Professional Documents

Culture Documents

The Order Instituting Proceedings in This Matter Was Issued On June 8, 2004

The Order Instituting Proceedings in This Matter Was Issued On June 8, 2004

Uploaded by

Mark ReinhardtCopyright:

Available Formats

You might also like

- Debt Validation Proof of ClaimDocument5 pagesDebt Validation Proof of ClaimPhil96% (68)

- Debt Validation Letter 2020Document6 pagesDebt Validation Letter 2020Nat Williams97% (30)

- Jeankeat TreatiseDocument96 pagesJeankeat Treatisereadit777100% (9)

- Fiduciary Appointment and Authorization: Respondent / Fiduciary Trustee Principal / BeneficiaryDocument6 pagesFiduciary Appointment and Authorization: Respondent / Fiduciary Trustee Principal / Beneficiarytony100% (23)

- Validation of Debt PackDocument9 pagesValidation of Debt Packpreston_40200380% (10)

- RevReg 13-77Document12 pagesRevReg 13-77dppascua100% (1)

- Debt Validation Proof Default 2Document6 pagesDebt Validation Proof Default 2spcbanking83% (6)

- Validation Proof of ClaimDocument4 pagesValidation Proof of ClaimJohn Nehmatallah90% (10)

- Validation Proof of ClaimDocument4 pagesValidation Proof of Claimroyalarch13100% (6)

- Service Agreement TemplateDocument3 pagesService Agreement Templateceleste law50% (6)

- Role of BrokerDocument16 pagesRole of BrokerajmeranamitNo ratings yet

- The Last Four Digits of The Debtor's Federal Tax Identification Number Are 6659Document24 pagesThe Last Four Digits of The Debtor's Federal Tax Identification Number Are 6659Chapter 11 DocketsNo ratings yet

- SEC v. Spencer Pharmaceutical Inc Et Al Doc 107-4 Filed 12 Sep 14Document5 pagesSEC v. Spencer Pharmaceutical Inc Et Al Doc 107-4 Filed 12 Sep 14scion.scionNo ratings yet

- Instructions On How To Get Rid of AnyDocument9 pagesInstructions On How To Get Rid of Anycmoffett1217No ratings yet

- Boby Collins' Final JudhmentDocument7 pagesBoby Collins' Final JudhmentAnonymous XetrNzNo ratings yet

- Notice of Sale of Estate Property: United States Bankruptcy Court Central District of CaliforniaDocument12 pagesNotice of Sale of Estate Property: United States Bankruptcy Court Central District of CaliforniaChapter 11 DocketsNo ratings yet

- Capitalized Terms Used But Not Defined Herein Shall Have The Respective Meanings Ascribed To Them in The Agency AgreementDocument94 pagesCapitalized Terms Used But Not Defined Herein Shall Have The Respective Meanings Ascribed To Them in The Agency AgreementChapter 11 DocketsNo ratings yet

- The Rehabilitation Proceedings Shall Commence Upon The Issuance of The Commencement Order Which Shall Include A Stay or Suspension OrderDocument8 pagesThe Rehabilitation Proceedings Shall Commence Upon The Issuance of The Commencement Order Which Shall Include A Stay or Suspension OrderVanessa VelascoNo ratings yet

- Fiduciaryappointment TEMPLATEDocument7 pagesFiduciaryappointment TEMPLATEJerry100% (3)

- Final Judgment As To Defendant Elon MuskDocument5 pagesFinal Judgment As To Defendant Elon MuskTodd BishopNo ratings yet

- Alpha Capital Consent Judgment Re Dkt. 92 (19cv8175) Gov - Uscourts.nysd.500558.92.0Document14 pagesAlpha Capital Consent Judgment Re Dkt. 92 (19cv8175) Gov - Uscourts.nysd.500558.92.0Thomas WareNo ratings yet

- Joe Six Pack VodDocument12 pagesJoe Six Pack VodTeresa ReneeNo ratings yet

- Written Request For MortgageDocument5 pagesWritten Request For MortgageS S Ali100% (8)

- Transaction Procedure PDFDocument1 pageTransaction Procedure PDFChristianMNo ratings yet

- Sample PetitionDocument4 pagesSample PetitionmmaverillaNo ratings yet

- SEC v. Spencer Pharmaceutical Inc Et Al Doc 107-2 Filed 12 Sep 14Document6 pagesSEC v. Spencer Pharmaceutical Inc Et Al Doc 107-2 Filed 12 Sep 14scion.scionNo ratings yet

- NEGO - Casedigest - 1st - 2nd WeekDocument17 pagesNEGO - Casedigest - 1st - 2nd WeekFrancisco MarvinNo ratings yet

- Final Judgment As To Defendant First in Awareness, LLCDocument5 pagesFinal Judgment As To Defendant First in Awareness, LLCscion.scionNo ratings yet

- Requirements For Information To Include in The Combined Plan and Disclosure Statement (Judge Phillip J. Shefferly)Document10 pagesRequirements For Information To Include in The Combined Plan and Disclosure Statement (Judge Phillip J. Shefferly)jarabboNo ratings yet

- Sample Real Estate Purchase & Sale Agreement Template: Aaron Hall Business Attorney Minneapolis, MinnesotaDocument13 pagesSample Real Estate Purchase & Sale Agreement Template: Aaron Hall Business Attorney Minneapolis, MinnesotabruuhhhhNo ratings yet

- Sample Real Estate Purchase & Sale Agreement Template: Aaron Hall Business Attorney Minneapolis, MinnesotaDocument13 pagesSample Real Estate Purchase & Sale Agreement Template: Aaron Hall Business Attorney Minneapolis, MinnesotabruuhhhhNo ratings yet

- Honorable Carol A. DoyleDocument3 pagesHonorable Carol A. DoyleChapter 11 DocketsNo ratings yet

- Abacus Securities Corporation, Petitioner, Vs - Ruben U. Ampil, RespondentDocument6 pagesAbacus Securities Corporation, Petitioner, Vs - Ruben U. Ampil, RespondentSam SaripNo ratings yet

- Tolentino Vs CADocument2 pagesTolentino Vs CAcheryl talisikNo ratings yet

- FTL 108944881v2Document5 pagesFTL 108944881v2Chapter 11 DocketsNo ratings yet

- BAY:01512259 VLDocument15 pagesBAY:01512259 VLChapter 11 DocketsNo ratings yet

- Interim Rules of Procedure On Corporate Rehabilitation: en BancDocument5 pagesInterim Rules of Procedure On Corporate Rehabilitation: en BancarloNo ratings yet

- Am No.00!8!10-Sc (Rehab Corporate)Document14 pagesAm No.00!8!10-Sc (Rehab Corporate)Jose BonifacioNo ratings yet

- RSPNDT PRVT Intl Remdy Dmand Plus Doc 2 1Document4 pagesRSPNDT PRVT Intl Remdy Dmand Plus Doc 2 1Theplaymaker508100% (2)

- Escrow Agreement TemplateDocument8 pagesEscrow Agreement TemplatethelegacylcNo ratings yet

- Phil Blooming Vs CADocument18 pagesPhil Blooming Vs CAJasOn EvangelistaNo ratings yet

- SB6199Document5 pagesSB6199DinSFLANo ratings yet

- Final Judgment As To Defendant Monk'S Den, LLCDocument5 pagesFinal Judgment As To Defendant Monk'S Den, LLCscion.scionNo ratings yet

- R-1 - Attorney - Notice of FraudDocument4 pagesR-1 - Attorney - Notice of Fraudderrick100% (6)

- Civil Law, Set 2 FULLDocument128 pagesCivil Law, Set 2 FULLApureelRoseNo ratings yet

- Interim Rules of Procedure On Corporate RehabDocument21 pagesInterim Rules of Procedure On Corporate RehabSharmen Dizon GalleneroNo ratings yet

- Commercial Contract SiteFormsDocument8 pagesCommercial Contract SiteFormsSt JeanNo ratings yet

- Insolvency Proceedings Under The Financial Rehabilitation and Insolvency Act (FRIA) of 2010Document22 pagesInsolvency Proceedings Under The Financial Rehabilitation and Insolvency Act (FRIA) of 2010Kobe BullmastiffNo ratings yet

- Debt Validation Letter July 2012Document5 pagesDebt Validation Letter July 2012amenelbey100% (5)

- Power House V CoronaDocument9 pagesPower House V CoronamkabNo ratings yet

- Robert Morgan SEC Settlement Letter (122733)Document37 pagesRobert Morgan SEC Settlement Letter (122733)News 8 WROCNo ratings yet

- Standing Order of Reference From The United States District Court For The District of DelawareDocument44 pagesStanding Order of Reference From The United States District Court For The District of DelawareLuis Fernando Pino RangelNo ratings yet

- 10000002251Document13 pages10000002251Chapter 11 DocketsNo ratings yet

- Mercantile Law NotesDocument42 pagesMercantile Law NotesMariel DavidNo ratings yet

- Supreme Transliner Vs BpiDocument10 pagesSupreme Transliner Vs BpiEricson Sarmiento Dela CruzNo ratings yet

- Complaint CTB SingleDocument4 pagesComplaint CTB SingleEppie SeverinoNo ratings yet

- United States Bankruptcy Court Southern District of New York in Re:) ) Metropark Usa, INC.,) ) Case No. 11-22866 (RDD) Debtor.)Document6 pagesUnited States Bankruptcy Court Southern District of New York in Re:) ) Metropark Usa, INC.,) ) Case No. 11-22866 (RDD) Debtor.)Chapter 11 DocketsNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Federal Rules of Civil Procedure: Hyperlinked, #2From EverandFederal Rules of Civil Procedure: Hyperlinked, #2Rating: 5 out of 5 stars5/5 (1)

- Soccer (Football) Contracts: An Introduction to Player Contracts (Clubs & Agents) and Contract Law: Volume 2From EverandSoccer (Football) Contracts: An Introduction to Player Contracts (Clubs & Agents) and Contract Law: Volume 2No ratings yet

- 43Document12 pages43Mark ReinhardtNo ratings yet

- 7Document6 pages7Mark ReinhardtNo ratings yet

- 6Document5 pages6Mark ReinhardtNo ratings yet

- Patrol LP Scenario03 July2021Document25 pagesPatrol LP Scenario03 July2021Mark ReinhardtNo ratings yet

- 10Document4 pages10Mark ReinhardtNo ratings yet

- 14Document7 pages14Mark ReinhardtNo ratings yet

- 8Document4 pages8Mark ReinhardtNo ratings yet

- 18Document23 pages18Mark ReinhardtNo ratings yet

- 17Document8 pages17Mark ReinhardtNo ratings yet

- Patrol LP Scenario04 July2021Document24 pagesPatrol LP Scenario04 July2021Mark ReinhardtNo ratings yet

- 13Document3 pages13Mark ReinhardtNo ratings yet

- Large Bank Assets (Federal Reserve) 2023Document103 pagesLarge Bank Assets (Federal Reserve) 2023Mark ReinhardtNo ratings yet

- 3Document4 pages3Mark ReinhardtNo ratings yet

- 15Document5 pages15Mark ReinhardtNo ratings yet

- 9Document3 pages9Mark ReinhardtNo ratings yet

- MMCP CY2023 Idaho Blue Cross Medicaid ContractDocument185 pagesMMCP CY2023 Idaho Blue Cross Medicaid ContractMark ReinhardtNo ratings yet

- 20221230final Order No 35651Document5 pages20221230final Order No 35651Mark ReinhardtNo ratings yet

- Sustainability of Idaho's Direct Care Workforce (Idaho Office of Performance Evaluations)Document80 pagesSustainability of Idaho's Direct Care Workforce (Idaho Office of Performance Evaluations)Mark ReinhardtNo ratings yet

- WW Idaho Power Co. - Natural Gas Plant Cooling Water Draft PermitDocument27 pagesWW Idaho Power Co. - Natural Gas Plant Cooling Water Draft PermitMark ReinhardtNo ratings yet

- H0001Document2 pagesH0001Mark ReinhardtNo ratings yet

- City of Boise Housing Bonus Ordinance and Zoning Code Rewrite MemoDocument11 pagesCity of Boise Housing Bonus Ordinance and Zoning Code Rewrite MemoMark ReinhardtNo ratings yet

- Crime Scene Manual Rev3Document153 pagesCrime Scene Manual Rev3Mark ReinhardtNo ratings yet

- A Bill: 117 Congress 1 SDocument22 pagesA Bill: 117 Congress 1 SMark ReinhardtNo ratings yet

- A Bill: 116 Congress 2 SDocument15 pagesA Bill: 116 Congress 2 SMark ReinhardtNo ratings yet

- Bills 113s987rsDocument44 pagesBills 113s987rsMark ReinhardtNo ratings yet

- IDC MarketScape - Worldwide Business Consulting Services 2014 PDFDocument31 pagesIDC MarketScape - Worldwide Business Consulting Services 2014 PDFapritul3539No ratings yet

- Renewing SWIFT SubscriptionDocument5 pagesRenewing SWIFT SubscriptionchidieNo ratings yet

- Credit Card StatementDocument4 pagesCredit Card StatementbpraveensinghNo ratings yet

- Issued Through Nsureplus Application SoftwareDocument1 pageIssued Through Nsureplus Application SoftwaresureshNo ratings yet

- Bank Statements Provide Information About All of The Following ExceptDocument3 pagesBank Statements Provide Information About All of The Following Exceptyes yesnoNo ratings yet

- Function of HDFC BankDocument9 pagesFunction of HDFC BankRajesh Maharajan50% (2)

- Pakhtunkhwa Highways Authority (Pkha) : Eligibility CriteriaDocument4 pagesPakhtunkhwa Highways Authority (Pkha) : Eligibility CriteriaAdnanAlamKhanNo ratings yet

- CH 17 Completing The Audit EngagementDocument4 pagesCH 17 Completing The Audit EngagementjscrivanNo ratings yet

- Procurement Level ConstructionDocument43 pagesProcurement Level ConstructionGamini KodikaraNo ratings yet

- A Study On Ratio Analysis of Laxmi BankDocument7 pagesA Study On Ratio Analysis of Laxmi BankAyesha james75% (4)

- Incoterms: Eneral NformationDocument4 pagesIncoterms: Eneral NformationrooswahyoeNo ratings yet

- All Bank PL PolicyDocument23 pagesAll Bank PL PolicyVishal BawaneNo ratings yet

- Global. Targeted. Marketing.: Distribution - Fleet Matching TechnologyDocument3 pagesGlobal. Targeted. Marketing.: Distribution - Fleet Matching TechnologyskyshiftsNo ratings yet

- MaulanaDocument12 pagesMaulanaSamam AsarNo ratings yet

- Statement: (Including Pots)Document2 pagesStatement: (Including Pots)saysandarNo ratings yet

- Mock 03 001 PDFDocument30 pagesMock 03 001 PDFmasud khanNo ratings yet

- Questionnaire of Financial InclusionDocument6 pagesQuestionnaire of Financial InclusionRajan Sharma100% (2)

- Chapter 11 Testbank: StudentDocument71 pagesChapter 11 Testbank: StudentHoan Vu Dao KhacNo ratings yet

- Invoice TKI3615 PDFDocument1 pageInvoice TKI3615 PDFRohini SankaranarayananNo ratings yet

- Apna Microfinance Bank: Strategic Management Final ProjectDocument8 pagesApna Microfinance Bank: Strategic Management Final ProjectBilal AhmedNo ratings yet

- BSA ReportDocument50 pagesBSA Reportaanuj5996No ratings yet

- Standard Invitation To Bidders: Bid Notice Under Open Domestic BiddingDocument2 pagesStandard Invitation To Bidders: Bid Notice Under Open Domestic BiddingNGANJANI WALTERNo ratings yet

- Arthur Andersen CaseDocument10 pagesArthur Andersen CaseSakub Amin Sick'L'No ratings yet

- Edillon v. Manila Bankers Life Insurance Corp.Document2 pagesEdillon v. Manila Bankers Life Insurance Corp.Jellyn100% (1)

- ATNGE Manual v1 22Document134 pagesATNGE Manual v1 22ALI BOUKHTANo ratings yet

- Dalimbe Bank KaladgiDocument8 pagesDalimbe Bank KaladgiKartik BisheNo ratings yet

- Letter of Transmittal 01Document10 pagesLetter of Transmittal 01Md. Jasim UddinNo ratings yet

The Order Instituting Proceedings in This Matter Was Issued On June 8, 2004

The Order Instituting Proceedings in This Matter Was Issued On June 8, 2004

Uploaded by

Mark ReinhardtOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Order Instituting Proceedings in This Matter Was Issued On June 8, 2004

The Order Instituting Proceedings in This Matter Was Issued On June 8, 2004

Uploaded by

Mark ReinhardtCopyright:

Available Formats

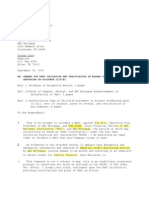

UNITED STATES OF AMERICA

Before the

SECURITIES AND EXCHANGE COMMISSION

SECURITIES ACT OF 1933

Release No. 8563 / April 6, 2005

SECURITIES EXCHANGE ACT OF 1934

Release No. 51480 / April 6, 2005

ADMINISTRATIVE PROCEEDING

File No. 3-11515

In the Matter of

CHARLES W. CROUSE, JR.

Respondent.

ORDER MAKING FINDINGS AND

IMPOSING REMEDIAL SANCTIONS AND A

CEASE-AND-DESIST ORDER PURSUANT

TO SECTION 8A OF THE SECURITIES ACT

OF 1933 AND SECTIONS 15(b) AND 21C OF

THE SECURITIES EXCHANGE ACT OF

1934.

I.

In connection with the public administrative proceedings previously instituted pursuant to

Section 8A of the Securities Act of 1933 (Securities Act) and Sections 15(b) and 21C of the

Securities Exchange Act of 1934 (Exchange Act)

1

, Respondent Charles W. Crouse

(Respondent or Crouse) has submitted an Offer of Settlement (Offer) which the Commission

has determined to accept. Solely for the purpose of these proceedings, and any other proceedings

brought by or on behalf of the Commission or in which the Commission is a party, and without

admitting or denying the findings herein, except as to the Commission's jurisdiction over him and

the subject matter of these proceedings, which are admitted. Respondent consents to the entry of

this Order Making Findings and Imposing Remedial Sanctions and a Cease-and-Desist Order

(Order) pursuant to Section 8A of the Securities Act and Sections 15(b) and 21C of the

Securities Exchange Act as set forth below.

1

The Order Instituting Proceedings in this matter was issued on J une 8, 2004.

II.

On the basis of this Order and Respondents Offer, the Commission finds

2

that:

Respondent

1. Crouse, 46, resides in Marietta, Georgia. He has been a registered representative

since May 1992. During the time period of the events discussed herein, Crouse was a registered

representative at a broker-dealer, Fidelity National Capital Investors (the Broker-Dealer). He

holds Series 7 and 63 securities licenses. Crouse left the Broker-Dealer in March 2001 and is

currently associated with another broker-dealer.

2. In December 1997, a customer (Customer) opened a brokerage account (the

Account) at the Broker-Dealer. His registered representative at the Broker-Dealer was Crouse.

The Ponzi Scheme

3. From at least J une 1998 through September 1999, Customer obtained funds from

investors by representing that he would use their funds to buy and sell securities through an

account at the Broker-Dealer in his name and under his management. During much of this

period, Customer operated a Ponzi scheme in which he deposited approximately $6.3 million of

investor funds into the Account. Customers investment strategy primarily consisted of day-

trading or short-term trading of options and equities in the Account using a momentum computer

program.

4. Most of Customers investors signed management agreements provided by the

customer allowing him to have full and complete discretion to invest, trade and make

transactions associated with the Account. While the terms of the investments varied from

investor to investor, in most cases, the customer promised guaranteed returns of up to fifty

percent (50%) in ninety days or less. In some instances, Customer provided investors with oral

and/or written agreements rolling over the original investment and purported profit. These

rollover agreements often indicated a higher value of their investments than actually existed.

5. Contrary to his representations to investors, Customer lost money from his trading.

For the thirteen-month period from December 2, 1997 through December 31, 1998, the customer

lost $225,660 in the Account.

6. Customers trading, and his trading losses, increased substantially in 1999. For the

nine-month period from J anuary 1, 1999 through September 30, 1999, net losses in the Account

2

The findings herein are made pursuant to Respondent's Offer of Settlement and are not binding on any

other person or entity in this or any other proceeding

2

amounted to $634,453. With the exceptions of J anuary and March, the Account lost money every

month in 1999.

7. Customers trading program was a Ponzi scheme in that payments to investors

were funded from deposits into the Account that came from new investors. Customer was

dependent on money from new investors to keep his scheme operating.

Crouses Assistance In Furtherance of Customers Ponzi Scheme

8. Crouse knew, among other things, of the Accounts high activity level and

substantial losses. He also knew or was reckless in not knowing that almost all the money

deposited into the Account was coming from checks written by other people to Customer

because, as a matter of office procedure, he received copies of all checks deposited into the

customer Account. Crouse also knew that Customer was managing the accounts of other Broker-

Dealer customers with whom power of attorney documents had been executed, and that he had

lost large amounts of money in some of those accounts as well. Additionally, Crouse received

letters from two of his other customer accounts at the Broker-Dealer in J une 1999 telling him to

transfer money into the Account; one letter stated He [Customer] will manage this money from

his account. Taken together these facts showed a scheme by Customer to defraud investors,

which Crouse facilitated by recklessly permitting Customer to trade with funds provided by

others.

9. Crouse substantially assisted Customer in furtherance of his Ponzi scheme by

executing virtually all trades in the Accounts.

10. From J une through September of 1999, Crouse received commissions for his work

with the Customer Account totaling $54,121.

11. As a result of the conduct described above, Crouse willfully aided and abetted and

caused Customers violations of Section 17(a) of the Securities Act, Section 10(b) of the

Exchange Act and Rule 10b-5 thereunder, which prohibit fraudulent conduct in the offer and sale

of securities and in connection with the purchase or sale of securities.

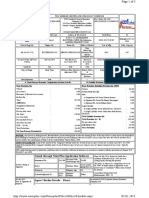

Civil Penalties

12. Respondent has submitted a sworn Statement of Financial Condition dated August

27, 2004 and revised September 3, 2004, and other evidence and has asserted his inability to pay

a civil penalty.

3

Undertakings

Respondent shall provide to the Commission, within thirty (30) days after the end of the

twelve (12) month suspension period described above, an affidavit that he has complied fully with

the sanctions described in Section III below.

III.

In view of the foregoing, the Commission deems it appropriate, in the public interest to

impose the sanctions agreed to in Respondent Crouses Offer.

Accordingly, pursuant to Section 8A of the Securities Act and Sections 15(b) and 21C of

the Exchange Act, it is hereby ORDERED that:

A. Respondent Crouse shall cease and desist from committing or causing any violations

and any future violations of Section 17(a) of the Securities Act, Section 10(b) of the Exchange Act

and Rule 10b-5 thereunder, which prohibit fraudulent conduct in the offer and sale of securities and

in connection with the purchase or sale of securities.

B. Respondent be, and hereby is, suspended from association with any broker or dealer

for a period of 12 months, effective on the second Monday following the entry of this Order.

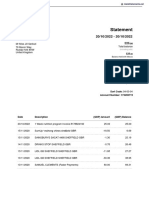

C. Respondent shall pay disgorgement in the amount of $54,121 and prejudgment

interest in the amount of $20,824.71, for a total of $74,945.71. Crouse shall pay the amount of

$17,000, required by the Offer to have been deposited in escrow with his attorney, within seven (7)

days of the entry of this Order. The remaining amount of $57,945.71 shall be paid in 31 equal

monthly installments of $1,869.22 due on the first of each month after the Offer has been accepted

by the Commission. Such payments shall be: (A) made by United States postal money order,

certified check, bank cashier's check, or bank money order; (B) made payable to the Securities and

Exchange Commission; (C) hand-delivered or mailed to the Office of Financial Management,

Securities and Exchange Commission, Operations Center, 6432 General Green Way, Alexandria,

Stop 0-3, VA 22312; and (D) submitted under cover letter that identifies Crouse as a Respondent in

these proceedings, the file number of these proceedings, a copy of which cover letter and money

order or check shall be sent to Michael J. OLeary, Senior Trial Counsel, Securities and Exchange

Commission, Atlanta District Office, 3475 Lenox Road, N.E., Suite 1000, Atlanta, GA 30326-1232.

D. Respondent shall comply with the undertaking enumerated above.

Respondent agrees that if the full amount of any payment described above is not made

within ten (10) days following the date the payment is required by this Order, the entire amount of

disgorgement and prejudgment interest, minus payments made, if any, is due and payable

immediately without further application.

4

E. Due to the Respondents financial condition, as set forth in his Statement of

Financial Condition dated August 27, 2004 and revised September 3, 2004, a civil money penalty

will not be imposed by the Commission.

F. The Division of Enforcement ("Division") may, at any time following the entry of

this Order, petition the Commission to: (1) reopen this matter to consider whether Respondent

provided accurate and complete financial information at the time such representations were

made; and (2) seek an order directing payment of the maximum civil penalty allowable under the

law. No other issue shall be considered in connection with this petition other than whether the

financial information provided by Respondent was fraudulent, misleading, inaccurate, or

incomplete in any material respect. Respondent may not, by way of defense to any such petition:

(1) contest the findings in this Order; (2) assert that payment of a penalty should not be ordered;

(3) contest the imposition of the maximum penalty allowable under the law; or (4) assert any

defense to liability or remedy, including, but not limited to, any statute of limitations defense.

By the Commission.

Jonathan G. Katz

Secretary

5

You might also like

- Debt Validation Proof of ClaimDocument5 pagesDebt Validation Proof of ClaimPhil96% (68)

- Debt Validation Letter 2020Document6 pagesDebt Validation Letter 2020Nat Williams97% (30)

- Jeankeat TreatiseDocument96 pagesJeankeat Treatisereadit777100% (9)

- Fiduciary Appointment and Authorization: Respondent / Fiduciary Trustee Principal / BeneficiaryDocument6 pagesFiduciary Appointment and Authorization: Respondent / Fiduciary Trustee Principal / Beneficiarytony100% (23)

- Validation of Debt PackDocument9 pagesValidation of Debt Packpreston_40200380% (10)

- RevReg 13-77Document12 pagesRevReg 13-77dppascua100% (1)

- Debt Validation Proof Default 2Document6 pagesDebt Validation Proof Default 2spcbanking83% (6)

- Validation Proof of ClaimDocument4 pagesValidation Proof of ClaimJohn Nehmatallah90% (10)

- Validation Proof of ClaimDocument4 pagesValidation Proof of Claimroyalarch13100% (6)

- Service Agreement TemplateDocument3 pagesService Agreement Templateceleste law50% (6)

- Role of BrokerDocument16 pagesRole of BrokerajmeranamitNo ratings yet

- The Last Four Digits of The Debtor's Federal Tax Identification Number Are 6659Document24 pagesThe Last Four Digits of The Debtor's Federal Tax Identification Number Are 6659Chapter 11 DocketsNo ratings yet

- SEC v. Spencer Pharmaceutical Inc Et Al Doc 107-4 Filed 12 Sep 14Document5 pagesSEC v. Spencer Pharmaceutical Inc Et Al Doc 107-4 Filed 12 Sep 14scion.scionNo ratings yet

- Instructions On How To Get Rid of AnyDocument9 pagesInstructions On How To Get Rid of Anycmoffett1217No ratings yet

- Boby Collins' Final JudhmentDocument7 pagesBoby Collins' Final JudhmentAnonymous XetrNzNo ratings yet

- Notice of Sale of Estate Property: United States Bankruptcy Court Central District of CaliforniaDocument12 pagesNotice of Sale of Estate Property: United States Bankruptcy Court Central District of CaliforniaChapter 11 DocketsNo ratings yet

- Capitalized Terms Used But Not Defined Herein Shall Have The Respective Meanings Ascribed To Them in The Agency AgreementDocument94 pagesCapitalized Terms Used But Not Defined Herein Shall Have The Respective Meanings Ascribed To Them in The Agency AgreementChapter 11 DocketsNo ratings yet

- The Rehabilitation Proceedings Shall Commence Upon The Issuance of The Commencement Order Which Shall Include A Stay or Suspension OrderDocument8 pagesThe Rehabilitation Proceedings Shall Commence Upon The Issuance of The Commencement Order Which Shall Include A Stay or Suspension OrderVanessa VelascoNo ratings yet

- Fiduciaryappointment TEMPLATEDocument7 pagesFiduciaryappointment TEMPLATEJerry100% (3)

- Final Judgment As To Defendant Elon MuskDocument5 pagesFinal Judgment As To Defendant Elon MuskTodd BishopNo ratings yet

- Alpha Capital Consent Judgment Re Dkt. 92 (19cv8175) Gov - Uscourts.nysd.500558.92.0Document14 pagesAlpha Capital Consent Judgment Re Dkt. 92 (19cv8175) Gov - Uscourts.nysd.500558.92.0Thomas WareNo ratings yet

- Joe Six Pack VodDocument12 pagesJoe Six Pack VodTeresa ReneeNo ratings yet

- Written Request For MortgageDocument5 pagesWritten Request For MortgageS S Ali100% (8)

- Transaction Procedure PDFDocument1 pageTransaction Procedure PDFChristianMNo ratings yet

- Sample PetitionDocument4 pagesSample PetitionmmaverillaNo ratings yet

- SEC v. Spencer Pharmaceutical Inc Et Al Doc 107-2 Filed 12 Sep 14Document6 pagesSEC v. Spencer Pharmaceutical Inc Et Al Doc 107-2 Filed 12 Sep 14scion.scionNo ratings yet

- NEGO - Casedigest - 1st - 2nd WeekDocument17 pagesNEGO - Casedigest - 1st - 2nd WeekFrancisco MarvinNo ratings yet

- Final Judgment As To Defendant First in Awareness, LLCDocument5 pagesFinal Judgment As To Defendant First in Awareness, LLCscion.scionNo ratings yet

- Requirements For Information To Include in The Combined Plan and Disclosure Statement (Judge Phillip J. Shefferly)Document10 pagesRequirements For Information To Include in The Combined Plan and Disclosure Statement (Judge Phillip J. Shefferly)jarabboNo ratings yet

- Sample Real Estate Purchase & Sale Agreement Template: Aaron Hall Business Attorney Minneapolis, MinnesotaDocument13 pagesSample Real Estate Purchase & Sale Agreement Template: Aaron Hall Business Attorney Minneapolis, MinnesotabruuhhhhNo ratings yet

- Sample Real Estate Purchase & Sale Agreement Template: Aaron Hall Business Attorney Minneapolis, MinnesotaDocument13 pagesSample Real Estate Purchase & Sale Agreement Template: Aaron Hall Business Attorney Minneapolis, MinnesotabruuhhhhNo ratings yet

- Honorable Carol A. DoyleDocument3 pagesHonorable Carol A. DoyleChapter 11 DocketsNo ratings yet

- Abacus Securities Corporation, Petitioner, Vs - Ruben U. Ampil, RespondentDocument6 pagesAbacus Securities Corporation, Petitioner, Vs - Ruben U. Ampil, RespondentSam SaripNo ratings yet

- Tolentino Vs CADocument2 pagesTolentino Vs CAcheryl talisikNo ratings yet

- FTL 108944881v2Document5 pagesFTL 108944881v2Chapter 11 DocketsNo ratings yet

- BAY:01512259 VLDocument15 pagesBAY:01512259 VLChapter 11 DocketsNo ratings yet

- Interim Rules of Procedure On Corporate Rehabilitation: en BancDocument5 pagesInterim Rules of Procedure On Corporate Rehabilitation: en BancarloNo ratings yet

- Am No.00!8!10-Sc (Rehab Corporate)Document14 pagesAm No.00!8!10-Sc (Rehab Corporate)Jose BonifacioNo ratings yet

- RSPNDT PRVT Intl Remdy Dmand Plus Doc 2 1Document4 pagesRSPNDT PRVT Intl Remdy Dmand Plus Doc 2 1Theplaymaker508100% (2)

- Escrow Agreement TemplateDocument8 pagesEscrow Agreement TemplatethelegacylcNo ratings yet

- Phil Blooming Vs CADocument18 pagesPhil Blooming Vs CAJasOn EvangelistaNo ratings yet

- SB6199Document5 pagesSB6199DinSFLANo ratings yet

- Final Judgment As To Defendant Monk'S Den, LLCDocument5 pagesFinal Judgment As To Defendant Monk'S Den, LLCscion.scionNo ratings yet

- R-1 - Attorney - Notice of FraudDocument4 pagesR-1 - Attorney - Notice of Fraudderrick100% (6)

- Civil Law, Set 2 FULLDocument128 pagesCivil Law, Set 2 FULLApureelRoseNo ratings yet

- Interim Rules of Procedure On Corporate RehabDocument21 pagesInterim Rules of Procedure On Corporate RehabSharmen Dizon GalleneroNo ratings yet

- Commercial Contract SiteFormsDocument8 pagesCommercial Contract SiteFormsSt JeanNo ratings yet

- Insolvency Proceedings Under The Financial Rehabilitation and Insolvency Act (FRIA) of 2010Document22 pagesInsolvency Proceedings Under The Financial Rehabilitation and Insolvency Act (FRIA) of 2010Kobe BullmastiffNo ratings yet

- Debt Validation Letter July 2012Document5 pagesDebt Validation Letter July 2012amenelbey100% (5)

- Power House V CoronaDocument9 pagesPower House V CoronamkabNo ratings yet

- Robert Morgan SEC Settlement Letter (122733)Document37 pagesRobert Morgan SEC Settlement Letter (122733)News 8 WROCNo ratings yet

- Standing Order of Reference From The United States District Court For The District of DelawareDocument44 pagesStanding Order of Reference From The United States District Court For The District of DelawareLuis Fernando Pino RangelNo ratings yet

- 10000002251Document13 pages10000002251Chapter 11 DocketsNo ratings yet

- Mercantile Law NotesDocument42 pagesMercantile Law NotesMariel DavidNo ratings yet

- Supreme Transliner Vs BpiDocument10 pagesSupreme Transliner Vs BpiEricson Sarmiento Dela CruzNo ratings yet

- Complaint CTB SingleDocument4 pagesComplaint CTB SingleEppie SeverinoNo ratings yet

- United States Bankruptcy Court Southern District of New York in Re:) ) Metropark Usa, INC.,) ) Case No. 11-22866 (RDD) Debtor.)Document6 pagesUnited States Bankruptcy Court Southern District of New York in Re:) ) Metropark Usa, INC.,) ) Case No. 11-22866 (RDD) Debtor.)Chapter 11 DocketsNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Federal Rules of Civil Procedure: Hyperlinked, #2From EverandFederal Rules of Civil Procedure: Hyperlinked, #2Rating: 5 out of 5 stars5/5 (1)

- Soccer (Football) Contracts: An Introduction to Player Contracts (Clubs & Agents) and Contract Law: Volume 2From EverandSoccer (Football) Contracts: An Introduction to Player Contracts (Clubs & Agents) and Contract Law: Volume 2No ratings yet

- 43Document12 pages43Mark ReinhardtNo ratings yet

- 7Document6 pages7Mark ReinhardtNo ratings yet

- 6Document5 pages6Mark ReinhardtNo ratings yet

- Patrol LP Scenario03 July2021Document25 pagesPatrol LP Scenario03 July2021Mark ReinhardtNo ratings yet

- 10Document4 pages10Mark ReinhardtNo ratings yet

- 14Document7 pages14Mark ReinhardtNo ratings yet

- 8Document4 pages8Mark ReinhardtNo ratings yet

- 18Document23 pages18Mark ReinhardtNo ratings yet

- 17Document8 pages17Mark ReinhardtNo ratings yet

- Patrol LP Scenario04 July2021Document24 pagesPatrol LP Scenario04 July2021Mark ReinhardtNo ratings yet

- 13Document3 pages13Mark ReinhardtNo ratings yet

- Large Bank Assets (Federal Reserve) 2023Document103 pagesLarge Bank Assets (Federal Reserve) 2023Mark ReinhardtNo ratings yet

- 3Document4 pages3Mark ReinhardtNo ratings yet

- 15Document5 pages15Mark ReinhardtNo ratings yet

- 9Document3 pages9Mark ReinhardtNo ratings yet

- MMCP CY2023 Idaho Blue Cross Medicaid ContractDocument185 pagesMMCP CY2023 Idaho Blue Cross Medicaid ContractMark ReinhardtNo ratings yet

- 20221230final Order No 35651Document5 pages20221230final Order No 35651Mark ReinhardtNo ratings yet

- Sustainability of Idaho's Direct Care Workforce (Idaho Office of Performance Evaluations)Document80 pagesSustainability of Idaho's Direct Care Workforce (Idaho Office of Performance Evaluations)Mark ReinhardtNo ratings yet

- WW Idaho Power Co. - Natural Gas Plant Cooling Water Draft PermitDocument27 pagesWW Idaho Power Co. - Natural Gas Plant Cooling Water Draft PermitMark ReinhardtNo ratings yet

- H0001Document2 pagesH0001Mark ReinhardtNo ratings yet

- City of Boise Housing Bonus Ordinance and Zoning Code Rewrite MemoDocument11 pagesCity of Boise Housing Bonus Ordinance and Zoning Code Rewrite MemoMark ReinhardtNo ratings yet

- Crime Scene Manual Rev3Document153 pagesCrime Scene Manual Rev3Mark ReinhardtNo ratings yet

- A Bill: 117 Congress 1 SDocument22 pagesA Bill: 117 Congress 1 SMark ReinhardtNo ratings yet

- A Bill: 116 Congress 2 SDocument15 pagesA Bill: 116 Congress 2 SMark ReinhardtNo ratings yet

- Bills 113s987rsDocument44 pagesBills 113s987rsMark ReinhardtNo ratings yet

- IDC MarketScape - Worldwide Business Consulting Services 2014 PDFDocument31 pagesIDC MarketScape - Worldwide Business Consulting Services 2014 PDFapritul3539No ratings yet

- Renewing SWIFT SubscriptionDocument5 pagesRenewing SWIFT SubscriptionchidieNo ratings yet

- Credit Card StatementDocument4 pagesCredit Card StatementbpraveensinghNo ratings yet

- Issued Through Nsureplus Application SoftwareDocument1 pageIssued Through Nsureplus Application SoftwaresureshNo ratings yet

- Bank Statements Provide Information About All of The Following ExceptDocument3 pagesBank Statements Provide Information About All of The Following Exceptyes yesnoNo ratings yet

- Function of HDFC BankDocument9 pagesFunction of HDFC BankRajesh Maharajan50% (2)

- Pakhtunkhwa Highways Authority (Pkha) : Eligibility CriteriaDocument4 pagesPakhtunkhwa Highways Authority (Pkha) : Eligibility CriteriaAdnanAlamKhanNo ratings yet

- CH 17 Completing The Audit EngagementDocument4 pagesCH 17 Completing The Audit EngagementjscrivanNo ratings yet

- Procurement Level ConstructionDocument43 pagesProcurement Level ConstructionGamini KodikaraNo ratings yet

- A Study On Ratio Analysis of Laxmi BankDocument7 pagesA Study On Ratio Analysis of Laxmi BankAyesha james75% (4)

- Incoterms: Eneral NformationDocument4 pagesIncoterms: Eneral NformationrooswahyoeNo ratings yet

- All Bank PL PolicyDocument23 pagesAll Bank PL PolicyVishal BawaneNo ratings yet

- Global. Targeted. Marketing.: Distribution - Fleet Matching TechnologyDocument3 pagesGlobal. Targeted. Marketing.: Distribution - Fleet Matching TechnologyskyshiftsNo ratings yet

- MaulanaDocument12 pagesMaulanaSamam AsarNo ratings yet

- Statement: (Including Pots)Document2 pagesStatement: (Including Pots)saysandarNo ratings yet

- Mock 03 001 PDFDocument30 pagesMock 03 001 PDFmasud khanNo ratings yet

- Questionnaire of Financial InclusionDocument6 pagesQuestionnaire of Financial InclusionRajan Sharma100% (2)

- Chapter 11 Testbank: StudentDocument71 pagesChapter 11 Testbank: StudentHoan Vu Dao KhacNo ratings yet

- Invoice TKI3615 PDFDocument1 pageInvoice TKI3615 PDFRohini SankaranarayananNo ratings yet

- Apna Microfinance Bank: Strategic Management Final ProjectDocument8 pagesApna Microfinance Bank: Strategic Management Final ProjectBilal AhmedNo ratings yet

- BSA ReportDocument50 pagesBSA Reportaanuj5996No ratings yet

- Standard Invitation To Bidders: Bid Notice Under Open Domestic BiddingDocument2 pagesStandard Invitation To Bidders: Bid Notice Under Open Domestic BiddingNGANJANI WALTERNo ratings yet

- Arthur Andersen CaseDocument10 pagesArthur Andersen CaseSakub Amin Sick'L'No ratings yet

- Edillon v. Manila Bankers Life Insurance Corp.Document2 pagesEdillon v. Manila Bankers Life Insurance Corp.Jellyn100% (1)

- ATNGE Manual v1 22Document134 pagesATNGE Manual v1 22ALI BOUKHTANo ratings yet

- Dalimbe Bank KaladgiDocument8 pagesDalimbe Bank KaladgiKartik BisheNo ratings yet

- Letter of Transmittal 01Document10 pagesLetter of Transmittal 01Md. Jasim UddinNo ratings yet