Professional Documents

Culture Documents

Waiver Request of Ineligible Issuer Status Under Rule 405 of The Securities Act

Waiver Request of Ineligible Issuer Status Under Rule 405 of The Securities Act

Uploaded by

Mark ReinhardtCopyright:

Available Formats

You might also like

- Entrepreneurial Finance 5th Edition Leach Solutions Manual Full Chapter PDFDocument34 pagesEntrepreneurial Finance 5th Edition Leach Solutions Manual Full Chapter PDFinverse.zinkthxzut100% (15)

- LLC Membership Interest Purchase AgreementDocument16 pagesLLC Membership Interest Purchase AgreementChristopher GonzalezNo ratings yet

- FAS 140 Setoff Isolation Letter 51004 PDFDocument15 pagesFAS 140 Setoff Isolation Letter 51004 PDFMikhael Yah-Shah Dean: Veilour100% (1)

- Vallar ProspectusDocument720 pagesVallar ProspectusdeanmaitNo ratings yet

- Platform Acquisition ProspectusDocument128 pagesPlatform Acquisition Prospectusathompson14No ratings yet

- Wells Far Go 120911Document5 pagesWells Far Go 120911Mark ReinhardtNo ratings yet

- Adverse Claims Under The Uniform Commercial Code - A Survey and PR PDFDocument39 pagesAdverse Claims Under The Uniform Commercial Code - A Survey and PR PDFblcksourceNo ratings yet

- Sec Form DDocument5 pagesSec Form DPando DailyNo ratings yet

- Rule 144Document7 pagesRule 144JoelMFunk100% (1)

- VCPEFdeskbook - SecuritiesLawOverview (Morgan Lewis)Document6 pagesVCPEFdeskbook - SecuritiesLawOverview (Morgan Lewis)pyrosriderNo ratings yet

- Form 211 - SEC Rule 15c2-11 Proposal - Brenda Hamilton Esq.Document5 pagesForm 211 - SEC Rule 15c2-11 Proposal - Brenda Hamilton Esq.BrendaHamiltonNo ratings yet

- Bloomberg: Bloomberg L.P. 731 Lexington Avenue Tel +12123182000 New York, NY 10022Document4 pagesBloomberg: Bloomberg L.P. 731 Lexington Avenue Tel +12123182000 New York, NY 10022MarketsWikiNo ratings yet

- Crowdfunding Regulation SummaryDocument25 pagesCrowdfunding Regulation SummaryAnonymous ukqEbKTNo ratings yet

- Proposed Changes To Definition of Dealer and Government Securities DealerDocument2 pagesProposed Changes To Definition of Dealer and Government Securities DealerAbdelmadjid djibrineNo ratings yet

- Lamprell ProspDocument165 pagesLamprell ProspdjvhNo ratings yet

- Petitioner Vs Vs Respondents: Second DivisionDocument5 pagesPetitioner Vs Vs Respondents: Second DivisionFrance SanchezNo ratings yet

- United States Securities RegulationDocument14 pagesUnited States Securities RegulationAntonia AmpireNo ratings yet

- Via Electronic Submission To: Comments@Sec - Gov: With A Copy ToDocument10 pagesVia Electronic Submission To: Comments@Sec - Gov: With A Copy ToMarketsWikiNo ratings yet

- Via Electronic Mail: Federal Register 62718, October 13, 2010Document4 pagesVia Electronic Mail: Federal Register 62718, October 13, 2010MarketsWikiNo ratings yet

- RSB RA 8799 LectureDocument4 pagesRSB RA 8799 LectureJave Mike AtonNo ratings yet

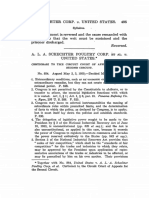

- 05-033 A.L.A. Schechter Poultry Corp. v. United States (Excerpted)Document34 pages05-033 A.L.A. Schechter Poultry Corp. v. United States (Excerpted)Enrique Julian EspinoNo ratings yet

- Service LL Usrep Usrep295 Usrep295495 Usrep295495Document61 pagesService LL Usrep Usrep295 Usrep295495 Usrep295495Esther MozoNo ratings yet

- 10 55 Subversive UnusualWhalesETFs 485B SAI NANCDocument55 pages10 55 Subversive UnusualWhalesETFs 485B SAI NANCechovictory39No ratings yet

- Via Web Submission: (WWW - Sec.gov)Document5 pagesVia Web Submission: (WWW - Sec.gov)MarketsWikiNo ratings yet

- Calpers: Investment OfficeDocument3 pagesCalpers: Investment OfficeMarketsWikiNo ratings yet

- 118 - Fleischer V Botica NolascoDocument3 pages118 - Fleischer V Botica Nolascomimiyuki_No ratings yet

- 2014.01.31 SEC No Action Letter Re M&A BrokersDocument14 pages2014.01.31 SEC No Action Letter Re M&A BrokersJoe WallinNo ratings yet

- UntitledDocument4 pagesUntitledapi-249785899No ratings yet

- G.R. No. 135808 ESCRADocument81 pagesG.R. No. 135808 ESCRASta Maria JamesNo ratings yet

- Issue of Prospectus2023Document16 pagesIssue of Prospectus2023TasmineNo ratings yet

- The Business Development Company SolutionDocument7 pagesThe Business Development Company SolutionRodney SampsonNo ratings yet

- Entrepreneurial Finance 4th Edition Leach Solutions Manual Full Chapter PDFDocument33 pagesEntrepreneurial Finance 4th Edition Leach Solutions Manual Full Chapter PDFinverse.zinkthxzut100% (17)

- Checklist On Fixed Income Securities FinalDocument15 pagesChecklist On Fixed Income Securities FinalmayorladNo ratings yet

- Admission Document Devolver Digital IncDocument186 pagesAdmission Document Devolver Digital IncMax PonoroffNo ratings yet

- Morgan Lewis Private Offering Dos and Dont'sDocument6 pagesMorgan Lewis Private Offering Dos and Dont'sB.C. MoonNo ratings yet

- Transcript SEC Fundamentals Part 1Document10 pagesTranscript SEC Fundamentals Part 1archanaanuNo ratings yet

- Legal Opinion of Thomas C. Cook and Associates, LTDDocument5 pagesLegal Opinion of Thomas C. Cook and Associates, LTDponticarlo7658No ratings yet

- Comments on the SEC's Proposed Rules for Regulation CrowdfundingFrom EverandComments on the SEC's Proposed Rules for Regulation CrowdfundingNo ratings yet

- Deutsche Bank: Consistent RulemakingDocument14 pagesDeutsche Bank: Consistent RulemakingMarketsWikiNo ratings yet

- Tanada V Angara: Will Result in The Dismissal of The PetitionDocument1 pageTanada V Angara: Will Result in The Dismissal of The PetitionDudly RiosNo ratings yet

- Tightening The Vise Grip On Private Funds: The Private Fund Investment Advisers Registration Act of 2010Document4 pagesTightening The Vise Grip On Private Funds: The Private Fund Investment Advisers Registration Act of 2010Trần HườngNo ratings yet

- By E-Mail: Rule-Comments@sec - GovDocument12 pagesBy E-Mail: Rule-Comments@sec - GovMarketsWikiNo ratings yet

- 6B. 2017 VC Report LetterDocument22 pages6B. 2017 VC Report LetterpyrosriderNo ratings yet

- TIKTOKBANDocument8 pagesTIKTOKBANyorbelizcohenNo ratings yet

- People v. Rosenthal & OsmenaDocument3 pagesPeople v. Rosenthal & OsmenaBoy Omar Garangan DatudaculaNo ratings yet

- Platform Acquisition Holdings Final Prospectus 2013-5-17Document128 pagesPlatform Acquisition Holdings Final Prospectus 2013-5-17athompson14No ratings yet

- Advocates For Truth v. BSP (2013)Document3 pagesAdvocates For Truth v. BSP (2013)Imee CallaoNo ratings yet

- Chap 8 SolutionsDocument8 pagesChap 8 SolutionsMiftahudin MiftahudinNo ratings yet

- GAO Study - Securities Fraud Liability of Secondary ActorsDocument47 pagesGAO Study - Securities Fraud Liability of Secondary ActorsVanessa SchoenthalerNo ratings yet

- Federalregister 020912 BDocument197 pagesFederalregister 020912 BMarketsWikiNo ratings yet

- Via Electronic Mail at Rule-Comments@sec - GovDocument11 pagesVia Electronic Mail at Rule-Comments@sec - GovCrowdfundInsiderNo ratings yet

- CryptoindexWP1 0Document139 pagesCryptoindexWP1 0mdazhar.maa85No ratings yet

- Wachoviabank120911 3bDocument5 pagesWachoviabank120911 3bMark ReinhardtNo ratings yet

- O Republic vs. SandiganbayanDocument3 pagesO Republic vs. SandiganbayanmlicudineNo ratings yet

- Ule 504/small Company Offering Registration ("SCOR")Document7 pagesUle 504/small Company Offering Registration ("SCOR")Douglas SlainNo ratings yet

- Loyola Grand Villas Homeowners (South) Association Inc. Vs Hon. CA, Home Insurance and Guaranty Corp., Encarnacion & AycardoDocument10 pagesLoyola Grand Villas Homeowners (South) Association Inc. Vs Hon. CA, Home Insurance and Guaranty Corp., Encarnacion & Aycardotalla aldoverNo ratings yet

- Proposed Rules Governing Regulation CrowdfundingFrom EverandProposed Rules Governing Regulation CrowdfundingNo ratings yet

- Raising Money – Legally: A Practical Guide to Raising CapitalFrom EverandRaising Money – Legally: A Practical Guide to Raising CapitalRating: 4 out of 5 stars4/5 (1)

- 43Document12 pages43Mark ReinhardtNo ratings yet

- 6Document5 pages6Mark ReinhardtNo ratings yet

- 7Document6 pages7Mark ReinhardtNo ratings yet

- 18Document23 pages18Mark ReinhardtNo ratings yet

- 14Document7 pages14Mark ReinhardtNo ratings yet

- 8Document4 pages8Mark ReinhardtNo ratings yet

- Large Bank Assets (Federal Reserve) 2023Document103 pagesLarge Bank Assets (Federal Reserve) 2023Mark ReinhardtNo ratings yet

- 10Document4 pages10Mark ReinhardtNo ratings yet

- 17Document8 pages17Mark ReinhardtNo ratings yet

- 3Document4 pages3Mark ReinhardtNo ratings yet

- MMCP CY2023 Idaho Blue Cross Medicaid ContractDocument185 pagesMMCP CY2023 Idaho Blue Cross Medicaid ContractMark ReinhardtNo ratings yet

- 13Document3 pages13Mark ReinhardtNo ratings yet

- 15Document5 pages15Mark ReinhardtNo ratings yet

- 20221230final Order No 35651Document5 pages20221230final Order No 35651Mark ReinhardtNo ratings yet

- 9Document3 pages9Mark ReinhardtNo ratings yet

- Patrol LP Scenario04 July2021Document24 pagesPatrol LP Scenario04 July2021Mark ReinhardtNo ratings yet

- Patrol LP Scenario03 July2021Document25 pagesPatrol LP Scenario03 July2021Mark ReinhardtNo ratings yet

- Crime Scene Manual Rev3Document153 pagesCrime Scene Manual Rev3Mark ReinhardtNo ratings yet

- H0001Document2 pagesH0001Mark ReinhardtNo ratings yet

- WW Idaho Power Co. - Natural Gas Plant Cooling Water Draft PermitDocument27 pagesWW Idaho Power Co. - Natural Gas Plant Cooling Water Draft PermitMark ReinhardtNo ratings yet

- Sustainability of Idaho's Direct Care Workforce (Idaho Office of Performance Evaluations)Document80 pagesSustainability of Idaho's Direct Care Workforce (Idaho Office of Performance Evaluations)Mark ReinhardtNo ratings yet

- A Bill: 116 Congress 2 SDocument15 pagesA Bill: 116 Congress 2 SMark ReinhardtNo ratings yet

- Bills 113s987rsDocument44 pagesBills 113s987rsMark ReinhardtNo ratings yet

- A Bill: 117 Congress 1 SDocument22 pagesA Bill: 117 Congress 1 SMark ReinhardtNo ratings yet

- City of Boise Housing Bonus Ordinance and Zoning Code Rewrite MemoDocument11 pagesCity of Boise Housing Bonus Ordinance and Zoning Code Rewrite MemoMark ReinhardtNo ratings yet

- Working Agreement Among The Company and All Employers / StaffDocument1 pageWorking Agreement Among The Company and All Employers / StaffTeeVee ThailandNo ratings yet

- 23-NATIO1499973.pdf Certificate of InsuranceDocument2 pages23-NATIO1499973.pdf Certificate of InsuranceCOASTNo ratings yet

- 05 - G.O. Ms. No. 526Document4 pages05 - G.O. Ms. No. 526Syed AzmathNo ratings yet

- b1. People Vs GatarinDocument23 pagesb1. People Vs GatarinBrenda WayneNo ratings yet

- Reading 101Document1 pageReading 101Mc SuanNo ratings yet

- Jusayan V SombillaDocument2 pagesJusayan V SombillaBeverlyn Jamison0% (1)

- Dr. Phylis Rio v. Colegio de Sta. Rosa-Makati And/or Sr. Marilyn Gustilo G.R. No. 189629, August 06, 2014Document2 pagesDr. Phylis Rio v. Colegio de Sta. Rosa-Makati And/or Sr. Marilyn Gustilo G.R. No. 189629, August 06, 2014mrlouiemabalotNo ratings yet

- Consti ListDocument6 pagesConsti ListAisha AhamadNo ratings yet

- Co Ownership DigestsDocument24 pagesCo Ownership Digestsmelaniem_1No ratings yet

- 20-Cv-1666 - Unicorn Order - Art Ask Agency 3-18-20Document3 pages20-Cv-1666 - Unicorn Order - Art Ask Agency 3-18-20joshua mayes0% (1)

- Thesis StatementDocument6 pagesThesis StatementDillan McNishNo ratings yet

- DigestDocument8 pagesDigestThata ThataNo ratings yet

- 6 - Appendices-Different FormsDocument9 pages6 - Appendices-Different FormschakmrinalNo ratings yet

- Cda Memorandum Circular 2015-09Document32 pagesCda Memorandum Circular 2015-09Jing Sagittarius100% (2)

- Affidavit of Adjoining Owners - Teresita GuceDocument3 pagesAffidavit of Adjoining Owners - Teresita Gucesld20100% (1)

- Bài Tập Học Kỳ: Môn: Tiếng Anh Pháp Lý 1Document10 pagesBài Tập Học Kỳ: Môn: Tiếng Anh Pháp Lý 1Mai Khanh Bùi ThịNo ratings yet

- Adharsitha: Center of Rehabilitation For Sex Workers and Children in MumbaiDocument10 pagesAdharsitha: Center of Rehabilitation For Sex Workers and Children in MumbaiRahul SaseendranNo ratings yet

- Comparative Corporate LawDocument76 pagesComparative Corporate LawzeenatmasoodiNo ratings yet

- Federal Lawsuit Holly RidgeDocument20 pagesFederal Lawsuit Holly RidgeMichael PraatsNo ratings yet

- Differences of Diplomacy, Litigation, Arbitration, and AdrDocument2 pagesDifferences of Diplomacy, Litigation, Arbitration, and AdrUtty F. SeieiNo ratings yet

- THE CONSTITUTION OF PAKISTAN 1956 and The Reasons For Its FailureDocument3 pagesTHE CONSTITUTION OF PAKISTAN 1956 and The Reasons For Its FailureZenab MohammadNo ratings yet

- PP V ComadreDocument1 pagePP V ComadrekhailcalebNo ratings yet

- In The Supreme Court of IndiaDocument19 pagesIn The Supreme Court of IndiaJai VermaNo ratings yet

- Beneficiality SpeechDocument3 pagesBeneficiality SpeechKylleJames VillasisNo ratings yet

- LETTER Re APPLICATION FOR AMICUS CURIE IN THE CASE OF SIRHAN SIRHAN FOR THE Inter-American Commission On Human Rights AUGUST 8, 2017Document29 pagesLETTER Re APPLICATION FOR AMICUS CURIE IN THE CASE OF SIRHAN SIRHAN FOR THE Inter-American Commission On Human Rights AUGUST 8, 2017Stan J. CaterboneNo ratings yet

- Dsnlu Final DraftDocument16 pagesDsnlu Final DraftMD SABEEH AHMADNo ratings yet

- Caasi vs. Comelec, GR No. 88831Document5 pagesCaasi vs. Comelec, GR No. 88831Naiza De los SantosNo ratings yet

- Family Pension FormatDocument7 pagesFamily Pension FormatAparna KaleNo ratings yet

- Process of Registration of DealingsDocument13 pagesProcess of Registration of DealingsAizat Lukman Bin JohanNo ratings yet

- Continue Guarantee Means A Guarantee Which Extends To A Series of Transactions. This IsDocument4 pagesContinue Guarantee Means A Guarantee Which Extends To A Series of Transactions. This Ispaco kazunguNo ratings yet

Waiver Request of Ineligible Issuer Status Under Rule 405 of The Securities Act

Waiver Request of Ineligible Issuer Status Under Rule 405 of The Securities Act

Uploaded by

Mark ReinhardtOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Waiver Request of Ineligible Issuer Status Under Rule 405 of The Securities Act

Waiver Request of Ineligible Issuer Status Under Rule 405 of The Securities Act

Uploaded by

Mark ReinhardtCopyright:

Available Formats

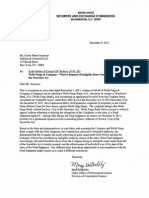

UNITED STATES

@

SECURITIES AND EXCHANGE COMMISSION

a WASHINGTON, D.C. 20549

?4r

March12,2007

DIVISION OF

CORPORATION FINANCE

Mr.MichaelA.DiGregorio

SeniorVicePresident& GeneralCounsel

WilmingtonTrustCompany

RodneySquareNorth

1 100NorthMarketStreet

Wilmington,DE 19890-0001

Re: InthematterofAuctionRateSecuritiesPractices(HO-09954),WilmingtonTrust

Company

Waiver Request of Ineligible Issuer Status under Rule 405 of the Securities

Act

DearMr.DiGregorio:

ThisisinresponsetoyourletterdatedDecember13,2006,writtenonbehalfof

WilmingtonTrustCorporation(Company)anditssubsidiaryWilmingtonTrustCompany

(WTC)andconstitutinganapplicationforrelieffromtheCompanyandWTCbeing

considered"ineligibleissuers"underRule405(l)(vi)oftheSecuritiesActof1933

(SecuritiesAct). TheCompanyandWTCrequestrelieffrombeingconsideredineligible

issuersunderRule405,duetotheentryonJanuary9,2007,ofaCommissionOrder

(Order)pursuanttoSection8AoftheSecuritiesActof1933(SecuritiesAct)naming

WTCasarespondent.TheOrderfinds,amongotherthings,thatWTCcausedviolations

ofSection17(a)(2)oftheSecuritiesAct.

Basedonthefactsandrepresentationsinyourletter,andassumingtheCompanyand

WTCcomplywiththeOrder,theCommission,pursuanttodelegatedauthorityhas

determinedthattheCompanyhasmadeashowingofgoodcauseunderRule405(2)and

thattheCompanyandWTCwillnotbeconsideredineligibleissuersbyreasonofthe

entryoftheOrder.Accordingly,thereliefdescribedabovefromtheCompanyandWTC

beingineligibleissuersunderRule405oftheSecuritiesActisherebygrantedandthe

dateofeffectivenessofthewaiverisJanuary9,2007. Anydifferentfactsfromthose

representedornon-compliancewiththeOrdermightrequireustoreachadifferent

conclusion.

Sincerely,

T??f MaryKosterlitz &@t$

Chief,OfficeofEnforcementLiaison

DivisionofCorporationFinance

WILMINGTON

Wilmington Trust Corporation

b ' TRUST

Rodney Square North

11 00 North Market Street

Wilmington, DE 19890-0001

December 13,2006

ViaFederalExpress

MaryKosterlitz,Esq.

ChiefoftheOfficeofEnforcementLiaison

DivisionofCorporationFinance

SecuritiesandExchangeCommission

100FStreet,N.E.

Washington,D.C. 20549

Re: IntheMatterofAuctionRateSecuritiesPractices,

FileNo.HO-09954(WilmingtonTrustCompany)

DearMs.Kosterlitz:

Iamwritingonbehalfofmyclient,WilmingtonTrustCorporation("WL"),

anditssubsidiary,WilmingtonTrustCompany("WTC"), whichisarespondentinthe

above-referencedinvestigationcommencedbytheSecuritiesandExchangeCommission

(the"Commission"). Theinvestigationrelatestocertainpracticesinvolvingauction-rate

securities. Twootherauctionagentsarealsorespondentsinthisproceedingand,together

withWTC,arenegotiatingasettlementwiththeDivisionofEnforcement.

Iherebyrequest,pursuanttoamendedRule405undertheSecuritiesActof

1933(the"SecuritiesAct"), thattheDivisionofCorporationFinance,onbehalfofthe

Commission,determinethatWL,WTCshallnotbeconsidered"ineligibleissuers"as

definedinRule405asaresultoftheproposedordertobeenteredintheabove-referenced

investigation,asdescribedbelow. Irequestthatthisdeterminationbemadeeffectiveupon

entryoftheproposedorder. IunderstandthattheDivisionofEnforcementdoesnotobject

tosuchdetermination.

BACKGROUND

Inconnectionwiththeabove-referencedproceeding,whichwasbrought

pursuanttoSection8AoftheSecuritiesAct,WTCandtheDivisionofEnforcementhave

reachedanagreementinprincipletosettlethematterasdescribedbelow,andWTCexpects

tosubmittotheCommissionanofferofsettlementinwhich,forthepurposeofthis

proceeding,itwillconsenttotheentryofanorderbytheCommission(the"Order") without

admittingordenyingthematterssetforthintheOrder(exceptastothejurisdiction ofthe

Commissionandthesubjectmatteroftheproceeding).

IntheOrder,theCommissionwillmakefindings,withoutadmissionor

denialbyWTC,thatWTCcausedviolationsofSection17(a)(2)oftheSecuritiesActin

connectionwithcertainpracticesrelatingtoauction-ratesecurities. Basedonthesefindings,

I

Mary Kosterlitz, Esq. -2-

the Order will require WTC to cease and desist from committing or causing any current or

future violations of Section 17(a)(2) and to pay a civil money penalty of $100,000.

DISCUSSION

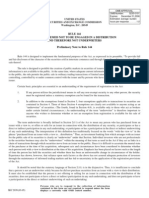

Under a number of Securities Act rules that became effective on December 1,

2005, a company that qualifies as a "well-known seasoned issuer" as defined in Rule 405

will be eligible, among other things, to register securities for offer and sale under an

"automatic shelf registration statement," as so defined, and to have the benefits of a

streamlined registration process under the Securities Act. Companies that qualify as well-

known seasoned issuers will be entitled to conduct registered offerings more easily and with

substantially fewer restrictions. Pursuant to Rule 405, however, a company cannot qualify

as a "well-known seasoned issuer" if it is an "ineligible issuer." Similarly, the new

Securities Act rules will permit an issuer and other offering participants to communicate

more freely during registered offerings by using free-writing prospectuses, but only if the

issuer is not an "ineligible issuer."' Thus, being an ineligible issuer will disqualify an issuer

from a number of significant benefits under the new rules.

Rule 405 defines "ineligible issuer" to include any issuer of securities with

respect to which the following is true: "Within the past three years . . ., the issuer or any

entity that at the time was a subsidiary of the issuer was made the subject of any . . .

administrative . . . order arising out of a governmental action that . . . [rlequires that the

person cease and desist from violating the anti-fraud provisions of the federal securities

laws." Notwithstanding the foregoing, paragraph (2) of the definition provides that an issuer

"shall not be an ineligible issuer if the Commission determines, upon a showing of good

cause, that it is not necessary under the circumstances that the issuer be considered an

ineligible issuer." The Commission has delegated authority to the Division of Corporation

Finance to grant waivers fiom any of the ineligibility provisions of this defi ni t i ~n. ~

Being an ineligible issuer will disqualify an issuer under the definition of "well-known seasoned

issuer," thereby preventing the issuer from using an automatic shelf registration statement (see

new Rule 405) and limiting its ability to communicate with the market prior to filing a

registration statement (see new Rule 163). In addition, being an "ineligible issuer" will

disqualify an issuer, whether or not it is a well-known seasoned issuer, under new Rules 164 and

433, thereby preventing the issuer and other offering participants from using free-writing

prospectuses during registered offerings of its securities. Consequently, this request for relief is

being made not only for the purpose of qualifying as a "well-known seasoned issuer" but for all

purposes of the definition of "ineligible issuer" in Rule 405 -i.e., for whatever purpose the

definition may now or hereafter be used under the federal securities laws, including SEC rules.

See 17 C.F.R. 5 200.30-1. See also note 215 in Release No. 33-8591 (July 19,2005).

Mary Kosterlitz, Esq. -3-

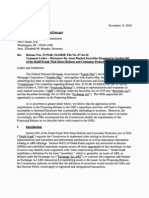

The Order might be deemed to be an administrative order of the kind that

would result in WL, as well as WTC, becoming an ineligible issuer for a period of three

years after the Order is entered. This result would preclude WL (and such other entities)

from qualifying as a well-known seasoned issuer and having the benefit of automatic shelf

registration and other provisions of the new rules for three years. This would be a

significant detriment for WL. WL is a frequent issuer of registered securities. For WL, the

shelf registration process provides an important means of access to the U.S. capital markets,

and these markets are an essential source of funding for the company's operations.

Consequently, automatic shelf registration and the other benefits available to a well-known

seasoned issuer will be significant for WL.

As described above, Rule 405 authorizes the Commission to determine that a

company shall not be an ineligible issuer, notwithstanding that the company becomes

subject to an otherwise disqualifying administrative order. WL and WTC believe that there

is good cause, in their case, for the Commission to make such a determination with respect

to the Order on the following grounds.

1. The conduct at issue to be addresses in the Order does not relate to

disclosures and offerings of securities by WL of WTC.

2. WL and WTC have a strong record of compliance with the securities

laws and voluntarily cooperated with the Division of Enforcement's inquiry into this matter.

WTC also has implemented policies and procedures designed to help prevent recurrence of

the conduct that is the subject of the.Order.

3. Disqualification of WL or WTC as an ineligible issuer would be

unduly and disproportionately severe. The Order will require WTC to pay a civil money

penalty of $100,000. Making WL an ineligible issuer would result in an additional penalty

beyond what the Order requires.

4. Disqualification of WL or WTC as an ineligible issuer also would be

unduly and disproportionately severe given the nature of the violation found in the Order.

Instead, the alleged conduct relates primarily to auction agents' conduct of auctions of

auction rate securities in ways that were not adequately disclosed or that did not conform to

the disclosed procedures.

In light of the foregoing, I believe that disqualification of WL, WTC or any

of their affiliates as an ineligible issuer is not necessary under the circumstances, either in

the public interest or for the protection of investors, and that WL and WTC have shown

good cause for the requested relief to be granted. Accordingly, I respectfully request that the

Division of Corporation Finance, on behalf of the Commission, pursuant to Rule 405,

determine that it is not necessary under the circumstances that WL, WTC or any of their

Mary Kosterlitz, Esq. -4-

affiliates be an "ineligible issuer" within the meaning of Rule 405 as a result of the Order. I

request that this determination be made for all purposes of the definition of "ineligible

issuer," however it may now or hereafter be used under the federal securities laws and the

rules thereunder.

If you have any questions regarding this request, please contact the

undersigned.

Sincerely,

Michael A. ~ i ~ r e ~ o r i %

Senior Vice President & General Counsel

(302) 65 1-8793 direct dial

mdigregorio@wilmingtontrust.com

You might also like

- Entrepreneurial Finance 5th Edition Leach Solutions Manual Full Chapter PDFDocument34 pagesEntrepreneurial Finance 5th Edition Leach Solutions Manual Full Chapter PDFinverse.zinkthxzut100% (15)

- LLC Membership Interest Purchase AgreementDocument16 pagesLLC Membership Interest Purchase AgreementChristopher GonzalezNo ratings yet

- FAS 140 Setoff Isolation Letter 51004 PDFDocument15 pagesFAS 140 Setoff Isolation Letter 51004 PDFMikhael Yah-Shah Dean: Veilour100% (1)

- Vallar ProspectusDocument720 pagesVallar ProspectusdeanmaitNo ratings yet

- Platform Acquisition ProspectusDocument128 pagesPlatform Acquisition Prospectusathompson14No ratings yet

- Wells Far Go 120911Document5 pagesWells Far Go 120911Mark ReinhardtNo ratings yet

- Adverse Claims Under The Uniform Commercial Code - A Survey and PR PDFDocument39 pagesAdverse Claims Under The Uniform Commercial Code - A Survey and PR PDFblcksourceNo ratings yet

- Sec Form DDocument5 pagesSec Form DPando DailyNo ratings yet

- Rule 144Document7 pagesRule 144JoelMFunk100% (1)

- VCPEFdeskbook - SecuritiesLawOverview (Morgan Lewis)Document6 pagesVCPEFdeskbook - SecuritiesLawOverview (Morgan Lewis)pyrosriderNo ratings yet

- Form 211 - SEC Rule 15c2-11 Proposal - Brenda Hamilton Esq.Document5 pagesForm 211 - SEC Rule 15c2-11 Proposal - Brenda Hamilton Esq.BrendaHamiltonNo ratings yet

- Bloomberg: Bloomberg L.P. 731 Lexington Avenue Tel +12123182000 New York, NY 10022Document4 pagesBloomberg: Bloomberg L.P. 731 Lexington Avenue Tel +12123182000 New York, NY 10022MarketsWikiNo ratings yet

- Crowdfunding Regulation SummaryDocument25 pagesCrowdfunding Regulation SummaryAnonymous ukqEbKTNo ratings yet

- Proposed Changes To Definition of Dealer and Government Securities DealerDocument2 pagesProposed Changes To Definition of Dealer and Government Securities DealerAbdelmadjid djibrineNo ratings yet

- Lamprell ProspDocument165 pagesLamprell ProspdjvhNo ratings yet

- Petitioner Vs Vs Respondents: Second DivisionDocument5 pagesPetitioner Vs Vs Respondents: Second DivisionFrance SanchezNo ratings yet

- United States Securities RegulationDocument14 pagesUnited States Securities RegulationAntonia AmpireNo ratings yet

- Via Electronic Submission To: Comments@Sec - Gov: With A Copy ToDocument10 pagesVia Electronic Submission To: Comments@Sec - Gov: With A Copy ToMarketsWikiNo ratings yet

- Via Electronic Mail: Federal Register 62718, October 13, 2010Document4 pagesVia Electronic Mail: Federal Register 62718, October 13, 2010MarketsWikiNo ratings yet

- RSB RA 8799 LectureDocument4 pagesRSB RA 8799 LectureJave Mike AtonNo ratings yet

- 05-033 A.L.A. Schechter Poultry Corp. v. United States (Excerpted)Document34 pages05-033 A.L.A. Schechter Poultry Corp. v. United States (Excerpted)Enrique Julian EspinoNo ratings yet

- Service LL Usrep Usrep295 Usrep295495 Usrep295495Document61 pagesService LL Usrep Usrep295 Usrep295495 Usrep295495Esther MozoNo ratings yet

- 10 55 Subversive UnusualWhalesETFs 485B SAI NANCDocument55 pages10 55 Subversive UnusualWhalesETFs 485B SAI NANCechovictory39No ratings yet

- Via Web Submission: (WWW - Sec.gov)Document5 pagesVia Web Submission: (WWW - Sec.gov)MarketsWikiNo ratings yet

- Calpers: Investment OfficeDocument3 pagesCalpers: Investment OfficeMarketsWikiNo ratings yet

- 118 - Fleischer V Botica NolascoDocument3 pages118 - Fleischer V Botica Nolascomimiyuki_No ratings yet

- 2014.01.31 SEC No Action Letter Re M&A BrokersDocument14 pages2014.01.31 SEC No Action Letter Re M&A BrokersJoe WallinNo ratings yet

- UntitledDocument4 pagesUntitledapi-249785899No ratings yet

- G.R. No. 135808 ESCRADocument81 pagesG.R. No. 135808 ESCRASta Maria JamesNo ratings yet

- Issue of Prospectus2023Document16 pagesIssue of Prospectus2023TasmineNo ratings yet

- The Business Development Company SolutionDocument7 pagesThe Business Development Company SolutionRodney SampsonNo ratings yet

- Entrepreneurial Finance 4th Edition Leach Solutions Manual Full Chapter PDFDocument33 pagesEntrepreneurial Finance 4th Edition Leach Solutions Manual Full Chapter PDFinverse.zinkthxzut100% (17)

- Checklist On Fixed Income Securities FinalDocument15 pagesChecklist On Fixed Income Securities FinalmayorladNo ratings yet

- Admission Document Devolver Digital IncDocument186 pagesAdmission Document Devolver Digital IncMax PonoroffNo ratings yet

- Morgan Lewis Private Offering Dos and Dont'sDocument6 pagesMorgan Lewis Private Offering Dos and Dont'sB.C. MoonNo ratings yet

- Transcript SEC Fundamentals Part 1Document10 pagesTranscript SEC Fundamentals Part 1archanaanuNo ratings yet

- Legal Opinion of Thomas C. Cook and Associates, LTDDocument5 pagesLegal Opinion of Thomas C. Cook and Associates, LTDponticarlo7658No ratings yet

- Comments on the SEC's Proposed Rules for Regulation CrowdfundingFrom EverandComments on the SEC's Proposed Rules for Regulation CrowdfundingNo ratings yet

- Deutsche Bank: Consistent RulemakingDocument14 pagesDeutsche Bank: Consistent RulemakingMarketsWikiNo ratings yet

- Tanada V Angara: Will Result in The Dismissal of The PetitionDocument1 pageTanada V Angara: Will Result in The Dismissal of The PetitionDudly RiosNo ratings yet

- Tightening The Vise Grip On Private Funds: The Private Fund Investment Advisers Registration Act of 2010Document4 pagesTightening The Vise Grip On Private Funds: The Private Fund Investment Advisers Registration Act of 2010Trần HườngNo ratings yet

- By E-Mail: Rule-Comments@sec - GovDocument12 pagesBy E-Mail: Rule-Comments@sec - GovMarketsWikiNo ratings yet

- 6B. 2017 VC Report LetterDocument22 pages6B. 2017 VC Report LetterpyrosriderNo ratings yet

- TIKTOKBANDocument8 pagesTIKTOKBANyorbelizcohenNo ratings yet

- People v. Rosenthal & OsmenaDocument3 pagesPeople v. Rosenthal & OsmenaBoy Omar Garangan DatudaculaNo ratings yet

- Platform Acquisition Holdings Final Prospectus 2013-5-17Document128 pagesPlatform Acquisition Holdings Final Prospectus 2013-5-17athompson14No ratings yet

- Advocates For Truth v. BSP (2013)Document3 pagesAdvocates For Truth v. BSP (2013)Imee CallaoNo ratings yet

- Chap 8 SolutionsDocument8 pagesChap 8 SolutionsMiftahudin MiftahudinNo ratings yet

- GAO Study - Securities Fraud Liability of Secondary ActorsDocument47 pagesGAO Study - Securities Fraud Liability of Secondary ActorsVanessa SchoenthalerNo ratings yet

- Federalregister 020912 BDocument197 pagesFederalregister 020912 BMarketsWikiNo ratings yet

- Via Electronic Mail at Rule-Comments@sec - GovDocument11 pagesVia Electronic Mail at Rule-Comments@sec - GovCrowdfundInsiderNo ratings yet

- CryptoindexWP1 0Document139 pagesCryptoindexWP1 0mdazhar.maa85No ratings yet

- Wachoviabank120911 3bDocument5 pagesWachoviabank120911 3bMark ReinhardtNo ratings yet

- O Republic vs. SandiganbayanDocument3 pagesO Republic vs. SandiganbayanmlicudineNo ratings yet

- Ule 504/small Company Offering Registration ("SCOR")Document7 pagesUle 504/small Company Offering Registration ("SCOR")Douglas SlainNo ratings yet

- Loyola Grand Villas Homeowners (South) Association Inc. Vs Hon. CA, Home Insurance and Guaranty Corp., Encarnacion & AycardoDocument10 pagesLoyola Grand Villas Homeowners (South) Association Inc. Vs Hon. CA, Home Insurance and Guaranty Corp., Encarnacion & Aycardotalla aldoverNo ratings yet

- Proposed Rules Governing Regulation CrowdfundingFrom EverandProposed Rules Governing Regulation CrowdfundingNo ratings yet

- Raising Money – Legally: A Practical Guide to Raising CapitalFrom EverandRaising Money – Legally: A Practical Guide to Raising CapitalRating: 4 out of 5 stars4/5 (1)

- 43Document12 pages43Mark ReinhardtNo ratings yet

- 6Document5 pages6Mark ReinhardtNo ratings yet

- 7Document6 pages7Mark ReinhardtNo ratings yet

- 18Document23 pages18Mark ReinhardtNo ratings yet

- 14Document7 pages14Mark ReinhardtNo ratings yet

- 8Document4 pages8Mark ReinhardtNo ratings yet

- Large Bank Assets (Federal Reserve) 2023Document103 pagesLarge Bank Assets (Federal Reserve) 2023Mark ReinhardtNo ratings yet

- 10Document4 pages10Mark ReinhardtNo ratings yet

- 17Document8 pages17Mark ReinhardtNo ratings yet

- 3Document4 pages3Mark ReinhardtNo ratings yet

- MMCP CY2023 Idaho Blue Cross Medicaid ContractDocument185 pagesMMCP CY2023 Idaho Blue Cross Medicaid ContractMark ReinhardtNo ratings yet

- 13Document3 pages13Mark ReinhardtNo ratings yet

- 15Document5 pages15Mark ReinhardtNo ratings yet

- 20221230final Order No 35651Document5 pages20221230final Order No 35651Mark ReinhardtNo ratings yet

- 9Document3 pages9Mark ReinhardtNo ratings yet

- Patrol LP Scenario04 July2021Document24 pagesPatrol LP Scenario04 July2021Mark ReinhardtNo ratings yet

- Patrol LP Scenario03 July2021Document25 pagesPatrol LP Scenario03 July2021Mark ReinhardtNo ratings yet

- Crime Scene Manual Rev3Document153 pagesCrime Scene Manual Rev3Mark ReinhardtNo ratings yet

- H0001Document2 pagesH0001Mark ReinhardtNo ratings yet

- WW Idaho Power Co. - Natural Gas Plant Cooling Water Draft PermitDocument27 pagesWW Idaho Power Co. - Natural Gas Plant Cooling Water Draft PermitMark ReinhardtNo ratings yet

- Sustainability of Idaho's Direct Care Workforce (Idaho Office of Performance Evaluations)Document80 pagesSustainability of Idaho's Direct Care Workforce (Idaho Office of Performance Evaluations)Mark ReinhardtNo ratings yet

- A Bill: 116 Congress 2 SDocument15 pagesA Bill: 116 Congress 2 SMark ReinhardtNo ratings yet

- Bills 113s987rsDocument44 pagesBills 113s987rsMark ReinhardtNo ratings yet

- A Bill: 117 Congress 1 SDocument22 pagesA Bill: 117 Congress 1 SMark ReinhardtNo ratings yet

- City of Boise Housing Bonus Ordinance and Zoning Code Rewrite MemoDocument11 pagesCity of Boise Housing Bonus Ordinance and Zoning Code Rewrite MemoMark ReinhardtNo ratings yet

- Working Agreement Among The Company and All Employers / StaffDocument1 pageWorking Agreement Among The Company and All Employers / StaffTeeVee ThailandNo ratings yet

- 23-NATIO1499973.pdf Certificate of InsuranceDocument2 pages23-NATIO1499973.pdf Certificate of InsuranceCOASTNo ratings yet

- 05 - G.O. Ms. No. 526Document4 pages05 - G.O. Ms. No. 526Syed AzmathNo ratings yet

- b1. People Vs GatarinDocument23 pagesb1. People Vs GatarinBrenda WayneNo ratings yet

- Reading 101Document1 pageReading 101Mc SuanNo ratings yet

- Jusayan V SombillaDocument2 pagesJusayan V SombillaBeverlyn Jamison0% (1)

- Dr. Phylis Rio v. Colegio de Sta. Rosa-Makati And/or Sr. Marilyn Gustilo G.R. No. 189629, August 06, 2014Document2 pagesDr. Phylis Rio v. Colegio de Sta. Rosa-Makati And/or Sr. Marilyn Gustilo G.R. No. 189629, August 06, 2014mrlouiemabalotNo ratings yet

- Consti ListDocument6 pagesConsti ListAisha AhamadNo ratings yet

- Co Ownership DigestsDocument24 pagesCo Ownership Digestsmelaniem_1No ratings yet

- 20-Cv-1666 - Unicorn Order - Art Ask Agency 3-18-20Document3 pages20-Cv-1666 - Unicorn Order - Art Ask Agency 3-18-20joshua mayes0% (1)

- Thesis StatementDocument6 pagesThesis StatementDillan McNishNo ratings yet

- DigestDocument8 pagesDigestThata ThataNo ratings yet

- 6 - Appendices-Different FormsDocument9 pages6 - Appendices-Different FormschakmrinalNo ratings yet

- Cda Memorandum Circular 2015-09Document32 pagesCda Memorandum Circular 2015-09Jing Sagittarius100% (2)

- Affidavit of Adjoining Owners - Teresita GuceDocument3 pagesAffidavit of Adjoining Owners - Teresita Gucesld20100% (1)

- Bài Tập Học Kỳ: Môn: Tiếng Anh Pháp Lý 1Document10 pagesBài Tập Học Kỳ: Môn: Tiếng Anh Pháp Lý 1Mai Khanh Bùi ThịNo ratings yet

- Adharsitha: Center of Rehabilitation For Sex Workers and Children in MumbaiDocument10 pagesAdharsitha: Center of Rehabilitation For Sex Workers and Children in MumbaiRahul SaseendranNo ratings yet

- Comparative Corporate LawDocument76 pagesComparative Corporate LawzeenatmasoodiNo ratings yet

- Federal Lawsuit Holly RidgeDocument20 pagesFederal Lawsuit Holly RidgeMichael PraatsNo ratings yet

- Differences of Diplomacy, Litigation, Arbitration, and AdrDocument2 pagesDifferences of Diplomacy, Litigation, Arbitration, and AdrUtty F. SeieiNo ratings yet

- THE CONSTITUTION OF PAKISTAN 1956 and The Reasons For Its FailureDocument3 pagesTHE CONSTITUTION OF PAKISTAN 1956 and The Reasons For Its FailureZenab MohammadNo ratings yet

- PP V ComadreDocument1 pagePP V ComadrekhailcalebNo ratings yet

- In The Supreme Court of IndiaDocument19 pagesIn The Supreme Court of IndiaJai VermaNo ratings yet

- Beneficiality SpeechDocument3 pagesBeneficiality SpeechKylleJames VillasisNo ratings yet

- LETTER Re APPLICATION FOR AMICUS CURIE IN THE CASE OF SIRHAN SIRHAN FOR THE Inter-American Commission On Human Rights AUGUST 8, 2017Document29 pagesLETTER Re APPLICATION FOR AMICUS CURIE IN THE CASE OF SIRHAN SIRHAN FOR THE Inter-American Commission On Human Rights AUGUST 8, 2017Stan J. CaterboneNo ratings yet

- Dsnlu Final DraftDocument16 pagesDsnlu Final DraftMD SABEEH AHMADNo ratings yet

- Caasi vs. Comelec, GR No. 88831Document5 pagesCaasi vs. Comelec, GR No. 88831Naiza De los SantosNo ratings yet

- Family Pension FormatDocument7 pagesFamily Pension FormatAparna KaleNo ratings yet

- Process of Registration of DealingsDocument13 pagesProcess of Registration of DealingsAizat Lukman Bin JohanNo ratings yet

- Continue Guarantee Means A Guarantee Which Extends To A Series of Transactions. This IsDocument4 pagesContinue Guarantee Means A Guarantee Which Extends To A Series of Transactions. This Ispaco kazunguNo ratings yet