Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

258 viewsCotton Vs Corn

Cotton Vs Corn

Uploaded by

Beth FergusonThis document discusses enterprise budgets that farmers can use to determine the most profitable crops to plant for the 2014 season given expected prices, yields, and costs. It provides enterprise budget data for peanuts, cotton, corn and soybeans under both irrigated and non-irrigated conditions from the University of Georgia and University of Tennessee. It also presents an example problem about allocating acreage between corn and cotton to maximize a farmer's income given land, seed and labor constraints.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- 3-Slope Intecept Form NotesDocument1 page3-Slope Intecept Form NotesBeth Ferguson50% (4)

- Case StudyDocument3 pagesCase StudyFredilyn Rimay0% (1)

- Sims 2 GBA - WalkthroughDocument26 pagesSims 2 GBA - Walkthroughmarilargalicia67% (3)

- Partner Activity - Graphing SystemsDocument2 pagesPartner Activity - Graphing SystemsBeth FergusonNo ratings yet

- Summary Web For Point Slope FormDocument1 pageSummary Web For Point Slope FormBeth Ferguson100% (1)

- Slope Intercept GameboardDocument42 pagesSlope Intercept GameboardBeth Ferguson100% (3)

- Focus On Ag: May 7, 2018 2018 Farm Custom Rates Hold SteadyDocument2 pagesFocus On Ag: May 7, 2018 2018 Farm Custom Rates Hold SteadyFluenceMediaNo ratings yet

- Focus On Ag: April 8, 2019 Farm Custom Rates Increase For 2019Document2 pagesFocus On Ag: April 8, 2019 Farm Custom Rates Increase For 2019FluenceMediaNo ratings yet

- User Notes For Small-Scale Virginia Commercial Hops Production Enterprise Budgets and Financial StatementsDocument7 pagesUser Notes For Small-Scale Virginia Commercial Hops Production Enterprise Budgets and Financial StatementsfodoNo ratings yet

- The Cost of Producing Potted Orchids Hawaiian Agricultural ProductsDocument4 pagesThe Cost of Producing Potted Orchids Hawaiian Agricultural ProductsStefana LnNo ratings yet

- Olive Oil: University of California - Cooperative ExtensionDocument20 pagesOlive Oil: University of California - Cooperative Extensionhassan_maatoukNo ratings yet

- Focus On Ag (4-19-21)Document3 pagesFocus On Ag (4-19-21)FluenceMediaNo ratings yet

- Strategic Planning For Business Producers Marketing Plan WorksheetDocument7 pagesStrategic Planning For Business Producers Marketing Plan WorksheetaistopNo ratings yet

- A Study in Profitability For A Mid-Sized Beekeeping OperationDocument23 pagesA Study in Profitability For A Mid-Sized Beekeeping OperationTudor VolintiruNo ratings yet

- Costos de Produccion PapasDocument21 pagesCostos de Produccion Papasmario5681No ratings yet

- Seed Demand Forecasting and Planning For Certified, Foundation and Breeder Seed Production Demand Forecasting of SeedDocument13 pagesSeed Demand Forecasting and Planning For Certified, Foundation and Breeder Seed Production Demand Forecasting of SeedChinmaya SahuNo ratings yet

- Farm Family IncomeDocument3 pagesFarm Family Incomehoneyjam89No ratings yet

- Shelled MKT Price: Market Loan Weekly PricesDocument1 pageShelled MKT Price: Market Loan Weekly PricesMorgan IngramNo ratings yet

- Focus On Ag (3-28-22)Document3 pagesFocus On Ag (3-28-22)FluenceMediaNo ratings yet

- Cost of ProductionDocument5 pagesCost of ProductionYaronBabaNo ratings yet

- Strawberry Profit$: - . - Profit Planning Tools For An Alberta Strawberry EnterpriseDocument4 pagesStrawberry Profit$: - . - Profit Planning Tools For An Alberta Strawberry EnterpriseZeki ZekijaNo ratings yet

- Capital Budgeting Case Study 1Document3 pagesCapital Budgeting Case Study 1Rocket SinghNo ratings yet

- Focus On Ag (3-25-24)Document3 pagesFocus On Ag (3-25-24)Mike MaybayNo ratings yet

- PEANUT MARKETING NEWS - May 19, 2021 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 19, 2021 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,174,075 Tons, Up 3.0 % UP-$01. CT/LBDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,174,075 Tons, Up 3.0 % UP-$01. CT/LBBrittany EtheridgeNo ratings yet

- Eco DairyDocument16 pagesEco DairyNilamdeen Mohamed ZamilNo ratings yet

- Economics of Nutrient Systems and SourcesDocument4 pagesEconomics of Nutrient Systems and SourcesAndresMariaNo ratings yet

- Modern Heritage Swine Series Guide 100716Document68 pagesModern Heritage Swine Series Guide 100716Atii JerryNo ratings yet

- 13 - Chapter 7Document25 pages13 - Chapter 7Krishna KumarNo ratings yet

- CQ Perspectives Jan 2005Document4 pagesCQ Perspectives Jan 2005Crop QuestNo ratings yet

- EPD PaperDocument3 pagesEPD PaperAlexis OrduñoNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last Week 4-23-2021 (2020 Crop) 3,107,188 3,067,168 Tons DOWN $0.4 CT/LBDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 4-23-2021 (2020 Crop) 3,107,188 3,067,168 Tons DOWN $0.4 CT/LBMorgan IngramNo ratings yet

- Farm Organisation and PlanningDocument6 pagesFarm Organisation and Planningvarunlutchman2009No ratings yet

- The Cost Is Right BreakevensDocument17 pagesThe Cost Is Right BreakevensErna CulalaNo ratings yet

- PEANUT MARKETING NEWS - May 29, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 29, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Oliveoilnc CC 2011Document19 pagesOliveoilnc CC 2011kareem3456No ratings yet

- PEANUT MARKETING NEWS - May 11, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 11, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Research OutputDocument6 pagesResearch OutputMariphie OsianNo ratings yet

- Agricultural Yield and Profit Prediction Using Big Data Analysis Techniques in Ethiopia On Wheat and TeffDocument1 pageAgricultural Yield and Profit Prediction Using Big Data Analysis Techniques in Ethiopia On Wheat and TeffEyob TesfayeNo ratings yet

- Game of Rice: Background InformationDocument6 pagesGame of Rice: Background InformationhoneyschuNo ratings yet

- Cost of Onion Production in Eastern Oregon and IdahoDocument12 pagesCost of Onion Production in Eastern Oregon and IdahoByaktiranjan PattanayakNo ratings yet

- Blueberry EconomicsDocument26 pagesBlueberry EconomicsAntonio Gonzalez PatricioNo ratings yet

- Energy Used in Farm PM2089ADocument2 pagesEnergy Used in Farm PM2089AJeevaa RajNo ratings yet

- Food Production and Economics of Fertilizer Use - Tracking The Returns in A Grain Crop (Northern Great Plains)Document2 pagesFood Production and Economics of Fertilizer Use - Tracking The Returns in A Grain Crop (Northern Great Plains)AndresMariaNo ratings yet

- July&August MtngsDocument92 pagesJuly&August MtngsDeDe Beaty JonesNo ratings yet

- Research ProjectDocument9 pagesResearch Projectjagritiparmar92No ratings yet

- As A Farmer or-WPS OfficeDocument17 pagesAs A Farmer or-WPS OfficeBiniyam OliNo ratings yet

- Executive Summary ORGANIC FARMDocument8 pagesExecutive Summary ORGANIC FARMkenkimanthiNo ratings yet

- Corn Management Comparisons: Irrigated Crop BudgetsDocument22 pagesCorn Management Comparisons: Irrigated Crop BudgetsDeDe Beaty JonesNo ratings yet

- PEANUT MARKETING NEWS - May 21, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 21, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Farm Organisation and PlanningDocument24 pagesFarm Organisation and PlanningGarcia LewisNo ratings yet

- 440a9 Agricultural Inputs Part II - Compressed 2Document12 pages440a9 Agricultural Inputs Part II - Compressed 2kanishk singhNo ratings yet

- Literature Review On Agricultural Productivity in IndiaDocument7 pagesLiterature Review On Agricultural Productivity in IndiaafmzitaaoxahvpNo ratings yet

- SumanDocument3 pagesSumanDibya Kumari RaiNo ratings yet

- Financial Planning For The Small FarmDocument81 pagesFinancial Planning For The Small FarmNguyet MinhNo ratings yet

- Managing Dairy Farm Finances: Larry F. Tranel ISU Extension Dairy Field SpecialistDocument17 pagesManaging Dairy Farm Finances: Larry F. Tranel ISU Extension Dairy Field SpecialistAbc AbcNo ratings yet

- Relative Maturity and Its Relationship To Yield and MoistureDocument5 pagesRelative Maturity and Its Relationship To Yield and MoistureArgot CaloNo ratings yet

- Crop Insurance Agents of AmericaDocument19 pagesCrop Insurance Agents of Americaifti007No ratings yet

- Chapter 4 - Forecasting Demand: BackgroundDocument5 pagesChapter 4 - Forecasting Demand: BackgroundJeetender MishraNo ratings yet

- KPIs in AgricultureDocument6 pagesKPIs in AgricultureMekonnen ZegaNo ratings yet

- Establishing Pastures FullDocument103 pagesEstablishing Pastures FullMevlut Gunal100% (1)

- Business Plan For Establishing A 100 Hectare Farm For Niyola Farm1Document18 pagesBusiness Plan For Establishing A 100 Hectare Farm For Niyola Farm1Ifedamilola Odepidan100% (1)

- Poultry BusinessDocument63 pagesPoultry BusinessSamuel Ivan Ngan100% (1)

- HOW TO BUILD ORGANIC FARM STARTING FROM ZEROFrom EverandHOW TO BUILD ORGANIC FARM STARTING FROM ZERORating: 4 out of 5 stars4/5 (1)

- Compact Farms (2 Books in 1): Mini Farming for Beginners and IntermediateFrom EverandCompact Farms (2 Books in 1): Mini Farming for Beginners and IntermediateNo ratings yet

- Station 5 Domain & Range: Graph 1 Graph 2Document1 pageStation 5 Domain & Range: Graph 1 Graph 2Beth Ferguson100% (1)

- Wrap-Around Reflection - After Week 2Document1 pageWrap-Around Reflection - After Week 2Beth FergusonNo ratings yet

- Station 3Document1 pageStation 3Beth FergusonNo ratings yet

- Station 2Document1 pageStation 2Beth FergusonNo ratings yet

- Day 1 Solving Systems of Equations by GraphingDocument2 pagesDay 1 Solving Systems of Equations by GraphingBeth FergusonNo ratings yet

- Station 1Document4 pagesStation 1Beth Ferguson100% (1)

- Day 3 Solving Systems Using EliminationDocument2 pagesDay 3 Solving Systems Using EliminationBeth FergusonNo ratings yet

- Rational Exponents Booklet Pages 3 and 6Document1 pageRational Exponents Booklet Pages 3 and 6Beth FergusonNo ratings yet

- Day 2 Solving Systems of Equations Using SubstitutionDocument2 pagesDay 2 Solving Systems of Equations Using SubstitutionBeth FergusonNo ratings yet

- Analyzing Data: Discuss These Questions With Your Math TeamDocument2 pagesAnalyzing Data: Discuss These Questions With Your Math TeamBeth FergusonNo ratings yet

- Rational Exponents Booklet Pages 4 and 5Document1 pageRational Exponents Booklet Pages 4 and 5Beth FergusonNo ratings yet

- Poetry Rubric For Math ClassDocument1 pagePoetry Rubric For Math ClassBeth FergusonNo ratings yet

- Review Graphing Linear Equations NotesDocument1 pageReview Graphing Linear Equations NotesBeth Ferguson0% (1)

- Observation Lesson PlanDocument2 pagesObservation Lesson PlanBeth FergusonNo ratings yet

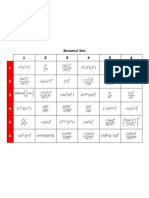

- Monomial War ProblemsDocument1 pageMonomial War ProblemsBeth FergusonNo ratings yet

- 4a LINES ActivityDocument1 page4a LINES ActivityBeth Ferguson100% (1)

- Purple Invaders MissionDocument1 pagePurple Invaders MissionBeth FergusonNo ratings yet

- Point-Slope Class NotesDocument1 pagePoint-Slope Class NotesBeth Ferguson100% (3)

- 4b-LINES Answer SheetDocument1 page4b-LINES Answer SheetBeth FergusonNo ratings yet

- 1 Introductory ExplorationDocument1 page1 Introductory ExplorationBeth Ferguson100% (3)

- 2-Guided Discussion #1 & #2Document1 page2-Guided Discussion #1 & #2Beth FergusonNo ratings yet

- Partner Slope ActivityDocument1 pagePartner Slope ActivityBeth Ferguson100% (1)

- Profile: Olwen Rhiannon Davies C.VDocument2 pagesProfile: Olwen Rhiannon Davies C.Vapi-300660750No ratings yet

- Impact of Industries and UrbanizationDocument104 pagesImpact of Industries and UrbanizationrosememoryNo ratings yet

- DBK sch2016Document185 pagesDBK sch2016vpharsora4205No ratings yet

- General Review Questions in AnimalsDocument9 pagesGeneral Review Questions in AnimalsAnonymous VkI5xDuNo ratings yet

- 9.weed Control Practices of Organic Farmers in Malaysia (Mohamad Amir Shah Yusop) PP 57-62Document6 pages9.weed Control Practices of Organic Farmers in Malaysia (Mohamad Amir Shah Yusop) PP 57-62upenapahangNo ratings yet

- Tom Browns School DaysDocument181 pagesTom Browns School DayssagemarkNo ratings yet

- Neolithic AgeDocument4 pagesNeolithic AgeRamita UdayashankarNo ratings yet

- Case Study of LGU Extension in Ubay, BoholDocument139 pagesCase Study of LGU Extension in Ubay, BoholKat Lasco100% (1)

- Freeman, John Joseph. 1838. General Observations On The Malagasy Language - Outline of Grammar, and Illustrations.Document564 pagesFreeman, John Joseph. 1838. General Observations On The Malagasy Language - Outline of Grammar, and Illustrations.AymericDM100% (2)

- Women Empowerment AmulDocument10 pagesWomen Empowerment AmulSrushti YadhunathNo ratings yet

- Vasanth Cis Project 6.1Document24 pagesVasanth Cis Project 6.1Mr RooneyNo ratings yet

- Physical and Natural Resources of CaviteDocument6 pagesPhysical and Natural Resources of CaviteDaryl Santiago Delos ReyesNo ratings yet

- Package ForestryDocument163 pagesPackage ForestryGary BhullarNo ratings yet

- Cattle Jeopardy: Name That Breed Breed ID Origins Colors Cattle FactsDocument53 pagesCattle Jeopardy: Name That Breed Breed ID Origins Colors Cattle FactsOrmie ChanNo ratings yet

- Phenological Growth Stages of Edible Asparagus (Asparagus To The BBCH ScaleDocument7 pagesPhenological Growth Stages of Edible Asparagus (Asparagus To The BBCH Scalerudy cab kuNo ratings yet

- Birsa Munda: Birsa Munda Pronunciation (1875-1900) Was An Indian Tribal FreedomDocument2 pagesBirsa Munda: Birsa Munda Pronunciation (1875-1900) Was An Indian Tribal FreedomramakntaNo ratings yet

- Tragedy of The CommonsDocument5 pagesTragedy of The Commonsjoseph YattaNo ratings yet

- Broiler Weight Estimation Based On Machine Vision and Artificial Neural NetworkDocument23 pagesBroiler Weight Estimation Based On Machine Vision and Artificial Neural NetworkEwerton DuarteNo ratings yet

- One Vowel - Two Vowels - Three Vowels - More: First NameDocument5 pagesOne Vowel - Two Vowels - Three Vowels - More: First Nameapi-316763559No ratings yet

- 4) Word List Straightforward Upper Intermediate Translations CastillianDocument54 pages4) Word List Straightforward Upper Intermediate Translations Castilliankerr980No ratings yet

- Swine Nutrition BasicsDocument56 pagesSwine Nutrition BasicsAbhijith S. PNo ratings yet

- Vertical Farming Centre by Aram Shahoyan & Lusine BaghdasaryanDocument5 pagesVertical Farming Centre by Aram Shahoyan & Lusine BaghdasaryanIan Delos Santos100% (2)

- P 201771605Document14 pagesP 201771605RaviChowdaryNo ratings yet

- Bacon Ipsum GeneratorDocument1 pageBacon Ipsum GeneratorBubbaNo ratings yet

- Components of SoilDocument6 pagesComponents of SoilRyanNo ratings yet

- Holloway PDFDocument24 pagesHolloway PDFKanika167No ratings yet

- Agro United EngineeringDocument14 pagesAgro United EngineeringMohammad Abu shhabNo ratings yet

Cotton Vs Corn

Cotton Vs Corn

Uploaded by

Beth Ferguson0 ratings0% found this document useful (0 votes)

258 views2 pagesThis document discusses enterprise budgets that farmers can use to determine the most profitable crops to plant for the 2014 season given expected prices, yields, and costs. It provides enterprise budget data for peanuts, cotton, corn and soybeans under both irrigated and non-irrigated conditions from the University of Georgia and University of Tennessee. It also presents an example problem about allocating acreage between corn and cotton to maximize a farmer's income given land, seed and labor constraints.

Original Description:

Linear Programming "real world" problem

Original Title

Cotton vs Corn

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses enterprise budgets that farmers can use to determine the most profitable crops to plant for the 2014 season given expected prices, yields, and costs. It provides enterprise budget data for peanuts, cotton, corn and soybeans under both irrigated and non-irrigated conditions from the University of Georgia and University of Tennessee. It also presents an example problem about allocating acreage between corn and cotton to maximize a farmer's income given land, seed and labor constraints.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

258 views2 pagesCotton Vs Corn

Cotton Vs Corn

Uploaded by

Beth FergusonThis document discusses enterprise budgets that farmers can use to determine the most profitable crops to plant for the 2014 season given expected prices, yields, and costs. It provides enterprise budget data for peanuts, cotton, corn and soybeans under both irrigated and non-irrigated conditions from the University of Georgia and University of Tennessee. It also presents an example problem about allocating acreage between corn and cotton to maximize a farmer's income given land, seed and labor constraints.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

Peanuts, Cotton, Corn, or Soybeans?

Enterprise Budgets Help You Decide (Apr 02, 2014)

By Henry G. Grant, Gadsden County Extension Director

The most importance decision to be made by farmers for the 2014

cropping season is the choice to develop a management plan and

budget. Unusual weather events, increased production costs, and an

expected decline in return on investment demands a survival

strategy. Therefore, the decision to plant one or more of the four major

row crops in this region relies on what you are best equipped to

manage. Well thought-out management will be the key to profit,

breakeven, or loss.

The use of an enterprise budget is a key tool to use in making decisions on what to plant and how much

you are willing to invest after looking at the projected profit and break even scenarios. Maintaining

structured control of input costs, and at the same time producing the highest yields possible under these

restrained conditions, is paramount for success.

Enterprise budgets are a guide that individual producers can use to determine risk and return. More

importantly, growers can use their own figures to develop a more realistic estimate of profit, breakeven, or

loss. Enterprise budgets use only estimates and projections. Changes in price, yield, and actual costs of

production will influence the return on investment. Therefore, your management plan should go a long

way in helping you make the best choices. The following link provides a list of enterprise budget

worksheets for each commodity to help you analyze production costs, etc. North Florida Research and

Education Center Enterprise Budget Information.

The tables below from the University of Georgia 2014 Peanut Update-2014 Cost And Returns Outlook,

show 2014 budget estimates for peanuts, cotton, corn, and soybean. The budget estimates are intended

as only a guideline as individual operations and local input prices vary. The fixed cost must also be

considered and is deducted from the return above variable cost. For financial planning purposes, Chuck

Danehower, University of Tennessee Extension has been using the following projected prices for 2014:

corn $4-$4.50 bushel corn; cotton $0.78 $0.80 per pound, and soybeans $11 $11.50, and

Nathan B. Smith and Amanda Smith, University of Georgie Extension, use a price of $440 per ton for

peanuts in their enterprise budget estimates

Table 1. Comparison of Per Acre Return above Variable Cost for Non-Irrigated Crops

Expected Price Expected Yield Variable Cost* Return Above VC

Peanut $440 3400 $554 $194

Cotton $0.75 750 $419 $144

Corn $4.60 85 $285 $106

Soybean $10.80 30 $227 $97

Table 2. Comparison of Per Acre Return above Variable Cost for Irrigated Crops.

Expected Price Expected Yield Variable Cost* Return Above VC

Peanut $440 4700 $670 $364

Cotton $0.75 1200 $532 $368

Corn $4.60 200 $630 $290

Soybean $10.80 60 $328 $320

2014 University of Georgia preliminary cost enterprise budgets. Source:ifas.ufl.edu

The information above is from Tennessee. We have slightly different data for Texas. Suppose a

farmer has 150 acres available for planting corn and cotton on irrigated land. The cotton seeds cost

$3 per acre and the corn seeds cost $5 per acre. The total labor costs for cotton will be $15 per acre

and the total labor costs for corn will be $8 per acre. The farmer expects the income from cotton to be

$80 per acre and the income from corn to be $110 per acre. The farmer can spend no more than

$540 on seeds and $1800 on labor. How many acres of corn and how many acres of cotton should

the farmer plant in order to maximize his income?

Organize the information given in a table.

Write a system of linear inequalities in x and y that describe the constraints on this situation.

Connect each inequality with the problem situation.

Graph the inequalities. What are the vertices of your feasible region?

Check three points inside your feasible region. What do

you notice?

Check three points outside your feasible region. What do

you notice?

How many acres of cotton seed and how many acres of corn seed should the farmer plant in order to

maximize his income? Will the farmer plant all 150 acres? Why or why not?

How does this data compare with the information from Tennessee?

You might also like

- 3-Slope Intecept Form NotesDocument1 page3-Slope Intecept Form NotesBeth Ferguson50% (4)

- Case StudyDocument3 pagesCase StudyFredilyn Rimay0% (1)

- Sims 2 GBA - WalkthroughDocument26 pagesSims 2 GBA - Walkthroughmarilargalicia67% (3)

- Partner Activity - Graphing SystemsDocument2 pagesPartner Activity - Graphing SystemsBeth FergusonNo ratings yet

- Summary Web For Point Slope FormDocument1 pageSummary Web For Point Slope FormBeth Ferguson100% (1)

- Slope Intercept GameboardDocument42 pagesSlope Intercept GameboardBeth Ferguson100% (3)

- Focus On Ag: May 7, 2018 2018 Farm Custom Rates Hold SteadyDocument2 pagesFocus On Ag: May 7, 2018 2018 Farm Custom Rates Hold SteadyFluenceMediaNo ratings yet

- Focus On Ag: April 8, 2019 Farm Custom Rates Increase For 2019Document2 pagesFocus On Ag: April 8, 2019 Farm Custom Rates Increase For 2019FluenceMediaNo ratings yet

- User Notes For Small-Scale Virginia Commercial Hops Production Enterprise Budgets and Financial StatementsDocument7 pagesUser Notes For Small-Scale Virginia Commercial Hops Production Enterprise Budgets and Financial StatementsfodoNo ratings yet

- The Cost of Producing Potted Orchids Hawaiian Agricultural ProductsDocument4 pagesThe Cost of Producing Potted Orchids Hawaiian Agricultural ProductsStefana LnNo ratings yet

- Olive Oil: University of California - Cooperative ExtensionDocument20 pagesOlive Oil: University of California - Cooperative Extensionhassan_maatoukNo ratings yet

- Focus On Ag (4-19-21)Document3 pagesFocus On Ag (4-19-21)FluenceMediaNo ratings yet

- Strategic Planning For Business Producers Marketing Plan WorksheetDocument7 pagesStrategic Planning For Business Producers Marketing Plan WorksheetaistopNo ratings yet

- A Study in Profitability For A Mid-Sized Beekeeping OperationDocument23 pagesA Study in Profitability For A Mid-Sized Beekeeping OperationTudor VolintiruNo ratings yet

- Costos de Produccion PapasDocument21 pagesCostos de Produccion Papasmario5681No ratings yet

- Seed Demand Forecasting and Planning For Certified, Foundation and Breeder Seed Production Demand Forecasting of SeedDocument13 pagesSeed Demand Forecasting and Planning For Certified, Foundation and Breeder Seed Production Demand Forecasting of SeedChinmaya SahuNo ratings yet

- Farm Family IncomeDocument3 pagesFarm Family Incomehoneyjam89No ratings yet

- Shelled MKT Price: Market Loan Weekly PricesDocument1 pageShelled MKT Price: Market Loan Weekly PricesMorgan IngramNo ratings yet

- Focus On Ag (3-28-22)Document3 pagesFocus On Ag (3-28-22)FluenceMediaNo ratings yet

- Cost of ProductionDocument5 pagesCost of ProductionYaronBabaNo ratings yet

- Strawberry Profit$: - . - Profit Planning Tools For An Alberta Strawberry EnterpriseDocument4 pagesStrawberry Profit$: - . - Profit Planning Tools For An Alberta Strawberry EnterpriseZeki ZekijaNo ratings yet

- Capital Budgeting Case Study 1Document3 pagesCapital Budgeting Case Study 1Rocket SinghNo ratings yet

- Focus On Ag (3-25-24)Document3 pagesFocus On Ag (3-25-24)Mike MaybayNo ratings yet

- PEANUT MARKETING NEWS - May 19, 2021 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 19, 2021 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,174,075 Tons, Up 3.0 % UP-$01. CT/LBDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 7-08-2021 (2020 Crop) 3,174,075 Tons, Up 3.0 % UP-$01. CT/LBBrittany EtheridgeNo ratings yet

- Eco DairyDocument16 pagesEco DairyNilamdeen Mohamed ZamilNo ratings yet

- Economics of Nutrient Systems and SourcesDocument4 pagesEconomics of Nutrient Systems and SourcesAndresMariaNo ratings yet

- Modern Heritage Swine Series Guide 100716Document68 pagesModern Heritage Swine Series Guide 100716Atii JerryNo ratings yet

- 13 - Chapter 7Document25 pages13 - Chapter 7Krishna KumarNo ratings yet

- CQ Perspectives Jan 2005Document4 pagesCQ Perspectives Jan 2005Crop QuestNo ratings yet

- EPD PaperDocument3 pagesEPD PaperAlexis OrduñoNo ratings yet

- Shelled MKT Price Weekly Prices: Same As Last Week 4-23-2021 (2020 Crop) 3,107,188 3,067,168 Tons DOWN $0.4 CT/LBDocument1 pageShelled MKT Price Weekly Prices: Same As Last Week 4-23-2021 (2020 Crop) 3,107,188 3,067,168 Tons DOWN $0.4 CT/LBMorgan IngramNo ratings yet

- Farm Organisation and PlanningDocument6 pagesFarm Organisation and Planningvarunlutchman2009No ratings yet

- The Cost Is Right BreakevensDocument17 pagesThe Cost Is Right BreakevensErna CulalaNo ratings yet

- PEANUT MARKETING NEWS - May 29, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 29, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Oliveoilnc CC 2011Document19 pagesOliveoilnc CC 2011kareem3456No ratings yet

- PEANUT MARKETING NEWS - May 11, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 11, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Research OutputDocument6 pagesResearch OutputMariphie OsianNo ratings yet

- Agricultural Yield and Profit Prediction Using Big Data Analysis Techniques in Ethiopia On Wheat and TeffDocument1 pageAgricultural Yield and Profit Prediction Using Big Data Analysis Techniques in Ethiopia On Wheat and TeffEyob TesfayeNo ratings yet

- Game of Rice: Background InformationDocument6 pagesGame of Rice: Background InformationhoneyschuNo ratings yet

- Cost of Onion Production in Eastern Oregon and IdahoDocument12 pagesCost of Onion Production in Eastern Oregon and IdahoByaktiranjan PattanayakNo ratings yet

- Blueberry EconomicsDocument26 pagesBlueberry EconomicsAntonio Gonzalez PatricioNo ratings yet

- Energy Used in Farm PM2089ADocument2 pagesEnergy Used in Farm PM2089AJeevaa RajNo ratings yet

- Food Production and Economics of Fertilizer Use - Tracking The Returns in A Grain Crop (Northern Great Plains)Document2 pagesFood Production and Economics of Fertilizer Use - Tracking The Returns in A Grain Crop (Northern Great Plains)AndresMariaNo ratings yet

- July&August MtngsDocument92 pagesJuly&August MtngsDeDe Beaty JonesNo ratings yet

- Research ProjectDocument9 pagesResearch Projectjagritiparmar92No ratings yet

- As A Farmer or-WPS OfficeDocument17 pagesAs A Farmer or-WPS OfficeBiniyam OliNo ratings yet

- Executive Summary ORGANIC FARMDocument8 pagesExecutive Summary ORGANIC FARMkenkimanthiNo ratings yet

- Corn Management Comparisons: Irrigated Crop BudgetsDocument22 pagesCorn Management Comparisons: Irrigated Crop BudgetsDeDe Beaty JonesNo ratings yet

- PEANUT MARKETING NEWS - May 21, 2020 - Tyron Spearman, EditorDocument1 pagePEANUT MARKETING NEWS - May 21, 2020 - Tyron Spearman, EditorBrittany EtheridgeNo ratings yet

- Farm Organisation and PlanningDocument24 pagesFarm Organisation and PlanningGarcia LewisNo ratings yet

- 440a9 Agricultural Inputs Part II - Compressed 2Document12 pages440a9 Agricultural Inputs Part II - Compressed 2kanishk singhNo ratings yet

- Literature Review On Agricultural Productivity in IndiaDocument7 pagesLiterature Review On Agricultural Productivity in IndiaafmzitaaoxahvpNo ratings yet

- SumanDocument3 pagesSumanDibya Kumari RaiNo ratings yet

- Financial Planning For The Small FarmDocument81 pagesFinancial Planning For The Small FarmNguyet MinhNo ratings yet

- Managing Dairy Farm Finances: Larry F. Tranel ISU Extension Dairy Field SpecialistDocument17 pagesManaging Dairy Farm Finances: Larry F. Tranel ISU Extension Dairy Field SpecialistAbc AbcNo ratings yet

- Relative Maturity and Its Relationship To Yield and MoistureDocument5 pagesRelative Maturity and Its Relationship To Yield and MoistureArgot CaloNo ratings yet

- Crop Insurance Agents of AmericaDocument19 pagesCrop Insurance Agents of Americaifti007No ratings yet

- Chapter 4 - Forecasting Demand: BackgroundDocument5 pagesChapter 4 - Forecasting Demand: BackgroundJeetender MishraNo ratings yet

- KPIs in AgricultureDocument6 pagesKPIs in AgricultureMekonnen ZegaNo ratings yet

- Establishing Pastures FullDocument103 pagesEstablishing Pastures FullMevlut Gunal100% (1)

- Business Plan For Establishing A 100 Hectare Farm For Niyola Farm1Document18 pagesBusiness Plan For Establishing A 100 Hectare Farm For Niyola Farm1Ifedamilola Odepidan100% (1)

- Poultry BusinessDocument63 pagesPoultry BusinessSamuel Ivan Ngan100% (1)

- HOW TO BUILD ORGANIC FARM STARTING FROM ZEROFrom EverandHOW TO BUILD ORGANIC FARM STARTING FROM ZERORating: 4 out of 5 stars4/5 (1)

- Compact Farms (2 Books in 1): Mini Farming for Beginners and IntermediateFrom EverandCompact Farms (2 Books in 1): Mini Farming for Beginners and IntermediateNo ratings yet

- Station 5 Domain & Range: Graph 1 Graph 2Document1 pageStation 5 Domain & Range: Graph 1 Graph 2Beth Ferguson100% (1)

- Wrap-Around Reflection - After Week 2Document1 pageWrap-Around Reflection - After Week 2Beth FergusonNo ratings yet

- Station 3Document1 pageStation 3Beth FergusonNo ratings yet

- Station 2Document1 pageStation 2Beth FergusonNo ratings yet

- Day 1 Solving Systems of Equations by GraphingDocument2 pagesDay 1 Solving Systems of Equations by GraphingBeth FergusonNo ratings yet

- Station 1Document4 pagesStation 1Beth Ferguson100% (1)

- Day 3 Solving Systems Using EliminationDocument2 pagesDay 3 Solving Systems Using EliminationBeth FergusonNo ratings yet

- Rational Exponents Booklet Pages 3 and 6Document1 pageRational Exponents Booklet Pages 3 and 6Beth FergusonNo ratings yet

- Day 2 Solving Systems of Equations Using SubstitutionDocument2 pagesDay 2 Solving Systems of Equations Using SubstitutionBeth FergusonNo ratings yet

- Analyzing Data: Discuss These Questions With Your Math TeamDocument2 pagesAnalyzing Data: Discuss These Questions With Your Math TeamBeth FergusonNo ratings yet

- Rational Exponents Booklet Pages 4 and 5Document1 pageRational Exponents Booklet Pages 4 and 5Beth FergusonNo ratings yet

- Poetry Rubric For Math ClassDocument1 pagePoetry Rubric For Math ClassBeth FergusonNo ratings yet

- Review Graphing Linear Equations NotesDocument1 pageReview Graphing Linear Equations NotesBeth Ferguson0% (1)

- Observation Lesson PlanDocument2 pagesObservation Lesson PlanBeth FergusonNo ratings yet

- Monomial War ProblemsDocument1 pageMonomial War ProblemsBeth FergusonNo ratings yet

- 4a LINES ActivityDocument1 page4a LINES ActivityBeth Ferguson100% (1)

- Purple Invaders MissionDocument1 pagePurple Invaders MissionBeth FergusonNo ratings yet

- Point-Slope Class NotesDocument1 pagePoint-Slope Class NotesBeth Ferguson100% (3)

- 4b-LINES Answer SheetDocument1 page4b-LINES Answer SheetBeth FergusonNo ratings yet

- 1 Introductory ExplorationDocument1 page1 Introductory ExplorationBeth Ferguson100% (3)

- 2-Guided Discussion #1 & #2Document1 page2-Guided Discussion #1 & #2Beth FergusonNo ratings yet

- Partner Slope ActivityDocument1 pagePartner Slope ActivityBeth Ferguson100% (1)

- Profile: Olwen Rhiannon Davies C.VDocument2 pagesProfile: Olwen Rhiannon Davies C.Vapi-300660750No ratings yet

- Impact of Industries and UrbanizationDocument104 pagesImpact of Industries and UrbanizationrosememoryNo ratings yet

- DBK sch2016Document185 pagesDBK sch2016vpharsora4205No ratings yet

- General Review Questions in AnimalsDocument9 pagesGeneral Review Questions in AnimalsAnonymous VkI5xDuNo ratings yet

- 9.weed Control Practices of Organic Farmers in Malaysia (Mohamad Amir Shah Yusop) PP 57-62Document6 pages9.weed Control Practices of Organic Farmers in Malaysia (Mohamad Amir Shah Yusop) PP 57-62upenapahangNo ratings yet

- Tom Browns School DaysDocument181 pagesTom Browns School DayssagemarkNo ratings yet

- Neolithic AgeDocument4 pagesNeolithic AgeRamita UdayashankarNo ratings yet

- Case Study of LGU Extension in Ubay, BoholDocument139 pagesCase Study of LGU Extension in Ubay, BoholKat Lasco100% (1)

- Freeman, John Joseph. 1838. General Observations On The Malagasy Language - Outline of Grammar, and Illustrations.Document564 pagesFreeman, John Joseph. 1838. General Observations On The Malagasy Language - Outline of Grammar, and Illustrations.AymericDM100% (2)

- Women Empowerment AmulDocument10 pagesWomen Empowerment AmulSrushti YadhunathNo ratings yet

- Vasanth Cis Project 6.1Document24 pagesVasanth Cis Project 6.1Mr RooneyNo ratings yet

- Physical and Natural Resources of CaviteDocument6 pagesPhysical and Natural Resources of CaviteDaryl Santiago Delos ReyesNo ratings yet

- Package ForestryDocument163 pagesPackage ForestryGary BhullarNo ratings yet

- Cattle Jeopardy: Name That Breed Breed ID Origins Colors Cattle FactsDocument53 pagesCattle Jeopardy: Name That Breed Breed ID Origins Colors Cattle FactsOrmie ChanNo ratings yet

- Phenological Growth Stages of Edible Asparagus (Asparagus To The BBCH ScaleDocument7 pagesPhenological Growth Stages of Edible Asparagus (Asparagus To The BBCH Scalerudy cab kuNo ratings yet

- Birsa Munda: Birsa Munda Pronunciation (1875-1900) Was An Indian Tribal FreedomDocument2 pagesBirsa Munda: Birsa Munda Pronunciation (1875-1900) Was An Indian Tribal FreedomramakntaNo ratings yet

- Tragedy of The CommonsDocument5 pagesTragedy of The Commonsjoseph YattaNo ratings yet

- Broiler Weight Estimation Based On Machine Vision and Artificial Neural NetworkDocument23 pagesBroiler Weight Estimation Based On Machine Vision and Artificial Neural NetworkEwerton DuarteNo ratings yet

- One Vowel - Two Vowels - Three Vowels - More: First NameDocument5 pagesOne Vowel - Two Vowels - Three Vowels - More: First Nameapi-316763559No ratings yet

- 4) Word List Straightforward Upper Intermediate Translations CastillianDocument54 pages4) Word List Straightforward Upper Intermediate Translations Castilliankerr980No ratings yet

- Swine Nutrition BasicsDocument56 pagesSwine Nutrition BasicsAbhijith S. PNo ratings yet

- Vertical Farming Centre by Aram Shahoyan & Lusine BaghdasaryanDocument5 pagesVertical Farming Centre by Aram Shahoyan & Lusine BaghdasaryanIan Delos Santos100% (2)

- P 201771605Document14 pagesP 201771605RaviChowdaryNo ratings yet

- Bacon Ipsum GeneratorDocument1 pageBacon Ipsum GeneratorBubbaNo ratings yet

- Components of SoilDocument6 pagesComponents of SoilRyanNo ratings yet

- Holloway PDFDocument24 pagesHolloway PDFKanika167No ratings yet

- Agro United EngineeringDocument14 pagesAgro United EngineeringMohammad Abu shhabNo ratings yet