Professional Documents

Culture Documents

12 Lecture 6

12 Lecture 6

Uploaded by

muralimoviesCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

12 Lecture 6

12 Lecture 6

Uploaded by

muralimoviesCopyright:

Available Formats

Lecture 6

Arbitrage in multiperiod models

In multiperiod models arbitrage is dened similarly.

Denition

1) An arbitrage opportunity is some trading strategy H such that:

(a) V

0

= 0

(b) V

T

0

(c) EV

T

> 0

(d) H is self-nancing

2) A self nancing strategy H is an arbitrage opportunity i:

(a) V

0

= 0 or (a) G

T

0

(b) V

T

0 or (b) EG

T

> 0

(c) EV

T

> 0 or (c) V

0

= 0

But the risk neutral measure the denition is a bit dierent:

Denition

A risk neutral measure (martingale measure) is a probability measure Q such that:

1) Q() > 0 for all

2) S

n

is a martingale under Q for every n = 1, 2, ..., N

E

Q

[S

n

(t +s)|F

t

] = S

n

(t), t, s 0

or

E

Q

[S

n

(t +s) S

n

(t)|F

t

] = 0

or

E

Q

[S

n

(t +s)/B(t +s)|F

t

] = S

n

(t)/B(t)

=E

Q

[B

t

S

n

(t +s)/B(t +s)|F

t

].

First fundamental theorem of nance:

There are no arbitrage opportunities if and only if there exists a martingale measure Q.

Proposition

1

If the multiperiod model does not have any arbitrage opportunitity, then none of the underlying

single period models has any arbitrage opportunities in the single period sense.

Example

Consider a 2-period problem with = {

1

,

2

, ...,

5

} and one risky security:

S

0

() S

1

() S

2

()

1

6 5 3

2

6 5 4

3

6 5 8

4

6 7 6

5

6 2 8

Find: V

t

, V

t

, G

t

, G

t

for all strategies (H

0

, H

1

) and check for the existance of martingale measures

or linear pricing measure. Find all of them. Keep in mind B

t

= (

10

9

)

t

.

Is the strategy: H

0

(1)() = 2 for all

s a self nancing startegy?

H

1

(1)() = 3 for all

s

H

0

(2)() =

1, for =

1

,

2

,

3

2, for =

4

,

5

H

1

(2)() =

29/9, for =

1

,

2

,

3

4, for =

4

,

5

The binomial model

Is a partocular case of the multiperiod model. Each period there are 2 possibilities: the security

price either goes up by the factor u (u > 1) orgoes down by a factor d (0 < d < 1). The probability

of an up move is equal to p, and the moves over time are independent of each other. Hence

the binomial model is related to the Binomial process (Bernoulli process) from probability in the

following fashion.

S

n+1

= S

n

Z

n

where {Z

n

}

nN

are iid with the distribution:

z =

u, with probability p

d, with probability 1 p

This is a multiplicative model.The reason we prefer multiplicative models to additive ones is because

stock prices have an exponential behavious that could be explained by the multiplicative models.

Also, additive models may result in negative prices.

2

Let k = # of up moves. in general, if

# up steps = n

total # steps = t t n

then the # of path to reach state m =

t

m

P(S

t

= Su

n

d

tn

) =

t

m

p

n

(1 p)

tn

n = 0, 1, ..., t

The self nancing equation now is

H

0

(t)(1 +R) +H

1

(t)S

t

= H

0

(t + 1) +H

1

(t + 1)S

t

What equation does the risk neutral probability verify here?

S

0

=

1

1 +r

E

Q

[S

1

|F

0

], in general S

t

=

1

1 +r

E

Q

[S

t+1

|F

t

]

q[

u 1 r

1 +r

] + (1 q)[

d 1 r

1 +r

] = 0 q =

1 +r d

u d

In general q is the conditional probability the next move is an up move given the information F

t

at time t. So q =

1+rd

ud

for all F

t

and t.

Also remark that in order for Q to exist we need 0 < q < 1 d < 1 +r < u

The martingale measure will be given by

Q() = q

n

(1 q)

Tn

where is any state corresponding to n ups and T n downs.

Hence the probability distribution of S

t

under the risk neutral probability measure is given for all

t by

Q(S

t

= S

0

u

n

d

tn

) =

t

m

q

n

(1 q)

tn

, n = 0, 1, ..., t.

A contingent claim is a r.v. X that represents the time T pay o from a seller to a buyer. The

contingent claim is simple if X = (S(T)).

Example

European call option X = max{S(T) K, 0}. If

k

t = 0 t = 1 t = 2

1

S

0

= 5 S

1

= 8 S

2

= 9

2

S

0

= 5 S

1

= 8 S

2

= 6

3

3

S

0

= 5 S

1

= 4 S

2

= 6

4

S

0

= 5 S

1

= 4 S

2

= 3

then X = max{S

2

K, 0}, for K = 5

X() =

4, =

1

1, =

2

,

3

0, =

4

Example of a contingent claim (derivative security) that is not simple:

X = max{

S

0

+S

1

+S

2

3 5

, 0}

This is called an Asian or averaging option.

X() =

7/3, =

1

4/3, =

2

0, =

3

,

4

Question:

The question of pricing is similer to the one-period model. Find (t, x) the price of the contingent

claim at time t = 0, 1, ..., T.

Denition

A contingent claim is said to be marketable or attainable if there exists a self-nancing strategy

such that V

T

() = X() for all . The corresponding portfolio or trading startegy H is said

to be replicate or generate X.

Risk neutral valuation principle

The time t value of a marketable contingent claim X is equal to V

t

, the time t of the portfolio

which replicates X. Moreover:

V

t

= V

t

/B

t

= E

Q

[X/B

T

|F

t

], t = 0, 1, ..., T

for all risk neutral probability measures Q.

Binomial model review

Recall that at time T, each possibility for S

T

is parameterized by K = # of ups from t = 0 to T.

So the value of the option at time T, if # ups = k

V

T

(k) = (S

0

u

k

d

Tk

)

We saw that

V

0

=

1

(1 +r)T

E

Q

[X] =

1

(1 +r)T

T

n=0

T

n

q

n

(1 q)

Tn

max{0, S

0

u

n

d

Tnk

}

4

where k is the strike price.

But what is the option price at time 0 t T?

For any t T 1, there are at most t ups.

V

t

(k) =

1

1 +r

E

Q

[V

t+1

|(# ups up to time t) = k]

=

1

1 +r

(q

u

V

t+1

(k + 1) + (1 q

u

)V

t+1

(k))

So, we have proved the recursion relation:

V

T

(k) = (S

0

u

k

d

Tk

), k = 0, 1, ..., T

t T 1, k t:

V

t

(k) =

1

1 +R

(q

u

V

t+1

(k + 1) + (1 q

u

)V

t+1

(k))

The only question we might need to answer is what are the hedging strategies.

For hedging we need to start at t = 0 and work forward by using the 1-period model hedging

strategy to obtain H = (x, y) which hedges the option given by:

V

1

(1), with probability q

u

V

1

(0), with probability q

d

Specically,

x =

1

1 +r

(uV

1

(0) dV

1

(1))

1

u d

y =

1

S

0

(V

1

(1) V

1

(0))

1

u d

This is obtain by solving the system:

(1 +r)x +S

0

uy = V

1

(1)

(1 +r)x +S

0

dy = V

1

(0)

In general: at time t T 1, for a xed k {0, 1, ..., t}

x =

1

1 +r

(uV

t+1

(k) dV

t+1

(k + 1))

1

u d

y =

1

S

0

(V

t+1

(k + 1) V

t+1

(k))

1

u d

Call options on a stock index

5

Options, so far, were dened in term of one underlying security. But in general one can dene

options one two or more underlying securities. For example, given a function g : R

N

R

+

one

can take X to be X = g(S

1

(T), ..., S

N

(T)). Then if you know the joint probability distribution

of the random variables S

1

(T), ..., S

N

(T) under the martingale measure, it is easy to compute the

time 0 value of this contingent claim. In particular, with:

g(S

1

, ..., S

N

) = (a

1

S

1

+... +a

N

S

N

e)

+

for positive scalars a

1

, ..., a

N

, you could have a call option on a stock index.

Or with

g(S

1

, ..., S

N

) = max{S

1

, ..., S

N

, e}

you could have a contingent claim delivering the best of N securities and the cash amount e.

Example

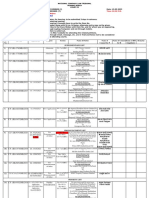

Suppose K = 9, N = 2, T = 2, r = 0 and the price process and information are as bellow. Also this

model (one can show with a few computations) has an unique probability measure Q, computed as

below.

Consider a call option with exercise price 13 on the time T = 2 value of the stock index S

1

(t)+S

2

(t)

What is the time 0 value of such a call option? What is the time 0 value of a contingent claim on

the 2 stocks and 8?

6

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- EMS Term 2 Controlled Test 1Document15 pagesEMS Term 2 Controlled Test 1emmanuelmutemba919100% (4)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- MR RegressionDocument523 pagesMR RegressionmuralimoviesNo ratings yet

- 2012 - Careers in Financial Markets - EfinancialDocument88 pages2012 - Careers in Financial Markets - EfinanciallcombalieNo ratings yet

- Currency Derivatives: D F D FDocument11 pagesCurrency Derivatives: D F D FmuralimoviesNo ratings yet

- 12 Lecture 11Document4 pages12 Lecture 11muralimoviesNo ratings yet

- Algorithms: Call For PapersDocument2 pagesAlgorithms: Call For PapersmuralimoviesNo ratings yet

- A Guide To Surviving Ipc498a Apr 2008Document46 pagesA Guide To Surviving Ipc498a Apr 2008muralimoviesNo ratings yet

- Instruction Kit For Eform Iepf-5Document9 pagesInstruction Kit For Eform Iepf-5Anisha bhalaNo ratings yet

- Managerial Accounting 2nd Edition Braun Test BankDocument24 pagesManagerial Accounting 2nd Edition Braun Test BankAnthonyWeaveracey100% (50)

- OS2614353Document1 pageOS2614353bbibit828No ratings yet

- Sick Scanner Catalog - PDF Room PDFDocument56 pagesSick Scanner Catalog - PDF Room PDFThien MaiNo ratings yet

- Social Impact Consulting vs. Strategy ConsultingDocument11 pagesSocial Impact Consulting vs. Strategy ConsultingCareer EdgeNo ratings yet

- APPOINTMENT LETTER Repblick of Kenya WANGANGADocument4 pagesAPPOINTMENT LETTER Repblick of Kenya WANGANGAJose mainaNo ratings yet

- Corporate & Global Strategy - of DaimlerChryslerDocument11 pagesCorporate & Global Strategy - of DaimlerChryslerSandro Ananiashvili100% (6)

- Protected Structure Vs Targeted StructureDocument4 pagesProtected Structure Vs Targeted StructureFrom Shark To WhaleNo ratings yet

- 3.-GE11 EntrepreneurialMind FINALDocument15 pages3.-GE11 EntrepreneurialMind FINALLEA MAE ANAYON100% (2)

- Salient Features of TRAIN LawDocument11 pagesSalient Features of TRAIN LawTiffany TuñacaoNo ratings yet

- EcoMan Problem Set 1Document2 pagesEcoMan Problem Set 1Katharine NervaNo ratings yet

- Article Review On Supply Chain of WalmartDocument7 pagesArticle Review On Supply Chain of WalmartNaina AgarwalNo ratings yet

- Foxconn and AppleDocument9 pagesFoxconn and AppleAndriani GraceNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument2 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancePriyanka SangleNo ratings yet

- The 5 Hour MillionaireDocument33 pagesThe 5 Hour Millionairehello_ayanNo ratings yet

- 4049q2 SpecimenDocument20 pages4049q2 Specimenkamwambanash5No ratings yet

- Zacks Black Box Trader Intraday Alert - 06142021Document3 pagesZacks Black Box Trader Intraday Alert - 06142021massimo borrioneNo ratings yet

- 15.05.2023 Cause List C - IiDocument6 pages15.05.2023 Cause List C - IiPranay ChauguleNo ratings yet

- Vivos Thera Report 11.30.23Document6 pagesVivos Thera Report 11.30.23physicallen1791No ratings yet

- Mining RghtsDocument10 pagesMining RghtsNahmyNo ratings yet

- Interest RatesDocument21 pagesInterest RatesMariel BerdigayNo ratings yet

- B.S RevisionDocument34 pagesB.S RevisionHimanth RNo ratings yet

- GROUP II PPT (2 5pm) Chapter 7, Food IndustryDocument29 pagesGROUP II PPT (2 5pm) Chapter 7, Food IndustryMaryjo RamirezNo ratings yet

- Farhan Autocad Civil EngineerDocument9 pagesFarhan Autocad Civil EngineerKhan MuhammadNo ratings yet

- GST AmendmentDocument14 pagesGST Amendmentbcomh2103012No ratings yet

- IQP Final Report PDFDocument135 pagesIQP Final Report PDFmalingyee100% (1)

- Liquid Penetrant Testing PDFDocument1 pageLiquid Penetrant Testing PDFKUMARNo ratings yet

- Deed of Sale With Assumption of MortgageDocument3 pagesDeed of Sale With Assumption of MortgageReb Reymund Castillo100% (1)

- Functions of Material ManagementDocument3 pagesFunctions of Material ManagementAnkkit BafnaNo ratings yet