral: cost pool ; / mln

'llocation base ; 13 employees

*trecht: (07 . 13B / mln ; 9 7"38 mln

6>dam: (/3 . 13B / mln ; 9 7"21 mln

9 /"77 mln

:hree support department allocation methods

/" Iirect allocation

allocate the costs of service departments to operating departments only

no accounting for inter$service department activities

0" +tep$do%n allocation

allocate the costs of the service departments in a specific order

1" 6eciprocal allocation

account for inter$service department activities in both directions

%irect allocation

!%o production departments:

/" +mall and medium sized firms (K+mallL

0" Multinationals (KMultiL

!%o service departments

/" Jeneral management

Costs: 90777

0" 4!

Costs: 95777

JM 4! +mall Multi Total

Dept.Costs 9 2000 9 6000

JM /7@ 07@ 27@ 17@

4! 03@ /3@ 13@ 03@

JM 2.8 1.8

4! 8./0 3./0

JM 9//21 9C38 90777

4! 91377 90377 95777

Total 9 4643 93357 98000

tep down allocation

-M &irst

-M 0: mall Multi :otal to mall @ Multi

%ept.Costs 2"444 23444

-M 146 "46 >46 *46

0: "<6 1<6 *<6 "<6

-M "AB >AB *AB

0: 9A1" <A1"

-M 2>>> 288B 2339 21<<3

0: 2*9<B 2"38< 23>>>

:otal 2>3>* 2**<9 28444

0: &irst

-M 0: mall Multi :otal

to

mall

@

Multi

%ept.Costs 2"444 23444

-M 146 "46 >46 *46

0: "<6 1<6 *<6 "<6

-M >A9 *A9

0: <A19 9A19 <A19

-M 2"1<1 2131> 2*93<

0: 2193< 2">94 2193< 2>"*<

:otal 2>3"1 2**9B 28444

Ceciprocal allocation

-M 0: mall Multi

%ept.Costs 2"444 23444

-M 146 "46 >46 *46

0: "<6 1<6 *<6 "<6

JM ; 0777 F 7"/JM F 7"034!

4! ; 5777 F 7"0JM F 7"/3 4!

+mall ; 7"2 JM F 7"13 4!

Multi ; 7"1 JM F 7"03 4!

JM ; 0777 F 7"/JM F 7"034!

4! ; 5777 F 7"0JM F 7"/34!

+olve through substitution:

7,EJM ; 0777 F7"034! etc"

JM ; 2283

4! ; C//0

+mall ; 7"2 JM F 7"13 4! ; 250E

Multi ; 7"1 JM F 7"03 4! ; 118/

-M 0: mall Multi :otal

Iept"

Costs

92000 96000

JM 922C 9CE3 9/8E7 9/121 91/11

4! 9070C 9/0/8 90C1E 9070C 92C58

Total 9250E 9118/ 9C777

Common costs allocation methods

' cost of operating a facility, operation, activity or other cost ob(ect that is shared by t%o or more users"

.'ample:

Paul ,>+hes lives in Jal%ay" 4nvited for intervie% in Mosco%, ticket;9/077,$ 'nother invite for intervie%

in Prague, ticket Mosco%$Prague;9C77,$" He decides to combine the tickets to get Jal%ay$Mosco%$

Prague; 9/377

tand=alone cost=allocation method

Cost allocation divided fairly across the employers

Mosco% employer: 9/077.(9/077F9C77 B 9/377; 7"5B9/377;9E77

Prague employer: 9C77.(9C77F9/077 B 9/377; 7"2B9/377;9577

0ncremental cost=allocation method

Cost divided trough employers by taking total amount and allocate original costs to primary party

(Mosco% and the rest to the secondary party (prague

Mosco%(primary original costs 9/077

Prague(secondary rest amount 9177

chapter 3: #oint costs

-oint costs are the costs of a production process that yields multiple products simultaneously

Main issue is ho% the allocate the (oint costs over the different end products

Common in for e#ample chemical and food industries

-oint costs are incurred for producing t%o or more products (outputs

so %e have multiple cost ob(ects

Common costs are also incurred for multiple cost ob(ects

Main difference

common costs are a choice: you can use separate processes

(oint costs are a necessity (given the production process

.'ample

Production of one batch of /0 mln kg of peanuts

-oint costs of 9 /7 mln

+atay sause

yield: E mln kg

price: 9 /"58 per kg

specific costs: 9 2 mln

Peanut butter

yield: / mln kg

price: 9 /7 per kg

specific costs: 9 3mln

Physical measures

allocation base is kg, liter, unit

Measure ; kg of product: E F / ; /7 mln kg

-oint cost ; 9 /7 mln

+auce: E./7 B /7 mln ; 9 E mln

:utter: /./7 B /7 mln ; 9 / mln

ales $alue

allocation base is euro sales

Measure ; sales value of products:

+auce: E mln kg # 9 /"58 per kg ; 9 /3 mln

:utter: / mln kg # 9 /7 per kg ; 9 /7 mln

/3 F /7 ; 9 03 mln

-oint cost ; 9 /7 mln

+auce: /3.03 B /7 mln ; 9 5 mln

:utter: /7.03 B /7 mln ; 9 2 mln

/et realiDable $alue

allocation base is euro sales minus direct (separable costs

Measure ; ?6M of product: sales G separable costs

+auce: /3 mln G 2 mln ; 9 // mln

:utter: /7 mln G 3 mln ; 9 3 mln

!otal ?6M ; 9 /5 mln

-oint costs ; 9 /7 mln

+alt: //./5 B /7 mln ; 9 5"E mln

Chlorine: 3./5 B /7 mln ; 9 1"/ mln

Constant gross margin

Margin on individual products is margin on overall process

Measure ; same gross margin for all products

Jross margin ; +ales $ costs

!otal sales value: /3 F/7 ; 9 03 mln

!otal costs: /7 F 2 F 3 ; 9 /E mln

Jross margin ; 9 5 mln

Jross margin @ ; 5.03 ; 02@

Margin should be 02@ for both products

+auce

o Margin should be 7"02 # 9 /3 mln ; 9 1"5 mln

o !hus allocation should be /3 G 2 G 1"5 ; 9 8"2 mln

:utter

o Margin should be 7"02 # 9 /7 mln ; 9 0"2 mln

o !hus allocation should be /7 G 3 G 0"2 ; 9 0"5 mln

chapter 9: absorption costing and $ariable costing

Assential difference: to %hat e#tent do %e incorporate fi#ed costs in value of stock?

,ne possibility: take fi#ed costs as a period cost

all fi#ed costs are e#pensed in the current period

ariable costin! "also: direct costin!#

,ther possibility: include fi#ed costs in inventory

fi#ed costs are part of the unit cost

they are absorbed in the unit cost: absorption costin!

Formula for ad(ustment

(& G b B (f.b

(actual activity level G budgeted activity level B (fi#ed costs . budgeted activity level

4n %ords: the difference bet%een the actual and the budgeted volume times the budgeted

fi#ed costs per unit

)hat if you produce less than budgeted?

too fe% units that carry the fi#ed costs: %e need to take an e#tra charge for the remaining

fi#ed costs

+mall factory producing carrier bikes

Fi#ed costs per month: 9 177

+elling price per unit: 9 /7

Mariable costs per unit: 9 5

?ormal (budgeted production: /37

6ate for allocating fi#ed costs to units:

9177 . /37 ; 90 per unit

*nit costs:

9 5 F 90 ; 9C per unit

February

Production: /37

+ales: /07

And stock: 17

February:

Cogs ; 9C # /07 ; 9E57

Fi#ed costs accounted for: /37 # 90 ; 9177

6eal fi#ed costs: 9177

'd(ustment needed: 97

-an Feb Mar 'pr

sales /37 /07 /57 /57

production /37 /37 /17 /57

March:

:egin stock: 17 units

Production: /17 units

+ales: /57 units

And stock: 7

Cogs ; 9C # /57 ; 9/0C7

Fi#ed costs accounted for: /17 # 90 ; 9057

6eal fi#ed costs: 9177

'd(ustment needed: $927

'pril:

:egin stock: 7 units

Production: /57 units

+ales: /57 units

And stock: 7

Cogs ; 9C # /57 ; 9/0C7

Fi#ed costs accounted for: /57 # 90 ; 9107

6eal fi#ed costs: 9177

'd(ustment needed: 907

Assential difference is treatment of fi#ed costs:

MC: Fi#ed costs are not allocated but taken as period costs

?o ad(ustment neededN

'C: Fi#ed costs are allocated to products and some end up in stock

'd(ustments needed if actual production differs from planned production

4f production;sales

no difference in period result

4f productionOsales

result ac O result vc

part of the fi#ed costs are not e#pensed this period, but taken into inventory (so out of

the cost of goods sold

4f productionPsales

result ac P result vc

(e#tra fi#ed costs are taken out of inventory and into the cost of goods sold

'dvantages variable costing

:etter for short term decisions: if %e make an e#tra batch, the e#tra profit e&uals

contribution margin B number of units

no possibility for pumping up profits

'dvantages absorption costing

:etter for long term decisions: full cost price includes all costs:

chapter 8: brea)=e$en analysis

Cost$volume$profit (CMP analysis

' simple techni&ue to make business decisions regarding the production and sales of products

Calculating ho% profit depends on sales volume

:asic tenet: by selling products %ith a positive contribution margin (per unit you first earn back

your fi#ed costs and then start making profit

)here is this Kbreak$even pointL?

!erminology

:reak even point: sales level at %hich profit is zero

revenue driver: factor that affects revenues (products sold, services delivered, number of

hotel nights

operating profit: result before ta#es

net profit: operating profit G ta#es

contribution margin (per unit

P G M

%hat you earn per unit to cover your fi#ed costs, and contribute to your profit

revenue

D # P

total costs

F F D # M

break$even sales: %hen is profit 7?

D # P ; F F D # M

D ; F . (P G M

Firm data

fi#ed costs: 577

variable cost per unit: 5

price: /7

:reak even point:

D ; F . (P G M

D ; 577 . (/7 G 5 ; /37

Ho% much must %e sell to achieve a certain target?

Profit ; D # (P G M G F

D ; (F F Profit . (P G M

Firm data

F ; 577, M ; 5, P ; /7

+uppose profit target is 077

D ; (F F Profit . (P G M

D ; (577 F 077 . (/7 G 5 ; C77 . 2 ; 077

%hat is the effect on the break even sales level of an increase in

Price

decreases

variable cost

increases

fi#ed cost

increases

chapter B: cost estimation

Cost estimation approaches

4ndustrial engineering method. %ork$measurement method

'nalyses the relationship bet%een input and output in terms of physical units

Conference method

e#pert kno%ledge . opinions about cost(s(drivers

'ccount analysis method

breaking up accounts in fi#ed and variable costs

Duantitative analysis

re&uires a number of observations

6egression analysis

/" Choose the dependent variable

0" 4dentify the independent variable or cost driver

1" Collect data on the dependent variable and the cost driver

2" Plot the data

3" Astimate the cost function

5" Avaluate the estimated cost function

/ature of the cause and effect criterion.

/" 4t may be due to a physical relationship bet%een costs and the cost driver"

0" Can arise from a contractual arrangement

1" Can be implicitly established by logic and kno%ledge of operations" 'n e#ample is %hen the

number of component parts is used as a cost driver"

chapter 14: rele$ant costs

Five step approach to (economic decision making in organizations

/" gathering information

0" making predictions

1" choosing an alternative

2" implementing decision

3" evaluating performance

)hat to remember about opportunity costs

Chosen course of action does not only involve monetary costs, but also means that other things

cannot be done

,pportunity costs take into account the benefits foregone by not choosing the best

available alternativeQ

,pportunities do not al%ays make themselves kno%n

not easy to estimate the e#act opportunity costs

+unk costs

past investments

materials

machines

soft%are

anything

you cannot change the past

you can>t make money in the past

sunk costs are never relevant

is it a shame to thro% something good a%ay? not if you can make more money by doing

so

Many people find this counterintuitive

!hey are strongly committed to their initial choice and find it hard to look at economic decisions

from a rational economic perspective

A#ample: the ne% 'msterdam sub%ay line

,riginal estimate of costs: 9/"2 bln

+uppose that right no% 9/ bln has been spent

?e% estimate is that total costs %ill be 9 1 bin

+hould %e continue?

?ote that the 9/ bln that has already been spent are sunk costs

!hey should not affect your decisionN

'lternatives are:

?o sub%ay, %hich re&uires 97

' sub%ay %hich re&uires 9/"5 bln

Jood and bad cost accounting systems

' good cost accounting system provides insight in the relevant costs

'llo%s managers to see %hat drives costs and to make smart decisions

'll costs vary %ith something (in the long term

Many accounting systems used in practice are of mediocre &uality

+ome researchers have even &uestioned the relevance of cost accounting

'n import firm sells tropical food items to both restaurants and consumers

!otal indirect costs a year are 9/77,777

6estaurants

+ales: 9177"777 a year, personnel: 8 F!A, normal number of orders per year:

07,777, +&uare meters used: 007

Consumers (through store

+ales: 9037"777 a year, personnel: /7 F!A, number of orders: 17,777, s&uare

meters used: /77

)hich allocation base should %e use to allocate the 9/77,777 to the %holesale and the consumer

division?

4t depends on type of indirect costs

4s the cost level more closely associated %ith the sales level, the number of orders, the

number of employees, or s&uare meters used?

Iifferent types of indirect costs may re&uire different allocation bases

4n general an allocation base is better, if it better reflects the actual use of an indirect cost by a

cost ob(ect

!he closer it gets to Kcost tracingL

4f you look at real %orld organizations, a very large proportion (ust allocates all indirect

costs based on some measure of volume or in proportion to direct costs

chapter 11: acti$ity based costing

!echni&ue developed in the /E87>s

'ckno%ledges that costs arise from the fact that organizations do something: they perform

activities

insert parts

set up the production line for a ne% batch

process an invoice

perform maintenance on it$hard%are

take calls at a helpdesk

!he basic tenet of ':C is that %e should look for activities in organizations that cause costs

Cost drivers

+ince these activities are performed for specific departments of products relations bet%een cost

pools and cost ob(ects can be identified"

A#ample: order processing

you do this to take orders and perform administrative activities (booking, preparing

invoices

the more orders, the bigger your administration

cost pool: order administration department

cost driver: number of orders

':C recognizes that cost drivers e#ist at different levels"

,utput$unit level

:atch level

Product sustaining level

Facility sustaining level

Cost at higher levels are indirect from a lo%er level perspective

,utput level costs

costs that are made for each unit individually

ra% materials

depreciation

:atch level costs

costs that are made for a group of units

set$up costs

distribution

note that you can lo%er the costs per unit by increasing batch size

Product sustaining costs

also for services

design costs

marketing activities?

Facility sustaining costs

support the organization as a %hole

general management

building %ith multiple product lines

!he activity rate is the cost Kper unit of activityL

'ctivity rate ; activity cost pool . total units of activity

For e#ample: costs of maintenance department may depend on hours %orked on maintaining

machines

!otal costs are 9277,777

!otal hours %orked are /0,777

'ctivity rate ; 11"11 per hour

4f some departments have machines that re&uire more maintenance, they get allocated more costs

+teps to take in ':C

/" %hat are the cost ob(ects?

0" %hat are the direct costs of the cost ob(ects?

1" %hat activities are performed?

2" %hat cost pools are associated %ith activities?

3" calculate the activity rates

5" allocate the activity costs to the cost ob(ects

8" add direct costs

chapter 1": pricing and profitability

0nfluences on pricing.

$ Customers

$ Competitors

$ Costs

hort=run pricing is based on rele$ant costs, full costs are important in long=run pricing.

:arget costing

!he estimated long$run cost per unite of a product that, %hen sold at the target price, enables the

company to achieve the target operating profit per unit"

;oc)ed=in costs

!he costs that have not yet been incurred but that %ill be incurred in the future on the basis of decisions

that have already been made"

;ife=cycle costing.

!racks and accumulates the actual costs attributable to each product from start to finish"

Customer profitability analysis, and notice the similarity to activity based costing"

chapter 1>: moti$ation, budgets and responsibility accounting

force planning

%hat is that you %ant to achieve?

coordination and communication

%hat is re&uired for this in terms of activities and resources?

evaluation of performance

so ho% %ell did you do?

motivation

by setting goals and tying re%ards to evaluation

allocation of decision rights

budget holder can make choices %ithin his . her budget

he . she is responsible for the budget result

this is the concept of responsibility accounting

master budget: overall plan for the organization

it consists of various components that are linked

revenue budget

production budget

marketing budget

etc

note that the starting point is revenue budget

this gives the e#pected activity level

budgets are the plans for the coming period

cost budget

costs you make for your activities

=allo%ed costs>

target is met if costs are belo% allo%ed costs

revenue budget

sales that you must make

target is met if sales are higher than planned sales

static budget: no correction for activity level

fle#ible budget: allo%ed costs are corrected for actual activity level

in evaluating budgetary performance, %e correct for the actual activity level

since variable part of the budget %ill change if the volume (; activity level changes

this can be done at various levels of detail

Colling budgets

:udget or plan that is al%ays available for a specified future period by adding a month, &uarter or year in

the future as the month, &uarter or year (ust ended is dropped

KaiDen

:udgetary approach that e#plicitly incorporates continuous improvement during the budget period into

the resultant budget numbers

+cti$ity=based budgeting.

'pproach to budgeting that focuses on the costs of activities necessary to produce and sell products and

services

:he four types of responsibility centers

/" cost centre G manager accountable for costs only

0" revenue centre G manager accountable for revenue only

1" profit centre G manager accountable for revenues and costs

2" investment centre G manager accountable for investments, revenues and costs

:he concept of controllability.

Controllability is the degree of influence that a specific manager has over costs, revenues or other items in

&uestion"

chapter 1<: fle'ible budgets and management control 0

Horngren uses the follo%ing terminology

level 7 variance: actual profit $ budgeted profit

level / variance: the static budget variance of the separate revenue and cost items

level 0 variance: the fle#ible budget variances, correcting for the actual activitity level

level 1 variance: price and efficiency variances that e#plain the fle#ible budget variances

the static budget variance is the difference bet%een the actual and static budget amounts

you cannot simply do budgeted amount G actual amount to get the correct =sign>: it depends on

%hether it is a revenue item or a cost itemN

al%ays ask yourself: does the variance amount increase or decrease profit?

actuals static

budget

variances

units sold 237 377

revenues C3,377 /77,777 /2,377 u

variable costs 27,377 27,777 377 u

fi#ed costs 0E,777 17,777 /,777 f

operating

profit

/5,777 17,777 /2,777 u

%e have to correct the budget for differences in activity amounts

here: sales volume

calculate the fle#ible budget, e"g"

budgeted variable cost per unit: 27,777 . 377 ; C7

fle#ible budgeted variable costs: 237 B C7 ; 15,777

so the allo%ed variable costs at this activity level are 15,777

actuals fle#ible budget variances

units sold 237 237

revenues C3,377 E7,777 2,377 u

variable costs 27,377 15,777 2,377 u

fi#ed costs 0E,777 17,777 /,777 f

operating profit /5,777 02,777 C,777 u

the difference bet%een fle#ible budget and static budget is the volume variance

because this arises from volume (activity differences

combining volume and fle#ible budget variances:

static budget variable costs: 27,777

fle#ible budget variable costs: 15,777

actual variable costs: 27,377

the static budget variable cost variance of 377 u consists of a volume variance of 2,777 f and a fle#ible

budget variance of 2,377 u

actual fle# b variance fle#ible budget volume variance static budget

units 237 237 377

rev C3,377 2,377 u E7,777 /7,777u /77,777

var 27,377 2,377 u 15,777 2,777 f 27,777

fi#ed 0E,777 /,777 f 17,777 7 17,777

profit /5,777 C,777 u 02,777 5,777 u 17,777

volume variances are mainly important for evaluating the sales and marketing activities

these can influence the total volume

so the volume variance of /7,777 u for revenue is important information: the sales target has not been

met

fle#ible budget revenue variance

result of difference in selling price

fle#ible budget cost variances

can result from prices, but also from usage of inputs

fle#ible budget cost variance: difference bet%een actual costs and allo$ed costs

%hat determines the allo%ed costs?

'llo%ed input for actual output B budgeted price

%hat causes the fle#ible budget variance?

differences in price: materials bought for a different price, %age rate per labor hour different

differences in usage (efficiency: more or less materials . labor hours per unit of output

e#ample: producing one table re&uires 1 labor hours at a price of 07 per hour

during a certain period, 07 tables %ere produced, re&uiring 3C hours for a total labor cost of /,085

%hat is the budget result? 85 *

%hat is the price effect (if any? //5 *

%hat is the efficiency effect (if any? 27 F

generating one unit re&uires & units of a resource at price p

allo%ed costs: &b B pb

fle#ible budgetN

actual costs: &a B pa

budget result ; budgeted costs G actual costs

price variance ; actual usage B (actual price G budgeted price

efficiency variance ; budgeted price B (budgeted usage G actual usage

for one table, %e need /7 kg %ood at a price of /0 per kg

budgeted production for -anuary: 183 tables

actual production: 180 tables, for %hich 2,7E0 kg of %ood %ere used, at a total cost of 28,73C

budgeted (allo%ed costs: 180 B /7 B /0 ; 22,527

so variance is 22,527 G 28,73C ; 0,2/C u

actuals

price per kg: 28,73C . 2,7E0 ; //"37

usage per unit (table: 2,7E0 . 180 ; //

variances

price: 2,7E0 B (/0 G //"37 ; 0,725 f

efficiency: /0 B (1,807 G 2,7E0 ; 2,252 u

this adds up to 0,2/C u

possible reasons for lo%er materials prices

good bargain

lo%er &uality materials

bulk buying (leading to higher stocks

possible reasons for higher material use

lo%er &uality materials

scheduling problems (rush orders

lo%er skilled labor

possible reasons for lo%er labor rates

lo%er skilled %orkers

possible reasons for higher labor use

lo%er skilled %orkers

lo%er &uality materials

al%ays note the interdependencies

cheap material may mean inferior &uality, leading to more re%ork, more labor time

cheap labor may mean un&ualified staff, resulting in more hours needed, or in too much material used

chapter 13: fle'ible budgets and management control 00

overhead costs

in general: indirect costs of production or services

supervision, supplies, storage, it support, administrative support, marketing

in manufacturing settings also the fi#ed costs of machinery and e&uipment

the level of overhead costs has no direct link %ith the activity level of the main product or service

but if for e#ample more consultants are hired, the administrative support %ill increase

variable overhead cost: energy

cost driver: manufacturing hours

one unit of output re&uires 0 manufacturing hours

budgeted production is 3,777 units

budgeted energy costs are /3,777

so variable overhead rate of /3,777 . /7,777 ; /"37

actuals

3,077 units produced in /7,E07 machine hours

energy: total costs /3,0CC

:M ; /7,777 MH

'M; /7,E07 MH

+M; /7,277 MH (3,077 B 0 MH

:udgeted ,H 6ate /"37 per MH

'ctual ,H : /3,0CC

Fle#ible budget R 'M: /7,E07 B /"37

+pending$variance : /,7E0 F

Fle#ible budget R 'M: /7,E07 B /"37

Fle#ible budget R +M: /7,277 B /"37

Afficiency variance: 8C7 *

this adds up to 1/0 f

spending variance

this e&uals the price variance

note that the overhead rate of /"37 energy costs per machine hour can change because of savings in

energy use, or price changes per unit of energy

efficiency variance

results from changes in machine hour use (not because of efficient energy use

variable overhead: there is no direct link bet%een machine hours and energy use

fi#ed costs are assumed fi#ed

so no activity level re&uired

never an efficiency variance, only spending

ho%ever, volume variances are important

in case of absorption costing, costs per unit include a part overhead costs

this is similar to the manufacturing volume variance discussed %ith absorption costing

,verabsorbed ,verhead:;the amount of overhead applied O actual overhead incurred

*nderabsorbed ,verhead:; the amount of overhead applied P actual overhead incurred

Iisaggregation into:

,verhead spending variance

,verhead efficiency variance

,verhead volume variance

chapter 19: yield, mi' and ?uantity effects

budget: sales 077 units at /7, market size 377

market share 27@

actual: sales 007 units, market size 577

market share 15"8@

market size variance

27@ B (577 G 377 B /7 ; 277 f

market share variance

577 B (15"8@ G 27@ B /7 ; 077 u

%here do variances come from

measurement error

no kno%ledge of operations

incorrect standards

price changes, change in activities

standard set too high . too lo%

out$of$control operations

bad performance

uncontrollable factors

economy, competitors?

%ith substitutable inputs, differences in input combinations result in variances

oranges or apples for (uice

standard chemicals from different suppliers

mi# variances

if the inputs are used in different proportions

yield variances

efficiency of using inputs

Assume that:

A Company produces a product T.

Standard cost of producing a 500 liter batch of T is 135

See below for the standard materials and related standard cost of each component used in a 500-

liter batch.

Standard Standard

Input Quantity Costs

in liters per liter Total cost

P 200 0.2 40

Q 100 0.425 42.5

R 250 0.15 37.5

S 50 0.3 15

600 135 0.225

Quantity Total Purchase Quantity

Purchased price used

P 25000 5365 26600

Q 13000 6240 12880

R 40000 5840 37800

S 7500 2220 7140

85500 19665 84420

A total of 140 batches of T were produced during the current period.

We want to know: price variances, efficiency variances, mix variances and total yield variances

Price Variances

Purchased Standard Variance

Protex 5365 5000 -365

Q 6240 5525 -715

R 5840 6000 160

S 2220 2250 30

19665 18775 -890

Actual number of batches 140

Efficiency variances

Used Standard Ps Variance

P 26600 28000 0.2 280

Q 12880 14000 0.425 476

R 37800 35000 0.15 -420

S 7140 7000 0.3 -42

84420 84000 294

Actual Q Budget Q Ps Yield

Standardmix Standaardmix

P 28140 28000 0.2 28

Q 14070 14000 0.425 29.75

R 35175 35000 0.15 26.25

S 7035 7000 0.3 10.5

84420 84000 94.5 U

Used Actual Mix Standardmix Ps Mix variance

P 26600 28140 1540 0.2 308

Q 12880 14070 1190 0.425 505.75

R 37800 35175 -2625 0.15 -393.75

S 7140 7035 -105 0.3 -31.5

84420 84420 388.5

chapter "4: cost management

/" Prevention costs $ costs incurred in precluding the production of products that do not conform

to specifications

0" 'ppraisal costs G costs incurred in detecting %hich of the individual units of products do not

conform to specifications

1" 4nternal failure costs G costs incurred %hen a non$conforming product is detected before it is

shipped to customers"

2" A#ternal failure costs G costs incurred %hen a non$conforming product is detected after it is

shipped to customers"

short term approach to operations problems

identify bottleneck in operations

%hich activities limit the total output?

ma#imize throughput

sales revenues G direct variable costs

all other operating costs are assumed fi#ed

short term focus

in the long term, the bottleneck should be removed by investments or

restructuring of processes

optimize the bottleneck activities

reschedule to non$bottleneck activities

improve &uality of input into bottleneck activities

adapt performance measures

adherence to schedule: %orkers at non$bottleneck operations shouldn>t produce more

than is re&uired according to bottleneck schedule

also in services

hospitals

courts

universities

.'ample

T%C Co&pan' produces < en S

2 departments '$I involved:

Product < 1 types of material: 6M/ , 6M0 and 6M2

Product S 0 types: 6M0 and 6M1"

6esources ?eeded per unit

<

?eeded per

unit S

Material / T /77

Material 0 T/77 T /77

Material 1 T /77

Material 2 T /3

Iepartment ' /3 minutes /7 minutes

Iepartment : /3 minutes 17 minutes

Iepartment C /3 minutes 3 minutes

Iepartment I /3 minutes 3 minutes

Aach department:0277 minutes per %eek available

!,C>s operating e#penses T 17"777 per %eek

Iemand: /77 units < per %eek en 37 S

+alesprice: T 237 per < en T 377 per S

Material and labor are sufficiently available

Iepartment Product < Product S !otal needed time per

%eek

' /3 min"# /77 units /7 min" # 37 0777 min"

: /3 min" # /77 17 min # 37 1777 min"

C /3 min" # /77 3 min" # 37 /837 min"

I /3 min" # /77 3 min" # 37 /837 min"

Conclusion: department : is bottle$neck: there is not enough capacity to produce

/77 < and 37 S

Product +alesprice$

Materialcosts

!hroughput per unit

< T 237$ T0/3 T013

S T377$T077 T177

Product !hroughput per unit .

Minutes needed for :

!hroughput per minute

< T013 : /3 T /3,58

S T 177:17 T /7

!,C has to produce /77 units <" !his process takes /77 # /3 ; /377 minutes in department :

6emaining E77 minutes for S; 17 units"

A#treme !hroughput

/77 < and 7 S /77 # 013

(01"377

/77 < and 17 S /77 # 013 F 17# 177

(10"377

57 < and 37 S 57 # 013 F 37 # 177

(0E"/77

7 < and 37 S 37 # 177

(/3"777

6evenues /77 < 23"777

17 S /3"777 57"777

Cogs /77 < 0/"377

17 S 5"777 08"377

!hroughput 10"377

,per" A#penses 17"777

?et income 0"377

*nderstand the techni&ues to identify &uality problems" !,C is related to capacity constraint analysis

(Chapter /7"

You might also like

- 06 Process CostingDocument21 pages06 Process CostingKaen Meagan Gasmen92% (12)

- IMTC633Document33 pagesIMTC633Ajit Kumar71% (7)

- Produce Job Costing InformationDocument18 pagesProduce Job Costing InformationAshenafi Abdurkadir100% (1)

- Chap 008Document69 pagesChap 008jjseven22100% (1)

- ABC CostingDocument28 pagesABC CostingKiraYamatoNo ratings yet

- Hilton 9E Global Edition Solutions Manual Chapter03Document58 pagesHilton 9E Global Edition Solutions Manual Chapter03Bea71% (7)

- A 325Document28 pagesA 325Pilly PhamNo ratings yet

- Chapter 4 Cost AccountngDocument4 pagesChapter 4 Cost AccountngFarah YasserNo ratings yet

- Practical Earned Value Analysis: 25 Project Indicators from 5 MeasurementsFrom EverandPractical Earned Value Analysis: 25 Project Indicators from 5 MeasurementsNo ratings yet

- Earned Value Project Management (Fourth Edition)From EverandEarned Value Project Management (Fourth Edition)Rating: 1 out of 5 stars1/5 (2)

- Corporate Strategy - Dysons Position andDocument16 pagesCorporate Strategy - Dysons Position andNga PhamNo ratings yet

- Red Bull Teaching NotesDocument6 pagesRed Bull Teaching Noteskrips16No ratings yet

- Costing and Quantitative Techniques Chapters 7-8Document68 pagesCosting and Quantitative Techniques Chapters 7-8jyotiyugalNo ratings yet

- ACC102 Chapter4newDocument17 pagesACC102 Chapter4newjohn_26_jjmNo ratings yet

- Hca14 SM Ch04Document45 pagesHca14 SM Ch04DrellyNo ratings yet

- Cost Accounting 1Document3 pagesCost Accounting 1Rudy Setiawan KamadjajaNo ratings yet

- Cost Center PlanningDocument2 pagesCost Center Planningkisan_compNo ratings yet

- Process CostingDocument17 pagesProcess CostingKhing Dragon ManlangitNo ratings yet

- How Does Value Stream Costing Work?Document4 pagesHow Does Value Stream Costing Work?tanpreet_makkadNo ratings yet

- Ii Internal Management Accounting and Control Systems: 3 MarksDocument5 pagesIi Internal Management Accounting and Control Systems: 3 MarksSunil BharadwajNo ratings yet

- Chapter 7 Job CostingDocument6 pagesChapter 7 Job CostingmujeroenNo ratings yet

- SM ch04Document30 pagesSM ch04Ngurah Panji Putra100% (1)

- Cost Estimation and EvaluationDocument4 pagesCost Estimation and EvaluationMuddassir DanishNo ratings yet

- Job Costing and Process CostingDocument3 pagesJob Costing and Process CostingUmair Siyab100% (1)

- Cost Volume ProfitDocument45 pagesCost Volume ProfitmiolataNo ratings yet

- CMA Part 1 Sec CDocument131 pagesCMA Part 1 Sec CMusthaqMohammedMadathilNo ratings yet

- Process Costing: Questions For Writing and DiscussionDocument49 pagesProcess Costing: Questions For Writing and DiscussionKhoirul MubinNo ratings yet

- Managerial AccountingDocument13 pagesManagerial AccountingSagar BansalNo ratings yet

- Job OrdercostingDocument31 pagesJob OrdercostingGunawan Setio PurnomoNo ratings yet

- Actual Costing SystemDocument19 pagesActual Costing SystemFarid MahdaviNo ratings yet

- Slide of Chapter 2Document19 pagesSlide of Chapter 2Uyen ThuNo ratings yet

- Chapter 4 Process Costing Cost of Production ReportDocument32 pagesChapter 4 Process Costing Cost of Production Reportzaman0% (1)

- Summary Notes 2-Cost ClassificationDocument10 pagesSummary Notes 2-Cost ClassificationDKzNo ratings yet

- Part A 3 Target CostingDocument9 pagesPart A 3 Target CostingJohn ElliottNo ratings yet

- Process Costing: Learning ObjectivesDocument15 pagesProcess Costing: Learning ObjectivesjuangwapotalagaNo ratings yet

- Chap 004Document149 pagesChap 004Jessica Cola100% (1)

- T6 Chapter 5 Solutions To The Essential ActivitiesDocument12 pagesT6 Chapter 5 Solutions To The Essential Activitiesoddsey0713No ratings yet

- Ch17 Quiz SampleDocument8 pagesCh17 Quiz SampleEwelina ChabowskaNo ratings yet

- What Is Process CostingDocument4 pagesWhat Is Process CostingAj LeeNo ratings yet

- Solution C03ProcessCostingDocument68 pagesSolution C03ProcessCostingbk201heitrucle86% (7)

- Procedure For Job Cost AccountingDocument6 pagesProcedure For Job Cost Accountingravi sainiNo ratings yet

- Rei - Process CostingDocument12 pagesRei - Process CostingSnow TurnerNo ratings yet

- Horngren12eim ch02Document8 pagesHorngren12eim ch02Tra-My VoNo ratings yet

- Dictionary For ControllersDocument6 pagesDictionary For ControllerscerescoNo ratings yet

- Chapter 16 FilI-In NotesDocument10 pagesChapter 16 FilI-In Noteslowell MooreNo ratings yet

- Cost Accounting Normal Job Costing: Presented By: Umut Korkuter & Sina BakhshalianDocument35 pagesCost Accounting Normal Job Costing: Presented By: Umut Korkuter & Sina BakhshalianBurakhan YanıkNo ratings yet

- Ankita ProjectDocument17 pagesAnkita ProjectRaman NehraNo ratings yet

- Assingment 1Document5 pagesAssingment 1Suzana IthnainNo ratings yet

- CH 17 SolDocument52 pagesCH 17 SolCarlos J. Cancel AyalaNo ratings yet

- BPP KEPM Planning Framework NMEDDocument7 pagesBPP KEPM Planning Framework NMEDSathish ManukondaNo ratings yet

- Design Project 5Document3 pagesDesign Project 5pelayo240No ratings yet

- MasDocument27 pagesMaskevinlim186No ratings yet

- Dfe Ems AppfDocument13 pagesDfe Ems AppfMilena GojkovićNo ratings yet

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesFrom EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesNo ratings yet

- Book Series Increasing Productivity of Software Development, Part 2: Management Model, Cost Estimation and KPI ImprovementFrom EverandBook Series Increasing Productivity of Software Development, Part 2: Management Model, Cost Estimation and KPI ImprovementNo ratings yet

- Project DocumentDocument80 pagesProject DocumentAnonymous 5RO7Xov3A4100% (1)

- Yasir & Seher Final Report CDDocument61 pagesYasir & Seher Final Report CDMuhammad Munib KhanNo ratings yet

- SPM - (4 Chapters)Document68 pagesSPM - (4 Chapters)ayazahmedsk67% (3)

- Field Marketing Training Manual by Victor NyambokDocument12 pagesField Marketing Training Manual by Victor NyambokVictor NyambokNo ratings yet

- Preview PDFDocument57 pagesPreview PDFTiffany Spence100% (1)

- Work Completed: Formatted: English (United States)Document2 pagesWork Completed: Formatted: English (United States)Almas Pratama IndrastiNo ratings yet

- Thai LawDocument18 pagesThai LawsohaibleghariNo ratings yet

- Textile IndustryDocument94 pagesTextile IndustryPayalAgarwal100% (2)

- Europass CV Template For SDDocument4 pagesEuropass CV Template For SDapi-284502271No ratings yet

- Chapter 8Document74 pagesChapter 8Fahad FerozNo ratings yet

- AStudyon Extended Marketing MixDocument9 pagesAStudyon Extended Marketing MixAsanga MalNo ratings yet

- Business ProposalDocument21 pagesBusiness ProposalmerilNo ratings yet

- JD Flipkart Manager-BusinessDevelopmentDocument3 pagesJD Flipkart Manager-BusinessDevelopmentmanjrekarnNo ratings yet

- Basic Aspects of Society and Culture: Keegan: Global Marketing Management Chapter 3/ 1Document18 pagesBasic Aspects of Society and Culture: Keegan: Global Marketing Management Chapter 3/ 1Sharang KaushikNo ratings yet

- Bus AssignmentDocument21 pagesBus AssignmentUllash JoyNo ratings yet

- BMA PRO Brand Stategy Blueprint 4Document19 pagesBMA PRO Brand Stategy Blueprint 4davidNo ratings yet

- Customer Relationship Management TutorialDocument14 pagesCustomer Relationship Management TutorialManickath Mani Nair100% (2)

- Module 2 - Strategic ManagementDocument3 pagesModule 2 - Strategic ManagementDonato B. SerranoNo ratings yet

- Grades 4-10: Search Jobs in IndiaDocument2 pagesGrades 4-10: Search Jobs in IndiaMD AKIL AHMEDNo ratings yet

- DJI Agriculture 2021 Dealer Content Plan DCP ProgramDocument7 pagesDJI Agriculture 2021 Dealer Content Plan DCP ProgramclvaldesNo ratings yet

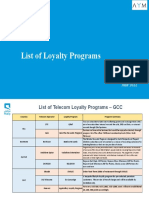

- List of Loyalty ProgramsDocument2 pagesList of Loyalty Programssathya narayana RajuNo ratings yet

- Witsow Branding Corporate ProfileDocument8 pagesWitsow Branding Corporate ProfileAnonymous EKyR3rY5zNo ratings yet

- Tata Nano-A Game Changer or Failure!!Document23 pagesTata Nano-A Game Changer or Failure!!Arun CHNo ratings yet

- Lva1 App6891 PDFDocument79 pagesLva1 App6891 PDFSharjeel AlviNo ratings yet

- Targeting Attractive Market SegmentsDocument20 pagesTargeting Attractive Market SegmentsNur Shiyaam100% (1)

- Definition of BrandingDocument7 pagesDefinition of BrandingtekleyNo ratings yet

- Chapter11 - Slides Centralized Vs DecentralizedDocument29 pagesChapter11 - Slides Centralized Vs DecentralizedluisrebagliatiNo ratings yet