Professional Documents

Culture Documents

First Tech Credit Union Fees Schedule

First Tech Credit Union Fees Schedule

Uploaded by

Namtien UsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

First Tech Credit Union Fees Schedule

First Tech Credit Union Fees Schedule

Uploaded by

Namtien UsCopyright:

Available Formats

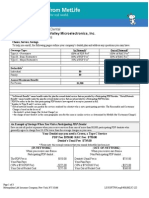

Savings and Checking Rate and Fee Schedule

855.855.8805 | firsttechfed.com

Effective date: August 1, 2014

The rates set forth on this sheet are subject to change without notice.

Dividend

Rate

Accounts

Annual

Percentage

Yield

Min. Opening

Balance

Min. Avg. Daily

Balance to

Avoid Fee

Dividend

Compounded

& Credited

Dividend

Period

Savings Accounts

Membership Savings

0.05%

0.05%

$5.00

NA

Monthly

Monthly

Carefree Savings

0.10%

0.10%

$0.01

NA

Monthly

Monthly

IRA Savings, Roth IRA Savings, Coverdell Savings

0.05%

0.05%

$0.01

NA

Monthly

Monthly

$0.01 - $2,499.99

0.05%

0.05%

$5,000

NA

Monthly

Monthly

$2,500 - $9,999.99

0.15%

0.15%

$5,000

NA

Monthly

Monthly

$10,000 - $24,999.99

0.23%

0.23%

$5,000

NA

Monthly

Monthly

$25,000 - $99,999.99

0.25%

0.25%

$5,000

NA

Monthly

Monthly

$100,000 - $249,999.99

0.33%

0.33%

$5,000

NA

Monthly

Monthly

$250,000+

0.35%

0.35%

$5,000

NA

Monthly

Monthly

$0.01

NA

NA

NA

Instant Access (Savings, IRA, Roth IRA, Coverdell)

Checking Accounts

Carefree Checking

NA

NA

Dividend Rewards Checking (Qualified Rate)

**

$0.01 - $10,000.00

1.57%

1.58%

$0.01

NA

Monthly

Monthly

0.16%

0.16%

$0.01

NA

Monthly

Monthly

Dividend Rewards Checking (Non-Qualified Rate)

0.05%

0.05%

$0.01

NA

Monthly

Monthly

HSA Checking

1.00%

1.00%

$0.01

NA

Monthly

Monthly

$10,000.01+

**

Dividend Rewards Checking. The dividend rate and the corresponding annual percentage yield (APY) on your account will be determined by

whether or not account qualifications have been met per monthly cycle. Qualifications per monthly cycle are 12 debit card purchases, one direct

deposit or ACH withdrawal and receipt of electronic statements. Qualifying transactions must post to the account prior to the last day of the

month. Debit card purchases can take up to 3 days to post and are dependent on merchant processing times. If the requirements per qualification

period are not met, the dividend rate and corresponding APY earned will be the non-qualified rate. Fees charged at U.S. ATMs will be refunded if

account qualifications are met for the monthly cycle the fee was charged in.

**

1 of 3

Savings and Checking Rate and Fee Schedule

855.855.8805 | firsttechfed.com

Effective date: August 1, 2014

We may assess the following fees against your account. The following transaction limitations, if any, apply to your account.

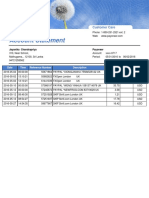

Account activity printout...................................................................................................................................................................................$1.00

Account balancing assistance.........................................................................................................................................................$25.00 per hour

Account research.............................................................................................................................................................................$25.00 per hour

American Express check dispensing machine.......................................................................................................................................................1%

American Express Gift Checks............................................................................................................................................................$2.50 per check

ATM cash withdrawal or inquiry from non-proprietary ATMs in excess of six during a month

(does not apply to Dividend Rewards Checking)........................................................................................................................................$2.00

ATM deposit adjustment...................................................................................................................................................................................$5.00

Cashiers check....................................................................................................................................................................................................Free

Check orders and re-orders...............................................................................................................(fee depends on style and quantity ordered)

Check copy.........................................................................................................................................................................................................$1.00

Deposit verification.............................................................................................................................................................................................Free

Fed Ex Overnight.............................................................................................................................................................................................$20.00

First Checking Plus account if $500.00 minimum average daily balance is not maintained........................................................$7.50 per month

(not available for new accounts)

Foreign item fee...............................................................................................................................................................................................$15.00

Foreign currency exchange fee........................................................................................................................................................................$15.00

Legal actions, garnishments, executions or levies...........................................................................................................................................$25.00

Nonsufficient funds*.......................................................................................................................................................................................$28.00

Online BillPay expedited payment.................................................................................................................................................................$15.00

Overdraft*......................................................................................................................................................................................................$28.00

Payment or deposit over the telephone from non-First Tech debit or credit card...................................................................................$10.00

Returned deposited item................................................................................................................................................................................$10.00

Safe deposit box

3 x 5...........................................................................................................................................................................................................$23.00

3 x 10...........................................................................................................................................................................................................$45.00

5 x 5..............................................................................................................................................................................................................$46.00

5 x 10........................................................................................................................................................................................................$58.00

10 x 10.......................................................................................................................................................................................................$97.00

Box drilling................................................................................................................................................................................................$200.00

Lock change..............................................................................................................................................................................................$10.00

Key deposit...............................................................................................................................................................................................$16.00

Specialized letters............................................................................................................................................................................................$25.00

Statement copy (prior to most recent).............................................................................................................................................................$1.00

Stop payments (each check, BillPay, ACH, cashiers check)............................................................................................................................$20.00

Temporary check.................................................................................................................................................................................................Free

Travelers checks..................................................................................................................................................................................................Free

VISA International transaction fee (applies to debit and ATM transactions outside of the U.S...............................1% of purchase amount

Wire transfer (domestic outgoing)..................................................................................................................................................................$15.00

Wire transfer (foreign outgoing).....................................................................................................................................................................$40.00

* This fee applies to the following categories of transactions: share draft, check, ACH or other electronic means.

2 of 3

Savings and Checking Rate and Fee Schedule

855.855.8805 | firsttechfed.com

Effective date: August 1, 2014

Membership Savings, Carefree Savings, IRA Savings, Roth IRA Savings, Coverdell Savings, Instant Access Savings, IRA Instant Access

Savings, Roth Instant Access Savings, Coverdell Instant Access Savings, Carefree Checking, HSA Checking and Dividend Rewards Checking

RATE INFORMATION:

The dividend rate and annual percentage yield may change at any

time, as we determine.

Compounding and crediting. We compound and credit your dividends

monthly.

Dividend period. For the above account types, the dividend period is

monthly, for example, the beginning date of the first dividend period

of the calendar year is January 1, and the ending date of such dividend

period is January 31. All other dividend periods follow this same date

pattern. The dividend declaration date is the last day of the dividend

period, and for the example above is January 31.

MINIMUM BALANCE REQUIREMENTS:

We list the minimum balance required to open an account on our rate

sheets.

Daily balance computation method. We calculate dividends by the

daily balance method, which applies a daily periodic rate to your daily

account balance.

Accrual of dividends on noncash deposits. Dividends will begin to

accrue on the business day you deposit non-cash items (for example,

checks) to your account.

Transaction limitations. Applies only to Membership Savings, Carefree

Savings and Instant Access Savings accounts. As required by Federal

Reserve Regulation D, you may not make more than six withdrawals or

transfers to your credit union account or to a third party by means of

a preauthorized or automatic transfer, telephone order or instructions

during any statement period.

BYLAW REQUIREMENTS:

Please refer to our separate rate sheet for current dividend rates and

annual percentage yield information and to our separate fee scheule for

additional information about charges.

APPLIES ONLY TO DIVIDEND REWARDS CHECKING ACCOUNT:

Rate Information. Your dividend rate and corresponding annual

percentage yield (APY) will either be the qualified or non-qualified

rate, depending on whether or not your account qualified during the

monthly cycle.

Qualification requirements per monthly cycle:

Make 12 debit card purchases

Have 1 direct deposit or ACH withdrawal

Be enrolled in electronic statements

Qualifying transactions must post to your account prior to the last

day of the month. Debit card purchases can take up to 3 days to post

and depend on merchant processing times. If you dont meet the

requirements for a qualification period, youll earn the non-qualified

rate and corresponding APY.

Well refund any U.S. ATM fees charged if you meet the account

qualifications in the month you incurred the fee.

National Credit Union Share Insurance Fund. Your credit union

accounts are federally insured by the National Credit Union Share

Insurance Fund.

1993 Wolters Kluwer Financial Services Bankers Systems Form

TIS-BRO-CU 12/14/93 Custom 4q 2788429-010

You must complete payment of one share in your Membership Savings

account as a condition of your membership.

Nature of dividends. We pay dividends from current income and

available earnings, after reserve transfers at the end of a dividend

period. (This disclosure further explains the dividend feature of your

non-term share account(s).)

3 of 3

You might also like

- Statement 011417 PDFDocument3 pagesStatement 011417 PDFKathleen MendegorinNo ratings yet

- Virtual Annual Meeting Friday, June 12 at 1:30 P.M. PT: Direct Inquiries ToDocument2 pagesVirtual Annual Meeting Friday, June 12 at 1:30 P.M. PT: Direct Inquiries Tosusu ultra men100% (1)

- Banner BankDocument1 pageBanner BankhartNo ratings yet

- Sample Credit Card Statement FiqDocument1 pageSample Credit Card Statement FiqAditya KulkarniNo ratings yet

- Pay StubsDocument14 pagesPay Stubsapi-341301555No ratings yet

- Metlife - Dental Ppo 12 15Document3 pagesMetlife - Dental Ppo 12 15api-252555369No ratings yet

- 100 Sales Qualification Questions PDFDocument16 pages100 Sales Qualification Questions PDFNamtien UsNo ratings yet

- Liquidity Ratios: Ratio AnalysisDocument3 pagesLiquidity Ratios: Ratio Analysisgautam1110851054No ratings yet

- Environgard Corp CaseDocument45 pagesEnvirongard Corp Casejack johnson100% (1)

- Account Is Owned by SYNCHRONY BANKDocument1 pageAccount Is Owned by SYNCHRONY BANKMichael CrawfordNo ratings yet

- Statement 201407Document1 pageStatement 201407DaniHoffmanNo ratings yet

- StatementsDocument1 pageStatementsAnthony EvansNo ratings yet

- Rate Schedule - American Airlines Credit UnionDocument2 pagesRate Schedule - American Airlines Credit UnionJonathan Seagull LivingstonNo ratings yet

- ShowLV2Document PDFDocument2 pagesShowLV2Document PDFAnonymous tRY1QOeNo ratings yet

- R PDFDocument2 pagesR PDFmariana tkachNo ratings yet

- Account Settings ComEd - An Exelon Company PDFDocument1 pageAccount Settings ComEd - An Exelon Company PDFLola100% (1)

- Statement Sep 2023Document3 pagesStatement Sep 2023Gabe MirkinNo ratings yet

- Transaction Summary: Contact UsDocument1 pageTransaction Summary: Contact UsJesseneNo ratings yet

- Feb 2022 Operations Acct StatementDocument24 pagesFeb 2022 Operations Acct StatementNik LedNo ratings yet

- Jpmorgan Chase Bank, N.A. P O Box 659754 San Antonio, TX 78265 - 9754 August 17, 2015 Through September 14, 2015 Account NumberDocument2 pagesJpmorgan Chase Bank, N.A. P O Box 659754 San Antonio, TX 78265 - 9754 August 17, 2015 Through September 14, 2015 Account NumberShorav SuriyalNo ratings yet

- Monthly Statement: Name Address Account Number Statement PeriodDocument18 pagesMonthly Statement: Name Address Account Number Statement PeriodAlexander Weir-WitmerNo ratings yet

- Bank Statement: Rokeditswe R Masange 266 Sauce Town Bulawayo ZimbabweDocument2 pagesBank Statement: Rokeditswe R Masange 266 Sauce Town Bulawayo ZimbabweWierd SpecieNo ratings yet

- Bank Statement: If You Have Any Questions About Your Statement, Please Call Us at 021-622299Document1 pageBank Statement: If You Have Any Questions About Your Statement, Please Call Us at 021-622299Tri Adi NugrohoNo ratings yet

- CRDB Bank Q3 2020 Financial Statement PDFDocument1 pageCRDB Bank Q3 2020 Financial Statement PDFPatric CletusNo ratings yet

- Statement Details: Your Account SummaryDocument3 pagesStatement Details: Your Account SummaryTJ JanssenNo ratings yet

- Citibank Client Services 013 PO Box 6201 000 Sioux Falls, SD 57117-6201 Citibank, N. ADocument8 pagesCitibank Client Services 013 PO Box 6201 000 Sioux Falls, SD 57117-6201 Citibank, N. Amy nameNo ratings yet

- Statement Apr 2023Document2 pagesStatement Apr 2023Sandra OtmarNo ratings yet

- IDS 2013 RecapDocument28 pagesIDS 2013 RecapDiaa Eldin SaadNo ratings yet

- SodaPDF-converted-Micah May StatementDocument3 pagesSodaPDF-converted-Micah May StatementalysNo ratings yet

- StatementDocument4 pagesStatementUchi MoNo ratings yet

- 2021 (2) January Amanda2Document6 pages2021 (2) January Amanda2Amanda ConryNo ratings yet

- Account Ending 1509 Notice of Insufficient/ Unavailable FundsDocument2 pagesAccount Ending 1509 Notice of Insufficient/ Unavailable FundsChristopher TorresNo ratings yet

- MonthlyStatement PDFDocument1 pageMonthlyStatement PDFJayanika ChandrapriyaNo ratings yet

- Brokerage Statement - XXXX8720 - 201906 PDFDocument6 pagesBrokerage Statement - XXXX8720 - 201906 PDFSwapnil GolegaonkarNo ratings yet

- Statement of Account: Credit Limit Rs Available Credit Limit RsDocument4 pagesStatement of Account: Credit Limit Rs Available Credit Limit RsSayiram GNo ratings yet

- Estmt - 2022 04 29Document12 pagesEstmt - 2022 04 29Katelynn LiuNo ratings yet

- Statement For Blink LTD As at 31jul2020 PDFDocument1 pageStatement For Blink LTD As at 31jul2020 PDFMary Anne JamisolaNo ratings yet

- GPDocument3 pagesGPHarshitNo ratings yet

- Alabama OneDocument2 pagesAlabama OneDen JellNo ratings yet

- Your Account Statement: Payment Information Summary of Account ActivityDocument4 pagesYour Account Statement: Payment Information Summary of Account ActivityAndreina VillalobosNo ratings yet

- 8924-6981 Janet E Lynch Designated Bene Plan/TodDocument18 pages8924-6981 Janet E Lynch Designated Bene Plan/TodMarcus GreenNo ratings yet

- Safari - Nov 2, 2017 at 4:13 PM PDFDocument1 pageSafari - Nov 2, 2017 at 4:13 PM PDFAmy HernandezNo ratings yet

- Portfolio 74246 OnDate 5-5-2022Document1 pagePortfolio 74246 OnDate 5-5-2022Shahid MahmudNo ratings yet

- Statement Date:Jul 15, 2019 Billing Period Covering: Jun 16, 2019 - Jul 15, 2019Document2 pagesStatement Date:Jul 15, 2019 Billing Period Covering: Jun 16, 2019 - Jul 15, 2019Nica09_foreverNo ratings yet

- SCHNEIDERS (00102) Peridic Billing Statement Ending 03.15.2017 - RedactedDocument1 pageSCHNEIDERS (00102) Peridic Billing Statement Ending 03.15.2017 - Redactedlarry-612445No ratings yet

- Bank of Missouri Privacy PolicyDocument2 pagesBank of Missouri Privacy PolicykirstieNo ratings yet

- Amex EstatementDocument2 pagesAmex Estatementjohn vikNo ratings yet

- CheckingDocument4 pagesCheckingAlexander Barno AlexNo ratings yet

- TfecuDocument2 pagesTfecuBeverly LewisNo ratings yet

- Financial Statement - Rent RollDocument3 pagesFinancial Statement - Rent Rollsadik lawanNo ratings yet

- Account Statement: Kristopher JacobsDocument2 pagesAccount Statement: Kristopher JacobsalexNo ratings yet

- HDFC Regalia UnlockedDocument4 pagesHDFC Regalia UnlockedMayank RaghuwanshiNo ratings yet

- Fetch Statementand NoticesDocument3 pagesFetch Statementand NoticessweigartmarianNo ratings yet

- Chime Bank Statement 2020.Document4 pagesChime Bank Statement 2020.kutner8181No ratings yet

- Principal June StatementDocument10 pagesPrincipal June Statementsusu ultra menNo ratings yet

- No Fear!Document3 pagesNo Fear!mikeNo ratings yet

- f133 PDFDocument1 pagef133 PDFfaresNo ratings yet

- Mohamed MahdiDocument5 pagesMohamed Mahdimohamed khadarNo ratings yet

- Checking Account StatementDocument2 pagesChecking Account Statementbrainroach15No ratings yet

- Statement 201411 PDFDocument1 pageStatement 201411 PDFJoseph KingNo ratings yet

- The Yuppy Puppy, LLC 9511 N Newport Highway Spokane, WA 99218Document1 pageThe Yuppy Puppy, LLC 9511 N Newport Highway Spokane, WA 99218Dr. GigglesproutNo ratings yet

- Dave Bank StatementDocument1 pageDave Bank StatementrolphcourtenayNo ratings yet

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

- Ozlink MobileDocument2 pagesOzlink MobileNamtien UsNo ratings yet

- Graph Pattern Mining, Search and OLAPDocument14 pagesGraph Pattern Mining, Search and OLAPNamtien UsNo ratings yet

- An Investor's Due DiligenceDocument3 pagesAn Investor's Due DiligenceNamtien UsNo ratings yet

- ISO Datasheet UE-71D10 Preliminary BMSTDocument1 pageISO Datasheet UE-71D10 Preliminary BMSTNamtien UsNo ratings yet

- System 3R EMD Electrode Holder T-2389-E - EdmDocument108 pagesSystem 3R EMD Electrode Holder T-2389-E - EdmNamtien UsNo ratings yet

- Moldbase Library CatalogDocument406 pagesMoldbase Library CatalogNamtien UsNo ratings yet

- Iida Group Holdings Mortgage and Securitization Business in JapanDocument28 pagesIida Group Holdings Mortgage and Securitization Business in JapanRuth TheresiaNo ratings yet

- Problems Identified by The Narasimham CommitteeDocument3 pagesProblems Identified by The Narasimham Committeeshaikhaamir21No ratings yet

- Wellington Global Innovation Fund Factsheet July 2022Document2 pagesWellington Global Innovation Fund Factsheet July 2022snehalNo ratings yet

- SC Circular Am No 05-11-04 - SCDocument20 pagesSC Circular Am No 05-11-04 - SCColleen Rose GuanteroNo ratings yet

- Cipla Valuation ModelDocument17 pagesCipla Valuation ModelPuneet GirdharNo ratings yet

- SFC ICON 2013 First MemoDocument19 pagesSFC ICON 2013 First MemoAiza GarnicaNo ratings yet

- Indus Motor Ratio AnalysisDocument4 pagesIndus Motor Ratio AnalysisNabil QaziNo ratings yet

- Online StatementDocument2 pagesOnline StatementLong Lee100% (1)

- Bcom Fa - 20230121013946Document9 pagesBcom Fa - 20230121013946Swayam AgarwalNo ratings yet

- HW4 - Ch.4 Completing The Accounting CycleDocument9 pagesHW4 - Ch.4 Completing The Accounting Cyclevico lorenzoNo ratings yet

- The Cost of Capital The Cost of CapitalDocument4 pagesThe Cost of Capital The Cost of CapitalRocker BrosNo ratings yet

- Countries and Currencies - GK Notes in PDFDocument7 pagesCountries and Currencies - GK Notes in PDFhelldelosbendersNo ratings yet

- Case Study 2 - ReportDocument10 pagesCase Study 2 - ReportTomás TavaresNo ratings yet

- HSBC Premier Savings Terms & Charges Disclosure: EligibilityDocument3 pagesHSBC Premier Savings Terms & Charges Disclosure: EligibilityAndi PrabowoNo ratings yet

- Exchange Rate DeterminationDocument15 pagesExchange Rate DeterminationShrey GoelNo ratings yet

- New Microsoft Word DocumentDocument7 pagesNew Microsoft Word DocumentShakikNo ratings yet

- Cartas Ingles EspañolDocument6 pagesCartas Ingles EspañolJunior HernandezNo ratings yet

- Chapter 4-Statement of Cash FlowsDocument3 pagesChapter 4-Statement of Cash FlowsDan GalvezNo ratings yet

- Finance Project - KSFEDocument48 pagesFinance Project - KSFEDinesh77% (13)

- Bank StatementDocument24 pagesBank StatementJames PeterNo ratings yet

- Comprative Analysis of Aditya Birla Sunlife Equity Hybrid 95 Fund & Sebi Equity Hybrid Fund in Hubli CityDocument70 pagesComprative Analysis of Aditya Birla Sunlife Equity Hybrid 95 Fund & Sebi Equity Hybrid Fund in Hubli CitySampath DontaNo ratings yet

- Report On Js Bank Account OpeningDocument9 pagesReport On Js Bank Account OpeningGulraiz AhmadNo ratings yet

- Question-01: What Are The Basic Steps in Strategic Planning For A Merger? AnswerDocument6 pagesQuestion-01: What Are The Basic Steps in Strategic Planning For A Merger? AnswerAnkur BhavsarNo ratings yet

- EDsd 35 B78 Syp 19 A Ucji 1 RZ 37 HKMHps Va NR MODbgyDocument11 pagesEDsd 35 B78 Syp 19 A Ucji 1 RZ 37 HKMHps Va NR MODbgyManvi TyagiNo ratings yet

- Branch Banking Vs Unit BankingDocument7 pagesBranch Banking Vs Unit BankingBoruah SwapnaNo ratings yet

- Group 2: Topic 1Document29 pagesGroup 2: Topic 1jsemlpzNo ratings yet

- EI Fund Transfer Intnl TT Form V5.1 VTDocument2 pagesEI Fund Transfer Intnl TT Form V5.1 VTpowellarryNo ratings yet

- Exam For Quiz BeeDocument2 pagesExam For Quiz Beealie tolentinoNo ratings yet