Professional Documents

Culture Documents

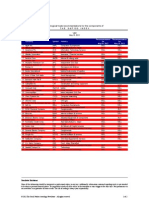

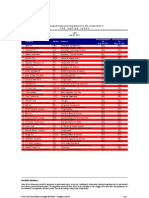

BetterInvesting Weekly Stock Screen 9-15-14

BetterInvesting Weekly Stock Screen 9-15-14

Uploaded by

BetterInvestingCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BetterInvesting Weekly Stock Screen 9-15-14

BetterInvesting Weekly Stock Screen 9-15-14

Uploaded by

BetterInvestingCopyright:

Available Formats

Company Name

Check Point Software Technologies

Lumber Liquidators

Lululemon Athletica

Mednax

Mindray Medical International

MWI Veterinary Supply

NetEase

Oceaneering International

Panera Bread

ResMed

Sociedad Quimica Y Minera De Chile SA

T. Rowe Price

Urban Outfitters

Varian Medical Systems

Valmont Industries

Westinghouse Air Brake Technologies

Symbol

CHKP

LL

LULU

MD

MR

MWIV

NTES

OII

PNRA

RMD

SQM

TROW

URBN

VAR

VMI

WAB

Industry

Software - Application

Home Improvement Stores

Apparel Stores

Medical Care

Medical Instruments & Supplies

Medical Distribution

Internet Content & Information

Oil & Gas Equipment & Services

Restaurants

Medical Instruments & Supplies

Chemicals

Asset Management

Apparel Stores

Medical Devices

Metal Fabrication

Railroads

Screen Notes

MyStockProspector screen on Sept. 15

10-year annual sales, EPS and implied growth of 10% and above

10-year annual sales, EPS growth R2 of at least 0.80

Analysts' projected 5-year annual EPS growth rate of 10% and higher

Current P/E below 30

Ratio of P/E to both historical and projected EPS growth of 2.0 and below

Ratio of debt to equity of 0.33 and less

WEEK OF SEPTEMBER 15, 2014

Sales

Hist 10 Yr

Hist 10 Yr

(millions)

Rev Gr

EPS Gr

$1,394.1

12.9%

14.7%

$1,000.2

19.4%

19.2%

$1,591.2

48.4%

108.6%

$2,154.0

14.8%

13.1%

$1,214.0

34.3%

25.2%

$2,347.5

21.8%

29.0%

$1,495.3

33.1%

49.7%

$3,287.0

15.0%

22.6%

$2,385.0

18.5%

20.7%

$1,555.0

14.7%

22.8%

$2,203.1

13.5%

25.4%

$3,484.2

10.2%

11.4%

$3,086.6

15.1%

13.5%

$2,942.9

10.3%

14.4%

$3,304.2

14.2%

26.9%

$2,566.4

12.4%

22.4%

Implied Gr

16.7%

17.6%

25.1%

13.1%

12.9%

14.0%

23.1%

13.5%

20.4%

13.6%

13.5%

11.0%

17.1%

27.3%

15.2%

16.0%

Sales R2 EPS R2 Proj 5 Yr PE/Hist PE/Proj Current

10 Yr

10 Yr

EPS Gr EPS Gr EPS Gr

P/E

0.98

0.96

11.8%

1.42

1.77

20.91

0.96

0.84

15.0%

1.19

1.52

22.87

0.97

0.85

27.2%

0.23

0.93

25.42

1.00

0.97

13.8%

1.44

1.37

18.88

0.94

0.92

16.7%

0.74

1.11

18.60

0.99

0.96

15.0%

0.92

1.77

26.54

0.98

0.85

13.3%

0.31

1.16

15.41

0.92

0.86

18.3%

0.80

0.99

18.12

0.97

0.97

18.1%

1.11

1.27

22.91

0.96

0.95

15.4%

0.97

1.43

22.06

0.92

0.83

13.8%

0.77

1.43

19.68

0.90

0.81

13.0%

1.63

1.42

18.49

0.98

0.89

18.2%

1.59

1.18

21.45

0.98

0.98

11.3%

1.53

1.95

22.09

0.97

0.89

19.5%

0.61

0.83

16.25

0.94

0.91

15.0%

1.14

1.71

25.59

Debt/

Equity

0.00

0.00

0.00

0.01

0.14

0.00

0.00

0.00

0.00

0.17

0.13

0.00

0.00

0.27

0.31

0.28

You might also like

- BetterInvesting Weekly Stock Screen 9-29-14Document1 pageBetterInvesting Weekly Stock Screen 9-29-14BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-7-14Document1 pageBetterInvesting Weekly Stock Screen 4-7-14BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-15-13Document1 pageBetterInvesting Weekly Stock Screen 7-15-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 5-13-13Document1 pageBetterInvesting Weekly Stock Screen 5-13-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-20-14Document1 pageBetterInvesting Weekly Stock Screen 10-20-14BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 1-20-14Document1 pageBetterInvesting Weekly Stock Screen 1-20-14BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 6-17-13Document1 pageBetterInvesting Weekly Stock Screen 6-17-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 2-3-14Document1 pageBetterInvesting Weekly Stock Screen 2-3-14BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-29-13Document1 pageBetterInvesting Weekly Stock Screen 4-29-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 2-24-14Document1 pageBetterInvesting Weekly Stock Screen 2-24-14BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 12-16-13Document1 pageBetterInvesting Weekly Stock Screen 12-16-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 5-27-13Document1 pageBetterInvesting Weekly Stock Screen 5-27-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-6-15Document1 pageBetterInvesting Weekly Stock Screen 4-6-15BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 8-19-13Document1 pageBetterInvesting Weekly Stock Screen 8-19-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 3-3-14Document1 pageBetterInvesting Weekly Stock Screen 3-3-14BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-29-13Document1 pageBetterInvesting Weekly Stock Screen 7-29-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-1-13Document1 pageBetterInvesting Weekly Stock Screen 4-1-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-21-14Document1 pageBetterInvesting Weekly Stock Screen 7-21-14BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 9-23-13Document1 pageBetterInvesting Weekly Stock Screen 9-23-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-20-15Document1 pageBetterInvesting Weekly Stock Screen 7-20-15BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-22-13Document1 pageBetterInvesting Weekly Stock Screen 7-22-13BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-14-14Document1 pageBetterInvesting Weekly Stock Screen 7-14-14BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-2-12Document1 pageBetterInvesting Weekly Stock Screen 7-2-12BetterInvestingNo ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- ListasectoresDocument4 pagesListasectoresManuel ChavezNo ratings yet

- BetterInvesting Weekly Stock Screen 7-28-14Document1 pageBetterInvesting Weekly Stock Screen 7-28-14BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 2-16-15Document1 pageBetterInvesting Weekly Stock Screen 2-16-15BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-10-14Document1 pageBetterInvesting Weekly Stock Screen 11-10-14BetterInvestingNo ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- BetterInvesting Weekly Stock Screen 091012Document6 pagesBetterInvesting Weekly Stock Screen 091012BetterInvestingNo ratings yet

- Conmed Investor Presentation - 2016.08.11Document21 pagesConmed Investor Presentation - 2016.08.11medtechyNo ratings yet

- Ny IndexDocument9 pagesNy IndextalupurumNo ratings yet

- BetterInvesting Weekly Stock Screen 4-20-15Document1 pageBetterInvesting Weekly Stock Screen 4-20-15BetterInvestingNo ratings yet

- U.S.dividendChampions 30042015Document120 pagesU.S.dividendChampions 30042015kamtzompingNo ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- India and US v2.1Document258 pagesIndia and US v2.1Abhiram AdityaNo ratings yet

- BetterInvesting Weekly Stock Screen 3-14-16Document1 pageBetterInvesting Weekly Stock Screen 3-14-16BetterInvestingNo ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- BetterInvesting Weekly Stock Screen 6-29-15Document1 pageBetterInvesting Weekly Stock Screen 6-29-15BetterInvestingNo ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- BetterInvesting Weekly Stock Screen 8-10-15Document1 pageBetterInvesting Weekly Stock Screen 8-10-15BetterInvestingNo ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- BetterInvesting Weekly Stock Screen 10-14-13Document1 pageBetterInvesting Weekly Stock Screen 10-14-13BetterInvestingNo ratings yet

- Alabama JobsDocument2 pagesAlabama JobsaahbuhkuhNo ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- BetterInvesting Weekly Stock Screen 4-14-14Document1 pageBetterInvesting Weekly Stock Screen 4-14-14BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 3-26-12Document3 pagesBetterInvesting Weekly Stock Screen 3-26-12BetterInvestingNo ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- Astrological Trade Recommendations For The Components of The S&P100 IndexDocument2 pagesAstrological Trade Recommendations For The Components of The S&P100 Indexapi-139665491No ratings yet

- BetterInvesting Weekly Stock Screen 11-26-12Document1 pageBetterInvesting Weekly Stock Screen 11-26-12BetterInvestingNo ratings yet

- Copia de GAS Module - 4 Years of Financial DataDocument53 pagesCopia de GAS Module - 4 Years of Financial Dataadrian5pgNo ratings yet

- Stock Up - Overstock - Com UpgradedDocument5 pagesStock Up - Overstock - Com UpgradedValuEngine.comNo ratings yet

- EMRDocument7 pagesEMRShreshtha KanojiaNo ratings yet

- Dental Equipment & Materials World Summary: Market Sector Values & Financials by CountryFrom EverandDental Equipment & Materials World Summary: Market Sector Values & Financials by CountryNo ratings yet

- Surgical, Orthopaedic & Prosthetic Appliances & Supplies World Summary: Market Sector Values & Financials by CountryFrom EverandSurgical, Orthopaedic & Prosthetic Appliances & Supplies World Summary: Market Sector Values & Financials by CountryNo ratings yet

- BetterInvesting Weekly Stock Screen 1-27-2020Document3 pagesBetterInvesting Weekly Stock Screen 1-27-2020BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-7-19Document1 pageBetterInvesting Weekly Stock Screen 10-7-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-11-19Document1 pageBetterInvesting Weekly Stock Screen 11-11-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 9-9-19Document1 pageBetterInvesting Weekly Stock Screen 9-9-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-14-19Document1 pageBetterInvesting Weekly Stock Screen 10-14-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-28-19Document1 pageBetterInvesting Weekly Stock Screen 10-28-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 8-5-19Document1 pageBetterInvesting Weekly Stock Screen 8-5-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-16-18Document1 pageBetterInvesting Weekly Stock Screen 7-16-18BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 10-2-19Document1 pageBetterInvesting Weekly Stock Screen 10-2-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 3-11-19Document1 pageBetterInvesting Weekly Stock Screen 3-11-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 9-2-19Document1 pageBetterInvesting Weekly Stock Screen 9-2-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 7-1-19Document1 pageBetterInvesting Weekly Stock Screen 7-1-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 8-19-19Document1 pageBetterInvesting Weekly Stock Screen 8-19-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 9-23-19Document1 pageBetterInvesting Weekly Stock Screen 9-23-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-22-19Document1 pageBetterInvesting Weekly Stock Screen 4-22-19BetterInvestingNo ratings yet

- Financial Strength Rating Earnings Predictabilit y Price Growth Persistenc e Price Stability Proj High TTL Return Projected EPS Growth 3 To 5 YrDocument2 pagesFinancial Strength Rating Earnings Predictabilit y Price Growth Persistenc e Price Stability Proj High TTL Return Projected EPS Growth 3 To 5 YrBetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 6-24-19Document1 pageBetterInvesting Weekly Stock Screen 6-24-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 6-10-19Document1 pageBetterInvesting Weekly Stock Screen 6-10-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 6-3-19Document1 pageBetterInvesting Weekly Stock Screen 6-3-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-15-19Document1 pageBetterInvesting Weekly Stock Screen 4-15-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 5-16-19Document1 pageBetterInvesting Weekly Stock Screen 5-16-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 5-27-19Document1 pageBetterInvesting Weekly Stock Screen 5-27-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 2-25-19Document1 pageBetterInvesting Weekly Stock Screen 2-25-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 4-9-19Document1 pageBetterInvesting Weekly Stock Screen 4-9-19BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 1-23-19Document1 pageBetterInvesting Weekly Stock Screen 1-23-19BetterInvesting100% (1)

- BetterInvesing Weekly Stock Screen 12-3-18Document1 pageBetterInvesing Weekly Stock Screen 12-3-18BetterInvesting100% (1)

- BetterInvesting Weekly Stock Screen 11-19-18Document1 pageBetterInvesting Weekly Stock Screen 11-19-18BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-5-18Document1 pageBetterInvesting Weekly Stock Screen 11-5-18BetterInvestingNo ratings yet

- BetterInvesting Weekly Stock Screen 11-12-18Document1 pageBetterInvesting Weekly Stock Screen 11-12-18BetterInvestingNo ratings yet