Professional Documents

Culture Documents

A Study of Financial Performance: A Comparative Analysis of Sbi and Icici Bank

A Study of Financial Performance: A Comparative Analysis of Sbi and Icici Bank

Uploaded by

GauravMehta0 ratings0% found this document useful (0 votes)

49 views16 pagesThis document compares the financial performance of State Bank of India (SBI) and ICICI Bank over 11 years. It finds that while SBI performs well and is financially sound, ICICI Bank manages deposits and expenditures more efficiently. Ratios show SBI has a larger market share for deposits and loans, but ICICI Bank has more branches and ATMs. Both banks offer a wide range of banking products and services through large domestic and international networks. The study aims to analyze and compare the financial performance of the two major public and private sector banks in India.

Original Description:

FINANCIAL PERFORMANCE BY GAURAV MEHTA

Original Title

5

Copyright

© © All Rights Reserved

Available Formats

RTF, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document compares the financial performance of State Bank of India (SBI) and ICICI Bank over 11 years. It finds that while SBI performs well and is financially sound, ICICI Bank manages deposits and expenditures more efficiently. Ratios show SBI has a larger market share for deposits and loans, but ICICI Bank has more branches and ATMs. Both banks offer a wide range of banking products and services through large domestic and international networks. The study aims to analyze and compare the financial performance of the two major public and private sector banks in India.

Copyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

Download as rtf, pdf, or txt

0 ratings0% found this document useful (0 votes)

49 views16 pagesA Study of Financial Performance: A Comparative Analysis of Sbi and Icici Bank

A Study of Financial Performance: A Comparative Analysis of Sbi and Icici Bank

Uploaded by

GauravMehtaThis document compares the financial performance of State Bank of India (SBI) and ICICI Bank over 11 years. It finds that while SBI performs well and is financially sound, ICICI Bank manages deposits and expenditures more efficiently. Ratios show SBI has a larger market share for deposits and loans, but ICICI Bank has more branches and ATMs. Both banks offer a wide range of banking products and services through large domestic and international networks. The study aims to analyze and compare the financial performance of the two major public and private sector banks in India.

Copyright:

© All Rights Reserved

Available Formats

Download as RTF, PDF, TXT or read online from Scribd

Download as rtf, pdf, or txt

You are on page 1of 16

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 11, November !1, ISSN "" #$

%nline available at &&&.in'ianresearch(ournals.com

A STUDY OF FINANCIAL PERFORMANCE: A COMPARATIVE

ANALYSIS OF SBI AND ICICI BANK

DR. ANURAG. B. SINGH*; MS. PRIYANKA TANDON**

* Associate Professor

LDC Institute of Technical Studies

Soraon, Allahabad (Uttar Pradesh)

India

** Assistant Professor

LDC Institute of Technical Studies

Soraon, Allahabad

India

_____________________________________________________________________________________

ABSTRACT

Banin! Sector "la#s an i$"ortant role in econo$ic de%elo"$ent of a countr#& The banin!

s#ste$ of India is featured b# a lar!e net'or of ban branches, ser%in! $an# inds of financial

ser%ices of the "eo"le& The State Ban of India, "o"ularl# no'n as SBI is one of the leadin!

ban of "ublic sector in India& SBI has () Local *ead +ffices and ,- .onal +ffices located at

i$"ortant cities throu!hout the countr#& ICICI Ban is second lar!est and leadin! ban of "ri%ate

sector in India& The Ban has /,,00 branches and 1,233 AT4s in India& The "ur"ose of the stud#

is to e5a$ine the financial "erfor$ance of SBI and ICICI Ban, "ublic sector and "ri%ate sector

res"ecti%el#& The research is descri"ti%e and anal#tical in nature& The data used for the stud# 'as

entirel# secondar# in nature& The "resent stud# is conducted to co$"are the financial

"erfor$ance of SBI and ICICI Ban on the basis of ratios such as credit de"osit, net "rofit

$ar!in etc& The "eriod of stud# taen is fro$ the #ear /33-632 to /3((6(/& The stud# found that

SBI is "erfor$in! 'ell and financiall# sound than ICICI Ban but in conte5t of de"osits and

e5"enditure ICICI ban has better $ana!in! efficienc# than SBI&

KEYWORDS7 Credit De"osit 8atio, ICICI, 9et Profit 4ar!in, 9et 'orth 8atio, Ad%ances, SBI&

_________________________________________________________________________

INTRODUCTION

An efficient banin! s#ste$ is reco!ni:ed as basic re;uire$ent for the econo$ic de%elo"$ent of

an# econo$#& Bans $obili:e the sa%in!s of co$$unit# into "roducti%e channels& The banin!

s#ste$ of India is featured b# a lar!e net'or of ban branches, ser%in! $an# inds of financial

needs of the "eo"le&

The State Ban of India, "o"ularl# no'n as SBI is one of the leadin! bans in India& The State

Ban <rou", 'ith o%er (1,333 branches "ro%ides a 'ide ran!e of banin! "roducts throu!h its

%ast net'or of branches in India and o%erseas, includin! "roducts ai$ed at 9on68esident

Indians (98Is)& The head;uarter of SBI is at 4u$bai& SBI has () Local *ead +ffices and ,-

.onal +ffices that are located at i$"ortant cities throu!hout the countr#& It also has around (03

56

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 11, November !1, ISSN "" #$

%nline available at &&&.in'ianresearch(ournals.com

branches out of the countr#& It has a $aret share a$on! Indian co$$ercial bans of about /3=

in de"osits and loans&

The roots of the State Ban of India rest in the first decade of (>th centur#, 'hen the Ban of

Calcutta later on rena$ed the Ban of Ben!al, 'as established on / ?une (231& The Ban of

Ben!al 'as one of three Presidenc# bans, the other t'o bein! the Ban of Bo$ba#

(incor"orated on (, A"ril (2)3) and the Ban of 4adras (incor"orated on ( ?ul# (2)0)& @ith the

result of the ro#al charters all three Presidenc# bans 'ere incor"orated as Aoint stoc co$"anies

and recei%ed the e5clusi%e ri!ht to issue "a"er currenc# in (21( 'ith the Pa"er Currenc# Act&

The# retained this ri!ht till the for$ation of the 8eser%e Ban of India& The Presidenc# bans

a$al!a$ated on /- ?anuar# (>/(, and rena$ed I$"erial Ban of India& The I$"erial Ban of

India re$ained a Aoint stoc co$"an#&

The State Ban of India 'as constituted on (st ?ul# (>,,, "ursuant to the State Ban of India

Act, (>,, (the BSBI ActB) for the "ur"ose of creatin! a state6"artnered and state6s"onsored ban

inte!ratin! the for$er I$"erial Ban of India& In (>,>, the State Ban of India (Subsidiar#

Bans) Act 'as "assed, enablin! the Ban to tae o%er ei!ht for$er state associated bans as its

subsidiaries&

The State Ban of IndiaCs is lar!est ban, 'ith a""ro5i$atel# >,333 branches in India and ,)

international offices& Its Associate Bans ha%e a do$estic net'or of around ),133 branches,

'ith stron! re!ional ties& The Ban also has subsidiaries and Aoint %entures outside India,

includin! Duro"e, the United States, Canada, 4auritius, 9i!eria, 9e"al, and Bhutan& The Ban

has the lar!est retail banin! custo$er base in India&

SUBSIDIARIES OF SBI

State Ban of Bianer E ?ai"ur

State Ban of *#derabad

State Ban of 4#sore

State Ban of Patiala

State Ban of Patiala

State Ban of Tra%ancore

ICICI BANK-PROFILE

ICICI Ban is second lar!est and leadin! ban of "ri%ate sector in India& It s head;uarter is in

4u$bai, India& Accordin! to Forbes State Ban of India is the />th $ost re"uted co$"an# in the

'orld& The Ban has /,,00 branches and 1,233 AT4s in India& In (>>2 ICICI Ban launched

internet banin! o"erations& The Ban offers a 'ide ran!e of banin! "roducts and financial

ser%ices to the cor"orate and retail custo$ers& It also "ro%ides ser%ices in the areas of %enture

ca"ital in%est$ent banin!, asset $ana!e$ent and life and non6life insurance& ICICI BanCs

e;uit# shares are listed in India on Bo$ba# Stoc D5chan!e (BSD) and the 9ational Stoc

57

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 11, November !1, ISSN "" #$

%nline available at &&&.in'ianresearch(ournals.com

D5chan!e (9SD) and its A$erican De"ositar# 8ecei"ts (AD8s) are also listed on the 9e' Gor

Stoc D5chan!e (9GSD)&

ICICI Ban li$ited is $aAor banin! and financial ser%ices or!ani:ation in India& The ban is the

second lar!est ban in India and the lar!est "ri%ate sector ban in India b# $aret ca"itali:ation&

The# are "ublicl# held banin! co$"an# en!a!ed in "ro%idin! a 'ide ran!e of banin! and

financial ser%ices includin! co$$ercial banin! and treasur# o"erations& The ban and their

subsidiaries offers a 'ide ran!e of banin! and financial ser%ices includin! co$$ercial banin!,

retail banin!, "roAect and cor"orate finance, 'orin! ca"ital finance, insurance, %enture ca"ital

and "ri%ate e;uit#, in%est$ent banin!, broin! and treasur# "roducts and ser%ices& The# offer

throu!h a %ariet# of deli%er# channels and throu!h their s"eciali:ed subsidiaries in the area of

in%est$ent banin!, life and non6life insurance, %enture ca"ital and assets $ana!e$ent& The

ban has a net'or of /30, branches and about ,,(2 AT4s in India and "resence in (2

countries& The# ha%e subsidiaries in the United Hin!do$, 8ussia and Canada, branches in United

States, Sin!a"ore, Bahrain, *on!6Hon!, Srilana, Iatar and Dubai International finance centre

and re"resentati%e offices in United Arab D$irates, China, South Africa, Ban!ladesh, Thailand,

4ala#sia and Indonesia& +ur UH subsidiar# has established branches in Bel!iu$ and <er$an#&

The ban e;uit# shares are listed in India on Bo$ba# Stoc D5chan!e and 9ational stoc

e5chan!e of India Li$ited and their A$erican De"ositor# 8ecei"ts (AD8s) are listed on 9GSD&

The ban is first Indian bans listed 9GSD&

SUBSIDIARIES OF ICICI BANK

NATIONAL INTERNATIONAL

ICICI Lo$bard ICICI Ban UH PLC

ICICI Prudential Life Insurance Co$"an# ICICI Ban Canada

Ltd

ICICI Securities Li$ited ICICI Ban Durasia LLC

ICICI Prudential Asset 4ana!e$ent

Co$"an# Li$ited

ICICI Jenture

ICICI direct&co$

ICICI Foundation

OBJECTIVE OF THE STUDY

1 To stud# the financial "erfor$ance of SBI and ICICI Ban&

2 To co$"are the financial "erfor$ance of SBI and ICICI Ban&

RESEARCH METHODOLOGY

58

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 11, November !1, ISSN "" #$

%nline available at &&&.in'ianresearch(ournals.com

In the "resent stud#, an atte$"t has been $ade to $easure, e%aluate and co$"are the financial

"erfor$ance of SBI and ICICI Ban 'hich one related to the "ublic sector and "ri%ate sector

res"ecti%el#& The stud# is based on secondar# data that has been collected fro$ annual re"orts of

the res"ecti%e bans, $a!a:ines, Aournals, docu$ents and other "ublished infor$ation& The stud#

co%ers the "eriod of , #ears i&e& fro$ #ear /33-632 to #ear /3((6(/& 8atio Anal#sis 'as a""lied

to anal#:e and co$"are the trends in banin! business and financial "erfor$ance& 4ean and

Co$"ound <ro'th 8ate (C<8) ha%e also been de"lo#ed to anal#:e the trends in banin!

business "rofitabilit#&

LIMITATION OF THE STUDY

Due to constraints of ti$e and resources, the stud# is liel# to suffer fro$ certain li$itations&

So$e of these are $entioned here under so that the findin!s of the stud# $a# be understood in a

"ro"er "ers"ecti%e&

The li$itations of the stud# are7

1 The stud# is based on the secondar# data and the li$itation of usin! secondar#

data $a# affect the results&

2 The secondar# data 'as taen fro$ the annual re"orts of the SBI and ICICI Ban&

It $a# be "ossible that the data sho'n in the annual re"orts $a# be 'indo' dressed

'hich does not sho' the actual "osition of the bans&

Financial anal#sis is $ainl# done to co$"are the !ro'th, "rofitabilit# and financial soundness of

the res"ecti%e bans b# dia!nosin! the infor$ation contained in the financial state$ents&

Financial anal#sis is done to identif# the financial stren!ths and 'eanesses of the t'o bans b#

"ro"erl# establishin! relationshi" bet'een the ite$s of Balance Sheet and Profit E Loss

Account& It hel"s in better understandin! of bans financial "osition, !ro'th and "erfor$ance b#

anal#:in! the financial state$ents 'ith %arious tools and e%aluatin! the relationshi" bet'een

%arious ele$ents of financial state$ents&

FOR THIS PURPOSE THE FOLLOWING PARAMETERS HAVE BEEN STUDIED

1. Credit De"osit 8atio

2. Interest D5"enses to Total D5"enses

3. Interest Inco$e to Total Inco$e

4. +ther Inco$e to Total Inco$e

5. 9et Profit 4ar!in

6. 9et 'orth 8atio

7. Percenta!e Chan!e in 9et Profits

8. Percenta!e Chan!e in Total Inco$e

9. Percenta!e Chan!e in Total D5"enditure

10. Percenta!e Chan!e in De"osits

11. Percenta!e Chan!e in Ad%ances

CREDIT DEPOSIT RATIO:-

Credit6De"osit 8atio is the "ro"ortion of loan6assets created b# a ban fro$ the de"osits

recei%ed& Credits are the loans and ad%ances !ranted b# the ban& In other 'ords it is the a$ount

lent b# the ban to a "erson or an or!ani:ation 'hich is reco%ered later on& Interest is char!ed

fro$ the borro'er& De"osit is the a$ount acce"ted b# ban fro$ the sa%ers and interest is "aid to

the$&

59

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 11, November !1, ISSN "" #$

%nline available at &&&.in'ianresearch(ournals.com

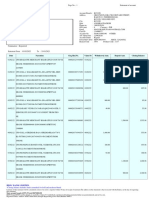

TABLE 1.1 - CREDIT DEPOSIT RATIO

(I9 PD8CD9T)

YEAR SBI ICICI

2!-" --&,- 2)&>>

2"-# -)&>- >(&))

2#-1 -0&,1 >3&3)

21-11 -1&0/ 2-&2(

211-12 -2&,3 >/&/0

MEAN -1&(2) 2>&03/

CGR (&(> 2&,(

Source7 Annual 8e"orts of SBI and ICICI fro$ /33-632 to /3((6(/

FIG. NO. 1.1:- CREDIT DEPOSIT RATIO

Table (&( de"icts that o%er the course of fi%e financial "eriods of stud# the $ean of Credit

De"osit 8atio in ICICI 'as hi!her (2>&03/=) than in SBI (-1&(2)=)& But the Co$"ound <ro'th

8ate in SBI lo'ers (&(>= than in ICICI (2&,(=)& In case of SBI the credit de"osit ratio 'as

hi!hest in /3((6(/ and lo'est in /33>6(3& But in case of ICICI credit de"osit ratio 'as hi!hest in

/3((6(/ and lo'est in /33-632& This sho's that ICICI Ban has created $ore loan assets fro$

its de"osits as co$"ared to SBI&

INTEREST E$PENSES TO TOTAL E$PENSES:-

Interest D5"enses to Total D5"enses re%eals the e5"enses incurred on interest in

"ro"ortion to total e5"enses& Bans acce"ts de"osits fro$ sa%ers and "a# interest on these

accounts& This "a#$ent of interest is no'n as interest e5"enses& Total e5"enses include the

a$ount s"ent in the for$ of staff e5"enses, interest e5"enses, o%erhead e5"enses and other

o"eratin! e5"enses etc&

60

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 11, November !1, ISSN "" #$

%nline available at &&&.in'ianresearch(ournals.com

TABLE 1.2:- INTEREST E$PENSES TO TOTAL E$PENSES

(I9 PD8CD9T)

YEAR SBI ICICI

2!-" 1(&2, 11&(0,

2"-# 10&/- 1)&(3

2#-1 1(&1/ 13&-(

21-11 ,)&>0 13&-3

211-12 ,-&>3 1,&(>

MEAN ,>&> 10&01

CGR 61&02 6(&)1

Source7 Annual 8e"orts of SBI and ICICI fro$ /33-632 to /3((6(/

FIG.NO.1.2:- INTEREST E$PENSES TO TOTAL E$PENSES

The table (&/ sho's that the ratio of interest e5"enses to total e5"enses in SBI 'as hi!hl#

%olatile it increased fro$ 1(&2, "er cent to 10&/- "er cent durin! the "eriod /33-632 to /33263>&

After'ards it 'as decreased till /3(36(( and then a!ain increased to ,-&>3 "er cent& The ratio of

interest e5"enses to total e5"enses in ICICI 'as also decreased fro$ 11&(0, "er cent to 1)&(3 "er

cent durin! the "eriod /33-632 to /33263>& It re$ain stable fro$ /33>6(3 to /3(36/3(( but

Further it 'as increased to 1,&(> "er cent in /3((6(/ & It has been found that the share of interest

e5"enses in total e5"enses 'as hi!her in case of SBI as co$"ared to ICICI, 'hich sho's that

"eo"le "referred to in%est their sa%in!s in SBI than ICICI&

INTEREST INCOME TO TOTAL INCOME:-

Interest Inco$e to Total Inco$e sho's the "ro"ortionate contribution of interest inco$e

in total inco$e& Bans lend $one# in the for$ of loans and ad%ances to the borro'ers and

61

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 11, November !1, ISSN "" #$

%nline available at &&&.in'ianresearch(ournals.com

recei%e interest on it& This recei"t of interest is called interest inco$e& Total inco$e includes

interest inco$e, non6interest inco$e and o"eratin! inco$e&

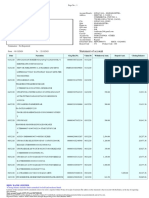

TABLE 1.%:-INTEREST INCOME TO TOTAL INCOME IN SBI AND ICICI

(I9 PD8 CD9T)

YEAR SBI ICICI

2!-" 20&2> --&1(

2"-# 20&)3 ->&/>

2#-1 2/&,2 --&>3

21-11 2)&)> -2&,(

211-12 22&(/ 23&>/

MEAN 2)&)> -2&2)

CGR ,&3) )&/1

Source7 Annual 8e"orts of SBI and ICICI fro$ /33-632 to /3((6(/

FIG.NO.1.% INTEREST INCOME TO TOTAL INCOME IN SBI AND ICICI

The table (&0 re"resents that the ratio of interest inco$e to total inco$e in SBI and ICICI both is

;uite stable and %olatile o%er the #ears& The !ro'th rate of SBI is ,&3) 'hile that of ICICI is

)&/1& Thus, the "ro"ortion of interest inco$e to total inco$e in SBI 'as hi!her than that of

ICICI, 'hich sho's that "eo"le "referred SBI to tae loans and ad%ances&

OTHER INCOME TO TOTAL INCOME:-

+ther inco$e to total inco$e re%eals the "ro"ortionate share of other inco$e in total

inco$e& +ther inco$e includes non6interest inco$e and o"eratin! inco$e& Total inco$e includes

interest inco$e, non6interest inco$e and o"eratin! inco$e&

62

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 11, November !1, ISSN "" #$

%nline available at &&&.in'ianresearch(ournals.com

TABLE 1.&:-OTHER INCOME TO TOTAL INCOME IN SBI AND ICICI

(I9 PD8CD9T)

YEAR SBI ICICI

2!-" (1&(3 //&02

2"-# (1 /3&-3

2#-1 (- //&3>

21-11 (1 /(&)2

211-12 (( (>&3-

MEAN (,&// /(&))

CGR 60(&1 6()&-

Source7 Annual 8e"orts of SBI and ICICI Ban fro$ /33-632 to /3((6(/

FIG.NO.1.& OTHER INCOME TO TOTAL INCOME IN SBI AND ICICI

The table (&) sho's that the ratio of other inco$e to total inco$e 'as decreased fro$ (1&(3 "er

cent in /33-632 to ((&33 "er cent in /3((6(/ in case of SBI& *o'e%er, the share of other inco$e

in total inco$e of ICICI 'as also decreased fro$ //&02 "er cent in /33-632 to (>&3- "er cent

/3((6(/& The table sho's that the ratio of other inco$e to total inco$e 'as relati%el# hi!her in

ICICI (/(&))=) as co$"ared to SBI ((,&//=) durin! the "eriod of stud#&

NET PROFIT MARGIN:-

9et Profit 4ar!in re%eals the financial results of the business acti%it# and efficienc# of

$ana!e$ent in o"erations& The table ,&2 sho's the net "rofit $ar!in in SBI and ICICI durin! the

Period /33,631 to /33>6(3&

63

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 11, November !1, ISSN "" #$

%nline available at &&&.in'ianresearch(ournals.com

TABLE-1.':-NET PROFIT MARGIN IN SBI AND ICICI

(I9 PD8CD9T)

YEAR SBI ICICI

2!-" (/&1) ((&2(

2"-# (0&(( ((&),

2#-1 (3&,) (0&1)

21-11 2&,, (-&,/

211-12 >&-0 (-&),

MEAN (3&>( ()&0-

CGR /0&3/ )-&-

Source7 Annual 8e"orts of SBI and ICICI fro$ /33-632 to /3((6(/

FIG. NO.1.' NET PROFIT MARGIN IN SBI AND ICICI

The table (&, re%eals that the ratio of net "rofits to total inco$e of ICICI 'as %aried fro$ ((&2(

"er cent to (-&), "ercent 'hereas in case of SBI it is not stable& It increased to (0&(( "ercent

fro$ (/&1) "ercent in /33263> then further decreased to (3&,) "ercent in /33>6(3 and 2&,,

"ercent in /3(36(( and finall# increased to >&-0 "ercent in /3((6(/ durin! the "eriod of , #ears

of stud#& *o'e%er, the net "rofit $ar!in 'as hi!her in ICICI (()&0-=) as co$"ared to SBI

((3&>(=) durin! the "eriod of stud#& But it 'as continuousl# decreased fro$ /33-632 to /3((6(/

in ICICI& Thus, the ICICI has sho'n co$"arati%el# lo'er o"erational efficienc# than SBI&

NET WORTH RATIO:-

9et 'orth 8atio is used for $easurin! the o%erall efficienc# of a fir$& This ratio establishes the

relationshi" bet'een net "rofit and the "ro"rietor s funds&

64

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 11, November !1, ISSN "" #$

%nline available at &&&.in'ianresearch(ournals.com

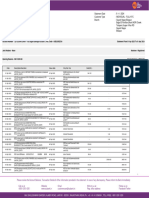

TABLE 1.( NET WORTH RATIO

(I9 PD8CD9T)

YEAR SBI ICICI

2!-" (0&-3 2&>)

2"-# (,&-) -&,2

2#-1 (0&>( -&->

21-11 (/&2) >&0,

211-12 ()&01 (3&-3

MEAN ()&(( 2&2-

CGR )&2- (>&12

Source7 Annual 8e"orts of SBI and ICICI fro$ /33-632 to /3((6(/

FIG.NO.1.( NET WORTH RATIO

It is clear fro$ the table (&1 that the net 'orth ratio of SBI 'as increased fro$ (0&-3 "er cent to

()&01 "er cent durin! /33-632 to /3((6(/, and decreased in /33>6(3 and /3(36/3((& @hereas

the ratio 'as increased fro$ 2&>) "er cent to (3&-3 "er cent in ICICI& The table sho'ed that the

net 'orth ratio 'as hi!her in SBI (()&((=) as co$"ared to ICICI (2&2-=) durin! the "eriod of

stud#, 'hich re%ealed that SBI has utili:ed its resources $ore efficientl# as co$"ared to ICICI&

GROWTH OF PROFIT:-

65

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 11, November !1, ISSN "" #$

%nline available at &&&.in'ianresearch(ournals.com

9et "rofit 8atio is used for $easurin! the "rofitabilit# of the fir$& It is calculated b# di%idin! net

"rofit b# net sales $ulti"lied b# (33& It establishes the relationshi" bet'een the net "rofit and

sales&

TABLE 1.( GROWTH OF PROFIT IN SBI AND ICICI

(I9 C8+8DS)

SBI ICICI

YEAR PROFIT ) CHANGE PROFIT ) CHANGE

2!-" 1-/> **.. )(,-&-0 ***

2"-# >(/( 0,&,= 0-,2&(0 6>&1(

2#-1 >(1( )>= )3/)&>2 -&(3

21-11 2/1, 6>&2= ,(,(&02 /-&>

211-12 ((-3- )/= 1)1,&/1 /,&,3

MEAN 2>>1&1 )-((&)>

CGR -0&>- ,,&)>

Source7 Annual 8e"orts of SBI and ICICI fro$ /33-632 to/3((6(/

FIG.NO.1.( GROWTH OF PROFIT IN SBI AND ICICI

The table (&2 hi!hli!hts that the $ean %alue of net "rofit 'as hi!her in SBI (8s& 2>>1&1 crores)

as co$"ared to that in ICICI (8s& )-((&> crores) durin! the "eriod of stud#& Further the !ro'th

66

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 11, November !1, ISSN "" #$

%nline available at &&&.in'ianresearch(ournals.com

rate of 9et Profits 'as also hi!her in SBI (-0&>-=) than that in ICICI (,,&)>=) durin! the stud#

"eriod& The table also sho's that the annual !ro'th rate of "rofit in SBI 'as hi!hest in the #ear

/33>6(3 and 'as ne!ati%e (6>&2=) in the #ear /3(36((& In ICICI, the annual !ro'th rate of "rofit

'as hi!hest in the #ear /3(36(((/-&>=) and 'as ne!ati%e in the #ear /33263> (6>&1(=)&

TOTAL INCOME:-

The total inco$e indicates the ru"ee %alue of the inco$e earned durin! a "eriod& The hi!her

%alue of total inco$e re"resents the efficienc# and !ood "erfor$ance&

TABLE 1.! GROWTH IN TOTAL INCOME OF SBI AND ICICI

(I9 C8+8DS)

SBI ICICI

YEAR INCOME ) CHANGE INCOME ) CHANGE

2!-" ,2,0)2&-) **.. 0>,11-&(> ***

2"-# -1,)->&-2 0(= 0>,/(3&0( 6(&(,=

2#-1 2,,>1/&3- (/&0= 0/,>>>&01 6(,&2=

21-11 >1,0/>&), (/&31= 00,32/&>1 3&/,=

211-12 (/3,2-/&>3 /,&)= )(,),3&-, /,&/=

MEAN 2-,,>2&,2 0-/2/&(()

CGR (3-&(, )&)>

Source7 Annual 8e"orts of SBI and ICICI fro$ /33-632 to /3((6(/

FIG.NO.1.! GROWTH IN TOTAL INCOME OF SBI AND ICICI

The table (&> hi!hli!hts that the $ean %alue of total inco$e 'as hi!her in SBI (8s& 2-,,>2&,2

crores) as co$"ared to that in ICICI (8s& 0-/2/&(() crores) durin! the "eriod of stud#& *o'e%er

the rate of !ro'th re!ardin! total inco$e 'as hi!her in SBI ((3-&(, =) than in ICICI ()&)> =)

durin! the "eriod of stud#&

TOTAL E$PENDITURE:-

67

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 11, November !1, ISSN "" #$

%nline available at &&&.in'ianresearch(ournals.com

The total e5"enditure re%eals the "ro"ortionate share of total e5"enditure s"ent on the

de%elo"$ent of staff, interest e5"ended and other o%erheads& The hi!her %alue of total

TABLE 1.":- TOTAL E$PENDITURE OF SBI AND ICICI

(I9 C8+8DS)

SBI ICICI

YEAR E$PENDITURE ) CHANGE E$PENDITURE ) CHANGE

2!-" ,(,1(>&1// **.. 0,,,3>&)- ***

2"-# 1-,0,2&,, 03&)= 0,,),/&(- 3&(1=

2#-1 -1,->1&3/ ()&3(= /2,>-)&0- 6(2&/=

21-11 22,>,>&(/ (,&20= /-,>0(&,2 60&,>=

211-12 (3>,(21&>> //&-0= 0),>2,&,3 /,&/,=

MEAN -2,-2)&31 0/,-3&1(

CGR (((&,/ 6(&)-

Source7 Annual 8e"orts of SBI and ICICI fro$ /33-632 to /3((6(/

FIG.NO.1." TOTAL E$PENDITURE OF SBI AND ICICI

The table (&(3 discloses that the $ean %alue of total e5"enditure 'as hi!her in SBI (8s&

-2,-2)&31 crores) as co$"ared to that in ICICI (8s& 0/,-3&1( crore) durin! the "eriod of stud#&

But the rate of !ro'th re!ardin! e5"enditure in ICICI 'as (6(&)- =) than that in SBI ((((&,/=)

durin! the sa$e "eriod& It is clear that ICICI is successful in decreasin! their total e5"enditure as

co$"ared to SBI& The table also hi!hli!hts that the annual !ro'th rate of e5"enditure in SBI 'as

hi!hest (03&3)) in the #ear /33263> and 'as lo'est (()&3() in the #ear /33>6(3& In ICICI, the

annual !ro'th rate of e5"enditure 'as ne!ati%e in the #ear /33>6(3 and /3(36(( i&e& (6(2&/3) and

(60&,>) res"ecti%el#& *ence it is clear that ICICI is $ore efficient as co$"ared to SBI in ter$s of

$ana!in! e5"enditure&

ADVANCES:-

Ad%ances are the credit facilit# !ranted b# the ban& In other 'ords it is the a$ount borro'ed b#

a "erson fro$ the Ban& It is also no'n as KCredit !ranted 'here the $one# is disbursed and

reco%er# of 'hich is $ade later on&

TABLE 1.#- TOTAL ADVANCES OF SBI AND ICICI

(I9 C8+8DS)

68

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 11, November !1, ISSN "" #$

%nline available at &&&.in'ianresearch(ournals.com

SBI ICICI

YEAR ADVANCES ) CHANGE ADVANCES ) CHANGE

2!-" )(1,-12&/3 **.. //,,1(1&32 ***

2"-# ,)/,,30&/3 03&(1= /(2,0(3&2, 60&/,=

2#-1 10(,>()&(, (1&)2= (2(,/3,&13 6(1=

21-11 -,1,-(>&), (>&-,= /(1,01,&>3 (>&)3=

211-12 21-,,-2&2> ()&1= /,0,-/-&11 (-&/1=

MEAN 1)1,,-2&2> //),1),

CGR (32&(1 (/&),

Source7 Annual 8e"orts of SBI and ICICI fro$ /33-632 to /3((6(/

FIG.NO.1.#- TOTAL ADVANCES OF SBI AND ICICI

Table (&> "resents that the $ean of Ad%ances of SBI 'as hi!her (1)1,,-2&2>) as co$"ared to

$ean of Ad%ances of ICICI (//),1),)& 8ate of !ro'th 'as also hi!her in SBI ((32&(1 =) than in

ICICI ((/&),=)& Table also sho's the "er cent Chan!e in Ad%ances o%er the "eriod of , #ears& In

case of SBI Ad%ances 'ere continuousl# increased ('ith a decreasin! trend) o%er the "eriod of

stud#& *o'e%er Ad%ances in ICICI 'ere decreased till /33>6(3 but these 'ere increased in the

subse;uent #ears&

DEPOSITS:-

De"osit is the a$ount acce"ted b# ban fro$ the sa%ers in the for$ of current de"osits, sa%in!s

de"osits and fi5ed de"osits and interest is "aid to the$

69

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 11, November !1, ISSN "" #$

%nline available at &&&.in'ianresearch(ournals.com

TABLE 1.1-TOTAL DEPOSITS OF SBI AND ICICI

(I9 C8+8DS)

SBI ICICI

YEAR DEPOSITS ) CHANGE DEPOSITS ) CHANGE

2!-" ,0-,)30&>) **.. /)),)0(&3, ***

2"-# -)/,3-0&(0 02&32= /(2,0)-&2/ 6(3&1=

2#-1 23),((1&/0 2&01= /3/,3(1&13 6-&)3=

21-11 >00,>0/&2( (1&() //,,13/&(( ((&1=

211-12 (,3),1)-&01 ((&-= /,,,)>>&>1 (0&/=

MEAN 2(/,/0) //>,(->

CGR >)&/3 )&,/

Source7 Annual 8e"orts of SBI and ICICI fro$ /33-632 to /3((6(/

FIG. NO.1.1:- TOTAL DEPOSITS OF SBI AND ICICI

Table (&(( "resents that the $ean of De"osits of SBI 'as hi!her (2(/,/0)) as co$"ared to $ean

of de"osits of ICICI (//>,(->=)& *o'e%er the rate of !ro'th 'as hi!her in SBI (>)&/3=) than

that in ICICI ()&,/=) durin! the "eriod of stud#& Table also sho's the "er cent Chan!e in

De"osits o%er the "eriod of , #ears& In case of SBI De"osits 'ere continuousl# fluctuatin! o%er

the "eriod of stud#& *o'e%er de"osits in ICICI 'ere decreased in /33263> and /33>6(3 but these

'ere increased in the #ear /3(36(( and /3((6(/ 'ith ((&1= and (0&/= res"ecti%el#&

FINDINGS AND CONCLUSIONS:-

The stud# found that the $ean of Credit De"osit 8atio in ICICI 'as hi!her (2>&03/ =) than in

SBI (-1&(2)=)& This sho's that ICICI Ban has created $ore loan assets fro$ its de"osits as

co$"ared to SBI& The share of interest e5"enses in total e5"enses hi!her in ICICI (10&01 =) as

co$"are to SBI (,>&>> =) and the "ro"ortion of interest inco$e to total inco$e 'as hi!her in

case of SBI(2)&)> = ) as co$"ared to ICICI (-2&2)=), 'hich sho's that "eo"le "refer ICICI to

in%est their sa%in!s and SBI to tae loans E ad%ances& The ratio of other inco$e to total inco$e

70

International Journal of Marketing, Financial Services & Management Research

Vol.1 Issue 11, November !1, ISSN "" #$

%nline available at &&&.in'ianresearch(ournals.com

'as relati%el# hi!her in ICICI (/(&)) =) as co$"ared to SBI ((,&// =)& The 9et Profit 4ar!in

of ICICI is hi!her (()&0- =) 'hereas in SBI it 'as ((3&>> =), 'hich sho's that ICICI has

sho'n co$"arati%el# better o"erational efficienc# than SBI& The !ro'th rate of net "rofit is

-0&>-= in SBI 'hich is hi!her than ICICI 'hich is ,,&)>=& This sho's that SBI "erfor$ed 'ell

as co$"ared to ICICI& The $ean %alue of total inco$e 'as hi!her in SBI (2-,,>2&,2) as

co$"ared to that in ICICI (0-,/2/&(())& 9et 'orth ratio 'as also hi!her in SBI (()&(( =) than

ICICI (2&2- =), 'hich re%ealed that SBI has utili:ed its resources $ore efficientl# as co$"ared

to ICICI&

The $ean %alue of total e5"enditure 'as hi!her in SBI (8s& -2,-2)&31 crores) as co$"ared to

that in ICICI (8s&0/,,-3&1() and the co$bined !ro'th rate of e5"enditure 'as ne!ati%e (6(&)-=)

in the case of ICICI 'hereas in SBI it is (((&,/=& De"osits in SBI 'ere continuousl# increased&

*o'e%er de"osits in ICICI 'ere decreased ('ith a declinin! trend) till /33>6(3 but these 'ere

increased in the subse;uent #ears& In case of SBI Ad%ances 'ere continuousl# increased ('ith a

decreasin! trend) 'ith the co$bined !ro'th rate of ((32&(1 =), *o'e%er Ad%ances in ICICI

'ere decreased ('ith a declinin! trend) till /33>6(3 but these 'ere increased thereafter 'ith

co$bined !ro'th rate of ((/&), =)& It sho's that ICICI has suffered 'ith funds or a%oid

"ro%idin! ad%ances throu!h /33-632 to /33>6(3& *ence, on the basis of the abo%e stud# or

anal#sis banin! custo$er has $ore trust on the "ublic sector bans as co$"ared to "ri%ate

sector bans&

REFERENCES:-

1 4ahesh'ari E 4ahesh'ari, Banin! La' and Practices, *i$ala#a Publishin!

P%t Ltd, Allahabad, ""&(,/&

2 Pande#, I&4& Financial 4ana!e$ent, Jias Publishin!& *ouse P%t& Ltd& /33/, ""&

100&

3 Stud# $aterial, Financial 4ana!e$ent Unit (-, I<9+U, 9e' Delhi& ""&1

4 Trend and "ro!ress of banin!, 8BI, ""&//6/0

5 <a#lord A Free$an, L The Proble$ of Ade;uate ban Ca"italM, ;uoted b#

*o'ard D&

Crosse in his boo on 4ana!e$ent Policies for Co$$ercial Bans, ""& (,2&

6 De%elo"$ent 8esearch <rou" Stud#, 9o& //, De"art$ent of Dcono$ic Anal#sis

and Polic#, 8eser%e Ban of India, 4u$bai Se"te$ber /3, /333&

7 Financial #ear re"ort of SBI /33-632 to /3((6(/&

8 SBI bulletin "ublication /3(/&

Financial #ear re"ort of ICICI Ban /33-632 to /3((6(/&

1 ICICI Ban bulletin "ublication /3(/

2 8BI statistical table relatin! to bans /3((6(/&

I+,-./012-+ M3/-.0+45/

3 SBI and ICICI Ban annual re"ort /33-6(/&

71

You might also like

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Banking & InsuranceDocument3 pagesBanking & Insurancempatel48No ratings yet

- Credit Risk Sbi Project Report Mba FinanceDocument104 pagesCredit Risk Sbi Project Report Mba FinanceArpanpreet KaurNo ratings yet

- Scenario of Foreign Banks in IndiaDocument37 pagesScenario of Foreign Banks in IndiaAshwini PawarNo ratings yet

- HDFC G - 1Document83 pagesHDFC G - 1Gurinder SinghNo ratings yet

- Accounting Project On AXIS BANK PrintDocument58 pagesAccounting Project On AXIS BANK PrintBimal Kumar Dash100% (1)

- Declaration: Gokak Urban C0-Operative Credit Bank LTDDocument69 pagesDeclaration: Gokak Urban C0-Operative Credit Bank LTDBhanu GuptaNo ratings yet

- Summer Internship ProjectDocument85 pagesSummer Internship ProjectSrikant RaoNo ratings yet

- Audit ManagementDocument75 pagesAudit Managementdk6666No ratings yet

- Standard Charted BankDocument84 pagesStandard Charted BankPari SavlaNo ratings yet

- Axis BNKDocument71 pagesAxis BNKMukeshSharmaNo ratings yet

- Syndicate Bank HRDocument64 pagesSyndicate Bank HRsrinibashb5546100% (1)

- Project Report On Employees Satisfaction Regarding HDFC BankDocument77 pagesProject Report On Employees Satisfaction Regarding HDFC BankSunil Soni100% (1)

- Hummaira First PaperDocument32 pagesHummaira First PaperKazi Ramiz UddinNo ratings yet

- F VersionDocument43 pagesF VersionAzim KowshikNo ratings yet

- Axis BankDocument81 pagesAxis BankAmit SharmaNo ratings yet

- Project On Foreign BanksDocument57 pagesProject On Foreign BanksAditya SawantNo ratings yet

- Comparative Study On Services Provided by Icici and HDFC BankDocument61 pagesComparative Study On Services Provided by Icici and HDFC BankRahul BarnwalNo ratings yet

- Project Report OnDocument79 pagesProject Report OnKuladeepa KrNo ratings yet

- After 100 Days of New Government No Khushi, Still Gham For Bank EmployeesDocument20 pagesAfter 100 Days of New Government No Khushi, Still Gham For Bank EmployeesAnonymous 4yXWpDNo ratings yet

- Assignment On SebiDocument24 pagesAssignment On SebiHemant Chaudhari100% (1)

- Kochi, Mysore, Jaipur, Bhubaneswar and Shimla.: One Billion Plastic Notes of Rs.10 DenominationDocument27 pagesKochi, Mysore, Jaipur, Bhubaneswar and Shimla.: One Billion Plastic Notes of Rs.10 Denominationhindu2012No ratings yet

- DraftDocument11 pagesDraftVasundhara KediaNo ratings yet

- Final Report On Financial Analysis of Icici BankDocument32 pagesFinal Report On Financial Analysis of Icici Bankhardikng50% (2)

- QuestionsDocument30 pagesQuestionsAnish BabuNo ratings yet

- Market-Based Financing Urban Infrastructure IndiaDocument12 pagesMarket-Based Financing Urban Infrastructure IndiaAkash ShuklaNo ratings yet

- Indian Banking IndustryDocument30 pagesIndian Banking IndustryApoorv GoelNo ratings yet

- Impact of Service Quality On Customer Loyalty in LICDocument66 pagesImpact of Service Quality On Customer Loyalty in LICMann Saini0% (1)

- State Bank of IndiaDocument13 pagesState Bank of IndiaRaman RandhawaNo ratings yet

- Finance (MBA)Document106 pagesFinance (MBA)Deepika KrishnaNo ratings yet

- Sharekhan Internship ReportDocument45 pagesSharekhan Internship ReportKritika JainNo ratings yet

- Chapter - 01Document48 pagesChapter - 01Tamanna MahmudaNo ratings yet

- Acknowledgement: Shukla, RPEC Sec 78 Mohali For Allowing Me To Undergo Training at Karvy StockDocument52 pagesAcknowledgement: Shukla, RPEC Sec 78 Mohali For Allowing Me To Undergo Training at Karvy StockPreet JosanNo ratings yet

- ICICI Bank Financial Statement AnnalisisDocument104 pagesICICI Bank Financial Statement AnnalisisYaadrahulkumar Moharana100% (3)

- Ubi, Icici, HDFCDocument70 pagesUbi, Icici, HDFCankitverma9716No ratings yet

- 1.1 Banking Structure in IndiaDocument33 pages1.1 Banking Structure in IndiadevrajkinjalNo ratings yet

- Evaluation of Job Satisfaction of Social Islami Bank Limited.Document73 pagesEvaluation of Job Satisfaction of Social Islami Bank Limited.Redwan FerdousNo ratings yet

- Banking and Insurance Banking and Financial Systems: Dr. D.M. Mithani E.GordonDocument3 pagesBanking and Insurance Banking and Financial Systems: Dr. D.M. Mithani E.GordonSatish Varma100% (1)

- List of AbbreviationsDocument6 pagesList of AbbreviationsNirmal SinghNo ratings yet

- Icici BankDocument137 pagesIcici BankGurinder SinghNo ratings yet

- Sagar M.P.: Marketing Policies B/W HDFC & Icici BankDocument72 pagesSagar M.P.: Marketing Policies B/W HDFC & Icici BankSaurabh UpadhyayNo ratings yet

- Execution and Analysis of Working Capital As A Product of HDFC BankDocument43 pagesExecution and Analysis of Working Capital As A Product of HDFC Banknikhil0889No ratings yet

- Study of HDFC Mutual FundDocument75 pagesStudy of HDFC Mutual FundJaiHanumankiNo ratings yet

- Financial Appraisal of Project Sbi Project Report Mba FinanceDocument90 pagesFinancial Appraisal of Project Sbi Project Report Mba FinanceakanjithNo ratings yet

- Final Proejct Report Yoshita TolaniDocument63 pagesFinal Proejct Report Yoshita TolaniNamanThakurNo ratings yet

- MT 2 NPADocument30 pagesMT 2 NPAPri AgarwalNo ratings yet

- Banking in IndiaDocument6 pagesBanking in IndiaJay KoliNo ratings yet

- EXIM ConceptsDocument3 pagesEXIM ConceptsBhavesh YadavNo ratings yet

- A STUDY ON THE INNOVATIONS IN RETAIL LENDING WITH REFERENCE TO VIJAYA BANK (JAYANAGAR IIIrd BLOCK BRANCH) .Document101 pagesA STUDY ON THE INNOVATIONS IN RETAIL LENDING WITH REFERENCE TO VIJAYA BANK (JAYANAGAR IIIrd BLOCK BRANCH) .BasavaReddyeNo ratings yet

- Sequrity AnalysisDocument72 pagesSequrity AnalysisGanganiMehulNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Financial Soundness Indicators for Financial Sector Stability in BangladeshFrom EverandFinancial Soundness Indicators for Financial Sector Stability in BangladeshNo ratings yet

- Summary of Saurabh Mukherjea, Rakshit Ranjan & Salil Desai's Diamonds in the DustFrom EverandSummary of Saurabh Mukherjea, Rakshit Ranjan & Salil Desai's Diamonds in the DustNo ratings yet

- Financial Soundness Indicators for Financial Sector Stability: A Tale of Three Asian CountriesFrom EverandFinancial Soundness Indicators for Financial Sector Stability: A Tale of Three Asian CountriesNo ratings yet

- Trial Balance: Private Sector Financing for Road Projects in IndiaFrom EverandTrial Balance: Private Sector Financing for Road Projects in IndiaNo ratings yet

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesFrom EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume III: Thematic Chapter—Fintech Loans to Tricycle Drivers in the PhilippinesFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume III: Thematic Chapter—Fintech Loans to Tricycle Drivers in the PhilippinesNo ratings yet

- Reforms, Opportunities, and Challenges for State-Owned EnterprisesFrom EverandReforms, Opportunities, and Challenges for State-Owned EnterprisesNo ratings yet

- OpTransactionHistory25 01 2024Document48 pagesOpTransactionHistory25 01 2024rathornitin7812No ratings yet

- TTM Squeeze Daily Darvax, Technical Analysis ScannerDocument2 pagesTTM Squeeze Daily Darvax, Technical Analysis ScannerAmit ViraNo ratings yet

- NPS Return 15052012 Credit Date May 01 To May 14 2012Document302 pagesNPS Return 15052012 Credit Date May 01 To May 14 2012Yashpal TalanNo ratings yet

- Retail Loan Rates Comparision Chart PDFDocument3 pagesRetail Loan Rates Comparision Chart PDF9778486995No ratings yet

- History of Banking in IndiaDocument5 pagesHistory of Banking in IndiamylahNo ratings yet

- Hyderabad Circle & BranchesDocument138 pagesHyderabad Circle & BranchesploknyNo ratings yet

- All Bank Ceo List PDFDocument5 pagesAll Bank Ceo List PDFanjali gupta100% (1)

- Khel Maharan Teacher NameDocument6 pagesKhel Maharan Teacher NameZalorthang ZateNo ratings yet

- BanksDocument39 pagesBanksdanniel foyNo ratings yet

- India Credit Card ReportDocument12 pagesIndia Credit Card ReportmalvikasinghalNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument7 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancesknagarNo ratings yet

- Medi-Caps University: IndoreDocument73 pagesMedi-Caps University: IndoreUJJWAL PATIDARNo ratings yet

- PV Infr Projects Pay Sheet 24.04.2020 To 01.05.2020 Advance 40000 35000 2000 20000Document107 pagesPV Infr Projects Pay Sheet 24.04.2020 To 01.05.2020 Advance 40000 35000 2000 20000Senthil kNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument42 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancedattam venkateswarluNo ratings yet

- Mittal School of Business Lovely Professional University: Continuous Assessment IIDocument6 pagesMittal School of Business Lovely Professional University: Continuous Assessment IIAradhya BambamNo ratings yet

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument6 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any SignatureSachinNo ratings yet

- Acct Statement - XX9928 - 22122021Document49 pagesAcct Statement - XX9928 - 22122021viveknaikNo ratings yet

- A Bank Statement - Requirement 2020-21Document26 pagesA Bank Statement - Requirement 2020-21Satyam KumarNo ratings yet

- ATCH To Cir. No. 89 - PERFORMANCE OF 39 RRBS AS ON 31.03.2024Document2 pagesATCH To Cir. No. 89 - PERFORMANCE OF 39 RRBS AS ON 31.03.2024pateldixit.dx3No ratings yet

- Aapdamitra Volunteers DetailsDocument8 pagesAapdamitra Volunteers Detailssiva santhosh100% (1)

- Partial Transaction Listing: L017G-SBI Large & Midcap Fund Regular GrowthDocument3 pagesPartial Transaction Listing: L017G-SBI Large & Midcap Fund Regular GrowthKirti Kant SrivastavaNo ratings yet

- IFSC Code Available in NACH For Banks Live in ACH Credit Ason Mar132015Document7,883 pagesIFSC Code Available in NACH For Banks Live in ACH Credit Ason Mar132015Samuel GeorgeNo ratings yet

- SBT Ifsc DetailsDocument125 pagesSBT Ifsc DetailsPanruti S Sathiyavendhan0% (1)

- Adobe Scan Mar 09, 2022Document3 pagesAdobe Scan Mar 09, 2022Ashish gautamNo ratings yet

- 1553944252387Document15 pages1553944252387Gokul Singh BishtNo ratings yet

- Account Statement: Sonu RamDocument33 pagesAccount Statement: Sonu Ramkreetika kumariNo ratings yet

- AARYADocument6 pagesAARYARavindra JadhavNo ratings yet

- Canara1st Apr 2022 To 21march 2023Document110 pagesCanara1st Apr 2022 To 21march 2023JAWED MOHAMMADNo ratings yet

- 6781 I-VII & IX STD Students DetailsDocument127 pages6781 I-VII & IX STD Students Detailsk_vk2000No ratings yet

- Group ADocument3 pagesGroup ANisha Agarwal 3No ratings yet