Professional Documents

Culture Documents

The Economies of The United States China Europe 6 May 2012

The Economies of The United States China Europe 6 May 2012

Uploaded by

woojerOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Economies of The United States China Europe 6 May 2012

The Economies of The United States China Europe 6 May 2012

Uploaded by

woojerCopyright:

Available Formats

06 May 2012 The Economies of The United States, China and Europe

Economic systems of these the three largest financial regions will see the greatest effects.

The United States owe massive amounts of money to China. Faced with dwindling receipts, the

debt will be kept current by creating money. When growth stops and the United States economy

shrinks, the ability to purchase goods and services will naturally diminish for each dollar. As

debts are paid with more printed money, lending will stop. China will have less and less ability

to purchase with US dollars but this situation will become moot as the ability to ship goods

offshore will be halted. China, addicted to supplying the world, will undergo radical economic

transformation. Most manufacturing will stop, as most of it involves export goods.

As China halts exports, refuses to buy US debt and becomes economically isolated once again,

the United States will stop servicing its own debt. As the debt to China is ignored, the value of

US Treasury securities will plummet in general. All attempts to print money will further erode

confidence.

Europes debt, already unmanageable for several nations, will have a similar effect across the

European Union. Nations with greatest perceived ability to withstand the financial onslaught

will abandon the eurozone, revert to prior currencies and stand-alone monetary policy. The

European Union will break up and cease to exist. These steps will do little more than delay the

onset of permanent economic change.

Unlike its central government, the states of the USA cannot print currency or make monetary

policy. As the central governments ability to grapple with the financial downturn proves

insufficient, pressure will come to bear on bankrupt states. Faced with mounting debt and

declining revenue, many will default on state bonds. Not only will this kill the lending and

borrowing but will also cause the states far from this position to reconsider their role. The 40+%

of spending that is borrowed by the USAs federal government is not spread evenly; some states

get little or none of it and not even the equivalent of taxes levied by the central government

comes back in services and benefits. Other states get a far higher % than their population bears

to the national total.

Faced with a share of the national debt from which it received no benefit, such states will bitterly

resent continued tax payments perceived to be destined for a bottomless black hole. There will

be pressure for some to secede and this will occur, likely where abundant natural resources

allow temporary economic isolation. The condition will pass quickly as other states lacking

certain urgent production will barter, if necessary, with the newly independent territory. Central

government reaction will be predictable but any pressure placed on a remaining state

attempting to barter this way will be seen as hostile.

Against the backdrop of financial shifts, this will be less devastating than it might first appear.

National pride will be injured, to be sure, however little practical damage will be done. The

seceding state(s) will see a benefit from such a move.

Trade barriers will be temporarily erected between former European Union nations but these

will crumble. As most trade between Europe, the USA and China will cease, little effect will be

felt in the one region from what befalls another. International currency trading will all but halt,

as relative values of one to the other will become risky and difficult to establish. As trade will

drop off, the need for currency trading will fade anyway.

As trade drops between nations and becomes a memory, so will the vast majority of workers in

the trade & logistics business. International finance will be curtailed as a result.

You might also like

- Bob Chapman Bursting Bubbles Waning Currency Systems and Insolvent Financial Institutions 30 4 2011Document4 pagesBob Chapman Bursting Bubbles Waning Currency Systems and Insolvent Financial Institutions 30 4 2011sankaratNo ratings yet

- Never Accept Economic Truths Merely Because Somebody Said SoDocument3 pagesNever Accept Economic Truths Merely Because Somebody Said SoARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanNo ratings yet

- On Target: Martin Spring's Private Newsletter On Global StrategyDocument13 pagesOn Target: Martin Spring's Private Newsletter On Global StrategydiannebNo ratings yet

- The Economist - Finacial CrisisDocument4 pagesThe Economist - Finacial CrisisEnzo PitonNo ratings yet

- Sumner Gold Report May2015Document3 pagesSumner Gold Report May2015mercosurNo ratings yet

- Final Days of The Dollar 11 22 10Document13 pagesFinal Days of The Dollar 11 22 10exDemocratNo ratings yet

- Bob Chapman Fiscal Debt and Monetization Are Taking The Financial System Down 28 8 2010Document3 pagesBob Chapman Fiscal Debt and Monetization Are Taking The Financial System Down 28 8 2010sankaratNo ratings yet

- Bob Chapman Plummeting Dollar A New Wave of Treasuries and Toxic Waste 27 4 2011Document4 pagesBob Chapman Plummeting Dollar A New Wave of Treasuries and Toxic Waste 27 4 2011sankaratNo ratings yet

- "This Is Our Currency, But Your Problem" Foreign Debt Accumulation and Its ImplicationsDocument12 pages"This Is Our Currency, But Your Problem" Foreign Debt Accumulation and Its ImplicationsJohnPapaspanosNo ratings yet

- Bob Chapman Economic Crisis The Sovereign Debt Bubble 19 February 2010Document10 pagesBob Chapman Economic Crisis The Sovereign Debt Bubble 19 February 2010sankaratNo ratings yet

- Keynesian Economics Doesn't WorkDocument9 pagesKeynesian Economics Doesn't WorkkakeroteNo ratings yet

- Discussion Around The Article Linked BelowDocument12 pagesDiscussion Around The Article Linked BelowAllan WortNo ratings yet

- Bob Chapman The Demise of The Euro As A World Currency 12 5 10Document3 pagesBob Chapman The Demise of The Euro As A World Currency 12 5 10sankaratNo ratings yet

- Bob Chapman The Global Monetary System in Crisis 30 10 10Document3 pagesBob Chapman The Global Monetary System in Crisis 30 10 10sankaratNo ratings yet

- Wien Byron - July 2010 Market Commentary - Smartest ManDocument4 pagesWien Byron - July 2010 Market Commentary - Smartest ManGlenn BuschNo ratings yet

- Keynesian Economics Doesn't WorkDocument9 pagesKeynesian Economics Doesn't WorkkakeroteNo ratings yet

- Do Deficits MatterDocument5 pagesDo Deficits MatterNicholas IordanisNo ratings yet

- Doomsday For The US DollarDocument7 pagesDoomsday For The US DollarklatifdgNo ratings yet

- Global Monetary Systems Set To CollapseDocument4 pagesGlobal Monetary Systems Set To Collapsebrahma2358No ratings yet

- European ReformDocument3 pagesEuropean ReformChintu PatelNo ratings yet

- Dollars and EurosDocument4 pagesDollars and EurosSamuel RinesNo ratings yet

- The Great Debt ShiftDocument2 pagesThe Great Debt Shiftgaurav99rocksNo ratings yet

- Bob Chapman Saving The Eurozone Will It Work 29 10 2011Document4 pagesBob Chapman Saving The Eurozone Will It Work 29 10 2011sankaratNo ratings yet

- An Open Letter To The Next President: Newport Beach, New York, and An SIC Conference UpdateDocument16 pagesAn Open Letter To The Next President: Newport Beach, New York, and An SIC Conference Updaterichardck61No ratings yet

- Government Policy and The Markets:: Prepare For Some Big ChangesDocument22 pagesGovernment Policy and The Markets:: Prepare For Some Big Changesrichardck50No ratings yet

- The Currency Puzzle (29!10!2010)Document21 pagesThe Currency Puzzle (29!10!2010)adhirajrNo ratings yet

- Government Austerity Measures Next StepDocument10 pagesGovernment Austerity Measures Next StepkakeroteNo ratings yet

- How Debt Limits A Country's OptionDocument5 pagesHow Debt Limits A Country's Optionoptimistic07No ratings yet

- Bob Chapman Global Financial Conflagration The World of Fiat Money Is Buckling Under The Pressure of Unpayable Debts 01 05 10Document11 pagesBob Chapman Global Financial Conflagration The World of Fiat Money Is Buckling Under The Pressure of Unpayable Debts 01 05 10sankaratNo ratings yet

- Keynesian Economics Doesn't WorkDocument8 pagesKeynesian Economics Doesn't WorkkakeroteNo ratings yet

- Bob Chapman An Economy On Steroids US Poverty Levels Equal To The 1930s 12 3 2011Document4 pagesBob Chapman An Economy On Steroids US Poverty Levels Equal To The 1930s 12 3 2011sankaratNo ratings yet

- The Bailout's New Financial OligarchyDocument17 pagesThe Bailout's New Financial OligarchyvanathelNo ratings yet

- Greek Fiscal Crisis: Is A First World Debt Crisis in The Making?Document32 pagesGreek Fiscal Crisis: Is A First World Debt Crisis in The Making?Babasab Patil (Karrisatte)No ratings yet

- ProspectusDocument2 pagesProspectusapi-344645880No ratings yet

- America in PerilDocument12 pagesAmerica in PerilkakeroteNo ratings yet

- Barron's: Why The Market Will Keep Sliding: Perry DDocument32 pagesBarron's: Why The Market Will Keep Sliding: Perry DAlbert L. PeiaNo ratings yet

- Bob Chapman Credit Crisis Outrage Far From OverDocument4 pagesBob Chapman Credit Crisis Outrage Far From OversankaratNo ratings yet

- The Diminshing USD ($) TrendDocument5 pagesThe Diminshing USD ($) TrendGilani, ObaidNo ratings yet

- 7-12-11 Too Big To FailDocument3 pages7-12-11 Too Big To FailThe Gold SpeculatorNo ratings yet

- Global Economy in 2014Document8 pagesGlobal Economy in 2014evamcbrownNo ratings yet

- Bob Chapman Spending Debt Which Is Other People S Money Further Recession and Financial Turmoil in America and The EU 1 10 2011Document4 pagesBob Chapman Spending Debt Which Is Other People S Money Further Recession and Financial Turmoil in America and The EU 1 10 2011sankaratNo ratings yet

- Russia Shifts Half of External Transactions Away From Dollar and EuroDocument7 pagesRussia Shifts Half of External Transactions Away From Dollar and EuroDebre AllenNo ratings yet

- Bob Chapman Deepening Financial Crisis 15 10 09Document22 pagesBob Chapman Deepening Financial Crisis 15 10 09sankaratNo ratings yet

- Bob Chapman The European Debt Crisis The Creditors Are America's Too Big To Fail Wall Street Banksters 26 10 2011Document4 pagesBob Chapman The European Debt Crisis The Creditors Are America's Too Big To Fail Wall Street Banksters 26 10 2011sankaratNo ratings yet

- Big Picture: Reflections, Assessments, Outlook, ApproachDocument17 pagesBig Picture: Reflections, Assessments, Outlook, ApproachHenry BeckerNo ratings yet

- China and the US Foreign Debt Crisis: Does China Own the USA?From EverandChina and the US Foreign Debt Crisis: Does China Own the USA?No ratings yet

- Government Austerity Measures Next StepDocument10 pagesGovernment Austerity Measures Next StepkakeroteNo ratings yet

- What Needs To Be DoneDocument9 pagesWhat Needs To Be DonebowssenNo ratings yet

- Hudson, M. Scenarios For Recovery - How To Write Down The Debts and Restructure The Financial SystemDocument28 pagesHudson, M. Scenarios For Recovery - How To Write Down The Debts and Restructure The Financial SystemxdimitrisNo ratings yet

- 21st Century Global EconomicsDocument9 pages21st Century Global EconomicsMary M HuberNo ratings yet

- Bob Chapman Economic Collapse Amidst A Mini Recovery 21 1 2012Document5 pagesBob Chapman Economic Collapse Amidst A Mini Recovery 21 1 2012sankaratNo ratings yet

- Jim Grant Why No OutrageDocument4 pagesJim Grant Why No OutrageCharlton ButlerNo ratings yet

- International Monetary SystemDocument6 pagesInternational Monetary SystemBora EfeNo ratings yet

- 2019-8-05 Inaugural EditionDocument5 pages2019-8-05 Inaugural Editionsvejed123No ratings yet

- What To Do With Your Money NowDocument8 pagesWhat To Do With Your Money NowDavid C. Leipold100% (1)

- Us Debt CrisisDocument1 pageUs Debt CrisisShailja MudgalNo ratings yet

- Fixing The CrisisDocument8 pagesFixing The Crisisckarsharma1989No ratings yet

- China's Secret Plan To Take Over The World's Gold Market: Investment AdvisoryDocument12 pagesChina's Secret Plan To Take Over The World's Gold Market: Investment Advisorymtnrunner7No ratings yet

- Bring On The Crash: A 3-Step Practical Survival Guide: Prepare for Economic Collapse and Come Out WealthierFrom EverandBring On The Crash: A 3-Step Practical Survival Guide: Prepare for Economic Collapse and Come Out WealthierNo ratings yet

- What Is The Final Test of The Genuineness of So Called Trance Addresses by A W AustenDocument2 pagesWhat Is The Final Test of The Genuineness of So Called Trance Addresses by A W AustenwoojerNo ratings yet

- What The Bible Really Says About MediumshipDocument8 pagesWhat The Bible Really Says About MediumshipwoojerNo ratings yet

- Mediumship and Survival A Century of Investigations Alan GauldDocument254 pagesMediumship and Survival A Century of Investigations Alan GauldwoojerNo ratings yet

- Mediumship The Greatest Evidence of The AfterlifeDocument13 pagesMediumship The Greatest Evidence of The Afterlifewoojer100% (1)

- Materializations With Lula TaberDocument17 pagesMaterializations With Lula TaberwoojerNo ratings yet

- An Investigation of Mediums Who Claim To Give InformationDocument20 pagesAn Investigation of Mediums Who Claim To Give InformationwoojerNo ratings yet

- Usenet StuffDocument101 pagesUsenet StuffwoojerNo ratings yet

- Deep Trance Medium Beatrice BunnerDocument4 pagesDeep Trance Medium Beatrice Bunnerwoojer100% (1)

- Wire Transfer(s) and Account ActivityDocument2 pagesWire Transfer(s) and Account ActivitywoojerNo ratings yet

- Toddle House Choc Icebox PieDocument4 pagesToddle House Choc Icebox Piewoojer100% (1)

- For Network Shared Printing:: For Windows® 2000/XP UsersDocument1 pageFor Network Shared Printing:: For Windows® 2000/XP UserswoojerNo ratings yet

- Pets Assn Dues Cable Utilities - Whose Name Washer/Dryer/Refrig Screened LanaiDocument1 pagePets Assn Dues Cable Utilities - Whose Name Washer/Dryer/Refrig Screened LanaiwoojerNo ratings yet

- Box Accounts and FilesDocument2 pagesBox Accounts and FileswoojerNo ratings yet

- Modul Lab Komputer L2 PDFDocument109 pagesModul Lab Komputer L2 PDFNatalia ChristinaNo ratings yet

- Monetary PolicyDocument7 pagesMonetary PolicyAppan Kandala VasudevacharyNo ratings yet

- HRM 370 AssignmentDocument16 pagesHRM 370 AssignmentSafwan JamilNo ratings yet

- Fund Raising 1Document2 pagesFund Raising 1Devesh JhaNo ratings yet

- CHECK LIST Form WKDocument1 pageCHECK LIST Form WKLakmal WijayawardhanaNo ratings yet

- Assignment On Motivation Polices of GodrejDocument9 pagesAssignment On Motivation Polices of GodrejNitesh SharmaNo ratings yet

- Eco Lec3 Fin MathDocument83 pagesEco Lec3 Fin MathMiguel Toriente0% (1)

- Strategy FormulationDocument38 pagesStrategy FormulationRobin Bhagat100% (1)

- Chapter - 01 ACCOUNTING AND THE BUSINESS ENVIRONMENTDocument66 pagesChapter - 01 ACCOUNTING AND THE BUSINESS ENVIRONMENTRajesh Arora100% (1)

- Company Law Moot MemorialDocument32 pagesCompany Law Moot MemorialShubham AgarwalNo ratings yet

- RPM Fitness RPM4000 4.5 HP Peak Motorized With Free Installation TreadmillDocument1 pageRPM Fitness RPM4000 4.5 HP Peak Motorized With Free Installation TreadmillYwiakabNo ratings yet

- RCII Admission DocumentDocument60 pagesRCII Admission DocumentSergiu CrisanNo ratings yet

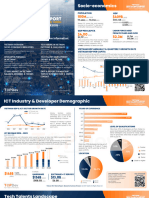

- TopDev VietnamITMarketReport2023 VietnamTechTalentsReport SummaryDocument5 pagesTopDev VietnamITMarketReport2023 VietnamTechTalentsReport SummaryneitcouqNo ratings yet

- StatementschaseDocument7 pagesStatementschasewhozfoolingwhoNo ratings yet

- Tha Capital TIRDocument42 pagesTha Capital TIRjonNo ratings yet

- PAYTMDocument12 pagesPAYTMS.P DATTANo ratings yet

- Long-Term Asset and Liability ManagementDocument27 pagesLong-Term Asset and Liability ManagementImtiaz MasroorNo ratings yet

- Updated Client List J4690, 47,48 OnwardsDocument18 pagesUpdated Client List J4690, 47,48 Onwardshbgroups3018No ratings yet

- Permanent Loan Form (New & Amendment) : DD MM YyyyDocument1 pagePermanent Loan Form (New & Amendment) : DD MM Yyyymushtaq sindhu100% (2)

- OPTTI ENG 17112014 Verision 1Document154 pagesOPTTI ENG 17112014 Verision 1CJNo ratings yet

- 2012 08 15 - Keyway BDocument17 pages2012 08 15 - Keyway BRotary Club of QueanbeyanNo ratings yet

- Ra 8550 PDFDocument18 pagesRa 8550 PDFDawn Jessa100% (1)

- Eun8e CH 006 TomDocument41 pagesEun8e CH 006 TomCarter JayanNo ratings yet

- NJ Seller's Residencey CertificateDocument2 pagesNJ Seller's Residencey CertificateAndrew LiputNo ratings yet

- MIDC's Role in Economy of MaharashtraDocument13 pagesMIDC's Role in Economy of MaharashtraAbhishek SinghNo ratings yet

- Failure of The Kingfisher AirlinesDocument12 pagesFailure of The Kingfisher AirlinesVikas SinghNo ratings yet

- Automobile Sector-Two Wheeler SegmentDocument41 pagesAutomobile Sector-Two Wheeler SegmentSandhya UpadhyayNo ratings yet

- Introduction To Geo-TechnologyDocument45 pagesIntroduction To Geo-TechnologyEngr Muhammad WaseemNo ratings yet

- The Human Development Index - A History PDFDocument37 pagesThe Human Development Index - A History PDFmuhasrulNo ratings yet

- Classical School of ThoughtDocument8 pagesClassical School of ThoughtSaira Naheed0% (1)