Professional Documents

Culture Documents

Street Levy Open House 9-11-2014

Street Levy Open House 9-11-2014

Uploaded by

MNCOOhio0 ratings0% found this document useful (0 votes)

501 views35 pagesInformation from the city engineer on the proposed income tax hike to benefit city streets, bridges and sidewalks.

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentInformation from the city engineer on the proposed income tax hike to benefit city streets, bridges and sidewalks.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

501 views35 pagesStreet Levy Open House 9-11-2014

Street Levy Open House 9-11-2014

Uploaded by

MNCOOhioInformation from the city engineer on the proposed income tax hike to benefit city streets, bridges and sidewalks.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 35

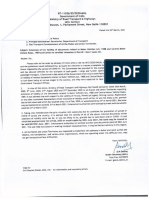

CITY OF NEWARK

PROPOSED 0. 15% INCOME TAX ISSUE

TO IMPROVE OUR STREETS AND INFRASTRUCTURE

MEETI NGS HELD SEPTEMBER 11

TH

, 2 3

RD

, OCTOBER 1

ST

, 9

TH

Street Funding - Open House

Proposed 0.15% Income Tax Increase

How much will the proposed increase generate?

Estimated additional $1.6 million annually, to be dedicated to the

improvement of the street / transportation system in Newark.

What will this cost the taxpayer?

An additional $1.25 per month for every $10,000 of earned income

Not all Income is taxable!

Income Tax is only collected on EARNED income

Income tax is NOT collected by the City on:

Retirement Funds, Social Security, Annuities, Pensions, IRAs,

Life Insurance Pay-outs, Capital Gains, State Unemployment, Alimony,

Government Allotments, Welfare Payments, Workers Compensation

History

1986 - City Engineer presents concerns regarding lack of dedicated

funding for street maintenance issues.

1993-1995 Lack of funding reduces preventative maintenance to

minimum standards.

1990-2008 Growth of street network, primarily due to new residential

development across the city.

2001 Council defeated a proposed increase to LPPT.

2008 Council approves $5 increase in LPPT. Collection begins.

2009 Council approves $10 increase in LPPT. Collection begins.

2011 Pavement Maintenance Analysis is conducted on all streets.

2014 Council approves 0.15% income tax increase to appear on 11/2014

ballot.

Paving / Resurfacing

Paving is not just asphalt

Install ADA-compliant curb ramps at intersections with sidewalk

Milling / grinding existing top layer of asphalt pavement

Make full depth repairs to areas of base failure

Place new asphalt surface typically 1.25 to 3 thick

Re-grade berms

Install new pavement stripes and markings

Replace signal detector loops at intersections

Adjust manhole and water valve boxes to new surface level

All of these additional items contribute to the costs of paving a street!

High cost - $7 to $11 per square yard

Non-Compliant Curb Ramp

Curb Ramp Under Construction

Preventative Maintenance

Crack Sealing 3 to 5 years after resurfacing

Slurry Sealing 4 to 7 years after resurfacing

Microsurfacing 4 to 7 years after resurfacing

Pothole Patching Done by Street Dept.

We are not doing enough of these first 3 items to preserve the life of the

pavement!

Lower cost than resurfacing - $1.50 to $5.00 per square yard

Pavement Deterioration and Life Cycle Costs

Pavement Life Cycle Curve

Newarks Street System

226 centerline miles of streets in the City, approximately 480 lane

miles

Currently, the City is paving an average of 8.5 miles of streets per year

At the current rate, would take 27 years to complete cycle of paving

each street one time

For good quality streets, we should be on a 15 year cycle, paving an

average of 15 miles of streets per year

Equates to findings of Pavement Analysis study - $2.26 million

annually to keep system from declining further

Pavement Analysis and Management Results

City of Newark, Ohio

The goal of the Pavement Management System is to give a

reasonably accurate model of the roadway system,

then identify strategies to maintain the system

to the level decided upon by the owner.

Data Collection Activities

Pavement Distress (Surface Condition)

Pavement Roughness/Smoothness Acceptance

Overall Pavement Quality

Analysis of all factors is used to develop a Pavement

Condition Index number

PCI ranges from -0- (very poor) to 100 (new pavement)

Pavement Distress

Surface Distress Index (SDI) by street section

Surface Distress Rating System is a score that takes

into account:

Patching (ACC)

Rippling & Shoving

Raveling & Streak

Flushing & Bleeding

Deformation & Distortions

Excessive Crown

Progressive Edge Cracking

Alligator Cracking

Potholes

Map Cracking

Longitudinal Cracking

Transverse Cracks

Wheel Track Rutting

Understanding the PCI Score

PCI Distribution-All Streets

0

5

10

15

20

25

0 to 10 10 to 20 20 to 30 30 to 40 40 to 50 50 to 60 60 to 70 70 to 80 80 to 90 90 to 100

P

e

r

c

e

n

t

a

g

e

o

f

N

e

t

w

o

r

k

-

b

y

A

r

e

a

Pavement Condition Index (PCI) Distribution (0 to 100)

All Streets

Pavement Condition Summary

0

5

10

15

20

25

Very Poor (0 to 25) Poor (25 to 40) Marginal (40 to

50)

Fair (50 to 60) Good (60 to 70) Very Good (70 to

85)

Excellent (85 to

100)

P

e

r

c

e

n

t

a

g

e

o

f

N

e

t

w

o

r

k

-

b

y

A

r

e

a

Pavement Condition Summary

Using Descriptive Terms - All Streets

Year 5 Network PCI Analysis Results

5 Year Annual PCI

Network Split by Functional Classification

Cost Comparison Street Classifications

Asphalt Price Per Ton Last 20 Years

$0

$10

$20

$30

$40

$50

$60

$70

1

9

9

4

1

9

9

5

1

9

9

6

1

9

9

7

1

9

9

8

1

9

9

9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

Price Per Ton

Annual Funding Sources for all

Transportation Projects

License Plate Permissive Tax (LPPT) funds - $800,000

State Gas Tax (SGT) funds - $300,000

City Capital Improvements (CI) funds - $500,000

Community Development Block Grant funds - $50,000 for ADA

ramps

Water, Sanitary, Stormwater Utility funds - $20,000 for utility

adjustments

Total - $1,670,000 for 2014

From the above, approximately $800,000 to $1,000,000 is needed annually

to provide the matching funds for the following:

OPWC-SCIP Grant / Loan funds variable $ per project

Federal funds administered by ODOT variable $ per project

The Citys match on these projects consists of design work, right-of-way

acquisition costs and a portion of the construction costs.

A Note on Federal and State Funding

Federal & State funds are available for projects on those streets generally

classified as arterials and collectors. For local and residential streets, the

City must provide its own funding for street maintenance.

We want to continue to apply and receive the Federal and State funding,

but these all require matching funds.

To keep the grant money coming, we use a large portion of the Citys

current transportation funds to provide the needed matching funds.

Leaves fewer $$ left for work on the local / residential streets that are 100%

City costs.

The proposed increase will allow us to continue accessing the Federal and

State funds for the major streets, while greatly improving the local and

residential street network.

Centerline Miles Paved Per Year

9

.

1

1

2

.

6

7

.

9

7

.

7

1

2

.

7

1

2

.

1

6

.

0

1

.

6

6

.

6

4

.

1

3

.

74

.

8

5

.

7

6

.

4

9

.

2

1

3

.

7

9

.

7

8

.

3

4

.

9

4

.

8

0

.

6

8

1

.

7

3

2

.

7

0

0

.

7

0

1

.

3

5

2

.

4

8

2

.

4

2

1

.

5

6

1

.

9

2

2

.

7

6

2

.

1

8

0

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

1

9

9

4

1

9

9

5

1

9

9

6

1

9

9

7

1

9

9

8

1

9

9

9

2

0

0

0

2

0

0

1

2

0

0

2

2

0

0

3

2

0

0

4

2

0

0

5

2

0

0

6

2

0

0

7

2

0

0

8

2

0

0

9

2

0

1

0

2

0

1

1

2

0

1

2

2

0

1

3

Non-ODOT Funded ODOT Funded

Miles

Pavement Funding Sources

CI, SGT, LPPT CDBT CI, SGT, LPPT CDBG

Year CI, SGT, LPPT CDBG OPWC Local Match Local Match Federal-LCATS Total incl. Match Total incl. Match Funding Total

1994 215,260.00 $ 89,286.00 $ 34,500.00 $ 81,668.00 $ 249,760.00 $ 89,286.00 $ 420,714.00 $

1995 350,444.00 $ 119,458.00 $ 74,750.00 $ 245,981.00 $ 425,194.00 $ 119,458.00 $ 790,633.00 $

1996 128,459.00 $ 177,535.00 $ 128,459.00 $ 177,535.00 $ 305,994.00 $

1997 55,779.00 $ 342,643.00 $ 55,779.00 $ - $ 398,422.00 $

1998 407,074.00 $ 130,189.00 $ 220,301.00 $ 318,000.00 $ 627,375.00 $ 130,189.00 $ 1,075,564.00 $

1999 384,429.00 $ 128,761.00 $ 384,429.00 $ 128,761.00 $ 513,190.00 $

2000 219,479.00 $ 87,671.00 $ 219,479.00 $ 87,671.00 $ 307,150.00 $

2001 961,306.00 $ 961,306.00 $ - $ 961,306.00 $

2002 258,306.00 $ 94,243.00 $ 270,381.00 $ 573,916.00 $ 528,687.00 $ 94,243.00 $ 1,196,846.00 $

2003 201,879.00 $ 211,883.00 $ 170,358.00 $ 413,762.00 $ - $ 584,120.00 $

2004 383,311.00 $ 287,827.00 $ 185,537.00 $ 671,138.00 $ - $ 856,675.00 $

2005 453,955.00 $ 287,309.00 $ 612,378.00 $ 741,264.00 $ - $ 1,353,642.00 $

2006 626,970.00 $ 87,689.00 $ 626,970.00 $ 87,689.00 $ 714,659.00 $

2007 653,505.00 $ 264,040.00 $ 225,000.00 $ 850,000.00 $ 917,545.00 $ 225,000.00 $ 1,992,545.00 $

2008 920,385.00 $ 65,581.00 $ 498,404.00 $ 920,385.00 $ 65,581.00 $ 1,484,370.00 $

2009 975,284.00 $ 136,377.00 $ 714,824.00 $ 975,284.00 $ 136,377.00 $ 1,826,485.00 $

2010 1,103,615.00 $ 25,000.00 $ 534,760.00 $ 1,103,615.00 $ 25,000.00 $ 1,663,375.00 $

2011 801,392.00 $ 73,740.00 $ 572,542.00 $ 86,802.00 $ 347,208.00 $ 888,194.00 $ 73,740.00 $ 1,881,684.00 $

2012 620,462.00 $ 820,337.00 $ 750,000.00 $ 1,440,799.00 $ - $ 2,190,799.00 $

2013 748,246.00 $ 76,000.00 $ 457,224.00 $ 350,000.00 $ 1,205,470.00 $ 76,000.00 $ 1,631,470.00 $

2014 - $ - $ - $ - $

Pavement Funding Sources

3

4

2

,

6

4

3

4

9

8

,

4

0

4

7

1

4

,

8

2

4

5

3

4

,

7

6

0

5

7

2

,

5

4

2

2

4

9

,

7

6

0

4

2

5

,

1

9

4

1

2

8

,

4

5

9

6

2

7

,

3

7

5

3

8

4

,

4

2

9

2

1

9

,

4

7

9

9

6

1

,

3

0

6

5

2

8

,

6

8

7

4

1

3

,

7

6

2

6

7

1

,

1

3

8

7

4

1

,

2

6

4

6

2

6

,

9

7

0

9

1

7

,

5

4

5

9

2

0

,

3

8

5

9

7

5

,

2

8

4

1

,

1

0

3

,

6

1

5

8

8

8

,

1

9

4

1

,

4

4

0

,

7

9

9

1

,

2

0

5

,

4

7

0

2

4

5

,

9

8

1

3

1

8

,

0

0

0

5

7

3

,

9

1

6

6

1

2

,

3

7

8

8

5

0

,

0

0

0

3

4

7

,

2

0

8

7

5

0

,

0

0

0

3

5

0

,

0

0

0

$0

$100,000

$200,000

$300,000

$400,000

$500,000

$600,000

$700,000

$800,000

$900,000

$1,000,000

$1,100,000

$1,200,000

$1,300,000

$1,400,000

$1,500,000

$1,600,000

$1,700,000

$1,800,000

$1,900,000

$2,000,000

$2,100,000

$2,200,000

1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013

OPWC CI, SGT, LPPT CDBG FEDERAL/ODOT

If the Increase is Passed

City will establish a Citizens Committee to review

the expenditures of the increased funds annually,

and publically report on the uses.

City is considering budgeting an annual amount to

reconstruct or resurface alleys in older

neighborhoods.

City will increase preventative maintenance in an

effort to preserve the life of recently paved streets.

West Church Street

Kennedy Street

West Main Street - Eastbound

West Main Street - Westbound

West Main Street - Westbound

Beacon Road Reconstruction - 2013

King Road Street Dept. Work

Proposed Income Tax for the City of Newark

Shall Ordinance No. 14-13

providing for a 0.15% levy

increase on income for the

purposes of general

construction, re-construction,

resurfacing and repair of

streets, roads, bridges and

sidewalks within the

municipality, beginning

January 1, 2015 be passed?

FOR THE INCOME TAX

You might also like

- Gokart Arachnid V1Document74 pagesGokart Arachnid V1Francisco Werner B100% (9)

- HBCI-HBGI Historical FundingDocument1 pageHBCI-HBGI Historical FundingWUSA9-TV80% (5)

- Historical Funding ProjectionDocument2 pagesHistorical Funding ProjectionAnonymous GF8PPILW5No ratings yet

- Strategy Sheet - Sachin Deo KumarDocument16 pagesStrategy Sheet - Sachin Deo KumarSACHIN DEO KUMARNo ratings yet

- Ocean Carriers - Case (Final)Document18 pagesOcean Carriers - Case (Final)Namit LalNo ratings yet

- Bar and Restaurant Assistance FundDocument126 pagesBar and Restaurant Assistance FundMNCOOhio100% (1)

- Bar and Restaurant Assistance FundDocument286 pagesBar and Restaurant Assistance FundMNCOOhioNo ratings yet

- Thule 2012 CatalogDocument96 pagesThule 2012 CatalograckwarehouseNo ratings yet

- Belt Selection CalculationDocument29 pagesBelt Selection CalculationElwathig BakhietNo ratings yet

- Vol13 1 Convoy&EscortDocument25 pagesVol13 1 Convoy&Escortsenjespar100% (1)

- September 2009 Forecast of Alameda Point Revenues and ExpensesDocument1 pageSeptember 2009 Forecast of Alameda Point Revenues and ExpensesAction Alameda NewsNo ratings yet

- Proposed Bond IssueDocument8 pagesProposed Bond IssueAnonymous qZqfNijiNo ratings yet

- TM Budget Presentation 2015Document34 pagesTM Budget Presentation 2015jxmackNo ratings yet

- California Tesla RoboTaxi ServiceDocument9 pagesCalifornia Tesla RoboTaxi ServiceLaika AerospaceNo ratings yet

- Elected Officials Compensation - 1975 - 2022 - Attachment BDocument2 pagesElected Officials Compensation - 1975 - 2022 - Attachment BWXYZ-TV Channel 7 DetroitNo ratings yet

- How Much Money Has Been Previously Budgeted and Earmarked For Bus Purchases?Document5 pagesHow Much Money Has Been Previously Budgeted and Earmarked For Bus Purchases?NorthwesternCARESNo ratings yet

- Total RevenueDocument1 pageTotal RevenueethanselphNo ratings yet

- Budgetjan1-Dec31 2009Document1 pageBudgetjan1-Dec31 2009Teena Post/LaughtonNo ratings yet

- PSP Simulation Exam IVDocument4 pagesPSP Simulation Exam IVDeejaay2010No ratings yet

- Trend Comparison 2Document2 pagesTrend Comparison 2NaplesNYNo ratings yet

- Median Home Sales Price (1982 To 2007) : M-NCPPC 01+000 03+000 Research Technology Ce NterDocument4 pagesMedian Home Sales Price (1982 To 2007) : M-NCPPC 01+000 03+000 Research Technology Ce NterM-NCPPCNo ratings yet

- Practice Time Value of MoneyDocument7 pagesPractice Time Value of Moneymohamed00007No ratings yet

- End of Year (1) Annual O & M (2) Annual Dep (3) Annual Cost (4 2+3)Document1 pageEnd of Year (1) Annual O & M (2) Annual Dep (3) Annual Cost (4 2+3)amanuel mindaNo ratings yet

- Inc From FY10 Inc From FY10Document1 pageInc From FY10 Inc From FY10api-26007379No ratings yet

- 2012-13 Budget Presentation As of 1-4-12Document38 pages2012-13 Budget Presentation As of 1-4-12Hemanta BaishyaNo ratings yet

- FINC 721 Project 3Document6 pagesFINC 721 Project 3Sameer BhattaraiNo ratings yet

- Dalbudget ChartDocument1 pageDalbudget ChartcityhallblogNo ratings yet

- Income: Salary (Hotel Recepcionist) Previous Balance Savings Premium Extra PaymentsDocument14 pagesIncome: Salary (Hotel Recepcionist) Previous Balance Savings Premium Extra PaymentsSANTIAGO QUIROGANo ratings yet

- Mercury Case Report Vedantam GuptaDocument9 pagesMercury Case Report Vedantam GuptaVedantam GuptaNo ratings yet

- Campbell SubsidiesDocument2 pagesCampbell SubsidiesRob PortNo ratings yet

- Synergy Arena International LTD: 3 Years Perpective Business Plan APRIL 2023Document10 pagesSynergy Arena International LTD: 3 Years Perpective Business Plan APRIL 2023brook emenikeNo ratings yet

- InuseesDocument481 pagesInuseesAkshat TarateNo ratings yet

- Wind Energy Quiz 3Document5 pagesWind Energy Quiz 3Ivan RozoNo ratings yet

- 8-27-10 MemosDocument57 pages8-27-10 MemosDallasObserverNo ratings yet

- Codigo Cuenta: Alcaldia Recibido POR Valor AsignadoDocument4 pagesCodigo Cuenta: Alcaldia Recibido POR Valor AsignadoRoberto VacaNo ratings yet

- Homework 3 SDocument18 pagesHomework 3 SDeisy Paola Suarez LopezNo ratings yet

- Cincinnati DOTE 2017 Infrastructure Condition Reports SummaryDocument6 pagesCincinnati DOTE 2017 Infrastructure Condition Reports SummaryWCPO 9 NewsNo ratings yet

- 2012 Budget Process To Neighborhood Groups - FINALDocument40 pages2012 Budget Process To Neighborhood Groups - FINALdmcintosh853No ratings yet

- VAN y TIR ProjectDocument12 pagesVAN y TIR ProjectEduardo FélixNo ratings yet

- DisclosureDocument2 pagesDisclosurenuseNo ratings yet

- CityofSouthMia CitywideDrainImprovPhaseIV C107 1214 Nov 07Document10 pagesCityofSouthMia CitywideDrainImprovPhaseIV C107 1214 Nov 07graneros1944No ratings yet

- SOBO June 27, 2018, Agenda PacketDocument15 pagesSOBO June 27, 2018, Agenda PacketOaklandCBDsNo ratings yet

- Paperless 201 RN1549Document53 pagesPaperless 201 RN1549Tim ReedNo ratings yet

- DCCC Dues Spreadsheet (Feb. 2014)Document6 pagesDCCC Dues Spreadsheet (Feb. 2014)Daily Kos ElectionsNo ratings yet

- Contributions (Money Received)Document3 pagesContributions (Money Received)Zach EdwardsNo ratings yet

- 2008-2012 Capital Improvements Program: City of MckinneyDocument53 pages2008-2012 Capital Improvements Program: City of Mckinneyanon-234783No ratings yet

- E Street Development Waterfall - Fall 2020 Part 2 - MasterDocument38 pagesE Street Development Waterfall - Fall 2020 Part 2 - Masterapi-544095773No ratings yet

- BudgetDocument2 pagesBudgetMitch FelsmanNo ratings yet

- SOBO Jan 9, 2018 Agenda PacketDocument19 pagesSOBO Jan 9, 2018 Agenda PacketOaklandCBDsNo ratings yet

- Councils Capital Plan 2014Document25 pagesCouncils Capital Plan 2014windsorstarNo ratings yet

- Segway Final PowerpointDocument26 pagesSegway Final PowerpointJaiminSolankiNo ratings yet

- New Permit Fees Building 2016Document5 pagesNew Permit Fees Building 2016TheCullmanTribuneNo ratings yet

- Budgeting Mac Horngren 14eDocument6 pagesBudgeting Mac Horngren 14eAnsuman MohapatroNo ratings yet

- Data Center Facility Budget ToolDocument8 pagesData Center Facility Budget ToolElfrado AnthonyNo ratings yet

- UntitledDocument8 pagesUntitledAndres Felipe Perez PsicologoNo ratings yet

- Examenes de 2nd Week-SolucionesDocument14 pagesExamenes de 2nd Week-SolucionesCesar Herrera RomeroNo ratings yet

- 2012-Noman TextileDocument3 pages2012-Noman TextileShahadat Hossain ShahinNo ratings yet

- April 8 2021 East Grand Forks DeMers and 4th Construction Bid MaterialsDocument5 pagesApril 8 2021 East Grand Forks DeMers and 4th Construction Bid MaterialsJoe BowenNo ratings yet

- Bel Air BudgetDocument15 pagesBel Air BudgetelizabethNo ratings yet

- Missouri State Board of Education Agenda Item: October 2018Document15 pagesMissouri State Board of Education Agenda Item: October 2018Kyreon LeeNo ratings yet

- Hinds County Public WorksDocument1 pageHinds County Public WorksSteve WilsonNo ratings yet

- Income Projection Statement TemplateDocument4 pagesIncome Projection Statement TemplateJune AguinaldoNo ratings yet

- Capital Equipment BudgetDocument20 pagesCapital Equipment BudgetbstockusNo ratings yet

- Data Science Case StudyDocument6 pagesData Science Case StudyMrunmaiNo ratings yet

- Tile, Marble, Terrazzo & Mosaic Contractors World Summary: Market Values & Financials by CountryFrom EverandTile, Marble, Terrazzo & Mosaic Contractors World Summary: Market Values & Financials by CountryNo ratings yet

- Ceramic Wall & Floor Tiles World Summary: Market Values & Financials by CountryFrom EverandCeramic Wall & Floor Tiles World Summary: Market Values & Financials by CountryNo ratings yet

- Hospital Regions and ZonesDocument4 pagesHospital Regions and ZonesMNCOOhioNo ratings yet

- Main Street Improvement PlanDocument27 pagesMain Street Improvement PlanMNCOOhioNo ratings yet

- The West End Neighborhood PlanDocument25 pagesThe West End Neighborhood PlanMNCOOhioNo ratings yet

- St. Peter's Reopening PlanDocument9 pagesSt. Peter's Reopening PlanMNCOOhioNo ratings yet

- Covid-19 Reopening GuidanceDocument8 pagesCovid-19 Reopening GuidanceMNCOOhioNo ratings yet

- Park System Master PlanDocument57 pagesPark System Master PlanMNCOOhio100% (1)

- Summary Alert IndicatorsDocument3 pagesSummary Alert IndicatorsMNCOOhioNo ratings yet

- IAFF Local 266Document2 pagesIAFF Local 266MNCOOhioNo ratings yet

- Westgate Shopping CenterDocument2 pagesWestgate Shopping CenterMNCOOhioNo ratings yet

- GENERAL Election Candidate/Issues ListDocument33 pagesGENERAL Election Candidate/Issues ListMNCOOhio100% (1)

- South Main ST MailingDocument6 pagesSouth Main ST MailingMNCOOhioNo ratings yet

- Usjr Basak CampusDocument44 pagesUsjr Basak Campuslexzy_24100% (1)

- Road Safety Data Management SystemDocument15 pagesRoad Safety Data Management SystemNiju Azhakesan100% (1)

- Adobe Scan 21-Oct-2022Document3 pagesAdobe Scan 21-Oct-2022Mahesh GounikadiNo ratings yet

- AvadiDocument3 pagesAvadiefasaravananNo ratings yet

- Soal Asesmen Bahasa Inggris Kelas 8Document14 pagesSoal Asesmen Bahasa Inggris Kelas 8budiNo ratings yet

- Pi12064865 PDFDocument6 pagesPi12064865 PDFGourav BansalNo ratings yet

- Secondary Data of The Besant RoadDocument8 pagesSecondary Data of The Besant RoadM VIJAYA SIMHA REDDYNo ratings yet

- Lista de Precios Con Imagenes 0410Document18 pagesLista de Precios Con Imagenes 0410nikaboy1982100% (1)

- Performance Evaluation of BRTS in Various Indian Cities: Dharmkumar ShihoraDocument5 pagesPerformance Evaluation of BRTS in Various Indian Cities: Dharmkumar Shihorakolluri srinivas reddyNo ratings yet

- Design of The Rama 8 Bridge in BangkokDocument10 pagesDesign of The Rama 8 Bridge in BangkokChartree LertsimaNo ratings yet

- Extension of ValidityDocument1 pageExtension of ValidityChampaka Prasad RanaNo ratings yet

- Cost of Handling and TR Ansporting Material: 1 - Loading 2 - Hauling, Loaded 3 - Unloading 4 - Returning, EmptyDocument29 pagesCost of Handling and TR Ansporting Material: 1 - Loading 2 - Hauling, Loaded 3 - Unloading 4 - Returning, Emptyascom asNo ratings yet

- Installation Advice FF SUPER Concrete F900 enDocument1 pageInstallation Advice FF SUPER Concrete F900 enMihail KoprivchinNo ratings yet

- Proposal PresentationDocument58 pagesProposal Presentationmannu057No ratings yet

- Semitrailer, Tactical, Dual Purpose Breakbulk/Container Transporter, 22-1/2 TON, M871 (NSN 2330-00-122-6779) M871A1 (NSN 2330-01-226-0701)Document412 pagesSemitrailer, Tactical, Dual Purpose Breakbulk/Container Transporter, 22-1/2 TON, M871 (NSN 2330-00-122-6779) M871A1 (NSN 2330-01-226-0701)regulators1No ratings yet

- Aptitude Questions 1.if 2x-Y 4 Then 6x-3y ? (A) 15 (B) 12 (C) 18 (D) 10Document27 pagesAptitude Questions 1.if 2x-Y 4 Then 6x-3y ? (A) 15 (B) 12 (C) 18 (D) 10vpandiyarajan2413No ratings yet

- Java Network Model Development and ApplicationDocument140 pagesJava Network Model Development and Applicationadi.nugroNo ratings yet

- Road and Airport Engineering: New FrontiersDocument362 pagesRoad and Airport Engineering: New FrontierstahaNo ratings yet

- CarsimDocument12 pagesCarsimmanoelaNo ratings yet

- ACO Systems Ductile Iron Brochure Small PDFDocument28 pagesACO Systems Ductile Iron Brochure Small PDFĐorđe RadisavljevićNo ratings yet

- GTA SA CheatsDocument7 pagesGTA SA CheatsMuhammad AlfarizyNo ratings yet

- Integrated Public Transportation SystemDocument18 pagesIntegrated Public Transportation SystemSwarnima Verma0% (1)

- RDSO Guidelines For Planning of Road Over BridgesDocument2 pagesRDSO Guidelines For Planning of Road Over BridgesFarrukh RizwanNo ratings yet

- 9.3.7 Parking and Access CodeDocument21 pages9.3.7 Parking and Access CodeSteve GradyNo ratings yet

- Advantages and Disadvantages of The Village Life and City LifeDocument2 pagesAdvantages and Disadvantages of The Village Life and City LifeScotrraaj Gopal75% (4)

- Ford in Bangladesh PDFDocument12 pagesFord in Bangladesh PDFAhAd SAmNo ratings yet