Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

17 viewsDevelopments in India's Balance of Payments During Fourth Quarter (January-March) of 2011-12

Developments in India's Balance of Payments During Fourth Quarter (January-March) of 2011-12

Uploaded by

chengadbop

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Recent Trends in India's BopDocument6 pagesRecent Trends in India's BopAashi Jain100% (1)

- FXTM - Model Question PaperDocument36 pagesFXTM - Model Question PaperRajiv Warrier0% (1)

- Indian Economy JUNE 2011Document52 pagesIndian Economy JUNE 2011Moizur Rahman KhanNo ratings yet

- Scroll Down For ReadingDocument44 pagesScroll Down For ReadingMothukuri SrikanthNo ratings yet

- FRBM1 STQRT 201112Document33 pagesFRBM1 STQRT 201112prajesh612No ratings yet

- ICRA Financial Markets and Banking Update Vol 2Document13 pagesICRA Financial Markets and Banking Update Vol 2Sitaram SwaroopNo ratings yet

- Analysis of RBI's Quarterly StatementsDocument3 pagesAnalysis of RBI's Quarterly StatementsNitish BajajNo ratings yet

- Monthly Review of Indian Economy: April 2011Document36 pagesMonthly Review of Indian Economy: April 2011Rahul SainiNo ratings yet

- Echap-07 International TradeDocument24 pagesEchap-07 International TradeRabmeetNo ratings yet

- Bop Q1fy12Document4 pagesBop Q1fy12Amol PhadaleNo ratings yet

- Indian EconomyDocument37 pagesIndian EconomyDvitesh123No ratings yet

- RBI Policy Dec 2011Document4 pagesRBI Policy Dec 2011Mitesh MahidharNo ratings yet

- Economic Survey of PakistanEconomic Survey of Pakistan Trade and Payments Trade and PaymentsDocument28 pagesEconomic Survey of PakistanEconomic Survey of Pakistan Trade and Payments Trade and PaymentsmadddiuNo ratings yet

- India's Balance of Payments: The Alarm Bells Are Ringing: Ashoak UpadhyayDocument6 pagesIndia's Balance of Payments: The Alarm Bells Are Ringing: Ashoak UpadhyayBikash Ranjan SatapathyNo ratings yet

- Widening Gap Between FDIDocument18 pagesWidening Gap Between FDIYugalkishore ChellaniNo ratings yet

- Conomic: The Impending Signs of Global UncertaintyDocument16 pagesConomic: The Impending Signs of Global UncertaintyS GNo ratings yet

- Chap 110Document2 pagesChap 110asifanisNo ratings yet

- Monetary Policy Statement Jan 11 EngDocument28 pagesMonetary Policy Statement Jan 11 EngHamad RasoolNo ratings yet

- Shrinking Foreign Trade: INDIA's Trade Deficit During The First Nine Months of Fiscal 2009-10 On A Balance ofDocument10 pagesShrinking Foreign Trade: INDIA's Trade Deficit During The First Nine Months of Fiscal 2009-10 On A Balance ofManminder KaurNo ratings yet

- The Economic Outlook of Taiwan: October 2011Document8 pagesThe Economic Outlook of Taiwan: October 2011Phú NguyễnNo ratings yet

- Major Economic Indicators: Monthly Update: Volume 06/2012Document26 pagesMajor Economic Indicators: Monthly Update: Volume 06/2012Golam KibriaNo ratings yet

- TP Ifm Rr1906a21Document17 pagesTP Ifm Rr1906a21nipunvij87No ratings yet

- Third Quarter Review of Monetary Policy 2011-12: Reserve Bank of IndiaDocument21 pagesThird Quarter Review of Monetary Policy 2011-12: Reserve Bank of Indiaomi_pallaviNo ratings yet

- Trade Cycle Since 2003-04Document19 pagesTrade Cycle Since 2003-04Md IstiakNo ratings yet

- Balance of Payments: Lobal ConomyDocument19 pagesBalance of Payments: Lobal ConomyPraveen Reddy PenumalluNo ratings yet

- World Economy: South ADocument3 pagesWorld Economy: South APriyanka JainNo ratings yet

- Budget Impact - MacroDocument3 pagesBudget Impact - MacroAkhilesh PanwarNo ratings yet

- Bop India Oct Dec 2012Document6 pagesBop India Oct Dec 2012mainu30No ratings yet

- Lebanon's Economic EnvironmentDocument1 pageLebanon's Economic EnvironmentGerard ArabianNo ratings yet

- A Project On SCMDocument12 pagesA Project On SCMVivek JhaNo ratings yet

- Echapter Vol2Document214 pagesEchapter Vol2dev shahNo ratings yet

- State of The Economy: An OverviewDocument30 pagesState of The Economy: An OverviewsujoyludNo ratings yet

- 2012 Q1 GDP Report (Nigeria)Document15 pages2012 Q1 GDP Report (Nigeria)Gundeep SinghNo ratings yet

- BOP, CAD and Fiscal Deficit Analysis: Task - 5Document13 pagesBOP, CAD and Fiscal Deficit Analysis: Task - 5shubhamNo ratings yet

- Economic Survey 2011 12Document33 pagesEconomic Survey 2011 12swagger98979294No ratings yet

- Chapter 1Document5 pagesChapter 1Jakir_bnkNo ratings yet

- Nuances of The Reserve Banks Exchange Rate and Reserves ManagementDocument3 pagesNuances of The Reserve Banks Exchange Rate and Reserves ManagementselvamuthukumarNo ratings yet

- Reserve Bank of India Second Quarter Review of Monetary Policy 2011-12Document20 pagesReserve Bank of India Second Quarter Review of Monetary Policy 2011-12FirstpostNo ratings yet

- Indian EconomyDocument15 pagesIndian EconomyleoboyrulesNo ratings yet

- Balance of PaymentsDocument23 pagesBalance of PaymentsRashi ShahiNo ratings yet

- Macro-Economic Framework Statement: Overview of The EconomyDocument6 pagesMacro-Economic Framework Statement: Overview of The Economyknew1No ratings yet

- Economic Indicator PakistanDocument5 pagesEconomic Indicator PakistanMian MudasserNo ratings yet

- Indian EconomyDocument17 pagesIndian EconomymanboombaamNo ratings yet

- Credit Policy September 2011Document6 pagesCredit Policy September 2011Gaurav WamanacharyaNo ratings yet

- INDIA Balance of PaymentsDocument11 pagesINDIA Balance of PaymentsMohana PriyaNo ratings yet

- Balance of Payments: Recent Developments and ImplicationsDocument3 pagesBalance of Payments: Recent Developments and Implicationsshobu_iujNo ratings yet

- Indo Monetary PolicyDocument11 pagesIndo Monetary PolicyBoyke P SiraitNo ratings yet

- External Sector: Lobal Conomic NvironmentDocument25 pagesExternal Sector: Lobal Conomic NvironmentShaharukh KhanNo ratings yet

- Economic Environment of Business: Group 1Document4 pagesEconomic Environment of Business: Group 1Darshan SankheNo ratings yet

- India FRBMDocument6 pagesIndia FRBMindianeconomistNo ratings yet

- Role of Unorganised Corporate Market in Future Financial Status of IndiaDocument17 pagesRole of Unorganised Corporate Market in Future Financial Status of IndiaSourabh ChopraNo ratings yet

- Surge in Union Government RevenuesDocument4 pagesSurge in Union Government RevenuesscrNo ratings yet

- Union Budget 2012-13: The Past and The Present Budget - BackgroundDocument18 pagesUnion Budget 2012-13: The Past and The Present Budget - BackgrounddivertyourselfNo ratings yet

- Rupee DepreciationDocument6 pagesRupee DepreciationRahul ChaturvediNo ratings yet

- Annexure IIIDocument13 pagesAnnexure IIIchengadNo ratings yet

- Notice Inviting Financial Bids For Sale of Wheat To Bulk Consumers/Traders Under Omss (D) Bulk Through E-AuctionDocument1 pageNotice Inviting Financial Bids For Sale of Wheat To Bulk Consumers/Traders Under Omss (D) Bulk Through E-AuctionchengadNo ratings yet

- Notice Inviting Bids For Sale of Raw Rice Ga To Bulk Consumers/Traders Under Omss (D) Bulk Through E-AuctionDocument1 pageNotice Inviting Bids For Sale of Raw Rice Ga To Bulk Consumers/Traders Under Omss (D) Bulk Through E-AuctionchengadNo ratings yet

- MTF Rice 27.08.18 PDFDocument13 pagesMTF Rice 27.08.18 PDFchengadNo ratings yet

- NIT Dt.23.05.19 (FSD Kathua)Document3 pagesNIT Dt.23.05.19 (FSD Kathua)chengadNo ratings yet

- Rice Depotwise QuantityDocument1 pageRice Depotwise QuantitychengadNo ratings yet

- NIT Dt.23.05.19 (FSD Srinagar)Document3 pagesNIT Dt.23.05.19 (FSD Srinagar)chengadNo ratings yet

- MTF Wheat 03 - 10 - 2019Document17 pagesMTF Wheat 03 - 10 - 2019chengadNo ratings yet

- Food Corporation of India Regional Office: JammuDocument3 pagesFood Corporation of India Regional Office: JammuchengadNo ratings yet

- Food Corporation of India Regional Office: Kesavadasapuram Pattom Palace P.O: Thiruvananthapuram 695 004Document2 pagesFood Corporation of India Regional Office: Kesavadasapuram Pattom Palace P.O: Thiruvananthapuram 695 004chengadNo ratings yet

- MTF Wheat 16.08.2019Document17 pagesMTF Wheat 16.08.2019chengadNo ratings yet

- fci Date of NIT Last Date For Depositing EMD Starting Date and Time For Online Bidding End Date and Time For Online BiddingDocument1 pagefci Date of NIT Last Date For Depositing EMD Starting Date and Time For Online Bidding End Date and Time For Online BiddingchengadNo ratings yet

- Food Corporation of India: Ph. No. 0135-2970038, 0135-2665993 e Mail: Gmukfci@gov - inDocument1 pageFood Corporation of India: Ph. No. 0135-2970038, 0135-2665993 e Mail: Gmukfci@gov - inchengadNo ratings yet

- Tender For Mpeg Narmada 07022019Document71 pagesTender For Mpeg Narmada 07022019chengadNo ratings yet

- MTF Wheat 26 - 07 - 2018Document17 pagesMTF Wheat 26 - 07 - 2018chengadNo ratings yet

- Tender NIT No - 03 2017-18 Website-BSWCDocument4 pagesTender NIT No - 03 2017-18 Website-BSWCchengadNo ratings yet

- MTF of Wheat - 5Document18 pagesMTF of Wheat - 5chengadNo ratings yet

- Nit (2) - 3Document7 pagesNit (2) - 3chengadNo ratings yet

- MTF Wheat TE-35 - 1Document11 pagesMTF Wheat TE-35 - 1chengadNo ratings yet

- Agency Wise Procurement of Paddy (KMS 2016-17) - 51Document1 pageAgency Wise Procurement of Paddy (KMS 2016-17) - 51chengadNo ratings yet

- State Wise Procurement of Wheat For Rms 2017-18-21Document1 pageState Wise Procurement of Wheat For Rms 2017-18-21chengadNo ratings yet

- Craig Pirrong-Commodity Price Dynamics - A Structural Approach-Cambridge University Press (2011) PDFDocument239 pagesCraig Pirrong-Commodity Price Dynamics - A Structural Approach-Cambridge University Press (2011) PDFchengadNo ratings yet

- Statewise Procurement of Rice (KMS 2016-17) - 44Document1 pageStatewise Procurement of Rice (KMS 2016-17) - 44chengadNo ratings yet

- AP Macroeconomics Syllabus 2013Document11 pagesAP Macroeconomics Syllabus 2013Irakli MaisuradzeNo ratings yet

- Uruguay BankingDocument13 pagesUruguay BankingKanikaGaurNo ratings yet

- Austerity in The UK: A False Sense of SecurityDocument30 pagesAusterity in The UK: A False Sense of SecurityVariantPerceptionNo ratings yet

- Disequilibrium in Balance of PaymentsDocument83 pagesDisequilibrium in Balance of PaymentsBhavik Thaker100% (1)

- Mba Bdu Concurrent AssignmentDocument22 pagesMba Bdu Concurrent AssignmentDivniLhlNo ratings yet

- Ch16 Salvatore PPPDocument40 pagesCh16 Salvatore PPPRyan J Anward0% (1)

- The Sibenik Times, August 30thDocument16 pagesThe Sibenik Times, August 30thSibenskilist100% (1)

- Econ 442 Problem Set 2 (Umuc)Document2 pagesEcon 442 Problem Set 2 (Umuc)OmarNiemczykNo ratings yet

- Offering CircularDocument286 pagesOffering CircularmuktiyantoNo ratings yet

- Multinational Business Finance Assignment 3Document6 pagesMultinational Business Finance Assignment 3AnjnaKandariNo ratings yet

- BKG System Review (2003)Document101 pagesBKG System Review (2003)AyeshaJangdaNo ratings yet

- Economics Unit 2 May 2012 MarkschemeDocument16 pagesEconomics Unit 2 May 2012 MarkschemeEzioAudi77No ratings yet

- GCC Fact SheetDocument22 pagesGCC Fact SheetRoaa IbrahimNo ratings yet

- Economic Effects of An AppreciationDocument11 pagesEconomic Effects of An AppreciationIndeevari SenanayakeNo ratings yet

- Turkish Economy 1990-2000Document18 pagesTurkish Economy 1990-2000ademNo ratings yet

- Ar EnglishDocument154 pagesAr EnglishAdeeb HusnainNo ratings yet

- T.Y.B.A. Paper - Vi Export Managment PDFDocument182 pagesT.Y.B.A. Paper - Vi Export Managment PDFNaresh PentaNo ratings yet

- I-Direct - Monthly Investment StrategyDocument11 pagesI-Direct - Monthly Investment StrategyRajesh KatareNo ratings yet

- Chapter-9 (Parkin, M) : The Exchange Rate and The Balance of PaymentDocument36 pagesChapter-9 (Parkin, M) : The Exchange Rate and The Balance of PaymentAshik RahmanNo ratings yet

- Current AccoCurrent AccountDocument25 pagesCurrent AccoCurrent AccountRajesh NairNo ratings yet

- Dollar Fall Vs Rupees PDFDocument56 pagesDollar Fall Vs Rupees PDFwarezisgr8No ratings yet

- Very Condensed IGCSE Revision Notes PDFDocument11 pagesVery Condensed IGCSE Revision Notes PDFshahabNo ratings yet

- Colombia Monitor PESTLEDocument75 pagesColombia Monitor PESTLEAnderson Gutierrez GarciaNo ratings yet

- Edited MCQ - MacroeconomyDocument32 pagesEdited MCQ - MacroeconomyAnurag TiwariNo ratings yet

- International Trade and Balance of PaymentDocument20 pagesInternational Trade and Balance of PaymentFatihah SharkawiNo ratings yet

- VNM48Document205 pagesVNM48hddkickNo ratings yet

- Study On Foreign Exchange Remittances & Interbank DealingsDocument95 pagesStudy On Foreign Exchange Remittances & Interbank DealingsSachin KajaveNo ratings yet

- USA Eco ProjectDocument18 pagesUSA Eco ProjectAnubhav GaurNo ratings yet

- Turkish Economy and Global Financial CrisisDocument34 pagesTurkish Economy and Global Financial CrisisademNo ratings yet

Developments in India's Balance of Payments During Fourth Quarter (January-March) of 2011-12

Developments in India's Balance of Payments During Fourth Quarter (January-March) of 2011-12

Uploaded by

chengad0 ratings0% found this document useful (0 votes)

17 views16 pagesbop

Original Title

boprbi2011-12

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentbop

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

17 views16 pagesDevelopments in India's Balance of Payments During Fourth Quarter (January-March) of 2011-12

Developments in India's Balance of Payments During Fourth Quarter (January-March) of 2011-12

Uploaded by

chengadbop

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 16

Developments in Indias Balance of Payments

during Fourth Quarter (January-March) of 2011-12

RBI Monthly Bulletin August 2012

1483

A RT IC LE

With export growth remaining substantially lower

than import growth, the trade decit widened to

US$ 51.6 billion in Q4 of 2011-12 as compared

with US$ 30.0 billion in Q4 of 2010-11.

Growth in net services exports in Q4 of 2011-12

also decelerated to 21.1 per cent as compared to

72.0 per cent in Q4 of 2010-11.

Falling exchange rate seems to have induced a

significant pick up in net secondary income

(private transfers) receipts which rose by 24.0 per

cent (y-o-y) to US$ 16.9 billion in Q4 of 2011-12 as

compared with US$ 13.6 billion in Q4 of 2010-11.

The primary income account (mainly investment

income) showed a net outow of US$ 4.6 billion

in Q4 of 2011-12, broadly the same as in the

corresponding quarter of the previous year.

Consequently, the current account decit (CAD)

widened to US$ 21.7 billion in Q4 of 2011-12

which works out to 4.5 per cent of GDP (US$ 6.3

billion in Q4 of 2010-11 i.e., 1.3 per cent of GDP).

Capital and Financial account (excluding change

in foreign exchange reserves), on a net basis,

recorded a higher inow of US$ 16.5 billion in Q4

of 2011-12 as compared with US$ 9.1 billion in Q4

of 2010-11.

Despite signicant improvement in the capital

inows in Q4 of 2011-12, there was a drawdown

of foreign exchange reserves of US$ 5.7 billion

(excluding valuation) as against an increase of US$

2.0 billion in the corresponding quarter of 2010-11,

essentially reecting deterioration in the current

account.

Highlights of BoP during 2011-12

During 2011-12, Indias BoP deteriorated as trade

decit widened and invisibles remained sluggish due

to low external demand and relatively inelastic imports

Developments in Indias Balance of

Payments during Fourth Quarter

(January-March) of 2011-12*

The data on Indias Balance of Payments (BoP) are

compiled and published by the Reserve Bank on a

quarterly basis with a lag of one quarter. This article

covers the analysis of major developments in Indias

BoP during the fourth quarter of 2011-12 along with

the quarterly revised data for earlier three quarters of

2011-12 on the basis of new format of BoP

1

. These data

have been provided in the statistical section of the

Bulletin

In addition, the disaggregated data on invisibles

for all the quarters of 2011-12 and annual data for the

preceding two years are also being published as a part

of this article (Attachment I).

Highlights of BoP during January-March

(Q4) of 2011-12

The stress witnessed in Indias BoP in Q3

continued during Q4 of 2011-12 as well with trade

decit and current account decit widening to highest

ever levels. Capital inflows improved reflecting

signicant increase in portfolio investment and non-

resident deposits, however, they fell short of nancing

requirements, resulting in a drawdown of foreign

exchange reserves. The trade decit on BoP basis during

the fourth quarter exceeded US$ 50 billion (10.6 per

cent of GDP) and CAD has been nearly US$ 22 billion

(4.5 per cent of GDP).

On a BoP basis, growth in merchandise exports

(y-o-y) decelerated sharply to 3.4 per cent during

Q4 of 2011-12 from 46.9 per cent during the

corresponding quarter of 2010-11.

Imports registered a growth of 22.6 per cent during

Q4 of 2011-12 as compared with 27.7 per cent in

the corresponding quarter of the preceding year.

1

Prepared in the Division of International Trade and Finance, Department

of Economic and Policy Research, Reserve Bank of India.

2

The Balance of Payments data are compiled and presented based on the

IMF guidelines set out in its Balance of Payments Manual Sixth Edition

(BPM-6).

Developments in Indias Balance of Payments

during Fourth Quarter (January-March) of 2011-12

RBI Monthly Bulletin August 2012

A RT IC LE

1484

of POL & gold and silver. Capital ows, though have

been higher than that in the preceding year, were

inadequate and the gap had to be met through draw

down of reserves.

In 2011-12, the trade decit rose to US$ 189.7

billion amounting to 10.3 per cent of GDP from

US$ 130.4 billion (7.7 per cent of GDP) in 2010-11.

Similarly, CAD also rose to US$ 78.2 billion (4.2

per cent of GDP) from US$ 46.0 billion (2.7 per

cent of GDP) in 2010-11.

Net inows under Capital and Financial account

(excluding changes in reserve assets) were higher

at US$ 67.8 billion during 2011-12 as compared

with US$ 62.0 billion during 2010-11. There was

a draft on reserves to the extent of US$ 12.8 billion

during the year as against an accretion of US$ 13.1

billion in 2010-11.

1. Balance of Payments during January-

March (Q4) of 2011-12

Stress witnessed in Indias BoP during the rst

three quarters of 2011-12 continued in Q4 of 2011-12

as trade balance deteriorated further and invisibles

account remained subdued resulting in further

widening of current account decit. While, the rupee

depreciation, given the weak and lagged relationship

of exports with exchange rate movement, could not

boost export performance, the inelastic nature of

imports in particular POL and gold & silver, in the wake

of rising international prices, widened the trade gap

further. Though, inows under capital and nancial

account, improved partly responding to policy measures

announced by the RBI to encourage ows under NRI

deposits, ECB and FII investments, the level of ows,

however, remained insufcient to meet the widening

current account decit and there was net withdrawal

from foreign exchange reserves. The developments in

the major items of the BoP for Q4 of 2011-12 are set

out below in Table 1.

Goods Trade

On a BoP basis, growth in merchandise exports

(y-o-y), decelerated sharply to 3.4 per cent during

Q4 of 2011-12 as compared to 46.9 per cent in the

same quarter of previous year. Export diversication

efforts could not sustain favourable results as the

sluggish economic conditions in advanced

economies gradually spilled over to the developing

world.

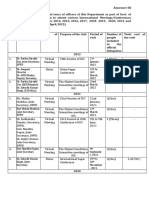

Table 1: Major items of Indias Balance of Payments

(US$ billion)

Fourth Quarter

January-March

Full Year

April-March

2011 (PR) 2012 (P) 2010-11 (PR) 2011-12 (P)

1. Goods exports 77.4 80.0 250.6 309.8

2. Goods Imports 107.4 131.7 381.1 499.5

3. Trade Balance(1-2) -30.0 -51.6 -130.4 -189.7

4. Services Exports 35.3 37.7 131.7 140.9

5. Services Imports 20.7 20.0 83.0 76.9

6. Net Services (4-5) 14.6 17.7 48.7 64.0

7. Goods & Services Balances (3+6) -15.4 -34.0 -81.8 -125.7

8. Primary Income, Net (Compensation of employees and Investment Income) -4.5 -4.6 -17.3 -16.0

9. Secondary Income, Net ( Private Transfers) 13.6 16.9 53.1 63.5

10. Net Income (8+9) 9.1 12.3 35.8 47.5

11. Current Account Balance (7+10) -6.3 -21.7 -46.0 -78.2

12. Capital and Financial Account Balance, Net (Excl. change in reserves) 9.1 16.5 62.0 67.8

13.Change in Reserves (-)increase/(+)decrease -2.0 5.7 -13.1 12.8

14. Errors & Omissions (-)(11+12+13) -0.8 -0.6 -3.0 -2.4

P: Preliminary; PR: Partially Revised

Developments in Indias Balance of Payments

during Fourth Quarter (January-March) of 2011-12

RBI Monthly Bulletin August 2012

1485

A RT IC LE

Despite the slowdown in domestic economic

activity and rupee depreciation, growth in

merchandise imports (on BoP basis) moderated

only mildly from 27.7 per cent in Q4 of 2010-11

to 22.6 per cent in Q4 of 2011-12, reflecting

inelastic demand for gold and crude oil. The non-

oil non-gold segment of imports, grew by 15.4 per

cent, much lower than 26.1 per cent in Q4 of the

previous year.

While the rise in oil imports was largely a reection

of higher international prices, rise in gold imports

has been due to increase in both quantum as well

as prices. The price of Indian basket of crude oil

at the elevated level of US$ 117.3 per bbl has been

around 15 per cent higher than that in the same

period in the preceding year (Chart 1).

Trade Decit

With faster growth in imports than in exports, the

trade decit increased to US$ 51.6 billion in Q4 of

2011-12 (10.6 per cent of GDP) as compared with

US$ 30.0 billion in Q4 of 2010-11, showing an

increase of around 72 per cent on y-on-y basis

(Chart 2).

Services

During the quarter though growth in services

exports witnessed sharp moderation, decline in

services imports in absolute terms, resulted in

improvement in exports of services on a net basis

(Table 2).

During the quarter, growth in services receipts on

y-o-y basis, moderated to 6.7 per cent (27.4 per

cent in Q4 of 2010-11) and services payments

declined by 3.4 per cent largely on account of

contraction in payments of nancial services. Net

services exports, thus, amounted to US$ 17.7

billion (US$ 14.6 billion in Q4 of 2010-11). Rise in

services receipts was mainly contributed by

software services and travel. Improvement in the

latter may be attributed to higher prices and

depreciation of rupee (Table 2).

Income

While net outow on account of primary income

continued, there has been a sharp increase in net

secondary income in Q4 of 2011-12 (Table 2). The sharp

rise under secondary income account may be attributed

to weakening of Indian rupee which induced higher

workers remittances for family maintenance.

Net outow on account of primary income in Q4

of 2011-12 at US$ 4.6 billion was broadly the same

as recorded in Q4 of 2010-11 (US$ 4.5 billion).

Compensation of employees continued to record

surpluses, albeit marginal, in Q4 of 2011-12 for

the fourth successive quarter.

Developments in Indias Balance of Payments

during Fourth Quarter (January-March) of 2011-12

RBI Monthly Bulletin August 2012

A RT IC LE

1486

During Q4 of 2011-12, payments on account of

investment income, comprising mainly the

interest payments on the external commercial

borrowings (ECBs), NRI deposits and prots &

reinvested earnings of FDI companies in India,

rose by 2.9 per cent. In contrast, investment

income receipts, largely representing earning on

foreign currency assets, recorded a decline of 7.3

per cent in Q4.

Secondary income (on a net basis), reflecting

mainly the remittances from overseas Indians, at

US$ 16.9 billion remained buoyant and recorded

a growth of 23.9 per cent in Q4 as compared with

8.1 per cent in Q4 of 2010-11.

Current Account

Despite improvement in secondary income and

a marginal rise in net services receipts, higher trade

deficit coupled with deterioration in the primary

income led to an all time high of current account decit

during January-March 2012. The CAD widened to US$

21.7 billion in Q4 as compared with US$ 20.2 billion in

Q3 of 2011-12 and US$ 6.3 in Q4 of 2010-11. At this

level, CAD worked out to 4.5 per cent of GDP in Q4 of

2011-12 as compared with 1.3 per cent in Q4 of 2010-11.

Table 2: Disaggregated Items of Current Account (net)

(US$ billion)

Fourth Quarter

January-March

Full Year

April-March

2011 (PR) 2012 (P) 2010-11 (PR) 2011/12 (P)

1. Goods -30.0 -51.6 -130.4 -189.7

2. Services 14.6 17.7 48.7 64.0

2.a Transport 0.9 0.4 0.4 1.8

2.b Travel 1.3 2.2 4.2 4.7

2.c Construction -0.2 -0.1 -0.5 -0.2

2.d Insurance and pension services 0.3 0.3 0.5 1.1

2.e Financial Services -0.4 -0.4 -1.0 -2.0

2.f Charges for the use of intellectual property -0.5 -0.9 -2.2 -2.9

2.g Telecommunications, computer and information services 15.5 16.7 53.8 60.7

2.h Personal, cultural and recreational services -0.1 0.05 -0.3 0.1

2.i Government goods & services -0.1 -0.2 -0.3 -0.3

2.j Other Business services -0.9 -0.2 -3.9 -0.9

2.k Others n.i.e -1.3 -0.2 -2.1 1.9

3. Primary Income -4.5 -4.6 -17.3 -16.0

3.a Compensation of Employees -0.2 0.01 -0.9 0.5

3.b Investment Income -4.3 -4.6 -16.4 -16.5

4. Secondary Income 13.6 16.9 53.1 63.5

4.a Personal Transfers 13.1 16.4 51.5 61.5

4.b Other Transfers 0.5 0.4 1.6 2.0

5. Current Account (1+2+3+4) -6.3 -21.7 -46.0 -78.2

Note: Total of subcomponents may not tally with aggregate due to rounding off.

P: Preliminary; PR: Partially Revised.

Developments in Indias Balance of Payments

during Fourth Quarter (January-March) of 2011-12

RBI Monthly Bulletin August 2012

1487

A RT IC LE

Capital & Financial Account

Growing fragility in global nancial markets and

slowdown in the domestic economy continued to

impact the long term nancial ows to India in Q4 of

2011-12. However, ows under FII investment and NRI

deposits revived during the quarter, following the policy

measures announced by the Reserve Bank.

Net inows under capital and nancial account

(excluding change in foreign exchange reserves)

improved signicantly to US$ 16.5 billion in Q4 of

2011-12 as compared with US$ 7.9 billion during Q3 of

2011-12 and US$ 9.1 billion in Q4 of 2010-11 (Table 3).

Capital Account

The capital account, which includes official

transfers and purchase/sale of intangible assets like

patents, copyrights, trademarks, etc., recorded a

marginal decit of US$ 0.2 billion during January-March

2012 mainly on account of other capital transfers.

Financial Account

The gross nancial inows, excluding reserve

changes, in Q4 amounted to US $ 125.8 billion

during Q4 of 2011-12 (US$ 117.5 billion a year ago)

and similarly gross nancial outows during the

period were marginally higher at US$ 109.1 billion

(US$ 108.3 billion a year ago).

On net basis, overall nancial account (excluding

changes in reserves) in Q4 recorded a steep rise

mainly on account of higher inflows under

portfolio investment, NRI deposits, banks

overseas borrowings apart from decline in FDI by

India (Table 3).

Net inows under portfolio investment improved

signicantly to US$ 13.9 billion during the quarter

Table 3: Disaggregated Items of Financial Account

(US$ billion)

Fourth Quarter

January-March

Full Year

April-March

2011 (PR) 2012 (P) 2010-11 (PR) 2011-12 (P)

1. Direct Investment (net) 1.1 1.4 9.4 22.1

1.a Direct Investment to India 5.5 4.2 25.9 33.0

1.b Direct Investment by India -4.4 -2.9 -16.5 -10.9

2. Portfolio Investment -0.01 13.9 28.2 16.6

2.a Portfolio Investment in India -0.03 14.1 29.4 16.8

2.b Portfolio Investment by India 0.02 -0.2 -1.2 -0.2

3. Other investment 8.1 1.4 24.4 29.2

3.a Other equity (ADRs/GDRs) 0.2 0.03 2.0 0.6

3.b Currency and deposits 2.0 4.6 3.8 12.1

Deposit-taking corporations, except the central bank: (NRI Deposits) 0.9 4.7 3.2 11.9

3.c Loans* 1.0 -0.03 18.6 16.8

3.c.i Loans to India 0.7 -0.02 18.3 15.7

Deposit-taking corporations, except the central bank -2.7 -2.6 1.2 4.1

General government (External Assistance) 0.8 0.3 5.0 2.5

Other sectors (ECBs) 2.7 2.3 12.2 9.1

3.c.ii Loans by India 0.3 -0.01 0.3 1.0

General government (External Assistance) -0.01 -0.04 -0.03 -0.2

Other sectors (ECBs) 0.3 0.0 0.3 1.2

3.d. Trade credit and advances 2.7 0.2 11.0 6.7

3.e. Other accounts receivable/payable other 2.2 -3.3 -11.1 -6.9

4. Reserve assets -2.0 5.7 -13.1 12.8

Financial Account (1+2+3+4) 7.1 22.4 48.9 80.7

Note: Total of subcomponents may not tally with aggregate due to rounding off.

P: Preliminary; PR: Partially Revised.

*: includes External Assistance, ECBs, non-NRI Banking Capital and short term trade credit.

Developments in Indias Balance of Payments

during Fourth Quarter (January-March) of 2011-12

RBI Monthly Bulletin August 2012

A RT IC LE

1488

(inows of US$ 1.8 billion in Q3 of 2011-12) and

negligible ows during the same period in the

preceding year. Increase in FII inflows was

witnessed under both the category of equity and

debt partly reflecting the relaxation in FII

guidelines relating to lock-in-period.

Trade credits & advances to India in the quarter at

US$ 0.2 billion stood signicantly lower than US$

2.7 billion in Q4 of 2010-11. The rising risk

aversion and deleveraging in global financial

markets seem to have impacted the availability

and rolling over of trade credits.

Similarly, there has been a marked increase in

inows under currency and deposits of commercial

banks, i.e., NRI deposits to US$ 4.7 billion in Q4

of 2011-12 reecting the impact of exchange rate

depreciation and deregulation of interest rates on

NRI deposits.

Despite signicant improvement in the capital

and nancial account, net capital inows were not

sufcient to nance the CAD recorded in Q4,

thereby leading to a drawdown of foreign exchange

reserves to the extent of US$ 5.7 billion as against

a reserve build-up of US$ 2.0 billion in Q4 of 2010-

11. In nominal terms (i.e., including valuation

changes), foreign exchange reserves declined by

US$ 2.3 billion during the quarter.

Balance of Payments during April-March

2011-12

Taking into account the partially revised data for

Q1, Q2 and Q3 along with preliminary data for Q4, the

BoP data for the full year 2011-12 (April-March) have

been compiled. While the detailed data are set out in

Table 41 of the RBI Bulletin (Statistical Section) in the

standard format of BoP presentation, the major items

are presented in Table 1.

Economic slowdown in advanced countries and

its spillover effects in EMEs coupled with rising

commodity prices, particularly crude oil and gold, led

to sharp increase in trade decit. This caused a steep

rise in CAD to the highest ever level both in absolute

as well as in terms of GDP. Global and domestic

economic concerns also led to moderation of inows

under capital and nancial account (excluding change

in reserves) and therefore, foreign exchange reserves

had to be drawn to nance the elevated level of CAD

in 2011-12.

During nancial year 2011-12, growth in Indias

merchandise exports at US$ 309.8 billion on a BoP

basis, decelerated to 23.6 per cent as compared

with a growth of 37.5 per cent during previous

year. Slowdown was more pronounced in the

second half of the year when growth in exports

decelerated to less than 6 per cent from more than

47 per cent in the rst half. This asymmetric

pattern may partly be the result of some front of

exports loading as some incentive schemes were

to be withdrawn in the second half of the year.

Moreover, during 2011, the world trade volume

grew by mere 5.9 per cent as against 12.8 per cent

in 2010.

Import payments during the same period at US$

499.5 billion, on a BoP basis, registered a growth

of 31.1 per cent as compared with an increase of

26.7 per cent in the previous year. Like exports,

imports also decelerated during the second half

of the year from around 41 per cent to 23 per cent.

Moderation in imports during second half may

partly be attributed to weakening of domestic

demand coupled with rupee depreciation and

sluggish external demand impacting export

related imports.

At disaggregated level, growth in exports of

petroleum products, engineering goods, textile

and textile products, gems & jewellery and ores &

minerals witnessed a moderation during 2011-12

over the previous year. Among imports, petroleum

and petroleum products, food products, capital

goods, gold & silver, coal, coke & briquettes and

other bulk items, including fertilisers and

metalliferrous ores & metal scrap recorded higher

growth while growth of export related import

items showed a steep deceleration during the year.

During the year, POL products and gold & silver

together accounted for around 45 per cent of

Indias merchandise imports in 2011-12. Oil

imports at US$ 155 billion recorded an increase of

nearly 46 per cent over the years (as compared

Developments in Indias Balance of Payments

during Fourth Quarter (January-March) of 2011-12

RBI Monthly Bulletin August 2012

1489

A RT IC LE

with an increase of 21.6 per cent in 2010-11).

Import of gold and silver at US$ 61.3 billion were

higher by 44.4 per cent in 2011-12 as compared

with 43.5 per cent recorded during the previous

year. Notably, predominant proportion of rise in

oil and gold imports has been on account of rise

in respective international prices (Crude Oil: 31

per cent and Gold: 27 per cent).

Trade Decit

Merchandise trade balance (on BoP basis) during

2011-12 worsened to US$ 189.7 billion from US$

130.4 billion recorded in the preceding year. In

terms of GDP, it increased from 7.7 per cent in

2010-11 to 10.3 per cent in 2011-12, one of the

highest in the world.

Services

Growth of services exports moderated to 7.1 per

cent during 2011-12 as compared with 37.5 per cent

during the previous year, while imports of services

declined by 7.3 per cent as against an increase of 39.4

per cent during the same period. This led to an increase

of 31.6 per cent in services exports in net terms during

2011-12 (34.4 per cent in 2010-11).

Moderation in the growth of the services receipts

was mainly on account of decline in nancial

services and decleration in growth rate of other

business services. Other services, viz., travel,

t r a n s p o r t a t i o n s , i n s u r a n c e a n d

telecommunications, computer & information

services also recorded some moderation in

growth.

Decline in services payments during 2011-12 as

against a sharp growth in 2010-11 was noticed in

construction services, computer services, research

& developmental services, professional &

management consultancy services, personal

cultural & recreational services and other services.

On the other hand, services payments on account

of travel, transport and insurance & pension

services recorded higher growth primarily on

account of weakening of rupee.

Exports of computer services, i.e., software

receipts at US$ 62.2 billion during 2011-12

recorded an increase of 12.2 per cent as compared

with a growth of 11.6 per cent a year ago.

Income

Primary income

Primary income balance, comprising compensation

of employees and investment income, improved

marginally during 2011-12 as compared with the

corresponding period of preceding year mainly due to

turnaround in the compensation of employees.

Investment income receipts during the year

declined by 3.9 per cent over the previous year

reecting lower interest/discount earnings on

foreign exchange reserves. Compensation of

employees, in net terms, however, showed a small

inow of US$ 0.5 billion in 2011-12 as against an

outow of US$ 0.9 billion during 2010-11.

Investment income payments at US$ 24.1 billion

stood marginally lower by 1.0 per cent in 2011-12.

Decline in investment income payments was

primarily on account of decline in reinvested

earnings of FDI companies reflecting falling

protability of Indian corporate sector. In contrast,

there was steep rise in the interest payments on

account of ECBs, trade credits, NRI deposits and

FII investment in debt securities. Higher interest

payment during the year may partly be attributed

to deregulation of interest rate on NRI rupee

deposits, increase in cap on FCNR deposits and

on ECB borrowings during the second half of the

year.

Nonetheless, improvement in receipts on account

of compensation of employees led to a marginal

improvement in net primary income as net

outow remained lower than the previous year.

Secondary Income

Net secondary income receipts that primarily

comprise private transfers recorded a robust

growth of 19.5 per cent to US$ 63.5 billion during

the year (US$ 53.1 billion a year ago).

NRI deposits, when withdrawn domestically, form

part of private transfers as they become unilateral

transfers and do not have any quid pro quo. During

Developments in Indias Balance of Payments

during Fourth Quarter (January-March) of 2011-12

RBI Monthly Bulletin August 2012

A RT IC LE

1490

2011-12, the share of local withdrawals in total

outows from NRI deposits was at 62.0 per cent

as compared to 56.8 per cent in previous year

(Table 4).

Under private transfers, the inward remittances

for family maintenance accounted for 47.3 per

cent of the total private transfer receipts, while

local withdrawals accounted for 49.1 per cent

during 2011-12 (Table 5).

Current Account Balance

During the nancial year 2011-12, worsening trade

decit coupled with higher interest payments led

to increase in current account deficit despite

improvement in net services and secondary

income. The CAD during in 2011-12 stood at US$

78.2 billion as compared with US$ 46.0 billion

during 2010-11. As a percentage of GDP, CAD

amounted to 4.2 per cent during 2011-12 as

compared with 2.7 per cent recorded during the

same period of the preceding year.

Capital and Financial Account

Net inows under capital and nancial account

(excluding changes in reserve assets) at US$ 67.8

billion stood higher than that recorded in the

previous year (US$ 62.0 billion) primarily on

account of revival in FDI ows to India, surge in

NRI deposits and higher overseas borrowings by

banks. However, there was a decline in inows

under FII investments, ADRs/GDRs, external

assistance, ECBs and short term trade credit.

Capital Account

The capital account recorded a marginal decit of

US$ 61 million during 2011-12 as against a surplus

of US$ 40 million a year ago.

Financial Account

Net ows under the nancial account (excluding

changes in reserve assets) were higher during

2011-12 as compared with that in 2010-11

(Table 3).

Rise has been signicant in case of inward FDI

(benefiting from BP-Reliance deal of US$ 7.0

billion) which on net basis rose to US$ 33.0 billion

during 2011-12 from US$ 25.9 billion during

2010-11. Sector-wise, the increase in FDI inows

during the year was mainly led by ows under

manufacturing, construction, nancial services,

business services and communication services

(Table 6). Country-wise, investment routed

through Mauritius remained, as in the past, the

largest component, followed by Singapore and the

UK (Table 7).

FDI by India (i.e., outward FDI) in net terms

moderated by around 34 per cent to US$ 10.9

billion in 2011-12 (US$ 16.5 billion a year ago) due

to lower outows under both equity investment

and other capital (inter-company borrowings).

Sector-wise, moderation in outward FDI was

observed in agriculture, hunting, forestry &

shing, nancial insurance, real estate & business

services, manufacturing and wholesale, retail

trade, restaurants & hotels. Furthermore, sectors,

viz. nancial, insurance, real estate & business

services and manufacturing continued to account

Table 4: Inows and Outows from NRI Deposits

and Local Withdrawals

(US$ billion)

Year Inows Outows Local

Withdrawals

2009-10 (R) 41.4 38.4 23.3

2010-11 (PR) 49.3 46.0 26.2

2011-12 (P) 64.3 52.4 32.5

P: Preliminary. PR: Partially Revised. R: Revised.

Table 5: Details of Secondary Income

Receipts to India

(US$ billion)

Year Secondary

Income

Receipts

of Which:

Inward remittances

for family

maintenance

Local withdrawals/

redemptions of NRI

Deposits

Amount Percentage

Share in

Total

Amount Percentage

Share in

Total

2009-10 (R) 53.6 28.4 53.0 23.3 43.5

2010-11 (PR) 55.6 27.4 49.3 26.2 47.0

2011-12 (P) 66.1 31.3 47.3 32.5 49.1

P: Preliminary. PR: Partially Revised. R: Revised.

Developments in Indias Balance of Payments

during Fourth Quarter (January-March) of 2011-12

RBI Monthly Bulletin August 2012

1491

A RT IC LE

for more than 50 percent of total outward FDI

during 2011-12 (Table 6).

Direction-wise (i.e. in terms of recipient countries),

investment routed through Mauritius constituted

the largest component of gross outward FDI during

the period, followed by Singapore (Table 7).

With signicant improvement in FDI inows and

lower outward FDI, the net FDI (i.e., inward FDI

minus outward FDI) to India was signicantly

higher at US$ 22.1 billion in 2011-12 as compared

with US$ 9.4 billion in 2010-11.

During 2011-12, the outward FDI in joint ventures

(JVs) and wholly owned subsidiaries (WOSs) stood

at US$ 11.1 billion, around 33.2 per cent lower

than that during preceding year. During 2011-12,

investment nanced through equity recorded a

Table 6: Sector-wise FDI: Inows and Outows (US$ Billion)

(US$ billion)

Gross FDI inows to India# Gross FDI outows from India*

Industry 2010-11 2011-12 Industry 2010-11 2011-12

1 2 3 4 5 6

Manufacture 4.8 9.3 Financial, Insurance, Real Estate and Business Services 6.5 3.2

Construction 1.6 2.6 Manufacturing 4.9 3.2

Financial Services 1.4 2.6 Transport, Storage and Communication Services 0.8 2.0

Business Services 0.6 1.6 Wholesale, Retail Trade, Restaurants and Hotels 1.9 1.2

Communication Services 1.1 1.5 Agriculture , Hunting, Forestry and Fishing 1.2 0.5

Electricity and others 1.3 1.4 Construction 0.4 0.5

Restaurants and Hotels 0.3 0.9 Electricity, Gas and Water 0.1 0.0

Computer Services 0.6 0.7 Community, Social and Personal Services 0.7 0.4

Others 3.2 2.9 Miscellaneous 0.2 0.1

Total 14.9 23.5 Total 16.7 11.1

#: Includes equity FDI through SIA/FIPB and RBI routes only and hence are not comparable with data in other tables.

*: Includes equity (except that of individuals and banks), loans and guarantee invoked, and hence are not comparable with data in other tables.

Table 7: Country-wise FDI: Inows and Outows

(US$ billion)

Gross FDI inows to India# Gross FDI outows from India*

Country Apr-Mar Country Apr-Mar

2010-11 2011-12 2010-11 2011-12

1 2 3 4 5 6

Mauritius 5.6 8.1 Mauritius 5.1 2.6

Singapore 1.5 3.3 Singapore 4.0 2.2

UK 0.5 2.8 Netherlands 1.5 1.2

Japan 1.3 2.1 USA 1.2 1.0

Cyprus 0.6 1.6 British Virgin Islands 0.3 0.6

Netherlands 1.4 1.3 UK 0.4 0.5

U.S.A 1.1 1.0 UAE 0.9 0.4

France 0.5 0.6 Australia 0.2 0.3

Germany 0.2 0.4 Hongkong 0.2 0.3

UAE 0.2 0.3 Japan 0.0 0.2

Others 2.0 2.0 Others 2.9 1.7

Total 14.9 23.5 Total 16.7 11.1

#: Includes equity FDI through SIA/FIPB and RBI routes only and hence are not comparable with data in other tables.

*: Includes equity (except that of individuals and banks), loans and guarantee invoked, and hence are not comparable with data in other tables.

Developments in Indias Balance of Payments

during Fourth Quarter (January-March) of 2011-12

RBI Monthly Bulletin August 2012

A RT IC LE

1492

sharper decline of 42.1 per cent compared to the

loan component which declined by 22.2 per cent

over a year ago. Accordingly, the share of equity

in total outward FDI fell to 47.8 per cent as

compared with 55.2 per cent in the preceding year

(Table 8).

FII investment ows remained volatile throughout

the year. On net basis, FII inows declined sharply

to US$ 16.8 billion during the year as compared

with a large inow of US$ 29.4 billion recorded

during preceding year.

Inows under currency and deposits by banking

sector (NRI deposits) witnessed a sharp rise of

more than 200 per cent and stood at US$ 11.9

billion as compared with an inow of US$ 3.2

billion a year ago. Such an impressive rise in NRI

deposits may be attributed to weakening of rupee

and deregulation of interest rate on NRI deposits

in the latter half of the year.

Net loans availed by non-Government and non-

banking sectors (net ECBs) were lower at US$ 9.1

billion as compared with US$ 12.2 billion in 2010-

11 primarily on account of a sharp rise in the

amortisation of ECBs during Q3 of 2011-12 due to

FCCB redemptions. Net inows under short-term

trade credit also moderated to US$ 6.7 billion

during the period from US$ 11.0 billion recorded

a year ago as the cost of short-term trade credit

rose and availability became difcult.

Net loans availed by banks more than doubled to

US$ 4.1 billion during the year partly due to rise

in their overseas borrowings.

Other receivables/payables that include leads

and lags in exports, SDR allocation, net funds

held abroad, advances received pending issue of

shares under FDI, rupee debt service and other

capital not included elsewhere recorded a lower

net outflow of US$ 6.9 billion in 2011-12 as

compared with a net outow of US$ 11.0 billion

in the corresponding period of preceding year

(Table 9). Leads & lags in exports also include

trade credit extended by Indian exporters to non-

residents.

Reserve Variation

There was a net drawdown of foreign exchange

reserves to the extent of US$ 12.8 billion during

Table 8: Indias Outward FDI

(US$ billion)

Period Equity* Loan Guarantees

Invoked

Total

2011-12 (P) 5.3 5.8 0 11.1

(47.8) (52.2) (0)

2010-11 (PR) 9.2 7.5 0 16.7

(55.2) (44.8) (0)

2009-10 (R) 10.6 4.2 0 14.8

(71.6) (28.4) (0)

*: The equity data do not include equity of individuals and banks.

Note: Figures in brackets relate to percentage share in total outward FDI

for the period.

Table 9: Details of Other Receivables/

Payables (Net)

(US$ billion)

Item 2009-10

(R)

2010-11

(PR)

2011-12

(P)

Lead and Lags in Exports -3.4 -8.8 -10.4

Net Funds Held Abroad -7.6 -5.4 -2.8

Advances Received Pending Issue of

Shares under FDI

3.1 6.9 2.7

SDR Allocation 5.2

Other capital not included elsewhere# -10.6 -3.8 3.6

Total (1 to 5) -13.3 -11.1 -6.9

#: Inclusive of derivatives and hedging, migrant transfers and other

capital transfers

P: Preliminary. PR: Partially Revised. R: Revised. -: Nil/NA.

Developments in Indias Balance of Payments

during Fourth Quarter (January-March) of 2011-12

RBI Monthly Bulletin August 2012

1493

A RT IC LE

nancial year 2011-12 (Chart 4). In nominal terms

(i.e., including valuation changes), foreign

exchange reserves declined by US$ 10.4 billion

during the period reecting depreciation of US

dollar against the major international currencies.

At the end of March 2012, the level of foreign

exchange reserves stood at US$ 294.4 billion.

Difference between DGCI&S and Balance

of Payments Imports

The data on imports based on DGCI&S (customs

statistics) and the BoP (banking channel data) are

Table 10: DGCI&S and the BoP Import Data

(US$ billion)

Item April-March

2009-10 2010-11 2011-12

1 2 3 4

1. BoP Imports 300.6 381.1 499.5

2. DGCI&S Imports 288.4 369.8 488.7

3. Difference (1-2) 12.2 11.3 10.8

given in Table 10. The difference between the two

sets of data are likely to get reduced when both

the data sets would be later revised (Table 10).

Developments in Indias Balance of Payments

during Fourth Quarter (January-March) of 2011-12

RBI Monthly Bulletin August 2012

A RT IC LE

1494

Attachment I : Invisibles by Category

( US$ million)

Items 2009-10 R 2010-11 PR 2011-12 P 2011-12

Apr-Jun PR Jul-Sep PR Oct-Dec PR Jan-Mar P

1 2 2 3 4 5 6 7

I. Invisibles Receipts ( A+B+C) 1,63,430 1,98,248 2,19,229 52,085 52,107 56,866 58,172

A. Services 96,045 1,32,880 1,42,325 34,055 32,643 37,552 38,075

1) Travel 11,859 15,275 18,462 3,697 4,235 5,068 5,462

2) Transportation 11,178 14,271 18,241 4,355 4,499 4,705 4,681

3) Insurance 1,591 1,948 2,632 569 629 799 635

4) GNIE 441 535 478 139 147 145 47

5) Miscellaneous 70,977 1,00,851 1,02,513 25,295 23,134 26,835 27,250

of which:

Software Services 49,705 55,460 62,212 14,950 13,940 16,123 17,199

B. Transfers 54,363 56,265 66,761 15,537 16,376 17,024 17,824

1) Ofcial Transfers 727 647 632 46 136 351 99

2) Private Transfers 53,636 55,618 66,129 15,491 16,240 16,673 17,725

C. Income 13,022 9,102 10,144 2,493 3,088 2,290 2,273

1) Investment Income 12,108 7,986 7,676 1,904 2,377 1,707 1,688

2) Compensation of Employees 915 1,116 2,468 589 711 583 585

II. Invisibles Payments ( A+B+C) 83,408 1,13,600 1,07,625 24,617 26,471 28,116 28,421

A. Services 60,029 84,064 78,227 17,637 18,651 21,385 20,554

1) Travel 9,343 11,108 13,762 3,461 3,534 3,530 3,238

2) Transportation 11,933 13,880 16,382 4,002 3,624 4,444 4,311

3) Insurance 1,285 1,400 1,497 298 423 440 337

4) GNIE 525 820 780 201 179 186 214

5) Miscellaneous 36,944 56,856 45,806 9,675 10,891 12,785 12,455

of which:

Software Services 1,468 2,194 1,256 302 307 317 329

B. Transfers 2,318 3,125 3,267 858 775 614 1,021

1) Ofcial Transfers 473 631 607 146 152 149 160

2) Private Transfers 1,845 2,494 2,660 712 622 465 861

C. Income 21,061 26,412 26,131 6,122 7,045 6,118 6,846

1) Investment Income 19,355 24,384 24,141 5,722 6,578 5,566 6,274

2) Compensation of Employees 1,705 2,028 1,991 400 467 551 572

Net Invisibles ( I II) 80,022 84,648 1,11,604 27,468 25,636 28,750 29,751

Developments in Indias Balance of Payments

during Fourth Quarter (January-March) of 2011-12

RBI Monthly Bulletin August 2012

1495

A RT IC LE

Attachment I A: Invisibles Receipts by Category of Transactions

( US$ million)

Items 2009-

10 R

2010-11

PR

2011-

12 P

2011-12

Apr-Jun

PR

Jul-Sep

PR

Oct-Dec

PR

Jan-Mar

P

1 2 3 4 5 6 7

I. Invisibles Receipts ( A+B+C) 163430 198248 219229 52085 52107 56866 58172

A) SERVICES 96045 132880 142325 34055 32643 37552 38075

1) TRAVEL ACCOUNT

Tourist Expenses in India 11859 15275 18462 3697 4235 5068 5462

TOTAL 11859 15275 18462 3697 4235 5068 5462

2) TRANSPORTATION ACCOUNT

a ) Sea Transport

i) Surplus remitted by Indian companies operating abroad 609 649 731 205 219 162 145

ii) Operating expenses of foreign companies in India 788 765 753 275 187 139 152

iii) Charter hire charges 140 116 149 41 34 36 38

b) Air Transport

i) Surplus remitted by Indian companies operating abroad 420 530 801 153 193 177 277

ii) Operating expenses of foreign companies in India 66 56 113 38 39 28 9

iii) Charter hire charges 12 20 9 1 3 5 0

c) Freight on exports 7967 10361 13073 3070 3217 3432 3354

d) Others 1177 1773 2612 573 607 726 706

TOTAL ( a to d) 11178 14270 18241 4355 4499 4705 4681

3) INSURANCE ACCOUNT

a) Insurance on export 1040 1354 1709 401 421 449 438

b) Premium

i) Life 46 50 147 29 45 44 29

ii) Non-life 99 124 160 30 44 52 35

iii) Reinsurance from foreign companies 212 126 172 29 33 90 21

c) Commission on Business received from foreign companies 24 33 59 7 20 22 9

d) Others 169 263 384 74 67 142 102

TOTAL ( a to d) 1591 1949 2632 569 629 799 635

4) Government Not Included Elsewhere

a) Maintenance of foreign embassies and diplomatic missions in India 279 387 344 100 112 98 34

b) Maintenance of international and regional institutions in India 162 147 134 39 35 47 13

TOTAL ( a to b) 441 534 478 139 147 145 47

5) MISCELLANEOUS ACCOUNT

a) Communication services 1229 1562 1601 360 390 456 395

b) Construction services 589 676 813 253 137 204 219

c) Financial services 3692 6508 5967 1282 1577 1613 1495

d) Software services 49705 55461 62212 14950 13940 16123 17199

e) News agency services 351 605 109 30 24 31 24

f) Royalties, copyright and license fees 202 193 281 40 78 78 85

g) Business services (i to xii) 11323 24049 25910 5780 6120 6807 7203

i) Merchanting services 316 1223 1352 332 348 300 372

ii) Trade related services 1688 5356 2882 748 716 700 718

iii) Operational Leasing Services 423 829 757 200 189 194 174

iv) Legal services 609 439 556 118 129 167 142

v) Accounting/Auditing services 224 301 474 81 106 157 130

vi) Business Management & consultancy services 3776 9184 9335 2040 2182 2210 2903

vii) Advertising/trade fair 568 703 774 224 171 192 187

viii) Research & Development services 565 878 819 161 187 207 264

ix) Architectural Engineering & other technical services 1380 2013 2750 642 693 828 587

x) Agricultural Mining & on-site processing services 196 286 78 35 16 17 10

xi) Maintanence of ofces abroad services 1507 2777 6040 1183 1358 1815 1684

xii) Environmental services 71 60 93 16 25 20 32

h) Personal, Cultural & Recreational services 527 227 406 86 120 67 133

i) Refunds/rebates 597 507 605 8 149 200 248

j) Other services 2762 11062 4609 2505 598 1256 249

TOTAL ( a to j) 70977 100850 102513 25294 23133 26835 27250

Developments in Indias Balance of Payments

during Fourth Quarter (January-March) of 2011-12

RBI Monthly Bulletin August 2012

A RT IC LE

1496

Attachment I A: Invisibles Receipts by Category of Transactions (Concld.)

(US$ million)

Items 2009-10

R

2010-11

PR

2011-12

P

2011-12

Apr-Jun

PR

Jul-Sep

PR

Oct-Dec

PR

Jan-Mar

P

1 2 3 4 5 6 7

B) TRANSFERS (I + II) 54364 56265 66761 15538 16376 17024 17824

I) OFFICIAL TRANSFERS

i) Donations received from Non- residents 67 75 77 19 19 21 18

ii) Grant under PL 480 II 4 0 0 0 0 0 0

iii) Grants from other Governments 656 573 555 27 117 330 81

TOTAL ( i to iii) 727 648 632 46 136 351 99

II) PRIVATE TRANSFERS

i) Inward remittance from Indian workers abroad for family

maintenance etc.

28406 27408 31262 7372 7718 7912 8260

ii) Local withdrawals/redemptions from non-resident deposits 23288 26151 32471 7503 7930 8106 8932

iii) Gold and silver brought through passenger baggage 85 36 54 18 15 3 18

iv) Personal gifts/donations to charitable/religious institutions in India 1857 2023 2342 598 577 652 515

TOTAL (i to iv) 53636 55618 66129 15491 16240 16673 17725

C) INCOME ACCOUNT (I + II) 13023 9102 10144 2493 3088 2290 2273

I) Compensation of Employees

Wages received by Indians working on foreign contracts 914 1117 2468 589 711 583 585

II) Investment Income

i) Interest received on loans to non-residents 4138 1722 567 202 219 72 74

ii) Dividend/prot received by Indians on foreign investment 349 283 766 276 149 104 236

of which:

Dividend received by Indians on foreign investment 224 156 547 241 101 51 154

Prot received by Indians on foreign investment 125 127 219 35 48 53 82

iii) Reinvested Earning 1084 1084 1208 302 302 302 302

iv) Interest received on debentures,FRNs,CPs, xed deposits and

funds held abroad by ADs out of foreign currency loans/export

proceeds

57 42 405 150 85 126 44

v) Interest received on overdraft of VOSTRO accounts of foreign

correspondents/branches by the ADs

16 12 25 7 13 3 2

vi) Payment of taxes by the non-residents/refund of taxes by foreign

governments to Indians

554 681 615 152 293 100 70

vii) Interest/discount earnings etc. earnings on RBI investment 5900 4142 4063 811 1304 994 954

viii) Interest/remuneration on SDR holdings 10 20 27 4 11 6 6

TOTAL ( i to viii) 12108 7986 7676 1904 2377 1707 1688

Developments in Indias Balance of Payments

during Fourth Quarter (January-March) of 2011-12

RBI Monthly Bulletin August 2012

1497

A RT IC LE

Attachment I B: Invisibles Payments by Category of Transactions

( US$ million)

Items 2009-10

R

2010-11

PR

2011-

12 P

2011-12

Apr-Jun

PR

Jul-Sep

PR

Oct-Dec

PR

Jan-Mar

P

1 2 3 4 5 6 7

Invisibles Payments ( A+B+C) 83408 113600 107625 24617 26471 28116 28421

A) SERVICES (I to V) 60030 84064 78227 17637 18651 21385 20554

I) TRAVEL ACCOUNT

i) Business 3569 4978 7297 1847 1650 1921 1879

ii) Health Related 29 59 36 10 11 7 7

iii) Education Related 2252 1892 1864 330 631 467 436

iv) Basic travel quota ( BTQ) 2336 2780 2800 895 733 602 571

v) Pilgrimage 232 309 510 48 210 201 51

vi) Others 924 1090 1255 331 299 332 294

TOTAL ( i to vi) 9342 11108 13762 3461 3534 3530 3238

II) TRANSPORTATION ACCOUNT

a. Sea Transport

i) Surplus remitted by Foreign companies operating in India 1209 1771 2961 805 797 704 655

ii) Operating expenses of Indian companies abroad 1670 962 1056 312 311 231 202

iii) Charter hire charges 97 93 72 13 10 29 20

iv) Freight on imports 3265 4186 3848 996 905 999 948

v) Freight on Exports 1019 1119 1237 436 253 266 283

vi) Remittance of passage booking abroad 6 11 10 8 1 0 0

b. Air Transport

i) Surplus remitted by Foreign companies operating in India 2452 3120 2457 794 619 485 559

ii) Operating expenses of Indian companies abroad 603 923 867 234 227 199 208

iii) Charter hire charges 510 491 422 119 120 98 85

iv) Freight on imports 112 152 176 34 39 43 60

v) Freight on Exports 23 50 31 3 8 4 17

vi) Remittance of passage booking abroad 38 41 56 10 17 12 17

c. Others 930 961 3187 238 318 1374 1257

TOTAL ( a to c) 11934 13880 16382 4002 3624 4444 4311

III) INSURANCE ACCOUNT

a. Premium

i) Life 25 15 11 2 4 1 4

ii) Non-life 117 128 88 19 25 26 18

iii) Reinsurance 653 750 824 198 220 243 163

b. Commission on Business 58 65 73 18 33 6 16

c. Others 432 442 501 61 140 164 137

TOTAL ( a to c) 1285 1400 1497 298 423 440 337

IV) Government Not Included Elsewhere

a. Maintenance of Indian embassies and diplomatic mission abroad 358 531 460 115 101 122 122

b. Remittances by foreign embassies and mission in India 167 288 320 86 78 64 92

TOTAL ( a to b) 525 819 780 201 179 186 214

V) MISCELLANEOUS ACCOUNT

a) Communication services 1355 1152 1556 415 309 341 491

b) Construction services 998 1157 1002 203 315 155 329

c) Financial services 4643 7483 7985 1764 2130 2189 1902

d) Software services 1469 2195 1255 302 307 317 329

e) News agency services 639 467 517 194 87 112 124

f) Royalties, copyright and license fees 2017 2424 3208 606 693 919 990

g) Business services (i to xii) 18050 27763 26791 5914 6352 6951 7574

i) Merchanting services 496 1068 1321 211 331 241 538

ii) Trade related services 1772 1878 2427 590 545 395 897

iii) Operational Leasing Services 907 1236 1168 338 250 282 298

iv) Legal services 193 158 224 46 48 65 65

v) Accounting/Auditing services 179 274 210 77 37 46 50

vi) Business Management & consultancy services 5376 10613 10224 2022 2394 2994 2814

vii) Advertising/trade fair 792 945 982 211 280 243 248

viii) Research & Development services 319 249 223 48 26 91 58

ix) Architectural Engineering & other technical services 4252 5127 4871 1092 1262 1416 1101

x) Agricultural Mining & on-site processing services 191 131 64 11 17 17 19

xi) Maintanence of ofces abroad services 3573 6072 5066 1267 1160 1157 1482

xii) Environmental services 3 12 11 1 2 4 4

h) Personal, Cultural & Recreational services 260 543 275 80 78 48 69

i) Refunds/rebates 473 641 808 111 266 176 255

j) Other services 7040 13031 2409 86 354 1577 392

TOTAL ( a to j) 36944 56856 45806 9675 10891 12785 12455

Developments in Indias Balance of Payments

during Fourth Quarter (January-March) of 2011-12

RBI Monthly Bulletin August 2012

A RT IC LE

1498

Attachment I B: Invisibles Payments by Category of Transactions (Concld.)

( US$ million)

Items 2009-10

R

2010-11

PR

2011-12

P

2011-12

Apr-Jun

PR

Jul-Sep

PR

Oct-Dec

PR

Jan-Mar

P

1 2 3 4 5 6 7

B) TRANSFERS (I + II) 2318 3125 3267 858 775 614 1021

I) OFFICIAL TRANSFERS

Grants/donations from ofcial sector 473 631 607 146 152 149 160

TOTAL 473 631 607 146 152 149 160

II) PRIVATE TRANSFERS

i) Remittance by non-residents towards family maintenance and

savings

1515 2078 2270 588 530 396 756

ii) Personal gifts/donations to charitable/religious institutions 329 415 390 123 93 69 105

of which:

Remittance towards personal gifts and donations 286 405 372 114 91 67 100

Remittance towards donations to religious and charitable

institutions abroad

41 9 15 8 1 2 4

Remittance towards grants and donations to other governments

and charitable institutions established by the governments

2 1 3 1 1 0 1

TOTAL ( i to ii) 1844 2493 2660 712 622 465 861

C) INCOME (I + II) 21061 26412 26131 6122 7045 6118 6846

I) Compensation of Employees

Payment of wages/salary to Non-residents working in India 1705 2027 1990 400 467 551 572

TOTAL 1705 2027 1990 400 467 551 572

II) Investment Income

i) Payment of interest on NRI deposits 1599 1737 2312 503 531 567 711

ii) Payment of interest on loans from non-residents 4165 5071 7904 1831 1762 1895 2416

iii) Payment of dividend/prot to non-resident share holder 3810 4681 4861 1167 2075 789 830

of which:

Payment of dividend to non-resident share holder 3208 4337 4541 1076 1947 725 793

Payment of prot to non-resident share holder 602 344 320 91 128 64 37

iv) Reinvested Earning 8668 11940 8204 2051 2051 2051 2051

v) Payment of interest on debentures,FRNs, CPs xed deposits,

Government securities etc.

227 320 216 47 48 77 44

vi) Charges on SDRs 9 19 22 7 4 5 6

vii) Interest paid on overdraft on VOSTRO a/c Holders/OD on

NOSTRO a/c

656 397 222 23 28 146 25

viii) Payment of taxes by the Indians/refund of taxes by government

to non-residents

221 219 399 93 79 36 191

TOTAL ( i to viii) 19355 24384 24140 5722 6578 5566 6274

P: Preliminary. PR: Partially Revised. R: Revised.

You might also like

- Recent Trends in India's BopDocument6 pagesRecent Trends in India's BopAashi Jain100% (1)

- FXTM - Model Question PaperDocument36 pagesFXTM - Model Question PaperRajiv Warrier0% (1)

- Indian Economy JUNE 2011Document52 pagesIndian Economy JUNE 2011Moizur Rahman KhanNo ratings yet

- Scroll Down For ReadingDocument44 pagesScroll Down For ReadingMothukuri SrikanthNo ratings yet

- FRBM1 STQRT 201112Document33 pagesFRBM1 STQRT 201112prajesh612No ratings yet

- ICRA Financial Markets and Banking Update Vol 2Document13 pagesICRA Financial Markets and Banking Update Vol 2Sitaram SwaroopNo ratings yet

- Analysis of RBI's Quarterly StatementsDocument3 pagesAnalysis of RBI's Quarterly StatementsNitish BajajNo ratings yet

- Monthly Review of Indian Economy: April 2011Document36 pagesMonthly Review of Indian Economy: April 2011Rahul SainiNo ratings yet

- Echap-07 International TradeDocument24 pagesEchap-07 International TradeRabmeetNo ratings yet

- Bop Q1fy12Document4 pagesBop Q1fy12Amol PhadaleNo ratings yet

- Indian EconomyDocument37 pagesIndian EconomyDvitesh123No ratings yet

- RBI Policy Dec 2011Document4 pagesRBI Policy Dec 2011Mitesh MahidharNo ratings yet

- Economic Survey of PakistanEconomic Survey of Pakistan Trade and Payments Trade and PaymentsDocument28 pagesEconomic Survey of PakistanEconomic Survey of Pakistan Trade and Payments Trade and PaymentsmadddiuNo ratings yet

- India's Balance of Payments: The Alarm Bells Are Ringing: Ashoak UpadhyayDocument6 pagesIndia's Balance of Payments: The Alarm Bells Are Ringing: Ashoak UpadhyayBikash Ranjan SatapathyNo ratings yet

- Widening Gap Between FDIDocument18 pagesWidening Gap Between FDIYugalkishore ChellaniNo ratings yet

- Conomic: The Impending Signs of Global UncertaintyDocument16 pagesConomic: The Impending Signs of Global UncertaintyS GNo ratings yet

- Chap 110Document2 pagesChap 110asifanisNo ratings yet

- Monetary Policy Statement Jan 11 EngDocument28 pagesMonetary Policy Statement Jan 11 EngHamad RasoolNo ratings yet

- Shrinking Foreign Trade: INDIA's Trade Deficit During The First Nine Months of Fiscal 2009-10 On A Balance ofDocument10 pagesShrinking Foreign Trade: INDIA's Trade Deficit During The First Nine Months of Fiscal 2009-10 On A Balance ofManminder KaurNo ratings yet

- The Economic Outlook of Taiwan: October 2011Document8 pagesThe Economic Outlook of Taiwan: October 2011Phú NguyễnNo ratings yet

- Major Economic Indicators: Monthly Update: Volume 06/2012Document26 pagesMajor Economic Indicators: Monthly Update: Volume 06/2012Golam KibriaNo ratings yet

- TP Ifm Rr1906a21Document17 pagesTP Ifm Rr1906a21nipunvij87No ratings yet

- Third Quarter Review of Monetary Policy 2011-12: Reserve Bank of IndiaDocument21 pagesThird Quarter Review of Monetary Policy 2011-12: Reserve Bank of Indiaomi_pallaviNo ratings yet

- Trade Cycle Since 2003-04Document19 pagesTrade Cycle Since 2003-04Md IstiakNo ratings yet

- Balance of Payments: Lobal ConomyDocument19 pagesBalance of Payments: Lobal ConomyPraveen Reddy PenumalluNo ratings yet

- World Economy: South ADocument3 pagesWorld Economy: South APriyanka JainNo ratings yet

- Budget Impact - MacroDocument3 pagesBudget Impact - MacroAkhilesh PanwarNo ratings yet

- Bop India Oct Dec 2012Document6 pagesBop India Oct Dec 2012mainu30No ratings yet

- Lebanon's Economic EnvironmentDocument1 pageLebanon's Economic EnvironmentGerard ArabianNo ratings yet

- A Project On SCMDocument12 pagesA Project On SCMVivek JhaNo ratings yet

- Echapter Vol2Document214 pagesEchapter Vol2dev shahNo ratings yet

- State of The Economy: An OverviewDocument30 pagesState of The Economy: An OverviewsujoyludNo ratings yet

- 2012 Q1 GDP Report (Nigeria)Document15 pages2012 Q1 GDP Report (Nigeria)Gundeep SinghNo ratings yet

- BOP, CAD and Fiscal Deficit Analysis: Task - 5Document13 pagesBOP, CAD and Fiscal Deficit Analysis: Task - 5shubhamNo ratings yet

- Economic Survey 2011 12Document33 pagesEconomic Survey 2011 12swagger98979294No ratings yet

- Chapter 1Document5 pagesChapter 1Jakir_bnkNo ratings yet

- Nuances of The Reserve Banks Exchange Rate and Reserves ManagementDocument3 pagesNuances of The Reserve Banks Exchange Rate and Reserves ManagementselvamuthukumarNo ratings yet

- Reserve Bank of India Second Quarter Review of Monetary Policy 2011-12Document20 pagesReserve Bank of India Second Quarter Review of Monetary Policy 2011-12FirstpostNo ratings yet

- Indian EconomyDocument15 pagesIndian EconomyleoboyrulesNo ratings yet

- Balance of PaymentsDocument23 pagesBalance of PaymentsRashi ShahiNo ratings yet

- Macro-Economic Framework Statement: Overview of The EconomyDocument6 pagesMacro-Economic Framework Statement: Overview of The Economyknew1No ratings yet

- Economic Indicator PakistanDocument5 pagesEconomic Indicator PakistanMian MudasserNo ratings yet

- Indian EconomyDocument17 pagesIndian EconomymanboombaamNo ratings yet

- Credit Policy September 2011Document6 pagesCredit Policy September 2011Gaurav WamanacharyaNo ratings yet

- INDIA Balance of PaymentsDocument11 pagesINDIA Balance of PaymentsMohana PriyaNo ratings yet

- Balance of Payments: Recent Developments and ImplicationsDocument3 pagesBalance of Payments: Recent Developments and Implicationsshobu_iujNo ratings yet

- Indo Monetary PolicyDocument11 pagesIndo Monetary PolicyBoyke P SiraitNo ratings yet

- External Sector: Lobal Conomic NvironmentDocument25 pagesExternal Sector: Lobal Conomic NvironmentShaharukh KhanNo ratings yet

- Economic Environment of Business: Group 1Document4 pagesEconomic Environment of Business: Group 1Darshan SankheNo ratings yet

- India FRBMDocument6 pagesIndia FRBMindianeconomistNo ratings yet

- Role of Unorganised Corporate Market in Future Financial Status of IndiaDocument17 pagesRole of Unorganised Corporate Market in Future Financial Status of IndiaSourabh ChopraNo ratings yet

- Surge in Union Government RevenuesDocument4 pagesSurge in Union Government RevenuesscrNo ratings yet

- Union Budget 2012-13: The Past and The Present Budget - BackgroundDocument18 pagesUnion Budget 2012-13: The Past and The Present Budget - BackgrounddivertyourselfNo ratings yet

- Rupee DepreciationDocument6 pagesRupee DepreciationRahul ChaturvediNo ratings yet

- Annexure IIIDocument13 pagesAnnexure IIIchengadNo ratings yet

- Notice Inviting Financial Bids For Sale of Wheat To Bulk Consumers/Traders Under Omss (D) Bulk Through E-AuctionDocument1 pageNotice Inviting Financial Bids For Sale of Wheat To Bulk Consumers/Traders Under Omss (D) Bulk Through E-AuctionchengadNo ratings yet

- Notice Inviting Bids For Sale of Raw Rice Ga To Bulk Consumers/Traders Under Omss (D) Bulk Through E-AuctionDocument1 pageNotice Inviting Bids For Sale of Raw Rice Ga To Bulk Consumers/Traders Under Omss (D) Bulk Through E-AuctionchengadNo ratings yet

- MTF Rice 27.08.18 PDFDocument13 pagesMTF Rice 27.08.18 PDFchengadNo ratings yet

- NIT Dt.23.05.19 (FSD Kathua)Document3 pagesNIT Dt.23.05.19 (FSD Kathua)chengadNo ratings yet

- Rice Depotwise QuantityDocument1 pageRice Depotwise QuantitychengadNo ratings yet

- NIT Dt.23.05.19 (FSD Srinagar)Document3 pagesNIT Dt.23.05.19 (FSD Srinagar)chengadNo ratings yet

- MTF Wheat 03 - 10 - 2019Document17 pagesMTF Wheat 03 - 10 - 2019chengadNo ratings yet

- Food Corporation of India Regional Office: JammuDocument3 pagesFood Corporation of India Regional Office: JammuchengadNo ratings yet

- Food Corporation of India Regional Office: Kesavadasapuram Pattom Palace P.O: Thiruvananthapuram 695 004Document2 pagesFood Corporation of India Regional Office: Kesavadasapuram Pattom Palace P.O: Thiruvananthapuram 695 004chengadNo ratings yet

- MTF Wheat 16.08.2019Document17 pagesMTF Wheat 16.08.2019chengadNo ratings yet

- fci Date of NIT Last Date For Depositing EMD Starting Date and Time For Online Bidding End Date and Time For Online BiddingDocument1 pagefci Date of NIT Last Date For Depositing EMD Starting Date and Time For Online Bidding End Date and Time For Online BiddingchengadNo ratings yet

- Food Corporation of India: Ph. No. 0135-2970038, 0135-2665993 e Mail: Gmukfci@gov - inDocument1 pageFood Corporation of India: Ph. No. 0135-2970038, 0135-2665993 e Mail: Gmukfci@gov - inchengadNo ratings yet

- Tender For Mpeg Narmada 07022019Document71 pagesTender For Mpeg Narmada 07022019chengadNo ratings yet

- MTF Wheat 26 - 07 - 2018Document17 pagesMTF Wheat 26 - 07 - 2018chengadNo ratings yet

- Tender NIT No - 03 2017-18 Website-BSWCDocument4 pagesTender NIT No - 03 2017-18 Website-BSWCchengadNo ratings yet

- MTF of Wheat - 5Document18 pagesMTF of Wheat - 5chengadNo ratings yet

- Nit (2) - 3Document7 pagesNit (2) - 3chengadNo ratings yet

- MTF Wheat TE-35 - 1Document11 pagesMTF Wheat TE-35 - 1chengadNo ratings yet

- Agency Wise Procurement of Paddy (KMS 2016-17) - 51Document1 pageAgency Wise Procurement of Paddy (KMS 2016-17) - 51chengadNo ratings yet

- State Wise Procurement of Wheat For Rms 2017-18-21Document1 pageState Wise Procurement of Wheat For Rms 2017-18-21chengadNo ratings yet

- Craig Pirrong-Commodity Price Dynamics - A Structural Approach-Cambridge University Press (2011) PDFDocument239 pagesCraig Pirrong-Commodity Price Dynamics - A Structural Approach-Cambridge University Press (2011) PDFchengadNo ratings yet

- Statewise Procurement of Rice (KMS 2016-17) - 44Document1 pageStatewise Procurement of Rice (KMS 2016-17) - 44chengadNo ratings yet

- AP Macroeconomics Syllabus 2013Document11 pagesAP Macroeconomics Syllabus 2013Irakli MaisuradzeNo ratings yet

- Uruguay BankingDocument13 pagesUruguay BankingKanikaGaurNo ratings yet

- Austerity in The UK: A False Sense of SecurityDocument30 pagesAusterity in The UK: A False Sense of SecurityVariantPerceptionNo ratings yet

- Disequilibrium in Balance of PaymentsDocument83 pagesDisequilibrium in Balance of PaymentsBhavik Thaker100% (1)

- Mba Bdu Concurrent AssignmentDocument22 pagesMba Bdu Concurrent AssignmentDivniLhlNo ratings yet

- Ch16 Salvatore PPPDocument40 pagesCh16 Salvatore PPPRyan J Anward0% (1)

- The Sibenik Times, August 30thDocument16 pagesThe Sibenik Times, August 30thSibenskilist100% (1)

- Econ 442 Problem Set 2 (Umuc)Document2 pagesEcon 442 Problem Set 2 (Umuc)OmarNiemczykNo ratings yet

- Offering CircularDocument286 pagesOffering CircularmuktiyantoNo ratings yet

- Multinational Business Finance Assignment 3Document6 pagesMultinational Business Finance Assignment 3AnjnaKandariNo ratings yet

- BKG System Review (2003)Document101 pagesBKG System Review (2003)AyeshaJangdaNo ratings yet

- Economics Unit 2 May 2012 MarkschemeDocument16 pagesEconomics Unit 2 May 2012 MarkschemeEzioAudi77No ratings yet

- GCC Fact SheetDocument22 pagesGCC Fact SheetRoaa IbrahimNo ratings yet

- Economic Effects of An AppreciationDocument11 pagesEconomic Effects of An AppreciationIndeevari SenanayakeNo ratings yet