Professional Documents

Culture Documents

Fdi in Defence

Fdi in Defence

Uploaded by

Vinit ShahCopyright:

Available Formats

You might also like

- International Trade Law Final VarunDocument15 pagesInternational Trade Law Final Varunvritaant varunNo ratings yet

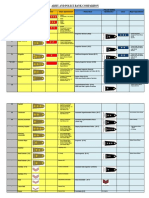

- Army and Police Rank ComparisonDocument2 pagesArmy and Police Rank ComparisonTaif Arif100% (4)

- Written Analysis and Communication II: Assignment II Submitted ToDocument6 pagesWritten Analysis and Communication II: Assignment II Submitted Toaks0388No ratings yet

- RNCR S 22 00176Document29 pagesRNCR S 22 00176rahulnathcNo ratings yet

- INTRO, Types, and More. SODocument11 pagesINTRO, Types, and More. SOpanchaljanak0021No ratings yet

- Give Ten Reasons Why FDI Is Beneficial To Developing Economy? AnsDocument19 pagesGive Ten Reasons Why FDI Is Beneficial To Developing Economy? AnsFaisal MohdNo ratings yet

- Fdi in Insurance SectorDocument36 pagesFdi in Insurance Sectorprince33% (3)

- Foreign Direct Investment: Why in News?Document4 pagesForeign Direct Investment: Why in News?sejalkacherNo ratings yet

- PB FDIDefenceIndustryDocument16 pagesPB FDIDefenceIndustryManish JaiswalNo ratings yet

- Project Report Master of Management Studies-MMS Degree in Partial Requirement During 3 Semester, 2010-11Document14 pagesProject Report Master of Management Studies-MMS Degree in Partial Requirement During 3 Semester, 2010-11mandy_t06No ratings yet

- Unit 5 BEDocument11 pagesUnit 5 BESharwan SinghNo ratings yet

- C C C CDocument9 pagesC C C Cruchinsodhani5187No ratings yet

- Research Publication SeemaDocument7 pagesResearch Publication SeemaAmit MirjiNo ratings yet

- Ijmra 11646 PDFDocument15 pagesIjmra 11646 PDFdeepakadhanaNo ratings yet

- Buisnes EnvioDocument18 pagesBuisnes EnvioAparna A D NairNo ratings yet

- International InvestmentDocument16 pagesInternational Investmentmisty_nairNo ratings yet

- A Study To Analyze FDI Inflow To India: Jyoti Gupta, Dr. Rachna ChaturvediDocument9 pagesA Study To Analyze FDI Inflow To India: Jyoti Gupta, Dr. Rachna ChaturvediananyaNo ratings yet

- Foreign Direct InvestmentDocument11 pagesForeign Direct Investmentdivyesh_variaNo ratings yet

- Sardar Patel College of Administration and Management Bba-Vi Global Business Environment Ch:2 International InvestmentDocument7 pagesSardar Patel College of Administration and Management Bba-Vi Global Business Environment Ch:2 International InvestmentJigisha MugdalNo ratings yet

- Full Report On Reasons For FDIDocument19 pagesFull Report On Reasons For FDIKrishnapalsinh Indrajitsinh VirparaNo ratings yet

- International Business: Foreign Direct InvestmentDocument23 pagesInternational Business: Foreign Direct InvestmentKapil PrabhuNo ratings yet

- Foreign Direct Investment in The Retail Sector in IndiaDocument5 pagesForeign Direct Investment in The Retail Sector in IndiaKashaf ShaikhNo ratings yet

- Types of Investments in The Investment IndustryDocument6 pagesTypes of Investments in The Investment IndustrySonu Antony NjaravelilNo ratings yet

- Fdi 12Document70 pagesFdi 12cityNo ratings yet

- Fdi in IndiaDocument21 pagesFdi in Indiabestowedart8905No ratings yet

- International Business: Group-8Document5 pagesInternational Business: Group-8pavanNo ratings yet

- FDI-Foreign Direct InvestmentDocument1 pageFDI-Foreign Direct Investmentdivyathakurcrap6905No ratings yet

- Foreign Direct InvestmentDocument32 pagesForeign Direct InvestmentVikas GaurNo ratings yet

- FDI in India..RM AssignmentDocument8 pagesFDI in India..RM AssignmentTanisha MukherjeeNo ratings yet

- Investment and Comp LawDocument5 pagesInvestment and Comp LawPulkit JainNo ratings yet

- Foreign Direct Investment in Defence Sector, IndiaDocument10 pagesForeign Direct Investment in Defence Sector, IndiaPallav PalitNo ratings yet

- Foreign Direct InvestmentDocument13 pagesForeign Direct InvestmentGaurav GuptaNo ratings yet

- Synopsis Expectation of FII in Terms of HR Law: Submitted By: Group-3Document3 pagesSynopsis Expectation of FII in Terms of HR Law: Submitted By: Group-3abhishekNo ratings yet

- IEBDocument25 pagesIEBAnkit Kumar SinhaNo ratings yet

- Project Onforeign Direct InvestmentDocument20 pagesProject Onforeign Direct InvestmentNimesh MokaniNo ratings yet

- SM Assignment 1Document25 pagesSM Assignment 1Utkarsh AryanNo ratings yet

- Finanace International Equity MarketsDocument8 pagesFinanace International Equity Marketsguptasoniya247No ratings yet

- Fdi Research Paper in IndiaDocument4 pagesFdi Research Paper in Indiaafeaynwqz100% (1)

- Fdi in IndiaDocument8 pagesFdi in IndiamoniluckNo ratings yet

- Updated FC QB AnsDocument41 pagesUpdated FC QB AnsMr.No ratings yet

- Impact of Fdi in India - Annai MathammalDocument7 pagesImpact of Fdi in India - Annai MathammalSubakarthi KarthiNo ratings yet

- Foreign Direct InvestnmentDocument23 pagesForeign Direct InvestnmentAryan BhageriaNo ratings yet

- Opportunities in The Indian Defence SectorDocument78 pagesOpportunities in The Indian Defence SectorPratip BhattacharyyaNo ratings yet

- International Financial MarketDocument19 pagesInternational Financial Marketzohebdhuka_libraNo ratings yet

- Evolution of Investment LawDocument35 pagesEvolution of Investment LawAvik Das RoyNo ratings yet

- Foreign Direct Investment (FDI)Document19 pagesForeign Direct Investment (FDI)SaurabhNo ratings yet

- Difference Between FDI & Portfolio Investment: PurposesDocument6 pagesDifference Between FDI & Portfolio Investment: PurposesNupur MathurNo ratings yet

- Foreign Direct Investment: Master in Management Studies Semester - I ACADEMIC YEAR 2010-2011Document18 pagesForeign Direct Investment: Master in Management Studies Semester - I ACADEMIC YEAR 2010-2011Smita AvhadNo ratings yet

- Final Me EcoDocument2 pagesFinal Me Ecojyoti90No ratings yet

- Fdi in Indian Retail Sector: Opportunities and Challenges: Ritika, Neha DangiDocument6 pagesFdi in Indian Retail Sector: Opportunities and Challenges: Ritika, Neha DangiArvind NayakaNo ratings yet

- 08 Intl Business F D I Sess 13, 14Document30 pages08 Intl Business F D I Sess 13, 14Swapnil MukadamNo ratings yet

- FDI in India Case Study WalmartDocument32 pagesFDI in India Case Study WalmartSaad KhanNo ratings yet

- Foreign Institutional Investments and Its Influence On Equity Stock Market in IndiaDocument14 pagesForeign Institutional Investments and Its Influence On Equity Stock Market in IndiaNeha KumariNo ratings yet

- ChinchuDocument19 pagesChinchuAnu AndrewsNo ratings yet

- Chap 9Document29 pagesChap 9ghanjuNo ratings yet

- Mod 4 BeDocument25 pagesMod 4 BePratha JainNo ratings yet

- Foreign Direct InvestmentDocument5 pagesForeign Direct InvestmentRiddhee GosarNo ratings yet

- Essay Writing Competition 2022Document7 pagesEssay Writing Competition 2022whateverittakess2001No ratings yet

- Globalisation of Economy and The Impact of FDI On Sustainable Growth: An Indian PerspectiveDocument5 pagesGlobalisation of Economy and The Impact of FDI On Sustainable Growth: An Indian Perspectiveadityasaxena11No ratings yet

- Of Matters Military: Indian Defence Deals (Need for Transparency and Probity)From EverandOf Matters Military: Indian Defence Deals (Need for Transparency and Probity)No ratings yet

- Master Doc File EPS MATHDocument1 pageMaster Doc File EPS MATHVinit ShahNo ratings yet

- Company Focus: Tata Consultancy ServicesDocument10 pagesCompany Focus: Tata Consultancy ServicesVinit ShahNo ratings yet

- Furniture Design OrbitDocument28 pagesFurniture Design OrbitVinit ShahNo ratings yet

- Simulation CaseDocument7 pagesSimulation Casekeith105No ratings yet

- Six Sigma Certification Exam - Sample Paper - GB PDFDocument10 pagesSix Sigma Certification Exam - Sample Paper - GB PDFVinit ShahNo ratings yet

- CSSYB Insert B1698 PDFDocument8 pagesCSSYB Insert B1698 PDFVinit ShahNo ratings yet

- China's Stock Market BubbleDocument6 pagesChina's Stock Market BubbleVinit ShahNo ratings yet

- Nostro Financial Services PVT LTD: V N Mohan PlacementsDocument1 pageNostro Financial Services PVT LTD: V N Mohan PlacementsVinit ShahNo ratings yet

- S. No State and U.T. Chief Minister GovernorDocument2 pagesS. No State and U.T. Chief Minister GovernorVinit ShahNo ratings yet

- Initiatives of The Ministry of Micro, Small and Medium Enterprises (Msme) in Recent YearsDocument16 pagesInitiatives of The Ministry of Micro, Small and Medium Enterprises (Msme) in Recent YearsVinit ShahNo ratings yet

- Thank You!!! For Using WWW - Freecharge.in: Payment ReceiptDocument1 pageThank You!!! For Using WWW - Freecharge.in: Payment ReceiptVinit ShahNo ratings yet

- Highlights of The Stock Market: YearsDocument15 pagesHighlights of The Stock Market: YearsVinit ShahNo ratings yet

- Fdi in Retail AssignmentDocument6 pagesFdi in Retail AssignmentVinit ShahNo ratings yet

- Connect RulesDocument1 pageConnect RulesVinit ShahNo ratings yet

- EU Mergers and Takeovers & IndianDocument5 pagesEU Mergers and Takeovers & IndianVinit ShahNo ratings yet

- Technology'S Child: Schwarzkopf and Operation Desert Storm: BackgroundDocument17 pagesTechnology'S Child: Schwarzkopf and Operation Desert Storm: BackgroundosamazimNo ratings yet

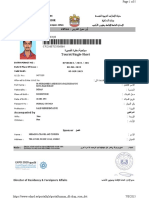

- ﺳ ﯿﺎ ﺣ ﯿ ﺔ / ﺳ ﻔ ﺮ ﺓ - ﻗ ﺼ ﯿ ﺮ ﺓ Tourist/Single-Short: Evisa - إّذ ن د ﺧ و ل ا ﻟﻛ ﺗ ر وﻧ ﻲDocument1 pageﺳ ﯿﺎ ﺣ ﯿ ﺔ / ﺳ ﻔ ﺮ ﺓ - ﻗ ﺼ ﯿ ﺮ ﺓ Tourist/Single-Short: Evisa - إّذ ن د ﺧ و ل ا ﻟﻛ ﺗ ر وﻧ ﻲshahid pkNo ratings yet

- RSA Assignment2 ShreyiDocument10 pagesRSA Assignment2 ShreyiAmardeep SinghNo ratings yet

- HRM ReportDocument18 pagesHRM ReportMuaz AhmedNo ratings yet

- Department of Homeland Security (DHS) GuidelinesDocument5 pagesDepartment of Homeland Security (DHS) GuidelinesAli T. GilaniNo ratings yet

- Foot Pursuit Report Officer Ruiz FP 2023 - Reginald Clay, Jr.Document1 pageFoot Pursuit Report Officer Ruiz FP 2023 - Reginald Clay, Jr.John KuglerNo ratings yet

- Default Bail The Infirmities Noted in Section 187 of The BharatiyaDocument17 pagesDefault Bail The Infirmities Noted in Section 187 of The BharatiyagajendraburagaNo ratings yet

- BriarpatchDocument45 pagesBriarpatchalexe012No ratings yet

- Search and RescueDocument25 pagesSearch and RescueJerrymiah.maligonNo ratings yet

- Mizoram Police Manual 2006 PDFDocument457 pagesMizoram Police Manual 2006 PDFpzohmingthanga100% (1)

- Authorization Letter CTCU19Document1 pageAuthorization Letter CTCU19kholisNo ratings yet

- Drills/Procedures For The Intelligence Section ARTEP 34-245Document49 pagesDrills/Procedures For The Intelligence Section ARTEP 34-245jimdigrizNo ratings yet

- Chillicothe Police Reports For July 17th 2013Document32 pagesChillicothe Police Reports For July 17th 2013Andrew AB BurgoonNo ratings yet

- Death Squads The Killing Never StopsDocument131 pagesDeath Squads The Killing Never StopsYedasiNo ratings yet

- Start Date End Date # of Target Days Chapter # Name of The ChapterDocument7 pagesStart Date End Date # of Target Days Chapter # Name of The Chapterravi kantNo ratings yet

- Apache County Sheriff Id Theft Act July 9 2020Document12 pagesApache County Sheriff Id Theft Act July 9 2020Marsha MainesNo ratings yet

- World War 2 Summary & QuestionnsDocument4 pagesWorld War 2 Summary & QuestionnsMariam SharafNo ratings yet

- 2016 VHOF Book and Cover For WebDocument70 pages2016 VHOF Book and Cover For WebNew York SenateNo ratings yet

- Bu Dop A-341, 1967Document534 pagesBu Dop A-341, 1967David Pristash67% (3)

- Why Did Japan SurrenderDocument4 pagesWhy Did Japan Surrendervidro3No ratings yet

- Prelims Lea 3Document3 pagesPrelims Lea 3JuLievee LentejasNo ratings yet

- IRA MindmapDocument1 pageIRA MindmapJames Cooke0% (1)

- Transcript ColloquimDocument28 pagesTranscript ColloquimEd Ravfhor Amen AmenNo ratings yet

- Posadas vs. Court of Appeals, G.R. No. 89139, August 2, 1990.Document8 pagesPosadas vs. Court of Appeals, G.R. No. 89139, August 2, 1990.Joshua RodriguezNo ratings yet

- CP LTC Ley GB CGSC Cl68Document151 pagesCP LTC Ley GB CGSC Cl68Jun LlaveNo ratings yet

- Conserve And/or Redeem Convicted Offenders and Prisoners Who Are Under The Probation or Parole SystemDocument6 pagesConserve And/or Redeem Convicted Offenders and Prisoners Who Are Under The Probation or Parole SystemJellyn CastilloNo ratings yet

- The On The Roof GangDocument3 pagesThe On The Roof GangTyler KirklandNo ratings yet

- Case FolderrrDocument12 pagesCase FolderrrpauNo ratings yet

Fdi in Defence

Fdi in Defence

Uploaded by

Vinit ShahOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fdi in Defence

Fdi in Defence

Uploaded by

Vinit ShahCopyright:

Available Formats

FDI IN DEFENCE

HISTORY:

Most prospective foreign investors consider the Indian FDI policy in the defence industry to

be dissuasive in intent and content.

Indias policy on Foreign Direct Investment (FDI) in defence industry is symptomatic of

bureaucratic obduracy and perverse intransigence. Unwillingness to learn from experience

has been the bane of Indian governance. Persistence with failed policy initiatives can never

yield results. In May 2001, the defence industry was thrown open to the private sector. The

Government permitted 100 per cent equity with a maximum of 26 per cent FDI component,

both subject to licensing. Unattractiveness of the policy became evident in a short span of

time. By 2004, then Defence Minister George Fernandes was forced to admit in the Lok

Sabha that India had received no FDI proposal till then.

Observing the lack of enthusiasm amongst the prospective entrepreneurs at Aero India 2005,

Defence Minister Pranab Mukherjee considered it necessary to exhort interested foreign

companies to invest in the Indian defence industry. As per the reports appearing in the press,

India has received less than US$5 million of FDI inflow in defence manufacturing during the

last decade. Most prospective foreign investors consider the Indian FDI policy in the defence

industry to be dissuasive in intent and content.

In 2010, the Commerce Ministry circulated a note recommending the raising of FDI cap to 74

per cent to encourage established players in the defence industry to set up manufacturing

facilities and integration of systems in India. It was vehemently opposed by the interested

parties, with Ministry of Defence (MoD) insisting that the 26 per cent FDI limit should be

retained. In May 2013, modifying his earlier proposal, Commerce Minister Anand Sharma

suggested that the upper cap be raised to 49 per cent as a first step. It has also been shot down

by the MoD. However, in a deft move, the MoD has suggested that higher FDI may be

considered for modern and state-of-the-art technology by the Cabinet Committee on Security

on a case to case basis.

The World Bank defines FDI as net inflows of investment to acquire a lasting management

interest (ten per cent or more of voting stock) in an enterprise operating in an economy other

than that of the investor. FDI comprises funds provided by the foreign direct investor to the

FDI enterprise as equity capital, reinvested earnings and intra-company loans. Attractiveness

of a nation for foreign investments in any sector is judged by its FDI Confidence Index

which depends on various factors such as stable policy, favourable investment climate,

structural adjustments, economic freedom and a fair market access. India fares rather poorly

on this account.

Unwillingness to learn from experience has been the bane of Indian governance. As

recounted earlier, it is an undisputed fact that the current Indian policy has been an abject

failure. Whereas an intense debate was taking place to influence the decision makers, a

number of articles had been planted in the media to sway the public opinion. Unfortunately,

objectivity was conspicuous by its absence. Stakeholders had taken stand that suits their

interests.

As the debate had been highly skewed, some of the common misconceptions have been

discussed below and all issues are put in their proper perspective.

Misconception One: Indian policy is highly investor friendly and does not require any

changes.

The MoD continues to insist that the Indian policy is highly investor friendly and requires no

changes. It attributes lack of response to the individual entrepreneurs decision depending on

his commercial perception. However, a closer look at the policy reveals that virtually every

provision is dissuasive in nature management control of the company must remain in Indian

hands with majority representation in the board. The Chief Executive has to be a resident

Indian; a licensee can produce only the licensed products and in the sanctioned quantity and

he can neither diversify nor enhance production without prior sanction. A foreign investor

cannot transfer his equity before the expiry of the lock-in period of three-years. Even after

that, such transfers have to be with the approval of the Government.

Although the Government can give no purchase guarantee, the proposed quantity for

acquisition and overall requirements may be made known to the extent possible. The policy

directive further stipulates that arms and ammunition will be primarily sold to the MoD.

Their sale to other security organisations in the country and exports will be with the prior

approval of the Government. Non-lethal items may be sold to non-Government agencies but

with the concurrence of the MoD.

FDI is a need-based concept; whereas a host nation needs FDI for accelerated growth,

prospective investors are guided purely by economic considerations. Oddly, India expects a

prospective foreign investor to be excited by such an asymmetrical policy wherein he is

expected to invest his resources in a venture where he has no significant control, faces strict

capacity/product constraints, gets no purchase guarantee and has no open access to other

markets (including exports). It defies logic. Such a lop-sided policy can never attract FDI.

Misconception Two: Higher FDI limit is a threat to national security

When every other argument fails, the spectre of security concerns is raised by the interested

elements in the MoD to stymie any proposal to raise FDI limit. Apprehensions are often

expressed that during operational emergencies, foreign investors may shut down their

factories and choke supplies to the armed forces. In his recent letter to the Commerce

Minister, Defence Minister Antony has opposed the raising of FDI cap on grounds that the

country could not afford to be dependent on foreign companies and be vulnerable to policies

of their countries of origin in the field of defence on the long-term basis.

India is procuring all critical weapon systems produced/integrated abroad. It is not

understood as to how Indias security would get threatened if the same weapon systems are

produced/integrated in India. As a matter of fact, indigenous production will insulate India

from unilateral imposition of embargos on contracted supplies by whimsical foreign

governments. The degree of assurance and resulting comfort accruing from indigenous

facilities will always be significantly more than dependence on imports. Additionally,

indigenous manufacturing facilities will also ensure better life-time support including supply

of spares.

As regards dependability during crisis situations, no foreign investor can risk loss of his total

investment by shutting down his production facilities. Further, all major defence equipment

producers follow Global Factory concept, wherein various manufacturing functions are

spread over a number of locations in different countries. When a major defence company

invests in any country, it makes it an integral part of its overall production chain. In such a

scenario, it is not easy for the company to shut down any facility and disrupt its worldwide

production network. If India is serious about attracting FDI in defence, it has to position itself

as the most lucrative FDI destination.

Most importantly, adequate safeguards can be incorporated while issuing licenses. India can

reserve the right to take over the licensed facility under certain extraordinary circumstances

of national emergencies. Most nations include such an enabling provision. It is ridiculous that

imports are considered more reliable than production in India. Needless to say, security

concerns are overhyped to perpetuate status quo by entrenched interests by resorting to

specious logic. Fears expressed are totally unfounded and highly exaggerated.

Misconception Three: Investment decisions are taken by foreign companies and India

has no role to play

It is often claimed by the MoD that foreign investors are guided purely by economic

considerations and that they are neither influenced by the FDI limit nor by other provisions.

The above argument reflects ignorance of the dynamics of FDI flow. It is often forgotten that

FDI is a need-based concept. Whereas a host nation needs FDI for accelerated growth,

prospective investors are guided purely by economic considerations. As investible funds are

limited, all countries covet them. Foreign investors carry out an inter-reappraisal of all likely

destinations to determine the one that appears most lucrative for optimum returns. Therefore,

every host country has to strive to project itself as the ideal FDI destination vis--vis other

competing suitors.

It is prudent to understand what motivates an investor to invest his resources in another

country and undertake risks associated with it. As investment in defence production means a

lasting and protracted relationship, he seeks a stable environment with long-term, well-

defined economic policies which are fair and consistent. In addition, there are four factors

which influence such decisions availability of abundant raw material, skilled work force,

low cost of production and lucrative market. It is the interplay of all these factors which

influence an investment decision. If India is serious about attracting FDI in defence, it has to

position itself as the most lucrative FDI destination with improved FDI Confidence Index.

For that, it must make structural adjustment to provide functional freedom to joint ventures to

respond to market dynamics.

FDI pre-supposes a long term commitment and lasting relationship between the foreign and

local enterprise. As regards the FDI cap of 26 per cent, no foreign investor is going to part

with his closely guarded technology unless he has adequate control over the enterprise and is

assured of sufficient autonomy as regards capacity enhancement and access to markets to

ensure commercial viability through economies of scales.

Misconception Four: FDI will stymie the growth of indigenous defence industry

Defence Minister Antonys statement that building up Indias own indigenous capabilities for

designing and developing weapon systems is vital cannot be disputed at all. However, his

assertion that allowing foreign companies to set up manufacturing/assembly facilities in India

would be a retrograde step and stymie the growth of indigenous capability is certainly

misplaced. He expressed apprehensions that such a move would perpetuate Indias

dependence on foreign countries for modern weapons.

Further, the Ex- Defence Minister has expressed confidence in Indias capability to build-up

defence industry through indigenous efforts, especially with the help of the private sector.

According to him, only immediate requirement of weapon systems is being imported till

India develops its own weapon systems. It will not be incorrect to term the above optimism as

a case of self-delusion. One has been hearing such declarations since early 1990s when

confident predictions were made that defence imports would be reduced from 70 per cent to

30 per cent within a period of ten years. On the contrary, after two decades, imports have now

climbed to close to 75 per cent.

A look at the dismal performance of the Defence Research and Development Organisation

(DRDO) and the public sector hardly inspires any confidence in their capability to deliver.

Both are equally responsible for the current abysmal state of affairs. Although DRDO has 51

laboratories with 5,000 scientists and over 25,000 support personnel, it has not been able to

develop a single system in the promised time-frame and conforming to the accepted

parameters. Mediocrity thrives due to lack of accountability.

Even after spending crores of rupees, the only success it has to its credit relates to replication

of some imported products (fancifully called reverse engineering and indigenisation).

India needs defence technology desperately. Even if the DRDO is able to make some

progress in a few cases, it is always done with major compromises with respect to the stated

qualitative requirements. In most cases, by the time equipment is developed and delivered, it

becomes obsolete. Thus, the services are forced to live with out-dated and useless equipment.

As the performance of DRDO over the last five decades has been highly unsatisfactory elying

all hopes of development of indigenous competence, it will be unrealistic to expect DRDO to

change overnight and make India self-reliant. The defence public sector consists of nine

defence public sector undertakings and 39 Ordnance Factories. Despite getting preferential

treatment from MoD, it has singularly failed to keep pace with technological developments. It

thrives on periodic infusion of transferred technology and has developed no indigenous

competence at all.

Purchase of technologies under Buy and Make route has failed to ensure infusion of

meaningful technologies. Even Antony had admitted that India had not benefitted much from

the transferred technologies. Most unfortunately, the Indian military is a captive customer of

the Indian public sector and is forced to buy what it produces. With assured orders in hand,

the public sector carries on with its lethargic and inefficient manner, without bothering about

the quality parameters or the time frame. Indias private sector has certainly come of age but

needs hand-holding in the interim to be able to graduate to the production of complex weapon

systems. This hand-holding can be done only by foreign technology majors. For that,

establishment of joint ventures with equity participation is a prerequisite. India has to make

up its mind whether it wants FDI in the defence industry or not. It was left to Anand Sharma

to remind the policy makers that it was unrealistic to expect domestic manufacturing to make

state-of-the-art equipment without sourcing high-end technologies. He advocated

encouraging foreign defence manufacturers to help catalyse the growth of the indigenous

industry.

Misconception Five: Foreign technology can be sourced through offsets

In a paradigm shift in Indias approach towards offsets, the Defence Offset Guidelines (DOG)

issued by MoD in August 2012 allowed the Transfer of Technology (ToT) as a permissible

avenue for discharging offset obligations. DOG offers three recipient-centric options to

foreign vendors to earn offset credits against ToT.

One, the foreign vendor can make investment in Indian enterprises in kind in terms of ToT

through joint ventures or through the non-equity route for co-production, co-development and

production or licensed production and/or maintenance of eligible products and provision of

eligible services. Offset credit for ToT would be ten per cent of the value of buy-back by the

OEM during the period of the offset contract, to the extent of value addition in India.

Two, ToT can be provided to government institutions and establishments engaged in the

manufacture and/or maintenance of eligible products and provision of eligible services,

including DRDO. It includes augmentation of capacity for research, design and development,

training and education. However, there is no mandatory buy-back stipulation.

Three, DRDO can acquire technologies and test facilities in areas of high technology. A

highly imprecise list with open-ended description of vast array of related technologies that

DRDO seeks has been made public. It is left to a foreign vendor to study the list and offer

technology of his choice. Overlooking the basic fact that it is not the type of technology but

its relevance that should dictate the selection, India has abrogated that right in favour of the

vendors. Thus technologies that will flow to India will be availability-based and not need-

based. Needless to say, every vendor will try to pass off low-end technologies that do not

require export licenses and are cheap to implement. Production of high-tech systems by a

foreign company in India would be infinitely better than India importing systems from

abroad.

Further, multipliers are normally used to assign additional weightage to different offset

programmes to provide vendors with incentives to offer offsets in targeted areas.

Unfortunately, India has trashed the concept of multipliers by making their assignment usage-

based and not as per the degree and exclusivity of technology. Resultantly, vendors will have

no incentive to offer high-end technologies. As seen above, DOG demonstrates the muddled

thinking of the policy makers. It is extremely doubtful if the new policy can lead the country

towards the achievement of much touted aim of self-sufficiency in defence production,

especially as the upper cap for FDI has been retained at 26 per cent for offset cases as well.

Misconception Six: India can do without foreign funds in defence.

An influential segment of decision makers had been propagating the view that India does not

need foreign funds and can afford to pay for what it wants. It cites Indias huge shopping list

to buttress the argument. For an aspiring power like India, FDI is not just a question of

acquiring funds, but more importantly, it represents access to the latest technologies. Most

defence products involve a relatively high level of technology and this technology gets

transferred only if the foreign partner has a long term stake in the company. FDI pre-supposes

a long term commitment and lasting relationship between the foreign and local enterprise.

FDI sets in motion a chain reaction wherein FDI upgrades local technology which, in turn,

attracts more FDI with higher technology and the cycle goes on. This is of vital importance to

the defence sector which is highly capital intensive and undergoes rapid obsolescence of

technology. India needs defence technology desperately. It is lagging behind by up to twenty

years. It is foolhardy to waste time and resources in trying to reinvent the wheel. India needs

to import latest technology through FDI to bridge the current gap. Thereafter, the imported

technology should be used as a spring board for developing newer technologies indigenously.

India must exploit its favourable geo-political location and aspire to be a regional hub for

global outsourcing of defence equipment.

PRESENT SENARIEO:

On 10

th

July, 2014, the Finance Minister Mr. Arun Jaitley proposed to raise the limit of FDI

in Defence to 49% from 26% in the Union Budget for 2014-2015.

On 6

th

August, 2014 the cabinet approved raising FDI limit to 49% in defence sector. The

move was made with an aim to boost domestic industry of the country, which presently

imports up to 70% of its military hardware. The Cabinet Committee on Security (CCS) will

be the final decision making body for Foreign Direct Investment (FDI) proposals in Defence

beyond 49 per cent.

According to the new rules on FDI in Defence notified by the Department of Industrial Policy

& Promotion, based on the Cabinet decision taken on 6

th

Aug, 2014, FDI proposals beyond

49% vetted by the CCS need not be cleared by the Cabinet Committee on Economic Affairs

(CCEA). So far, all FDI proposals with foreign investments over 1,200 crore had to be

cleared by the CCEA.

The FDI limit to be cleared through the Foreign Investment Promotion Board (FIPB) route

has been raised to 49% from 26%. The press note clarified that the cap is composite and

includes different types of foreign investments such as FDI, Foreign Institutional Investors

(FIIs), Foreign Portfolio Investors (FPIs), Non-Resident Indians (NRIs), Foreign Venture

Capital Investors (FVCI) and Qualified Foreign Investors (QFIs), it said.

Further, portfolio investment by FPIs, FIIs, NRIs, QFIs and investments by FVCIs together

will not exceed 24 per cent of the total equity of the investee or Joint Venture Company.

The final clearance for FDI proposals within the 49% limit will be given by the CCEA in

case foreign investments exceed 1,200 crore. All decisions on FDI applications will be

normally communicated within a time frame of 10 weeks from the date of acknowledgement,

the note said.

Ownership

The licence applications will be considered and given by the DIPP in consultation with the

Ministries of Defence and External Affairs.

The note specifically laid down that the applicant company seeking permission of the

Government for FDI up to 49% should be an Indian company owned and controlled by

resident Indian citizens. The management of the applicant company should be in Indian

hands.

However, for proposals seeking approval for foreign investment beyond 49 per cent, the

applicant could be an Indian company or a foreign investor. The condition of Indian

management control is also not applicable in this case.

Latest Update:

Foreign Investment Promotion Board (FIPB) on 16

th

September, 2014 cleared 21 proposals

including that of Bharti Shipyard, but turned down the Sistema Shyam's request to raise

foreign holding. The FIPB, headed by Finance Secretary Arvind Mayaram, at its meeting

considered 35 proposals. The proposal of Bharti Shipyard -- an Indian company in ship

building sector which has existing FDI through FIIs and NRIs -- to undertake defence

activities was cleared.

The proposal of Verizon Communications India which sought approval to increase foreign

equity participation by its foreign parent from 74% to 100% was also approved by the FIPB.

The board also gave a go ahead to Indusind Bank's proposal with regard to foreign

investment.

The other proposals cleared by the FIPB include that of Kineco Kaman Composites India Ltd

in the defence sector and ANZ Capital Ltd in the financial services sector. However, the

proposal of Sistema Shyam Teleservices Ltd (SSTL) to raise foreign stake holding in the

company beyond the current 74% was rejected by the FIPB. The company has not specified

the extent to which the foreign holding would be raised. Russian conglomerate Sistema JSFC

holds 56.68% in SSTL, Russian government 7.14% and 0.13% other foreign entities.

You might also like

- International Trade Law Final VarunDocument15 pagesInternational Trade Law Final Varunvritaant varunNo ratings yet

- Army and Police Rank ComparisonDocument2 pagesArmy and Police Rank ComparisonTaif Arif100% (4)

- Written Analysis and Communication II: Assignment II Submitted ToDocument6 pagesWritten Analysis and Communication II: Assignment II Submitted Toaks0388No ratings yet

- RNCR S 22 00176Document29 pagesRNCR S 22 00176rahulnathcNo ratings yet

- INTRO, Types, and More. SODocument11 pagesINTRO, Types, and More. SOpanchaljanak0021No ratings yet

- Give Ten Reasons Why FDI Is Beneficial To Developing Economy? AnsDocument19 pagesGive Ten Reasons Why FDI Is Beneficial To Developing Economy? AnsFaisal MohdNo ratings yet

- Fdi in Insurance SectorDocument36 pagesFdi in Insurance Sectorprince33% (3)

- Foreign Direct Investment: Why in News?Document4 pagesForeign Direct Investment: Why in News?sejalkacherNo ratings yet

- PB FDIDefenceIndustryDocument16 pagesPB FDIDefenceIndustryManish JaiswalNo ratings yet

- Project Report Master of Management Studies-MMS Degree in Partial Requirement During 3 Semester, 2010-11Document14 pagesProject Report Master of Management Studies-MMS Degree in Partial Requirement During 3 Semester, 2010-11mandy_t06No ratings yet

- Unit 5 BEDocument11 pagesUnit 5 BESharwan SinghNo ratings yet

- C C C CDocument9 pagesC C C Cruchinsodhani5187No ratings yet

- Research Publication SeemaDocument7 pagesResearch Publication SeemaAmit MirjiNo ratings yet

- Ijmra 11646 PDFDocument15 pagesIjmra 11646 PDFdeepakadhanaNo ratings yet

- Buisnes EnvioDocument18 pagesBuisnes EnvioAparna A D NairNo ratings yet

- International InvestmentDocument16 pagesInternational Investmentmisty_nairNo ratings yet

- A Study To Analyze FDI Inflow To India: Jyoti Gupta, Dr. Rachna ChaturvediDocument9 pagesA Study To Analyze FDI Inflow To India: Jyoti Gupta, Dr. Rachna ChaturvediananyaNo ratings yet

- Foreign Direct InvestmentDocument11 pagesForeign Direct Investmentdivyesh_variaNo ratings yet

- Sardar Patel College of Administration and Management Bba-Vi Global Business Environment Ch:2 International InvestmentDocument7 pagesSardar Patel College of Administration and Management Bba-Vi Global Business Environment Ch:2 International InvestmentJigisha MugdalNo ratings yet

- Full Report On Reasons For FDIDocument19 pagesFull Report On Reasons For FDIKrishnapalsinh Indrajitsinh VirparaNo ratings yet

- International Business: Foreign Direct InvestmentDocument23 pagesInternational Business: Foreign Direct InvestmentKapil PrabhuNo ratings yet

- Foreign Direct Investment in The Retail Sector in IndiaDocument5 pagesForeign Direct Investment in The Retail Sector in IndiaKashaf ShaikhNo ratings yet

- Types of Investments in The Investment IndustryDocument6 pagesTypes of Investments in The Investment IndustrySonu Antony NjaravelilNo ratings yet

- Fdi 12Document70 pagesFdi 12cityNo ratings yet

- Fdi in IndiaDocument21 pagesFdi in Indiabestowedart8905No ratings yet

- International Business: Group-8Document5 pagesInternational Business: Group-8pavanNo ratings yet

- FDI-Foreign Direct InvestmentDocument1 pageFDI-Foreign Direct Investmentdivyathakurcrap6905No ratings yet

- Foreign Direct InvestmentDocument32 pagesForeign Direct InvestmentVikas GaurNo ratings yet

- FDI in India..RM AssignmentDocument8 pagesFDI in India..RM AssignmentTanisha MukherjeeNo ratings yet

- Investment and Comp LawDocument5 pagesInvestment and Comp LawPulkit JainNo ratings yet

- Foreign Direct Investment in Defence Sector, IndiaDocument10 pagesForeign Direct Investment in Defence Sector, IndiaPallav PalitNo ratings yet

- Foreign Direct InvestmentDocument13 pagesForeign Direct InvestmentGaurav GuptaNo ratings yet

- Synopsis Expectation of FII in Terms of HR Law: Submitted By: Group-3Document3 pagesSynopsis Expectation of FII in Terms of HR Law: Submitted By: Group-3abhishekNo ratings yet

- IEBDocument25 pagesIEBAnkit Kumar SinhaNo ratings yet

- Project Onforeign Direct InvestmentDocument20 pagesProject Onforeign Direct InvestmentNimesh MokaniNo ratings yet

- SM Assignment 1Document25 pagesSM Assignment 1Utkarsh AryanNo ratings yet

- Finanace International Equity MarketsDocument8 pagesFinanace International Equity Marketsguptasoniya247No ratings yet

- Fdi Research Paper in IndiaDocument4 pagesFdi Research Paper in Indiaafeaynwqz100% (1)

- Fdi in IndiaDocument8 pagesFdi in IndiamoniluckNo ratings yet

- Updated FC QB AnsDocument41 pagesUpdated FC QB AnsMr.No ratings yet

- Impact of Fdi in India - Annai MathammalDocument7 pagesImpact of Fdi in India - Annai MathammalSubakarthi KarthiNo ratings yet

- Foreign Direct InvestnmentDocument23 pagesForeign Direct InvestnmentAryan BhageriaNo ratings yet

- Opportunities in The Indian Defence SectorDocument78 pagesOpportunities in The Indian Defence SectorPratip BhattacharyyaNo ratings yet

- International Financial MarketDocument19 pagesInternational Financial Marketzohebdhuka_libraNo ratings yet

- Evolution of Investment LawDocument35 pagesEvolution of Investment LawAvik Das RoyNo ratings yet

- Foreign Direct Investment (FDI)Document19 pagesForeign Direct Investment (FDI)SaurabhNo ratings yet

- Difference Between FDI & Portfolio Investment: PurposesDocument6 pagesDifference Between FDI & Portfolio Investment: PurposesNupur MathurNo ratings yet

- Foreign Direct Investment: Master in Management Studies Semester - I ACADEMIC YEAR 2010-2011Document18 pagesForeign Direct Investment: Master in Management Studies Semester - I ACADEMIC YEAR 2010-2011Smita AvhadNo ratings yet

- Final Me EcoDocument2 pagesFinal Me Ecojyoti90No ratings yet

- Fdi in Indian Retail Sector: Opportunities and Challenges: Ritika, Neha DangiDocument6 pagesFdi in Indian Retail Sector: Opportunities and Challenges: Ritika, Neha DangiArvind NayakaNo ratings yet

- 08 Intl Business F D I Sess 13, 14Document30 pages08 Intl Business F D I Sess 13, 14Swapnil MukadamNo ratings yet

- FDI in India Case Study WalmartDocument32 pagesFDI in India Case Study WalmartSaad KhanNo ratings yet

- Foreign Institutional Investments and Its Influence On Equity Stock Market in IndiaDocument14 pagesForeign Institutional Investments and Its Influence On Equity Stock Market in IndiaNeha KumariNo ratings yet

- ChinchuDocument19 pagesChinchuAnu AndrewsNo ratings yet

- Chap 9Document29 pagesChap 9ghanjuNo ratings yet

- Mod 4 BeDocument25 pagesMod 4 BePratha JainNo ratings yet

- Foreign Direct InvestmentDocument5 pagesForeign Direct InvestmentRiddhee GosarNo ratings yet

- Essay Writing Competition 2022Document7 pagesEssay Writing Competition 2022whateverittakess2001No ratings yet

- Globalisation of Economy and The Impact of FDI On Sustainable Growth: An Indian PerspectiveDocument5 pagesGlobalisation of Economy and The Impact of FDI On Sustainable Growth: An Indian Perspectiveadityasaxena11No ratings yet

- Of Matters Military: Indian Defence Deals (Need for Transparency and Probity)From EverandOf Matters Military: Indian Defence Deals (Need for Transparency and Probity)No ratings yet

- Master Doc File EPS MATHDocument1 pageMaster Doc File EPS MATHVinit ShahNo ratings yet

- Company Focus: Tata Consultancy ServicesDocument10 pagesCompany Focus: Tata Consultancy ServicesVinit ShahNo ratings yet

- Furniture Design OrbitDocument28 pagesFurniture Design OrbitVinit ShahNo ratings yet

- Simulation CaseDocument7 pagesSimulation Casekeith105No ratings yet

- Six Sigma Certification Exam - Sample Paper - GB PDFDocument10 pagesSix Sigma Certification Exam - Sample Paper - GB PDFVinit ShahNo ratings yet

- CSSYB Insert B1698 PDFDocument8 pagesCSSYB Insert B1698 PDFVinit ShahNo ratings yet

- China's Stock Market BubbleDocument6 pagesChina's Stock Market BubbleVinit ShahNo ratings yet

- Nostro Financial Services PVT LTD: V N Mohan PlacementsDocument1 pageNostro Financial Services PVT LTD: V N Mohan PlacementsVinit ShahNo ratings yet

- S. No State and U.T. Chief Minister GovernorDocument2 pagesS. No State and U.T. Chief Minister GovernorVinit ShahNo ratings yet

- Initiatives of The Ministry of Micro, Small and Medium Enterprises (Msme) in Recent YearsDocument16 pagesInitiatives of The Ministry of Micro, Small and Medium Enterprises (Msme) in Recent YearsVinit ShahNo ratings yet

- Thank You!!! For Using WWW - Freecharge.in: Payment ReceiptDocument1 pageThank You!!! For Using WWW - Freecharge.in: Payment ReceiptVinit ShahNo ratings yet

- Highlights of The Stock Market: YearsDocument15 pagesHighlights of The Stock Market: YearsVinit ShahNo ratings yet

- Fdi in Retail AssignmentDocument6 pagesFdi in Retail AssignmentVinit ShahNo ratings yet

- Connect RulesDocument1 pageConnect RulesVinit ShahNo ratings yet

- EU Mergers and Takeovers & IndianDocument5 pagesEU Mergers and Takeovers & IndianVinit ShahNo ratings yet

- Technology'S Child: Schwarzkopf and Operation Desert Storm: BackgroundDocument17 pagesTechnology'S Child: Schwarzkopf and Operation Desert Storm: BackgroundosamazimNo ratings yet

- ﺳ ﯿﺎ ﺣ ﯿ ﺔ / ﺳ ﻔ ﺮ ﺓ - ﻗ ﺼ ﯿ ﺮ ﺓ Tourist/Single-Short: Evisa - إّذ ن د ﺧ و ل ا ﻟﻛ ﺗ ر وﻧ ﻲDocument1 pageﺳ ﯿﺎ ﺣ ﯿ ﺔ / ﺳ ﻔ ﺮ ﺓ - ﻗ ﺼ ﯿ ﺮ ﺓ Tourist/Single-Short: Evisa - إّذ ن د ﺧ و ل ا ﻟﻛ ﺗ ر وﻧ ﻲshahid pkNo ratings yet

- RSA Assignment2 ShreyiDocument10 pagesRSA Assignment2 ShreyiAmardeep SinghNo ratings yet

- HRM ReportDocument18 pagesHRM ReportMuaz AhmedNo ratings yet

- Department of Homeland Security (DHS) GuidelinesDocument5 pagesDepartment of Homeland Security (DHS) GuidelinesAli T. GilaniNo ratings yet

- Foot Pursuit Report Officer Ruiz FP 2023 - Reginald Clay, Jr.Document1 pageFoot Pursuit Report Officer Ruiz FP 2023 - Reginald Clay, Jr.John KuglerNo ratings yet

- Default Bail The Infirmities Noted in Section 187 of The BharatiyaDocument17 pagesDefault Bail The Infirmities Noted in Section 187 of The BharatiyagajendraburagaNo ratings yet

- BriarpatchDocument45 pagesBriarpatchalexe012No ratings yet

- Search and RescueDocument25 pagesSearch and RescueJerrymiah.maligonNo ratings yet

- Mizoram Police Manual 2006 PDFDocument457 pagesMizoram Police Manual 2006 PDFpzohmingthanga100% (1)

- Authorization Letter CTCU19Document1 pageAuthorization Letter CTCU19kholisNo ratings yet

- Drills/Procedures For The Intelligence Section ARTEP 34-245Document49 pagesDrills/Procedures For The Intelligence Section ARTEP 34-245jimdigrizNo ratings yet

- Chillicothe Police Reports For July 17th 2013Document32 pagesChillicothe Police Reports For July 17th 2013Andrew AB BurgoonNo ratings yet

- Death Squads The Killing Never StopsDocument131 pagesDeath Squads The Killing Never StopsYedasiNo ratings yet

- Start Date End Date # of Target Days Chapter # Name of The ChapterDocument7 pagesStart Date End Date # of Target Days Chapter # Name of The Chapterravi kantNo ratings yet

- Apache County Sheriff Id Theft Act July 9 2020Document12 pagesApache County Sheriff Id Theft Act July 9 2020Marsha MainesNo ratings yet

- World War 2 Summary & QuestionnsDocument4 pagesWorld War 2 Summary & QuestionnsMariam SharafNo ratings yet

- 2016 VHOF Book and Cover For WebDocument70 pages2016 VHOF Book and Cover For WebNew York SenateNo ratings yet

- Bu Dop A-341, 1967Document534 pagesBu Dop A-341, 1967David Pristash67% (3)

- Why Did Japan SurrenderDocument4 pagesWhy Did Japan Surrendervidro3No ratings yet

- Prelims Lea 3Document3 pagesPrelims Lea 3JuLievee LentejasNo ratings yet

- IRA MindmapDocument1 pageIRA MindmapJames Cooke0% (1)

- Transcript ColloquimDocument28 pagesTranscript ColloquimEd Ravfhor Amen AmenNo ratings yet

- Posadas vs. Court of Appeals, G.R. No. 89139, August 2, 1990.Document8 pagesPosadas vs. Court of Appeals, G.R. No. 89139, August 2, 1990.Joshua RodriguezNo ratings yet

- CP LTC Ley GB CGSC Cl68Document151 pagesCP LTC Ley GB CGSC Cl68Jun LlaveNo ratings yet

- Conserve And/or Redeem Convicted Offenders and Prisoners Who Are Under The Probation or Parole SystemDocument6 pagesConserve And/or Redeem Convicted Offenders and Prisoners Who Are Under The Probation or Parole SystemJellyn CastilloNo ratings yet

- The On The Roof GangDocument3 pagesThe On The Roof GangTyler KirklandNo ratings yet

- Case FolderrrDocument12 pagesCase FolderrrpauNo ratings yet