Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

42 viewsSun Pharma: Annual Report 2014 Analysis

Sun Pharma: Annual Report 2014 Analysis

Uploaded by

SohamsThis document provides an analysis of Sun Pharma's annual report for 2014 and its outlook. It finds that the report offers good visibility on Sun Pharma's growth pillars, including enhancing its complex products pipeline in the US and turning around Ranbaxy's operations. It maintains a buy rating for Sun Pharma, setting a target price of INR980 per share based on its sum-of-the-parts valuation approach. While it expects a slow 2015 for Sun Pharma's base business, it views prospects for consolidating Ranbaxy and potential turnaround as appealing.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- A Lazy Persons Guide To Getting Rich in The Next Few Years PDFDocument119 pagesA Lazy Persons Guide To Getting Rich in The Next Few Years PDFMitru BrusNo ratings yet

- IFRS 9 Financial Instruments Quiz.Document4 pagesIFRS 9 Financial Instruments Quiz.حسين عبدالرحمنNo ratings yet

- Sun Pharma - Motilal Oswal - Detailed ReportDocument10 pagesSun Pharma - Motilal Oswal - Detailed ReportHemal DaniNo ratings yet

- Stock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedDocument24 pagesStock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedNarnolia Securities LimitedNo ratings yet

- La Opala RG - Initiating Coverage - Centrum 30062014Document21 pagesLa Opala RG - Initiating Coverage - Centrum 30062014Jeevan PatwaNo ratings yet

- Sun Pharma MODocument10 pagesSun Pharma MOGoel VaibhavNo ratings yet

- GSK Consumer: Excessive Price Hikes May Upset Price-Value EquationDocument6 pagesGSK Consumer: Excessive Price Hikes May Upset Price-Value EquationHimanshuNo ratings yet

- Indian Stock Market Analytics - Buy Stock of Prestige Estates, Tech Mahindra and LupinDocument17 pagesIndian Stock Market Analytics - Buy Stock of Prestige Estates, Tech Mahindra and LupinNarnolia Securities LimitedNo ratings yet

- Investment Funds Advisory Today - Buy Stock of Escorts LTD and Neutral View On Hindustan UnileverDocument26 pagesInvestment Funds Advisory Today - Buy Stock of Escorts LTD and Neutral View On Hindustan UnileverNarnolia Securities LimitedNo ratings yet

- Aurobindo 4Q FY 2013Document10 pagesAurobindo 4Q FY 2013Angel BrokingNo ratings yet

- Ranbaxy, 2Q CY 2013Document11 pagesRanbaxy, 2Q CY 2013Angel BrokingNo ratings yet

- Nivesh Stock PicksDocument13 pagesNivesh Stock PicksAnonymous W7lVR9qs25No ratings yet

- Best Performing Stock Advice For Today - Neutral Rating On GAIL Stock With A Target Price of Rs.346Document22 pagesBest Performing Stock Advice For Today - Neutral Rating On GAIL Stock With A Target Price of Rs.346Narnolia Securities LimitedNo ratings yet

- CMP: Rs.94 Rating: BUY Target: Rs.149: J.B. Chemicals & Pharmaceuticals Ltd. (JBCL)Document0 pagesCMP: Rs.94 Rating: BUY Target: Rs.149: J.B. Chemicals & Pharmaceuticals Ltd. (JBCL)api-234474152No ratings yet

- Quick Note: Sintex IndustriesDocument6 pagesQuick Note: Sintex Industriesred cornerNo ratings yet

- Aurobindo, 1Q FY 2014Document11 pagesAurobindo, 1Q FY 2014Angel BrokingNo ratings yet

- India Equity Analytics: HCLTECH: "Retain Confidence"Document27 pagesIndia Equity Analytics: HCLTECH: "Retain Confidence"Narnolia Securities LimitedNo ratings yet

- First Source Solutions LTD - Karvy Recommendation 11 Mar 2016Document5 pagesFirst Source Solutions LTD - Karvy Recommendation 11 Mar 2016AdityaKumarNo ratings yet

- V-Guard Industries: CMP: INR523 TP: INR650 BuyDocument10 pagesV-Guard Industries: CMP: INR523 TP: INR650 BuySmriti SrivastavaNo ratings yet

- Alembic Pharma LTD (APL) Stock Update: Retail ResearchDocument5 pagesAlembic Pharma LTD (APL) Stock Update: Retail ResearchShashi KapoorNo ratings yet

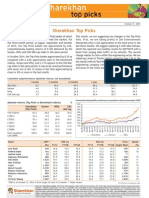

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocument7 pagesSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapRajesh KarriNo ratings yet

- 2013-04-08 CORD - Si (Phillip Secur) Cordlife - Strong FCF Generation at A Reasonable PriceDocument21 pages2013-04-08 CORD - Si (Phillip Secur) Cordlife - Strong FCF Generation at A Reasonable PriceKelvin FuNo ratings yet

- Muhurat Picks 2015: Company CMP Target Upside (%)Document12 pagesMuhurat Picks 2015: Company CMP Target Upside (%)abhijit99541623974426No ratings yet

- Sharekhan Top Picks: November 30, 2012Document7 pagesSharekhan Top Picks: November 30, 2012didwaniasNo ratings yet

- Aurobindo Pharma Result UpdatedDocument10 pagesAurobindo Pharma Result UpdatedAngel BrokingNo ratings yet

- Set For Strong Growth: FMCG Q2FY14 Result Preview 08 Oct 2013Document5 pagesSet For Strong Growth: FMCG Q2FY14 Result Preview 08 Oct 2013Abhishek SinghNo ratings yet

- Iiww 161210Document4 pagesIiww 161210rinku23patilNo ratings yet

- Indoco RemediesDocument19 pagesIndoco RemediesMNo ratings yet

- Top 10 Mid-Cap Ideas: Find Below Our Top Mid Cap Buys and The Rationale For The SameDocument4 pagesTop 10 Mid-Cap Ideas: Find Below Our Top Mid Cap Buys and The Rationale For The Sameapi-234474152No ratings yet

- Fortnightly: Ipca LabDocument5 pagesFortnightly: Ipca Labbinoy666No ratings yet

- Linc Pen & Plastics LTD.: CMP INR 161.0 Target Inr 218 Result Update - BuyDocument6 pagesLinc Pen & Plastics LTD.: CMP INR 161.0 Target Inr 218 Result Update - Buynare999No ratings yet

- Piramal Enterprises Limited Investor Presentation Nov 2016 20161108025005Document74 pagesPiramal Enterprises Limited Investor Presentation Nov 2016 20161108025005ratan203No ratings yet

- Ratio Analysis Project On Lupin Pharmaceutical CompanyDocument93 pagesRatio Analysis Project On Lupin Pharmaceutical CompanyShilpa Reddy50% (2)

- Indianivesh Securities Private Limited: Balanced Aggressive ConservativeDocument9 pagesIndianivesh Securities Private Limited: Balanced Aggressive ConservativeShashi KapoorNo ratings yet

- Sun Pharma-Ranbaxy DealDocument5 pagesSun Pharma-Ranbaxy DealishaneliteNo ratings yet

- Mid-Cap Marvels: RCM ResearchDocument20 pagesMid-Cap Marvels: RCM ResearchmannimanojNo ratings yet

- IDirect MuhuratPicks 2014Document8 pagesIDirect MuhuratPicks 2014Rahul SakareyNo ratings yet

- IDirect JubilantLife CoUpdate Sep16Document4 pagesIDirect JubilantLife CoUpdate Sep16umaganNo ratings yet

- Investment Funds Advisory For Today: Buy Stock of Powergrid and IFGL Refractories LTDDocument23 pagesInvestment Funds Advisory For Today: Buy Stock of Powergrid and IFGL Refractories LTDNarnolia Securities LimitedNo ratings yet

- Sun Pharma: CMP: INR413 TP: INR480 (+16%)Document10 pagesSun Pharma: CMP: INR413 TP: INR480 (+16%)Harshul BansalNo ratings yet

- Stocksview Report On JiyaDocument3 pagesStocksview Report On JiyaMuralidhar RayapeddiNo ratings yet

- Selan Exploration TechnologyDocument3 pagesSelan Exploration TechnologyPaul GeorgeNo ratings yet

- Cipla LTD Q2'13 Earning EstimateDocument2 pagesCipla LTD Q2'13 Earning EstimateSuranjoy SinghNo ratings yet

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocument7 pagesSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapJignesh RampariyaNo ratings yet

- Reliance Communications (Q4 FY11)Document2 pagesReliance Communications (Q4 FY11)Apoorva GuptaNo ratings yet

- D&L Industries Still Growing StrongDocument6 pagesD&L Industries Still Growing Strongανατολή και πετύχετεNo ratings yet

- LKP Sec 7 Techno FundaDocument11 pagesLKP Sec 7 Techno FundaAnonymous W7lVR9qs25No ratings yet

- Arvind Remedies VenturaDocument13 pagesArvind Remedies VenturaAshish GuptaNo ratings yet

- J. P Morgan - Pidilite IndustriesDocument36 pagesJ. P Morgan - Pidilite Industriesparry0843No ratings yet

- Marico 4Q FY 2013Document11 pagesMarico 4Q FY 2013Angel BrokingNo ratings yet

- Research Note - Shoprite FY23 Results 220923Document3 pagesResearch Note - Shoprite FY23 Results 220923zaahirahabrahams786No ratings yet

- Lupin Pharmaceutical: Mandideep IDocument41 pagesLupin Pharmaceutical: Mandideep INishant NamdeoNo ratings yet

- Jubilant Lifesciences: CMP: INR179 TP: INR199 NeutralDocument8 pagesJubilant Lifesciences: CMP: INR179 TP: INR199 NeutralRishabh JainNo ratings yet

- Independent Equity Research: Enhancing Investment DecisionDocument0 pagesIndependent Equity Research: Enhancing Investment DecisionvivekdkrpuNo ratings yet

- Angel One: Revenue Misses Estimates Expenses in LineDocument14 pagesAngel One: Revenue Misses Estimates Expenses in LineRam JaneNo ratings yet

- Tata Consultancy Services: CMP: INR1,459 TP: INR1,500 NeutralDocument10 pagesTata Consultancy Services: CMP: INR1,459 TP: INR1,500 NeutralktyNo ratings yet

- United Spirits Report - MotilalDocument12 pagesUnited Spirits Report - Motilalzaheen_1No ratings yet

- Research Report SunPharma ICICI DirectDocument13 pagesResearch Report SunPharma ICICI DirectDev MishraNo ratings yet

- Relaxo Footwear: Healthy Performance Maintain BuyDocument2 pagesRelaxo Footwear: Healthy Performance Maintain BuyRajasekhar Reddy AnekalluNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Âp¡ V$) Dpl®¡$V$"U BDPFS"¡ B ( Hv$U"U S¡Æ"P¡ V¡$L$P¡ Dm$I¡?: RBT"¡KDocument1 pageÂp¡ V$) Dpl®¡$V$"U BDPFS"¡ B ( Hv$U"U S¡Æ"P¡ V¡$L$P¡ Dm$I¡?: RBT"¡KSohamsNo ratings yet

- Ap L$RH Ep S ÞD¡ R ¡ A"¡ Iy L$L¡HP DPN¡ R ¡?: L¡$ (Ëied A"¡ QHV$PQD" "X$U'"U Sy NGB U..Document1 pageAp L$RH Ep S ÞD¡ R ¡ A"¡ Iy L$L¡HP DPN¡ R ¡?: L¡$ (Ëied A"¡ QHV$PQD" "X$U'"U Sy NGB U..SohamsNo ratings yet

- AKC - Q3 Event Calendar 2014 - Back SideDocument1 pageAKC - Q3 Event Calendar 2014 - Back SideSohamsNo ratings yet

- AKC - Q3 Event Calendar 2014Document1 pageAKC - Q3 Event Calendar 2014SohamsNo ratings yet

- BoilDocument4 pagesBoilSohamsNo ratings yet

- Utsav Sun 12-03-2017 Page 11 MC PeriodsDocument1 pageUtsav Sun 12-03-2017 Page 11 MC PeriodsSohamsNo ratings yet

- Equitymaster's The 5 Minute WrapUpDocument19 pagesEquitymaster's The 5 Minute WrapUpSohamsNo ratings yet

- Dubai Map Resized PDFDocument1 pageDubai Map Resized PDFSohamsNo ratings yet

- Co O O: Time: 2 Hours Maximum Marks: 50 Note: (I) Answer Any Five Questions. (Ii) All Questions Carry Equal MarksDocument2 pagesCo O O: Time: 2 Hours Maximum Marks: 50 Note: (I) Answer Any Five Questions. (Ii) All Questions Carry Equal MarksSohamsNo ratings yet

- Time: 2 Hours Maximum Marks: 50: Note: Answer Any Five Questions. All Questions CarryDocument2 pagesTime: 2 Hours Maximum Marks: 50: Note: Answer Any Five Questions. All Questions CarrySohamsNo ratings yet

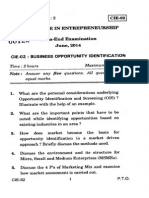

- Certificate in Entrepreneurship: Time: 2 Hours Maximum Marks: 50 Answer Any Questions. All Questions Carry Equal MarksDocument2 pagesCertificate in Entrepreneurship: Time: 2 Hours Maximum Marks: 50 Answer Any Questions. All Questions Carry Equal MarksSohamsNo ratings yet

- CIE-04 Certificate in Entrepreneurship Term-End Examination June, 2014 CIE 04Document2 pagesCIE-04 Certificate in Entrepreneurship Term-End Examination June, 2014 CIE 04SohamsNo ratings yet

- CIE-01 Certificate in Entrepreneurship Term-End Examination June, 2014 CIE-01Document2 pagesCIE-01 Certificate in Entrepreneurship Term-End Examination June, 2014 CIE-01SohamsNo ratings yet

- Leakseal: India Pvt. Ltd. Green Revolution in Cooling IndiaDocument1 pageLeakseal: India Pvt. Ltd. Green Revolution in Cooling IndiaSohamsNo ratings yet

- Parent Interface and Reports: 3 .1 Parent's Monthly ReportDocument6 pagesParent Interface and Reports: 3 .1 Parent's Monthly ReportSohamsNo ratings yet

- National Skill Development Policy 12th PlanDocument5 pagesNational Skill Development Policy 12th PlanSohamsNo ratings yet

- Swami Vivekananda, Born Narendra Nath Datta (: BengaliDocument22 pagesSwami Vivekananda, Born Narendra Nath Datta (: BengaliSohamsNo ratings yet

- Syllabus & Sample Questions: SKGKO 14Document2 pagesSyllabus & Sample Questions: SKGKO 14SohamsNo ratings yet

- Members Ihcn - inDocument16 pagesMembers Ihcn - inSohamsNo ratings yet

- SSRVM Ahmedabad DetailsDocument3 pagesSSRVM Ahmedabad DetailsSohamsNo ratings yet

- Assignment - 4 Thailand Imbalance of Payments Sumeet Kant Kaul-G20088Document4 pagesAssignment - 4 Thailand Imbalance of Payments Sumeet Kant Kaul-G20088sumeetkantkaulNo ratings yet

- Market Cap To GDP RatioDocument8 pagesMarket Cap To GDP RatiokalpeshNo ratings yet

- Strategic Tax Management Midterm Period: QUIZ No 2 2nd SEM AY 2021-22Document15 pagesStrategic Tax Management Midterm Period: QUIZ No 2 2nd SEM AY 2021-22Earl Daniel RemorozaNo ratings yet

- Pitchbook - Europe VC Valuations Report - Q12023Document20 pagesPitchbook - Europe VC Valuations Report - Q12023Олег КарбышевNo ratings yet

- 2Q10 Op Fund Quarterly LetterDocument24 pages2Q10 Op Fund Quarterly Letterscribduser76No ratings yet

- Demat AccountDocument82 pagesDemat AccountJASONM2250% (4)

- Test 1Document11 pagesTest 1VânAnh Nguyễn100% (1)

- Financial Statement AnalysisDocument6 pagesFinancial Statement AnalysisuaenaNo ratings yet

- Tai Chinh Quoc Te Nguyen Cam Nhung c4 The Theory of Purchasing Power Parity (PPP) and Generalized Model of The Exchange Rate (Cuuduongthancong - Com)Document35 pagesTai Chinh Quoc Te Nguyen Cam Nhung c4 The Theory of Purchasing Power Parity (PPP) and Generalized Model of The Exchange Rate (Cuuduongthancong - Com)Thái Nguyễn Thị HồngNo ratings yet

- Accounts Holiday HW 1Document4 pagesAccounts Holiday HW 1AlishbaNo ratings yet

- Form 26ASDocument3 pagesForm 26ASHarshil MehtaNo ratings yet

- Financial PlanDocument68 pagesFinancial PlanYASHA BAIDNo ratings yet

- POADocument3 pagesPOAr_bornarkar8458No ratings yet

- Barcelona, Joyce Ann A. - FMA-3A - Quiz#2 PDFDocument1 pageBarcelona, Joyce Ann A. - FMA-3A - Quiz#2 PDFJoyce Ann Agdippa BarcelonaNo ratings yet

- Lec 7 FX Swaps Ver2Document45 pagesLec 7 FX Swaps Ver2AprilNo ratings yet

- Balance Sheet of Bajaj AutoDocument6 pagesBalance Sheet of Bajaj Autogurjit20No ratings yet

- Income Taxation Assignment 1Document2 pagesIncome Taxation Assignment 1Carmela Tuquib RebundasNo ratings yet

- Bill Statement: Previous Balance (RM) Payment Received (RM) Balance B/F (RM)Document4 pagesBill Statement: Previous Balance (RM) Payment Received (RM) Balance B/F (RM)bain89No ratings yet

- MC Eco121Document20 pagesMC Eco121Vu Truc Ngan (K17 HCM)No ratings yet

- How To Buy CryptocurrenciesDocument2 pagesHow To Buy CryptocurrenciesObinna ObiefuleNo ratings yet

- Gonzales - Assignment 2 (BSMA 3-8) ANSWERSDocument6 pagesGonzales - Assignment 2 (BSMA 3-8) ANSWERSGONZALES, IAN ROGEL L.No ratings yet

- Acc Limited Ledger (Usshar)Document12 pagesAcc Limited Ledger (Usshar)smn.ussharNo ratings yet

- Direct-Deposit-DocDocument5 pagesDirect-Deposit-Docbowzerblade88No ratings yet

- Consolidation of Wholly Owned Subsidiaries Acquired at More Than Book ValueDocument11 pagesConsolidation of Wholly Owned Subsidiaries Acquired at More Than Book ValueJeklin LewaneyNo ratings yet

- SFM - Forex - QuestionsDocument23 pagesSFM - Forex - QuestionsVishal SutarNo ratings yet

- Indian Bank ChallanDocument1 pageIndian Bank ChallansujathalaviNo ratings yet

- CA. Sanjay K Agarwal: Bank Audit ManualDocument38 pagesCA. Sanjay K Agarwal: Bank Audit Manualcaabhaiagarwal1No ratings yet

- Dividends Act 1Document1 pageDividends Act 1Jane DizonNo ratings yet

Sun Pharma: Annual Report 2014 Analysis

Sun Pharma: Annual Report 2014 Analysis

Uploaded by

Sohams0 ratings0% found this document useful (0 votes)

42 views8 pagesThis document provides an analysis of Sun Pharma's annual report for 2014 and its outlook. It finds that the report offers good visibility on Sun Pharma's growth pillars, including enhancing its complex products pipeline in the US and turning around Ranbaxy's operations. It maintains a buy rating for Sun Pharma, setting a target price of INR980 per share based on its sum-of-the-parts valuation approach. While it expects a slow 2015 for Sun Pharma's base business, it views prospects for consolidating Ranbaxy and potential turnaround as appealing.

Original Description:

Report

Original Title

SunPharma MOst 080914

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides an analysis of Sun Pharma's annual report for 2014 and its outlook. It finds that the report offers good visibility on Sun Pharma's growth pillars, including enhancing its complex products pipeline in the US and turning around Ranbaxy's operations. It maintains a buy rating for Sun Pharma, setting a target price of INR980 per share based on its sum-of-the-parts valuation approach. While it expects a slow 2015 for Sun Pharma's base business, it views prospects for consolidating Ranbaxy and potential turnaround as appealing.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

42 views8 pagesSun Pharma: Annual Report 2014 Analysis

Sun Pharma: Annual Report 2014 Analysis

Uploaded by

SohamsThis document provides an analysis of Sun Pharma's annual report for 2014 and its outlook. It finds that the report offers good visibility on Sun Pharma's growth pillars, including enhancing its complex products pipeline in the US and turning around Ranbaxy's operations. It maintains a buy rating for Sun Pharma, setting a target price of INR980 per share based on its sum-of-the-parts valuation approach. While it expects a slow 2015 for Sun Pharma's base business, it views prospects for consolidating Ranbaxy and potential turnaround as appealing.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 8

Alok Dalal (Alok.Dalal@MotilalOswal.

com); +91 22 3982 5584

Hardick Bora (Hardick.Bora@MotilalOswal.com); +91 22 3982 5423

3 September 2014

Update | Sector: Healthcare

Sun Pharma

CMP: INR863 TP: INR980 Buy

Annual Report 2014 Analysis

Well charted strategy offers growth visibility

SUNPs FY14 annual report provides good visibility on the key pillars of growth

which include enhancing its pipeline of complex/specialty products for the US and

successfully turning around Ranbaxys operations.

Future focus will be on building a differentiated product basket, foraying into

products that yield stable and consistent cash flows.

At the same time, the company continues to be on the lookout for value

enhancing inorganic opportunities in the US.

Financial analysis

The India subsidiary created last year (Sun Pharma Global) has shown a PBT

of INR3.4b versus a negative PBT of INR1.3b in FY13.

URL Pharma did sales of INR 17.6b with PAT of INR 6b (margins of ~30). A

significant part of URL Pharma performance in FY14 was driven by

favourable pricing for key products and re-launch of some of the

discontinued products from URLs portfolio. Recently, prices of some of

these products have normalised significantly and hence a part of URL

Pharmas performance may not be sustainable in our view.

Dusa Pharma reported sales of INR 4.3b versus INR975m in FY13

(consolidated for three months) while it turned profitable in FY14 (INR237m

vs loss of INR47m in FY13). This was driven by greater penetration with

dermatologists and gradual price increases.

SUNP is carrying hedges of USD240m with MTM loss of INR2b classified as

long-term provision. This implies hedges are for a period of over one year,

largely hedged in the range of 50-52.

Contingent liabilities related to income tax on account of disallowance/

addition has increased from INR7.6b in FY13 to INR12.1b in FY14.

Valuation and view

We remain confident of SUNPs business mix and execution skills in its key

markets.

We however see a slow FY15 for SUNPs base business which we believe is

expected to bounce back to mid teens growth in FY16. But, prospects of

consolidating Ranbaxys business and potential turn-around continue to

remain appealing.

We maintain Buy with a revised target SoTP price target of INR980 which

includes upsides from Ranbaxys business.

However, stock may trade in a narrow range till the RBXY deal concludes

and any decline presents a buying opportunity.

BSE Sensex S&P CNX

27,140 8,115

Stock Info

Bloomberg SUNP IN

Equity Shares (m) 2,071.1

52-Week Range (INR) 877/500

1, 6, 12 Rel. Per (%) 8/13/20

M.Cap. (INR b) 1,787.8

M.Cap. (USD b) 29.6

Financial Snapshot (INR b)

Y/E Mar 2015E 2016E 2017E

Sales 175.8 204.6 230.7

EBITDA 77.5 88.9 96.4

Rep. PAT 61.7 72.7 81.6

RepEPS (INR) 29.8 35.1 39.4

Adj. PAT 54.3 66.3 76.5

Core EPS (INR) 26.2 32.0 36.9

EPS Gr. (%) 11.9 22.0 15.3

RoE (%) 25.6 24.6 22.7

RoCE (%) 35.2 34.9 31.2

Valuations

P/E (x) 32.9 27.0 23.4

P/BV (x) 7.5 5.9 4.8

Shareholding Pattern (%)

As on Jun-14 Mar-14 Jun-13

Promoter 63.7 63.7 63.7

DII 5.1 5.6 3.2

FII 23.0 22.5 22.8

Others 8.3 8.3 10.3

Notes: FII incl. depository receipts

Stock Performance (1-year)

Investors are advised to refer through disclosures made at the end of the Research Report.

Sun Pharma

3 September 2014 2

Well charted strategy offers growth visibility

SUNPs FY14 annual report provides good visibility on the key pillars of growth

which include enhancing its pipeline of complex/specialty products for the US

and successfully turning around Ranbaxys operations.

Future focus will be on building a differentiated product basket, foraying into

products that yield stable and consistent cash flows.

At the same time, the company continues to be on the lookout for value

enhancing inorganic opportunities in the US.

Acquisition of Ranbaxy

SUNP is in the process of acquiring RBXY for USD4b in an all stock deal:

Post-deal closure, the merged entity targets to generate synergy benefits of

USD250m by the third year - driven by a combination of revenue, procurement,

supply chain and other cost synergies.

SUNP believes its ability to juggle different businesses and multiple cultures is

likely to help achieve the transformation at RBXY.

SUNP plans to leverage complementary functional strengths to achieve top line

growth and gains through both revenue enhancement and cost efficiencies-

translating into higher margins, greater market share and more operating

profits.

Financial Analysis

The India subsidiary created last year (Sun Pharma Global) has shown a PBT of

INR3.4b versus a negative PBT of INR1.3b in FY13.

SUNP has outstanding hedges of USD240m, for which it has made a long term

provision of INR2b. This implies hedges are for a period of over one year, largely

hedged in the range of 50-52.

URL Pharma did sales of INR 17.6b with PAT of INR 6b (margins of ~30). A

significant part of URL Pharma performance in FY14 was driven by favorable

pricing for key products and re-launch of some of the discontinued products

from URLs portfolio. Recently, prices of some of these products have

normalized significantly and hence a part of URL Pharmas performance may not

be sustainable in our view.

Dusa Pharma reported sales of INR 4.3b versus INR975m in FY13 (consolidated

for three months) while it turned profitable in FY14 (INR237m vs loss of INR47m

in FY13). This was driven by greater penetration with dermatologists and

gradual price increases

Contingent liabilities related to income tax on account of disallowance/addition

have increased from INR7.6b in FY13 to INR12.1b in FY14.

Net working capital days in FY14 have reduced to 91 days from 112 days last

year.

Cash tax rate for the year stood at 11.1% while the effective tax rate was 9.9%.

Consultancy fees of INR4.8b for FY14 versus INR4.2b for FY13.

Long term loans and advances have increased 25% YoY to INR10.5b. However as

a percentage of sales, it has come down to 6.5% as compared to 7.4% in FY13.

Capex for FY14 stood at INR9b.

For FY14, SUNP made an additional provision of INR23.2b towards settlement

for patent infringement litigation related to generic versions of Protonix.

Sun Pharma

3 September 2014 3

Improving profitability in recently acquired companies (INR m)

URL Pharma FY14 FY13

DUSA Pharma FY14 FY13

Revenue 17699 1838

Revenue 4232 976

PBT 9642 565

PBT -52 -90.1

PBT (%) 54.5 30.7

PBT (%) -1.2 -9.2

PAT 6048 339

PAT 237 -47

PAT (%) 34.2 18.5

PAT (%) 5.6 -4.8

Note: URL Pharma was consolidated for 55 days in FY13 and DUSA Pharma was consolidated for 101

days in FY13

Sun Pharma

3 September 2014 4

Story in charts

US generic sales to be driven by new launches

Source: Company, MOSL

Domestic formulations sales to sustain momentum

Source: Company, MOSL

RoW sales to grow over 17% CAGR over FY14-16E

Source: Company, MOSL

Profitability to moderate under competitive pressure

Source: Company, MOSL

Building cash war-chest

Source: Company, MOSL

Healthy return ratios to sustain

Source: Company, MOSL

337

234

494

733

1,135

1,621

1,805

2,025

FY09 FY10 FY11 FY12 FY13 FY14 FY15E FY16E

US Sales (USD m)

18,301

23,801

29,154 29,657

36,918

43,473

51,298

60,019

FY10 FY11 FY12 FY13 FY14 FY15E FY16E FY17E

India sales (INR m)

4,806

6,444

11,124

15,271

19,084

21,344

26,059

30,968

FY10 FY11 FY12 FY13 FY14 FY15E FY16E FY17E

RoW formulations (INR m)

13,633 19,566

31,947

49,063

69,257

77,527

88,944

96,448

34.0 34.2

39.9

43.7 43.3

44.1

43.5

41.8

FY10 FY11 FY12 FY13 FY14 FY15E FY16E FY17E

EBITDA (INR m) EBITDA Margin (%)

36,753 44,344 55,801 64,703

103,762

126,350

180,057

241,292

FY10 FY11 FY12 FY13 FY14 FY15E FY16E FY17E

Cash & cash equivalents (INR m)

13.3

16.2

21.5

22.5

29.0

25.6

24.6

22.7

18.6

23.6

30.4

31.5

25.6

35.2

34.9

31.2

FY10 FY11 FY12 FY13 FY14 FY15E FY16E FY17E

RoE (%) RoCE (%)

Sun Pharma

3 September 2014 5

Valuation and view

We remain confident of SUNPs business mix and execution skills in its key

markets.

We however see a slow FY15 for SUNPs base business which we believe is

expected to bounce back to mid teens growth in FY16. But, prospects of

consolidating Ranbaxys business and potential turn-around continue to remain

appealing.

We maintain Buy with a revised target SoTP price target of INR980 which

includes upsides from Ranbaxys business.

However, stock may trade in a narrow range till the RBXY deal concludes and

any decline presents a buying opportunity.

Financial snapshot (INR m)

Particulars

Sun Pharma Ranbaxy

FY15E FY16E FY17E FY15E FY16E FY17E FY18E FY19E

Core sales 162,645 193,167 221,495 104,026 123,303 139,711 159,271 181,569

YoY growth (%) 9.0 18.8 14.7

-21.6 18.5 13.3 14.0 14.0

Core EBITDA 67,037 80,627 89,850

10,014 15,384 20,882 25,483 32,682

Margin (%) 41.2 41.7 40.6

9.6 12.5 14.0 16.0 18.0

Core PAT 54,338 66,319 76,471

2,379 6,807 10,669 15,150 20,512

YoY growth (%) 11.9 22.0 15.3

-39.6 186.2 56.7 42.0 35.4

Core EPS (INR) 26.2 32.0 36.9 5.6 16.1 25.2 35.8 48.5

Target multiple for terminal value

20

Terminal value

410,235

Discount factor for 3 years @15%

0.6575

One-year forward RBXY value

269,736

Per share value 115

SoTP based valuation

Particulars Valuation basis Per share value (INR)

SUNP's business 26x FY17E FDEPS 825

RBXY business DCF of TV terminal value in FY19E 115

FTF opportunities + Doxil DCF of exclusive sales 40

Total intrinsic value Sum-of-parts 980

Sun Pharma

3 September 2014 6

Financials and valuations

Income statement (INR Million)

Y/E Mar 2012 2013 2014 2015E 2016E 2017E

Net Sales 80,098 112,388 160,044 175,758 204,563 230,744

Change (%) 40 40 42 10 16 13

EBITDA 31,947 49,063 69,257 77,527 88,944 96,448

EBITDA Margin (%) 39.9 43.7 43.3 44.1 43.5 41.8

Depreciation 2,912 3,362 4,092 5,240 5,252 5,664

EBIT 29,035 45,701 65,165 72,287 83,692 90,784

Interest 282 443 442 308 308 308

Other Income 4,856 3,727 6,282 6,680 10,556 14,394

Extraordinary items 11 5,836 25,174 0 0 0

PBT 33,598 43,148 45,831 78,660 93,940 104,871

Tax 2,991 8,456 7,022 10,147 14,091 15,731

Tax Rate (%) 8.9 19.6 15.3 12.9 15.0 15.0

Min. Int. & Assoc. Share -3,855 -4,863 -7,375 -6,831 -7,148 -7,491

Reported PAT 30,607 34,693 38,809 68,513 79,849 89,140

Adjusted PAT 23,273 30,550 48,572 54,338 66,319 76,471

Change (%) 66 31 59 12 22 15

Margins (%) 24 23 26 27 29 30

Balance sheet (INR Million)

Y/E Mar 2012 2013 2014 2015E 2016E 2017E

Share Capital 1,036 1,036 2,071 2,071 2,071 2,071

Reserves 120,628 148,862 183,178 236,379 299,386 368,920

Net Worth 121,663 149,897 185,249 238,450 301,458 370,991

Debt 2,739 2,072 24,982 403 403 403

Deferred Tax -5,199 -7,122 -9,110 -9,110 -9,110 -9,110

Total Capital Employed 130,820 161,197 220,333 255,785 325,942 402,966

Gross Fixed Assets 46,542 56,026 63,886 72,886 81,886 90,886

Less: Acc Depreciation 20,406 24,421 28,904 34,144 39,396 45,060

Net Fixed Assets 26,136 31,604 34,982 38,741 42,490 45,826

Capital WIP 3,447 5,626 8,415 8,415 8,415 8,415

Investments 22,129 24,116 27,860 27,860 27,860 27,860

Current Assets 90,681 113,420 177,393 219,210 291,567 372,827

Inventory 20,870 25,778 31,230 36,771 43,787 51,837

Debtors 19,261 27,108 22,004 29,762 34,706 39,131

Cash & Bank 33,672 40,587 75,902 98,489 152,197 213,432

Loans & Adv, Others 16,878 19,948 48,257 54,188 60,878 68,427

Curr Liabs & Provns 24,950 38,439 61,509 71,633 77,583 85,154

Curr. Liabilities 14,410 15,752 15,887 22,765 27,108 32,092

Provisions 10,541 22,687 45,622 48,869 50,475 53,062

Net Current Assets 65,730 74,981 115,884 147,577 213,985 287,673

Total Assets 130,820 161,198 220,333 255,785 325,941 402,965

E: MOSL Estimates

Sun Pharma

3 September 2014 7

Financials and valuations

Ratios

Y/E Mar 2012 2013 2014 2015E 2016E 2017E

Basic (INR)

EPS 11.2 14.8 23.5 26.2 32.0 36.9

Cash EPS 13.9 16.0 17.2 32.3 37.6 42.2

Book Value 58.7 72.4 89.4 115.1 145.5 179.1

DPS 2.1 2.5 3.0 3.5 4.0 5.0

Payout (incl. Div. Tax.) 22.0 39.7 15.0 15.6 14.6 15.8

Valuation(x)

P/E 76.8 58.5 36.8 32.9 27.0 23.4

Cash P/E 62.0 53.9 50.3 26.7 22.9 20.5

Price / Book Value 14.7 11.9 9.7 7.5 5.9 4.8

EV/Sales 21.7 15.4 10.7 9.5 7.9 6.7

EV/EBITDA 54.3 35.2 24.7 21.4 18.1 16.0

Dividend Yield (%) 0.2 0.3 0.3 0.4 0.5 0.6

Profitability Ratios (%)

RoE 21.5 22.5 29.0 25.6 24.6 22.7

RoCE 30.4 31.5 25.6 35.2 34.9 31.2

Turnover Ratios (%)

Asset Turnover (x) 0.6 0.7 0.7 0.7 0.6 0.6

Debtors (No. of Days) 87.8 88.0 50.2 61.8 61.9 61.9

Inventory (No. of Days) 95.1 83.7 71.2 76.4 78.1 82.0

Creditors (No. of Days) 65.7 51.2 36.2 47.3 48.4 50.8

Leverage Ratios (%)

Net Debt/Equity (x) 0.0 0.0 0.1 0.0 0.0 0.0

Cash flow statement (INR Million)

Y/E Mar 2012 2013 2014 2015E 2016E 2017E

OP/(Loss) before Tax 28,742 39,422 39,549 71,979 83,384 90,477

Depreciation 2,912 3,362 4,092 5,240 5,252 5,664

Others 4,856 3,727 6,282 6,680 10,556 14,394

Interest 282 443 442 308 308 308

Direct Taxes Paid -5,373 -10,379 -9,010 -10,147 -14,091 -15,731

(Inc)/Dec in Wkg Cap -8,319 -2,336 -5,589 -9,105 -12,700 -12,453

CF from Op. Activity 23,099 34,239 35,767 64,956 72,708 82,659

(Inc)/Dec in FA & CWIP -10,585 -22,501 -18,580 -9,000 -9,000 -9,000

(Pur)/Sale of Invt 169 -1,987 -3,745 0 0 0

Others 0 0 0 0 0 0

CF from Inv. Activity -10,416 -24,488 -22,324 -9,000 -9,000 -9,000

Inc/(Dec) in Net Worth 5,318 4,334 6,674 0 0 0

Inc / (Dec) in Debt -978 -668 22,910 -24,578 0 0

Interest Paid -282 -443 -442 -308 -308 -308

Divd Paid (incl Tax) -5,115 -6,058 -7,270 -8,481 -9,693 -12,116

CF from Fin. Activity -1,058 -2,835 21,872 -33,368 -10,001 -12,424

Inc/(Dec) in Cash 11,626 6,915 35,315 22,588 53,707 61,235

Add: Opening Balance 22,046 33,672 40,587 75,902 98,489 152,197

Closing Balance 33,672 40,587 75,902 98,490 152,197 213,432

E: MOSL Estimates

Sun Pharma

3 September 2014 8

Disclosures

This research report has been prepared by MOSt to provide information about the company(ies) and sector(s), if any, covered in the report and may be distributed by it and/or its affiliated company(ies). This

report is for personal information of the select recipient and does not construe to be any investment, legal or taxation advice to you. This research report does not constitute an offer, invitation or inducement to

invest in securities or other investments and Motilal Oswal Securities Limited (hereinafter referred as MOSt) is not soliciting any action based upon it. This report is not for public distribution and has been

furnished to you solely for your general information and should not be reproduced or redistributed to any other person in any form. This report does not constitute a personal recommendation or take into

account the particular investment objectives, financial situations, or needs of individual clients. Before acting on any advice or recommendation in this material, investors should consider whether it is suitable

for their particular circumstances and, if necessary, seek professional advice. The price and value of the investments referred to in this material and the income from them may go down as well as up, and

investors may realize losses on any investments. Past performance is not a guide for future performance, future returns are not guaranteed and a loss of original capital may occur.

MOSt and its affiliates are a full-service, integrated investment banking, investment management, brokerage and financing group. We and our affiliates have investment banking and other business

relationships with a significant percentage of the companies covered by our Research Department Our research professionals provide important input into our investment banking and other business selection

processes. Investors should assume that MOSt and/or its affiliates are seeking or will seek investment banking or other business from the company or companies that are the subject of this material and that

the research professionals who were involved in preparing this material may participate in the solicitation of such business. The research professionals responsible for the preparation of this document may

interact with trading desk personnel, sales personnel and other parties for the purpose of gathering, applying and interpreting market information. Our research professionals are paid in part based on the

profitability of MOSt which include earnings from investment banking and other business. MOSt generally prohibits its analysts, persons reporting to analysts, and members of their households from

maintaining a financial interest in the securities or derivatives of any companies that the analysts cover. Additionally, MOSt generally prohibits its analysts and persons reporting to analysts from serving as an

officer, director, or advisory board member of any companies that the analysts cover. Our salespeople, traders, and other professionals or affiliates may provide oral or written market commentary or trading

strategies to our clients that reflect opinions that are contrary to the opinions expressed herein, and our proprietary trading and investing businesses may make investment decisions that are inconsistent with

the recommendations expressed herein. In reviewing these materials, you should be aware that any or all o the foregoing, among other things, may give rise to real or potential conflicts of interest . MOSt and

its affiliated company(ies), their directors and employees may; (a) from time to time, have a long or short position in, and buy or sell the securities of the company(ies) mentioned herein or (b) be engaged in

any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the company(ies) discussed herein or act as an advisor or

lender/borrower to such company(ies) or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.

Unauthorized disclosure, use, dissemination or copying (either whole or partial) of this information, is prohibited. The person accessing this information specifically agrees to exempt MOSt or any of its

affiliates or employees from, any and all responsibility/liability arising from such misuse and agrees not to hold MOSt or any of its affiliates or employees responsible for any such misuse and further agrees to

hold MOSt or any of its affiliates or employees free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors and delays. The

information contained herein is based on publicly available data or other sources believed to be reliable. Any statements contained in this report attributed to a third party represent MOSts interpretation of the

data, information and/or opinions provided by that third party either publicly or through a subscription service, and such use and interpretation have not been reviewed by the third party. This Report is not

intended to be a complete statement or summary of the securities, markets or developments referred to in the document. While we would endeavor to update the information herein on reasonable basis, MOSt

and/or its affiliates are under no obligation to update the information. Also there may be regulatory, compliance, or other reasons that may prevent MOSt and/or its affiliates from doing so. MOSt or any of its

affiliates or employees shall not be in any way responsible and liable for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. MOSt or any of

its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of

merchantability, fitness for a particular purpose, and non-infringement. The recipients of this report should rely on their own investigations.

Recipients who are not institutional investors should seek advice of their independent financial advisor prior to taking any investment decision based on this report or for any necessary explanation of its

contents.

MOSt and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. To enhance transparency, MOSt has incorporated a Disclosure of

Interest Statement in this document. This should, however, not be treated as endorsement of the views expressed in the report.

Disclosure of Interest Statement SUN PHARMACEUTICAL IN

Analyst ownership of the stock No

Analyst Certification

The views expressed in this research report accurately reflect the personal views of the analyst(s) about the subject securities or issues, and no part of the compensation of the research analyst(s) was, is, or

will be directly or indirectly related to the specific recommendations and views expressed by research analyst(s) in this report. The research analysts, strategists, or research associates principally responsible

for preparation of MOSt research receive compensation based upon various factors, including quality of research, investor client feedback, stock picking, competitive factors and firm revenues.

Regional Disclosures (outside India)

This report is not directed or intended for distribution to or use by any person or entity resident in a state, country or any jurisdiction, where such distribution, publication, availability or use would be contrary to

law, regulation or which would subject MOSt & its group companies to registration or licensing requirements within such jurisdictions.

For U.K.

This report is intended for distribution only to persons having professional experience in matters relating to investments as described in Article 19 of the Financial Services and Markets Act 2000 (Financial

Promotion) Order 2005 (referred to as "investment professionals"). This document must not be acted on or relied on by persons who are not investment professionals. Any investment or investment activity to

which this document relates is only available to investment professionals and will be engaged in only with such persons.

For U.S.

Motilal Oswal Securities Limited (MOSL) is not a registered broker - dealer under the U.S. Securities Exchange Act of 1934, as amended (the"1934 act") and under applicable state laws in the United States.

In addition MOSL is not a registered investment adviser under the U.S. Investment Advisers Act of 1940, as amended (the "Advisers Act" and together with the 1934 Act, the "Acts), and under applicable state

laws in the United States. Accordingly, in the absence of specific exemption under the Acts, any brokerage and investment services provided by MOSL, including the products and services described herein

are not available to or intended for U.S. persons.

This report is intended for distribution only to "Major Institutional Investors" as defined by Rule 15a-6(b)(4) of the Exchange Act and interpretations thereof by SEC (henceforth referred to as "major institutional

investors"). This document must not be acted on or relied on by persons who are not major institutional investors. Any investment or investment activity to which this document relates is only available to major

institutional investors and will be engaged in only with major institutional investors. In reliance on the exemption from registration provided by Rule 15a-6 of the U.S. Securities Exchange Act of 1934, as

amended (the "Exchange Act") and interpretations thereof by the U.S. Securities and Exchange Commission ("SEC") in order to conduct business with Institutional Investors based in the U.S., MOSL has

entered into a chaperoning agreement with a U.S. registered broker-dealer, Motilal Oswal Securities International Private Limited. ("MOSIPL"). Any business interaction pursuant to this report will have to be

executed within the provisions of this chaperoning agreement.

The Research Analysts contributing to the report may not be registered /qualified as research analyst with FINRA. Such research analyst may not be associated persons of the U.S. registered broker-dealer,

MOSIPL, and therefore, may not be subject to NASD rule 2711 and NYSE Rule 472 restrictions on communication with a subject company, public appearances and trading securities held by a research

analyst account.

For Singapore

Motilal Oswal Capital Markets Singapore Pte Limited is acting as an exempt financial advisor under section 23(1)(f) of the Financial Advisers Act(FAA) read with regulation 17(1)(d) of the Financial Advisors

Regulations and is a subsidiary of Motilal Oswal Securities Limited in India. This research is distributed in Singapore by Motilal Oswal Capital Markets Singapore Pte Limited and it is only directed in Singapore

to accredited investors, as defined in the Financial Advisers Regulations and the Securities and Futures Act (Chapter 289), as amended from time to time.

In respect of any matter arising from or in connection with the research you could contact the following representatives of Motilal Oswal Capital Markets Singapore Pte Limited:

Anosh Koppikar Kadambari Balachandran

Email:anosh.Koppikar@motilaloswal.com Email : kadambari.balachandran@motilaloswal.com

Contact(+65)68189232 Contact: (+65) 68189233 / 65249115

Office Address:21 (Suite 31),16 Collyer Quay,Singapore 04931

Motilal Oswal Securities Ltd

Motilal Oswal Tower, Level 9, Sayani Road, Prabhadevi, Mumbai 400 025

Phone: +91 22 3982 5500 E-mail: reports@motilaloswal.com

You might also like

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- A Lazy Persons Guide To Getting Rich in The Next Few Years PDFDocument119 pagesA Lazy Persons Guide To Getting Rich in The Next Few Years PDFMitru BrusNo ratings yet

- IFRS 9 Financial Instruments Quiz.Document4 pagesIFRS 9 Financial Instruments Quiz.حسين عبدالرحمنNo ratings yet

- Sun Pharma - Motilal Oswal - Detailed ReportDocument10 pagesSun Pharma - Motilal Oswal - Detailed ReportHemal DaniNo ratings yet

- Stock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedDocument24 pagesStock Advisory For Today - But Stock of Coal India LTD and Cipla LimitedNarnolia Securities LimitedNo ratings yet

- La Opala RG - Initiating Coverage - Centrum 30062014Document21 pagesLa Opala RG - Initiating Coverage - Centrum 30062014Jeevan PatwaNo ratings yet

- Sun Pharma MODocument10 pagesSun Pharma MOGoel VaibhavNo ratings yet

- GSK Consumer: Excessive Price Hikes May Upset Price-Value EquationDocument6 pagesGSK Consumer: Excessive Price Hikes May Upset Price-Value EquationHimanshuNo ratings yet

- Indian Stock Market Analytics - Buy Stock of Prestige Estates, Tech Mahindra and LupinDocument17 pagesIndian Stock Market Analytics - Buy Stock of Prestige Estates, Tech Mahindra and LupinNarnolia Securities LimitedNo ratings yet

- Investment Funds Advisory Today - Buy Stock of Escorts LTD and Neutral View On Hindustan UnileverDocument26 pagesInvestment Funds Advisory Today - Buy Stock of Escorts LTD and Neutral View On Hindustan UnileverNarnolia Securities LimitedNo ratings yet

- Aurobindo 4Q FY 2013Document10 pagesAurobindo 4Q FY 2013Angel BrokingNo ratings yet

- Ranbaxy, 2Q CY 2013Document11 pagesRanbaxy, 2Q CY 2013Angel BrokingNo ratings yet

- Nivesh Stock PicksDocument13 pagesNivesh Stock PicksAnonymous W7lVR9qs25No ratings yet

- Best Performing Stock Advice For Today - Neutral Rating On GAIL Stock With A Target Price of Rs.346Document22 pagesBest Performing Stock Advice For Today - Neutral Rating On GAIL Stock With A Target Price of Rs.346Narnolia Securities LimitedNo ratings yet

- CMP: Rs.94 Rating: BUY Target: Rs.149: J.B. Chemicals & Pharmaceuticals Ltd. (JBCL)Document0 pagesCMP: Rs.94 Rating: BUY Target: Rs.149: J.B. Chemicals & Pharmaceuticals Ltd. (JBCL)api-234474152No ratings yet

- Quick Note: Sintex IndustriesDocument6 pagesQuick Note: Sintex Industriesred cornerNo ratings yet

- Aurobindo, 1Q FY 2014Document11 pagesAurobindo, 1Q FY 2014Angel BrokingNo ratings yet

- India Equity Analytics: HCLTECH: "Retain Confidence"Document27 pagesIndia Equity Analytics: HCLTECH: "Retain Confidence"Narnolia Securities LimitedNo ratings yet

- First Source Solutions LTD - Karvy Recommendation 11 Mar 2016Document5 pagesFirst Source Solutions LTD - Karvy Recommendation 11 Mar 2016AdityaKumarNo ratings yet

- V-Guard Industries: CMP: INR523 TP: INR650 BuyDocument10 pagesV-Guard Industries: CMP: INR523 TP: INR650 BuySmriti SrivastavaNo ratings yet

- Alembic Pharma LTD (APL) Stock Update: Retail ResearchDocument5 pagesAlembic Pharma LTD (APL) Stock Update: Retail ResearchShashi KapoorNo ratings yet

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocument7 pagesSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapRajesh KarriNo ratings yet

- 2013-04-08 CORD - Si (Phillip Secur) Cordlife - Strong FCF Generation at A Reasonable PriceDocument21 pages2013-04-08 CORD - Si (Phillip Secur) Cordlife - Strong FCF Generation at A Reasonable PriceKelvin FuNo ratings yet

- Muhurat Picks 2015: Company CMP Target Upside (%)Document12 pagesMuhurat Picks 2015: Company CMP Target Upside (%)abhijit99541623974426No ratings yet

- Sharekhan Top Picks: November 30, 2012Document7 pagesSharekhan Top Picks: November 30, 2012didwaniasNo ratings yet

- Aurobindo Pharma Result UpdatedDocument10 pagesAurobindo Pharma Result UpdatedAngel BrokingNo ratings yet

- Set For Strong Growth: FMCG Q2FY14 Result Preview 08 Oct 2013Document5 pagesSet For Strong Growth: FMCG Q2FY14 Result Preview 08 Oct 2013Abhishek SinghNo ratings yet

- Iiww 161210Document4 pagesIiww 161210rinku23patilNo ratings yet

- Indoco RemediesDocument19 pagesIndoco RemediesMNo ratings yet

- Top 10 Mid-Cap Ideas: Find Below Our Top Mid Cap Buys and The Rationale For The SameDocument4 pagesTop 10 Mid-Cap Ideas: Find Below Our Top Mid Cap Buys and The Rationale For The Sameapi-234474152No ratings yet

- Fortnightly: Ipca LabDocument5 pagesFortnightly: Ipca Labbinoy666No ratings yet

- Linc Pen & Plastics LTD.: CMP INR 161.0 Target Inr 218 Result Update - BuyDocument6 pagesLinc Pen & Plastics LTD.: CMP INR 161.0 Target Inr 218 Result Update - Buynare999No ratings yet

- Piramal Enterprises Limited Investor Presentation Nov 2016 20161108025005Document74 pagesPiramal Enterprises Limited Investor Presentation Nov 2016 20161108025005ratan203No ratings yet

- Ratio Analysis Project On Lupin Pharmaceutical CompanyDocument93 pagesRatio Analysis Project On Lupin Pharmaceutical CompanyShilpa Reddy50% (2)

- Indianivesh Securities Private Limited: Balanced Aggressive ConservativeDocument9 pagesIndianivesh Securities Private Limited: Balanced Aggressive ConservativeShashi KapoorNo ratings yet

- Sun Pharma-Ranbaxy DealDocument5 pagesSun Pharma-Ranbaxy DealishaneliteNo ratings yet

- Mid-Cap Marvels: RCM ResearchDocument20 pagesMid-Cap Marvels: RCM ResearchmannimanojNo ratings yet

- IDirect MuhuratPicks 2014Document8 pagesIDirect MuhuratPicks 2014Rahul SakareyNo ratings yet

- IDirect JubilantLife CoUpdate Sep16Document4 pagesIDirect JubilantLife CoUpdate Sep16umaganNo ratings yet

- Investment Funds Advisory For Today: Buy Stock of Powergrid and IFGL Refractories LTDDocument23 pagesInvestment Funds Advisory For Today: Buy Stock of Powergrid and IFGL Refractories LTDNarnolia Securities LimitedNo ratings yet

- Sun Pharma: CMP: INR413 TP: INR480 (+16%)Document10 pagesSun Pharma: CMP: INR413 TP: INR480 (+16%)Harshul BansalNo ratings yet

- Stocksview Report On JiyaDocument3 pagesStocksview Report On JiyaMuralidhar RayapeddiNo ratings yet

- Selan Exploration TechnologyDocument3 pagesSelan Exploration TechnologyPaul GeorgeNo ratings yet

- Cipla LTD Q2'13 Earning EstimateDocument2 pagesCipla LTD Q2'13 Earning EstimateSuranjoy SinghNo ratings yet

- Sharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapDocument7 pagesSharekhan Top Picks: Absolute Returns (Top Picks Vs Benchmark Indices) % Sharekhan Sensex Nifty CNX (Top Picks) Mid-CapJignesh RampariyaNo ratings yet

- Reliance Communications (Q4 FY11)Document2 pagesReliance Communications (Q4 FY11)Apoorva GuptaNo ratings yet

- D&L Industries Still Growing StrongDocument6 pagesD&L Industries Still Growing Strongανατολή και πετύχετεNo ratings yet

- LKP Sec 7 Techno FundaDocument11 pagesLKP Sec 7 Techno FundaAnonymous W7lVR9qs25No ratings yet

- Arvind Remedies VenturaDocument13 pagesArvind Remedies VenturaAshish GuptaNo ratings yet

- J. P Morgan - Pidilite IndustriesDocument36 pagesJ. P Morgan - Pidilite Industriesparry0843No ratings yet

- Marico 4Q FY 2013Document11 pagesMarico 4Q FY 2013Angel BrokingNo ratings yet

- Research Note - Shoprite FY23 Results 220923Document3 pagesResearch Note - Shoprite FY23 Results 220923zaahirahabrahams786No ratings yet

- Lupin Pharmaceutical: Mandideep IDocument41 pagesLupin Pharmaceutical: Mandideep INishant NamdeoNo ratings yet

- Jubilant Lifesciences: CMP: INR179 TP: INR199 NeutralDocument8 pagesJubilant Lifesciences: CMP: INR179 TP: INR199 NeutralRishabh JainNo ratings yet

- Independent Equity Research: Enhancing Investment DecisionDocument0 pagesIndependent Equity Research: Enhancing Investment DecisionvivekdkrpuNo ratings yet

- Angel One: Revenue Misses Estimates Expenses in LineDocument14 pagesAngel One: Revenue Misses Estimates Expenses in LineRam JaneNo ratings yet

- Tata Consultancy Services: CMP: INR1,459 TP: INR1,500 NeutralDocument10 pagesTata Consultancy Services: CMP: INR1,459 TP: INR1,500 NeutralktyNo ratings yet

- United Spirits Report - MotilalDocument12 pagesUnited Spirits Report - Motilalzaheen_1No ratings yet

- Research Report SunPharma ICICI DirectDocument13 pagesResearch Report SunPharma ICICI DirectDev MishraNo ratings yet

- Relaxo Footwear: Healthy Performance Maintain BuyDocument2 pagesRelaxo Footwear: Healthy Performance Maintain BuyRajasekhar Reddy AnekalluNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Âp¡ V$) Dpl®¡$V$"U BDPFS"¡ B ( Hv$U"U S¡Æ"P¡ V¡$L$P¡ Dm$I¡?: RBT"¡KDocument1 pageÂp¡ V$) Dpl®¡$V$"U BDPFS"¡ B ( Hv$U"U S¡Æ"P¡ V¡$L$P¡ Dm$I¡?: RBT"¡KSohamsNo ratings yet

- Ap L$RH Ep S ÞD¡ R ¡ A"¡ Iy L$L¡HP DPN¡ R ¡?: L¡$ (Ëied A"¡ QHV$PQD" "X$U'"U Sy NGB U..Document1 pageAp L$RH Ep S ÞD¡ R ¡ A"¡ Iy L$L¡HP DPN¡ R ¡?: L¡$ (Ëied A"¡ QHV$PQD" "X$U'"U Sy NGB U..SohamsNo ratings yet

- AKC - Q3 Event Calendar 2014 - Back SideDocument1 pageAKC - Q3 Event Calendar 2014 - Back SideSohamsNo ratings yet

- AKC - Q3 Event Calendar 2014Document1 pageAKC - Q3 Event Calendar 2014SohamsNo ratings yet

- BoilDocument4 pagesBoilSohamsNo ratings yet

- Utsav Sun 12-03-2017 Page 11 MC PeriodsDocument1 pageUtsav Sun 12-03-2017 Page 11 MC PeriodsSohamsNo ratings yet

- Equitymaster's The 5 Minute WrapUpDocument19 pagesEquitymaster's The 5 Minute WrapUpSohamsNo ratings yet

- Dubai Map Resized PDFDocument1 pageDubai Map Resized PDFSohamsNo ratings yet

- Co O O: Time: 2 Hours Maximum Marks: 50 Note: (I) Answer Any Five Questions. (Ii) All Questions Carry Equal MarksDocument2 pagesCo O O: Time: 2 Hours Maximum Marks: 50 Note: (I) Answer Any Five Questions. (Ii) All Questions Carry Equal MarksSohamsNo ratings yet

- Time: 2 Hours Maximum Marks: 50: Note: Answer Any Five Questions. All Questions CarryDocument2 pagesTime: 2 Hours Maximum Marks: 50: Note: Answer Any Five Questions. All Questions CarrySohamsNo ratings yet

- Certificate in Entrepreneurship: Time: 2 Hours Maximum Marks: 50 Answer Any Questions. All Questions Carry Equal MarksDocument2 pagesCertificate in Entrepreneurship: Time: 2 Hours Maximum Marks: 50 Answer Any Questions. All Questions Carry Equal MarksSohamsNo ratings yet

- CIE-04 Certificate in Entrepreneurship Term-End Examination June, 2014 CIE 04Document2 pagesCIE-04 Certificate in Entrepreneurship Term-End Examination June, 2014 CIE 04SohamsNo ratings yet

- CIE-01 Certificate in Entrepreneurship Term-End Examination June, 2014 CIE-01Document2 pagesCIE-01 Certificate in Entrepreneurship Term-End Examination June, 2014 CIE-01SohamsNo ratings yet

- Leakseal: India Pvt. Ltd. Green Revolution in Cooling IndiaDocument1 pageLeakseal: India Pvt. Ltd. Green Revolution in Cooling IndiaSohamsNo ratings yet

- Parent Interface and Reports: 3 .1 Parent's Monthly ReportDocument6 pagesParent Interface and Reports: 3 .1 Parent's Monthly ReportSohamsNo ratings yet

- National Skill Development Policy 12th PlanDocument5 pagesNational Skill Development Policy 12th PlanSohamsNo ratings yet

- Swami Vivekananda, Born Narendra Nath Datta (: BengaliDocument22 pagesSwami Vivekananda, Born Narendra Nath Datta (: BengaliSohamsNo ratings yet

- Syllabus & Sample Questions: SKGKO 14Document2 pagesSyllabus & Sample Questions: SKGKO 14SohamsNo ratings yet

- Members Ihcn - inDocument16 pagesMembers Ihcn - inSohamsNo ratings yet

- SSRVM Ahmedabad DetailsDocument3 pagesSSRVM Ahmedabad DetailsSohamsNo ratings yet

- Assignment - 4 Thailand Imbalance of Payments Sumeet Kant Kaul-G20088Document4 pagesAssignment - 4 Thailand Imbalance of Payments Sumeet Kant Kaul-G20088sumeetkantkaulNo ratings yet

- Market Cap To GDP RatioDocument8 pagesMarket Cap To GDP RatiokalpeshNo ratings yet

- Strategic Tax Management Midterm Period: QUIZ No 2 2nd SEM AY 2021-22Document15 pagesStrategic Tax Management Midterm Period: QUIZ No 2 2nd SEM AY 2021-22Earl Daniel RemorozaNo ratings yet

- Pitchbook - Europe VC Valuations Report - Q12023Document20 pagesPitchbook - Europe VC Valuations Report - Q12023Олег КарбышевNo ratings yet

- 2Q10 Op Fund Quarterly LetterDocument24 pages2Q10 Op Fund Quarterly Letterscribduser76No ratings yet

- Demat AccountDocument82 pagesDemat AccountJASONM2250% (4)

- Test 1Document11 pagesTest 1VânAnh Nguyễn100% (1)

- Financial Statement AnalysisDocument6 pagesFinancial Statement AnalysisuaenaNo ratings yet

- Tai Chinh Quoc Te Nguyen Cam Nhung c4 The Theory of Purchasing Power Parity (PPP) and Generalized Model of The Exchange Rate (Cuuduongthancong - Com)Document35 pagesTai Chinh Quoc Te Nguyen Cam Nhung c4 The Theory of Purchasing Power Parity (PPP) and Generalized Model of The Exchange Rate (Cuuduongthancong - Com)Thái Nguyễn Thị HồngNo ratings yet

- Accounts Holiday HW 1Document4 pagesAccounts Holiday HW 1AlishbaNo ratings yet

- Form 26ASDocument3 pagesForm 26ASHarshil MehtaNo ratings yet

- Financial PlanDocument68 pagesFinancial PlanYASHA BAIDNo ratings yet

- POADocument3 pagesPOAr_bornarkar8458No ratings yet

- Barcelona, Joyce Ann A. - FMA-3A - Quiz#2 PDFDocument1 pageBarcelona, Joyce Ann A. - FMA-3A - Quiz#2 PDFJoyce Ann Agdippa BarcelonaNo ratings yet

- Lec 7 FX Swaps Ver2Document45 pagesLec 7 FX Swaps Ver2AprilNo ratings yet

- Balance Sheet of Bajaj AutoDocument6 pagesBalance Sheet of Bajaj Autogurjit20No ratings yet

- Income Taxation Assignment 1Document2 pagesIncome Taxation Assignment 1Carmela Tuquib RebundasNo ratings yet

- Bill Statement: Previous Balance (RM) Payment Received (RM) Balance B/F (RM)Document4 pagesBill Statement: Previous Balance (RM) Payment Received (RM) Balance B/F (RM)bain89No ratings yet

- MC Eco121Document20 pagesMC Eco121Vu Truc Ngan (K17 HCM)No ratings yet

- How To Buy CryptocurrenciesDocument2 pagesHow To Buy CryptocurrenciesObinna ObiefuleNo ratings yet

- Gonzales - Assignment 2 (BSMA 3-8) ANSWERSDocument6 pagesGonzales - Assignment 2 (BSMA 3-8) ANSWERSGONZALES, IAN ROGEL L.No ratings yet

- Acc Limited Ledger (Usshar)Document12 pagesAcc Limited Ledger (Usshar)smn.ussharNo ratings yet

- Direct-Deposit-DocDocument5 pagesDirect-Deposit-Docbowzerblade88No ratings yet

- Consolidation of Wholly Owned Subsidiaries Acquired at More Than Book ValueDocument11 pagesConsolidation of Wholly Owned Subsidiaries Acquired at More Than Book ValueJeklin LewaneyNo ratings yet

- SFM - Forex - QuestionsDocument23 pagesSFM - Forex - QuestionsVishal SutarNo ratings yet

- Indian Bank ChallanDocument1 pageIndian Bank ChallansujathalaviNo ratings yet

- CA. Sanjay K Agarwal: Bank Audit ManualDocument38 pagesCA. Sanjay K Agarwal: Bank Audit Manualcaabhaiagarwal1No ratings yet

- Dividends Act 1Document1 pageDividends Act 1Jane DizonNo ratings yet